“principal officer”, in relation to a Commonwealth authority, means the person who constitutes, or is acting as the person who constitutes, that authority or, if the authority is constituted by 2 or more persons, the person who is entitled to preside at any meeting of the authority at which he or she is present;

“proceeding under Part VI” has the meaning given in subsection (12);

“property used by an employee” means an artificial limb or other artificial substitute, or a medical, surgical or other similar aid or appliance, used by the employee;

“rehabilitation authority”, in relation to an employee, means:

(a) where the employee is employed by an exempt authority— the Commission;

(b) where the employee is employed by an administering authority—the principal officer of that authority; and

(c) where the employee is employed by a Department or a Commonwealth authority, other than an exempt authority— the Secretary of the Department or the principal officer of the Commonwealth authority, as the case may be;

“rehabilitation program” includes medical, dental, psychiatric and hospital services (whether on an in-patient or out-patient basis), physical training and exercise, physiotherapy, occupational therapy and vocational training;

“relevant authority” means:

(a) in relation to an employee who is employed by an administering authority—that administering authority; and

(b) in relation to any other employee—the Commission;

“relevant period” means the period calculated under section 9;

“spouse” includes:

(a) in relation to an employee or a deceased employee—a person of the opposite sex to the employee who lives with, or immediately before the date of the employee’s death lived with, the employee as the spouse of the employee on a bona fide domestic basis although not legally married to the employee; and

(b) in relation to an employee or a deceased employee who is or was a member of the Aboriginal race of Australia or a descendant of indigenous inhabitants of the Torres Strait Islands—a person who is or was recognised as the employee’s husband or wife by the custom prevailing in the tribe or group to which the employee belongs or belonged;

“suitable employment”, in relation to an employee who has suffered an injury in respect of which compensation is payable under this Act, means:

(a) in the case of an employee who, on the day on which he or she was injured was a permanent employee of the Commonwealth and who did not subsequently terminate that employment—employment by the Commonwealth in work for which the employee is suited having regard to:

(i) the employee’s age, experience, training, language and other skills;

(ii) the employee’s suitability for rehabilitation or vocational retraining;

(iii) where employment is available in a place that would require the employee to change his or her place of residence—whether it is reasonable to expect the employee to change his or her place of residence; and

(iv) any other relevant matter; and

(b) in any other case—any employment (including self-employment), having regard to the matters specified in subparagraphs (a) (i), (ii), (iii) and (iv);

“superannuation amount”, in relation to a pension received by an employee in respect of a week, or a lump sum benefit received by an employee, being a pension or benefit under a superannuation scheme, means an amount equal to:

(a) if the scheme identifies a part of the pension or lump sum as attributable to the contributions made under the scheme by the Commonwealth or Commonwealth authority—the amount of that part; or

(b) in any other case—the amount assessed by the relevant authority to be the part of the pension or lump sum that is so attributable or, if such an assessment cannot be made, the amount of the pension received by the employee in respect of that week or the amount of the lump sum, as the case requires;

“superannuation scheme” means any superannuation scheme under which the Commonwealth or a Commonwealth authority makes contributions on behalf of employees and includes a superannuation or provident scheme established or maintained by the Commonwealth or a Commonwealth authority;

“the 1912 Act” means the Commonwealth Workmen’s Compensation Act 1912;

“the 1930 Act” means the Commonwealth Employees’ Compensation Act 1930;

“the 1971 Act” means the Compensation (Commonwealth Government Employees) Act 1971;

“therapeutic treatment” includes an examination, test or analysis done for the purpose of diagnosing, or treatment given for the purpose of alleviating, an injury.

(2) For the purposes of paragraph (a) of the definition of “dependant”, relationships referred to in that paragraph shall be taken to include:

(a) illegitimate relationships and relationships by adoption; and

(b) relationships that are traced through illegitimate relationships or relationships by adoption.

(3) For the purposes of this Act, any physical or mental injury or ailment suffered by an employee as a result of medical treatment of an injury shall be taken to be an injury if, but only if:

(a) compensation is payable under this Act in respect of the injury for which the medical treatment was obtained; and

(b) it was reasonable for the employee to have obtained that medical treatment in the circumstances.

(4) For the purposes of this Act, a person shall be taken to have been wholly or partly dependent on an employee at the date of the employee’s death if the person would have been so dependent but for an incapacity of the employee that resulted from an injury.

(5) For the purposes of this Act, a person who, immediately before the date of an employee’s death, lived with the employee and was:

(a) the spouse of the employee; or

(b) a child of the employee, being a prescribed child;

shall be taken to be a person who was wholly dependent on the employee at that date.

(6) For the purposes of this Act, other than subsection 17 (5), a son or daughter of a deceased employee who was born alive after the employee’s death shall be treated as if he or she had been born immediately before the employee’s death and was wholly dependent upon the employee at the date of the employee’s death.

(7) In ascertaining, for the purposes of this Act, whether a child is or was dependent on an employee, any amount of:

(a) allowance under Part IX, X or XII of the Social Security Act 1947; or

(b) pension under Part XI of that Act;

shall not be taken into account.

(8) A reference in this Act to an injury suffered by an employee is, unless the contrary intention appears, a reference to an injury suffered by the employee in respect of which compensation is payable under this Act.

(9) A reference in this Act to an incapacity for work is a reference to an incapacity suffered by an employee as a result of an injury, being:

(a) an incapacity to engage in any work; or

(b) an incapacity to engage in work at the same level at which he or she was engaged by the Commonwealth in that work or any other work immediately before the injury happened.

(10) For the purposes of the application of this Act in relation to an employee employed by an administering authority, or a dependant of such a person, a reference in this Act (other than in section 28 or Part III, V, VI, VII or VIII) to the Commission is, unless the contrary intention appears, a reference to that authority.

(11) A reference in this Act to a claimant is, in relation to any time after the death of the claimant, a reference to his or her legal personal representative.

(12) A reference in this Act to the institution of a proceeding under Part VI in respect of a reviewable decision is a reference to the making of an application to the Administrative Appeals Tribunal for review of that decision.

(13) For the purposes of this Act, an employee who is under the influence of alcohol or a drug (other than a drug prescribed for the employee by a legally qualified medical practitioner or dentist and used by the employee in accordance with that prescription) shall be taken to be guilty of serious and wilful misconduct.

Employees

5. (1) In this Act, unless the contrary intention appears, “employee” means a person who is employed by the Commonwealth or by a Commonwealth authority, whether the person is so employed under a law of the Commonwealth or of a Territory or under a contract of service or apprenticeship.

(2) Without limiting the generality of subsection (1):

(a) a member of the Australian Federal Police;

(b) a member of the Defence Force; or

(c) a person (other than a person to whom subsection (3) applies) who is the holder of or is acting in:

(i) an office established by a law of the Commonwealth, other than an office that is declared by the Minister, by notice in writing, to be an office to which this Act does not apply; or

(ii) an office that is established by a law of a Territory (other than the Northern Territory) and is declared by the Minister, by notice in writing, to be an office to which this Act applies;

shall, for the purposes of this Act, be taken to be employed by the Commonwealth, and the person’s employment shall, for those purposes, be taken to be constituted by the person’s performance of duties as such a member of the Australian Federal Police or member of the Defence Force or the duties of that office, as the case may be.

(3) A person who:

(a) constitutes, or is acting as the person constituting, a Commonwealth authority;

(b) is, or is acting as, a member of such an authority; or

(c) is a deputy of such a member;

shall, for the purposes of this Act, be taken to be employed by that authority, and the person’s employment shall, for those purposes, be taken to be constituted by the performance of:

(d) the duties of the authority;

(e) the person’s duties as such a member or acting member; or

(f) the person’s duties as such a deputy;

as the case may be.

(4) A person:

(a) who is ordinarily engaged for employment at a prearranged place at which employers engage persons for employment; and

(b) whose last employer under an engagement at that place was the Commonwealth or a Commonwealth authority;

shall, for the purposes of this Act, be taken to be employed by the Commonwealth, or that authority, as the case may be, until the person is next engaged under such an engagement, and the person’s employment shall, for those purposes, be taken to be constituted by the person’s attendance at that place for the purpose of seeking such an engagement.

(5) Subsection (4) does not operate to make the Commission liable to pay compensation in respect of an injury sustained by an employee during an attendance to which that subsection applies if the injury was sustained because the employee voluntarily and unreasonably subjected himself or herself to an abnormal risk of injury.

(6) The Minister may, by notice in writing, declare:

(a) that persons specified in the notice, being persons who engage in activities or perform acts:

(i) at the request or direction, for the benefit, or under a requirement made by or under a law, of the Commonwealth; or

(ii) at the request or direction, or for the benefit, of a Commonwealth authority;

shall, for the purposes of this Act, be taken to be employed by the Commonwealth, or by that authority, as the case may be; and

(b) that the employment of the person shall, for those purposes, be taken to be constituted by the performance by the person of such acts as are specified in the notice;

and such a declaration shall have effect accordingly.

(7) For the purposes of the application of this Act in relation to a person employed by a Commonwealth authority, references in this Act to the Commonwealth shall be read as references to that authority.

(8) This Act does not apply to:

(a) a member of the Parliament or a Minister of State;

(b) a person who is a Judge as defined by section 4 of the Judges’ Pensions Act 1968;

(c) an officer or employee of the Public Service of an external Territory; or

(d) a seaman to whom the Seamen’s Compensation Act 1911 applies.

(9) A reference to an employee in a provision of this Act that applies to an employee at a time after the Commission or an administering authority has incurred a liability in relation to the employee under this Act includes, unless the contrary intention appears, a reference to a person who has ceased to be an employee.

(10) This Act does not apply in relation to service of a member of the Defence Force in respect of which provision for the payment of pension is made by:

(a) the Veterans’ Entitlement Act 1986 (other than Part IV); or

(b) the Papua New Guinea (Members of the Forces Benefits) Act 1957.

Injury arising out of or in the course of employment

6. (1) Without limiting the circumstances in which an injury to an employee may be treated as having arisen out of, or in the course of, his or her employment, an injury shall, for the purposes of this Act, be treated as having so arisen if it was sustained:

(a) as a result of an act of violence that would not have occurred but for the employee’s employment or the performance by the employee of the duties or functions of his or her employment; or

(b) while the employee:

(i) was at his or her place of work, for the purposes of that employment, or was temporarily absent from that place during an ordinary recess in that employment;

(ii) was travelling between his or her place of residence and place of work, other than during an ordinary recess in that employment;

(iii) was travelling between the place where he or she normally resides and another place, being a place where he or she resides temporarily, as a matter of necessity or convenience, for the purposes of his or her employment;

(iv) was travelling between one of his or her places of work and another of his or her places of work;

(v) was travelling between his or her place of work or place of residence and a place of education for the purpose of attending that place in accordance with:

(a) a condition of his or her employment by the Commonwealth; or

(b) a request or direction of the Commonwealth;

or for the purpose of attending that place with the approval of the Commonwealth, unless he or she was so travelling while on leave without pay;

(vi) was at a place of education, except while on leave without pay, for a purpose referred to in subparagraph (v);

(vii) was travelling between his or her place of work or place of residence and any other place for the purpose of:

(a) obtaining a medical certificate for the purposes of this Act;

(b) receiving medical treatment for an injury;

(c) undergoing a rehabilitation program provided under this Act;

(d) receiving a payment of compensation under this Act;

(e) undergoing a medical examination or rehabilitation assessment in accordance with a requirement made under this Act; or

(f) receiving money due to the employee under the terms of his or her employment, being money that, under the terms of that employment or any agreement or arrangement between the employee and the Commonwealth, is available, or reasonably expected by the employee to be available, for collection at that place; or

(viii) was at a place for a purpose referred to in subparagraph (vii).

(2) Subparagraph (1) (b) (ii), (iii), (iv), (v) or (vii) does not apply where the travel:

(a) was by a route that substantially increased the risk of sustaining an injury when compared with a more direct route; or

(b) was interrupted in a way that substantially increased the risk of sustaining an injury.

(3) Subsection (1) does not apply where an employee sustains an injury while at a place referred to in that subsection if the employee sustained the injury because he or she voluntarily and unreasonably submitted to an abnormal risk of injury.

Provisions relating to diseases

7. (1) Where:

(a) an employee has suffered, or is suffering, from a disease or the death of an employee results from a disease;

(b) the disease is of a kind specified by the Minister by notice in writing as a disease related to employment of a kind specified in the notice; and

(c) the employee was, at any time before symptoms of the disease first became apparent, engaged by the Commonwealth in employment of that kind;

the employment in which the employee was so engaged shall, for the purposes of this Act, be taken to have contributed in a material degree to the contraction of the disease, unless the contrary is established.

(2) Where an employee contracts a disease, any employment in which he or she was engaged by the Commonwealth at any time before symptoms of the disease first became apparent shall, unless the contrary is established, be taken, for the purposes of this Act, to have contributed in a material degree to the contraction of the disease if the incidence of that disease among persons who have engaged in such employment is significantly greater than the incidence of the disease among persons who have engaged in other employment in the place where the employee is ordinarily employed.

(3) Where an employee suffers an aggravation of a disease, any employment in which he or she was engaged by the Commonwealth at any time before symptoms of the aggravation first became apparent shall, unless the contrary is established, be taken, for the purposes of this Act, to have contributed in a material degree to the aggravation if the incidence of the aggravation of that disease among persons suffering from it who have engaged in such employment is significantly greater than the incidence of the aggravation of that disease among persons suffering from it who have engaged in other employment in the place where the employee was ordinarily employed.

(4) For the purposes of this Act, an employee shall be taken to have sustained an injury, being a disease, or an aggravation of a disease, on the day when:

(a) the employee first sought medical treatment for the disease, or aggravation; or

(b) the disease or aggravation resulted in the death of the employee or first resulted in the incapacity for work, or impairment of the employee;

whichever happens first.

(5) The death of an employee shall be taken, for the purposes of this Act, to have resulted from a disease or an aggravation of a disease, if, but

for that disease or aggravation, as the case may be, the death of the employee would have occurred at a significantly later time.

(6) An incapacity for work or impairment of an employee shall be taken, for the purposes of this Act, to have resulted from a disease, or an aggravation of a disease, if, but for that disease or aggravation, as the case may be:

(a) the incapacity or impairment would not have occurred;

(b) the incapacity would have commenced, or the impairment would have occurred, at a significantly later time; or

(c) the extent of the incapacity or impairment would have been significantly less.

(7) A disease suffered by an employee, or an aggravation of such a disease, shall not be taken to be an injury to the employee for the purposes of this Act if the employee has at any time, for purposes connected with his or her employment or proposed employment by the Commonwealth, made a wilful and false representation that he or she did not suffer, or had not previously suffered, from that disease.

Normal weekly earnings

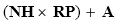

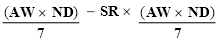

8. (1) For the purposes of this Act, the normal weekly earnings of an employee (other than an employee referred to in subsection (2)) before an injury shall be calculated in relation to the relevant period under the formula:

where:

NH is the average number of hours worked in each week by the employee in his or her employment during the relevant period;

RP is the employee’s average hourly ordinary time rate of pay during that period; and

A is the average amount of any allowance payable to the employee in each week in respect of his or her employment during the relevant period, other than an allowance payable in respect of special expenses incurred, or likely to be incurred, by the employee in respect of that employment.

(2) Where an employee is required to work overtime on a regular basis, the normal weekly earnings of the employee before an injury shall be the amount calculated in accordance with subsection (1) plus an additional amount calculated in relation to the relevant period under the formula:

where:

NH is the average number of hours of overtime worked in each week by the employee in his or her employment during the relevant period; and

OR is the employee’s average hourly overtime rate of pay during that period.

(3) Where an employee was, at the date of the injury, employed by the Commonwealth in part-time employment, temporary employment or unpaid employment, any earnings of the employee from any other employment shall, for the purposes of this section, be treated as earnings of the employee from his or her employment by the Commonwealth.

(4) Where, because of the shortness of the relevant period, it is impracticable to calculate the normal weekly earnings of an employee before an injury under subsection (1) or (2), the normal weekly earnings of the employee before the date of injury shall be taken to be the normal weekly earnings before that date of another employee performing comparable work, being normal weekly earnings from employment by the Commonwealth and calculated under subsection (1) or (2), as the case requires.

(5) Where, because of the shortness of the relevant period, the normal weekly earnings as calculated in relation to the relevant period under subsection (1) or (2) would not fairly represent the weekly rate at which the employee was being paid in respect of his or her employment before the injury, the normal weekly earnings before the date of the injury shall be calculated in relation to such other period as the Commission considers reasonable for the purpose of arriving at an amount that does fairly represent the weekly rate at which the employee was being so paid.

(6) Subject to this section, if the minimum amount per week payable to an employee in respect of his or her employment by the Commonwealth at the date of the injury is increased, or would have been increased if the employee had continued in that employment, because of:

(a) the attainment by the employee of a particular age;

(b) the completion by the employee of a particular period of service; or

(c) the receipt by the employee of an increase in salary, wages or pay by way of an increment in a range of salary, wages or pay applicable to the employee or to his or her office, position or appointment;

the normal weekly earnings of the employee before the injury, as calculated under the preceding subsections, shall be increased by the same percentage as the percentage by which that minimum amount per week is increased, or would have been increased, as the case may be.

(7) Subject to this section, if:

(a) an employee continues to be employed by the Commonwealth after the date of an injury; and

(b) the minimum amount per week payable to the employee in respect of that employment is increased because of the promotion of the employee;

the normal weekly earnings of the employee before the injury, as calculated under the preceding subsections, shall be increased by the same percentage as the percentage by which that minimum amount per week is increased.

(8) Subject to this section, where:

(a) the employment of an employee is of a kind referred to in subsection 5 (4) or (6) or subsection (3) of this section; and

(b) the employee is not receiving earnings from any other employment at the date of the injury;

the normal weekly earnings of the employee before the injury shall be an amount determined by the Commission to be the amount per week that the employee would have been able to earn at the date of the injury (including any amount in respect of overtime worked on a regular basis) if he or she had engaged in suitable paid employment.

(9) If the minimum amount per week payable in respect of employees included in a class of employees of which the employee was a member at the date of the injury is increased or reduced on or after that date as a result of:

(a) the operation of a law of the Commonwealth or of a State or Territory; or

(b) the making, alteration or operation of an award, order, determination or industrial agreement, or of the doing of any other act or thing, under such a law;

the normal weekly earnings of the employee before the injury, as calculated under the preceding subsections, shall be increased or reduced by the same percentage as the percentage by which that minimum amount was so increased or reduced, as the case may be.

(10) If the amount of the normal weekly earnings of an employee before an injury, as calculated under the preceding subsections, would exceed:

(a) where the employee continues to be employed by the Commonwealth—the amount per week of the earnings that the employee would receive if he or she were not incapacitated for work; or

(b) where the employee has ceased to be employed by the Commonwealth—whichever is the greater of the following amounts:

(i) the amount per week of the earnings that the employee would receive if he or she had continued to be employed by the Commonwealth in the employment in which he or she was engaged at the date of the injury;

(ii) the amount per week of the earnings that the employee would receive if he or she had continued to be employed by

the Commonwealth in the employment in which he or she was engaged at the date on which the employment by the Commonwealth ceased;

the amount so calculated shall be reduced by the amount of the excess.

Relevant period

9. (1) For the purposes of calculating the normal weekly earnings of an employee before an injury, a reference in section 8 to the relevant period is, subject to this section, a reference to the latest period of 2 weeks before the date of the injury during which the employee was continuously employed by the Commonwealth.

(2) Subject to subsection (3), if, during the period referred to in subsection (1), the minimum amount per week payable to an employee in respect of his or her employment by the Commonwealth was varied as a result of:

(a) the operation of a law of the Commonwealth or of a State or Territory; or

(b) the making, alteration or operation of an award, order, determination or industrial agreement, or the doing of any other act or thing, under such a law;

any part of that period that occurred before the variation, or last variation, took place shall be disregarded for the purposes of calculating the relevant period.

(3) Where in any case the application of subsection (2) would require that a period be disregarded for the purposes of calculating the relevant period in relation to an employee, and as a result of disregarding that period:

(a) it would be impracticable to calculate under section 8 the normal weekly earnings of the employee before an injury; or

(b) the normal weekly earnings as so calculated would not fairly represent the weekly rate at which the employee was being paid in respect of his or her employment by the Commonwealth before the injury;

subsection (2) shall not apply in that case, but the normal weekly earnings of the employee during that period shall be taken to be the amount that would have been his or her normal weekly earnings during that period if the variation had taken effect at the beginning of that period.

(4) If, during any part of the period calculated under the preceding subsections, the employee’s earnings were reduced, or the employee did not receive any earnings, because of absence from his or her employment for any reason, that part of that period shall be disregarded for the purposes of calculating the relevant period.

Recovery of damages

10. For the purposes of this Act, damages shall be taken to have been recovered by an employee, or by or for the benefit of a dependant of a deceased employee, when the amount of the damages was paid to or for the benefit of the employee or dependant, as the case may be.

Liability of relevant authority

11. The liability of a relevant authority to pay compensation to a person under this Act is the liability of that authority to pay to the person such amount or amounts as are determined by that authority to be payable to the person under this Act.

Amounts of compensation

12. An amount of compensation payable under a provision of this Act in respect of an injury is, unless the contrary intention appears, in addition to an amount of compensation paid or payable under any other provision of this Act in respect of that injury.

Indexation

13. (1) In this section:

“index number”, in relation to a quarter, means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of that quarter;

“relevant amount” means the amount specified in subsection 17 (3), (4) or (5), 18 (2), 19 (7), (8) or (9), 24 (9), 27 (2), 29 (1) or (3), 30 (1) or 137 (1);

“relevant year” means the period of 12 months commencing on 1 July 1988 and each subsequent period of 12 months.

(2) Subject to subsection (3), if at any time, whether before or after the commencement of this section, the Australian Statistician has published or publishes an index number in respect of a quarter in substitution for an index number previously published by the Australian Statistician in respect of that quarter, the publication of the later index number shall be disregarded for the purposes of this section.

(3) If at any time, whether before or after the commencement of this section, the Australian Statistician has changed or changes the reference base for the Consumer Price Index, then, for the purposes of the application of this section after the change took place or takes place, regard shall be had only to the index number published in terms of the new reference base.

(4) Where the factor ascertained under subsection (5) in relation to a relevant year is greater than one, this Act has effect as if for each relevant amount there were substituted, on the first day of that relevant year, an amount calculated by multiplying by that factor:

(a) if, by virtue of another application or other applications of this section, this Act has effect as if another amount or amounts were substituted for the relevant amount—the substituted amount or the last substituted amount; or

(b) in any other case—the relevant amount.

(5) The factor to be ascertained for the purposes of subsection (4) in relation to a relevant year is the number (calculated to 3 decimal places) ascertained by dividing the index number of the December quarter immediately before the relevant year by the index number for the December quarter immediately before that first-mentioned December quarter.

(6) Where the factor ascertained under subsection (5) in relation to a relevant year would, if it were calculated to 4 decimal places, end with a number greater than 4, the factor ascertained under that subsection in relation to that relevant year shall be taken to be the factor calculated to 3 decimal places in accordance with that subsection and increased by 0.001.

PART II—COMPENSATION

Division 1—Injuries, property loss or damage, medical expenses

Compensation for injuries

14. (1) Subject to this Part, the Commission is liable to pay compensation in accordance with this Act in respect of an injury suffered by an employee if the injury results in death, incapacity for work, or impairment.

(2) Compensation is not payable in respect of an injury that is intentionally self-inflicted.

(3) Compensation is not payable in respect of an injury that is caused by the serious and wilful misconduct of the employee but is not intentionally self-inflicted, unless the injury results in death, or serious and permanent impairment.

Compensation for loss of or damage to property used by employee

15. (1) If:

(a) an employee has an accident arising out of and in the course of his or her employment by the Commonwealth; and

(b) the accident does not cause injury to the employee but results in the loss of, or damage to, property used by the employee;

the Commission is liable to pay compensation to the employee of an amount equal to the amount of the expenditure reasonably incurred by the employee in the necessary replacement or repair of the property.

(2) For the purposes of subsection (1), expenditure incurred by an employee in the necessary replacement or repair of property used by the employee shall be taken to include any fees or charges paid or payable by

the employee to a legally qualified medical practitioner or dentist or other qualified person for a consultation, examination, prescription or other service reasonably rendered in connection with the replacement or repair.

(3) Compensation is not payable under this section if the loss or damage is attributable to the serious and wilful misconduct of the employee.

Compensation in respect of medical expenses etc.

16. (1) Where an employee suffers an injury, the Commission is liable to pay, in respect of the cost of medical treatment obtained in relation to the injury (being treatment that it was reasonable for the employee to obtain in the circumstances), compensation of such amount as the Commission determines is appropriate to that medical treatment.

(2) Subsection (1) applies whether or not the injury results in death, incapacity for work, or impairment.

(3) For the purposes of subsection (1), the cost of medical treatment shall, in a case where the treatment involves the supply, replacement or repair of property used by the employee, be deemed to include any fees or charges paid or payable by the employee to a legally qualified medical practitioner or dentist or other qualified person for a consultation, examination, prescription or other service reasonably required in connection with that supply, replacement or repair.

(4) An amount of compensation payable by the Commission under subsection (1) is payable:

(a) to, or in accordance with the directions of, the employee;

(b) if the employee dies before the compensation is paid and without having paid the cost referred to in subsection (1) and another person, not being the legal personal representative of the employee, has paid that cost—to that other person; or

(c) if that cost has not been paid and the employee, or the legal personal representative of the employee, does not make a claim for the compensation—to the person to whom that cost is payable.

(5) Where a person is liable to pay any cost referred to in subsection (1), any amount paid under subsection (4) to the person to whom that cost is payable is, to the extent of the payment, a discharge of the liability of the first-mentioned person.

(6) Subject to subsection (7), where compensation in respect of the cost of medical treatment is payable, the Commission is liable to pay compensation to the employee of an amount equal to the amount of the expenditure reasonably incurred by the employee in making a necessary journey for the purpose of obtaining that medical treatment or remaining, for the purpose of obtaining that medical treatment, at a place to which the employee has made a journey for that purpose.

(7) The Commission is not liable to pay compensation under subsection (6) unless:

(a) the journey covered a substantial distance; or

(b) where the journey involved the use of public transport or ambulance services—the employee’s injury reasonably required the use of such transport or services regardless of the distance involved.

(8) The matters to which the Commission shall have regard in deciding questions arising under subsections (6) and (7) include:

(a) the place or places where appropriate medical treatment was available to the employee;

(b) the means of transport available to the employee for the journey;

(c) the route or routes by which the employee could have travelled; and

(d) the accommodation available to the employee.

(9) Where:

(a) an employee suffers an injury;

(b) a person has reasonably incurred expenditure in connection with the transportation of the employee, or, if the employee has died, of his or her body, from the place where the injury was sustained to a hospital or similar place, or to a mortuary; and

(c) the employee, or the legal personal representative of the employee, does not make a claim for compensation in respect of that expenditure;

the Commission is liable to pay compensation to the person who incurred the expenditure of an amount equal to the amount of that expenditure.

Division 2—Injuries resulting in death

Compensation for injuries resulting in death

17. (1) This section applies where an injury to an employee results in death.

(2) Subject to this section and sections 16 and 18, if the employee dies without leaving dependants, compensation is not payable in respect of the injury.

(3) Subject to this section and to sections 16 and 18, if the employee dies leaving dependants some or all of whom were, at the date of the employee’s death, wholly dependent on the employee, the Commission is liable to pay compensation in respect of the injury of $120,000 and that compensation is payable to, or in accordance with the directions of, the Commission for the benefit of all of those dependants.

(4) If the employee dies without leaving dependants who were wholly dependent on the employee at the date of the employee’s death but leaving dependants who were partly dependent on the employee at that date:

(a) subject to this section and to sections 16 and 18, the Commission is liable to pay compensation in respect of the injury of such amount, not exceeding $120,000, as the Commission determines, having regard to any losses suffered by those dependants as a result of the cessation of the employee’s earnings; and

(b) that compensation is payable to, or in accordance with the directions of, the Commission for the benefit of those dependants.

(5) If:

(a) a prescribed child was, at the date of the injury or at the date of the employee’s death, wholly or mainly dependent on the employee;

(b) a prescribed child, being a child of the employee, was born after the employee’s death; or

(c) a prescribed child would, if the employee had not died, have been wholly or mainly dependent on the employee;

the Commission is liable to pay compensation at the rate of $40 a week and that compensation is payable to, or in accordance with the directions of, the Commission for the benefit of that child from the date of the employee’s death or the date of the birth of the child, whichever is the later.

(6) Compensation is not payable under subsection (5) in respect of:

(a) any period during which the child is not a prescribed child; and

(b) in the case of a child referred to in paragraph (5) (c)—any period during which, if the employee had not died, the child would not have been wholly or mainly dependent upon the employee.

(7) An amount of compensation paid or payable under this Act before the death of an employee:

(a) is not affected by subsection (2);

(b) shall not be deducted from the compensation payable under subsection (3); and

(c) shall not be taken into account in determining the compensation payable under subsection (4).

(8) Where an amount of compensation is payable under this section for the benefit of 2 or more dependants of the deceased employee, the Commission shall determine the shares of those dependants in that amount as the Commission thinks fit, having regard to any losses suffered by those dependants as a result of the cessation of the employee’s earnings.

(9) A reference in this section to a dependant of a deceased employee shall be read as a reference to a dependant by or on behalf of whom a claim is made for compensation under this section.

(10) Where claims for compensation under this section are made by or on behalf of 2 or more dependants of a deceased employee, the Commission shall make one determination in respect of those claims.

Compensation in respect of funeral expenses

18. (1) Where an injury to an employee results in death, the Commission is liable to pay compensation in respect of the cost of the employee’s funeral to the person who paid the cost of the funeral or, if that cost has not been paid, to the person who carried out the funeral.

(2) The amount of compensation is such amount, not exceeding $1,500, as the Commission considers reasonable, having regard to:

(a) the charges ordinarily made for funerals in the place where the funeral was carried out; and

(b) any amount paid or payable in respect of the cost of the funeral under any other law of the Commonwealth.

(3) Where a person is liable to pay the cost of the funeral of an employee, any amount paid under this section to the person who carried out the funeral is, to the extent of the payment, a discharge of the liability of the first-mentioned person.

Division 3—Injuries resulting in incapacity for work

Compensation for injuries resulting in incapacity

19. (1) This section applies to an employee who is incapacitated for work as a result of an injury, other than an employee to whom section 20, 21 or 22 applies.

(2) Subject to this Part, the Commission is liable to pay compensation to the employee in respect of the injury, for each of the first 45 weeks (whether consecutive or otherwise) during which the employee is incapacitated, of an amount calculated under the formula:

where:

NWE is the amount of the employee’s normal weekly earnings; and

AE is the amount per week (if any) that the employee is able to earn in suitable employment.

(3) Subject to this Part, the Commission is liable to pay to the employee, in respect of the injury, for each week during which the employee is incapacitated, other than a week referred to in subsection (2), compensation:

(a) where the employee is not employed during that week—of an amount equal to 75% of his or her normal weekly earnings less the amount (if any) that he or she was able to earn during that week in suitable employment;

(b) where the employee is employed for 25% or less of his or her normal weekly hours during that week—of an amount that, when added to the amount of earnings payable to the employee for that employment, results in an amount equal to 80% of his or her normal weekly earnings;

(c) where the employee is employed for more than 25% but not more than 50% of his or her normal weekly hours during that week—of an amount that, when added to the amount of earnings payable to the employee for that employment, results in an amount equal to 85% of his or her normal weekly earnings;

(d) where the employee is employed for more than 50% but not more than 75% of his or her normal weekly hours during that week—of an amount that, when added to the amount of earnings payable to the employee for that employment, results in an amount equal to 90% of his or her normal weekly earnings;

(e) where the employee is employed for more than 75% but less than 100% of his or her normal weekly hours during that week—of an amount that, when added to the amount of earnings payable to the employee for that employment, results in an amount equal to 95% of his or her normal weekly earnings; and

(f) where the employee is employed for 100% of his or her normal weekly hours during that week—of an amount that, when added to the amount of earnings payable to the employee for that employment, results in an amount equal to 100% of his or her normal weekly earnings.

(4) In determining, for the purposes of subsections (2) and (3), the amount per week that an employee is able to earn in suitable employment, the Commission shall have regard to:

(a) where the employee is in employment—the amount per week that the employee is earning in that employment;

(b) where, after becoming incapacitated for work, the employee received an offer of suitable employment and failed to accept that offer— the amount per week that the employee would be earning in that employment if he or she were engaged in that employment;

(c) where, after becoming incapacitated for work, the employee received an offer of suitable employment and, having accepted that offer, failed to engage, or to continue to engage, in that employment—the amount per week that the employee would be earning in that employment if he or she were engaged in that employment;

(d) where, after becoming incapacitated for work, the employee received an offer of suitable employment on condition that the employee completed a reasonable rehabilitation or vocational retraining program and the employee failed to fulfil that condition—the amount that the employee would be earning in that employment if he or she were engaged in that employment;

(e) where, after becoming incapacitated for work, the employee has failed to seek suitable employment—the amount per week that, having regard to the state of the labour-market at the relevant time, the employee could reasonably be expected to earn in such employment if he or she were engaged in such employment;

(f) where paragraph (b), (c), (d) or (e) applies to the employee— whether the employee’s failure to accept an offer of employment, to engage, or to continue to engage, in employment, to undertake, or to complete, a rehabilitation or vocational retraining program or to seek employment, as the case may be, was, in the Commission’s opinion, reasonable in all the circumstances; and

(g) any other matter that the Commission considers relevant.

(5) Where an amount of compensation calculated under subsection (3) exceeds 150% of the amount called the “Average Weekly Ordinary Time Earnings of Full-time Adults”, as published from time to time by the Australian Statistician, the amount so calculated shall be reduced by an amount equal to the excess.

(6) Where an amount of compensation calculated under paragraph (3) (a) is less than the minimum earnings, the amount so calculated shall be increased by an amount equal to the difference between that amount and the minimum earnings.

(7) For the purposes of subsection (6), the minimum earnings of an employee shall be taken to be:

(a) $202, or, if subsection (8) or (9) applies in relation to the employee, the sum of $202 and the amount or amounts required to be added under whichever of those subsections applies; or

(b) an amount equal to 90% of the employee’s normal weekly earnings;

whichever is less.

(8) If there are prescribed persons wholly or mainly dependent on the employee, there shall be added to the amount of $202 specified in paragraph (7) (a) the amount of $50.

(9) If there are prescribed children in relation to whom this Act applies (whether born before, on or after the date of the injury) wholly or mainly dependent on the employee, there shall be added to the amount of $202 specified in paragraph (7) (a) the amount of $25 for each of those children, but an amount shall not be so added for a child in relation to any period before the date of birth of that child.

(10) If a prescribed child is:

(a) a prescribed person in relation to the employee; and

(b) the only prescribed person who is wholly or mainly dependent on the employee;

subsection (9) does not apply in relation to that child.

(11) If 2 or more prescribed children are each:

(a) a prescribed person in relation to the employee; and

(b) wholly or mainly dependent on the employee;

subsection (8) applies in relation to one of those children and subsection (9) applies in relation to the remainder of those children.

(12) In this section, “prescribed person”, in relation to an employee, means:

(a) the spouse of the employee; or

(b) any of the following persons, being a person who is 16 or more:

(i) the father, mother, step-father, step-mother, father-in-law, mother-in-law, grandfather, grandmother, son, daughter, step-son, step-daughter, grandson, granddaughter, brother, sister, half-brother or half-sister of the employee;

(ii) a person in relation to whom the employee stands in the position of a parent or who stands in the position of a parent to the employee;

(iii) a person (other than the spouse of the employee or a person referred to in subparagraph (i) or (ii)) who is wholly or mainly maintained by the employee and has the care of a prescribed child, being a child who is wholly or mainly dependent on the employee.

(13) For the purposes of the definition of “prescribed person” in subsection (12), relationships referred to in that definition shall be taken to include illegitimate relationships and relationships by adoption and relationships that are traced through illegitimate relationships or relationships by adoption.

(14) For the purposes of the definition of “prescribed person” in subsection (12), a person who has the care of a child referred to in subparagraph (12) (b) (iii) shall not be taken not to be wholly or mainly maintained by an employee merely because the employee pays remuneration to the person for caring for that child.

Compensation for injuries resulting in incapacity where employee is in receipt of a superannuation pension

20. (1) This section applies to an employee who, being incapacitated for work as a result of an injury, retires voluntarily, or is compulsorily retired, from his or her employment at any time after the commencement of this section and, as a result of the retirement, receives a pension under a superannuation scheme.

(2) The Commission is liable to pay compensation to the employee, in respect of the injury, in accordance with this section for each week after the date of the retirement during which the employee is incapacitated.

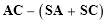

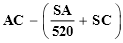

(3) The amount of compensation is an amount calculated under the formula:

where:

AC is the amount of compensation that would have been payable to the employee for a week if:

(a) section 19, other than subsection 19 (6), had applied to the employee; and

(b) the week were a week referred to in subsection 19 (3);

SA is the superannuation amount; and

SC is the amount of superannuation contributions that would have been required to be paid by the employee in that week if he or she were still contributing to the superannuation scheme.

Compensation for injuries resulting in incapacity where employee is in receipt of a lump sum benefit

21. (1) This section applies to an employee who, being incapacitated for work as a result of an injury retires voluntarily, or is compulsorily retired, from his or her employment at any time after the commencement of this section and, as a result of the retirement, receives a lump sum benefit under a superannuation scheme.

(2) The Commission is liable to pay compensation to the employee, in respect of the injury, in accordance with this section for each week after the date of the retirement during which the employee is incapacitated.

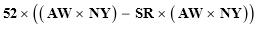

(3) The amount of compensation is an amount calculated under the formula:

where:

AC is the amount of compensation that would have been payable to the employee for a week if:

(a) section 19, other than subsection 19 (6), had applied to the employee; and

(b) the week were a week referred to in subsection 19 (3);

SA is the superannuation amount; and

SC is the amount of superannuation contributions that would have been required to be paid by the employee in that week if he or she were still contributing to the superannuation scheme.

Compensation where employee is maintained in a hospital

22. (1) Where:

(a) as a result of an injury, an employee (other than an employee to whom section 20 or 21 applies) is maintained as a patient in a hospital, nursing home or similar place and has been so maintained for a continuous period of not less than one year; and

(b) there are no prescribed persons or prescribed children who are dependent on the employee;

the Commission is liable to pay compensation to the employee in respect of the injury of such amount, for each week during which the employee is so maintained, as is determined by the Commission having regard to:

(c) the present and probable future needs and expenses of the employee; and

(d) the period during which the employee is likely to be such a patient;

but the amount so determined shall not be less than one-half of, nor more than, the amount per week of compensation that would have been payable to the employee under section 19, 20 or 21, as the case requires, had that section applied to the employee.

(2) In this section, “prescribed person”, in relation to an employee, has the same meaning as in section 19.

Compensation for incapacity not payable in certain cases

23. (1) Compensation is not payable under section 19, 20, 21 or 22 to a person who has reached 65.

(2) Compensation is not payable under section 19, 20 or 21 in respect of any period during which the employee is imprisoned in connection with his or her conviction of an offence.

(3) Subject to section 31, where a determination is made that an amount of compensation is payable to an employee under section 30 in respect of an injury, compensation is not payable to the employee under section 19, 20 or 21 in respect of a period of incapacity for work resulting from that injury, being a period occurring after the day on which the determination is made.

Division 4—Injuries resulting in impairment

Compensation for injuries resulting in permanent impairment

24. (1) Where an injury to an employee results in a permanent impairment, the Commission is liable to pay compensation to the employee, in respect of the injury.

(2) For the purpose of determining whether an impairment is permanent, the Commission shall have regard to:

(a) the duration of the impairment;

(b) the likelihood of improvement in the employee’s condition;

(c) whether the employee has undertaken all reasonable rehabilitative treatment for the impairment; and

(d) any other relevant matters.

(3) Subject to this section, the amount of compensation payable to the employee is such amount, as is assessed by the Commission under subsection (4), being an amount not exceeding the maximum amount at the date of the assessment.

(4) The amount assessed by the Commission shall be an amount that is the same percentage of the maximum amount as the percentage determined by the Commission under subsection (5).

(5) The Commission shall determine the degree of permanent impairment of the employee resulting from an injury under the provisions of the approved Guide.

(6) The degree of permanent impairment shall be expressed as a percentage.

(7) Subject to section 25, where the Commission determines that the degree of permanent impairment of the employee is less than 10%, an amount of compensation is not payable to the employee under this section.

(8) Subsection (7) does not apply in relation to an impairment resulting from the loss, or injury to, a finger or toe.

(9) For the purposes of this section, the maximum amount is $80,000.

Interim payment of compensation

25. (1) Where the Commission:

(a) makes a determination that an employee is suffering from a permanent impairment as a result of an injury; and

(b) is satisfied that the degree of the impairment is equal to or more than 10% but has not made a final determination of the degree of impairment;

the Commission shall, on the written request of the employee made at any time before the final determination is made, make an interim determination of the degree of permanent impairment under section 24 and assess an amount of compensation payable to the employee.

(2) The amount assessed by the Commission under subsection (1) shall be an amount that is the same percentage of the maximum amount specified in subsection 24 (9) as the percentage determined by the Commission under subsection (1) to be the degree of permanent impairment of the employee.

(3) Where, after an amount of compensation has been paid to an employee following the making of an interim determination, the Commission makes a final determination of the degree of permanent impairment of the employee, there is payable to the employee an amount equal to the difference (if any) between the amount payable under section 24 on the making of the final determination and the amount paid to the employee under this section.

(4) Where the Commission has made a final assessment of the degree of permanent impairment of an employee, no further amounts of compensation shall be payable to the employee in respect of a subsequent increase in the degree of impairment, unless the increase is 10% or more.

Payment of compensation

26. (1) Subject to this section, an amount of compensation payable to an employee under section 24 or 25, shall be paid to the employee within 30 days after the date of the assessment of the amount.

(2) Where an amount of compensation is not paid to an employee in accordance with subsection (1), interest is payable to the employee on that amount in respect of the period commencing on the expiration of the period of 30 days referred to in that subsection and ending on the day on which the amount is paid.

(3) Interest payable under subsection (2) shall be paid at such rate as is from time to time specified by the Minister for the purposes of this section by notice in writing.

(4) This section does not apply where:

(a) the Commission has been requested under Part VI to reconsider a determination under section 24 or 25, as the case may be; or

(b) a proceeding in respect of such a determination has been instituted under Part VI.

Compensation for non-economic loss

27. (1) Where an injury to an employee results in a permanent impairment and compensation is payable in respect of the injury under section 24, the Commission is liable to pay additional compensation in accordance with this section to the employee in respect of that injury for any non-economic loss suffered by the employee as a result of that injury or impairment.

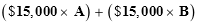

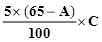

(2) The amount of compensation is an amount assessed by the Commission under the formula:

where:

A is the percentage finally determined by the Commission under section 24 to be the degree of permanent impairment of the employee; and

B is the percentage determined by the Commission under the approved Guide to be the degree of non-economic loss suffered by the employee.

Approved Guide

28. (1) The Commission may, from time to time, prepare a written document, to be called the “Guide to the Assessment of the Degree of Permanent Impairment”, setting out:

(a) criteria by reference to which the degree of the permanent impairment of an employee resulting from an injury shall be determined;

(b) criteria by reference to which the degree of non-economic loss suffered by an employee as a result of an injury or impairment shall be determined; and

(c) methods by which the degree of permanent impairment and the degree of non-economic loss, as determined under those criteria, shall be expressed as a percentage.

(2) The Commission may, from time to time, by instrument in writing, vary or revoke the approved Guide.

(3) A document prepared by the Commission under subsection (1), and an instrument under subsection (2), have no force or effect unless and until approved by the Minister.

(4) Where the Commission, an administering authority or the Administrative Appeals Tribunal is required to assess or re-assess, or review the assessment or re-assessment of, the degree of permanent impairment of an employee resulting from an injury, or the degree of non-economic loss suffered by an employee, the provisions of the approved Guide are binding on the Commission, the administering authority or the Administrative Appeals Tribunal, as the case may be, in the carrying out of that assessment, reassessment or review, and the assessment, re-assessment or review shall be made under the relevant provisions of the approved Guide.

(5) The percentage of permanent impairment or non-economic loss suffered by an employee as a result of an injury ascertained under the methods referred to in paragraph (1) (c) may be 0%.

(6) In preparing criteria for the purposes of paragraphs (1) (a) and (b), or in varying those criteria, the Commission shall have regard to medical opinion concerning the nature and effect (including possible effect) of the injury and the extent (if any) to which impairment resulting from the injury, or non-economic loss resulting from the injury or impairment, may reasonably be capable of being reduced or removed.

(7) When a document prepared by the Commission in accordance with subsection (1), or an instrument under subsection (2), has been approved by the Minister, the Commission shall cause copies of the document or instrument, as the case may be, to be laid before each House of the Parliament within 15 sitting days of that House after the Minister receives those copies.

(8) The Commission shall make copies of the “Guide to the Assessment of the Degree of Permanent Impairment” that has been approved by the Minister, and of any variation of that Guide that has been so approved, available upon application by a person and payment of the prescribed fee (if any).

(9) Sections 48 (other than paragraphs (1) (a) and (b) and subsection (2) ), 49 and 50 of the Acts Interpretation Act 1901 apply in relation to a document, being the approved Guide or an instrument varying or revoking that Guide that has been approved by the Minister, as if, in those sections, references to regulations were references to such a document and references to a regulation were references to a provision of such a document.

(10) For the purpose of the application of the provisions of the Acts Interpretation Act 1901 in accordance with subsection (9), a document referred to in that subsection shall be taken to have been made on the date on which it was approved by the Minister under this section.

Division 5—Household and attendant care services

Compensation for household services and attendant care services

29. (1) Subject to subsection (5), where, as a result of an injury to an employee, the employee obtains household services that he or she reasonably requires, the Commission is liable to pay compensation of such amount per week as the Commission considers reasonable in the circumstances, being not less than 50% of the amount per week paid or payable by the employee for those services nor more than $200.

(2) Without limiting the matters that the Commission may take into account in determining the household services that are reasonably required in a particular case, the Commission shall, in making such a determination, have regard to the following matters:

(a) the extent to which household services were provided by the employee before the date of the injury and the extent to which he or she is able to provide those services after that date;

(b) the number of persons living with the employee as members of his or her household, their ages and their need for household services;

(c) the extent to which household services were provided by the persons referred to in paragraph (b) before the injury;

(d) the extent to which the persons referred to in paragraph (b), or any other members of the employee’s family, might reasonably be expected to provide household services for themselves and for the employee after the injury;

(e) the need to avoid substantial disruption to the employment or other activities of the persons referred to in paragraph (b).

(3) Where, as a result of an injury to an employee, the employee obtains attendant care services that he or she reasonably requires, the Commission is liable to pay compensation of:

(a) $200 per week; or

(b) an amount per week equal to the amount per week paid or payable by the employee for those services;

whichever is less.

(4) Without limiting the matters that the Commission may take into account in determining the attendant care services that are reasonably required in a particular case, the Commission shall, in making such a determination, have regard to the following matters:

(a) the nature of the employee’s injury and the degree to which that injury impairs his or her ability to provide for his or her personal care;

(b) the extent to which any medical service or nursing care received by the employee provides for his or her essential and regular personal care;

(c) the extent to which it is reasonable to meet any wish by the employee to live outside an institution;

(d) the extent to which attendant care services are necessary to enable the employee to undertake or continue employment;

(e) any assessment made in relation to the rehabilitation of the employee;

(f) the extent to which a relative of the employee might reasonably be expected to provide attendant care services.

(5) The Commission is not liable to pay compensation under subsection (1) in respect of any week within the period of 28 days beginning on the date of the injury unless the Commission determines otherwise in a particular case on the ground of financial hardship or the need to provide for adequate supervision of dependent children.

(6) An amount of compensation payable by the Commission under subsection (1) or (3) is payable:

(a) where the employee has paid for the household services or attendant care services, as the case may be—to the employee; or

(b) in any other case—to the person who provided those services.

(7) Where the Commission pays an amount to a person who provided household services or attendant care services to an employee, the payment of the amount is, to the extent of the payment, a discharge of the liability of the employee to pay for those services.

Division 6—Miscellaneous

Redemption of compensation

30. (1) Where:

(a) the Commission is liable to make weekly payments under section 19, 20 or 21 to an employee in respect of an injury resulting in an incapacity;

(b) the amount of those payments is $50 per week or less; and

(c) the Commission is satisfied that the degree of the employee’s incapacity is unlikely to change;

the Commission shall make a determination that its liability to make further payments to the employee under that section be redeemed by the payment to the employee of a lump sum.

(2) The amount of the lump sum is the amount calculated under the formula:

where:

AW is the amount per week payable to the employee under section 19, 20 or 21, as the case may be, at the date of the determination;

ND is the number of days between the date of the determination and the day on which the employee reaches 65; and

SR is the specified rate applicable at the date of the determination.

(3) The Minister may, from time to time, by notice in writing, specify a rate for the purposes of subsection (2).

Recurrent payments after payment of lump sum

31. (1) Where:

(a) at any time after a lump sum is paid to an employee under section 30 in respect of an injury, the injury results in the employee being incapacitated for work to the extent that the employee is not able to engage in suitable employment; and

(b) the incapacity is likely to continue indefinitely;

the Commission is liable to pay compensation to the employee under this section during the period of the incapacity.

(2) The amount of compensation is an amount per week equal to the amount per week that would, but for the payment of the lump sum, have been payable to the employee under section 19, 20 or 21, as the case may be, in respect of the incapacity, less the amount per week that was redeemed at the date of the determination under section 30.

Cancelled determinations not to affect certain payments of compensation

32. (1) For the purposes of subsections 23 (3) and 31 (2), account shall not be taken of a determination that the liability of the Commission to make further payments to an employee under section. 19, 20 or 21 is to be redeemed if the determination:

(a) is revoked by the Commission; or

(b) is set aside by a tribunal or court.

(2) Paragraph (1) (b) does not apply if a further determination is made by a tribunal or court, being a determination under which the liability of the Commission to make further payments to the employee under section 19, 20 or 21 is to be redeemed.

Reduction of compensation in certain cases

33. (1) Where, in relation to a day in respect of which compensation is payable to an employee under section 19, 20, 21, 22 or 31, an amount or amounts are paid or payable to the employee by the Commonwealth by way of salary, wages or pay, the amount of compensation payable under

that section in respect of that day shall be reduced by the amount, or the sum of the amounts, so paid or payable to the employee.

(2) In this section, a reference to an amount paid or payable to an employee by the Commonwealth does not include a reference to:

(a) an amount by way of pay in respect of a period of leave of absence granted, or in lieu of the grant of a period of leave of absence, under section 16 or 17 of the Long Service Leave (Commonwealth Employees) Act 1976, section 73 or 74 of the Public Service Act 1922 as in force before 20 December 1976 or section 7 or 8 of the Commonwealth Employees’ Furlough Act 1943 as in force before that day;

(b) an amount by way of pay in respect of a period of leave of absence granted, or in lieu of the grant of a period of leave of absence, under regulations in force under the Naval Defence Act 1910, the Defence Act 1903 or the Air Force Act 1923;

(c) any amount that the employee is able to earn in suitable employment or any amount of earnings payable to an employee, being an amount that has been taken into account for the purposes of calculating the amount of compensation payable to the employee under section 19; or

(d) an amount of deferred pay within the meaning of Part III of the Defence Forces Retirement Benefits Act 1959 or of any provision of that Part.

PART III—REHABILITATION

Approved rehabilitation program providers

34. (1) The Commission may, by instrument in writing, approve, for the purposes of this Act, a person who provides rehabilitation programs.

(2) An administering authority may, by instrument in writing, approve, for the purposes of this Act and in relation to its employees only, a person who provides rehabilitation programs.

(3) The Commission or an administering authority may approve a person either on its own motion or on request by the person.

(4) The matters to which the Commission or an administering authority shall have regard in deciding whether to approve a person include:

(a) the qualifications of the person and the person’s employees; and

(b) the effectiveness, availability and cost of the rehabilitation programs provided by the person.

Exempt authorities

35. The Minister may, by notice in writing, declare a Department or Commonwealth authority specified in the notice to be an exempt authority.

Assessment of capability of undertaking rehabilitation program

36. (1) Where an employee suffers an injury resulting in an incapacity for work or an impairment, the rehabilitation authority may at any time, and shall on the written request of the employee, arrange for the assessment of the employee’s capability of undertaking a rehabilitation program.

(2) An assessment shall be made by:

(a) a legally qualified medical practitioner nominated by the rehabilitation authority;

(b) a suitably qualified person (other than a medical practitioner) nominated by the rehabilitation authority; or

(c) a panel comprising such legally qualified medical practitioners or other suitably qualified persons (or both) as are nominated by the rehabilitation authority.

(3) The rehabilitation authority may require the employee to undergo an examination by the person or panel of persons making the assessment.

(4) Where an employee refuses or fails, without reasonable excuse, to undergo an examination in accordance with a requirement, or in any way obstructs such an examination, the employee’s rights to compensation under this Act, and to institute or continue any proceedings under this Act in relation to compensation, are suspended until the examination takes place.

(5) The relevant authority shall pay the cost of conducting any examination of an employee and is liable to pay to the employee an amount equal to the amount of the expenditure reasonably incurred by the employee in making a necessary journey in connection with the examination or remaining, for the purpose of the examination, at a place to which the employee has made a journey for that purpose.

(6) In deciding questions arising under subsection (5), a relevant authority shall have regard to:

(a) the means of transport available to the employee for the journey;

(b) the route or routes by which the employee could have travelled; and

(c) the accommodation available to the employee.

(7) Where an employee’s right to compensation is suspended under subsection (4), compensation is not payable in respect of the period of the suspension.

(8) Where an examination is carried out, the person or persons who carried out the examination shall give to the rehabilitation authority a written assessment of the employee’s capability of undertaking a rehabilitation program, specifying, where appropriate, the kind of program which he or she is capable of undertaking and containing any other information relating to the provision of a rehabilitation program for the employee that the rehabilitation authority may require.

Provision of rehabilitation programs

37. (1) A rehabilitation authority may make a determination that an employee who has suffered an injury resulting in an incapacity for work or an impairment should undertake a rehabilitation program and, where the authority so determines, it may make arrangements with an approved program provider for the provision of a rehabilitation program for the employee.

(2) A rehabilitation authority (other than an administering authority) shall not make arrangements with an approved program provider who is not approved by the Commission under section 34.

(3) In making a determination under subsection (1), a rehabilitation authority shall have regard to:

(a) any written assessment given under subsection 36 (8);

(b) any reduction in the future liability to pay compensation if the program is undertaken;

(c) the cost of the program;

(d) any improvement in the employee’s opportunity to be employed after completing the program;

(e) the likely psychological effect on the employee of not providing the program;

(f) the employee’s attitude to the program;

(g) the relative merits of any alternative and appropriate rehabilitation program; and

(h) any other relevant matter.

(4) The cost of any rehabilitation program provided for an employee under this section shall be paid by the relevant authority in relation to that employee.

(5) Where an employee is undertaking a rehabilitation program under this section, compensation is not payable to the employee under section 19 or 31 but:

(a) if the employee is undertaking a full-time program—compensation is payable to the person of an amount per week equal to the amount per week of the compensation that would, but for this subsection, have been payable under section 19 if the incapacity referred to in that section had continued throughout the period of the program; or

(b) if the employee is undertaking a part-time program—compensation is payable to the employee of such amount per week as the relevant authority determines, being an amount not less than the amount per week of the compensation that, but for this subsection, would have been payable to the employee under this Act and not greater than the amount per week of the compensation that would have been

payable under paragraph (a) if the employee had been undertaking a full-time program.

(6) An employee who is entitled to receive compensation under subsection (5) during a period is not entitled to receive an amount under Part XVI of the Social Security Act 1947 during that period.

(7) Where an employee refuses or fails, without reasonable excuse, to undertake a rehabilitation program provided for the employee under this section, the employee’s rights to compensation under this Act, and to institute or continue any proceedings under this Act in relation to compensation, are suspended until the employee begins to undertake the program.

(8) Where an employee’s right to compensation is suspended under subsection (7), compensation is not payable in respect of the period of the suspension.

Review of certain determinations by Commission

38. (1) As soon as practicable after a rehabilitation authority (other than a relevant authority) makes a determination under section 36 or 37, the authority shall cause to be served on the employee to whom the determination relates a notice in writing setting out:

(a) the terms of the determination;

(b) the reasons for the determination; and

(c) a statement to the effect that the employee may, if dissatisfied with the determination, request the Commission for a review of the determination under this section.

(2) An employee in respect of whom a determination under section 36 or 37 is made by a rehabilitation authority (other than a relevant authority) may, by notice in writing given to the Commission, request the Commission to review the determination.

(3) A request shall:

(a) set out the reasons for the request; and