Authorised Deposit‑taking Institutions Supervisory Levy Imposition Act 1998

No. 51, 1998

Authorised Deposit‑taking Institutions Supervisory Levy Imposition Act 1998

No. 51, 1998

Authorised Deposit‑taking Institutions Supervisory Levy Imposition Act 1998

No. 51, 1998

An Act to impose a levy on authorised deposit‑taking institutions

Contents

1 Short title..................................1

2 Commencement..............................2

3 Act binds the Crown............................2

4 External Territories............................2

5 Definitions.................................2

6 Imposition of authorised deposit‑taking institutions supervisory levy 3

7 Amount of levy...............................3

8 Calculation of indexation factor.....................5

9 Regulations.................................5

Authorised Deposit-taking Institutions Supervisory Levy Imposition Act 1998

No. 51, 1998

An Act to impose a levy on authorised deposit-taking institutions

[Assented to 29 June 1998]

The Parliament of Australia enacts:

This Act may be cited as the Authorised Deposit‑taking Institutions Supervisory Levy Imposition Act 1998.

(1) Subject to subsection (2), this Act commences on a day to be fixed by Proclamation.

(2) If this Act does not commence under subsection (1) within the period of 24 months beginning on the day on which this Act receives the Royal Assent, it commences on the first day after the end of that period.

(3) If this Act commences during a financial year (but not on 1 July of that financial year), this Act has effect in relation to that financial year subject to the modifications specified in the regulations.

This Act binds the Crown in each of its capacities.

This Act extends to each external Territory.

In this Act, unless the contrary intention appears:

ADI has the same meaning as in the Banking Act 1959.

Note: ADI is short for authorised deposit‑taking institution.

indexation factor means the indexation factor calculated under section 8.

index number, in relation to a quarter, means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of that quarter.

levy imposition day, in relation to an ADI for a financial year, means:

(a) if the ADI is an ADI on 1 July of the financial year—that day; or

(b) in any other case—the day, during the financial year, on which the ADI becomes an ADI.

statutory upper limit means:

(a) in relation to the first financial year that ends after this Act commences—$1,000,000; or

(b) in relation to a later financial year—the amount calculated by multiplying the statutory upper limit for the previous financial year by the indexation factor for the later financial year.

Levy payable in accordance with subsection 8(1) of the Financial Institutions Supervisory Levies Collection Act 1998 is imposed.

(1) Subject to subsection (2), the amount of levy payable by an ADI for a financial year is:

(a) unless paragraph (b) or (c) applies—the amount that, for the financial year, is the levy percentage of the ADI’s asset value; or

(b) if the amount worked out under paragraph (a) exceeds the maximum levy amount for the financial year—the maximum levy amount; or

(c) if the amount worked out under paragraph (a) is less than the minimum levy amount for the financial year—the minimum levy amount.

Note: The levy percentage, maximum levy amount, minimum levy amount and the method of working out the ADI’s asset value, are as determined under subsection (3).

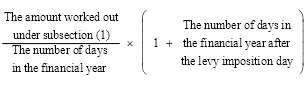

(2) If the levy imposition day for the ADI for the financial year is later than 1 July in the financial year, the amount of levy payable by the ADI for the financial year is the amount worked out using the following formula:

(3) The Treasurer is, in writing, to determine:

(a) the maximum levy amount for each financial year; and

(b) the minimum levy amount for each financial year; and

(c) the levy percentage for each financial year; and

(d) how an ADI’s asset value is to be worked out.

(4) An amount determined under subsection (3) as the maximum levy amount must not exceed the statutory upper limit as at the time when the determination is made.

(5) The Treasurer’s determination under paragraph (3)(d) of how an ADI’s asset value is to be worked out is to include, but is not limited to, a determination of the day as at which the ADI’s asset value is to be worked out. That day must be:

(a) if the ADI was an ADI at all times from and including 17 March of the previous financial year to and including the following 30 June—a day in the period from and including that 17 March to and including the following 14 April; or

(b) if the ADI was not an ADI at all times from and including 17 March of the previous financial year to and including the following 30 June—the day after that 17 March when the ADI became, or becomes, an ADI.

(6) A determination under subsection (3) may make different provision for different classes of ADIs.

(7) A determination under subsection (3) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

(1) The indexation factor for a financial year is the number worked out by dividing the index number for the March quarter immediately preceding that financial year by the index number for the March quarter immediately preceding that first‑mentioned March quarter.

(2) The indexation factor is to be calculated to 3 decimal places, but increased by .001 if the 4th decimal place is more than 4.

(3) Calculations under subsection (1):

(a) are to be made using only the index numbers published in terms of the most recently published reference base for the Consumer Price Index; and

(b) are to be made disregarding index numbers that are published in substitution for previously published index numbers (where the substituted numbers are published to take account of changes in the reference base).

The Governor‑General may make regulations for the purposes of subsection 2(3).

[Minister's second reading speech made in—

House of Representatives on 26 March 1998

Senate on 13 May 1998]

(32/98)