States Grants (General Purposes) Act 1991

No. 170 of 1991

An Act to provide for grants to the States and the Northern Territory

The Parliament of Australia enacts:

[Assented to 20 November 1991]

PART 1—PRELIMINARY

Short title

1. This Act may be cited as the States Grants (General Purposes) Act 1991.

Commencement

2.(1) Subject to subsection (2), this Act commences on the day on which it receives the Royal Assent.

(2) Section 21 commences on 31 December 1991.

Interpretation

3.(1) In this Act, unless the contrary intention appears:

"adjusted population", in relation to a State, means the estimated population of the State on 31 December 1991 multiplied by the population factor for the State;

"base assistance amount" means $13,381,200,733;

"calculation quarter" means a period of 3 months ending on 30 June 1991, 30 September 1991, 31 December 1991 or 31 March 1992;

"Education Minister" means the Minister for Employment, Education and Training;

"estimated population" has the meaning given by section 5;

"grant year" means the financial year that commenced on 1 July 1991;

"Health Minister" means the Minister for Health, Housing and Community Services;

"higher education institution" has the same meaning as in the Employment, Education and Training Act 1988;

"hospital funding arrangements" means the arrangements set out in the agreements entered into with the States under section 23F of the Health Insurance Act 1973;

"hospital grant" has the meaning given by section 4;

"index estimate" means:

(a) except where paragraph (b) applies, 876.1, being the sum of the index numbers, in respect of the calculation quarters, estimated by the Department in May 1991; or

(b) if the Statistician changes the reference base for the Consumer Price Index in relation to a calculation quarter, the number that the Treasurer determines would have been the sum of the index numbers, in respect of the calculation quarters, estimated by the Department in May 1991 if it had known the terms of the new reference base;

"index factor" means the factor worked out by dividing the sum of the index numbers in respect of the calculation quarters by the index estimate;

"index number", in relation to a calculation quarter, means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Statistician in respect of that quarter;

"population factor" means:

(a) in relation to New South Wales—1.015; or

(b) in relation to Victoria—1.000; or

(c) in relation to Queensland—1.335; or

(d) in relation to Western Australia—1.408; or

(e) in relation to South Australia—1.526; or

(f) in relation to Tasmania—1.731; or

(g) in relation to the Northern Territory—5.673;

"State" includes the Northern Territory;

"Statistician" means the Australian Statistician;

"unfunded superannuation liabilities", in relation to higher education institutions in a State, means unfunded superannuation liabilities in relation to higher education under superannuation schemes conducted by the State.

(2) Subject to subsection (3), if, at any time after the publication of an index number in respect of the calculation quarter ending on 31 March 1992, the Statistician publishes an index number in respect of a calculation quarter in substitution for an index number previously published by the Statistician in respect of the last-mentioned quarter, the publication of the later index number is to be disregarded for the purposes of this Act.

(3) If at any time the Statistician changes the reference base for the Consumer Price Index in relation to a calculation quarter, then, for the purposes of the application of this Act, regard is to be had only to index numbers published in terms of the new reference base.

Hospital grant

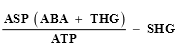

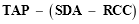

4. In this Act, a reference to a hospital grant, in relation to a State, is a reference to an amount worked out using the formula:

where:

"TAP" [Total Amount Payable] means the amount determined by the Health Minister before 10 June 1992 to be the estimate of the total amount payable to the State, during the grant year, under the hospital funding arrangements for that year;

"SDA" [Sum of Deductible Amounts] means the amount determined by that Minister before that date to be the estimate of such part of TAP as is the sum of the amounts payable to the State, during the grant ,year, under the hospital funding arrangements for that year, for:

(a) additional day surgery procedures; and

(b) post-acute and palliative care services; and

(c) development of cost-based information systems; and

(d) purposes relating to Acquired Immune Deficiency Syndrome;

"RCC" [Reduction in Certain Circumstances] means the amount determined by that Minister before that date to be the estimate of any reduction in the amount otherwise payable to the State, during the grant year, under the hospital funding arrangements for that year, because of the existence of circumstances that under those arrangements require the reduction to be made.

Determination of population of a State

5.(1) Subject to subsection (2), a reference in this Act to the estimated population of a State on 31 December 1991 is a reference to the population of the State on that date as determined by the Statistician after that date and before 10 June 1992.

(2) The Statistician, in making a determination under this section of the estimated population of a State, must, where practicable, consult with the official Statistician of the State and must have regard to the latest statistics in relation to population available to the Statistician on the day on which the determination is made.

PART 2—GRANTS TO THE STATES AND THE NORTHERN

TERRITORY

Division 1—General Revenue Grants

Financial assistance grants

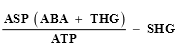

6.(1) Subject to this Act, each State is entitled to the payment by way of financial assistance, in relation to the grant year, of a financial assistance grant worked out using the formula:

where:

"ASP" [Adjusted State Population] means the adjusted population of that State;

"ABA" [Amount of Base Assistance] means the base assistance amount multiplied by the index factor;

"THG" [Total Hospital Grants] means the sum of the hospital grants for all the States;

"ATP" [Adjusted Total Population] means the sum of the adjusted populations of all of the States;

"SHG" [State Hospital Grant] means the hospital grant in relation to that State.

(2) The amount that would, but for this subsection, be payable under this section in relation to the grant year to Victoria is to be reduced by $2,428,000.

Identified road grants

7. Subject to this Act, each State specified in column 1 of the following table is entitled to the payment by way of financial assistance, in relation to the grant year, of an amount worked out by multiplying the amount specified for the State in column 2 of that table by the index factor.

AMOUNTS OF IDENTIFIED ROAD GRANTS

Column 1 | Column 2 |

State | Maximum amount

of grant

under this section |

| $ |

New South Wales . . . . . . . . . . . . . . . . . . . . . . . . . . . | 4,569,086 |

Victoria . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 2,668,885 |

Queensland. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 6,054,619 |

South Australia. . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 8,822,759 |

Tasmania. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 5,223,074 |

Northern Territory. . . . . . . . . . . . . . . . . . . . . . . . . . | 12,276,870 |

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 39,615,293 |

States not bound to apply payments towards expenditure on roads

8. Nothing in this Act prevents a State from applying an amount paid to it under section 7 for a purpose that is not connected with roads.

Special revenue assistance grant

9. Subject to this Act, the Northern Territory is entitled to the payment by way of financial assistance, in relation to the grant year, of a special revenue assistance grant of an amount worked out by multiplying $40,000,000 by the index factor.

Reduction of general revenue grants to take account of certain advance payments

10. The sum of the amounts that would, but for this section, be payable under this Division in relation to the grant year to a State is to be reduced by an amount equal to the sum of any amounts paid to the State under section 14 of the States Grants (General Purposes) Act 1990, not being amounts that the Treasurer has determined, under section 13 of this Act, to be amounts paid in connection with expenditure of a capital nature.

Division 2—Capital Expenditure Grants

Grants to States in respect of capital expenditure

11. Subject to this Act, each State specified in column 1 of the following table is entitled to the payment by way of financial assistance, in relation to the grant year, in connection with expenditure of a capital

nature, of amounts the total of which is not to exceed the amount specified for the State in column 2 of that table.

AMOUNTS OF CAPITAL GRANTS

Column 1 | Column 2 |

State | Maximum amount

of grant

under this section |

| $ |

New South Wales . . . . . . . . . . . . . . . . . . . . . . . . . . . | 79,756,000 |

Victoria . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 68,263,000 |

Queensland. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 16,095,000 |

Western Australia | 22,425,000 |

South Australia. . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 38,963,000 |

Tasmania. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 27,468,000 |

Northern Territory. . . . . . . . . . . . . . . . . . . . . . . . . . | 43,816,000 |

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 296,786,000 |

States not bound to apply payments towards capital expenditure

12. Nothing in this Act prevents a State from applying an amount paid to it under section 11 for the purpose of expenditure that is not of a capital nature.

Reduction of capital expenditure grants to take account of certain advance payments

13. The sum of the amounts that would, but for this section, be payable under this Division in relation to the grant year to a State is to be reduced by an amount equal to the sum of any amounts paid to the State under section 14 of the States Grants (General Purposes) Act 1990, being amounts that the Treasurer determines in writing to be amounts paid in connection with expenditure of a capital nature.

Division 3—Conditions on which grants made

State contribution to costs of higher education superannuation

14.(1) Financial assistance to which a State is entitled under this Act in relation to the grant year is granted on the following conditions:

(a) that the State will pay to the Commonwealth the amount (if any) determined by the Education Minister on or before 31 March 1992 as representing the State's share of the costs of any unfunded superannuation liabilities of higher education institutions in the State, being liabilities required to be discharged during the grant year;

(b) that the Treasurer may, after 31 May 1992, deduct from payment due to the State under this Act any amount that is

payable by the State to the Commonwealth under paragraph (a) and remains unpaid.

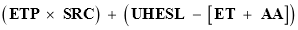

(2) The amount to be determined under paragraph (1)(a) in relation to a State is the amount worked out using the formula:

where:

"ETP" [Estimated Total Payments] means the estimated total of the payments required to be made during the grant year in discharge of unfunded superannuation liabilities of higher education institutions in the State attributable to service before 1 January 1974;

"SRC" [State Recurrent Costs] means the fraction representing, as nearly as is practicable, the proportion of the recurrent costs of higher education in the State borne by the State in the period during which that service was being performed;

"UHESL" [Unfunded Higher Education Superannuation Liabilities] means the estimated total of the payments required to be made during the grant year in discharge of unfunded superannuation liabilities of higher education institutions in the State attributable to service on or after 1 January 1982;

"ET" [Estimated Total] means the amount that would be the estimated total of such payments if the benefits provided under superannuation schemes under which those liabilities arise were reduced to a level that could be financed by a long-term employer contribution at the rate of 14% of members' salaries;

"AA" [Additional Amount] means any amount that the Education Minister determines is appropriate having regard to relevant industrial awards relating to superannuation.

(3) An amount deducted under paragraph (1)(b) from payment due to a State is taken to have been paid by the State to the Commonwealth under paragraph (1)(a).

PART 3—MISCELLANEOUS

Advance payments for grant year

15. The Treasurer may make advances to a State of portions of the amount or amounts to which it appears to the Treasurer the State will be entitled under this Act in relation to the grant year.

Advance payments for succeeding year

16.(1) The Treasurer may, during the period of 6 months commencing on 1 July 1992, make payments to a State of amounts not exceeding in the aggregate 55% of the sum of the amounts payable to the State under this Act in relation to the grant year.

(2) In working out, for the purposes of subsection (1), the sum of the amounts payable to a State, the operation of sections 10 and 13 is to be disregarded.

(3) The sum of the amounts paid under subsection (1) must not exceed 50% of all the amounts payable under this Act in relation to the grant year.

Treasurer may fix amounts, and times of payments, of financial assistance

17. Financial assistance payable to a State under this Act is to be paid in such amounts, and at such times, as the Treasurer determines in writing.

Appropriation

18. Payments under this Act are to be made out of the Consolidated Revenue Fund, which is appropriated accordingly.

Delegation by Treasurer

19.(1) The Treasurer may, by writing signed by him or her, delegate to a person holding, or performing the duties of, an office in the Department all or any of the Treasurer's powers under sections 13, 14, 15, 16 and 17.

(2) A delegate is, in the exercise of a power so delegated, subject to the Treasurer's directions.

Determinations

20. A determination made under this Act by:

(a) the Treasurer; or

(b) the Education Minister; or

(c) the Health Minister; or

(d) the Statistician;

is, for the purposes of this Act, conclusively presumed to be correct.

Repeal

21. The States Grants (General Purposes) Act 1990 is repealed.

_____________________________________________________________________________________

[Minister's second reading speech made in—

House of Representatives on 10 October 1991

Senate on 5 November 1991]