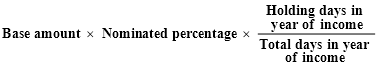

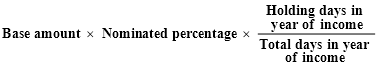

where:

‘Base amount’ means whichever is the lesser of:

(a) the cost price of the horse; or

(b) the depreciated value of the horse, within the meaning of section 62, at the time the horse became live stock of the taxpayer;

‘Nominated percentage’ means the percentage, not exceeding 25%, nominated by the taxpayer at the same time as the taxpayer selects the option referred to in paragraph (2)(a);

‘Holding days in year of income’ means:

(a) if the horse was held by the taxpayer for breeding purposes during the whole of the year of income—the number of days in the year of income; or

(b) if the taxpayer commenced to hold the horse for breeding purposes during the year of income—the number of whole days in so much of the year of income as occurred after that commencement;

‘Total days in year of income’ means the number of days in the year of income.

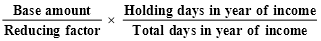

[Reduction amount—female horse less than 12 years old]

“(9) If a female horse has not attained the age of 12 years before the end of the year of income, then, for the purposes of this section, the reduction amount in relation to the horse in relation to the year of income is worked out using the formula:

where:

‘Base amount’ means whichever is the lesser of:

(a) the cost price of the horse; or

(b) the depreciated value of the horse, within the meaning of section 62, at the time the horse became live stock of the taxpayer;

‘Reducing factor’ means whichever is the greater of:

(a) 3; or

(b) the difference between 12 and the number of whole years in the age attained by the horse on the day on which the horse commenced to be held by the taxpayer for breeding purposes;

‘Holding days in year of income’ means:

(a) if the horse was held by the taxpayer for breeding purposes during the whole of the year of income—the number of days in the year of income; or

(b) if the taxpayer commenced to hold the horse for breeding purposes during the year of income—the number of whole days in so much of the year of income as occurred after that commencement;

‘Total days in year of income’ means the number of days in the year of income.

[Age of horse]

“(10) For the purposes of this section, the time when a horse attains a particular age expressed in years is the commencement of the relevant anniversary of the birth date of the horse.

[Horse becoming live stock more than once before end of year of income]

“(11) For the purposes of this section, if a horse becomes live stock of the taxpayer more than once before the end of the year of income, the horse is taken to have become live stock of the taxpayer on the last occasion before the end of the year of income on which it became live stock of the taxpayer.

[Horse commencing to be held for breeding purposes more than once before end of year of income]

“(12) For the purposes of this section, if the taxpayer commences to hold a horse for breeding purposes more than once before the end of the year of income, the taxpayer is taken to have commenced to hold the horse for breeding purposes on the last occasion before the end of the year of income on which the taxpayer commenced to hold the horse for breeding purposes.

[Definitions]

“(13) In this section:

‘birth date’:

(a) in relation to a horse foaled on or after 1 August in a calendar year—means 1 August in that year; and

(b) in relation to a horse foaled before 1 August in a calendar year—means 1 August in the preceding year;

‘horse breeding stock’ has the meaning given by subsection (5);

‘opening value’ has the meaning given by subsection (7);

‘reduction amount’ has the meaning given by whichever of subsections (8) and (9) is applicable;

‘special closing value’ has the meaning given by subsection (6).”.

Application

[Sections 32 and 32A of the amended Act]

24.(1) Sections 32 and 32A of the Principal Act as amended by this Act apply in relation to live stock:

(a) in any case—acquired by a taxpayer under a contract entered into on or after 19 August 1992; or

(b) in the case of section 32 of the Principal Act as amended by this Act—acquired by a taxpayer otherwise than under a contract, where the acquisition occurred on or after 19 August 1992.

[Section 32 of the Principal Act]

(2) In spite of the repeal of section 32 of the Principal Act effected by this Division, that section continues to apply, in relation to live stock:

(a) acquired by a taxpayer under a contract entered into before 19 August 1992; or

(b) acquired by a taxpayer otherwise than under a contract, where the acquisition occurred before 19 August 1992;

as if that repeal had not been effected.

Division 8—Amendments to allow deductions for environment protection expenditure

25. After section 82BG of the Principal Act the following Subdivision is inserted:

“Subdivision CA—Deductions for environment protection expenditure

Objects of Subdivision

“82BH. The objects of this Subdivision are:

(a) to provide for the deductibility of allowable environment protection expenditure (section 82BK); and

(b) to allow property used for eligible environment protection activities to be treated as if it were used for the purpose of producing assessable income (section 82BR).

Interpretation

“82BJ. In this Subdivision:

‘allowable environment protection expenditure’ has the meaning given by section 82BL;

‘eligible environment protection activity’ has the meaning given by section 82BM;

‘environment’ includes all aspects of the surroundings of humans, whether affecting them as individuals or in social groupings;

‘income-producing activity’, in relation to a taxpayer, means an activity (including an investment activity) carried on for the purpose, or for purposes that include the purpose, of producing assessable income (other than assessable income attributable to section 160Z) of the taxpayer of any year of income;

‘site’ includes a part of a site.

Deduction of allowable environment protection expenditure

[Deduction allowable]

“82BK.(1) Subject to this Subdivision, allowable environment protection expenditure incurred by a taxpayer on or after 19 August 1992 is an allowable deduction for the year of income in which the expenditure is incurred.

[Section 51 limits apply]

“(2) A provision of this Act (including a provision of section 51, other than subsection 51(1)) that expressly prevents or restricts the operation of section 51 applies in the same way to this section.

Allowable environment protection expenditure

[Meaning of “allowable environment protection expenditure”]

“82BL.(1) For the purposes of this Subdivision, if:

(a) a taxpayer incurs expenditure (whether of a capital nature or otherwise) for the sole or dominant purpose of carrying on one or more eligible environment protection activities;

then:

(b) the expenditure, to the extent that the expenditure is in respect of eligible environment protection activities in relation to the taxpayer, is allowable environment protection expenditure of the taxpayer.

[Allowable environment protection expenditure does not include allowable environmental impact expenditure]

“(2) Expenditure is taken not to be allowable environment protection expenditure to the extent to which it is allowable environmental impact expenditure (within the meaning of section 82BC).

[Deduction of last resort]

“(3) Expenditure is taken not to be allowable environment protection expenditure to the extent to which a deduction is allowable in respect of that expenditure under a provision of this Act other than section 82BK.

Eligible environment protection activity

[Meaning of “eligible environment protection activity”]

“82BM.(1) A reference in this Subdivision to an eligible environment protection activity in relation to a taxpayer is a reference to any of the following activities carried on by or on behalf of the taxpayer:

(a) preventing, combating or rectifying pollution of the environment, where:

(i) the pollution has resulted, or is likely to result, from an income-producing activity that was, is, or is proposed to be, carried on by the taxpayer; or

(ii) the pollution is of a site on which the taxpayer carried on, carries on, or proposes to carry on, an income-producing activity; or

(iii) the source of the pollution is a site on which the taxpayer carried on, carries on, or proposes to carry on, an income-producing activity; or

(iv) the pollution is of a site on which the predecessor of the taxpayer carried on a business activity; or

(v) the source of the pollution is a site on which the predecessor of the taxpayer carried on a business activity;

(b) treating, cleaning up, removing or storing waste, where:

(i) the waste has resulted, or is likely to result, from an income-producing activity that was, is, or is proposed to be, carried on by the taxpayer; or

(ii) the waste is on a site on which the taxpayer carried on, carries on, or proposes to carry on, an income-producing activity; or

(iii) the source of the waste is a site on which the taxpayer carried on, carries on, or proposes to carry on, an income-producing activity; or

(iv) the waste is on a site on which the predecessor of the taxpayer carried on a business activity; or

(v) the source of the waste is a site on which the predecessor of the taxpayer carried on a business activity.

[Site on which investment activities carried on]

“(2) For the purposes of this section, if a taxpayer carried on, carries on, or proposes to carry on, an income-producing activity consisting of:

(a) the leasing of a site owned by the taxpayer; or

(b) the granting of rights to use a site owned by, or under the control of, the taxpayer; or

(c) any similar thing;

the taxpayer is taken to have carried on, to carry on, or to propose to carry on, the income-producing activity on that site, as the case requires.

[Site on which predecessor of taxpayer carried on a business activity]

“(3) For the purposes of this section, a site (‘old site’) is a site on which the predecessor of a taxpayer carried on a business activity, if, and only if:

(a) the taxpayer carries on an income-producing activity on another site (‘new site’); and

(b) the taxpayer’s income-producing activity consists of the carrying on of a business; and

(c) the taxpayer acquired the business from another person who, or whose predecessor (whether immediate or otherwise), carried on the business on the old site; and

(d) apart from the change of site, the taxpayer’s business is the same, or substantially the same, as the business carried on by the other person, or by the other person’s predecessor, as the case requires, on the old site.

No deduction for expenditure on land, plant etc.

[No deduction for expenditure on land, buildings etc.]

“82BN.(1) A deduction is not allowable under section 82BK for:

(a) expenditure in respect of acquiring land; or

(b) expenditure of a capital nature in respect of constructing a building, structure or structural improvement; or

(c) expenditure of a capital nature in respect of constructing an extension, alteration or improvement to a building, structure or structural improvement; or

(d) expenditure in respect of a bond or security, however described, for the performance of eligible environment protection activities.

[No deduction for depreciable plant]

“(2) A deduction is not allowable under section 82BK for expenditure to the extent to which it is taken into account in calculating an amount of depreciation that is allowable as a deduction.

No deduction where expenditure is recouped

[No deduction where expenditure is recouped]

“82BP.(1) Section 82BK does not apply, and is taken never to have applied, to expenditure if:

(a) the taxpayer, whether before or after the commencement of this subsection, receives, or becomes entitled to receive, a recoupment of, or grant in respect of, the expenditure; and

(b) the amount of the recoupment or the grant is not, and will not be, included in the taxpayer’s assessable income of any year of income.

[Dissection of amounts]

“(2) For the purposes of subsection (1), if a taxpayer receives, or becomes entitled to receive, an amount that constitutes to an unspecified extent a recoupment of, or a grant in respect of, expenditure, then so much of that amount as is reasonable is taken to be a recoupment of, or grant in respect of, that expenditure, as the case requires.

[Amendment of assessments]

“(3) Section 170 does not prevent the amendment of an assessment at any time for the purpose of giving effect to this section.

Transactions between persons not at arm’s length

“82BQ. If:

(a) a person has incurred expenditure in connection with a transaction where the parties to the transaction are not dealing with each other at arm’s length in relation to the transaction; and

(b) deductions are or have been allowable under this Subdivision in respect of the expenditure; and

(c) the amount of the expenditure is greater or less than is reasonable;

the amount of the expenditure is taken, for all purposes of the application of this Act in relation to the parties to the transaction, to be the amount that would have been reasonable if the parties were dealing with each other at arm’s length.

Property used for eligible environment protection activities taken to be used for the purpose of producing assessable income

“82BR.(1) For the purposes of this Act, if property is used by a taxpayer on or after 19 August 1992 for eligible environment protection activities. that use of the property by the taxpayer is taken to be for the purpose of producing assessable income of the taxpayer.

“(2) Subsection (1) has effect subject to a provision of this Act that expressly provides that a particular use of property is not taken to be for the purpose of producing assessable income.”.

Interpretation

26. Section 124ZF of the Principal Act is amended by omitting from subsection (1) the definition of “building” and substituting the following definition:

“‘building’ includes:

(a) a structural improvement covered by section 124ZFB; and

(b) an earthwork covered by section 124ZFC;”.

27. After section 124ZFB of the Principal Act the following section is inserted:

Division has effect as if certain environment protection earthworks were buildings

[Earthworks to which this section applies]

“124ZFC.(1) This section applies to an earthwork if:

(a) the earthwork was constructed as the result of carrying out an

eligible environment protection activity in relation to any taxpayer (within the meaning of section 82BM); and

(b) the earthwork can be economically maintained in reasonably good order and condition for an indefinite period; and

(c) the earthwork is not integral to the construction of a building.

[Earthworks deemed to be buildings]

“(2) This Division has effect as if the earthwork were a building.

[Application]

“(3) This section applies in relation to expenditure incurred on or after 19 August 1992 in respect of the construction of an earthwork, or an extension, alteration or improvement to an earthwork.”.

Division 9—Amendments relating to research and development

Expenditure on research and development activities

[Amendments to extend the 150% concession for an indefinite period]

28.(1) Section 73B of the Principal Act is amended:

(a) by omitting “(a) in the case of the year of income ending on 30 June 1993 or an earlier year of income:’’ from the definition of “deduction acceleration factor” in subsection (1);

(b) by re-numbering and re-aligning subparagraphs (a)(i) and (ii) of the definition of “deduction acceleration factor” in subsection (1) so that they become paragraphs (a) and (b) respectively of that definition;

(c) by omitting “or” from the end of paragraph (a) of the definition of “deduction acceleration factor” in subsection (1);

(d) by omitting paragraph (b) of the definition of “deduction acceleration factor” in subsection (1);

(e) by omitting from subsection (13) all the words after “multiplied” and substituting “by 1.5 is an allowable deduction to the company for the year of income.”;

(f) by omitting subsection (15B).

[Amendments to remove the $10 million limit applying to pilot plant]

(2) Section 73B of the Principal Act is amended by omitting subsection (6) and substituting the following subsection:

“(6) If:

(a) the cost of a unit of pilot plant to an eligible company exceeds $10 million; and

(b) any of the following applies:

(i) the unit was acquired by the eligible company under a contract entered into before 19 August 1992;

(ii) the construction of the unit commenced before 19 August 1992;

(iii) a contract for the construction of the unit was entered into before 19 August 1992;

the cost of the unit of plant is taken, for the purposes of this section, to be $10 million.”.

[Amendments consequential upon amendments of the Industry Research and Development Act 1986 made by this Act]

(3) Section 73B of the Principal Act is amended:

(a) by omitting subsection (10) and substituting the following subsection:

“(10) A deduction is not allowable under this section to an eligible company for a year of income in respect of expenditure in relation to research and development activities unless:

(a) the company is registered, in relation to the year of income, under section 39J of the Industry Research and Development Act 1986; or

(b) the company is registered, in relation to the year of income and in relation to a project comprising or including those activities, under section 39P of that Act.”;

(b) by inserting in subsection (33) “or 39MA” after “39M”.

Recouped expenditure on research and development activities

29. Section 73C of the Principal Act is amended by omitting from subsection (8) all the words after “that subsection” and substituting “‘multiplied by 1.5’”.

30. After section 73CA of the Principal Act the following section is inserted:

Expenditure incurred to government bodies—guaranteed returns

[Interpretation—this section to be treated as part of section 73B]

“73CB.(1) For the purposes of interpretation, this section is to be construed as if it were part of section 73B.

[No deduction for expenditure incurred to government body if return guaranteed]

“(2) If:

(a) an eligible company incurs expenditure to a government body, or an associate of a government body, in connection with research and development activities carried out on behalf of the company; and

(b) the Commissioner is satisfied that, when the expenditure was incurred, the company was not at risk in respect of the whole or a part of the expenditure; and

(c) at the time when the expenditure was incurred, the government body or associate, as the case requires, was not entered on the Register of Commercial Government Bodies kept under section 39HA of the Industry Research and Development Act 1986;

a deduction is not allowable to the company under section 73B for any part of that expenditure.

[When company not at risk in respect of expenditure]

“(3) Subsection 73CA(5) applies for the purposes of this section in the same way as it applies for the purposes of section 73CA.

[Universities, research institutions etc. deemed to be government bodies]

“(4) For the purposes of this section:

(a) a university or other educational institution established by a law of the Commonwealth, a State or a Territory is taken to be an authority of the Commonwealth, the State or the Territory, as the case requires; and

(b) a research institution established by a law of the Commonwealth, a State or a Territory is taken to be an authority of the Commonwealth, the State or the Territory, as the case requires.

[Extended meaning of “associate”—government authorities]

“(5) For the purposes of this section, but without limiting the meaning of the expression ‘associate’:

(a) the Commonwealth is taken to be an associate of each authority of the Commonwealth; and

(b) an authority of the Commonwealth is taken to be an associate of each other authority of the Commonwealth; and

(c) a State is taken to be an associate of each authority of the State; and

(d) an authority of a State is taken to be an associate of each other authority of the State; and

(e) a Territory is taken to be an associate of each authority of the Territory; and

(f) an authority of a Territory is taken to be an associate of each other authority of the Territory.

[Meaning of “government body”]

“(6) In this section:

‘government body’ means:

(a) the Commonwealth, a State or a Territory; or

(b) an authority of the Commonwealth, a State or a Territory.”.

Amendment of assessments

31. Section 170 of the Principal Act is amended by inserting in subsection (10) “, 73CB” after “73C”.

Application

[Subsection 73B(10)]

32.(1) The amendments made by subsection 28(3) of this Act apply in relation to registration under section 39J or 39P of the Industry Research and Development Act 1986, where the application for registration was made after 15 October 1992.

[Section 73CB]

(2) Subject to subsection (3) of this section, section 73CB of the amended Act applies in relation to expenditure incurred by an eligible company in a year of income in connection with particular research and development activities where:

(a) on or after 19 August 1992, the company made an application under section 39J of the Industry Research and Development Act 1986 for registration in respect of the year of income; or

(b) on or after 19 August 1992, an application was made under section 39P of the Industry Research and Development Act 1986 on behalf of the company for joint registration of the company and one or more other companies in respect of the year of income in relation to one or more proposed projects comprising or including those research and development activities; or

(c) both:

(i) before 19 August 1992, the company made an application under section 39J of the Industry Research and Development Act 1986 for registration in respect of the year of income; and

(ii) a finance scheme in relation to those research and development activities was entered into, or varied, on or after 19 August 1992; or

(d) both:

(i) before 19 August 1992, an application was made under section 39P of the Industry Research and Development Act 1986 on behalf of the company for joint registration of the company and one or more other companies in respect of the year of income in relation to one or more proposed projects comprising or including those research and development activities; and

(ii) a finance scheme in relation to those research and development activities was entered into, or varied, on or after 19 August 1992.

[Exception to the rule in subsection (2)]

(3) Section 73CB of the amended Act does not apply in relation to expenditure incurred by an eligible company in a year of income in connection with particular research and development activities if:

(a) during the interim period:

(i) the company made an application under section 39J of the Industry Research and Development Act 1986 for registration in respect of the year of income; or

(ii) an application was made under section 39P of the Industry Research and Development Act 1986 on behalf of the company for joint registration of the company and one or more other companies in respect of the year of income in relation to one or more proposed projects comprising or including those research and development activities; or

(iii) the Board granted an application made by the company under section 39J of the Industry Research and Development Act 1986 for registration in respect of the year of income; or

(iv) the Board granted an application made under section 39P of the Industry Research and Development Act 1986 on behalf of the company for joint registration of the company and one or more other companies in respect of the year of income in relation to one or more proposed projects comprising or including those research and development activities; or

(v) the company made an application for an advance eligibility ruling in relation to an application proposed to be made by the company under section 39J of the Industry Research and Development Act 1986 for registration in respect of the year of income; or

(vi) an application was made for an advance eligibility ruling in relation to an application proposed to be made under section 39P of the Industry Research and Development Act 1986 on behalf of the company for joint registration of the company and one or more other companies in respect of the year of income in relation to one or more proposed projects comprising or including those research and development activities; or

(vii) the Board issued an advance eligibility ruling in relation to an application proposed to be made by the company under section 39J of the Industry Research and Development Act 1986 for registration in respect of the year of income; or

(viii) the Board issued an advance eligibility ruling in relation to an application proposed to be made under section 39P of the Industry Research and Development Act 1986 on behalf of the company for joint registration of the company and one or more other companies in respect of the year of income in relation to one or more proposed

projects comprising or including those research and development activities; and

(b) if there was or is a finance scheme in relation to those research and development activities—the finance scheme was not entered into, or varied, on or after 1 July 1993.

[Definitions]

(4) In this section:

“advance eligibility ruling”, in relation to a proposed application for the registration of a company or companies, means a statement issued by the Board to the effect that the Board is of the opinion that particular activities carried on, or proposed to be carried on, by or on behalf of the company or companies are research and development activities, where the statement is issued in connection with the proposed application;

“amended Act” means the Principal Act as amended by this Act;

“finance scheme” has the same meaning as in section 39A of the Industry Research and Development Act 1986 as amended by this Act;

“interim period” means the period:

(a) commencing on 31 March 1992; and

(b) ending at the end of 10 June 1992.

Division 10—Amendments to limit deductions for intere6st etc. on loans obtained to finance certain superannuation contributions and life assurance premiums

33. After section 67 of the Principal Act the following section is inserted:

Deductions not allowable for interest etc. on loans obtained to finance certain superannuation contributions and life assurance premiums

[Superannuation contributions—interest etc. not deductible unless contributions deductible under section 82AAC]

“67AAA.(1) A deduction is not allowable under this Act to a taxpayer in respect of a financing cost in relation to:

(a) contributions made to a fund for the purpose of making provision for superannuation benefits for, or for dependants of, the taxpayer or another person;

unless:

(b) a deduction is allowable to the taxpayer under section 82AAC for those contributions (assuming subsections 82AAC(2) to (3) (inclusive) had not been enacted).

[Life assurance premiums—interest etc. not deductible unless premium consists wholly of risk component and policy pay-out is assessable]

“(2) A deduction is not allowable under this Act to a taxpayer in respect of a financing cost in relation to a premium for a life assurance policy unless:

(a) the whole of the premium received by the insurer consists of a risk component within the meaning of section 110; and

(b) each amount which the insurer is liable to pay under the policy would be included in the taxpayer’s assessable income if it were paid.

[Definitions]

“(3) In this section:

‘dependant’ has the same meaning as in the Occupational Superannuation Standards Act 1987;

‘financing cost’, in relation to an amount (‘financed amount’), means expenditure incurred by a taxpayer to the extent to which it is incurred in respect of obtaining finance for the financed amount and, without limiting the generality of the foregoing, includes:

(a) interest or a payment in the nature of interest; and

(b) expenses of borrowing;

‘life assurance policy’ has the same meaning as in section 110, but does not include an annuity.”.

Application

34. Section 67AAA of the Principal Act as amended by this Division applies to a financing cost to the extent to which it is incurred in respect of:

(a) a loan, or other financing arrangement, that was entered into after 18 August 1992; or

(b) a loan, or other financing arrangement, resulting from a “roll-over”, after 18 August 1992, of the whole or a part of a previous loan or financing arrangement; or

(c) a period of extension of the period for which:

(i) loan money was lent; or

(ii) other finance was provided;

where the extension occurred after 18 August 1992.

Division 11—Amendments to extend the concept of Crown leases for the purposes of the depreciation provisions

Property installed on leased Crown land—lessee deemed to be owner etc.

35. Section 54AA of the Principal Act is amended:

(a) by inserting before subsection (1) the following subsection:

[“Crown lease”, “lessee” and “lessor” have extended meanings]

“(1A) The expressions “Crown lease”, “lessee” and “lessor” are given extended meanings for the purposes of this section (see subsection (8)).”;

(b) by omitting “the lease” (wherever occurring) and substituting “the Crown lease”;

(c) by omitting from paragraph (2)(a) and subsection (4) “the lessor” and substituting “any other person”;

(d) by inserting after subsection (7) the following subsection:

[Meaning of “eligible government body”]

“(7A) For the purposes of this section, a person is an eligible government body at a particular time if:

(a) the person is the Commonwealth, a State or a Territory; or

(b) both:

(i) the person is an authority of the Commonwealth, a State or a Territory; and

(ii) assuming that the authority had derived income at that time, that income would be exempt from tax because of a relevant exempting provision (within the meaning of section 160K); or

(c) the person is the government of, or of a part of, a foreign country; or

(d) both:

(i) the person is an authority of the government of a foreign country or an authority of the government of a part of a foreign country; and

(ii) the authority is of a similar nature to an authority covered by paragraph (b).”;

(e) by omitting from subsection (8) the definition of “Crown lease” and substituting the following definition:

“‘Crown lease’ means:

(a) a lease of land granted by an eligible government body; or

(b) an easement in connection with land, where the easement was granted by an eligible government body; or

(c) any other right, power or privilege over, or in connection with, land, where the right, power or privilege was granted by an eligible government body;”;

(f) by inserting in subsection (8) the following definitions:

“‘eligible government body’ has the meaning given by subsection (7A);

‘lessee’, in relation to a Crown lease, means the holder of the Crown lease;

‘lessor’, in relation to a Crown lease, means:

(a) the eligible government body which granted the Crown lease; or

(b) if the interests of the grantor in relation to the Crown lease are held by another person—that other person;”.

Application

36. Section 38 of the Taxation Laws Amendment Act (No. 3) 1992 has, and is taken to have had, effect as if the amendments made by this Division had been made by that Act.

Division 12—Amendments to extend the concept of eligible lessees for the purposes of the provisions relating to deductions for capital expenditure on buildings and structural improvements

Interpretation

37. Section 124ZF of the Principal Act is amended by inserting the following definitions in subsection (1):

“‘Crown lease’ has the same meaning as in section 54AA;

‘lease’ includes a Crown lease;

‘lessee’, in relation to a Crown lease, means a person who is a lessee within the meaning of section 54AA;”.

Application

38. The amendments made by this Division apply in relation to expenditure incurred in respect of the construction of a building, or an extension, alteration or improvement to a building, if the construction commenced after 26 February 1992.

Division 13—Amendments to deem the lessee of property installed on leased Crown land to be the owner for the purposes of the development allowance provisions

Interpretation

39. Section 82AQ of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) a taxpayer is the lessee of land under a Crown lease; and

(b) a unit of property is affixed to the land; and

(c) because of section 54AA, the provisions of this Act relating to depreciation apply as if the taxpayer were the owner of the property instead of any other person;

this Subdivision applies as if the taxpayer were the owner of the property instead of any other person.

“(3B) In subsection (3A):

‘Crown lease’ has the same meaning as in section 54AA;

‘lessee’ has the same meaning as in section 54AA.”.

Application

40. The amendment made by this Division applies to expenditure incurred by a taxpayer:

(a) in respect of the acquisition of a unit of property under a contract entered into after 26 February 1992; or

(b) in respect of the construction of a unit of property where the construction commenced after 26 February 1992.

Division 14—Amendments relating to roll-over relief where deductions allowed for research and development under section 73B

Disposal, loss or destruction of depreciated property

41. Section 59 of the Principal Act is amended:

(a) by omitting from subsection (2AA) “For” and substituting “Subject to subsection (2AB), for”;

(b) by inserting after subsection (2AA) the following subsection:

“(2AB) If:

(a) property of a taxpayer was acquired as the result of a disposal to which section 58 or 73E applied; and

(b) either:

(i) a deduction or deductions has or have been allowed or allowable to the transferor concerned under section 73B in relation to the property; or

(ii) if the disposal of the property to the taxpayer was the last of a series of 2 or more successive transfers of the property to which either one of section 58 or 73E has applied (whether alternately or otherwise)—a deduction or deductions has or have been allowed or allowable to any of the prior successive transferors under section 73B in relation to the property;

then, for the purposes of the application of subsection (2) of this section to the property, the amount worked out using the following formula is taken to have been an amount allowed to the taxpayer in respect of depreciation in relation to the property:

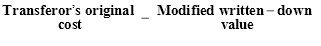

where:

‘Transferor’s original cost’ means:

(a) the cost of the property to the transferor for the purposes of section 73B (worked out as if subsection 73B(6) had not been enacted); or

(b) if the disposal of the property to the taxpayer was the

last of a series of 2 or more successive transfers to which either one of section 58 or 73E has applied (whether alternately or otherwise)—the cost of the property to the earliest prior successive transferor for the purposes of section 73B (worked out as if subsection 73B(6) had not been enacted);

‘Modified written-down value’ means the amount that would have been the written-down value of the property to the taxpayer for the purposes of section 73B if:

(a) whichever of the following is applicable:

(i) the deductions allowed or allowable under section 73B to the transferor in respect of one or more years of income in relation to the property;

(ii) if the disposal of the property to the taxpayer was the last of a series of 2 or more successive transfers to which either one of section 58 or 73E has applied (whether alternately or otherwise)—the deductions allowed or allowable under section 73B to the prior successive transferors in respect of one or more years of income in relation to the property;

had been deductions allowed or allowable to the taxpayer under section 73B in respect of the years of income in relation to the property; and

(b) whichever of the following is applicable:

(i) the cost of the property to the transferor for the purposes of section 73B (worked out as if subsection 73B(6) had not been enacted);

(ii) if the disposal of the property to the taxpayer was the last of a series of 2 or more successive transfers to which either one of section 58 or 73E has applied (whether alternately or otherwise)—the cost of the property to the earliest prior successive transferor for the purposes of section 73B (worked out as if subsection 73B(6) had not been enacted);

had been the cost of the property to the taxpayer.”.

42. After section 73D of the Principal Act the following sections are inserted:

Section 73B roll-over relief on disposal of unit of plant where CGT roll-over relief allowed under section 160ZZO

[Roll-over relief where CGT roll-over relief allowed]

“73E.(1) This section applies to the disposal of a unit of plant by an eligible company (in this section called the ‘transferor’) to another eligible company (in this section called the ‘transferee’) if:

(a) section 160ZZO applies to the disposal of the unit by the transferor; and

(b) subject to subsection (11), a deduction or deductions have been allowed or are allowable under subsection 73B(15) to the transferor in respect of the unit; and

(c) no deduction has been allowed or is allowable under section 54 to the transferor in respect of the unit.

[No balancing charges]

“(2) Subsection 73B(23) or (24), as the case requires, does not apply in respect of the disposal of the unit by the transferor.

[No depreciation deduction for transferor in year of disposal]

“(3) A deduction under section 54 is not allowable to the transferor in respect of the unit in relation to the year of income in which the disposal took place.

[Subsection 73B(4) definition of “qualifying plant expenditure” not applicable to transferee]

“(4) Subsection 73B(4) does not apply to the transferee in relation to the unit.

[Transferee to inherit transferor’s qualifying plant expenditure]

“(5) If:

(a) immediately after the disposal took place, the transferee commences to use the unit exclusively for the purpose of the carrying on by or on behalf of the transferee of research and development activities; and

(b) apart from the disposal, there would have been an amount of qualifying plant expenditure in relation to the transferor in relation to:

(i) the year of income of the transferor in which the disposal took place; or

(ii) the first subsequent year of income of the transferor;

then:

(c) subject to subsection 73B(5), section 73B and this section have effect as if an amount equal to that amount were taken:

(i) to have been incurred by the transferee in the acquisition of the unit; and

(ii) to be an amount of qualifying plant expenditure in relation to the transferee in relation to:

(A) if subparagraph (b)(i) applies—the year of income of the transferee in which the disposal took place; and

(B) if subparagraph (b)(ii) applies—the first subsequent year of income of the transferee; and

(d) a reference in subsection 73B(21) to the end of the second year of income after the year of income in which the transferee first used the unit exclusively for the purpose of the carrying on by or on behalf of the transferee of research and development activities is to be read as a reference to the end of the 3-year period commencing at the beginning of:

(i) the year of income in which the transferor first used the unit exclusively for the purpose of the carrying on by or on behalf of the transferor of research and development activities; or

(ii) if there have been 2 or more prior successive applications of this section—the earliest year of income in which a prior successive transferor first used the unit exclusively for the purpose of the carrying on by or on behalf of the prior successive transferor of research and development activities; and

(e) the reference in subsection 73B(22) to deductions having been allowed to the transferee under subsection 73B(15) in relation to the unit in respect of 3 years of income is to be read as a reference to deductions having been allowed to the transferee under subsection 73B(15) in relation to the unit in respect of 3 years of income, reduced by one year for each year of income for which a deduction was allowed or allowable under subsection 73B(15)to:

(i) the transferor in respect of the unit; or

(ii) if there have been 2 or more prior successive applications of this section—any of the prior successive transferors in respect of the unit.

[Modification of depreciation provisions applicable to transferee]

“(6) If depreciation is or becomes allowable to the transferee in respect of the unit, the provisions of this Act relating to depreciation apply as if:

(a) the transferee had acquired the unit for a cost equal to the modified written-down value of the unit; and

(b) subsections 73B(21) and (22) had effect as if a reference in those subsections to the written-down value of the unit were a reference to the modified written-down value of the unit; and

(c) subsection 56(1A) had effect, in relation to the year of income of the transferee in which the disposal took place, as if a day in that year of income on which the unit was dealt with in the prescribed manner (within the meaning of that subsection) by the transferor were treated as if it were a day in that year of income on which the unit was dealt with in the prescribed manner (within the meaning of that subsection) by the transferee.

[Disposal by transferee where no roll-over relief—inheritance of transferor’s cost and deductions]

“(7) If:

(a) after the disposal of the unit to the transferee, the unit is lost or destroyed or the transferee disposes of the unit; and

(b) in the case of a disposal by the transferee—this section does not apply to the disposal;

then, for the purposes of the application of subsection 73B(23) or (24), as the case may be, in relation to the loss, destruction or disposal, those subsections have effect as if:

(c) a reference in those subsections to the written-down value of the unit were a reference to the modified written-down value of the unit; and

(d) a reference in those subsections, and in the definition of ‘ineligible pilot plant amount’ in subsection 73B(1), to the cost of the unit were a reference to:

(i) the cost of the unit to the transferor (worked out as if subsection 73B(6) had not been enacted); or

(ii) if there have been 2 or more prior successive applications of this section—the cost of the unit to the earliest prior successive transferor (worked out as if subsection 73B(6) had not been enacted); and

(e) a reference in paragraph 73B(24)(f) to a year of income in respect of which a deduction has been allowed under section 73B to the transferee in respect of the unit were worked out on the basis that whichever of the following is applicable:

(i) the deductions allowed or allowable to the transferor under section 73B in respect of one or more years of income in relation to the unit;

(ii) if there have been 2 or more prior successive applications of this section—the deductions allowed or allowable to the prior successive transferors under section 73B in respect of one or more years of income in relation to the unit;

had been deductions allowed or allowable to the transferee under section 73B in respect of the years of income in relation to the unit.

[Meaning of “modified written-down value”]

“(8) For the purposes of the application of subsections (6) and (7) to the transferee, the modified written-down value of the unit is the amount that would have been the written-down value if:

(a) whichever of the following is applicable:

(i) the deductions allowed or allowable to the transferor

under section 73B in respect of one or more years of income in relation to the unit;

(ii) if there have been 2 or more prior successive applications of this section—the deductions allowed or allowable to the prior successive transferors under section 73B in respect of one or more years of income in relation to the unit;

had been deductions allowed or allowable to the transferee under section 73B in respect of the years of income in relation to the unit; and

(b) whichever of the following is applicable:

(i) the cost of the unit to the transferor (worked out as if subsection 73B(6) had not been enacted);

(ii) if there have been 2 or more prior successive applications of this section—the cost of the unit to the earliest prior successive transferor (worked out as if subsection 73B(6) had not been enacted);

had been the cost of the unit to the transferee.

[Pilot plant covered by subsection 73B(6)]

“(9) If subsection 73B(6) applied to the unit in relation to the transferor, section 73B and this section have effect as if subsection 73B(6) applies to the unit in relation to the transferee.

[Recoupment of expenditure—consequential amendment of assessments]

“(10) Section 170 does not prevent the amendment at any time of an assessment of the transferee where section 73C, 73CB or 73D has applied to:

(a) the transferor in respect of the unit; or

(b) if there have been 2 or more prior successive applications of this section—any of the prior successive transferors in respect of the unit.

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(11) If, apart from this subsection, this section has applied to the disposal of the unit to the transferee, then, in working out whether this section applies to a subsequent disposal of the unit by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.

[CGT roll-over relief applies to motor vehicles]

“(12) For the purposes of this section, in addition to the effect that section 160ZZO has apart from this subsection, that section also has the effect that it would have if a reference in that section to an asset included a reference to a motor vehicle of a kind mentioned in paragraph 82AF(2)(a).

[Interpretation]

“(13) For the purposes of interpretation, this section is to be construed as if it were part of section 73B.

[Definition]

“(14) In this section:

‘modified written-down value’ has the meaning given by subsection (8).

Section 73B roll-over relief on disposal of building etc. where CGT roll-over relief allowed under section 160ZZO

[Meaning of “unit”]

“73F.(1) In this section:

‘unit’ means a building or an extension, alteration or improvement to a building.

[Roll-over relief where CGT roll-over relief allowed]

“(2) This section applies to the disposal of a unit by an eligible company (in this section called the ‘transferor’) to another eligible company (in this section called the ‘transferee’) if:

(a) section 160ZZO applies to the disposal of the unit by the transferor; and

(b) subject to subsection (14), a deduction or deductions have been allowed or are allowable under subsection 73B(17) to the transferor in respect of the unit.

[No balancing charges]

“(3) Subsection 73B(27) does not apply in respect of the disposal of the unit by the transferor.

[5-year deduction disallowance rule does not apply]

“(4) Subsection 73B(28) does not apply in respect of the disposal of the unit by the transferor.

[Subsection 73B(4) definition of “qualifying building expenditure” not applicable to transferee]

“(5) Subsection 73B(4) does not apply to the transferee in relation to the unit.

[Transferee to inherit transferor’s qualifying building expenditure]

“(6) If:

(a) immediately after the disposal took place, the transferee commences to use the unit exclusively for the purpose of the carrying on by or on behalf of the transferee of research and development activities; and

(b) apart from the disposal, there would have been an amount of qualifying building expenditure in relation to the transferor in relation to:

(i) the year of income of the transferor in which the disposal took place; or

(ii) the first subsequent year of income of the transferor;

then, subject to subsection 73B(5), section 73B and this section have effect as if an amount equal to that amount were taken:

(c) to have been incurred by the transferee in the acquisition of the unit; and

(d) to be an amount of qualifying building expenditure in relation to the transferee in relation to:

(i) if subparagraph (b)(i) applies—the year of income of the transferee in which the disposal took place; and

(ii) if subparagraph (b)(ii) applies—the first subsequent year of income of the transferee.

[Pre-21 November 1987 rule not applicable to transferee]

“(7) Subsection 73B(5A) does not apply in relation to the acquisition of the unit by the transferee.

[Modification of 5-year deduction disallowance rule]

“(8) A reference in subsection 73B(28) to the day on which the transferee commenced to use the unit exclusively for the purpose of the carrying on by or on behalf of the transferee of research and development activities is to be read as a reference to:

(a) the day on which the transferor first used the unit exclusively for the purpose of the carrying on by or on behalf of the transferor of research and development activities; or

(b) if there have been 2 or more prior successive applications of this section—the earliest day on which a prior successive transferor first used the unit exclusively for the purpose of the carrying on by or on behalf of the prior successive transferor of research and development activities.

[Deemed cessation of use by transferee—5-year deduction disallowance rule]

“(9) For the purposes of the application of subsection 73B(28) and subsection (10) of this section to the transferee, if, immediately after the disposal of the property to the transferee took place, the transferee

did not commence to use the unit exclusively for the purpose of the carrying on by or on behalf of the transferee of research and development activities, the transferee is taken to have ceased to use the unit for that purpose immediately after the disposal took place.

[Adjustments where 5-year deduction disallowance rule applies]

“(10) If:

(a) after the disposal of the unit to the transferee, the transferee:

(i) disposes of the unit; or

(ii) ceases to use the unit exclusively for the purpose of the carrying on by or on behalf of the transferee of research and development activities; and

(b) subsection 73B(28) applies in relation to the disposal of the unit by the transferee or in relation to the cessation of use by the transferee;

then:

(c) the transferee’s assessable income of the year of income in which the acquisition of the unit by the transferee took place includes:

(i) the total amount allowed or allowable as deductions to the transferor under subsection 73B(17) in relation to the unit; or

(ii) if there have been 2 or more prior successive applications of this section—the total amount allowed or allowable as deductions to the prior successive transferors under subsection 73B(17) in relation to the unit; and

(d) the following amounts are allowable deductions to the transferee for the year of income in which the acquisition of the unit by the transferee took place:

(i) the total amount of the deductions (if any) that would have been allowable to the transferor under section 75B or 124JA or Division 10, 10AAA, 10AA or 10D in relation to the unit if section 73B had not been enacted; or

(ii) if there have been 2 or more prior successive applications of this section—the total amount of the deductions (if any) that would have been allowable to the prior successive transferors under section 75B or 124JA or Division 10, 10AAA, 10AA or 10D in relation to the unit if section 73B had not been enacted; and

(e) for the purposes of the application of section 75B or 124JA or Division 10, 10AAA, 10AA or 10D to the transferee in relation to the unit:

(i) whichever of the following is applicable:

(A) the expenditure incurred by the transferor in the acquisition or construction of the unit;

(B) if there have been 2 or more prior successive applications of this section—the expenditure incurred by the earliest prior successive transferor in the acquisition or construction of the unit;

is taken to have been expenditure incurred by the transferee in the acquisition of the unit; and

(ii) a deduction allowable to the transferee under paragraph (d) of this subsection in relation to the unit is taken to be a deduction allowable to the transferee in relation to the unit under section 75B or 124JA or Division 10, 10AAA, 10AA or 10D, as the case requires.

[Disposal by transferee where no roll-over relief—inheritance of transferor’s deductions]

“(11) If:

(a) after the disposal of the unit to the transferee, the transferee disposes of the unit; and

(b) this section does not apply to the disposal by the transferee; and

(c) subsection 73B(27) applies to the disposal by the transferee;

then, for the purposes of the application of subsection 73B(27) in relation to the disposal:

(d) whichever of the following is applicable:

(i) the expenditure incurred by the transferor in the acquisition or construction of the unit;

(ii) if there have been 2 or more prior successive applications of this section—the expenditure incurred by the earliest prior successive transferor in the acquisition or construction of the unit;

is taken to have been expenditure incurred by the transferee in the acquisition of the unit; and

(e) the total of:

(i) the amounts that would, apart from section 73B, have been allowed or allowable as deductions to the transferor under Division 10D in respect of the expenditure of the transferor in the acquisition or construction of the unit; and

(ii) if there have been 2 or more prior successive applications of this section—the amounts that would, apart from section 73B, have been allowed or allowable as deductions to the prior successive transferors under Division 10D in respect of the expenditure incurred by the earliest prior

successive transferor in the acquisition or construction of the unit;

are taken to have been amounts that would, apart from section 73B, have been allowed or allowable as deductions to the transferee under Division 10D in respect of expenditure incurred by the transferee in the acquisition of the unit.

[Destruction of building etc.—inheritance of transferor’s deductions]

“(12) If, after the disposal of the unit to the transferee, the unit, or a part of the unit, is destroyed, then, for the purposes of the application of subsection 73B(25) or (26), as the case may be, in relation to the destruction:

(a) whichever of the following is applicable:

(i) the expenditure incurred by the transferor in the acquisition or construction of the unit;

(ii) if there have been 2 or more prior successive applications of this section—the expenditure incurred by the earliest prior successive transferor in the acquisition or construction of the unit;

is taken to have been expenditure incurred by the transferee in the acquisition of the unit; and

(b) the total of:

(i) the amounts allowed or allowable as deductions to the transferor under. subsection 73B(17) in relation to the unit; or

(ii) if there have been 2 or more prior successive applications of this section—the amounts allowed or allowable as deductions to the prior successive transferors under subsection 73B(17) in relation to the unit;

are taken to have been amounts allowed or allowable to the transferee as deductions under subsection 73B(17) in relation to the unit.

[Recoupment of expenditure—consequential amendment of assessments]

“(13) Section 170 does not prevent the amendment at any time of an assessment of the transferee where section 73C or 7 3D has applied to:

(a) the transferor in respect of the unit; or

(b) if there have been 2 or more prior successive applications of this section—any of the prior successive transferors in respect of the unit.

[Second or subsequent application of section—paragraph (2)(b) does not apply]

“(14) If, apart for this subsection, this section has applied to the disposal of the unit to the transferee, then, in working out whether this section applies to a subsequent disposal of the unit by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (2)(b) (which deals with deductions) had not been enacted.

[Interpretation]

“(15) For the purposes of interpretation, this section is to be construed as if it were part of section 73B.

Section 73B roll-over relief on disposal of unit of industrial property where CGT roll-over relief allowed under section 160ZZO

[Roll-over relief where CGT roll-over relief allowed]

“73G.(1) This section applies to the disposal of a unit of industrial property (within the meaning of Division 10B) by an eligible company (the ‘transferor’) to another eligible company (the ‘transferee’) if:

(a) section 160ZZO applies to the disposal of the unit by the transferor; and

(b) subject to subsection (5), apart from this section, an amount would be included in the transferor’s assessable income under subsection 73B(27A) in respect of the disposal.

[Transferor not assessable under subsection 73B(27A) on disposal]

“(2) Subsection 73B(27A) does not apply in respect of the disposal of the unit by the transferor.

[No deduction for transferee’s acquisition expenditure]

“(3) No part of the expenditure (if any) incurred by the transferee in the acquisition of the unit is an allowable deduction to the transferee under any provision of this Act.

[Disposal by transferee where no roll-over relief—proceeds of disposal assessable to transferee]

“(4) If:

(a) after the disposal of the unit to the transferee, the transferee disposes of the unit; and

(b) this section does not apply to the disposal by the transferee;

the transferee’s assessable income of the year of income in which the disposal by the transferee took place includes the consideration receivable in respect of the disposal.

[Subsequent application of section—paragraph (1)(b) does not apply]

“(5) If, apart from this subsection, this section has applied to the disposal of the unit to the transferee, then, in working out whether this section applies to a subsequent disposal of the unit by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with assessability under subsection 73B(27A)) had not been enacted.

[Interpretation]

“(6) For the purposes of interpretation, this section is to be construed as if it were part of section 73B.”.

Keeping of records

43. Section 262A of the Principal Act is amended:

(a) by inserting in subsection (4AC) “73E(1), 73F(1), 73G(1),” after “73AA(1),”;

(b) by inserting in paragraph (4AC)(a) “73E, 73F, 73G,” after “73AA,”.

Application

[Meaning of “amended Act”]

44.(1) In this section:

“amended Act” means the Principal Act as amended by this Act.

[Depreciation balancing charge—section 58 or 73E roll-over relief]

(2) The amendments of section 59 of the Principal Act made by this Division apply in relation to disposals of property before, at or after the commencement of this subsection.

[Section 73B (research and development) roll-over relief]

(3) Sections 73E, 73F and 73G of the amended Act apply to disposals of property after 15 October 1992.

Transitional—elective roll-over relief where property disposed of after 6 December 1990

[Definitions]

45.(1) In this section:

“amended Act” means the Principal Act as amended by this Act;

“eligible company” has the same meaning as in section 73B of the Principal Act;

“roll-over section” means section 73E, 73F or 73G.

[Extended application of roll-over sections]

(2) If:

(a) an eligible company (the “transferor”) disposed of property to another eligible company (the “transferee”); and

(b) the disposal took place after 6 December 1990 and before 16 October 1992; and

(c) the transferor and the transferee make a joint election that this section apply to the disposal; and

(d) assuming that both the transferor and the transferee had elected under paragraph 160ZZO(1)(d) of the Principal Act that section 160ZZO of the Principal Act apply in respect of the disposal of the property:

(i) section 160ZZO of the Principal Act would have applied to the disposal of the property; and

(ii) if the disposal had taken place after 15 October 1992, a roll-over section would have applied to the disposal of the property;

then, in addition to the application of the roll-over section concerned apart from this section, the roll-over section applies to the disposal.

[How joint election made]

(3) A joint election under subsection (2) has no effect unless it:

(a) is in writing; and

(b) is made:

(i) within 6 months after the later of the following:

(A) the end of the year of income of the transferee in which the disposal occurred;

(B) the commencement of this subsection; or

(ii) within such further period as the Commissioner allows.

[Retention of joint election]

(4) A person who is a party to a joint election under subsection (2) must retain the election, or a copy, until the end of 5 years after the earlier of:

(a) the disposal by the person of the property; or

(b) the loss or destruction of the property.

Penalty: $3,000.

[Exceptions to retention rules]

(5) Subsection (4) does not require a person to retain an election, or a copy, if:

(a) the Commissioner has notified the person that retention of the election or copy is not required; or

(b) the person is a company that has gone into liquidation and has been finally dissolved.

[Extension of roll-over relief to motor vehicles]

(6) For the purposes of this section, in addition to the effect that section 160ZZO of the Principal Act has apart from this subsection, that section also has the effect that it would have if a reference in that section to an asset included a reference to a motor vehicle of a kind mentioned in paragraph 82AF(2)(a) of the Principal Act.

Division 15—Amendments relating to roll-over relief where capital deductions have been allowed

Depreciation roll-over relief for unpooled property where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 59AA

46. Section 58 of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (7A),” before “depreciation”;

(b) by inserting after subsection (7) the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(7A) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions for depreciation) had not been enacted.”.

Section 73A roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO

47. Section 73AA of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (7),” before “deductions”;

(b) by adding at the end the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(7) If, apart from this subsection, this section has applied to the disposal of the building or the part of the building to the transferee, then, in working out whether this section applies to a subsequent disposal of the building or the part of the building by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 122R

48. Section 122JAA of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (22A),” before “deductions”;

(b) by inserting after subsection (22) the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(22A) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 122R

49. Section 122JG of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (12A),” before “deductions”;

(b) by inserting after subsection (12) the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(12A) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 123F

50. Section 123BBA of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (16),” before “deductions”;

(b) by adding at the end the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(16) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 123F

51. Section 123BF of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (9),” before “deductions”;

(b) by adding at the end the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(9) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 124AO

52. Section 124AMAA of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (18A),” before “deductions”;

(b) by inserting after subsection (18) the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(18A) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO

53. Section 124GA of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (5),” before “deductions”;

(b) by adding at the end the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(5) If, apart from this subsection, this section has applied to the disposal of the property to the transferee, then, in working out whether this section applies to a subsequent disposal of the property by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO

54. Section 124JD of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (5),” before “deductions”;

(b) by adding at the end the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(5) If, apart from this subsection, this section has applied to the disposal of the building to the transferee, then, in working out whether this section applies to a subsequent disposal of the building by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Roll-over relief where CGT roll-over relief allowed under section 160ZZM, 160ZZMA, 160ZZN, 160ZZNA or 160ZZO or where election for roll-over relief made under section 122W

55. Section 124PA of the Principal Act is amended:

(a) by inserting in paragraph (1)(b) “subject to subsection (6),” before “deductions”;

(b) by adding at the end the following subsection:

[Second or subsequent application of section—paragraph (1)(b) does not apply]

“(6) If, apart from this subsection, this section has applied to the disposal of the unit to the transferee, then, in working out whether this section applies to a subsequent disposal of the unit by:

(a) the transferee; or

(b) one or more subsequent successive transferees;

this section has effect as if paragraph (1)(b) (which deals with deductions) had not been enacted.”.

Application

56. The amendments made by this Division apply to disposals of property after 19 December 1991.

Transitional—elective capital deduction roll-over relief where CGT roll-over relief available under section 160ZZO of the Principal Act and property disposed of after 6 December 1990

57. Section 72 of the Taxation Laws Amendment Act 1992 has, and is taken to have had, effect as if the amendments made by this Division had been made by that Act.

Division 16—Amendment relating to record-keeping

Keeping of records

58. Section 262A of the Principal Act is amended by re-locating subsection (4A) so that it becomes the subsection after subsection (4).

Division 17—Amendments relating to royalties

Interpretation

59. Section 6 of the Principal Act is amended:

(a) by inserting after paragraph (d) of the definition of “royalty” or “royalties” in subsection (1) the following paragraphs:

“(da) the reception of, or the right to receive, visual images or sounds, or both, transmitted to the public by:

(i) satellite; or

(ii) cable, optic fibre or similar technology;

(db) the use in connection with television broadcasting or radio broadcasting, or the right to use in connection with television broadcasting or radio broadcasting, visual images or sounds, or both, transmitted by:

(i) satellite; or

(ii) cable, optic fibre or similar technology;”;

(b) by omitting “or” from the end of subparagraph (f)(ii) of the definition of “royalty” or “royalties” in subsection (1);

(c) by inserting after subparagraph (f)(ii) of the definition of “royalty” or “royalties” in subsection (1) the following subparagraphs:

“(iia) the reception of, or the granting of the right to receive, any such visual images or sounds as are mentioned in paragraph (da);

(iib) the use of, or the granting of the right to use, any such visual images or sounds as are mentioned in paragraph (db); or”.

Source of royalty income derived by a non-resident

60. Section 6C of the Principal Act is amended by omitting from subsection (2) “, section 25, Division 13A of Part III and section 255” and substituting “and section 25”.

Interpretation

61. Section 103 of the Principal Act is amended by inserting in paragraph (a) of the definition of “the distributable income” in subsection (1) “the repealed” before “section 136A”.

Heading to Division 11A of Part III

62. The heading to Division 11A of Part III of the Principal Act is amended by omitting “and Interest” and substituting “, Interest and Royalties”.

Interpretation

63. Section 128A of the Principal Act is amended:

(a) by inserting after subsection (1) the following subsection:

“(1AA) In this Division and in an Act imposing withholding tax:

‘income’ includes a royalty.”;

(b) by inserting in subsection (2) “or a royalty” after “interest”;

(c) by omitting from subsection (3) “or to interest” and substituting “, to interest or to a royalty”;

(d) by omitting from subsection (3) “or interest” and substituting “, interest or royalty”.

Liability to withholding tax

64. Section 128B of the Principal Act is amended:

(a) by inserting after subsection (2A) the following subsection:

“(2B) Subject to subsection (3), this section also applies to income that:

(a) is derived by a non-resident:

(i) during the 1993-94 year of income of the non-resident; or

(ii) during a later year of income of the non-resident; and

(b) consists of a royalty that:

(i) is paid to the non-resident by a person to whom this section applies and is not an outgoing wholly incurred by that person in carrying on business in a foreign country at or through a permanent establishment of that person in that country; or

(ii) is paid to the non-resident by a person who, or by persons each of whom, is not a resident and is, or is in part, an outgoing incurred by that person or those persons in carrying on business in Australia at or through a permanent establishment of that person or those persons in Australia.”;

(b) by inserting after subsection (5) the following subsection:

“(5A) A person who derives income to which this section applies that consists of a royalty is liable to pay income tax upon that income at the rate declared by the Parliament in respect of income to which this subsection applies.”.

Repeal of Division 13A of Part III

65. Division 13A of Part III of the Principal Act is repealed.

Interpretation

66. Section 221YHZA of the Principal Act is amended:

(a) by omitting “a royalty payment” from the definition of “natural resource payment” in subsection (1) and substituting “a payment of, or by way of, royalty”;

(b) by omitting from subsection (1) the definition of “royalty payment”.

Person making natural resource payment to non-resident to ascertain amount to be deducted in respect of tax

67. Section 221YHZB of the Principal Act is amended:

(a) by omitting from subsection (1) “, or a royalty payment,”;

(b) by omitting from paragraph (1)(a) “, or royalty payment, as the case may be,”.

Duties of payers

68. Section 221YHZC of the Principal Act is amended by omitting from subsection (1) “, or a royalty payment,”.

Interpretation

69. Section 221YK of the Principal Act is amended by inserting in paragraphs (3)(a) and (b) “or a royalty” after “interest”.

Deductions from dividends, interest and royalties

70. Section 221YL of the Principal Act is amended:

(a) by inserting after subsection (2F) the following subsections:

“(2G) If a royalty is payable by a person, including the Commonwealth, a State or an authority of the Commonwealth or of a State (the ‘royalty payer’) to another person, or to other persons jointly, and: