Taxation Laws Amendment (Superannuation) Act (No. 2) 2002

No. 51, 2002

An Act to amend laws relating to taxation and superannuation, and for related purposes

Taxation Laws Amendment (Superannuation) Act (No. 2) 2002

No. 51, 2002

An Act to amend laws relating to taxation and superannuation, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

4 Amendment of assessments........................

Schedule 1—Quarterly superannuation guarantee charge and miscellaneous amendments

Part 1—Main amendments

Superannuation Guarantee (Administration) Act 1992

Part 2—Consequential amendments

Defence Act 1903

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Superannuation Act 1976

Superannuation Contributions Tax Imposition Act 1997

Superannuation Contributions Tax (Members of Constitutionally Protected Superannuation Funds) Imposition Act 1997

Part 3—Application and transitional provisions

Schedule 3—Deductions for contributions to complying superannuation funds or RSAs

Part 1—Amendments

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Part 2—Application provision

Schedule 4—Taxable contributions paid for benefit of children under 18

Income Tax Assessment Act 1936

Schedule 5—Increasing deduction limits for superannuation contributions

Income Tax Assessment Act 1936

Schedule 6—Other amendments

Bankruptcy Act 1966

Family Law Legislation Amendment (Superannuation) (Consequential Provisions) Act 2001

Superannuation Contributions Tax (Members of Constitutionally Protected Superannuation Funds) Assessment and Collection Act 1997

Superannuation Guarantee (Administration) Act 1992

Taxation Administration Act 1953

Taxation Laws Amendment (Superannuation) Act (No. 2) 2002

No. 51, 2002

An Act to amend laws relating to taxation and superannuation, and for related purposes

[Assented to 29 June 2002]

The Parliament of Australia enacts:

This Act may be cited as the Taxation Laws Amendment (Superannuation) Act (No. 2) 2002.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, on the day or at the time specified in column 2 of the table.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent | 29 June 2002 |

2. Schedule 1, Parts 1 and 2 | 1 July 2003 | 1 July 2003 |

3. Schedule 1, Part 3 | The earlier of: (a) the day on which this Act receives the Royal Assent; and (b) 1 July 2003 | 29 June 2002 |

7. Schedule 3 | The day on which this Act receives the Royal Assent | 29 June 2002 |

8. Schedule 4 | The day on which this Act receives the Royal Assent | 29 June 2002 |

9. Schedule 5 | The day on which this Act receives the Royal Assent | 29 June 2002 |

10. Schedule 6, items 1 and 2 | The later of: (a) the day on which this Act receives the Royal Assent; and (b) immediately after the commencement of item 77 of Schedule 1 to the Bankruptcy Legislation Amendment Act 2002 | 5 May 2003 (Gazette 2003, No. S138) |

11. Schedule 6, items 3 to 8 | The day on which this Act receives the Royal Assent | 29 June 2002 |

12. Schedule 6, item 9 | The later of: (a) the day on which this Act receives the Royal Assent; and (b) immediately after the commencement of item 77 of Schedule 1 to the Bankruptcy Legislation Amendment Act 2002 | 5 May 2003 (Gazette 2003, No. S138) |

13. Schedule 6, items 10 and 11 | The later of: (a) the day on which this Act receives the Royal Assent; and (b) 1 July 2002 | 1 July 2002 |

14. Schedule 6, items 12 to 14 | The later of: (a) the 28th day after the day on which this Act receives the Royal Assent; and (b) 1 July 2002 | 27 July 2002 |

Note: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

(2) Column 3 of the table is for additional information that is not part of this Act. This information may be included in any published version of this Act.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Section 37 of the Superannuation Guarantee (Administration) Act 1992 and section 170 of the Income Tax Assessment Act 1936 do not prevent the amendment of an assessment for the purposes of giving effect to this Act.

1 Subsection 5(3)

Repeal the subsection, substitute:

(3) Part 8 has effect as if any superannuation guarantee charge for a quarter in respect of a superannuation guarantee shortfall of the Commonwealth had been paid on:

(a) for a quarter beginning on 1 January—14 May in the next quarter; and

(b) for a quarter beginning on 1 April—14 August in the next quarter; and

(c) for a quarter beginning on 1 July—14 November in the next quarter; and

(d) for a quarter beginning on 1 October—14 February in the next quarter.

2 Subsection 5A(2)

Omit “, for the year beginning on 1 July 1993 and for all later years,”.

3 Subsection 5A(3)

Omit “, for the year beginning on 1 July 1993 or for any later year,”.

4 Subsection 6(1) (definition of administration component)

Omit “year”, substitute “quarter”.

5 Subsection 6(1) (definition of annual national payroll)

Repeal the definition.

6 Subsection 6(1) (paragraph (a) of the definition of assessment)

Omit “in a year”, substitute “for a quarter”.

7 Subsection 6(1) (definition of base year)

Repeal the definition.

8 Subsection 6(1) (definition of contribution period)

Repeal the definition.

9 Subsection 6(1) (definition of half‑year)

Repeal the definition.

10 Subsection 6(1) (definition of individual superannuation guarantee shortfall)

Omit “sections 18 and 19”, substitute “section 19”.

11 Subsection 6(1) (definition of nominal interest component)

Omit “year”, substitute “quarter”.

12 Subsection 6(1) (paragraph (b) of the definition of ordinary time earnings)

Omit “contribution period”, substitute “quarter”.

13 Subsection 6(1)

Insert:

penalty charge, in respect of superannuation guarantee charge and a quarter, means:

(a) general interest charge in respect of non‑payment of the superannuation guarantee charge; or

(b) additional superannuation guarantee charge that is payable under section 59 and calculated by reference to the superannuation guarantee charge.

14 Subsection 6(1) (definition of quarter)

Repeal the definition, substitute:

quarter means a period of 3 months beginning on 1 January, 1 April, 1 July or 1 October.

15 Subsection 6A(2)

After “in relation to the fund”, insert “or scheme”.

16 Subsection 6A(4)

Omit “contribution period”, substitute “quarter”.

17 Subsection 6B(1)

Repeal the subsection, substitute:

(1) A conversion notice is a written notice by the trustee of a superannuation fund given to the Commissioner stating that the fund, or a particular superannuation scheme embodied in the governing rules of the fund, is to be treated as a defined benefit superannuation scheme for the purposes of this Act.

18 Subsection 6B(2)

After “fund”, insert “or scheme”.

19 Subsection 6B(2)

Omit “of Insurance and Superannuation”.

20 Subsection 6B(3)

Repeal the subsection, substitute:

(3) A conversion notice may be expressed to take effect on a day that is not earlier than:

(a) if the notice is given before 15 May in a quarter starting on 1 April—1 January in the previous quarter; or

(b) if the notice is given before 15 August in a quarter starting on 1 July—1 April in the previous quarter; or

(c) if the notice is given before 15 November in a quarter starting on 1 October—1 July in the previous quarter; or

(d) if the notice is given before 15 February in a quarter starting on 1 January—1 October in the previous quarter; or

(e) in any other case—the first day of the quarter in which the notice is given.

21 Subsection 6B(4)

Omit “all employers contributing to the fund”, substitute “each employer contributing to the fund or scheme”.

22 Subsection 6B(5)

After “superannuation fund”, insert “or a superannuation scheme”.

23 Subsection 6B(5)

After “the fund”, insert “or scheme”.

24 At the end of subsection 9(1)

Add:

Note: The March quarter is a quarter beginning on 1 January.

25 Subsections 10(4) and (5)

Repeal the subsections, substitute:

(4) A benefit certificate may be expressed to have effect from:

(a) a day that is no earlier than:

(i) if the certificate is issued before 15 May in a quarter starting on 1 April, or before a later day in that quarter allowed by the Commissioner—1 January in the previous quarter; or

(ii) if the certificate is issued before 15 August in a quarter starting on 1 July, or before a later day in that quarter allowed by the Commissioner—1 April in the previous quarter; or

(iii) if the certificate is issued before 15 November in a quarter starting on 1 October, or before a later day in that quarter allowed by the Commissioner—1 July in the previous quarter; or

(iv) if the certificate is issued before 15 February in a quarter starting on 1 January, or before a later day in that quarter allowed by the Commissioner—1 October in the previous quarter; or

(v) in any other case—the first day of the quarter in which the certificate is issued; and

(b) a day that is no later than the day on which the certificate is issued.

26 Paragraph 13(1)(b)

Omit “contribution period”, substitute “quarter”.

27 Subsection 13(1B)

Omit “in relation to a contribution period”.

28 Subsection 13(1C)

Omit “that other employee, in relation to a contribution period”, substitute “that other employee”.

29 Subsection 13(1C)

Omit “the current employee, in relation to a contribution period”, substitute “the current employee, in relation to a quarter”.

30 Paragraph 13(2)(a)

Omit “contribution period”, substitute “quarter”.

31 Subsection 13(3)

Omit “contribution period”, substitute “quarter”.

32 Subsection 13(3)

Omit “that period”, substitute “that quarter”.

33 Subsection 13(5) (paragraphs (aa) and (ab) of the definition of reference earnings)

Omit “contribution period”, substitute “quarter”.

34 Paragraph 13A(1)(a)

Omit “contribution period”, substitute “quarter”.

35 Section 13B

Omit “contribution period”, substitute “quarter”.

36 Paragraphs 14(1)(a), (ab) and (b)

Omit “contribution period”, substitute “quarter”.

37 Paragraph 14(2)(a)

Omit “contribution period”, substitute “quarter”.

38 Subsection 14(3)

Omit “contribution period” (wherever occurring), substitute “quarter”.

39 Subsection 14(4)

Omit “contribution period”, substitute “quarter”.

40 Subsection 14(4)

Omit “that period”, substitute “that quarter”.

41 Subsections 15(1) and (2)

Repeal the subsections, substitute:

(1) The maximum contribution base for a quarter in the 2001‑02 year is $27,510.

42 Subsection 15(3)

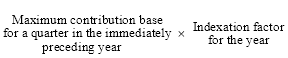

Omit “contribution period” (first occurring), substitute “quarter”.

43 Subsection 15(3) (formula)

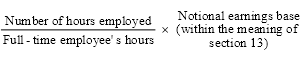

Repeal the formula, substitute:

44 Subsection 15(4)

Omit “(2) or”.

45 Section 16

Omit “year”, substitute “quarter”.

46 Section 17

Omit “year” (wherever occurring), substitute “quarter”.

47 Section 18

Repeal the section.

48 Subsections 19(1) and (2)

Repeal the subsections, substitute:

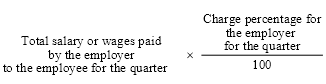

(1) An employer’s individual superannuation guarantee shortfall for an employee for a quarter is the amount worked out using the formula:

where:

charge percentage, for an employer for a quarter, means:

(a) the number specified in subsection (2) (unless paragraph (b) applies); or

(b) if the number specified in subsection (2) is reduced in respect of the employee by either or both sections 22 and 23—the number as reduced.

(2) The charge percentage is 9.

Note: This might be reduced under section 22 or 23.

Note: The heading to section 19 is replaced by the heading “Individual superannuation guarantee shortfalls”.

49 Subsection 19(3)

Omit “the contribution period that corresponds to that quarter”, substitute “the quarter”.

50 Subsection 19(4)

Omit “quarterly shortfall in respect of an employee”, substitute “individual superannuation guarantee shortfall for an employee”.

51 Sections 20 and 21

Repeal the sections.

52 Paragraph 22(2)(a)

Omit “a contribution period”, substitute “a quarter”.

53 Subsection 22(2)

Omit “charge percentage for the employer, as calculated under section 20 or 21, in respect of an employee in the class for the contribution period”, substitute “charge percentage for the employer, as specified in subsection 19(2), in respect of an employee in the class for the quarter,”.

54 Subsection 22(2) (paragraph (B) of the definition of B)

Omit “the contribution period”, substitute “the quarter”.

55 Subsection 22(3) (definition of the employment period)

Omit “contribution period”, substitute “quarter”.

56 Subsection 22(3) (definition of the scheme membership period)

Omit “contribution period”, substitute “quarter”.

57 Subsection 22(3) (definition of the certificate period)

Omit “contribution period”, substitute “quarter”.

58 Subsection 22(4)

Omit “contribution period”, substitute “quarter”.

59 Subsection 23(2)

Omit “subsections (6), (6A) and (7), if, in a contribution period”, substitute “subsections (6) and (7), if, in a quarter”.

60 Paragraph 23(2)(a)

Omit “a law of a kind referred to in paragraph 13(1)(ab) or 14(1)(ab)”, substitute “a law of the Commonwealth, a State or a Territory”.

61 Subsection 23(2)

Omit “charge percentage for the employer, as calculated under section 20 or 21, in respect of the employee for the contribution period”, substitute “charge percentage for the employer, as specified in subsection 19(2), in respect of the employee for the quarter,”.

62 Subsection 23(2) (paragraph (A) of the definition of A)

Omit “the contribution period—for the whole of that period”, substitute “the quarter—for the whole of the quarter”.

63 Subsection 23(2) (paragraph (B) of the definition of A)

Omit “the period” (wherever occurring), substitute “the quarter”.

64 Subsection 23(2) (paragraph (B) of the definition of B)

Omit “the contribution period” (wherever occurring), substitute “the quarter”.

65 Subsection 23(3)

Omit “subsections (6), (6A) and (7), if, in a contribution period”, substitute “subsections (6) and (7), if, in a quarter”.

66 Subsection 23(3)

Omit “charge percentage for the employer, as calculated under section 20 or 21, in respect of the employee for the contribution period”, substitute “charge percentage for the employer, as specified in subsection 19(2), in respect of the employee for the quarter,”.

67 Subsection 23(3) (paragraph (A) of the definition of A)

Omit “the contribution period—for the whole of that period”, substitute “the quarter—for the whole of the quarter”.

68 Subsection 23(3) (paragraph (B) of the definition of A)

Omit “the period” (wherever occurring), substitute “the quarter”.

69 Subsection 23(3) (paragraph (B) of the definition of B)

Omit “the contribution period” (wherever occurring), substitute “the quarter”.

70 Subsection 23(4)

Omit “subsections (6), (6A) and (7), if, in a contribution period”, substitute “subsections (6) and (7), if, in a quarter”.

71 Paragraph 23(4)(c)

Omit “the contribution period”, substitute “the quarter”.

72 Subsection 23(4)

Omit “charge percentage for the employer, as calculated under section 20 or 21, in respect of the employee for the contribution period”, substitute “charge percentage for the employer, as specified in subsection 19(2), in respect of the employee for the quarter,”.

73 Subsection 23(4) (paragraph (A) of the definition of A)

Omit “the contribution period—for the whole of that period”, substitute “the quarter—for the whole of the quarter”.

74 Subsection 23(4) (paragraph (B) of the definition of A)

Omit “the period” (wherever occurring), substitute “the quarter”.

75 Subsection 23(4) (paragraph (B) of the definition of B)

Omit “the contribution period” (wherever occurring), substitute “the quarter”.

76 Subsection 23(4A)

Omit “subsections (6), (6A) and (7)”, substitute “subsections (6) and (7)”.

77 Paragraph 23(4A)(a)

Omit “a contribution period”, substitute “a quarter”.

78 Paragraph 23(4A)(a)

Omit “current contribution period”, substitute “current quarter”.

79 Paragraph 23(4A)(d)

Omit “contribution period” (wherever occurring), substitute “quarter”.

80 Paragraph 23(4A)(e)

Omit “contribution period”, substitute “quarter”.

81 Subsection 23(4A)

Omit “the charge percentage for the employer, as calculated under section 20 or 21, in respect of the employee for the current contribution period”, substitute “the charge percentage for the employer, as specified in subsection 19(2), in respect of the employee for the current quarter”.

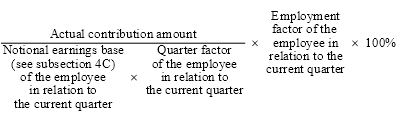

82 Subsection 23(4B) (formula)

Repeal the formula, substitute:

83 Subsection 23(4C) (definition of contribution period factor)

Repeal the definition.

84 Subsection 23(4C) (definition of employment factor)

Omit “a contribution period”, substitute “a quarter”.

85 Subsection 23(4C) (paragraph (a) of the definition of employment factor)

Omit “the contribution period” (wherever occurring), substitute “the quarter”.

86 Subsection 23(4C) (definition of notional earnings base)

Omit “a contribution period”, substitute “a quarter”.

87 Subsection 23(4C) (definition of notional earnings base)

Omit “the period” (first occurring), substitute “the quarter”.

88 Subsection 23(4C) (paragraph (a) of the definition of notional earnings base)

Omit “the contribution period”, substitute “the quarter”.

89 Subsection 23(4C) (definition of Adjustment earnings)

Omit “the contribution period”, substitute “the quarter”.

90 Subsection 23(4C) (definition of Full‑time employee’s hours)

Omit “in the period in which the employee is employed”, substitute “in the quarter in which the employee is employed”.

91 Subsection 23(4C) (definition of Number of hours employed)

Omit “the contribution period”, substitute “the quarter”.

92 At the end of subsection 23(4C)

Add:

quarter factor, in relation to an employee in the class for a quarter, means:

(a) if, in the quarter, the period for which the employee is employed by the employer under the award is less than the whole of the quarter—the fraction that represents the period for which the employee is employed by the employer under the award as a proportion of the whole of the quarter; or

(b) in any other case—1.

93 Subsection 23(4D)

Omit “subsections (6), (6A) and (7), if, during a contribution period”, substitute “subsections (6) and (7), if, in a quarter”.

94 Subsection 23(4D)

Omit “as calculated under section 20 or 21, in respect of the employee for the contribution period”, substitute “as specified in subsection 19(2), in respect of the employee for the quarter”.

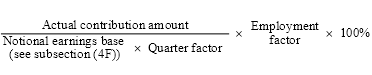

95 Subsection 23(4E) (formula)

Repeal the formula, substitute:

96 Subsection 23(4F) (definition of contribution period factor)

Repeal the definition.

97 Subsection 23(4F) (paragraph (a) of the definition of employment factor)

Omit “contribution period”, substitute “quarter”.

98 Subsection 23(4F) (definition of notional earnings base)

Repeal the definition, substitute:

notional earnings base means:

(a) if the employee is a full‑time employee—the notional earnings base of the employee within the meaning of section 13; or

(b) if the employee is a part‑time employee—the amount worked out using the formula:

where:

full‑time employee’s hours means the number of ordinary hours of work for which an equivalent full‑time employee would have been employed in the quarter in which the employee is employed.

number of hours employed means the number of hours for which the employee is employed in the quarter.

99 At the end of subsection 23(4F)

Add:

quarter factor means:

(a) if, in the quarter, the period for which the employer contributes for the benefit of the employee to the Aberfoyle Award Superannuation Fund is less than the whole of the quarter—the fraction that represents the period for which the employer so contributes as a proportion of the whole of the quarter; or

(b) in any other case—1.

100 Subsection 23(5)

Omit “subsections (6), (6A) and (7), if, in a contribution period”, substitute “subsections (6) and (7), if, in a quarter”.

101 Paragraph 23(5)(b)

Omit “the contribution period”, substitute “the quarter”.

102 Subsection 23(5)

Omit “as calculated under section 20 or 21, in respect of the employee for the contribution period”, substitute “as specified in subsection 19(2), in respect of the employee for the quarter,”.

103 Subsection 23(5) (paragraph (A) of the definition of A)

Omit “the contribution period—for the whole of that period”, substitute “the quarter—for the whole of the quarter”.

104 Subsection 23(5) (paragraph (B) of the definition of A)

Omit “the period” (wherever occurring), substitute “the quarter”.

105 Subsection 23(5) (paragraph (B) of the definition of B)

Omit “the contribution period” (wherever occurring), substitute “the quarter”.

106 Subsections 23(6) and (6A)

Repeal the subsections, substitute:

Some contributions made after a quarter ends may be taken into account in the quarter

(6) A contribution to a complying superannuation fund or an RSA made by an employer for the benefit of an employee may be taken into account under this section as having been made in a quarter if it is in fact made within the period of 28 days after the end of the quarter.

107 Subsection 23(6B)

Repeal the subsection.

108 Subsection 23(7)

Omit “contribution period commencing after 30 June 1993”, substitute “quarter”.

Note: The heading to subsection 23(7) is replaced by the heading “Certain contributions made before a quarter may be taken into account in the quarter”.

109 Subsection 23(7)

Omit “the contribution period”, substitute “the quarter”.

110 Subsection 23(8)

Omit “contribution period” (wherever occurring), substitute “quarter”.

Note: The following heading to subsection 23(8) is inserted “Contributions taken into account for a quarter not to be taken into account for any other quarter”.

111 Subsection 23(8A)

Omit “RSA” (first occurring), substitute “superannuation scheme”.

112 Subsection 23(8A)

Omit “RSA” (second occurring), substitute “scheme”.

113 Subsection 23(9)

Omit “a law of a kind referred to in paragraph 13(1)(ab) or 14(1)(ab)”, substitute “a law of the Commonwealth, a State or a Territory”.

114 Subsection 23(10)

Omit “contribution period”, substitute “quarter”.

115 Subsections 23(11) and (12)

Omit “18 or”.

116 After section 23

Insert:

(1) This section applies if an employer makes a contribution to a superannuation fund or an RSA, for the benefit of an employee, that reduces the rate of the employer’s charge percentage under section 23 (other than a contribution that is taken to have been made because of subsection 23(9A)).

Note: This section does apply to contributions that are taken to have been made because of subsection 23(13).

(2) The employer must give a report to the employee in writing identifying the amount of the contribution and setting out any other information required by the regulations.

(3) The employer must give the report within 30 days of making the contribution.

(4) An employer commits an offence if:

(a) the employer makes a contribution to an RSA or a superannuation fund for the benefit of an employee; and

(b) the contribution reduces the rate of the employer’s charge percentage under section 23; and

(c) the employer does not give a report to the employee as required.

Penalty: 30 penalty units.

Note: False or misleading reports are covered by the offences in sections 137.1 and 137.2 of the Criminal Code.

(5) Strict liability applies to paragraph (4)(b).

Note: For strict liability, see section 6.1 of the Criminal Code.

117 Subsection 24(1)

Omit “a contribution period”, substitute “a quarter”.

118 Subsection 24(1)

Omit “the contribution period”, substitute “the quarter”.

119 Paragraph 24(1)(b)

Omit “earlier contribution period”, substitute “earlier quarter”.

120 Subsection 24(2)

Omit “a contribution period”, substitute “a quarter”.

121 Paragraph 24(2)(a)

Omit “the contribution period”, substitute “the quarter”.

122 Subsection 24(2)

Omit “the contribution period” (last occurring), substitute “the quarter”.

123 Subsection 24(5) (definition of starting day)

Repeal the definition, substitute:

starting day means:

(a) in relation to a benefit certificate that has effect in relation to a superannuation scheme for the whole of a quarter—the first day of the quarter; or

(b) in relation to a benefit certificate that has effect in relation to a superannuation scheme for a part of a quarter—the first day in the quarter for which the benefit certificate has effect.

124 Subsection 26(2)

Omit “18 or”.

125 Subsection 27(1)

Omit “18 or”.

127 Subsection 27(2)

Omit “18 or”.

128 Section 28

Omit “section 18 or 19”, substitute “section 19”.

129 Paragraph 30(b)

Omit “in a year”, substitute “for a quarter”.

130 Section 30

Omit “for the year”, substitute “for the quarter”.

131 Section 31

Omit “year” (wherever occurring), substitute “quarter”.

132 Section 32

Omit “a year”, substitute “a quarter”.

133 Section 32 (definition of Base amount)

Repeal the definition, substitute:

base amount is the amount (if any) prescribed in the regulations.

134 Section 32 (definition of N)

Omit “for the year”, substitute “for the quarter”.

135 Section 32 (definition of Per capita amount)

Omit “$30”, substitute “$20”.

136 Subsection 33(1)

Repeal the subsection, substitute:

(1) An employer who has a superannuation guarantee shortfall for a quarter must lodge a superannuation guarantee statement for the quarter on or before:

(a) for a quarter beginning on 1 January—14 May in the next quarter; or

(b) for a quarter beginning on 1 April—14 August in the next quarter; or

(c) for a quarter beginning on 1 July—14 November in the next quarter; or

(d) for a quarter beginning on 1 October—14 February in the next quarter.

(1A) However, the Commissioner may allow an employer to lodge a superannuation guarantee statement on a later day.

Note: The heading to section 33 is replaced by the heading “Superannuation guarantee statements”.

137 Paragraphs 33(2)(b), (d) and (e)

Omit “the year”, substitute “the quarter”.

138 Paragraph 33(2)(f)

Repeal the paragraph.

139 Paragraphs 33(2)(g) and (h)

Omit “the year”, substitute “the quarter”.

140 Subsection 33(4)

Omit “the year”, substitute “the quarter”.

141 Section 34

Omit “year” (wherever occurring), substitute “quarter”.

142 Paragraph 35(1)(a)

Omit “a year”, substitute “a quarter”.

Note: The heading to section 35 is altered by omitting “for year” and substituting “for a quarter”.

143 Paragraph 35(1)(b)

Omit “the year”, substitute “the quarter”.

144 Paragraph 35(1)(c)

Omit “the year”, substitute “the quarter”.

145 Paragraph 35(1)(d)

Repeal the paragraph, substitute:

(d) the assessment is taken to have been made on the later of the day on which the statement was lodged and the following day:

(i) for a quarter beginning on 1 January—14 May in the next quarter;

(ii) for a quarter beginning on 1 April—14 August in the next quarter;

(iii) for a quarter beginning on 1 July—14 November in the next quarter;

(iv) for a quarter beginning on 1 October—14 February in the next quarter; and

146 Paragraph 35(1)(e)

Omit “the year”, substitute “the quarter”.

147 Subsection 35(2)

Omit “a year”, substitute “a quarter”.

148 Subsection 36(1)

Omit “year” (wherever occurring), substitute “quarter”.

149 Subsection 36(3)

Repeal the subsection, substitute:

(3) Superannuation guarantee charge in relation to an assessment made under subsection (1) is payable on the day on which the assessment is made.

150 Section 46

Repeal the section, substitute:

(1) Superannuation guarantee charge for a quarter is payable:

(a) if, on or before the lodgment day for the quarter, the employer lodges a superannuation guarantee statement or a statement under section 34 indicating a superannuation guarantee shortfall for that quarter—on the lodgment day; or

(b) if, after the lodgment day, the employer lodges a superannuation guarantee statement or a statement under section 34 indicating a superannuation guarantee shortfall for that quarter—on the day on which the statement is lodged.

Note 1: If a default assessment is made for a quarter then the superannuation guarantee charge is payable on the day on which the assessment is made: see section 36.

Note 2: For provisions about collection and recovery of superannuation guarantee charge, see Part 4‑15 in Schedule 1 to the Taxation Administration Act 1953.

(2) In this section:

lodgment day for a quarter means the following day:

(a) for a quarter beginning on 1 January—14 May in the next quarter;

(b) for a quarter beginning on 1 April—14 August in the next quarter;

(c) for a quarter beginning on 1 July—14 November in the next quarter;

(d) for a quarter beginning on 1 October—14 February in the next quarter.

151 Paragraphs 49(2)(a) and (b)

Omit “for the year”, substitute “for the quarter”.

152 After section 49

Insert:

The Commissioner must apply payments of superannuation guarantee charge, or related penalty charge, for a quarter that are made by or on behalf an employer, so that the employer’s liability to pay the nominal interest component for the quarter is discharged before all other amounts.

153 Part 7 (heading)

Repeal the heading, substitute:

154 Subsection 59(1)

Omit “year” (wherever occurring), substitute “quarter”.

155 Subsection 59(2)

Omit “in relation to a year”, substitute “for a quarter”.

156 Paragraph 59(2)(a)

Omit “the year”, substitute “the quarter”.

157 Subparagraph 59(2)(a)(i)

Repeal the subparagraph.

158 Subparagraphs 59(2)(a)(ii), (iii) and (iv)

Omit “for the year”, substitute “for the quarter”.

159 Part 8 (heading)

Repeal the heading, substitute:

160 Section 63

Repeal the section, substitute:

(1) This Part applies to a charge payment in respect of one or more employees (the benefiting employee or benefiting employees) that is made by or on behalf of an employer.

(2) In this section:

charge payment means a payment of superannuation guarantee charge, or related penalty charge, for a quarter.

(1) If a payment to which this Part applies is made, the Commissioner is required to pay (or otherwise deal with) an amount, which is called the shortfall component, for the benefit of a benefiting employee under sections 65 to 67.

(2) If there is only one benefiting employee, the shortfall component for the payment is worked out under section 64A.

(3) If there is more than one benefiting employee, there will be separate shortfall components for each of the employees for the payment, worked out under section 64B.

161 Section 64

Repeal the section, substitute:

(1) This section applies if there is only one benefiting employee.

(2) The shortfall component for the payment is the lesser of the following amounts:

(a) the amount of the payment;

(b) the amount of the employee entitlement, calculated at the time when the payment is made (see subsection (3)).

(3) The employee entitlement, calculated at a particular time, is the sum of the following amounts:

(a) the individual superannuation guarantee shortfall for the employee for the quarter;

(b) any general interest charge, in respect of non‑payment of superannuation guarantee charge payable on that shortfall, that has been paid by, or is payable at, the particular time;

(c) any nominal interest component for the quarter that has been paid by, or is payable at, the particular time;

reduced (but not below zero) by the amounts of any previous payments to which this Part applies that relate to the same quarter, employer and employee.

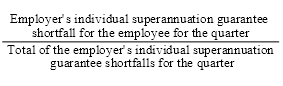

(1) This section applies if there is more than one benefiting employee. In this situation, separate shortfall components are worked out for each of the benefiting employees.

(2) The shortfall component for a payment, in respect of a particular employee, is the employee’s proportion of the lesser of the following amounts:

(a) the amount of the payment;

(b) the amount of the total employee entitlement, calculated at the time when the payment is made.

(3) An employee’s proportion of an amount is the following proportion:

(4) The total employee entitlement, calculated at a particular time, is the sum of the following amounts:

(a) the employer’s individual superannuation guarantee shortfalls for the quarter;

(b) any general interest charge, in respect of non‑payment of superannuation guarantee charge payable on those shortfalls, that has been paid by, or is payable at, the particular time;

(c) any nominal interest component for the quarter that has been paid by, or is payable at, the particular time;

reduced (but not below zero) by the amounts of any previous payments to which this Part applies that relate to the same quarter, employer and employees.

162 Subsection 65(1)

Repeal the subsection, substitute:

(1) Except in a case covered by section 65A, 66 or 67, the Commissioner is required to deal with the amount of the shortfall component in one of the following ways:

(a) in any case—pay the amount of the component, for the benefit of the employee, to:

(i) an RSA; or

(ii) an account with a complying superannuation fund; or

(iii) an account with a complying approved deposit fund;

that is held in the name of the employee and that is determined by the Commissioner to belong to the employee;

(b) if the employee has nominated an RSA, a complying superannuation fund or a complying approved deposit fund in accordance with the regulations:

(i) pay the amount of the component to the RSA or fund for the benefit of the employee; or

(ii) make arrangements in accordance with the regulations to enable the amount of the component to be paid to the RSA or fund for the benefit of the employee;

(c) if the employee has not made a nomination under paragraph (b)—credit the amount of the component to an account kept under the Small Superannuation Accounts Act 1995 in the name of the employee.

163 Subsection 65(2)

Omit “A payment of a shortfall component”, substitute “A payment of the amount of a shortfall component”.

164 Subsection 65(3)

Omit “A payment of a shortfall component”, substitute “A payment of the amount of a shortfall component”.

165 At the end of section 65

Add:

(6) A payment under paragraph (1)(a) to a particular account is taken to be a payment to the complying superannuation fund or the complying approved deposit fund with which the account is held, for the purposes of this section and any other laws of the Commonwealth that refer to payments under this section.

166 After section 65

Insert:

The Commissioner must pay the amount of the shortfall component directly to the employee (whether or not he or she is still an employee) if:

(a) the employee is 65 years or more; and

(b) the employee has requested the Commissioner in the approved form to pay the amount to him or her.

167 Subsection 79(2)

Repeal the subsection, substitute:

(2) The records must include any documents relevant to ascertaining the individual superannuation guarantee shortfalls of the employer for a quarter.

168 Section 80

Omit “$500”, substitute “5 penalty units”.

169 Subsection 52(3A)

Omit “in respect of a member referred to in subsection (1) for any contribution period”, substitute “for a member referred to in subsection (1) for any quarter”.

170 Subsection 27A(1) (paragraph (fe) of the definition of eligible termination payment)

After “section”, insert “65A or”.

171 Paragraph 82AAS(4)(a)

Omit “superannuation guarantee charge is made for a financial year”, substitute “superannuation guarantee charge, or related penalty charge, is made for a quarter”.

172 Paragraph 82AAS(4)(b)

Omit “shortfall component of the payment”, substitute “shortfall component for the payment”.

173 Paragraphs 82AAS(4)(d) and (f)

Omit “that financial year”, substitute “the financial year within which the quarter falls”.

174 Paragraph 82AAS(5)(a)

Omit “superannuation guarantee charge is made for a financial year”, substitute “superannuation guarantee charge, or related penalty charge, is made for a quarter”.

175 Paragraph 82AAS(5)(b)

Omit “shortfall component of the payment”, substitute “shortfall component for the payment”.

176 Paragraph 82AAS(5)(c)

After “section”, insert “65A or”.

177 Paragraphs 82AAS(5)(d) and (f)

Omit “that financial year”, substitute “the financial year within which the quarter falls”.

178 Paragraph 82AAS(6)(a)

Omit “superannuation guarantee charge is made for a financial year”, substitute “superannuation guarantee charge, or related penalty charge, is made for a quarter”.

179 Paragraph 82AAS(6)(b)

Omit “shortfall component of the payment”, substitute “shortfall component for the payment”.

180 Paragraphs 82AAS(6)(d) and (f)

Omit “that financial year”, substitute “the financial year within which the quarter falls”.

181 Paragraphs 82AAT(1F)(a) and (b)

Omit “contribution period”, substitute “quarter”.

182 Subsection 57‑50(6) of Schedule 2D

Omit “at the start of the earliest contribution period (within the meaning of the Superannuation Guarantee (Administration) Act 1992)”, substitute “on 1 July 1992”.

183 Subsection 57‑50(8) of Schedule 2D

Omit all the words after “in respect of” (first occurring), substitute “a period so as not to have a superannuation guarantee shortfall under the Superannuation Guarantee (Administration) Act 1992 in respect of that period”.

184 At the end of subsection 57‑50(8) of Schedule 2D

Add:

Note: The relevant periods for which shortfalls are or were calculated under that Act are quarters (from 1 July 1993 onwards) or half‑years (from 1 July 1992 to 30 June 1993).

185 Subsection 85‑25(3)

Omit “an *individual superannuation guarantee shortfall in respect of the associate”, substitute “any *individual superannuation guarantee shortfalls in respect of the associate for any of the *quarters in the income year”.

186 Subsection 86‑75(2)

Omit “an *individual superannuation guarantee shortfall in respect of the individual”, substitute “any *individual superannuation guarantee shortfalls in respect of the individual for any of the *quarters in the income year”.

187 Subsection 110SC(3)

Repeal the subsection, substitute:

(3) In so determining, the Board is to have regard to the charge percentage as specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992.

188 Subsection 110SE(6)

Omit “in respect of the person for a financial year”, substitute “for the person for a quarter”.

189 Subsection 6(2) (definition of current charge percentage)

Repeal the definition, substitute:

current charge percentage means the number that is specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the quarter beginning on 1 July of the relevant financial year.

190 Subsection 6(2) (definition of previous charge percentage)

Repeal the definition, substitute:

previous charge percentage means the number that is specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the quarter beginning on 1 July of the financial year immediately before the relevant financial year.

191 Subsection 6(2) (definition of current charge percentage)

Repeal the definition, substitute:

current charge percentage means the number that is specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the quarter beginning on 1 July of the relevant financial year.

192 Subsection 6(2) (definition of previous charge percentage)

Repeal the definition, substitute:

previous charge percentage means the number that is specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the quarter beginning on 1 July of the financial year immediately before the relevant financial year.

193 Application of amendments made by Part 1—general

Subject to this Part, the amendments made by Part 1 apply in relation to:

(a) the determination of superannuation guarantee shortfalls under the Superannuation Guarantee (Administration) Act 1992 for quarters that commence on or after 1 July 2003; and

(b) matters relating to such shortfalls.

Note 1: A matter relating to a shortfall includes, for example, the requirement to keep records under section 79 in respect of the period to which the shortfall relates.

Note 2: The Superannuation Guarantee (Administration) Act 1992 continues to apply in relation to the determination of superannuation guarantee shortfalls for years that ended before 1 July 2003, and matters relating to those shortfalls, as if the amendments made by Part 1 of this Schedule had not been made.

194 Special rule for the first 2 quarters of the 2003‑04 year—nominal interest component and administration component do not apply if charge paid by 28 April 2004

(1) This item applies to an employer who, under the Superannuation Guarantee (Administration) Act 1992 as amended by Part 1 of this Schedule, has one or more individual superannuation guarantee shortfalls for the quarter starting on 1 July 2003 or 1 October 2003.

(2) Subject to subitem (3), the employer’s nominal interest component for the quarter and the employer’s administration component for the quarter are not included in the employer’s superannuation guarantee shortfall for the quarter.

(3) However, if the employer has not paid the superannuation guarantee charge on the shortfall (determined taking account of the effect of subitem (2)) in full by 28 April 2004, the employer’s nominal interest component for the quarter, and the employer’s administration component for the quarter, are taken to be, and always to have been, included in the employer’s superannuation guarantee shortfall for the quarter.

Note: This provision does not change the day by which the superannuation guarantee charge is payable for those 2 quarters or the day on which general interest charge will begin to run.

195 Special provisions relating to conversion notices

(1) Subject to subitem (2), the amendments made by items 17 to 21 apply in relation to conversion notices given on or after 1 July 2003 under section 6B of the Superannuation Guarantee (Administration) Act 1992.

(2) Despite the amendment made by item 20, a conversion notice given on or after 1 July 2003 and before 15 August 2003 may be expressed to take effect on a day that is not earlier than 1 July 2002.

(3) During the period starting on 1 July 1998 and ending on the commencement of this item, section 6B of the Superannuation Guarantee (Administration) Act 1992 is taken to have had effect as if the references to the Commissioner of Insurance and Superannuation were instead references to the Australian Prudential Regulation Authority.

Note: 1 July 1998 is the day on which the Insurance and Superannuation Commissioner Act 1987 was repealed and the Australian Prudential Regulation Authority Act 1998 commenced.

(4) If this item commences before 1 July 2003, then during the period starting on the commencement of this item and ending on 1 July 2003, section 6B of the Superannuation Guarantee (Administration) Act 1992 is taken to have effect as if the references to the Commissioner of Insurance and Superannuation were instead references to the Commissioner of Taxation.

196 Special provisions relating to benefit certificates

(1) Subject to subitem (2), the amendment made by item 25 applies in relation to benefit certificates given on or after 1 July 2003 under section 10 of the Superannuation Guarantee (Administration) Act 1992.

(2) Despite the amendment made by that item, a benefit certificate given on or after 1 July 2003 and before 15 August 2003, or a later day allowed by the Commissioner, may be expressed to have effect from a day that is not earlier than 1 July 2002 and not later than the day on which the certificate is issued.

197 Reporting of superannuation contributions

The amendment made by item 116 applies in relation to contributions made on or after 1 July 2003.

198 Default assessments

The amendment made by item 149 applies in relation to assessments made on or after 1 July 2003 (irrespective of when the relevant superannuation guarantee shortfall arose).

199 Shortfall components—payments direct to superannuation accounts etc. and people over 65

The amendments made by items 162, 165 and 166 apply in relation to payments (or other dealings) by the Commissioner of an amount of a shortfall component made on or after 1 July 2003 (irrespective of when the relevant superannuation guarantee shortfall arose).

200 Relief from annual national payroll requirements for pre‑1 July 2003 shortfalls if employer’s base year is 1996‑97 or later

If:

(a) an employer has a superannuation guarantee shortfall for a period that ended before 1 July 2003; and

(b) the employer’s base year, within the meaning of the Superannuation Guarantee (Administration) Act 1992 as it continues to apply in relation to shortfalls for years that ended before 1 July 2003 (see item 193), is the year beginning on 1 July 1996 or a later year;

the employer does not, from 1 July 2003, have to comply with the requirements of paragraph 33(2)(f), subparagraph 59(2)(a)(i) and paragraph 79(2)(a) of that Act (as so continuing to apply) in relation to that shortfall and that period.

Note: This provision relieves the employer from having to comply with requirements related to the employer’s annual national payroll. However, an employer whose base year is an earlier year must continue to comply with those requirements in relation to shortfalls for pre‑1 July 2003 periods.

201 Preservation of regulations made for the purposes of subsection 65(1)

Regulations in force for the purposes of subsection 65(1) of the Superannuation Guarantee (Administration) Act 1992 immediately before 1 July 2003 have effect on and after that day as if they were made for the purposes of that subsection as amended by item 162 of this Schedule.

202 Application of amendments made by Part 2

(1) The amendment made by item 169 applies in relation to determinations under section 52 of the Defence Act 1903 for periods starting on or after 1 July 2003.

(2) The amendments made by items 170 to 186 apply in relation to assessments under the Income Tax Assessment Act 1936 for the 2003‑2004 year of income and later years of income.

(3) The amendment made by item 187 applies in relation to determinations under subsection 110SC(2) of the Superannuation Act 1976 for contribution days that are on or after 1 July 2003.

(4) The amendment made by item 188 applies in relation to top‑up benefit under section 110SE of the Superannuation Act 1976 for periods commencing on or after 1 July 2003.

(5) Subject to subitem (6), the amendments made by items 189 to 192 apply in relation to surcharge imposed by the Superannuation Contributions Tax Imposition Act 1997 and the Superannuation Contributions Tax (Members of Constitutionally Protected Superannuation Funds) Imposition Act 1997 for the 2003‑2004 financial year and later financial years.

(6) However, for the 2003‑2004 year, the amount that is the previous charge percentage (which is a number that relates to the 2002‑2003 year) is to be determined as if the amendments made by items 190 and 192 had not been made.

1 At the end of subsection 82AAC(1)

Add:

Note 3: However, a deduction might be denied or reduced by section 26‑80 of the Income Tax Assessment Act 1997 if the contribution is made more than 28 days after the month in which the eligible employee turns 70.

2 At the end of subsection 82AAT(1)

Add:

Note: However, a deduction is denied by section 26‑80 of the Income Tax Assessment Act 1997 if the contribution is made more than 28 days after the month in which the person turns 70.

3 At the end of Division 26 of Part 2‑5

Add:

(1) You cannot deduct under this Act an amount you pay as a contribution to a *complying superannuation fund or *RSA except as provided by this section.

Contributions in respect of those who are less than 70 years old

(2) You can deduct an amount under section 82AAC of the Income Tax Assessment Act 1936 if:

(a) you are entitled to the deduction under that section; and

(b) you pay the contribution in respect of an eligible employee (within the meaning of section 82AAA of that Act) on or before the day that is 28 days after the end of the month in which the employee turns 70 years old.

(3) You can deduct an amount under section 82AAT of the Income Tax Assessment Act 1936 if:

(a) you are entitled to the deduction under that section; and

(b) you pay the contribution on or before the day that is 28 days after the end of the month in which you turn 70 years old.

Contributions in respect of those who are 70 years or more

(4) You can deduct an amount under section 82AAC of the Income Tax Assessment Act 1936 if:

(a) you are entitled to the deduction under that section; and

(b) you pay the contribution in respect of an eligible employee (within the meaning of section 82AAA of that Act) after the day referred to in paragraph (2)(b); and

(c) you are required to pay the contribution by an industrial award or determination that is in force under an *Australian law.

However, you can only deduct the amount of the contribution that is actually required by the industrial award or determination.

Note: An industrial agreement, such as an Australian Workplace Agreement or a Certified Agreement, is not an award or determination.

(5) You can deduct an amount under section 82AAC of the Income Tax Assessment Act 1936 if:

(a) you are entitled to the deduction under that section; and

(b) you pay the contribution in respect of an eligible employee (within the meaning of section 82AAA of that Act) after the day referred to in paragraph (2)(b); and

(c) the contribution reduces your charge percentage in respect of the employee under section 22 or 23 of the Superannuation Guarantee (Administration) Act 1992.

(6) If both subsections (4) and (5) potentially apply in respect of the deduction, you can choose which of those subsections actually applies.

4 Application of amendments made by Part 1

The amendments made by Part 1 apply in relation to assessments for the 2002‑2003 year of income and later years of income.

1 At the end of subparagraph 274(1)(a)(i)

Add:

or (D) if that other person is less than 18 years old—contributions made to a complying superannuation fund for the benefit of that other person that are not contributions made by or on behalf of an employer of that other person;

2 Subparagraph 274(1)(ba)(i)

Repeal the subparagraph, substitute:

(i) contributions made for the purpose of making provision for superannuation benefits for another person, other than:

(A) eligible spouse contributions within the meaning of section 159T; and

(B) if that other person is less than 18 years old—contributions made for the benefit of that other person that are not contributions made by or on behalf of an employer of that other person; and

3 Application of amendments

The amendments made by items 1 and 2 apply in relation to assessments for the 2002‑2003 year of income and later years of income.

1 Subparagraphs 82AAT(2)(a)(i) and (ii)

Omit “$3,000”, substitute “$5,000”.

2 Application of amendment

The amendment made by item 1 applies in relation to assessments for the 2002‑2003 year of income and later years of income.

1 After subsection 109(1B)

Insert:

(1C) The reference in paragraph (1)(e) to amounts due to or in respect of any employee of the bankrupt also includes a reference to amounts due as superannuation guarantee charge (within the meaning of the Superannuation Guarantee (Administration) Act 1992), or general interest charge in respect of non‑payment of the superannuation guarantee charge.

2 Application of amendment made by item 1

The amendment made by item 1 applies to bankruptcies for which the date of the bankruptcy is after the commencement of that item.

3 Item 34 of Schedule 1

Omit “(6A)(d)”, substitute “(6AA)(d)”.

4 Item 36 of Schedule 1

Omit “(6A)”, substitute “(6AA)”.

5 Item 37 of Schedule 1 (subsection (6A))

Renumber as subsection (6AA).

6 Item 38 of Schedule 1

Omit “or (6A)”, substitute “, (6AA)”.

7 Item 39 of Schedule 1

Omit “(6A)”, substitute “(6AA)”.

8 Subsection 15(7)

Before “, the Commissioner”, insert “or (6A)”.

9 At the end of section 52

Add:

Note: The priority of superannuation guarantee charge in a bankruptcy is dealt with in section 109 of the Bankruptcy Act 1966.

10 Subsection 16‑170(3) in Schedule 1

After “16‑165”, insert “, 16‑166”.

11 Application of amendment made by item 10

The amendment made by item 10 applies in relation to payments made on or after the commencement of that item.

12 Subsection 16‑175(1) in Schedule 1

After “16‑165”, insert “, 16‑166”.

13 Subsection 16‑175(1) in Schedule 1 (before the note)

Insert:

Penalty: 20 penalty units.

14 Application of amendments made by items 12 and 13

The amendments made by items 12 and 13 apply in relation to payments made on or after the commencement of those items.

[Minister’s second reading speech made in—

House of Representatives on 16 May 2002

Senate on 19 June 2002]

(111/02)