States Grants (General Purposes) Amendment Act 1998

No. 109, 1998

States Grants (General Purposes) Amendment Act 1998

No. 109, 1998

States Grants (General Purposes) Amendment Act 1998

No. 109, 1998

An Act to amend the States Grants (General Purposes) Act 1994, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedule(s)

Schedule 1—Amendment of the States Grants (General Purposes) Act 1994

States Grants (General Purposes) Amendment Act 1998

No. 109, 1998

An Act to amend the States Grants (General Purposes) Act 1994, and for related purposes

[Assented to 7 December 1998]

The Parliament of Australia enacts:

This Act may be cited as the States Grants (General Purposes) Amendment Act 1998.

This Act commences on the day on which it receives the Royal Assent.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Subsection 4(1)

Insert:

Torres Strait Treaty means the Treaty between Australia and the Independent State of Papua New Guinea concerning Sovereignty and Maritime Boundaries in the area between the 2 countries, including the area known as Torres Strait, and Related Matters, signed at Sydney, Australia on 18 December 1978.

Note: The text of the Treaty is set out in the Australian Treaty Series 1985 No. 4.

2 Subsection 5(1)

Omit all the words after “where:”, substitute:

RCC (reduction in certain circumstances) means the amount determined by the Health Minister before 10 June in the grant year to be the estimate of the reduction in the amount otherwise payable to the State during the grant year under a health care grant (being a reduction required by the conditions of the grant).

SDA (sum of deductible amounts) means the amount determined by the Health Minister before 10 June in the grant year to be the estimate of such part of TAP as is the sum of the following amounts:

(a) the sum of the deductible amounts payable to the State during the grant year;

(b) the sum of the deductible amounts payable to a hospital, or to another person, during the grant year, being amounts that would have been payable to the State had the Health Minister been satisfied that the State was adhering to the principles set out in subsection 6(2) of the Health Care (Appropriation) Act 1998.

TAP (total amount payable) means the amount determined by the Health Minister before 10 June in the grant year to be the estimate of the sum of the following amounts:

(a) the amount payable to the State during the grant year under a health care grant;

(b) the amount payable to a hospital, or to another person, during the grant year under a health care grant, being an amount that would have been payable to the State had the Health Minister been satisfied that the State was adhering to the principles set out in subsection 6(2) of the Health Care (Appropriation) Act 1998.

3 Subsection 5(2)

Repeal the subsection, substitute:

(2) For the purposes of this section:

deductible amounts are amounts that relate to the following:

(a) mental health services;

(b) projects or programs of a kind referred to in paragraph 4(1)(b) of the Health Care (Appropriation) Act 1998;

(c) the critical and urgent treatment incentive program;

(d) the recognition of special demands arising from the Torres Strait Treaty;

(e) the transition from a 1993‑98 Medicare Agreement to another agreement or arrangement between the Commonwealth and a State, being an agreement or arrangement that specifies conditions applying to health care grants;

(f) a service, project or program, or a component of a health care grant, that is determined by the Health Minister to be a service, project, program or component in relation to which an amount payable is to be treated as a deductible amount.

health care grant means a grant of financial assistance under section 4 of the Health Care (Appropriation) Act 1998.

4 Section 10

Omit “the grant year commencing 1 July 1997”, substitute “a grant year”.

5 After section 11

Insert:

(1) This section applies if the amounts paid, or taken (under this Act or any other Act) to have been paid, by a State during the grant year commencing on 1 July 1998 in satisfaction of the State’s 1998‑99 fiscal contribution (within the meaning of section 15C), exceed the amount of the State’s 1998‑99 fiscal contribution.

(2) The Treasurer may pay an amount by way of financial assistance to the State during the grant year commencing on 1 July 1998, or during the next grant year, that is equal to the amount of the excess.

6 Section 12A

Omit “the grant year commencing on 1 July 1997”, substitute “a grant year”.

Note: The heading to section 10 is altered by omitting “—1997‑98”.

7 After section 15B

Insert:

(1) Financial assistance to which a State is entitled under section 9 (a financial assistance grant) in relation to the grant year commencing on 1 July 1998 is granted on condition that the State will pay to the Commonwealth an amount of fiscal contribution (1998‑99 fiscal contribution) worked out in accordance with the applicable Schedule.

(2) The Treasurer may deduct from a financial assistance grant to a State in relation to the grant year commencing on 1 July 1998:

(a) an amount that does not exceed the unpaid amount of the State’s 1998‑99 fiscal contribution; and

(b) if part of the State’s 1997‑98 fiscal contribution (within the meaning of section 15B) remained unpaid on 1 July 1998—an amount that does not exceed the unpaid amount of the State’s 1997‑98 fiscal contribution.

(3) An amount deducted under subsection (2) is taken to have been paid by the State to the Commonwealth in satisfaction of whichever of the following fiscal contributions is applicable:

(a) if the amount was deducted under paragraph (2)(a)—the State’s 1998‑99 fiscal contribution;

(b) if the amount was deducted under paragraph (2)(b)—the State’s 1997‑98 fiscal contribution.

(4) A reference in this section to an unpaid amount of a State’s fiscal contribution for a grant year does not include a reference to an amount taken (under this Act or any other Act) to have been paid by the State in satisfaction of the State’s fiscal contribution for the grant year.

8 Subsection 20(1)

After “15B,” insert “15C,”

9 At the end of the Act

Add:

This Schedule relates to the grant year commencing on 1 July 1998.

(1) In this Schedule:

base assistance amount has the meaning given by subclause (2).

CEO means the Chief Executive Officer of Customs.

Commissioner means the Commissioner of Taxation.

June 1998 ABA amount means the amount determined by the Commissioner, before 15 June 1999, to be the additional amount of sales tax on taxable dealings to which the Sales Tax Surcharge Acts relate that was collected during the month of June 1998 because of a Commonwealth surcharge.

June 1998 ABA estimate amount means the amount determined by the Commissioner under paragraph (b) of the definition of ABA in subclause 5(1) of Schedule 4.

June 1998 PBA amount means the sum of the amounts determined by the CEO, before 15 June 1999, to be:

(a) the additional amount of customs duty falling to subheadings of Chapter 27 of Schedule 3 to the Customs Tariff Act 1995 that was collected during the month of June 1998 because of a Commonwealth surcharge; and

(b) the additional amount of excise duty falling to items 11 and 12 of the Schedule to the Excise Tariff Act 1921 that was collected during the month of June 1998 because of a Commonwealth surcharge.

June 1998 PBA estimate amount means the sum of the amounts determined by the CEO under paragraphs (b) and (d) of the definition of PBA in subclause 5(1) of Schedule 4.

June 1998 TBA amount means the sum of the amounts determined by the CEO, before 15 June 1999, to be:

(a) the additional amount of customs duty falling to subheadings of Chapter 24 of Schedule 3 to the Customs Tariff Act 1995 that was collected during the month of June 1998 because of a Commonwealth surcharge; and

(b) the additional amount of excise duty falling to items 6, 7 and 8 of the Schedule to the Excise Tariff Act 1921 that was collected during the month of June 1998 because of a Commonwealth surcharge.

June 1998 TBA estimate amount means the sum of the amounts determined by the CEO under paragraphs (b) and (d) of the definition of TBA in subclause 5(1) of Schedule 4.

pre‑1 June period means the period from the beginning of 1 July 1998 to the end of 31 May 1999.

previous year means the financial year commencing on 1 July 1997.

(2) In this Schedule:

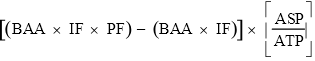

base assistance amount means the amount worked out using the formula:

![]()

where:

PYBAA (previous year base assistance amount) means $15,828,423,529.

PYIF (previous year index factor) means the index factor for the previous year.

PYPF (previous year population factor) means the population factor for the previous year.

Note: $366,641,403 is an amount that was paid under section 12 in relation to the grant year commencing on 1 July 1996, which would otherwise have been paid under section 9.

The relativities factor for each State for the grant year is as shown in the following table:

Relativities factors | ||

Item | State | Relativities factor |

1 | New South Wales | 0.87765 |

2 | Victoria | 0.88042 |

3 | Queensland | 1.02186 |

4 | Western Australia | 0.98252 |

5 | South Australia | 1.22194 |

6 | Tasmania | 1.55086 |

7 | Australian Capital Territory | 0.95145 |

8 | Northern Territory | 4.81869 |

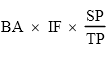

For the purposes of section 10, the maximum amount that may be deducted from the financial assistance grant payable to a State is the amount worked out using the formula:

where:

ASP (adjusted state population) means the adjusted population of the State in relation to the grant year.

ATP (adjusted total population) means the sum of the adjusted populations of all the States in relation to the grant year.

BAA (base assistance amount) means the base assistance amount for the grant year.

IF (index factor) means the index factor for the grant year.

PF (population factor) means the population factor for the grant year.

(1) For the purposes of section 11A, the revenue replacement payment to be made to a State is worked out using the formula:

![]()

where:

ABA (alcohol base amount) means the sum of:

(a) the amounts determined by the Commissioner, before 15 June 1999, to be:

(i) the additional amount of sales tax on taxable dealings to which the Sales Tax (Surcharge) Acts relate that was collected during the pre‑1 June period because of a Commonwealth surcharge; and

(ii) the additional amount of sales tax on taxable dealings to which the Sales Tax (Surcharge) Acts relate that the Commissioner estimates to be likely to be collected during the month of June 1999 because of a Commonwealth surcharge; and

(b) if the June 1998 ABA amount exceeds the June 1998 ABA estimate amount—the amount of the excess;

less the sum of:

(c) if the June 1998 ABA estimate amount exceeds the June 1998 ABA amount—the amount of the excess; and

(d) the amount determined by the Commissioner to be the additional administrative costs incurred by the Commonwealth in the grant year because of that surcharge or those surcharges.

AS (alcohol share) for a State means:

(a) if paragraph (b) does not apply—the number set out opposite the name of the State in the table at the end of this definition; or

(b) if the regulations prescribe a number as the alcohol share for each State for the purposes of this definition—the number so prescribed for the State.

Revenue replacement payments—alcohol share | ||

Item | State | Alcohol share |

1 | New South Wales | 0.33796 |

2 | Victoria | 0.22332 |

3 | Queensland | 0.19314 |

4 | Western Australia | 0.11147 |

5 | South Australia | 0.07857 |

6 | Tasmania | 0.02415 |

7 | Australian Capital Territory | 0.01569 |

8 | Northern Territory | 0.01569 |

PBA (petroleum base amount) means the sum of:

(a) the amounts determined by the CEO, before 15 June 1999, to be:

(i) the additional amount of customs duty on goods falling to subheadings of Chapter 27 of Schedule 3 to the Customs Tariff Act 1995 that was collected during the pre‑1 June period because of a Commonwealth surcharge; and

Note: Chapter 27 of Schedule 3 to the Customs Tariff Act 1995 deals with petroleum products.

(ii) the additional amount of customs duty on goods falling to subheadings of Chapter 27 of Schedule 3 to the Customs Tariff Act 1995 that the CEO estimates to be likely to be collected during the month of June 1999 because of a Commonwealth surcharge; and

(iii) the additional amount of excise duty on goods falling to items 11 and 12 of the Schedule to the Excise Tariff Act 1921 that was collected during the pre‑1 June period because of a Commonwealth surcharge; and

Note: Items 11 and 12 of the Schedule to the Excise Tariff Act 1921 deals with petroleum products.

(iv) the additional amount of excise duty on goods falling to items 11 and 12 of the Schedule to the Excise Tariff Act 1921 that the CEO estimates to be likely to be collected during the month of June 1999 because of a Commonwealth surcharge;

(b) if the June 1998 PBA amount exceeds the June 1998 PBA estimate amount—the amount of the excess;

less the sum of:

(c) if the June 1998 PBA estimate amount exceeds the June 1998 PBA amount—the amount of the excess; and

(d) the amount determined by the CEO to be the additional administrative costs incurred by the Commonwealth in the grant year because of those surcharges.

PS (petroleum share) for a State means:

(a) if paragraph (b) does not apply—the number set out opposite the name of the State in the table at the end of this definition; or

(b) if the regulations prescribe a number as the petroleum share for each State for the purposes of this definition—the number so prescribed for the State.

Revenue replacement payments—petroleum share | ||

Item | State | Petroleum share |

1 | New South Wales | 0.30039 |

2 | Victoria | 0.20153 |

3 | Queensland | 0.19593 |

4 | Western Australia | 0.17118 |

5 | South Australia | 0.07549 |

6 | Tasmania | 0.02453 |

7 | Australian Capital Territory | 0.01291 |

8 | Northern Territory | 0.01804 |

TBA (tobacco base amount) means the sum of:

(a) the amounts determined by the CEO, before 15 June 1999, to be:

(i) the additional amount of customs duty on goods falling to subheadings of Chapter 24 of Schedule 3 to the Customs Tariff Act 1995 that was collected during the pre‑1 June period because of a Commonwealth surcharge; and

Note: Chapter 24 of Schedule 3 to the Customs Tariff Act 1995 deals with tobacco and manufactured tobacco substitutes.

(ii) the additional amount of customs duty on goods falling to subheadings of Chapter 24 of Schedule 3 to the Customs Tariff Act 1995 that the CEO estimates to be likely to be collected during the month of June 1999 because of a Commonwealth surcharge; and

(iii) the additional amount of excise duty on goods falling to items 6, 7 and 8 of the Schedule to the Excise Tariff Act 1921 that was collected during the pre‑1 June period because of a Commonwealth surcharge; and

Note: Items 6, 7 and 8 of the Schedule to the Excise Tariff Act 1921 deal with tobacco, cigars and cigarettes.

(iv) the additional amount of excise duty on goods falling to items 6, 7 and 8 of the Schedule to the Excise Tariff Act 1921 that the CEO estimates to be likely to be collected during the month of June 1999 because of a Commonwealth surcharge; and

(b) if the June 1998 TBA amount exceeds the June 1998 TBA estimate amount—the amount of the excess;

less the sum of:

(c) if the June 1998 TBA estimate amount exceeds the June 1998 TBA amount—the amount of the excess; and

(d) the amount determined by the CEO to be the additional administrative costs incurred by the Commonwealth in the grant year because of those surcharges.

TS (tobacco share) for a State means:

(a) if paragraph (b) does not apply—the number set out opposite the name of the State in the table at the end of this definition; or

(b) if the regulations prescribe a number as the tobacco share for each State for the purposes of this definition—the number so prescribed for the State.

Revenue replacement payments—tobacco share | ||

Item | State | Tobacco share |

1 | New South Wales | 0.32492 |

2 | Victoria | 0.21803 |

3 | Queensland | 0.19065 |

4 | Western Australia | 0.11100 |

5 | South Australia | 0.08988 |

6 | Tasmania | 0.03226 |

7 | Australian Capital Territory | 0.01456 |

8 | Northern Territory | 0.01870 |

(2) In determining, for the purposes of subclause (1), the additional amount of customs duty or excise duty that was collected, or is likely to be collected, during a particular period because of a Commonwealth surcharge, the CEO is to take into account the impact of the operation of:

(a) section 19 of the Customs Tariff Act 1995; or

(b) section 6A of the Excise Tariff Act 1921;

as the case requires.

Note: Section 19 of the Customs Tariff Act 1995 and section 6A of the Excise Tariff Act 1921 provide for the automatic indexation of certain rates of duty which include rates payable on tobacco etc. and petroleum products.

For the purposes of section 11B, the franchise fees windfall tax reimbursement payment to be made to a State is equal to the sum of the amounts determined by the Commissioner, before 22 June 1999, to be:

(a) the total of the amounts of tax collected, and remitted to the Commissioner, by the State under the Franchise Fees Windfall Tax (Collection) Act 1997 during the period beginning at the beginning of 1 July 1998 and ending at the end of 21 June 1999; and

(b) the total of the amounts of tax likely to be collected, and remitted to the Commissioner, by the State under that Act during the month of June 1999.

For the purposes of section 12, the base amount for each State is zero.

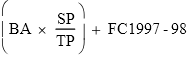

For the purposes of section 12A, the maximum amount that may be paid to a State is the amount worked out using the formula:

where:

BA (base amount) means $213,138,038.

IF (index factor) means the index factor for the grant year.

SP (State population) means the estimated population of the State on 31 December 1998.

TP (total population) means the sum of the estimated populations of all States on 31 December 1998.

(1) For the purposes of section 15C, the amount of fiscal contribution payable by a State is as follows:

(a) for a State other than Tasmania or the Australian Capital Territory—the amount worked out using the following formula:

(b) for Tasmania or the Australian Capital Territory—the amount worked out using the formula:

Note: In 1997‑98, one half of the scheduled fiscal contributions of Tasmania and the ACT were deferred to 1998‑99.

(2) In this clause:

BA (base amount) means $300,000,000.

FC1997‑98 means the amount of the 1997‑98 fiscal contribution worked out using the formula set out in paragraph 9(1)(b) of Schedule 4 to this Act.

SP (state population) means the estimated population of the State on 31 December 1998.

TP (total population) means the estimated populations of all States on 31 December 1998.

[Minister’s second reading speech made in—

House of Representatives on 11 November 1998

Senate on 23 November 1998]

(146/98)