Taxation Laws Amendment Act (No. 2) 2002

No. 57, 2002

An Act to amend the law relating to taxation, and for related purposes

Taxation Laws Amendment Act (No. 2) 2002

No. 57, 2002

An Act to amend the law relating to taxation, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

Schedule 1—Company rate changes (franking account consequentials)

Income Tax Assessment Act 1936

Schedule 2—Friendly societies

Income Tax Assessment Act 1997

Schedule 3—Prescribed dual residents

Income Tax Assessment Act 1936

Schedule 4—Refundable tax offsets

Part 1—Certain trustees and beneficiaries

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Part 2—Non‑complying superannuation funds and non‑complying ADFs

Income Tax Assessment Act 1997

Schedule 5—Franking rebate on indirect distributions to exempt institutions

Income Tax Assessment Act 1936

Schedule 6—Tax rebate for low income aged persons

Income Tax Assessment Act 1936

Schedule 7—Demutualisation of Tower Corporation

Income Tax Assessment Act 1997

Schedule 8—Minor amendments of Medicare Levy Act 1986

Medicare Levy Act 1986

Schedule 9—Income tax deductions for gifts

Part 1—Income Tax Assessment Act 1936

Part 2—Income Tax Assessment Act 1997

Part 3—Application of amendments

Schedule 10—Demutualisation of mutual entities other than insurance companies

Income Tax Assessment Act 1936

Schedule 11—Same asset roll‑over

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Schedule 12—Technical amendments

Part 1—Amendments of Principal Acts

Crimes (Taxation Offences) Act 1980

Fringe Benefits Tax Assessment Act 1986

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

International Tax Agreements Act 1953

Taxation Administration Act 1953

Part 2—Amendments of amending Acts

Aged Care (Consequential Provisions) Act 1997

A New Tax System (Indirect Tax and Consequential Amendments) Act 1999

A New Tax System (Pay As You Go) Act 1999

A New Tax System (Tax Administration) Act 1999

Income Tax (Consequential Amendments) Act 1997

New Business Tax System (Capital Allowances—Transitional and Consequential) Act 2001

New Business Tax System (Miscellaneous) Act (No. 2) 2000

Taxation Laws Amendment Act (No. 1) 1997

Taxation Laws Amendment Act (No. 1) 2001

Taxation Laws Amendment Act (No. 2) 1999

Taxation Laws Amendment Act (No. 3) 1997

Taxation Laws Amendment Act (No. 3) 1999

Taxation Laws Amendment Act (No. 3) 2001

Taxation Laws Amendment Act (No. 6) 2001

Taxation Laws Amendment (Company Law Review) Act 1998

Taxation Laws Amendment (Private Health Insurance) Act 1998

Taxation Laws Amendment (Research and Development) Act 2001

Taxation Laws Amendment (Trust Loss and Other Deductions) Act 1998

Tax Law Improvement Act 1997

Tax Law Improvement Act (No. 1) 1998

Part 3—Repeals

A New Tax System (Indirect Tax and Consequential Amendments) Act 1999

A New Tax System (Tax Administration) Act (No. 2) 2000

Financial Sector Reform (Consequential Amendments) Act 1998

Social Security and Veterans’ Affairs Legislation Amendment (Pension Bonus Scheme) Act 1998

Taxation Laws Amendment Act (No. 1) 1998

Taxation Laws Amendment Act (No. 2) 2000

Taxation Laws Amendment Act (No. 3) 1998

Taxation Laws Amendment (Film Licensed Investment Company) Act 1998

Taxation Laws Amendment (Landcare and Water Facility Tax Offset) Act 1998

Taxation Laws Amendment (Private Health Insurance) Act 1998

Taxation Laws (Technical Amendments) Act 1998

Tax Law Improvement Act 1997

Tax Law Improvement Act (No. 1) 1998

Part 4—Amendments to correct asterisks

Taxation Administration Act 1953

Taxation Laws Amendment Act (No. 2) 2002

No. 57, 2002

An Act to amend the law relating to taxation, and for related purposes

[Assented to 3 July 2002]

The Parliament of Australia enacts:

This Act may be cited as the Taxation Laws Amendment Act (No. 2) 2002.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, on the day or at the time specified in column 2 of the table.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent | 3 July 2002 |

2. Schedule 1 | 1 July 2001 | 1 July 2001 |

3. Schedule 2 | 1 July 2002 | 1 July 2002 |

4. Schedule 3 | The day on which this Act receives the Royal Assent | 3 July 2002 |

5. Schedule 4, Part 1 | 1 July 2000 | 1 July 2000 |

6. Schedule 4, Part 2 | The day on which this Act receives the Royal Assent | 3 July 2002 |

7. Schedules 5, 6, 7 and 8 | The day on which this Act receives the Royal Assent | 3 July 2002 |

8. Schedule 9, Part 1 | The day on which this Act receives the Royal Assent | 3 July 2002 |

9. Schedule 9, item 9 | The day on which this Act receives the Royal Assent | 3 July 2002 |

10. Schedule 9, item 10 | Immediately after section 30‑25 of the Income Tax Assessment Act 1997 commenced | 1 July 1997 |

11. Schedule 9, items 11 and 12 | The day on which this Act receives the Royal Assent | 3 July 2002 |

12. Schedule 9, items 13 and 14 | Immediately after section 30‑45 of the Income Tax Assessment Act 1997 commenced | 1 July 1997 |

13. Schedule 9, items 15 to 20 | The day on which this Act receives the Royal Assent | 3 July 2002 |

14. Schedule 9, item 21 | Immediately after section 30‑55 of the Income Tax Assessment Act 1997 commenced | 1 July 1997 |

15. Schedule 9, items 22 to 40 | The day on which this Act receives the Royal Assent | 3 July 2002 |

16. Schedule 9, Part 3 | The day on which this Act receives the Royal Assent | 3 July 2002 |

17. Schedule 10 | 17 November 1999 | 17 November 1999 |

18. Schedule 11 | The day on which this Act receives the Royal Assent | 3 July 2002 |

19. Schedule 12, item 1 | Immediately after the time specified in the Crimes and Other Legislation Amendment Act 1997 for the commencement of item 3 of Schedule 2 to that Act | 7 April 1997 |

20. Schedule 12, items 2 and 3 | Immediately after item 11 of Schedule 8 to the Taxation Laws Amendment Act (No. 3) 1998 commenced | 23 June 1998 |

21. Schedule 12, item 4 | Immediately after item 22 of Schedule 5 to the Taxation Laws Amendment (Company Law Review) Act 1998 commenced | 1 July 1998 |

22. Schedule 12, items 5 and 6 | Immediately after the time specified in the Taxation Laws Amendment (Private Health Insurance) Act 1998 for the commencement of item 3 of Schedule 1 to that Act | 21 December 1998 |

23. Schedule 12, item 7 | Immediately after the time specified in the Taxation Laws Amendment (Film Licensed Investment Company) Act 1998 for the commencement of item 12 of Schedule 1 to that Act | 7 December 1998 |

24. Schedule 12, items 8, 9 and 10 | The day on which this Act receives the Royal Assent | 3 July 2002 |

25. Schedule 12, item 11 | Immediately after the time specified in the Financial Sector Reform (Consequential Amendments) Act 1998 for the commencement of item 92 of Schedule 1 to that Act | 1 July 1998 |

26. Schedule 12, items 12 and 13 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 3) 1998 for the commencement of item 19 of Schedule 3 to that Act | 23 June 1998 |

27. Schedule 12, items 14 and 15 | The day on which this Act receives the Royal Assent | 3 July 2002 |

28. Schedule 12, items 16 to 18 | The day on which this Act receives the Royal Assent | 3 July 2002 |

29. Schedule 12, item 19 | Immediately after the time specified in the Social Security and Veterans’ Affairs Legislation Amendment (Pension Bonus Scheme) Act 1998 for the commencement of item 1 of Schedule 3 to that Act | 30 June 1998 |

30. Schedule 12, item 20 | The day on which this Act receives the Royal Assent | 3 July 2002 |

31. Schedule 12, items 21 and 22 | Immediately after the time specified in the Tax Law Improvement Act (No. 1) 1998 for the commencement of item 3 of Schedule 3 to that Act | 22 June 1998 |

32. Schedule 12, items 23 and 24 | Immediately after the time specified in the Tax Law Improvement Act 1997 for the commencement of item 15 of Schedule 4 to that Act | 1 July 1997 |

33. Schedule 12, items 25 and 26 | The day on which this Act receives the Royal Assent | 3 July 2002 |

34. Schedule 12, items 27 and 28 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 1) 1998 for the commencement of items 8 and 9 of Schedule 3 to that Act | 16 April 1998 |

35. Schedule 12, item 29 | At the same time as item 5 of Schedule 1 to the Franchise Fees Windfall Tax (Consequential Amendments) Act 1997 commenced | 19 September 1997 |

36. Schedule 12, item 30 | Immediately after the commencement of section 38 of the Taxation Laws Amendment Act (No. 3) 1986 | 4 November 1986 |

37. Schedule 12, item 31 | Immediately after the commencement of section 10 to the Income Tax (International Agreements) Amendment Act (No. 2) 1989 | 19 December 1989 |

38. Schedule 12, item 32 | Immediately after the commencement of section 4 of the Income Tax (International Agreements) Amendment Act 1991 | 26 June 1991 |

39. Schedule 12, items 33, 34 and 35 | Immediately after the commencement of section 7 of the Income Tax (International Agreements) Amendment Act 1992 | 23 November 1992 |

40. Schedule 12, item 36 | Immediately after item 63 of Schedule 3 to the Treasury Legislation Amendment (Application of Criminal Code) Act (No. 2) 2001 commenced | 15 December 2001 |

41. Schedule 12, item 37 | Immediately after item 64 of Schedule 3 to the Treasury Legislation Amendment (Application of Criminal Code) Act (No. 2) 2001 commenced | 15 December 2001 |

42. Schedule 12, item 38 | Immediately after the time specified in the Aged Care (Consequential Provisions) Act 1997 for the commencement of item 30 of Schedule 5 to that Act | 1 October 1997 |

43. Schedule 12, item 39 | Immediately after the time specified in the A New Tax System (Indirect Tax and Consequential Amendments) Act 1999 for the commencement of item 17 of Schedule 7 to that Act | 1 July 2000 |

44. Schedule 12, item 40 | Immediately after the time specified in the A New Tax System (Pay As You Go) Act 1999 for the commencement of item 62 of Schedule 2 to that Act | 22 December 1999 |

45. Schedule 12, item 41 | Immediately after the time specified in the A New Tax System (Tax Administration) Act 1999 for the commencement of item 22 of Schedule 6 to that Act | 22 December 1999 |

46. Schedule 12, item 42 | Immediately after the time specified in the A New Tax System (Tax Administration) Act 1999 for the commencement of item 33 of Schedule 11 to that Act | 1 July 2000 |

47. Schedule 12, item 43 | Immediately after the time specified in the Income Tax (Consequential Amendments) Act 1997 for the commencement of item 30 of Schedule 1 to that Act | 1 July 1997 |

48. Schedule 12, items 44 and 45 | Immediately after the time specified in the New Business Tax System (Capital Allowances—Transitional and Consequential) Act 2001 for the commencement of items 219 and 230 of Schedule 2 to that Act | 30 June 2001 |

49. Schedule 12, item 46 | Immediately after the commencement of subsection 2(6) of the New Business Tax System (Miscellaneous) Act (No. 2) 2000 | 30 June 2000 |

50. Schedule 12, items 47 to 49 | Immediately after the time specified in the New Business Tax System (Miscellaneous) Act (No. 2) 2000 for the commencement of items 26 to 29 of Schedule 1 to that Act | 31 May 2000 |

51. Schedule 12, item 50 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 1) 1997 for the commencement of item 8 of Schedule 3 to that Act | 8 July 1997 |

52. Schedule 12, items 51 and 52 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 1) 2001 for the commencement of items 9 and 36 of Schedule 2 to that Act | 30 June 2001 |

53. Schedule 12, item 53 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 2) 1999 for the commencement of item 36 of Schedule 1 to that Act | 16 July 1999 |

54. Schedule 12, item 54 | Immediately after the commencement of section 2 of the Taxation Laws Amendment Act (No. 3) 1997 | 14 October 1997 |

55. Schedule 12, item 55 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 3) 1999 for the commencement of items 165 and 167 of Schedule 1 to that Act | 1 July 1999 |

56. Schedule 12, item 56 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 3) 2001 for the commencement of item 36 of Schedule 2 to that Act | 30 June 2001 |

57. Schedule 12, item 57 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 6) 2001 for the commencement of item 11 of Schedule 5 to that Act | 1 October 2001 |

58. Schedule 12, items 58 and 59 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 6) 2001 for the commencement of item 16L of Schedule 6 to that Act | 1 October 2001 |

59. Schedule 12, items 60 and 61 | Immediately after the time specified in the Taxation Laws Amendment (Company Law Review) Act 1998 for the commencement of Schedule 6 to that Act | 1 July 1998 |

60. Schedule 12, item 62 | Immediately after the time specified in the Taxation Laws Amendment (Private Health Insurance) Act 1998 for the commencement of item 4 of Schedule 2 to that Act | 21 December 1998 |

61. Schedule 12, item 63 | Immediately after section 2 of the Taxation Laws Amendment (Research and Development) Act 2001 commenced | 1 October 2001 |

62. Schedule 12, item 64 | Immediately after item 23 of Schedule 1 to the Taxation Laws Amendment (Trust Loss and Other Deductions) Act 1998 commenced | 16 April 1998 |

63. Schedule 12, item 65 | Immediately after the time specified in the Tax Law Improvement Act 1997 for the commencement of item 69 of Schedule 6 to that Act | 1 July 1997 |

64. Schedule 12, item 66 and 67 | Immediately after the time specified in the Tax Law Improvement Act (No. 1) 1998 for the commencement of items 373 and 374 of Schedule 2 to that Act | 22 June 1998 |

65. Schedule 12, item 68 | Immediately after the time specified in the Tax Law Improvement Act (No. 1) 1998 for the commencement of item 519 of Schedule 2 to that Act | 22 June 1998 |

66. Schedule 12, Parts 3 and 4 | The day on which this Act receives the Royal Assent | 3 July 2002 |

Note: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

(2) Column 3 of the table is for additional information that is not part of this Act. This information may be included in any published version of this Act.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Company rate changes (franking account consequentials)

Income Tax Assessment Act 1936

1 Section 160APA (paragraph (baa) of the definition of applicable general company tax rate)

Omit “34%”, substitute “30%”.

2 Section 160APA (paragraph (cb) of the definition of applicable general company tax rate)

Omit “34%”, substitute “30%”.

3 At the end of section 160AQG

Add:

(5) If a company has a franking year that includes, but does not start on, 1 July 2001, subsections (1) to (3) apply to the company as if the following periods were separate franking years:

(a) the period starting at the start of the company’s franking year and ending on 30 June 2001;

(b) the period starting on 1 July 2001 and ending at the end of the franking year.

4 Subparagraph 160AQH(1)(b)(iva)

Omit “34%”, substitute “30%”.

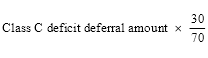

5 Subsection 160AQJC(4) (formula)

Repeal the formula, substitute:

6 Subsection 160ATA(3)

After “1 July 2000”, insert “(and before 1 July 2001)”.

7 Paragraph 160ATD(1)(a)

After “on or after 1 July 2000”, insert “and before 1 July 2001”.

8 Subsection 160ATD(1) (table heading)

After “on or after 1 July 2000”, insert “and before 1 July 2001”.

9 Paragraph 160ATDA(2)(b)

Repeal the paragraph.

10 At the end of Part IIIAA

Add:

Division 15—Transitional provisions for conversion to 30% rate on 1 July 2001

160AUA Conversion of account balances on 1 July 2001

(1) On 1 July 2001, a company’s franking accounts are dealt with as follows:

(a) first:

(i) the company’s class C franking account balance (if any) at the start of that day is converted under section 160AUB to reflect the new company tax rate; and

(ii) the company’s venture capital sub‑account balance (if any) at the start of that day is converted under section 160AUB to reflect the new company tax rate;

(b) then, any other credits and debits that occur on that day are processed.

(2) For the purposes of this Division, if 1 July 2001 is the first day of a franking year for the company, the balance in a franking account or sub‑account of the company at the start of that day includes any credit arising for that account on that day under section 160APL (carry forward of surplus from previous franking year) or 160ASEE (carry forward of venture capital sub‑account surplus from previous franking year).

(3) Section 160AUC tells you how to deal with franking credits and debits that arise on or after 1 July 2001 but reflect tax paid at the old company tax rates.

160AUB Conversion of balance of class C franking account to reflect the new company tax rate

(1) If a company has a class C franking surplus at the start of 1 July 2001:

(a) a class C franking debit of the company arises equal to that surplus; and

(b) a class C franking credit of the company arises equal to the amount of that debit multiplied by the conversion factor in subsection (5).

(2) If a PDF has a venture capital sub‑account surplus at the start of 1 July 2001:

(a) a venture capital debit of the PDF arises equal to that surplus; and

(b) a venture capital credit of the PDF arises equal to the amount of that debit multiplied by the conversion factor in subsection (5).

(3) If a company has a class C franking deficit at the start of 1 July 2001:

(a) a class C franking credit of the company arises equal to that deficit; and

(b) a class C franking debit of the company arises equal to the amount of that credit multiplied by the conversion factor in subsection (5).

(4) If a PDF has a venture capital sub‑account deficit at the start of 1 July 2001:

(a) a venture capital credit of the PDF arises equal to that deficit; and

(b) a venture capital debit of the PDF arises equal to the amount of that credit multiplied by the conversion factor in subsection (5).

(5) The conversion factor is:

160AUC Special treatment of some franking credits and debits arising on or after 1 July 2001

(1) If:

(a) any of the events specified in the event column of the following table occurs in relation to a company on or after 1 July 2001; and

(b) the event:

(i) is not a franking credit or debit arising under this Division; and

(ii) is not a franking credit arising under section 160APL (carry forward of surplus from previous franking year) or 160ASEE (carry forward of venture capital sub‑account surplus from previous franking year); and

(iii) is not a franking debit arising under section 160APX (under‑franking of a dividend), 160AQB (payment of a franked dividend), 160AQCB, 160AQCBA, 160AQCNA or 160AQCNB (dividend streaming or franking credit trading arrangements), 160AQCC (on‑market share buy back arrangements) or 160AQCNC (private company distributions treated as dividends);

the adjustments specified in the adjustments column for that item are made to the company’s franking accounts:

Certain credits and debits arising on or after 1 July 2001 | ||

Item | Event | Adjustments |

1 | a class A franking credit of the company arises under this Part | (a) a class A franking debit arises equal to the amount of the class A franking credit; and (b) a class C franking credit also arises equal to the amount worked out using the formula:

|

2 | a class A franking debit of the company arises under this Part | (a) a class A franking credit arises equal to the amount of the class A franking debit; and (b) a class C franking debit also arises equal to the amount worked out using the formula:

|

3 | a class B franking credit of a company arises under this Part | (a) a class B franking debit arises at that time equal to the amount of the class B franking credit; and (b) a class C franking credit also arises at that time equal to the amount worked out using the formula:

|

4 | a class B franking debit of a company arises under this Part | (a) a class B franking credit arises at that time equal to the amount of the class B franking debit; and (b) a class C franking debit also arises at that time equal to the amount worked out using the formula:

|

5 | a class C franking credit of a company arises under this Part and the amount of the credit reflects an applicable general company tax rate of 34% | (a) a class C franking debit arises at that time equal to the amount of the class C franking credit; and (b) a class C franking credit also arises at that time equal to the amount worked out using the formula:

|

6 | a class C franking debit of a company arises under this Part and the amount of the debit reflects an applicable general company tax rate of 34% | (a) a class C franking credit arises at that time equal to the amount of the class C franking debit; and (b) a class C franking debit also arises at that time equal to the amount worked out using the formula:

|

7 | a venture capital credit of the PDF arises under this Part and the amount of the credit reflects an applicable general company tax rate of 34% | (a) a venture capital debit of the PDF arises at that time equal to the amount of the venture capital credit; and (b) a venture capital credit of the PDF also arises at that time equal to the amount worked out using the formula:

|

8 | a venture capital debit of a PDF arises under this Part and the amount of the debit reflects an applicable general company tax rate of 34% | (a) a venture capital credit of the PDF arises at that time equal to the amount of the venture capital debit; and (b) a venture capital debit also arises at that time equal to the amount worked out using the formula:

|

9 | a class C franking credit of a company arises under this Part and the amount of the credit reflects an applicable general company tax rate of 36% | (a) a class C franking debit arises at that time equal to the amount of the class C franking credit; and (b) a class C franking credit also arises at that time equal to the amount worked out using the formula:

|

10 | a class C franking debit of a company arises under this Part and the amount of the debit reflects an applicable general company tax rate of 36% | (a) a class C franking credit arises at that time equal to the amount of the class C franking debit; and (b) a class C franking debit also arises at that time equal to the amount worked out using the formula:

|

11 | a venture capital credit of the PDF arises under this Part and the amount of the credit reflects an applicable general company tax rate of 36% | (a) a venture capital debit of the PDF arises at that time equal to the amount of the venture capital credit; and (b) a venture capital credit of the PDF also arises at that time equal to the amount worked out using the formula:

|

12 | a venture capital debit of a PDF arises under this Part and the amount of the debit reflects an applicable general company tax rate of 36% | (a) a venture capital credit of the PDF arises at that time equal to the amount of the venture capital debit; and (b) a venture capital debit also arises at that time equal to the amount worked out using the formula:

|

(2) For the purposes of items 5, 6, 7 and 8 of the table in subsection (1), the amount of a credit or debit reflects an applicable general company tax rate of 34% if:

(a) the applicable general company tax rate used to calculate the amount of the debit or credit is 34%; or

(b) the debit arises under subsection 160AQC(3) or section 160ASEI and the amount specified in the application for the estimated debit concerned is based on a 34% general company tax rate; or

(c) the credit or debit is equal to the amount of an earlier debit or credit and the earlier debit or credit reflected an applicable general company tax rate of 34%.

Note 1: Paragraph (a)—the applicable general company tax rate will always be involved in the calculation of a credit or debit if an “adjusted amount” is used in the calculation.

Note 2: Paragraph (c) covers provisions such as sections 160APV, 160APVB, 160AQCA and 160AQCCB.

(3) For the purposes of items 9, 10, 11 and 12 of the table in subsection (1), the amount of a credit or debit reflects an applicable general company tax rate of 36% if:

(a) the applicable general company tax rate used to calculate the amount of the debit or credit is 36%; or

(b) the credit or debit is equal to the amount of an earlier debit or credit and the earlier debit or credit reflected an applicable general company tax rate of 36%.

Note 1: Paragraph (a)—the applicable general company tax rate will always be involved in the calculation of a credit or debit if an “adjusted amount” is used in the calculation.

Note 2: Paragraph (b) covers provisions such as sections 160APV, 160APVB, 160AQCA and 160AQCCB.

160AUD Special treatment of some franking credits and debits arising before 1 July 2001

(1) If:

(a) any of the events specified in the event column of the following table occurred in relation to a company before 1 July 2001; and

(b) the event:

(i) was not a franking credit arising under section 160APL (carry forward of surplus from previous franking year) or 160ASEE (carry forward of venture capital sub‑account surplus from previous franking year); and

(ii) was not a franking debit arising under section 160APX (under‑franking of a dividend), 160AQB (payment of a franked dividend), 160AQCB, 160AQCBA, 160AQCNA or 160AQCNB (dividend streaming or franking credit trading arrangements), 160AQCC (on‑market share buy back arrangements) or 160AQCNC (private company distributions treated as dividends);

the adjustments specified in the adjustment column for that item are taken to have been made to the company’s franking accounts immediately after the event occurred:

Credits and debits arising before 1 July 2001 | ||

Item | Event | Adjustments |

1 | a class C franking credit of a company arose under this Part and the amount of the credit reflected an applicable general company tax rate of 30% | (a) a class C franking debit equal to the amount of the class C franking credit; and (b) a class C franking credit equal to the amount worked out using the formula:

|

2 | a class C franking debit of a company arose under this Part and the amount of the debit reflected an applicable general company tax rate of 30% | (a) a class C franking credit equal to the amount of the class C franking debit; and (b) a class C franking debit equal to the amount worked out using the formula:

|

3 | a venture capital credit of a PDF arose under this Part and the amount of the credit reflected an applicable general company tax rate of 30% | (a) a venture capital debit of the PDF equal to the amount of the venture capital credit; and (b) a venture capital credit of the PDF equal to the amount worked out using the formula:

|

4 | a venture capital debit of a PDF arose under this Part and the amount of the debit reflected an applicable general company tax rate of 30% | (a) a venture capital credit of the PDF equal to the amount of the venture capital debit; and (b) a venture capital debit equal to the amount worked out using the formula:

|

(2) The amount of a credit or debit reflects an applicable general company tax rate of 30% if:

(a) the applicable general company tax rate used to calculate the amount of the credit or debit is 30%; or

(b) the debit arises under subsection 160AQC(3) or section 160ASEI and the amount of the estimated debit concerned is based on a 30% general company tax rate; or

(c) the credit or debit is equal to the amount of an earlier debit or credit and the earlier debit or credit reflected an applicable general company tax rate of 30%.

Note 1: Paragraph (a)—the applicable general company tax rate will always be involved in the calculation of a credit or debit if an “adjusted amount” is used in the calculation.

Note 2: Paragraph (c) covers provisions such as sections 160APV, 160APVB, 160AQCA and 160AQCCB.

160AUE Series of dividends crossing over 1 July 2001

(1) This section deals with the situation in which:

(a) a company pays a number of class C franked dividends under a resolution made before 1 July 2001; and

(b) some of the dividends (the first series dividends) are paid before 1 July 2001; and

(c) some of the dividends (the second series dividends) are paid on or after 1 July 2001.

(2) For the purposes of this Part:

(a) the first series dividends and the second series dividends are to be taken to have been made under separate resolutions; and

(b) any declaration (the original declaration) made under section 160AQF or 160ASEL in relation to the dividends is taken to have effect only in relation to the first series dividends; and

(c) the consequences provided for in the following table occur if the company does not make a declaration under section 160AQF or 160ASEL in relation to the second series dividends before the reckoning day for the second series dividends:

Default declaration for second series dividends | |||

| If... | the company is taken to have declared that... | under... |

1 | the first series dividends were class C franked | each dividend in the second series is a class C franked dividend to the extent of the same percentage as in the original declaration | subsection 160AQF(1AAA) |

2 | the first series dividends were also franked with a venture capital franked amount | each dividend in the second series is a venture capital dividend to the extent of the same percentage as in the original declaration | section 160ASEL |

Note 1: Paragraph (a) means that the 2 series of dividends will have separate reckoning days (see the definition of reckoning day in section 160APA). The reckoning day for the second series dividends will be the day on which the first of the second series dividends is paid. This in turn affects the calculation of the required franking amount for the second series dividends.

Note 2: Paragraph (b) means that the company may make a fresh declaration under section 160AQF in relation to the second series dividends. The company may wish to do this to ensure that the second series dividends are franked to the new required franking amount that will need to be calculated under Division 4. It will also mean that the company may make a fresh declaration under section 160ASEL.

(1) This section deals with the situation in which:

(a) on or after 1 July 2001, a company pays a class C franked dividend or a number of class C franked dividends under a resolution made before 1 July 2001; and

(b) section 160AUE does not apply to the dividend or dividends.

(2) For the purposes of this Part:

(a) despite subsection 160AQF(2), the company may:

(i) vary any declaration it made under section 160AQF or 160ASEL in relation to the dividend or dividends; or

(ii) revoke any declaration it made under section 160AQF or 160ASEL in relation to the dividend or dividends and make a fresh declaration under that section in relation to the dividend or dividends;

before the reckoning day for the dividend or dividends; and

(b) a declaration varied, or a fresh declaration made, under this section cannot itself be varied or revoked.

160AUG Modifying the operation of subsection 160AQE(3)

When this section applies

(1) This section deals with the situation in which:

(a) subsection 160AQE(3) is applied to work out the provisional required franking amount for a dividend (the current dividend) paid on or after 1 July 2001; and

(b) the earlier franked dividend referred to in that subsection was paid before 1 July 2001.

Effect on required franking amount

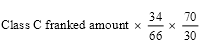

(2) The component EFA in the formula in subsection 160AQE(3) is worked out using the following formula:

where:

class C franked amount is the amount that is the class C franked amount of the earlier dividend.

11 Application

(1) The amendment made by item 1 of this Schedule applies to:

(a) franking deficit tax for franking years ending on or after 1 July 2001; and

(b) deficit deferral tax in relation to PAYG instalments paid during a franking year ending on or after 1 July 2001.

(2) The amendment made by item 2 of this Schedule applies to:

(a) the payment of a class C franked dividend to a shareholder of a company on or after 1 July 2001; and

(b) a trust amount or partnership amount that relates, directly or indirectly, to payment of a class C franked dividend to a shareholder in a company on or after 1 July 2001.

(3) The amendment made by item 4 of this Schedule applies to dividends paid on or after 1 July 2001.

(4) The amendment made by item 5 of this Schedule applies to deficit deferral tax in relation to PAYG instalments paid during a franking year ending on or after 1 July 2001.

Income Tax Assessment Act 1997

1 Subparagraph 320‑35(1)(f)(ii)

Repeal the subparagraph, substitute:

(ia) amounts received on or after 1 July 2001 but before 1 January 2003, that are attributable to *income bonds or *funeral policies; and

(ib) amounts received on or after 1 July 2001 but before 1 January 2003, that are attributable to *scholarship plans and would have been exempt from income tax under section 50‑1 if they had been received before 1 July 2001; and

(ii) amounts received on or after 1 January 2003 that are attributable to income bonds, funeral policies or scholarship plans issued before 1 December 1999.

2 Subsection 320‑75(2)

Repeal the subsection.

3 Subsection 320‑75(3)

Omit “In respect of policies issued before 1 July 2001, the”, substitute “The”.

3A Subsection 320‑75(4)

Omit “paragraph 2(b) or”.

4 Section 320‑110

Omit “1 July 2001”, substitute “1 January 2003”.

Schedule 3—Prescribed dual residents

Income Tax Assessment Act 1936

1 Subsection 46F(3)

Omit “Subsection (2) does not apply”, substitute “Subject to subsection (3A), subsection (2) does not apply”.

2 After subsection 46F(3)

Insert:

(3A) Subsection (3) does not affect the application of subsection (2) to the extent that subsection (2) deals with the payment of the unfranked part of a dividend (whether or not under subparagraph (a)(i) of that subsection):

(a) to a shareholder that is a prescribed dual resident at the time the dividend is paid; or

(b) by a company that is a prescribed dual resident at the time the dividend is paid.

3 After paragraph 46FA(1)(b)

Insert:

(ba) neither the resident company, nor the company that pays the dividend, is a prescribed dual resident; and

4 Application

The amendments made by this Schedule apply to dividends paid on or after 1 July 2000.

Schedule 4—Refundable tax offsets

Part 1—Certain trustees and beneficiaries

Income Tax Assessment Act 1936

1 After subsection 100(1)

Insert:

(1A) If:

(a) a beneficiary in a trust estate is under a legal disability or is deemed to be presently entitled to any of the income of the trust estate by virtue of the operation of subsection 95A(2); and

(b) the beneficiary is not a beneficiary in any other trust estate and does not derive income from any other source; and

(c) the beneficiary would receive a refund of tax offsets under Division 67 of the Income Tax Assessment Act 1997 for a particular year of income if the following amounts were included in the assessable income of the beneficiary for that year:

(i) so much of the individual interest of the beneficiary in the net income of the trust estate for that year as is attributable to a period when the beneficiary was a resident;

(ii) so much of the individual interest of the beneficiary in the net income of the trust estate for that year as is attributable to a period when the beneficiary was not a resident and is also attributable to sources in Australia;

then those amounts are included in the assessable income of the beneficiary for that year.

2 Subsection 100(2)

Omit “such beneficiary”, substitute “a beneficiary to whom subsection (1) or (1A) applies”.

Income Tax Assessment Act 1997

3 Subsection 67‑25(1)

Omit “98 or”.

4 Application

(1) The amendments made by items 1 and 2 of this Schedule apply to assessments for years of income that begin on or after 1 July 2000.

(2) The amendment made by item 3 of this Schedule applies to tax offsets that relate to dividends paid on or after 1 July 2000.

Part 2—Non‑complying superannuation funds and non‑complying ADFs

Income Tax Assessment Act 1997

5 Subsection 67‑25(1)

Omit “The tax offset referred to in paragraph (c) is subject to the refundable tax offset rules only if the trustee entitled to the rebate is liable to be assessed under section 99 of the Income Tax Assessment Act 1936.”.

6 After subsection 67‑25(1)

Insert:

(1A) The *tax offset referred to in paragraph (1)(a) is not subject to the refundable tax offset rules if the shareholder entitled to the rebate is the trustee of a *non‑complying superannuation fund or a *non‑complying ADF.

(1B) The *tax offset referred to in paragraph (1)(c) is subject to the refundable tax offset rules only if the trustee entitled to the rebate is liable to be assessed under section 99 of the Income Tax Assessment Act 1936.

(1C) The *tax offset referred to in paragraph (1)(d) is not subject to the refundable tax offset rules if the taxpayer entitled to the rebate is the trustee of a *non‑complying superannuation fund or a *non‑complying ADF.

7 Section 995‑1

Insert:

non‑complying ADF has the same meaning as in Part IX of the Income Tax Assessment Act 1936.

8 Application

The amendments made by items 5 to 7 of this Schedule apply to assessments for income years ending on or after 22 May 2001.

Schedule 5—Franking rebate on indirect distributions to exempt institutions

Income Tax Assessment Act 1936

1 Subparagraph 160AQX(1)(b)(iii)

Omit “(other than a trustee)”.

2 Application

The amendment made by this Schedule applies to trust amounts that are attributable to dividends paid on or after 1 July 2000.

Schedule 6—Tax rebate for low income aged persons

Income Tax Assessment Act 1936

1 Paragraphs 160AAAA(2)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer:

(i) is eligible for a pension, allowance or benefit under the Veterans’ Entitlements Act 1986 (other than Part VII); and

(ii) has reached pension age, within the meaning of that Act; and

(iii) is not in gaol; or

(b) the taxpayer:

(i) is qualified for an age pension under the Social Security Act 1991; and

(ii) is not in gaol.

2 Paragraphs 160AAAB(2)(a) and (b)

Repeal the paragraphs, substitute:

(a) the beneficiary:

(i) is eligible for a pension, allowance or benefit under the Veterans’ Entitlements Act 1986 (other than Part VII); and

(ii) has reached pension age, within the meaning of that Act; and

(iii) is not in gaol; or

(b) the beneficiary:

(i) is qualified for an age pension under the Social Security Act 1991; and

(ii) is not in gaol.

3 Application

The amendments made by this Schedule apply to assessments for the 2000‑2001 year of income and later years of income.

Schedule 7—Demutualisation of Tower Corporation

Income Tax Assessment Act 1997

1 After section 112‑90

Insert:

112‑92 Demutualisation of certain entities

Demutualisation of certain entities | |||

Item | In this situation: | Element affected: | See section: |

1 | Just before the mutual entity known in New Zealand as Tower Corporation ceased to be a mutual entity, you had membership rights in that entity | The total cost base and reduced cost base | 118‑550 |

2 At the end of Division 118

Add:

Subdivision 118‑H—Demutualisation of Tower Corporation

118‑550 Demutualisation of Tower Corporation

(1) This section applies if, just before the mutual entity known in New Zealand as Tower Corporation ceased to be a mutual entity, you had membership rights in that entity.

Note: Tower Corporation demutualised on 1 October 1999.

No capital gain or capital loss from end of membership rights

(2) Disregard any *capital gain or *capital loss that resulted from any of your membership rights in Tower Corporation ceasing to exist when that entity ceased to be a mutual entity.

Note: Subsection (2) applies to you even if, because you could not be located at the time of demutualisation, you were not immediately issued with shares in the demutualised entity in substitution for your old membership rights, and rights to shares were instead put aside in a trust.

Cost base of replacement assets

(3) The *cost base and the *reduced cost base of any *shares or other *CGT assets that you *acquire in substitution for the membership rights that have ceased to exist do not include any amounts that you paid in acquiring or maintaining those old rights.

3 Application

The amendments made by this Schedule apply to all income years, whether beginning before or after this item commences.

Schedule 8—Minor amendments of Medicare Levy Act 1986

1 Subsection 3(1) (definition of phase‑in limit)

Omit “section 160AAA”, substitute “subsection 160AAA(2)”.

2 Subsection 3(1) (definition of threshold amount)

Omit “section 160AAA”, substitute “subsection 160AAA(2)”.

3 Application

The amendments made by this Schedule apply to assessments for the 2000‑2001 year of income and later years of income.

Schedule 9—Income tax deductions for gifts

Part 1—Income Tax Assessment Act 1936

1 Subsection 78(3)

After “Amnesty International”, insert “Australia”.

2 Subsection 78(3)

Omit:

Australian Administrative Staff College | (4)‑Table 2, item 2.2.5 |

3 Subsection 78(3)

After:

Medical research | (4)‑Table 1 |

insert:

Monash Mt Eliza Graduate School of Business and Government Limited | (4)‑Table 2, item 2.2.5 |

4 Subsection 78(3)

After “National Safety Council of Australia”, insert “Limited”.

5 Subsection 78(4) (item 2.2.5 of table 2)

Omit “Australian Administrative Staff College”, substitute “Monash Mt Eliza Graduate School of Business and Government Limited”.

6 Subsection 78(4) (item 4.2.1 of table 4)

After “Amnesty International”, insert “Australia”.

7 Subsection 78(4) (item 4.2.4 of table 4)

After “National Safety Council of Australia”, insert “Limited”.

8 Subsection 78(4) (item 6.2.5 of table 6)

After “Victorian National Parks Association”, insert “Incorporated”.

Part 2—Income Tax Assessment Act 1997

9 Subsection 30‑20(2) (at the end of the table)

Add:

1.2.16 | National Breast Cancer Centre Gift Fund | the gift must be made after 24 September 2001 |

1.2.17 | The Bionic Ear Institute | the gift must be made after 4 October 2001 |

10 Subsection 30‑25(2) (table item 2.2.5)

Repeal the item, substitute:

2.2.5 | Monash Mt Eliza Graduate School of Business and Government Limited | the gift must be made before 6 April 2000 |

11 Subsection 30‑25(2) (table item 2.2.12)

Omit “none”, substitute “the gift must be made before 21 February 2001”.

12 Subsection 30‑25(2) (at the end of the table)

Add:

2.2.22 | Australian Primary Principals Association Education Foundation | the gift must be made after 1 October 2001 |

2.2.23 | Commonwealth Study Conferences (Australia) Incorporated | the gift must be made after 19 February 2001 |

2.2.24 | Mt Eliza Graduate School of Business and Government Limited | the gift must be made after 4 April 2000 |

2.2.25 | Australian Human Rights Education Fund | the gift must be made after 24 September 2001 |

13 Subsection 30‑45(2) (table item 4.2.1)

After “Amnesty International”, insert “Australia”.

14 Subsection 30‑45(2) (table item 4.2.4)

After “Australia”, insert “Limited”.

15 Subsection 30‑45(2) (table item 4.2.8)

Omit “none”, substitute “the gift must be made before 24 December 1999”.

16 Subsection 30‑45(2) (table item 4.2.16)

Omit “none”, substitute “the gift must be made before 18 November 2000”.

17 Subsection 30‑45(2) (at the end of the table)

Add:

4.2.20 | Royal Society for the Prevention of Cruelty to Animals, Queensland Incorporated | the gift must be made after 22 December 1999 |

18 Subsection 30‑50(2) (table item 5.2.9)

Omit “2001”, substitute “2003”.

19 Subsection 30‑50(2) (table item 5.2.13)

Omit “2001”, substitute “2002”.

20 Subsection 30‑50(2) (at the end of the table)

Add:

5.2.14 | Sir Hughie Edwards VC Foundation Incorporated | the gift must be made after 21 August 2001 and before 23 August 2003 |

5.2.15 | Warringah, Australia Remembers Trust | the gift must be made after 8 November 2001 and before 9 November 2003 |

5.2.16 | Bowral Vietnam Memorial Walk Trust Incorporated | the gift must be made after 15 August 2001 and before 16 August 2003 |

5.2.17 | The Albert Coates Memorial Trust | the gift must be made after 30 January 2002 and before 31 January 2004 |

5.2.18 | Tea Gardens / Hawks Nest War Memorial Committee | the gift must be made after 30 January 2002 and before 31 January 2004 |

21 Subsection 30‑55(2) (table item 6.2.5)

After “Association”, insert “Incorporated”.

22 Subsection 30‑80(2) (at the end of the table)

Add:

9.2.11 | Australian Red Cross Society—American Disaster Fund | the gift must be made after 9 September 2001 and before 11 September 2003 |

23 Section 30‑105 (at the end of the table)

Add:

13.2.3 | Young Endeavour Youth Scheme Public Fund | the gift must be made after 24 September 2001 |

24 Subsection 30‑315(2) (after table item 2)

Insert:

2A | Albert Coates Memorial Trust | item 5.2.17 |

25 Subsection 30‑315(2) (table item 3)

After “Amnesty International”, insert “Australia”.

26 Subsection 30‑315(2) (table item 13)

Repeal the item.

27 Subsection 30‑315(2) (after table item 20A)

Insert:

20B | Australian Ex‑Prisoners of War Memorial Fund | item 5.2.9 |

28 Subsection 30‑315(2) (after table item 21)

Insert:

21A | Australian Human Rights Education Fund | item 2.2.25 |

29 Subsection 30‑315(2) (table item 25A)

Repeal the item, substitute

25A | Australian Primary Principals Association Education Foundation | item 2.2.22 |

25B | Australian Red Cross Society—American Disaster Fund | item 9.2.11 |

30 Subsection 30‑315(2) (after table item 27)

Insert:

27A | Bionic Ear Institute | item 1.2.17 |

31 Subsection 30‑315(2) (after table item 28)

Insert:

28AAA | Bowral Vietnam Memorial Walk Trust Incorporated | item 5.2.16 |

32 Subsection 30‑315(2) (after table item 34)

Insert:

34AA | Commonwealth Study Conferences (Australia) Incorporated | item 2.2.23 |

33 Subsection 30‑315(2) (after table item 72A)

Insert:

72AA | Monash Mt Eliza Graduate School of Business and Government Limited | item 2.2.5 |

34 Subsection 30‑315(2) (after table item 72B)

Insert:

72C | Mt Eliza Graduate School of Business and Government Limited | item 2.2.24 |

35 Subsection 30‑315(2) (after table item 73)

Insert:

73A | National Breast Cancer Centre Gift Fund | item 1.2.16 |

36 Subsection 30‑315(2) (table item 76)

After “Australia”, insert “Limited”.

37 Subsection 30‑315(2) (after table item 110A)

Insert:

110B | Sir Hughie Edwards VC Foundation Incorporated | item 5.2.14 |

38 Subsection 30‑315(2) (after table item 114)

Insert:

114A | Tea Gardens / Hawks Nest War Memorial Committee | item 5.2.18 |

39 Subsection 30‑315(2) (after table item 123)

Insert:

123A | Warringah, Australia Remembers Trust | item 5.2.15 |

40 Subsection 30‑315(2) (at the end of the table)

Add:

128 | Young Endeavour Youth Scheme Public Fund | item 13.2.3 |

Part 3—Application of amendments

41 Application

The amendments made by items 1 and 6 apply to gifts made after 30 June 1985 and before 1 July 1997.

42 Application

The amendments made by items 2, 3 and 5 apply to gifts made after 22 July 1994 and before 1 July 1997.

43 Application

The amendments made by items 4 and 7 apply to gifts made after 14 September 1993 and before 1 July 1997.

44 Application

The amendment made by item 8 applies to gifts made after 18 March 1985 and before 1 July 1997.

45 Application—various items in Part 2

The amendments made by items 10, 13, 14, 21, 25, 26, 33 and 36 apply in relation to gifts made after 30 June 1997.

Schedule 10—Demutualisation of mutual entities other than insurance companies

Income Tax Assessment Act 1936

1 Paragraph 326‑5(1)(a)

Omit “4 February 1999”, substitute “14 March 2002”.

2 At the end of subsection 326‑5(2) of Schedule 2H

Add:

; or (c) if the demutualisation is implemented in accordance with the combined direct and holding company method of demutualisation—on the later of the following days:

(i) the day on which all the shares in the company that the entity became or becomes that were or are to be issued in connection with the demutualisation have been issued;

(ii) the day on which all the shares in the holding company that were or are to be issued in connection with the demutualisation have been issued.

3 After paragraph 326‑25(b) of Schedule 2H

Insert:

(ba) the ordinary shares in the entity that are issued as mentioned in paragraphs 326‑52(1)(c) and (e); and

(bb) the ordinary shares in the holding company that are issued as mentioned in paragraphs 326‑52(1)(f) and (g); and

4 Section 326‑40 of Schedule 2H

After “326‑50”, insert “, 326‑52”.

5 After section 326‑50 of Schedule 2H

Insert:

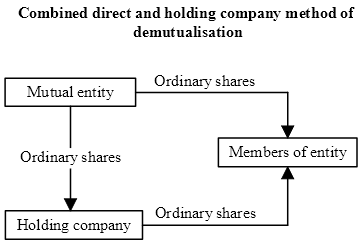

326‑52 Combined direct and holding company method

(1) The combined direct and holding company method of demutualisation is as follows:

(a) all membership rights in the entity are extinguished;

(b) the entity becomes a company with a share capital;

(c) shares (ordinary shares) of only one class in the entity are issued within the limitation period to existing members in exchange for the membership rights referred to in paragraph (a);

(d) shares (also ordinary shares) of the same class in the entity are also issued to a company (the holding company) within the limitation period;

(e) shares (also ordinary shares) of the same class in the entity may be issued within the limitation period to new members;

(f) shares (also ordinary shares) of only one class in the holding company are issued within the limitation period to existing members as a result of the extinguishment of the membership rights referred to in paragraph (a);

(g) shares (also ordinary shares) of the same class in the holding company may be issued within the limitation period to new members;

(h) the total number of ordinary shares issued to members under paragraphs (f) and (g) is the same as the total number of ordinary shares issued to the holding company under paragraph (d);

(i) if a listing resolution was passed by the members of the entity—the ordinary shares in the entity are listed within the limitation period.

Note: Other things may happen in connection with the implementation of the demutualisation.

(2) The following diagram shows the main events that occur where this demutualisation method is used.

6 Paragraph 326‑60(2)(b) of Schedule 2H

Repeal the paragraph, substitute:

(b) where the demutualisation is implemented by the method set out in section 326‑45, 326‑50 or 326‑55—of the ordinary shares in the demutualised entity or holding company that are issued in connection with the demutualisation (the issued shares), the total number that are issued to existing members or to a trustee on behalf of existing members constitutes at least 90% of the issued shares; and

(ba) where the demutualisation is implemented by the method set out in section 326‑52:

(i) of the ordinary shares in the demutualised entity that are issued to members other than the holding company in connection with the demutualisation (the issued entity shares), the total number that are issued to existing members constitutes at least 90% of the issued entity shares; and

(ii) of the ordinary shares in the holding company that are issued in connection with the demutualisation (the issued holding company shares), the total number that are issued to existing members constitutes at least 90% of the issued holding company shares; and

7 Subsection 326‑65(1) of Schedule 2H

After “326‑50(1)(a)”, insert “, 326‑52(1)(a)”.

8 Paragraph 326‑70(1)(a) of Schedule 2H

After “demutualisation share”, insert “in the listed public company”.

9 Paragraph 326‑135(1)(a) of Schedule 2H

After “demutualisation share”, insert “in that company that is not a listed public company”.

10 Paragraph 326‑185(1)(a) of Schedule 2H

After “direct method of demutualisation”, insert “, or the combined direct and holding company method of demutualisation,”.

11 At the end of section 326‑190 of Schedule 2H

Add:

(2) If, under the combined direct and holding company method of demutualisation, shares in a demutualised entity or in a holding company are issued to an existing member, neither Part IIIA of this Act nor Parts 3‑1 and 3‑3 of the Income Tax Assessment Act 1997 apply in respect of any disposal of, or any CGT event constituted by the extinguishment of, as the case may be, the member’s rights to have the shares issued to the member.

12 Paragraph 326‑195(1)(a) of Schedule 2H

After “demutualisation”, insert “, or the combined direct and holding company method of demutualisation,”.

Schedule 11—Same asset roll‑over

Income Tax Assessment Act 1936

1 Section 121AS (at the end of the notes)

Add:

6. A trustee who gets a roll‑over under Subdivision 124‑M of the Income Tax Assessment Act 1997 for an original interest consisting of shares issued as part of a demutualisation may be eligible for a further roll‑over under Subdivision 126‑D of that Act when a beneficiary becomes absolutely entitled to the replacement shares.

Income Tax Assessment Act 1997

2 Section 112‑150 (after table item 6)

Insert:

7 | Beneficiary becomes absolutely entitled to a share following a roll‑over under Subdivision 124‑M | Subdivision 126‑D |

3 Subsection 124‑780(1) (after note 2)

Insert:

Note 3: A trustee who gets a roll‑over under this Subdivision for an original interest consisting of shares issued as part of a demutualisation may be eligible for a further roll‑over under Subdivision 126‑D when a beneficiary becomes absolutely entitled to the replacement shares.

4 At the end of Division 126

Add:

Subdivision 126‑D—Entitlement to shares after demutualisation and scrip for scrip roll‑over

126‑185 What this Subdivision is about

This Subdivision sets out when there is a roll‑over for a CGT event that happens because a beneficiary becomes absolutely entitled to a share as against the trustee where the trustee obtained a roll‑over under Subdivision 124‑M following a demutualisation.

Table of sections

Operative provisions

126‑190 When there is a roll‑over

126‑195 Consequences of roll‑over

[This is the end of the Guide.]

126‑190 When there is a roll‑over

There is a roll‑over if:

(a) an insurance company demutualises; and

(b) the trustee of a trust holds a *share issued under the demutualisation in trust for an entity to whom the share would have been issued if the entity could, and were in a position to, prove the entity’s entitlement to the share; and

(c) the trustee obtains a roll‑over under Subdivision 124‑M of this Act (Scrip for scrip roll‑over) for the share because the trustee exchanges the share for a share (the replacement share) in another company (whether or not the trustee receives something in addition to the replacement share); and

(d) a *CGT event happens in relation to the replacement share because the entity becomes absolutely entitled to the share as against the trustee.

126‑195 Consequences of roll‑over

(1) A *capital gain or *capital loss the trustee makes from the *CGT event is disregarded.

(2) The first element of the *cost base of the replacement share for the entity is the cost base of the replacement share in the hands of the trustee just before the *CGT event happened. The first element of the *reduced cost base of the replacement share for the entity is worked out similarly.

Example: The JB mutual insurance company demutualises, issuing shares in JB Limited to its policyholders. It is unable to locate some of its policyholders so it establishes a trust and issues shares to the trustee on behalf of those policyholders. Steve is one of those policyholders (being potentially entitled to 50 shares).

JB Limited is taken over by PVDM Limited. Members of JB are issued with 2 shares in PVDM for each share they have in JB. The trustee obtains a roll‑over under Subdivision 124‑M for the exchange. Each PVDM share held by the trustee has a cost base and reduced cost base of $15.

Steve writes to the trustee and proves his entitlement to the shares held in trust for him.

There is a roll‑over under this Subdivision so that any capital gain or loss made by the trustee is disregarded. The first element of the cost base and reduced cost base of each of Steve’s PVDM shares is $15.

5 Application

The amendments made by this Schedule apply to CGT events happening on or after 10 December 1999.

Schedule 12—Technical amendments

Part 1—Amendments of Principal Acts

Crimes (Taxation Offences) Act 1980

1 Subsections 9(5) and (6)

Repeal the subsections.

Fringe Benefits Tax Assessment Act 1986

2 Subsection 136(1) (paragraph (q) of the definition of fringe benefit as inserted by item 31 of Schedule 1 to the Taxation Laws Amendment (Trust Loss and Other Deductions) Act 1998)

Omit “included.”, substitute “included; or”.

3 Subsection 136(1) (paragraph (q) of the definition of fringe benefit as inserted by item 11 of Schedule 8 to the Taxation Laws Amendment Act (No. 3) 1998)

Reletter as paragraph (r).

Income Tax Assessment Act 1936

4 Paragraph 103A(3)(a)

Omit “only.”, substitute “only;”.

5 Subsection 170(10AA) (after table item 20)

Insert:

25 | Subdivision 61‑H | Private health insurance offset complementary to the Private Health Insurance Incentives Act 1998 |

6 Application

The amendment made by item 5 applies to assessments in respect of income for the 1998‑99 year of income and all later years of income.

7 Subsection 170(10AA) (after table item 180)

Insert:

185 | Subdivision 375‑H | Deductions for shares in a film licensed investment company |

8 Paragraph 170(13)(b)

Omit “63B,”.

9 Application

The amendment made by item 8 applies to assessments for the 1998‑99 income year and later income years.

10 Subsection 222AOA(3) (the subsection (3) inserted by item 71 of Schedule 1 to the New Business Tax System (Alienation of Personal Services Income) Act 2000)

Renumber as subsection (4).

11 Subsection 262A(1B)

Omit “(within the meaning of subsection 5(1) of the Banking Act 1959)”.

12 Subsection 262A(1C)

Omit “23AAAB”, substitute “50‑80 of the Income Tax Assessment Act 1997”.

13 Application

The amendment made by item 12 applies in relation to income derived on or after 1 July 1997.

14 Section 264BA

Renumber as section 264CA.

15 Subparagraph 245‑170(h)(i) in Schedule 2C (the subparagraph 245‑170(h)(i) inserted by the Tax Law Improvement Act (No. 1) 1998)

Re‑letter as subparagraph (ii).

Income Tax Assessment Act 1997

16 Before section 9‑1

Insert:

This Division is a *Guide.

17 Before section 10‑5

Insert:

This Division is a *Guide.

18 Before section 11‑1

Insert:

This Division is a *Guide.

19 Section 11‑15 (table item headed “social security or like payments”)

After:

farm household support converted into a grant................................ | 24AIC and 53‑25 |

insert:

pension bonus................................................................................... | 52‑10 and 52‑65 |

20 Before section 12‑5

Insert:

This Division is a *Guide.

21 Section 12‑5 (table item headed “bad debts”)

Omit:

companies.............................................................................................. | 63A to 63CA |

substitute:

companies...................................................... | Subdivisions 165‑C, 166‑C and 175‑C |

22 Application

The amendment made by item 21 applies to assessments for the 1998‑99 income year and later income years.

23 Section 12‑5 (table item headed “Higher Education Contribution Scheme (HECS)”)

Omit:

no deduction for unless fringe benefit................................................... | 51(6), 51(6A) |

substitute:

no deduction for unless fringe benefit................................................... | 26‑20 |

24 Application

The amendment made by item 23 applies to assessments for the 1997‑98 income year and later income years.

25 Before section 13‑1

Insert:

This Division is a *Guide.

26 Section 13‑1 (table item headed “dividends”)

Omit:

company through a partnership or trust................................................. | 160APQ |

27 Paragraph 25‑25(6)(a)

Omit “borrowing”, substitute “*borrowing”.

28 Subsection 25‑30(1)

Omit “borrowed”, substitute “*borrowed”.

29 Section 26‑10 (link note)

Repeal the link note.

International Tax Agreements Act 1953

30 Paragraph (3) of article 8 of the agreement set out in Schedule 27

Omit “pargraphs”, substitute “paragraphs”.

31 Paragraph (3)(d) of article 5 of the agreement set out in Schedule 29

Omit “maintenace”, substitute “maintenance”.

32 Paragraph (1) of article 19 of the agreement set out in Schedule 34

Omit “receipient”, substitute “recipient”.

33 Paragraph (3)(b) of article 5 of the agreement set out in Schedule 37

Omit “mechandise”, substitute “merchandise”.

34 Paragraph (3)(b) of article 12 of the agreement set out in Schedule 39

Omit “commerical”, substitute “commercial”.

35 Paragraph (5) of article 12 of the agreement set out in Schedule 39

Omit “deemd”, substitute “deemed”.

Taxation Administration Act 1953

36 Paragraph 8WA(1AA)(b)

After “(g),”, insert “(ga),”.

37 Paragraphs 8WB(1A)(a) and (b)

After “(g),”, insert “(ga),”.

Part 2—Amendments of amending Acts

Aged Care (Consequential Provisions) Act 1997

38 Item 30 of Schedule 5

Omit “to the”, substitute “for the”.

A New Tax System (Indirect Tax and Consequential Amendments) Act 1999

39 Item 17 of Schedule 7

Repeal the fourth column of proposed table item LE14A.

A New Tax System (Pay As You Go) Act 1999

40 Item 62 of Schedule 2

Omit “is”.

A New Tax System (Tax Administration) Act 1999

41 Item 22 of Schedule 6

Omit “60 days”, substitute “the 60 days”.

42 Item 33 of Schedule 11 (heading)

Omit “160AQH(b)(vi)”, substitute “160AQH(1)(b)(vi)”.

Income Tax (Consequential Amendments) Act 1997

43 Item 30 of Schedule 1

Omit “(8A) or”, substitute “(8A), or”.

New Business Tax System (Capital Allowances—Transitional and Consequential) Act 2001

44 Item 219 of Schedule 2

Omit “car depreciation”, substitute “*car depreciation”.

45 Item 230 of Schedule 2

Omit “quasi‑owner of the *plant”, substitute “*quasi‑owner of the plant”.

New Business Tax System (Miscellaneous) Act (No. 2) 2000

46 Subsection 2(6)

Omit “(Taxation Administration) Act (No. 2) 2000”, substitute “(Tax Administration) Act (No. 1) 2000”.

47 Item 26 of Schedule 1

Omit “loss year”, substitute “*loss year”.

48 Item 27 of Schedule 1

Omit “loss year”, substitute “*loss year”.

49 Item 29 of Schedule 1

Omit “first continuity period or the second”, substitute “*first continuity period or the *second”.

Taxation Laws Amendment Act (No. 1) 1997

50 Item 8 of Schedule 3

Omit “or right”, substitute “or a right”.

Taxation Laws Amendment Act (No. 1) 2001

51 Item 9 of Schedule 2

Omit “*hire”, substitute “hire”.

52 Item 36 of Schedule 2 (heading)

Omit “195‑15”, substitute “195‑35”.

Taxation Laws Amendment Act (No. 2) 1999

53 Item 36 of Schedule 1

Omit “employment”, substitute “employment income”.

Taxation Laws Amendment Act (No. 3) 1997

54 After subsection 2(6)

Insert:

(6A) Item 40 of Schedule 14 is taken to have commenced on 1 July 1997, immediately before the commencement of item 248 of Schedule 1 to the Income Tax (Consequential Amendments) Act 1997.

Taxation Laws Amendment Act (No. 3) 1999

55 Items 165 and 167 of Schedule 1

Omit “16%”, substitute “20%”.

Taxation Laws Amendment Act (No. 3) 2001

56 Item 36 of Schedule 2

Omit “pays”, substitute “pay”.

Taxation Laws Amendment Act (No. 6) 2001

57 Item 11 of Schedule 5

Omit “*consideration,”, substitute “*consideration”.

58 Before item 16L of Schedule 6

Insert:

Income Tax Assessment Act 1997

59 Heading before item 17 of Schedule 6

Repeal the heading.

Taxation Laws Amendment (Company Law Review) Act 1998

60 Item 5 of Schedule 6

Omit “is a dividend”, substitute “is a *dividend”.

61 Item 8 of Schedule 6

Omit “is a dividend”, substitute “is a *dividend”.

Taxation Laws Amendment (Private Health Insurance) Act 1998

62 Item 4 of Schedule 2

Omit “23(kca)”, substitute “23(kc)”.

Taxation Laws Amendment (Research and Development) Act 2001

63 Subsection 2(3)

After “commencement of”, insert “Schedule 1 to”.

Taxation Laws Amendment (Trust Loss and Other Deductions) Act 1998

64 Subitem 23(4) of Schedule 1

Omit “1997‑98 year of income or a day in an earlier”, substitute “qualifying”.

65 Item 69 of Schedule 6 (heading)

Omit “53H”, substitute “53G”.

Tax Law Improvement Act (No. 1) 1998

66 Item 373 of Schedule 2

Omit “1991”, substitute “1990”.

67 Item 374 of Schedule 2

Omit “1991”, substitute “1990”.

68 Item 519 of Schedule 2 (heading)

Omit “254‑255”, substitute “245‑255”.

A New Tax System (Indirect Tax and Consequential Amendments) Act 1999

69 Item 13 of Schedule 3

Repeal the item.

70 Item 77 of Schedule 3

Repeal the item.

A New Tax System (Tax Administration) Act (No. 2) 2000

71 Item 8A of Schedule 2

Repeal the item.

Financial Sector Reform (Consequential Amendments) Act 1998

72 Item 92 of Schedule 1

Repeal the item.

Social Security and Veterans’ Affairs Legislation Amendment (Pension Bonus Scheme) Act 1998

73 Item 1 of Schedule 3

Repeal the item.

Taxation Laws Amendment Act (No. 1) 1998

74 Items 8 and 9 of Schedule 3

Repeal the items.

75 Item 108 of Schedule 11

Repeal the item.

Taxation Laws Amendment Act (No. 2) 2000

76 Items 14, 15, 16 and 17 of Schedule 6

Repeal the items.

77 Item 9 of Schedule 11

Repeal the item.

Taxation Laws Amendment Act (No. 3) 1998

78 Item 19 of Schedule 3

Repeal the item.

Taxation Laws Amendment (Film Licensed Investment Company) Act 1998

79 Item 12 of Schedule 1

Repeal the item.

Taxation Laws Amendment (Landcare and Water Facility Tax Offset) Act 1998

80 Item 10 of Schedule 1

Repeal the item.

Taxation Laws Amendment (Private Health Insurance) Act 1998

81 Item 3 of Schedule 1

Repeal the item.

Taxation Laws (Technical Amendments) Act 1998

82 Item 17 of Schedule 1

Repeal the item.

83 Item 15 of Schedule 4

Repeal the item.

Tax Law Improvement Act (No. 1) 1998

84 Items 95 and 466 of Schedule 2

Repeal the items.

85 Items 3 and 18 of Schedule 3

Repeal the items.

86 Application

An item in a Schedule to an Act that is repealed by an item in this Part is taken never to have had any effect.

Part 4—Amendments to correct asterisks

Taxation Administration Act 1953

87 Paragraph 360‑100(1)(b) in Schedule 1

Omit “*inquiry period”, substitute “inquiry period”.

88 Subsection 360‑100(2) in Schedule 1

Omit “*capital gain” (second occurring), substitute “capital gain”.

89 Subsection 360‑100(2) in Schedule 1

Omit “*capital loss” (second occurring), substitute “capital loss”.

90 Paragraph 360‑100(3)(a) in Schedule 1

Omit “cars”, substitute “*cars”.

91 Subsection 360‑100(4) in Schedule 1

Omit “*inquiry period”, substitute “inquiry period”.

92 Paragraphs 360‑140(1)(a) and (2)(a) in Schedule 1

Omit “*inquiry period”, substitute “inquiry period”.

93 Paragraph 360‑145(1)(g) in Schedule 1

Omit “*SPOR taxpayer”, substitute “SPOR taxpayer”.

94 Paragraph 360‑145(1)(g) in Schedule 1

Omit “*income tax return”, substitute “income tax return”.

[Minister’s second reading speech made in—

House of Representatives on 14 March 2002

Senate on 24 June 2002]

(72/02)