New Business Tax System (Simplified Tax System) Act 2001

No. 78, 2001

New Business Tax System (Simplified Tax System) Act 2001

No. 78, 2001

New Business Tax System (Simplified Tax System) Act 2001

No. 78, 2001

An Act to amend the law about taxation to implement the New Business Tax System, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

Schedule 1—Simplified tax system

Income Tax Assessment Act 1997

Schedule 2—Consequential amendments

Income Tax Assessment Act 1997

Schedule 3—Deducting prepayments

Income Tax Assessment Act 1936

New Business Tax System (Integrity and Other Measures) Act 1999

New Business Tax System (Simplified Tax System) Act 2001

No. 78, 2001

An Act to amend the law about taxation to implement the New Business Tax System, and for related purposes

[Assented to 30 June 2001]

The Parliament of Australia enacts:

This Act may be cited as the New Business Tax System (Simplified Tax System) Act 2001.

(1) Subject to this section this Act commences on the day on which it receives the Royal Assent.

(2) Items 5 and 14 of Schedule 3 commence on 22 September 2002.

Subject to section 2, each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Before Division 330

Insert:

Table of Subdivisions

328‑A Guide to Division 328

328‑B Objects of this Division

328‑C Accounting method for STS taxpayers

328‑D Capital allowances for STS taxpayers

328‑E Trading stock for STS taxpayers

328‑F Entities eligible to be STS taxpayers

328‑G Entering and leaving the STS

Table of sections

328‑5 What this Division is about

328‑10 Map of this Division

This Division gives you a choice to change the way the income tax law applies to you in these 3 ways if you are carrying on a business with a small turnover, and you pass certain other criteria:

• you use a cash accounting system for ordinary income, general deductions and deductions for tax‑related expenses and repairs; and

• you only account for annual changes in trading stock value that are more than $5,000; and

• you put your depreciating assets into either a long life pool or a general pool and treat each pool as a single asset.

In usual circumstances, these changes will simplify the working out of your taxable income, and so reduce your compliance costs.

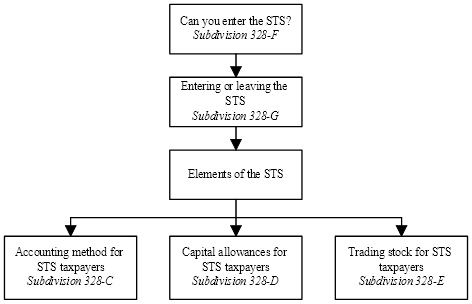

The following map shows the elements of the simplified tax system and how they relate to each other:

(1) The main object of this Division is to offer eligible small businesses the choice of a new platform to deal with their tax. The platform is designed to benefit those businesses in one or more of these ways:

• reducing their tax;

• providing simpler rules for determining their income and deductions;

• providing simpler capital allowances and trading stock requirements;

• reducing their compliance costs.

(2) This Division also provides rules that are intended to prevent other businesses from taking advantage of those benefits.

STS taxpayers account for their ordinary income when received and general deductions when paid.

Table of sections

Operative provisions

328‑105 STS accounting method

328‑110 When you start being an STS taxpayer

328‑115 When you stop being an STS taxpayer

[This is the end of the Guide.]

(1) While you are an *STS taxpayer, this Act applies to you as if:

(a) an amount that would be included in your assessable income under section 6‑5 when *derived were derived only when you received it; and

Note: You are taken to have received an amount when it is applied or dealt with on your behalf or as you direct: see subsection 6‑5(4).

(b) an amount you could deduct under section 8‑1 (about general deductions), 25‑5 (about tax‑related expenses) or 25‑10 (about repairs) when incurred were incurred only when you paid it or it was paid for you.

Example: Reena operates a document handling business. She chooses to become an STS taxpayer for the 2002‑03 income year.

For that income year:

Under the STS accounting method:

Exceptions

(2) However:

(a) subsection (1) does not apply if another provision of this Act (except section 6‑5, 8‑1, 25‑5 or 25‑10) would include the amount, or allow the deduction, at a different time; and

(b) paragraph (1)(a) does not apply to an amount to the extent that it has not been, and will not be, received by you; and

(c) paragraph (1)(b) does not apply to an amount to the extent that it has not been, and will not be, paid by you or for you.

Example: Subdivision 385‑G allows you to defer including profit from second wool clips in your assessable income to the next income year. This Subdivision does not override that deferral.

(1) This section sets out what happens to your *ordinary income and *general deductions, and deductions under section 25‑5 or 25‑10, when you become an *STS taxpayer.

Ordinary income

(2) Any *ordinary income that you *derived but did not receive, and was assessable, before you became an *STS taxpayer is not again included in your assessable income when you receive it.

Example: Sylvia chooses to become an STS taxpayer for the 2005‑06 income year. In the previous income year, she derived $27,000 of ordinary income that she did not receive in that previous year. It was included in her assessable income for that previous year because she was using an accruals basis of accounting.

That amount is not again included when Sylvia receives it in the 2005‑06 income year.

(3) Any *ordinary income that you received, but had not *derived, before you became an *STS taxpayer is included in your assessable income for the income year you became an STS taxpayer.

General deductions etc.

(4) Any *general deductions, and deductions under section 25‑5 or 25‑10, that you incurred but did not pay, and were deductible, before you became an *STS taxpayer are not again deductible when you pay them.

Example: To continue the example, Sylvia incurred business expenses of $12,000 in the 2004‑05 income year. She did not pay these expenses until the next income year.

The expenses were deductible for the 2004‑05 income year because she was using an accruals basis of accounting. That amount is not again deductible when she pays it in the 2005‑06 income year.

(5) You can deduct for the income year you became an *STS taxpayer any *general deductions, and deductions under section 25‑5 or 25‑10, that you paid, but did not incur, before you became an STS taxpayer.

Note: Section 8‑10 prevents double deductions in respect of the same amount.

Trading stock

(6) You can deduct for an income year for which you are an *STS taxpayer an amount you incurred and paid before that year if:

(a) the amount was incurred in connection with acquiring an item of *trading stock; and

(b) you could not deduct the amount before that year because of section 70‑15; and

(c) the item becomes part of your trading stock on hand during that year.

(1) This section sets out what happens to your *ordinary income and *general deductions, and deductions under section 25‑5 or 25‑10, when you stop being an *STS taxpayer for an income year (the changeover year).

Ordinary income

(2) Any *ordinary income that, apart from paragraph 328‑105(1)(a), you would have *derived before the changeover year (while you were an *STS taxpayer) and you have not included in your assessable income because you have not received it is included in your assessable income for the changeover year.

Example: Sonja’s Shoe Shop is an STS taxpayer for the 2003‑04 income year, but is forced to leave the STS for the 2004‑05 income year because of increased turnover. After leaving the STS, the business changes its accounting method to an accruals basis.

The customers of Sonja’s Shoe Shop owe $10,000 at the end of the 2003‑04 income year. That amount is not included in assessable income for that income year because it was not received in that year.

This section includes the $10,000 in assessable income for the 2004‑05 income year. This is because the STS accounting method did not bring it to account in the 2003‑04 income year.

General deductions etc.

(3) Any *general deductions, and deductions under section 25‑5 or 25‑10, that, apart from paragraph 328‑105(1)(b), you would have incurred before the changeover year (while you were an *STS taxpayer) and that you have not deducted because you have not paid them can be deducted for the changeover year.

Example: To continue the example, Sonja’s Shoe Shop made purchases of $7,000 in the 2003‑04 income year, but could not deduct that amount because it was not paid during that year.

This section allows Sonja’s Shoe Shop to deduct the $7,000 for the 2004‑05 income year. This is because the STS accounting method did not allow it as a deduction in the 2003‑04 income year.

STS taxpayers deduct amounts for most of their depreciating assets on a diminishing value basis using a pool that is treated as a single depreciating asset.

Broadly, a pool is made up of the costs of the depreciating assets that are allocated to it or, in some cases, a proportion of those costs.

The pool rate is 30% for most depreciating assets, and 5% for depreciating assets that have an effective life of 25 years or more.

There is an immediate deduction for low‑cost assets.

This Subdivision sets out how to calculate the pool deductions, and also sets out the consequences of:

(a) disposal of depreciating assets; and

(b) ceasing to be an STS taxpayer; and

(c) changing the business use of depreciating assets.

Table of sections

Operative provisions

328‑175 Calculations for depreciating assets

328‑180 Low cost assets

328‑185 Pooling

328‑190 Calculation

328‑195 Opening pool balance

328‑200 Closing pool balance

328‑205 Estimate of taxable use

328‑210 Low pool value

328‑215 Disposal etc. of depreciating assets

328‑220 What happens when you stop being an STS taxpayer

328‑225 Change in business use

328‑230 Estimate where deduction denied

328‑235 Interaction with Divisions 85 and 86

[This is the end of the Guide.]

(1) You calculate your deductions and some amounts of assessable income under this Subdivision instead of under Division 40 for an income year for a *depreciating asset that you *hold if:

(a) you are an *STS taxpayer for the income year; and

(b) you started to use the asset, or have it *installed ready for use, for a *taxable purpose during or before that income year.

Note: You continue to use this Subdivision for your STS pools after you leave the STS: see section 328‑220.

Exception: assets to which Division 40 does not apply

(2) This Subdivision does not apply to a *depreciating asset to which Division 40 does not apply because of section 40‑45.

Exception: primary production

(3) If you are an *STS taxpayer for the income year, for each *depreciating asset you use to carry on a *primary production business and for which you could deduct amounts under Subdivision 40‑F (about primary production depreciating assets) or Subdivision 40‑G (about capital expenditure of primary producers and other landholders) apart from subsection (1), you can choose:

(a) to deduct amounts for it under Subdivision 40‑F or 40‑G; or

(b) to calculate your deductions for it under this Subdivision.

(4) You must make that choice for each *depreciating asset of that kind for the later of:

(a) the first income year for which you are, or last became, an *STS taxpayer; or

(b) the income year in which you started to use the asset, or have it *installed ready for use, for a *taxable purpose.

Once you have made the choice for an asset, you cannot change it.

Exception: horticultural plants

(5) You cannot deduct amounts for *horticultural plants (including grapevines) under this Subdivision.

Exception: asset let on depreciating asset lease

(6) You cannot deduct amounts for a *depreciating asset under this Subdivision if the asset is being or is intended to be let predominantly on a *depreciating asset lease.

Exception: assets in a low‑value or software development pool

(7) You cannot deduct amounts for a *depreciating asset under this Subdivision if:

(a) the asset was allocated to your low‑value pool under Subdivision 40‑E, or to your pool under the former Subdivision 42‑L, before you became an *STS taxpayer; or

(b) the asset is *in‑house software and expenditure on the asset is allocated to a software development pool under that Subdivision.

Note: You will have to continue deducting amounts for these assets under Division 40.

(8) A *depreciating asset referred to in subsection (7) is not allocated to a pool under this Subdivision and does not qualify for a deduction under section 328‑180.

(1) You deduct the *taxable purpose proportion of the *adjustable value of a *depreciating asset for the income year in which you start to use the asset, or have it *installed ready for use, for a *taxable purpose if:

(a) you were an *STS taxpayer for that year and the year in which you started to *hold it; and

(b) the asset is a *low‑cost asset.

You cannot deduct any further amount for the asset.

(2) An asset to which this section applies is not allocated to a pool.

(1) As an *STS taxpayer, you deduct amounts for your *depreciating assets (except *low‑cost assets for which you have deducted or can deduct an amount under section 328‑180) through a pool, which allows you to deduct amounts for them as if they were a single asset, thereby simplifying your calculations. You use one rate for the pool.

(2) There are 2 kinds of pools:

(a) a general STS pool to which *depreciating assets having *effective lives of less than 25 years are allocated; and

(b) a long life STS pool to which depreciating assets having effective lives of 25 years or more are allocated.

Allocating assets to a pool

(3) A *depreciating asset:

(a) that you *hold just before, and at the start of, the first income year for which you are, or last became, an *STS taxpayer; and

(b) for which you calculate your deductions under this Subdivision instead of under Division 40; and

(c) that has not previously been allocated to your *general STS pool or *long life STS pool; and

(d) that you have started to use, or have *installed ready for use, for a *taxable purpose;

is automatically allocated to your general STS pool or long life STS pool according to its *effective life.

(4) A *depreciating asset that you start to use, or have *installed ready for use, for a *taxable purpose during an income year while you are an *STS taxpayer is allocated to the appropriate pool at the end of that year.

Note: The allocation happens even if you no longer hold the asset at the end of that income year.

Exception for long life assets

(5) You can choose not to have a *depreciating asset allocated to a *long life STS pool to which it would otherwise have been allocated if you started to use it, or have it *installed ready for use, for a *taxable purpose before 1 July 2001.

Note: If you make this choice, you would continue to deduct amounts for the asset under Division 40.

(6) You must make that choice for the first income year for which you are an *STS taxpayer. Once you have made the choice for an asset, you cannot change it.

No re‑allocation

(7) Once a *depreciating asset is allocated to your *general STS pool or *long life STS pool, it is not re‑allocated, even if you stop being an *STS taxpayer and again become one.

Note: You continue to use this Subdivision for your STS pools after you leave the STS: see section 328‑220.

Example: Greg chooses to leave the STS for the 2002‑03 income year. At that time, his long life STS pool contains one depreciating asset that has an effective life of 28 years.

When Greg chooses to re‑enter the STS for the 2008‑09 income year, he still holds that asset. The asset has remained in the pool since Greg left the STS and is not re‑allocated when he re‑enters, even though its remaining effective life is now 22 years.

(1) You calculate your deduction for each pool for an income year using this formula:

![]()

where:

pool rate is:

(a) 30% for a *general STS pool; or

(b) 5% for a *long life STS pool.

Note: You use section 328‑210 instead if the pool has a low pool value.

(2) Your deduction for each *depreciating asset that you start to use, or have *installed ready for use, for a *taxable purpose during an income year while you are an *STS taxpayer is:

(a) 15% of the *taxable purpose proportion of its *adjustable value if its *effective life is less than 25 years; or

(b) 2.5% of the taxable purpose proportion of its adjustable value if its effective life is 25 years or more.

(3) You can also deduct for an income year for which you are an *STS taxpayer the amount worked out under subsection (4) for an amount (the cost addition amount) included in the second element of the *cost of a *depreciating asset for that year if you started to use the asset, or have it *installed ready for use, for a *taxable purpose during an earlier income year.

Note: The second element of cost is worked out under section 40‑190.

(4) The amount you can deduct is:

(a) 15% of the *taxable purpose proportion of the cost addition amount if the asset’s *effective life is less than 25 years; or

(b) 2.5% of the taxable purpose proportion of the cost addition amount if the asset’s effective life is 25 years or more.

(1) For the first income year for which you are an *STS taxpayer, the opening pool balance of a pool is the sum of the *taxable purpose proportions of the *adjustable values of *depreciating assets allocated to the pool under subsection 328‑185(3).

(2) For a later income year, the opening pool balance of a pool is that pool’s *closing pool balance for the previous income year, reduced or increased by any adjustment required under section 328‑225 (about change in the business use of an asset).

Note: You continue to deduct amounts using your STS pools after you leave the STS: see section 328‑220.

(3) However, if you stop being an *STS taxpayer and again become one for an income year, the opening pool balance of a pool includes the sum of the *taxable purpose proportions of the *adjustable values of *depreciating assets allocated to the pool under subsection 328‑185(3) for that year.

You work out the closing pool balance of a pool for an income year in this way:

Method statement

Step 1. Add to the *opening pool balance of the pool for the income year:

(a) the sum of the *taxable purpose proportions of the *adjustable values of *depreciating assets you started to use, or have *installed ready for use, for a *taxable purpose during the income year and that are allocated to that pool; and

(b) the taxable purpose proportion of any cost addition amounts (see subsection 328‑190(3)) for the income year for assets allocated to the pool.

Step 2. Subtract from the step 1 amount:

(a) the *taxable purpose proportions of the *termination values of *depreciating assets allocated to the pool and for which a *balancing adjustment event occurred during the income year; and

(b) your deduction under subsection 328‑190(1) for the pool for the income year; and

(c) your deductions under subsection 328‑190(2) for *depreciating assets you started to use, or have *installed ready for use, for a *taxable purpose during the income year and that are allocated to that pool; and

(d) your deductions under subsection 328‑190(3) for the income year for cost addition amounts for assets allocated to the pool.

Step 3. The result is the closing pool balance of the pool for the income year.

(1) You must, for the first income year for which you are, or last became, an *STS taxpayer, make a reasonable estimate for that year of the proportion you will use, or have *installed ready for use, each *depreciating asset that you *held just before, and at the start of, that year for a *taxable purpose if:

(a) the asset has not previously been allocated to your *general STS pool or *long life STS pool; and

(b) you have started to use it, or have it installed ready for use, for a taxable purpose; and

(c) you calculate your deductions for it under this Subdivision.

Note 1: That proportion will be 100% for an asset that you expect to use, or have installed ready for use, solely for a taxable purpose.

Note 2: Your estimate will be zero for an income year if another provision of this Act denies a deduction for that year: see section 328‑230.

(2) You must also make this estimate for each *depreciating asset that you *hold and start to use, or have *installed ready for use, for a *taxable purpose while you are an *STS taxpayer. You must make the estimate for the income year in which you start to use it, or have it installed ready for use, for such a purpose.

(3) The taxable purpose proportion of a *depreciating asset’s *adjustable value, or of an amount included in the second element of its *cost, is that part of that amount that represents:

(a) the proportion you estimated under subsection (1) or (2); or

(b) if you have had to make an adjustment under section 328‑225 for the asset—the proportion most recently applicable to the asset under that section.

Note: An amount included in the second element of the cost of a depreciating asset is referred to in this Division as a cost addition amount: see subsection 328‑190(3).

(4) The taxable purpose proportion of a *depreciating asset’s *termination value is that part of that amount that represents:

(a) if you have not had to make an adjustment under section 328‑225 for the asset—the proportion you estimated under subsection (1) or (2); or

(b) if you have had to make at least one such adjustment and the asset is allocated to a *general STS pool—the average of:

(i) the proportion you estimated under subsection (1) or (2); and

(ii) the proportion applicable to the asset for each of the 3 income years you *held the asset after the one in which the asset was allocated to the pool; or

(c) if you have had to make at least one such adjustment and the asset is allocated to a long life STS pool—the average of:

(i) the proportion you estimated under subsection (1) or (2); and

(ii) the proportion applicable to the asset for each of the 20 income years you *held the asset after the one in which the asset was allocated to the pool.

Example: When Bria’s van was allocated to her general STS pool for the 2001‑02 income year, she estimated that it would be used 50% for deliveries in her florist business. Due to increasing deliveries, Bria estimates the van’s business use to be 70% for the 2002‑03 year, and 90% for the 2003‑04 year. She makes an adjustment under section 328‑225 for both those years.

Bria sells the van for $3,000 at the start of the 2005‑06 income year. She must now average the business use estimates for the van for the year it was allocated to the pool and the next 3 years to work out the taxable purpose proportion of its termination value. The average is worked out as follows:

![]()

The taxable purpose proportion of the van’s termination value is, therefore:

![]()

(1) Your deduction for a *general STS pool or *long life STS pool for an income year is the amount worked out under subsection (2) (instead of an amount calculated under section 328‑190) if that amount is less than $1,000 but more than zero.

Note: See section 328‑215 for the result when the amount is less than zero.

(2) The amount is the sum of:

(a) the pool’s *opening pool balance for the income year; and

(b) the *taxable purpose proportion of the *adjustable value of each *depreciating asset you started to use, or have *installed ready for use, for a *taxable purpose during the income year and that is allocated to that pool; and

(c) the taxable purpose proportion of any cost addition amounts (see subsection 328‑190(3)) for the income year for assets allocated to the pool;

less the sum of the taxable purpose proportion of the *termination values of depreciating assets allocated to that pool and for which a *balancing adjustment event occurred during the income year.

(3) In that case, the *closing pool balance of the pool for that income year then becomes zero.

Example: Amanda’s Graphics, an STS taxpayer, has an opening pool balance of $1,200 for its general STS pool for the 2004‑05 income year.

During that year, Amanda acquired a new computer for $2,000. The taxable purpose proportion of its adjustable value is:

![]()

Amanda also sold her business car for $1,900 during that year. The car was used 100% in the business.

To work out whether she can deduct an amount under this section, Amanda uses this calculation:

![]()

Because the result is less than $1,000, Amanda can deduct the $900 for the income year. The pool’s closing balance for the year is zero.

(1) This section sets out adjustments you may have to make if a *balancing adjustment event occurs for a *depreciating asset for which you calculate your deductions under this Subdivision.

(2) If the asset is allocated to a pool and:

(a) the *closing pool balance of the pool for the income year in which the event occurred is less than zero; or

(b) the amount worked out under subsection 328‑210(2) for that income year is less than zero;

the amount by which that balance or amount is less than zero is included in your assessable income for that year.

(3) In that case, the *closing pool balance of the pool for that income year then becomes zero.

(4) If the asset was one for which you deducted an amount under section 328‑180 (about low‑cost assets), you include the *taxable purpose proportion of the asset’s *termination value in your assessable income.

(1) If you stop being an *STS taxpayer for an income year, this Subdivision continues to apply to your *general STS pool and *long life STS pool for that year and later years.

(2) However, *depreciating assets you started to use, or have *installed ready for use, for a *taxable purpose while you are not an *STS taxpayer cannot be allocated to a pool under this Subdivision until you again become an STS taxpayer.

(1) You must, for each income year (the present year) after the year in which a *depreciating asset is allocated to a pool, make a reasonable estimate of the proportion you use the asset, or have it *installed ready for use, for a *taxable purpose in that year.

(1A) You must make an adjustment for the present year if your estimate for that year under subsection (1) is different by more than 10 percentage points from:

(a) your original estimate (see section 328‑205); or

(b) if you have made an adjustment under this section—the most recent estimate you made under subsection (1) that resulted in an adjustment under this section.

(2) The adjustment is made to the *opening pool balance of the *general STS pool or *long life STS pool to which the asset was allocated, and it must be made before you calculate your deduction under this Subdivision for the present year.

Note: The opening pool balance will be reduced if the adjustment worked out under subsection (3) is a negative amount. It will be increased if the adjustment is positive.

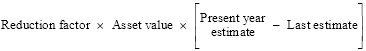

(3) The adjustment is:

where:

asset value is:

(a) for a *depreciating asset you started to use, or have *installed ready for use, for a *taxable purpose while you were an *STS taxpayer—the asset’s *adjustable value at that time; or

(b) for an asset you started to use, or have installed ready for use, for a taxable purpose while you were not an STS taxpayer—its adjustable value at the start of the income year for which it was allocated to a *general STS pool or a *long‑life STS pool;

increased by any amounts included in the second element of the asset’s *cost from the time mentioned in paragraph (a) or (b) until the end of the income year for which you are making the adjustment.

last estimate is:

(a) your original estimate of the proportion you use, or have *installed ready for use, a *depreciating asset for a *taxable purpose (see section 328‑205); or

(b) if you have made an adjustment under this section—the latest estimate taken into account under this section.

present year estimate is your reasonable estimate of the proportion you use the asset, or have it *installed ready for use, for a *taxable purpose during the present year.

reduction factor is the number worked out under subsection (4).

(4) The reduction factor in the formula in subsection (3) is:

(a) for a *depreciating asset you started to use, or have *installed ready for use, for a *taxable purpose while you were an *STS taxpayer:

(b) for an asset you started to use, or have *installed ready for use, for a taxable purpose while you were not an STS taxpayer:

![]()

where:

n is the number of income years (counting part of an income year as a whole year) before the present year for which you have deducted or can deduct an amount for the *depreciating asset under this Subdivision.

rate is the rate applicable to the pool to which the asset is allocated.

Note: The reduction factor for a depreciating asset in your general STS pool which you started to use, or have installed ready for use, for a taxable purpose while you were not an STS taxpayer is:

The reduction factor for a depreciating asset in your general STS pool which you started to use, or have installed ready for use, for a taxable purpose while you were an STS taxpayer is:

Exceptions

(5) However:

(a) you do not need to make an estimate or an adjustment under this section for a *depreciating asset for an income year that is at least:

(i) for an asset allocated to a *general STS pool—3 income years after the income year in which it was allocated; or

(ii) for an asset allocated to a *long life STS pool—20 income years after the income year in which it was allocated; and

(b) you cannot make an adjustment for a depreciating asset if your reasonable estimate of the proportion you use a depreciating asset, or have it *installed ready for use, for a *taxable purpose changes in a later income year by the 10 percentage points mentioned in subsection (1) or less.

This Subdivision applies to you as if you had estimated that you will not use, or have *installed ready for use, a *depreciating asset at all for a *taxable purpose during an income year if a provision of this Act outside this Division denies a deduction for the asset for that year.

(1) Despite sections 85‑10 and 86‑60, as an *STS taxpayer you can deduct amounts for *depreciating assets under this Subdivision.

(2) However, you cannot deduct an amount for a *car under this Subdivision if, had you not chosen to be an *STS taxpayer, sections 86‑60 and 86‑70 would have prevented you deducting an amount for it.

STS taxpayers do not need to account for their trading stock in some circumstances. This Subdivision modifies the rules in Division 70 about trading stock for STS taxpayers.

Table of sections

Operative provisions

328‑285 Trading stock for STS taxpayers

328‑290 Adjustments in certain cases

328‑295 Value of trading stock on hand

[This is the end of the Guide.]

(1) You do not have to account for changes in the *value of your *trading stock for an income year if:

(a) you are an *STS taxpayer for that year; and

(b) the difference between the value of all your trading stock on hand at the start of that year and the value you reasonably estimate of all your trading stock on hand at the end of that year is not more than $5,000.

Note 1: As a result, sections 70‑35 and 70‑45 (about comparing the value of each item of trading stock on hand at the start and end of an income year) will not apply to you for the income year.

Note 2: When making a reasonable estimate of the value of trading stock on hand:

Exception: choice to account for trading stock

(2) However, you can choose to account for changes in the *value of your *trading stock for an income year.

Note: If you make this choice, you will have to do a stocktake and account for the change in the value of all your trading stock: see Subdivision 70‑C.

If you are an *STS taxpayer for an income year and you account for changes in the *value of your *trading stock for the income year, you must:

(a) value each item of your trading stock on hand at the end of the income year in accordance with section 70‑45; and

(b) take into account the *value of all your *trading stock, in accordance with section 70‑35, in working out your assessable income and deductions.

Note 1: You account for changes in the value of your trading stock for the income year if:

Note 2: Section 70‑35 includes in assessable income any excess of the value of trading stock at the end of the income year over the value at the start of the income year, and allows a deduction for any excess of the value at the start of the income year over the value at the end of the income year.

(1) If you are an *STS taxpayer for an income year, the *value of all your *trading stock on hand at the start of the income year is:

(a) the same amount as was taken into account under this Act at the end of the previous income year; or

(b) zero if no item of trading stock was taken into account under this Act at the end of the previous income year.

Note: The amount taken into account at the end of the previous income year is worked out under either section 70‑45 or subsection (2) of this section.

(2) If subsection 328‑285(1) applies to you for an income year and you have not made a choice under subsection 328‑285(2) for that year, this Act applies to you as if the *value of all your *trading stock on hand at the end of the year were equal to the value of all your trading stock on hand at the start of the year.

Note: If subsection 328‑285(1) does not apply, the value of trading stock on hand at the end of the year is worked out using section 70‑45.

Example: Angela operates a riding school, and also sells riding gear. She is an STS taxpayer.

At the start of the 2003‑04 income year, the opening value of Angela’s trading stock is $30,000. Using her reliable inventory system, she estimates the closing value to be $34,000.

The closing value for the 2003‑04 income year, and the opening value for the 2004‑05 income year, will be $30,000.

This Subdivision explains that you can choose to be an STS taxpayer only if you are carrying on a business. In addition, you (and others who can be expected to act in concert with you in your business) together must have:

• an average annual business turnover of less than $1m; and

• depreciating assets with an end of year value below $3m.

You normally work out your average turnover using any 3 of the last 4 years, but there are special rules for some other cases.

Table of sections

Operative provisions

328‑365 Eligibility to be an STS taxpayer

328‑370 Meaning of STS average turnover

328‑375 Meaning of STS group turnover

328‑380 Grouped entities

[This is the end of the Guide.]

(1) You are eligible to be an *STS taxpayer for an income year if:

(a) you carry on a *business in that year; and

(b) your *STS average turnover for that year is less than $1,000,000 (ignoring any *input tax credits to which you are entitled and *decreasing adjustments that you have); and

(c) the sum of the *adjustable values of the *depreciating assets (for which an amount can be deducted under Division 40, or under this Division apart from this paragraph) that you, and entities (the grouped entities) whose value of business supplies is grouped with yours in accordance with section 328‑380, *held at the end of that year is less than $3,000,000.

Note: If you are eligible to be an STS taxpayer, you can choose to become one: see section 328‑435.

(2) You use the *closing pool balance of your, or your grouped entities, *general STS pool, *long life STS pool or low‑value pool instead of the *adjustable values of the *depreciating assets allocated to it in working out whether paragraph (1)(c) applies to you.

Note: You use the adjustable values of depreciating assets that are not allocated to such a pool.

(3) This Subdivision applies to you as if you carried on a *business in an income year if:

(a) in that year you were winding up a business you previously carried on; and

(b) you were an *STS taxpayer for the income year in which you stopped carrying on that business.

(1) Your STS average turnover for an income year (the present year) is:

where:

number of averaging years is:

(a) 3; or

(b) the number of years you take into account under paragraph (b) of the definition of sum of relevant STS group turnovers.

sum of relevant STS group turnovers is:

(a) the sum of your *STS group turnovers for any 3 of the previous 4 income years; or

(b) if you did not carry on a *business in each of those last 4 years—the sum of your STS group turnovers for each of those years in which you carried on a business.

(2) For the purpose of working out your *STS average turnover under subsection (1) where you or a grouped entity carried on a *business for part only of one or more of those years, use a reasonable estimate of what your *STS group turnover would have been for that year or those years if you and the grouped entity had carried on a business throughout those years.

(3) You work out your STS average turnover for an income year (also the present year) in this way if you are not eligible to be an *STS taxpayer for that year using subsection (1):

(a) work out your *STS group turnover for the present year or a reasonable estimate of it and a reasonable estimate of it for each of the 2 following income years (ignoring any of those years if you do not expect to be carrying on a *business at any time in that year); and

(b) work out the average of your *STS group turnovers for those years.

(4) For the purpose of working out your *STS average turnover under subsection (3) where you or a grouped entity carried on a *business for part only of the present year, use a reasonable estimate of what your *STS group turnover would have been for that year if you and the grouped entity had carried on a business throughout that year.

Example: Kevin starts his locksmith business on 1 January 2002. He decides that he would like to enter the STS. He works out his STS average turnover for the income year as $420,000, calculated as follows:

The total STS turnover for the 3 years is $1,260,000, and the average for those years is $420,000. The value of Kevin’s depreciating assets is $120,000. He is therefore eligible to be an STS taxpayer.

(1) Your STS group turnover for an income year is the sum of:

(a) the *value of the business supplies you made in the income year; and

(b) the value of the business supplies made in the income year by grouped entities while they were grouped with you;

reduced by:

(c) the value of the business supplies you made in the income year to entities grouped with you while they were grouped with you; and

(d) the value of the business supplies entities grouped with you made in the income year to you while you were grouped with them; and

(e) the value of the business supplies another entity made in the income year to a third entity while the other entity and the third entity were grouped with you.

(2) To the extent that the *taxable supplies an entity makes in an income year includes *gambling supplies, use an amount equal to 11 times the entity’s *global GST amount for those supplies rather than the *value of the business supplies in working out the entity’s *STS group turnover.

(3) In working out the *value of the business supplies made by an entity, disregard:

(a) any *supply made to the extent that the consideration for the supply is a payment or a supply by an insurer in settlement of a claim under an insurance policy; and

(b) to the extent that a supply is constituted by a loan—any repayment of principal, and any obligation to repay principal.

(4) The regulations may provide that *STS group turnover is to be calculated in a different way, but only so that it would be less than the amount worked out under this section.

(1) The *value of the business supplies made in an income year by an entity is grouped with another entity’s if:

(a) either entity controls the other entity in the way described in this section; or

(b) both entities are controlled in that way by the same third entity; or

(c) the entities are *STS affiliates of each other.

(2) This section applies to an entity that directly controls a second entity as if the first entity also controlled any other entity that is directly, or indirectly by any other application or applications of this section, controlled by the second entity.

Individuals, companies and fixed trusts

(3) An entity controls another entity if the first entity, its *STS affiliates or the first entity together with its STS affiliates:

(a) legally or beneficially own, or have the right to acquire the legal or beneficial ownership of, interests in the other entity that carry between them the right to receive at least 40% of any distribution of income or capital by the other entity; or

(b) if the other entity is a company—legally or beneficially own, or have the right to acquire the legal or beneficial ownership of, interests in the company that carry between them the right to exercise, or control the exercise of, at least 40% of the voting power in the company.

Non‑fixed trusts

(4) An entity controls a trust that is not a *fixed trust if:

(a) the trustee has made a distribution, in any of the last 4 income years (except the present year) of $100,000 or more to the entity, its *STS affiliates or the entity together with its STS affiliates; or

(b) the entity, its *STS affiliates or the entity together with its STS affiliates:

(i) have the power, directly or indirectly, to obtain the beneficial enjoyment of any of the capital or income of the trust; or

(ii) are capable of gaining that enjoyment under a *scheme; or

(c) a trustee of the trust is accustomed or under an obligation (whether formal or informal), or might reasonably be expected, to act in accordance with the directions, instructions or wishes of the entity, its STS affiliates or the entity together with its STS affiliates.

Partnerships

(5) An entity controls a partnership if the entity, its *STS affiliates or the entity together with its STS affiliates have the right to at least 40% of the partnership net income, or have at least a 40% interest in assets used in the partnership *business (except assets that are leased to the partnership).

(6) A partnership (the first entity) controls another entity if a partner in the first entity, or 2 or more partners in the first entity, have the right to receive at least 40% of the partnership net income, or have at least a 40% interest in assets used in the partnership *business, and:

(a) if the other entity is a company—the same partner, or the same 2 or more partners, have the right to receive at least 40% of any distribution of income or capital by the other entity, or to exercise, or to control the exercise of, at least 40% of the voting power in the company; or

(b) if the other entity is a *fixed trust—the same partner, or the same 2 or more partners, have the right to receive at least 40% of any distribution of income or capital by the other entity; or

(c) if the other entity is a trust that is not a fixed trust—a condition in a paragraph of subsection (4) is satisfied for the same partner, or the same 2 or more partners in relation to the trust; or

(d) if the other entity is a partnership—the same partner, or the same 2 or more partners, have the right to receive at least 40% of the partnership net income, or have at least a 40% interest in assets used in the partnership business, of the other entity.

(7) If the control percentage mentioned in this section is at least 40%, but less than 50%, then the Commissioner may determine that the first entity does not control the other entity if the Commissioner is satisfied, or thinks it reasonable to assume, that the other entity is controlled by an entity other than, or by entities that do not include, the first entity or any of its *STS affiliates.

(8) An entity is an STS affiliate of yours if the entity acts, or could reasonably be expected to act, in accordance with your directions or wishes, or in concert with you, in relation to the affairs of the entity’s *business.

(9) Another partner in a partnership in which you are a partner is not your STS affiliate only because the partner acts, or could reasonably be expected to act, in concert with you in relation to the affairs of the partnership.

Eligible taxpayers have a choice as to whether to enter the STS.

The rules for entering and leaving the STS are set out in this Subdivision.

Table of sections

Operative provisions

328‑435 Entering the STS

328‑440 Leaving the STS

[This is the end of the Guide.]

You are an STS taxpayer for an income year if:

(a) you are eligible to be an *STS taxpayer for that year (see Subdivision 328‑F); and

(b) you notify the Commissioner, in the *approved form, of your choice to become such a taxpayer for that year.

(1) You continue to be an STS taxpayer for each later income year unless:

(a) you notify the Commissioner, in the *approved form, of your choice to stop being an STS taxpayer; or

(b) you are not eligible to be an STS taxpayer for that later year (see Subdivision 328‑F).

(2) If you are not eligible to be an STS taxpayer for that later year, you must notify the Commissioner, in the *approved form, of that fact.

Restriction on re‑entry

(3) If you choose to stop being an *STS taxpayer, you cannot again become an STS taxpayer until at least 5 years after the income year that you left the STS.

Note: If you stop being an STS taxpayer because of increased turnover or because of the value of your depreciating assets, you can become an STS taxpayer for an income year again as soon as you are eligible.

2 Application of amendments

The amendments made by this Schedule apply to assessments for the first income year starting after 30 June 2001, and for later income years.

1 Subsection 4‑15(2) (after table item 1)

Insert:

1A. | An entity becomes an *STS taxpayer for an income year | Division 328 |

2 At the end of section 6‑5

Add:

Note: A cash accounting regime applies for ordinary income derived by STS taxpayers: see Division 328.

3 Subsection 8‑1(3) (note)

Omit “Note”, substitute “Note 1”.

4 At the end of section 8‑1

Add:

Note 2: A cash accounting regime applies for general deductions, and some other deductions, incurred by STS taxpayers: see Division 328.

4A After section 20‑155

Insert:

This Subdivision does not apply to you if, at any time in the income year in which you disposed of the *car, it was allocated to a pool of yours under Division 328.

5 At the end of subsection 70‑5(3)

Add:

Note: You may not have to bring to account that difference if you are an STS taxpayer: see Division 328.

6 Subsection 70‑15(3) (note)

Omit “Note”, substitute “Note 1”.

7 At the end of section 70‑15

Add:

Note 2: The timing of the deduction may alter if you are an STS taxpayer: see Division 328.

8 At the end of subsection 70‑35(1)

Add:

Note: You may not need to do this stocktaking if you are an STS taxpayer: see Division 328.

9 Subsection 70‑40(1)

After “this Division”, insert “or Subdivision 328‑E (about trading stock for STS taxpayers)”.

10 Subsection 70‑40(2)

After “this Division”, insert “or Subdivision 328‑E (about trading stock for STS taxpayers)”.

11 Subsection 70‑45(2) (after table item 4)

Insert:

5 | The value of the item at the end of an income year may be the same as at the start of the year for an STS taxpayer | Subdivision 328‑E of this Act |

13 Subsection 995‑1(1)

Insert:

depreciating asset lease: a depreciating asset lease is an agreement (including a renewal of an agreement) under which the entity that *holds the *depreciating asset grants a right to use the asset to another entity. However, a depreciating asset lease does not include a *hire purchase agreement or a *short‑term hire agreement.

14 Subsection 995‑1(1)

Insert:

general STS pool has the meaning given by section 328‑185.

15 Subsection 995‑1(1)

Insert:

global GST amount has the meaning given by section 195‑1 of the *GST Act.

16 Subsection 995‑1(1)

Insert:

long life STS pool has the meaning given by section 328‑185.

17 Subsection 995‑1(1)

Insert:

opening pool balance has the meaning given by section 328‑195.

18 Subsection 995‑1(1)

Insert:

short‑term hire agreement: a short‑term hire agreement is an agreement for the intermittent hire of an asset on an hourly, daily, weekly or monthly basis. However, an agreement for the hire of an asset is not a short‑term hire agreement if, having regard to any other agreements for the hire of the same asset to the same entity or an *associate of that entity, there is a substantial continuity of hiring so that the agreements together are for longer than a short‑term basis.

19 Subsection 995‑1(1)

Insert:

STS affiliate has the meaning given by section 328‑380.

20 Subsection 995‑1(1)

Insert:

STS average turnover has the meaning given by section 328‑370.

21 Subsection 995‑1(1)

Insert:

STS group turnover has the meaning given by section 328‑375.

22 Subsection 995‑1(1)

Insert:

STS taxpayer has the meaning given by section 328‑435.

23 Subsection 995‑1(1)

Insert:

taxable purpose proportion has the meaning given by section 328‑205.

24 Application of amendments

The amendments made by this Schedule apply to assessments for the first income year starting after 30 June 2001, and for later income years.

1 Subsection 82KZL(1)

Insert:

STS taxpayer has the meaning given by section 328‑435 of the Income Tax Assessment Act 1997.

2 Subparagraph 82KZM(1)(aa)(i)

Omit “a small business taxpayer”, substitute “an STS taxpayer”.

Note: The heading to section 82KZM is altered by omitting “small business taxpayer and” and substituting “STS taxpayer and individuals incurring”.

3 Subparagraph 82KZM(1)(aa)(ii)

Before “the expenditure”, insert “the taxpayer is an individual and”.

4 Paragraph 82KZM(1)(b)

Repeal the paragraph, substitute:

(b) the expenditure is not excluded expenditure; and

(ba) either:

(i) the eligible service period for the expenditure is longer than 12 months; or

(ii) the eligible service period for the expenditure is 12 months or shorter but ends after the last day of the year of income after the one in which the expenditure was incurred; and

5 Subsection 82KZMA(1) (notes 1 and 2)

Repeal the notes.

6 Paragraph 82KZMA(2)(a)

Repeal the paragraph, substitute:

(a) must:

(i) carry on a business; or

(ii) be a taxpayer that is not an individual and that does not carry on a business; and

7 Paragraph 82KZMA(2)(b)

Omit “a small business taxpayer”, substitute “an STS taxpayer”.

8 Subsection 82KZMA(3)

Repeal the subsection, substitute:

(3) The expenditure must be:

(a) either:

(i) incurred in carrying on a business; or

(ii) incurred otherwise than in carrying on a business by a taxpayer that is not an individual; and

(b) incurred under an agreement (see subsection 82KZL(1); and

(c) incurred in return for the doing of a thing under the agreement that is not to be wholly done within the expenditure year.

9 Subsection 82KZMB(7)

Omit “To avoid doubt, the”, substitute “The”.

9A At the end of section 82KZMB

Add:

(8) Subsection (7) does not apply to:

(a) expenditure described in paragraph 82KZMC(1A)(a); or

(b) a taxpayer described in paragraph 82KZMC(1A)(b).

10 Subsection 82KZMC(1) (before the note)

Insert:

(1A) This section does not apply, for a year of income starting after 30 June 2001, to:

(a) expenditure incurred otherwise than in carrying on a business by a taxpayer who is not an individual; or

(b) a taxpayer who was a small business taxpayer but not an STS taxpayer for that year.

11 Paragraph 82KZME(1)(b)

Repeal the paragraph.

Note: The heading to section 82KZME is replaced by the heading “Expenditure under some agreements”.

12 Subsection 82KZME(1) (note 1)

Repeal the note.

13 Subsection 82KZME(1) (note 2)

Omit “Note 2”, substitute “Note”.

14 Item 9 of Schedule 7 (note)

Repeal the note, substitute:

Note: The heading to section 82KZMD is replaced by the heading “Business expenditure (except by an STS taxpayer) and non‑business expenditure by non‑individual”.

15 Application

(1) Subject to this item, the amendments made by this Schedule apply to assessments for the first year of income starting after 30 June 2001 and later years of income.

(2) The amendments made by items 5 and 14 apply to expenditure incurred by a taxpayer in a year of income after the taxpayer’s year of income that includes 21 September 2002.

[Minister’s second reading speech made in—

House of Representatives on 7 December 2000

Senate on 26 June 2001]

(218/00)