A New Tax System (Goods and Services Tax) Act 1999

No. 55, 1999

A New Tax System (Goods and Services Tax) Act 1999

No. 55, 1999

A New Tax System (Goods and Services Tax) Act 1999

No. 55, 1999

Chapter 1—Introduction

Part 1‑1—Preliminary

Division 1—Preliminary

1‑1.................................Short title

1‑2.............................Commencement

1‑3.........Commonwealth‑State financial relations

Part 1‑2—Using this Act

Division 2—Overview of the GST legislation

2‑1..........................What this Act is about

2‑5.......................The basic rules (Chapter 2)

2‑10.....................The exemptions (Chapter 3)

2‑15.....................The special rules (Chapter 4)

2‑20......................Miscellaneous (Chapter 5)

2‑25................Interpretative provisions (Chapter 6)

2‑30Administration, collection and recovery provisions (Part VI of the Taxation Administration Act 1953)

Division 3—Defined terms

3‑1...................When defined terms are identified

3‑5.....................When terms are not identified

3‑10.............Identifying the defined term in a definition

Division 4—Status of Guides and other non‑operative material

4‑1....................Non‑operative material

4‑5...........................Explanatory sections

4‑10..............................Other material

Chapter 2—The basic rules

Division 5—Introduction

5‑1.......................What this Chapter is about

5‑5......................The structure of this Chapter

Part 2‑1—The central provisions

Division 7—The central provisions

7‑1........................GST and input tax credits

7‑5...............................Net amounts

7‑10...............................Tax periods

7‑15.........................Payments and refunds

Part 2‑2—Supplies and acquisitions

Division 9—Taxable supplies

9‑1.......................What this Division is about

Subdivision 9‑A—What are taxable supplies?

9‑5.............................Taxable supplies

9‑10...........................Meaning of supply

9‑15..............................Consideration

9‑20................................Enterprises

9‑25..................Supplies connected with Australia

9‑30........Supplies that are GST‑free or input taxed

9‑39..............Special rules relating to taxable supplies

Subdivision 9‑B—Who is liable for GST on taxable supplies?

9‑40................Liability for GST on taxable supplies

9‑69..Special rules relating to liability for GST on taxable supplies

Subdivision 9‑C—How much GST is payable on taxable supplies?

9‑70..............The amount of GST on taxable supplies

9‑75.....................The value of taxable supplies

9‑80The value of taxable supplies that are partly GST‑free or input taxed

9‑99Special rules relating to the amount of GST on taxable supplies

Division 11—Creditable acquisitions

11‑1......................What this Division is about

11‑5...................What is a creditable acquisition?

11‑10........................Meaning of acquisition

11‑15...................Meaning of creditable purpose

11‑20Who is entitled to input tax credits for creditable acquisitions?

11‑25How much are the input tax credits for creditable acquisitions?

11‑30...............Acquisitions that are partly creditable

11‑99................Special rules relating to acquisitions

Part 2‑3—Importations

Division 13—Taxable importations

13‑1......................What this Division is about

13‑5....................What are taxable importations?

13‑10..........Meaning of non‑taxable importation

13‑15.........Who is liable for GST on taxable importations?

13‑20......How much GST is payable on taxable importations?

13‑25The value of taxable importations that are partly non‑taxable importations

13‑99...........Special rules relating to taxable importations

Division 15—Creditable importations

15‑1......................What this Division is about

15‑5..................What are creditable importations?

15‑10...................Meaning of creditable purpose

15‑15Who is entitled to input tax credits for creditable importations?

15‑20How much are the input tax credits for creditable importations?

15‑25...............Importations that are partly creditable

15‑99.........Special rules relating to creditable importations

Part 2‑4—Net amounts and adjustments

Division 17—Net amounts and adjustments

17‑1......................What this Division is about

17‑5...............................Net amounts

17‑10..............................Adjustments

17‑99.......Special rules relating to net amounts or adjustments

Division 19—Adjustment events

19‑1......................What this Division is about

19‑5...........Explanation of the effect of adjustment events

Subdivision 19‑A—Adjustment events

19‑10..........................Adjustment events

Subdivision 19‑B—Adjustments for supplies

19‑40...............Where adjustments for supplies arise

19‑45................Previously attributed GST amounts

19‑50................Increasing adjustments for supplies

19‑55................Decreasing adjustments for supplies

Subdivision 19‑C—Adjustments for acquisitions

19‑70.............Where adjustments for acquisitions arise

19‑75..........Previously attributed input tax credit amounts

19‑80..............Increasing adjustments for acquisitions

19‑85..............Decreasing adjustments for acquisitions

Division 21—Bad debts

21‑1......................What this Division is about

21‑5..............Writing off bad debts (taxable supplies)

21‑10.Recovering amounts previously written off (taxable supplies)

21‑15..........Bad debts written off (creditable acquisitions)

21‑20Recovering amounts previously written off (creditable acquisitions)

21‑99........Special rules relating to adjustments for bad debts

Part 2‑5—Registration

Division 23—Who is required to be registered and who may be registered

23‑1........................Explanation of Division

23‑5...................Who is required to be registered

23‑10........................Who may be registered

23‑15.................The registration turnover threshold

23‑99Special rules relating to who is required to be registered or who may be registered

Division 25—How you become registered, and how your registration can be cancelled

Subdivision 25‑A—How you become registered

25‑1................When you must apply for registration

25‑5.............When the Commissioner must register you

25‑10...............The date of effect of your registration

25‑15...............Effect of backdating your registration

25‑49................Special rules relating to registration

Subdivision 25‑B—How your registration can be cancelled

25‑50......When you must apply for cancellation of registration

25‑55........When the Commissioner must cancel registration

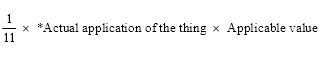

25‑60...............The date of effect of your cancellation

25‑65......Effect of backdating your cancellation of registration

25‑99.......Special rules relating to cancellation of registration

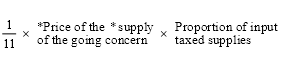

Part 2‑6—Tax periods

Division 27—How to work out the tax periods that apply to you

27‑1......................What this Division is about

27‑5.................General rule—3 month tax periods

27‑10.................Election of one month tax periods

27‑15..............Determination of one month tax periods

27‑20.........Withdrawing elections of one month tax periods

27‑25.......Revoking determinations of one month tax periods

27‑30Tax periods determined by the Commissioner to take account of changes in tax periods

27‑35........Changing the days on which your tax periods end

27‑37.........Special determination of tax periods on request

27‑38..........Revoking special determination of tax periods

27‑40.................An entity’s concluding tax period

27‑99................Special rules relating to tax periods

Division 29—What is attributable to tax periods

29‑1......................What this Division is about

Subdivision 29‑A—The attribution rules

29‑5...........Attributing the GST on your taxable supplies

29‑10Attributing the input tax credits for your creditable acquisitions

29‑15Attributing the input tax credits for your creditable importations

29‑20....................Attributing your adjustments

29‑25....Commissioner may determine particular attribution rules

29‑39.............Special rules relating to attribution rules

Subdivision 29‑B—Accounting on a cash basis

29‑40................Choosing to account on a cash basis

29‑45...............Permission to account on a cash basis

29‑50.................Ceasing to account on a cash basis

Subdivision 29‑C—Tax invoices and adjustment notes

29‑70..............................Tax invoices

29‑75...........................Adjustment notes

29‑80Tax invoices and adjustment notes not required for low value transactions

29‑99...Special rules relating to tax invoices and adjustment notes

Part 2‑7—Returns, payments and refunds

Division 31—GST returns

31‑1......................What this Division is about

31‑5.....................Who must give GST returns

31‑10.................When GST returns must be given

31‑15...............The form and contents of GST returns

31‑20.......................Additional GST returns

31‑25................Electronic lodgment of GST returns

31‑30.........................Signing GST returns

31‑99................Special rules relating to GST returns

Division 33—Payments of GST

33‑1......................What this Division is about

33‑5...........When payments of net amounts must be made

33‑10.............How payments of net amounts are made

33‑15..........Payments of amounts of GST on importations

33‑20...........Commissioner may extend time for payment

33‑25Commissioner may bring forward payment date if you are about to leave Australia

33‑30.......Net amounts etc. a debt due to the Commonwealth

33‑99............Special rules relating to payments of GST

Division 35—Refunds

35‑1......................What this Division is about

35‑5.....................When refunds must be made

35‑10........................How refunds are made

35‑99...................Special rules relating to refunds

Part 2‑8—Checklist of special rules

Division 37—Checklist of special rules

37‑1.......................Checklist of special rules

Chapter 3—The exemptions

Part 3‑1—Supplies that are not taxable supplies

Division 38—GST‑free supplies

38‑1......................What this Division is about

Subdivision 38‑A—Food

38‑2...................................Food

38‑3.................Food that is not GST‑free

38‑4............................Meaning of food

38‑5...................Premises used in supplying food

38‑6...........................Packaging of food

Subdivision 38‑B—Health

38‑7............................Medical services

38‑10.........................Other health services

38‑15.............Other government funded health services

38‑20..........................Hospital treatment

38‑25.........................Residential care etc.

38‑30.........................Community care etc.

38‑35..............................Flexible care

38‑40.....................Specialist disability services

38‑45.....................Medical aids and appliances

38-47 Other GST‑free health goods..................

38‑50...............Drugs and medicinal preparations etc.

38‑55.....................Private health insurance etc.

Subdivision 38‑C—Education

38‑85...........................Education courses

38‑90.......................Excursions or field trips

38‑95...........................Course materials

38‑100.............Supplies that are not GST‑free

38‑105............Accommodation at boarding schools etc.

38‑110.................Recognition of prior learning etc.

Subdivision 38‑D—Child care

38‑140Child care—suppliers registered under the Childcare Rebate Act

38‑145..............Child care—eligible child care centres

38‑150...........................Other child care

38‑155Supplies directly related to child care that is GST‑free

Subdivision 38‑E—Exports and other supplies for consumption outside Australia

38‑185...........................Exports of goods

38‑190Supplies of things, other than goods or real property, for consumption outside Australia

Subdivision 38‑F—Religious services

38‑220..........................Religious services

Subdivision 38‑G—Non‑commercial activities of charitable institutions etc.

38‑250.....................Nominal consideration etc.

38‑255...................Second‑hand goods

Subdivision 38‑H—Raffles and bingo conducted by charitable institutions etc.

38‑270..Raffles and bingo conducted by charitable institutions etc.

Subdivision 38‑I—Water and sewerage

38‑285.................................Water

38‑290...............................Sewerage

38‑295......................Emptying of septic tanks

Subdivision 38‑J—Supplies of going concerns

38‑325.....................Supply of a going concern

Subdivision 38‑K—Transport and related matters

38‑355.............Supplies of transport and related matters

Subdivision 38‑L—Precious metals

38‑385....................Supplies of precious metals

Subdivision 38‑M—Supplies through inwards duty free shops

38‑415............Supplies through inwards duty free shops

Subdivision 38‑N—Grants of freehold and similar interests by governments

38‑445...Grants of freehold and similar interests by governments

Subdivision 38‑O—Farm land

38‑475........................Subdivided farm land

38‑480..................Farm land supplied for farming

Subdivision 38‑P—Cars for use by disabled people

38‑505..........................Disabled veterans

38‑510........................Other disabled people

Division 40—Input taxed supplies

40‑1......................What this Division is about

Subdivision 40‑A—Financial supplies

40‑5...........................Financial supplies

Subdivision 40‑B—Residential rent

40‑35............................Residential rent

Subdivision 40‑C—Residential premises

40‑65....................Sales of residential premises

40‑70Supplies of residential premises by way of long‑term lease

Subdivision 40‑D—Precious metals

40‑100...........................Precious metals

Subdivision 40‑E—School tuckshops and canteens

40‑130..................School tuckshops and canteens

Part 3‑2—Non‑taxable importations

Division 42—Non‑taxable importations

42‑1......................What this Division is about

42‑5Non‑taxable importations—Schedule 4 to the Customs Tariff Act 1995

42‑10........................Ship and aircraft stores

42‑15......Goods imported or purchased by overseas travellers

Chapter 4—The special rules

Division 45—Introduction

45‑1......................What this Chapter is about

45‑5.......................The effect of special rules

Part 4‑1—Special rules mainly about particular ways entities are organised

Division 48—GST groups

48‑1......................What this Division is about

Subdivision 48‑A—Approval of GST groups

48‑5.......................Approval of GST groups

48‑10............Membership requirements of a GST group

Subdivision 48‑B—Consequences of approval of GST groups

48‑40........................Who is liable for GST

48‑45.................Who is entitled to input tax credits

48‑50..............................Adjustments

48‑55...GST groups treated as single entities for certain purposes

48‑60..............................GST returns

Subdivision 48‑C—Administrative matters

48‑70..........Changing the membership etc. of GST groups

48‑75...............Revoking the approval of GST groups

48‑80..............Notification by representative members

48‑85............Date of effect of approvals and revocations

48‑90.................Notification by the Commissioner

Division 51—GST joint ventures

51‑1......................What this Division is about

Subdivision 51‑A—Approval of GST joint ventures

51‑5...................Approval of GST joint ventures

51‑10........Participation requirements of a GST joint venture

Subdivision 51‑B—Consequences of approval of GST joint ventures

51‑30........................Who is liable for GST

51‑35.................Who is entitled to input tax credits

51‑40..............................Adjustments

51‑45.....Additional net amounts relating to GST joint ventures

51‑50............GST returns relating to GST joint ventures

51‑55.........Payments of GST relating to GST joint ventures

51‑60..............Refunds relating to GST joint ventures

Subdivision 51‑C—Administrative matters

51‑70......Changing the participants etc. of GST joint ventures

51‑75...........Revoking the approval of GST joint ventures

51‑80...............Notification by joint venture operators

51‑85............Date of effect of approvals and revocations

51‑90.................Notification by the Commissioner

Division 54—GST branches

54‑1......................What this Division is about

Subdivision 54‑A—Registration of GST branches

54‑5....................Registration of GST branches

54‑10........The date of effect of registration of a GST branch

54‑15..................GST branch registration number

Subdivision 54‑B—Consequences of registration of GST branches

54‑40........Additional net amounts relating to GST branches

54‑45....................Net amounts of parent entities

54‑50.................Tax invoices and adjustment notes

54‑55...............GST returns relating to GST branches

54‑60............Payments of GST relating to GST branches

54‑65.................Refunds relating to GST branches

Subdivision 54‑C—Cancellation of registration of GST branches

54‑70When an entity must apply for cancellation of registration of a GST branch

54‑75When the Commissioner must cancel registration of a GST branch

54‑80The date of effect of cancellation of registration of a GST branch

54‑85............Application of Subdivision 25‑B

54‑90.Effect on GST branches of cancelling the entity’s registration

Division 57—Resident agents acting for non‑residents

57‑1......................What this Division is about

57‑5.........................Who is liable for GST

57‑10.................Who is entitled to input tax credits

57‑15..............................Adjustments

57‑20...........Resident agents are required to be registered

57‑25..........Cancellation of registration of a resident agent

57‑30....................Notice of cessation of agency

57‑35....................Tax periods of resident agents

57‑40..............GST returns for non‑residents

57‑45................Resident agents giving GST returns

57‑50.......Non‑residents that belong to GST groups

Division 60—Pre‑establishment costs

60‑1......................What this Division is about

60‑5Input tax credit for acquisitions and importations before establishment

60‑10.........Registration etc. not needed for input tax credits

60‑15...Pre‑establishment acquisitions and importations

60‑20..........................Creditable purpose

60‑25Attributing the input tax credit for pre‑establishment acquisitions

60‑30Attributing the input tax credit for pre‑establishment importations

60‑35.....................Application of Division 129

Part 4‑2—Special rules mainly about supplies and acquisitions

Division 66—Second‑hand goods

66‑1......................What this Division is about

66‑5.....Creditable acquisitions of second‑hand goods

66‑10Amounts of input tax credits for creditable acquisitions of second‑hand goods

66‑15Attributing input tax credits for creditable acquisitions of second‑hand goods

66‑20........................Returnable containers

Division 69—Non‑deductible expenses

69‑1......................What this Division is about

69‑5Non‑deductible expenses do not give rise to creditable acquisitions or creditable importations

69‑10Amounts of input tax credits for creditable acquisitions or creditable importations of certain cars

Division 70—Financial supplies (reduced credit acquisitions)

70‑1......................What this Division is about

70‑5.............Acquisitions that attract the reduced credit

70‑10.............Extended meaning of creditable purpose

70‑15...........How much are the reduced input tax credits?

70‑20.....................Extent of creditable purpose

70‑25........Sale of reduced credit acquisitions (Division 132)

Division 72—Associates

72‑1......................What this Division is about

Subdivision 72‑A—Supplies without consideration

72‑5...............Taxable supplies without consideration

72‑10.......The value of taxable supplies without consideration

72‑15.................Attributing the GST to tax periods

Subdivision 72‑B—Acquisitions without consideration

72‑40..........Creditable acquisitions without consideration

72‑45.................The amount of the input tax credit

72‑50...........Attributing the input tax credit to tax periods

Subdivision 72‑C—Supplies for inadequate consideration

72‑70...The value of taxable supplies for inadequate consideration

Division 75—Sale of freehold interests etc.

75‑1......................What this Division is about

75‑5................Choosing to apply the margin scheme

75‑10..............The amount of GST on taxable supplies

75‑15............................Subdivided land

75‑20Supplies under a margin scheme do not give rise to creditable acquisitions

75‑25.................Adjustments relating to bad debts

Division 78—Insurance

78‑1......................What this Division is about

Subdivision 78‑A—Insurers

78‑5Creditable acquisitions relating to settlements of insurance claims

78‑10Amount of input tax credits relating to settlements of insurance claims

78‑15Acquisitions of goods by insurers in the course of settling claims

Subdivision 78‑B—Insured entities

78‑30..Taxable supplies relating to settlements of insurance claims

78‑35Payments of excess under insurance policies are not consideration for supplies

78‑40Effect of payments of excess under insurance policies on amounts of GST

78‑45.Supplies of goods to insurers in the course of settling claims

78‑50Settlements of claims relating to non‑creditable insurance events

Subdivision 78‑C—Third parties

78‑65.............Payments etc. to third parties by insurers

78‑70.........Payments etc. to third parties by insured entities

Subdivision 78‑D—Insured entities that are not registered etc.

78‑80..............................Net amounts

78‑85..............................GST returns

78‑90...........................Payments of GST

Division 81—Payments of taxes

81‑1......................What this Division is about

81‑5..........Payments of taxes can constitute consideration

81‑10Supplies need not be connected with Australia if the consideration is the payment of tax

Division 84—Offshore supplies other than goods or real property

84‑1......................What this Division is about

84‑5....Intangible supplies from offshore may be taxable supplies

84‑10........“Reverse charge” on offshore intangible supplies

84‑15.......Transfers etc. between branches of the same entity

Division 87—Long‑term accommodation in commercial residential premises

87‑1......................What this Division is about

87‑5Commercial residential premises that are predominantly for long‑term accommodation

87‑10Commercial residential premises that are not predominantly for long‑term accommodation

87‑15.............Meaning of commercial accommodation

87‑20......Meaning of long‑term accommodation etc.

87‑25.........Suppliers may choose not to apply this Division

Division 90—Company amalgamations

90‑1......................What this Division is about

90‑5Supplies not taxable—amalgamated company registered or required to be registered

90‑10Value of taxable supplies—amalgamated company not registered or required to be registered

90‑15Acquisitions not creditable—amalgamated company registered or required to be registered

90‑20Liability after amalgamation for GST on amalgamating company’s supplies

90‑25Entitlement after amalgamation to input tax credits for amalgamating company’s acquisitions

90‑30..............................Adjustments

90‑35......Amalgamating companies accounting on a cash basis

Division 93—Returnable containers

93‑1......................What this Division is about

93‑5..........Creditable acquisitions of returnable containers

93‑10How much are the input tax credits for creditable acquisitions of returnable containers?

93‑15...Attributing creditable acquisitions of returnable containers

93‑20................Ownership of returnable containers

Division 96—Supplies partly connected with Australia

96‑1......................What this Division is about

96‑5......Supplies that are only partly connected with Australia

96‑10The value of the taxable components of supplies that are only partly connected with Australia

Division 99—Deposits as security

99‑1......................What this Division is about

99‑5..Giving a deposit as security does not constitute consideration

99‑10.Attributing the GST relating to deposits that are forfeited etc.

Division 102—Cancelled lay‑by sales

102‑1.....................What this Division is about

102‑5...................Cancelled lay‑by sales

102‑10..............Attributing GST and input tax credits

Division 105—Supplies in satisfaction of debts

105‑1.....................What this Division is about

105‑5Supplies by creditors in satisfaction of debts may be taxable supplies

105‑10.............................Net amounts

105‑15.............................GST returns

105‑20..........................Payments of GST

Division 108—Valuation of taxable supplies of goods in bond

108‑1.....................What this Division is about

108‑5..............Taxable supplies of goods in bond etc.

Division 111—Reimbursement of employees etc.

111‑1.....................What this Division is about

111‑5.......Creditable acquisitions relating to reimbursements

111‑10...Amounts of input tax credits relating to reimbursements

111‑15.............Tax invoices relating to reimbursements

Part 4‑3—Special rules mainly about importations

Division 114—Importations without entry for home consumption

114‑1.....................What this Division is about

114‑5........Importations without entry for home consumption

Division 117—Importations of goods that were exported for repair or renovation

117‑1.....................What this Division is about

117‑5Valuation of taxable importations of goods that were exported for repair or renovation

117‑10...............The value of repairs and renovations

Part 4‑4—Special rules mainly about net amounts and adjustments

Division 126—Gambling

126‑1.....................What this Division is about

126‑5.........Global accounting system for gambling supplies

126‑10........................Global GST amounts

126‑15.......................Losses carried forward

126‑20...............................Bad debts

126‑25............Application of Subdivision 9‑C

126‑30.Gambling supplies do not give rise to creditable acquisitions

126‑32.....Repayments of gambling losses are not consideration

126-33 Tax invoices not required for gambling supplies............

126‑35.......Meaning of gambling supply and gambling event

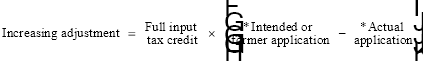

Division 129—Changes in the extent of creditable purpose

129‑1.....................What this Division is about

Subdivision 129‑A—General

129‑5..............Adjustments arising under this Division

129‑10Adjustments do not arise under this Division for acquisitions and importations below a certain value

Subdivision 129‑B—Adjustment periods

129‑20.........................Adjustment periods

129‑25.Effect on adjustment periods of things being disposed of etc.

Subdivision 129‑C—When adjustments for acquisitions and importations arise

129‑40.........Working out whether you have an adjustment

129‑45.............Gifts to gift‑deductible entities

129‑50.........................Creditable purpose

129‑55..........................Meaning of apply

Subdivision 129‑D—Amounts of adjustments for acquisitions and importations

129‑70.............The amount of an increasing adjustment

129‑75.............The amount of a decreasing adjustment

129‑80.............Effect of adjustments under Division 19

Subdivision 129‑E—Attributing adjustments under this Division

129‑90Attributing your adjustments for changes in extent of creditable purpose

Division 132—Supplies of things acquired, imported or applied to make financial supplies

132‑1.....................What this Division is about

132‑5Decreasing adjustments for supplies of things acquired, imported or applied to make financial supplies

132‑10.........Attribution of adjustments under this Division

Division 135—Supplies of going concerns

135‑1.....................What this Division is about

135‑5........Initial adjustments for supplies of going concerns

135‑10........Later adjustments for supplies of going concerns

Division 138—Cessation of registration

138‑1.....................What this Division is about

138‑5.............Adjustments for cessation of registration

138‑10......Attributing adjustments for cessation of registration

138‑15.Ceasing to be registered—amounts not previously attributed

138‑20....................Application of Division 129

Part 4‑5—Special rules mainly about registration

Division 144—Taxis

144‑1.....................What this Division is about

144‑5.......................Requirement to register

Division 147—Representatives of incapacitated entities

147‑1.....................What this Division is about

147‑5...........Representatives are required to be registered

147‑10.........Cancellation of registration of a representative

147‑15...............Notice of cessation of representation

147‑20.............................Adjustments

Part 4‑6—Special rules mainly about tax periods

Division 153—Agents

153‑1.....................What this Division is about

153‑5Attributing the input tax credits for your creditable acquisitions

153‑10...................Attributing your adjustments

153‑15.............................Tax invoices

153‑20..........................Adjustment notes

Division 156—Supplies and acquisitions made on a progressive or periodic basis

156‑1.....................What this Division is about

156‑5....Attributing the GST on progressive or periodic supplies

156‑10Attributing the input tax credits on progressive or periodic acquisitions

156‑15Progressive or periodic supplies partly connected with Australia

156‑20Application of Division 129 to progressive or periodic acquisitions

156‑25....................Accounting on a cash basis

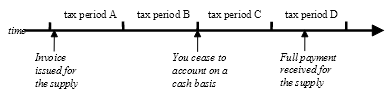

Division 159—Changing your accounting basis

159‑1.....................What this Division is about

159‑5Ceasing to account on a cash basis—amounts not previously attributed

159‑10Ceasing to account on a cash basis—amounts partly attributed

159‑15.........Ceasing to account on a cash basis—bad debts

159‑20................Starting to account on a cash basis

159‑25.........Starting to account on a cash basis—bad debts

159‑30........Entities ceasing to exist or coming into existence

Part 4‑7—Special rules mainly about returns, payments and refunds

Division 165—Anti‑avoidance

165‑1.....................What this Division is about

Subdivision 165‑A—Application of this Division

165‑5.................When does this Division operate?

165‑10....When does an entity get a GST benefit from a scheme?

165‑15..Matters to be considered in determining purpose or effect

Subdivision 165‑B—Commissioner may negate effects of schemes for GST benefits

165‑40.......Commissioner may negate avoider’s GST benefits

165‑45Commissioner may reduce an entity’s net amount or GST to compensate

165‑50....GST or refund payable in accordance with declaration

165‑55Commissioner may disregard scheme in making declarations

165‑60One declaration may cover several tax periods and importations

165‑65Commissioner must give copy of declaration to entity affected

Subdivision 165‑C—Penalties for getting GST benefits from schemes

165‑80................................Penalty

Division 168—Tourist refund scheme

168‑1.....................What this Division is about

168‑5........................Tourist refund scheme

Division 171—Customs security etc. given on taxable importations

171‑1.....................What this Division is about

171‑5Security or undertaking given under section 162 or 162A of the Customs Act

Chapter 5—Miscellaneous

Part 5‑1—Miscellaneous

Division 177—Miscellaneous

177‑1............Commonwealth etc. not liable to pay GST

177‑3Acquisitions from State or Territory bodies where GST liability is notional

177‑5...............Cancellation of exemptions from GST

177‑10.....................Ministerial determinations

177‑15..............................Regulations

Chapter 6—Interpreting this Act

Part 6‑1—Rules for interpreting this Act

Division 182—Rules for interpreting this Act

182‑1.....................What forms part of this Act

182‑5................What does not form part of this Act

182‑10..Explanatory sections, and their role in interpreting this Act

182‑15..........................Schedules 1 and 2

Part 6‑2—Meaning of some important concepts

Division 184—Meaning of entity

184‑1.................................Entities

Division 186—Meaning of approved form

186‑1............................Approved forms

Division 188—Meaning of annual turnover

188‑1.....................What this Division is about

188‑5...............Explanation of the turnover thresholds

188‑10Whether your annual turnover meets, or does not exceed, a turnover threshold

188‑15......................Current annual turnover

188‑20.....................Projected annual turnover

188‑25Transfer of capital assets, and termination etc. of enterprise, to be disregarded

188‑30...........The value of non‑taxable supplies

Division 190—90% owned groups of companies

190‑1..........................90% owned groups

190‑5When a company has at least a 90% stake in another company

Part 6‑3—Dictionary

Division 195—Dictionary

195‑1...............................Dictionary

Schedule 1—Food that is not GST‑free

1 Food that is not GST‑free....................

2 Prepared food, bakery products and biscuit goods...........

3 Prepared meals................................

4 Candied peel.................................

5 Goods that are not biscuit goods......................

Schedule 2—Beverages that are GST‑free

1 Beverages that are GST‑free..................

2 Tea, coffee etc.................................

3 Fruit and vegetable juices..........................

Schedule 3—Medical aids and appliances

A New Tax System (Goods and Services Tax) Act 1999

No. 55, 1999

An Act about a goods and services tax to implement A New Tax System, and for related purposes

[Assented to 8 July 1999]

The Parliament of Australia enacts:

This Act may be cited as the A New Tax System (Goods and Services Tax) Act 1999.

(1) This Act commences on 1 July 2000.

(2) However, if, before the day on which this Act would (but for this subsection) commence under subsection (1), there have not been appropriated, for the purposes of the programs referred to in the second column of an item in the table:

(a) in respect of the financial year starting on 1 July 2000—the amount referred to in the third column of that item; and

(b) in respect of the financial year starting on 1 July 2001—the amount referred to in the fourth column of that item; and

(c) in respect of the financial year starting on 1 July 2002—the amount referred to in the fifth column of that item; and

(d) in respect of the financial year starting on 1 July 2003—the amount referred to in the sixth column of that item;

this Act commences on, and tax is not payable under the *GST law until, the day on which the last of those amounts to be appropriated for those purposes has been appropriated under an Act.

Amounts to be appropriated | |||||

| Program | Financial years | |||

2000/01 | 2001/02 | 2002/03 | 2003/04 | ||

|

| ($ million) | ($ million) | ($ million) | ($ million) |

1 | Book industry assistance plan | 60 | 60 | 60 | 60 |

2 | Supported Accommodation Assistance Program | 15 | 15 | 15 | 15 |

| Total | 75 | 75 | 75 | 75 |

The Parliament acknowledges that the Commonwealth:

(a) will introduce legislation to provide that the revenue from the GST will be granted to the States, the Australian Capital Territory and the Northern Territory; and

(b) will maintain the rate and base of the GST in accordance with the Agreement on Principles for the Reform of Commonwealth‑State Financial Relations endorsed at the Special Premiers’ Conference in Canberra on 13 November 1998.

This Act is about the GST.

It begins (in Chapter 2) with the basic rules about the GST, and then sets out in Chapter 3 the exemptions from the GST and in Chapter 4 the special rules that can apply in particular cases.

It concludes with definitions and other interpretative material.

Note: The GST is imposed by 3 Acts:

(a) the A New Tax System (Goods and Services Tax Imposition—General) Act 1999; and

(b) the A New Tax System (Goods and Services Tax Imposition—Customs) Act 1999; and

(c) the A New Tax System (Goods and Services Tax Imposition—Excise) Act 1999.

Chapter 2 has the basic rules for the GST, including:

when and how the GST arises, and who is liable to pay it;

when and how input tax credits arise, and who is entitled to them;

how to work out payments and refunds of GST;

when and how the payments and refunds are to be made.

Chapter 3 sets out the supplies and importations that are GST‑free or input taxed.

Chapter 4 has special rules which, in particular cases, have the effect of modifying the basic rules in Chapter 2.

Note: There is a checklist of special rules at the end of Chapter 2 (in Part 2‑8).

Chapter 5 deals with miscellaneous matters.

Chapter 6 contains the Dictionary, which sets out a list of all the terms that are defined in this Act. It also sets out the meanings of some important concepts and rules on how to interpret this Act.

Part VI of the Taxation Administration Act 1953 contains provisions relating to the administration of the GST, and to collection and recovery of amounts of GST.

(1) Many of the terms used in the law relating to the GST are defined.

(2) Most defined terms in this Act are identified by an asterisk appearing at the start of the term: as in “*enterprise”. The footnote that goes with the asterisk contains a signpost to the Dictionary definitions starting at section 195‑1.

(1) Once a defined term has been identified by an asterisk, later occurrences of the term in the same subsection are not usually asterisked.

(2) Terms are not asterisked in the non‑operative material contained in this Act.

Note: The non‑operative material is described in Division 4.

(3) The following basic terms used throughout the Act are not identified with an asterisk.

Common definitions that are not asterisked | |

Item | This term: |

1 | acquisition |

2 | amount |

3 | Australia |

4 | Commissioner |

5 | entity |

6 | goods |

7 | GST |

8 | import |

9 | input tax credit |

10 | tax period |

11 | thing |

12 | supply |

13 | you |

Within a definition, the defined term is identified by bold italics.

In addition to the operative provisions themselves, this Act contains other material to help you identify accurately and quickly the provisions that are relevant to you and to help you understand them.

This other material falls into 2 main categories.

One category is the explanatory section in many Divisions. Under the section heading “What this Division is about”, a short explanation of the Division appears in boxed text.

Explanatory sections form part of this Act but are not operative provisions. In interpreting an operative provision, explanatory sections may only be considered for limited purposes. They are set out in section 182‑10.

The other category consists of material such as notes and examples. These also form part of the Act. They are distinguished by type size from the operative provisions (except for formulas), but are not kept separate from them.

This Chapter sets out the basic rules for the GST. In particular, these rules will tell you:

• where liability for GST arises;

• where entitlements to input tax credits arise;

• how the amounts of GST and input tax credits are combined to work out the amount payable by you or to you;

• when and how that amount is to be paid.

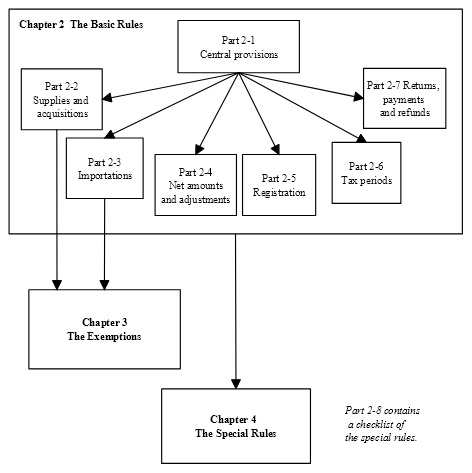

The diagram on the next page shows how the basic rules in this Chapter relate to each other. It also shows their relationship with:

• the exemptions (Chapter 3)—these provisions exempt from the GST what would otherwise be taxable; and

• the special rules (Chapter 4)—these provisions modify the basic rules in particular situations, often in quite limited ways.

(1) GST is payable on *taxable supplies and *taxable importations.

(2) Entitlements to input tax credits arise on *creditable acquisitions and *creditable importations.

For taxable supplies and creditable acquisitions, see Part 2‑2.

For taxable importations and creditable importations, see Part 2‑3.

Amounts of GST and amounts of input tax credits are set off against each other to produce a *net amount for a tax period (which may be altered to take account of *adjustments).

For net amounts (including adjustments to net amounts), see Part 2‑4.

Every entity that is *registered, or *required to be registered, has tax periods applying to it.

For registration, see Part 2‑5.

For tax periods, see Part 2‑6.

The *net amount for a tax period is the amount that the entity must pay to the Commonwealth, or the Commonwealth must refund to the entity, in respect of the period.

For payments and refunds (and GST returns), see Part 2‑7.

Note: Refunds may be set off against your other liabilities (if any) under laws administered by the Commissioner.

Table of Subdivisions

9‑A What are taxable supplies?

9‑B Who is liable for GST on taxable supplies?

9‑C How much GST is payable on taxable supplies?

GST is payable on taxable supplies. This Division defines taxable supplies, states who is liable for the GST, and describes how to work out the GST on supplies.

You make a taxable supply if:

(a) you make the supply for *consideration; and

(b) the supply is made in the course or furtherance of an *enterprise that you *carry on; and

(c) the supply is *connected with Australia; and

(d) you are *registered, or *required to be registered.

However, the supply is not a *taxable supply to the extent that it is *GST‑free or *input taxed.

(1) A supply is any form of supply whatsoever.

(2) Without limiting subsection (1), supply includes any of these:

(a) a supply of goods;

(b) a supply of services;

(c) a provision of advice or information;

(d) a grant, assignment or surrender of *real property;

(e) a creation, grant, transfer, assignment or surrender of any right;

(f) a *financial supply;

(g) an entry into, or release from, an obligation:

(i) to do anything; or

(ii) to refrain from an act; or

(iii) to tolerate an act or situation;

(h) any combination of any 2 or more of the matters referred to in paragraphs (a) to (g).

However, it does not include a supply of *money unless the money is provided as *consideration for a supply that is a supply of money.

(3) It does not matter whether it is lawful to do, to refrain from doing or to tolerate the act or situation constituting the supply.

(1) Consideration includes:

(a) any payment, or any act or forbearance, in connection with a supply of anything; and

(b) any payment, or any act or forbearance, in response to or for the inducement of a supply of anything.

(2) It does not matter whether the payment, act or forbearance was voluntary, or whether it was by the *recipient of the supply.

(3) However:

(a) if a right or option to acquire a thing is granted, then:

(i) the consideration for the supply of the thing on the exercise of the right or option is limited to any additional consideration provided either for the supply or in connection with the exercise of the right or option; or

(ii) if there is no such additional consideration—there is no consideration for the supply; and

(b) a payment made as a gift to a non‑profit body is not the provision of consideration; and

(c) a payment made by an *Australian government agency to another Australian government agency is not the provision of consideration if the payment is specifically covered by an appropriation under an *Australian law.

(1) An enterprise is an activity, or series of activities, done:

(a) in the form of a *business; or

(b) in the form of an adventure or concern in the nature of trade; or

(c) on a regular or continuous basis, in the form of a lease, licence or other grant of an interest in property; or

(d) by the trustee of a fund that is covered by, or by an authority or institution that is covered by, Subdivision 30‑B of the Income Tax Assessment Act 1997 and to which deductible gifts can be made; or

(e) by a charitable institution or by a trustee of a charitable fund; or

(f) by a religious institution; or

(g) by the Commonwealth, a State or a Territory, or by a body corporate, or corporation sole, established for a public purpose by or under a law of the Commonwealth, a State or a Territory.

(2) However, enterprise does not include an activity, or series of activities, done:

(a) as an employee or other *PAYE earner (unless it is done in supplying services as the holder of an office that the employee or PAYE earner has accepted in the course of or in connection with an activity or series of activities of the kind mentioned in subsection (1)); or

Note: An employee’s or PAYE earner’s acts will still form part of the activities of the enterprise in which he or she is employed.

(b) as a private recreational pursuit or hobby; or

(c) by an individual (other than a trustee of a charitable fund), or a *partnership (all the members of which are individuals), without a reasonable expectation of profit or gain; or

(d) as a member of a local governing body established by or under a *State law or *Territory law (other than an eligible local governing body within the meaning of section 221A of the Income Tax Assessment Act 1936).

Supplies of goods wholly within Australia

(1) A supply of goods is connected with Australia if the goods are delivered, or made available, in Australia to the *recipient of the supply.

Supplies of goods from Australia

(2) A supply of goods that involves the goods being removed from Australia is connected with Australia.

Supplies of goods to Australia

(3) A supply of goods that involves the goods being brought to Australia is connected with Australia if the supplier either:

(a) imports the goods into Australia; or

(b) installs or assembles the goods in Australia.

Supplies of real property

(4) A supply of *real property is connected with Australia if the real property is in Australia.

Supplies of anything else

(5) A supply of anything other than goods or *real property is connected with Australia if either:

(a) the thing is done in Australia; or

(b) the supplier makes the supply through an *enterprise that the supplier *carries on in Australia.

When enterprises are carried on in Australia

(6) An *enterprise is carried on in Australia if the enterprise is carried on through:

(a) a permanent establishment (as defined in subsection 6(1) of the Income Tax Assessment Act 1936); or

(b) a place that would be such a permanent establishment if paragraph (e), (f) or (g) of that definition did not apply.

GST‑free

(1) A supply is GST‑free if it is GST‑free under Division 38.

Input taxed

(2) A supply is input taxed if it is input taxed under Division 40.

Note: If a supply is input taxed, there is no entitlement to an input tax credit for the things that are acquired or imported to make the supply (see sections 11‑15 and 15‑10).

GST‑free overrides input taxed

(3) If, apart from this subsection, a supply would be both wholly *GST‑free and wholly *input taxed, then the supply is taken to be GST‑free and not input taxed.

Supply of things used solely in connection with making supplies that are input taxed but not financial supplies

(4) A supply is taken to be a supply that is *input taxed if it is a supply of anything that you have used solely in connection with your supplies that are input taxed but are not *financial supplies.

Chapter 4 contains special rules relating to taxable supplies, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | Associates | Division 72 |

2 | Cancelled lay‑by sales | Division 102 |

3 | Company amalgamations | Division 90 |

4 | Deposits as security | Division 99 |

5 | Gambling | Division 126 |

6 | Insurance | Division 78 |

7 | Offshore supplies other than goods or real property | Division 84 |

8 | Payments of taxes | Division 81 |

9 | Supplies and acquisitions made on a progressive or periodic basis | Division 156 |

10 | Supplies in satisfaction of debts | Division 105 |

11 | Supplies partly connected with Australia | Division 96 |

You must pay the GST payable on any *taxable supply that you make.

Chapter 4 contains special rules relating to liability for GST on taxable supplies, as follows:

Checklist of special rules |

| |

Item | For this case ... | See: |

1 | Company amalgamations | Division 90 |

2 | GST groups | Division 48 |

3 | GST joint ventures | Division 51 |

4 | Offshore supplies other than goods or real property | Division 84 |

5 | Resident agents acting for non‑residents | Division 57 |

The amount of GST on a *taxable supply is 10% of the *value of the taxable supply.

The value of a *taxable supply is as follows:

where:

price is the sum of:

(a) so far as the *consideration for the supply is consideration expressed as an amount of *money—the amount (without any discount for the amount of GST (if any) payable on the supply); and

(b) so far as the consideration is not consideration expressed as an amount of money—the *GST inclusive market value of that consideration.

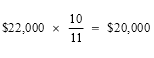

Example: You make a taxable supply by selling a car for $22,000 in the course of carrying on an enterprise.

The value of the supply is:

The GST on the supply is therefore $2,000 (i.e. 10% of $20,000).

If a supply (the actual supply) is:

(a) partly a *taxable supply; and

(b) partly a supply that is *GST‑free or *input taxed;

the value of the part of the actual supply that is a taxable supply is the proportion of the value of the actual supply (worked out as if it were solely a taxable supply) that the taxable supply represents.

Chapter 4 contains special rules relating to the amount of GST on taxable supplies, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | Associates | Division 72 |

2 | Company amalgamations | Division 90 |

3 | Gambling | Division 126 |

4 | Long‑term accommodation in commercial residential premises | Division 87 |

5 | Sale of freehold interests etc. | Division 75 |

6 | Second‑hand goods | Division 66 |

7 | Supplies partly connected with Australia | Division 96 |

8 | Transactions relating to insurance policies | Division 78 |

9 | Valuation of taxable supplies of goods in bond | Division 108 |

You make a creditable acquisition if:

(a) you acquire anything solely or partly for a *creditable purpose; and

(b) the supply of the thing to you is a *taxable supply; and

(c) you provide, or are liable to provide, *consideration for the supply; and

(d) you are *registered, or *required to be registered.

(1) An acquisition is any form of acquisition whatsoever.

(2) Without limiting subsection (1), acquisition includes any of these:

(a) an acquisition of goods;

(b) an acquisition of services;

(c) a receipt of advice or information;

(d) an acceptance of a grant, assignment or surrender of *real property;

(e) an acceptance of a grant, transfer, assignment or surrender of any right;

(f) an acquisition of something the supply of which is a *financial supply;

(g) an acquisition of a right to require another person:

(i) to do anything; or

(ii) to refrain from an act; or

(iii) to tolerate an act or situation;

(h) any combination of any 2 or more of the matters referred to in paragraphs (a) to (g).

However, it does not include an acquisition of *money unless the money is provided as *consideration for a supply that is a supply of money.

(1) You acquire a thing for a creditable purpose to the extent that you acquire it in *carrying on your *enterprise.

(2) However, you do not acquire the thing for a creditable purpose to the extent that:

(a) the acquisition relates to making supplies that would be *input taxed; or

(b) the acquisition is of a private or domestic nature.

(3) To the extent that an acquisition relates to making *financial supplies through an *enterprise, or a part of an enterprise, that you *carry on outside Australia, the acquisition is not, for the purposes of paragraph (2)(a), treated as one that relates to making supplies that would be *input taxed.

You are entitled to the input tax credit for any *creditable acquisition that you make.

The amount of the input tax credit for a *creditable acquisition is an amount equal to the GST payable on the supply of the thing acquired. However, the amount of the input tax credit is reduced if the acquisition is only *partly creditable.

(1) An acquisition that you make is partly creditable if it is a *creditable acquisition to which one or both of the following apply:

(a) you make the acquisition only partly for a *creditable purpose;

(b) you provide, or are liable to provide, only part of the *consideration for the acquisition.

(2) However, the acquisition is not *partly creditable if:

(a) it was made for a *creditable purpose except to the extent (if any) that the acquisition relates to making *financial supplies; and

(b) your *annual turnover of financial supplies does not exceed either:

(i) $50,000 or such other amount specified in the regulations; or

(ii) 5% of your *annual turnover (treating supplies that are input taxed as part of your annual turnover).

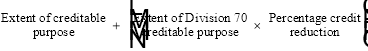

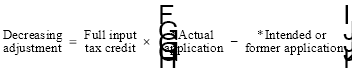

(3) The amount of the input tax credit on an acquisition that you make that is *partly creditable is as follows:

![]()

where:

extent of consideration is the extent to which you provide, or are liable to provide, the *consideration for the acquisition, expressed as a percentage of the total consideration for the acquisition.

extent of creditable purpose is the extent to which the *creditable acquisition is for a *creditable purpose, expressed as a percentage of the total purpose of the acquisition.

full input tax credit is what would have been the amount of the input tax credit for the acquisition if it had been made solely for a creditable purpose and you had provided, or had been liable to provide, all of the consideration for the acquisition.

(4) For the purpose of working out the extent of the *consideration, so far as the consideration is not expressed as an amount of *money, take into account the *GST inclusive market value of the consideration.

Chapter 4 contains special rules relating to acquisitions, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | Associates | Division 72 |

2 | Company amalgamations | Division 90 |

3 | Financial supplies (reduced credit acquisitions) | Division 70 |

4 | Gambling | Division 126 |

5 | GST groups | Division 48 |

6 | GST joint ventures | Division 51 |

7 | Insurance | Division 78 |

8 | Non‑deductible expenses | Division 69 |

9 | Pre‑establishment costs | Division 60 |

10 | Reimbursement of employees etc. | Division 111 |

11 | Resident agents acting for non‑residents | Division 57 |

12 | Returnable containers | Division 93 |

13 | Sale of freehold interests etc. | Division 75 |

14 | Second‑hand goods | Division 66 |

Note 1: This Division applies whether or not you are registered.

Note 2: Things other than goods that are supplied overseas for use in Australia (and are therefore in that sense “imported”) are not taxable importations, but they can attract GST under Division 84.

(1) A taxable importation is an *importation of goods into Australia, but only to the extent that it is not a *non‑taxable importation.

Note: There is no registration requirement for taxable importations, and the importer need not be carrying on an enterprise.

(2) You make an importation of goods into Australia if:

(a) you enter the goods for home consumption (within the meaning of the Customs Act 1901); and

(b) at the time they are so entered for home consumption, you are the owner (within the meaning of that Act) of the goods.

(3) However, an importation of *money is not an importation of goods into Australia.

An importation is a non‑taxable importation if:

(a) it is a non‑taxable importation under Part 3‑2; or

(b) it would have been a supply that was *GST‑free or *input taxed if it had been a supply.

You must pay the GST payable on any *taxable importation that you make.

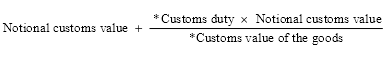

(1) The amount of GST on the *taxable importation is 10% of the *value of the taxable importation.

(2) The value of a *taxable importation is the sum of:

(a) the customs value (for the purposes of Division 2 of Part VIII of the Customs Act 1901) of the goods imported; and

(b) the amount paid or payable:

(i) to transport the goods to Australia; and

(ii) to insure the goods for that transport;

to the extent that the amount is not already included under paragraph (a); and

(c) any *customs duty payable in respect of the importation of the goods.

If an importation (the actual importation) is:

(a) partly a *taxable importation; and

(b) partly a *non‑taxable importation;

the value of the part of the actual importation that is a taxable importation is the proportion of the value of the actual importation (worked out as if it were solely a taxable importation) that the taxable importation represents.

Chapter 4 contains special rules relating to taxable importations, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | GST groups | Division 48 |

2 | GST joint ventures | Division 51 |

3 | Importations without entry for home consumption | Division 114 |

4 | Non‑deductible expenses | Division 69 |

5 | Resident agents acting for non‑residents | Division 57 |

6 | Valuation of taxable importations of goods that were exported for repair or renovation | Division 117 |

You are entitled to input tax credits for your creditable importations. This Division defines creditable importations, states who is entitled to the input tax credits and describes how to work out the input tax credits on importations.

You make a creditable importation if:

(a) you import goods solely or partly for a *creditable purpose; and

(b) the importation is a *taxable importation; and

(c) you are *registered, or *required to be registered.

(1) You import goods for a creditable purpose to the extent that you import the goods in *carrying on your *enterprise.

(2) However, you do not import the goods for a creditable purpose to the extent that:

(a) the importation relates to making supplies that would be *input taxed; or

(b) the importation is of a private or domestic nature.

(3) To the extent that an importation relates to making *financial supplies through an *enterprise, or a part of an enterprise, that you *carry on outside Australia, the importation is not, for the purposes of paragraph (2)(a), treated as one that relates to making supplies that would be *input taxed.

You are entitled to the input tax credit for any *creditable importation that you make.

The amount of input tax credit for a *creditable importation is an amount equal to the GST payable on the importation. However, the amount of the input tax credit is reduced if the importation is only *partly creditable.

(1) An importation that you make is partly creditable if it is a *creditable importation that you make only partly for a *creditable purpose.

(2) However, the importation is not *partly creditable if:

(a) it was made for a *creditable purpose except to the extent (if any) that the importation relates to making *financial supplies; and

(b) your *annual financial supplies turnover does not exceed either:

(i) $50,000 or such other amount specified in the regulations; or

(ii) 5% of your *annual turnover (treating supplies that are input taxed as part of your annual turnover)

(3) The amount of the input tax credit on an importation that you make that is *partly creditable is as follows:

![]()

where:

extent of creditable purpose is the extent to which the importation is for a *creditable purpose, expressed as a percentage of the total purpose of the importation.

full input tax credit is what would have been the amount of the input tax credit for the importation if it had been made solely for a creditable purpose.

Chapter 4 contains special rules relating to creditable importations, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | GST groups | Division 48 |

2 | GST joint ventures | Division 51 |

3 | Pre‑establishment costs | Division 60 |

4 | Resident agents acting for non‑residents | Division 57 |

A net amount is worked out for each tax period that applies to you. This is the amount payable by you to the Commonwealth, or payable to you by the Commonwealth, for the tax period.

Adjustments can be made to the net amount. Increasing adjustments increase your net amount, and decreasing adjustments decrease your net amount.

Note 1: GST on taxable importations is not included in the net amount. It is dealt with separately under section 33‑15.

Note 2: Net amounts payable to the Commonwealth are to be paid to the Commissioner on the Commonwealth’s behalf (see Division 33).

(1) The net amount for a tax period applying to you is worked out using the following formula:

![]()

where:

GST is the sum of all of the GST for which you are liable on the *taxable supplies that are attributable to the tax period.

input tax credits is the sum of all of the input tax credits to which you are entitled for the *creditable acquisitions and *creditable importations that are attributable to the tax period.

For the basic rules on what is attributable to a particular period, see Division 29.

(2) However, the *net amount for the tax period may be increased or decreased if you have any *adjustments for the tax period.

If you have any *adjustments that are attributable to a tax period applying to you, alter your *net amount for the period as follows:

(a) add to the amount worked out under subsection 17‑5(1) for the period the sum of all the *increasing adjustments (if any) that are attributable to the period;

(b) subtract from that amount the sum of all the *decreasing adjustments (if any) that are attributable to the period.

For the basic rules on what adjustments are attributable to a particular period, see Division 29.

Chapter 4 contains special rules relating to net amounts or adjustments, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | Anti‑avoidance | Division 165 |

2 | Cessation of registration | Division 138 |

3 | Changes in the extent of creditable purpose | Division 129 |

4 | Company amalgamations | Division 90 |

5 | Gambling | Division 126 |

6 | GST branches | Division 54 |

7 | GST groups | Division 48 |

8 | GST joint ventures | Division 51 |

9 | Insurance | Division 78 |

10 | Representatives of incapacitated entities | Division 147 |

11 | Resident agents acting for non‑residents | Division 57 |

12 | Second‑hand goods | Division 66 |

13 | Supplies in satisfaction of debts | Division 105 |

14 | Supplies of going concerns | Division 135 |

15 | Supplies of things acquired, imported or applied to make financial supplies | Division 132 |

Table of Subdivisions

19‑A Adjustment events

19‑B Adjustments for supplies

19‑C Adjustments for acquisitions

Adjustments can arise because of adjustment events. They are events such as a cancellation of a supply or acquisition, or a change in the consideration for a supply or acquisition (for example, because of a volume discount).

Note: Importations do not give rise to adjustment events.

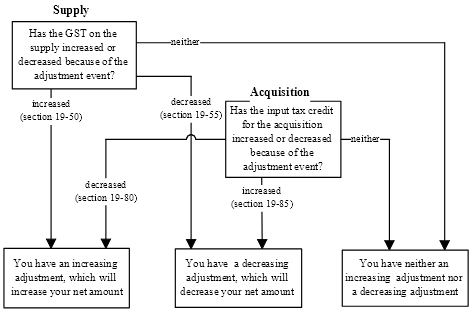

The following diagram shows how an *adjustment event for a supply or acquisition can give rise to an *increasing adjustment or a *decreasing adjustment.

(1) An adjustment event is any event which has the effect of:

(a) cancelling a supply or acquisition; or

(b) changing the *consideration for a supply or acquisition; or

(c) causing a supply or acquisition to become, or stop being, a *taxable supply or *creditable acquisition.

Example: If goods that are supplied for export are not exported within the time provided in section 38‑185, the supply is likely to become a taxable supply after originally being a supply that was GST‑free.

(2) Without limiting subsection (1), these are *adjustment events:

(a) the return to a supplier of a thing, or part of a thing, supplied (whether or not the return involves a change of ownership of the thing);

(b) a change to the previously agreed *consideration for a supply or acquisition, whether due to the offer of a discount or otherwise;

(c) a change in the extent to which an entity that makes an acquisition provides, or is liable to provide, consideration for the acquisition (unless the entity *accounts on a cash basis).

(3) An *adjustment event:

(a) can arise in relation to a supply even if it is not a *taxable supply; and

(b) can arise in relation to an acquisition even if it is not a *creditable acquisition.

You have an adjustment for a supply for which you are liable to pay GST (or would be liable to pay GST if it were a *taxable supply) if:

(a) in relation to the supply, one or more *adjustment events occur during a tax period; and

(b) GST on the supply was attributable to an earlier tax period (or, if the supply was not a taxable supply, would have been attributable to an earlier tax period had the supply been a taxable supply); and

(c) as a result of those adjustment events, the *previously attributed GST amount for the supply no longer correctly reflects the amount of GST on the supply (the corrected GST amount), taking into account any adjustments for the supply.

The previously attributed GST amount for a supply is:

(a) the amount of any GST that was attributable to a tax period in respect of the supply; plus

(b) the sum of any *increasing adjustments, under this Subdivision, that were previously attributable to a tax period in respect of the supply; minus

(c) the sum of any *decreasing adjustments, under this Subdivision, that were previously attributable to a tax period in respect of the supply.

If the *corrected GST amount is greater than the *previously attributed GST amount, you have an increasing adjustment equal to the difference between the corrected GST amount and the previously attributed GST amount.

If the *corrected GST amount is less than the *previously attributed GST amount, you have a decreasing adjustment equal to the difference between the previously attributed GST amount and the corrected GST amount.

You have an adjustment for an acquisition for which you are entitled to an input tax credit (or would be entitled to an input tax credit if the acquisition were a *creditable acquisition) if:

(a) in relation to the acquisition, one or more *adjustment events occur during a tax period; and

(b) an input tax credit on the acquisition was attributable to an earlier tax period (or, if the acquisition was not a creditable acquisition, would have been attributable to an earlier tax period had the acquisition been a creditable acquisition); and

(c) as a result of those adjustment events, the *previously attributed input tax credit amount for the acquisition (if any) no longer correctly reflects the amount of the input tax credit (if any) on the acquisition (the corrected input tax credit amount), taking into account any adjustments for the acquisition.

The previously attributed input tax credit amount for an acquisition is:

(a) the amount of any input tax credit that was attributable to a tax period in respect of the acquisition; plus

(b) the sum of any *increasing adjustments, under this Subdivision, that were previously attributable to a tax period in respect of the acquisition; minus

(c) the sum of any *decreasing adjustments, under this Subdivision, that were previously attributable to a tax period in respect of the acquisition.

If the *previously attributed input tax credit amount is greater than the *corrected input tax credit amount, you have an increasing adjustment equal to the difference between the previously attributed input tax credit amount and the corrected input tax credit amount.

If the*previously attributed input tax credit amount is less than the *corrected input tax credit amount, you have a decreasing adjustment equal to the difference between the corrected input tax credit amount and the previously attributed input tax credit amount.

If debts are written off as bad or are outstanding after 12 months, adjustments (for the purpose of working out net amounts) are made. They can arise both for amounts written off or outstanding and for recovery of amounts previously written off or outstanding.

Note: This Division does not apply to supplies and acquisitions that you account for on a cash basis (except in the limited circumstances referred to in Division 159).

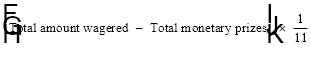

(1) You have a decreasing adjustment if:

(a) you made a *taxable supply; and

(b) the whole or part of the *consideration for the supply has not been received; and

(c) you write off as bad the whole or a part of the debt, or the whole or a part of the debt has been due for 12 months or more.

The amount of the decreasing adjustment is 1/11 of the amount written off, or 1/11 of the amount that has been due for 12 months or more, as the case requires.

(2) However, you cannot have an *adjustment under this section if you *account on a cash basis.

You have an increasing adjustment if:

(a) you made a *taxable supply in relation to which you had a *decreasing adjustment under section 21‑5 for a debt; and

(b) you recover the whole or a part of the amount written off, or the whole or a part of the amount that has been due for 12 months or more, as the case requires.

The amount of the increasing adjustment is 1/11 of the amount recovered.

(1) You have an increasing adjustment if:

(a) you made a *creditable acquisition for *consideration; and

(b) the whole or part of the consideration is due, but you have not provided the consideration due; and

(c) the supplier of the thing you acquired writes off as bad the whole or a part of the debt, or the whole or a part of the debt has been due for 12 months or more.

The amount of the increasing adjustment is 1/11 of the amount written off, or 1/11 of the amount that has been due for 12 months or more, as the case requires.

(2) However, you cannot have an *adjustment under this section if you *account on a cash basis.

You have a decreasing adjustment if:

(a) you made a *creditable acquisition in relation to which you had an *increasing adjustment under section 21‑15 for a debt; and

(b) you pay to the supplier of the thing you acquired the whole or a part of the amount written off, or the whole or a part of the amount that has been due for 12 months or more, as the case requires.

The amount of the decreasing adjustment is 1/11 of the amount recovered.

Chapter 4 contains special rules relating to adjustments for bad debts, as follows:

Checklist of special rules | |||

Item | For this case ... | See: | |

1 | Changing your accounting basis | Division 159 | |

2 | Gambling | Division 126 | |

3 | Sale of freehold interests etc. | Division 75 | |

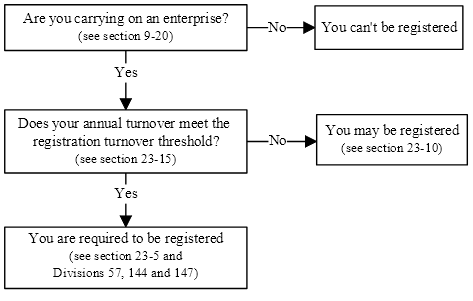

This diagram shows when you are required to be, and when you may, be registered.

Note: This section is an explanatory section.

You are required to be registered under this Act if:

(a) you are *carrying on an *enterprise; and

(b) your *annual turnover meets the *registration turnover threshold.

Note: It is the entity that carries on the enterprise that is required to be registered (and not the enterprise).

(1) You may be *registered under this Act if you are carrying on an *enterprise (whether or not your turnover is at, above or below the *registration turnover threshold).

(2) You may be *registered under this Act if you intend to carry on an *enterprise from a particular date.

(1) Your registration turnover threshold (unless you are a non‑profit body) is:

(a) $50,000; or

(b) such higher amount as the regulations specify.

(2) Your registration turnover threshold if you are a non‑profit body is:

(a) $100,000; or

(b) such higher amount as the regulations specify.

Chapter 4 contains special rules relating to who is *required to be registered, or who may be *registered, as follows:

Checklist of special rules | ||

Item | For this case ... | See: |

1 | Representatives of incapacitated entities | Division 147 |

2 | Resident agents acting for non‑residents | Division 57 |

3 | Taxis | Division 144 |

Table of Subdivisions

25‑A How you become registered

25‑B How your registration can be cancelled

You must apply, in the *approved form, to be *registered under this Act if:

(a) you are not registered under this Act; and

(b) you are *required to be registered.

You must make your application within 21 days after becoming required to be registered.

(1) The Commissioner must *register you if:

(a) you have applied for registration in an *approved form; and

(b) the Commissioner is satisfied that you are *carrying on an *enterprise, or you intend to carry on an enterprise from a particular date specified in your application.

Note: Refusing to register you under this subsection is a reviewable GST decision (see Division 7 of Part VI of the Taxation Administration Act 1953).

(2) The Commissioner must *register you (even if you have not applied for registration) if the Commissioner is satisfied that you are *required to be registered.

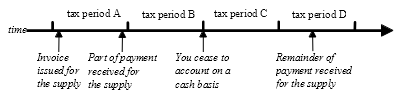

Note: Registering you under this subsection is a reviewable GST decision (see Division 7 of Part VI of the Taxation Administration Act 1953).