Social Security Legislation Amendment Act 1993

No. 36 of 1993

An Act to amend the Social Security Act 1991, and for

related purposes

[Assented to 20 September 1993]

The Parliament of Australia enacts:

PART 1—PRELIMINARY

Short title etc.

1.(1) This Act may be cited as the Social Security Legislation Amendment Act 1993.

(2) In this Act, “Principal Act” means the Social Security Act 19911.

Commencement

2.(1) The following provisions commence on the day on which this Act receives the Royal Assent:

(a) Part 1;

(b) Division 1 of Part 2 (except section 9);

(c) Division 2 of Part 2;

(d) Divisions 4, 5, 12, 13, 14 and 15 of Part 2;

(e) sections 34 and 35;

(f) Division 11 of Part 2 (except sections 59 and 61);

(g) Part 3;

(h) Part 1 of Schedule 3;

(i) Schedule 5.

(2) Section 16 commences immediately after section 70.

(3) Section 17 commences immediately after section 71.

(4) Part 2 of Schedule 3 is taken to have commenced on 1 July 1991.

(5) Division 9 of Part 2 and Part 3 of Schedule 3 are taken to have commenced on 12 November 1991, immediately after the commencement of Part 2 of Schedule 2 to the Social Security Legislation Amendment Act (No. 4) 1991.

(6) Part 4 of Schedule 3 is taken to have commenced on 12 November 1991, immediately after the commencement of Part 6 of Schedule 3 to the Social Security Legislation Amendment Act (No. 2) 1992.

(7) Part 5 of Schedule 3 and item 1 of Schedule 4 are taken to have commenced on 24 December 1992, immediately after the Social Security Legislation Amendment Act (No. 2) 1992 received the Royal Assent.

(8) Items 2 and 3 of Schedule 4 are taken to have commenced on 24 December 1992, immediately after the Social Security Legislation Amendment Act (No. 3) 1992 received the Royal Assent.

(9) Part 6 of Schedule 3 is taken to have commenced on 1 January 1993.

(10) Sections 59 and 61, Division 6 of Part 2 and Part 7 of Schedule 3 are taken to have commenced on 1 January 1993, immediately after the commencement of the Social Security (Family Payment) Amendment Act 1992.

(11) Division 8 of Part 2 (except sections 34 and 35) is taken to have commenced on 1 January 1993, immediately after the commencement of Part 1 of Schedule 4 to the Social Security Legislation Amendment Act (No. 3) 1992.

(12) Part 8 of Schedule 3 is taken to have commenced on 1 January 1993, immediately after the commencement of section 59 of the Social Security Legislation Amendment Act (No. 2) 1992.

(13) Division 7 of Part 2 is taken to have commenced on 1 January 1993, immediately after the commencement of Division 13 of Part 2 of the Social Security Legislation Amendment Act (No. 3) 1992.

(14) Part 9 of Schedule 3 is taken to have commenced on 1 January 1993, immediately after the commencement of Division 23 of Part 2 of the Social Security Legislation Amendment Act (No. 3) 1992.

(15) Part 10 of Schedule 3 is taken to have commenced on 28 January 1993.

(16) Part 11 of Schedule 3 is taken to have commenced on 20 March 1993, immediately after the commencement of Division 8 of Part 2 of the Social Security Legislation Amendment Act (No. 3) 1992.

(17) Division 10 of Part 2 (except section 48) and Part 12 of Schedule 3 are taken to have commenced on 25 March 1993.

(18) Part 13 of Schedule 3 is taken to have commenced on 1 April 1993.

(19) Section 9 and Part 14 of Schedule 3 commence, or are taken to have commenced, as the case requires, on 1 July 1993.

(20) Part 15 of Schedule 3 commences, or is taken to have commenced, as the case requires, on 20 September 1993.

(21) Section 48 and Schedule 2 commence on 1 January 1994.

(22) Division 3 of Part 2 (except sections 16 and 17) and Schedule 1 commence, or are taken to have commenced, on 19 September 1993.

(23) Division 1 of Part 4 commences immediately after Division 18 of the Social Security Legislation Amendment Act (No. 3) 1992.

(24) Division 2 of Part 4 commences immediately after Division 9 of the Veterans’ Affairs Legislation Amendment Act (No. 2) 1992.

Application

3.(1) The amendments made by section 21 apply to claims for child disability allowance made on or after the day on which this Act receives the Royal Assent.

(2) The amendment made by paragraph 29(b) applies to:

(a) a decision of an officer under the Social Security Act 1991; and

(b) a decision under section 5A, 5B, 5C, 5D, 5E or 5EA of the Health Insurance Act 1973;

if the decision was made on or after 1 January 1993.

PART 2—AMENDMENTS OF THE SOCIAL SECURITY ACT 1991

Division 1—Debt recovery

General definitions

4. Section 23 of the Principal Act is amended by inserting in subsection (1) the following definition:

“ ‘social security payment’ means:

(a) a social security pension; or

(b) a social security benefit; or

(c) an allowance under this Act; or

(d) a family payment; or

(e) any other kind of payment under Chapter 2 of this Act; or

(f) a pension, benefit or allowance under the 1947 Act;”.

Prospective determinations for some allowees

5. Section 521 of the Principal Act is amended by omitting subsection (3).

Prospective determinations for some allowees

6. Section 600 of the Principal Act is amended by omitting subsection (3).

Debts arising under this Act and the 1947 Act

7. Section 1223 of the Principal Act is amended:

(a) by omitting subsections (2) and (3) and substituting the following subsection:

Recalculation of amount of family payment

“(3) Subject to subsection (4), if:

(a) an amount (the ‘received amount’) has been paid to a person by way of family payment; and

(b) the person’s rate of family payment is recalculated under:

(i) section 884 (amendment of assessable income); or

(ii) section 885 (underestimate of taxable income); or

(iii) section 886 (failure to notify notifiable event); and

(c) the received amount is more than the amount (the ‘correct amount’) of the family payment payable to the person;

the difference between the received amount and the correct amount is a debt due to the Commonwealth.

Note: For the date of effect of a determination made to take account of an amendment of assessable income, see section 890.”;

(b) by omitting subsection (11).

Debts arising from prepayments

8. Section 1223AA of the Principal Act is amended by omitting subsection (1) and substituting the following subsections:

“(1) If:

(a) a person has received a prepayment of a social security benefit for a period; and

(b) the person fails to provide a statement under section 575 (job search allowance) or 658 (newstart allowance) in relation to the period;

the amount of the prepayment is a debt due to the Commonwealth.

“(1A) If the Secretary is satisfied that, in the special circumstances of the case, it is appropriate to do so, the Secretary may determine in writing that subsection (1) does not apply to the prepayment.

“(1B) If:

(a) a person has received a prepayment of a social security benefit for a period; and

(b) the amount of the prepayment is more than the amount (if any) (the ‘correct amount’) of social security benefit that would have been payable to the person if:

(i) the prepayment had not been made; and

(ii) the person had not made a false statement or false representation in relation to matters that affect payment for the period; and

(iii) the person had not failed or omitted to comply with a provision of this Act in relation to matters that affect payment for the period; and

(c) subsection (1) does not apply to the prepayment;

the difference between the prepayment and the correct amount is a debt due to the Commonwealth.

“(1C) A debt due to the Commonwealth under subsection (1) or (1B) is recoverable by the Commonwealth by means of:

(a) if the person is receiving a social security payment—deductions from that person’s social security payment; or

(b) if section 1234A applies to another person who is receiving a social security payment under this Act—deductions from that other person’s social security payment; or

(c) legal proceedings; or

(d) garnishee notice.

Note 1: For deductions see sections 1231 and 1234A.

Note 2: For legal proceedings see section 1232.

Note 3: For garnishee notice see section 1233.”.

Overpayments arising under other Acts and schemes

9. Section 1228 of the Principal Act is amended by inserting after subsection (2A) the following subsection:

“(2B) A debt referred to in section 79 of the Child Support (Registration and Collection) Act 1988 is an overpayment that is recoverable by the Commonwealth by means of deductions.”.

Secretary may allow payment of debt by instalments

10. Section 1234 of the Principal Act is amended by omitting subsection (3) and substituting the following subsection:

“(3) In subsection (1), ‘debt’ means:

(a) a debt recoverable by the Commonwealth under Part 5.2; or

(b) a debt under the 1947 Act.

Note: Overpayments under section 1228 are not debts for the purposes of Part 5.2.”.

Repeal of section 1235 and substitution of new section

11. Section 1235 of the Principal Act is repealed and the following section is substituted:

Meaning of “debt”

“1235. In this Part, ‘debt’ means:

(a) a debt recoverable by the Commonwealth under Part 5.2; or

(b) a debt under the 1947 Act.

Note: Overpayments under section 1228 are not debts for the purposes of Part 5.2.”.

Amendments relating to use of “social security payment”

12. The Principal Act is amended as set out in Schedule 5.

Division 2—Penalties

Penalties

13. Section 1350 of the Principal Act is amended by omitting “2 years” and substituting “12 months”.

Division 3—People with partners in gaol

Family relationships definitions—couples

14. Section 4 of the Principal Act is amended:

(a) by inserting in subsection (1) the following definition:

“ ‘partnered (partner in gaol)’ has the meaning given by subsection (11);”;

(b) by inserting after paragraph (11)(e) the following word and paragraph:

“; and (f) a person is partnered (partner in gaol) if the person is a member of a couple and the person’s partner is:

(i) in gaol; or

(ii) undergoing psychiatric confinement because the partner has been charged with committing an offence.”;

(c) by adding at the end of subsection (11) the following Notes:

“Note 2: For ‘in gaol’ see subsection 23(5).

Note 3: For ‘psychiatric confinement’ see subsections 23(8) and (9).”.

Standard categories of family situations

15. Section 1063 of the Principal Act is amended by inserting in subsection (1) after “partnered (partner getting benefit)”:

“; partnered (partner in gaol)”.

Benefit Rate Calculator A

16. The Rate Calculator in section 1067 of the Principal Act is amended:

(a) by inserting after paragraph 1067-C2(e) the following word and paragraph:

“; or(f) the person’s partner is:

(i) in gaol; or

(ii) undergoing psychiatric confinement because the partner has been charged with committing an offence.”;

(b) by adding at the end of point 1067-C2 the following Notes:

“Note 3: For ‘in gaol’ see subsection 23(5).

Note 4: For ‘psychiatric confinement’ see subsections 23(8) and (9).”.

Benefit Rate Calculator B

17. The Rate Calculator in section 1068 of the Principal Act is amended:

(a) by inserting after paragraph 1068-C3(e) the following word and paragraph:

“; or (f) the person’s partner is:

(i) in gaol; or

(ii) undergoing psychiatric confinement because the partner has been charged with committing an offence.”;

(b) by adding at the end of point 1068-C3 the following Notes:

“Note 3: For ‘in gaol’ see subsection 23(5).

Note 4: For ‘psychiatric confinement’ see subsections 23(8) and (9).”.

Replacement Rate Tables

18. The Principal Act is amended as set out in Schedule 1.

Division 4—Child disability allowance

Qualification for child disability allowance

19. Section 954 of the Principal Act is amended:

(a) by omitting Note 4 to subsection (1) and substituting the following Note:

“Note 4: If the young person is absent during part of a day but is otherwise being cared for by the person, the person receives the full rate of allowance. If the person does not provide care to the young person because the young person is away receiving education, training or treatment (but not in hospital), the person may remain qualified for the allowance (see subsection 955(4)) but the person’s rate will be reduced under section 967.”;

(b) by omitting subsection (2) and substituting the following subsection:

“(2) Two people are each qualified for child disability allowance for a young person if between them they provide the care and attention referred to in subsection (1) for the young person.

Note: If the Secretary is satisfied that 2 people are each qualified for child disability allowance for the same young person, the Secretary may, by declaration, specify the share of child disability allowance that each person is to receive (see section 975A).”.

Repeal of section 955 and substitution of new section

20. Section 955 of the Principal Act is repealed and the following section is substituted:

Qualification while person not providing care

42 days or less

“955.(1) If:

(a) a person would, apart from this subsection, stop being qualified for a child disability allowance for a CDA child for a period, or periods, in a particular calendar year, because during the period, or periods, the child is not receiving care and attention on a daily basis from:

(i) if the person is a member of a couple—the person or the person’s partner; or

(ii) if the person is not a member of a couple—the person;

in a private home that is the residence of the person and the child; and

(b) during the period, or periods, the child is in respite care or is in hospital; and

(c) the period, or the aggregate of the periods, during which the child is in respite care (if any) does not exceed, or is not likely to exceed, 42 days in that calendar year; and

(d) the period, or the aggregate of the periods, during which the child is in a hospital (if any) does not exceed, or is not likely to exceed, 42 days in that calendar year;

the person continues to be qualified for a child disability allowance for the CDA child during the period or periods.

Note 1: A person who continues to be qualified because of subsection (1) will receive the full rate of child disability allowance.

Note 2: For circumstances which are not respite care see subsection (3).

More than 42 days in respite care or in hospital

“(2) If:

(a) a person would, apart from this subsection, stop being qualified for a child disability allowance for a CDA child for a period because during the period the child is not receiving care and attention on a daily basis from:

(i) if the person is a member of a couple—the person or the person’s partner; or

(ii) if the person is not a member of a couple—the person;

in a private home that is the residence of the person and the child; and

(b) during the period the child is in short-term respite care or is in a hospital on a short-term basis; and

(c) subsection (1) does not apply to the period;

the Secretary may decide that the person continues to be qualified for a child disability allowance for the child for a period determined by the Secretary.

Note 1: A person who continues to be qualified because of subsection (2) will receive the full rate of child disability allowance.

Note 2: For circumstances which are not respite care see subsection (3).

Meaning of respite care

“(3) For the purposes of subsections (1) and (2), a CDA child who is boarding away from home to receive education, training or treatment is taken not to be in respite care.

CDA child receiving education, training or treatment (but not in hospital)

“(4) If:

(a) a person would, apart from this subsection, stop being qualified for a child disability allowance for a CDA child for a period because during the period the child is not receiving care and attention on a daily basis from:

(i) if the person is a member of a couple—the person or the person’s partner; or

(ii) if the person is not a member of a couple—the person;

in a private home that is the residence of the person and the child; and

(b) during the period, the child is, or is likely to be, receiving education, training or treatment (other than treatment in hospital); and

(c) subsection (1) does not apply to the period;

the person continues to be qualified for a child disability allowance for the child during the period.

Note: A person who is qualified for a child disability allowance because of subsection (4) will receive a reduced rate (see subsection 967(2)).”.

Provisional commencement day

21. Section 958 of the Principal Act is amended:

(a) by omitting from subsection (1) “subsection (2) and”;

(b) by omitting subsection (2).

Rate of child disability allowance

22. Section 967 of the Principal Act is amended:

(a) by omitting from subsection (1) “, (3)”;

(b) by omitting subsections (2), (3) and (4) and substituting the following subsection:

Reduced rate of child disability allowance if child receiving education, training or treatment (but not in hospital)

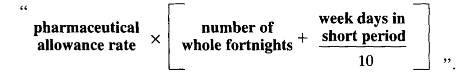

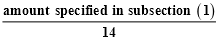

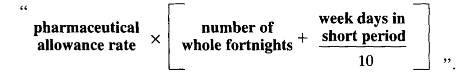

“(2) If on one or more days in the period of 14 days ending on a family payment payday, a person would have stopped being qualified for a child disability allowance for a CDA child apart from subsection 955(4) (child receiving education, training or treatment (but not in hospital)), the rate of child disability allowance payable to the person on the family payment payday for the CDA child is to be reduced by the following amount for each day in the period to which this subsection applies:

(c) by omitting from subsection (5) “by” and substituting “in a declaration under”.

Secretary may make declaration where 2 people are qualified for child disability allowance for the same young person

23. Section 975A of the Principal Act is amended by omitting subsection (1) and substituting the following subsection:

“(1) If the Secretary is satisfied that 2 people are each qualified under subsection 954(2) for child disability allowance for the same young person, the Secretary is to make a declaration:

(a) stating that the Secretary is satisfied that the 2 people are each qualified for child disability allowance for the young person; and

(b) specifying the share of the child disability allowance for the young person that each of the 2 people is to receive.”.

Schedule 1A

24.(1) Schedule 1A to the Principal Act is amended by adding at the end the following clauses:

Saving of certain claims for child disability allowance

“64.(1) This clause applies to a person if:

(a) the person is receiving child disability allowance for a young person immediately before the commencement of this clause; or

(b) the person has claimed child disability allowance for a young person and the person’s claim is not determined before the commencement of this clause.

“(2) If a person to whom this clause applies:

(a) is not qualified for child disability allowance for that young person under subsections 955(1) and 955(2) of this Act as in force immediately after that commencement; and

(b) would have been qualified for child disability allowance for that young person under subsection 955(3) of this Act as in force immediately before that commencement;

subsection 955(3) of this Act as in force immediately before that commencement continues to apply to the person.

“(3) If subclause (2) ceases to apply to the person, that subclause does not apply to the person again.

“(4) If subclause (2) applies to a person, the person’s rate of child disability allowance is the rate in section 967 of this Act as in force immediately before the commencement of this clause that would apply in respect of the young person.

Saving of declarations made under subsection 975A(1) (sharing of child disability allowance)

“65.(1) Despite the repeal of subsection 975A(1) of this Act by section 23 of the Social Security Legislation Amendment Act 1993, any declarations made by the Secretary under that subsection continue in force as if the repeal had not been made.

“(2) If:

(a) 2 people are each qualified for child disability allowance for the same young person; and

(b) the Secretary has made a declaration under subsection 975A(1) of this Act as in force immediately before the commencement of this clause in respect of child disability allowance for the young person;

the person’s rate of child disability allowance is the share specified by that subsection of the child disability allowance rate in section 967 of this Act as in force immediately before the commencement of this clause that would otherwise apply in respect of the young person.

“(3) The Secretary may amend or revoke a declaration referred to in subclause (1).”.

(2) Clauses 64 and 65 of Schedule 1A to the Principal Act inserted by subsection (1) come before clause 66 of that Schedule inserted by section 74.

Division 5—Payments from New South Wales Medically-Acquired HIV Trust

Income test definitions

25. Section 8 of the Principal Act is amended by inserting after paragraph (8)(va) the following paragraph:

“(vb) a payment made by the New South Wales Medically-Acquired HIV Trust to a person by way of financial assistance with expenses incurred in relation to a person who has medically acquired HIV infection;”.

Division 6—Sole parent pension—threshold amount

Sole parent pension recipients

26. Section 664A of the Principal Act is amended by adding at the end of the definition of “threshold amount” in subsection (4) the following word and paragraph:

“; and (e) has no dependent children.”.

Division 7—Review of decisions

Application of Part to decisions under the 1947 Act

27. Section 1238 of the Principal Act is amended by adding at the end the following Note:

“Note: For ‘rate of return decision’ see subsection 9(1).”.

Secretary may review decisions

28. Section 1239 of the Principal Act is amended by omitting the Note to subsection (7).

Application for review

29. Section 1240 of the Principal Act is amended:

(a) by adding at the end of subsection (1) the following Note:

“Note 2: For ‘rate of return decision’ see subsection 9(1).”;

(b) by adding at the end the following subsection:

“(4) If:

(a) a person who may apply to the Secretary for review of a decision under subsection (1) has not so applied; and

(b) the person applies to the Social Security Appeals Tribunal for review of the decision;

the person is taken to apply to the Secretary for review of the decision under subsection (1) on the day on which the person applies to the Social Security Appeals Tribunal.”.

Division 8—Job search allowance, newstart allowance and sickness allowance

Commencement of job search allowance

30. Section 534 of the Principal Act is amended by omitting Notes 3 to 6 and substituting the following Notes:

Note 3: If the person:

(a) is subject to an unused annual leave waiting period; and

(b) is subject to an ordinary waiting period;

the ordinary waiting period will follow the unused annual leave waiting period (see subsection 539(2)).

Note 4: If the person is subject to an education leavers waiting period and another waiting period, the education leavers waiting period runs concurrently with the other waiting period and the job search allowance will not be payable until the longest waiting period has ended.

Note 5: If the person is subject to a newly arrived resident’s waiting period and another waiting period, the newly arrived resident’s waiting period runs concurrently with the other waiting period and the job search allowance will not be payable until the longest waiting period has ended.”.

Duration of ordinary waiting period

31. Section 539 of the Principal Act is amended:

(a) by omitting paragraph (1)(ba);

(b) by adding at the end of subsection (1) the following Notes:

“Note 2: If the person is subject to an education leavers waiting period, the education leavers waiting period runs concurrently with the ordinary waiting period.

Note 3: If the person is subject to a newly arrived resident’s waiting period, the newly arrived resident’s waiting period runs concurrently with the ordinary waiting period.”;

(c) by omitting paragraph (2)(c);

(d) by adding at the end of subsection (2) the following Notes:

“Note 1: If the person is subject to an education leavers waiting period, the education leavers waiting period runs concurrently with the unused annual leave waiting period and the ordinary waiting period.

“Note 2: If the person is subject to a newly arrived resident’s waiting period, the newly arrived resident’s waiting period runs concurrently with the unused annual leave waiting period and the ordinary waiting period.”;

(e) by omitting subsections (2A) and (2B);

(f) by omitting paragraph (3)(b).

Commencement of newstart allowance

32. Section 616 of the Principal Act is amended by omitting Notes 3 to 6 and substituting the following Notes:

“Note 3: If the person:

(a) is subject to an unused annual leave waiting period; and

(b) is subject to an ordinary waiting period;

the ordinary waiting period will follow the unused annual leave waiting period (see subsection 621(2)).

Note 4: If the person is subject to an education leavers waiting period and another waiting period, the education leavers waiting period runs concurrently with the other waiting period and the newstart allowance will not be payable until the longest waiting period has ended.

Note 5: If the person is subject to a newly arrived resident’s waiting period and another waiting period, the newly arrived resident’s waiting period runs concurrently with the other waiting period and the newstart allowance will not be payable until the longest waiting period has ended.”.

Duration of ordinary waiting period

33. Section 621 of the Principal Act is amended:

(a) by omitting paragraph (1)(ba);

(b) by adding at the end of subsection (1) the following Notes:

Note 2: If the person is subject to an education leavers waiting period, the education leavers waiting period runs concurrently with the ordinary waiting period.

Note 3: If the person is subject to a newly arrived resident’s waiting period, the newly arrived resident’s waiting period runs concurrently with the ordinary waiting period.”;

(c) by omitting paragraph (2)(c);

(d) by adding at the end of subsection (2) the following Notes:

“Note 1: If the person is subject to an education leavers waiting period, the education leavers waiting period runs concurrently with the unused annual leave waiting period and the ordinary waiting period.

Note 2: If the person is subject to a newly arrived resident’s waiting period, the newly arrived resident’s waiting period runs concurrently with the unused annual leave waiting period and the ordinary waiting period.”;

(e) by omitting subsections (2A) and (2B);

(f) by omitting paragraph (3)(b).

Qualification for sickness allowance

34. Section 666 of the Principal Act is amended:

(a) by omitting from paragraph (1)(g) “, or is likely to be,”;

(b) by omitting from paragraph (1)(h) “, or is likely to be,”;

(c) by omitting from subparagraph (1A)(h)(iii) “, or is likely to be,”;

(d) by omitting from subparagraph (1A)(h)(iv) “, or is likely to be,”.

Person undertaking rehabilitation program may qualify for sickness allowance

35. Section 667 of the Principal Act is amended:

(a) by omitting from paragraph (4)(c) “, or is likely to be,”;

(b) by omitting from paragraph (4)(d) “, or is likely to be,”.

Commencement of sickness allowance

36. Section 688 of the Principal Act is amended:

(a) by omitting paragraphs (2)(b) and (c) and substituting the following paragraph:

“(b) the person is not subject to a waiting period;”;

(b) by omitting Note 1 to subsection (2) and substituting the following Note:

“Note 1: A waiting period is:

(a) an unused annual leave waiting period (see sections 690 to 692); or

(b) an ordinary waiting period (see sections 693 and 694); or

(c) an education leavers waiting period (see sections 695 to 696A); or

(d) a newly arrived resident’s waiting period (see sections 696B and 696C).”;

(c) by omitting subsections (3), (4) and (4A) and substituting the following subsection:

Claim within 5 weeks of incapacity and waiting period applying

“(3) If the person:

(a) claims the allowance within 5 weeks after the day on which the person becomes incapacitated for work; and

(b) the person is subject to a waiting period;

the allowance is not payable to the person before the first day after the end of the waiting period.

Note 1: If the person:

(a) is subject to an unused annual leave waiting period; and

(b) an ordinary waiting period;

the ordinary waiting period will follow the unused annual leave waiting period (see subsection 694(2)).

Note 2: If the person is subject to an education leavers waiting period and another waiting period, the education leavers waiting period runs concurrently with the other waiting period and the sickness allowance will not be payable until the longest waiting period has ended.

Note 3: If the person is subject to a newly arrived resident’s waiting period and another waiting period, the newly arrived resident’s waiting period runs concurrently with the other waiting period and the sickness allowance will not be payable until the longest waiting period has ended.”;

(d) by omitting paragraphs (6)(b) and (c) and substituting the following paragraph:

“(b) if the person is subject to a waiting period—must not be earlier than the first day after the end of the waiting period.

Note 1: If the person:

(a) is subject to an unused annual leave waiting period; and

(b) an ordinary waiting period;

the ordinary waiting period will follow the unused annual leave waiting period (see subsection 694(2)).

Note 2: If the person is subject to an education leavers waiting period and another waiting period, the education leavers waiting period runs concurrently with the other waiting period and the sickness allowance will not be payable until the longest waiting period has ended.

Note 3: If the person is subject to a newly arrived resident’s waiting period and another waiting period, the newly arrived resident’s waiting period runs concurrently with the other waiting period and the sickness allowance will not be payable until the longest waiting period has ended.”.

Duration of ordinary waiting period

37. Section 694 of the Principal Act is amended:

(a) by omitting paragraph (1)(ba);

(b) by adding at the end of subsection (1) the following Notes:

“Note 1: For ‘provisional commencement day’ see section 687.

Note 2: If the person is subject to an education leavers waiting period, the education leavers waiting period runs concurrently with the ordinary waiting period.

Note 3: If the person is subject to a newly arrived resident’s waiting period, the newly arrived resident’s waiting period runs concurrently with the ordinary waiting period.”;

(c) by omitting paragraph (2)(c);

(d) by adding at the end of subsection (2) the following Notes:

“Note 1: If the person is subject to an education leavers waiting period, the education leavers waiting period runs concurrently with the unused annual leave waiting period and the ordinary waiting period.

Note 2: If the person is subject to a newly arrived resident’s waiting period, the newly arrived resident’s waiting period runs concurrently with the unused annual leave waiting period and the ordinary waiting period.”;

(e) by omitting subsections (2A) and (2B);

(f) by omitting paragraph (3)(ba).

Division 9—Impairment Table

Schedule 1B

38. Schedule 1B to the Principal Act is amended by omitting from Table 16.2 “1.4” corresponding to HTL—BETTER EAR ≤ 15 and HTL—WORSE EAR ≤ 95 and substituting “3.4”.

Division 10—Investment income

Structure of Division

39. Section 1073 of the Principal Act is amended:

(a) by omitting from column 3 in the Table in subsection (1) “1075” and substituting “1075-1076”;

(b) by omitting from column 3 in the Table in subsection (1) “1082-1083” and substituting “1077-1079”;

(c) by omitting from column 3 in the Table in subsection (1) “1097” and substituting “1080, 1097”.

How investment losses are taken into account in working out pension and benefit rates

40. Section 1074C of the Principal Act is amended:

(a) by omitting from subsection (2) “increases to be made under section 1074B” and substituting “investment-related increases in income made”;

(b) by adding at the end the following subsection:

“(3) For the purposes of subsection (2), an ‘investment-related increase in income’ is an increase in the person’s ordinary income on a yearly basis:

(a) that is made under section 1074B; or

(b) that:

(i) is attributable to an investment to which Subdivision B applies; and

(ii) is not attributable to a realisation to which section 1075, 1077 or 1080 applies.”.

Annualised rate of return or loss on investment product

41. Section 1074E of the Principal Act is amended by omitting paragraph (1)(a) and substituting the following paragraphs:

“(a) if only one rate of return on the product has been declared during the period—the declared rate of return; or

(aa) if 2 or more rates of return on the product have been declared during the period—the average of those declared rates of return; or”.

Heading to Subdivision B of Division 1 of Part 3.10

42. The heading to Subdivision B of Division 1 of Part 3.10 is amended by omitting “Accruing return investments made or acquired before 1 January 1988” and substituting “Investments taken into account on realisation”.

Investments made before 1 January 1988 with friendly societies or where no immediate return

43. Section 1075 of the Principal Act is amended by inserting after subsection (1) the following subsection:

“(2) If subsection (1) applied to an investment because it was with a friendly society, subsection (1) does not cease to apply to the investment merely because the society ceases to be a friendly society. Subsection (1), however, only continues to apply to the investment while the terms of the investment remain substantially the same as they were when the investment was with a friendly society.

Note: This subsection is intended to deal with cases in which a friendly society restructures and as a result of the restructuring loses its friendly society status. If the terms of the investment remain substantially the same, the investor can still have the investment dealt with under this section.”.

Insertion of new sections

44. After section 1075 of the Principal Act the following sections are inserted in Subdivision B of Division 1 of Part 3.10:

How investment losses are taken into account in working out pension and benefit rates

“1076.(1) If:

(a) a person has an investment; and

(b) section 1075 applies to the investment; and

(c) the investment is realised at a loss;

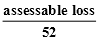

the person’s ordinary income is taken to be reduced during each week in the 12 months commencing on the day on which the person realises the investment by the amount worked out using the formula:

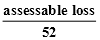

where:

‘assessable loss’ is so much (if any) of the amount of the loss as is attributable to the person’s assessable period.

Note: For ‘assessable period’ see subsection 9(1).

“(2) Subsection (1) has effect subject to section 1082 (limits on offsetting losses).

Market-linked investments made or acquired before 9 September 1988

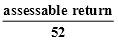

“1077.(1) Subject to subsection (4), if a person realises a market-linked investment that was made or acquired before 9 September 1988 and receives an amount by way of return, the person is taken to receive as ordinary income of the person during each week in the 12 months commencing on the day on which the person realises the investment the amount worked out using the formula:

where:

‘assessable return’ is so much (if any) of the amount of the return as is attributable to the person’s assessable period.

Note: For ‘assessable period’ see subsection 9(1).

“(2) For the purposes of subsection (1), a person realises an investment if, and only if:

(a) all or part of the amount of the investment is withdrawn; or

(b) where the investment is an eligible investment in a body corporate or trust fund—the person transfers all or part of the investment to another body corporate or trust fund; or

(c) all or part of the return on the investment is paid to another person; or

(d) the investment matures; or

(e) the investment is assigned by the person to another person; or

(f) the investment is disposed of by the person otherwise than in the way referred to in paragraph (e).

“(3) For the purposes of this section, if a person realises an investment in circumstances where the return on the investment is paid to another person, the return is taken to be received by the person realising the investment.

“(4) This section does not apply to the realisation of a person’s market-linked investment if:

(a) the investment is in a public unit trust; and

(b) the trust is a property trust; and

(c) the trust is not listed on a stock exchange; and

(d) the person made or acquired the investment before 9 September 1988; and

(e) the investment is realised on or after 24 July 1991 and before 23 July 1992; and

(f) the investment is realised due to a restructuring of the trust.

“(5) For the purposes of paragraph (4)(f), a person’s investment is realised due to a restructuring if:

(a) in realising the investment the person exchanges the investment for an investment in another public unit trust that is a property trust; and

(b) the same manager manages both the investments referred to in paragraph (a).

Special provisions about certain investments made before 9 September 1988

“1078.(1) If:

(a) before 9 September 1988, a person made or acquired a market-linked investment; and

(b) under an agreement made before 9 September 1988, dividends payable to the person in respect of that investment are not paid to the person directly but are invested in the person’s name in market-linked investments included in the same investment product;

any market-linked investment arising from the investment of a dividend pursuant to that agreement on or after 9 September 1988 is taken, for the purposes of this Subdivision, to have been made, or acquired, by the person before 9 September 1988.

“(2) Subsections (3) and (4) apply if, at any time after 9 September 1988:

(a) a person held, or holds, 2 or more market-linked investments included in the same investment product; and

(b) at least one of the investments was made, or acquired, by the person before 9 September 1988 and at least one of the investments was made or acquired on or after that day; and

(c) the person disposed, or disposes, of any of those investments.

“(3) If the amount received in respect of the disposal is or was greater than or equal to:

(a) the value or amount, at the time of the disposal, of the investment made, or acquired, by the person before 9 September 1988; or

(b) the sum of the values or amounts, at the time of the disposal, of the investments made, or acquired, by the person before 9 September 1988;

as the case requires, the person is taken, for the purposes of this Subdivision, to have disposed of the whole of that investment or those investments.

“(4) If the amount received in respect of the disposal (the ‘disposal amount’) is or was less than:

(a) the value or amount, at the time of the disposal, of the investment made before 9 September 1988; or

(b) the sum of the values or amounts, at the time of the disposal, of the investments made before 9 September 1988;

as the case requires, the person is to be taken, for the purposes of this Subdivision, to have disposed of so much of that investment or those investments as is equal to the disposal amount.

How investment losses are taken into account in working out pension and benefit rates

“1079.(1) If:

(a) a person has an investment; and

(b) section 1077 applies to the investment; and

(c) the investment is realised at a loss;

the person’s ordinary income is taken to be reduced during each week in the 12 months commencing on the day on which the person realises the investment by the amount worked out using the formula:

where:

‘assessable loss’ is so much (if any) of the amount of the loss as is attributable to the person’s assessable period.

Note: For ‘assessable period’ see subsection 9(1).

“(2) Subsection (1) has effect subject to section 1082 (limits on offsetting losses).

Early withdrawal from superannuation fund

“1080. If:

(a) a person realises an investment in a superannuation fund, approved deposit fund or deferred annuity before the person reaches pension age; and

(b) the amount realised is not rolled over into:

(i) a superannuation fund; or

(ii) an approved deposit fund; or

(iii) a deferred annuity; or

(iv) an immediate annuity;

the person is taken to receive one fifty-second of the assessable growth component of that amount as ordinary income of the person during each week in the period of 12 months commencing on the day on which the person realises the investment.

Note: For ‘assessable growth component’ see subsection 9(1).

How investment losses are taken into account in working out pension and benefit rates

“1081.(1) If:

(a) a person has an investment; and

(b) section 1080 applies to the investment; and

(c) the investment is realised at a loss;

the person’s ordinary income is taken to be reduced during each week in the 12 months commencing on the day on which the person realises the investment by the amount worked out using the formula:

where:

‘assessable loss’ is so much (if any) of the amount of the loss as is attributable to the person’s assessable period.

Note: For ‘assessable period’ see subsection 9(1).

“(2) Subsection (1) has effect subject to section 1082 (limits on offsetting losses).

Limit on reduction of ordinary income for losses

“1082. The sum of the reductions under sections 1076, 1079 and 1081 in calculating a person’s rate as at a particular day are not to exceed the sum of the increases to be made under sections 1075, 1077 and 1080 in working out the person’s pension or benefit rate as at that day.”.

Repeal of Subdivision C of Division 1 of Part 3.10

45. Subdivision C of Division 1 of Part 3.10 of the Principal Act is repealed.

Provisions affecting superannuation fund investments before pension age

46. Section 1097 of the Principal Act is amended by omitting from paragraph (f) “1097A” and substituting “1080”.

Repeal of section 1097A

47. Section 1097A of the Principal Act is repealed.

Rate of return decision amendments

48. The Principal Act is amended as set out in Schedule 2 to this Act.

Division 11—Family payments

Insertion of new section

49. After section 831 of the Principal Act the following section is inserted:

FP child of approved care organisation

“831A.(1) Subject to subsections (2) and (3) and sections 832 and 833, a person is an FP child of an approved care organisation if:

(a) the person is a young person; and

(b) the person is a client of the organisation; and

(c) the person is an inhabitant of Australia.

Note 1: For ‘young person’ see subsection 5(1).

Note 2: For ‘inhabitant of Australia’ see subsection 23(1).

“(2) The young person cannot be an FP child of the organisation if:

(a) the young person has not turned 16; and

(b) the young person is not a full-time student; and

(c) the young person is receiving income; and

(d) the rate of that income exceeds $111.35 per week.

Note: The amount referred to in paragraph (d) is indexed annually in line with CPI increases (see sections 1191 and 1194).

“(3) The young person cannot be an FP child of the organisation if the young person is receiving:

(a) a social security pension or benefit; or

(b) a payment under a program included in the programs known as Labour Force Programs.”.

FP child—prescribed student child not included

50. Section 832 of the Principal Act is amended by omitting subsection (1) and substituting the following subsection:

“(1) A person cannot be an FP child if the person:

(a) has turned 16; and

(b) is a prescribed student child.”.

FP child—child over 16

51. Section 833 of the Principal Act is amended:

(a) by omitting from subsection (1) “dependent child” and substituting “person”;

(b) by omitting subsection (2) and substituting the following subsection:

“(2) A person who has turned 16 and is undertaking secondary studies may be an FP child until:

(a) the end of the calendar year in which the person turns 18; or

(b) the person ceases secondary studies;

whichever happens first.”.

Repeal of section 834

52. Section 834 of the Principal Act is repealed.

FP child of a person—residence requirements

53. Section 835 of the Principal Act is amended by inserting “of a person” after “FP child”.

Repeal of section 839 and substitution of new section

54. Section 839 of the Principal Act is repealed and the following section is substituted:

Qualification for approved care organisation family payment

“839.(1) Subject to subsection (2), an approved care organisation is qualified for family payment for a young person if:

(a) the young person is an FP child of the organisation; and

(b) no person is receiving family payment for the young person.

“(2) If a person is qualified for family payment for a young person, an approved care organisation is not qualified for family payment for the young person.

Note: For ‘young person’ see subsection 5(1).”.

Family payment generally not payable before claim

55. Section 842 of the Principal Act is amended by omitting from subsection (1) “Family” and substituting “Subject to sections 845A, 846 and 847, family”.

Family payment provisional commencement day

56. Section 843 of the Principal Act is amended by omitting from subsection (1) “, 845, 846 and 847” and substituting “and 845”.

Insertion of new section

57. After section 845 of the Principal Act the following section is inserted:

Backdating—grant under prescribed educational scheme

“845A. If:

(a) a person (the ‘PES recipient’) is granted payments under a prescribed educational scheme; and

(b) the grant is effective as from a particular day (the ‘PES start day’); and

(c) because of the grant, family payment is payable to the PES recipient or the recipient’s partner; and

(d) the PES recipient or the recipient’s partner lodges a claim for family payment:

(i) before the recipient is advised of the grant; or

(ii) within 28 days after the recipient is advised of the grant; and

(e) within 28 days after the PES recipient is advised of the grant, the person who is claiming family payment gives the Secretary notice of the grant;

family payment can become payable before the provisional commencement day but cannot become payable before the PES start day.

Note 1: For ‘prescribed educational scheme’ see subsection 5(1).

Note 2: For ‘provisional commencement day’ see section 843.

Note 3: The family payment will not necessarily be backdated to the PES start day—some other factor may make the payment not payable at that time.”.

Date of effect of favourable determination

58. Section 887 of the Principal Act is amended by inserting after subsection (8) the following subsections:

“(8A) If:

(a) a person (the ‘PES recipient’) is granted payments under a prescribed educational scheme; and

(b) because of the grant, family payment is payable to the PES recipient or the recipient’s partner at a higher rate; and

(c) before the PES recipient was advised of the grant, the recipient or the recipient’s partner was receiving family payment; and

(d) within 28 days after the PES recipient was advised of the grant, the person who is receiving family payment gives the Secretary notice of the grant;

the determination to increase the family payment rate takes effect on the day specified in the determination.

Note: For ‘prescribed educational scheme’ see subsection 5(1).

“(8B) The day specified under subsection (8A) is not to be earlier than the day as of which the grant of payments under the prescribed educational scheme takes effect.”.

Continuation of qualification for family payment for 4 weeks in some cases where recipient’s only FP child dies

59. Section 897 of the Principal Act is amended by omitting paragraph (d) and substituting the following paragraph:

“(d) the person is not qualified for family payment under section 892;”.

Family Payment Rate Calculator

60. The Rate Calculator in section 1069 is amended:

(a) by inserting after Step 1 in the Method statement in point 1069-A1 the following Note:

“Note: If 2 people share the daily care and control of a child, Module E may apply.”;

(b) by inserting after Step 2 in the Method statement in point 1069-A1 the following Note:

“Note: If 2 people share the daily care and control of a child, Module E may apply.”;

(c) by inserting after Step 5 in the Method statement in point 1069-A1 the following Note:

“Note: If 2 people share the daily care and control of a child, Module E may apply.”;

(d) by inserting in point 1069-D2 “1069-D2A, 1069-D2B,” after “points”;

(e) by inserting after point 1069-D2 the following points:

Approved care organisation not qualified for additional family payment

“1069-D2A. An approved care organisation is not qualified for additional family payment.

No person qualified for additional family payment if approved care organisation receiving family payment for the child

“1069-D2B. If an approved care organisation is receiving family payment for a young person, no person is qualified for additional family payment for the young person.”;

(f) by omitting point 1069-E4 and substituting the following point:

Reduction in additional family payment if only one person qualified for additional family payment and declaration under subsection 869(1) is in force

“1069-E4. If:

(a) 2 people share the daily care and control of the same child; and

(b) only one of those people (the ‘AFP recipient’) is qualified for additional family payment for the child; and

(c) the Secretary has made a declaration under subsection 869(1) that specifies the share of the family payment that the AFP recipient is to receive for the child;

the maximum AFP rate for the child is that share of the maximum

AFP rate that would otherwise apply.”.

Access to financial hardship rules—family payment

61. Section 1132A of the Principal Act is amended by omitting from subsection (2) the definition of “MBR” and substituting the following definition:

“ ‘MBR’ is the maximum basic rate of age pension payable, as at the last 1 January, to a person who has a partner;”.

Indexed and adjusted amounts

62. Section 1190 of the Principal Act is amended by omitting from column 4 of item 40 of the Indexed and Adjusted Amounts Table “839(2)(c)” and substituting “831A(2)(d)”.

Debts arising under this Act and the 1947 Act

63. Section 1223 of the Principal Act is amended by omitting paragraph (4)(c) and substituting the following paragraph:

“(c) the amount would be recoverable because of:

(i) an increase in the person’s taxable income; or

(ii) an underestimate of the person’s taxable income;”.

Division 12—Landcare and Environment Action Program (LEAP)

Index of definitions

64. Section 3 of the Principal Act is amended by inserting the following entry in the Index:

“LEAP program 23(1)”.

General definitions

65. Section 23 of the Principal Act is amended by inserting in subsection (1) the following definition:

“ ‘LEAP program’ means a Landcare and Environment Action Program administered by the Employment Department;”.

Multiple entitlement exclusion

66. Section 532 of the Principal Act is amended:

(a) by inserting after paragraph (4)(b) the following word and paragraph:

“; or (c) a LEAP program.”;

(b) by adding at the end of subsection (4) the following Note:

“Note 2: For ‘LEAP program’ see subsection 23(1).”.

Ordinary waiting period

67. Section 538 of the Principal Act is amended:

(a) by inserting after paragraph (f) the following word and paragraph:

“; or (g) the following conditions apply:

(i) the person undertakes a LEAP program;

(ii) immediately before undertaking the program, the person was receiving a social security pension or benefit;

(iii) the person completes the program;

(iv) immediately after completing the program, the person is qualified for job search allowance;

(v) the person claims job search allowance within 14 days after the day on which the person completes the program.”;

(b) by adding at the end the following Note:

“Note 7: For ‘LEAP program’ see subsection 23(1).”.

Multiple entitlement exclusion

68. Section 614 of the Principal Act is amended:

(a) by inserting after paragraph (4)(b) the following word and paragraph:

“;or (c) a LEAP program.”;

(b) by adding at the end of subsection (4) the following Note:

“Note 2: For ‘LEAP program’ see subsection 23(1).”.

Ordinary waiting period

69. Section 620 of the Principal Act is amended:

(a) by inserting after paragraph (i) the following word and paragraph:

“; or (j) the following conditions apply:

(i) the person undertakes a LEAP program;

(ii) immediately before undertaking the program, the person was receiving a social security pension or benefit;

(iii) the person completes the program;

(iv) immediately after completing the program, the person is qualified for newstart allowance;

(v) the person claims newstart allowance within 14 days after the day on which the person completes the program.”;

(b) by adding at the end the following Note:

“Note 8: For ‘LEAP program’ see subsection 23(1).”.

Benefit Rate Calculator A

70. The Rate Calculator in section 1067 of the Principal Act is amended:

(a) by inserting after paragraph 1067-C2(d) the following word and paragraph:

“; or (e) the person’s partner is receiving payments under a LEAP program.”;

(b) by adding at the end of point 1067-C2 the following Note:

“Note 2: For ‘LEAP program’ see subsection 23(1).”;

(c) by omitting point 1067-H2 and substituting the following points:

Ordinary income of members of couples

“1067-H2. Subject to point 1067-H2A, the ordinary income of a person who is a member of a couple is taken for the purposes of this Module to include the ordinary income of the person’s partner.

“1067-H2A. Point 1067-H2 does not apply to ordinary income of the person’s partner in the form of:

(a) AUSTUDY allowance; or

(b) ABSTUDY allowance; or

(c) financial supplement under the Student Financial Supplement Scheme; or

(d) payments under a LEAP program.

Note: For ‘AUSTUDY allowance’, ‘ABSTUDY’, ‘Student Financial Supplement Scheme’ and ‘LEAP program’ see subsection 23(1).”.

Benefit Rate Calculator B

71. The Rate Calculator in section 1068 of the Principal Act is amended:

(a) by inserting after paragraph 1068-C3(d) the following word and paragraph:

“; or (e) the person’s partner is receiving payments under a LEAP program.”;

(b) by adding at the end of point 1068-C3 the following Note:

“Note 2: For ‘LEAP program’ see subsection 23(1).”;

(c) by omitting point 1068-G2 and substituting the following points:

Ordinary income of members of couples

“1068-G2. Subject to point 1068-G2A, the ordinary income of a person who is a member of a couple is taken for the purposes of this Module to include the ordinary income of the person’s partner.

“1068-G2A. Point 1068-G2 does not apply to ordinary income of the person’s partner in the form of:

(a) AUSTUDY allowance; or

(b) ABSTUDY allowance; or

(c) financial supplement under the Student Financial Supplement Scheme; or

(d) payments under a LEAP program.

Note: For ‘AUSTUDY allowance’, ‘ABSTUDY’, ‘Student Financial Supplement Scheme’ and ‘LEAP program’ see subsection 23(1).”.

Division 13—Jobskills

General definitions

72. Section 23 of the Principal Act is amended by omitting from subsection (1) the definition of “Jobskills” and substituting the following definition:

“ ‘Jobskills’ means:

(a) the work experience program that is administered by the Employment Department and is called Jobskills; or

(b) the work experience program that is administered by the government of the Australian Capital Territory and is called ACT Government Jobskills;”.

Division 14—Mobility allowance

Qualification for mobility allowance

73. Section 1035 of the Principal Act is amended:

(a) by inserting after subparagraph (b)(ii) the following subparagraph:

“(iia) the person is not receiving an amount called the training component from the Employment Department;

Note: The training component is paid to a person to assist with his or her expenses in undertaking vocational training.”;

(b) by inserting after subparagraph (c)(ii) the following subparagraph:

“(iia) the person is not receiving an amount called the training component from the Employment Department;

Note: The training component is paid to a person to assist with his or her expenses in undertaking the job search activities.”.

Schedule 1A

74.(1) Schedule 1A to the Principal Act is amended by adding at the end the following clause:

Mobility allowance (changes made by section 73 of the Social Security Legislation Amendment Act 1993)

“66.(1) If:

(a) immediately before the day on which the Social Security Legislation Amendment Act 1993 received the Royal Assent, a person was receiving a mobility allowance; and

(b) immediately before that day, the person was receiving an amount called the training component from the Employment Department;

the person does not have to satisfy subparagraph 1035(b)(iia) or (c)(iia) of this Act on and after that day in order to be qualified for mobility allowance.

“(2) If:

(a) mobility allowance ceases to be payable to a person referred to in subclause (1); or

(b) the training component ceases to be payable to the person;

subclause (1) ceases to apply to the person.

“(3) If subclause (1) ceases to apply to the person, that subclause does not apply to the person again.”.

(2) Clause 66 of Schedule 1A to the Principal Act inserted by subsection (1) comes after clause 65 of that Schedule inserted by subsection 24(1) of this Act.

Division 15—New Enterprise Incentive Scheme and Aboriginal Employment Incentive Scheme

General effect of Part

75. Section 1186 of the Principal Act is amended by omitting Note 2.

Reduction in rate of payments under this Act if recipient or partner also receiving payments under New Enterprise Incentive Scheme (NEIS) or Aboriginal Employment Incentive Scheme (AEIS)

76. Section 1187 of the Principal Act is amended:

(a) by inserting before subparagraph (1)(a)(i) the following subparagraph:

“(ia) age pension; or”;

(b) by inserting after subparagraph (1)(a)(v) the following subparagraph:

“(va) widow B pension; or”;

(c) by inserting before subparagraph (2)(a)(i) the following subparagraph:

“(ia) age pension; or”.

PART 3—FURTHER AMENDMENTS

Amendments of the Principal Act

77. The Principal Act is amended as set out in Schedule 3.

Amendments of other Acts

78. The Acts specified in Schedule 4 are amended as set out in that Schedule.

PART 4—SHARES AND OTHER LISTED SECURITIES

Division 1—Amendment of the Social Security Act 1991

Principal Act

79. In this Division, “Principal Act” means the Social Security Act 19911.

Investments to which this Subdivision applies

80. Section 1074A of the Principal Act is amended by omitting subsection (2) and substituting the following subsection:

“(2) This Subdivision applies to a person’s investment in the form of a listed security if the person acquired the investment after 18 August 1992.

Note: For ‘listed security’ see subsection 9(1).”.

Division 2—Amendment of the Veterans’ Entitlements Act 1986

Principal Act

81. In this Division, “Principal Act” means the Veterans’ Entitlements Act 19862.

Investments to which this Subdivision applies

82. Section 46AA of the Principal Act is amended by omitting subsection (2) and substituting the following subsection:

“(2) This Subdivision applies to a person’s investment in the form of a listed security if the person acquired the investment after 18 August 1992.

Note: For ‘listed security’ see subsection 5J(1).”.

SCHEDULE 1 Section 18

PEOPLE WITH PARTNERS IN GAOL (REPLACEMENT TABLES)

1. Section 1064 (Pension Rate Calculator A—point 1064–B1—Table B):

Omit the Table (but not the Notes), substitute:

“

| TABLE B | |

| MAXIMUM BASIC RATES | |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | rate

per year | rate

per fortnight |

1. | Not member of couple | $8,114.60 | $312.10 |

2. | Partnered | $6,767.80 | $260.30 |

3. | Member of illness separated couple | $8,114.60 | $312.10 |

4. | Member of respite care couple | $8,114.60 | $312.10 |

5. | Partnered (partner in gaol) | $8,114.60 | $312.10 |

”.

2. Section 1064 (Pension Rate Calculator A—point 1064–B1—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.”.

3. Section 1064 (Pension Rate Calculator A—point 1064–C8—Pharmaceutical Allowance Amount Table):

Omit the Table (including the Note), substitute:

“

| PHARMACEUTICAL ALLOWANCE AMOUNT TABLE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | rate

per year | rate

per fortnight |

1. | Not member of couple | $135.20 | $5.20 |

2. | Partnered | $67.60 | $2.60 |

3. | Member of illness separated couple | $135.20 | $5.20 |

4. | Member of respite care couple | $135.20 | $5.20 |

5. | Partnered (partner getting service pension) | $67.60 | $2.60 |

6. | Partnered (partner in gaol) | $135.20 | $5.20 |

SCHEDULE 1—continued

Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.

Note 2: The amounts in column 3 are adjusted annually in line with CPI increases (see section 1206A).”.

4. Section 1064 (Pension Rate Calculator A—point 1064–D5—Table D):

Omit the Table (but not the Notes), substitute:

“

| TABLE D | |

| RATE OF RENT ASSISTANCE | |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | Rate A | Rate B |

1. | Not member of couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

2. | Partnered—partner does not have rent increased pension | 3 × (annual rent – $2,600.00)

4 | $1,643.20 |

| | | |

3. | Partnered and partner: | 3 × (annual rent – $2,600.00) | $821.60 |

| (a) is receiving a social security pension; and | 8 | |

| (b) has rent increased pension | | |

4. | Partnered and partner: | 3 × (annual rent – $2,600.00) | $821.60 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) does not have a dependent child or dependent children | | |

5. | Partnered and partner: | 3 × (annual rent – $3,120.00) | $959.40 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) has 1 or 2 dependent children | | |

6. | Partnered and partner: | 3 × (annual rent – $3,120.00) | $1,094.60 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) has 3 or more dependent children | | |

7. | Member of illness separated couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

8. | Member of respite care couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

SCHEDULE 1—continued

TABLE D—continued |

RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | Rate A | Rate B |

9. | Member of temporarily separated | 3 × (annual rent – $1,560.00) | $1,643.20 |

| couple | 4 | |

10. | Partnered (partner in gaol) | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

5. Section 1064 (Pension Rate Calculator A—point 1064–D5—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’, ‘temporarily separated couple’ and ‘partnered (partner in gaol)’ see section 4.

Note 1A: For ‘dependent child’ see section 5.”.

6. Section 1064 (Pension Rate Calculator A—point 1064–D5A):

Omit the point.

7. Section 1064 (Pension Rate Calculator A—point 1064–H2—Table H):

Omit the Table (but not the Notes), substitute:

“

| | TABLE H | | |

| REMOTE AREA ALLOWANCE | |

column 1 | column 2 | column 3 | column 4 | column 5 | column 6 |

item | person’s family situation | basic allowance per year | basic allowance per fortnight | additional allowance per year | additional allowance per fortnight |

1. | Not member of couple | $455.00 | $17.50 | $182.00 | $7.00 |

2. | Partnered | $390.00 | $15.00 | $182.00 | $7.00 |

3. | Member of illness separated couple | $455.00 | $17.50 | $182.00 | $7.00 |

4. | Member of respite care couple | $455.00 | $17.50 | $182.00 | $7.00 |

5. | Partnered (partner in gaol) | $455.00 | $17.50 | $182.00 | $7.00 |

SCHEDULE 1—continued

8. Section 1064 (Pension Rate Calculator A—point 1064–H2—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.”.

9. Section 1065 (Pension Rate Calculator B—point 1065–B1—Table B):

Omit the Table (but not the Notes), substitute:

“

| TABLE B | |

| MAXIMUM BASIC RATES | |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | rate per year | rate per fortnight |

1. | Not member of couple | $8,114.60 | $312.10 |

2. | Partnered | $6,767.80 | $260.30 |

3. | Member of illness separated couple | $8,114.60 | $312.10 |

4. | Member of respite care couple | $8,114.60 | $312.10 |

5. | Partnered (partner in gaol) | $8,114.60 | $312.10 |

”.

10. Section 1065 (Pension Rate Calculator B—point 1065–B1—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.”.

11. Section 1065 (Pension Rate Calculator B—point 1065–C8—Pharmaceutical Allowance Amount Table):

Omit the Table (including the Note), substitute:

“

PHARMACEUTICAL ALLOWANCE AMOUNT TABLE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | amount per year | amount per fortnight |

1. | Not member of couple | $135.20 | $5.20 |

2. | Partnered | $67.60 | $2.60 |

3. | Member of illness separated couple | $135.20 | $5.20 |

SCHEDULE 1—continued

PHARMACEUTICAL ALLOWANCE AMOUNT TABLE—continued |

column 1 | column 2 | column 3 | column 4 |

| | amount | amount |

item | person’s family situation | per year | per fortnight |

4. | Member of respite care couple | $135.20 | $5.20 |

5. | Partnered (partner getting service pension) | $67.60 | $2.60 |

6. | Partnered (partner in gaol) | $135.20 | $5.20 |

Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.

Note 2: The amounts in column 3 are adjusted annually in line with CPI increases (see section 1206A).”.

12. Section 1065 (Pension Rate Calculator B—point 1065–E2— Table E):

Omit the Table (but not the Notes), substitute:

“

| | TABLE E | | |

| REMOTE AREA ALLOWANCE | |

column 1 | column 2 | column 3 | column 4 | column 5 | column 6 |

item | person’s family situation | basic allowance per year | basic allowance per fortnight | additional allowance per year | additional allowance per fortnight |

1. | Not member of couple | $455.00 | $17.50 | $182.00 | $7.00 |

2. | Partnered | $390.00 | $15.00 | $182.00 | $7.00 |

3. | Member of illness separated couple | $455.00 | $17.50 | $182.00 | $7.00 |

4. | Member of respite care couple | $455.00 | $17.50 | $182.00 | $7.00 |

5. | Partnered (partner in gaol) | $455.00 | $17.50 | $182.00 | $7.00 |

”.

13. Section 1065 (Pension Rate Calculator B—point 1065–E2—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.”.

SCHEDULE 1—continued

14. Section 1066 (Pension Rate Calculator C—point 1066–H2—Table H):

Omit the Table (but not the Notes), substitute:

“

| | TABLE H | | |

| REMOTE AREA ALLOWANCE | |

column 1 | column 2 | column 3 | column 4 | column 5 | column 6 |

item | person’s family situation | basic allowance per year | basic allowance per fortnight | additional allowance per year | additional allowance per fortnight |

1. | Not member of couple | $455.00 | $17.50 | $182.00 | $7.00 |

2. | Partnered | $390.00 | $15.00 | $182.00 | $7.00 |

3. | Partnered (partner in gaol) | $455.00 | $17.50 | $182.00 | $7.00 |

”.

15. Section 1066 (Pension Rate Calculator C—point 1066–H2—Notes):

(a) Omit Notes 1 and 2, substitute:

“Note 1: For ‘member of couple’, ‘partnered’ and ‘partnered (partner in gaol)’ see section 4.”.

(b) Renumber Note 3 as Note 2.

16. Section 1066A (Pension Rate Calculator D—point 1066A–B1—Table B):

Add at the end the following items:

“

9. | Member of respite care couple and person has not turned 18 | $8,114.60 | $5,571.80 | $312.10 | $214.30 |

10. | Member of respite care couple and person has turned 18 | $8,114.60 | $6,162.00 | $312.10 | $237.00 |

11. | Partnered (partner in gaol) and person has not turned 18 | $8,114.60 | $5,571.80 | $312.10 | $214.30 |

12. | Partnered (partner in gaol) and person has turned 18 | $8,114.60 | $6,162.00 | $312.10 | $237.00 |

”.

17. Section 1066A (Pension Rate Calculator D—point 1066A–B1—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.”.

SCHEDULE 1—continued

18. Section 1066A (Pension Rate Calculator D—point 1066A–D8—Pharmaceutical Allowance Amount Table):

Omit the Table (including the Note), substitute:

“

PHARMACEUTICAL ALLOWANCE AMOUNT TABLE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | amount per year | amount per fortnight |

1. | Not member of couple | $135.20 | $5.20 |

2. | Partnered | $67.60 | $2.60 |

3. | Member of illness separated couple | $135.20 | $5.20 |

4. | Member of respite care couple | $135.20 | $5.20 |

5. | Partnered (partner getting service pension) | $67.60 | $2.60 |

6. | Partnered (partner in gaol) | $135.20 | $5.20 |

Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’ and ‘partnered (partner in gaol)’ see section 4.

Note 2: The amounts in column 3 are adjusted annually in line with CPI increases (see section 1206A).”.

19. Section 1066A (Pension Rate Calculator D—point 1066A–EA12—Table EA):

Omit the Table (but not the Notes), substitute:

“

| TABLE EA |

| RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | Rate A | Rate B |

1. | Not member of couple and in disability accommodation | 3 × (annual rent – $1,560.00)

4 | $1,747.20 |

| | | |

2. | Partnered—partner does not have rent increased pension | 3 × (annual rent – $2,600.00)

4 | $1,643.20 |

| | | |

3. | Partnered and partner: | 3 × (annual rent – $2,600.00)

8 | $821.60 |

| (a) is receiving a social security pension; and | | |

| (b) has rent increased pension | | |

SCHEDULE 1—continued

TABLE EA—continued |

RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | Rate A | Rate B |

4. | Partnered and partner: | 3 × (annual rent – $2,600.00) | $821.60 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) does not have a dependent child or dependent children | | |

5. | Partnered and partner: | 3 × (annual rent – $3,120.00) | $959.40 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) has 1 or 2 dependent children | | |

6. | Partnered and partner: | 3 × (annual rent – $3,120.00) | $1,094.60 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) has 3 or more dependent children | | |

7. | Member of illness separated couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

8. | Member of respite care couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

9. | Member of temporarily separated couple | 3 × (annual rent – $1,560.00) | $1,643.20 |

| | 4 | |

10. | Partnered (partner in gaol) | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

20. Section 1066A (Pension Rate Calculator D—point 1066A–EA12—Note 1):

Omit the Note, substitute:

“Note 1: For ‘member of couple’, ‘partnered’, ‘illness separated couple’, ‘respite care couple’, ‘temporarily separated couple’ and ‘partnered (partner in gaol)’ see section 4.

Note 1A: For ‘dependent child’ see section 5.”.

21. Section 1066A (Pension Rate Calculator D—point 1066A–EA12A):

Omit the point.

SCHEDULE 1—continued

22. Section 1066A (Pension Rate Calculator D—point 1066A–EB13—Table EB):

Omit the Table (but not the Notes), substitute:

“

TABLE EB |

RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | Rate A | Rate B |

1. | Not member of couple and in disability accommodation | 3 × (annual rent – $1,560.00)

4 | $1,747.20 |

| | | |

2. | Not member of couple and living permanently or indefinitely away from the person’s parental home | 3 × (annual rent – $1,560.00)

4 | $1,747.20 |

| | | |

3. | Partnered—partner does not have rent increased pension | 3 × (annual rent – $2,600.00)

4 | $1,643.20 |

| | | |

4. | Partnered and partner: | 3 × (annual rent – $2,600.00) | $821.60 |

| (a) is receiving a social security pension; and | 8 | |

| (b) has rent increased pension | | |

5. | Partnered and partner: | 3 × (annual rent – $2,600.00) | $821.60 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) does not have a dependent child or dependent children | | |

6. | Partnered and partner: | 3 × (annual rent – $3,120.00) | $959.40 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) has 1 or 2 dependent children | | |

7. | Partnered and partner: | 3 × (annual rent – $3,120.00) | $1,094.60 |

| (a) is receiving a service pension; and | 8 | |

| (b) has rent increased pension; and | | |

| (c) has 3 or more dependent children | | |

8. | Member of illness separated couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

9. | Member of respite care couple | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

SCHEDULE 1—continued

| TABLE EB—continued | |

| RATE OF RENT ASSISTANCE | |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | Rate A | Rate B |

10. | Member of temporarily separated couple | 3 × (annual rent – $1,560.00) | $1,643.20 |

| | 4 | |

11. | Partnered (partner in gaol) | 3 × (annual rent – $1,560.00) | $1,747.20 |

| | 4 | |

”.

23. Section 1066A (Pension Rate Calculator D—point 1066A–EB13—Note 1):

Omit the Note, substitute: