Commencement

2.(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Part 1 of Schedule 10 is taken to have commenced on 12 June 1989.

(3) Part 2 of Schedule 10 is taken to have commenced on 1 July 1991.

(4) Part 1 of Schedule 11 is taken to have commenced on 20 March 1993.

(5) Part 3 of Schedule 10, and Part 2 of Schedule 11, are taken to have commenced on 20 March 1995.

(6) Schedule 8 and Part 2 of Schedule 12 commence, or are taken to have commenced, on I January 1996.

(7) The following provisions commence, or are taken to have commenced, on 19 March 1996:

(a) Schedule 2;

(b) item 11 in Schedule 10;

(c) item 5 in Schedule 11;

(d) Schedule 14.

(8) Items 1 and 9 in Schedule 1 and Schedules 3,4,5 and 6 commence, or are taken to have commenced, on 20 March 1996.

(9) Items 6 and 7 in Schedule 9 commence, or are taken to have commenced, on 1 May 1996.

(10) Items 1, 3 and 4 in Schedule 9 commence, or are taken to have commenced, on 1 July 1996.

(11) Schedule 7 commences, or is taken to have commenced, on 4 July 1996.

(12) Items 2 and 5 in Schedule 9 commence, or are taken to have commenced, on 19 September 1996.

(13) Schedule 1 (other than items 1 and 9) and Part 1 of Schedule 12 commence on 1 January 1997.

Amendments

3. (1) The Veterans’ Entitlements Act 1986 is amended in accordance with the applicable items in Schedules 1, 2, 3, 4, 5, 6, 7, 8 and 9 and the other items in those Schedules have effect according to their terms.

(2) The Social Security and Veterans’ Affairs Legislation Amendment Act 1988 is amended in accordance with Schedule 10.

(3) The Veterans' Affairs Legislation Amendment Act (No. 2) 1992 is amended in accordance with Schedule 11.

(4) The Income Tax Assessment Act 1936 is amended in accordance with the applicable items in Schedule 12, and item 13 in that Schedule has effect according to its terms.

(5) The Fringe Benefits Tax (Application to the Commonwealth) Act 1986 is amended in accordance with the applicable items in Schedule 13 and item 3 in that Schedule has effect according to its terms.

(6) The Social Security Act 1991 is amended in accordance with Schedule 14.

____________

SCHEDULE 1 Subsection 3(1)

AMENDMENT OF THE VETERANS’ ENTITLEMENTS ACT 1986 IN RELATION TO RESIDENTIAL CARE ALLOWANCE AND RENT ASSISTANCE

1. Section 5 (Index):

Insert in their respective alphabetical positions determined on a letter-by-letter basis:

“excluded property owner 5NAA(1)

in residential care 5NAA(2)

residential care charge 5NAA(3)”.

2. Paragraph 5H(8)(e) (Note):

(a) After “rent assistance” insert “or residential care allowance”.

(b) After “Rent Assistance Module” insert “or Residential Care Allowance Module”.

3. Subsection 5L(7) (Note):

Omit, substitute:

“Note 1: For residing in a nursing home see subsection 5N(8).

Note 2: For in residential care see subsection 5NAA(2).”.

4. Subsection 5N(1) (definition of ineligible property owner):

Omit paragraph (b).

5. Subsection 5N(1) (definition of ineligible property owner—Note to paragraph (e)):

Omit “and for approved respite care see subsection 5R(8)”.

6. Subsection 5N(1) (definition of rent):

Omit “, (3) and (4)”, substitute “and (3)”.

7. Subsection 5N(4):

Omit.

8. Subsection 5N(8):

Omit, substitute:

“(8) Unless the contrary intention appears, a reference in this Act to a person residing in a nursing home is a reference to a person who is:

(a) residing in premises at which accommodation is provided exclusively or principally for people who have a mental disability; or

SCHEDULE 1—continued

(b) a nursing-home type patient, within the meaning of the Health Insurance Act 1973, of a hospital.”.

9. After section 5N:

Insert:

Residential care allowance definitions

“5NAA.(1) In this Act, unless the contrary intention appears:

excluded property owner means a property owner other than a person who:

(a) is in residential care; and

(b) is not residing in a retirement village.

in residential care has the meaning given by subsection (2).

residential care charge has the meaning given by subsection (3).

Note: For retirement village see subsections 5M(3) and (4) and for property owner see subsection 5L(4).

When a person is in residential care

“(2) For the purposes of this Act, a person is in residential care if the person:

(a) is residing in premises that are:

(i) an approved nursing home for the purposes of the National Health Act 1953 or the Nursing Homes Assistance Act 1974; or

(ii) an approved home for the purposes of the Aged or Disabled Persons Care Act 1954; or

(iii) an approved hostel for the purposes of the Aged or Disabled Persons Hostels Act 1972; or

(iv) made available for the accommodation of the person by an approved organisation providing hostel care services or personal care services to the person for the purposes of Part III of the Aged or Disabled Persons Care Act 1954; and

(b) has resided, or is in the Commission’s opinion likely to reside, in the premises for at least 14 consecutive days.

Residential care charge

“(3) Amounts payable for accommodation of a person in residential care are a residential care charge if:

(a) the amounts are payable every 3 months or more frequently; or

(b) the amounts are payable at regular intervals (greater than 3 months) and the Commission is satisfied that the amounts should be treated as a residential care charge for the purposes of this Act.

SCHEDULE 1—continued

Proportion of total care charge that is residential care charge

“(4) If:

(a) a person who is in residential care pays, or is liable to pay, amounts for accommodation and other services; and

(b) it is not possible to work out the part of each of those amounts that is paid or payable for accommodation;

the amount of residential care charge paid or liable to be paid by the person is taken, for the purposes of this Act, to be two-thirds of each of the amounts mentioned in paragraph (a).”.

10. Subsection 5NB(1) (definition of dependent child component):

After “rent assistance” in paragraph (a) insert “or residential care allowance”.

11. Subsection 5NB(1) (Note 1 to definition of dependent child component):

After “rent assistance” in paragraph (a) insert “or residential care allowance”.

12. Section 36V (Note 3):

After “additional rent assistance” insert “or residential care allowance”.

13. Section 37V (Note 3):

After “additional rent assistance” insert “or residential care allowance”.

14. Section 38U (Note 4):

After “additional rent assistance” insert “or residential care allowance”.

15. Section 39X (Note 3):

After “additional rent assistance” insert “or residential care allowance”.

16. Subsection 40(1) (Note 1):

After “rent assistance” insert residential care allowance”.

17 Paragraph 40C(1)(a):

After “rent assistance Module of a Rate Calculator” insert the residential care allowance Module of a Rate Calculator”.

18. Paragraph 40C(1)(c):

After “rent assistance Module” insert “, the residential care allowance Module”.

SCHEDULE 1—continued

19. Paragraph 40C(l)(d):

After “Module” insert “or the residential care allowance Module”.

20. Paragraph 40C(1A)(a):

After “rent assistance Module of a Rate Calculator” insert the residential care allowance Module of a Rate Calculator”.

21. Paragraph 40C(1A)(c):

After “rent assistance Module” insert the residential care allowance Module”.

22. Paragraph 40C(1A)(d):

After “Module” insert “or the residential care allowance Module”.

23. Subsection 40C(2) (Relevant Modules Table):

After column 3 insert:

“

column 3A

residential care allowance

Module |

Module CAA |

Module DAAA |

”.

24. Point 41-A1 (Method statement—Step 2):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE CAA below”.

25. Point 41-A1 (Note 2):

Omit, substitute:

“Note 2: If a person’s rate is reduced under Step 8, the order in which the reduction is to be made against the components of the maximum payment rate is laid down by section 40C (maximum basic rate first, then rent assistance or residential care allowance).”.

26. Point 41-C2:

(a) Before paragraph (a) insert:

“(aa) the person’s rate of pension does not include an amount of residential care allowance; and”.

(b) Before Note 1 insert:

“Note 1A: For residential care allowance see Module CAA.”.

SCHEDULE 1—continued

27. Point 41-C2A (Table C) (excluding the Notes):

Omit, substitute:

“

TABLE C |

RENT THRESHOLD RATES |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | rate per year | rate per fortnight |

1. | Not member of a couple | $1,674.40 | $64.40 |

2. | Partnered—partner does not have rent | $1,674.40 | $64.40 |

| increased pension | | |

3. | Partnered—partner has rent increased | $1,401.40 | $53.90 |

| pension | | |

4. | Member of illness separated couple or | $1,674.40 | $64.40 |

| respite care couple | | |

”

28. Point 41-C2A:

After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”.

29. After point 41-C2A:

Insert:

Increase in rent threshold rate

“41-C2B. Each rent threshold rate set out in Table C in point 41-C2A, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $130 from and including that date.".

30. Point 41-C6 (Table C-l) (excluding the Notes):

Omit, substitute:

SCHEDULE 1—continued

“

TABLE C-l |

RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | family situation | Rate A | Rate B |

1. | Not member of a couple |

| $1,882.40 |

2. | Partnered— partner does not have rent increased pension |

| $1,882.40 |

3. | Partnered— partner has rent increased pension |

8 | $886.60 |

4. | Member of illness separated couple or respite care couple |

| $1,882.40 |

”

31. Point 41-C6:

(a) After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”.

(b) Omit Note 4, substitute:

“Note 4: The rent threshold rates referred to in column 3 are contained in Table C in point 41-C2A and are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).”.

32. Point 41-C6A:

Omit.

33. Point 41-C12 (Table C-2—item 1):

Omit “$2,080” and “$80”, substitute “$2,444” and “$94”, respectively.

34. Point 41-C12 (Table C-2—item 2):

Omit “$1,820” and “$70”, substitute “$2,132” and “$82”, respectively.

SCHEDULE 1—continued

35. After Module C of the Service Pension Rate Calculator at the end of section 41:

Insert:

“MODULE CAA—RESIDENTIAL CARE ALLOWANCE

Residential care allowance

“41-CAA 1. Residential care allowance is an amount that may be added to the maximum basic rate to help cover the cost of accommodation of a person in residential care. A person who is eligible for residential care allowance under point 4I-CAA2 can have added to his or her maximum basic rate the amount applying to that person under point 41-CAA5. This is the provisional amount of residential care allowance the person is entitled to. However, if the person or the person’s partner receives disability pension, the provisional amount of residential care allowance may be reduced under point 41-CAA6.

Note: For disability pension see section 5N and for in residential care see subsection 5NAA(2).

Eligibility for residential care allowance

“41-CAA2. Residential care allowance is to be added to a person’s maximum basic rate if:

(a) the person is in residential care; and

(b) the person is not an excluded property owner; and

(c) the person’s rate of pension does not include an amount of rent assistance; and

(d) the person pays, or is liable to pay, a residential care charge for the person’s residential care; and

(e) the charge is payable at a rate that is higher than the residential care charge threshold rate; and

(f) the person is in Australia.

Note 1: For in residential care, excluded property owner and residential care charge see section 5NAA.

Note 2: For residential care charge threshold rate see point 41-CAA3.

Residential care charge threshold rate

“41-CAA3. A person’s residential care charge threshold rate is $1,674.40 per year (equivalent to $64.40 per fortnight).

Note: The amounts are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).

Factors affecting rate of residential care allowance

“41-CAA4. The rate of residential care allowance depends on:

SCHEDULE 1—continued

(a) the annual residential care charge paid or payable by the person; and

(b) whether or not the person or the person’s partner is receiving a disability pension.

Note: For residential care charge and disability pension see sections 5NAA and 5N, respectively.

Rate of residential care allowance

“41-CAA5. The rate of residential care allowance is whichever is the lesser of the following rates:

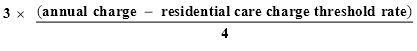

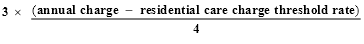

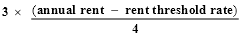

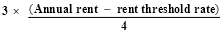

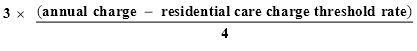

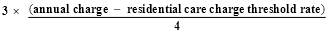

(a) the rate per year worked out using the formula:

;

;

(b) $1,882.40 per year;

where:

annual charge means the annual residential care charge paid or payable by the person whose pension rate is being calculated.

Note 1: For residential care charge threshold rate see point 41-CAA3.

Note 2: For residential care charge see section 5NAA.

Note 3: The residential care charge threshold rate is in point 41-CAA3. This rate and the amount in paragraph (b) are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).

Effect of disability pension on rate of residential care allowance

“41-CAA6. This is how to work out the effect of a person’s disability pension on the person’s rate of residential care allowance:

SCHEDULE 1—continued

Method statement |

Step 1. Work out the annual rate of the person's disability pension: the result is the person’s disability pension income. |

Note 1: For disability pension see section 5N. Note 2: For the treatment of the amount of disability pension of members of a couple see point 41-CAA7. |

Step 2. Work out the person’s residential care allowance free area (see point 41-CAA8 below). |

Step 3. Work out whether the person’s disability pension income exceeds the person’s residential care allowance free area. |

Step 4. If the person’s disability pension income does not exceed the person’s residential care allowance free area, the person’s rate of residential care allowance worked out under point 41-CAA5 is not affected. |

Step 5. If the person’s disability pension income exceeds the person’s residential care allowance free area, take the person’s residential care allowance free area away from the person’s disability pension income: the result is the person’s disability pension income excess. |

Step 6. Halve the person’s disability pension income excess: the result is the residential care allowance reduction amount. |

Step 7. Take the person’s residential care allowance reduction amount away from the rate of residential care allowance worked out under point 41-CAA5: the result is the person’s rate of residential care allowance. |

Members of couples

“41-CAA7.(1) If a person is a member of a couple and the person’s partner also receives disability pension, add the couple’s disability pensions (on a yearly basis) and divide by 2 to work out the amount of the disability pension income of each of them for the purposes of this Module.

Note: For disability pension see section 5N. For member of a couple see subsection 5E(1).

“(2) If a person is a member of an illness separated couple or a respite care couple, any amount that the person’s partner pays or is liable to pay in respect of the accommodation of the person is to be treated as paid or payable by the person.

Note: For illness separated couple and respite care couple see subsections 5R(5) and (6).

SCHEDULE 1—continued

How to calculate a person’s residential care allowance free area

“41-CAA8. A person’s residential care allowance free area is worked out using Table CAA. Work out which family situation in Table CAA applies to the person. The residential care allowance free area is the corresponding amount in column 3.

TABLE CAA |

RESIDENTIAL CARE ALLOWANCE FREE AREA |

column 1 | column 2 | column 3 | column 4 |

item | category of person | basic free area per year | basic free area per fortnight |

1. | Not member of a couple | $2,444 | $94 |

2. | Partnered | $2,132 | $82 |

Note 1: For member of a couple and partnered see section 5E.

Note 2: Item 2 of Table CAA applies to members of illness separated couples and respite care couples.

Note 3: The free area is adjusted annually in line with CPI increases (see section 59GAA).

Increase in residential care charge threshold rate

“41-CAA9. On and after 1 January 1997, point 41-CAA3 has effect as if, immediately after indexation on 20 March 1996, the residential care charge threshold rate set out in that point had been increased by $130.”.

36. Point 42-A1 (Method statement—Step 3):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE DAAA below”.

37. Point 42-A1 (Note 2):

After “rent assistance” insert “, or residential care allowance,”.

38. Point 42-D2:

(a) Before paragraph (a) insert:

“(aa) the person’s rate of pension does not include an amount of residential care allowance; and”.

(b) Before Note 1 insert:

“Note 1A: For residential care allowance see Module DAAA.”.

39. Point 42-D2A (Table D) (excluding the Notes):

Omit, substitute:

SCHEDULE 1—continued

“

TABLE D |

RENT THRESHOLD RATES |

column 1 | column 2 | column 3 | column 4 |

| | | rate per |

item | person’s family situation | rate per year | fortnight |

1. | Not member of a couple | $2,236.00 | $86.00 |

2. | Partnered—partner does not have rent increased pension | $2,236.00 | $86.00 |

3. | Partnered—partner has rent increased pension | $1,682.20 | $64.70 |

4. | Member of illness separated or respite care couple | $2,236.00 | $86.00 |

”.

40. Point 42-D2A:

After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”.

41. After point 42-D2A:

Insert:

Increase in rent threshold rate

“42-D2B. Each rent threshold rate set out in Table D in point 42-DA, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $130 from and including that date.”.

42. Point 42-D6 (Table D-l) (excluding the Notes):

Omit, substitute:

SCHEDULE 1—continued

“

TABLE D-l |

RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | family situation | Rate A | Rate B |

| | | column 4A 1 or 2 pension increase children | column 4B 3 or more pension increase children |

1. | Not member of a couple |

| $2,064.40 | $2,355.60 |

2. | Partnered— partner does not have rent increased pension |

| $2064.40 | $2,355.60 |

3. | Partnered— partner has rent increased pension |

| $1,032.20 | $1,177.80 |

4. | Member of illness separated or respite care couple |

| $2,064.40 | $2,355.60 |

”

43. Point 42-D6:

(a) After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”.

(b) Omit Note 4, substitute:

“Note 4: The rent threshold rates referred to in column 3 are contained in Table D in point 42-D2A and are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).”.

44. After point 42-D6:

Insert:

Rate B increase

“42-D6A.(1) Each rate set out in items 1, 2 and 4 in column 4 of Table D-l in point 42-D6, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $130 from and including that date.

SCHEDULE 1—continued

“(2) The rate set out in item 3 in column 4 of Table D-l in point 42-D6, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $65 from and including that date.”.

45. Point 42-D12 (Table D-2) (excluding the Notes):

Omit, substitute:

“

TABLE D-2 |

RENT ASSISTANCE FREE AREA |

column 1 | column 2 | column 3 | column 4 | column 5 | column 6 |

| | | | | additional free |

| category of | basic free area | basic free area | additional free | area per |

item | person | per year | per fortnight | area per year | fortnight |

1. | Not member | $2,444 | $94 | $624 | $24 |

| of a couple | | | | |

2. | Partnered | $2,132 | $82 | $312 | $12 |

”.

46. Point 42-D12 (Note 2):

Omit, substitute:

“Note 2: Item 2 applies to members of illness separated couples and respite care couples.”.

47. Point 42-D14:

(a) Omit “, 2 or 3”.

(b) Omit “or the person’s partner”.

48. Point 42-D15:

Omit “item 3”, substitute “item 2”.

49. Point 42-D16:

Insert after “Part III” in paragraph (a) “or Part IIIA”.

50. After Module D of the Service Pension Rate Calculator at the end of section 42:

Insert:

“MODULE DAAA—RESIDENTIAL CARE ALLOWANCE

Residential care allowance

“42-DAAA1. Residential care allowance is an amount that may be added to the maximum basic rate to help cover the cost of accommodation of a person in residential care. A person who is eligible for residential care

SCHEDULE 1—continued

allowance under point 42-DAAA2 can have added to his or her maximum basic rate the amount applying to that person under point 42-DAAA5. This is the provisional amount of residential care allowance the person is entitled to. However, if the person or the person’s partner receives disability pension, the provisional amount of residential care allowance may be reduced under point 42-DAAA6.

Note: For disability pension see section 5N and for in residential care see subsection 5NAA(2).

Eligibility for residential care allowance

“42-DAAA2. Residential care allowance is to be added to a person’s maximum basic rate if:

(a) the person is in residential care; and

(b) the person is not an excluded property owner; and

(c) the person’s rate of pension does not include an amount of rent assistance; and

(d) the person pays, or is liable to pay, a residential care charge for the person’s residential care; and

(e) the charge is payable at a rate that is higher than the residential care charge threshold rate; and

(f) the person is in Australia.

Note 1: For in residential care, excluded property owner and residential care charge see section 5NAA.

Note 2: For residential care charge threshold rate see point 42-DAAA3.

Residential care charge threshold rate

“42-DAAA3. A person’s residential care charge threshold rate is $2,236 per year (equivalent to $86 per fortnight).

Note: The amounts are indexed 6 monthly in line with CPI increases (sec sections 59B to 59E).

Factors affecting rate of residential care allowance

“42-DAAA4. The rate of residential care allowance depends on:

(a) the annual residential care charge paid or payable by the person; and

(b) whether or not the person or the person’s partner is receiving a disability pension; and

(c) the number of pension increase children (if any) that the person has.

Note 1: For residential care charge and disability pension see sections 5NAA and 5N respectively.

Note 2: For pension increase child see subsection 5F(6).

Rate of residential care allowance

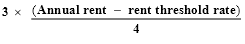

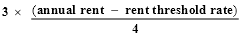

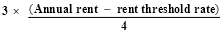

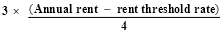

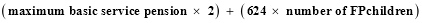

“42-DAAA5.(1) The rate of residential care allowance in respect of a person is the rate per year that is the lesser of Rate A and Rate B applicable to the person in accordance with Table DAAA-1.

SCHEDULE 1—continued

TABLE DAAA-1 |

RATE OF RESIDENTIAL CARE ALLOWANCE |

column 1 | column 2 |

Rate A | Rate B |

| column 2A | column 2B |

| | 3 or more pension increase children |

| 1 or 2 pension Increase children |

|

|

| $2,064.40 | $2,355.60 |

“(2) In the Table in subpoint (1):

annual charge means the annual residential care charge paid or payable by the person whose pension rate is being calculated.

Note 1: For residential care charge threshold rate see point 42-DAAA3.

Note 2: For residential care charge see section 5NAA.

Note 3: The residential care charge threshold rate is in point 42-DAAA3. This rate and the amounts in column 2 of Table DAAA-1 are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).

Effect of disability pension on rate of residential care allowance

“42-DAAA6. This is how to work out the effect of a person’s disability pension on the person’s rate of residential care allowance:

SCHEDULE 1—continued

Method statement |

Step 1. Work out the annual rate of the person’s disability pension: the result is the person’s disability pension income. |

Note 1: For disability pension see section 5N. Note 2: For the treatment of the amount of disability pension of members of a couple see point 42-DAAA7. |

Step 2. Work out the person’s residential care allowance free area (see point 42-DAAA8 below). |

Step 3. Work out whether the person’s disability pension income exceeds the person’s residential care allowance free area. |

Step 4. If the person’s disability pension income does not exceed the person’s residential care allowance free area, the person’s rate of residential care allowance worked out under point 42-DAAA5 is not affected. |

Step 5. If the person’s disability pension income exceeds the person’s residential care allowance free area, take the person’s residential care allowance free area away from the person’s disability pension income: the result is the person’s disability pension income excess. |

Step 6. Halve the person’s disability pension income excess: the result is the residential care allowance reduction amount. |

Step 7. Take the person’s residential care allowance reduction amount away from the rate of residential care allowance worked out under point 42-DAAA5: the result is the person’s rate of residential care allowance. |

Members of couples

“42-DAAA7.(l) If a person is a member of a couple and the person’s partner also receives disability pension, add the couple’s disability pensions (on a yearly basis) and divide by 2 to work out the amount of the disability pension income of each of them for the purposes of this Module.

Note: For disability pension see section 5N. For member of a couple see subsection 5E(1).

“(2) If a person is a member of an illness separated couple or a respite care couple, any amount that the person’s partner pays or is liable to pay in respect of the accommodation of the person is to be treated as paid or payable by the person.

Note: For member of an illness separated couple and member of a respite care couple see subsections 5R(5) and (6).

SCHEDULE 1—continued

Person's residential care allowance free area

“42-DAAA8. A person’s residential care allowance free area is worked out using Table DAAA-2. Work out which family situation in Table DAAA-2 applies to the person. The residential care allowance free area is the corresponding amount in column 3 plus an additional corresponding amount in column 5 for each dependent child of the person.

TABLE DAAA-2 |

RESIDENTIAL CARE ALLOWANCE FREE AREA |

column 1 | column 2 | column 3 | column 4 | column 5 | column 6 |

| | | basic free | additional | additional |

| category of | basic free | area per | free area per | free area per |

item | person | area per year | fortnight | year | fortnight |

1. | Not member | $2,444 | $94 | $624 | $24 |

| of a couple | | | | |

2. | Partnered | $2,132 | $82 | $312 | $12 |

Note 1: For member of a couple and partnered see section 5E.

Note 2: For dependent child see section 5F.

Note 3: Item 2 of Table DAAA-2 applies to members of illness separated couples and respite care couples.

Note 4: The basic free area is adjusted annually (see section 59GAA).

No additional free area for certain prescribed student children

“42-DAAA9. No additional free area is to be added for a dependent child who:

(a) has reached the age of 18 years; and

(b) is a prescribed student child;

unless the person whose rate is being calculated, or the person’s partner, receives child disability allowance under the Social Security Act for the child.

Reduction of additional free area for dependent children

“42-DAAA 10.(1) The additional free area for a dependent child of a person to whom item 1 in Table DAAA-2 applies is reduced by the annual amount of any payment received by the person for or in respect of that particular child.

“(2) The additional free area for a dependent child of a person to whom item 2 in Table DAAA-2 applies is reduced by one-half of the annual amount of any payment received by the person or the person’s partner for or in respect of that particular child.

SCHEDULE 1—continued

“(3) The payments referred to in point 42-DAAA11 do not result in a reduction.

“42-DAAA11. No reduction is to be made under point 42-DAAA10 for a payment:

(a) under Part III or Part IIIA of this Act; or

(b) under the Social Security Act; or

(c) that is similar in nature to family payment under the Social Security Act.

Increase in residential care charge threshold rate

“42-DAAA12. On and after 1 January 1997, point 42-DAAA3 has effect as if, immediately after indexation on 20 March 1996, the annual residential care charge threshold rate set out in that point had been increased by $130.

Increase in rate of residential care allowance

“42-DAAA13. On and after 1 January 1997, subpoint 42-DAAA5(1) has effect as if, immediately after indexation on 20 March 1996, each rate of residential care allowance set out in column 2 of Table DAAA-1 in that subpoint had been increased by $130.”.

51. Point 42-DAA12:

Add at the end “or residential care allowance”.

52. Point 42-DAA12 (Note):

Add at the end “For residential care allowance see Module DAAA.”.

53. Paragraph 43(4)(d) (formula):

Omit “RA”, substitute “RA/RCA”.

54. Subsection 43(4) (definition of RA):

Omit, substitute:

“RA/RCA means the amount for rent or residential care added to the person’s maximum basic rate under Step 3 of Method statement A in point 43-A1.”.

55. Point 43-A1 (Method statement A—Step 3):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE 43DAA below”.

56. Point 43-C1 (Note to Step 2 of Method statement):

Omit “rent”, substitute “rent assistance or residential care allowance”.

SCHEDULE 1—continued

57. Point 43-D2:

(a) Before paragraph (a) insert:

“(aa) the person’s rate of pension does not include an amount of residential care allowance; and”.

(b) Before Note 1 insert:

“Note 1A: For residential care allowance see Module DAA.”.

58. After Module D of the Service Pension Rate Calculator at the end of section 43:

Insert:

“MODULE DAA—RESIDENTIAL CARE ALLOWANCE

Residential care allowance

“43-DAA1. Residential care allowance is an amount that may be added to the maximum basic rate to help cover the cost of accommodation in residential care of a person who is eligible for residential care allowance under point 43-DAA2.

Note: For in residential care see subsection 5NAA(2).

Eligibility for residential care allowance

“43-DAA2. Residential care allowance is to be added to the person’s maximum basic rate if:

(a) the person is in residential care; and

(b) the person is not an excluded property owner; and

(c) the person’s rate of pension does not include an amount of rent assistance; and

(d) the person pays, or is liable to pay, a residential care charge for the person’s residential care; and

(e) the residential care charge is payable at a rate that is more than:

(i) if the Service Pension Rate Calculator Where There Are No Dependent Children applied to the person—the rate in paragraph 41-CAA(2)(e); or

(ii) if the Service Pension Rate Calculator Where There Are Dependent Children applied to the person—the rate in paragraph 42-DAAA(2)(e); and

(f) the person is in Australia; and

(g) the person would be entitled to an additional amount by way of residential care allowance:

SCHEDULE 1—continued

(i) if the Service Pension Rate Calculator Where There Are No Dependent Children would have applied to the person if the person were not permanently blind—under Module CAA of that Rate Calculator; or

(ii) if the Service Pension Rate Calculator Where There Are Dependent Children would have applied to the person if the person were not permanently blind—under Module DAAA of that Rate Calculator.

Note 1: For in residential care, excluded property owner and residential care charge see section 5NAA.

Note 2: Service Pension Rate Calculator Where There Are No Dependent Children is found in section 41.

Note 3: Service Pension Rate Calculator Where There Are Dependent Children is found in section 42.

Rate of residential care allowance

“43-DAA3. The rate of residential care allowance is:

(a) if the Service Pension Rate Calculator Where There Are No Dependent Children would have applied to the person if the person were not permanently blind—the rate at which residential care allowance would be payable to the person under Module CAA of that Rate Calculator; or

(b) if the Service Pension Rate Calculator Where There Are Dependent Children would have applied to the person if the person were not permanently blind—the rate at which residential care allowance would be payable to the person under Module DAAA of that Rate Calculator.

Note 1: If the Service Pension Rate Calculator Where There Are No Dependent Children (see section 41) applied to the person, the person would be subject to an ordinary income test (Module D) and an assets test (Module F).

Note 2: If the Service Pension Rate Calculator Where There Are No Dependent Children applied to the person and there was to be a reduction in pension rate because of the application of the ordinary income test or the assets test, section 40C would govern the order in which the reduction would be made against the components of the maximum payment rate (first against maximum basic rate, then against the residential care allowance).

Note 3: If the Service Pension Rate Calculator Where There Are Dependent Children (see section 42) applied to the person, the person would be subject to a maintenance income test (Module DAA), an ordinary income test (Module E) and an assets test (Module G).

Note 4: If the Service Pension Rate Calculator Where There Are Dependent Children applied to a person and there was to be a reduction in pension rate because of the application of the ordinary income test, the maintenance income test or the assets test, section 40C would govern the order in which the reduction would be made against the components of the maximum payment rate (first against the maximum basic rate, then against the residential care allowance, then against the dependent child amount).’’.

SCHEDULE 1—continued

59. Point 45-B4 (Note):

Add at the end “Modules DAAA and DAA are the Modules used to calculate residential care allowance in the Rate Calculators in sections 42 and 43, respectively.”.

60. Paragraphs 45V(1)(b), (d) and (f) and (2)(b), (d) and (e):

After “Module” insert “or the residential care allowance Module”.

61. Paragraph 45V(3)(b):

Omit, substitute:

“(b) the person would be eligible:

(i) to have rent assistance added to his or her maximum basic rate under point 45X-D2 if the person were not blind (i.e. if the rate of the person’s income support supplement were calculated using the Method statement set out in point 45X-B1 instead of that set out in point 45X-B2); or

(ii) to have residential care allowance added to his or her maximum basic rate under point 45X-DA2 if the person were not blind (i.e. if the rate of the person’s income support supplement were calculated using the Method statement set out in point 45X-B1 instead of that set out in point 45X-B2); ”.

62. Subsection 45V(3):

Add at the end “or an amount for residential care allowance worked out under Module DA of the Rate Calculator, as the case may be”.

63. Point 45X-B1 (Method statement—Step 2):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE DA below”.

64. Point 45X-B1 (Note 3):

After “rent assistance” insert “or residential care allowance”.

65. Point 45X-B2 (Method statement—Step 3):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE DA below”.

66. Point 45X-D2:

(a) Before paragraph (a) insert:

“(aa) the person’s rate of pension does not include an amount of residential care allowance; and”.

SCHEDULE 1—continued

(b) Before Note 1 insert:

“Note 1A: For residential care allowance see Module DA.”.

67. Point 45X-D3 (Table D) (excluding the Notes):

Omit, substitute:

“

TABLE D |

RENT THRESHOLD RATES |

column 1 | column 2 | column 3 | column 4 |

item | person's family situation | rate per year | rate per fortnight |

1. | Not member of a couple | $1,674.40 | $64.40 |

2. | Partnered—partner does not have rent increased pension | $1,674.40 | $64.40 |

3. | Partnered—partner has rent increased pension | $1,401.40 | $53.90 |

4. | Member of illness separated couple or respite care couple | $1,674.40 | $64.40 |

’’

68. Point 45X-D3:

After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).’’.

69. After point 45X-D3:

Insert:

Increase in rent threshold rate

“45X-D3A. On and after 1 January 1997, point 45X-D3 has effect as if, immediately after indexation on 20 March 1996, each annual rent threshold rate set out in column 3 of Table D in that point had been increased by $130.”.

70. Point 45X-D7 (Table D-1) (excluding the Notes):

Omit, substitute:

SCHEDULE 1—continued

“

TABLE D-l |

RATE OF RENT ASSISTANCE |

column 1 | column 2 | column 3 | column 4 |

item | family situation | Rate A | Rate B |

1. | Not member of a couple |

| $1,882.40 |

2. | Partnered—partner does not have rent increased pension |

| $1,882.40 |

3. | Partnered—partner has rent increased pension |

| $886.60 |

4. | Member of illness separated couple or respite care couple |

| $1,882.40 |

’’

71. Point 45X-D7:

(a) After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”.

(b) Omit Note 4, substitute:

“Note 4: The rent threshold rates referred to in column 3 are contained in Table D in point 4SX-D3 and are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).’’.

72. After Module D of the Income Support Supplement Rate Calculator at the end of section 45X:

Insert:

“MODULE DA—RESIDENTIAL CARE ALLOWANCE

Residential care allowance

“45X-DA1. Residential care allowance is an amount that may be added to the maximum basic rate to help cover the cost of accommodation of a person in residential care. A person who is eligible for residential care allowance under point 45X-DA2 can have added to his or her maximum basic rate the amount applying to that person under point 45X-DA5.

Note: For in residential care see subsection 5NAA(2).

Eligibility for residential care allowance

“45X-DA2. Residential care allowance is to be added to a person’s maximum basic rate if:

SCHEDULE 1—continued

(a) the person is in residential care; and

(b) the person is not an excluded property owner; and

(c) the person’s rate of income support supplement does not include an amount of rent assistance; and

(d) the person pays, or is liable to pay, a residential care charge for the person’s residential care; and

(e) the charge is payable at a rate that is higher than the residential care charge threshold rate; and

(f) the person is in Australia.

Note 1: For in residential care, excluded property owner and residential care charge see section 5NAA.

Note 2: For residential care charge threshold rate see point 45X-DA3.

Residential care charge threshold rate

“45X-DA3. A person’s residential care charge threshold rate is $1,674.40 per year (equivalent to $64.40 per fortnight).

Note: The amounts are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).

Factors affecting rate of residential care allowance

“45X-DA4. The rate of residential care allowance depends on the annual residential care charge paid or payable by the person.

Note: For residential care charge see section 5NAA.

Rate of residential care allowance

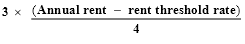

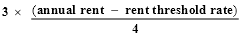

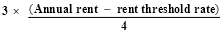

“45X-DA5. The rate of residential care allowance is whichever is the lesser of the following rates:

(a) the rate per year worked out using the formula:

(b) $1,882.40 per year;

where:

annual charge means the annual residential care charge paid or payable by the person whose supplement rate is being calculated.

Note 1: For residential care charge threshold rate see point 4SX-DA3.

Note 2: For residential care charge see section 5NAA.

Note 3: The residential care charge threshold rate is in point 45X-DA3. This rate and the amount in paragraph (b) are indexed 6 monthly in line with CPI increases (see sections S9B to 59E).

SCHEDULE 1—continued

Cost of accommodation paid by member of an illness separated or respite care couple

“45X-DA6. If a person is a member of an illness separated couple or a respite care couple, any amount that the person’s partner pays or is liable to pay in respect of the accommodation of the person is to be treated as paid or payable by the person.

Note: For illness separated couple and respite care couple see subsections 5R(5) and (6).

Increase in residential care charge threshold rate

“45X-DA7. On and after 1 January 1997, point 45X-DA3 has effect as if, immediately after indexation on 20 March 1996, the residential care charge threshold rate set out in that point had been increased by $130.”.

73. Point 45Y-B1 (Method statement—Step 11):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE FA below”.

74. Point 45Y-B2 (Method statement—Step 3):

Add at the end “or the amount per year (if any) for residential care allowance using MODULE FA below”.

75. Point 45Y-F2:

(a) Before paragraph (a) insert:

“(aa) the person’s rate of income support supplement does not include an amount of residential care allowance; and”.

(b) Before Note 1 insert:

“Note 1 A: For residential care allowance see Module FA.”.

76. Point 45Y-F3 (Table F) (excluding the Notes):

Omit, substitute:

“

TABLE F |

RENT THRESHOLD RATES |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | rate per year | rate per fortnight |

1. | Not member of a couple | $2,236.00 | $86.00 |

2. | Partnered—partner does not have rent increased pension | $2,236.00 | $86.00 |

3. | Partnered—partner has rent increased pension | $1,682.20 | $64.70 |

4. | Member of illness separated couple or respite care couple | $2,236.00 | $86.00 |

”

SCHEDULE 1—continued

77. Point 45Y-F3:

After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”.

78. After point 45Y-F3:

Insert:

Increase in rent threshold rate

“45Y-F3A. Each annual rent threshold rate set out in column 3 of Table F in point 45Y-F3, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $130 from and including that date.”.

79. Point 45Y-F7 (Table F-1) (excluding the Notes):

Omit, substitute:

“

TABLE F-1 |

RATE OF RENT ASSISTANCE |

column l | column 2 | column 3 | column 4 |

item | family situation | Rate A | Rate B |

| | | column 4A | column 4B |

| | | 1 or 2 | 3 or more |

| | | pension | pension |

| | | increase | increase |

| | | children | children |

1. | Not member of a couple |

| $2,064.40 | $2,355.60 |

2. | Partnered— partner does not have rent increased pension |

| $2064.40 | $2,355.60 |

3. | Partnered— partner has rent increased pension |

| $1,032.20 | $1,177.80 |

4. | Member of illness separated or respite care couple |

| $2,064.40 | $2,355.60 |

’’

80. Point 45Y-F7:

(a) After Note 2 insert:

“Note 2A: For illness separated couple and respite care couple see subsections 5R(5) and (6).”

SCHEDULE 1—continued

(b) Omit, substitute:

“Note 4: The rent threshold rates referred to in column 3 are contained in Table F in point 45Y-F3 and are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).”.

81. After point 45Y-F7:

Insert:

Rate B increase

“45Y-F7A.(1) Each rate set out in items 1, 2 and 4 in column 4 of Table F-l in point 45Y-F7, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $130 with effect from and including that date.

“(2) The rate set out in item 3 in column 4 of Table F-l in point 45Y-F7, or, if a higher rate is taken by section 59C to be substituted for that rate on 20 March 1996 as a result of indexation, the higher rate, is increased by $65 with effect from and including that date.”.

82. After Module F of the Income Support Supplement Rate Calculator at the end of section 45Y:

Insert:

“MODULE FA—RESIDENTIAL CARE ALLOWANCE

Residential care allowance

“45Y-FA1. Residential care allowance is an amount that may be taken into account to help cover the cost of accommodation of a person in residential care when working out the rate of the person’s income support supplement. If the person is eligible for residential care allowance under point 45Y-FA2, the amount to be so taken into account is the amount applying to that person under point 45Y-FA5.

Note: For in residential care see subsection 5NAA(2).

Eligibility for residential care allowance

“45Y-FA2. A person is eligible for residential care allowance if:

(a) the person is in residential care; and

(b) the person is not an excluded property owner; and

(c) the person’s rate of income support supplement does not include an amount of rent assistance; and

(d) the person pays, or is liable to pay, a residential care charge for the person’s residential care; and

SCHEDULE 1—continued

(e) the charge is payable at a rate that is higher than the residential care charge threshold rate; and

(f) the person is in Australia.

Note 1: For in residential care, excluded property owner and residential care charge see section 5NAA.

Note 2: For residential care charge threshold rate see point 45Y-FA3.

Residential care charge threshold rate

“45Y-FA3. A person’s residential care charge threshold rate is $2,236 per year (equivalent to $86 per fortnight).

Note: The amounts are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).

Factors affecting rate of residential care allowance

“45Y-FA4. The rate of residential care allowance depends on:

(a) the annual residential care charge paid or payable by the person; and

(b) the number of pension increase children (if any) that the person has.

Note: For pension increase child see subsection 5F(6).

Rate of residential care allowance

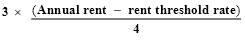

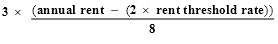

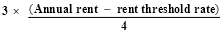

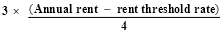

“45Y-FA5.(1) The rate of residential care allowance in respect of a person is the rate per year that is the lesser of Rate A and Rate B applicable to the person in accordance with Table FA-1.

TABLE FA-1 |

RATE OF RESIDENTIAL CARE ALLOWANCE |

column 1 | column 2 |

Rate A | Rate B |

| column 2A | column 2B |

| | 3 or more pension increase children |

1 or 2 pension increase children |

|

| | $2,064.40 | $2.355.60 |

|

“(2) In the Table in subpoint (1):

annual charge means the annual residential care charge paid or payable by the person whose income support supplement is being calculated.

Note 1: For residential care charge threshold rate see point 45Y-FA3

Note 2: For residential care charge see section 5NAA.

Note 3: The residential care charge threshold rate is in point 45Y-FA3. This rate and the amount in paragraph (b) are indexed 6 monthly in line with CPI increases (see sections 59B to 59E).

SCHEDULE 1—continued

Cost of accommodation paid by member of an illness separated or respite care couple

“45Y-FA6. If a person is a member of an illness separated couple or a respite care couple, any amount that the person’s partner pays or is liable to pay in respect of the accommodation of the person is to be treated as paid or payable by the person.

Note: For illness separated couple and respite care couple sec subsections 5R(5) and (6).

Increase in residential care charge threshold rate

“45Y-FA7. On and after 1 January 1997, point 45 Y-FA3 has effect as if, immediately after indexation on 20 March 1996, the annual residential care charge threshold rate set out in that point had been increased by $130.

Increase in rate of residential care allowance

“45Y-FA8. On and after 1 January 1997, subpoint 45Y-FA5(1) has effect as if, immediately after indexation on 20 March 1996, each rate of residential care allowance set out in column 2 of Table FA-1 in that subpoint had been increased by $130.”.

83. Point 45Y-H5 (definition of DC add-ons):

After “rent assistance” insert “or residential care allowance”.

84. Section 45ZG (Note 3):

After “additional rent assistance” insert “or residential care allowance”.

85. Subsection 52M(2):

After “rent” insert “or a residential care charge”.

SCHEDULE 1—continued

86. Section 59A (Indexed and Adjusted Amounts Table):

After item 6A insert:

“

| Residential care allowance | | |

6B. | Maximum residential care allowance for service pension or income support supplement | Pension MRCA | *Service Pension Rate Calculator Where There Are No Dependent Children— point 41-CAA5— paragraph (b). |

| | | *Service Pension Rate Calculator Where There Are Dependent Children— point 42-DAAA5— paragraph (b). |

| | | *Income Support Supplement Rate Calculator Where There Are No Dependent Children— point 45X-DA5— paragraph (b). |

| | | *Income Support Rate Calculator Where There Are Dependent Children— point 45Y-FA5—paragraph (b). |

6C. | residential care charge threshold rate for service pension or income support supplement | pension residential care charge threshold | *Service Pension Rate Calculator Where There Are No Dependent Children— point 41-CAA3—rate per year. |

| | | *Service Pension Rate Calculator Where There Are Dependent Children—point 42-DAAA3—rate per year. |

| | | *Income Support Supplement Rate Calculator Where There Are No Dependent Children— point 45X-DA3—rate per year. |

| | | *Income Support Supplement Rate Calculator Where There Are Dependent Children— point 45Y-FA3—rate per year. ”. |

SCHEDULE 1—continued

87. Section 59A (Indexed and Adjusted Amounts Table):

After item 7AA insert:

“

7AAAA. | residential care allowance free area | residential care free area | *Service Pension Rate Calculator Where There Are No Dependent Children— point 41-CAA8—rate per year. |

| | | *Service Pension Rate Calculator Where There Are Dependent Children— point 42-DAAA8—Table DAAA-2—columns 3 and 5— all amounts |

’’

88. Section 59B (CPI Indexation Table):

After item 3A insert:

“

3B. | Residential care allowance pension MRCA | (a) 20 March | (a) December | highest June or December quarter before reference quarter (but not earlier than June quarter 1979) | $5.20 |

(b) 20 September | (b)June |

3C. | Pension residential care charge threshold | (a) 20 March | (a) December | highest June or December quarter before reference quarter (but not earlier than June quarter 1979) | $5.20 |

(b) 20 September | (b) June |

”

89. After section 59GA:

Insert:

Adjustment of residential care allowance free area

“59GAA.(1) This Act has effect as if, on 1 July each year, the residential care allowance free area applicable to a person who is not a member of a couple were replaced with an amount that is, on that day, the pension free area applicable to a person who is not a member of a couple.

“(2) This Act has effect as if, on 1 July each year, the residential care allowance free area applicable to a person who is partnered were replaced with an amount that is, on that day, the pension free area applicable to a person who is partnered.”.

SCHEDULE 1—continued

90. Subsection 198(1) (definition of relevant period):

Omit, substitute:

“relevant period means:

(a) the period that started on 15 November 1989 and ended on 17 April 1990; and

(b) the period that started on 18 April 1990 and ended on 19 September 1990; and

(c) the period of 6 months that started on 20 September 1990; and

(d) each later period of 6 months (other than the period of 6 months that started on 20 September 1992).”.

_______________

SCHEDULE 2 Subsection 3(1)

AMENDMENT OF THE VETERANS’ ENTITLEMENTS ACT 1986 TO REPLACE

CERTAIN 1989 AND 1993 SAVING AND

TRANSITIONAL PROVISIONS

1. Schedule 5:

Add at the end:

Rent assistance—boarders and lodgers (changes introduced on 12 June 1989)

“2.(1) If:

(a) immediately before 12 June 1989:

(i) a person was receiving a service pension under or because of this Act as in force at that time; and

(ii) the person’s service pension rate included an amount by way of rent assistance in respect of payments made for board and lodging; and

(b) at all times since 12 June 1989, the person:

(i) has been receiving a pension under this Act or a social security payment under the Social Security Act; and

(ii) has been a boarder; and

(c) immediately before the commencement of this clause, subsection 30(1) of the Social Security and Veterans’ Affairs Legislation Amendment Act 1988 applied to the person;

the amount by way of rent assistance included in the person’s pension rate is not to fall below the floor amount.

“(2) If:

(a) a decision was made under this Act on or after 12 June 1989 that a person was entitled to rent assistance under this Act in respect of a period; and

(b) the period started before 12 June 1989; and

(c) the period continued until at least 11 June 1989;

the person is taken, for the purposes of this clause, to have been receiving rent assistance under this Act immediately before 12 June 1989.

“(3) If:

(a) immediately before 12 June 1989, a person was receiving rent assistance under or because of the Social Security Act 1947 in respect of payments for board and lodging; and

(b) on or after 12 June 1989, the person became or becomes entitled to be paid a pension under this Act; and

SCHEDULE 2—continued

(c) subsection 18(1) of the Social Security and Veterans’ Affairs Legislation Amendment Act 1988 had not ceased to apply to the person until the person became entitled to the pension; and

(d) at all times since the person became entitled to the pension the person:

(i) has been receiving a pension; and

(ii) has been a boarder; and

(e) either of the following subparagraphs applies to the person:

(i) if the person became entitled to the pension before the commencement of this clause, subsection 30(3) of the Social Security and Veterans’ Affairs Legislation Amendment Act 1988 applied to the person immediately before that commencement;

(ii) if the person becomes entitled to the pension after that commencement—that subsection would have applied to the person immediately before he or she became so entitled if it had not been repealed;

the amount of rent assistance included in the person’s pension rate is not to fall below the person’s floor amount.

“(4) Despite subclause (1) or (3), the rate of rent assistance payable to a person to whom that subclause applies is reduced by the sum of any indexation or adjustment increases occurring after the commencement of this clause to the person’s pension rate.

“(5) Subclause (1) or (3) ceases to apply to a person if the person’s pension rate that is applicable because of that subclause is equal to or less than the rate that would be the person’s pension rate if that subclause had not applied to the person.

“(6) If subclause (1) or (3) ceases to apply to a person, it does not again apply to the person.

“(7) In this clause:

boarder means a person who ordinarily lives on premises where the person is provided with board and lodging.

floor amount, in relation to a person, means the amount by way of rent assistance that would be included in the person’s pension rate if:

(a) that amount were worked out, subject to paragraph (b), under this Act as in force immediately before 12 June 1989; and

(b) this Act as in force at that time were modified as follows:

(i) the following paragraph applied instead of paragraph 55(1)(a):

SCHEDULE 2—continued

‘(a) the person pays, or is liable to pay, rent, other than government rent, at a rate exceeding $1,040 per year;’;

(ii) ‘the amount set out in paragraph (1)(a)’ were substituted for ‘$780’ in subparagraph 55(3)(a)(i); and

(c) any increase in the amounts being paid by the person from time to time for board and lodging above the level being paid immediately before 11 June 1989 were disregarded.

indexation or adjustment increase means an increase resulting from the operation of Division 18 of Part IIIB.

payments for board and lodging includes payments for accommodation and other services that are provided to a person who is residing in a nursing home.

Rent assistance—retirement village residents (changes introduced on 12 June 1989)

“3.(1) If:

(a) immediately before 3 November 1988:

(i) a person was receiving a service pension; and

(ii) the person’s pension rate included an amount by way of rent assistance under or because of this Act as in force at that time; and

(b) at all times since 3 November 1988:

(i) the person has been entitled to a pension under this Act or a social security payment under the Social Security Act; and

(ii) the person’s principal home has been in a retirement village; and

(c) immediately before the commencement of this clause, subsection 31(1) of the Social Security and Veterans’ Affairs Legislation Amendment Act 1988 applied to the person;

the person is taken not to be an ineligible property owner or an excluded property owner for the purposes of this Act.

“(2) If:

(a) immediately after 12 June 1989:

(i) a person was receiving a social security payment under the Social Security Act; and

(ii) the person’s pension, benefit or allowance rate included an amount by way of rent assistance because of the operation of subsection 19(1) of the Social Security and Veterans’ Affairs Legislation Amendment Act 1988; and

SCHEDULE 2—continued

(b) after 12 June 1989, the person began or begins to receive a pension; and

(c) subsection 19(1) of the Social Security and Veterans' Affairs Legislation Amendment Act 1988 applied to the person at all times between 12 June 1989 and the person’s beginning to receive the pension; and

(d) at all times since the person began to receive the pension:

(i) the person has continued to receive a pension; and

(ii) the person’s principal home has continued to be in the retirement village; and

(e) either of the following subparagraphs applies to the person:

(i) if the person began to receive the pension before the commencement of this clause, subsection 31(2) of the Social Security and Veterans’ Affairs Legislation Amendment Act 1988 applied to the person immediately before that commencement;

(ii) if the person begins to receive the pension after that commencement—that subsection would have applied to the person immediately before he or she began to receive the pension if it had not been repealed;

the person is taken not to be an ineligible property owner or an excluded property owner for the purposes of this Act.

“(3) Despite subclause (1) or (2), the rate of rent assistance or residential care allowance payable to a person to whom that subclause applies (whether that rate is required to be worked out under this Act (other than this Schedule) or is required to be worked out under subclause (4) of clause 4) is reduced by the sum of any indexation or adjustment increases occurring after the commencement of this clause to the person’s pension rate.

“(4) If, because of subclause (3), the rate of rent assistance or residential care allowance payable to a person to whom subclause (1) or (2) applies is reduced to nil, subclause (1) or (2), as the case may be, ceases to apply to the person.

“(5) If subclause (1) or (2) ceases to apply to a person, that subclause does not apply to the person again.

“(6) In this clause:

indexation or adjustment increase means an increase resulting from the operation of Division 18 of Part IIIB.

SCHEDULE 2—continued

Rent assistance (changes introduced on 20 March 1993)

“4.(1) This clause applies to a person if:

(a) immediately before 20 March 1993:

(i) the person was receiving a service pension; and

(ii) the person’s pension included an amount by way of rent assistance; and

(b) immediately before the commencement of this clause, section 111 of the Veterans' Affairs Legislation Amendment Act (No. 2) 1992 applied to the person; and

(c) this subclause continues to apply to the person.

“(2) If:

(a) a decision was made on or after 20 March 1993 under this Act that a person was entitled to rent assistance in respect of a period; and

(b) the period started before 20 March 1993; and

(c) the period continued until at least 19 March 1993;

the person is taken, for the purposes of this clause, to have been receiving rent assistance under this Act immediately before 20 March 1993.

“(3) This clause applies to a person if:

(a) immediately before 20 March 1993, the person was receiving rent assistance under the Social Security Act; and

(b) on or after that date, the person became or becomes entitled to be paid a pension; and

(c) either of the following subparagraphs applies to the person:

(i) if the person became entitled to be paid the pension before the commencement of this clause—section 111 of the Veterans' Affairs Legislation Amendment Act (No. 2) 1992 applied to the person immediately before that commencement;

(ii) if the person becomes entitled to be paid the pension after that commencement—that section would have applied to the person immediately before he or she became so entitled if it had not been repealed; and

(d) this subclause continues to apply to the person.

“(4) Subject to subclauses (7), (8), (9), (10) and (11), if subclause (1) or (3) applies to a person, the amount by way of rent assistance to be used to calculate the person’s pension rate is the amount (the floor amount) by way of rent assistance that would be included in the person’s pension rate if:

(a) the person’s pension rate were neither income reduced nor assets reduced; and

SCHEDULE 2—continued

(b) the amount of rent assistance were calculated under this Act as in force immediately before 20 March 1993.

“(5) Subclause (1) or (3) ceases to apply to a person if:

(a) the person no longer receives a service pension, an income support supplement, or a social security pension under the Social Security Act; or

(b) the person ceases to be eligible for rent assistance; or

(c) the pension rate that is applicable to the person because of that subclause is equal to or less than the rate that would be the person’s pension rate if that subclause did not apply to the person; or

(d) the Commission considers that there is a significant change in the person’s circumstances that would affect the amount of rent assistance that is payable to the person apart from this clause.

“(6) If:

(a) subclause (1) or (3) ceases to apply to a person because of subclause (5); and

(b) within 42 days, or any longer period that the Commission determines, after the day on which that subclause ceases to apply to the person, there is a change in the person’s circumstances; and

(c) the Commission considers that the change in the person’s circumstances is so significant that subclause (1) or (3) should apply to the person;

the Commission may determine in writing that subclause (1) or (3) is to apply to the person from a stated date.

“(7) Subject to subclauses (11) and (13), if:

(a) subclause (1) or (3) applies to a person; and

(b) the person has become or becomes a member of a couple; and

(c) the person’s partner is receiving a pension, or a social security payment under the Social Security Act, but:

(i) is not a person to whom subclause (1) or (3) applies; and

(ii) is not a person to whom clause 63 of Schedule 1A to the Social Security Act applies;

the amount by way of rent assistance to be used to calculate the person’s pension rate or the person’s partner’s pension rate is not to fall below one-half of the person’s floor amount.

“(8) Subject to subclause (11), if:

(a) subclause (1) or (3) applies to a person; and

SCHEDULE 2—continued

(b) the person has become or becomes a member of a couple; and

(c) the person’s partner is a person to whom subclause (1) or (3) applies; the amount by way of rent assistance to be used to calculate the person’s pension rate or the person’s partner’s pension rate is not to fall below one-half of the person’s floor amount or one-half of the person’s partner’s floor amount, whichever is the greater.

“(9) Subject to subclause (11), if:

(a) subclause (1) or (3) applies to a person; and

(b) the person has become or becomes a member of a couple; and

(c) the person’s partner is a person to whom clause 63 of Schedule 1A to the Social Security Act applies;

the amount by way of rent assistance to be used to calculate the person’s pension rate is not to fall below one-half of the person’s floor amount or one-half of the amount that would be the person’s partner’s floor amount if subsection (1) or (3) applied to the partner, whichever is the greater.

“(10) Subject to subclause (11), if:

(a) a person is receiving a pension; and

(b) neither subclause (1) nor (3) applies to the person; and

(c) the person has become or becomes a member of a couple; and

(d) the person’s partner is receiving a social security payment under the Social Security Act and is a person to whom clause 63 of Schedule 1A to the Social Security Act applies;

the amount by way of rent assistance to be used to calculate the person’s pension rate is not to fall below one-half of the amount that would be the person’s partner’s floor amount if subclause (1) or (3) applied to the partner.

“(11) Despite anything in the preceding provisions of this clause, the rate of rent assistance payable to a person to whom this clause applies is reduced by the sum of any indexation or adjustment increases occurring after the commencement of this clause to the person’s pension rate.

“(12) Subject to subclause (6), if subclause (1) or (3) ceases to apply to a person because of subclause (5), it does not again apply to the person.

“(13) Subclause (7) ceases to apply to the partner of a person to whom subclause (1) or (3) applies if the pension rate that is applicable to the partner because of subclause (7) is equal to or less than the rate that would be the partner’s pension rate if subclause (7) did not apply to the partner.

“(14) If subclause (7) ceases to apply to the partner of a person to whom subclause (1) or (3) applies, subclause (7) does not again apply to the partner.

SCHEDULE 2—continued

“(15) Nothing in this clause affects the application of clause 3 to a person to whom subclause (1) or (3) of this clause ceases to apply.

“(16) In this clause:

floor amount has the meaning given by subsection (4).

indexation or adjustment increase means an increase resulting from the operation of Division 18 of Part IIIB.”.

______________

SCHEDULE 3 Subsection 3(1)

AMENDMENT OF THE VETERANS’ ENTITLEMENTS ACT 1986 TO CONTINUE CARER SERVICE PENSION OR INCOME SUPPORT SUPPLEMENT DURING TRANSITION PERIOD

1. Section 39:

Add at the end:

“Note: For the impact on payment of carer service pension when the person being cared for begins to reside in a nursing home or to be in residential care see section 53X.’’.

2. Section 45AB:

Add at the end:

“Note: For the impact on payment of income support supplement when the person being cared for begins to reside in a nursing home or to be in residential care see section 53X.”.

3. After Division 12A of Part IIIB:

Insert:

“Division 12B—Continuation of carer service pension or income support supplement

during transition period

Effect on pension or supplement if person being cared for begins to reside permanently in a nursing home or to be permanently in residential care

“53X.(1) This section applies if:

(a) a carer service pension or an income support supplement is payable to a person (the carer) who has ordinarily been providing constant care for a severely handicapped person; and

(b) the carer would, apart from this section, cease to be eligible for the pension or supplement because the severely handicapped person has begun to reside in a nursing home, or to be in residential care, on a permanent basis.

“(2) The carer service pension or income support supplement continues to be payable to the carer on each of the first 7 paydays after the carer ceases to be eligible, and is then cancelled by this subsection.

“(3) Subject to subsection (4), if a person is receiving a carer service pension or an income support supplement solely because of subsections (1) and (2), the rate at which the pension or supplement is payable is to be determined having regard to the person’s actual circumstances.

“(4) If the person and the person’s partner were a respite care couple immediately before the partner began to reside in a nursing home or to be in residential care on a permanent basis, the rate at which the person’s pension is payable will be calculated as if they were not a respite care couple.

SCHEDULE 3—continued

“(5) If the carer dies while receiving payments under this section, the severely handicapped person is not entitled to a payment under Subdivision B of Division 12A of Part IIIB because of the carer’s death.

Note: If the carer dies while receiving a carer service pension or income support supplement, section 53Q applies.

“(6) If the severely handicapped person dies after beginning to reside in the nursing home or in residential care, the carer is not entitled to a payment ' under Division 12A of Part IIIB because of the person’s death.

“(7) A person’s entitlements under this Division are instead of, and not in addition to, any entitlements the person would, apart from this section, have to a service pension, an income support supplement, a social security pension or a social security benefit.”.

_____________

SCHEDULE 4 Subsection 3(1)

AMENDMENT OF THE VETERANS’ ENTITLEMENTS ACT 1986 TO EXTEND DISREGARD OF HOMES OF PEOPLE WHO ARE RECEIVING OR PROVIDING COMMUNITY-BASED CARE

1. Paragraph 5L(7)(b):

Omit, substitute:

“(b) if the person is in a relevant care situation—the period of 2 years beginning when the person started to be in a relevant care situation; and”.

2. Subparagraph 5L(7)(c)(i):

Omit “residing in a nursing home”, substitute “in a relevant care situation”.

3. Paragraph 5L(7)(d):

Omit, substitute:

“(d) if:

(i) the person is in a relevant care situation; and

(ii) while paragraph (c) applies, the person’s partner or non-illness separated spouse dies while in a relevant care situation; and

(iii) the person’s partner or non-illness separated spouse had been in a relevant care situation for less than 2 years;

the period of 2 years beginning at the time when the person’s partner or non-illness separated spouse started to be in a relevant care situation; and”.

4. Subparagraph 5L(7)(e)(i):

Omit “residing in a nursing home”, substitute “in a relevant care situation”.

5. Subparagraph 5L(7)(e)(ii):

Omit “a resident of a nursing home”, substitute “in a relevant care situation”.

6. After subsection 5L(7):

Insert:

“(7A) In subsection (7):

in a relevant care situation means in a care situation or in residential care.”.

SCHEDULE 4—continued

7. Application of amendments made by preceding items in this Schedule

Section 5L of the Veterans' Entitlements Act 1986 (as amended by the preceding items in this Schedule) extends to periods beginning before the commencement of this Schedule. However, the amendments made by those items do not affect a person’s entitlement (or lack of entitlement) to an amount by way of rent assistance in relation to a time before the commencement of this item.

8. Subsection 5L(7):

Add at the end:

“; and (f) any period of up to 2 years while the person is absent from the residence and is personally providing community-based care for another person.”.

9. Application of amendment made by item 8

Paragraph 5L(7)(f) of the Veterans’ Entitlements Act 1986 extends to periods that began when a person started personally to provide community-based care before the commencement of this Schedule. However, the amendment made by the last preceding item does not affect a person’s entitlement (or lack of entitlement) to an amount by way of rent assistance in relation to a time before the commencement of this Schedule.

10. Subsection 5L(7) (Note):

Omit, substitute:

“Note: For in a care situation see subsection 5N(9); for in residential care see subsection 5NAA(2).”.

_____________

SCHEDULE 5 Subsection 3(1)

AMENDMENT OF THE VETERANS’ ENTITLEMENTS ACT 1986 TO PROVIDE FOR IMMEDIATE RENT ASSISTANCE FOR PEOPLE LEAVING HOME TO RECEIVE OR GIVE COMMUNITY-BASED CARE

1. Section 5 (Index):

Insert in their appropriate alphabetical position determined on a letter-by-letter basis:

“in a care situation 5N(9)

personally providing community-based care 5N(9)

receiving community-based care 5N(9)”.

2. Subsection 5N(1) (paragraph (c) of definition of ineligible property owner):

Omit, substitute:

“(c) a person who:

(i) is absent from the person’s principal home, in relation to which the person is a property owner; and

(ii) is in a care situation but is not residing in a retirement village; or

(ca) a person who:

(i) is absent from the person’s principal home, in relation to which the person is a property owner; and

(ii) is personally providing community-based care for another person; or”.

3. Subsection 5N(1) (Note after definition of ineligible property owner):

After “and (7)”, insert “and for personally providing community-based care and in a care situation see subsection 5N(9),”.

4. After subparagraph 5N(2)(a)(i):

Insert:

“(ia) as a condition of occupancy of premises, or of a part of premises, occupied by the person to allow him or her personally to provide community-based care for another person; or”.

5. Subparagraph 5N(2)(a)(iii):

Omit, substitute:

SCHEDULE 5—continued

“(iii) if the person is in a care situation and the place where the person receives the care is the person’s principal home or would be the person’s principal home apart from subsection 5L(7)—for accommodation in the place where the person receives care; or”.

6. After subsection 5N(3):

Insert:

“(3A) If a person is in a care situation and the person’s principal home is not the place where the person receives the care, the person’s rent may be an amount described in any of the subparagraphs of paragraph (2)(a) that applies to the person but cannot include amounts described in different subparagraphs of paragraph (2)(a).

Note: Under subsection 5L(7), the principal home of a person in a care situation may be a place other than the place where the person receives care.