Superannuation (Government Co‑contribution for Low Income Earners) Act 2003

No. 110, 2003

An Act to provide for contributions to be made towards the superannuation of low income earners, and for related purposes

Superannuation (Government Co‑contribution for Low Income Earners) Act 2003

No. 110, 2003

An Act to provide for contributions to be made towards the superannuation of low income earners, and for related purposes

Contents

Part 1—Preliminary

1 Short title

2 Commencement

3 Act binds Crown

4 Geographical application of Act

5 Overview of the Act

Part 2—Government co‑contribution in respect of low income earners

Division 1—Government co‑contribution

6 Person in respect of whom Government co‑contribution payable

7 Contributions that attract matching Government co‑contributions

8 Total income for income year

Division 2—Amount of the Government co‑contribution

9 Basic rule—Government co‑contribution matches personal contributions

10 Taper based on total income for the income year

10A Increases in lower and higher income threshold

11 Minimum Government co‑contribution

12 Government co‑contribution increased by interest amount if paid late in certain circumstances

Part 3—Determination that Government co‑contribution payable

13 Commissioner’s determination

14 Matters Commissioner has regard to in making determination

Part 4—Payment of the Government co‑contribution

15 Commissioner to determine where the Government co‑contribution payment is to be directed

16 Superannuation provider to return Government co‑contribution that cannot be credited to account

17 Payment of Government co‑contribution

18 Commissioner to give information if co‑contribution paid

Part 5—Underpayments and overpayments

Division 1—Underpayments

19 Underpayment determinations

20 Superannuation provider to return underpaid amount that cannot be credited to account

21 Government co‑contribution increased by interest amount if underpaid amount paid late in certain circumstances

22 Government co‑contribution increased by interest amount if underpaid amount due to administrative error

23 Small underpayments

Division 2—Recovery of overpayments

24 Recovery of overpayment of Government co‑contribution in respect of a person

25 When general interest charge payable on overpayment

Part 6—Information gathering

Division 1—General

26 Superannuation providers must give statements to Commissioner

27 Statements where contributed amounts transferred between superannuation providers

28 Statements from superannuation providers to members

29 Form in which information is to be given to Commissioner or superannuation provider

30 Commissioner may require member or legal representative to give information

31 Commissioner may require superannuation provider to give information

32 Records to be kept and retained by superannuation provider

Division 2—Infringement notices

33 When an infringement notice can be served

34 Matters to be included in an infringement notice

35 Withdrawal of infringement notice

36 What happens if penalty is paid

37 More than one infringement notice may not be served for the same offence

38 Infringement notice not required to be served

39 Commissioner may extend period for payment of penalty

Division 3—Access to premises

40 Appointment of authorised persons

41 Powers of authorised person in relation to premises

42 Obstruction of authorised person acting under a warrant

43 Persons to assist authorised persons acting under a warrant

44 Warrant to enter premises

45 Identity cards

Part 7—Administration

Division 1—General administration

46 Commissioner to have general administration of the Act

47 Decisions to be in writing

48 Commissioner may arrange for use of computer programs to make decisions

Division 2—Review of decisions

49 Review of decisions

50 Authorised review officers

51 Withdrawal of review applications

Division 3—Other administrative matters

52 Tax file numbers

53 Secrecy

54 Reports

Part 8—Miscellaneous

55 Regulations

Part 9—Dictionary

56 Dictionary

Superannuation (Government Co‑contribution for Low Income Earners) Act 2003

No. 110, 2003

An Act to provide for contributions to be made towards the superannuation of low income earners, and for related purposes

[Assented to 12 November 2003]

The Parliament of Australia enacts:

This Act may be cited as the Superannuation (Government Co‑contribution for Low Income Earners) Act 2003.

This Act commences on the day on which it receives the Royal Assent.

(1) This Act binds the Crown in each of its capacities.

(2) However, this Act does not make the Crown liable to be prosecuted for an offence.

4 Geographical application of Act

This Act extends to:

(a) Norfolk Island; and

(b) the Territory of Cocos (Keeling) Islands; and

(c) the Territory of Christmas Island.

(1) This Act provides for Government co‑contributions to be made towards the superannuation of low income earners.

Note: The Government co‑contributions replace the rebates that used to be provided for in Subdivision AAC of Division 17 of Part III of the Income Tax Assessment Act 1936.

(2) The following is a simplified explanation of this Act:

• Part 2 (sections 6 to 12) tells you who are the people in respect of whom a Government co‑contribution is payable. It also tells you how much the co‑contribution is.

• Part 3 (sections 13 and 14) tells you how the Commissioner of Taxation determines whether a Government co‑contribution is payable in respect of a person.

• Part 4 (sections 15 to 18) tells you how the Government co‑contribution is paid.

• Part 5 (sections 19 to 25) tells you what happens if there is an overpayment or an underpayment of a Government co‑contribution.

• Part 6 (sections 26 to 45) tells you how the Commissioner of Taxation gathers the information needed for making decisions about Government co‑contributions.

• Parts 7 and 8 (sections 46 to 55) provide for administrative matters.

• Part 9 (section 56) sets out the terms that are defined to have a particular meaning when used in this Act.

Part 2—Government co‑contribution in respect of low income earners

Division 1—Government co‑contribution

6 Person in respect of whom Government co‑contribution payable

(1) A Government co‑contribution is payable under this Act in respect of a person for an income year of the person if:

(a) the person makes one or more eligible personal superannuation contributions during the income year; and

(b) the person has employer‑supported superannuation for the income year; and

(c) the person’s total income for the income year is less than the higher income threshold; and

(d) an income tax return for the person for the income year is lodged; and

(e) the person is less than 71 years old at the end of the income year; and

(f) the person does not hold an eligible temporary resident visa at any time during the income year.

(2) For the purposes of paragraph (1)(b), the person has employer‑supported superannuation for the income year if the person is not an eligible person in relation to the income year for the purposes of Subdivision AB of Division 3 of Part III of the Income Tax Assessment Act 1936.

7 Contributions that attract matching Government co‑contributions

A contribution a person made or makes is an eligible personal superannuation contribution if:

(a) the contribution was or is made on or after 1 July 2003 to:

(i) a fund that is a complying superannuation fund in relation to the income year of the fund in which the contribution was or is made; or

(ii) an RSA the person holds; and

(b) the contribution was or is made to obtain superannuation benefits:

(i) for the person; or

(ii) in the event of the person’s death, for dependants of the person.

8 Total income for income year

The person’s total income for the income year is the sum of:

(a) the person’s assessable income for the income year; and

(b) the person’s reportable fringe benefits total for the income year.

Division 2—Amount of the Government co‑contribution

9 Basic rule—Government co‑contribution matches personal contributions

(1) The amount of the Government co‑contribution in respect of a person for an income year is equal to the sum of the eligible personal superannuation contributions the person makes during the income year.

(2) Subsection (1) has effect subject to sections 10, 10A, 11, 12, 21, 22 and 23.

10 Taper based on total income for the income year

(1) The amount of the Government co‑contribution in respect of a person for an income year must not exceed the maximum amount worked out using the following table:

Maximum Government co‑contribution | ||

Item | Person’s total income for the income year | Maximum amount |

1 | the lower income threshold or less | $1,000 |

2 | more than the lower income threshold but less than the higher income threshold | $1,000 reduced by 8 cents for each dollar by which the person’s total income for the income year exceeds the lower income threshold |

(2) Subsection (1) has effect subject to sections 10A, 11, 12, 21, 22 and 23.

10A Increases in lower and higher income threshold

(1) This section provides for:

(a) indexation of the lower income threshold for the 2007‑08 income year and later income years; and

(b) increases in the higher income threshold for the 2007‑08 income year and each later income year equal to the indexation increase in the lower income threshold for that year.

(2) The lower income threshold for an income year is:

(a) for an income year before the 2007‑08 income year—$27,500; or

(b) for the 2007‑08 income year—$27,500 multiplied by the indexation factor for that income year; or

(c) for a later income year—the amount of the lower income threshold for the previous income year multiplied by the indexation factor for that later income year.

(3) The higher income threshold for an income year is:

(a) for an income year before the 2007‑08 income year—$40,000; or

(b) for a later income year—the sum of:

(i) the lower income threshold for that later income year; and

(ii) $12,500.

(4) If the lower income threshold for an income year is an amount of dollars and cents:

(a) if the number of cents is less than 50—the lower income threshold is to be rounded down to the nearest whole dollar; or

(b) otherwise—the lower income threshold is to be rounded up to the nearest whole dollar.

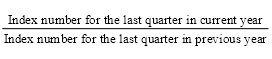

(5) The indexation factor for an income year is the number calculated, to 3 decimal places, using the formula:

where:

current year means the period of 12 months ending on 31 March immediately before the income year for which the lower income threshold is being calculated.

index number, for a quarter, means the estimate of full‑time adult average weekly ordinary time earnings for the middle month of the quarter published by the Australian Statistician.

previous year means the period of 12 months immediately before the current year.

(6) If the number calculated under subsection (5) for a financial year would, if it were worked out to 4 decimal places, end with a number greater than 4, the number so calculated is increased by 0.001.

(7) If at any time, whether before or after the commencement of this Act, the Australian Statistician has published or publishes an index number for a quarter in substitution for an index number previously published for the quarter, the publication of the later index number is to be disregarded.

(8) The Commissioner must publish before, or as soon as practicable after, the start of the 2007‑08 income year, and before the start of each later income year, the lower income threshold and the higher income threshold for the income year.

11 Minimum Government co‑contribution

If the amount of the Government co‑contribution in respect of a person for an income year, as calculated under sections 9 and 10 would be less than $20, the amount of the co‑contribution is to be increased to $20.

12 Government co‑contribution increased by interest amount if paid late in certain circumstances

(1) The amount of the Government co‑contribution in respect of a person for an income year is increased by the amount of interest worked out under subsection (2) if the Commissioner pays none of the Government co‑contribution on or before the payment date for the co‑contribution.

(2) The interest is to be calculated:

(a) on the amount of the Government co‑contribution; and

(b) for the period from the payment date for the Government co‑contribution until the day on which the Commissioner first pays an amount in satisfaction of the Government co‑contribution; and

(c) on a daily basis; and

(d) at the rate specified in the regulations.

Part 3—Determination that Government co‑contribution payable

13 Commissioner’s determination

(1) The Commissioner must determine that a Government co‑contribution is payable in respect of a person for an income year if the Commissioner is satisfied that the co‑contribution is payable in respect of the person for the income year.

(2) The regulations may prescribe the time within which determinations under this section are to be made.

14 Matters Commissioner has regard to in making determination

(1) In deciding whether to make a determination under section 13, the Commissioner must have regard to:

(a) the income tax return lodged for the person for the income year; and

(b) information about the contributions made to a complying superannuation fund, or an RSA, during the income year by, or in respect of, the person contained in:

(i) statements given to the Commissioner by superannuation providers under the Superannuation Contributions Tax (Assessment and Collection) Act 1997; and

(ii) statements given to the Commissioner by superannuation providers under the Superannuation Contributions Tax (Members of Constitutionally Protected Superannuation Funds) Assessment and Collection Act 1997; and

(iii) statements given to the Commissioner under section 26 of this Act; and

(c) information provided to the Commissioner in relation to the income year in response to requests by the Commissioner under sections 30 and 31 of this Act.

(2) Paragraph (1)(b) does not apply if:

(a) the person dies during the income year; and

(b) the trustee of the person’s estate requests the Commissioner to make a determination before the statements referred to in that paragraph are given to the Commissioner.

Part 4—Payment of the Government co‑contribution

15 Commissioner to determine where the Government co‑contribution payment is to be directed

(1) If the Commissioner makes a determination under section 13 that a Government co‑contribution is payable in respect of a person for an income year, the Commissioner must determine whether the co‑contribution is to be paid:

(a) to the trustee of a complying superannuation fund for crediting to an account of the person within that fund; or

(b) to the provider of an RSA that the person holds for crediting to the RSA; or

(c) to the person; or

(d) to the person’s legal personal representative; or

(e) into an account of the person in the Superannuation Holding Accounts Reserve.

(2) If the Commissioner makes a determination under paragraph (1)(a) or (b), the Commissioner must also determine which particular account the Government co‑contribution is to be paid into.

(3) The Commissioner must make determinations under subsections (1) and (2) in accordance with the regulations made for the purposes of this section.

(4) The Commissioner may revoke a determination made under this section if the Commissioner is satisfied that:

(a) payment of the Government co‑contribution cannot be effected in accordance with the determination; or

(b) it is otherwise appropriate in the circumstances to revoke the determination.

(5) The regulations may prescribe the time within which determinations under this section are to be made.

16 Superannuation provider to return Government co‑contribution that cannot be credited to account

(1) If:

(a) a Government co‑contribution in respect of a person is paid:

(i) to the trustee of a complying superannuation fund for crediting to an account of the person within that fund; or

(ii) to the provider of an RSA that the person holds for crediting to the RSA; and

(b) the trustee or the provider is not able to credit the co‑contribution to an account of that kind;

the trustee or the provider:

(c) is liable to repay the co‑contribution to the Commonwealth; and

(d) must give the Commissioner the prescribed information in relation to the co‑contribution at the time when the co‑contribution is repaid.

(2) The Commissioner may recover from the trustee or provider the amount the trustee or provider is liable to repay under subsection (1) as a debt due to the Commonwealth.

(3) The trustee or provider commits an offence if the trustee or provider fails to give the Commissioner the prescribed information in relation to the co‑contribution at the time when the co‑contribution is repaid.

Penalty: 50 penalty units.

(4) An offence against subsection (3) is an offence of strict liability.

17 Payment of Government co‑contribution

(1) The Commissioner must, in accordance with determinations made under sections 13 and 15, pay the Government co‑contribution payable in respect of a person for an income year on or before the payment date for the Government co‑contribution.

(2) The payment date for a Government co‑contribution is to be worked out in accordance with the regulations.

(3) The regulations may provide that, in the circumstances specified in the regulations, the payment date for a Government co‑contribution is to be a day that occurs before the determinations under sections 13 and 15 are made in relation to the Government co‑contribution.

18 Commissioner to give information if co‑contribution paid

(1) If the Commissioner pays a Government co‑contribution in respect of a person to:

(a) the person; or

(b) the person’s legal personal representative;

the Commissioner must give the person or the representative the prescribed information in relation to the co‑contribution at the time the co‑contribution is paid.

Note: The person will be given the details of the contribution:

(a) by the superannuation provider under the Corporations Regulations 2001 if the Government co‑contribution is paid into a complying superannuation fund or an RSA account; and

(b) by the Commissioner under the Small Superannuation Accounts Act 1995 if the Government co‑contribution is paid into an account in the Superannuation Holding Accounts Reserve.

(2) If the Commissioner pays a Government co‑contribution in respect of a person to:

(a) the trustee of a complying superannuation fund for crediting to an account of the person within that fund; or

(b) the provider of an RSA that the person holds for crediting to the RSA;

the Commissioner must give the trustee or provider the prescribed information in relation to the co‑contribution at the time the co‑contribution is paid.

Part 5—Underpayments and overpayments

19 Underpayment determinations

(1) This section applies if the Commissioner:

(a) pays an amount by way of Government co‑contribution in respect of a person for an income year; and

(b) is satisfied that the amount paid is less than the correct amount of the co‑contribution.

(2) The amount by which the correct amount exceeds the amount paid is the underpaid amount.

(3) The Commissioner must determine that the underpaid amount is to be paid in respect of the person for the income year.

(4) If the Commissioner makes a determination under subsection (3), the Commissioner must determine whether the underpaid amount is to be paid:

(a) to the trustee of a complying superannuation fund for crediting to an account of the person within that fund; or

(b) to the provider of an RSA that the person holds for crediting to the RSA; or

(c) to the person; or

(d) to the person’s legal personal representative; or

(e) into an account of the person in the Superannuation Holding Accounts Reserve.

(5) If the Commissioner makes a determination under paragraph (4)(a) or (b), the Commissioner must also determine which particular account the underpaid amount is to be paid into.

(6) The Commissioner must make determinations under subsections (4) and (5) in accordance with the regulations made for the purposes of this section.

(7) The Commissioner may revoke a determination made under this section if the Commissioner is satisfied that:

(a) payment of the underpaid amount cannot be effected in accordance with the determination; or

(b) it is otherwise appropriate in the circumstances to revoke the determination.

(8) The regulations may prescribe the time within which determinations under this section are to be made.

(9) The Commissioner must, in accordance with the determinations made under this section, pay the underpaid amount on or before the payment date for the underpaid amount.

20 Superannuation provider to return underpaid amount that cannot be credited to account

(1) If:

(a) the underpaid amount in respect of a person is paid:

(i) to the trustee of a complying superannuation fund for crediting to an account of the person within that fund; or

(ii) to the provider of an RSA that the person holds for crediting to the RSA; and

(b) the trustee or the provider is not able to credit the underpaid amount to an account of that kind;

the trustee or the provider:

(c) is liable to repay the underpaid amount to the Commonwealth; and

(d) must give the Commissioner the prescribed information in relation to the underpaid amount at the time when the underpaid amount is repaid.

(2) The Commissioner may recover from the trustee or provider the amount the trustee or provider is liable to repay under subsection (1) as a debt due to the Commonwealth.

(3) The trustee or provider commits an offence if the trustee or provider fails to give the Commissioner the prescribed information in relation to the underpaid amount at the time when the underpaid amount is repaid.

Penalty: 50 penalty units.

(4) An offence against subsection (3) is an offence of strict liability.

(1) The amount of the Government co‑contribution in respect of a person for an income year is increased by the amount of interest worked out under subsection (3) if the Commissioner does not pay the underpaid amount in full on or before the payment date for the underpaid amount.

(2) The payment date for the underpaid amount is to be worked out in accordance with the regulations.

(3) The interest is to be calculated:

(a) on the underpaid amount that remains unpaid on the payment date for the underpaid amount; and

(b) for the period from the payment date for the underpaid amount (see subsection (2)) until the day on which the underpaid amount is paid in full; and

(c) on a daily basis; and

(d) at the rate specified in the regulations.

(1) This section applies if:

(a) the Commissioner makes a determination under section 19 that an underpaid amount is to be paid in respect of a person for an income year; and

(b) the determination is made on the basis that a particular amount is the correct amount of the Government co‑contribution payable in respect of the person for the income year; and

(c) the determination is necessary to correct an administrative error.

(2) The payment shortfall is the difference between:

(a) the amount referred to in paragraph (1)(b); and

(b) the sum of the amounts that have already been paid by way of Government co‑contribution in respect of the person for the income year before the determination under section 19 is made.

(3) The amount of the Government co‑contribution in respect of the person for the income year is increased by the amount of interest worked out under subsection (4).

(4) The interest is to be calculated:

(a) on the amount of the payment shortfall; and

(b) for the period from the payment date for the Government co‑contribution (see subsection 17(2)) until the payment date for the underpaid amount (see subsection 21(2)); and

(c) on a daily basis; and

(d) at the rate specified in the regulations.

(5) The regulations:

(a) may provide that an error of a kind specified in the regulations is an administrative error for the purposes of this section; and

(b) may provide that an error of a kind specified in the regulations is not an administrative error for the purposes of this section.

If:

(a) the Commissioner makes a determination under section 19 in relation to a Government co‑contribution in respect of a person for an income year; and

(b) the underpaid amount is less than $5; and

(c) the underpaid amount is to be paid by cheque to:

(i) the person; or

(ii) the person’s legal personal representative;

the amount of the co‑contribution is increased by the difference between $5 and the underpaid amount.

Division 2—Recovery of overpayments

24 Recovery of overpayment of Government co‑contribution in respect of a person

(1) This section applies if:

(a) the Commissioner pays an amount by way of Government co‑contribution in respect of a person for an income year; and

(b) either:

(i) the co‑contribution was not payable in respect of the person for the income year; or

(ii) the amount paid is more than the correct amount of the co‑contribution.

(2) The amount overpaid is:

(a) the whole of the amount referred to in paragraph (1)(a) if the co‑contribution was not payable in respect of the person for the income year; or

(b) the amount by which the amount paid exceeds the correct amount if the amount paid is more than the correct amount of the co‑contribution.

(3) The Commissioner may take action to recover the amount overpaid under one or more of the items in the following table but may only take action under an item if the conditions (if any) specified for that item are satisfied:

Methods for recovering amount overpaid | ||

Item | Action the Commissioner may take to recover amount overpaid | Conditions to be satisfied |

1 | The Commissioner may deduct the whole or a part of the amount overpaid from any Government co‑contribution payable in respect of the person. |

|

2 | The Commissioner may debit an account of the person in the Superannuation Holding Accounts Reserve with the whole or a part of the amount overpaid. | The account must include one or more Government co‑contributions in respect of the person. The amount debited must not exceed the amount of those Government co‑contributions. |

3 | The Commissioner may recover the whole or a part of the amount overpaid from the person (or the person’s legal personal representative) as a debt due by the person (or the representative) to the Commonwealth. | The Government co‑contribution must have been paid by the Commissioner to the person (or the representative). The Commissioner must give the person (or the representative) written notice, as prescribed, of the proposed recovery (including the amount to be recovered). At least 28 days must have elapsed since the notice was given. The amount recovered must not exceed the amount specified in the notice. |

4 | The Commissioner may recover the whole or a part of the amount overpaid from a superannuation provider to whom: (a) the Commissioner paid the Government co‑contribution; or (b) another superannuation provider transferred the Government co‑contribution; as a debt due by the superannuation provider to the Commonwealth. | The superannuation provider must hold one or more Government co‑contributions in respect of the person. The amount recovered must not exceed the amount of those Government co‑contributions. The Commissioner must give the superannuation provider written notice, as prescribed, of the proposed recovery (including the amount to be recovered). At least 28 days must have elapsed since the notice was given. The amount recovered must not exceed the amount specified in the notice. |

(4) If:

(a) the Commissioner gives a superannuation provider a notice under item 4 of the table in subsection (3) in relation to an amount overpaid in respect of a person; and

(b) the provider holds one or more Government co‑contributions in respect of the person at the time when the Commissioner gives the provider the notice;

the Commissioner may recover from the provider under that item whether or not the provider continues to hold the contribution or contributions after that time.

(5) The Commissioner may revoke a notice given under item 3 or 4 of the table in subsection (3) if the Commissioner is satisfied that it is appropriate in the circumstances to do so.

(6) The total of the amounts deducted, debited or recovered under subsection (3) in relation to an overpayment must not exceed the amount overpaid.

(7) If the Commissioner makes:

(a) a deduction under item 1 of the table in subsection (3); or

(b) a debit under item 2 of the table;

in relation to a Government co‑contribution in respect of a person, the Commissioner must give the person the prescribed information in relation to the deduction or debit within 28 days after the deduction or debit is made.

25 When general interest charge payable on overpayment

(1) If:

(a) the Commissioner gives a person notice under item 3 or 4 of the table in subsection 24(3); and

(b) an amount that the person must pay under the notice remains unpaid after the time by which it is due to be paid;

the person is liable to pay general interest charge on the unpaid amount.

(2) The person is liable to pay the charge for each day in the period that:

(a) started at the beginning of the day by which the unpaid amount was due to be paid; and

(b) finishes at the end of the last day at the end of which any of the following remains unpaid:

(i) the unpaid amount;

(ii) general interest charge on any of the unpaid amount.

(3) For the purposes of this section, an amount payable under a notice given under item 3 or 4 of the table in subsection 24(3) is due to be paid 28 days after the day on which the notice is given.

(4) In this section:

general interest charge means the charge worked out under Division 1 of Part IIA of the Taxation Administration Act 1953.

26 Superannuation providers must give statements to Commissioner

(1) This section applies only to financial years that start on or after a day prescribed by the regulations.

(2) A superannuation provider commits an offence if:

(a) the provider has a member or members in relation to whom the provider is a superannuation provider at the end of a financial year; and

(b) the provider fails to give the Commissioner a statement setting out the prescribed information in respect of that member or each of those members on or before:

(i) the prescribed date for the financial year; or

(ii) such later date (if any) as the Commissioner allows.

Penalty: 50 penalty units.

(3) A superannuation provider commits an offence if:

(a) the superannuation provider pays a member any of the contributed amounts in relation to the member during a financial year; and

(b) the superannuation provider fails to give the Commissioner a statement setting out the prescribed information on or before:

(i) the prescribed date for the financial year; or

(ii) such later date (if any) as the Commissioner allows.

Penalty: 50 penalty units.

(4) An offence against subsection (2) or (3) is an offence of strict liability.

27 Statements where contributed amounts transferred between superannuation providers

(1) This section applies only to financial years that start on or after a day prescribed by the regulations.

(2) A superannuation provider commits an offence if:

(a) the provider transfers to another superannuation provider any of the contributed amounts in relation to a member during a financial year; and

(b) the provider fails to give the other provider a statement setting out the prescribed information within 30 days after the day on which the amount is transferred.

Penalty: 50 penalty units.

(3) An offence against subsection (2) is an offence of strict liability.

28 Statements from superannuation providers to members

(1) A member, or the trustee of a deceased former member’s estate:

(a) may ask a superannuation provider who has given the Commissioner information in a statement in relation to the member under section 26 to give the member or the trustee the same information; and

(b) may ask the superannuation provider to give the information in writing.

(2) The superannuation provider commits an offence if the provider fails to comply with the request within 30 days after receiving it.

Penalty: 50 penalty units.

(3) Subsection (2) does not apply if the superannuation provider has given the same information to the member or the trustee previously (whether or not on request by the member or trustee).

Note: The defendant bears an evidential burden in relation to the matter in this subsection (see subsection 13.3(3) of the Criminal Code).

(4) An offence against subsection (2) is an offence of strict liability.

(5) If the member or the trustee does not ask for the information to be given in writing, the superannuation provider may give the information to the member or trustee in a way that the provider considers appropriate.

29 Form in which information is to be given to Commissioner or superannuation provider

Notice stating how information to be given

(1) The Commissioner may, by notice published in the Gazette, set out the way in which information to be contained in a statement under section 26 or 27 is to be given to the Commissioner or to another superannuation provider.

Information may be given in statement provided for different purpose

(2) Without limiting subsection (1), the notice may require the information to be included in a statement to be given to the Commissioner or another superannuation provider for the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

Notice may require information to be given electronically

(3) Without limiting subsection (1), the notice may require the information to be given electronically.

(4) If the notice requires information to be given electronically, the Commissioner may, by writing, exempt a superannuation provider from that requirement.

(5) An exemption under subsection (4) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

Date of effect of notice

(6) The notice has effect on and after the day stated in the notice.

Offence

(7) A superannuation provider commits an offence if:

(a) the provider gives information in a statement under section 26 or 27; and

(b) a notice under subsection (1) sets out the way in which that information is to be given; and

(c) the provider fails to give the information in that way; and

(d) the failure is not covered by an exemption under subsection (4).

Penalty: 50 penalty units.

(8) An offence against subsection (7) is an offence of strict liability.

30 Commissioner may require member or legal representative to give information

(1) The Commissioner may give a member, or the legal personal representative of a member, a written notice requiring the member or representative to give the Commissioner a statement setting out:

(a) information to enable the Commissioner to determine:

(i) whether a Government co‑contribution is payable in respect of the member; or

(ii) the amount of any Government co‑contribution payable in respect of the member; or

(b) information to enable the Commissioner to determine the superannuation provider to which the Commissioner should pay a Government co‑contribution, or an underpaid amount, payable in respect of the member; or

(c) information to enable the Commissioner to determine:

(i) whether an amount is recoverable under section 24 (which deals with overpayments) in relation to a Government co‑contribution paid in respect of the member; or

(ii) the amount overpaid in relation to a Government co‑contribution paid in respect of the member; or

(d) any other matters specified in the regulations.

The notice must specify the period within which the statement must be given to the Commissioner. The period specified must end not less than 21 days after the day the notice is given.

(2) The member or representative commits an offence if:

(a) the notice requires the member or representative to give the Commissioner a statement setting out information to enable the Commissioner to determine:

(i) whether an amount is recoverable under section 24 (which deals with overpayments) in relation to a Government co‑contribution paid in respect of the member; or

(ii) the amount overpaid in relation to a Government co‑contribution paid in respect of the member; and

(b) the member or representative fails to comply with the notice.

Penalty: 60 penalty units.

(3) The Commissioner may give a notice under subsection (1) at any time and from time to time.

31 Commissioner may require superannuation provider to give information

(1) The Commissioner may give a superannuation provider a written notice requiring the provider to give the Commissioner a statement setting out:

(a) information to enable the Commissioner to determine:

(i) whether a Government co‑contribution is payable in respect of a person; or

(ii) the amount of any Government co‑contribution payable in respect of a person; or

(b) information to enable the Commissioner to determine the superannuation provider to which the Commissioner should pay a Government co‑contribution, or an underpaid amount, in respect of a person; or

(c) information to enable the Commissioner to determine:

(i) whether an amount is recoverable under section 24 (which deals with overpayments) in relation to a Government co‑contribution paid in respect of a person; or

(ii) the amount overpaid in relation to a Government co‑contribution paid in respect of a person; or

(d) any other matters required by the regulations.

The notice must specify the period within which the statement must be given to the Commissioner. The period specified must end not less than 21 days after the day the notice is given.

(2) The superannuation provider commits an offence if the provider fails to comply with the notice.

Penalty: 60 penalty units.

(3) The Commissioner may give a notice under subsection (1) at any time and from time to time.

32 Records to be kept and retained by superannuation provider

Superannuation provider to keep records

(1) A superannuation provider commits an offence if the provider fails to keep records that record and explain all transactions and other acts the provider engages in, or is required to engage in, under this Act or the regulations.

Penalty: 30 penalty units.

How records to be kept

(2) The superannuation provider commits an offence if the records are not either:

(a) kept in writing in the English language; or

(b) kept so as to enable the records to be readily accessible and convertible into writing in the English language.

Penalty: 30 penalty units.

Period for retention of records

(3) A superannuation provider commits an offence if the provider fails to retain any records kept or obtained under or for the purposes of this Act until the later of:

(a) the end of 5 years after they were prepared or obtained; and

(b) the completion of the transactions or acts to which those records relate.

Penalty: 30 penalty units.

When records need not be kept

(4) Subsections (2) and (3) do not apply if:

(a) the Commissioner has notified the superannuation provider that the retention of the records is not required; or

(b) the superannuation provider is a company that has gone into liquidation and been finally dissolved.

Note: In a prosecution for an offence against subsection (2) or (3), the defendant bears an evidential burden in relation to the matters in this subsection (see subsection 13.3(3) of the Criminal Code).

Division 2—Infringement notices

33 When an infringement notice can be served

(1) Subject to subsection (2), the Commissioner may cause an infringement notice to be served on a superannuation provider in accordance with this Division if the Commissioner has reasonable grounds to believe that the superannuation provider has committed an offence against:

(a) subsection 16(3); or

(b) subsection 20(3); or

(c) subsection 26(2) or (3); or

(d) subsection 27(2); or

(e) subsection 28(2); or

(f) subsection 29(7).

(2) An infringement notice must not relate to more than one offence unless:

(a) the offences are:

(i) an offence constituted by refusing or failing to comply with a requirement before a specified time or within a specified period; and

(ii) one or more daily offences constituted by refusing or failing to comply with the requirement after that time or period; or

(b) the offences are 2 or more daily offences constituted by refusing or failing to comply with the same requirement after the time before which, or the end of the period within which, the requirement was to be complied with.

Note: For daily offences, see section 4K of the Crimes Act 1914.

(3) An infringement notice does not have any effect unless it is served within one year after the day on which the offence or the earlier or earliest of the offences is alleged to have been committed.

34 Matters to be included in an infringement notice

(1) An infringement notice must:

(a) state the name of the person on whom it is to be served; and

(b) state that it is being served on behalf of the Commissioner; and

(c) state:

(i) the nature of the alleged offence or offences; and

(ii) the time (if known) and date on which, and the place at which, the offence or the earlier or earliest of the offences is alleged to have been committed; and

(iii) the maximum penalty that a court could impose for the alleged offence or offences; and

(d) specify a penalty that is payable under the notice in respect of the alleged offence or offences; and

(e) state that, if the person does not wish the matter to be dealt with by a court, the person may pay to the Commissioner the amount of the penalty specified in the notice within 28 days after the date of service of the notice; and

(f) state that the person may make written representations to the Commissioner seeking the withdrawal of the notice.

Note: The Commissioner has power to extend periods stated in notices under paragraph (1)(e) (see section 39).

(2) An infringement notice may contain any other matters that the Commissioner considers necessary.

(3) The penalty to be specified in an infringement notice under paragraph (1)(d) is 20% of the maximum amount of the fine or fines that a court could impose for the offence or offences.

35 Withdrawal of infringement notice

(1) A person on whom an infringement notice has been served may make written representations to the Commissioner seeking the withdrawal of the notice.

(2) The Commissioner may withdraw an infringement notice served on a person (whether or not the person has made representations seeking the withdrawal) by causing written notice of the withdrawal to be served on the person within the period within which the penalty specified in the infringement notice is required to be paid.

(3) The matters to which the Commissioner may have regard in deciding whether or not to withdraw an infringement notice include, but are not limited to, the following:

(a) whether the person has previously been convicted of an offence for a contravention of this Act;

(b) the circumstances in which the offence or offences specified in the notice are alleged to have been committed;

(c) whether the person has previously been served with an infringement notice in respect of which the person paid the penalty specified in the notice;

(d) any written representations made by the person.

(4) If:

(a) the person pays the penalty specified in the infringement notice within the period within which the penalty is required to be paid; and

(b) the notice is withdrawn after the person pays the penalty;

the Commissioner must refund to the person, out of money appropriated by the Parliament, an amount equal to the amount paid.

36 What happens if penalty is paid

(1) This section applies if:

(a) an infringement notice is served on a person; and

(b) the person pays the penalty specified in the notice before the end of the period referred to in paragraph 34(1)(e); and

(c) the infringement notice is not withdrawn.

(2) Any liability of the person for the offence or offences specified in the notice, and for any other offence or offences constituted by the same omission, is taken to be discharged.

(3) Further proceedings cannot be taken against the person for the offence or offences specified in the notice and proceedings cannot be taken against the person for any other offence or offences constituted by the same omission.

(4) The person is not regarded as having been convicted of the offence or offences specified in the notice.

37 More than one infringement notice may not be served for the same offence

This Division does not permit the service of more than one infringement notice on a person for the same offence or offences.

38 Infringement notice not required to be served

This Division does not:

(a) require an infringement notice to be served on a person in relation to an offence; or

(b) affect the liability of a person to be prosecuted for an offence if:

(i) an infringement notice is not served on the person in relation to the offence or in relation to any other offence constituted by the same omission; or

(ii) an infringement notice served on the person in relation to the offence or in relation to any other offence constituted by the same omission has been withdrawn; or

(c) affect the liability of a person to be prosecuted for an offence if the person does not comply with an infringement notice served on the person in relation to the offence or in relation to any other offence constituted by the same omission; or

(d) limit the amount of the penalty that may be imposed by a court on a person convicted of an offence.

39 Commissioner may extend period for payment of penalty

(1) The Commissioner may, by writing, extend, in relation to a particular person, the period referred to in paragraph 34(1)(e).

(2) The power of the Commissioner under subsection (1) to extend the period may be exercised before or after the end of the period.

(3) If the Commissioner extends a period under subsection (1), a reference in this Division, or in a notice or other instrument under this Division, to the period is taken, in relation to the person, to be a reference to the period as so extended.

40 Appointment of authorised persons

The Commissioner may, by writing signed by the Commissioner, appoint a person, or a person included in a class of persons, to be an authorised person for the purposes of this Division or of a specified provision of this Division.

41 Powers of authorised person in relation to premises

(1) An authorised person may:

(a) with the consent of the occupier or person in charge of premises; or

(b) in accordance with a warrant issued under section 44 in relation to premises;

enter the premises for the purpose of:

(c) obtaining information to determine:

(i) whether a Government co‑contribution is payable in respect of a person; or

(ii) the amount of a Government co‑contribution that is payable in respect of a person; or

(iii) whether an amount is recoverable under section 24 (which deals with overpayments) in relation to a Government co‑contribution paid in respect of a person; or

(iv) the amount overpaid in relation to a Government co‑contribution in respect of a person; or

(d) ascertaining whether a person has contravened or is contravening a provision of this Act.

(2) If an authorised person enters any premises under subsection (1), the authorised person may search the premises for, inspect, examine, take extracts from, and make copies of, any examinable documents.

42 Obstruction of authorised person acting under a warrant

A person commits an offence if:

(a) the person obstructs or hinders an authorised person in the exercise of the authorised person’s power under section 41; and

(b) the authorised person exercises that power in accordance with a warrant issued under section 44.

Penalty: 30 penalty units.

43 Persons to assist authorised persons acting under a warrant

(1) If an authorised person enters any premises under section 41 in accordance with a warrant issued under section 44, the occupier or the person in charge must, if requested to do so by the authorised person, provide reasonable assistance to the authorised person in the exercise of his or her power under that section in relation to those premises.

(2) The occupier or the person in charge commits an offence if he or she fails to provide that reasonable assistance to the authorised person.

Penalty: 30 penalty units.

(1) If a magistrate, on application by an authorised person, is satisfied, by information on oath or affirmation:

(a) that there are reasonable grounds for believing that there are examinable documents on particular premises; and

(b) that the issue of the warrant is reasonably required for the purpose of ascertaining:

(i) whether a Government co‑contribution is payable in respect of a person; or

(ii) the amount of a Government co‑contribution that is payable in respect of a person; or

(iii) whether an amount is recoverable under section 24 (which deals with overpayments) in relation to a Government co‑contribution paid in respect of a person; or

(iv) the amount overpaid in relation to a Government co‑contribution in respect of a person; or

(v) whether a person has contravened or is contravening a provision of this Act;

the magistrate may issue a warrant authorising the authorised person to enter the premises:

(c) with such assistance, and by such force, as is necessary and reasonable; and

(d) during such hours as the warrant specifies, or, if the warrant so specifies, at any time.

(2) A warrant must specify:

(a) the powers exercisable under subsection 41(2) by the authorised person to whom the warrant is issued; and

(b) the day (not more than 14 days after the issue of the warrant) on which the warrant ceases to have effect.

(1) The Commissioner may cause an identity card to be issued to an authorised person.

(2) An identity card must:

(a) contain a recent photograph of the authorised person to whom it is issued; and

(b) be in a form approved, in writing, by the Commissioner.

(3) A person commits an offence if:

(a) the person has been issued with an identity card under subsection (1); and

(b) the person ceases to be an authorised person for the purposes of this Division; and

(c) the person does not immediately return the identity card to the Commissioner.

Penalty: 1 penalty unit.

(4) An offence against subsection (3) is an offence of strict liability.

(5) If an authorised person proposes to enter premises otherwise than in accordance with a warrant issued under section 44:

(a) the authorised person must produce his or her identity card to the occupier or the person in charge of the premises for inspection; and

(b) if the authorised person fails to do so, the authorised person is not entitled to enter the premises under section 41.

Division 1—General administration

46 Commissioner to have general administration of the Act

The Commissioner has the general administration of this Act.

(1) A decision of the Commissioner under this Act or the regulations must be in writing.

(2) Such a decision is taken to be in writing if it is made, or recorded, by means of a computer.

48 Commissioner may arrange for use of computer programs to make decisions

(1) The Commissioner may arrange for the use, under the Commissioner’s control, of computer programs for any purposes for which the Commissioner may make decisions under this Act or the regulations.

(2) A decision made by the operation of a computer program under an arrangement made under subsection (1) is taken to be a decision made by the Commissioner.

Division 2—Review of decisions

(1) A person affected by a decision (the original decision) made by the Commissioner under Part 2, 3, 4 or 5 may apply to the Commissioner for review of the decision.

Note: A person may make a complaint to the Superannuation Complaints Tribunal under section 15CA of the Superannuation (Resolution of Complaints) Act 1993 if the person is dissatisfied with a statement given to the Commissioner by a superannuation provider under section 26.

(2) If the person does so, the Commissioner must either:

(a) review the original decision and decide to:

(i) affirm it; or

(ii) vary it; or

(iii) set it aside and substitute a new decision; or

(b) arrange for an authorised review officer (see section 50) to do so.

(3) In making arrangements for a review under subsection (2), the Commissioner must have regard to the need for the review to be an independent one.

The Commissioner must authorise taxation officers to be authorised review officers for the purposes of this Division.

51 Withdrawal of review applications

(1) An applicant for review under section 49 may, in writing or in any other manner approved by the Commissioner, withdraw the application at any time before the decision reviewer does any of the things in subsection 49(2).

(2) If an application is so withdrawn, it is taken never to have been made.

Division 3—Other administrative matters

The Commissioner may use for the purposes of this Act, or the regulations, a tax file number that has been provided for any other purpose under a law relating to taxation or superannuation.

Persons covered by this section

(1) This section applies to a person who is or has been:

(a) the Commissioner, a Second Commissioner or a Deputy Commissioner; or

(b) a person engaged under the Public Service Act 1999 in the Agency (within the meaning of that Act) of which the Commissioner is the Agency Head; or

(c) otherwise appointed or employed by, or a provider of services for, the Commonwealth.

Information may be recorded or divulged only for purposes of Act

(2) A person to whom this section applies commits an offence if:

(a) the person:

(i) makes a record of any protected information; or

(ii) whether directly or indirectly, divulges or communicates to a person any protected information about another person; and

(b) the record is not made, or the information is not divulged or communicated:

(i) under or for the purposes of this Act or the regulations; or

(ii) in the performance of duties, as a person to whom this section applies, under or in relation to this Act or the regulations.

Penalty: Imprisonment for 2 years.

Information may be divulged to persons performing duties under Acts administered by Commissioner

(3) Subsection (2) does not prohibit the Commissioner, a Second Commissioner or a Deputy Commissioner, or a person authorised by any of them, from divulging or communicating any protected information to a person performing, as a person to whom this section applies:

(a) duties under, or in relation to, an Act of which the Commissioner has the general administration; or

(b) duties under regulations made under such an Act;

for the purpose of enabling the person to perform the duties.

Note: In a prosecution for an offence against subsection (2), the defendant bears an evidential burden in relation to the matters in this subsection (see subsection 13.3(3) of the Criminal Code).

Divulging information to Minister

(4) A person divulges or communicates protected information to a person in contravention of subsection (2) if the person divulges or communicates the information to a Minister.

Court may not require information or documents

(5) A person to whom this section applies is not required:

(a) to divulge or communicate protected information to a court; or

(b) to produce a protected document in court;

except where it is necessary to do so for the purpose of carrying into effect the provisions of this Act or the regulations.

Information may be divulged to persons performing duties under this Act

(6) Nothing in this or any other Act of which the Commissioner has the general administration prohibits the Commissioner, a Second Commissioner or a Deputy Commissioner, or a person authorised by any of them, from divulging or communicating any information to a person performing, as a person to whom this section applies, duties under or in relation to this Act or the regulations for the purpose of enabling the person to perform the duties.

Note: In a prosecution for an offence against subsection (2), the defendant bears an evidential burden in relation to the matters in this subsection (see subsection 13.3(3) of the Criminal Code).

Information may be divulged to court for purposes of this Act

(7) Nothing in this or any other Act of which the Commissioner has the general administration prohibits the Commissioner, a Second Commissioner, a Deputy Commissioner, or a person authorised by any of them, from:

(a) divulging or communicating to a court any information obtained under or for the purposes of such an Act; or

(b) producing in court a document obtained or made under or for the purposes of such an Act;

if it is necessary to do so for the purpose of carrying into effect the provisions of this Act or the regulations.

Note: In a prosecution for an offence against subsection (2), the defendant bears an evidential burden in relation to the matters in this subsection (see subsection 13.3(3) of the Criminal Code).

Information may be divulged for the purpose of the Superannuation Industry (Supervision) Act 1993

(8) Nothing in this section prohibits the Commissioner, a Second Commissioner or a Deputy Commissioner, or a person authorised by any of them, from divulging or communicating any protected information to:

(a) the Australian Prudential Regulation Authority; or

(b) the Australian Securities and Investments Commission;

for the purpose of the administration of the Superannuation Industry (Supervision) Act 1993.

Note: In a prosecution for an offence against subsection (2), the defendant bears an evidential burden in relation to the matters in this subsection (see subsection 13.3(3) of the Criminal Code).

Oath or declaration of secrecy

(9) A person to whom this section applies must, if and when required by the Commissioner, a Second Commissioner or a Deputy Commissioner to do so, make an oath or declaration, in a manner and form determined by the Commissioner in writing, to maintain secrecy in accordance with this section.

(1) After the end of each quarter, and after the end of each financial year, the Commissioner must give the Minister a report on the working of this Act during the quarter or during the year for presentation to the Parliament.

(2) A report under subsection (1) must include, for the quarter or financial year to which the report relates, the prescribed details about beneficiaries of, and amounts of, co‑contribution payments.

The Governor‑General may make regulations prescribing matters:

(a) required or permitted by this Act to be prescribed; or

(b) necessary or convenient to be prescribed for carrying out or giving effect to this Act;

and, in particular, prescribing penalties, not exceeding a fine of 5 penalty units, for offences against the regulations.

In this Act, unless the contrary intention appears:

approved deposit fund has the same meaning as in section 10 of the Superannuation Industry (Supervision) Act 1993.

assessable income has the same meaning as in the Income Tax Assessment Act 1997.

authorised person means a person appointed as an authorised person under section 40.

Commissioner means the Commissioner of Taxation.

complying superannuation fund has the same meaning as in Part IX of the Income Tax Assessment Act 1936.

Note: Section 267 of the Income Tax Assessment Act 1936 defines complying superannuation fund by reference to the provisions of Division 3 of Part 5 of the Superannuation Industry (Supervision) Act 1993.

constitutionally protected fund has the meaning given by section 267 of the Income Tax Assessment Act 1936.

contributed amounts has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

court includes any tribunal, authority or person having power to require the production of documents or the answering of questions.

credit to an RSA that is a policy (within the meaning of the Life Insurance Act 1995) means pay as a premium in relation to the policy.

decision includes a decision not to make a determination under section 13, 15 or 19.

dependant has the same meaning as in the Superannuation Industry (Supervision) Act 1993.

Deputy Commissioner means the Deputy Commissioner of Taxation.

eligible personal superannuation contribution has the meaning given by section 7.

eligible temporary resident visa has the same meaning as in the Superannuation Industry (Supervision) Regulations 1994.

examinable documents means any documents relevant to the operation of this Act or the regulations.

Government co‑contribution means a Government co‑contribution payable under this Act.

higher income threshold has the meaning given by section 10A.

hold: a person holds an RSA account if the person is the holder of the account within the meaning of the Retirement Savings Accounts Act 1997.

income tax return means:

(a) a return under section 161, 162 or 163 of the Income Tax Assessment Act 1936; or

(b) a return by the trustee of a deceased person’s estate under Subdivision 260‑E of Schedule 1 to the Taxation Administration Act 1953.

income year has the same meaning as in the Income Tax Assessment Act 1997.

indexation factor has the meaning given by section 10A.

infringement notice means a notice given under section 33.

lower income threshold has the meaning given by section 10A.

member means a member, or former member, of a superannuation fund or of an approved deposit fund and includes the holder, or former holder, of an RSA.

payment date means:

(a) for a Government co‑contribution—the date worked out in accordance with the regulations made for the purposes of section 17; or

(b) for an underpaid amount of a Government co‑contribution—the date worked out in accordance with the regulations made for the purposes of section 21.

prescribed penalty for a contravention means 5 penalty units for each week or part of a week during which the contravention continues.

Note: See section 4AA of the Crimes Act 1914 for the current value of a penalty unit.

produce a document includes permit access to the document.

protected document means a document that:

(a) contains information about a person; and

(b) is obtained or made by a person to whom section 53 applies in the course of, or because of, the person’s duties under or in relation to this Act or the regulations.

protected information means information that:

(a) concerns a person; and

(b) is disclosed to, or obtained by, a person to whom section 53 applies in the course of, or because of, the person’s duties under or in relation to this Act or the regulations.

provider of an RSA has the same meaning as in the Retirement Savings Accounts Act 1997.

reportable fringe benefits total has the same meaning as in the Income Tax Assessment Act 1936.

RSA has the same meaning as in the Retirement Savings Accounts Act 1997.

Second Commissioner means a Second Commissioner of Taxation.

superannuation provider means:

(a) the trustee of a complying superannuation fund; or

(b) the provider of an RSA; or

(c) the trustee of a constitutionally protected fund.

taxation officer means a person employed or engaged under the Public Service Act 1999 who is:

(a) exercising powers; or

(b) performing functions;

under, pursuant to or in relation to a taxation law (as defined in section 2 of the Taxation Administration Act 1953).

total income of a person for an income year has the meaning given by section 8.

trustee of a superannuation fund, or constitutionally protected fund, means:

(a) if there is a trustee (within the ordinary meaning of that expression) of the fund—the trustee; or

(b) otherwise—the person who manages the fund.

trustee, when used in relation to a deceased person’s estate, has the same meaning as in the Income Tax Assessment Act 1936.

underpaid amount of a Government co‑contribution has the meaning given by subsection 19(2).

[Minister’s second reading speech made in—

House of Representatives on 29 May 2003

Senate on 23 June 2003]

(76/03)