An Act to declare the rates of income tax

Part I—Preliminary

1 Short title

This Act may be cited as the Income Tax Rates Act 1986.

2 Commencement

This Act shall come into operation on the day on which it receives the Royal Assent.

3 Interpretation

(1) In this Act, unless the contrary intention appears:

abnormal income amount, in relation to the taxable income of a taxpayer of a year of income, means any above‑average special professional income included in the taxpayer’s taxable income for the year of income under section 405‑15 of the Income Tax Assessment Act 1997.

ADI has the same meaning as in the Income Tax Assessment Act 1997.

AMIT (short for attribution managed investment trust) has the same meaning as in the Income Tax Assessment Act 1997.

Assessment Act means the Income Tax Assessment Act 1936.

attribution managed investment trust: see AMIT.

base rate entity has the meaning given by section 23AA.

base rate entity passive income has the meaning given by section 23AB.

complying ADF means a complying approved deposit fund as defined in the Income Tax Assessment Act 1997.

complying superannuation class of the taxable income of a life insurance company has the same meaning as in the Income Tax Assessment Act 1997.

complying superannuation fund has the same meaning as in the Income Tax Assessment Act 1997.

determined member component has the same meaning as in the Income Tax Assessment Act 1997.

eligible ADF means a fund that is a complying approved deposit fund or a non‑complying approved deposit fund, as defined in the Income Tax Assessment Act 1997.

eligible part, in relation to the special income component of the taxable income of a taxpayer, means so much of the special income component as is eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act.

eligible superannuation fund means a fund that is a complying superannuation fund or a non‑complying superannuation fund, as defined in the Income Tax Assessment Act 1997.

employment termination remainder of taxable income means so much of the taxable income as:

(a) is included in assessable income under a maximum tax rate provision in Division 82 of the Income Tax Assessment Act 1997 or Division 82 of the Income Tax (Transitional Provisions) Act 1997; and

(b) does not give rise to an entitlement to a tax offset under that maximum tax rate provision.

friendly society has the same meaning as in the Income Tax Assessment Act 1997.

life insurance company has the same meaning as in the Life Insurance Act 1995.

low tax component has the same meaning as in the Income Tax Assessment Act 1997.

managed investment trust has the same meaning as in the Income Tax Assessment Act 1997.

maximum tax rate provision means any of the following provisions:

(a) section 82‑10 of the Income Tax Assessment Act 1997;

(b) section 82‑65 of the Income Tax Assessment Act 1997;

(c) section 82‑70 of the Income Tax Assessment Act 1997;

(d) section 301‑95 of the Income Tax Assessment Act 1997;

(e) section 301‑105 of the Income Tax Assessment Act 1997;

(f) section 301‑115 of the Income Tax Assessment Act 1997;

(g) section 82‑10A of the Income Tax (Transitional Provisions) Act 1997;

(h) section 82‑10C of the Income Tax (Transitional Provisions) Act 1997.

net income phase‑out limit has the meaning given by subsection 14(3).

non‑arm’s length component has the same meaning as in the Income Tax Assessment Act 1997.

non‑complying ADF means a fund that, at all times during the year of income when the fund is in existence, is an approved deposit fund within the meaning of the Income Tax Assessment Act 1997, but does not include a fund that is a complying ADF.

non‑complying superannuation fund has the same meaning as in the Income Tax Assessment Act 1997.

non‑profit company means:

(a) a company that is not carried on for the purposes of profit or gain to its individual members and is, by the terms of the company’s constituent document, prohibited from making any distribution, whether in money, property or otherwise, to its members; or

(b) a friendly society dispensary.

non‑resident beneficiary, in relation to a year of income, means a beneficiary of a trust estate who is a prescribed non‑resident in relation to that year of income.

non‑resident phase‑out limit has the meaning given by subsection 15(8).

non‑resident taxpayer, in relation to a year of income, means a taxpayer who is a prescribed non‑resident in relation to that year of income.

non‑resident trust estate, in relation to a year of income, means a trust estate that is not a resident trust estate in relation to that year of income.

no‑TFN contributions income has the same meaning as in the Income Tax Assessment Act 1997.

ordinary class of the taxable income of a life insurance company has the same meaning as in the Income Tax Assessment Act 1997.

ordinary taxable income means the taxable income, reduced by the superannuation remainder of the taxable income and by the employment termination remainder of the taxable income.

PDF (pooled development fund) has the same meaning as in the Assessment Act.

PDF component has the same meaning as in the Assessment Act.

pooled superannuation trust has the same meaning as in the Income Tax Assessment Act 1997.

prescribed non‑resident, in relation to a year of income, means a person who, at all times during the year of income, is a non‑resident, not being a person to whom, at any time during the year of income, compensation or a pension, allowance or benefit is payable under:

(a) the Veterans’ Entitlements Act 1986;

(b) subsection 4(6) of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986; or

(ba) the Military Rehabilitation and Compensation Act 2004; or

(c) the Social Security Act 1991;

being compensation or a pension, allowance or benefit in respect of which the person is liable to be assessed and to pay income tax in Australia.

prescribed unit trust, in relation to a year of income, means a trust estate that is a public trading trust in relation to the year of income.

public trading trust, in relation to a year of income, means a unit trust that is a public trading trust, within the meaning of Division 6C of Part III of the Assessment Act, in relation to the year of income.

reduced taxable income means the part (if any) of the taxable income other than the special income component.

resident beneficiary, in relation to a year of income, means a beneficiary of a trust estate who is not a prescribed non‑resident in relation to that year of income.

resident phase‑out limit has the meaning given by subsection 13(10).

resident taxpayer, in relation to a year of income, means a taxpayer who is not a prescribed non‑resident in relation to that year of income.

resident trust estate, in relation to a year of income, means a trust estate that, under subsection 95(2) of the Assessment Act, is to be taken to be a resident trust estate in relation to that year of income.

RSA component has the same meaning as in the Income Tax Assessment Act 1997.

second resident personal tax rate means the rate mentioned in item 2 of the table in clause 1 of Part I of Schedule 7 that is applicable to the year of income.

SME income component has the same meaning as in Subdivision B of Division 10E of Part III of the Assessment Act.

sovereign entity has the same meaning as in the Income Tax Assessment Act 1997.

special income component, in relation to a taxable income for which there is an abnormal income amount, means:

(a) so much of the taxable income as does not exceed the abnormal income amount; or

(b) if the sum (the component sum) of:

(i) the abnormal income amount; and

(ii) the superannuation remainder of the taxable income; and

(iii) the employment termination remainder of the taxable income;

is more than the taxable income—the abnormal income amount, reduced by the amount by which the component sum exceeds the taxable income.

standard component has the same meaning as in the Income Tax Assessment Act 1997.

superannuation remainder of taxable income means so much of the taxable income as:

(a) is included in assessable income under a maximum tax rate provision in Division 301 of the Income Tax Assessment Act 1997; and

(b) does not give rise to an entitlement to a tax offset under that maximum tax rate provision.

tax means income tax imposed as such by any Act other than income tax payable in accordance with section 121H, 126, 128B, 128N, 128NA, 128NB, 128T, 128V, 136A or 159C of the Assessment Act.

tax‑free threshold means $18,200.

tax offset has the same meaning as in the Income Tax Assessment Act 1997.

unregulated investment component has the same meaning as in Subdivision B of Division 10E of Part III of the Assessment Act.

working holiday maker has the meaning given by subsection 3A(1).

working holiday taxable income has the meaning given by subsections 3A(2) and (3).

(2) In this Act:

(a) a reference to net income, taxable income or reduced taxable income shall be read as a reference to net income, taxable income or reduced taxable income, as the case may be, of the year of income; and

(b) a reference to eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act shall be read as a reference to eligible taxable income of the year of income for the purposes of that Division.

(3) A reference in this Act to the part to which Division 6AA of Part III of the Assessment Act applies of the share of a beneficiary of the net income of a trust estate shall, if that Division applies to the whole of such a share, be read as a reference to the whole of that share.

3A Working holiday makers and working holiday taxable income

(1) An individual is a working holiday maker at a particular time if the individual holds at that time:

(a) a Subclass 417 (Working Holiday) visa; or

(b) a Subclass 462 (Work and Holiday) visa; or

(c) a bridging visa permitting the individual to work in Australia if:

(i) the bridging visa was granted under the Migration Act 1958 in relation to an application for a visa of a kind described in paragraph (a) or (b); and

(ii) the Minister administering that Act is still to make a decision in relation to the application; and

(iii) the most recent visa, other than a bridging visa, granted under that Act to the individual was a visa of a kind described in paragraph (a) or (b).

(2) An individual’s working holiday taxable income for a year of income is the individual’s assessable income for the year of income derived:

(a) from sources in Australia; and

(b) while the individual is a working holiday maker;

less so much of any amount the individual can deduct for the year of income as relates to that assessable income.

(3) However, the individual’s working holiday taxable income does not include any superannuation remainder, or employment termination remainder, of the individual’s taxable income for the year of income.

4 Incorporation

The Assessment Act is incorporated, and shall be read as one, with this Act.

Part II—Rates of income tax payable upon incomes other than incomes of companies, prescribed unit trusts, superannuation funds and certain other trusts

Division 1—Preliminary

5 Interpretation

In this Part, tax means:

(a) tax payable by a natural person, other than:

(i) a person in the capacity of a trustee of an eligible superannuation fund; or

(ii) a person in the capacity of a trustee of a prescribed unit trust; or

(iii) a person in the capacity of a trustee of an eligible ADF; or

(iiia) a person in the capacity of a trustee of a pooled superannuation trust; or

(iv) a person in the capacity of a trustee of a trust estate, being a person who is liable to be assessed and to pay tax under paragraph 98(3)(b) or subsection 98(4) of the Assessment Act; or

(v) a person in the capacity of a trustee of an AMIT, being a person who is liable to be assessed and to pay tax under paragraph 276‑105(2)(b) or (c) of the Income Tax Assessment Act 1997; or

(b) tax payable by a company in the capacity of a trustee, other than:

(i) a company in the capacity of a trustee of an eligible superannuation fund; or

(ii) a company in the capacity of a trustee of a prescribed unit trust; or

(iii) a company in the capacity of a trustee of an eligible ADF; or

(iiia) a company in the capacity of a trustee of a pooled superannuation trust; or

(iv) a company in the capacity of a trustee of a trust estate, being a company that is liable to be assessed and to pay tax under paragraph 98(3)(b) or subsection 98(4) of the Assessment Act; or

(v) a company in the capacity of a trustee of an AMIT, being a company that is liable to be assessed and to pay tax under paragraph 276‑105(2)(b) or (c) of the Income Tax Assessment Act 1997.

Division 3—Rates of tax

Subdivision B—Rates of tax and notional rates

12 Rates of tax and notional rates

(1) Except as otherwise provided by this Division, the rates of tax are as set out in Schedule 7.

(2) The notional rates for the purposes of section 156 of the Assessment Act are as set out in Schedule 8.

(4) For every dollar of so much of the net income of a trust estate as is equal to the deemed net income from primary production, the rate of complementary tax for the purposes of subsection 156(5A) of the Assessment Act is the amount ascertained by dividing the amount of the excess referred to in paragraph (b) of that subsection by the number of whole dollars in the eligible net income of the trust estate.

(6) Subject to sections 13, 14 and 15, the rates of tax payable by a trustee under section 98 or 99 of the Assessment Act are as set out in Schedule 10.

(6A) The rate of tax payable by a trustee under paragraph 276‑105(2)(a) of the Income Tax Assessment Act 1997 is as set out in Schedule 10A.

(7) The rate of further tax payable by a person under subsection 94(9) of the Assessment Act is:

(a) in respect of the part of the taxable income of the person that is the relevant part of that taxable income for the purposes of subsections 94(10A) and (10B) of the Assessment Act—the amount (if any) per dollar ascertained in accordance with the formula  where:

where:

A is an amount equal to 45% of the taxable income of the person;

B is the amount of tax (if any) that, but for this subsection, section 12A and any rebate, credit or other tax offset (as defined in the Income Tax Assessment Act 1997) to which the person is entitled, would be payable by the person in respect of the taxable income of the person; and

C is the number of whole dollars in the taxable income of the person; and

(b) in respect of the part of the taxable income of the person that is the prescribed part of that taxable income for the purposes of subsection 94(10B) of the Assessment Act—the amount (if any) per dollar ascertained in accordance with the formula  where:

where:

A is an amount equal to 45% of the taxable income of the person;

B is the amount of tax (if any) that would be payable by the person on the person’s taxable income if:

(i) the comparison rate described in section 392‑55 of the Income Tax Assessment Act 1997 were the rate of tax payable by the person on that income; and

(ii) this subsection and section 12A did not apply; and

(iii) the person were not entitled to any rebate, credit or other tax offset (as defined in the Income Tax Assessment Act 1997); and

C is the number of whole dollars in the taxable income of the person.

(8) The rate of further tax payable by a trustee under subsection 94(11) or (12) of the Assessment Act is:

(a) in respect of the part of the net income of the trust estate that is the relevant part of that net income for the purposes of subsections 94(12A) and (12B) of the Assessment Act—the amount (if any) per dollar ascertained in accordance with the formula  where:

where:

A is an amount equal to 45% of the net income of the trust estate in respect of which the trustee is liable to be assessed and to pay tax under section 98 or 99 of the Assessment Act;

B is the amount of tax (if any) that, but for this subsection, subsection (4) and any rebate, credit or other tax offset (as defined in the Income Tax Assessment Act 1997) to which the trustee is entitled, would be payable by the trustee in respect of that net income; and

C is the number of whole dollars in that net income; and

(b) in respect of the part of the net income of the trust estate that is the prescribed part of that net income for the purposes of subsection 94(12B) of the Assessment Act—the amount (if any) per dollar ascertained in accordance with the formula  where:

where:

A is an amount equal to 45% of the net income of the trust estate in respect of which the trustee is liable to be assessed and to pay tax under section 98 or 99 of the Assessment Act;

B is the amount of tax (if any) that, but for this subsection, subsection (4) and any rebate, credit or other tax offset (as defined in the Income Tax Assessment Act 1997) to which the trustee is entitled, would be payable by the trustee in respect of that net income if the notional rates declared by this Division for the purposes of section 156 of the Assessment Act were the rates of tax payable by the trustee in respect of that net income; and

C is the number of whole dollars in that net income.

(9) The rate of tax payable by a trustee in respect of the net income of a trust estate in respect of which the trustee is liable, under section 99A of the Assessment Act, to be assessed and to pay tax is 45%.

(10) The rate of tax payable by a trustee of a managed investment trust under subsection 275‑605(2) of the Income Tax Assessment Act 1997 is 30%.

(11) The rate of tax payable by a trustee of an AMIT under subsection 276‑405(2) of the Income Tax Assessment Act 1997 is 45%.

(12) The rate of tax payable by a trustee of an AMIT under subsection 276‑415(2) of the Income Tax Assessment Act 1997 is 45%.

(13) The rate of tax payable by a trustee of an AMIT under subsection 276‑420(2) of the Income Tax Assessment Act 1997 is 45%.

12A Rate of extra income tax for primary producers

(1) This section sets the rate of extra income tax payable under subsection 392‑35(3) of the Income Tax Assessment Act 1997 on every dollar of a taxpayer’s averaging component for a year of income.

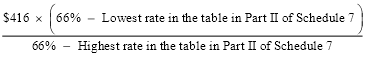

(2) The rate is worked out using the formula:

Rate if taxable income is less than tax‑free threshold adjusted by family tax assistance

(6) In this section:

averaging adjustment means the taxpayer’s smoothing adjustment, worked out for the year of income under section 392‑75 of the Income Tax Assessment Act 1997.

averaging component means the taxpayer’s averaging component in whole dollars, worked out for the year of income under Subdivision 392‑C of the Income Tax Assessment Act 1997.

Subdivision C—Resident taxpayers, resident beneficiaries and resident trust estates

13 Rates of tax where Division 6AA of Part III of the Assessment Act applies

(1) The rates of tax in respect of the taxable income of a resident taxpayer:

(a) who is a prescribed person in relation to the year of income for the purposes of Division 6AA of Part III of the Assessment Act; and

(b) who has, for the purposes of that Division, an eligible taxable income of an amount exceeding $416;

are as set out in Part I of Schedule 11.

(2) Where the eligible taxable income of a resident taxpayer for the purposes of Division 6AA of Part III of the Assessment Act exceeds $416 but does not exceed the resident phase‑out limit, the amount of tax payable under subsection (1) in respect of that eligible taxable income shall not exceed:

(a) 66% of the amount by which that eligible taxable income exceeds $416; or

(b) the amount ascertained by deducting from the amount of tax that would be payable by the taxpayer if the rates set out in Part I of Schedule 7 were applied to the taxable income of the taxpayer the amount of tax that would be payable by the taxpayer if those rates were applied to the taxable income of the taxpayer reduced by the amount of that eligible taxable income;

whichever is the greater.

(3) Where:

(a) a trustee of a trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of the share of a resident beneficiary of the net income of the trust estate;

(b) Division 6AA of Part III of the Assessment Act applies to a part of that share; and

(c) the part of that share to which that Division applies exceeds $416;

the rates of tax payable by the trustee in respect of that share of the net income of the trust estate are as set out in Part I of Schedule 12.

(4) Where:

(a) a trustee of a trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of the share of a resident beneficiary of the net income of the trust estate;

(b) Division 6AA of Part III of the Assessment Act applies to a part of that share;

(c) the part of that share to which that Division applies does not exceed $416;

(d) Division 6AA of Part III of the Assessment Act also applies to a part of the share of the beneficiary of the net income of another trust estate or to parts of the shares of the beneficiary of the net incomes of other trust estates; and

(e) the sum of the part referred to in paragraph (b) and the part or parts referred to in paragraph (d) exceeds $416;

the trustee of the trust estate referred to in paragraph (a) is liable to pay tax in respect of the share of the net income of the trust estate referred to in that paragraph at the rates set out in Part I of Schedule 12.

(5) Where:

(a) the amount of tax that a trustee of a trust estate is liable to pay in respect of the share of a resident beneficiary of the net income of the trust estate is, by virtue of subsection (4), to be calculated in accordance with Part I of Schedule 12; and

(b) the sum of:

(i) the part of that share to which Division 6AA of Part III of the Assessment Act applies; and

(ii) the part of the share of the beneficiary of the net income of the other trust estate or the parts of the shares of the beneficiary of the net incomes of the other trust estates, as the case may be, to which that Division applies;

does not exceed the resident phase‑out limit;

the tax that, apart from this subsection, would be payable by the trustee in respect of the share referred to in paragraph (a) shall be reduced by such amount (if any) as, in the opinion of the Commissioner, is fair and reasonable.

(6) Subject to subsection (7), where:

(a) the trustee of a trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of the share of a resident beneficiary of the net income of the trust estate;

(b) Division 6AA of Part III of the Assessment Act applies to a part (in this subsection referred to as the eligible part) of that share; and

(c) the eligible part of that share exceeds $416 but does not exceed the resident phase‑out limit;

the amount of tax payable under subsection (3) in respect of the eligible part of that share shall not exceed:

(d) 66% of the amount by which the eligible part of that share exceeds $416; or

(e) the amount ascertained by deducting from the amount of tax that would be payable by the trustee if the rates referred to in Part I of Schedule 10 were applied to that share of that net income the amount of tax that would be payable by the trustee if those rates were applied to that share of that net income reduced by the amount of the eligible part of that share;

whichever is the greater.

(7) Subsection (6) does not apply in relation to the share of a beneficiary of the net income of a trust estate if Division 6AA of Part III of the Assessment Act applies to a part of a share of the beneficiary of the net income of another trust estate or to parts of the shares of the beneficiary of the net incomes of other trust estates.

(8) Where:

(a) by reason of the application of subsection (7), subsection (6) does not apply in relation to the share of a beneficiary of the net income of a trust estate in respect of which a trustee is liable to be assessed and to pay tax under section 98 of the Assessment Act; and

(b) the sum of:

(i) the part of that share to which Division 6AA of Part III of the Assessment Act applies; and

(ii) the part of the share of the beneficiary of the net income of the other trust estate or the parts of the shares of the beneficiary of the net incomes of the other trust estates, as the case may be, to which that Division applies;

does not exceed the resident phase‑out limit;

the tax that, apart from this subsection, would be payable by the trustee in respect of the share referred to in paragraph (a) shall be reduced by such amount (if any) as, in the opinion of the Commissioner, is fair and reasonable.

(9) In forming an opinion for the purposes of subsection (5) or (8) (in this subsection referred to as the relevant subsection) in relation to the share of a beneficiary of the net income of a trust estate of a year of income, the Commissioner shall have regard to:

(a) any limitation that would be applicable under subsection (6) on the amount of tax that would be payable by a trustee in accordance with Part I of Schedule 12 in respect of a share of the net income of a trust estate of the year of income of an amount equal to the sum of the shares referred to in paragraph (b) of the relevant subsection if:

(i) Division 6AA of Part III of the Assessment Act applied to so much of that share as is equal to the sum of the parts of the shares referred to in paragraph (b) of the relevant subsection; and

(ii) that share were a share of a resident beneficiary who is not presently entitled to a share of the income of the year of income of any other trust estate;

(b) the amount of any reduction previously granted by the Commissioner under subsection (5) or (8) in relation to the share of the beneficiary of the net income of the year of income of any other trust estate; and

(c) such other matters (if any) as the Commissioner thinks fit.

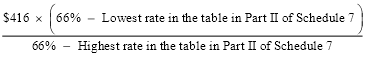

(10) The resident phase‑out limit is the following amount rounded down to the nearest dollar:

14 Limitation on tax payable by certain trustees

(1) Where:

(a) the trustee of a resident trust estate is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of the net income or a part of the net income of the trust estate;

(b) in the case of a trust estate of a deceased person, the deceased person died not less than 3 years before the end of the year of income; and

(c) that net income or that part of the net income of the trust estate does not exceed $416;

no tax is payable under subsection 12(6) in respect of that net income or that part of the net income, as the case may be.

(2) Where:

(a) the trustee of a resident trust estate is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of the net income or a part of the net income of the trust estate;

(b) in the case of a trust estate of a deceased person, the deceased person died not less than 3 years before the end of the year of income; and

(c) that net income or that part of the net income of the trust estate exceeds $416 but does not exceed the net income phase‑out limit;

the amount of tax payable by the trustee under subsection 12(6) in respect of that net income or that part of the net income shall not exceed 50% of the amount by which that net income or that part of the net income, as the case may be, exceeds $416, less any rebate or credit to which the trustee is entitled.

(3) The net income phase‑out limit is the following amount rounded down to the nearest dollar:

Subdivision D—Non‑resident taxpayers, non‑resident beneficiaries and non‑resident trust estates

15 Rates of tax where Division 6AA of Part III of the Assessment Act applies

(1) The rates of tax in respect of the taxable income of a non‑resident taxpayer:

(a) who is a prescribed person in relation to the year of income for the purposes of Division 6AA of Part III of the Assessment Act; and

(b) who has, for the purposes of that Division, an eligible taxable income;

are as set out in Part II of Schedule 11.

(2) Where the eligible taxable income of a non‑resident taxpayer for the purposes of Division 6AA of Part III of the Assessment Act:

(a) does not exceed $416—the amount of tax payable under subsection (1) in respect of that eligible taxable income shall not exceed:

(i) the amount ascertained by applying the second resident personal tax rate to that eligible taxable income; or

(ii) the amount ascertained by deducting from the amount of tax that would be payable by the taxpayer if the rates set out in Part II of Schedule 7 were applied to the taxable income of the taxpayer the amount of tax that would be payable by the taxpayer if those rates were applied to the taxable income of the taxpayer reduced by the amount of that eligible taxable income;

whichever is the greater; or

(b) exceeds $416 but does not exceed the non‑resident phase‑out limit—the amount of tax payable under subsection (1) in respect of that eligible taxable income shall not exceed:

(i) the amount ascertained by applying the second resident personal tax rate to $416, and then adding 66% of the amount by which that eligible taxable income exceeds $416; or

(ii) the amount ascertained by deducting from the amount of tax that would be payable by the taxpayer if the rates set out in Part II of Schedule 7 were applied to the taxable income of the taxpayer the amount of tax that would be payable by the taxpayer if those rates were applied to the taxable income of the taxpayer reduced by the amount of that eligible taxable income;

whichever is the greater.

(3) Where:

(a) a trustee of a trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of the share of a non‑resident beneficiary of the net income of the trust estate; and

(b) Division 6AA of Part III of the Assessment Act applies to a part of that share;

the rates of tax payable by the trustee in respect of that share of the net income of the trust estate are as set out in Part II of Schedule 12.

(4) Subject to subsection (5), where:

(a) the trustee of a trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of the share of a non‑resident beneficiary of the net income of the trust estate; and

(b) Division 6AA of Part III of the Assessment Act applies to a part (in this subsection referred to as the eligible part) of that share;

the amount of tax payable under subsection (3) in respect of the eligible part of that share shall not exceed:

(c) where the eligible part of that share does not exceed $416:

(i) the amount ascertained by applying the second resident personal tax rate to the amount of the eligible part of that share; or

(ii) the amount ascertained by deducting from the amount of tax that would be payable by the trustee if the rates referred to in Part II of Schedule 10 were applied to that share of that net income the amount of tax that would be payable by the trustee if those rates were applied to that share of that net income reduced by the amount of the eligible part of that share;

whichever is the greater; or

(d) where the eligible part of that share exceeds $416 but does not exceed the non‑resident phase‑out limit:

(i) the amount ascertained by applying the second resident personal tax rate to $416, and then adding 66% of the amount by which the eligible part of that share exceeds $416; or

(ii) the amount ascertained by deducting from the amount of tax that would be payable by the trustee if the rates referred to in Part II of Schedule 10 were applied to that share of that net income the amount of tax that would be payable by the trustee if those rates were applied to that share of that net income reduced by the amount of the eligible part of that share;

whichever is the greater.

(5) Subsection (4) does not apply in relation to the share of a beneficiary of the net income of a trust estate if Division 6AA of Part III of the Assessment Act applies to a part of a share of the beneficiary of the net income of another trust estate or to parts of the shares of the beneficiary of the net incomes of other trust estates.

(6) Where:

(a) by reason of the application of subsection (5), subsection (4) does not apply in relation to the share of a beneficiary of the net income of a trust estate in respect of which a trustee is liable to be assessed and to pay tax under section 98 of the Assessment Act; and

(b) the sum of:

(i) the part of that share to which Division 6AA of Part III of the Assessment Act applies; and

(ii) the part of the share of the beneficiary of the net income of the other trust estate or the parts of the shares of the beneficiary of the net incomes of the other trust estates, as the case may be, to which that Division applies;

does not exceed the non‑resident phase‑out limit;

the tax that, apart from this subsection, would be payable by the trustee in respect of the share referred to in paragraph (a) shall be reduced by such amount (if any) as, in the opinion of the Commissioner, is fair and reasonable.

(7) In forming an opinion for the purposes of subsection (6) in relation to the share of a beneficiary of the net income of a trust estate of a year of income, the Commissioner shall have regard to:

(a) any limitation that would be applicable under subsection (4) on the amount of tax that would be payable by a trustee in accordance with Part II of Schedule 12 in respect of a share of the net income of a trust estate of the year of income of an amount equal to the sum of the shares referred to in paragraph (6)(b) if:

(i) Division 6AA of Part III of the Assessment Act applied to so much of that share as is equal to the sum of the parts of the shares referred to in paragraph (6)(b); and

(ii) that share were a share of a non‑resident beneficiary who is not presently entitled to a share of the income of the year of income of any other trust estate;

(b) the amount of any reduction previously granted by the Commissioner under subsection (6) in relation to the share of the beneficiary of the net income of the year of income of any other trust estate; and

(c) such other matters (if any) as the Commissioner thinks fit.

(8) The non‑resident phase‑out limit is the following amount rounded down to the nearest dollar:

Division 4—Pro‑rating of the tax‑free threshold

16 Interpretation

In this Division:

beneficiary, in relation to a trust estate, includes a person who is capable (whether by the exercise of a power of appointment or otherwise) of benefiting under the trust.

eligible pensioner, in relation to a year of income, means a person to whom, at any time during the year of income, compensation or a pension, allowance or benefit is payable under:

(a) the Veterans’ Entitlements Act 1986;

(b) subsection 4(6) of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986; or

(ba) the Military Rehabilitation and Compensation Act 2004; or

(c) a provision of the Social Security Act 1991 other than Part 2.11, 2.12, 2.15 or 3.15A of that Act;

being compensation or a pension, allowance or benefit in respect of which the person is liable to be assessed and to pay income tax in Australia.

18 Part‑year residency period

(1) Subject to subsection (2), the following periods are part‑year residency periods in relation to a person in relation to a year of income:

(a) where the person was a resident at the beginning of the first month of the year of income and continued to be a resident until a time during a subsequent month in the year of income when the person ceased to be a resident—the period from the beginning of the year of income until the end of that subsequent month;

(b) where the person commenced to be a resident during a month of the year of income and continued to be a resident until the end of the year of income—the period from the beginning of that month until the end of the year of income;

(c) where the person commenced to be a resident during a month of the year of income and continued to be a resident until a time during a subsequent month of the year of income when the person ceased to be a resident—the period from the beginning of that first‑mentioned month until the end of that subsequent month.

(2) A period shall not be taken to be a part‑year residency period in relation to a person in relation to a year of income if:

(a) the person is an eligible pensioner in relation to the year of income; or

(b) the period is the whole of the year of income.

20 Pro‑rating of the tax‑free threshold

Part‑year residency periods

(1) This Act applies in relation to a person and a year of income as if the reference in the table applicable to the year of income in Part I of Schedule 7 to the tax‑free threshold were a reference to the amount calculated in accordance with the following formula, if there are one or more part‑year residency periods in relation to the person in relation to the year of income:

Trustees

(1A) Subsection (1) does not apply in calculating the tax payable by the trustee of a trust estate under section 98 of the Assessment Act in respect of a share of a beneficiary of the net income of the trust estate of a year of income.

(2) However, this Act applies in calculating the tax payable by the trustee in respect of that share as if the reference in the table applicable to the year of income in Part I of Schedule 7 to the tax‑free threshold were a reference to the amount calculated in accordance with the following formula, if there are one or more part‑year residency periods in relation to the beneficiary in relation to the year of income:

(3) Subsection (1) does not apply in calculating the tax payable by the trustee of a trust estate under section 99 of the Assessment Act.

Part III—Rates of income tax payable upon incomes of companies, prescribed unit trusts, superannuation funds, certain other trusts and sovereign entities

21 Interpretation

In this Part, tax does not include tax within the meaning of Part II.

23 Rates of tax payable by companies

(1A) This section has effect subject to section 23A.

(1) The rates of tax payable by a company, other than a company in the capacity of a trustee, are as set out in the following provisions of this section.

(2) The rate of tax in respect of the taxable income of a company is:

(a) if the company is a base rate entity for a year of income—26%; or

(b) otherwise—30%;

if subsections (3) to (5) and section 23A do not apply to the company.

(3) The rates of tax in respect of the taxable income of a company (other than a life insurance company) that is an RSA provider are:

(a) in respect of the RSA component—15%; and

(b) in respect of the standard component:

(i) if the company is a base rate entity for a year of income—26%; or

(ii) otherwise—30%.

(4) The rates of tax in respect of the taxable income of a company that becomes a PDF during a year of income and is still a PDF at the end of the year of income are:

(a) in respect of the SME income component—15%; and

(b) in respect of the unregulated investment component—25%; and

(c) in respect of so much of the taxable income as exceeds the PDF component:

(i) if the company is a base rate entity for a year of income—26%; or

(ii) otherwise—30%.

(5) The rates of tax in respect of the taxable income of a company that is a PDF throughout the year of income are:

(a) in respect of the SME income component—15%; and

(b) in respect of the unregulated investment component—25%.

(6) The amount of tax payable by a company (before applying any rebate, credit or other tax offset (within the meaning of the Income Tax Assessment Act 1997)) must not be greater than 55% of the amount (if any) by which the taxable income of the company exceeds $416, if:

(a) the company is a non‑profit company; and

(b) the taxable income is not greater than:

(i) if the company is a base rate entity for a year of income—$788; or

(ii) otherwise—$915.

(7) The amount of tax payable by a company (before applying any rebate, credit or other tax offset (within the meaning of the Income Tax Assessment Act 1997)) must not be greater than:

(a) if the company is a base rate entity for a year of income—39%; or

(b) otherwise—45%;

of the amount by which the taxable income of the company exceeds $49,999, if the company is a recognised medium credit union in relation to the year of income.

23AA Meaning of base rate entity

An entity is a base rate entity for a year of income if:

(a) no more than 80% of its assessable income for the year of income is base rate entity passive income; and

(b) its aggregated turnover (within the meaning of the Income Tax Assessment Act 1997) for the year of income, worked out as at the end of that year, is less than $50 million.

23AB Meaning of base rate entity passive income

(1) Base rate entity passive income is assessable income that is any of the following:

(a) a distribution (within the meaning of the Income Tax Assessment Act 1997) by a corporate tax entity (within the meaning of that Act), other than a non‑portfolio dividend (within the meaning of section 317 of the Assessment Act);

(b) an amount of a franking credit (within the meaning of the Income Tax Assessment Act 1997) on such a distribution;

(c) a non‑share dividend (within the meaning of the Income Tax Assessment Act 1997) by a company;

(d) interest (or a payment in the nature of interest), royalties and rent;

(e) a gain on a qualifying security (within the meaning of Division 16E of Part III of the Assessment Act);

(f) a net capital gain (within the meaning of the Income Tax Assessment Act 1997);

(g) an amount included in the assessable income of a partner in a partnership or of a beneficiary of a trust estate under Division 5 or 6 of Part III of the Assessment Act, to the extent that the amount is referable (either directly or indirectly through one or more interposed partnerships or trust estates) to another amount that is base rate entity passive income under a preceding paragraph of this subsection.

(2) However, if an entity has assessable income that is interest (or a payment in the nature of interest):

(a) treat the assessable income as not being interest (or a payment in the nature of interest) of the entity for the purposes of paragraph (1)(d) if:

(i) the entity is a financial institution (within the meaning of section 202A of the Assessment Act); or

(ii) the entity is a registered entity (within the meaning of the Financial Sector (Collection of Data) Act 2001) that carries on a general business of providing finance (within the meaning of that Act) on a commercial basis; or

(iii) the entity holds an Australian credit licence (within the meaning of the National Consumer Credit Protection Act 2009), or is a credit representative (within the meaning of that Act) of another entity that holds such an Australian credit licence; or

(iv) the entity is a financial services licensee (within the meaning of the Corporations Act 2001) whose licence covers dealings in financial products mentioned in paragraph 764A(1)(a) of that Act (securities), or is an authorised representative (within the meaning of section 761A of that Act) of such a financial services licensee; or

(v) the entity is an entity of a kind specified in a legislative instrument made under subsection (3); and

(b) treat the assessable income as not being interest (or a payment in the nature of interest) of the entity for the purposes of paragraph (1)(d) to the extent that it is a return on an equity interest in a company.

(3) The Minister may, by legislative instrument, specify one or more kinds of entities for the purposes of subparagraph (2)(a)(v).

23A Rates of tax payable by life insurance companies

The rates of tax in respect of the taxable income of a life insurance company are:

(a) in respect of the ordinary class—30%; and

(b) in respect of the complying superannuation class—15%.

25 Rate of tax payable by trustees of public trading trusts

The rate of tax payable by a trustee of a public trading trust in respect of the net income of the public trading trust in respect of which the trustee is liable, under section 102S of the Assessment Act, to be assessed and to pay tax is:

(a) if the trust is a base rate entity for a year of income—26%; or

(b) otherwise—30%.

26 Rates of tax payable by trustees of superannuation funds

(1) The rates of tax payable by a trustee of a complying superannuation fund in respect of the taxable income of the fund are:

(a) in respect of the low tax component—15%; and

(b) in respect of the non‑arm’s length component—45%.

(2) The rate of tax payable by a trustee of a non‑complying superannuation fund in respect of the taxable income of the fund is 45%.

27 Rates of tax payable by trustees of approved deposit funds

(1) The rates of tax payable by a trustee of a complying ADF in respect of the taxable income of the fund are:

(a) in respect of the low tax component—15%; and

(b) in respect of the non‑arm’s length component—45%.

(2) The rate of tax payable by a trustee of a non‑complying ADF in respect of the taxable income of the fund is 45%.

27A Rates of tax payable by trustees of pooled superannuation trusts

The rates of tax payable by a trustee of a pooled superannuation trust in respect of the taxable income of the trust are:

(a) in respect of the low tax component—15%; and

(b) in respect of the non‑arm’s length component—45%.

28 Rates of tax payable by certain trustees to whom section 98 of the Assessment Act applies

The rates of tax payable by a trustee of a trust estate in respect of a share of the net income of the trust estate in respect of which the trustee is liable to be assessed and to pay tax are:

(a) if paragraph 98(3)(b) of the Assessment Act (about beneficiaries that are companies) applies:

(i) if the beneficiary is a company to which paragraph 23(2)(a) of this Act applies—the rate specified in paragraph 23(2)(a); or

(ii) otherwise—the rate specified in paragraph 23(2)(b); and

(b) if subsection 98(4) of the Assessment Act applies—the maximum rate specified in column 3 of the table applicable to the year of income in Part II of Schedule 7 to this Act that applies for the year of income.

Note: If paragraph 98(3)(a) of the Assessment Act applies, see subsection 12(6).

28A Rates of tax payable by trustees of AMITs under paragraph 276‑105(2)(b) or (c) of the Income Tax Assessment Act 1997

The rates of tax payable by a trustee of an AMIT under paragraph 276‑105(2)(b) or (c) of the Income Tax Assessment Act 1997 are:

(a) if paragraph 276‑105(2)(b) of the Income Tax Assessment Act 1997 applies—the rate specified in paragraph 23(2)(b) of this Act; and

(b) if paragraph 276‑105(2)(c) of that Act applies—the maximum rate specified in column 3 of the table applicable to the year of income in Part II of Schedule 7 to this Act that applies for the year of income.

Note: If paragraph 276‑105(2)(a) of the Income Tax Assessment Act 1997 applies, see subsection 12(6A).

29 Rate of tax on no‑TFN contributions income

(1) This section sets the rate of tax payable:

(a) by a trustee of a complying superannuation fund in respect of the no‑TFN contributions income of the fund; and

(b) by a trustee of a non‑complying superannuation fund in respect of the no‑TFN contributions income of the fund; and

(c) by a company that is an RSA provider in respect of no‑TFN contributions income.

(2) The rate of tax is worked out in the following way:

(a) first, work out the maximum rate specified in column 3 of the table applicable to the year of income in Part I of Schedule 7 to this Act that applies for the year of income;

(b) next, add 2%;

(c) next, subtract the rate of tax:

(i) for a trustee of a complying superannuation fund—set out in paragraph 26(1)(a); or

(ii) for a trustee of a non‑complying superannuation fund—set out in subsection 26(2); or

(iii) for a company (other than a life insurance company) that is an RSA provider—set out in paragraph 23(3)(a); or

(iv) for a life insurance company that is an RSA provider—set out in paragraph 23A(b).

30 Rate of tax payable by sovereign entities

The rate of tax payable in respect of the taxable income of a sovereign entity is 30%, unless another provision of this Part sets the rate of tax in respect of that taxable income.

Schedule 7—General rates of tax

Subsection 12(1)

Part I—Resident taxpayers

1. Subject to clauses 2, 3 and 4, the rates of tax on the taxable income of a resident taxpayer are as follows:

(a) 45% for the superannuation remainder (if any) of the taxable income;

(aa) 45% for the employment termination remainder (if any) of the taxable income;

(b) for each part of the ordinary taxable income specified in the table applicable to the year of income—the rate applicable under that table.

Tax rates for resident taxpayers for the 2020‑21, 2021‑22, 2022‑23 or 2023‑24 year of income |

Item | For the part of the ordinary taxable income of the taxpayer that: | The rate is: |

1 | exceeds the tax‑free threshold but does not exceed $45,000 | 19% |

2 | exceeds $45,000 but does not exceed $120,000 | 32.5% |

3 | exceeds $120,000 but does not exceed $180,000 | 37% |

4 | exceeds $180,000 | 45% |

Note: The above table will be repealed on 1 July 2024 by the Treasury Laws Amendment (A Tax Plan for the COVID‑19 Economic Recovery) Act 2020.

Tax rates for resident taxpayers for the 2024‑25 year of income or a later year of income |

Item | For the part of the ordinary taxable income of the taxpayer that: | The rate is: |

1 | exceeds the tax‑free threshold but does not exceed $45,000 | 19% |

2 | exceeds $45,000 but does not exceed $200,000 | 30% |

3 | exceeds $200,000 | 45% |

2. Where:

(a) the taxable income of a resident taxpayer consists of or includes a special income component; and

(b) Division 16 of Part III of the Assessment Act does not apply to the income of the taxpayer; and

(c) Division 392 (Long‑term averaging of primary producers’ tax liability) of the Income Tax Assessment Act 1997 does not apply to the taxpayer’s assessment;

the rate of tax for every $1 of the taxable income is the amount ascertained in accordance with the formula  where:

where:

A is the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the reduced taxable income;

B is 5 times the difference between:

(c) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the sum of:

(i) the reduced taxable income; and

(ii) 20% of the special income component of the taxable income; and

(d) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the reduced taxable income; and

C is the number of whole dollars in the taxable income.

In applying the formula, component B is to be worked out on the assumption that the whole of the taxable income is ordinary taxable income.

3. Where:

(a) the taxable income of a resident taxpayer consists of or includes a special income component; and

(b) Division 16 of Part III of the Assessment Act applies to the income of the taxpayer or Division 392 (Long‑term averaging of primary producers’ tax liability) of the Income Tax Assessment Act 1997 applies to the taxpayer’s assessment;

the rate of tax for every $1 of the taxable income is the amount ascertained in accordance with the formula  where:

where:

A is the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the reduced taxable income;

B is 5 times the difference between:

(c) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the sum of:

(i) the average income; and

(ii) 20% of the special income component of the taxable income; and

(d) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the average income; and

C is the number of whole dollars in the taxable income.

In applying the formula, component B is to be worked out on the assumption that the whole of the taxable income is ordinary taxable income.

4. If the resident taxpayer is a working holiday maker at any time during the year of income:

(a) count the taxpayer’s working holiday taxable income for the year of income as the first parts (starting from $0) of the taxpayer’s ordinary taxable income for the purposes of the table in clause 1 that is applicable to the year of income; and

(b) do not apply the rates in that table to that working holiday taxable income; and

(c) do not count that working holiday taxable income when working out the taxpayer’s taxable income for the purposes of clause 2 or 3.

Note: The rates for the taxpayer’s working holiday taxable income for the year of income are set out in Part III.

Part II—Non‑resident taxpayers

1. Subject to clauses 2, 3 and 4, the rates of tax on the taxable income of a non‑resident taxpayer are as follows:

(a) 45% for the superannuation remainder (if any) of the taxable income;

(aa) 45% for the employment termination remainder (if any) of the taxable income;

(b) for each part of the ordinary taxable income specified in the table applicable to the year of income—the rate applicable under that table.

Tax rates for non‑resident taxpayers for the 2020‑21, 2021‑22, 2022‑23 or 2023‑24 year of income |

Item | For the part of the ordinary taxable income of the taxpayer that: | The rate is: |

1 | does not exceed $120,000 | The second resident personal tax rate |

2 | exceeds $120,000 but does not exceed $180,000 | 37% |

3 | exceeds $180,000 | 45% |

Note: The above table will be repealed on 1 July 2024 by the Treasury Laws Amendment (A Tax Plan for the COVID‑19 Economic Recovery) Act 2020.

Tax rates for non‑resident taxpayers for the 2024‑25 year of income or a later year of income |

Item | For the part of the ordinary taxable income of the taxpayer that: | The rate is: |

1 | does not exceed $200,000 | The second resident personal tax rate |

2 | exceeds $200,000 | 45% |

2. Where:

(a) the taxable income of a non‑resident taxpayer consists of or includes a special income component; and

(b) Division 16 of Part III of the Assessment Act does not apply to the income of the taxpayer; and

(c) Division 392 (Long‑term averaging of primary producers’ tax liability) of the Income Tax Assessment Act 1997 does not apply to the taxpayer’s assessment;

the rate of tax for every $1 of the taxable income is the amount ascertained in accordance with the formula  where:

where:

A is the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the reduced taxable income;

B is 5 times the difference between:

(c) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the sum of:

(i) the reduced taxable income; and

(ii) 20% of the special income component of the taxable income; and

(d) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the reduced taxable income; and

C is the number of whole dollars in the taxable income.

In applying the formula, component B is to be worked out on the assumption that the whole of the taxable income is ordinary taxable income.

3. Where:

(a) the taxable income of a non‑resident taxpayer consists of or includes a special income component; and

(b) Division 16 of Part III of the Assessment Act applies to the income of the taxpayer or Division 392 (Long‑term averaging of primary producers’ tax liability) of the Income Tax Assessment Act 1997 applies to the taxpayer’s assessment;

the rate of tax for every $1 of the taxable income is the amount ascertained in accordance with the formula  where:

where:

A is the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the reduced taxable income;

B is 5 times the difference between:

(c) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the sum of:

(i) the average income; and

(ii) 20% of the special income component of the taxable income; and

(d) the amount of tax that would be payable by the taxpayer under clause 1 on a taxable income equal to the average income; and

C is the number of whole dollars in the taxable income.

In applying the formula, component B is to be worked out on the assumption that the whole of the taxable income is ordinary taxable income.

4. If the non‑resident taxpayer is a working holiday maker at any time during the year of income:

(a) count the taxpayer’s working holiday taxable income for the year of income as the first parts (starting from $0) of the taxpayer’s ordinary taxable income for the purposes of the table in clause 1 applicable to the year of income; and

(b) do not apply the rates in that table to that working holiday taxable income; and

(c) do not count that working holiday taxable income when working out the taxpayer’s taxable income for the purposes of clause 2 or 3.

Note: The rates for the taxpayer’s working holiday taxable income for the year of income are set out in Part III.

Part III—Working holiday makers

1. The rates of tax on a taxpayer’s working holiday taxable income for a year of income are as set out in the table that is applicable to the year of income.

Tax rates for working holiday makers for the 2020‑21, 2021‑22, 2022‑23 or 2023‑24 year of income |

Item | For the part of the taxpayer’s working holiday taxable income that: | The rate is: |

1 | does not exceed $45,000 | 15% |

2 | exceeds $45,000 but does not exceed $120,000 | 32.5% |

3 | exceeds $120,000 but does not exceed $180,000 | 37% |

4 | exceeds $180,000 | 45% |

Note: The above table will be repealed on 1 July 2024 by the Treasury Laws Amendment (A Tax Plan for the COVID‑19 Economic Recovery) Act 2020.

Tax rates for working holiday makers for the 2024‑25 year of income or a later year of income |

Item | For the part of the taxpayer’s working holiday taxable income that: | The rate is: |

1 | does not exceed $45,000 | 15% |

2 | exceeds $45,000 but does not exceed $200,000 | 30% |

3 | exceeds $200,000 | 45% |

Schedule 8—Notional rates for the purposes of section 156 of the Assessment Act

Subsection 12(2)

Part I—Resident taxpayers, resident beneficiaries and resident trust estates

Division 1—Normal notional rate

1. This Division applies to the income of a resident taxpayer, other than income in respect of which a trustee is liable to be assessed and to pay tax under section 98 or 99 of the Assessment Act, if Division 16 of Part III of the Assessment Act applies in relation to that income.

2. Subject to clause 3, the notional rate in respect of income to which this Division applies is, for every $1 of the taxable income, the amount ascertained by determining the tax that would be payable if the rates set out in Part I of Schedule 7 were applied to a taxable income equal to the taxpayer’s average income and dividing the resultant amount by a number equal to the number of whole dollars in that average income.

3. The notional rate in respect of income to which this Division applies is to be calculated under clause 2 as if Division 5 of Part II had not been enacted.

Division 2—Notional rates in respect of certain trust income

1. This Division applies:

(a) to a share of a resident beneficiary of the net income of a trust estate, if:

(i) the trustee of the trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of that share; and

(ii) Division 16 of Part III of the Assessment Act applies in relation to that share; and

(b) to the net income or a part of the net income of a resident trust estate, if:

(i) the trustee of the trust estate is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of that net income or that part of that net income of the trust estate; and

(ii) Division 16 of Part III of the Assessment Act applies in relation to that net income or that part of that net income.

2. The notional rate in respect of income to which this Division applies is:

(a) in a case where the income is:

(i) a share of the net income of a trust estate in respect of which the trustee is liable to be assessed and to pay tax under section 98 of the Assessment Act; or

(ii) the net income or a part of the net income of a trust estate in respect of which the trustee is liable to be assessed and to pay tax under section 99 of the Assessment Act, being the net income or a part of the net income of the estate of a deceased person who died less than 3 years before the end of the year of income;

the rate that would be calculated in accordance with Division 1 if that income were the taxable income of one individual and were not income in respect of which a trustee is liable to be assessed and to pay tax under section 98 or 99 of the Assessment Act; and

(b) in any other case—the rate that would be calculated in accordance with Division 1 in respect of a taxable income equal to the income if:

(i) that income were the taxable income of one individual and were not income in respect of which a trustee is liable to be assessed and to pay tax under section 99 of the Assessment Act; and

(ii) the words “exceeds the tax‑free threshold but” were omitted from item 1 of the table applicable to the year of income in Part I of Schedule 7.

Part II—Non‑resident taxpayers, non‑resident beneficiaries and non‑resident trust estates

Division 1—Normal notional rate

1. This Division applies to the income of a non‑resident taxpayer, other than income in respect of which a trustee is liable to be assessed and to pay tax under section 98 or 99 of the Assessment Act, if Division 16 of Part III of the Assessment Act applies in relation to that income.

2. The notional rate in respect of income to which this Division applies is, for every $1 of the taxable income, the amount ascertained by determining the tax that would be payable if the rates set out in Part II of Schedule 7 were applied to a taxable income equal to the taxpayer’s average income and dividing the resultant amount by a number equal to the number of whole dollars in that average income.

Division 2—Notional rates in respect of certain trust income

1. This Division applies:

(a) to a share of a non‑resident beneficiary of the net income of a trust estate if:

(i) the trustee of the trust estate is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of that share; and

(ii) Division 16 of Part III of the Assessment Act applies in relation to that share; and

(b) to the net income or a part of the net income of a non‑resident trust estate if:

(i) the trustee of the trust estate is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of that net income or that part of that net income of the trust estate; and

(ii) Division 16 of Part III of the Assessment Act applies in relation to that net income or that part of that net income.

2. The notional rate in respect of income to which this Division applies is the rate that would be calculated in accordance with Division 1 in respect of a taxable income equal to the income if that income were the taxable income of one individual and were not income in respect of which a trustee is liable to be assessed and to pay tax under section 98 or 99 of the Assessment Act.

Schedule 10—Rates of tax payable by a trustee under section 98 or 99 of the Assessment Act

Subsection 12(6)

Part I—Resident beneficiaries and resident trust estates

1. In the case of a trustee who is liable to be assessed and to pay tax:

(a) under section 98 of the Assessment Act in respect of a share of a resident beneficiary of the net income of a trust estate; or

(b) under section 99 of the Assessment Act in respect of the net income or part of the net income of a resident trust estate, being the net income or part of the net income of the estate of a deceased person who died less than 3 years before the end of the year of income;

the rate of tax in respect of that share of the net income or that net income or that part of that net income is the rate that would be payable under Part I of Schedule 7 if one individual were liable to be assessed and to pay tax on that income as his or her taxable income.

2. In the case of a trustee who is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of the net income or part of the net income of a resident trust estate, other than income to which clause 1 applies, the rate of tax is the rate that would be payable under Part I of Schedule 7 in respect of a taxable income equal to that net income or that part of the net income if:

(a) one individual were liable to be assessed and to pay tax on that income; and

(b) the words “exceeds the tax‑free threshold but” were omitted from item 1 of the table applicable to the year of income in Part I of Schedule 7.

Part II—Non‑resident beneficiaries and non‑resident trust estates

In the case of a trustee who is liable to be assessed and to pay tax:

(a) under section 98 of the Assessment Act in respect of a share of a non‑resident beneficiary of the net income of a trust estate; or

(b) under section 99 of the Assessment Act in respect of the net income or part of the net income of a non‑resident trust estate;

the rate of tax in respect of that share of the net income or that net income or that part of that net income is the rate that would be payable under Part II of Schedule 7 if one individual were liable to be assessed and to pay tax on that income as his or her taxable income.

Schedule 10A—Rates of tax payable by an AMIT trustee under paragraph 276‑105(2)(a) of the Income Tax Assessment Act 1997

Note: See subsection 12(6A).

In the case of a trustee who is liable to be assessed and to pay tax under paragraph 276‑105(2)(a) of the Income Tax Assessment Act 1997 in respect of an amount mentioned in subsection 276‑105(3) of that Act, the rate of tax in respect of that amount is the rate that would be payable under Part II of Schedule 7 if one individual were liable to be assessed and to pay tax on that amount as his or her taxable income.

Schedule 11—Rates of tax payable on eligible taxable income

Subsections 13(1) and 15(1)

Part I—Resident taxpayers

1. In the case of a resident taxpayer whose eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act exceeds $416 and whose taxable income does not consist of or include a special income component, the rates of tax in respect of that part (in this clause referred to as the relevant part) of the taxable income of the taxpayer other than the eligible taxable income of the taxpayer are the rates that would be payable under Part I of Schedule 7 if the relevant part of that taxable income were the taxable income of the taxpayer.

2. In the case of a resident taxpayer whose eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act exceeds $416 and whose taxable income does not consist of or include a special income component, the rate of tax in respect of the eligible taxable income of the taxpayer is 45%.

3. For every $1 of the taxable income of a resident taxpayer:

(a) whose eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act exceeds $416; and

(b) whose taxable income consists of or includes a special income component;

the rate of tax is the amount ascertained in accordance with the formula  where:

where:

A is the amount of tax that would be payable by the taxpayer under clauses 1 and 2 on a taxable income equal to the reduced taxable income;

B is 5 times the difference between:

(c) the amount of tax that would be payable by the taxpayer under clause 1 of Part I of Schedule 7 on a taxable income equal to the sum of:

(i) whichever of the following amounts is applicable:

(A) if Division 392 (Long‑term averaging of primary producers’ tax liability) of the Income Tax Assessment Act 1997 applies—the average income worked out under section 392‑45 of that Act;

(B) if sub‑subparagraph (A) does not apply—the reduced taxable income; and

(ii) 20% of the part of the special income component other than the eligible part of the special income component; and

(d) the amount of tax that would be payable by the taxpayer under clause 1 of Part I of Schedule 7 on a taxable income equal to the average income worked out under section 392‑45 of the Income Tax Assessment Act 1997 or reduced taxable income, as the case may be;

C is 45% of the eligible part of the special income component; and

D is the number of whole dollars in the taxable income.

In applying the formula, component B is to be worked out on the assumption that the whole of the taxable income is ordinary taxable income.

Part II—Non‑resident taxpayers

1. In the case of a non‑resident taxpayer who has an eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act and whose taxable income does not consist of or include a special income component, the rates of tax in respect of that part (in this clause referred to as the relevant part) of the taxable income of the taxpayer other than the eligible taxable income of the taxpayer are the rates that would be payable under Part II of Schedule 7 if the relevant part of that taxable income were the taxable income of the taxpayer.

2. In the case of a non‑resident taxpayer who has an eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act and whose taxable income does not consist of or include a special income component, the rate of tax in respect of the eligible taxable income of the taxpayer is 45%.

3. For every $1 of the taxable income of a non‑resident taxpayer:

(a) who has an eligible taxable income for the purposes of Division 6AA of Part III of the Assessment Act; and

(b) whose taxable income consists of or includes a special income component;

the rate of tax is the amount ascertained in accordance with the formula  where:

where:

A is the amount of tax that would be payable by the taxpayer under clauses 1 and 2 on a taxable income equal to the reduced taxable income;

B is 5 times the difference between:

(c) the amount of tax that would be payable by the taxpayer under clause 1 of Part II of Schedule 7 on a taxable income equal to the sum of:

(i) whichever of the following amounts is applicable:

(A) if Division 392 (Long‑term averaging of primary producers’ tax liability) of the Income Tax Assessment Act 1997 applies—the average income worked out under section 392‑45 of that Act;

(B) if sub‑subparagraph (A) does not apply—the reduced taxable income; and

(ii) 20% of the part of the special income component other than the eligible part of the special income component; and

(d) the amount of tax that would be payable by the taxpayer under clause 1 of Part II of Schedule 7 on a taxable income equal to the average income worked out under section 392‑45 of the Income Tax Assessment Act 1997 or reduced taxable income, as the case may be;

C is 45% of the eligible part of the special income component; and

D is the number of whole dollars in the taxable income.

In applying the formula, component B is to be worked out on the assumption that the whole of the taxable income is ordinary taxable income.

Schedule 12—Rates of tax payable by a trustee under section 98 of the Assessment Act where Division 6AA of Part III of that Act applies

Subsections 13(3) and (4) and 15(3)

Part I—Resident beneficiaries

1. In the case of a trustee of a trust estate who is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of a share of a resident beneficiary of the net income of the trust estate where Division 6AA of Part III of that Act applies to a part (in this clause referred to as the eligible part) of that share, the rates of tax in respect of the part (in this clause referred to as the relevant part) of that share other than the eligible part of that share are the rates that would be payable under Part I of Schedule 7 in respect of a taxable income equal to the relevant part of that share if one individual were liable to be assessed and to pay tax on that income.

2. In the case of a trustee of a trust estate who is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of a share of a resident beneficiary of the net income of the trust estate where Division 6AA of Part III of that Act applies to a part of that share, the rate of tax in respect of that part of that share is 45%.

Part II—Non‑resident beneficiaries

1. In the case of a trustee of a trust estate who is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of a share of a non‑resident beneficiary of the net income of the trust estate where Division 6AA of Part III of that Act applies to a part (in this clause referred to as the eligible part) of that share, the rates of tax in respect of the part (in this clause referred to as the relevant part) of that share other than the eligible part of that share are the rates that would be payable under Part II of Schedule 7 in respect of a taxable income equal to the relevant part of that share if one individual were liable to be assessed and to pay tax on that income.

2. In the case of a trustee of a trust estate who is liable to be assessed and to pay tax under section 98 of the Assessment Act in respect of a share of a non‑resident beneficiary of the net income of the trust estate where Division 6AA of Part III of that Act applies to a part of that share, the rate of tax in respect of that part of that share is 45%.