An Act to provide financial assistance to the States, the Australian Capital Territory and the Northern Territory, and for related purposes

Part 1—Preliminary

1 Short title [see Note 1]

This Act may be cited as the A New Tax System (Commonwealth‑State Financial Arrangements) Act 1999.

2 Commencement [see Note 1]

(1) This Act commences at the later of:

(a) the start of the day on which this Act receives the Royal Assent; and

(b) the start of the day after the last day on which any of the following receive the Royal Assent:

(i) the GST Act; and

(iii) the A New Tax System (Goods and Services Tax Administration) Act 1999.

(2) To avoid doubt, this Act does not commence unless all of the Acts mentioned in subsection (1) have received the Royal Assent

3 Outline of Act

This Act provides for GST revenue to be distributed to the States. This revenue can be used by the States for any purpose. In addition, some other amounts are payable to the States.

It also deals with circumstances in which the rate of the GST and the GST base can be altered.

Part 1 of the Act deals with preliminary matters and contains the definitions of terms used throughout the Act.

Part 2 deals with the Intergovernmental Agreement on the Reform of Commonwealth‑State Financial Relations.

Part 3 contains the provisions related to changing the rate and base of the GST.

Part 4 provides for grants to the States. Division 1 of that Part provides for the GST revenue to be paid to the States, Division 2 provides for the payment of other amounts and Division 3 contains general provisions about the timing and payments of grants.

Part 5 contains miscellaneous provisions.

Schedule 1 contains provisions that apply for the transitional GST years. These ensure that no State can receive less than a guaranteed minimum amount and allow the Commonwealth to make grants totalling more than the GST revenue in certain circumstances.

Schedule 2 contains a copy of the Intergovernmental Agreement on the Reform of Commonwealth‑State Financial Relations.

4 Definitions

In this Act, unless the contrary intention appears:

estimated population has the meaning given by section 7.

general interest charge means the charge worked out under Part IIA of the Taxation Administration Act 1953.

GST has the same meaning as in the GST Act.

GST Act means the A New Tax System (Goods and Services Tax) Act 1999.

GST Imposition Acts mean:

(a) the A New Tax System (Goods and Services Tax Imposition—Customs) Act 1999;

(b) the A New Tax System (Goods and Services Tax Imposition—Excise) Act 1999;

(c) the A New Tax System (Goods and Services Tax Imposition—General) Act 1999;

(d) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005;

(e) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Excise) Act 2005;

(f) the A New Tax System (Goods and Services Tax Imposition (Recipients)—General) Act 2005.

GST law has the same meaning as in the GST Act.

GST revenue has the meaning given by section 5.

GST year means:

(a) the financial year commencing on 1 July 2000; and

(b) each succeeding financial year.

These are described by a figure referring to 2 years (for example, the 2000‑01 GST year is the GST year commencing on 1 July 2000).

guaranteed minimum amount for a State for a GST year has the meaning given by clause 2 of Schedule 1.

Health Minister means the Minister administering the National Health Act 1953.

hospital grant has the meaning given by section 6.

index factor for a GST year means the factor worked out under section 8.

index number, for a quarter, means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of that quarter.

luxury car tax law has the meaning given by section 27‑1 of the A New Tax System (Luxury Car Tax) Act 1999.

relativities factor for a State for a GST year has the meaning given by section 9.

State includes the Australian Capital Territory and the Northern Territory.

Torres Strait Treaty means the Treaty between Australia and the Independent State of Papua New Guinea concerning Sovereignty and Maritime Boundaries in the area between the 2 countries, including the area known as Torres Strait, and Related Matters, signed at Sydney, Australia on 18 December 1978.

Note: The text of the Treaty is set out in the Australian Treaty Series 1985 No. 4.

transitional GST year means:

(a) a GST year commencing on or before 1 July 2002; or

(b) a later prescribed GST year.

These are described by a figure referring to 2 years (for example, the 2000‑01 transitional GST year is the transitional GST year commencing on 1 July 2000).

wine equalisation tax law has the meaning given by section 33‑1 of the A New Tax System (Wine Equalisation Tax) Act 1999.

5 GST revenue

(1) The Commissioner must make a determination for each of the matters covered by subsections (3) and (4) stating:

(a) the actual amount for the period from 1 July to 31 May in the GST year; and

(b) the estimated amount for June in the GST year; and

(c) except for the first GST year—the actual amount for June in the previous GST year.

(2) The GST revenue for a GST year is the amount determined by the Commissioner as the amount worked out in the following way:

Step 1. Add together all of the actual amounts determined for matters covered by subsection (3) for the period from 1 July to 31 May in the GST year.

Step 2. Add together all of the estimates for June in the GST year for matters covered by subsection (3).

Step 3. Add the result of Step 1 to the result of Step 2.

Step 4. Add together all of the actual amounts determined for matters covered by subsection (4) for the period from 1 July to 31 May in the GST year.

Step 5. Add together all of the estimates for June in the GST year for matters covered by subsection (4).

Step 6. Add the result of Step 4 to the result of Step 5.

Step 7. Subtract the result of Step 6 from the result of Step 3.

Step 8. Adjust the result worked out in Step 7 for the GST year by the amount necessary to take account of the difference between the estimates made in relation to June in the previous GST year and the actual amounts determined for that month.

(3) The matters are:

(a) the amount of GST that was collected; and

(aa) the amount of general interest charge that was collected to the extent that it is attributable to:

(i) unpaid GST; or

(ii) unpaid general interest charge, being general interest charge payable in respect of unpaid GST; and

(b) the amount of payments made to the Commissioner of Taxation where the payment represents an amount of GST that would have been payable if the Constitution did not prevent tax from being imposed on property of any kind belonging to a State and if section 5 of the GST Imposition Acts had not been enacted; and

(c) the amount of additional amounts of GST that would have been collected if the Commonwealth and Commonwealth entities could be made subject to taxation by a Commonwealth law and if section 177‑1 of the GST Act made those entities actually liable rather than notionally liable; and

(d) the amount, determined in a manner agreed by the Commonwealth and all of the States, that represents amounts of voluntary GST payments that should have, but have not, been paid by local government bodies.

(4) The matters are:

(a) the amount that was paid under the GST refund provisions; and

(b) the amount that was payable under the GST refund provisions and that (rather than being paid directly under those provisions) was allocated, applied or refunded in accordance with Part IIB of the Taxation Administration Act 1953;

to the extent that the amounts are attributable to GST.

(4A) In making determinations and estimates for the purposes of subsection (2), the Commissioner must make such adjustments as are necessary to ensure that any effect that the luxury car tax law or wine equalisation tax law would otherwise have on the amounts of GST, and the amounts attributable to GST, is removed.

(5) The Commissioner of Taxation must make determinations under this section for a GST year before 20 June in the GST year.

(6) In this section:

GST refund provision means a provision of a Commonwealth law the effect of which is to require the Commonwealth to refund some or all of an amount of GST that has been paid, whether or not the provision also applies in relation to other kinds of tax.

Note: The capacity for new GST refund provisions to be created is limited by section 11, which requires each State’s agreement for changes to the GST base.

6 Hospital grants

(1) A hospital grant for a State for a GST year is the amount worked out using the formula:

where:

applicable reduction means the amount determined by the Health Minister before 6 June in the GST year to be the estimate of the reduction in the amount otherwise payable to the State during the GST year under a health care grant (being a reduction required by the conditions of the grant).

sum of deductible amounts means the amount determined by the Health Minister before 6 June in the GST year to be the estimate of such part of the total amount payable as is the sum of the following amounts:

(a) the sum of the deductible amounts payable to the State during the GST year;

(b) the sum of the deductible amounts payable to a hospital, or to another person, during the GST year, being amounts that would have been payable to the State had the Health Minister been satisfied that the State was adhering to the principles set out in subsection 6(2) of the Health Care (Appropriation) Act 1998.

total amount payable means the amount determined by the Health Minister before 6 June in the GST year to be the estimate of the sum of the following amounts:

(a) the amount payable to the State during the GST year under a health care grant;

(b) the amount payable to a hospital, or to another person, during the GST year under a health care grant, being an amount that would have been payable to the State had the Health Minister been satisfied that the State was adhering to the principles set out in subsection 6(2) of the Health Care (Appropriation) Act 1998.

(2) In this section:

deductible amounts are amounts that relate to the following:

(a) mental health services;

(b) projects or programs of a kind referred to in paragraph 4(1)(b) of the Health Care (Appropriation) Act 1998;

(c) the critical and urgent treatment incentive program;

(d) the recognition of special demands arising from the Torres Strait Treaty;

(e) the transition from a 1993‑98 Medicare Agreement to another agreement or arrangement between the Commonwealth and a State, being an agreement or arrangement that specifies conditions applying to health care grants;

(f) a service, project or program, or a component of a health care grant, that is determined by the Health Minister to be a service, project, program or component in relation to which an amount payable is to be treated as a deductible amount.

health care grant means a grant of financial assistance under section 4 of the Health Care (Appropriation) Act 1998.

7 Determination of population of a State

(1) The estimated population of a State on 31 December in a GST year is the population of the State on that date as determined by the Australian Statistician after that date and before 6 June in the GST year.

(2) In making a determination under this section, the Australian Statistician must:

(a) if practicable, consult with the official Statistician of each State concerned; and

(b) have regard to the latest statistics in relation to population available to the Australian Statistician on the day on which the determination is made.

8 Index factor

(1) The index factor for a GST year is the factor worked out using the formula:

where:

GST year index number means the sum of the index numbers for each of the first 3 quarters in the GST year and the final quarter for the previous GST year.

previous GST year index number means the GST year index number for the previous GST year.

(2) For the purposes of subsection (1), all financial years are taken to be GST years.

9 Relativities factor

(1) The relativities factor for a State for a GST year is the factor determined in writing by the Treasurer. The Treasurer must determine the factor before 10 June in the GST year.

(2) Before making the determination, the Treasurer must consult each of the States.

Part 2—Intergovernmental Agreement on the Reform of Commonwealth‑State Financial Relations

10 Intergovernmental Agreement on the Reform of Commonwealth‑State Financial Relations

(1) A copy of the Intergovernmental Agreement on the Reform of Commonwealth‑State Financial Relations is set out in Schedule 2.

Note: Paragraph B3(ii) of Appendix B to the agreement, as set out in Schedule 2, refers to section 39 of the Taxation Administration Act 1953. That section has been remade as section 105‑65 in Schedule 1 to that Act.

(2) It is the intention of the Commonwealth to comply with, and give effect to, the agreement.

Part 3—Changing the rate and base of GST

11 Changing the rate and base of GST

(1) The rate of the GST, and the GST base, are not to be changed unless each State agrees to the change. Such changes to the GST base should be consistent with:

(a) maintaining the integrity of the GST base; and

(b) administrative simplicity; and

(c) minimising compliance costs for taxpayers.

(2) In particular, but without limiting subsection (1), a Minister may only make a determination under the GST Act, or the A New Tax System (Goods and Services Tax Transition) Act 1999, that affects the GST base if the determination is made in accordance with a procedure to which all of the States have agreed.

(3) This section does not apply to the changes to the GST base that are contained in legislation introduced, or regulations or other instruments made, before 1 July 2001 if the changes are:

(a) of an administrative nature; and

(b) necessary to facilitate minor adjustments to the GST; and

(c) made having regard to the need to protect the revenue of the States.

(4) Also, this section does not apply to later changes to the GST base if the changes are of an administrative nature and are approved by a majority of the Commonwealth and the States.

12 Definitions

(1) In this Part:

rate of the GST is the rate of tax specified in the GST Imposition Acts.

(2) A change is of an administrative nature only if the change is necessary to:

(a) maintain the integrity of the GST base; or

(b) prevent tax avoidance.

Part 4—Grants to the States

Division 1—GST revenue grants

13 GST revenue grants

Subject to this Act, each State is entitled to the payment, by way of financial assistance, for a GST year, of a grant worked out using the formula:

where:

adjusted State population means the estimated population of the State on 31 December in the GST year (see subsection 7(1)) multiplied by the relativities factor (see section 9) for the State for that year.

adjusted total population means the sum of the adjusted populations of all of the States for the GST year.

GST revenue means the GST revenue for the GST year (see section 5).

State hospital grant means the hospital grant for the State for the GST year (see section 6).

total hospital grants means the sum of the hospital grants for all of the States for the GST year.

Note: See also Schedule 1 which deals with transitional GST years.

Division 2—Other grants

14 Franchise fees windfall tax reimbursement payments

Each State is to be paid by way of financial assistance, for a GST year, a franchise fees windfall tax reimbursement payment equal to the sum of the amounts determined by the Commissioner of Taxation, before 22 June in the GST year, to be:

(a) the total of the amounts of tax collected by the State under the Franchise Fees Windfall Tax (Collection) Act 1997 that are remitted to the Commissioner of Taxation before 1 June in the GST year; and

(b) the total of the amounts of tax to be collected by the State under that Act that is likely to be remitted to the Commissioner of Taxation during the month of June in the GST year.

15 Competition Agreement payments

(1) The Treasurer may pay, by way of financial assistance to a State, for a GST year:

(a) an amount that does not exceed; or

(b) amounts that in total do not exceed;

the maximum competition payment amount worked out under whichever of subsection (2), (3) or (4) applies.

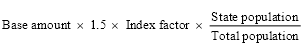

(2) The maximum competition payment amount for a State for the 2000‑01 GST year is:

where:

base amount means the sum of the maximum amounts referred to in section 12A of the States Grants (General Purposes) Act 1994 (as in force immediately before its repeal) for the financial year commencing on 1 July 1999.

index factor means the index factor for the GST year (see section 8).

State population means the estimated population of the State on 31 December in the GST year (see subsection 7(1)).

total population means the sum of the estimated populations of all of the States on 31 December in the GST year.

(3) The maximum competition payment amount for a State for the 2001‑02 GST year is:

where:

base amount means the total of the maximum competition payment amounts for the year commencing on 1 July 2000 for each of the States.

index factor means the index factor for the GST year (see section 8).

State population means the estimated population of the State on 31 December in the GST year (see subsection 7(1)).

total population means the sum of the estimated populations of all the States on 31 December in the GST year.

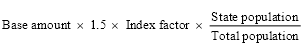

(4) The maximum competition payment amount for a State for a later GST year is:

where:

base amount means the total of the maximum competition payment amounts for the previous GST year for each of the States.

index factor means the index factor for the GST year (see section 8).

State population means the estimated population of the State on 31 December in the GST year (see subsection 7(1)).

total population means the sum of the estimated populations of all of the States on 31 December in the GST year.

Division 3—Payment of grants

17 Overpayment or underpayment of grant

(1) If a State has been paid an amount in excess of the amount that, under a provision of this Act, it was entitled to receive by way of financial assistance for a GST year, the Treasurer must deduct an amount equal to the excess from any amount that the State is entitled to receive by way of financial assistance under this Act for the year immediately following the GST year.

(2) If a State has been paid less than the amount that, under a provision of this Act, it was entitled to receive by way of financial assistance for a GST year, the Treasurer must add an amount equal to the shortfall to any amount that the State is entitled to receive by way of financial assistance under this Act for the year immediately following the GST year.

18 Advance payments for GST year

The Treasurer may make advances to a State of portions of the amount or amounts to which, it appears to the Treasurer, the State will be entitled under this Act for a GST year.

19 Treasurer may fix amounts, and times of payments, of financial assistance

Financial assistance payable to a State under this Act is to be paid in such amounts, and at such times, as the Treasurer determines in writing.

Part 5—Miscellaneous

20 Appropriation

Payments under this Act are to be made out of the Consolidated Revenue Fund, which is appropriated accordingly.

21 Delegation by Treasurer

(1) The Treasurer may, by signed writing, delegate to an SES employee in the Department all or any of the Treasurer’s powers under sections 18 and 19.

(2) A delegate is, in the exercise of a power so delegated, subject to the Treasurer’s directions.

22 Determinations

A determination made under this Act by:

(a) the Treasurer; or

(b) the Health Minister; or

(c) the Commissioner of Taxation; or

(d) the Australian Statistician;

is, for the purposes of this Act, conclusively presumed to be correct.

23 Regulations

The Governor‑General may make regulations:

(a) prescribing matters required or permitted by this Act to be prescribed; or

(b) prescribing matters necessary or convenient to be prescribed for carrying out or giving effect to this Act.

Schedule 2—Intergovernmental Agreement on the Reform of Commonwealth‑State Financial Relations

Note: See section 10.

THE COMMONWEALTH OF AUSTRALIA

THE STATE OF NEW SOUTH WALES

THE STATE OF VICTORIA

THE STATE OF QUEENSLAND

THE STATE OF WESTERN AUSTRALIA

THE STATE OF SOUTH AUSTRALIA

THE STATE OF TASMANIA

THE AUSTRALIAN CAPITAL TERRITORY, AND

THE NORTHERN TERRITORY OF AUSTRALIA

WHEREAS

(1) the Special Premiers’ Conference on 13 November 1998 developed principles for the reform of Commonwealth‑State financial relations;

(2) the Commonwealth, States and Territories are in agreement that the current financial relationship between levels of government must be reformed to facilitate a stronger and more productive federal system for the new millennium;

(3) while a majority of the States and Territories support the introduction of the Goods and Services Tax (GST), the agreement of New South Wales, Queensland and Tasmania to the reform of Commonwealth‑State financial relations does not imply their in‑principle endorsement of the GST;

(4) an Agreement was reached between the Commonwealth and the States and Territories on the reform of Commonwealth‑State financial relations on 9 April 1999;

(5) this revised Agreement was made necessary by the changes to the Commonwealth Government’s A New Tax System (ANTS) package announced by the Prime Minister on 28 May 1999; and

(6) this revised Agreement supersedes the previous Agreement of 9 April 1999:

IT IS HEREBY AGREED:

PART 1—PRELIMINARY

Commencement Clause

1. This Agreement will commence between the Commonwealth, the States and the Territories on 1 July 1999 unless otherwise agreed by the Parties.

Objectives

2. The objectives of the reforms set down in this agreement include:

(i) the achievement of a new national tax system, including the elimination of a number of existing inefficient taxes which are impeding economic activity;

(ii) the provision to State and Territory Governments of revenue from a more robust tax base that can be expected to grow over time; and

(iii) an improvement in the financial position of all State and Territory Governments, once the transitional changes have been completed, relative to that which would have existed had the current arrangements continued.

3. All Parties to the Agreement acknowledge the need to pursue on‑going reform of Commonwealth‑State financial relations.

Acknowledgement of Agreement

4. The Commonwealth will attach the Agreement as a schedule to the A New Tax System (Commonwealth‑State Financial Arrangements) Act 1999. The Commonwealth will use its best endeavours to ensure the Act will require compliance with the Agreement. The States and Territories will attach the Agreement as a schedule to relevant State and Territory legislation. The States and Territories will use their best endeavours to ensure their legislation will require compliance with the Agreement.

PART 2—Commonwealth‑State Financial reform

Reform Measures

5. The Parties will undertake all necessary steps to have appropriate legislation enacted to give effect to the following reform measures.

(i) The Commonwealth will legislate to provide all of the revenue from the GST to the States and Territories and will legislate to maintain the rate and base of the GST in accordance with this Agreement.

(ii) The Commonwealth will cease to apply the Wholesale Sales Tax from 1 July 2000 and will not reintroduce it or a similar tax in the future.

(iii) The temporary arrangements for the taxation of petrol, liquor and tobacco under the safety net arrangements announced by the Commonwealth on 6 August 1997 will cease on 1 July 2000.

(iv) The payment of Financial Assistance Grants will cease on 1 July 2000.

(v) The Commonwealth will continue to provide Specific Purpose Payments (SPPs) to the States and Territories and has no intention of cutting aggregate SPPs as part of the reform process set out in this Agreement, consistent with the objective of the State and Territory Governments being financially better off under the new arrangements.

(vi) The States and Territories will cease to apply the taxes referred to in Appendix A from the dates outlined below and will not reintroduce them or similar taxes in the future.

• Bed taxes, from 1 July 2000;

• Financial Institutions Duty, from 1 July 2001;

• Stamp duties on quoted marketable securities from 1 July 2001;

• Debits tax by 1 July 2005, subject to review by the Ministerial Council;

(vii) The Ministerial Council will by 2005 review the need for retention of stamp duty on non‑residential conveyances; leases; mortgages, debentures, bonds and other loan securities; credit arrangements, installment purchase arrangements and rental arrangements; and on cheques, bills of exchange, promissory notes; and unquoted marketable securities.

(viii) The States and Territories will adjust their gambling tax arrangements to take account of the impact of the GST on gambling operators.

(ix) Following negotiations under the CSHA, the States and Territories will ensure that increases in pensions and allowances specified in the tax reform package will not flow through to increased public housing rents where these rents are linked to the level of pensions.

(x) Nothing in this clause will prevent any Party from introducing anti‑avoidance measures that are reasonably necessary to protect its remaining tax base or liabilities accrued prior to the date the tax ceases to apply.

GST Legislation

6. All Parties agree to reconsider this Agreement should the Commonwealth Parliament pass the GST legislation in a way that significantly affects this Agreement.

Distribution of GST Revenue

7. The Commonwealth will make GST revenue grants to the States and Territories equivalent to the revenue from the GST subject to the arrangements in this Agreement. GST revenue grants will be freely available for use by the States and Territories for any purpose.

8. The Commonwealth will distribute GST revenue grants among the States and Territories in accordance with horizontal fiscal equalisation (HFE) principles subject to the transitional arrangements set out below and other relevant provisions of this Agreement.

9. Details of the payment arrangements are contained in Appendix B to this Agreement.

Transitional Arrangements

10. In each of the transitional years following the introduction of the GST, the Commonwealth guarantees that the budgetary position of each individual State and Territory will be no worse off than it would have been had the reforms set out in this Agreement not been implemented.

11. The Commonwealth will extend the transitional period by Regulation (as provided for in the A New Tax System (Commonwealth‑State Financial Arrangements) Act 1999) to give effect to the commitments in clause 10 in the event that transitional assistance is required by any State or Territory after 30 June 2003.

12. To meet this guarantee, the Commonwealth will make transitional assistance payments to each State and Territory, as necessary, over this period. These payments will take the form of interest free loans and grants in July 2000‑01 and grants paid quarterly in subsequent years and will be freely available for use by the States and Territories for any purpose. Any payments or repayments made by way of loans or grants under the Commonwealth’s guarantee will be excluded from assessments of per capita relativities recommended by the Commonwealth Grants Commission (CGC).

13. The amounts of any additional assistance under the guarantee will be determined in accordance with the processes set out in Appendix C to this Agreement.

14. After the second year following the introduction of the GST, GST revenue grants will be determined on the basis of HFE principles. That is, after the first two years, any State or Territory which is receiving more than would have been received under the current arrangements will retain that excess.

First Home Owners Scheme

15. To offset the impact of the introduction of a GST, the States and Territories will assist first homebuyers through the funding and administration of a new uniform First Home Owners Scheme.

16. This assistance will be provided to first home owners consistent with Appendix D to this Agreement.

Application of the GST to Government

17. The Parties intend that the Commonwealth, States, Territories and local government and their statutory corporations and authorities will operate as if they were subject to the GST legislation. They will be entitled to register, will pay GST or make voluntary or notional payments where necessary and will be entitled to claim input tax credits in the same way as non‑Government organisations. All such payments will be included in GST revenue.

18. The Commonwealth will legislate to require the States and the Northern Territory to withhold from any local government authority being in breach of clause 17 a sum representing the amount of unpaid voluntary or notional GST payments. Amounts withheld will form part of the GST revenue pool. Detailed arrangements will be agreed by the Ministerial Council on advice from Heads of Treasuries.

Government Taxes and Charges

19. The Commonwealth, States and Territories agree that the GST does not apply to the payment of some taxes and compulsory charges.

20. The Parties will agree a list of taxes and compulsory charges that are outside the scope of the GST. This list will be promulgated by a determination by the Commonwealth Treasurer as set out in Division 81‑5 of the A New Tax System (Goods and Services Tax) Act 1999 (the GST Act).

21. In agreeing the list, the Commonwealth, States and Territories will have regard to the following principles:

(i) taxes that are in the nature of a compulsory impost for general purposes and compulsory charges by the way of fines or penalties should not be subject to GST as these will not relate to any specific supply of goods or services;

(ii) similarly, those regulatory charges that do not relate to particular goods or services should be outside the scope of the GST; and

(iii) the inclusion of any other charge in the Commonwealth Treasurer’s determination notwithstanding that it may relate to the supply of a particular good or service will require the unanimous agreement of the Commonwealth, States and Territories.

22. The agreed list of taxes and other compulsory charges that are outside the scope of the GST will be subject to on‑going review and adjustment as necessary in consultation with the Ministerial Council. The Parties will notify any objections to changes to the list within a period to be specified by the Ministerial Council.

Reciprocal Taxation

23. Reciprocal taxation will be progressed on a revenue neutral basis, through the negotiation of a Reciprocal Taxation Agreement with the objectives of:

(i) improving the transparency of tax arrangements between all levels of government;

(ii) ensuring tax neutrality; and

(iii) replacing the Statement of Policy Intent (SOPI) for the taxation treatment of Government Business Enterprises with tax arrangements which are broader in scope.

24. It is the intention of the Parties to this Agreement that a National Tax Equivalent Regime (NTER) for income tax will be operational for State and Territory government business enterprises from 1 July 2000. It is also intended that the reciprocal application of other Commonwealth, State and Territory taxes will be subsequently implemented as soon as practicable.

25. Local government organisations will be consulted with a view to making the NTER for income tax operational for wholly owned local government business enterprises from 1 July 2000 and including local government in the Reciprocal Tax Agreement at a later date.

26. Where the application of full indirect reciprocal tax arrangements is prevented by the Constitution, jurisdictions have agreed to work cooperatively to introduce voluntary payment arrangements in these circumstances.

27. All governments have agreed that no further compensation payments will be payable by any jurisdiction under the SOPI.

Monitoring of Prices

28. In accordance with the Trade Practices Act 1974, as amended, the Australian Competition and Consumer Commission will formally monitor prices and take action against businesses that take pricing decisions in a manner inconsistent with tax reform.

29. In order to ensure that these measures apply to the whole economy, the States and Territories will adopt the Schedule version of Part VB of the Trade Practices Act 1974 (Part XIAA of The New Tax System Price Exploitation Code) to extend the measures in Part VB to cover those areas outside the Commonwealth’s constitutional power. All Parties will work towards having any necessary legislation in place by 1 July 1999.

30. The monitoring and prohibition on unreasonable pricing decisions will commence on 1 July 1999 and continue until 30 June 2002.

part 3—administration of the GST

Management of the GST Rate

31. After the introduction of the GST, a proposal to vary the 10 per cent rate of the GST will require:

(i) the unanimous support of the State and Territory Governments;

(ii) the endorsement by the Commonwealth Government of the day; and

(iii) the passage of relevant legislation by both Houses of the Commonwealth Parliament.

Management of the GST Base

32. Subject to clauses 34, 35 and 36 of this Agreement, after the introduction of the GST, any proposal to vary the GST base will require:

(i) the unanimous support of the State and Territory Governments;

(ii) the endorsement by the Commonwealth Government of the day; and

(iii) the passage of relevant legislation by both Houses of the Commonwealth Parliament.

33. All future changes to the GST base should be consistent with:

(i) the maintenance of the integrity of the tax base;

(ii) simplicity of administration; and

(iii) minimising compliance costs for taxpayers.

34. A proposal to vary the GST base by way of a Ministerial determination under the GST Act and the GST Transition Act will require the unanimous agreement of the Ministerial Council established under clause 40. The Ministerial Council will develop practical arrangements to ensure timely consideration of proposed Ministerial determinations.

35. During the first 12 months following the implementation of the GST, the Commonwealth Government will retain the discretion to make changes unilaterally to the GST base where such changes:

(i) are of an administrative nature (as defined in Appendix E to this Agreement);

(ii) are necessary to facilitate the implementation of the new tax; and

(iii) have regard to the need to protect the revenue of the States and Territories.

36. From July 2001, changes to the GST base of an administrative nature (as defined in Appendix E) would require the majority support of the Commonwealth, the States and the Territories.

Australian Taxation Office

37. The States and Territories will compensate the Commonwealth for the agreed costs incurred by the Australian Taxation Office (ATO) in administering the GST.

38. Accountability and performance arrangements will be established between the ATO and the State and Territory Governments consistent with Appendix F to this Agreement. These arrangements will include maximising compliance, cost efficiency, simplicity for taxpayers and administrative transparency.

39. The ATO and State and Territory Governments will collaborate to explore options for the States and Territories to benefit from the use of the Australian Business Number system.

Part 4—institutional arrangements

Establishment of Ministerial Council

40. A Ministerial Council comprising the Commonwealth, the States and the Territories will be established from 1 July 1999 to oversee the operation of this Agreement.

41. The membership of the Ministerial Council will comprise the Treasurer of the Commonwealth and the Treasurers of the States and Territories (or designated representatives).

42. The functions of the Ministerial Council will include:

(i) the oversight of the operation of the GST;

(ii) the oversight and coordination of the implementation of this Agreement;

(iii) the review of matters of operational significance raised through the GST Administration Sub‑Committee;

(iv) discussion of CGC recommendations regarding relativities prior to the Commonwealth Treasurer making a determination;

(v) monitoring compliance with the conditions governing the provision of assistance to first home owners set out in Appendix D to this Agreement;

(vi) monitoring compliance with the Commonwealth’s undertaking with respect to SPPs;

(vii) considering reports of the GST Administration Sub‑Committee on the performance of the ATO in GST administration;

(viii) reviewing the operation of the Agreement over time and considering any amendments which may be proposed as a consequence of such review;

(ix) making recommendations to the Commonwealth Treasurer on the Guaranteed Minimum Amount applying to each State and Territory under the Transitional Arrangements;

(x) approving changes to the GST base which require the support of a majority of Commonwealth, State and Territory Governments;

(xi) considering on‑going reform of Commonwealth‑State financial relations; and

(xii) considering other matters covered in this Agreement.

43. The Treasurer of the Commonwealth will convene the Ministerial Council in consultation with the other members of the Council not less than once each financial year. If the Commonwealth Treasurer receives a request from a member of the Council, he will consult with the other members concerning convening a meeting. The Treasurer of the Commonwealth will be the chair of the Council. The Council may also conduct its business by correspondence.

44. All questions arising in the Ministerial Council will be determined by unanimous agreement unless otherwise specified in this Agreement.

45. While it is envisaged that the Ministerial Council will take decisions on most business arising from the operation of this Agreement, major issues will be referred by the Ministerial Council to Heads of Government for consideration, including under the auspices of the Council of Australian Governments.

46. The Ministerial Council will establish a GST Administration Sub‑Committee comprised of Commonwealth, State and Territory officials to monitor the operation of the GST, make recommendations regarding possible changes to the GST base and rate and to monitor the ATO’s performance in GST administration. The GST Administration Sub‑Committee will function in accordance with the arrangements set out in Appendix E to this Agreement.

SIGNED for and on behalf of the Parties by:

The Honourable John Winston Howard, Prime Minister of the Commonwealth of Australia, on the 20th day of June 1999 | |

The Honourable Robert John Carr, Premier of the State of New South Wales, on the 24th day of June 1999 | |

| |

The Honourable Jeffrey Gibb Kennett, Premier of the State of Victoria, on the 26th day of June 1999 | |

| |

The Honourable Peter Douglas Beattie, Premier of the State of Queensland, on the 25th day of June 1999 | |

| |

The Honourable Richard Fairfax Court, Premier of the State of Western Australia, on the 29th day of June 1999 | |

| |

The Honourable John Wayne Olsen, Premier of the State of South Australia, on the 25th day of June 1999 | |

| |

The Honourable James Alexander Bacon, Premier of the State of Tasmania, on the 25th day of June 1999 | |

| |

Kate Carnell, Chief Minister of the Australian Capital Territory, on the 22nd day of June 1999 | |

| |

The Honourable Denis Gabriel Burke, Chief Minister of the Northern Territory of Australia, on the 22nd day of June 1999 | |

APPENDICES

A: Taxes Subject to Reform

B: Payment of GST Revenues to the States and Territories

C: Transitional Arrangements

D: First Home Owners Scheme

E: GST Administration

F: GST Administration Performance Agreement—Guiding Principles

APPENDIX A

TAXES SUBJECT TO REFORM

The taxes which will cease to apply in accordance with paragraph 5 of this Agreement are set out below and in the relevant Commonwealth, State and Territory statutes as at 13 November 1998.

A1. The following taxes will cease to apply from 1 July 2000:

(i) Wholesale Sales Tax

Sales tax levied on the value of the last wholesale sale of goods sold or otherwise dealt with as imposed by the Commonwealth’s Sales Tax (Imposition) Acts.

(ii) Bed Taxes

Accommodation taxes levied on the cost of temporary residential accommodation.

A2. The following State and Territory taxes will cease to apply from 1 July 2001:

(i) Financial Institutions Duty

Financial Institutions Duty levied on the value of receipts (credits) at financial institutions and on the average daily liabilities and/or investments of short term money market dealers.

(ii) Stamp Duty on Marketable Securities

Stamp duty levied on turnover (ie sale price times quantity traded) on the transfer of marketable securities quoted on the ASX or another recognised stock exchange.

This excludes transfers of marketable securities in private companies and trusts, and in public companies and trusts where the securities are not quoted on the ASX or another recognised stock exchange.

A3. The following State and Territory tax will cease to apply by 1 July 2005, subject to review by the Ministerial Council:

(i) Debits Tax

Debits tax levied on the value of withdrawals (debits) from accounts with financial institutions with cheque drawing facilities.

Debits duty levied on transactions, including credit card transactions. This does not include stamp duty on electronic debits (refer A4 (v) below).

A4. The Ministerial Council will by 2005 review the need for retention of stamp duties on the following:

(i) Stamp Duty on Non‑residential Conveyances

Stamp duty levied on the value of conveyances other than residential property conveyances.

(ii) Stamp Duty on Non‑quotable Marketable Securities

Stamp duty levied on transfers of marketable securities in private companies and trusts, and in public companies and trusts where the securities are not quoted on the ASX or another recognised stock exchange.

(iii) Stamp Duty on Leases

Stamp duty levied on the rental payable under tenancy agreements.

(vi) Stamp Duty on Mortgages, Bonds, Debentures and Other Loan Securities

Stamp duty levied on the value of a secured loan property.

(v) Stamp Duty on Credit Arrangements, Installment Purchase Arrangements and Rental Arrangements

Stamp duty levied on the value of the loan under credit arrangements.

Stamp duty levied on credit business in respect of loans made, discount transactions and credit arrangements.

Stamp duty levied on the price of goods purchased under installment purchase arrangements.

Stamp duty levied on the rent paid in respect of the hire of goods, including consumer and producer goods.

(vi) Stamp Duty on Cheques, Bills of Exchange and Promissory Notes

Stamp duty levied on cheques, bills of exchange, promissory notes, or other types of payment orders, promises to pay or acknowledgment of debts, including duty on electronic debits.

APPENDIX B

PAYMENT OF GST REVENUES TO THE STATES AND TERRITORIES

B1. Subject to the transitional arrangements and other relevant provisions in this Agreement, the Commonwealth will distribute GST revenue grants among the States and Territories in accordance with horizontal fiscal equalisation (HFE) principles.

B2. The pool of funding to be distributed according to HFE principles in a financial year will comprise GST revenue grants and health care grants as defined under an Australian Health Care Agreement between the Commonwealth and the States and Territories. A State or Territory’s share of the pool will be based on its population share, adjusted by a relativity factor which embodies per capita financial needs based on recommendations of the Commonwealth Grants Commission. The relativity factor for a State or Territory will be determined by the Commonwealth Treasurer after he has consulted with each State and Territory.

B3. The total amount of GST revenue to be provided to the States and Territories in a financial year will be defined as:

(i) the sum of GST collections, voluntary and notional payments made by government bodies, and amounts withheld pursuant to clause 18; reduced by

(ii) the amounts paid or applied under Division 35 of the GST Act and under section 39 of the Taxation Administration Act 1953.

B4. The total amount of GST revenue in a financial year will be determined by the Commissioner of Taxation in the following way:

(i) actual outcomes for the items listed in paragraph B3 for the period 1 July to 31 May; plus

(ii) estimated outcomes for the items listed in paragraph B3 for the month of June; plus

(iii) an adjustment amount (which may be positive or negative) to account for any difference between the estimated and actual outcome for the items listed in paragraph B3 for the month of June in the previous year.

B5. GST revenue grants will be paid by the Commonwealth on the twenty‑seventh day of each month. Where the scheduled payment day is a Saturday, Sunday or public holiday in Canberra, the payment will be made on the next business day of the Reserve Bank of Australia in Canberra.

B6. The States and Territories shall be informed of the quantum of each monthly payment by close of business Canberra time on the twenty sixth day of each month. Where the day is a Saturday, Sunday or public holiday in Canberra, the States and Territories shall be informed of the quantum of the payment on the last business day of the Reserve Bank of Australia in Canberra prior to payment day.

B7. The distribution between the States and Territories of the payments of GST revenue grants up to 15 June in each year will be based on:

(i) the Treasurer’s determination of per capita relativities;

(ii) the latest available Australian Bureau of Statistics’ projections, or estimates, of State and Territory populations as at 31 December;

(iii) the latest available Department of Health and Aged Care estimates of health care grants to be provided to a State or Territory; and

(iv) the latest available estimates of the guaranteed minimum amount for each State and Territory to be calculated under Appendix C of this Agreement.

The Commonwealth will inform the States and Territories of any changes to the estimates as part of the advice to be provided to the States and Territories under paragraph B6.

B8. The payments of GST revenue grants after 15 June in each year will take into account the determinations of:

(i) per capita relativities and Guaranteed Minimum Amounts by the Treasurer;

(ii) populations by the Statistician;

(iii) health care grants by the Minister administering the National Health Act 1953; and

(iv) GST revenues by the Commissioner of Taxation.

For this purpose, the final payment will be made no later than the seventeenth day of June in each year. Where the seventeenth day of June is a Saturday, Sunday or public holiday in Canberra, the payment will be made on the next business day of the Reserve Bank of Australia in Canberra.

B9. States shall be informed of the quantum of the final monthly payment of GST revenues grants by close of business Canberra time on the sixteenth day of June. Where the sixteenth day of June is a Saturday, Sunday or public holiday in Canberra, the Commonwealth shall inform the States of the quantum of the final payment on the last business day of the Reserve Bank of Australia in Canberra prior to the thirteenth.

B10. The timing of payments of GST revenue grants may be varied by agreement between the Parties to this Agreement.

APPENDIX C

TRANSITIONAL ARRANGEMENTS

Guarantee in Legislation

C1. Commonwealth legislation will provide a State or Territory with an entitlement to an additional amount of funding from the Commonwealth to offset any shortfall between its entitlement to GST revenue grants and the total amount of funding which would ensure that the budgetary position of a State or Territory is not worse off during the transition period.

(i) In 2000‑01, transitional assistance will be provided to a State or Territory as a grant or an interest free loan to be repaid to the Commonwealth in full in 2001‑02.

(ii) In subsequent transitional years, transitional assistance will be provided to a State or Territory as a grant.

Guaranteed Minimum Amount

C2. The amount of a State or Territory’s entitlement to transitional assistance in a financial year will be calculated by subtracting its entitlement to GST revenue grants from a “Guaranteed Minimum Amount” constructed in the following way:

State revenues forgone: financial assistance grants, revenue replacement payments and State and Territory taxes as defined in Appendix A of this Agreement with the exception of stamp duties on marketable securities which will be the amount as if fully abolished.

plus

Reduced revenues: the amount by which States and Territories adjust gambling taxation arrangements to take account of the impact of the GST on gambling operators.

plus

Interest costs on cash flow shortfalls: the interest cost incurred by States and Territories as a result of the change to cash flows arising from the replacement of weekly financial assistance grants, revenue replacements and State and Territory taxes with monthly GST revenue grants.

plus

Loan Repayments: in 2001‑02 only, the repayment of a guarantee loan by a State or Territory.

plus

Additional expenditures: payments to first home owners in accordance with Appendix D of this Agreement and the amount of the agreed GST administration costs payable to the ATO by a State or Territory.

plus

Other items: $338 million spread evenly over three years starting in 2000‑01 in respect of the claim by States and Territories in relation to revenue forgone from the abolition of the Wholesale Sales Tax (WST) Tax Equivalent Regimes (with the distribution to be agreed among the States and Territories).

minus

Reduced expenditures: off‑road diesel subsidies and reduced costs from the removal of embedded WST and excises on purchases by a State or Territory government.

minus

Growth dividend: the increase in revenue to a State or Territory (not including GST revenue payments) that is attributable to the impact of the Commonwealth’s taxation reform measures on economic growth.

plus

Adjustments: from 2001‑02, the net difference between preliminary estimates and outcomes or final estimates for items that were taken into account in the previous year’s Guaranteed Minimum Amount.

In addition, $269 million in total, spread evenly over three years, will be included in the new Commonwealth State Housing Agreement starting in 2000‑01 in respect of the net increased public housing costs as a result of tax reform (with the distribution to be agreed among the States and Territories).

Heads of Treasuries’ Advice to Ministerial Council

C3. The Guaranteed Minimum Amount for a State or Territory will be determined by the Commonwealth Treasurer by 10 June of each year of the transition period. The Ministerial Council will make recommendations to the Treasurer on the Guaranteed Minimum Amount for each State and Territory.

C4. The Heads of Treasuries will provide written advice to the Ministerial Council on the following issues by the indicated dates.

(i) By 1 March 2000, advice on the estimated loans and grants to be provided to each State and Territory in 2000‑01 and the amounts which the Commonwealth should provide to each State and Territory on Tuesday 4 July 2000.

(ii) By 1 November 2000 advice on the most recent estimates of transitional assistance for the year and any adjustment that may need to be made to the amount of the loans and grants made to each State and Territory.

(iii) By 1 September of each subsequent year of the transition period, advice on the most recent estimates of the transitional assistance to be provided to each State and Territory in the financial year and the installment amounts which the Commonwealth should provide to each State and Territory on the first Tuesday of the following October and January. This advice should identify the adjustments for the net difference between preliminary estimates and outcomes or final estimates for items that were taken into account in the previous year’s Guaranteed Minimum Amount for a State or Territory.

(iv) By 1 March of each subsequent year of the transition period, advice on the most recent estimates of the transitional assistance to be provided to each State and Territory in both the current financial year and the next financial year, and the installment amounts which the Commonwealth should provide to each State and Territory on the first Tuesday of the following April and July.

(v) By 1 June of each year of the transition period, advice on the Guaranteed Minimum Amount for each State and Territory in the current financial year.

Frequency and Amounts of Payments and Repayments

C5. In each year of the transitional period after 2000‑01, the Commonwealth will provide an installment of the guarantee payment to a State or Territory on the first Tuesday (or the first business day thereafter) of January, April, July and October. The installment amounts will reflect the advice to be provided to the Ministerial Council by the Heads of Treasuries under paragraph C4.

C6. Adjustments to the total amount of additional assistance to a State or Territory in light of actual GST collections and the Treasurer’s determination of the Guaranteed Minimum Amount will be made in conjunction with the payments of GST revenue grants after 10 June in each year.

C7. A State or Territory will repay a loan which it receives from the Commonwealth in 2000‑01 in quarterly installments in 2001‑02. These installments will be paid to the Commonwealth on the same day on which a State or Territory receives an amount of GST revenue grants in the months of July, October, January and April.

C8. The methodology for calculating the amounts of particular components of the Guaranteed Minimum Amount for a State or Territory has been agreed by the Heads of Treasuries and is set out in the document titled Methodology for Estimation of Components of the Guaranteed Minimum Amount.

APPENDIX D

FIRST HOME OWNERS SCHEME

Principles

D1. The States and Territories will make legislative provision for the First Home Owners Scheme (FHOS) from 1 July 2000 which will incorporate programme criteria consistent with the following principles:

(i) Eligible applicants will be entitled to $7,000 assistance (per application) on eligible homes under the FHOS.

(ii) Assistance will be available directly as a one off payment. If the recipient expressly consents, it may be available as an offset against statutory levies and charges or some combination of these.

(iii) Eligible applicants must be natural persons who are Australian citizens or permanent residents who are buying or building their first home in Australia. An applicant’s spouse (or de facto) must be included on the application.

(iv) To qualify for assistance, neither the applicant or the applicant’s spouse (or de facto) must have previously owned a home, either jointly, separately or with some other person.

(v) Entering into a binding contract or commencement of building in the case of owner builders, must have occurred on or after 1 July 2000.

(vi) An eligible home will be a new or established house, home unit, flat or other type of self contained fixed dwelling that meets local planning standards. Fixed dwellings will include demountable dwellings where these meet local planning standards.

(vii) An eligible home must be intended to be a principal place of residence and occupied within a reasonable period. The home must be located in the State or Territory in which the application is made. Applicants who have entered into a financing mechanism which involves a shared equity arrangement will be eligible.

(viii) Assistance will not be means tested.

(ix) The relevant State and Territory legislation will contain adequate administrative review and appeal mechanisms, along with provision to prevent abuse of the FHOS. The States and Territories will cooperate in the exchange of information to identify eligible first home owners.

Other matters

D2. Funding of grants under the FHOS may not be drawn from Home Purchase Assistance (HPA) funds provided through the Commonwealth State Housing Agreement, including the pool of existing HPA revenues.

D3. Further details concerning eligibility criteria consistent with the above principles are to be agreed between the Commonwealth and each State and Territory.

D4. The States and Territories will not introduce or vary any taxes or charges associated with home purchase with the intention of offsetting the benefits of the FHOS for recipients.

APPENDIX E

GST ADMINISTRATION

E1. The Commissioner of Taxation has the general administration of the GST law.

E2. The ATO will arrange for the Australian Customs Service to assist with the collection of the GST on imports.

E3. During the first 12 months following the implementation of the GST, the Commonwealth will retain the discretion to make changes to the GST base of an administrative nature. For this purpose, changes of an administrative nature involves legislation necessary to:

(i) protect the integrity of the GST base; or

(ii) prevent tax avoidance.

E4. The Commonwealth will include the definition of change of an administrative nature in the A New Tax System (Commonwealth‑State Financial Arrangements) Bill 1999.

E5. From July 2001, changes of an administrative nature as defined in E3 will require the majority support of the Commonwealth, States and Territories.

E6. The GST Administration Sub‑Committee, which will commence operation from 1 July 1999, will monitor the operation and administration of the GST and make recommendations regarding modifications to the GST and the administration of the GST.

E7. The GST Administration Sub‑Committee will comprise officials from each Party to the Agreement including representatives from the ATO as required. The Commonwealth Treasury will chair the GST Administration Sub‑Committee.

E8. The Chair will convene the GST Administration Sub‑Committee in consultation with other members of the Sub‑Committee as often as may be necessary to conduct its business. If the Chair receives a request from a member of the Sub‑Committee, the Chair will consult with the other members concerning convening a meeting.

E9. The functions of the Sub‑Committee will include:

(i) monitoring the performance of the ATO in the administration of the GST (Appendix F of this Agreement);

(ii) the assessment of policy proposals for the modification of the GST rate and base;

(iii) making recommendations to the Ministerial Council on the need for legislation which might significantly affect the GST base; and

(iv) requesting the ATO to produce draft Public Rulings in specified areas.

E10. The States and Territories will be consulted on draft Public Rulings prior to consideration by the ATO Rulings Panel and before public consultation. There will be a representative from the States and Territories on the ATO Rulings Panel in relation to GST matters.

E11. Public rulings will not be referred to the Ministerial Council. However, the GST Administration Sub‑Committee will refer a proposed GST change to the Ministerial Council for consideration if the Sub‑Committee is of the view that the change could have a significant impact on GST revenues and so warrants Ministerial review.

E12. Draft legislation which might significantly affect the GST base will be forwarded through the GST Administrative Sub‑Committee to the Ministerial Council for consideration.

APPENDIX F

GST ADMINISTRATION PERFORMANCE AGREEMENT—GUIDING PRINCIPLES

Preamble

F1. This Appendix outlines the principles that will guide the subsequent development of a GST Administration Performance Agreement (the Performance Agreement) between the ATO and its agents, and the States and Territories (the Parties).

Objectives and Context of the Performance Agreement

F2. The purpose of the Performance Agreement is to provide accountability between the ATO and the States and Territories on behalf of whom the GST revenue is being collected. It also provides an agreed basis for the GST Administration Sub‑Committee to monitor the administration of the GST by the ATO and its agents in return for the agreed GST administration costs being paid by the States and Territories.

F3. The Performance Agreement will reflect the commitment by the Parties to:

(i) achieving world’s best practice for GST administration in Australia;

(ii) a cost‑effective and transparent GST administration; and

(iii) a cooperative relationship between the Parties.

F4. The Performance Agreement will recognise that achievement of world’s best practice GST administration, including cost‑effectiveness, is dependent on the GST policy framework and integrated administrative design.

F5. The Performance Agreement will be consistent with the arrangements set out in this Intergovernmental Agreement.

Components of Agreement

F6. The Performance Agreement will include outcomes to be achieved, budgeting arrangements and monitoring and review arrangements for the purposes of maintaining accountability and transparency of operations. The Performance Agreement will also include the process for raising matters of operational significance with the Ministerial Council.

Outcomes

F7. The Performance Agreement will stipulate performance outcomes and appropriate benchmarks to be achieved by the ATO. These outcomes may include, but are not limited to: revenue, taxpayer registration, compliance, reporting, education and legislative review. Consistent with the objectives of the Agreement, the benchmarks are to reflect world best practice in GST administration.

Cost of Administration

F8. The Performance Agreement will outline the Commonwealth administration activities that are GST related for the purposes of agreeing the GST administration costs.

F9. The Performance Agreement will stipulate arrangements for an audit of GST costs and the systems for the control of GST costs.

F10. The Performance Agreement will outline the process and timing of consultation for developing/modifying budgets and business plans for GST administration. These budgets and business plans will be developed, and/or revised, in an appropriate and timely manner so as to broadly accord with Commonwealth arrangements for funding agency operations.

F11. The Performance Agreement will recognise that the States and Territories will fully compensate the Commonwealth for the agreed costs of administering the GST.

Monitoring and Review

F12. The Performance Agreement will stipulate the:

(i) number and timing of formal reports by the ATO to the Sub‑Committee;

(ii) number and timing of progress reports by the ATO to the Sub‑Committee; and

(iii) arrangements for special briefings on particular issues.

F13. The Parties to the Performance Agreement will ensure appropriate alignment of ATO Parliamentary reporting responsibilities and reporting responsibilities under the Performance Agreement.

F14. The Performance Agreement will stipulate that ATO reports to the Sub‑Committee on outcomes will include:

(i) updates on relevant internal governance arrangements, including appropriate strategic plans and annual and other relevant reports that scrutinise aspects of GST operations (including annual and other relevant reports from the Australian National Audit Office);

(ii) accrual‑based financial reports;

(iii) key outcome performance indicators (including, registrations, revenue, refunds, costs, key processing workloads, Taxpayer Charter standards and international benchmark comparisons);

(iv) litigation and public ruling information;

(v) updates on relevant compliance and cost‑of‑compliance research;

(vi) administrative base issues; and

(vii) commentary on administrative performance and any key emerging GST compliance issues and related initiatives.

F15. The Performance Agreement will ensure that the States and Territories will have access to GST data held by the ATO subject to statutory limitations.

Matters of Operational Significance

F16. The Performance Agreement will outline arrangements for raising matters of operational significance with the Ministerial Council. Matters of operational significance may include disputes over the interpretation of the Performance Agreement and non‑performance by the ATO against agreed targets. The Performance Agreement will ensure that the ATO will have the opportunity to provide direct advice to the Ministerial Council on any matters submitted to the Council.

Development of Agreement

F17. The Performance Agreement will be developed by the GST Administration Sub‑Committee and representatives of the ATO. The Performance Agreement is to be developed with reference to both:

(i) the guiding principles outlined in this Appendix; and

(ii) actual GST performance data (including revenue) in the Australian context, gathered during the transitional years.

F18. The Performance Agreement is to be finalised by the end of the GST transitional year ending June 2002. The Performance Agreement is to be endorsed by the Ministerial Council prior to being signed.

F19. The Performance Agreement will stipulate the process for its amendment.

Transitional Arrangements

F20. The ATO and the GST Administration Sub‑Committee will discuss key operational issues and costs commencing in October 1999 and on a semiannual basis throughout the GST transitional year ending 30 June 2002.

F21. The ATO will arrange for an audit of the systems for the control of GST costs and the GST costs incurred during the period from 1 July 1999 to the date of the signing of the Performance Agreement by the Parties.

F22. The ATO will undertake to establish, by the end of the Transitional year ending 30 June 2002, final GST benchmarking arrangements with relevant overseas administrations, subject to their agreement. The ATO will discuss benchmarking plans with the GST Administration Sub‑Committee.