Taxation Laws Amendment Act (No. 6) 2003

No. 67, 2003

An Act to amend the law relating to taxation, and for related purposes

Taxation Laws Amendment Act (No. 6) 2003

No. 67, 2003

An Act to amend the law relating to taxation, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedule(s)

4 Amendment of assessments

Schedule 1—Medicare levy and Medicare levy surcharge low income thresholds

Medicare Levy Act 1986

A New Tax System (Medicare Levy Surcharge—Fringe Benefits) Act 1999

Schedule 3—Consolidation: treatment of linked assets and liabilities

Income Tax Assessment Act 1997

Schedule 4—Consolidation: partnerships

Income Tax Assessment Act 1997

Schedule 5—Consolidation: transitional foreign‑held membership structures

Income Tax Assessment Act 1997

Income Tax (Transitional Provisions) Act 1997

Schedule 6—Consolidation: application of rules to MEC groups

Income Tax (Transitional Provisions) Act 1997

Schedule 7—Consolidation: general application provision

Income Tax (Transitional Provisions) Act 1997

Schedule 8—Technical corrections

New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002

Schedule 9—Release from particular liabilities in cases of serious hardship

Part 1—Main amendments

Taxation Administration Act 1953

Part 2—Consequential amendments

Administrative Appeals Tribunal Act 1975

Fringe Benefits Tax Assessment Act 1986

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Part 3—Transitional and application provisions

Schedule 10—Trans‑Tasman triangular imputation

Part 1—Main amendment

Income Tax Assessment Act 1997

Part 2—Related amendments

Division 1—Consequential amendments

Income Tax Assessment Act 1997

Taxation Administration Act 1953

Division 2—Amendments contingent on imputation for co‑operative companies

Taxation Laws Amendment Act (No. 3) 2003

Division 3—Amendments contingent on taxation of financial arrangements

Income Tax Assessment Act 1997

Division 4—Application and transitional provisions

Income Tax (Transitional Provisions) Act 1997

Schedule 11—GST amendments relating to compulsory third party schemes

A New Tax System (Goods and Services Tax) Act 1999

A New Tax System (Goods and Services Tax Transition) Act 1999

Schedule 12—New deductible gift recipient category

Income Tax Assessment Act 1997

Taxation Laws Amendment Act (No. 6) 2003

No. 67, 2003

An Act to amend the law relating to taxation, and for related purposes

[Assented to 30 June 2003]

The Parliament of Australia enacts:

This Act may be cited as the Taxation Laws Amendment Act (No. 6) 2003.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, on the day or at the time specified in column 2 of the table.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 4 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent | 30 June 2003 |

2. Schedule 1 | The day on which this Act receives the Royal Assent | 30 June 2003 |

3. Schedules 3 to 7 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation and Other Measures) Act 2003 | 24 October 2002 |

4. Schedule 8 | The day on which this Act receives the Royal Assent | 30 June 2003 |

5. Schedule 9 | The later of: (a) 1 September 2003; and (b) the day on which this Act receives the Royal Assent | 1 September 2003 |

6. Schedule 10, Part 1 | The day on which this Act receives the Royal Assent | 30 June 2003 |

7. Schedule 10, Part 2, Division 1 | The day on which this Act receives the Royal Assent | 30 June 2003 |

8. Schedule 10, Part 2, Division 2 | At the start of the day on which the Taxation Laws Amendment Act (No. 3) 2003 receives the Royal Assent, subject to subsection (3) | 14 October 2003 |

9. Schedule 10, Part 2, Division 3 | The later of: (a) immediately after the start of the day on which this Act receives the Royal Assent; and (b) immediately after the commencement of the New Business Tax System (Taxation of Financial Arrangements) Act (No. 1) 2003 | 17 December 2003 |

10. Schedule 10, Part 2, Division 4 | The day on which this Act receives the Royal Assent | 30 June 2003 |

11. Schedule 11 | The day on which this Act receives the Royal Assent | 30 June 2003 |

12. Schedule 12 | 30 June 2003 | 30 June 2003 |

Note 1: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

Note 2: The Bill for the Taxation Laws Amendment Act (No. 3) 2003 originated as the Taxation Laws Amendment Bill (No. 8) 2002.

(2) Column 3 of the table is for additional information that is not part of this Act. This information may be included in any published version of this Act.

(3) If the day on which this Act receives the Royal Assent is after the day on which the Taxation Laws Amendment Act (No. 3) 2003 receives the Royal Assent, the provision covered by item 8 of the table does not commence at all.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Section 170 of the Income Tax Assessment Act 1936 does not prevent the amendment of an assessment made before the commencement of this section for the purposes of giving effect to this Act.

1 Subsection 3(1) (paragraph (b) of the definition of phase‑in limit)

Omit “$17,913”, substitute “$18,555”.

2 Subsection 3(1) (paragraph (c) of the definition of phase‑in limit)

Omit “$15,717”, substitute “$16,283”.

3 Subsection 3(1) (paragraph (b) of the definition of threshold amount)

Omit “$16,570”, substitute “$17,164”.

4 Subsection 3(1) (paragraph (c) of the definition of threshold amount)

Omit “$14,539”, substitute “$15,062”.

5 Subsection 8(5) (definition of family income threshold)

Omit “$24,534”, substitute “$25,417”.

6 Subsection 8(5) (definition of family income threshold)

Omit “$2,253”, substitute “$2,334”.

7 Subsection 8(6)

Omit “$24,534”, substitute “$25,417”.

8 Subsection 8(7)

Omit “$24,534”, substitute “$25,417”.

9 Paragraph 8D(3)(c)

Omit “$14,539”, substitute “$15,062”.

10 Subparagraph 8D(4)(a)(ii)

Omit “$14,539”, substitute “$15,062”.

11 Paragraph 8G(2)(c)

Omit “$14,539”, substitute “$15,062”.

12 Subparagraph 8G(3)(a)(ii)

Omit “$14,539”, substitute “$15,062”.

13 Paragraph 15(1)(c)

Omit “$14,539”, substitute “$15,062”.

14 Paragraph 16(2)(c)

Omit “$14,539”, substitute “$15,062”.

15 Application of amendments

The amendments made by this Schedule apply to assessments for the 2002‑2003 year of income and later years of income.

1 Paragraph 104‑510(1)(a) (second occurring)

Repeal the paragraph, substitute:

(b) the sum of the *tax cost setting amounts for all *retained cost base assets that:

(i) become assets of the *head company of the group because subsection 701‑1(1) (the single entity rule) applies; and

(ii) are taken into account under paragraph 705‑35(1)(b) in working out the tax cost setting amount of each reset cost base asset of the entity;

exceeds the group’s *allocable cost amount for the entity.

2 Subsection 705‑35(1) (after note 1)

Insert:

Note 1A: If a set of linked assets and liabilities includes one or more reset cost base assets, section 705‑59 may affect how this section applies. In particular, that section may exclude the application of paragraph 705‑35(1)(b) to retained cost base assets in the set; this in turn may affect the application of CGT event L3.

3 After section 705‑57

Insert:

(1) This Part applies separately to each asset and liability even if *accounting standards, or statements of accounting concepts made by the Australian Accounting Standards Board, require them to be set off against each other.

(2) This section has effect subject to section 705‑59.

(1) This section applies to each set of *linked assets and liabilities that the joining entity has immediately before the joining time.

(2) One or more assets, and one or more liabilities, that an entity has constitute a set of linked assets and liabilities of the entity if, and only if, in accordance with *accounting standards, or statements of accounting concepts made by the Australian Accounting Standards Board:

(a) the total of the one or more assets is to be set off against the total of the one or more liabilities in preparing statements of the entity’s financial position; and

(b) the net amount after the set‑off is to be recognised in those statements.

(3) If the set consists only of one reset cost base asset for the purposes of section 705‑35, and one or more liabilities:

(a) first, work out the total (the available amount) that, apart from this section and the accounting requirement referred to in subsection (2) of this section, would be taken into account under subsection 705‑70(1) (about step 2 in working out the allocable cost amount) for the one or more liabilities; and

(b) next, work out the consequences under this table.

Treatment of linked assets and liabilities: single reset cost base asset case | |||

Item | If the asset’s *market value at the joining time: | This is the result for the asset: | This is the result for the one or more liabilities: |

1 | is less than or equal to the available amount | its *tax cost setting amount is that market value (and the asset is not taken into account under paragraph 705‑35(1)(c)) | only the difference (if any) is taken into account under subsection 705‑70(1) for the one or more liabilities |

2 | is greater than the available amount | its *tax cost setting amount is: (a) the available amount; plus (b) the amount worked out for the asset under section 705‑35 on the basis that the asset’s *market value is reduced by the available amount | the one or more liabilities are not taken into account under subsection 705‑70(1) |

Note: Paragraph 705‑35(1)(c) allocates the allocable cost amount (as reduced by the tax cost setting amounts of retained cost base assets) among the joining entity’s reset cost base assets.

(4) If the set consists only of one or more *retained cost base assets and one or more liabilities, this section does not affect their treatment.

Note: This is because the tax cost setting amount for a retained cost base asset is worked out without regard to the allocable cost amount.

(5) In any other case:

(a) first, work out the available amount under paragraph (3)(a); and

(b) next, work out the consequences under this table.

Treatment of linked assets and liabilities: all other cases | |||

Item | In this case: | This is the result for the one or more assets in the set: | This is the result for the one or more liabilities in the set: |

1 | there is no *retained cost base asset in the set, and the total of the respective *market values (at the joining time) of the assets in the set is less than or equal to the available amount | the *tax cost setting amount of each of the assets is that asset’s market value at the joining time (and none of them is taken into account under paragraph 705‑35(1)(c)) | only the difference (if any) is taken into account under subsection 705‑70(1) |

2 | there is no *retained cost base asset in the set, and the total of the respective *market values (at the joining time) of the assets in the set is greater than the available amount | the *tax cost setting amount of each of the assets is the sum of: (a) a share of the available amount that is proportionate to that asset’s market value at the joining time; and (b) the amount worked out for the asset under section 705‑35 on the basis that the asset’s market value at the joining time is reduced by the share referred to in paragraph (a) | none is taken into account under subsection 705‑70(1) |

3 | there are one or more *retained cost base assets in the set, and the total of their respective *tax cost setting amounts is greater than or equal to the available amount | this section does not affect the treatment of the one or more assets in the set | this section does not affect the treatment of the one or more liabilities in the set |

4 | there are one or more *retained cost base assets in the set, and the total (the retained cost base total) of their respective *tax cost setting amounts is less than the available amount | the one or more retained cost base assets are not taken into account under paragraph 705‑35(1)(b); the *tax cost setting amount of each remaining asset in the set is worked out by applying item 1 or 2, as appropriate, of this table on the basis that: (a) the available amount is reduced by the retained cost base total; and (b) the one or more retained cost base assets are otherwise ignored | the available amount is reduced by the retained cost base total |

Note 1: Paragraph 705‑35(1)(b) reduces the allocable cost amount by the tax cost setting amounts of retained cost base assets. Item 4 of the table in this subsection excludes the application of paragraph 705‑35(1)(b) to retained cost base assets in the set; this in turn may affect the application of CGT event L3.

Note 2: Paragraph 705‑35(1)(c) then allocates the reduced allocable cost amount among the joining entity’s reset cost base assets.

(6) In applying subsections (3), (4) and (5) of this section, disregard an asset covered by subsection 705‑35(2) (assets that do not have a tax cost setting amount).

(7) This section does not affect the application of sections 705‑40, 705‑45 and 705‑50 (which adjust the tax cost setting amount for a reset cost base asset).

4 Subsection 995‑1(1)

Insert:

linked assets and liabilities has the meaning given by subsection 705‑59(2).

1 After Subdivision 713‑A

Insert:

This Subdivision modifies tax cost setting rules in Divisions 701 and 705 so that they take account of the special characteristics of partnerships. The modifications apply in these situations:

(a) an entity that is a partner in a partnership becomes a subsidiary member of a consolidated group;

(b) a partnership becomes a subsidiary member of a consolidated group.

Table of sections

Objects

713‑205 Objects of this Subdivision

Partnership cost setting interests etc.

713‑210 Partnership cost setting interests

713‑215 Terminating value for partnership cost setting interest

Setting tax cost of partnership cost setting interests

713‑220 Set tax cost of partnership cost setting interests if partner joins consolidated group

713‑225 Tax cost setting amount for partnership cost setting interest

713‑230 Reduction in allocable cost amount if partnership asset is over‑depreciated

Special rules where partnership joins consolidated group

713‑235 Partnership joins group—set tax cost of partnership assets

713‑240 Partnership joins group—tax cost setting amount for partnership asset

713‑245 Partnership joins group—pre‑CGT factor for partnership asset

[This is the end of the Guide.]

(1) The first object of this Subdivision is to ensure that if:

(a) an entity that is a partner in a partnership becomes a *subsidiary member of a *consolidated group; and

(b) the partnership does not become a *subsidiary member of the group;

the provisions mentioned in subsection (3) operate as if the *partnership cost setting interests of the entity in the partnership were the entity’s only assets relating to the partnership.

Note: In general, the head company of the consolidated group is treated as a partner in the partnership, in accordance with section 701‑1 (the single entity rule).

(2) The second object of this Subdivision is to ensure that where a partnership becomes a *subsidiary member of a *consolidated group, the provisions mentioned in subsection (3) operate:

(a) as if the group became the holder of the assets of the partnership; and

(b) to set the *tax cost of the assets of the partnership at an appropriate amount, taking into account the taxation treatment of partnerships.

Note: While the partnership is a subsidiary member of the group, it loses its separate tax identity (under the single entity rule in subsection 701‑1(1)). Therefore, in general, the assets of the partnership are treated as assets of the head company of the group and partnership cost setting interests in the partnership are ignored.

(3) The provisions are:

(a) section 701‑10 (about setting the tax cost of assets that an entity brings into the group); and

(b) Subdivision 705‑A; and

(c) any other provision of this Act giving Subdivision 705‑A a modified effect in circumstances other than those covered by that Subdivision.

Note: An example of provisions covered by paragraph (c) are the provisions of Subdivision 705‑B giving Subdivision 705‑A a modified effect when a consolidated group is formed.

A partnership cost setting interest in a partnership is the asset that is comprised of:

(a) an interest in an asset of the partnership; or

(b) an interest in the partnership that is not covered by paragraph (a);

but does not include an asset that is comprised of a *membership interest in the partnership.

Note 1: A partner may have more than one partnership cost setting interest that relates to an asset of the partnership (see section 106‑5).

Note 2: A partnership cost setting interest may relate to an asset of the partnership, but the asset of the partnership is not a partnership cost setting interest in the partnership.

(1) This section modifies the way in which the *terminating value of a *partnership cost setting interest in a partnership is worked out under section 705‑30.

(2) For the purposes of this Subdivision, the *terminating value of the *partnership cost setting interest at a time is:

(a) if the interest relates to an asset of the partnership—the interest’s individual share of the terminating value of that asset (worked out in accordance with subsection (3)) at that time; or

(b) otherwise—the terminating value of the interest at that time worked out under section 705‑30.

(3) To work out the amount of the *terminating value of the asset of the partnership mentioned in paragraph (2)(a), apply section 705‑30 as if:

(a) the time mentioned in subsection (2) were the joining time mentioned in that section; and

(b) the partnership were, at the time mentioned in subsection (2), the joining entity mentioned in that section.

(1) This section applies if an entity (the joining entity) that is a partner in a partnership becomes a *subsidiary member of a *consolidated group at a time (the joining time).

Note: If the partnership becomes a subsidiary member of the group at the joining time, the application of this section is affected by section 713‑235.

(2) In applying the provisions mentioned in subsection 713‑205(3) in relation to the joining entity:

(a) work out the *tax cost setting amount for each *partnership cost setting interest in the partnership that the joining entity holds at the joining time, in accordance with section 713‑225; and

(b) except for the purposes of section 713‑235 (which applies only if the partnership joins the group), do not work out tax cost setting amounts for the assets of the partnership; and

(c) do not work out tax cost setting amounts for the *membership interests in the partnership held by the joining entity.

Note 1: Because of paragraphs (b) and (c), no amount of allocable cost amount for the joining entity is allocated to the assets of the partnership, or to membership interests in the partnership held by the joining entity.

Note 2: If assets of the partnership are held on revenue account, the related partnership cost setting interests held by the joining entity have their tax cost set at the joining time. However, that tax cost does not alter calculations of the net income or exempt income of the partnership, or of a partnership loss, for the purposes of section 92 of the Income Tax Assessment Act 1936.

(1) This section modifies the way in which the *tax cost setting amounts are worked out under Division 705 for the *partnership cost setting interests mentioned in paragraph 713‑220(2)(a).

Partnership cost setting interest takes character of partnership asset—general

(2) Work out the *tax cost setting amounts for those *partnership cost setting interests as if any partnership cost setting interest that relates to an asset (the underlying partnership asset) of the partnership were an asset of the same kind as the underlying partnership asset.

Note: The kinds of assets mentioned in subsection (2) include the following:

(a) retained cost base assets;

(b) reset cost base assets that are held on revenue account (however, if such assets are trading stock or depreciating assets, the special rule in subsection (4) will apply) or on capital account;

(c) excluded assets (see subsection (3));

(d) current assets (within the meaning of subsection 705‑125(2)).

Example: The partnership has an asset that is Australian currency (which is a retained cost base asset). A partnership cost setting interest of the joining entity in that asset is treated as a retained cost base asset for the purpose of working out the tax cost setting amounts for the joining entity’s partnership cost setting interests in the partnership.

Partnership cost setting interest takes character of partnership asset—excluded assets

(3) If:

(a) tax cost setting amounts were to be worked out for the assets of the partnership under Division 705; and

(b) in working out those amounts, the underlying partnership asset mentioned in subsection (2) would be an excluded asset for the purposes of section 705‑35;

then subsection (2) operates so that the *tax cost setting amounts for those *partnership cost setting interests are worked out as if any partnership cost setting interest that relates to the underlying partnership asset were an excluded asset for the purposes of section 705‑35.

Special character of partnership cost setting interest in partnership asset that is trading stock or depreciating asset

(4) Despite subsection (2), if an asset of the partnership is *trading stock or a *depreciating asset, work out the *tax cost setting amounts for those *partnership cost setting interests as if:

(a) a partnership cost setting interest relating to that asset were a *retained cost base asset; and

(b) the tax cost setting amount for that partnership cost setting interest were equal to its *terminating value (worked out in accordance with section 713‑215).

Reduction in allocable cost amount for over‑depreciated partnership assets

(5) If one or more assets of the partnership are *over‑depreciated at the joining time, reduce the group’s allocable cost amount for the joining entity in accordance with section 713‑230.

Partnership liabilities—working out allocable cost amount

(6) If:

(a) according to *accounting standards, or statements of accounting concepts made by the Australian Accounting Standards Board, a thing (the partnership liability) is a liability of the partnership at the joining time that can or must be recognised in the partnership’s statement of financial position; and

(b) for that reason, the partnership liability is not an accounting liability of the joining entity at the joining time for the purposes of section 705‑70;

then sections 705‑70, 705‑75 and 705‑80 operate as if the partnership liability were an accounting liability of the joining entity at the joining time, to the extent of the joining entity’s individual share of the partnership liability.

Partnership deductions—working out allocable cost amount

(7) Section 705‑115 operates as if:

(a) a deduction to which the partnership is entitled (the partnership deduction) were a deduction to which the joining entity was entitled, to the extent of the joining entity’s individual share of the partnership deduction; and

(b) the deduction to which the joining entity was entitled were of the same kind as the partnership deduction.

Note: These kinds of deductions include acquired deductions and owned deductions (within the meaning of section 705‑115).

(1) The object of this section is to reduce the group’s allocable cost amount for the joining entity, if one or more assets of the partnership are *over‑depreciated at the joining time. The amount of the reduction is calculated under section 705‑50 in relation to the joining entity’s *partnership cost setting interests (the reduction interests) relating to those assets.

(2) Reduce the allocable cost amount mentioned in subsection 713‑225(5) by the reduction amount worked out under subsection (3).

(3) The reduction amount is the total of the amounts that would be reduced under section 705‑50 for all the reduction interests if:

(a) this Subdivision did not include subsection 713‑225(5) or this section; and

(b) subsection 713‑225(4) did not apply to any of the reduction interests; and

Note: This means that the reduction interests would be treated as over‑depreciated assets, in accordance with subsection 713‑225(2).

(c) the *adjustable value of a particular reduction interest were equal to its individual share of the adjustable value of the asset of the partnership to which it relates; and

(d) the *cost of the interest were equal to its individual share of the cost of the asset of the partnership to which it relates; and

(e) section 705‑50 did not include subsection 705‑50(4).

(1) This section applies if a partnership becomes a *subsidiary member of a *consolidated group at a time (the joining time).

(2) In applying the provisions mentioned in subsection 713‑205(3) in relation to the partnership:

(a) do not work out an allocable cost amount for the partnership; and

(b) work out the *tax cost setting amount for each asset of the partnership covered by subsection (3), in accordance with section 713‑240.

Note: If a partner in the partnership becomes a subsidiary member of the group at the joining time, tax cost setting amounts are worked out for the assets of the partner (including partnership cost setting interests) before tax cost setting amounts are worked out for the assets of the partnership.

(3) An asset of the partnership at the joining time is covered by this subsection, unless it would be an excluded asset for the purposes of section 705‑35 on the assumption that tax cost setting amounts were worked out for the assets of the partnership under Division 705 (instead of section 713‑240).

(1) Work out the *tax cost setting amounts for the assets covered by subsection 713‑235(3) as follows:

(a) firstly, add up the subsection (2) amounts for all the partnership cost setting interests in the partnership at the joining time (the result is the partnership cost pool);

Note 1: Partnership cost setting interests held by a partner that becomes a subsidiary member of the group at the joining time are included in the calculation in paragraph (a). The operation of the cost setting rules in relation to that partner at the joining time may affect the subsection (2) amounts for those interests.

Note 2: Partnership cost setting interests are included in the calculation in paragraph (a), even if the cost setting rules have not applied in relation to the interests (for example, if the interests were acquired directly by the head company).

(b) secondly, work out the tax cost setting amounts for the assets covered by subsection 713‑235(3) that are *retained cost base assets, in accordance with section 705‑25;

(c) thirdly, work out the tax cost setting amounts for the rest of the assets covered by subsection 713‑235(3), in accordance with subsection (3).

Subsection (2) amount for a partnership cost setting interest

(2) For the purposes of paragraph (1)(a), the subsection (2) amount for a *partnership cost setting interest is the amount specified in the following table:

Working out the subsection (2) amount | ||

Item | If the market value of the partnership cost setting interest is ... | the subsection (2) amount for the partnership cost setting interest is ... |

1 | equal to or greater than its *cost base | its cost base |

2 | less than its *cost base but greater than its *reduced cost base | its *market value |

3 | less than or equal to its *reduced cost base | its reduced cost base |

Allocating partnership cost pool to partnership assets that are not retained cost base assets

(3) Work out the *tax cost setting amounts for the assets mentioned in paragraph (1)(c) by applying sections 705‑35, 705‑40 and 705‑45 to those assets, as if:

(a) the partnership were, at the joining time, the joining entity mentioned in those sections; and

(b) the assets of the partnership were the assets covered by subsection 713‑235(3); and

(c) the allocable cost amount mentioned in paragraph 705‑35(1)(a) were the partnership cost pool.

(4) For the purposes of this section, section 104‑510 (CGT event L3) applies as if the group’s allocable cost amount for the entity mentioned in that section were the partnership cost pool.

(1) The *pre‑CGT factor for each asset covered by subsection 713‑235(3) is worked out under subsections (2) and (3) (instead of subsection 705‑125(3)).

(2) Firstly, identify the *partnership cost setting interests (the pre‑CGT interests) in the partnership, relating to assets of the partnership, for which there is a *pre‑CGT factor at the joining time.

Note: The pre‑CGT factor for such a partnership cost setting interest is worked out at the time the partner holding the interest became a subsidiary member of the group (whether that time is the joining time or was an earlier time).

(3) Secondly, work out the *pre‑CGT factor for each asset covered by subsection 713‑235(3) in this way:

Partnership assets’ pre‑CGT factor

Step 1. For each pre‑CGT interest, multiply its *market value at the joining time by its *pre‑CGT factor.

Step 2. Add up all the results of step 1.

Step 3. Add up the *market values of all the assets of the partnership at the joining time.

Step 4. Divide the result of step 2 by the result of step 3.

[The next Subdivision is Subdivision 713‑L.]

2 Subsection 995‑1(1)

Insert:

partnership cost setting interest, in a partnership, has the meaning given by section 713‑210.

1 Subparagraphs 719‑10(1)(b)(ii) and (iii)

Repeal the subparagraphs, substitute:

(ii) are entities for which the requirements in section 701C‑10 of the Income Tax (Transitional Provisions) Act 1997 are met; or

(iii) are entities for which the requirements in section 701C‑15 of the Income Tax (Transitional Provisions) Act 1997 are met.

2 Subsections 719‑10(4) and (5)

Repeal the subsections.

3 Paragraph 719‑10(6)(c)

Repeal the paragraph, substitute:

(c) there are no entities for which the requirements mentioned in subparagraph (1)(b)(ii) are met; and

(d) there are no entities for which the requirements mentioned in subparagraph (1)(b)(iii) are met;

4 At the end of section 701C‑1

Add:

Note: This Division has effect in relation to a MEC group in the same way in which it has effect in relation to a consolidated group (see sections 719‑2 and 719‑10 of this Act).

5 At the end of subsection 701C‑10(1)

Add:

Note: This subsection applies in relation to a MEC group as if the reference to item 2, column 4 of the table in subsection 703‑15(2) of the Income Tax Assessment Act 1997 were a reference to subparagraph 719‑10(1)(b)(ii) of that Act (see subsection 719‑2(3) of this Act).

6 At the end of subsection 701C‑15(1)

Add:

Note: This subsection applies in relation to a MEC group as if the reference to item 2, column 4 of the table in subsection 703‑15(2) of the Income Tax Assessment Act 1997 were a reference to subparagraph 719‑10(1)(b)(iii) of that Act (see subsection 719‑2(3) of this Act).

7 Section 701C‑30

Omit “transitional foreign‑held entity”, substitute “transitional foreign‑held joining entity”.

8 Section 701C‑30 (note 2)

Omit “transitional foreign‑held entity”, substitute “transitional foreign‑held joining entity”.

9 Section 701C‑35

Omit “transitional foreign‑held entity”, substitute “transitional foreign‑held joining entity”.

10 At the end of Subdivision 719‑B

Add:

(1) This section applies if the consolidated group mentioned in section 701C‑10 or 701C‑15 is a MEC group.

(2) To avoid doubt, for the purposes of those sections, the test entity cannot be a subsidiary member of the group if the group came into existence on or after 1 July 2004.

1 At the end of section 719‑2

Add:

(3) For the purposes of subsection (1), a reference in this Part (other than in Division 703 and this Division) to a provision in:

(a) Division 703 of this Act; or

(b) Division 703 of the Income Tax Assessment Act 1997;

applies as if it referred instead to the corresponding provision in:

(c) Division 719 of this Act; or

(d) Division 719 of the Income Tax Assessment Act 1997.

1 Subsection 700‑1(1)

Repeal the subsection, substitute:

(1) Part 3‑90 of the Income Tax Assessment Act 1997, as inserted by the New Business Tax System (Consolidation) Act (No. 1) 2002 and amended by:

(a) the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002; and

(b) the New Business Tax System (Consolidation and Other Measures) Act (No. 1) 2002; and

(c) the New Business Tax System (Consolidation and Other Measures) Act 2003; and

(d) the Taxation Laws Amendment Act (No. 6) 2003;

applies on and after 1 July 2002.

1 Item 1 of Schedule 15

Omit “Part 3‑45”, substitute “Part 3‑90”.

2 Item 2 of Schedule 15

Omit “Part 3‑45”, substitute “Part 3‑90”.

3 Application

Items 1 and 2 of Schedule 15 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 are taken always to have had effect as amended by this Schedule.

1 After Division 298 in Schedule 1 (before the link note)

Insert:

[The next Division is Division 340.]

The Commissioner may release you from a particular liability that you have incurred if you are an individual, or a trustee of the estate of a deceased person, and satisfying the liability would cause serious hardship.

Table of sections

340‑5 Release from particular liabilities in cases of serious hardship

340‑10 Liabilities to which this section applies

340‑15 Commissioner may take action to give effect to a release decision

340‑20 Extinguishing your liability to pay a fringe benefits tax instalment if you are released

340‑25 Extinguishing your liability to pay a PAYG instalment if you are released

[This is the end of the Guide.]

Applying for release

(1) You may apply to the Commissioner to release you, in whole or in part, from a liability of yours if section 340‑10 applies to the liability.

(2) The application must be in the approved form.

Release by the Commissioner

(3) The Commissioner may release you, in whole or in part, from the liability if you are a person specified in the column headed “Person” of the following table and the condition specified in the column headed “Condition” of the table is satisfied:

Person and condition | ||

Item | Person | Condition |

1 | an *individual | you would suffer serious hardship if you were required to satisfy the liability |

2 | a *trustee of the estate of a deceased person | the dependants of the deceased person would suffer serious hardship if you were required to satisfy the liability |

Effect of the Commissioner’s decision

(4) If the Commissioner:

(a) refuses to release you in whole from the liability; or

(b) releases you in part from the liability;

nothing in this section prevents you from making a further application or applications under subsection (1) in relation to the liability.

Notification of the Commissioner’s decision

(5) The Commissioner must notify you in writing of the Commissioner’s decision within 28 days after making the decision.

(6) A failure to comply with subsection (5) does not affect the validity of the Commissioner’s decision.

Objections against the Commissioner’s decision

(7) If you are dissatisfied with the Commissioner’s decision, you may object against the decision in the manner set out in Part IVC.

(1) This section applies to a liability if it is a liability of the following kind:

(a) fringe benefits tax;

(b) an instalment of fringe benefits tax;

(c) Medicare levy;

(d) Medicare levy surcharge;

(e) a *PAYG instalment.

(2) This section also applies to a liability if it is a liability that is specified in the column headed “Liabilities” of the following table and the liability is a liability under a provision or provisions of an Act specified in the column headed “Provision(s)” of the table:

Liabilities and provision(s) | ||

Item | Liabilities | Provision(s) |

1 | additional tax | (a) section 93 or 112B or Part VIII of the Fringe Benefits Tax Assessment Act 1986; or (b) section 163B or subsection 221YDB(1), (1AAA), (1AA) or (1ABA) or Part VII of the Income Tax Assessment Act 1936 |

2 | administrative penalty in relation to fringe benefits tax or *tax

| Part 4‑25 in this Schedule |

3 | general interest charge | (a) section 163AA or 170AA or subsections 204(3), 221AZMAA(1), 221AZP(1), 221YD(3) or 221YDB(3) of the Income Tax Assessment Act 1936; or (b) section 45‑80 or 45‑620 or subsection 45‑230(2), 45‑232(2), 45‑235(2) or 45‑235(3) in this Schedule |

4 | interest | section 102AAM of the Income Tax Assessment Act 1936 |

5 | penalty | section 163A of the Income Tax Assessment Act 1936 |

6 | *tax | (a) section 128B of the Income Tax Assessment Act 1936; or (b) section 128V of the Income Tax Assessment Act 1936; or (c) section 4‑1 of the Income Tax Assessment Act 1997 |

(1) If the Commissioner decides to release you from a liability to which section 340‑10 applies, the Commissioner may take such action as is necessary to give effect to the decision.

(2) Without limiting subsection (1), the Commissioner may amend an assessment within the meaning of the following provisions:

(a) subsection 6(1) of the Income Tax Assessment Act 1936;

(b) subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986;

by making such alterations or additions to the assessment as the Commissioner thinks necessary.

(3) Subsection (2) does not limit the power of the Commissioner to amend the assessment in accordance with any other provision of the Income Tax Assessment Act 1936 or the Fringe Benefits Tax Assessment Act 1986.

(1) This section applies if the Commissioner releases you from a liability to pay an instalment of fringe benefits tax.

(2) If your liability to pay the instalment is released in whole, you are taken, for the purposes of Division 2 of Part VII of the Fringe Benefits Tax Assessment Act 1986, not to be liable to pay the instalment.

Note: This means that for the purposes of section 105 of that Act you are not entitled to a credit for the instalment.

(3) If your liability to pay the instalment is released in part, you are taken, for the purposes of Division 2 of Part VII of the Fringe Benefits Tax Assessment Act 1986, to be liable to pay the instalment to the extent to which your liability has not been released.

Note: This means that for the purposes of section 105 of that Act you are entitled to a credit for the instalment to the extent to which your liability to pay the instalment has not been released.

(1) This section applies if the Commissioner releases you from a liability to pay a *PAYG instalment.

(2) If your liability to pay the instalment is released in whole, you are taken, for the purposes of Division 45 of Part 2‑10, not to be liable to pay the instalment.

Note: This means that for the purposes of section 45‑30 you are not entitled to a credit for the instalment.

(3) If your liability to pay the instalment is released in part, you are taken, for the purposes of Division 45 of Part 2‑10, to be liable to pay the instalment to the extent to which your liability has not been released.

Note: This means that for the purposes of section 45‑30 you are entitled to a credit for the instalment to the extent to which your liability to pay the instalment has not been released.

2 Paragraphs 353‑10(1)(a) and (b) in Schedule 1

After “this Schedule”, insert “(other than Division 340)”.

3 After paragraph 24AC(1)(a)

Insert:

(aa) the decision relates to an application made by the applicant under section 340‑5 in Schedule 1 to the Taxation Administration Act 1953; or

4 Subparagraph 34A(1A)(a)(i)

Omit “paragraph 24AC(1)(b)”, substitute “paragraph 24AC(1)(aa) or (b)”.

5 Section 133

Repeal the section.

6 Subsection 102AAM(14)

Omit “, 259 and 265”, substitute “and 259”.

7 Subsection 102AH(2)

Omit “section 102AJ”, substitute “Division 340 in Schedule 1 to the Taxation Administration Act 1953”.

8 Section 102AJ

Repeal the section.

9 Subsection 128A(4)

Omit “, 261 and 265”, substitute “and 261”.

10 Subsection 128U(2)

Omit “, 260 and 265”, substitute “and 260”.

11 Subsection 159GZZZZH(4)

Omit “, 259 and 265”, substitute “and 259”.

12 Subsection 163A(8)

Omit “, 259 and 265”, substitute “and 259”.

13 Subsection 163B(8)

Omit “, 259 and 265”, substitute “and 259”.

14 Subsection 170AA(9)

Omit “, 259 and 265”, substitute “and 259”.

15 Section 265

Repeal the section.

16 Section 12‑5 (table item headed “children’s income”)

Omit “102AA to 102AJ”, substitute “102AA to 102AH”.

17 Section 13‑1 (table item headed “child”)

Omit:

hardship..................................................................... | 102AJ |

18 Transitional provision

(1) This item applies to an application made under:

(a) section 133 of the Fringe Benefits Tax Assessment Act 1986 before its repeal by item 5 of this Schedule; or

(b) section 265 of the Income Tax Assessment Act 1936 before its repeal by item 15 of this Schedule.

(2) If the application has not been finally determined before the commencement of this Schedule, Division 340 in Schedule 1 to the Taxation Administration Act 1953 applies as if the application had been made under section 340‑5 in Schedule 1 to that Act.

19 Application provision

A person may be released, under Division 340 in Schedule 1 to the Taxation Administration Act 1953, from a liability that the person has incurred even if the liability was incurred before the commencement of this Schedule.

1 At the end of Part 3‑6

Add:

[The next Division is Division 220.]

Table of Subdivisions

Guide to Division 220

220‑A Objects of this Division

220‑B NZ company treated as Australian resident for imputation system if company chooses

220‑C Modifications of other Divisions of this Part

A company resident in New Zealand may choose that the imputation system apply in relation to it. If it does, the rest of this Part applies in relation to it as if it were an Australian resident company, but with modifications. Some of the modifications also affect:

(a) other companies that are members of the same wholly‑owned group; or

(b) entities that receive distributions from the company resident in New Zealand.

Table of sections

220‑15 Objects

220‑20 What is an NZ resident?

(1) The main objects of this Division are:

(a) to allow a company that is an *NZ resident to choose that the *imputation system apply in relation to it; and

(b) if the company makes that choice, to apply the rest of this Part in relation to the company generally as if it were an Australian resident.

(2) Another object of this Division is to prevent the benefits of the *imputation system from being inappropriately made available to or through a *member of a company that is a foreign resident, by modifying the way in which the rest of this Part applies to:

(a) a company that has chosen that the system apply in relation to it; and

(b) other companies that are members of the same *wholly‑owned group as that company; and

(c) other entities that receive (directly or indirectly) *distributions from that company.

Company

(1) A company is an NZ resident if:

(a) the company is incorporated in New Zealand; or

(b) the company is not incorporated in New Zealand but carries on business there and either:

(i) has its central management and control there; or

(ii) has its voting power controlled by *members who are NZ residents.

Natural person

(2) A natural person is an NZ resident if he or she resides in New Zealand.

(3) A natural person is also an NZ resident if his or her domicile is in New Zealand, unless the Commissioner is satisfied that the person’s permanent place of abode is outside New Zealand.

(4) A natural person is also an NZ resident if he or she has actually been in New Zealand, continuously or intermittently, during more than half of the income year, unless the Commissioner is satisfied that:

(a) the person’s usual place of abode is outside New Zealand; and

(b) the person does not intend to take up residence in New Zealand.

Not an NZ resident if an Australian resident

(5) A person is not an NZ resident if the person is an Australian resident. This has effect despite subsections (1), (2), (3) and (4).

Table of sections

220‑25 Application of provisions of Part 3‑6 outside this Division

220‑30 What is an NZ franking company?

220‑35 Making an NZ franking choice

220‑40 When is an NZ franking choice in force?

220‑45 Revoking an NZ franking choice

220‑50 Cancelling an NZ franking choice

(1) The provisions of Part 3‑6 outside this Division apply in relation to a company that is an *NZ franking company at a time as if it were an Australian resident at that time.

(2) They apply with the modifications made by the other sections of this Division.

A company is an NZ franking company at a time if, at the time, the company is an *NZ resident and has an *NZ franking choice in force.

A company that is an *NZ resident may, by notice in the *approved form given to the Commissioner, choose that the *imputation system is to apply in relation to the company. The choice is an NZ franking choice.

(1) A company’s *NZ franking choice comes into force:

(a) at the start of the company’s income year in which the notice was given to the Commissioner; or

(b) at the start of a later income year specified in the notice.

(2) The *NZ franking choice continues in force until it is revoked by the company or cancelled by the Commissioner.

(1) A company may revoke its *NZ franking choice by notice in the *approved form given to the Commissioner.

(2) To avoid doubt, the revocation takes effect when the notice is given to the Commissioner.

(1) The Commissioner may cancel a company’s *NZ franking choice by written notice given to the company, but only if the Commissioner is satisfied that either:

(a) the company was liable to pay *franking deficit tax or *over‑franking tax (whether or not because of section 220‑800 (about joint and several liability for the tax)) and the company did not pay the tax by the day on which it was due and payable; or

(b) the company has not complied with subsection 214‑15(2) or 214‑20(2) (about giving the Commissioner a *franking return).

(2) To avoid doubt, the cancellation takes effect when the notice is given to the company.

Review of cancellation

(3) If the company is dissatisfied with the cancellation of the choice, it may object against the cancellation in the manner set out in Part IVC of the Taxation Administration Act 1953.

Note: That Part provides for review of the cancellation objected against.

Effect of cancelling a choice on making another choice in future

(4) If the company makes another *NZ franking choice, it does not come into force unless the Commissioner consents in writing to the choice coming into force.

(5) In consenting, the Commissioner may specify when the choice is to come into force. The consent has effect according to its terms, despite section 220‑40.

(6) The Commissioner must give a copy of the consent to the company.

Table of sections

Franking NZ franking companies’ distributions

220‑100 Residency requirement for franking

220‑105 Unfrankable distributions by NZ franking companies

220‑110 Maximum franking credit under section 202‑60

NZ franking companies’ franking accounts etc.

220‑200 Keeping franking accounts in Australian currency

220‑205 Franking credit for payment of NZ franking company’s withholding tax liability

220‑210 Effect of franked distribution to NZ franking company or flowing indirectly to NZ franking company

220‑215 Effect on franking account if NZ franking choice ceases to be in force

Franking accounts of NZ franking company and some of its 100% subsidiaries

220‑300 NZ franking company’s franking account affected by franking accounts of some of its 100% subsidiaries

Effects of supplementary dividend from NZ franking company

220‑400 Gross‑up and tax offset for distribution from NZ franking company reduced by supplementary dividend

220‑405 Deduction and reduced tax offset for franked distribution and supplementary dividend flowing indirectly

220‑410 Franking credit reduced if tax offset reduced

Rules about exempting entities

220‑500 Publicly listed post‑choice NZ franking company and its 100% subsidiaries are not exempting entities

220‑505 Post‑choice NZ franking company is not automatically prescribed person

220‑510 Parent company’s status as prescribed person sets status of all other members of same wholly‑owned group

NZ franking companies’ exempting accounts

220‑600 Keeping exempting accounts in Australian currency

220‑605 Effect on exempting account if NZ franking choice ceases to be in force

Tax effect of distribution franked by NZ franking company with an exempting credit

220‑700 Tax effect of distribution franked by NZ franking company with an exempting credit

Joint and several liability for NZ resident company’s unmet franking liabilities

220‑800 Joint and several liability for NZ resident company’s franking tax etc.

(1) An *NZ franking company satisfies the residency requirement when making a *distribution only if the distribution is made at least one month after the notice constituting the company’s *NZ franking choice was given to the Commissioner.

Note: This section is relevant to both section 202‑5 and section 208‑60, which let a company frank a distribution, or frank a distribution with an exempting credit, only if the company satisfies the residency requirement when making the distribution.

(2) Section 202‑20, as applying because of section 220‑25, has effect subject to this section.

Note: Section 202‑20 sets out how a company satisfies the residency requirement when making a distribution.

(1) These *distributions by an *NZ franking company are *unfrankable:

(a) a conduit tax relief additional dividend (as defined in section OB1 of the Income Tax Act 1994 of New Zealand);

(b) a supplementary dividend (as defined in that section).

(2) This section does not limit section 202‑45 (about *unfrankable distributions).

For the purposes of working out the *maximum franking credit for a *frankable distribution made by an *NZ franking company in a currency other than Australian currency, translate the amount of the distribution into Australian currency at the exchange rate applicable at the time of the decision to make the *distribution.

[The next section is section 220‑200.]

A *franking account of an *NZ franking company must be kept in Australian currency.

(1) A *franking credit arises in the *franking account of a company on the day a payment is made of *withholding tax that the company is liable under section 128B of the Income Tax Assessment Act 1936 to pay, if:

(a) because of section 220‑25, the company satisfies the *residency requirement for the income year in which it derived the income on which it was liable to pay the withholding tax; and

(b) the company is a *franking entity for the whole or part of that income year.

The amount of the credit equals the amount of the payment.

(2) For the purposes of determining whether the company satisfies the *residency requirement for the income year described in paragraph (1)(a), section 205‑25 has effect as if the derivation of the income described in that paragraph were an event specified in a relevant table for the purposes of that section.

No tax offset for NZ franking company

(1) An *NZ franking company to which a *franked distribution is made or *flows indirectly is not entitled under Division 207 to a *tax offset for the *distribution. That Division has effect subject to this section.

Denial of tax offset does not stop franking credit or debit arising

(2) However, subsection (1) does not prevent a *franking credit or *franking debit from arising in the *NZ franking company’s *franking account under Division 205 or 208. To avoid doubt, the amount of the credit or debit, and the time at which it arises, are the same as they would be apart from subsection (1).

Note: This has the effect that the amount and timing of the credit or debit are worked out as if the NZ franking company had been entitled to the tax offset that subsection (1) prevents the company from being entitled to.

(1) This section has effect if:

(a) a company has made an *NZ franking choice; and

(b) the choice is revoked or cancelled at a time (the end time); and

(c) immediately before the end time the company is not an Australian resident.

Franking debit if franking surplus just before end time

(2) A *franking debit arises in the company’s *franking account on the day during which the end time occurs if the account was in *surplus immediately before that time. The amount of the debit equals the *franking surplus.

Franking deficit tax if franking deficit just before end time

(3) If the company’s *franking account was in *deficit immediately before the end time, subsection 205‑45(3) applies in relation to the company as if it ceased to be a *franking entity at the end time.

Note: Subsection 205‑45(3) makes an entity liable to pay franking deficit tax if the entity ceases to be a franking entity and had a franking deficit immediately before ceasing to be a franking entity.

(4) Subsection (3) does not limit the effect of subsection 205‑45(3).

Take account of franking debit arising under section 220‑605

(5) Take account of any *franking debit arising under section 220‑605 because of the revocation or cancellation in working out for the purposes of this section whether the company’s *franking account is in *surplus or *deficit immediately before the end time.

Note: Section 220‑605 provides for a franking debit to arise in the company’s franking account immediately before the end time if, immediately before the end time, the company was a former exempting entity and its exempting account was in deficit.

[The next section is section 220‑300.]

(1) This section has effect if all these conditions are met in relation to a company (the franking donor company) at a time:

(a) the franking donor company is at the time:

(i) an Australian resident or a *post‑choice NZ franking company; and

(ii) a *100% subsidiary of a post‑choice NZ franking company (the parent company) that is not a 100% subsidiary of another company that is a member of the same *wholly‑owned group as the parent company;

(b) the franking donor company is at the time a 100% subsidiary of a post‑choice NZ franking company (the NZ recipient company) in relation to which these requirements are met:

(i) there must be no companies that are *NZ residents and 100% subsidiaries of the NZ recipient company interposed between it and the franking donor company;

(ii) the NZ recipient company must be either the parent company or a 100% subsidiary of the parent company;

(c) there are interposed between the NZ recipient company and the franking donor company at the time one or more companies, each of which:

(i) is a 100% subsidiary of the NZ recipient company; and

(ii) is neither an Australian resident nor an NZ resident.

What is a post‑choice NZ franking company?

(2) A company is a post‑choice NZ franking company at a time if:

(a) at the time, the company is an *NZ franking company; and

(b) the notice constituting the *NZ franking choice that makes the company an NZ franking company at the time was given to the Commissioner at or before the time.

Franking donor company’s franking surplus when conditions met

(3) If the franking donor company’s *franking account is in *surplus at the first time all the conditions in subsection (1) are met:

(a) a *franking debit equal to the surplus arises in the franking donor company’s franking account immediately after that time; and

(b) a *franking credit equal to the surplus arises in the NZ recipient company’s franking account immediately after that time.

Franking donor company’s franking deficit when conditions met

(4) If the franking donor company’s *franking account is in *deficit at the first time all the conditions in subsection (1) are met, subsection 205‑45(3) applies in relation to the franking donor company as if:

(a) it ceased to be a *franking entity at that time; and

(b) its franking account had been in deficit to the same extent immediately before that cessation.

Note: Subsection 205‑45(3) makes an entity liable to pay franking deficit tax if the entity ceases to be a franking entity and had a franking deficit immediately before ceasing to be a franking entity.

NZ recipient company’s franking account after conditions are met

(5) If, apart from paragraph (a), a *franking credit or *franking debit would arise in the franking donor company’s *franking account at a time (the accounting time) that is a time when all the conditions in subsection (1) are met but after the first time at which all those conditions are met in relation to the franking donor company:

(a) the credit or debit does not arise in the franking donor company’s franking account; and

(b) a credit or debit of the same amount arises at the accounting time in the NZ recipient company’s franking account instead.

(6) However, subsection (5) does not apply in relation to:

(a) a *franking debit arising in the franking donor company’s *franking account under subsection (3); or

(b) a *franking credit arising in that account because of item 5 of the table in section 205‑15 in conjunction with subsection (4) of this section; or

(c) a franking debit arising in that account under paragraph 220‑605(3)(a).

Note 1: Item 5 of the table in section 205‑15 gives rise to a franking credit immediately after a liability to franking deficit tax arises. Subsection (4) of this section causes such a liability to arise under section 205‑45.

Note 2: Paragraph 220‑605(3)(a) gives rise to a franking debit if the NZ franking choice of a company that is a former exempting entity is revoked or cancelled and the company’s exempting account is in deficit immediately before the revocation or cancellation.

Franking donor company’s benchmark franking percentage

(7) Subsection (5) does not affect the franking donor company’s *benchmark franking percentage.

Special rules if franking donor company is former exempting entity

(8) If the franking donor company becomes a *former exempting entity at the first time all the conditions in subsection (1) are met:

(a) subsections (3) and (4) do not apply; and

(b) subsection (5) does not apply in relation to:

(i) a *franking credit arising in the franking donor company’s *franking account under item 1 of the table in section 208‑130 immediately after that time; or

(ii) a *franking debit arising in the franking donor company’s franking account under item 1 of the table in section 208‑145 immediately after that time.

Note: Subsection (8) ensures that the franking donor company’s franking account has a nil balance immediately after the company becomes a former exempting entity and that there is an appropriate balance in the company’s exempting account that is not made available for use by the NZ recipient company in franking distributions.

[The next section is section 220‑400.]

(1) This section has effect if:

(a) an *NZ franking company:

(i) makes a *franked distribution to an entity (the recipient) in an income year; and

(ii) pays a supplementary dividend (as defined in section OB1 of the Income Tax Act 1994 of New Zealand) to the recipient in connection with the franked distribution; and

(b) under section 207‑20:

(i) an amount is included in the recipient’s assessable income for the income year; and

(ii) the recipient is entitled to a *tax offset for the income year; and

(c) the recipient is entitled under section 160AF (Credits in respect of foreign tax) of the Income Tax Assessment Act 1936 to a credit because of the inclusion of the *distribution in the recipient’s assessable income for the income year; and

(d) the recipient’s income tax for the income year is reduced to some extent on account of the credit.

Reduced gross‑up

(2) The amount included in the recipient’s assessable income is reduced by the amount of the supplementary dividend (but not below zero).

Reduced tax offset

(3) The amount of the *tax offset is reduced by the amount of the supplementary dividend (but not below zero).

Amount of gross‑up and tax offset in case of manipulation

(4) If subsection 207‑145(2) applies in relation to the recipient as the entity mentioned in that subsection, it has effect as if the amount of the *franking credit were equal to the amount of the *tax offset after reduction under subsection (3) of this section.

Note: Subsection 207‑145(2) reduces the amount included in an entity’s assessable income, and the amount of the tax offset to which the entity is entitled, under section 207‑20 if the Commissioner determines that no franking credit benefit is to arise for part of a franked distribution to the entity.

Relationship with sections 207‑20 and 207‑145

(5) Sections 207‑20 and 207‑145 have effect subject to this section.

(1) This section has effect if:

(a) an *NZ franking company:

(i) makes a *franked distribution; and

(ii) pays a supplementary dividend (as defined in section OB1 of the Income Tax Act 1994 of New Zealand) in connection with the franked distribution; and

(b) the franked distribution and the supplementary dividend *flow indirectly to an entity (the recipient) in an income year because the recipient is a partner in a partnership or a beneficiary or trustee of a trust; and

(c) the recipient is entitled under section 207‑50 to a *tax offset in connection with the *distribution; and

(d) the recipient is entitled under section 160AF (Credits in respect of foreign tax) of the Income Tax Assessment Act 1936 to a credit for the income year because of the distribution; and

(e) the recipient’s income tax for the income year is reduced to some extent on account of the credit.

(2) The supplementary dividend flows indirectly to an entity if, had the supplementary dividend been a *franked distribution, it would have *flowed indirectly to the entity under section 207‑35.

Deduction for recipient

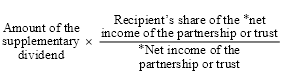

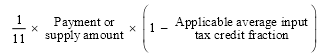

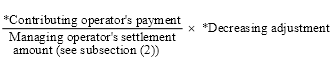

(3) The recipient can deduct for the income year the amount worked out using the formula:

Amount of recipient’s tax offset

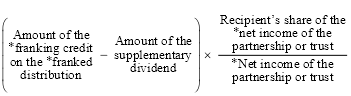

(4) Work out the amount of the recipient’s *tax offset using the formula:

However, the amount of the tax offset is nil if the amount of the supplementary dividend is greater than the amount of the franking credit on the franked distribution.

Reduction of amount on which trustee recipient is assessed

(5) If the recipient:

(a) is the trustee of a trust; and

(b) is liable under section 98, 99 or 99A of the Income Tax Assessment Act 1936 to be assessed on a share of the *net income, the net income or a part of the net income, of the trust;

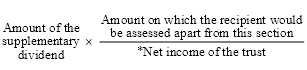

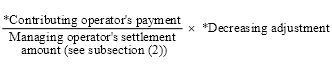

the amount on which the recipient is liable to be assessed is reduced by the amount worked out using the formula:

Tax offset if recipient is trustee who is assessed

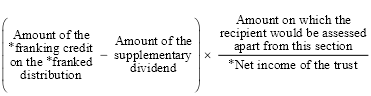

(6) Despite subsection (4), work out the amount of the recipient’s *tax offset using the formula if the recipient:

(a) is the trustee of a trust; and

(b) is liable under section 98, 99 or 99A of the Income Tax Assessment Act 1936 to be assessed on a share of the *net income, the net income or a part of the net income, of the trust;

However, the amount of the tax offset is nil if the amount of the supplementary dividend is greater than the amount of the franking credit on the franked distribution.

Amount of tax offset in case of manipulation

(7) If paragraph 207‑150(2)(b) applies in relation to the recipient as the entity mentioned in that paragraph, it has effect as if the amount of the entity’s *share of the *franking credit on the distribution were equal to the amount of the *tax offset worked out for the recipient under this section.

Note: Paragraph 207‑150(2)(b) reduces the amount of a tax offset an entity is entitled to under section 207‑50 for a franked distribution flowing indirectly to the entity if the Commissioner determines that no franking credit benefit is to arise for part of the distribution.

Relationship with Subdivisions 207‑B and 207‑F

(8) Subdivisions 207‑B and 207‑F have effect subject to this section.

Note: Subdivision 207‑B provides for an entitlement to a tax offset for a franked distribution flowing indirectly to an entity. Subdivision 207‑F provides for reducing the amount of the offset if the Commissioner determines that no franking credit benefit is to arise for part of the distribution.

(1) If, under section 220‑400 or 220‑405, a *corporate tax entity’s *tax offset (the reduced tax offset) for the *franked distribution described in that section is less than it would be apart from that section, the *franking credit arising in that entity’s *franking account because of the *distribution is equal to the reduced tax offset.

(2) Items 3 and 4 of the table in section 205‑15 have effect subject to this section.

Note: Items 3 and 4 of the table in section 205‑15 give rise to a franking credit for a franked distribution if the recipient is entitled under Division 207 to a tax offset for the distribution. Those items provide that the amount of the credit equals the amount of that offset.

[The next section is section 220‑500.]

(1) A company is not an *exempting entity at a particular time if:

(a) it is a *post‑choice NZ franking company at the time; and

(b) the company is a *listed public company at the time.

(2) A company (the non‑exempting company) is not an *exempting entity at a particular time if at the time:

(a) the non‑exempting company is a *100% subsidiary of a company (the listed company) that is not an exempting entity because of subsection (1); and

(b) the non‑exempting company is an Australian resident or a *post‑choice NZ franking company; and

(c) if:

(i) there are one or more companies interposed between the non‑exempting company and the listed company; and

(ii) one or more of the interposed companies are *NZ residents;

all of the interposed companies that are NZ residents are post‑choice NZ franking companies.

(3) This section has effect despite section 208‑20 (about an entity being an *exempting entity).

(1) A *post‑choice NZ franking company is not a prescribed person under section 208‑40 for the purposes of working out whether another *corporate tax entity is an *exempting entity at a particular time because it is effectively owned by prescribed persons within the meaning of section 208‑25.

(2) However, this section does not prevent the company from being taken under section 208‑45 to be a prescribed person for those purposes.

(1) This section has effect for the purposes of working out whether a company is an *exempting entity at a particular time because it is effectively owned by prescribed persons within the meaning of section 208‑25, if:

(a) at the time the company is a *100% subsidiary of another company (the parent company) that is not a 100% subsidiary of another member of the same *wholly‑owned group; and

(b) at the time the parent company is a *post‑choice NZ franking company; and

(c) there is at least one company (the non‑Tasman company) that meets all these conditions:

(i) the non‑Tasman company is neither an Australian resident nor an *NZ resident at the time;

(ii) the non‑Tasman company is a member of the same wholly‑owned group at the time;

(iii) the non‑Tasman company is interposed between the parent company and a company that, at the time, is an Australian resident or a post‑choice NZ franking company.

(2) At the time, each company that is a *100% subsidiary of the parent company is a prescribed person if the parent company is a prescribed person at the time for those purposes because of section 208‑40 or 208‑45 (taking account of section 220‑505, if relevant).

(3) At the time, each company that is a *100% subsidiary of the parent company is not a prescribed person if the parent company is not a prescribed person for those purposes because of section 208‑40 or 208‑45 (taking account of section 220‑505, if relevant).

(4) This section has effect despite sections 208‑40, 208‑45 and 220‑505 so far as those sections apply in relation to a *100% subsidiary of the parent company.

[The next section is section 220‑600.]

An *exempting account of an *NZ franking company must be kept in Australian currency.

(1) This section has effect if:

(a) a company has made an *NZ franking choice; and

(b) the choice is revoked or cancelled at a time (the end time); and

(c) immediately before the end time:

(i) the company is not an Australian resident; and

(ii) the company is a *former exempting entity.

Exempting debit if exempting surplus just before end time

(2) An *exempting debit arises in the company’s *exempting account at the end time if the account was in *surplus immediately before that time. The amount of the debit equals the *exempting surplus.

If exempting deficit just before end time

(3) If the company’s *exempting account was in *deficit immediately before the end time:

(a) a *franking debit equal to that deficit arises in the company’s *franking account immediately before the end time; and

(b) an *exempting credit equal to that deficit arises in the company’s exempting account at the end time.

[The next section is section 220‑700.]

(1) This section has effect if an *NZ franking company *franks with an exempting credit a *distribution the company makes when it is a *former exempting entity.

(2) If, under Subdivision 208‑H, Division 207 applies in relation to the *distribution, it applies subject to the provisions of this Division that modify the effect of that Division.

Note 1: Subdivision 208‑H provides in some cases for the tax effect of a distribution franked with an exempting credit by applying Division 207 as if the distribution were a franked distribution.

Note 2: Sections 220‑400 and 220‑405 modify the effect of Division 207 so far as it relates to the tax effect of distributions by NZ franking companies that pay supplementary dividends in connection with the distributions.

(3) Subdivision 208‑H has effect subject to this section.

[The next section is section 220‑800.]

(1) This section has effect if:

(a) a company (the defaulter) became liable under another section to pay an amount described in subsection (2) because the company was an *NZ franking company; and

(b) the amount was unpaid by the time (the defaulter’s due time) it was due and payable by the defaulter; and

(c) at any time during the period for the amount (see subsection (2)), the defaulter was a member of the same *wholly‑owned group as one or more other companies (each of which is a contributor).

(2) For the purposes of subsection (1), the amount and period are shown in the table:

Amount and period | ||

Item | For an amount of this kind: | The period is: |

1 | *Franking deficit tax | Whichever of these periods is relevant: (a) if the defaulter was liable to pay the tax because its franking account was in deficit at the end of an income year—that income year; (b) if the defaulter was liable to pay the tax because of another event—the period starting at the start of the income year in which the event occurred and ending when the event occurred |

2 | *Over‑franking tax | The income year in which the defaulter made the *frankable distribution that made the defaulter liable to pay the tax |

3 | *General interest charge on *franking deficit tax or *over‑franking tax | The period identified under item 1 or 2 for the tax |

4 | Administrative penalty that: (a) is mentioned in section 284‑75, 284‑145, 286‑75 or 288‑25 in Schedule 1 to the Taxation Administration Act 1953; and (b) relates entirely to *franking deficit tax or *over‑franking tax | The period identified under item 1 or 2 for the tax |

(3) Just after the defaulter’s due time, these companies become jointly and severally liable to pay the unpaid amount:

(a) the defaulter;

(b) each contributor, other than one that, at that time:

(i) is neither an Australian resident nor an *NZ resident; or

(ii) is prohibited by an *Australian law or a law of New Zealand from entering into an *arrangement that would make the contributor jointly or severally liable for the unpaid amount.

(4) The joint and several liability of a particular contributor becomes due and payable by the contributor 14 days after the Commissioner gives it written notice of the liability.

Note 1: Two or more contributors will have different due and payable dates for the same liability if the Commissioner gives them notice of their liability on different days.

Note 2: This section does not affect the time at which the liability for the unpaid amount arose for, or became due and payable by, the defaulter.

(5) If:

(a) the unpaid amount (the first interest amount) is *general interest charge for a day in relation to another unpaid amount (the primary liability) that consists of *franking deficit tax or *over‑franking tax; and

(b) on a day the Commissioner gives a particular contributor written notice under subsection (4) of the contributor’s liability for the first interest amount; and

(c) general interest charge arises:

(i) for a day (the later day) after the days mentioned in paragraphs (a) and (b); and

(ii) in relation to the primary liability; and

(d) the general interest charge for the later day has not been paid or otherwise discharged in full by the time it became due and payable;

the Commissioner is taken to have given the contributor written notice under subsection (4) of the general interest charge for the later day on that later day.

(6) Section 254 of the Income Tax Assessment Act 1936 applies in relation to the contributors’ liability as if it were a liability for tax.

Note: Section 254 of the Income Tax Assessment Act 1936 deals with the payment of tax by agents and trustees.

[The next Division is Division 240.]

2 At the end of section 200‑45

Add:

; and (e) franking by companies that are NZ residents or members of the same wholly‑owned group as one or more companies that are NZ residents.

3 At the end of section 202‑45

Add:

; (j) a distribution that section 220‑105 says is unfrankable.

4 Subsection 995‑1(1) (at the end of the definition of exempting entity)

Add “and affected by section 220‑500 if relevant”.

5 Subsection 995‑1(1) (at the end of the definition of flows indirectly)

Add:

; and (d) section 220‑405 sets out the circumstances in which a supplementary dividend (as defined in section OB1 of the Income Tax Act 1994 of New Zealand) flows indirectly to an entity.

6 Subsection 995‑1(1)

Insert:

NZ franking choice has the meaning given by section 220‑35.

7 Subsection 995‑1(1)

Insert:

NZ franking company has the meaning given by section 220‑30.

8 Subsection 995‑1(1)

Insert:

NZ resident has the meaning given by section 220‑20.

9 Subsection 995‑1(1)

Insert:

post‑choice NZ franking company has the meaning given by section 220‑300.

10 Subsection 995‑1(1) (paragraph (a) of the definition of residency requirement)

After “section 202‑20”, insert “(as affected by section 220‑100, if relevant)”.

11 Subsection 995‑1(1) (paragraph (b) of the definition of residency requirement)

Repeal the paragraph, substitute:

(b) for an income year that is one in which, or in relation to which, an event specified in a table in one of the following sections occurs:

(i) section 205‑15 (general table of *franking credits);