Petroleum Excise Amendment (Measures to Address Evasion) Act 2000

No. 125, 2000

Petroleum Excise Amendment (Measures to Address Evasion) Act 2000

No. 125, 2000

Petroleum Excise Amendment (Measures to Address Evasion) Act 2000

No. 125, 2000

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

Schedule 1—Amendment of the Aviation Fuel Revenues (Special Appropriation) Act 1988

Schedule 2—Amendment of the Excise Act 1901

Schedule 3—Amendment of the Excise Tariff Act 1921

Schedule 4—Amendment of other Acts

Fuel Blending (Penalty Surcharge) Act 1997

Fuel Misuse (Penalty Surcharge) Act 1997

Fuel (Penalty Surcharges) Administration Act 1997

Fuel Sale (Penalty Surcharge) Act 1997

Petroleum Excise Amendment (Measures to Address Evasion) Act 2000

No. 125, 2000

An Act to amend legislation relating to petroleum excise to institute measures to address evasion of excise duty, and for other purposes

[Assented to 26 October 2000]

This Act may be cited as the Petroleum Excise Amendment (Measures to Address Evasion) Act 2000.

(1) This Act, other than item 5 of Schedule 2, commences on the day on which it receives the Royal Assent.

(2) Item 5 of Schedule 2 commences immediately after the commencement of the other items of that Schedule.

Subject to section 2, each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Section 3 (definition of aviation gasoline)

Repeal the definition, substitute:

aviation gasoline means gasoline classified to item 11 of the Schedule to the Excise Tariff Act 1921 as gasoline for use as a fuel in aircraft.

2 Section 3 (definition of aviation kerosene)

Repeal the definition, substitute:

aviation kerosene means kerosene classified to item 11 of the Schedule to the Excise Tariff Act 1921 as kerosene for use as a fuel in aircraft.

1 Section 77G (paragraph (b) of the definition of blended petroleum product)

Repeal the paragraph, substitute:

(b) the product of the blending of:

(i) a designated petroleum product that is heating oil or kerosene classified to item 11 of the Schedule to the Excise Tariff Act 1921 as heating oil or kerosene for use as a fuel otherwise than in an internal combustion engine; and

(ii) a designated petroleum product that is heating oil or kerosene classified to item 11 of that Schedule as heating oil or kerosene for use otherwise than as a fuel.

2 Subsection 78AAAA(6)

Repeal the subsection, substitute:

(6) In this section:

unleaded gasoline means gasoline classified to item 11 of the Schedule to the Excise Tariff Act 1921 as gasoline for use as a fuel otherwise than in aircraft and having a lead content not exceeding 13 milligrams per litre.

3 Subsection 80B(2)

Repeal the subsection, substitute:

(2) If an excisable blended petroleum product is not constituted, in whole or in part, by:

(a) goods classifiable to item 11 of the Schedule to the Excise Tariff Act 1921, as follows:

(i) gasoline or other petroleum or shale spirit having a flashpoint of less than 0 degrees Celsius when tested in an Abel Pensky (closed test) apparatus;

(ii) coal tar and coke oven distillates, aromatic hydrocarbons and light oils consisting principally of aromatic hydrocarbons (not being petroleum or shale products), suitable for use as gasoline substitutes and having a flashpoint of less than 23 degrees Celsius when tested in an Abel Pensky (closed test) apparatus; or

(b) a blended petroleum product that is itself constituted, in whole or in part, by goods referred to in paragraph (a);

then, for the purposes of the diesel fuel rebate scheme, this Act has effect as if the excisable blended petroleum product were diesel fuel.

4 Subsection 80B(3)

Omit all the words before paragraph (a), substitute:

(3) If stabilised crude petroleum oil classified to item 11 of the Schedule to the Excise Tariff Act 1921 as stabilised crude petroleum oil for use as a fuel in an internal combustion engine:

5 Subsection 120(4) (second occurring)

Renumber the subsection as 120(4A).

6 Subsection 120(4) (second occurring) (penalty)

Repeal the penalty, substitute:

Penalty: 10 times the amount of excise duty, calculated at the maximum diesel rate that would have applied to the fuel at the time of the offence, or 500 penalty units, whichever is the greater.

7 Subsection 120(5) (penalty)

Repeal the penalty, substitute:

Penalty: 10 times the amount of excise duty, calculated at the maximum diesel rate that would have applied to the fuel at the time of the offence, or 500 penalty units, whichever is the greater.

8 Subsection 120(6) (penalty)

Repeal the penalty, substitute:

Penalty: 2 times the amount of excise duty, calculated at the maximum diesel rate that would have applied to the fuel at the time of the offence, or 100 penalty units, whichever is the greater.

9 Subsection 120(7) (penalty)

Repeal the penalty, substitute:

Penalty: 2 times the amount of excise duty, calculated at the maximum diesel rate that would have applied to the fuel at the time of the offence, or 100 penalty units, whichever is the greater.

10 At the end of section 120

Add:

(9) In this section:

maximum diesel rate means the maximum rate of excise duty applicable to diesel classified to item 11 of the Schedule to the Excise Tariff Act 1921, whether one or more categories of diesel attract that rate.

1 Subsection 6G(1) (definition of Blending rate)

Repeal the definition, substitute:

blending rate, in relation to an excisable blended petroleum product, means:

(a) if there is included in the excisable blended petroleum product any of the following:

(i) gasoline, other than recycled gasoline on which customs or excise duty has been paid, recovered by a process not being a process of refining; or

(ii) coal tar or coke oven distillates, aromatic hydrocarbons and light oils consisting principally of aromatic hydrocarbons (not being petroleum or shale products), suitable for use as gasoline substitutes and having a flashpoint of less than 23 degrees Celsius when tested in an Abel Pensky (closed test) apparatus;

the excise duty rate applicable to gasoline classified to item 11 of the Schedule as gasoline for use as a fuel otherwise than in aircraft and having a lead content exceeding 13 milligrams per litre; or

(b) if no goods included in subparagraph (a)(i) or (ii) are included in the excisable blended petroleum product—the maximum diesel rate.

2 After subsection 6G(1)

Insert:

(1A) For the purposes of subsection (1), the maximum diesel rate is the maximum rate of excise duty applicable to diesel classified to item 11 of the Schedule, whether one or more categories of diesel attract that rate.

3 Subsection 6G(2)

Repeal the subsection, substitute:

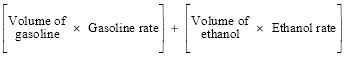

(2) Duty payable under this Act on an excisable blended petroleum product comprising a blend of:

(a) gasoline classified to item 11 of the Schedule as gasoline for use as a fuel otherwise than in aircraft; and

(b) denatured ethanol classified to item 2 of the Schedule as denatured ethanol for use as a fuel in internal combustion engines, as prescribed by by‑law;

with or without other substances, is worked out using the formula:

where:

ethanol rate means the excise duty rate applicable to denatured ethanol classified to item 2 of the Schedule as denatured ethanol for use as a fuel in an internal combustion engine, as prescribed by by‑law.

gasoline rate means the excise duty rate applicable to gasoline classified to item 11 of the Schedule as gasoline for use as a fuel otherwise than in aircraft and having a lead content either exceeding, or not exceeding, 13 milligrams per litre, whichever is appropriate.

volume of ethanol means the volume of ethanol in the excisable blended petroleum product.

volume of gasoline means the volume of gasoline in the excisable blended petroleum product.

1 Section 7

Repeal the section, substitute:

The rate of penalty surcharge per litre of fuel on which the surcharge is imposed is twice the maximum diesel rate.

2 Section 7

Repeal the section, substitute:

The rate of penalty surcharge per litre of fuel on which the surcharge is imposed is twice the maximum diesel rate.

3 Subsection 4(1)

Insert:

Customs place means:

(a) a port, airport or wharf that is appointed, and the limits of which are fixed, under section 15 of the Customs Act; or

(b) a place described in a depot licence that is granted under section 77G of the Customs Act; or

(c) a place described in a licence for warehousing goods that is granted under subsection 79(1) of the Customs Act.

4 Subsection 4(1)

Insert:

Excise place means:

(a) a place described in a declaration made under section 5A of the Excise Act; or

(b) a place described in a licence to manufacture excisable goods granted under section 34 of the Excise Act.

5 Subsection 4(1) (definition of fuel)

Repeal the definition, substitute:

fuel means:

(a) any excisable goods classified to item 11 or 12 of the Schedule to the Excise Tariff; or

(b) any imported goods that would be classified to item 11 or 12 of the Schedule to the Excise Tariff if they had been produced in Australia; or

(c) stabilised crude petroleum oil or condensate not covered by paragraph (a) or (b); or

(d) a blend of goods to which paragraph (a), (b) or (c), or any combination of those paragraphs, applies; or

(e) a blend:

(i) of goods to which paragraph (a), (b) or (c), or any combination of those paragraphs, applies; and

(ii) of goods comprising a blend created under paragraph (d); or

(f) a blend of goods to which paragraph (e) applies;

other than:

(g) goods at a Customs place that have not been entered for home consumption; or

(h) goods at an Excise place that have not been entered for home consumption; or

(i) goods in transit to a Customs place or an Excise place in a vessel, vehicle or pipeline in accordance with a written permission or authority granted under the Customs Act or Excise Act.

6 Subsection 4(1)

Insert:

maximum diesel rate means the maximum rate of excise duty applicable to diesel classified to item 11 of the Schedule to the Excise Tariff Act 1921, whether one or more categories of diesel attract that rate.

7 Subsection 10(1)

Omit “subsequently acquire ownership, or physical control, of some or all of that fuel”, substitute “acquire ownership, or physical control, of fuel”.

8 Section 11 (definition of type C record)

Omit all the words after paragraph (c), substitute:

by a person by whom, or for whom, the fuel was entered for home consumption, or who has acquired the ownership or physical control of the fuel.

9 Subsection 48(1) (penalty)

Repeal the penalty, substitute:

Penalty: 10 times the amount of excise duty, calculated at the maximum diesel rate that would have applied to the fuel if it had been entered for home consumption under the Excise Act on the date used under subsection (4) in working out that rate, or 500 penalty units, whichever is the greater.

10 Subsection 48(2) (penalty)

Repeal the penalty, substitute:

Penalty: 2 times the amount of excise duty, calculated at the maximum diesel rate that would have applied to the fuel if it had been entered for home consumption under the Excise Act on the date used under subsection (4) in working out that rate, or 100 penalty units, whichever is the greater.

11 At the end of section 48

Add:

(4) If a person is convicted of an offence against subsection (1) or (2), the maximum diesel rate for the purposes of the penalty is:

(a) if the date on which the offence was committed is known to the court—the maximum diesel rate on that date; or

(b) if that date is not known to the court—the maximum diesel rate on the date on which the prosecution for the offence was instituted.

12 After section 49

Insert:

The CEO may, by written instrument, appoint an officer of Customs or other suitably qualified person to be an analyst for the purposes of this Act.

Proceedings to which section applies

(1) This section applies to any proceedings (offence proceedings) for an offence against a provision of Part 2 or 3 or against section 48.

Customs officer’s certificate

(2) Subject to subsection (5), in any offence proceedings, a certificate, signed by an officer of Customs, stating that:

(a) a particular place was, or was not, at a particular time, a Customs place or an Excise place; or

(b) that particular goods in transit to a place in a vessel, vehicle or pipeline were, or were not, so in transit in accordance with a written permission or authority granted under the Customs Act or Excise Act; or

(c) that particular goods located at a particular place had or had not been entered for home consumption;

is admissible as prima facie evidence of the matters stated in the certificate.

Analyst’s certificate

(3) Subject to subsection (5), in any offence proceedings, a certificate, signed by an analyst, stating, in respect of a substance in relation to which the offence is alleged to have been committed:

(a) that the analyst who signed the certificate was appointed under section 49A; and

(b) when and from whom the substance was received; and

(c) what, if any, labels or other means of identifying the substance accompanied it when it was received; and

(d) what container or containers the substance was contained in when it was received; and

(e) a description of the substance received; and

(f) when the substance, or a portion of it, was analysed; and

(g) a description of the method of analysis; and

(h) the results of the analysis;

is admissible as prima facie evidence of the matters stated in the certificate and of the correctness of the results of the analysis.

Document taken to be a certificate under subsection (2) or (3) unless contrary intention established

(4) For the purposes of this section, a document purporting to be a certificate referred to in subsection (2) or (3) is, unless the contrary intention is established, to be taken to be such a certificate and to have been duly given.

Certificate not to be admitted unless copy given to defendant 14 days before certificate to be admitted in evidence

(5) A certificate must not be admitted in evidence under subsection (2) or (3) in offence proceedings unless the person charged with the offence or a solicitor who has appeared for the person in those proceedings has, at least 14 days before the certificate is sought to be so admitted, been given a copy of the certificate together with reasonable evidence of the intention to produce the certificate as evidence in the proceedings.

Person giving certificate may be called to give evidence

(6) Subject to subsection (7), if, under subsection (2) or (3), a certificate is admitted in evidence in offence proceedings, the person charged with the offence may require the person giving the certificate to be called as a witness for the prosecution and cross‑examined as if he or she had given evidence of the matters stated in the certificate.

(7) Subsection (6) does not entitle the person charged to require the person giving a certificate to be called as a witness for the prosecution unless:

(a) in the case of a certificate under subsection (3), the prosecutor has been given at least 4 days notice of the person’s intention to require the analyst to be so called; or

(b) the Court, by order, allows the person charged to require the person giving the certificate to be so called.

Evidence in support of rebuttal of matters in certificate to be considered on its merits

(8) Any evidence given in support, or in rebuttal, of a matter stated in a certificate given under subsection (2) or (3) must be considered on its merits and the credibility and probative value of such evidence must be neither increased nor diminished by reason of this section.

A sample taken by an officer under:

(a) the exercise of a preliminary audit or monitoring power; or

(b) a search warrant;

must be dealt with in the following manner:

(c) the officer taking the sample must, in the presence of the person, or the agent or servant of the person, from whom the sample is taken, divide the sample into 3 equal parts and label or mark and securely seal each part; and

(d) the officer must hand one part to the person, or the agent or servant of the person, deliver another part to an analyst appointed under section 49A, and retain the third part for further examination if necessary.

13 Section 7

Repeal the section, substitute:

The rate of penalty surcharge per litre of fuel on which the surcharge is imposed is twice the maximum diesel rate.

[Minister’s second reading speech made in—

House of Representatives on 6 April 2000

Senate on 15 June 2000]

(44/00)