Sales Tax Laws Amendment Act (No. 2) 1990

No. 81 of 1990

An Act to amend the law relating to sales tax

[Assented to 23 October 1990]

BE IT ENACTED by the Queen, and the Senate and the House of Representatives of the Commonwealth of Australia, as follows:

Short title

1. This Act may be cited as the Sales Tax Laws Amendment Act (No. 2) 1990.

Commencement

2. This Act is taken to have commenced at 7.30 p.m., by standard time in the Australian Capital Territory, on 21 August 1990.

Amendments relating to motor vehicles

3. Each of the following Acts is amended as set out in Schedule 1:

Sales Tax Act (No. 1) 1930

Sales Tax Act (No. 2) 1930

Sales Tax Act (No. 3) 1930

Sales Tax Act (No. 4) 1930

Sales Tax Act (No. 5) 1930

Sales Tax Act (No. 6) 1930

Sales Tax Act (No. 7) 1930

Sales Tax Act (No. 8) 1930

Sales Tax Act (No. 9) 1930.

Amendments relating to printed matter inserts

4. The Acts specified in Schedule 2 are amended as set out in that Schedule.

Application of amendments

5. The amendments made by this Act apply in relation to transactions, acts and operations effected or done in relation to goods after the commencement of this Act.

———————

SCHEDULE 1 Section 3

AMENDMENTS RELATING TO MOTOR VEHICLES

Paragraph 4 (ca):

Omit the paragraph, substitute the following paragraph:

“(ca) in respect of goods covered by the Sixth Schedule to that

Act—the lesser of the following rates:

(i) 50%;

(ii) the percentage rate calculated under section 5; and”.

After section 4:

Add the following section:

Special progressive rate of tax—luxury motor vehicles

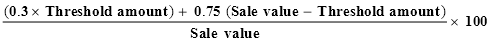

“5. The percentage rate referred to in paragraph 4 (ca) is the percentage rate calculated using the following formula (rounded down to the nearest whole percentage):

where:

‘Threshold amount’ means the amount calculated in relation to the goods concerned using the formula in sub-item 1 (2) of the Sixth Schedule to the Sales Tax (Exemptions and Classifications) Act 1935;

‘Sale value’ means the sale value of the goods.”.

——————

SCHEDULE 2 Section 4

AMENDMENTS RELATING TO PRINTED MATTER INSERTS

Sales Tax Assessment Act (No. 1) 1930

Section 3:

Add at the end the following subsection:

“(15) Where:

(a) disregarding:

(i) this subsection; and

(ii) anything to the same effect in any other Act relating to the imposition, assessment and collection of a tax upon the sale value of goods; and

(iii) subsection 3 (8) of the Sales Tax (Exemptions and Classifications) Act 1935;

SCHEDULE 2—continued

goods (in this subsection called the ‘item 51/54 goods’) are covered by item 51 or 54 in the First Schedule to the last- mentioned Act; and

(b) any one or more of the following subparagraphs applies to any part (in this subsection called an ‘insert’) of the item 51/54 goods:

(i) it has a different sheet size than most of the remainder of the goods;

(ii) it is printed by a different process than most of the remainder of the goods;

(iii) it consists of different paper or other material than most of the remainder of the goods;

(iv) it is inserted separately into the remainder of the goods after they have been made; and

(c) if the item 51/54 goods are a magazine or similar publication (other than a newspaper)—the insert is not a detachable part that is attached by perforation, or glued, sewn or stapled, to the remainder of the goods; and

(d) if the item 51/54 goods are a newspaper—the insert is not a news, sport, entertainment, travel, leisure or similar section (other than an advertising section);

then, for the purposes of this Act, the insert is taken not to be, and never to have been, part of the item 51/54 goods, but to be, and always to have been, separate goods.”.

After section 18c:

Insert the following section:

Sale value of certain printed matter inserts

“18d. Where:

(a) subsection 3 (15) applies to deem an insert, within the meaning of that subsection, not to be part of item 51/54 goods, within the meaning of that subsection; and

(b) the manufacturer of the insert sells it or is deemed by subsection 3 (4) to have sold it; and

(c) sales tax is payable under this Act by the manufacturer on the sale value (including a nil sale value) of the insert in respect of the sale or deemed sale;

then, subject to subsections 18 (4) and (5b), but notwithstanding any other provision of this Act, that sale value is taken to be of the same amount as the sale value that is, or would be, applicable if sales tax is, or were, payable by the manufacturer under this Act in respect of an application of the insert to the manufacturer’s own use at the time of the sale or deemed sale.”

SCHEDULE 2—continued

Sales Tax Assessment Act (No. 2) 1930

After section 4c:

Insert the following section:

Sale value of certain printed matter inserts

“4d. Where:

(a) subsection 3 (15) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, applies to deem an insert, within the meaning of that subsection, not to be part of item 51/54 goods, within the meaning of that subsection; and

(b) a person, being a registered person or a person required to be registered, who has purchased the insert from its manufacturer:

(i) sells the insert; or

(ii) is deemed by subsection 3 (4) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, to have sold the insert; and

(c) sales tax is payable under this Act by the person on the sale value (including a nil sale value) of the insert in respect of the sale or deemed sale;

then, subject to subsection 4 (4) of this Act and to subsection 18 (5b) of the Sales Tax Assessment Act (No. 1) 1930 in its application in accordance with section 12 of this Act, but notwithstanding any other provision of this Act, that sale value is taken to be of the same amount as the sale value that is, or would be, applicable if sales tax is, or were, payable by the person under the Sales Tax Assessment Act (No. 4) 1930 in respect of an application of the insert to the person’s own use at the time of the sale or deemed sale.”.

Sales Tax Assessment Act (No. 3) 1930

After section 4c:

Insert the following section:

Sale value of certain printed matter inserts

“4d. Where:

(a) subsection 3 (15) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, applies to deem an insert, within the meaning of that subsection, not to be part of item 51/54 goods, within the meaning of that subsection; and

(b) a registered person or a person required to be registered, not being either the manufacturer of the insert or a purchaser of the insert from the manufacturer:

SCHEDULE 2—continued

(i) sells the insert; or

(ii) is deemed by subsection 3 (4) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, to have sold the insert; and

(c) sales tax is payable under this Act by the person on the sale value (including a nil sale value) of the insert in respect of the sale or deemed sale;

then, subject to subsection 4 (4) of this Act and to subsection 18 (5b) of the Sales Tax Assessment Act (No. 1) 1930 in its application in accordance with section 12 of this Act, but notwithstanding any other provision of this Act, that sale value is taken to be of the same amount as the sale value that is, or would be, applicable if sales tax is, or were, payable by the person under the Sales Tax Assessment Act (No. 4) 1930 in respect of an application of the insert to the person’s own use at the time of the sale or deemed sale.”.

Sales Tax Assessment Act (No. 6) 1930

After section 4c:

Insert the following section:

Sale value of certain printed matter inserts

“4d. Where:

(a) subsection 3 (15) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, applies to deem an insert, within the meaning of that subsection, not to be part of item 51/54 goods, within the meaning of that subsection; and

(b) a person, being a registered person or a person required to be registered, who has imported the insert:

(i) sells the insert; or

(ii) is deemed by subsection 3 (4) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, to have sold the insert; and

(c) sales tax is payable under this Act by the person on the sale value (including a nil sale value) of the insert in respect of the sale or deemed sale;

then, subject to subsection 18 (5b) of the Sales Tax Assessment Act (No. 1) 1930 in its application in accordance with section 12 of this Act, but notwithstanding any other provision of this Act, that sale value is taken to be of the same amount as the sale value that is, or would be, applicable if sales tax is, or were, payable by the person under this Act in respect of an application of the insert to the person’s own use at the time of the sale or deemed sale.”.

SCHEDULE 2—continued

Sales Tax Assessment Act (No. 7) 1930

After section 4c:

Insert the following section:

Sale value of certain printed matter inserts

“4d. Where:

(a) subsection 3 (15) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, applies to deem an insert, within the meaning of that subsection, not to be part of item 51/54 goods, within the meaning of that subsection; and

(b) the insert was imported into Australia and a person who is a registered person or a person required to be registered, but is not the importer of the insert:

(i) sells the insert; or

(ii) is deemed by subsection 3 (4) of the Sales Tax Assessment Act (No. 1) 1930, in its application in accordance with section 12 of this Act, to have sold the insert; and

(c) sales tax is payable under this Act by the person on the sale value (including a nil sale value) of the insert in respect of the sale or deemed sale;

then, subject to subsection 4 (2) of this Act and to subsection 18 (5b) of the Sales Tax Assessment Act (No. 1) 1930 in its application in accordance with section 12 of this Act, but notwithstanding any other provision of this Act, that sale value is taken to be of the same amount as the sale value that is, or would be, applicable if sales tax is, or were, payable by the person under the Sales Tax Assessment Act (No. 8) 1930 in respect of an application of the insert to the person’s own use at the time of the sale or deemed sale.”.

[Minister’s second reading speech made in—

House of Representatives on 10 October 1990

Senate on 15 October 1990]