An Act to provide for the payment of certain pensions, benefits and allowances, and for related purposes

Chapter 1—Introductory

Part 1.1—Formal matters

1 Short title [see Note 1]

This Act may be cited as the Social Security Act 1991.

2 Commencement

This Act commences on 1 July 1991.

3 Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Act.

Part 1.2—Definitions

3A Power of Secretary to make determinations etc.

If:

(a) a provision of this Act refers to a determination made, approval given or other act done by the Secretary; and

(b) there is no other provision of this Act expressly conferring power on the Secretary to make the determination, give the approval or do the act;

the Secretary has power by this section to make such a determination, give such an approval or do such an act, as the case requires.

4 Family relationships definitions—couples

4(1) In this Act, unless the contrary intention appears:

approved respite care has the meaning given by subsection (9).

armed services widow means a woman who was the partner of:

(a) a person who was a veteran for the purposes of any provisions of the Veterans’ Entitlements Act; or

(b) a person who was a member of the forces for the purposes of Part IV of that Act; or

(c) a person who was a member of a peacekeeping force for the purposes of Part IV of that Act; or

(d) a person who was a member within the meaning of the Military Rehabilitation and Compensation Act for the purposes of that Act;

immediately before the death of the person.

armed services widower means a man who was the partner of:

(a) a person who was a veteran for the purposes of any provisions of the Veterans’ Entitlements Act; or

(b) a person who was a member of the Forces for the purposes of Part IV of that Act; or

(c) a person who was a member of a Peacekeeping Force for the purposes of Part IV of that Act; or

(d) a person who was a member within the meaning of the Military Rehabilitation and Compensation Act for the purposes of that Act;

immediately before the death of the person.

illness separated couple has the meaning given by subsection (7).

member of a couple has the meaning given by subsections (2), (3), (3A), (6) and (6A).

partner, in relation to a person who is a member of a couple, means the other member of the couple.

partnered has the meaning given by subsection (11).

partnered (partner getting benefit) has the meaning given by subsection (11).

partnered (partner getting neither pension nor benefit) has the meaning given by subsection (11).

partnered (partner getting pension) has the meaning given by subsection (11).

partnered (partner getting pension or benefit) has the meaning given by subsection (11).

partnered (partner in gaol) has the meaning given by subsection (11).

respite care couple has the meaning given by subsection (8).

Member of a couple—general

4(2) Subject to subsection (3), a person is a member of a couple for the purposes of this Act if:

(a) the person is legally married to another person and is not, in the Secretary’s opinion (formed as mentioned in subsection (3)), living separately and apart from the other person on a permanent or indefinite basis; or

(b) all of the following conditions are met:

(i) the person has a relationship with a person of the opposite sex (in this paragraph called the partner);

(ii) the person is not legally married to the partner;

(iii) the relationship between the person and the partner is, in the Secretary’s opinion (formed as mentioned in subsections (3) and (3A)), a marriage‑like relationship;

(iv) both the person and the partner are over the age of consent applicable in the State or Territory in which they live;

(v) the person and the partner are not within a prohibited relationship for the purposes of section 23B of the Marriage Act 1961.

Note: a prohibited relationship for the purposes of section 23B of the Marriage Act 1961 is a relationship between a person and:

- an ancestor of the person; or

- a descendant of the person; or

- a brother or sister of the person (whether of the whole blood or the part‑blood).

Member of a couple—criteria for forming opinion about relationship

4(3) In forming an opinion about the relationship between 2 people for the purposes of paragraph (2)(a) or subparagraph (2)(b)(iii), the Secretary is to have regard to all the circumstances of the relationship including, in particular, the following matters:

(a) the financial aspects of the relationship, including:

(i) any joint ownership of real estate or other major assets and any joint liabilities; and

(ii) any significant pooling of financial resources especially in relation to major financial commitments; and

(iii) any legal obligations owed by one person in respect of the other person; and

(iv) the basis of any sharing of day‑to‑day household expenses;

(b) the nature of the household, including:

(i) any joint responsibility for providing care or support of children; and

(ii) the living arrangements of the people; and

(iii) the basis on which responsibility for housework is distributed;

(c) the social aspects of the relationship, including:

(i) whether the people hold themselves out as married to each other; and

(ii) the assessment of friends and regular associates of the people about the nature of their relationship; and

(iii) the basis on which the people make plans for, or engage in, joint social activities;

(d) any sexual relationship between the people;

(e) the nature of the people’s commitment to each other, including:

(i) the length of the relationship; and

(ii) the nature of any companionship and emotional support that the people provide to each other; and

(iii) whether the people consider that the relationship is likely to continue indefinitely; and

(iv) whether the people see their relationship as a marriage‑like relationship.

4(3A) The Secretary must not form the opinion that the relationship between a person and his or her partner is a marriage‑like relationship if the person is living separately and apart from the partner on a permanent or indefinite basis.

Member of a couple—special excluding determination

4(6) A person is not a member of a couple if a determination under section 24 is in force in relation to the person.

Note: section 24 allows the Secretary to treat a person who is a member of a couple as not being a member of a couple in special circumstances.

4(6A) A person who:

(a) has claimed youth allowance and is not independent within the meaning of Part 3.5; or

(b) is receiving a youth allowance and is not independent within the meaning of Part 3.5; or

(c) is a member of a couple of which a person referred to in paragraph (b) is the other member;

is not a member of a couple for the purposes of:

(d) the provisions of this Act referred to in the table at the end of this subsection; and

(e) any provision of this Act that applies for the purposes of a provision mentioned in paragraph (d); and

(f) any provision of this Act that applies for the purposes of Module E (Ordinary income test) of the Pension PP (Single) Rate Calculator in section 1068A.

Note: Paragraphs (e) and (f) have the effect of treating a person as not being a member of a couple in provisions that apply for the purposes of the income test, assets test, liquid assets test or compensation recovery provisions, including section 8 (Income test definitions), section 11 (Assets test definitions), section 14A (Social security benefit liquid assets test provisions), section 17 (Compensation recovery definitions), section 19B (Financial hardship provisions liquid assets test definition), Part 2.26 (Fares allowance), Part 3.10 (General provisions relating to the ordinary income test) and Part 3.12 (General provisions relating to the assets test).

Affected provisions |

Item | Provisions of this Act | Subject matter |

1 | Subdivision AB of Division 2 of Part 2.11 | Youth allowance assets test |

1A | section 500Q | Parenting payment assets test |

2 | sections 549A to 549C | Youth allowance liquid assets test |

3 | Subdivision B of Division 2 of Part 2.11A | Austudy payment assets test |

4 | sections 575A to 575C | Austudy payment liquid assets test |

5 | section 598 | Newstart allowance liquid assets test |

6 | sections 611 and 612 | Newstart allowance assets test |

7 | sections 660YCJ and 660YCK | Mature age allowance assets test |

8 | section 676 | Sickness allowance liquid assets test |

9 | sections 680 and 681 | Sickness allowance assets test |

10 | sections 733 and 734 | Special benefit assets test |

11 | section 771HF | Partner allowance assets test |

11A | Part 2.26 | Fares allowance |

12 | Module E of Pension Rate Calculator A | Ordinary income test |

13 | Module G of Pension Rate Calculator A | Assets test |

14 | Module F of Pension Rate Calculator D | Ordinary income test |

15 | Module H of Pension Rate Calculator D | Assets test |

16 | Module H of Youth Allowance Rate Calculator | Income test |

17 | Module D of the Austudy Payment Rate Calculator | Income test |

18 | Module G of Benefit Rate Calculator B | Income test |

19 | Part 3.14 | Compensation recovery |

Illness separated couple

4(7) Where 2 people are members of a couple, they are members of an illness separated couple if:

(a) they are unable to live together in a matrimonial home as a result of the illness or infirmity of either or both of them; and

(b) because of that inability to live together, their living expenses are, or are likely to be, greater than they would otherwise be; and

(c) that inability is likely to continue indefinitely.

Respite care couple

4(8) Where 2 people are members of a couple, they are members of a respite care couple if:

(a) one of the members of the couple has entered approved respite care; and

(b) the member who has entered the approved respite care has remained, or is likely to remain, in that care for at least 14 consecutive days.

4(9) For the purpose of this Act, a person is in approved respite care on a particular day if the person is eligible for a respite care supplement in respect of that day under section 44‑12 of the Aged Care Act 1997.

Temporarily separated couple

4(9A) Two people are members of a temporarily separated couple if they:

(a) are members of a couple for the purposes of this Act; and

(b) are legally married to each other; and

(c) are living separately and apart from each other but not on a permanent or indefinite basis; and

(d) are neither an illness separated nor a respite care couple.

Note: for member of a couple see subsection 4(2) and section 24.

Standard family situation categories

4(11) For the purposes of this Act:

(a) a person is partnered if the person is a member of a couple; and

(b) a person is partnered (partner getting neither pension nor benefit) if the person is a member of a couple and the person’s partner:

(i) is not receiving a social security pension; and

(ii) is not receiving a social security benefit; and

(iii) is not receiving a service pension or income support supplement; and

(c) a person is partnered (partner getting pension or benefit) if the person is a member of a couple and the person’s partner is receiving:

(i) a social security pension; or

(ii) a social security benefit; or

(iii) a service pension or income support supplement; and

(d) a person is partnered (partner getting pension) if the person is a member of a couple and the person’s partner is receiving:

(i) a social security pension; or

(ii) a service pension or income support supplement; and

(e) a person is partnered (partner getting benefit) if the person is a member of a couple and the person’s partner is receiving a social security benefit; and

(f) a person is partnered (partner in gaol) if the person is a member of a couple and the person’s partner is:

(i) in gaol; or

(ii) undergoing psychiatric confinement because the partner has been charged with committing an offence.

Note 1: For social security pension see subsection 23(1).

Note 2: For in gaol see subsection 23(5).

Note 3: For psychiatric confinement see subsections 23(8) and (9).

5 Family relationships definitions—children

[see Appendix for CPI adjusted figures]

5(1) In this Act, unless the contrary intention appears:

adopted child means a young person adopted under the law of any place, whether in Australia or not, relating to the adoption of children.

dependent child has the meaning given by subsections (2) to (9).

independent, in Parts 2.11, 3.4A, 3.4B, 3.5 and 3.7, has the meaning given in section 1067A.

parent means:

(a) (except in Part 2.11 and in the Youth Allowance Rate Calculator in section 1067G):

(i) in relation to a young person, other than an adopted child—a natural parent of the young person; or

(ii) in relation to an adopted child—an adoptive parent of the young person; or

(b) in Part 2.11 and in the Youth Allowance Rate Calculator in section 1067G, in relation to a person (relevant person):

(i) a natural or adoptive parent of the relevant person with whom the relevant person normally lives; or

(ii) if a parent referred to in subparagraph (b)(i) is a member of a couple and normally lives with the other member of the couple—the other member of the couple; or

(iii) any other person (other than the relevant person’s partner) on whom the relevant person is wholly or substantially dependent; or

(iv) if none of the preceding paragraphs applies—the natural or adoptive parent of the relevant person with whom the relevant person last lived.

prescribed educational scheme means:

(b) the ABSTUDY Scheme; or

(ca) a Student Financial Supplement Scheme; or

Note: An application under the Student Financial Supplement Scheme cannot be made in respect of a year, or a part of a year, that begins on or after the day on which the Student Assistance Legislation Amendment Act 2006 receives the Royal Assent (see subsection 1061ZY(2)).

(e) the Veterans’ Children Education Scheme; or

(ea) the scheme to provide education and training under section 258 of the Military Rehabilitation and Compensation Act; or

(f) the Post‑Graduate Awards Scheme.

prescribed student child has the meaning given by subsection (11).

student child has the meaning given by subsection (1A).

substitute care, in relation to a person, means care of the person:

(a) provided by a carer (other than the natural or adoptive parent of the person) in the carer’s home under the law of a State or Territory; and

(b) for which no substitute care allowance or other allowance for the upkeep of the person is being paid to the carer by an authority of the State or Territory.

young person has the meaning given by subsection (1B).

5(1A) A person is a student child at a particular time if:

(a) at the time, the person:

(i) has reached 16, but is under 22, years of age; and

(ii) is receiving full‑time education at a school, college or university; and

(b) the person’s income in the financial year in which that time occurs will not be more than $6,403.

5(1B) A person is a young person at a particular time if at that time the person:

(a) is under 16 years of age; or

(b) is a student child.

Dependent child—under 16

5(2) Subject to subsections (3) and (6) to (8), a young person who has not turned 16 is a dependent child of another person (in this subsection called the adult) if:

(a) the adult is legally responsible (whether alone or jointly with another person) for the day‑to‑day care, welfare and development of the young person, and the young person is in the adult’s care; or

(b) the young person:

(i) is not a dependent child of someone else under paragraph (a); and

(ii) is wholly or substantially in the adult’s care.

5(3) A young person who has not turned 16 cannot be a dependent child if:

(a) the young person is not in full‑time education; and

(b) the young person is in receipt of income; and

(c) the rate of that income exceeds $107.70 per week.

Note: the amount in paragraph (c) is indexed annually in line with CPI increases (see sections 1191 to 1194).

Dependent child—16 to 21 years of age

5(4) Subject to subsections (5) to (8), a young person is a dependent child of another person at a particular time if:

(a) at that time, the young person:

(i) has reached 16, but is under 22, years of age; and

(ii) is wholly or substantially dependent on the other person; and

(b) the young person’s income in the financial year in which that time occurs will not be more than $6,403.

5(5) A young person who has turned 16 cannot be a dependent child of another person if the other person is the young person’s partner.

Dependent child—pension, benefit and Labour Market Program recipients

5(6) A young person cannot be a dependent child for the purposes of this Act if:

(a) the young person is receiving a social security pension; or

(b) the young person is receiving a social security benefit; or

(c) the young person is receiving payments under a program included in the programs known as Labour Market Programs.

Dependent child—residence requirements

5(7) For the purposes of this Act (other than the provisions dealing with special benefit), a young person is not to be treated as a dependent child of another person (in this subsection called the adult) unless:

(a) if the adult is an Australian resident:

(i) the young person is an Australian resident; or

(ii) the young person is living with the adult; or

(b) if the adult is not an Australian resident:

(i) the young person is an Australian resident; or

(ii) the young person has been an Australian resident and is living with the adult outside Australia; or

(iii) the young person had been living with the adult in Australia and is living with the adult outside Australia.

Note: for Australian resident see subsection 7(2).

5(8) For the purposes of working out the maximum rate of special benefit under subsection 746(2), a young person is not to be treated as a dependent child of another person (in this subsection called the adult) unless:

(a) if the adult is an Australian resident:

(i) the young person is an Australian resident or a resident of Australia; or

(ii) the young person is living with the adult; or

(b) if the adult is not an Australian resident—the young person is an Australian resident or a resident of Australia.

Note: Australian resident is defined by subsection 7(2) but resident of Australia has its ordinary meaning and is not given any special definition by this Act. Subsection 7(3) is relevant to the question of whether a person is residing in Australia.

5(8A) For the purposes of Part 2.10, a young person who is an inmate of a mental hospital is a dependent child of a member of a couple if there is in force under subsection 37(3) a determination in respect of the young person and the member of the couple.

Dependent child—inmate of mental hospital

5(9) For the purposes of Part 2.17, a young person who is an inmate of a mental hospital is a dependent child of another person if a determination under subsection 37(1) in respect of the young person and the other person is in force.

Prescribed student child

5(11) A person is a prescribed student child if:

(a) the person is a young person who has reached 16, but is under 22, years of age; and

(b) the young person is qualified to receive payments under a prescribed educational scheme.

5(12) For the purposes of subsection (11), a young person is, subject to subsection (13), qualified to receive a payment under a prescribed educational scheme if:

(a) the young person is receiving a payment under a prescribed educational scheme; or

(b) someone else is receiving, in respect of the young person, a payment under a prescribed educational scheme; or

(c) the Secretary has not formed the opinion that:

(i) the young person will not, or would not if an application were duly made, receive a payment under a prescribed educational scheme; and

(ii) no other person will, or would if an application were duly made, receive, in respect of the young person, a payment under a prescribed educational scheme.

5(13) For the purposes of subsection (11), a young person is not qualified to receive a payment under a prescribed educational scheme if:

(a) the young person is not receiving a payment under a prescribed educational scheme; and

(b) no other person is receiving, in respect of the young person, a payment under a prescribed educational scheme; and

(c) the Secretary is satisfied that the educational scheme rate would be less than the social security rate.

5(14) For the purposes of subsection (13):

(a) the educational scheme rate is the total of the amounts that would be payable to or in respect of the young person under the prescribed educational scheme; and

(b) the social security rate is the Part A rate of family tax benefit for which a person would be eligible (in respect of the young person) if the young person were not a prescribed student child.

5A Single person sharing accommodation

5A(1) For the purposes of this Act, a person is to be treated as a single person sharing accommodation if the person:

(a) is not a member of a couple; and

(b) has no dependent children; and

(c) has, in common with one or more other people, the right to use at least one major area of accommodation.

5A(2) A person is not to be treated as a single person sharing accommodation if the person:

(a) pays, or is liable to pay, amounts for the person’s board and lodging; or

(ab) is residing in exempt accommodation (see subsections (5A), (5B) and (5C)); or

(b) is the recipient of a disability support pension or a carer pension; or

(c) is residing in a nursing home.

5A(3) A person who has the exclusive right to use a bathroom, a kitchen and a bedroom is not to be treated as a single person sharing accommodation solely because the person has the right, in common with one or more other people, to use other major areas of accommodation.

5A(4) A person is not to be treated as a single person sharing accommodation solely because the person shares accommodation with one or more recipient children of the person.

5A(5) If:

(a) a person lives alone in a caravan or mobile home, or on board a vessel; or

(b) a person shares accommodation in a caravan, mobile home or vessel solely with one or more recipient children of the person;

the person is not to be treated as a single person sharing accommodation solely because the person has the right, in common with one or more other people, to use one or more major areas of accommodation in a caravan park or marina.

5A(5A) A person’s accommodation is exempt accommodation if it is in premises that are, in the Secretary’s opinion, a boarding house, guest house, hostel, hotel, private hotel, rooming house, lodging house or similar premises.

5A(5B) In forming an opinion about a person’s accommodation for the purposes of subsection (5A), the Secretary is to have regard to the characteristics of the accommodation including, in particular, whether or not the following are characteristics of the accommodation:

(a) the premises are known as a boarding house, guest house, hostel, hotel, private hotel, rooming house, lodging house or similar premises;

(b) a manager or administrator (other than a real estate agent) is retained to manage the premises or administer the accommodation on a daily or other frequent regular basis;

(c) staff are retained by the proprietor or manager of the premises to work in the premises on a daily or other frequent regular basis;

(d) the residents lack control over the day‑to‑day management of the premises;

(e) there are house rules, imposed by the proprietor or manager, that result in residents having rights that are more limited than those normally enjoyed by a lessee of private residential accommodation (for example, rules limiting the hours of residents’ access to their accommodation or limiting residents’ access to cooking facilities in the premises);

(f) the person does not have obligations to pay for his or her costs of gas, water or electricity separately from the cost of the accommodation;

(g) the accommodation is not private residential accommodation, having regard to:

(i) the number and nature of bedrooms in the premises; or

(ii) the number of people who are not related to one another living at the premises; or

(iii) the number and nature of bathrooms in the premises;

(h) the person’s accommodation has not been offered to the person on a leasehold basis;

(j) there is no requirement that the person pay a bond as security for either the payment of rent or the cost of any damage caused by the person, or for both;

(k) the person’s accommodation is available on a daily or other short‑term basis.

5A(5C) Each of the characteristics set out in subsection (5B) points towards the accommodation in question being exempt accommodation.

5A(6) In this section:

major area of accommodation means any of the following, whether identifiably separate from other areas of accommodation or not:

(a) a bathroom;

(b) a kitchen;

(c) a bedroom.

recipient child means a child who receives any of the following, but who does not receive any amount by way of rent assistance:

(a) a social security payment;

(c) a payment under the ABSTUDY Schooling scheme or the ABSTUDY Tertiary scheme;

(d) a service pension;

(e) a youth training allowance.

6 Double orphan pension definitions

In this Act, unless the contrary intention appears:

approved care organisation means an organisation approved by the Secretary under subsection 35(1).

double orphan means a young person who is a double orphan in accordance with section 993 or 994.

6A Concession card definitions

6A(1) In this Act, unless the contrary intention appears:

automatic issue card means:

(a) a pensioner concession card; or

(b) an automatic issue health care card.

automatic issue health care card means a health care card issued to a person qualified for the card under Subdivision A of Division 3 of Part 2A.1.

dependant, in relation to a person who is the holder of a pensioner concession card or an automatic issue health care card (other than a health care card for which the person is qualified under subsection 1061ZK(4)), means a person who is:

(a) the partner; or

(b) a dependent child;

of the holder of the card.

dependant, in relation to a person who is the holder of a health care card for which the person is qualified under subsection 1061ZK(4) or Subdivision B of Division 3 of Part 2A.1, means a person who is:

(a) the partner; or

(b) an FTB child;

of the holder of the card.

dependant, in relation to a person, other than a child in foster care, who has made a claim for a health care card (the claimant), means a person who is:

(a) the partner; or

(b) an FTB child;

of the claimant.

6A(2) For the purposes of the operation of a definition of dependant in subsection (1) in relation to a provision of Part 2A.1, a person (the child) is an FTB child of another person (the adult) if:

(a) the child is an FTB child of the adult within the meaning of the Family Assistance Act; and

(b) either:

(i) the child is under 16 years of age; or

(ii) the child is 16, but not yet 19, years of age and is undertaking secondary studies.

6A(3) For the purposes of the operation of a definition of dependant in subsection (1) in relation to a provision of this Act (other than a provision of Part 2A.1), a person (the child) is an FTB child of another person (the adult) if the child is an FTB child of the adult within the meaning of the Family Assistance Act.

7 Australian residence definitions

7(1) In this Act, unless the contrary intention appears:

Australian resident has the meaning given by subsection (2).

designated temporary entry permit means:

(a) an old PRC (temporary) entry permit held by the partner or a dependent child (if any) of a citizen of the People’s Republic of China if that citizen holds an old PRC (temporary) entry permit; or

(b) a new PRC (temporary) entry permit held by the partner or a dependent child (if any) of a citizen of the People’s Republic of China if that citizen holds:

(i) an old PRC (temporary) entry permit; or

(ii) a new PRC (temporary) entry permit.

former refugee means a person who was a refugee but does not include a person who ceased to be a refugee because his or her visa or entry permit (as the case may be) was cancelled.

holder, in relation to a visa, has the same meaning as in the Migration Act 1958.

new PRC (temporary) entry permit means an entry permit within class 437 of Division 2.6—Group 2.6 in Part 2 of Schedule 1 to the Migration (1993) Regulations as in force before 1 September 1994.

old PRC (temporary) entry permit means a PRC (temporary) entry permit within the meaning of the Migration (1989) Regulations as in force before 1 February 1993.

permanent visa, special category visa, special purpose visa, temporary visa and visa have the same meaning as in the Migration Act 1958.

protected SCV holder has the meaning given by subsections (2A), (2B), (2C) and (2D).

qualifying Australian residence has the meaning given by subsection (5).

qualifying residence exemption has the meaning given in subsections (6) and (6AA).

7(2) An Australian resident is a person who:

(a) resides in Australia; and

(b) is one of the following:

(i) an Australian citizen;

(ii) the holder of a permanent visa;

(iii) a special category visa holder who is a protected SCV holder.

Note: For holder and permanent visa see subsection (1).

7(2A) A person is a protected SCV holder if:

(a) the person was in Australia on 26 February 2001, and was a special category visa holder on that day; or

(b) the person had been in Australia for a period of, or for periods totalling, 12 months during the period of 2 years immediately before 26 February 2001, and returned to Australia after that day.

7(2B) A person is a protected SCV holder if the person:

(a) was residing in Australia on 26 February 2001; and

(b) was temporarily absent from Australia on 26 February 2001; and

(c) was a special category visa holder immediately before the beginning of the temporary absence; and

(d) was receiving a social security payment on 26 February 2001; and

(e) returned to Australia before the later of the following:

(i) the end of the period of 26 weeks beginning on 26 February 2001;

(ii) if the Secretary extended the person’s portability period for the payment under section 1218C—the end of the extended period.

7(2C) A person who commenced, or recommenced, residing in Australia during the period of 3 months beginning on 26 February 2001 is a protected SCV holder at a particular time if:

(a) the time is during the period of 3 years beginning on 26 February 2001; or

(b) the time is after the end of that period, and either:

(i) a determination under subsection (2E) is in force in respect of the person; or

(ii) the person claimed a payment under the social security law during that period, and the claim was granted on the basis that the person was a protected SCV holder.

7(2D) A person who, on 26 February 2001:

(a) was residing in Australia; and

(b) was temporarily absent from Australia; and

(c) was not receiving a social security payment;

is a protected SCV holder at a particular time if:

(d) the time is during the period of 12 months beginning on 26 February 2001; or

(e) the time is after the end of that period, and either:

(i) at that time, a determination under subsection (2E) is in force in respect of the person; or

(ii) the person claimed a payment under the social security law during that period, and the claim was granted on the basis that the person was a protected SCV holder.

7(2E) A person who is residing in Australia and is in Australia may apply to the Secretary for a determination under this subsection stating that:

(a) the person was residing in Australia on 26 February 2001, but was temporarily absent from Australia on that day; or

(b) the person commenced, or recommenced, residing in Australia during the period of 3 months beginning on 26 February 2001.

7(2F) If a person makes an application under subsection (2E), the Secretary must make the determination if:

(a) the Secretary is satisfied that paragraph (2E)(a) or (2E)(b) applies to the person; and

(b) the application was made within whichever of the following periods is applicable:

(i) if paragraph (2E)(a) applies to the person—the period of 12 months beginning on 26 February 2001;

(ii) if paragraph (2E)(b) applies to the person—the period of 3 years beginning on 26 February 2001.

The Secretary must give a copy of the determination to the person.

7(2G) The Secretary must make a determination under this subsection in respect of a person if the person is a protected SCV holder because of subsection (2B). If the Secretary is required to make such a determination:

(a) the determination must state that the person was residing in Australia on 26 February 2001, but was temporarily absent from Australia on that day; and

(b) the determination must be made within the period of 6 months of the person’s return to Australia; and

(c) a copy of the determination must be given to the person.

7(3) In deciding for the purposes of this Act whether or not a person is residing in Australia, regard must be had to:

(a) the nature of the accommodation used by the person in Australia; and

(b) the nature and extent of the family relationships the person has in Australia; and

(c) the nature and extent of the person’s employment, business or financial ties with Australia; and

(d) the nature and extent of the person’s assets located in Australia; and

(e) the frequency and duration of the person’s travel outside Australia; and

(f) any other matter relevant to determining whether the person intends to remain permanently in Australia.

7(4) For the purposes of:

(a) Part 2.2 (age pension); and

(b) Part 2.3 (disability support pension); and

(d) Part 2.7 (bereavement allowance); and

(e) Part 2.8 (widow B pension);

the following apply:

(f) residence of a claimant in an external Territory other than Norfolk Island is taken to be residence in Australia; and

(g) residence of a claimant in Norfolk Island is taken not to interrupt the continuity of residence of the claimant in Australia.

7(4AA) Whether residence in a particular place is residence in an external territory for the purposes of subsection (4) is to be determined as at the time of residence.

7(4B) For the purposes of a newly arrived resident’s waiting period, the day on which a permanent visa is granted to a person or a person becomes the holder of a permanent visa is:

(a) if an initial decision maker decides to grant a visa to the person—that day; or

(b) if:

(i) an initial decision maker decides not to grant a visa to the person; and

(ii) on a review of the decision referred to in subparagraph (i), that decision is set aside (however described) and a visa is granted to the person;

the day on which the initial decision maker decided not to grant the visa to the person.

7(5) A person has 10 years qualifying Australian residence if and only if:

(a) the person has, at any time, been an Australian resident for a continuous period of not less than 10 years; or

(b) the person has been an Australian resident during more than one period and:

(i) at least one of those periods is 5 years or more; and

(ii) the aggregate of those periods exceeds 10 years.

7(6) A person has a qualifying residence exemption for a social security pension, a social security benefit (other than a special benefit), a mobility allowance, a pensioner education supplement, a seniors health card or a health care card if, and only if, the person:

(a) resides in Australia; and

(b) is either:

(i) a refugee; or

(ii) a former refugee.

7(6AA) A person also has a qualifying residence exemption for a social security benefit (other than a special benefit), a pension PP (single), carer payment, a mobility allowance, a seniors health card or a health care card if, and only if, the person:

(b) was a family member of a refugee, or former refugee, at the time the refugee or former refugee arrived in Australia; or

(f) holds or was the former holder of a visa that is in a class of visas determined by the Minister for the purposes of this paragraph.

7(6B) A person is a refugee for the purposes of this section if the person:

(a) is taken, under the Migration Reform (Transitional Provisions) Regulations, to be the holder of a transitional (permanent) visa because the person was, immediately before 1 September 1994, the holder of:

(i) a visa or entry permit that fell within Division 1.3—Group 1.3 (Permanent resident (refugee and humanitarian) (offshore)) in Part 1 of Schedule 1 to the Migration (1993) Regulations as then in force; or

(ii) a visa or entry permit that fell within Division 1.5—Group 1.5 (Permanent resident (refugee and humanitarian) (on‑shore)) in Part 1 of Schedule 1 to the Migration (1993) Regulations as then in force; or

(b) was, immediately before 1 February 1993, the holder of a visa or entry permit of a class prescribed under the Migration Regulations as then in force that corresponds to a visa or entry permit referred to in subparagraph (a)(i) or (ii); or

(c) is the holder of:

(i) a permanent protection visa; or

(ii) a permanent visa of a class referred to in the Table at the end of this subsection; or

(iii) a permanent visa of a class referred to in a declaration of the Minister under subsection 25(1) that is in force.

Table—Classes of permanent visas giving refugee status and qualifying residence exemption |

Item No. | Class description | Relevant item in Schedule 1 to Migration Regulations |

1. | Burmese in Burma (Special Assistance) (Class AB) | 1102 |

2. | Burmese in Thailand (Special Assistance) (Class AC) | 1103 |

3. | Cambodian (Special Assistance) (Class AE) | 1105 |

4. | Camp Clearance (Migrant) (Class AF) | 1106 |

5. | Citizens of the Former Yugoslavia (Special Assistance) (Class AI) | 1109 |

6. | East Timorese in Portugal, Macau and Mozambique (Special Assistance) (Class AM) | 1113 |

7. | Minorities of Former USSR (Special Assistance) (Class AV) | 1122 |

8. | Refugee and Humanitarian (Migrant) (Class BA) | 1127 |

8A | Sri Lankan (Special Assistance) (Class BF) | 1129A |

9. | Sudanese (Special Assistance) (Class BD) | 1130 |

10. | Territorial Asylum (Residence) (Class BE) | 1131 |

7(6D) For the purposes of subsection (6AA):

family member, in relation to a person, means:

(a) a partner of the person; or

(b) a dependent child of the person; or

(c) another person who, in the opinion of the Secretary, should be treated for the purposes of this definition as a person described in paragraph (a) or (b).

7(6E) The Minister may, by determination in writing:

(a) set guidelines for the exercise of the Secretary’s power under paragraph (6D)(c); and

(b) may revoke or vary those guidelines.

7(6F) A determination made under paragraph (6AA)(f) or subsection (6E) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

7(7) For the purposes of paragraph 540(d), subparagraph 593(1)(g)(ii) and paragraph 666(1)(g), a person is exempt from the residence requirement in respect of a period if:

(a) throughout the period, the person was the holder of a special category visa; and

(b) immediately before the period commenced, the person had been residing in Australia for a continuous period of at least 10 years, being a period commencing on or after 26 February 2001;

unless the person’s exemption from the residence requirement in respect of the period would result in the person:

(c) receiving newstart allowance, sickness allowance or youth allowance for a continuous period of more than 6 months because of this subsection; or

(d) receiving newstart allowance, sickness allowance or youth allowance for more than one non‑continuous period because of this subsection; or

(e) receiving more than one of those allowances because of this subsection.

8 Income test definitions

8(1) In this Act, unless the contrary intention appears:

approved scholarship means a scholarship in relation to which a determination under section 24A is in force.

available money, in relation to a person, means money that:

(a) is held by or on behalf of the person; and

(b) is not deposit money of the person; and

(c) is not the subject of a loan made by the person.

deposit money, in relation to a person, means the person’s money that is deposited in an account with a financial institution.

dispose of income has the meaning given by section 1106.

domestic payment has the meaning given by subsection (3).

earned, derived or received has the meaning given by subsection (2).

employment income, in relation to a person, means ordinary income of the person that comprises employment income under subsection (1A) and includes ordinary income that is characterised as employment income of the person because of the operation of subsection (1B).

exempt lump sum has the meaning given by subsection (11).

home equity conversion agreement, in relation to a person, means an agreement under which the repayment of an amount paid to or on behalf of the person, or the person’s partner, is secured by a mortgage of the principal home of the person or the person’s partner.

Note: see also subsection (7).

income, in relation to a person, means:

(a) an income amount earned, derived or received by the person for the person’s own use or benefit; or

(b) a periodical payment by way of gift or allowance; or

(c) a periodical benefit by way of gift or allowance;

but does not include an amount that is excluded under subsection (4), (5) or (8).

Note 1: See also sections 1074 and 1075 (business income), sections 1076‑1084 (deemed income from financial assets), sections 1095 to 1099DAA (income from income streams), section 1099F (exempt bond amount does not count as income) and section 1099K (refunded amount does not count as income).

Note 2: where a person or a person’s partner has disposed of income, the person’s income may be taken to include the amount which has been disposed of—see sections 1106‑1112.

Note 3: income is equivalent to ordinary income plus maintenance income.

income amount means:

(a) valuable consideration; or

(b) personal earnings; or

(c) moneys; or

(d) profits;

(whether of a capital nature or not).

income from personal exertion means an income amount that is earned, derived or received by a person by way of payment for personal exertion by the person but does not include an income amount received as compensation for the person’s inability to earn, derive or receive income through personal exertion.

ordinary income means income that is not maintenance income or an exempt lump sum.

Note 1: for maintenance income see subsection 10(1).

Note 2: amounts received as a series of periodic compensation payments may result in reduction of the person’s rate of social security pension or benefit under Part 3.14: if this happens the amounts are not counted as ordinary income (see section 1171).

Note 3: For provisions affecting the amount of a person’s ordinary income see sections 1072 and 1073 (ordinary income concept), sections 1074 and 1075 (business income), sections 1076‑1084 (deemed income from financial assets) and sections 1095‑1099DAA (income from income streams).

student income bank means the student income bank set out:

(a) in Module J of the Youth Allowance Rate Calculator; or

(b) in Module E of the Austudy Payment Rate Calculator.

working credit participant means a person who is a working credit participant within the meaning of section 1073D.

8(1A) A reference in this Act to employment income, in relation to a person, is a reference to ordinary income of the person:

(a) that is earned, derived or received, or that is taken to have been earned, derived or received, by the person from remunerative work undertaken by the person as an employee in an employer/employee relationship; and

(b) that includes, but is not limited to, salary, wages, commissions and employment‑related fringe benefits that are so earned, derived or received or taken to have been so earned, derived or received;

but does not include:

(c) a superannuation payment to the person; or

(d) a payment of compensation, or a payment to the person under an insurance scheme, in relation to the person’s inability to earn, derive or receive income from that remunerative work; or

(e) a leave payment to the person; or

(f) a payment to the person by a former employer of the person in relation to the termination of the person’s employment; or

(g) a comparable foreign payment.

8(1B) For the avoidance of doubt, if:

(a) a person is treated, for the purposes of working out the person’s ordinary income, as having earned, derived or received any ordinary income that was in fact earned, derived or received, or taken to have been earned, derived or received, by the partner of the person; and

(b) that ordinary income would be characterised as employment income in the hands of the partner if the partner were not a member of a couple;

then, for the purposes of this Act, that ordinary income is to be similarly characterised in the hands of the person.

8(1C) For the purposes of paragraph (1A)(e), a leave payment:

(a) includes a payment in respect of sick leave, annual leave, maternity leave or long service leave; and

(b) may be made as a lump sum payment, a payment that is one of a series of regular payments or otherwise; and

(c) is taken to be made to the person if it is made to another person:

(i) at the direction of the first‑mentioned person or of a court; or

(ii) on behalf of the first‑mentioned person; or

(iii) for the benefit of the first‑mentioned person; or

(iv) if the first‑mentioned person waives or assigns his or her right to the payment.

Earned, derived or received

8(2) A reference in this Act to an income amount earned, derived or received is a reference to:

(a) an income amount earned, derived or received by any means; and

(b) an income amount earned, derived or received from any source (whether within or outside Australia).

Domestic payments

8(3) A payment received by a person is a domestic payment for the purposes of this Act if:

(a) the person receives the payment on the disposal of an asset of the person; and

(b) the asset was used, immediately before the disposal, by the person or the person’s partner for private or domestic purposes; and

(c) the asset was used by the person or the person’s partner for those purposes for:

(i) a period of 12 months before the disposal; or

(ii) if the Secretary considers it appropriate—a period of less than 12 months before the disposal.

Excluded amounts—home equity conversion (not member of a couple)

8(4) If a person is not a member of a couple, an amount paid to or on behalf of the person under a home equity conversion agreement is an excluded amount for the person to the extent that the total amount owed by the person from time to time under home equity conversion agreements does not exceed $40,000.

Excluded amounts—home equity conversion (member of a couple)

8(5) If a person is a member of a couple, an amount paid to or on behalf of the person or the person’s partner under a home equity conversion agreement is an excluded amount for the person to the extent that the total amount owed by the person and the person’s partner under home equity conversion agreements from time to time does not exceed $40,000.

Home equity conversion (amount owed)

8(6) For the purposes of this Act, the amount owed by a person under a home equity conversion agreement is the principal amount secured by the mortgage concerned and does not include:

(a) any amount representing mortgage fees; or

(b) any amount representing interest; or

(c) any similar liability whose repayment is also secured by the mortgage.

Home equity conversion (principal home)

8(7) For the purposes of the definition of home equity conversion agreement in subsection (1), an asset cannot be a person’s principal home unless the person or the person’s partner has a beneficial interest (but not necessarily the sole beneficial interest) in the asset.

Excluded amounts—general

8(8) The following amounts are not income for the purposes of this Act:

(a) a payment under this Act;

(b) any return on a person’s investment in:

(i) a superannuation fund; or

(ii) an approved deposit fund; or

(iii) a deferred annuity; or

(iv) an ATO small superannuation account;

until the person:

(v) reaches pension age; or

(vi) starts to receive a pension or annuity out of the fund;

(c) the value of emergency relief or like assistance;

(d) the value of any assistance that:

(i) is provided by an eligible organisation within the meaning of the Homeless Persons Assistance Act 1974; and

(ii) is assistance that consists of providing:

(A) accommodation or meals; or

(B) a ticket, voucher or token that may be exchanged for accommodation or meals;

(e) a payment under the Handicapped Persons Assistance Act 1974;

(f) a payment under Part III of the Disability Services Act 1986 or the value of any rehabilitation program (including any follow‑up program) provided under that Part;

(g) a payment of domiciliary nursing care benefit under Part VB of the National Health Act 1953 as in force immediately before 1 July 1999;

(h) a payment under a law of the Commonwealth, being a law having an object of assisting persons to purchase or build their own homes;

(ha) a payment made by a State or Territory for the purpose of assisting the person to purchase or build his or her own home;

(j) a payment made to the person for or in respect of a dependent child of the person;

(jaa) a payment of family assistance, or of one‑off payment to families, under the Family Assistance Act;

(jab) a payment under the scheme determined under Schedule 3 to the Family Assistance Legislation Amendment (More Help for Families—One‑off Payments) Act 2004;

(jac) a payment under the scheme determined under Schedule 2 to the Social Security Legislation Amendment (One‑off Payments for Carers) Act 2005;

(jad) a payment under the scheme determined under Schedule 4 to the Social Security and Veterans’ Entitlements Legislation Amendment (One‑off Payments to Increase Assistance for Older Australians and Carers and Other Measures) Act 2006;

(ja) disability expenses maintenance;

(k) insurance or compensation payments made by reason of the loss of, or damage to, buildings, plant or personal effects;

(ka) where:

(i) the person owes money under a mortgage or other arrangement; and

(ii) the person has insurance which requires the insurer to make payments to the creditor when the person is unemployed or ill or in other specified circumstances; and

(iii) payments are made to the creditor under the insurance;

a payment so made;

(m) money from an investment that is:

(i) an investment of payments of the kind referred to in paragraph (k); and

(ii) an investment for:

(A) a period of not more than 12 months after the person receives the payments; or

(B) if the Secretary thinks it appropriate—of 12 months or more after the person receives those payments;

(ma) money from an exempt funeral investment;

Note: for exempt funeral investment see subsection 23(1).

(n) an amount paid, under a law of, or applying in, a country or part of a country, by way of compensation for a victim of National Socialist persecution;

(q) in the case of a person who pays or who is liable to pay rent, a payment by way of rent subsidy made by the Commonwealth, by a State or Territory or by an authority of the Commonwealth or of a State or Territory to or on behalf of the person who pays or who is liable to pay rent;

(r) a payment received by a trainee in full‑time training under a program included in the programs known as Labour Market Programs, to the extent that the payment includes one or more of the following amounts:

(i) an amount calculated by reference to a rate of newstart allowance;

(ii) an amount known as the training component;

(iii) an amount by way of a living away from home allowance;

(s) in the case of a person who is receiving a social security pension, a social security benefit, a service pension or income support supplement and is in part‑time training, or engaged in part‑time work experience, under a program included in the programs known as Labour Market Programs—a payment received by the person under that program in respect of the person’s expenses associated with his or her participation in the training or work experience;

(t) a payment received by the person under the scheme known as the New Enterprise Incentive Scheme;

(u) a benefit under a law of the Commonwealth that relates to the provision of:

(i) pharmaceutical, sickness or hospital benefits; or

(ii) medical or dental services;

(v) a payment (other than a periodical payment or a payment representing an accumulation of instalments) made for or in respect of expenses incurred by a person for hospital, medical, dental or similar treatment;

(va) a payment made by the Mark Fitzpatrick Trust to a person by way of assistance with expenses incurred in relation to a person who has medically acquired HIV infection;

(vb) a payment made by the New South Wales

Medically‑Acquired HIV Trust to a person by way of financial assistance with expenses incurred in relation to a person who has medically acquired HIV infection;

(w) in the case of a member of:

(i) the Naval Reserve; or

(ii) the Army Reserve; or

(iii) the Air Force Reserve;

the pay and allowances paid to the person as such a member (other than pay and allowances in respect of continuous full‑time service);

(y) a payment by way of:

(i) service pension or income support supplement; or

(ia) one‑off payment to the aged under regulations made under the Veterans’ Entitlements Act; or

(ii) attendant allowance under section 98 of the Veterans’ Entitlements Act; or

(iii) recreation allowance under section 104 of that Act; or

(iv) an allowance for the running and maintenance of a motor vehicle under the Vehicle Assistance Scheme referred to in section 105 of that Act; or

(v) decoration allowance under section 102 of that Act; or

(vi) Victoria Cross allowance under section 103 of that Act; or

(vii) clothing allowance under section 97 of that Act; or

(viia) utilities allowance under Part VIIAC of that Act; or

(viib) seniors concession allowance under Part VIIAD of that Act; or

(viii) a bereavement payment under Part III, or section 98A of that Act; or

(ix) a funeral benefit under Part VI of that Act; or

(x) a payment under Part VIIAB (DFISA) of that Act (including a payment made under regulations made under that Part);

(ya) a payment made by the Commonwealth and known as the one‑off payment to the aged; or

(yb) 2006 one‑off payment to older Australians under the Veterans’ Entitlements Act;

(yc) a payment under a scheme determined under Schedule 2 to the Social Security and Veterans’ Entitlements Legislation Amendment (One‑off Payments to Increase Assistance for Older Australians and Carers and Other Measures) Act 2006;

(z) a periodical payment by way of gift or allowance, or a periodical benefit by way of gift or allowance, from the person’s father, mother, son, daughter, brother or sister;

Note: the rule in paragraph 8(8)(z) is reversed in Youth Allowance Rate Calculator (point 1067G‑H21), Austudy Payment Rate Calculator (point 1067L‑D15), Benefit Rate Calculator B (point 1068‑G5) and the Parenting Allowance Rate Calculator (point 1068B‑D5). Points 1067G‑H21, 1067L‑D15, 1068‑G5 and 1068A‑D6 are contrary intentions (see the opening words in subsection 8(1) and the definition of income in that subsection).

(za) the value of board or lodging received by the person;

(zb) a domestic payment;

(zc) so much of a payment received by the person as is, in accordance with an agreement between the Commonwealth and a foreign country, applied in reduction of the amount of social security payment that would otherwise be payable to the person under this Act;

(zd) a payment made to the person by the Government of New Zealand, being a payment known as:

(i) accommodation benefit; or

(ii) disability allowance; or

(iii) home help payment; or

(iv) special benefit; or

(v) training incentive allowance;

(ze) a payment made to the person by the Government of the United Kingdom, being a payment known as:

(i) clothing allowance; or

(ii) constant attendance allowance; or

(iii) decoration allowance; or

(iv) mobility supplement;

(zf) a payment under the ABSTUDY Scheme;

(zfa) a payment of financial supplement made to the person under a Student Financial Supplement Scheme;

(zg) a payment received by the person for serving, or being summoned to serve, on a jury;

(zh) a payment received by the person for expenses as a witness, other than an expert witness, before a court, tribunal or commission;

(zi) a payment towards the cost of personal care support services for the person, being a payment made under a scheme approved under section 35A;

(zia) the amount or value of a scholarship known as a Commonwealth Trade Learning Scholarship;

(zj) a payment of an approved scholarship awarded on or after 1 September 1990;

Note: for approved scholarship see subsection 8(1).

(zja) the amount or value of:

(i) a scholarship known as a Commonwealth Education Costs Scholarship; or

(ii) a scholarship known as a Commonwealth Accommodation Scholarship;

provided for under the Commonwealth Scholarships Guidelines made for the purposes of Part 2‑4 of the Higher Education Support Act 2003;

(zjb) an amount covered by subsection (8B) (about reductions of amounts payable for enrolment or tuition in certain courses);

(zjc) a payment covered by subsection (8C) (about payments that are made to an educational institution or the Commonwealth to reduce a person’s liability to the educational institution or Commonwealth and that are made by someone other than the person);

(zk) an amount paid by a buyer under a sale leaseback agreement;

(zl) if a person is a member of an approved exchange trading system—an amount credited to the person’s account for the purposes of the scheme in respect of any goods or services provided by the person to another member.

Note: For approved exchange trading system see subsections (9) and (10).

(zm) if a person:

(i) is a member of a couple; and

(ii) is receiving a social security benefit;

a payment received by the person either directly or indirectly from his or her partner.

(zn) while a person is accruing a liability to pay an accommodation charge—any rent from the person’s principal home that the person, or the person’s partner, earns, derives or receives from another person;

Note 1: For rent, see subsection 13(2).

Note 2: Under subsections 11(6A) and (7), the principal home of a person in a care situation may be a place other than the place where the person receives care.

(zna) while a person is liable to pay all or some of an accommodation bond by periodic payments—any rent from the person’s principal home that the person, or the person’s partner, earns, derives or receives from another person;

(zo) a payment under section 217 or 266 of the Military Rehabilitation and Compensation Act to reimburse costs incurred in respect of the provision of goods or services (other than a payment to the person who provided the goods or service);

(zp) if subsection 204(5) of the Military Rehabilitation and Compensation Act applies to a person—an amount per fortnight, worked out under subsection (12) of this section, that would, apart from this paragraph, be income of the person;

Note: Subsection 204(5) of the Military Rehabilitation and Compensation Act reduces a Special Rate Disability Pension by reference to amounts of Commonwealth superannuation that the person has received or is receiving.

(zq) a payment under the Motor Vehicle Compensation Scheme under section 212 of the Military Rehabilitation and Compensation Act;

(zr) a payment under section 242 of the Military Rehabilitation and Compensation Act (continuing permanent impairment and incapacity etc. payments);

(zs) the value of the benefit provided under the initiative known as the Tools for Your Trade initiative.

8(8A) For the purposes of the operation of section 5 in determining whether a person is:

(a) a student child; or

(b) a dependent child of another person;

this section has effect as if paragraph (8)(zf) were not included.

8(8B) This subsection covers the amount of a reduction (by discount, remission or waiver) of an amount that would otherwise be payable by a person:

(a) to an educational institution for enrolment or tuition of the person by the institution in a course that:

(i) is determined, under section 5D of the Student Assistance Act 1973, to be a secondary course or a tertiary course for the purposes of that Act; or

(ii) is a Masters or Doctoral degree course accredited as a higher education course by the authority responsible for accrediting higher education courses in the State or Territory in which the course is conducted or by the institution, if it is permitted by a law of the Commonwealth, a State or a Territory to accredit higher education courses that it conducts; or

(iii) is a course of vocational training; or

(b) to the Commonwealth as a result of the person’s enrolment in, or undertaking of, such a course at an educational institution.

8(8C) This subsection covers a payment:

(a) that is made to discharge, or to prevent from arising, to any extent:

(i) a person’s actual or anticipated liability to an educational institution for enrolment or tuition of the person by the institution in a course described in paragraph (8B)(a); or

(ii) a person’s actual or anticipated liability to the Commonwealth resulting from the person’s enrolment in, or undertaking of, such a course at an educational institution; and

(b) that is made by someone other than the person; and

(c) that is made to the institution or the Commonwealth; and

(d) that is not made at the direction of the person.

8(9) An exchange trading system is an arrangement between a number of persons (members) under which each member may obtain goods or services from another member for consideration that is wholly or partly in kind rather than in cash. Each member has, for the purposes of the arrangement, an account:

(a) to which is credited:

(i) the amount representing the value of any goods or services provided by the member to another member; or

(ii) if the goods or services were partly paid for in cash—the amount referred to in subparagraph (i) less the amount so paid in cash; and

(b) to which is debited:

(i) the amount representing the value of any goods or services supplied to the member by another member; or

(ii) if the goods or services were partly paid for in cash—the amount referred to in subparagraph (i) less the amount so paid in cash.

8(10) An exchange trading system is an approved exchange trading system if the Secretary is satisfied that:

(a) it is a local community‑based system; and

(b) its primary purpose is to help persons maintain their labour skills and keep them in touch with the labour market; and

(c) it is not a system run by a person or organisation for profit.

8(11) An amount received by a person is an exempt lump sum if:

(a) the amount is not a periodic amount (within the meaning of subsection 10(1A)); and

(b) the amount is not a leave payment within the meaning of points 1067G‑H20, 1067L‑D16 and 1068‑G7AR; and

(c) the amount is not income from remunerative work undertaken by the person; and

(d) the amount is an amount, or class of amounts, determined by the Secretary to be an exempt lump sum.

Note: Some examples of the kinds of lump sums that the Secretary may determine to be exempt lump sums include a lottery win or other windfall, a legacy or bequest, or a gift—if it is a one‑off gift.

8(12) For the purposes of paragraph 8(8)(zp), the amount per fortnight that is not income for the purposes of this Act is:

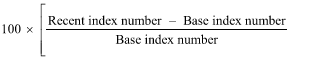

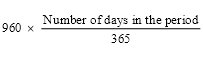

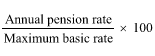

where:

Special Rate Disability Pension reduction amount means the amount by which the Special Rate Disability Pension (as reduced under subsection 204(3)) is reduced under subsection 204(6) of the Military Rehabilitation and Compensation Act (but not below zero).

9 Financial assets and income streams definitions [see Note 7]

9(1) In this Act, unless the contrary intention appears:

approved deposit fund means a fund that is an approved deposit fund for the purposes of Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act.

asset‑test exempt income stream has the meanings given by sections 9A, 9B and 9BA.

asset‑tested income stream (long term) means an income stream that is an asset‑tested income stream (long term) under section 9D or an income stream that:

(a) is not an asset‑test exempt income stream; and

(b) has, on its commencement day:

(i) a term of more than 5 years; or

(ii) if the person who has acquired the income stream has a life expectancy of 5 years or less—a term equal to or greater than the person’s life expectancy.

asset‑tested income stream (short term) means an income stream that is an asset‑tested income stream (short term) under section 9D or an income stream that is neither:

(a) an asset‑test exempt income stream; nor;

(b) an asset‑tested income stream (long term).

ATO small superannuation account means an account kept in the name of an individual under the Small Superannuation Accounts Act 1995.

commencement day, in relation to an income stream, means the first day of the period to which the first payment under the income stream relates.

deductible amount, in relation to an income stream, means the amount that would be the deductible amount in relation to the income stream under subsection 27H(2) of the Income Tax Assessment Act, if the references in that subsection to an annuity were references to an income stream.

deferred annuity means an annuity that is a deferred annuity for the purposes of Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act.

defined benefit income stream has the meaning given by subsection (1F).

deprived asset has the meaning given by subsection (4).

family law affected income stream has the meaning given by section 9C.

financial asset means:

(a) a financial investment; or

(b) a deprived asset.

Note: For deprived asset see subsection 9(4).

financial investment means:

(a) available money; or

(b) deposit money; or

(c) a managed investment; or

(d) a listed security; or

(e) a loan that has not been repaid in full; or

(f) an unlisted public security; or

(g) gold, silver or platinum bullion; or

(h) an asset‑tested income stream (short term).

friendly society means:

(a) a body that is a friendly society for the purposes of the Life Insurance Act 1995; or

(b) a body that is registered or incorporated as a friendly society under a law of a State or Territory; or

(c) a body that is permitted, by a law of a State or Territory, to assume or use the expression friendly society; or

(d) a body that, immediately before the date that is the transfer date for the purposes of the Financial Sector Reform (Amendments and Transitional Provisions) Act (No. 1) 1999, was registered or incorporated as a friendly society under a law of a State or Territory; or

(e) a body that had, before 13 December 1987, been approved for the purpose of the definition of friendly society in subsection 115(1) of the 1947 Act.

governing rules, in relation to an income stream, means any trust instrument, other document or legislation, or combination of them, governing the establishment and operation of the income stream.

income stream means:

(a) an income stream arising under arrangements that are regulated by the Superannuation Industry (Supervision) Act 1993; or

(b) an income stream arising under a public sector superannuation scheme (within the meaning of that Act); or

(c) an income stream arising under a retirement savings account; or

(d) an income stream provided by a life insurance business (within the meaning of the Life Insurance Act 1995); or

(e) an income stream provided by a friendly society; or

(f) an income stream designated in writing by the Secretary for the purposes of this definition, having regard to the guidelines determined under subsection (1E); or

(fa) a family law affected income stream;

but does not include any of the following:

(g) available money;

(h) deposit money;

(i) a managed investment;

(j) a listed security;

(k) a loan that has not been repaid in full;

(l) an unlisted public security;

(m) gold, silver or platinum bullion.

investment:

(a) in relation to a superannuation fund, approved deposit fund or deferred annuity—has the meaning given by subsection (9); or

(b) in relation to an ATO small superannuation account—has the meaning given by subsection (9A).

investor, in relation to an ATO small superannuation account, means the person in whose name the account is kept.

life expectancy has the same meaning as life expectation factor has in section 27H of the Income Tax Assessment Act.

listed security means:

(a) a share in a company; or

(b) another security;

listed on a stock exchange.

managed investment has the meaning given by subsections (1A), (1B) and (1C).

original family law affected income stream has the meaning given by section 9C.

pensioner couple means a couple, one or both of the members of which are receiving a social security pension, a service pension, income support supplement or a rehabilitation allowance.

primary FLA income stream has the meaning given by section 9C.

public unit trust means a unit trust that:

(a) except where paragraph (b) applies—was, in relation to the unit trust’s last year of income, a public unit trust for the purposes of Division 6B of Part III of the Income Tax Assessment Act; or

(b) where the first year of income of the unit trust has not yet finished—has, at some time since the trust was established, satisfied at least one of the paragraphs of subsection 102G(1) of the Income Tax Assessment Act.

purchase price, in relation to an income stream, means the sum of the payments made to purchase the income stream (including amounts paid by way of employer and employee contributions) less any commuted amounts.

relevant number, in relation to an income stream, means:

(a) if the income stream is payable for a fixed number of years—that number; or

(b) if the income stream is payable during the lifetime of a person and no longer—the number of years of the person’s life expectancy; or

(c) if the income stream:

(i) is jointly owned by a person and his or her partner and is payable for the lifetime of the person or the partner; or

(ii) is payable during the lifetime of a person and then for the lifetime of a reversionary beneficiary;

the number of years of the longer of the relevant life expectancies; or

(d) in any other case—the number that the Secretary considers appropriate having regard to the number of years in the total period during which the income stream will be, or may reasonably be expected to be, payable.

residual capital value, in relation to an income stream, has the meaning that it has in Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act.

retirement savings account has the meaning that it has in the Retirement Savings Account Act 1997.

return:

(a) in relation to an ATO small superannuation account—means so much of the balance of the account as is attributable to interest; or

(b) in relation to any other investment in the nature of superannuation—means any increase, whether of a capital or income nature and whether or not distributed, in the value or amount of the investment.

secondary FLA income stream has the meaning given by section 9C.

superannuation benefit, in relation to a person, means:

(a) a benefit arising directly or indirectly from amounts contributed (whether by the person or by any other person) to a superannuation fund in respect of the person; or

(b) a payment under Part 7 of the Small Superannuation Accounts Act 1995, where the payment is in respect of an ATO small superannuation account kept in the name of the person.

superannuation contributions surcharge has the meaning that it has in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

superannuation fund means:

(a) a fund or scheme included in the definition of superannuation fund in subsection 27A(1) of the Income Tax Assessment Act, other than a fund covered by subparagraph (a)(ia) of that definition; or

(b) an eligible resident non‑complying superannuation fund within the meaning of the Income Tax Assessment Act.

unlisted public security means:

(a) a share in a public company; or

(b) another security;

that is not listed on a stock exchange.

9(1A) Subject to subsections (1B) and (1C), an investment is a managed investment for the purposes of this Act if:

(a) the money or property invested is paid by the investor directly or indirectly to a body corporate or into a trust fund; and

(b) the assets that represent the money or property invested (the invested assets) are not held in the names of investors; and

(c) the investor does not have effective control over the management of the invested assets; and

(d) the investor has a legally enforceable right to share in any distribution of income or profits derived from the invested assets.

9(1B) Without limiting the generality of subsection (1A) but subject to subsection (1C), the following are managed investments for the purposes of this Act:

(a) an investment in a public unit trust;

(b) an investment in an insurance bond;

(c) an investment with a friendly society;

(d) an investment in a superannuation fund;

Note: see paragraph (1C)(a) for superannuation investments held before pension age is reached.

(e) an investment in an approved deposit fund;

Note: see paragraph (1C)(b) for investments in approved deposit funds held before pension age is reached.

(f) an investment in a deferred annuity;

Note: see paragraph (1C)(c) for deferred annuities held before pension age is reached.

(g) an investment in an ATO small superannuation account.

Note: See paragraph (1C)(ca) for investments in ATO small superannuation accounts held before pension age is reached.

9(1C) The following are not managed investments for the purposes of this Act:

(a) an investment in a superannuation fund if the investor has not yet reached pension age;

(b) an investment in an approved deposit fund if the investor has not yet reached pension age;

(c) an investment in a deferred annuity if the investor has not yet reached pension age;

(ca) an investment in an ATO small superannuation account if the investor has not yet reached pension age;

(d) deposit money;

(e) a loan;

(f) an asset‑test exempt income stream;

(g) an asset‑tested income stream (long term);

(h) an asset‑tested income stream (short term).

Note 2: for deposit money see subsection 8(1).

Note 3: For provisions relating to when a loan is taken to be made see subsection (2).

Note 4: Asset‑test exempt income streams are dealt with under sections 1098 to 1099AA.

Note 5: Asset‑tested income streams (long term) are dealt with under sections 1099B to 1099DAA.

9(1D) To avoid doubt, neither an accommodation bond nor an accommodation bond balance is a financial investment for the purposes of this Act.

9(1E) The Secretary may determine, in writing, guidelines to be complied with when designating an income stream for the purposes of the definition of income stream in subsection (1). The determination is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.