Tax Law Improvement Act (No. 1) 1998

No. 46 of 1998

Tax Law Improvement Act (No. 1) 1998

No. 46 of 1998

Tax Law Improvement Act (No. 1) 1998

No. 46, 1998

An Act to amend the law about income tax, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedules

4 Application of amendments

Schedule 1—Amendment of the Income Tax Assessment Act 1997

Part 3-1—Capital gains and losses: general topics

Division 100—A Guide to capital gains and losses

General overview

100-1 What this Division is about

100-5 Effect of this Division

100-10 Fundamentals of CGT

100-15 Overview of Steps 1 and 2

Step 1—Have you made a capital gain or a capital loss?

100-20 What events attract CGT?

100-25 What are CGT assets?

100-30 Does an exception or exemption apply?

100-33 Can there be a roll-over?

Step 2—Work out the amount of the capital gain or loss

100-35 What is a capital gain or loss?

100-40 What factors come into calculating a capital gain or loss?

100-45 How to calculate the capital gain or loss for most CGT events

Step 3—Work out your net capital gain or loss for the income year

100-50 How to work out your net capital gain or loss

100-55 How do you comply with CGT?

Keeping records for CGT purposes

100-60 Why keep records?

100-65 What records?

100-70 How long you need to keep records

Division 102—Assessable income includes net capital gain

Guide to Division 102

102-1 What this Division is about

Operative provisions

102-5 Assessable income includes net capital gain

102-10 How to work out your net capital loss

102-15 How to apply net capital losses

102-20 Ways you can make a capital gain or a capital loss

102-22 Amounts of capital gains and losses

102-23 CGT event still happens even if gain or loss disregarded

102-25 Order of application of CGT events

102-30 Exceptions and modifications

Division 103—General rules

Guide to Division 103

103-1 What this Division is about

Operative provisions

103-5 Giving property as part of a transaction

103-10 Entitlement to receive money or property

103-15 Requirement to pay money or give property

103-20 Amounts to be expressed in Australian currency

103-25 Choices

Division 104—CGT events

Guide to Division 104

104-1 What this Division is about

104-5 Summary of the CGT events

Subdivision 104-A—Disposals

104-10 Disposal of a CGT asset: CGT event A1

Subdivision 104-B—Use and enjoyment before title passes

104-15 Use and enjoyment before title passes: CGT event B1

Subdivision 104-C—End of a CGT asset

104-20 Loss or destruction of a CGT asset: CGT event C1

104-25 Cancellation, surrender and similar endings: CGT event C2

104-30 End of option to acquire shares etc.: CGT event C3

Subdivision 104-D—Bringing into existence a CGT asset

104-35 Creating contractual or other rights: CGT event D1

104-40 Granting an option: CGT event D2

104-45 Granting a right to income from mining: CGT event D3

Subdivision 104-E—Trusts

104-55 Creating a trust over a CGT asset: CGT event E1

104-60 Transferring a CGT asset to a trust: CGT event E2

104-65 Converting a trust to a unit trust: CGT event E3

104-70 Capital payment for trust interest: CGT event E4

104-75 Beneficiary becoming entitled to a trust asset: CGT event E5

104-80 Disposal to beneficiary to end income right: CGT event E6

104-85 Disposal to beneficiary to end capital interest: CGT event E7

104-90 Disposal by beneficiary of capital interest: CGT event E8

104-95 Making a capital gain

104-100 Making a capital loss

104-105 Creating a trust over future property: CGT event E9

Subdivision 104-F—Leases

104-110 Granting a lease: CGT event F1

104-115 Granting a long-term lease: CGT event F2

104-120 Lessor pays lessee to get lease changed: CGT event F3

104-125 Lessee receives payment for changing lease: CGT event F4

104-130 Lessor receives payment for changing lease: CGT event F5

Subdivision 104-G—Shares

104-135 Capital payment for shares: CGT event G1

104-140 Shifts in share values: CGT event G2

104-145 Liquidator declares shares worthless: CGT event G3

Subdivision 104-H—Special capital receipts

104-150 Forfeiture of deposit: CGT event H1

104-155 Receipt for event relating to a CGT asset: CGT event H2

Subdivision 104-I—Australian residency ends

104-160 Individual or company stops being resident: CGT event I1

104-165 Exception for individual who stops being resident

104-170 Trust stops being a resident trust: CGT event I2

Subdivision 104-J—Reversal of roll-overs

104-175 Company ceasing to be member of wholly-owned group after roll-over: CGT event J1

104-180 Sub-group break-up

Subdivision 104-K—Other CGT events

104-205 Partial realisation of intellectual property: CGT event K1

104-210 Bankrupt pays amount in relation to debt: CGT event K2

104-215 Asset passing to tax-advantaged entity: CGT event K3

104-220 CGT asset starts being trading stock: CGT event K4

104-225 Special collectable losses: CGT event K5

104-230 Pre-CGT shares or trust interest: CGT event K6

Division 106—Entity making the gain or loss

Guide to Division 106

106-1 What this Division is about

Subdivision 106-A—Partnerships

106-5 Partnerships

Subdivision 106-B—Bankruptcy and liquidation

106-30 Effect of bankruptcy

106-35 Effect of liquidation

Subdivision 106-C—Absolutely entitled beneficiaries

106-50 Absolutely entitled beneficiaries

Subdivision 106-D—Security holders

106-60 Acts by security holders

Division 108—CGT assets

Guide to Division 108

108-1 What this Division is about

Subdivision 108-A—What a CGT asset is

108-5 CGT assets

108-7 Interest in CGT assets as joint tenants

Subdivision 108-B—Collectables

108-10 Losses from collectables to be offset only against gains from collectables

108-15 Sets of collectables

108-17 Cost base of a collectable

Subdivision 108-C—Personal use assets

108-20 Losses from personal use assets must be disregarded

108-25 Sets of personal use assets

108-30 Cost base of a personal use asset

Subdivision 108-D—Separate CGT assets

Guide to Subdivision 108-D

108-50 What this Subdivision is about

Operative provisions

108-55 When is a building a separate asset from land?

108-60 Plant that is part of a building is a separate asset

108-65 Land adjacent to land acquired before 20 September 1985

108-70 When is a capital improvement a separate asset?

108-75 Capital improvements to CGT assets for which a roll-over may be available

108-80 Deciding if capital improvements are related to each other

108-85 Meaning of improvement threshold

Division 109—Acquisition of CGT assets

Guide to Division 109

109-1 What this Division is about

Subdivision 109-A—Operative rules

109-5 General acquisition rules

109-10 When you acquire a CGT asset without a CGT event

109-15 Exception

Subdivision 109-B—Signposts to other acquisition rules

109-50 Effect of this Subdivision

109-55 Other acquisition rules

109-60 Acquisition rules outside this Part and Part 3-3

Division 110—Cost base and reduced cost base

Guide to Division 110

110-1 What this Division is about

110-5 Modifications to general rules

110-10 Rules about cost base not relevant for some CGT events

Subdivision 110-A—Cost base

110-25 General rules about cost base

110-30 Cost base of partnership assets

110-35 Incidental costs

Subdivision 110-B—Reduced cost base

110-55 General rules about reduced cost base

110-60 Reduced cost base for partnership assets

Division 112—Modifications to cost base and reduced cost base

Guide to Division 112

112-1 What this Division is about

112-5 Discussion of modifications

Subdivision 112-A—General modifications

112-15 General rule for replacement modifications

112-20 Market value substitution rule

112-25 Split, changed or merged assets

112-30 Apportionment rules on acquisition or disposal of part

112-35 Assumption of liability rule

Subdivision 112-B—Finding tables for special rules

112-40 Effect of this Subdivision

112-45 CGT events

112-50 Main residence

112-55 Effect of you dying

112-60 Bonus shares or units

112-65 Rights

112-70 Convertible notes

112-75 Employee share schemes

112-80 Leases

112-85 Options

112-87 Residency

112-90 An asset stops being a pre-CGT asset

112-95 Transfer of net capital losses within wholly-owned groups of companies

112-97 Modifications outside this Part and Part 3-3

Subdivision 112-C—Replacement-asset roll-overs

112-100 Effect of this Subdivision

112-105 What is a replacement-asset roll-over?

112-110 How is the cost base of the replacement asset modified?

112-115 Table of replacement-asset roll-overs

Subdivision 112-D—Same-asset roll-overs

112-135 Effect of this Subdivision

112-140 What is a same-asset roll-over?

112-145 How is the cost base of the asset modified?

112-150 Table of same-asset roll-overs

Division 114—Indexation of cost base

114-1 Indexing elements of cost base

114-5 When indexation relevant

114-10 Requirement for 12 months ownership

114-15 Cost base modifications

114-20 When expenditure is incurred for roll-overs

Division 116—Capital proceeds

Guide to Division 116

116-1 What this Division is about

116-5 General rules

116-10 Modifications to general rules

General rules

116-20 General rules about capital proceeds

Modifications to general rules

116-25 Table of modifications to the general rules

116-30 Market value substitution rule: modification 1

116-40 Apportionment rule: modification 2

116-45 Non-receipt rule: modification 3

116-50 Repaid rule: modification 4

116-55 Assumption of liability rule: modification 5

Special rules

116-65 Disposal of a CGT asset the subject of an option

116-70 Option requiring both acquisition and disposal

116-75 Special rule for CGT event C2 happening to a lease

116-80 Special rule if CGT asset is shares or an interest in a trust

116-85 Section 47A of 1936 Act applying to rolled-over asset

116-95 Company changes residence from an unlisted country

Division 118—Exemptions

Guide to Division 118

118-1 What this Division is about

Subdivision 118-A—General exemptions

Exempt assets

118-5 Cars, motor cycles and valour decorations

118-10 Collectables and personal use assets

118-12 Assets used to produce exempt income

118-13 Shares in a PDF

Exempt receipts

118-15 Exempt capital receipts

Anti-overlap provisions

118-20 Reducing capital gains if amount otherwise assessable

118-22 Eligible termination payments

118-25 Trading stock

118-30 Film copyright

118-35 Research and development

Exempt or loss-denying transactions

118-40 Expiry of a lease

118-42 Transfer of stratum units

118-45 Sale of rights to mine

118-55 Foreign currency hedging gains and losses

118-60 Gifts under Cultural Bequests Program

Subdivision 118-B—Main residence

Guide to Subdivision 118-B

118-100 What this Subdivision is about

118-105 Map of this Subdivision

Basic case and concepts

118-110 Basic case

118-115 Meaning of dwelling

118-120 Extension to adjacent land

118-125 Meaning of ownership period

118-130 Meaning of ownership interest in land or a dwelling

Rules that may extend the exemption

118-135 Moving into a dwelling

118-140 Changing main residences

118-145 Absences

118-150 If you build, repair or renovate a dwelling

118-155 Where individual referred to in section 118-150 dies

118-160 Destruction of dwelling and sale of land

Rules that may limit the exemption

118-165 Separate CGT event for adjacent land or other structures

118-170 Spouse having different main residence

118-175 Dependent child having different main residence

118-180 Acquisition of dwelling from company or trust on marriage breakdown—roll-over provision applying

Partial exemption rules

118-185 Partial exemption where dwelling was your main residence during part only of ownership period

118-190 Use of dwelling for producing assessable income

118-192 Special rule for first use to produce income

Dwellings acquired from deceased estates

118-195 Dwelling acquired from a deceased estate

118-200 Partial exemption for deceased estate dwellings

118-205 Adjustment if dwelling inherited from deceased individual

118-210 Trustee acquiring dwelling under will

Subdivision 118-C—Goodwill

118-250 Exempting part of a capital gain attributable to goodwill

118-255 Exception

118-260 Meaning of business exemption threshold

Subdivision 118-D—Insurance and superannuation

118-300 Insurance policies

118-305 Superannuation

118-310 RSA’s

Subdivision 118-E—Units in pooled superannuation trusts

118-350 Units in pooled superannuation trusts

Division 121—Record keeping

Guide to Division 121

121-10 What this Division is about

Operative provisions

121-20 What records you must keep

121-25 How long you must retain the records

121-30 Exceptions

Part 3-3—Capital gains and losses: special topics

Division 122—Roll-over for the disposal of assets to, or the creation of assets in, a wholly-owned company

Guide to Division 122

122-1 What this Division is about

Subdivision 122-A—Disposal or creation of assets by individual to a wholly-owned company

Guide to Subdivision 122-A

122-5 What this Subdivision is about

When is a roll-over available

122-15 Disposal or creation of assets—wholly-owned company

122-20 What you receive for the trigger event

122-25 Other requirements to be satisfied

122-35 What if the company undertakes to discharge a liability (disposal case)

122-37 Rules for working out what a liability in respect of an asset is

Replacement-asset roll-over if you dispose of a CGT asset

122-40 Disposal of a CGT asset

Replacement-asset roll-over if you dispose of all the assets of a business

122-45 Disposal of all the assets of a business

122-50 All assets acquired on or after 20 September 1985

122-55 All assets acquired before 20 September 1985

122-60 Assets acquired before and after 20 September 1985

Replacement-asset roll-over for a creation case

122-65 Creation of asset

Same-asset roll-over consequences for the company (disposal case)

122-70 Consequences for the company (disposal case)

Same-asset roll-over consequences for the company (creation case)

122-75 Consequences for the company (creation case)

Subdivision 122-B—Disposal or creation of assets by partners to a wholly-owned company

Guide to Subdivision 122-B

122-120 What this Subdivision is about

When is a roll-over available

122-125 Disposal or creation of assets—wholly-owned company

122-130 What the partners receive for the trigger event

122-135 Other requirements to be satisfied

122-140 What if the company undertakes to discharge a liability (disposal case)

122-145 Rules for working out what a liability in respect of an interest in an asset is

Replacement-asset roll-over if partners dispose of a CGT asset

122-150 Capital gain or loss disregarded

122-155 Disposal of post-CGT or pre-CGT interests

122-160 Disposal of both post-CGT and pre-CGT interests

Replacement-asset roll-over if the partners dispose of all the assets of a business

122-170 Capital gain or loss disregarded

122-175 Other consequences

122-180 All interests acquired on or after 20 September 1985

122-185 All interests acquired before 20 September 1985

122-190 Interests acquired before and after 20 September 1985

Replacement-asset roll-over for a creation case

122-195 Creation of asset

Same-asset roll-over consequences for the company (disposal case)

122-200 Consequences for the company (disposal case)

Same-asset roll-over consequences for the company (creation case)

122-205 Consequences for the company (creation case)

Division 124—Replacement-asset roll-overs

Guide to Division 124

124-1 What this Division is about

124-5 How to find your way around this Division

Subdivision 124-A—General rules

124-10 Your ownership of one CGT asset ends

124-15 Your ownership of more than one CGT asset ends

Subdivision 124-B—Asset compulsorily acquired, lost or destroyed

When a roll-over is available

124-70 Events giving rise to a roll-over

124-75 Other requirements if you receive money

124-80 Other requirements if you receive an asset

The consequences of a roll-over being available

124-85 Consequences for receiving money

124-90 Consequences for receiving an asset

124-95 You receive both money and an asset

Subdivision 124-C—Statutory licences

124-140 Renewal or extension of a statutory licence

Subdivision 124-D—Strata title conversion

124-190 Strata title conversion

Subdivision 124-E—Exchange of shares or units

124-240 Exchange of shares in the same company

124-245 Exchange of units in the same unit trust

Subdivision 124-F—Exchange of rights or options

124-295 Exchange of rights or option to acquire shares in a company

124-300 Exchange of rights or option to acquire units in a unit trust

Subdivision 124-G—Exchange of shares in one company for shares in another company

Guide to Subdivision 124-G

124-350 What this Subdivision is about

124-355 Summary of rules

Disposal case

124-360 Disposal of shares in one company for shares in another one

124-365 Other requirements to be satisfied

Redemption or cancellation case

124-370 Redemption or cancellation of shares in one company for shares in another one

124-375 Other requirements to be satisfied

Rules applying to both cases

124-380 Requirements to be satisfied in both cases

Consequences for the interposed company

124-385 Consequences for the interposed company

Subdivision 124-H—Exchange of units in a unit trust for shares in a company

Guide to Subdivision 124-H

124-435 What this Subdivision is about

124-440 Summary of rules

Disposal case

124-445 Disposal of units in a unit trust for shares in a company

124-450 Other requirements to be satisfied

Redemption or cancellation case

124-455 Redemption or cancellation of units in a unit trust for shares in a company

124-460 Other requirements to be satisfied

Rules applying to both cases

124-465 Requirements to be satisfied in both cases

Consequences for the company

124-470 Consequences for the company

Subdivision 124-I—Conversion of a body to an incorporated company

124-520 Conversion of a body to an incorporated company

Subdivision 124-J—Crown leases

Guide to Subdivision 124-J

124-570 What this Subdivision is about

Operative provisions

124-575 Extension or renewal of Crown lease

124-580 Meaning of Crown lease

124-585 Original right differs in area from new right

124-590 Part of original right excised

124-595 Treating parts of new right as separate assets

124-600 What is the roll-over?

124-605 Change of lessor

Subdivision 124-K—Plant

124-655 Roll-over for depreciable plant

124-660 Right granted to associate

Subdivision 124-L—Prospecting and mining entitlements

Guide to Subdivision 124-L

124-700 What this Subdivision is about

Operative provisions

124-705 Extension or renewal of prospecting or mining entitlement

124-710 Meaning of prospecting entitlement and mining entitlement

124-715 Original entitlement differs in area from new entitlement

124-720 Part of original entitlement excised

124-725 Treating parts of new entitlement as separate assets

124-730 What is the roll-over?

Division 126—Same-asset roll-overs

Guide to Division 126

126-1 What this Division is about

Subdivision 126-A—Marriage breakdown

126-5 CGT event involving spouses

126-15 CGT event involving company or trustee

126-20 Subsequent CGT event happening to roll-over asset where transferor was a CFC or a non-resident trust

Subdivision 126-B—Companies in the same wholly-owned group

Guide to Subdivision 126-B

126-40 What this Subdivision is about

Operative provisions

126-45 Roll-over for members of wholly-owned group

126-50 Requirements for roll-over

126-55 When there is a roll-over

126-60 Consequences of roll-over

126-65 Choosing for no roll-over in loss situation

126-70 Loss disregarded if intention not realised

126-75 Originating company is a CFC

126-80 Roll-over asset is an interest in a CFC or FIF

126-85 Effect of roll-over on certain liquidations

Subdivision 126-C—Changes to trust deeds

Guide to Subdivision 126-C

126-125 What this Subdivision is about

126-130 Changes to trust deeds

126-135 Consequences of roll-over

Division 128—Effect of death

Guide to Division 128

128-1 What this Division is about

General rules

128-10 Capital gain or loss when you die is disregarded

128-15 Effect on the legal personal representative or beneficiary

128-20 When does an asset pass to a beneficiary?

128-25 The beneficiary is a trustee of a superannuation fund etc.

Special rules for joint tenants

128-50 Joint tenants

Division 130—Investments

Guide to Division 130

130-1 What this Division is about

Subdivision 130-A—Bonus shares and units

Guide to Subdivision 130-A

130-15 Acquisition time and cost base of bonus equities

Operative provisions

130-20 Issue of bonus shares or units

Subdivision 130-B—Rights

130-40 Exercise of rights

130-45 Timing rules

130-50 Application to options

Subdivision 130-C—Convertible notes

130-60 Shares or units acquired by converting a convertible note

Subdivision 130-D—Employee share schemes

130-80 Share or right acquired under employee share scheme

130-83 Qualifying shares and qualifying rights

130-85 Share or right acquired under employee share scheme involving your associate

130-90 Share or right acquired under an employee share trust

Division 132—Leases

132-1 Lessee incurs expenditure to get lease term varied or waived

132-5 Lessor pays lessee for improvements

132-10 Grant of a long-term lease

132-15 Lessee of land acquires reversionary interest of lessor

Division 134—Options

134-1 Exercise of options

Division 136—Non-residents

Guide to Division 136

136-1 What this Division is about

Subdivision 136-A—Making a capital gain or loss

136-5 What if you are a non-resident just before a CGT event

136-10 Making a capital gain or loss from most CGT events

136-15 Making a capital gain or loss from CGT events D1 and E9

136-20 Those events you cannot make a capital gain or loss from

136-25 When an asset has the necessary connection with Australia

136-30 Reducing a capital gain or loss from a business asset

Subdivision 136-B—Becoming a resident

136-40 Individual or company becomes resident

136-45 Trust becomes a resident trust

136-50 CFC becomes an Australian resident

Division 140—Share value shifting

Guide to Division 140

140-1 What this Division is about

140-5 Map of this Division

Subdivision 140-A—When is there share value shifting?

140-10 Shifts in share values

140-15 What is a share value shift

140-20 When is an entity a controller (for CGT purposes) of a company?

140-22 When an entity has an associate-inclusive control interest

140-25 When is there a material decrease in the value of a share?

140-30 Interests in shares etc.

Subdivision 140-B—Consequences of share value shifting

Guide to Subdivision 140-B

140-45 What this Subdivision is about

Different consequences where share value shift is neutral

140-50 What if the share value shift is neutral for each shareholder?

Value shifted to shares acquired on or after 20 September 1985

140-55 Making a capital gain

140-60 Cost base adjustment for shares decreasing in value

140-65 Cost base adjustment for shares increasing in value

140-70 Gain referable to fall in value of shares owned by others

140-75 Gain referable to fall in value of shares owned by the entity

Value shifted to shares acquired before 20 September 1985

140-90 Making a capital gain

140-95 Adjustments to cost base and reduced cost base

Division 149—When an asset stops being a pre-CGT asset

Subdivision 149-A—Key concepts

149-10 What is a pre-CGT asset?

149-15 Majority underlying interests in a CGT asset

Subdivision 149-B—When asset of non-public entity stops being a pre-CGT asset

149-25 Which entities are affected

149-30 Effects if asset no longer has same majority underlying ownership

149-35 Cost base elements of asset that stops being a pre-CGT asset

Subdivision 149-C—When asset of public entity stops being a pre-CGT asset

149-50 Which entities are affected

149-55 Entity to determine periodically whether asset still has same majority underlying ownership

149-60 What the determination must show

149-65 Effects of not making the determination

149-70 Effects if asset no longer has same majority underlying ownership

149-75 Cost base elements of asset that stops being a pre-CGT asset

149-80 No further determination needed after asset stops being a pre-CGT asset

Subdivision 149-D—How to treat holdings of less than 1% in certain entities

Guide to Subdivision 149-D

149-100 What this Subdivision is about

149-105 Basic principles

Special tracing rules for certain companies and publicly traded unit trusts

149-110 Holdings of less than 1% in the entity

149-115 Holdings of less than 1% in interposed company or unit trust

149-120 Notional single shareholder or unitholder of head entity

149-125 Notional single shareholder or unitholder of interposed company or trust

149-130 Notional shareholder taken to have minimum rights to distributions

149-135 Income and capital unitholding of less than 1%

When the rules in this Subdivision do not apply

149-140 If company or unit trust would not otherwise pass the continuity of ownership test

Subdivision 149-E—How to treat certain interposed funds, companies and government bodies

Guide to Subdivision 149-E

149-145 What this Subdivision is about

Special tracing rules for certain companies and publicly traded unit trusts

149-150 When certain funds, companies or government bodies are taken to have rights to capital, dividends or other income

149-155 Limits on tracing through interposed fund or body

Subdivision 149-F—How to treat a “demutualised” public entity

149-165 Members treated as having underlying interests in assets until demutualisation

149-170 Effect of demutualisation of interposed company

Subdivision 165-CA—Applying net capital losses of earlier income years

Guide to Subdivision 165-CA

165-93 What this Subdivision is about

Operative provisions

165-96 When a company cannot apply a net capital loss

Subdivision 165-CB—Working out the net capital gain and the net capital loss for the income year of the change

Guide to Subdivision 165-CB

165-99 What this Subdivision is about

When a company must work out its net capital gain and net capital loss under this Subdivision

165-102 On a change of ownership, or of control of voting power, unless the company carries on the same business

Working out the company’s net capital gain and net capital loss

165-105 First, divide the income year into periods

165-108 Next, calculate the notional net capital gain or notional net capital loss for each period

165-111 How to work out the company’s net capital gain

165-114 How to work out the company’s net capital loss

Subdivision 165-C—Deducting bad debts

Guide to Subdivision 165-C

165-117 What this Subdivision is about

Operative provisions

165-120 To deduct a bad debt

165-123 Company must maintain the same owners

165-126 Alternatively, company must carry on same business

165-129 Same people must control the voting power, or company must carry on same business

165-132 When tax losses resulting from bad debts cannot be deducted

Subdivision 166-C—Deducting bad debts

166-40 How Subdivision 165-C applies to a listed public company

166-45 How Subdivision 165-C applies to a 100% subsidiary of a listed public company

166-50 Companies can choose that this Subdivision is not to apply to them

Subdivision 170-B—Transfer of net capital losses within wholly-owned groups of companies

Guide to Subdivision 170-B

170-101 What this Subdivision is about

170-105 Basic principles for transferring a net capital loss

Effect of transferring a net capital loss

170-110 When a company can transfer a net capital loss

170-115 Who can apply transferred loss

170-120 Gain company is taken to have made transferred loss

170-125 Tax treatment of consideration for transferred tax loss

Conditions for transfer

170-130 Companies must be in existence and members of the same wholly-owned group

170-135 The loss company

170-140 The gain company

170-145 Maximum amount that can be transferred

170-150 Transfer by written agreement

170-155 Losses must be transferred in order they are made

170-160 Gain company cannot transfer transferred net capital loss

Effect of agreement to transfer more than can be transferred

170-165 Agreement transfers as much as can be transferred

170-170 Amendment of assessments

Effect of transfer on cost base of equity or debt interest held by company in the same wholly-owned group

170-175 Direct and indirect interests in the loss company

170-180 Direct and indirect interests in the gain company

Subdivision 175-CA—Tax benefits from unused net capital losses of earlier income years

175-40 When Commissioner can disallow net capital loss of earlier income year

175-45 First case: capital gain injected into company because of available net capital loss

175-50 Second case: someone else obtains a tax benefit because of net capital loss available to company

Subdivision 175-CB—Tax benefits from unused capital losses of the current year

175-55 When Commissioner can disallow capital loss of current year

175-60 Capital gain injected into company because of available capital loss

175-65 Capital loss injected into company because of available capital gain

175-70 Someone else obtains a tax benefit because of capital loss or gain available to company

175-75 Net capital loss resulting from disallowed capital losses

Subdivision 175-C—Tax benefits from unused bad debt deductions

175-80 When Commissioner can disallow deduction for bad debt

175-85 First case: income or capital gain injected into company because of available bad debt

175-90 Second case: someone else obtains a tax benefit because of bad debt deduction available to company

Subdivision 175-D—Shareholding interest in the company

175-95 When a person has a shareholding interest in the company

Division 373—Intellectual property

Guide to Division 373

373-1 What this Division is about

Subdivision 373-A—Deductions for registering items of intellectual property

373-5 Expenditure incurred in registering an item

Subdivision 373-B—Deductions for capital expenditure on intellectual property

373-10 Conditions for deduction

373-15 Meaning of item of intellectual property

373-20 How much you can deduct

373-25 Meaning of unrecouped expenditure

373-30 Meaning of expenditure on the item

373-35 Effective life of intellectual property

Subdivision 373-C—Partial realisation of item of intellectual property

Guide to Subdivision 373-C

373-40 What this Subdivision is about

Operative provisions

373-45 Amount arising from a partial realisation of the item

373-50 How to work out the effects of the partial realisation

373-55 Item of intellectual property left after partial realisation

Subdivision 373-D—Balancing adjustments

373-60 When balancing adjustment is required

373-65 How to do the adjustment

373-70 Meaning of termination value

373-75 Meaning of written down value

Subdivision 373-E—Application of the Common rules

373-80 Application of Common rules in Division 41

373-85 Common rule 1 (roll-over relief for related entities)

Subdivision 373-F—Adjustments affecting your deductions under this Division

Adjusting the amount you can deduct

373-90 Benefits from rights exercised outside Australia

Increasing your unrecouped expenditure on the item

373-95 Expenditure incurred in obtaining the surrender of a licence

Adjusting your expenditure on the item

373-100 If the item is acquired in a non-arm’s length transaction

373-105 Some cases where the item is a percentage interest of another item, or is a licence

Subdivision 387‑C—Establishing horticultural plants

Guide to Subdivision 387‑C

387‑160 What this Subdivision is about

387‑162 Simplified outline

Deductions

387‑165 Deduction for expenditure relating to establishment of a horticultural plant

387‑170 Meaning of horticultural plant, horticulture business, horticulture and commercial horticulture

387‑175 Meaning of effective life

387‑177 Determination of effective life by the Commissioner

387‑180 Immediate write‑off for a horticultural plant with an effective life under 3 years

387‑185 Deduction for a horticultural plant with an effective life of 3 years or more

387‑190 Extra deduction for income year of destruction of a horticultural plant with an effective life of 3 years or more

387‑195 Expenditure you cannot deduct

Change of ownership

387‑205 Getting tax information if you acquire a horticultural plant (regardless of its effective life)

Lessees and licensees of land with horticultural plants are treated as owners

387‑210 Lessees and licensees of land are treated as if they own horticultural plants on the land

Division 392—Long‑term averaging of primary producers’ tax liability

Guide to Division 392

392‑1 What this Division is about

392‑5 Overview of averaging process

Subdivision 392‑A—Is your income tax affected by averaging?

392‑10 Individuals who carry on a primary production business

392‑15 Meaning of basic taxable income

392‑20 Trust beneficiaries taken to be carrying on primary production business

392‑25 Choosing not to have your income tax averaged

Subdivision 392‑B—What kind of averaging adjustment must you make?

Guide to Subdivision 392‑B

392‑30 What this Subdivision is about

Tax offset or extra income tax

392‑35 Will you get a tax offset or have to pay extra income tax?

How to work out the comparison rate

392‑40 Identify income years for averaging your basic taxable income

392‑45 Work out your average income for those years

392‑50 Work out the income tax on your average income at basic rates

392‑55 Work out the comparison rate

Subdivision 392‑C—How big is your averaging adjustment?

Guide to Subdivision 392‑C

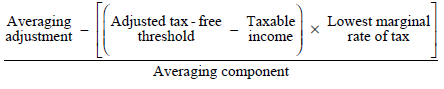

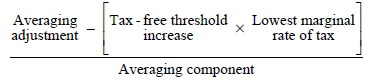

392‑60 What this Subdivision is about

392‑65 What your averaging adjustment reflects

Your gross averaging amount

392‑70 Working out your gross averaging amount

Your averaging adjustment

392‑75 Working out your averaging adjustment

How to work out your averaging component

392‑80 Work out your taxable primary production income

392‑85 Work out your taxable non‑primary production income

392‑90 Work out your averaging component

Subdivision 392‑D—Effect of permanent reduction of your basic taxable income

392‑95 You are treated as if you had not carried on business before

Division 400—Environmental impact assessment and environmental protection

Guide to Division 400

400‑1 What this Division is about

Subdivision 400‑A—Deducting expenditure on environmental impact assessment

400‑15 Deducting your expenditure on environmental impact assessment of your project

400‑20 Limits on deductions

Subdivision 400‑B—Deducting expenditure on environmental protection activities

400‑55 Deducting your expenditure on environmental protection activities

400‑60 Meaning of environmental protection activities

400‑65 Limits on deductions

Subdivision 400‑C—Property taken to be used for producing assessable income

400‑100 Use for environmental impact assessment or environmental protection activities taken to be use for purpose of producing assessable income

Division 405—Above‑average special professional income of authors, inventors, performing artists, production associates and sportspersons

Guide to Division 405

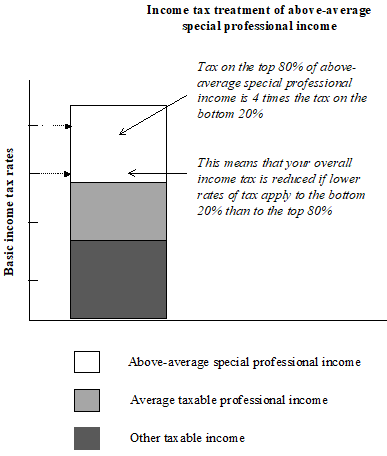

405‑1 What this Division is about

405‑5 Special rate of income tax on your above‑average special professional income

405‑10 Overview of the Division

Subdivision 405‑A—Above‑average special professional income

405‑15 When do you have above‑average special professional income?

Subdivision 405‑B—Assessable professional income

405‑20 What you count as assessable professional income

405‑25 Meaning of special professional, performing artist, production associate, sportsperson and sporting competition

405‑30 What you cannot count as assessable professional income

405‑35 Limits on counting amounts as assessable professional income

405‑40 Joint author or inventor treated as sole author or inventor

Subdivision 405‑C—Taxable professional income and average taxable professional income

405‑45 Working out your taxable professional income

405‑50 Working out your average taxable professional income

Schedule 2—CGT (new Parts 3-1, 3-3 and 3-5)

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Part 3-1—Capital gains and losses: general topics

Division 102—Application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997

102-1 Application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997

102-5 Working out capital gains and capital losses

102-15 Applying net capital losses

102-20 Net capital gains, capital gains and capital losses for income years before 1998‑99

Division 104—CGT events

Subdivision 104-B—Use and enjoyment before title passes

104-15 Use and enjoyment before title passes

Subdivision 104-E—Trusts

104-70 Capital payment before 18 December 1986 for trust interest

104-72 Application to Divisions 10C and 10D of Part III of the Income Tax Assessment Act 1936

Subdivision 104-J—Reversal of roll-overs

104-175 Company ceasing to be member of wholly-owned group after roll-over

Subdivision 104-K—Other CGT events

104-210 Bankrupt pays amount in relation to debt

Division 108—CGT assets

Subdivision 108-A—What a CGT asset is

108-5 CGT assets

Subdivision 108-B—Collectables

108-15 Sets of collectables

Subdivision 108-D—Separate CGT assets

108-75 Capital improvements to CGT assets for which a roll-over may be available

108-85 Improvement threshold

Division 109—Acquisition of CGT assets

Subdivision 109-A—Operative rules

109-5 General acquisition rules

Division 110—Cost base and reduced cost base

Subdivision 110-A—Cost base

110-35 Incidental costs

Division 112—Modifications to cost base and reduced cost base

Subdivision 112-A—General rules

112-20 Market value substitution rule

Division 118—Exemptions

Subdivision 118-A—General exemptions

118-10 Interests in collectables

Subdivision 118-B—Main residence

118-195 Exemption—dwelling acquired from deceased estate

Subdivision 118-C—Goodwill

118-260 Business exemption threshold

Division 121—Record keeping

121-15 Retaining records under Division 121

121-25 Records for mergers between qualifying superannuation funds

Part 3-3—Capital gains and losses: special topics

Division 126—Same asset roll-overs

126-100 Merger of qualifying superannuation funds

Division 128—Effect of death

128-15 Effect on the legal personal representative or beneficiary

Division 130—Investments

Subdivision 130-A—Bonus shares and units

130-20 Issue of bonus shares or units

Subdivision 130-B—Rights

130-40 Exercise of rights

Subdivision 130-C—Convertible notes

130-60 Shares or units acquired by converting a convertible note

Subdivision 130-D—Employee share schemes

130-95 Application of Division

130-100 Cost base modification

130-105 Time of acquisition

130-110 Disposals by trustees

130-115 Deceased estates

130-120 Amendment of assessments

Division 134—Options

134-1 Exercise of options

Division 136—Non-residents

Subdivision 136-A—Making a capital gain or loss

136-25 When an asset has the necessary connection with Australia

Division 140—Share value shifting

Subdivision 140-A—When is there share value shifting?

140-7 Pre-1994 share value shifts irrelevant

140-15 Off-market buy backs

Division 149—When an asset stops being a pre-CGT asset

149-5 Assets that stopped being pre-CGT assets under old law

Part 3-5—Corporate taxpayers and corporate distributions

Division 165—Income tax consequences of changing ownership or control of a company

Subdivision 165-CA—Applying net capital losses of earlier income years

165-95 Application of Subdivision 165-CA of the Income Tax Assessment Act 1997

Subdivision 165-CB—Working out the net capital gain and the net capital loss for the income year of the change

165-105 Application of Subdivision 165-CB of the Income Tax Assessment Act 1997

Division 170—Treatment of company groups for income tax purposes

Subdivision 170-B—Transfer of net capital losses within wholly-owned groups of companies

170-101 Application of Subdivision 170-B of the Income Tax Assessment Act 1997

170-175 Direct and indirect interests in the loss company

170-180 Direct and indirect interests in the gain company

Division 175—Use of a company’s losses, deductions or bad debts to avoid income tax

Subdivision 175-CA—Tax benefits from unused net capital losses of earlier income years

175-40 Application of Subdivision 175-CA of the Income Tax Assessment Act 1997

Subdivision 175-CB—Tax benefits from unused capital losses of the current year

175-55 Application of Subdivision 175-CB of the Income Tax Assessment Act 1997

Chapter 6—The Dictionary

Part 6-1—Concepts and topics

Division 960—General

Subdivision 960-M—Indexation

960-262 Application of Subdivision 960-M of the Income Tax Assessment Act 1997

960-275 Indexation factor

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

42-395 How CGT applies to pooled plant

Subdivision 166-B—Working out the taxable income, tax loss, net capital gain and net capital loss for the income year of the change

175-25 Deduction injected into company because of available income or capital gain

Working out a PDF’s net capital gain and net capital loss

195-25 Applying a PDF’s net capital losses

195-30 PDF cannot transfer net capital loss

195-35 Net capital loss for year in which company becomes a PDF

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

102AAZB General modifications—CGT

124ZZD No net capital loss

159GZZZBC Capital gains adjustment

159GZZZBD Capital loss adjustment

159GZZZN Buy-back and cancellation disregarded for certain purposes

160ZNBA Application of this Division

160ZNTA Application of this Division

160ZZPJA Continued operation of Division

160ZZPZAA Continued operation of Division

160ZZRAAAA Continued operation of Division

160ZZZH Net capital losses

304 CGT rules are primary code for treatment of gains and losses

306 Treatment of CGT asset owned at the end of 30 June 1988

311 Exercise of rights

315 Options

408 Certain capital gains and losses disregarded

408A Certain events before commencing day ignored

409 Losses before 30 June 1990 to be disregarded

410 General modifications—CGT

414 Exercise of rights

419 Modified application of Subdivision 126-B of the Income Tax Assessment Act 1997

Part 4—Consequential amendment of other Acts

Australian Industry Development Corporation Act 1970

Bank Integration Act 1991

Civil Aviation Legislation Amendment Act 1995

Commonwealth Serum Laboratories Act 1961

Defence Act 1903

Federal Airports Corporation Act 1986

57D Capital gains tax

Financial Corporations (Transfer of Assets and Liabilities) Act 1993

18 Additional roll-over relief

19 For the receiving corporation, asset has necessary connection with Australia

Schedule 2—Net capital losses and the Income Tax Assessment Act 1997

Effect of transferring a net capital loss

170-110 When a corporation can transfer a net capital loss

170-115 Who can apply transferred loss

170-120 Gain company is taken to have made transferred loss

170-125 Tax treatment of consideration for transferred tax loss

Conditions for transfer

170-128 Financial Corporations (Transfer of Assets and Liabilities) Act 1993 must apply to asset transfer from loss company to gain company

170-132 The loss year

170-133 The transfer year

170-135 The loss company

170-140 The gain company

170-145 Maximum amount that can be transferred

Income Tax Rates Act 1986

Industry Research and Development Act 1986

Transport Legislation Amendment (Search and Rescue Service) Act 1997

Schedule 3—Company bad debts

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Subdivision 165-C—Deducting bad debts

165-135 Application of Subdivision 165-C of the Income Tax Assessment Act 1997

Division 166—Income tax consequences of changing ownership or control of a listed public company

Subdivision 166-C—Deducting bad debts

166-40 Application of Subdivision 166-C of the Income Tax Assessment Act 1997

Subdivision 175-C—Tax benefits from unused bad debt deductions

175-40 Application of Subdivision 175-C of the Income Tax Assessment Act 1997

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

165-1 What this Division is about

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

Part 4—Consequential amendment of other Acts

Commonwealth Bank Sale Act 1995

Financial Corporations (Transfer of Assets and Liabilities) Act 1993

Schedule 4—Intellectual property (new Division 373)

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Division 373—Intellectual property

373-1 Application of Division 373 of the Income Tax Assessment Act 1997

373-10 Application to item of intellectual property you owned before 1998-99

373-65 Effect on balancing adjustment if there has been roll-over relief under the old law only

373-100 Item you acquired in a non-arm’s length transaction

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

Schedule 5—Horticultural plants (new Subdivision 387-C)

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Subdivision 387‑C—Establishing horticultural plants

387‑160 Application of Subdivision 387‑C of the Income Tax Assessment Act 1997

387‑175 Saving of determinations specifying periods for effective life

387‑190 Deduction for destruction of a horticultural plant first used for commercial horticulture before 1998‑99 income year

387‑195 Treatment of deductions under Division 10F of Part III of the Income Tax Assessment Act 1936

387‑205 New owners’ requests for tax information from last owners of horticultural plants

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

Subdivision AA—Application

124ZZEA This Division does not apply after 1997‑98 year of income

Schedule 6—Averaging primary producers’ tax liability (new Division 392)

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Division 392—Long‑term averaging of primary producers’ tax liability

392‑1 Application of Division 392 of the Income Tax Assessment Act 1997

392‑25 Transitional provision—election under section 158A of the Income Tax Assessment Act 1936

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

4‑25 Special provisions for working out your basic income tax liability

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

Part 4—Consequential amendment of the Income Tax Rates Act 1986

12A Rate of extra income tax for primary producers

Schedule 7— Environment (new Division 400)

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Division 400—Environmental impact assessment and environmental protection

400‑10 Application of Subdivision 400‑A of the Income Tax Assessment Act 1997

400‑20 Deductions under section 82BB of the Income Tax Assessment Act 1936

400‑50 Application of Subdivision 400‑B of the Income Tax Assessment Act 1997

400‑100 Application of Subdivision 400‑C of the Income Tax Assessment Act 1997

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

Schedule 8—Above-average special professional income (new Division 405)

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

Division 405—Above‑average special professional income of authors, inventors, performing artists, production associates and sportspersons

405‑1 Application of Division 405 of the Income Tax Assessment Act 1997

Part 2—Consequential amendment of the Income Tax Assessment Act 1936

158BA Division 16A does not apply to 1998‑99 or later year of income

Part 3—Consequential amendment of the Income Tax Rates Act 1986

Schedule 9—Consequential amendments relating to indexation

Part 1—Amendment of the Income Tax (Transitional Provisions) Act 1997

42-70 Adjustment: acquiring a car at a discount

Part 2—Consequential amendment of the Income Tax Assessment Act 1997

Part 3—Consequential amendment of the Income Tax Assessment Act 1936

Part 4—Application

Schedule 10—Amendment of Chapter 6 (the Dictionary) of the Income Tax Assessment Act 1997

Subdivision 960-M—Indexation

Guide to Subdivision 960-M

960-260 What this Subdivision is about

960-265 The provisions for which indexation is relevant

Operative provisions

960-270 Indexing amounts

960-275 Indexation factor

960-280 Index number

Tax Law Improvement Act (No. 1) 1998

No. 46, 1998

An Act to amend the law about income tax, and for related purposes

[Assented to 22 June 1998]

The Parliament of Australia enacts:

This Act may be cited as the Tax Law Improvement Act (No. 1) 1998.

(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Schedule 2 (except item 3 of it) commences immediately after the commencement of Schedule 1.

(3) Schedule 3 commences immediately after the commencement of Schedule 2 (except item 4 of it).

(4) Each of Schedules 4 to 8 commences immediately after the commencement of the immediately preceding Schedule.

(5) Item 3 of Schedule 2 commences immediately after the commencement of Schedule 8.

Subject to section 2, each Act specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned. Any other item in a Schedule to this Act has effect according to its terms.

An amendment made by an item in a Schedule (except an item in Schedule 1 or in Part 1 of any of Schedules 2 to 8) applies to assessments for the 1998-99 income year and later income years, unless otherwise indicated in the Schedule in which the item appears.

Schedule 1—Amendment of the Income Tax Assessment Act 1997

1 Before Part 3-5

Insert:

Part 3-1—Capital gains and losses: general topics

Division 100—A Guide to capital gains and losses

100-1 What this Division is about

This Division is a simplified outline of the capital gains and capital losses provisions, commonly referred to as capital gains tax (CGT). It will help you to understand your current liabilities, and to factor CGT into your on-going financial affairs.

Table of sections

100-5 Effect of this Division

100-10 Fundamentals of CGT

100-15 Overview of Steps 1 and 2

Step 1—Have you made a capital gain or a capital loss?

100-20 What events attract CGT?

100-25 What are CGT assets?

100-30 Does an exception or exemption apply?

100-33 Can there be a roll-over?

Step 2—Work out the amount of the capital gain or loss

100-35 What is a capital gain or loss?

100-40 What factors come into calculating a capital gain or loss?

100-45 How to calculate the capital gain or loss for most CGT events

Step 3—Work out your net capital gain or loss for the income year

100-50 How to work out your net capital gain or loss

100-55 How do you comply with CGT?

Keeping records for CGT purposes

100-60 Why keep records?

100-65 What records?

100-70 How long you need to keep records

This Division is a *Guide.

Note: In interpreting an operative provision, a Guide may be considered only for limited purposes: see section 950-150.

(1) CGT affects your income tax liability because your assessable income includes your net capital gain for the income year. Your net capital gain is the total of your capital gains for the income year, reduced by certain capital losses you have made.

See later in this Guide (section 100-50) for more detail.

(2) When you prepare your income tax return, you need to check whether you have made any capital gains for the income year.

You also need to check whether you have made any capital losses. You cannot deduct a capital loss from your assessable income, but it will reduce your capital gain in the current income year or later income years.

(3) You will also need to consider the impact of CGT when doing your financial planning. In particular, you will need adequate record-keeping to deal most effectively with any immediate or future CGT liability.

To give you a sense of the range of things affected by CGT, if you are involved with any of the following, you may have a CGT liability now or at some time in the future:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100-15 Overview of Steps 1 and 2

Step 1—Have you made a capital gain or a capital loss?

100-20 What events attract CGT?

(1) You can make a capital gain or loss only if a CGT event happens.

(2) There are a wide range of CGT events. Some happen often and affect many different taxpayers. Others are rare and affect only a few.

Some examples of CGT events | ||

Situation | Event | Which CGT event? |

You own shares you acquired on or after 20 September 1985 | You sell them | CGT event A1 |

You sell a business | You agree with the purchaser not to operate a similar business in the same area | CGT event D1 |

You are a lessor | You receive a payment for changing the lease | CGT event F5 |

You own shares in a company | The company makes a payment (not a dividend) to you as a shareholder | CGT event G1 |

A summary of all the CGT events is in section 104-5.

Identifying the time of a CGT event

(3) The specific time when a CGT event happens is important for various reasons: in particular, for working out whether a capital gain or loss from the event affects your income tax for the current or another income year.

If a CGT event involves a contract, the time of the event will often be when the contract is made, not when it is completed.

The time of each CGT event is explained early in

the relevant section in Division 104.

(1) Most CGT events involve a CGT asset. (For many, there is an exception if the CGT asset was acquired before 20 September 1985.) However, many CGT events are concerned directly with capital receipts and do not involve a CGT asset.

See the summary of the CGT events in section 104-5.

(2) Some CGT assets are reasonably well-known:

• land and buildings, for example, a weekender;

• shares;

• units in a unit trust;

• collectables which cost over $500, for example, jewellery or an artwork;

• personal use assets which cost over $10,000, for example, a boat.

(3) Other CGT assets are not so well-known. For example:

• your home;

• contractual rights;

• goodwill;

• foreign currency.

For a full explanation of what things are CGT assets: see Division 108.

100-30 Does an exception or exemption apply?

(1) Once you identify a CGT event which applies to you, you need to know if there is an exception or exemption that would reduce the capital gain or loss or allow you to disregard it.

(2) There are 4 categories of exemptions:

1. exempt assets: for example, cars;

2. exempt receipts: for example, compensation for personal injury;

3. exempt transactions: for example, your tenancy comes to an end;

4. anti-overlap provisions (that reduce your capital gain by the amount that is otherwise assessable).

Note: Most of the exceptions are in Division 104. You will find a full explanation of the possible exemptions in Division 118.

Some exemptions are limited

(3) Take the family home for example. Generally, you are exempt from CGT when you make a capital gain on disposing of your main residence.

But this can change depending on how you came to own the house and what you have done with it. For example, if you rent it out, you may be liable to CGT when you sell it.

For the limits on the general exemption of your main residence:

see Subdivision 118-B.

100-33 Can there be a roll-over?

(1) Roll-overs allow you to defer or disregard a capital gain or loss from a CGT event. They apply in specific situations. Some require a choice (for example, where an asset is compulsorily acquired: see Subdivision 124-B) and some are automatic (for example, where an asset is transferred because of marriage breakdown: see Subdivision 126-A).

(2) There are 2 types of roll-over:

1. a replacement-asset roll-over allows you to defer a capital gain or loss from one CGT event until a later CGT event happens where a CGT asset is replaced with another one;

2. a same-asset roll-over allows you to disregard a capital gain or loss from a CGT event where the same CGT asset is involved.

Note: The replacement-asset roll-overs are listed in section 112-115, and the same-asset roll‑overs are listed in section 112-150.

Step 2—Work out the amount of the capital gain or loss

100-35 What is a capital gain or loss?

For most CGT events:

• You make a capital gain if you receive (or are entitled to receive) capital amounts from the CGT event which exceed your total costs associated with that event.

• You make a capital loss if your total costs associated with the CGT event exceed the capital amounts you receive (or are entitled to receive) from the event.

100-40 What factors come into calculating a capital gain or loss?

Capital proceeds

(1) For most CGT events, the capital amounts you receive (or are entitled to receive) from the event are called the capital proceeds.

To work out the capital proceeds: see Division 116.

Cost base and reduced cost base

(2) For most CGT events, your total costs associated with the event are worked out in 2 different ways:

• For the purpose of working out a capital gain, those costs are called the cost base of the CGT asset.

• For the purpose of working out a capital loss, those costs are called the reduced cost base of the asset.

One of the main differences is that the costs are indexed for inflation in working out a capital gain (which reduces the size of the gain), but not in working out a capital loss.

To work out the cost base and reduced cost base: see Division 110.

100-45 How to calculate the capital gain or loss for most CGT events

1. Work out your capital proceeds from the CGT event.

2. Work out the cost base for the CGT asset.

3. Subtract the cost base from the capital proceeds.

4. If the proceeds exceed the cost base, the difference is your capital gain.

5. If not, work out the reduced cost base for the asset.

6. If the reduced cost base exceeds the capital proceeds, the difference is your capital loss.

7. If the capital proceeds are less than the cost base but more than the reduced cost base, you have neither a capital gain nor a capital loss.

Step 3—Work out your net capital gain or loss for the income year

100-50 How to work out your net capital gain or loss

1. Add up your capital gains for the income year. Then add up your capital losses for the income year.

2. Subtract the total losses from the total gains.

3. If the gains exceed the losses, then also subtract any unapplied net capital losses for previous income years. If the result is still more than zero, then this is your net capital gain.

4. If the capital losses for the income year exceed the capital gains, the difference is your net capital loss. (You cannot deduct a net capital loss from your assessable income.)

For the rules on working out your net capital gain or loss:

see Division 102.

100-55 How do you comply with CGT?

Declare any net capital gain as assessable income in your income tax return.

Defer any net capital loss to the next income year for which you have capital gains that exceed the capital losses for that income year.

Keeping records for CGT purposes

1. To ensure you do not disadvantage yourself.

2. To comply as easily as possible.

3. To plan for your CGT position in future income years.

4. The law requires you to: see Division 121.

Keeping full records will make it easier for you to comply. For example, keep records of:

• receipts of purchase or transfer;

• interest on money you borrowed;

• costs of agents, accountants, legal, advertising etc.;

• insurance costs and land rates or taxes;

• any market valuations;

• costs of maintenance, repairs or modifications;

• brokerage on shares;

• legal costs.

100-70 How long you need to keep records

The law requires you to keep records for 5 years after a CGT event has happened.

Division 102—Assessable income includes net capital gain

102-1 What this Division is about

This Division tells you how to work out if you have made a net capital gain or a net capital loss for the income year. A net capital gain is included in your assessable income. However, you cannot deduct a net capital loss. (Amounts otherwise included in your assessable income do not form part of a net capital gain.)

Table of sections

Operative provisions

102-5 Assessable income includes net capital gain

102-10 How to work out your net capital loss

102-15 How to apply net capital losses

102-20 Ways you can make a capital gain or a capital loss

102-22 Amounts of capital gains and losses

102-23 CGT event still happens even if gain or loss disregarded

102-25 Order of application of CGT events

102-30 Exceptions and modifications

102-5 Assessable income includes net capital gain

(1) Your assessable income includes your net capital gain (if any) for the income year. You work out your net capital gain in this way:

Working out your net capital gain

Step 1. Add up the *capital gains you made during the income year. Also add up the *capital losses you made.

Step 2. Subtract your *capital losses from your *capital gains. (If your capital losses exceed your capital gains, you have no net capital gain for the income year.)

Note: You do have a net capital loss if your capital losses exceed your capital gains: see section 102-10.

Step 3. If the Step 2 amount is more than zero, reduce it by applying any unapplied *net capital losses from previous income years. (If this reduces it to zero, you have no net capital gain for the income year.)

Note: To apply net capital losses: see section 102-15.

Step 4. If the Step 3 amount is more than zero, it is your net capital gain for the income year.

Note: For exceptions and modifications to these rules: see section 102-30.

(2) However, if during the income year:

(a) you became bankrupt; or

(b) you were released from debts under a law relating to bankruptcy;

any *net capital loss you made for an earlier income year must be disregarded in working out whether you made a *net capital gain for the income year or a later one.

(3) Subsection (2) applies even though your bankruptcy is annulled if:

(a) the annulment happens under section 74 of the Bankruptcy Act 1966; and

(b) under the composition or scheme of arrangement concerned, you were, will be or may be released from debts from which you would have been released if instead you had been discharged from the bankruptcy.

102-10 How to work out your net capital loss

(1) You work out if you have a net capital loss for the income year in this way:

Working out your net capital loss

Step 1. Add up the *capital losses you made during the income year. Also add up the *capital gains you made.

Step 2. Subtract your *capital gains from your *capital losses.

Step 3. If the Step 2 amount is more than zero, it is your net capital loss for the income year.

Note: For exceptions and modifications to these rules: see section 102-30.

(2) You cannot deduct from your assessable income a *net capital loss for any income year.

Note: However, it can be applied against your capital gains for a later income year: see section 102-5 and subsection 102-15(3).

102-15 How to apply net capital losses

(1) In working out if you have a *net capital gain, your *net capital losses are applied in the order in which you made them.

(2) A *net capital loss can be applied only to the extent that it has not already been applied.

(3) To the extent that a *net capital loss cannot be applied in an income year, it can be carried forward to a later income year.

Example: You have capital gains for the income year of $1,000 and capital losses for the income year of $600. Your capital losses are subtracted from your capital gains to leave a balance of $400.

You have available net capital losses of $300 (for last year) and $200 (for the year before that).

The $400 is reduced to zero by applying the available net capital losses in the order in which you made them. This leaves $100 of the $300 to be carried forward and extinguishes the $200.

Note: For applying a net capital loss for the 1997-98 income year or an earlier income year: see section 102-15 of the Income Tax (Transitional Provisions) Act 1997.

102-20 Ways you can make a capital gain or a capital loss

You can make a *capital gain or *capital loss if and only if a *CGT event happens. The gain or loss is made at the time of the event.

Note 1: The full list of CGT events is in section 104-5.

Note 2: These Divisions of Part IIIA of the Income Tax Assessment Act 1936 continue to have effect for the purposes of working out capital gains and capital losses under this Part and Part 3-3:

See sections 160ZZPJA, 160ZZPZAA and 160ZZRAAAA of that Act.

102-22 Amounts of capital gains and losses

Most *CGT events provide for calculating a *capital gain or *capital loss by comparing 2 different amounts. The amount of the gain or loss is the difference between those amounts.

102-23 CGT event still happens even if gain or loss disregarded

A *CGT event still happens even if:

(a) it does not result in a *capital gain or *capital loss; or

(b) a capital gain or capital loss from the event is disregarded.

Example: Lindy sells a car. Section 118-5 says that any capital gain or loss from a CGT event happening to a car is disregarded. However, the sale is still an example of CGT event A1.

102-25 Order of application of CGT events

(1) Work out if a *CGT event (except *CGT events D1 and H2) happens to your situation. If more than one event can happen, the one you use is the one that is the most specific to your situation.

(2) However, there is an exception for *CGT event K5 (which depends on CGT event A1, C2 or E8 happening). In that case, CGT event K5 happens in addition to the other event.

(3) If no *CGT event (except *CGT events D1 and H2) happens:

(a) work out if CGT event D1 happens and use that event if it does; and

(b) if it does not, work out if CGT event H2 happens and use that event if it does.

Note: The full list of CGT events is in section 104-5.

102-30 Exceptions and modifications

Provisions of this Act are in normal text, the other provisions, in bold, are provisions of the Income Tax Assessment Act 1936.

Special rules affecting capital gains and capital losses | |||

| For this kind of entity: |

|

|

| All entities | You can subtract capital losses from collectables only from your capital gains from collectables. | section 108-10 |

| All entities | Disregard capital losses you make from personal use assets. | section 108-20 |

| All entities | If any of your commercial debts have been forgiven in the income year, your net capital losses (including net capital losses from collectables) may be reduced. | sections 245‑130 and 245-135 of Schedule 2C to the Income Tax Assessment Act 1936 |

| A company | If it has a change of ownership or control during the income year, and has not carried on the same business, it works out its net capital gain and net capital loss in a special way. | Subdivision 165-CB |

| A company | It cannot apply a net capital loss unless: the same people owned the company during both the loss year and the income year; and no person controlled the company’s voting power at any time during the income year who did not also control it during the whole of the loss year; or the company has carried on the same business and commenced no additional business or new transactions. | Subdivision 165-CA |

| A company | If one or more of these things happen: a capital gain or loss is injected into it; a tax benefit is obtained from its available net capital losses or current year capital losses; a tax benefit is obtained because of its available capital gains; the Commissioner can disallow its net capital losses or current year capital losses, and it may have to work out its net capital loss in a special way. | Division 175 |

| A company | A company can transfer a surplus amount of its net capital loss to another company so that the other company can apply the amount in the income year of the transfer. (Both companies must be members of the same wholly-owned group.) | Subdivision 170-B |

8 | A PDF | If it is a PDF at the end of an income year for which it has a net capital loss, it can apply the loss in a later income year only if it is a PDF throughout the last day of the later income year. | section 195-25 |

9 | A PDF | If it becomes a PDF during an income year, it works out its net capital gain and net capital loss for the income year in a special way. | section 195-35 |

10 | Body that has ceased to be an STB | Net capital losses made before cessation disregarded. Special rules apply in cessation year where net capital gain before cessation and net capital loss after cessation. | section 24AX |

11 | A life assurance company | Sections 102-5 and 102-10 do not apply to the calculation of net capital gains and losses. Capital gains and losses are instead allocated to separate classes of income. | section 116CD |

12 | A registered organisation | Sections 102-5 and 102-10 do not apply to the calculation of net capital gains and losses. Capital gains and losses are instead allocated to separate classes of income. | section 116GB |

13 | A PDF | Sections 102-5 and 102-10 do not apply to the calculation of net capital gains and losses. Capital gains and losses are instead allocated to separate classes of income. | Subdivision C of Division 10E of Part III |

14 | A CFC | In calculating the CFC’s attributable income, pre-1 July 1990 capital losses are disregarded. | section 409 |

103-1 What this Division is about

This Division sets out some general rules that apply to the provisions dealing with capital gains and capital losses.

Table of sections

Operative provisions

103-5 Giving property as part of a transaction

103-10 Entitlement to receive money or property

103-15 Requirement to pay money or give property

103-20 Amounts to be expressed in Australian currency

103-25 Choices

103-5 Giving property as part of a transaction

There are a number of provisions in this Part and Part 3-3 that say that a payment, cost or expenditure can include giving property.

To the extent that one does, use the market value of the property in working out the amount of the payment, cost or expenditure.

103-10 Entitlement to receive money or property

(1) This Part and Part 3-3 apply to you as if you had received money or other property if it has been applied for your benefit (including by discharging all or part of a debt you owe) or as you direct.

(2) Those Parts apply to you as if you are entitled to receive money or other property:

(a) if you are entitled to have it so applied; or

(b) if:

(i) you will not receive it until a later time; or

(ii) the money is payable by instalments.

103-15 Requirement to pay money or give property

This Part and Part 3-3 apply to you as if you are required to pay money or give other property even if:

(a) you do not have to pay or give it until a later time; or

(b) the money is payable by instalments.

103-20 Amounts to be expressed in Australian currency

If an amount of money or the market value of other property:

(a) is to be taken into account at a particular time under this Part or Part 3-3; and

(b) is in a foreign currency;

it is to be converted into the equivalent amount of Australian currency at that time.

(1) A choice you can make under this Part or Part 3-3 must be made:

(a) by the day you lodge your *income tax return for the income year in which the relevant *CGT event happened; or

(b) within a further time allowed by the Commissioner.

(2) The way you (and any other entity making the choice) prepare your *income tax returns is sufficient evidence of the making of the choice.

(3) However, there are 2 exceptions: see subsections 124-380(5) and 124‑465(5). These relate to *replacement-asset roll-over events where there is an interposed company. The company is required to make the choice at an earlier time specified in that subsection.

Note: This section is modified in calculating the attributable income of a CFC: see section 421 of the Income Tax Assessment Act 1936.

Table of Subdivisions

Guide to Division 104

104-A Disposals

104-B Use and enjoyment before title passes

104-C End of a CGT asset

104-D Bringing into existence a CGT asset

104-E Trusts

104-F Leases

104-G Shares

104-H Special capital receipts

104-I Australian residency ends

104-J Reversals of roll-overs

104-K Other CGT events

104-1 What this Division is about

This Division sets out all the CGT events for which you can make a capital gain or loss. It tells you how to work out if you have made a gain or loss from each event and the time of each event. It also contains exceptions for gains and losses for many events (such as the exception for CGT assets acquired before 20 September 1985) and some cost base adjustment rules.

104-5 Summary of the CGT events