Social Security and Veterans’ Affairs Legislation Amendment Act (No. 3) 1989

No. 163 of 1989

An Act to amend the law relating to social security and veterans’ affairs, and for other purposes

[Assented to 19 December 1989]

BE IT ENACTED by the Queen, and the Senate and the House of Representatives of the Commonwealth of Australia, as follows:

PART 1—PRELIMINARY

Short title

1. This Act may be cited as the Social Security and Veterans’ Affairs Legislation Amendment Act (No. 3) 1989.

Commencement: Day of Royal Assent

Commencement

2. Each provision of this Act commences, or is to be taken to have commenced, as the case requires, on the day, or at the time, shown by the note in italics at the foot of that provision.

Commencement: Day of Royal Assent

Application

3. (1) The amendment of the Social Security Act 1947 made by section 28 applies in relation to periods of 8 weeks finishing after 1 January 1990.

Commencement: 1 January 1990

(2) The amendments of the Social Security Act 1947 made by paragraphs 29 (a) and 31 (a) apply in relation to payments that fall due on or after 1 January 1990.

Commencement: 1 January 1990

(3) The amendments of the Social Security Act 1947 made by paragraph 29 (c) and section 32 apply in relation to assessments of taxable income amended on or after 1 January 1990.

Commencement: 1 January 1990

(4) The amendments of the Social Security Act 1947 made by section 30, paragraph 31 (f) and section 33 apply in relation to payments that fall due on or after 1 December 1989.

Commencement: 1 December 1989

(5) The amendment of the Social Security Act 1947 made by paragraph 31 (b) applies in relation to payments that fall due on or after 1 January 1990.

Commencement: 1 January 1990

(6) The amendments of the Social Security Act 1947 made by paragraphs 31 (c) and (e) apply in relation to requests made under paragraph 74b (3) (b) on or after 1 December 1989.

Commencement: 1 December 1989

(7) The amendment of the Social Security Act 1947 made by paragraph 31 (d) applies in relation to notifiable events occurring on or after 29 December 1988.

Commencement: 1 January 1990

(8) The amendments of the Social Security Act 1947 made by section 34 apply in relation to payments that fall due on or after 1 January 1990.

Commencement: 1 January 1990

(9) The amendments of the Social Security Act 1947 made by sections 36, 39 and 41 apply in relation to moves occurring on or after 1 November 1989.

Commencement: 1 November 1989

(10) The amendments of the Social Security Act 1947 made by paragraphs 40 (a), (b) and (c) apply in relation to claims lodged on or after 1 January 1990.

Commencement: 1 January 1990

(11) The amendment of the Social Security Act 1947 made by paragraph 40 (d) applies in relation to claims lodged on or after 1 October 1989.

Commencement: 1 October 1989

(12) The amendments of the Social Security Act 1947 made by sections 44 and 45 apply in relation to payments made as mentioned in subsections 154 (4) and 155 (4) on or after 1 January 1990.

Commencement: 1 January 1990

(13) The amendments of the Social Security Act 1947 made by section 47 apply in relation to compensation debts arising on or after 1 January 1990.

Commencement: 1 January 1990

Transitional—unemployment and sickness benefits

4. (1) This section applies to an employment declaration made before 13 November 1989 by:

(a) an applicant for an unemployment benefit or a sickness benefit under the Social Security Act 1947; or

(b) a person who was, when the declaration was made, an employee for the purposes of the Income Tax Assessment Act 1936 because of the receipt by the person of such a benefit.

(2) The amendment made by section 19 of this Act does not apply in relation to an employment declaration to which this section applies.

(3) While subsection 202cb (2) of the Income Tax Assessment Act 1936 applies to a declaration to which this section applies, section 125a of the Social Security Act 1947 as amended by this Act does not apply to the person who made the declaration.

Commencement: 13 November 1989

PART 2—AMENDMENT OF CHILD SUPPORT (ASSESSMENT) ACT 1989

Principal Act

5. In this Part, “Principal Act” means the Child Support (Assessment) Act 19891.

Commencement: Day of Royal Assent

6. After section 163 of the Principal Act the following section is inserted:

Certain instruments not liable to duty

“163a. (1) The following agreements, deeds and other instruments are not subject to any duty or charge under any law of a State or Territory or any law of the Commonwealth that applies only in relation to a Territory:

(a) a deed or other instrument executed by a person under, or for the purposes of, an order made by a court under this Act;

(b) an eligible child support agreement that confers a benefit in relation to a child eligible for administrative assessment, to the extent to which the agreement confers the benefit;

(c) a deed or other instrument:

(i) that is executed by a person under, or for the purposes of, an eligible child support agreement; and

(ii) that confers a benefit in relation to a child eligible for administrative assessment;

to the extent to which it confers the benefit.

“(2) A child support agreement is an eligible child support agreement for the purposes of this section if:

(a) it has been accepted by the Registrar; and

(b) it is a child support agreement of one of the following kinds:

(i) a child support agreement made in connection with the dissolution or annulment of the marriage to which the agreement relates;

(ii) a child support agreement (other than an agreement falling within subparagraph (i)) made in contemplation of the dissolution or annulment of the marriage to which the agreement relates;

(iii) a child support agreement (other than an agreement falling within subparagraph (i) or (ii)) made in connection with the breakdown of the marriage to which the agreement relates;

(iv) a child support agreement made in connection with the breakdown of the de facto relationship to which the agreement relates;

(v) a child support agreement (other than a child support agreement falling within subparagraph (i), (ii), (iii) or (iv)) that relates to a child whose parents were not:

(a) married to each other; or

(b) living with each other in a de facto relationship;

at the time the child was conceived.

“(3) For the purposes of this section, a child support agreement, deed or other instrument that confers an entitlement to property in relation to a child may be taken to confer a benefit in relation to the child even though the agreement, deed or other instrument also deprives the child or another person of an entitlement to other property (being property of an equal or greater value) in relation to the child.

“(4) In this section:

(a) a reference to the marriage to which a child support agreement relates is a reference to the marriage the parties to which are parties to the agreement; and

(b) a reference to the de facto relationship to which a child support agreement relates is a reference to the de facto relationship the parties to which are parties to the agreement.

“(5) In this section:

‘de facto relationship’ means the relationship between a man and a woman who live with each other as spouses on a genuine domestic basis although not legally married to each other.”.

Commencement: Day of Royal Assent

PART 3—AMENDMENTS OF CHILD SUPPORT (REGISTRATION AND COLLECTION) ACT 1988

Principal Act

7. In this Part, “Principal Act” means the Child Support (Registration and Collection) Act 19882.

Commencement: Day of Royal Assent

Deputy Child Support Registrars

8. Section 12 of the Principal Act is amended by omitting from subsection (2) “Deputy Commissioner of Taxation” and substituting “Second Commissioner and Deputy Commissioner”.

Commencement: Day of Royal Assent

Registrar to register liability in Child Support Register on receipt of notification etc.

9. Section 24 of the Principal Act is amended by omitting from subsection (2) “shall” and substituting “may”.

Commencement: Day of Royal Assent

Day on which liability first becomes enforceable under Act

10. Section 28 of the Principal Act is amended:

(a) by omitting from paragraph (b) “section 24” and substituting “subsection 24 (1)”;

(b) by omitting from paragraph (b) “section” (last occurring) and substituting “subsection”;

(c) by inserting after paragraph (b) the following paragraph:

“(baa) if the liability is registered under subsection 24 (2)—such day as is determined, in writing, by the Registrar (being a day not earlier than the day on which the liability arose under, or was varied or otherwise affected by, the court order or maintenance agreement by virtue of which the liability is registered under that subsection);”.

Commencement: Day of Royal Assent

General rule of collection by automatic withholding in case of employees

11. Section 43 of the Principal Act is amended:

(a) by omitting from subsection (1) “during any period”;

(b) by inserting in subsection (1) “or in relation to” after “under” (first occurring);

(c) by omitting from subsection (1) “in relation to the period”.

Commencement: Day of Royal Assent

Cases in which automatic withholding not applicable

12. Section 44 of the Principal Act is amended:

(a) by omitting subsection (1) and substituting the following subsections:

“(1) Where the payer of a registrable maintenance liability that arose before the commencement of this Act elects that automatic withholding is not to apply in relation to the liability, the Registrar must include in the particulars of the entry in the Child Support Register in relation to the liability a statement that automatic withholding does not apply in relation to the liability.

“(1a) The election must be made by giving a duly completed approved form to the Registrar before, or within 28 days after, the registration of the liability.”;

(b) by omitting from subparagraph (5) (b) (i) “regular and”;

(c) by omitting from paragraph (7) (b) “regular and”.

Commencement: Day of Royal Assent

Notification to be given to employer and employee

13. Section 45 of the Principal Act is amended:

(a) by inserting in subsection (1) “or in relation to” after “under” (first occurring);

(b) by inserting after subsection (2) the following subsection:

“(2a) Where the Registrar thinks that the variation of a notice in force under subsection (1) in relation to an enforceable maintenance liability is necessary or desirable for the purpose of collecting amounts already due to the Commonwealth under or in relation to the liability by deduction from the salary or wages of the payer under this Part, the Registrar must immediately give a written notice to the employer to whom the notice was given varying the notice accordingly.”;

(c) by omitting from subsection (3) “or (2)” and substituting “, (2) or (2a)”.

Commencement: Day of Royal Assent

Additional duties of employers

14. Section 47 of the Principal Act is amended:

(a) by inserting after subsection (1) the following subsection:

“(1a) Where:

(a) a notice given to an employer under subsection 45 (1) in relation to an employee is in force at any time during a month; and

(b) the employer does not during the month make deductions under this Part in relation to the employee;

the employer must, not later than the seventh day of the following month, give to the Registrar, in the approved form, the particulars required by the form.

Penalty: $1,000.”;

(b) by inserting in subsection (4) “, (1a)” after “(1)”.

Commencement: Day of Royal Assent

Discharge of payer’s liability to Registrar and employer’s liability to payer

15. Section 49 of the Principal Act is amended:

(a) by inserting in paragraph (a) “or in relation to” after “under”;

(b) by inserting in paragraph (a) “, as the case requires” after “liability” (last occurring).

Commencement: Day of Royal Assent

Repeal of section 90

16. Section 90 of the Principal Act is repealed.

Commencement: Day of Royal Assent

Consideration of applications for extension of time for lodging objections

17. Section 91 of the Principal Act is amended:

(a) by omitting from subsection (1) “and any notice lodged with the Registrar under subsection 90 (3) in relation to the application”;

(b) by omitting from subsection (3) all the words after “application” (first occurring).

Commencement: Day of Royal Assent

PART 4—AMENDMENTS OF INCOME TAX ASSESSMENT ACT 1936

Principal Act

18. In this Part, “Principal Act” means the Income Tax Assessment Act 19363.

Commencement: 13 November 1989

Quotation of tax file number in employment declaration

19. Section 202cb of the Principal Act is amended by adding at the end the following subsection:

“(6) Subsections (2) to (4) do not apply to an employment declaration. given to the Secretary to the Department of Social Security:

(a) by a person who is an applicant for an unemployment benefit or a sickness benefit under the Social Security Act 1947; or

(b) by a person who is an employee for the purposes of this Part because of the receipt by the person of such a benefit.”.

Commencement: 13 November 1989

Effect of incorrect quotation of tax file number

20. Section 202ce of the Principal Act is amended by adding at the end the following subsection:

“(7) Subsection (6) does not apply to an employment declaration given to the Secretary to the Department of Social Security:

(a) by a person who is an applicant for an unemployment benefit or a sickness benefit under the Social Security Act 1947; or

(b) by a person who is an employee for the purposes of this Part because of the receipt by the person of such a benefit.”.

Commencement: 13 November 1989

PART 5—AMENDMENTS OF SEAMEN’S WAR PENSIONS AND ALLOWANCES ACT 1940

Principal Act

21. In this Part, “Principal Act” means the Seamen’s War Pensions and Allowances Act 19404.

Commencement: Day of Royal Assent

Interpretation

22. Section 3 of the Principal Act is amended:

(a) by omitting from subparagraph (1c) (a) (ii) “as her husband on a bona fide domestic basis” and substituting “in a marriage-like relationship”;

(b) by inserting afer subsection (1c) the following subsections:

“(1d) In forming an opinion for the purposes of this Act whether 2 people are living together in a marriage-like relationship, regard is to be had to all the circumstances of the relationship including, in particular, the matters specified in section 11a of the Veterans’ Entitlements Act 1986.

“(1e) For the purposes of this Act, 2 people are not to be taken to be living in a marriage-like relationship if they are within a

prohibited relationship for the purposes of section 23b of the Marriage Act 1961.”.

Commencement: 1 January 1990

PART 6—AMENDMENTS OF SOCIAL SECURITY ACT 1947

Principal Act

23. In this Part, “Principal Act” means the Social Security Act 19475.

Commencement: Day of Royal Assent

Interpretation

24. Section 3 of the Principal Act is amended:

(a) by omitting the definition of “de facto spouse” in subsection (1) and substituting the following definition:

“‘de facto spouse’ means a person who is living with a person of the opposite sex, to whom he or she is not legally married, in a relationship that, in the opinion of the Secretary formed as mentioned in section 3a, is a marriage-like relationship;”;

Commencement: 1 January 1990

(b) by inserting in the opinion of the Secretary formed as mentioned in section 3a,” after “who is” in paragraph (a) of the definition of “married person” in subsection (1);

Commencement: 1 January 1990

(c) by inserting in subsection (1) the following definition:

“ ‘Assessment Act’ means the Income Tax Assessment Act 1936;”;

Commencement: Day of Royal Assent

(d) by inserting in subsection (1) the following definition:

“ ‘compensation debt’ means an amount that a person is liable to pay to the Commonwealth because of a determination by the Secretary under section 153;”;

Commencement: 1 January 1990

(e) by inserting in subsection (1) the following definition:

“ ‘joint ownership’ includes ownership as joint tenants or as tenants in common;”;

Commencement: 1 January 1990

(f) by inserting in subsection (1) the following definitions:

“ ‘account’, in relation to a credit union or building society, means an account maintained by a person with the credit union or building society to which are credited moneys received on deposit by the credit union or building society from that person;

‘building society’ means an organisation registered as a permanent building society under a law of a State or Territory;

‘credit union’ means an organisation registered as a credit union under a law of a State or Territory;”;

Commencement: Day of Royal Assent

(g) by omitting subsections (8), (8a), (8b) and (9) and substituting the following subsection:

“(8) A person is not to be taken to be a de facto spouse for the purposes of this Act because he or she is living with another person if the 2 people are within a prohibited relationship for the purposes of section 23b of the Marriage Act 1961”.

Commencement: 1 January 1990

25. After section 3 of the Principal Act the following section is inserted:

Marriage-like relationships

“3a. In forming an opinion about the relationship between 2 people for the purposes of the definition of ‘de facto spouse’ or ‘married person’ in subsection 3 (1), the Secretary is to have regard to all the circumstances of the relationship including, in particular, the following matters:

(a) the financial aspects of the relationship, including:

(i) any joint ownership of real estate or other major assets and any joint liabilities; and

(ii) any significant pooling of financial resources especially in relation to major financial commitments; and

(iii) any legal obligations owed by one person in respect of the other person; and

(iv) the basis of any sharing of day-to-day household expenses;

(b) the nature of the household, including:

(i) any joint responsibility for providing care or support of children; and

(ii) the living arrangements of the people; and

(iii) the basis on which responsibility for housework is distributed;

(c) the social aspects of the relationship, including:

(i) whether the people hold themselves out as married to each other; and

(ii) the assessment of friends and regular associates of the people about the nature of their relationship; and

(iii) the basis on which the people make plans for, or engage in, joint social activities;

(d) any sexual relationship between the people;

(e) the nature of the people’s commitment to each other, including:

(i) the length of the relationship; and

(ii) the nature of any companionship and emotional support that the people provide to each other; and

(iii) whether the people consider that the relationship is likely to continue indefinitely; and

(iv) whether the people see their relationship as a marriage-like relationship.”.

Commencement: 1 January 1990

Calculation of value of property

26. Section 4 of the Principal Act is amended by inserting in subsection (1) “or 43a” after “section 6”.

Commencement: 1 January 1990

Rate of pension

27. Section 33 of the Principal Act is amended by inserting after subsection (12a) the following subsection:

“(12b) Subsection (12a) does not apply in relation to a person if:

(a) child support is not payable under the Child Support (Assessment) Act 1989 to the person for a child, but the person is entitled to make an application for assessment of child support under Part 5 of that Act for the child payable by another person and:

(i) the person has not properly made such an application or an application under Part 6 of that Act for acceptance of an agreement in relation to the child; or

(ii) the person has properly made an application of either kind, but:

(a) the person has subsequently withdrawn the application; or

(b) after child support has become payable by the other person under that Act for the child, the person has ended the entitlement to child support; or

(b) child support is payable under the Child Support (Assessment) Act 1989 to the person for a child and:

(i) the person is entitled to make an application under section 128 of that Act; but

(ii) an application by the person under that section is not in force.”.

Commencement: Day of Royal Assent

28. After section 43 of the Principal Act the following section is inserted in Division 1 of Part V:

Obligation to provide information about domestic circumstances

“43a. (1) This section applies where, for a period of at least 8 weeks, 2 people of opposite sexes who are not legally married to each other have shared a residence (in this section called the ‘shared residence’) with each

other and at least one of the following circumstances applies in relation to the people:

(a) a child of both the people also lives in the shared residence;

(b) the people have joint ownership of the shared residence;

(c) the people are joint lessees of the shared residence, where the original duration of the lease was at least 10 years;

(d) the people have:

(i) joint assets with a total value of more than $4,000; or

(ii) joint liabilities totalling more than $1,000;

(e) the people have at any time been married to each other;

(f) the people have at any time shared another residence with each other.

“(2) This section applies where, for a period of at least 8 weeks, 2 people of the opposite sex have shared a residence with each other and:

(a) the people are legally married to each other; and

(b) the people are, or claim to be, living separately and apart from each other on a permanent basis for the purposes of this Act.

“(3) Where this section applies in relation to a person who is receiving a sole parent’s pension (in this section called the ‘pensioner’) because the person has shared a residence with another person, the Secretary may give the pensioner a notice:

(a) requiring the pensioner to give the Secretary:

(i) such information about the pensioner’s relationship with the other person as is specified in the notice, being information:

(a) that is within the pensioner’s own knowledge; or

(b) that the pensioner can reasonably be expected to obtain; and

(ii) any other information that might be relevant to the question whether the pensioner is the de facto spouse of the other person or is separated from the other person; and

(b) specifying that, if the information is not given to the Secretary within 14 days after the notice is given, the pensioner’s pension will be suspended.

“(4) Where this section applies in relation to a person who has lodged a claim for a sole parent’s pension (in this section called the ‘claimant’) because the person has shared a residence with another person, the Secretary may give the claimant a notice:

(a) requiring the claimant to give the Secretary:

(i) such information about the claimant’s relationship with the other person as is specified in the notice, being information:

(a) that is within the claimant’s own knowledge; or

(b) that the claimant can reasonably be expected to obtain; and

(ii) any other information that might be relevant to the question whether the claimant is the de facto spouse of the other person or is separated from the other person; and

(b) specifying that, if the information is not given to the Secretary within 14 days after the notice is given, the claim will be taken not to have been lodged.

“(5) Where:

(a) a pensioner or claimant covered by subsection (1) purports to give the Secretary the information about his or her relationship with another person required by a notice under subsection (3) or (4); and

(b) the Secretary is satisfied that the pensioner or claimant has provided all the relevant information;

the Secretary must form an opinion whether the pensioner or claimant is living with the other person in a marriage-like relationship.

“(6) Where this section applies, the Secretary must not form the opinion that the pensioner or claimant is not living with the other person in a marriage-like relationship unless, having regard to all of the matters specified in the paragraphs of section 3a, the weight of evidence supports the formation of an opinion that the pensioner or claimant is not living in a marriage-like relationship with the other person.

“(7) Where:

(a) a pensioner or claimant covered by subsection (2) purports to provide information about his or her relationship with another person as required by a notice under subsection (3) or (4); and

(b) the Secretary is satisfied that the pensioner or claimant has provided all the relevant information;

the Secretary must form an opinion whether the pensioner or claimant is separated from the other person.

“(8) Where this section applies, the Secretary must not form the opinion that the pensioner or claimant is separated from the other person unless, having regard to all of the matters specified in the paragraphs of section 3a, the weight of evidence supports the formation of an opinion that the pensioner or claimant is separated from the other person.

“(9) Where a pensioner fails to give the Secretary the information required by a notice under subsection (3) within 14 days after the notice is given, the Secretary must:

(a) suspend the pensioner’s pension; and

(b) give the pensioner a notice (in this section called the ‘reminder notice’) stating that, if the information required by the notice under

subsection (3) is not given to the Secretary within 14 days after the reminder notice is given, the pension will be cancelled.

“(10) Where:

(a) a pensioner’s pension has been suspended under subsection (9); and

(b) the pensioner fails to give the Secretary the information required by the notice under subsection (3) within the 14 days referred to in the reminder notice;

the Secretary must cancel the pension.

“(11) Where:

(a) a pensioner’s pension has been suspended under subsection (9); and

(b) the pensioner gives the Secretary the information required within the 14 days referred to in the reminder notice; and

(c) the Secretary forms the opinion that the pensioner is not living with the other person in a marriage-like relationship, or is separated from the other person, as the case requires;

the pensioner is entitled to be paid any amounts of pension that he or she would have been entitled to be paid but for the suspension.

“(12) If a claimant does not give the Secretary the information required by a notice under subsection (4) within the 14 days referred to in the notice, the claimant’s claim is to be taken not to have been lodged.

“(13) Where:

(a) a pensioner or claimant has given the Secretary all the information about his or her relationship with another person required by a notice under subsection (3) or (4); and

(b) the Secretary has formed the opinion that the pensioner or claimant:

(i) is not living with the other person in a marriage-like relationship; or

(ii) is separated from the other person;

as the case requires;

subsection (14) applies.

“(14) The Secretary must not cause or permit any action to be taken for the purposes of, or in connection with, an investigation of the person’s relationship with the other person referred to in subsection (13) until:

(a) the Secretary has reason to believe that the person’s domestic circumstances have changed so that:

(i) a circumstance set out in subsection (1) that did not previously apply to the person now applies; or

(ii) a circumstance set out in subsection (1) that previously applied to the person now applies to the person for a different reason; or

(b) 12 weeks after the Secretary formed the opinion referred to in paragraph (13) (b);

whichever is earlier.

“(15) A person shall not, in purported compliance with a notice under subsection (3) or (4), knowingly or recklessly give the Secretary information that is false or misleading in a material particular.

Penalty: $2,000 or imprisonment for 12 months, or both.

“(16) This section does not apply in relation to any 2 people who are within a prohibited relationship for the purposes of section 23b of the Marriage Act 1961.

“(17) For the purposes of this section, 2 people are to be taken to share a residence if the residence is the principal home of each of them.

“(18) In this section:

‘child’, in relation to a person, means another person of any age who is a natural or adopted child of the person;

‘separated’, in relation to 2 people who are legally married to each other, means living separately and apart from each other on a permanent basis.”.

Commencement: 1 January 1990

Interpretation

29. Section 72 of the Principal Act is amended:

(a) by inserting in subsection (1) the following definition:

“ ‘notional notifiable event’ means an event specified by the Secretary in writing for the purposes of this definition, being an event that is specified in some or all notices given under subsection 163 (1) to persons who are granted allowances;”;

Commencement: 1 January 1990

(b) by omitting from subsection (2) “this section” and substituting “this Part”;

Commencement: Day of Royal Assent

(c) by omitting paragraph (2) (a) and substituting the following paragraph:

“(a) if, at that time, for the purposes of the Assessment Act:

(i) the Commissioner of Taxation has made an assessment or an amended assessment; or

(ii) a court or tribunal has amended an assessment or amended assessment made by the Commissioner of Taxation;

of the taxable income of the person for the year of income— the amount of the assessment, or the amended assessment, as the case may be; or”.

Commencement: 1 January 1990

Qualification to receive allowance

30. Section 73 of the Principal Act is amended by omitting subparagraph (1) (a) (ii) and substituting the following subparagraph:

“(ii) any other periodic payment (other than a compensation payment) under:

(a) a law of the Commonwealth; or

(b) a scheme administered by the Commonwealth;

that provides for increases in rate in respect of a child of a person; or”.

Commencement: 1 December 1989

Reduction of rate by reference to taxable income

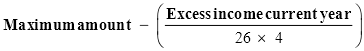

31. Section 74b of the Principal Act is amended:

(a) by inserting after subsection (1) the following subsections:

“(1a) Where:

(a) a person who has lodged a claim for an allowance is qualified to receive an allowance; and

(b) since the end of the base year of income of the person, a notional notifiable event has occurred in relation to the person; and

(c) the relevant taxable income of the person for the year of income in which the notional notifiable event occurred (in this subsection called the ‘event year of income’) exceeds 125% of each of:

(i) the relevant taxable income of the person for the base year of income; and

(ii) the income threshold in relation to the person; and

(d) the Secretary is satisfied that more than 25% of the amount by which the relevant taxable income of the person for the event year of income exceeds the relevant taxable income of the person for the base year of income is directly attributable to the notional notifiable event;

the rate per week of the allowance payable to the person during the allowance period is the rate per week worked out using the formula:

where:

‘Maximum rate’ means the maximum rate per week of the allowance that could be payable to the person;

‘Excess income event year’ means the amount by which the relevant taxable income of the person for the current year of income exceeds the income threshold in relation to the person.

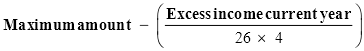

“(1b) Where:

(a) a person who has lodged a claim for an allowance is qualified to received an allowance; and

(b) the allowance will be payable from the first allowance pay day in a calendar year; and

(c) the allowance was payable to the person on the last allowance pay day in the immediately preceding calendar year at a rate worked out under subsection (3) by reference to the year of income in which that allowance pay day occurred;

the rate per week of the allowance payable to the person during the allowance period starting on the first allowance pay day of the first-mentioned calendar year is:

(d) if the relevant taxable income of the person for the year of income in which that calendar year starts (in this subsection called the ‘current year of income’) is less than the income threshold in relation to the person—the maximum rate per week that could be payable to the person; or

(e) in any other case:

(i) the rate per week of the allowance that would, but for this subsection, be payable to the person under subsection (1); or

(ii) the rate per week worked out using the formula:

where:

‘Maximum rate’ means the maximum rate per week of the allowance that could be payable to the person;

‘Excess income current year’ means the amount by which the relevant taxable income of the person for the current year of income exceeds the income threshold in relation to the person;

whichever is higher.”;

Commencement: 1 January 1990

(b) by inserting after paragraph (2) (b) the following word and paragraph:

“and (c) the Secretary is satisfied that more than 25% of the amount by which the relevant taxable income of the person for the current year of income exceeds the relevant taxable income of the person for the base year

of income is directly attributable to the notifiable event;”;

Commencement: 1 January 1990

(c) by omitting paragraph (3) (c) and substituting the following paragraph:

“(c) there has been an eligible reduction in the person’s income for the year of income in which the request is made (in this subsection called the ‘current year of income’);”;

Commencement: 1 December 1989

(d) by inserting in paragraph (6) (d) “more than 25% of after “satisfied that”;

Commencement: 1 January 1990

(e) by inserting after subsection (6) the following subsection:

“(6a) There shall be taken to have been an eligible reduction in a person’s income for a year of income (in this subsection called the ‘current year of income’) if:

(a) the person’s relevant taxable income for the current year of income is at least 25% less than the person’s relevant taxable income for the base year of income; or

(b) the person’s relevant taxable income for the current year of income is less than the person’s income threshold.”;

Commencement: 1 December 1989

(f) by inserting before subsection (7) the following subsection:

“(6b) This section does not apply in relation to a person who is qualified to receive an allowance and who is in receipt of payments under:

(a) the AUSTUDY scheme; or

(b) the ABSTUDY scheme; or

(c) the Post-Graduate Awards Scheme.”.

Commencement: 1 December 1989

32. After section 74b of the Principal Act the following section is inserted:

Effect of amended assessment of taxable income

“74ba. (1) Where:

(a) the rate of allowance payable to a person has been worked out by reference to an assessment of the person’s taxable income (in this section called the ‘original taxable income’) made for the purposes of the Assessment Act; and

(b) the assessment is amended as mentioned in paragraph 72 (2) (a);

the following provisions have effect.

“(2) The rate of allowance payable to the person is to be re-calculated by reference to the amended assessment of the person’s taxable income (in this section called the ‘new taxable income’).

“(3) Where the amendment has increased the taxable income of the person by 25% or less of the original taxable income, the person is to be taken not to have received any overpayment as a result of that increase in the taxable income.

“(4) Where the amendment has increased the taxable income of the person by more than 25% of the original taxable income, then, in relation to each payment of allowance made to the person at a rate worked out by reference to that original taxable income, so much of the payment as exceeds the amount that would have been payable if the rate had been worked out by reference to the new taxable income is to be taken to be an overpayment.

“(5) In spite of section 168, where:

(a) the amendment has reduced the taxable income of the person; and

(b) the amendment was made on application by the person;

there is payable to the person by way of arrears of allowance an amount worked out using the formula:

where:

‘NPD’ [Number of Pay Days] means the number of pay days on which the person has been paid at the previous weekly rate;

‘NWR’ [New Weekly Rate] means the rate of allowance payable to the person worked out under subsection (3);

‘PWR’ [Previous Weekly Rate] means the rate of allowance payable to the person worked out by reference to the original taxable income.

“(6) In spite of section 168, where:

(a) the amendment has reduced the taxable income of the person; and

(b) the amendment was made otherwise than on application by the person;

there is payable to the person by way of arrears of allowance an amount worked out using the formula:

where:

‘NPD’ [Number of Pay Days] means the number of pay days, since the person notified the Department or an officer of the amended assessment, on which the person has been paid at the previous weekly rate;

‘NWR’ [New Weekly Rate] means the rate of allowance payable to the person worked out under subsection (3);

‘PWR’ [Previous Weekly Rate] means the rate of allowance payable to the person worked out by reference to the original taxable income.

“(7) In this section:

‘overpayment’ means an amount of allowance that, for the purposes of subsection 246 (2), should not have been paid to a person.”.

Commencement: 1 January 1990

No allowance payable where taxable income is unascertainable

33. Section 74c of the Principal Act is amended by adding at the end the following subsection:

“(2) This section does not apply in relation to a person to whom section 74b does not apply because of subsection 74b (6b).”.

Commencement: 1 December 1989

Income test for family allowances

34. Section 85 of the Principal Act is amended:

(a) by inserting in subsection (1) the following definition:

“ ‘notifiable event’, in relation to a person, means an event:

(a) that is specified in a notice given to the person under subsection 163 (1) relating to payment of family allowance; and

(b) that is described in that notice as a notifiable event for the purposes of this section;”;

(b) by omitting subsection (3) and substituting the following subsections:

“(3) Subject to subsection (4), where:

(a) apart from this section, a family allowance would be payable to a person on a family allowance pay day; and

(b) the taxable income of the person for the last year of income of the person exceeds the income threshold in relation to the person;

the total amount of family allowance payable to the person until the person’s entitlement is next assessed is the amount worked out using the formula:

where:

‘Maximum amount’ means the maximum total amount of family allowance that could be payable to the person on a family allowance pay day (not including any amount payable to the person in respect of a child if the circumstances referred to in a paragraph of subsection 84 (2) apply in relation to the child);

‘Excess income last year’ means the amount by which the taxable income of the person for the last year of income exceeds the income threshold in relation to the person.

“(3a) Subject to subsections (4) and (5), where:

(a) a notifiable event occurs in relation to a person who is receiving family allowance; and

(b) the taxable income of the person for the year of income in which the notifiable event occurs (in this subsection called the ‘current year of income’) exceeds each of:

(i) 125% of the taxable income of the person for the last year of income; and

(ii) the income threshold in relation to the person;

the total amount of family allowance payable to the person until the person’s entitlement is next assessed is the amount worked out using the formula:

where:

‘Maximum amount’ means the maximum total amount of the family allowance that could be payable to the person on a family allowance pay day (not including any amount payable to the person in respect of a child covered by subsection 84 (2));

‘Excess income current year’ means the amount by which the taxable income of the person for the current year of income exceeds the income threshold in relation to the person.”;

(c) by inserting in subsection (4) “or (3a)” after “(3)”;

(d) by omitting subsection (5) and substituting the following subsection:

“(5) A person’s entitlement to family allowance in respect of a child, if the circumstances referred to in a paragraph of subsection 84 (2) apply in relation to the child, is not affected by the income test imposed by this section, and an amount of family allowance payable to a person in respect of such a child is payable in addition to the amount of family allowance (if any) payable to the person under the other provisions of this section.”;

(e) by inserting in paragraph (7) (a) “or (3a)” after “(3)”;

(f) by inserting after subsection (7) the following subsection:

“(8) Where the amount of family allowance payable to a person on family allowance pay days has been worked out under this section, the amount so payable does not have to be worked out again unless:

(a) the person makes a request under subsection (7); or

(b) the person notifies the Department or an officer of the occurrence of a notifiable event in relation to the person.”;

(g) by omitting subsection (9).

Commencement: 1 January 1990

Interpretation

35. Section 115 of the Principal Act is amended by inserting the following definitions in subsection (1):

“ ‘employment declaration’ has the same meaning as in Part Va of the Income Tax Assessment Act 1936;

‘tax file number’ has the same meaning as in Part Va of the Income Tax Assessment Act 1936”.

Commencement: 13 November 1989

Unemployment benefits

36. Section 116 of the Principal Act is amended by inserting after subsection (6) the following subsections:

“(6a) A person is not qualified to receive an unemployment benefit on a day on which the person reduces his or her employment prospects by moving to a new place of residence without sufficient reason for the move.

“(6b) For the purposes of subsection (6a), a person has a sufficient reason for moving to a new place of residence if and only if the person moves to live:

(a) with a family member who has already established his or her residence in that place of residence; or

(b) near a family member who has already established residence in the same area.”.

Commencement: 1 November 1989

Maintenance income test

37. Section 122a of the Principal Act is amended by adding at the end the following subsection:

“(6) Subsection (5) does not apply in relation to a person if:

(a) child support is not payable under the Child Support (Assessment) Act 1989 to the person for a child, but the person is entitled to make an application for assessment of child support under Part 5 of that Act for the child payable by another person and:

(i) the person has not properly made such an application or an application under Part 6 of that Act for acceptance of an agreement in relation to the child; or

(ii) the person has properly made an application of either kind, but:

(a) the person has subsequently withdrawn the application; or

(b) after child support has become payable by the other person under that Act for the child, the person has ended the entitlement to child support; or

(b) child support is payable under the Child Support (Assessment) Act 1989 to the person for a child and:

(i) the person is entitled to make an application under section 128 of that Act; but

(ii) an application by the person under that section is not in force.”.

Commencement: Day of Royal Assent

38. After section 125 of the Principal Act the following section is inserted:

Provision of tax file numbers

“125a. (1) An unemployment benefit or a sickness benefit that a person is qualified to receive under Division 2 is not to be paid to the person unless he or she has given the Secretary, in writing, a statement of his or her tax file number.

“(2) A person is to be regarded as having satisfied subsection (1) if:

(a) the person has given the Secretary an employment declaration; and

(b) the declaration states either:

(i) that the person has a tax file number but does not know what it is and has asked the Commissioner of Taxation to inform him or her of the number; or

(ii) that an application by the person for a tax file number is pending; and

(c) where subparagraph (b) (i) applies—the person has given the Secretary a document authorising the Commissioner of Taxation to tell the Secretary:

(i) whether the person has a tax file number; and

(ii) if so—the tax file number; and

(d) where subparagraph (b) (ii) applies—the person has given the Secretary a document authorising the Commissioner to tell the Secretary:

(i) if a tax file number is issued to the person—the tax file number; or

(ii) if the application is refused—that the application has been refused; or

(iii) if the application is withdrawn—that the application has been withdrawn; and

(e) the Commissioner of Taxation has not told the Secretary that the person has no tax file number or that an application by the person for a tax file number has been refused; and

(f) where the declaration states that an application by the person for a tax file number is pending—the application has not been withdrawn.”.

Commencement: 13 November 1989

Unemployment benefit not payable in certain cases

39. Section 126 of the Principal Act is amended:

(a) by inserting after paragraph (1) (a) the following paragraph:

“(aa) a person has reduced his or her employment prospects by moving to a new place of residence without sufficient reason for the move;”;

(b) by adding at the end the following subsections:

“(4) In a case to which paragraph (1) (aa) applies, the period in respect of which an unemployment benefit is not payable is 12 weeks.

“(5) For the purposes of paragraph (1) (aa), a person has a sufficient reason for a move in the circumstances in which he or she would have a sufficient reason for that move under subsection 116 (6b).”.

Commencement: 1 November 1989

Education leavers

40. Section 127 of the Principal Act is amended:

(a) by inserting after subsection (1) the following subsection:

“(la) Subsection (1) does not apply in relation to a claim for unemployment benefit lodged by a person where:

(a) immediately before starting to undertake the course of education concerned, the person was in receipt of unemployment benefit; and

(b) the person had been continuously in receipt of unemployment benefit since the end of a period during which unemployment benefit was not payable to the person because of subsection (1); and

(c) the claim was lodged within 4 weeks after the person started to undertake the course of education concerned.”;

Commencement: 1 January 1990

(b) by omitting from subsection (1) “subsections (2), (3) and (6)” and substituting “this section”;

Commencement: 1 January 1990

(c) by inserting after subsection (7) the following subsection:

“(7a) Where:

(a) subsection (1) applies to a person who has lodged a claim for unemployment benefit; and

(b) the person started to undertake the course of education concerned at a time when unemployment benefit was not

payable to the person because of a previous operation of subsection (1); and

(c) the claim was lodged within 4 weeks after the person started to undertake the course of education concerned;

subsection (1) applies to the person in relation to that claim as if the reference in the applicable paragraph of subsection (1) to 13 weeks or 6 weeks, as the case may be, were a reference to that period reduced by the period starting when subsection (1) previously started to apply to the person and ending when the person started to undertake the course of education concerned.”;

Commencement: 1 January 1990

(d) by omitting subsections (8) and (9) and substituting the following subsection:

“(8) For the purposes of subsection (1) of this section, section 116 and subsection 125 (2), where a person to whom subsection (1) applies registered with the Commonwealth Employment Service as being unemployed before ceasing to undertake the course of education, the person is to be taken to have become so registered on the last day on which the person was undertaking the course.”.

Commencement: 1 October 1989

Special benefit

41. Section 129 of the Principal Act is amended by inserting in paragraph (2) (a) “or (6a)” after “116 (5)”.

Commencement: 1 November 1989

42. After section 138 of the Principal Act the following section is inserted:

Tax file numbers

“138a. (1) In spite of section 8wa of the Taxation Administration Act 1953, the Secretary may request a person to quote his or her tax file number for the purpose of enabling a payment of an unemployment benefit or a sickness benefit to be made to the person.

“(2) Where a person has given the Secretary a document referred to in paragraph 125a (2) (c) or (d) the Commissioner of Taxation may:

(a) tell the Secretary whether the person has a tax file number; or

(b) in spite of section 8wb of the Taxation Administration Act 1953, tell the Secretary the person’s tax file number; or

(c) tell the Secretary if the person’s application for a tax file number is refused; or

(d) tell the Secretary if the person withdraws his or her application for a tax file number.

“(3) In spite of section 8wb of the Taxation Administration Act 1953, the Secretary may record:

(a) a tax file number quoted in a statement given to the Secretary for the purpose of section 125a; or

(b) a tax file number communicated to the Secretary by the Commissioner of Taxation.”.

Commencement: 13 November 1989

Reduction in rate of pension

43. Section 153 of the Principal Act is amended by omitting from subsection (4) “or property of the person” and substituting “of the person or of his or her spouse”.

Commencement: Day of Royal Assent

Recovery of amounts from person liable to make compensation payments

44. Section 154 of the Principal Act is amended:

(a) by omitting from subsection (1) “subsection” and substituting “section”;

(b) by omitting subsection (4) and substituting the following subsections:

“(4) Subject to subsections (4a) and (7), where, after having been given a notice under subsection (1), an employer makes a payment by way of compensation covered by the notice, the employer:

(a) is guilty of an offence punishable, on conviction, by a fine not exceeding:

(i) for a natural person—$2,000; or

(ii) for a body corporate—$10,000; and

(b) is liable to pay to the Commonwealth the recoverable amount.

“(4a) Subsection (4) does not apply where the Secretary so decides and the payment is made in accordance with the decision of the Secretary.”;

(c) by adding at the end the following subsections:

“(8) A reference in this section to a person who is liable to make a payment by way of compensation to another person includes a reference to an authority of a State or Territory that has determined that it will make a payment by way of compensation to another person, whether or not the authority was liable to make the payment.

“(9) In this section:

‘recoverable amount’, in relation to a payment made by an employer as mentioned in subsection (4), means:

(a) where the employer has been given a notice under

paragraph (1) (b)—the amount specified in the notice; or

(b) in any other case—an amount determined by the Secretary, being an amount not exceeding the smaller of the 2 amounts worked out under subparagraphs (1) (b) (i) and (ii).”.

Commencement: 1 January 1990

Notice to insurers

45. Section 155 of the Principal Act is amended:

(a) by omitting subsection (4) and substituting the following subsections:

“(4) Subject to subsections (4a) and (7), where, after having been given a notice under subsection (1), the insurer makes a payment under a contract of insurance with a client indemnifying the client in whole or part against the liability of the client to make a payment by way of compensation covered by the notice, the insurer:

(a) is guilty of an offence punishable, on conviction, by a fine not exceeding:

(i) for a natural person—$2,000; or

(ii) for a body corporate—$10,000; and

(b) is liable to pay to the Commonwealth the recoverable amount.

“(4a) Subsection (4) does not apply where the Secretary so decides and the payment is made in accordance with the decision of the Secretary.”;

Commencement: 1 January 1990

(b) by adding at the end the following subsections:

“(8) A reference in this section to an insurer who is, under a contract of insurance, liable to indemnify a client against the liability of the client to make a payment by way of compensation to a person includes a reference to an authority of a State or Territory that is liable to indemnify a client against the liability of the client to make such a payment, whether the authority is so liable under a contract, a law or otherwise.

“(9) A reference in this section to an insurer who is liable to indemnify a client against the liability of the client to make a payment by way of compensation to a person includes a reference to an authority of a State or Territory that determines to make a payment (in this subsection called the ‘indemnity payment’) to indemnify a client in respect of a liability of the client to make a payment by way of compensation to a person, whether or not the authority is liable to make the indemnity payment.

“(10) In this section:

‘recoverable amount’, in relation to a payment made by an insurer as mentioned in subsection (4), means:

(a) where the insurer has been given a notice under paragraph (1) (b)—the amount specified in the notice; or

(b) in any other case—an amount determined by the Secretary, being an amount not exceeding the smallest of the 3 amounts worked out under subparagraphs (1) (b) (i), (ii) and (iii).”.

Commencement: 1 January 1990

The Secretary may continue payment pending the determination of an application to the Secretary or the Social Security Appeals Tribunal for review of an adverse decision

46. Section 168a of the Principal Act is amended:

(a) by inserting after subsection (6) the following subsections:

“(6a) Where, within 14 days after being notified of a section 43a decision, a person applies to the Secretary under subsection 173 (1), or to the Social Security Appeals Tribunal, for review of the section 43a decision:

(a) payment of the sole parent’s pension is to continue, pending determination of the review, as if the section 43a decision had not been made; and

(b) if payment of the pension had ceased for a period before the person applied for review—in spite of section 168, arrears of pension are payable to the person in respect of that period; and

(c) this Act (other than Part XIX and this section) applies as if the section 43a decision had not been made.

“(6b) Subsection (6a) ceases to have effect if:

(a) the application for review is withdrawn; or

(b) the review of the section 43a decision is determined.”;

(b) by omitting subsection (8) and substituting the following subsection:

“(8) In this section:

‘adverse decision’ means:

(a) a determination under subsection 168 (1); or

(b) a decision under subsection 174 (1) the effect of which is that a person’s pension, benefit or allowance is cancelled or suspended or that the rate of a person’s pension, benefit, or allowance is decreased;

but does not include a section 43a decision;

‘section 43a decision’ means a decision the effect of which is that a sole parent’s pension is cancelled, being a decision resulting

from the formation of an opinion under subsection 43a (5) or (7) that the sole parent pensioner is living with another person in a marriage-like relationship, or is not separated from another person.”.

Commencement: 1 January 1990

Recovery of overpayments

47. Section 246 of the Principal Act is amended:

(a) by inserting in paragraph (2a) (a) “or a compensation debt” after “assurance of support debt”;

(b) by inserting in subparagraph (3) (a) (ii) “or a compensation debt” after “assurance of support debt”.

Commencement: 1 January 1990

48. After section 248 of the Principal Act the following section is inserted:

Pension, benefit or allowance may be paid to bank etc.

“248a. (1) The Secretary may direct that the whole or a part of the amount of a pension is to be paid, at such intervals as he or she directs, to the credit of an account nominated from time to time by the pensioner, either alone or jointly or in common with another person, with a bank, credit union or building society, and payment is to be made accordingly.

“(2) In this section:

‘pension’ means a pension, benefit or allowance under this Act;

‘pensioner’ means a person to whom a pension is payable, whether on his or her own behalf or on behalf of another person.”.

Commencement: Day of Royal Assent

PART 7—AMENDMENTS OF TAXATION ADMINISTRATION ACT 1953

Principal Act

49. In this Part, “Principal Act” means the Taxation Administration Act 19536.

Commencement: 13 November 1989

Unauthorised requirement etc. that tax file number be quoted

50. Section 8wa of the Principal Act is amended by adding at the end the following subsection:

“(5) This section has effect subject to section 138a of the Social Security Act 1947.”.

Commencement: 13 November 1989

Unauthorised recording etc. of tax file number

51. Section 8wb of the Principal Act is amended by adding at the end the following subsection:

“(3) This section has effect subject to section 138a of the Social Security Act 1947.”.

Commencement: 13 November 1989

PART 8—AMENDMENTS OF VETERANS’ ENTITLEMENTS ACT 1986

Principal Act

52. In this Part, “Principal Act” means the Veterans’ Entitlements Act 19867.

Commencement: Day of Royal Assent

Interpretation

53. Section 5 of the Principal Act is amended:

(a) by inserting in subsection (1) the following definition:

“ ‘joint ownership’ includes ownership as joint tenants or tenants in common;”;

(b) by inserting after subsection (7) the following subsections:

“(7a) In this Act:

(a) a reference to 2 persons living together as husband and wife on a bona fide domestic basis is a reference to 2 persons of opposite sexes living together in a marriage-like relationship; and

(b) a reference to a man who is living with a woman as her husband on a bona fide domestic basis is a reference to a man who is living with a woman in a marriage-like relationship; and

(c) a reference to a woman who is living with a man as his wife on a bona fide domestic basis is a reference to a woman who is living with a man in a marriage-like relationship.

“(7b) For the purposes of this Act, 2 persons are not to be taken to be living together as husband and wife on a bona fide domestic basis if they are within a prohibited relationship for the purposes of section 23b of the Marriage Act 1961.”.

Commencement: 1 January 1990

54. After section 11 of the Principal Act the following section is inserted in Part I:

Marriage-like relationships

“11a. In forming an opinion for the purposes of this Act whether 2 people are living together in a marriage-like relationship, regard is to be had to all the circumstances of the relationship including, in particular, the following matters:

(a) the financial aspects of the relationship, including:

(i) any joint ownership of real estate or other major assets and any joint liabilities; and

(ii) any significant pooling of financial resources especially in relation to major financial commitments; and

(iii) any legal obligations owed by one person in respect of the other person; and

(iv) the basis of any sharing of day-to-day household expenses;

(b) the nature of the household, including:

(i) any joint responsibility for providing care or support of children; and

(ii) the living arrangements of the people; and

(iii) the basis on which responsibility for housework is distributed;

(c) the social aspects of the relationship, including:

(i) whether the people hold themselves out as married to each other; and

(ii) the assessment of friends and regular associates of the people about the nature of their relationship; and

(iii) the basis on which the people make plans for, or engage in, joint social activities;

(d) any sexual relationship between the people;

(e) the nature of the people’s commitment to each other, including:

(i) the length of the relationship; and

(ii) the nature of any companionship and emotional support that the people provide to each other; and

(iii) whether the people consider that the relationship is likely to continue indefinitely; and

(iv) whether the people see their relationship as a marriage-like relationship.”.

Commencement: 1 January 1990

NOTES

1. No. 124, 1989.

2. No. 3, 1988, as amended. For previous amendments, see No. 132, 1988; and No. 124, 1989.

3. No. 27, 1936, as amended. For previous amendments, see No. 88, 1936; No. 5, 1937; No. 46, 1938; No. 30, 1939; Nos. 17 and 65, 1940; Nos. 58 and 69, 1941; Nos. 22 and 50, 1942; No. 10, 1943; Nos. 3 and 28, 1944; Nos. 4 and 37, 1945; No. 6, 1946; Nos. 11 and 63, 1947; No. 44, 1948; No. 66, 1949; No. 48, 1950; No. 44, 1951; Nos. 4, 28 and 90, 1952; Nos. 1, 28, 45 and 81, 1953; No. 43, 1954; Nos. 18 and 62, 1955; Nos. 25, 30 and 101, 1956; Nos. 39 and 65, 1957; No. 55, 1958; Nos. 12, 70 and 85, 1959; Nos. 17, 18, 58 and 108, 1960; Nos. 17, 27 and 94, 1961; Nos. 39 and 98, 1962; Nos. 34 and 69, 1963; Nos. 46, 68, 110 and 115, 1964; Nos. 33, 103 and 143, 1965; Nos. 50 and 83, 1966; Nos. 19, 38, 76 and 85, 1967; Nos. 4, 70, 87 and 148, 1968; Nos. 18, 93 and 101, 1969; No. 87, 1970; Nos. 6, 54 and 93, 1971; Nos. 5, 46, 47, 65 and 85, 1972; Nos. 51, 52, 53, 164 and 165, 1973; No. 216, 1973 (as amended by No. 20, 1974); Nos. 26 and 126, 1974; Nos. 80 and 117, 1975; Nos. 50, 53, 56, 98, 143, 165 and 205, 1976; Nos. 57, 126 and 127, 1977; Nos. 36, 57, 87, 90, 123, 171 and 172, 1978; Nos. 12, 19, 27, 43, 62, 146, 147 and 149, 1979; Nos. 19, 24, 57, 58, 124, 133, 134 and 159, 1980; Nos. 61, 92, 108, 109, 110, 111, 154 and 175, 1981; Nos. 29, 38, 39, 76, 80, 106 and 123, 1982; Nos. 14, 25, 39, 49, 51, 54 and 103, 1983; Nos. 14, 42, 47, 63, 76, 115, 124, 165 and 174, 1984; No. 123, 1984 (as amended by No. 65, 1985); Nos. 47, 49, 104, 123, 168 and 174, 1985; No. 173, 1985 (as amended by No. 49, 1986); Nos. 41, 46, 48, 51, 109, 112 and 154, 1986; No. 49, 1986 (as amended by No. 141, 1987); No. 52, 1986 (as amended by No. 141, 1987); No. 90, 1986 (as amended by No. 141, 1987); Nos. 23, 58, 61, 120, 145 and 163, 1987; No. 62, 1987 (as amended by No. 108, 1987); No. 108, 1987 (as amended by No. 138, 1987); No. 138, 1987 (as amended by No. 11, 1988); No. 139, 1987 (as amended by Nos. 11 and 78, 1988); Nos. 8, 11, 59, 75, 78, 80, 87, 95, 97, 127 and 153, 1988; and Nos. 2, 11 and 56, 1989.

4. No. 60, 1940, as amended. For previous amendments, see No. 77, 1946; No. 80, 1950; Nos. 17 and 75, 1952; No. 70, 1953; No. 32, 1954; No. 40, 1955; No. 45, 1957; No. 48, 1958; No. 59, 1959; No. 46, 1960; No. 47, 1961; Nos. 64 and 113, 1964; No. 65, 1965; No. 43, 1966; No. 102, 1967; No. 67, 1968; No. 96, 1969; No. 61, 1970; Nos. 18 and 69, 1971; Nos. 16 and 83, 1972; Nos. 6 and 106, 1973; Nos. 4, 25 and 90, 1974; Nos. 35 and 111, 1975; Nos. 27, 91 and 112, 1976; No. 56, 1977; No. 129, 1978; Nos. 18 and 124, 1979; No. 129, 1980; No. 160, 1981; Nos. 80 and 100, 1982; No. 70, 1983; Nos. 90 and 97, 1984; Nos. 90, 95 and 127, 1985; Nos. 28, 29 and 106, 1986; Nos. 78, 88 and 130, 1987; and Nos. 35 and 134, 1988.

5. No. 26, 1947, as amended. For previous amendments, see Nos. 38 and 69, 1948; No. 16, 1949; Nos. 6 and 26, 1950; No. 22, 1951; Nos 41 and 107, 1952; No. 51, 1953; No. 30, 1954; Nos. 15 and 38, 1955; Nos. 67 and 98, 1956; No. 46, 1957; No. 44, 1958; No. 57, 1959; No. 45, 1961; Nos. 1 and 95, 1962; No. 46, 1963; Nos. 3 and 63, 1964; Nos. 57 and 152, 1965; No. 41, 1966; Nos. 10 and 61, 1967; No. 65, 1968; No. 94, 1969; Nos. 2 and 59, 1970; Nos. 16 and 67, 1971; Nos. 1, 14, 53 and 79, 1972; Nos. 1, 26, 48, 103 and 216, 1973; Nos. 2, 23 and 91, 1974; Nos. 34, 56, 101 and 110, 1975; Nos. 26, 62 and 111, 1976; No. 159, 1977; No. 128, 1978; No. 121, 1979 (as amended by Nos. 37 and 98, 1982); No. 130, 1980; Nos. 61 and 170, 1981; No. 159, 1981 (as amended by No. 98, 1982); Nos. 37, 38 and 148, 1982; Nos. 4 and 36, 1983; No. 69, 1983 (as amended by No. 78, 1984); Nos. 46, 78, 93, 120, 134 and 165, 1984; Nos. 24, 52, 95, 127 and 169, 1985; Nos. 5, 28, 33, 106, 130 and 152, 1986; Nos. 77, 88 and 130, 1987; Nos. 13, 35, 58, 75 and 85, 1988; Nos. 133 and 135, 1988 (as amended by No. 84, 1989); and Nos. 59, 83 and 84, 1989.

NOTES—continued

6. No. 1, 1953, as amended. For previous amendments, see Nos. 28, 39, 40 and 52, 1953; No. 18, 1955; No. 39, 1957; No. 95, 1959; No. 17, 1960; No. 75, 1964; No. 155, 1965; No. 93, 1966; No. 120, 1968; No. 216, 1973; No. 133, 1974; No. 37, 1976; Nos. 19 and 59, 1979; Nos. 39 and 117, 1983; No. 123, 1984; No. 65, 1985 (as amended by No. 193, 1985); Nos. 4, 47, 104, 123 and 168, 1985; Nos. 41, 46, 48, 112, 144 and 154, 1986; No. 49, 1986 (as amended by No. 141, 1987); Nos. 120 and 145, 1987; No. 62, 1987 (as amended by No. 108, 1987); No. 108, 1987 (as amended by No. 138, 1987); No. 138, 1987 (as amended by No. 11, 1988); and Nos. 95 and 97, 1988.

7. No. 27, 1986, as amended. For previous amendments, see Nos. 106 and 130, 1986; Nos. 78, 88 and 130, 1987; Nos. 13, 35, 75, 99 and 134, 1988; No. 135, 1989 (as amended by No. 84, 1989); and Nos. 59 and 83, 1989.

[Minister’s second reading speech made in—

House of Representatives on 24 October 1989

Senate on 4 December 1989]