(3) Items 1, 2 and 86 of Schedule 2 commence on the later of the following days:

(a) the day on which this Act receives the Royal Assent; or

(b) the day on which the Taxation Laws Amendment Act (No. 3) 1995 receives the Royal Assent.

(4) Part 3 of Schedule 4 commences on 1 March 1996.

Schedules

3. The Acts specified in the Schedules to this Act are amended in accordance with the applicable items in the Schedules, and the other items in the Schedules have effect according to their terms.

Amendment of income tax assessments

4. Section 170 of the Income Tax Assessment Act 1936 does not prevent the amendment of an assessment made before the commencement of this section for the purpose of giving effect to this Act.

—————

SCHEDULE 1 Section 3

AMENDMENTS OF THE INCOME TAX ASSESSMENT ACT 1936 RELATING TO CAPITAL GAINS TAX

PART 1—AMENDMENTS RELATING TO DIVISION 19A OF PART IIIA

1. Subsection 160Z(5):

Omit “subsection 160ZZRE(3)”, substitute “subsection 160ZZRDJ(3) or (4), 160ZZRDM(2) or (5), or 160ZZRE(3)",

2. Before section 160ZZRA:

Insert in Division 19A:

“Subdivision A—Outline and interpretation

Outline of Division

“160ZZRAAA. (1)

This Division adjusts the cost bases of shares and loans in certain cases where assets are transferred between companies under common ownership and the transfer is likely to reduce the value of the share or loan. |

● There are detailed rules for the circumstances in which adjustments are made and the amount of those adjustments. |

● The rules that apply to most depreciable assets are different from the rules that apply to transfers of other assets. |

● Taxpayers are able to group certain assets before applying this Division. In some cases, this will result in no adjustment being required and in some other cases it will result in a lesser reduction being required. Taxpayers may also choose to group certain assets for administrative convenience. |

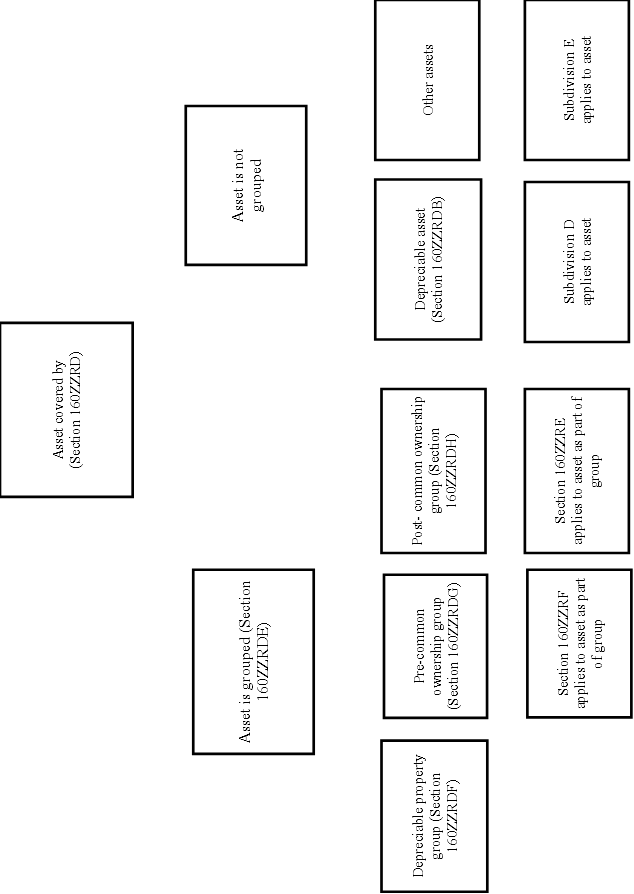

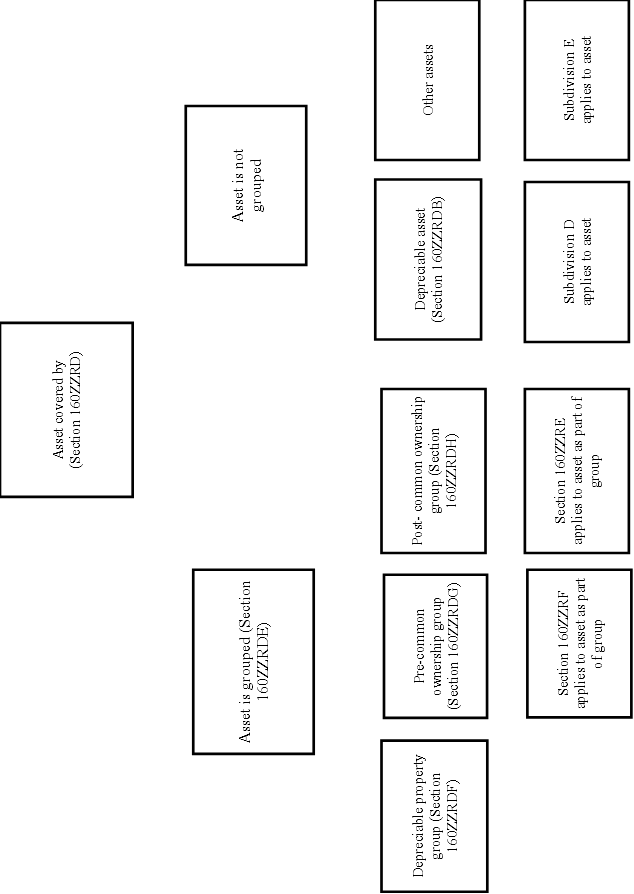

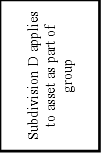

“(2) The following chart shows the operative provisions that will apply to particular assets:

SCHEDULE 1—continued

3. Section 160ZZRA (definition of indexed threshold amount):

Omit “section 160ZZRD”, substitute “subsection 160ZZRE(1B).”.

4. Section 160ZZRA:

Insert:

“original cost, of an asset to a taxpayer, means the consideration for the last acquisition of the asset by the taxpayer,

written down value, for an asset of a taxpayer at a particular time, means the greater of:

(a) the depreciated value of that asset at that time as recorded in the books of the taxpayer; and

(b) the depreciated value of the asset, within the meaning of section 62, at that time.”.

5. After section 160ZZRB:

Insert:

Cost base etc. of certain assets

“160ZZRBA. For the purpose of this Division, the cost base, the indexed cost base and the reduced cost base, at a particular time, of an asset to which subsection 160M(6) applies are taken to be equal to the market value of the asset at that time.

Meaning of indexed common ownership market value

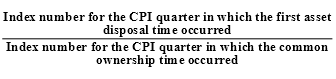

“160ZZRBB.(1) The indexed common ownership market value of an asset is worked out by multiplying the market value of the asset at the common ownership time by the following indexation factor:

“(2) The indexation factor is to be worked out to 3 decimal places, but increased by 0.001 if the 4th decimal place is 5 or more.

“(3) Calculations under subsection (1):

(a) are to be made using only the index numbers published in terms of the most recently published reference base for the Consumer Price Index; and

(b) are to disregard indexation numbers that are published in substitution for previously published index numbers (except where the substituted numbers are published to take account of changes in the reference base).

SCHEDULE 1—continued

“(4) In this section:

CPI quarter means a period of 3 months ending on 31 March, 30 June, 30 September or 31 December.

index number means the All Groups Consumer Price Index Number (being the weighted average of the 8 capital cities) published by the Australian Statistician.”.

6. After section 160ZZRC:

Insert:

"Subdivision B—Application of Division".

7. Subsection 160ZZRD(2):

Omit the subsection.

8. After section 160ZZRD:

Insert:

How Division applies to grouped assets

“160ZZRDA.(1) Subdivision C sets out how this Division applies to groups of assets and to assets that are in a group of assets.

“(2) Subdivision C applies Subdivisions D and E to the assets as a group. Those Subdivisions do not have any other operation in relation to an asset included in a group of assets.

How Division applies to depreciable assets

“160ZZRDB. (1) Subdivision D only applies to the disposal of the first asset if:

(a) the asset is a depreciable asset; and

(b) the consideration for the disposal of the asset is less than the written down value of the asset at the time of the disposal; and

(c) the market value of the asset is not more than 10% greater than the written down value of the asset at the time of the disposal; and

(d) the original cost of the asset to the transferor was less than $1 million; and

(e) the asset is not a building.

Note 1: Written down value and original cost are defined in section 160ZZRA.

Note 2: Subdivision D also applies to some depreciable assets as part of depreciable asset groups as a result of Subdivision C.

“(2) Subdivision E does not have any operation in relation to an asset to which Subdivision D applies.

SCHEDULE 1—continued

Application of Subdivision E

“160ZZRDC. Subdivision E applies in relation to assets that are covered by this Division but not by Subdivision C or D.

Note: Subdivision E also applies to some assets as part of pre-common ownership groups or post-common ownership groups as a result of Subdivision C.

Application of Subdivision F

“160ZZRDD. Subdivision F only applies to the disposal of an asset if Subdivision C, D or E applied in relation to that disposal.

“Subdivision C—Grouped assets

Transferor may elect to group assets

Reason for grouping

“160ZZRDE.(1) Grouping provides taxpayers with a simplified method of applying this Division to 2 or more assets that are transferred from the transferor to the transferee. It may also reduce the cases in which adjustments have to be made to cost bases of shares or loans under this Division and may reduce the amount of those adjustments.

The 3 kinds of groups

“(2) There are 3 kinds of groups:

(a) a depreciable property group (see section 160ZZRDF); and

(b) a pre-common ownership group (see section 160ZZRDG); and

(c) a post-common ownership group (see section 160ZZRDH).

The groups are mutually exclusive. An asset that could be included in the depreciable property group can not be included in either of the other groups.

“(3) The transferor may elect to allocate assets to which this Division applies that are transferred to a transferee to groups of assets. All of the assets in a group must be disposed of to the same transferee in the same year of income of the transferor.

“(4) An election under subsection (3) must be made in writing on or before the lodgment of the transferor’s return for the year of income in which the relevant disposals occurred. The Commissioner may allow the election to be made at a later time.

Depreciable property groups

Assets that may be in depreciable property group

“160ZZRDF.(1) An asset can be allocated to a depreciable property group if:

(a) the asset is a depreciable asset; and

SCHEDULE 1—continued

(b) the asset is the first asset to be allocated to the group or is disposed of to the transferee in the same year of income of the transferor as the year in which other assets in the group are disposed of; and

(c) the original cost of the asset to the transferor was less than $1 million; and

(d) the asset is not a building.

How and when Subdivision D applies to depreciable property groups

“(2) Subdivision D applies in a way specified in subsection (3) to all of the assets in a depreciable property group if:

(a) the sum of the consideration for the disposal of the assets in the group is less than the sum of the written down values of the assets in the group; and

(b) the sum of the market values of the assets in the group is not more than 10% greater than the sum of the written down values of the assets in the group.

The written down value and the market value of each asset is to be worked out when that asset is disposed of by the transferor.

“(3) Subdivision D applies to all of the assets in a depreciable property group as if all of the grouped assets were one asset that:

(a) was disposed of at the earliest first asset disposal time for any asset in the group; and

(b) was disposed of for consideration equal to the sum of the consideration for the disposal of each of the assets; and

(c) had a written down value equal to the sum of the written down values of each of the assets.

In calculating the sums of written down values, the written down value of each asset at the first asset disposal time for that asset is to be used.

Pre-common ownership groups

Assets that may be in pre-common ownership group

“160ZZRDG.(1) An asset can be allocated to a pre-common ownership group if:

(a) the asset was acquired by the transferor before the time at which the transferor and the transferee last came under common ownership; and

(b) the asset is the first asset to be allocated to the group or is disposed of to the transferee in the same year of income of the transferor as the year in which that asset is disposed of; and

SCHEDULE 1—continued

(c) the original cost of the asset to the transferor was less than $1 million; and

(d) the asset is not land or a building.

How and when section 160ZZRF applies to pre-common ownership groups

“(2) Section 160ZZRF applies to all of the assets in a pre-common ownership group in the way specified in subsection (3) if the sum of the consideration for the disposal of the assets in the group is less than the sum of the indexed common ownership market values of the assets in the group.

“(3) Section 160ZZRF applies as if all of the grouped assets were one asset that:

(a) was acquired on or after 20 September 1985; and

(b) was disposed of at the earliest first asset disposal time for any asset in the group; and

(c) was disposed of for consideration equal to the sum of the consideration for the disposal of each of the assets; and

(d) had a market value at the common ownership time equal to the sum of the market values of the assets at that time.

In applying section 160ZZRF to the grouped assets the matters in subsection (6) of that section must be used to determine what amount is reasonable.

Post-common ownership groups

Assets that may be in post-common ownership group

“160ZZRDH.(1) An asset can be allocated to a post-common ownership group if:

(a) the asset was acquired by the transferor at or after the time at which the transferor and the transferee last came under common ownership; and

(b) the asset was last acquired by the transferor on or after 20 September 1985; and

(c) the asset is the first asset to be allocated to the group or is disposed of to the transferee in the same year of income of the transferor as the year in which the first asset is disposed of; and

(d) the original cost of the asset to the transferor was less than $1 million; and

(e) the asset is not land or a building.

SCHEDULE 1—continued

How and when section 160ZZRE applies to post-common ownership groups

“(2) Section 160ZZRE applies to all of the assets in a post-common ownership group in the way specified in subsection (3) if the sum of the consideration for the disposal of the assets in the group is less than the sum of the indexed threshold amount of each asset in the group. The indexed threshold amount of each asset is to be worked out when that asset is disposed of by the transferor.

“(3) Section 160ZZRE applies as if all of the grouped assets were one asset that:

(a) was acquired by the transferor on or after 20 September 1985; and

(b) was disposed of at the earliest first asset disposal time for any asset in the group; and

(c) was disposed of for consideration equal to the sum of the consideration for the disposal of each of the assets; and

(d) had an indexed threshold amount equal to the sum of the indexed threshold amount for each of the assets; and

(e) had a reduced threshold amount equal to the sum of the reduced threshold amounts for each of the assets.

In calculating the sums of reduced threshold amounts, or indexed threshold amounts, the reduced threshold amount, or indexed threshold amount, of each asset at the first asset disposal time for that asset is to be used.

Shares or loans created after first asset in group is disposed of

“ 160ZZRDI.(1) This section applies if a share in the transferor, or a loan to the transferor, comes into existence after the first time (the adjustment time) in a year of income at which an asset in the group is disposed of by the transferor but before the last time in the year of income at which such an asset is actually disposed of.

“(2) This section does not apply to a share that is issued to replace a share that is, or is to be, cancelled.

“(3) This Division applies as if:

(a) the share or loan had been in existence immediately before the adjustment time; and

(b) the share or loan had all the same attributes at that time as it had immediately after it came into existence.

SCHEDULE 1—continued

“Subdivision D—Depreciable assets

Shares in, and loans to, transferor—depreciable assets—deemed disposal

“160ZZRDJ.(1) This section applies to each share in the transferor acquired by a taxpayer (the second taxpayer) on or after 20 September 1985 that is held by the second taxpayer at the first asset disposal time.

“(2) For each share to which this section applies, the second taxpayer is taken to have disposed of the share at the first asset disposal time for a consideration equal to the indexed cost base to the second taxpayer of the share.

“(3) For the purpose of ascertaining whether a capital gain accrued to the second taxpayer in the event of a subsequent disposal of the share by the second taxpayer, the second taxpayer is taken to have immediately re-acquired the share for a consideration equal to the indexed cost base to the second taxpayer of the share, reduced by the share reduction amount (see subsection (5)).

“(4) For the purpose of ascertaining whether the second taxpayer incurred a capital loss in the event of a subsequent disposal of the share by the second taxpayer, the second taxpayer is taken to have immediately re-acquired the share for a consideration equal to the reduced cost base to the second taxpayer of the share, reduced by the share reduction amount (see subsection (5)).

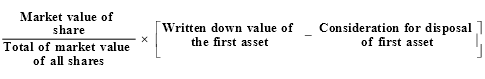

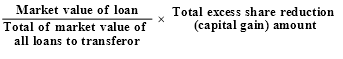

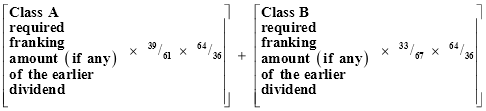

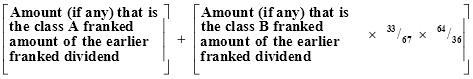

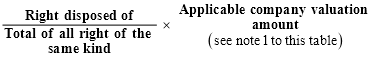

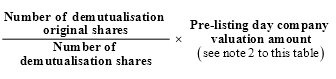

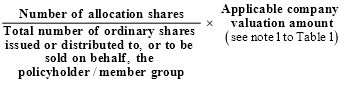

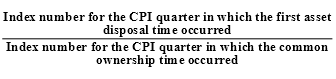

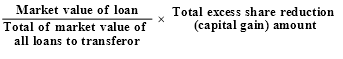

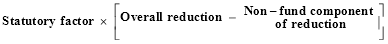

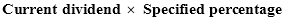

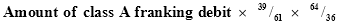

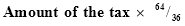

“(5) The share reduction amount is worked out, immediately before the first asset disposal time, using the formula:

“(6) If the second taxpayer or another taxpayer disposed of a share (otherwise than because of the application of this section) within 12 months after the taxpayer acquired the share (otherwise than because of the application of this section), subsections (2) and (3) have effect as if the references to the indexed cost base to the taxpayer in respect of the share were a reference to the cost base to the taxpayer in respect of the share.

Shares of different classes

“160ZZRDK. If:

SCHEDULE 1—continued

(a) at the first asset disposal time, a taxpayer (the second taxpayer) held a share of a particular class in the transferor that was acquired by the second taxpayer on or after 20 September 1985 (the post-CGT share); and

(b) at the first asset disposal time, the second taxpayer or another taxpayer held a share of another class in the transferor; and

(c) the application of section 160ZZRDJ to the post-CGT share would be unreasonable;

then, that section does not apply to the post-CGT share and the cost base, the indexed cost base or the reduced cost base of the post-CGT share to the second taxpayer is instead reduced by such amount (if any) as is reasonable having regard to:

(d) the circumstances in which the post-CGT share was acquired by the second taxpayer; and

(e) the extent (if any) to which the market value of the post-CGT share was reduced as a result of the disposal of the first asset at the first asset disposal time.

Loans to transferor—depreciable assets

“160ZZRDL. (1) Section 160ZZRDM applies to a loan to the transferor acquired by a taxpayer (the second taxpayer) if the 3 conditions below are satisfied.

“(2) The first condition is that the loan was acquired by the second taxpayer on or after 20 September 1985 and is held by the second taxpayer at the first asset disposal time.

“(3) The second condition is that:

(a) the parties to the loan were not dealing with each other at arm’s length in relation to the loan; or

(b) the value of the loan was reduced as a result of the disposal of the first asset.

“(4) The third condition is that:

(a) one or more shares in the transferor (the excess shares) are taken, because of section 160ZZRDJ or 160ZZRDK, to have a cost base, indexed cost base or reduced cost base of nil immediately after the first asset disposal time; or

(b) at the first asset disposal time, there were no shares in the transferor that were acquired (by the second taxpayer or otherwise) on or after 20 September 1985.

SCHEDULE 1—continued

Loans to transferor—depreciable assets—deemed disposal

“160ZZRDM.(1) If this section applies (see section 160ZZRDL), the second taxpayer is taken to have disposed of the loan at the first asset disposal time for a consideration equal to the indexed cost base to the second taxpayer of the loan.

“(2) For the purpose of ascertaining whether a capital gain accrued to the second taxpayer in the event of a subsequent disposal of the loan by the second taxpayer, the second taxpayer is taken to have immediately re-acquired the loan for a consideration equal to the indexed cost base to the second taxpayer of the loan, reduced by the reduction (capital gain) amount.

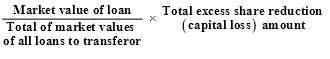

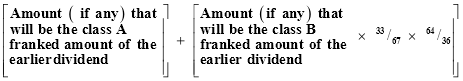

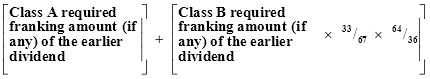

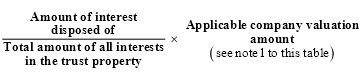

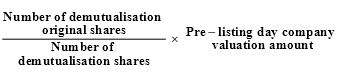

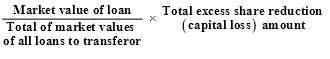

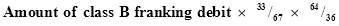

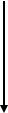

“(3) The reduction (capital gain) amount is worked out, immediately before the first asset disposal time, using the formula:

“(4) The total excess share reduction (capital gain) amount is:

(a) if paragraph 160ZZRDL(4)(a) applies—so much of the total share reduction amounts for the excess shares as was not applied in making reductions to the indexed cost bases of the excess shares in accordance with subsection 160ZZRDJ(3) or section 160ZZRDK; or

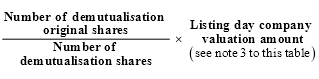

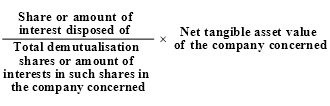

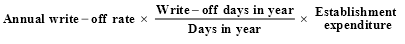

(b) if paragraph 160ZZRDL(4)(b) applies—the amount worked out using the formula:

“(5) For the purpose of ascertaining whether a capital loss accrued to the second taxpayer in the event of a subsequent disposal of the loan by the second taxpayer, the second taxpayer is taken to have immediately re-acquired the loan for a consideration equal to the reduced cost base to the second taxpayer of the loan, reduced by the reduction (capital loss) amount.

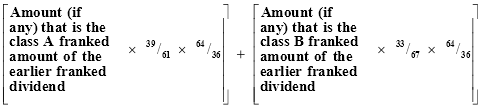

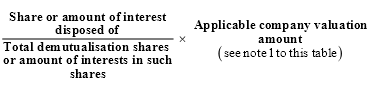

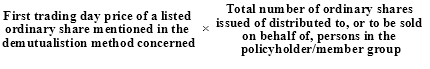

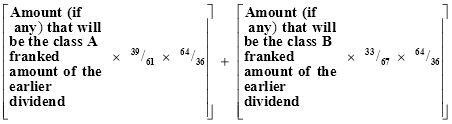

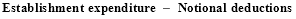

“(6) The reduction (capital loss) amount is worked out, immediately before the first asset disposal time, using the formula:

SCHEDULE 1—continued

“(7) The total excess share reduction (capital loss) amount is:

(a) if paragraph 160ZZRDL(4)(a) applies—so much of the total share reduction amounts for the excess shares as was not applied in making reductions to the reduced cost bases of the excess shares in accordance with subsection 160ZZRDJ(4) or section 160ZZRDK; or

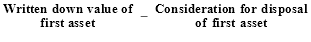

(b) if paragraph 160ZZRDL(4)(b) applies and the written down value of the first asset exceeds the consideration in respect of the disposal of the first asset—the amount of the excess; or

(c) in any other case—0.

“(8) If the second taxpayer or another taxpayer disposed of a loan (otherwise than because of the application of this section) within 12 months after the taxpayer acquired the loan (otherwise than because of the application of this section), subsections (1) and (2) have effect as if the references to the indexed cost base to the taxpayer in respect of the loan were a reference to the cost base to the taxpayer in respect of the loan.

More than one loan

“160ZZRDN. If:

(a) at the first asset disposal time, a taxpayer (the second taxpayer) held a loan to the transferor that was acquired by the second taxpayer on or after 20 September 1985 (the post-CGT loan); and

(b) at the first asset disposal time, the second taxpayer or another taxpayer held:

(i) a share in the transferor that was acquired by that taxpayer before 20 September 1985; or

(ii) another loan to the transferor; and

(c) the application of section 160ZZRDM to the post-CGT loan would be unreasonable;

then, that section does not apply to the post-CGT loan and the cost base, the indexed cost base or the reduced cost base of the post-CGT loan to the second taxpayer is instead reduced by such amount (if any) as is reasonable having regard to:

(d) the circumstances in which the post-CGT loan was acquired by the second taxpayer; and

(e) the extent (if any) to which the market value of the post-CGT loan was reduced as a result of the disposal of the first asset at the first asset disposal time.

SCHEDULE 1—continued

“Subdivision E—Other assets”

9. After subsection 160ZZRE (1A):

Insert:

“(1B) This section only applies if the consideration for the disposal of the first asset is less than the indexed threshold amount being the lesser of:

(a) the indexed cost base to the transferor of the first asset, or the amount that would have been the indexed cost base if this Part had applied in respect of the disposal of the first asset; and

(b) the market value of the first asset immediately before the first asset disposal time.”.

10. Subparagraph 160ZZRE(6)(b)(i):

Before “held” insert “or another taxpayer”.

11. Subparagraph 160ZZRE (6)(b)(i):

Omit “by the second taxpayer”, substitute “by that taxpayer”.

12. Sub-subparagraph 160ZZRE (6)(b)(ii)(A):

Omit all of the words after “disposal time,”, substitute “shares in the transferor belonging to 2 or more classes were in existence;”.

13. Sub-subparagraph 160ZZRE (6)(b)(ii)(B):

Omit all of the words after “disposal time,”, substitute “at least one other loan to the transferor was held by the second taxpayer, a company related to the transferor, or a person mentioned in paragraph 160ZZRB(b) in relation to the transferor; and”.

14. Subsections 160ZZRF (2) and (3):

Omit all of the words and paragraphs after “as is reasonable”.

15. Section 160ZZRF:

Add at the end:

“(4) The second taxpayer must choose whether to use the matters set out in subsection (5) or the matters set out in subsection (6) to determine what amount is reasonable.

“(5) The matters in this subsection are:

(a) the circumstances in which the share or the loan was acquired by the second taxpayer; and

(b) the extent (if any) to which the market value of the share or the loan was reduced as a result of the disposal of the first asset at the first asset disposal time; and

SCHEDULE 1—continued

(c) the extent (if any) to which any consideration paid or given by the second taxpayer for the acquisition of the share or the loan was attributable to the first asset.

“(6) The matters in this subsection are:

(a) the indexed common ownership market value of the first asset (see section 160ZZRBB); and

(b) the amount of the consideration for the disposal of the first asset to the transferee.”.

16. After section 160ZZRFA:

Insert:

“Subdivision F—Other adjustments”.

17. Paragraph 160ZZRH(d):

Omit all of the words after “under”, substitute “Subdivision C, D or E; and”.

18. Section 160ZZRH:

Add at the end:

“(2) The total of increases made under subsection (1) in relation to the first asset is not to exceed the total of adjustments made in relation to that asset under Subdivisions C, D and E.”.

19. Application of amendments

The amendments made by this Part apply to disposals after 7.30 p.m., by legal time in the Australian Capital Territory, on 9 May 1995.

SCHEDULE 1—continued

PART 2—OTHER AMENDMENTS RELATING TO CAPITAL

GAINS TAX

20. Section 160AZA (Sub Index—Roll-overs):

After the entry for “Strata title conversion” insert:

“Trusts—change in trust deed 160ZZPJ”.

21. After subsection 160B(1):

Insert:

“(1A) Subsections (2) and (2A) define listed personal-use asset for the purposes of this Part.”.

22. Subsection 160B(2):

Omit “$100”, substitute “$500”.

23. After subsection 160B(2):

Insert:

“(2A) An interest in an asset is also a listed personal-use asset if the interest is covered by subparagraph (2)(a)(vii) and the market value of the asset at the time when the interest is acquired is more than $500.”.

24. Subsection 160B(4):

Omit “non-listed” (wherever occurring).

25. Subsection 160Z(10):

Omit “or paragraph 99B(2)(d) or (e)”, substitute “, paragraph 99B(2)(d) or (e) or section 128D”.

26. Subsection 160ZA(7):

Add at the end “This subsection is subject to subsection (7A).”.

27. After subsection 160ZA(7):

Insert:

“(7A) Subsection (7) does not apply in relation to a dividend that is exempt from tax under section 23AJ to the extent that the dividend is:

(a) debited against a share capital account; or

(b) debited against a share premium account; or

(c) debited against a reserve to the extent that it consists of profits from the revaluation of assets of a company that have not been disposed of by the company; or

SCHEDULE 1—continued

(d) attributable, either directly or indirectly, to amounts that were transferred from an account or reserve of the company paying the dividend where the account or reserve is covered by one of the above paragraphs.

An account continues to be a share premium account for the purposes of this subsection even if, because the thing mentioned in paragraph (a) or (b) of the definition of share premium account in subsection 6(1) happens, it ceases to be a share premium account for other purposes of this Act.”.

28. Subsection 160ZA(8):

Omit the subsection, substitute:

“(8) For the purposes of subsection (4), if an eligible termination payment (within the meaning of Subdivision AA of Division 2 of Part III) is to be included in part in the assessable income of a taxpayer, then the whole of the payment is taken to be so included.”.

29. Section 160ZE:

Omit “5,000” (wherever occurring), substitute “10,000”.

30. Section 160ZG:

Omit “5,000” (wherever occurring), substitute “10,000”.

31.Paragraph I60ZZO(l)(d):

Omit the paragraph, substitute:

“(d) either:

(i) subsection (1AA) (disposals giving rise to capital losses) applies to the disposal; or

(ii) the transferor and the transferee have elected that this section is to apply in relation to the disposal;”.

32. After subsection 160ZZO(1):

Insert:

“(1AA) This subsection applies to a disposal if:

(a) assuming this Part applied to the disposal, the disposal would give rise to a capital loss; and

(b) the disposal is not covered by an election under subsection (1AB).

“(1AB) The transferor and the transferee may make an election under this subsection in relation to a disposal if the transferor and the transferee intend that, before the end of the year of income of the transferor after the year in which the disposal takes place, they will cease to be related and that the transferor, together with related companies of the transferor, will cease to hold 50% or more of the shares in the transferee.

SCHEDULE 1—continued

“(1AC) If a transferor and a transferee make an election under subsection (1AB) and the transferor, together with related companies of the transferor, does not cease to hold 50% or more of shares in the transferee before the end of the year of income of the transferor after the year in which the disposal occurs, no capital loss is taken to have arisen in relation to the disposal of the asset by the transferor.

“(1AD) No capital loss is taken to have arisen in relation to the disposal of the asset by the transferor if:

(a) the transferor and transferee make an election under subsection (1AB); and

(b) at any time in the 4 year period after the disposal of the asset, the asset is held by the transferor or a company that is related to the transferor or a company where, at that time, the transferor, together with other companies related to the transferor, holds 50% or more of the shares in the company.

Paragraph (b) does not apply in relation to the asset being held by the transferee in the period between the time when the asset is disposed of by the transferor and the time when the transferor, together with related companies of the transferor, ceases to hold 50% or more of the shares in the transferee. ”.

33. After subsection 160ZZO)(2D):

Insert:

“(3) An election under this section must be made in writing on or before the date of lodgment of the transferor’s return for the year of income in which the disposal took place. The Commissioner may allow the election to be made at a later time.

“(4) If:

(a) subsection (1AA) applies to a disposal (the first disposal) of an asset; and

(b) the asset is an interest in a CFC or a FIF; and

(c) the consideration in respect of the first disposal is reduced under section 461 or 613;

then:

(d) for the purpose of determining if a capital gain arises in respect of the subsequent disposal of the asset by the transferee, the indexed cost base of the asset to the transferee is to be increased, at the time of the subsequent disposal, by so much of the attribution surplus as was taken into account under paragraph 461(1)(c) or 613(1)(c) in relation to the first disposal; and

SCHEDULE 1—continued

(e) for the purpose of determining if a capital loss arises in respect of the subsequent disposal of the asset by the transferee, the reduced cost base of the asset to the transferee is to be increased, at the time of the subsequent disposal, by so much of the attribution surplus as was taken into account under paragraph 461(1)(c) or 613(1)(c) in relation to the first disposal.

“(5) In subsection (4):

attribution surplus means an attribution surplus under Part X or Part XI.

CFC has the same meaning as in Part X.

FIF has the same meaning as in Part XI.”.

34. Subsection 160ZZO)(9A):

After “paragraph (1)(bb)” insert “or subsection (1AC) or (1AD)”.

35. Before section 160ZZQ:

Insert in Division 17:

Changes in trust deeds

When section applies

“160ZZPJ. (1) This section applies to an asset that is disposed of as a result of the trust deed of a trust (the first trust) being amended or replaced where:

(a) immediately before the disposal the asset is held by the first trust; and

(b) immediately after the disposal the asset is held by a trust (the second trust) (which may or may not be the first trust); and

(c) the assets held by, and the members of, the first trust immediately before the disposal are identical to the assets held by, and the members of, the second trust immediately after the disposal; and

(d) either:

(i) the first trust is a complying ADF or a complying superannuation fund and the deed was amended or replaced to comply with the Superannuation Industry (Supervision) Act 1993; or

(ii) the first trust is a complying ADF and the deed was amended or replaced so that it became a complying superannuation fund.

Part does not apply to disposal

“(2) This Part (other than this section) does not apply in respect of the disposal of the asset.

SCHEDULE 1—continued

Asset last acquired before 20 September 1985

“(3) If the day (the last acquisition day) on which the last acquisition of the asset by the first trust before the disposal occurred was before 20 September 1985, the acquisition of the asset by the second trust is taken to have occurred before that day.

Asset last acquired on or after 20 September 1985

“(4) Subsections (5) to (8) apply if the last acquisition day was on or after 20 September 1985.

Trust to have acquired asset

“(5) The second trust is taken to have acquired the asset at the time of the disposal.

Calculating future capital gains

“(6) For the purpose of ascertaining if a capital gain accrued to the second trust in the event of a subsequent disposal of the asset by the second trust, the second trust is taken to have paid, as consideration for the acquisition of the asset, the amount that would have been the indexed cost base to the first trust of the asset for the purposes of this Part if this Part had applied to the disposal of the asset by the first trust.

Calculating future capital losses

“(7) For the purpose of ascertaining if the second trust incurred a capital loss in the event of a subsequent disposal of the asset by the second trust, the second trust is taken to have paid, as consideration for the acquisition of the asset, the amount that would have been the reduced cost base to the first trust of the asset for the purposes of this Part if this Part had applied to the disposal of the asset by the first trust.

Disposals within 12 months

“(8) If the asset is disposed of by the second trust within 12 months after the last acquisition day, the reference in subsection (6) to the indexed cost base to the second trust of the asset is to be read as a reference to the cost base to the second trust of the asset.

Interpretation

“(9) In this section, complying ADF and complying superannuation fund have the same meaning as in subsection 267(1).”.

36. Application of amendments to sections 160B, 160ZE and 160ZG

(1) Subject to subitem (2), the amendments made by item 24 apply to disposals of assets after 7.30 p.m. on 9 May 1995.

(2) The amendments made by item 24 and subitem (1) are to be disregarded in determining the application of Part IIIA of the Principal Act in relation to the disposal of assets before 7.30 p.m. on 9 May 1995.

SCHEDULE 1—continued

(3) The amendment made by item 24 applies to articles acquired after the commencement of this item.

37. Application of amendment to subsection 160Z(10)

(1) Subject to subitem (2), the amendments made by item 25 apply to disposals of assets on or after 20 September 1985.

(2) The amendments made by item 25 do not apply to a taxpayer in relation to a transaction that is part of an arrangement if:

(a) the arrangement is covered by a ruling issued before 7.30 p.m. on 9 May 1995 under Part IVAA of the Taxation Administration Act 1953; and

(b) the transaction had been commenced to be carried out before 7.30 p.m. on 9 May 1995.

(3) A reference in this item to 7.30 p.m. is a reference to 7.30 p.m. by legal time in the Australian Capital Territory.

38. Application of amendments to section 160ZA

The amendments made by items 26, 27, 33 and 28 apply to disposals occurring after 7.30 p.m., by legal time in the Australian Capital Territory, on 9 May 1995.

39. Application of amendments to section 160ZZO

The amendments made by items 31, 32 and 34 apply to disposals occurring after 7.30 p.m., by legal time in the Australian Capital Territory, on 9 May 1995.

40. Application of new section 160ZZPJ

The amendments made by items 20 and 35 apply to disposals of assets occurring on or after 12 January 1994.

——————————————

SCHEDULE 2 Section 3

AMENDMENTS OF THE INCOME TAX ASSESSMENT ACT 1936 RELATING TO DIVIDEND IMPUTATION

1. Paragraph 46L(3)(b):

Omit “paragraph 160AQF(1)(c) or (1AA)(c)”, substitute “paragraph 160AQF(l)(c), (1AA)(c) or

(1 AAA)(c)".

2. Subparagraph 46L(4)(a)(ii):

Omit “paragraph 160AQF(1)(c) or (1AA)(c)”, substitute “paragraph 160AQF(1)(c), (1AA)(c) or (1AAA)(c)”.

3. Section 160APA (after paragraph (ba) of the definition of applicable general company tax rate):

Insert:

“(baa) in relation to the liability of a company to pay class C franking deficit tax or a class C deficit deferral tax—36%;”.

4. Section 160APA (definition of applicable general company tax rate):

Add at the end:

“or (cb) in relation to:

(i) the payment of a class C franked dividend to a shareholder in a company; or

(ii) a trust amount or partnership amount that relates, directly or indirectly, to the payment of a class C franked dividend to a shareholder in a company;

36%.”.

5. Section 160APA (definition of deficit deferral amount):

Omit all the words after “(see subsection 160AQJA(2))”, substitute “, a class B deficit deferral amount (see subsection 160AQJB(2)) or a class C deficit deferral amount (see subsection 160AQJC(2)).”.

6. Section 160APA (definition of deficit deferral tax):

Omit “or class B deficit deferral tax;”, substitute “, class B deficit deferral tax or class C deficit deferral tax.”.

7. Section 160APA (definition of estimated debit):

Omit “or an estimated class B debit;”, substitute “, an estimated class B debit or an estimated class C debit.”.

8. Section 160APA (definition of estimated debit determination):

Omit “or an estimated class B debit determination;”, substitute “, an estimated class B debit determination or an estimated class C debit determination.”.

SCHEDULE 2—continued

9. Section 160APA (definition of franking account assessment):

Omit “or a class B franking account assessment;”, substitute “, a class B franking account assessment or a class C franking account assessment.”.

10. Section 160APA (definition of franking credit):

Omit “or a class B franking credit;”, substitute “, a class B franking credit or a class C franking credit.”.

11. Section 160APA (definition of franking debit):

Omit “or a class B franking debit;”, substitute “, a class B franking debit or a class C franking debit.”.

12. Section 160APA (definition of franking deficit tax):

Omit “, or class B franking deficit tax;”, substitute “, class B franking deficit tax or class C franking deficit tax.”.

13. Section 160APA (definition of franking percentage):

Omit the definition, substitute:

“franking percentage means:

(a) in relation to a franked dividend—the sum of:

(i) the class A franking percentage of the dividend; and

(ii) the class B franking percentage of the dividend; and

(iii) the class C franking percentage of the dividend; or

(b) in relation to an unfranked dividend—0%.”.

14. Section 160APA:

Insert the following definitions:

“class C deficit deferral tax means tax payable in accordance with section 160AQJC.

class C flow-on franking amount means an amount that would be a flow-on franking amount if:

(a) a reference in the definition of flow-on franking amount to a franked dividend were, by express provision, confined to a class C franked dividend; and

(b) a reference in that definition to the flow-on franking amount were, by express provision, confined to a class C flow-on franking amount.

class C franked amount, in relation to a dividend, means so much of the dividend as has been franked in accordance with subsection 160AQF(1AAA).

SCHEDULE 2—continued

class C franked dividend means a dividend the whole or a part of which has been franked in accordance with subsection 160AQF(1AAA).

class C franking account assessment means the ascertainment of the class C franking account balance and of any class C franking deficit tax payable.

class C franking account balance, in relation to a company, means:

(a) if the company has a class C franking surplus—the amount of that surplus; or

(b) if the company has a class C franking deficit—the amount of that deficit; or

(c) in any other case—nil.

class C franking deficit means a deficit calculated under subsection 160APJ(4).

class C franking deficit tax means tax payable in accordance with subsection 160AQJ(1B).

class C franking percentage means:

(a) in relation to a class C franked dividend—the percentage specified in the declaration made under subsection 160AQF(1AAA) in relation to the dividend; or

(b) in relation to a dividend (including a dividend that is not a frankable dividend) no part of which has been franked in accordance with subsection 160AQF(1AAA)—0%.

class C franking surplus means a surplus calculated under subsection 160APJ(1B).

class C potential rebate amount means an amount that would be a potential rebate amount if:

(a) each reference in the definition of potential rebate amount to a franked dividend were, by express provision, confined to a class C franked dividend; and

(b) each reference in that definition to a flow-on franking amount were, by express provision, confined to a class C flow-on franking amount; and

(c) each reference in that definition to a potential rebate amount were, by express provision, confined to a class C potential rebate amount.

class C conversion time has the meaning given by section 160ASF.

estimated class C debit means an estimated class C debit specified in an estimated class C debit determination.

estimated class C debit determination means a determination made by the Commissioner under subsection 160AQDAA(1).”,

SCHEDULE 2—continued

15. After section 160APA:

Insert:

Reduction of adjusted amount

“160APAAA.(1) In working out the adjusted amount of an amount (the basic amount), the basic amount is reduced by any reduction amount that arises in relation to the basic amount.

“(2) The reduction amount in relation to a basic amount that is attributable to a payment of tax is the whole, or any part, of the payment that arises as a result of the application or operation of:

(a) subsection 136AD(1), (2) or (3) or 136AE(1), (2) or (3); or

(b) paragraph 1 or 2 of Article 9 of the Vietnamese agreement or a provision of any other double taxation agreement that corresponds to either of those paragraphs.

“(3) The reduction amount in relation to a basic amount that is attributable to:

(a) an amount received as a refund of a payment of tax; or

(b) an amount credited under paragraph 221AZM(1)(a) or (c) against a liability of the company; or

(c) an amount applied by the Commissioner against a liability of the company; or

(d) a reduction mentioned in section 160APZ;

is the whole, or any part, of the amount or reduction that is attributable to a payment, or a part of a payment, of tax in relation to which subsection (2) gave rise to a reduction amount.

“(4) In this section:

double taxation agreement means an agreement within the meaning of the International Tax Agreements Act 1953.

the Vietnamese agreement has the same meaning as in the International Tax Agreements Act 1953”.

16. After section 160APB:

Insert:

References to franking year

“160APBA. A reference in this Part to a franking year preceded by a figure referring to 2 years (for example 1995-96 franking year) is a reference to the franking year of the company:

SCHEDULE 2—continued

(a) if the franking year of the company is covered by paragraph (a) or (b) of the definition of franking year—that begins on or after 1 January in the first year referred to in the figure but before 1 January in the second year referred to in that figure; or

(b) if the franking year of the company is covered by paragraph (c) of that definition—that begins on 1 July of the first year referred to in the figure.”.

17. After subsection 160APJ(1A):

Insert:

“(1B) The class C franking surplus of a company at a particular time in a franking year is the amount by which the total of the class C franking credits of the company arising in the franking year and before that time exceeds the total of the class C franking debits of the company arising in the franking year and before that time.”.

18. Section 160APJ:

Add at the end:

“(4) The class C franking deficit of a company at a particular time in a franking year is the amount by which the total of the class C franking debits of the company arising in the franking year and before that time exceeds the total of the class C franking credits of the company arising in the franking year and before that time.”.

19. Section 160APL:

Add at the end:

“(3) If a company has a class C franking surplus at the end of a franking year, there arises at the beginning of the next franking year a class C franking credit of the company equal to that class C franking surplus.”.

20. Section 160APM:

Repeal the section, substitute:

Payment of company tax instalment

“160APM. If, on a particular day, a company tax instalment payable under section 221AZK is paid in respect of a year of income, there arises on that day whichever of the following is applicable:

(a) if the year of income is the 1994-95 year of income—a class B franking credit of the company equal to the adjusted amount in relation to the amount paid;

SCHEDULE 2—continued

(b) if the year of income is the 1995-96 year of income or a later year of income—a class C franking credit of the company equal to the adjusted amount in relation to the amount paid.”.

21. Section 160APMAA:

Repeal the section, substitute:

Payment of additional amount on upwards estimate

“160APMAA. If, on a particular day, an amount payable under subsection 221 AZR(1) is paid in respect of a year of income, there arises on that day whichever of the following is applicable:

(a) if the year of income is the 1994-95 year of income—a class B franking credit of the company equal to the adjusted amount in relation to the amount paid;

(b) if the year of income is the 1995-96 year of income or a later year of income—a class C franking credit of the company equal to the adjusted amount in relation to the amount paid.”.

22. Section 160APMAB:

Add at the end:

“(3) If a company receives a refund in relation to which a class C deficit deferral amount arises (see subsection 160AQJC(2)) on a particular day, a class C franking credit of the company equal to the adjusted amount in relation to the class C deficit deferral tax payable in relation to the refund (see subsection 160AQJC(3)) arises on that day.”.

23. Paragraph 160APMD(d):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

24. Section 160APMD:

Add at the end:

“; (e) if the year of income is the 1995-96 year of income or a later year of income—a class C franking credit of the company equal to the adjusted amount in relation to the amount of that payment.”.

25. After subsection 160APP(1A):

Insert:

“(1B) Subject to this section, if:

(a) on a particular day, a class C franked dividend is paid to a shareholder being a company; and

SCHEDULE 2—continued

(b) the company is a resident at the time the dividend is paid; there arises on that day a class C franking credit of the company equal to the class C franked amount of the dividend.”.

26. Subsection 160APP(3):

Omit “subsection (1) or (1A)”, substitute “subsection (1), (1A) or (1B)”.

27. Subsection 160APP(3) (definition of FC):

Omit “subsections (1) and (1A)”, substitute “subsections (1), (1A) and (1B)”.

28. Subsection 160APP(5):

Omit “subsection (1) or (1A)”, substitute “subsection (1), (1A) or (1B)”.

29. After subsection 160APQ(1A):

Insert:

“(2) Subject to this section, if:

(a) a trust amount or partnership amount is included in, or a partnership amount is allowed as a deduction from, the assessable income of a company; and

(b) there is a class C flow-on franking amount in relation to the trust amount or the partnership amount;

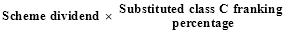

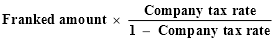

there arises, at the end of the year of income of the trustee or partnership to which the trust amount or partnership amount relates, a class C franking credit of the company equal to the amount worked out using the formula:

where:

Potential rebate amount means the class C potential rebate amount in relation to the trust amount or partnership amount.

Company tax rate means the applicable general company tax rate.”.

30. Subsection 160APQ(3):

Omit “subsection (1) or (1A)”, substitute “subsection (1), (1A) or (2)”.

31. Paragraph 160APQA(d):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

SCHEDULE 2—continued

32. Section 160APQA:

Add at the end:

“; (e) if the offset relates to company tax for the 1995-96 year of income or a later year of income—a class C franking credit of the company equal to the adjusted amount in relation to the amount of the payment.”.

33. Paragraph 160APQB(d):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

34. Section 160APQB:

Add at the end:

“; (e) if the year of income is the 1995-96 year of income or a later year of income—a class C franking credit of the company equal to the adjusted amount in relation to the amount of that payment.”.

35. Section 160APU:

Add at the end:

“(3) On the day on which the termination time in relation to an estimated class C debit of a company occurs, there arises a class C franking credit of the company equal to the estimated class C debit.”

36. Section 160APV:

Add at the end:

“(3) If, on a particular day, the Commissioner serves on a company a notice of an estimated class C debit determination that is in substitution for an earlier determination, there arises on that day a class C franking credit of the company equal to the amount of the class C franking debit that arose because of the earlier determination.”.

37. After subsection 160APVA(1):

Insert:

“(1A) If:

(a) on a particular day, a class C franking debit of a life assurance company arises under section 160APY in relation to a refund received by the company in respect of an instalment for a year of income (the current year of income); and

(b) a notice of an original company tax assessment for the current year of income has not been served, or been taken to have been served, on the company on or before that day;

SCHEDULE 2—continued

then a class C franking credit of the company worked out under subsection (2) of this section arises on that day.”.

38. After subsection 160APVA(3):

Insert:

“(3A) If:

(a) on a particular day a class C franking debit of a life assurance company arises:

(i) under section 160APY in relation to a refund received by the company in respect of an instalment for a year of income (the current year of income); or

(ii) under section 160APYA in relation to a refund received by the company, or an amount credited against a liability of the company, in respect of an instalment for a year of income (also the current year of income); and

(b) either:

(i) before that day, a notice of an original company tax assessment for the current year of income has been served, or is taken to have been served, on the company; or

(ii) on or after that day, a notice of an original company tax assessment for the current year of income is served, or taken to be served, on the company;

then a class C franking credit of the company worked out under subsection (4) of this section arises on the later of the particular day and the day on which the notice is served or taken to be served.”.

39. Section 160APVB:

Add at the end:

“(2) If:

(a) on a particular day, a class C franking debit of a life assurance company arises under subsection 160AQCCA(1A) in relation to:

(i) an instalment that the company is required to pay under section 221AZK in respect of a year of income (the current year of income); or

(ii) an amount that the company is required to pay under subsection 221 AZR(l) in respect of a year of income (also the current year of income); and

(b) on or after that day, a notice of an original company tax assessment for the current year of income is served, or taken to be served, on the company;

SCHEDULE 2—continued

then a class C franking credit of the company equal to the amount of the class C franking debit arises on the day on which the notice is served, or taken to be served.”.

Note: The heading to section 160APVB is altered by inserting “or 160AQCCA(1A)" after “subsection 160AQCCA(1)”.

40. Paragraph 160APVBA(l)(b):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

41. Subsection 160APVBA(1):

Add at the end:

“; (c) if the year of income is the 1995-96 year of income or a later year of income—a class C franking credit of the company worked out under subsection (2) of this section.”.

42. Subsection 160APVBA(2) (paragraph (b) of the definition of Statutory factor):

After “class B franking credit” insert “or a class C franking credit”.

43. Paragraph 160APVBB(1)(b):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

44. Subsection 160APVBB(1):

Add at the end:

“; (c) if the year of income is the 1995-96 year of income or a later year of income—a class C franking credit of the company worked out under subsection (2) of this section.”.

45. Subsection 160APVBB(2) (paragraph (b) of the definition of Statutory factor):

After “class B franking credit” insert “or a class C franking credit”.

46. Section 160APVD:

Add at the end:

“(3) If, on a particular day, a class C franking debit of a life assurance company arises under section 160APZ in relation to a reduction in the company tax of the company for a year of income, there arises on that day a class C franking credit of the company equal to the adjusted amount in relation to the amount worked out using the formula:

SCHEDULE 2—continued

where:

Statutory factor means 1.0.

Overall reduction means the amount of the reduction.

Non-fund component of reduction means so much of the amount of the reduction as is attributable to the non-fund component.”.

47. Paragraph 160APVH(3)(a):

After “of that subsection” insert or under subsection 160AQCN(2AA) because of paragraph (a) of that subsection,”.

48. Section 160APVH:

Add at the end:

“(4) If, on a particular day, a class C franking debit of a life assurance company arises under any of the following provisions:

(a) subsection 160AQCCA(1A);

(b) subsection 160AQCCA(3A);

(c) section 160AQCK;

(d) section 160AQCL;

there arises on that day a class A franking credit of the company equal to the amount that would have been the amount of that class C franking debit if the assumptions set out in subsection (5) were made.

“(5) The assumptions are as follows:

(a) the assumption that the class C franking debit had been calculated using a statutory factor of 0.2 instead of 1.0;

(b) the assumption that the class C franking debit had been calculated by reference to the special life company tax rate for the year of tax concerned instead of by reference to the general company tax rate for the year of tax concerned.”.

49. After subsection 160APX(1A):

Insert:

“(1B) If:

(a) the class C required franking amount for a frankable dividend paid by a company on a particular day is not less than 10% of the amount of the dividend; and

(b) that class C required franking amount exceeds the class C franked amount of the dividend;

there arises on that day a class C franking debit of the company equal to the excess referred to in paragraph (b).”.

SCHEDULE 2—continued

50. Section 160APY:

Repeal the section, substitute:

Refunds of company tax instalment

“160APY. If a company y receives an amount as a refund under subsection 221AZL(2) or 221AZQ(1):

(a) if the refund is in respect of the 1994-95 year of income—a class B franking debit of the company equal to the adjusted amount in relation to the amount received arises on the day on which the company receives the amount; or

(b) if the refund is in respect of the 1995-96 year of income or a later year of income—a class C franking debit of the company equal to the adjusted amount in relation to the amount received arises on the day on which the company receives the amount.”.

51. Section 160APYA:

Repeal the section, substitute:

Refunds of company tax

“160APYA. If:

(a) a company makes a payment covered by section 160APM or 160APMAA in respect of a year of income; and

(b) either:

(i) the company receives an amount as a refund of that payment (not being a refund covered by section 160APY); or

(ii) the Commissioner credits the payment under paragraph 221 AZM(1)(b) or (c) against a liability of the company; and

(c) the amount refunded or credited, as the case may be, is not attributable to a reduction of company tax covered by section 160APZ;

then:

(d) if the payment is in respect of the 1994-95 year of income—a class B franking debit of the company equal to the adjusted amount in relation to the amount received or credited arises on the day on which the company receives the refund or on the day on which that payment is credited; or

(e) if the payment is in respect of the 1995-96 year of income or a later year of income—a class C franking debit of the company equal to the adjusted amount in relation to the amount received or credited arises on the day on which the company receives the refund or on the day on which that payment is credited.”.

SCHEDULE 2—continued

52. Paragraph 160APYBA(e):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

53. Section 160APYBA:

Add at the end:

“; (f) if the payment mentioned in paragraph (a) is in respect of the 1995-96 year of income or a later year of income—a class C franking debit of the company equal to the adjusted amount in relation to the amount received or applied, as the case requires.”.

54. Paragraph 160APYBB(d):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

55. Section 160APYBB:

Add at the end:

“; (e) if the foreign tax credit was allowable in respect of tax paid or payable by the company in respect of income derived in the 1995-96 year of income or a later year of income—the class C franking debit of the company equal to the adjusted amount in relation to the amount paid or applied, as the case requires.”.

56. Paragraph 160APZ(d):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

57. Section 160APZ:

Add at the end:

“; (e) if the year of income is the 1995-96 year of income or a later year of income—a class C franking debit of the company equal to the adjusted amount in relation to the amount of the reduction.”.

58. Section 160AQB:

Add at the end:

“(3) If, on a particular day, a company pays a class C franked dividend, there arises on that day a class C franking debit of the company equal to the class C franked amount of the dividend.”.

59. Section 160AQC:

Add at the end:

“(3) If, on a particular day, the Commissioner serves on a company notice of an estimated class C debit determination, there arises on that day a class C franking debit of the company equal to the estimated class C debit specified in the notice.”.

SCHEDULE 2—continued

60. Section 160AQCA:

Add at the end:

“(3) If:

(a) a class C franking credit of a life assurance company arose under section 160APP or 160APQ at a particular time during a year of income of the company; and

(b) after that time and during the year of income:

(i) if section 160APP applied—the asset of the company from which the dividend referred to in subsection (1B) of that section was derived; or

(ii) if section 160APQ applied—the asset of the company to which the trust amount or partnership amount referred to in subsection (2) of that section is attributable;

becomes part of the insurance funds of the company;

there arises, on the day on which the asset becomes part of the insurance funds, a class C franking debit of the company equal to the class C franking credit.".

61 Subsection 160AQCB(1):

Add at the end:

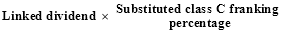

“; and (e) a class C franking debit of the debit company equal to the amount worked out using the following formula, as reduced by the amount (if any) of the class C franking debit of the company arising under section 160AQB in respect of the payment of the scheme dividend:

where:

Scheme dividend means the amount of the scheme dividend.

Substituted class C franking percentage means the actual or proposed class C franking percentage, or the greatest actual or proposed class C franking percentage, of the substituted dividends.”.

62 Subsection 160AQCB(2):

Add at the end:

“; and (e) a class C franking debit of the debit company equal to the actual or proposed class C franked amount, or the sum of the actual or proposed class C franked amounts, of the substituted dividends.”.

SCHEDULE 2—continued

63. Subsection 160AQCB(3):

Add at the end:

“; and (e) a class C franking debit of the debit company equal to the amount worked out using the formula:

where:

Linked dividend means the amount of the linked dividend. Substituted class C franking percentage means the actual or proposed class C franking percentage, or the greatest actual or proposed class C franking percentage, of the substituted dividends.”.

64. Paragraph 160AQCB(4)(a):

Omit “on a particular day after 30 June 1990, a company (in this subsection called the “debit company”) pays”, substitute “a company (the debit company) pays, on a particular day after 30 June 1990 and before the day on which the class C conversion time of the company occurs,”.

65. After subsection 160AQCB(4):

Insert:

“(4A) If:

(a) a company (the debit company) pays, on a particular day on or after the day on which the class C conversion time of the company occurs, one or more franked dividends (the scheme dividends) to one or more shareholders in the debit company; and

(b) the scheme dividends were paid:

(i) under a dividend streaming arrangement in relation to the debit company; and

(ii) in substitution, in whole or in part, for the payment, or proposed payment, by another company of one or more unfranked dividends (the substituted dividends) to one or more shareholders in that other company;

there arises on that day a class C franking debit of the debit company equal to the sum of the following amounts:

(c) to the extent that the substituted dividends comprise the whole or a part of a common issue of shares covered by paragraph (c) of the definition of dividend in subsection 6(1)—the sum of the actual or proposed amounts of the dividends to which that common issue relates;

SCHEDULE 2—continued

(d) to the extent that the substituted dividends:

(i) do not consist of shares issued by the other company; and

(ii) comprise the whole or a part of a common series of distributions covered by paragraph (a) of the definition of dividend in subsection 6(1);

the sum of the actual or proposed amounts of the dividends to which those distributions relate;

(e) to the extent that paragraph (d) of this subsection does not apply and the substituted dividends comprise the whole or a part of a common series of credits covered by paragraph (b) of the definition of dividend in subsection 6(1)—the sum of the actual or proposed amounts of the dividends to which those credits relate.”.

66. Subsection 160AQCC(4):

Omit “subsection 160AQDB(2)”, substitute “subsection 160AQDB(2) or 160AQDB(3)”.

67. Section 160AQCC:

Add at the end:

“(5) There arises on the day of an on-market purchase by a company of a share a class C franking debit of the company equal to the amount calculated under subsection (6).

“(6) The amount is the amount that would be calculated under subsection 160AQDB(4) or 160AQDB(5) (whichever is applicable) as the class C required franking amount for a dividend paid on that day to a shareholder in the company if that and any other on-market purchase by the company had been an off-market purchase.”.

68. After subsection 160AQCCA(1):

Insert:

“(1A) If:

(a) on a particular day, a class C franking credit of a life assurance company arises:

(i) under section 160APM in relation to an instalment that the company is required to pay under section 221AZK in respect of a year of income (the current year of income); or

(ii)under section 160APMAA in relation to an amount that the company is required to pay under subsection 221AZR(1) in respect of a year of income (also the current year of income); and

SCHEDULE 2—continued

(b) a notice of an original company tax assessment for the current year of income has not been served, or been taken to have been served, on the company on or before that day;

then a class C franking debit of the company worked out under subsection (2) of this section arises on that day.”.

69. After subsection 160AQCCA(3):

Insert:

“(3A) If:

(a) on a particular day, a class C franking credit of a life assurance company arises under:

(i) section 160APM in relation to an instalment that the company is required to pay under section 221AZK in respect of a year of income (the current year of income); or

(ii) under section 160APMAA in relation to an amount that the company is required to pay under subsection 221AZR(1) in respect of a year of income (also the current year of income); and

(b) either:

(i) before that day, a notice of an original company tax assessment for the current year of income has been served, or is taken to have been served, on the company; or

(ii) on or after that day, a notice of an original company tax assessment for the current year of income is served, or taken to be served, on the company;

then a class C franking debit of the company worked out under subsection (4) of this section arises on the later of the particular day and the day on which the notice is served or taken to be served.”.

70. Section 160AQCCB:

Add at the end:

“(2) If:

(a) on a particular day, a class C franking credit of a life assurance company arises under subsection 160APVA(1A) in relation to a refund received by the company in respect of an instalment for a year of income (the current year of income); and

(b) on or after that day, a notice of an original company tax assessment for the current year of income is served, or taken to be served, on the company;

SCHEDULE 2—continued

then a class C franking debit of the company equal to the amount of the class C franking credit arises on the day on which the notice is served, or taken to be served.”.

Note: The heading to section 160AQCCB is altered by inserting “or 160APVA(1A)’’ after “subsection 160APVA(1)”.

71. Paragraph 160AQCK(l)(b):

Omit “a later year of income”, substitute “the 1994-95 year of income ”.

72. Subsection 160AQCK(1):

Add at the end:

(a) if the year of income is the 1995-96 year of income or a later year of income—a class C franking debit of the company worked out under subsection (2) of this section.”.

73. Subsection 160AQCK(2) (paragraph (b) of the definition of Statutory factor):

After “class B franking debit” insert “or a class C franking debit”.

74. Paragraph 160AQCL(l)(b):

Omit “a later year of income”, substitute “the 1994-95 year of income”.

75. Subsection 160AQCL(1):

Add at the end:

(a) if the year of income is the 1995-96 year of income or a later year of income—a class C franking debit of the company worked out under subsection (2) of this section.”.

76. Subsection 160AQCL(2) (paragraph (b) of the definition of Statutory factor):

After “class B franking debit” insert “or a class C franking debit”.

77. After subsection 160AQCN(2):

Insert:

Life assurance companies—statutory fund component

“(2AA) If, on a particular day, a class C franking credit of a company arises under any of the following provisions:

(a) subsection 160APVA(1A);

(b) subsection 160APVA(3A);

(c) section 160APVBA;

SCHEDULE 2—continued

(d) section 160APVBB;

(e) subsection 160APVD(3);

there arises on that day a class A franking debit of the company equal to the amount that would have been the amount of that class C franking credit if the assumptions set out in subsection (2AB) were made.

‘‘(2AB) The assumptions are as follows:

(a) the assumption that the class C franking credit had been calculated using a statutory factor of 0.2 instead of 1.0;

(b) the assumption that the class C franking credit had been calculated by reference to the special life company tax rate for the year of tax concerned instead of by reference to the general company tax rate for the year of tax concerned.”.

78. Paragraph 160AQCN(2A)(a):

After “of that subsection” insert or under subsection 160APVH(4) because of paragraph (a) of that subsection,”.

79. After section 160AQDA:

Insert:

Determination of estimated class C debit

“160AQDAA.(1) If a company:

(a) has taken liability reduction action; or

(b) has paid a company tax instalment; the company may lodge an application with the Commissioner for:

(c) the determination of an estimated class C debit in relation to the liability reduction action or the company tax instalment; or

(d) the determination of such an estimated class C debit in substitution for an earlier determination.

"(2) An estimated class C debit in relation to a company tax instalment must relate to the refund of that instalment under section 221AZL or 221AZQ.

“(3) The application must:

(a) be made before the termination time; and

(b) be in the approved form; and

(c) specify the amount of the estimated class C debit applied for.

“(4) The Commissioner:

(a) may determine an estimated class C debit not greater than the amount specified in the application; and

SCHEDULE 2—continued

(b) must serve notice of any such determination on the company.

“(5) If:

(a) a company lodges an application with the Commissioner on a particular day (the application day); and

(b) at the end of the 21st day after the application day, the Commissioner has neither:

(i) served notice of an estimated class C debit determination on the company; nor

(ii) refused to make an estimated class C debit determination; the Commissioner is taken, on the 22nd day after the application day, to have:

(c) determined an estimated class C debit in accordance with the application; and

(d) served notice of the determination on the company.

“(6) A notice of an estimated class C debit determination has no effect if it is served after the termination time.”.

80. Subsection 160AQDB(2):

After “For the purposes of this Part,” insert “if the beginning of the reckoning day is before the company’s class C conversion time,”.

81. Subsection 160AQDB(2):

Omit “a company”, substitute “the company”.

82. Section 160AQDB:

Add at the end:

“(3) For the purposes of this Part, if the beginning of the reckoning day is after the company’s class C conversion time, the class B required franking amount for a dividend paid to a shareholder in the company is nil.

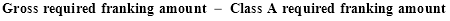

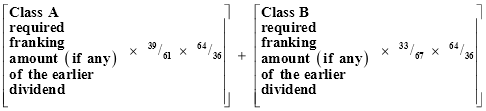

“(4) For the purposes of this Part, if the beginning of the reckoning day is after the company’s class C conversion time, the class C required franking amount for a dividend paid to a shareholder in the company is worked out using the formula:

where:

Gross required franking amount means the required franking amount for the dividend.

SCHEDULE 2—continued

Class A required franking amount means the class A required franking amount for the dividend.

“(5) For the purposes of this Part, if the beginning of the reckoning day is before the company’s class C conversion time, the class C required franking amount for a dividend paid to a shareholder in the company is nil.”.

83. Subsection 160AQE(2) (sub-subparagraph (a)(i)(A) of the definition of SD):

Omit “subsection 160ACQB(4) (which deals”, substitute “subsection 160AQCB(4) or (4A) (which deal”.

84. Subsection 160AQE(6):

Add at the end:

“; and (c) the class C franking surplus (if any) of the company as at that time.”.

85. After subsection 160AQF(1AA):

Insert:

“(1AAA) If:

(a) a frankable dividend (the current dividend) is paid to a shareholder in a company; and

(b) the company is a resident at the time of payment; and

(c) if the current dividend is paid under a resolution:

(i) before the reckoning day for the current dividend, the company makes a declaration that each dividend to which the resolution relates is a class C franked dividend to the extent of a percentage (not exceeding 100%) specified in the declaration in relation to the dividend; and

(ii) the percentage so specified is the same for each of the dividends to which the resolution relates; and

(d) if the current dividend is not paid under a resolution—the company makes a declaration before the reckoning day for the current dividend that the current dividend is a class C franked dividend to the extent of a percentage (not exceeding 100%) specified in the declaration;

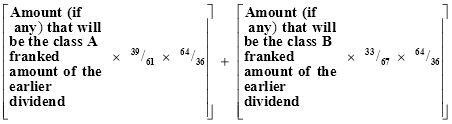

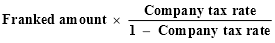

the current dividend is taken to have been class C franked to the extent of the amount worked out using the formula:

SCHEDULE 2—continued

where:

Current dividend means the amount of the current dividend.

Specified percentage means the percentage specified in the declaration in relation to the dividend.”.

86. Subsection 160AQF(1AAA):

Add at the end:

“Note: Because of subsection 46L(3) and paragraph 46L(4)(a), paragraph (c) of this subsection does not apply to dividends that are taken by subsection 46L(3) or paragraph 46L(4)(a) not to be frankable dividends.”.

87. After subsection 160AQF(1AB):

Insert:

“(1AC) Despite subsections (1) and (1AAA), a dividend is taken not to have been class A franked or class C franked if the sum of:

(a) the class A franked amount of the dividend; and

(b) the class C franked amount of the dividend;

exceeds the amount of the dividend.”.

88. Subparagraph 160AQH(b)(i):

Omit the subparagraph, substitute:

“(i) the class A franked amount of the dividend (if any), the class B franked amount of the dividend (if any) and the class C franked amount of the dividend (if any); and”.

89. Subparagraph 160AQH(b)(ii):

Omit “and the class B franked amount of the dividend”, substitute “(if any), the class B franked amount of the dividend (if any) and the class C franked amount of the dividend (if any)”.

90. After subparagraph 160AQH(b)(iv):

Insert:

“(iva) if the dividend is a class C franked dividend—the amount worked out in relation to the dividend using the formula in subsection 160AQT(1AB) (whether or not that subsection applies to the dividend); and”.

91. Subparagraph 160AQH(b)(v):

Omit “subparagraphs (iii) and (iv)”, substitute “subparagraphs (iii), (iv) and (iva)”.

SCHEDULE 2—continued

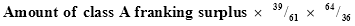

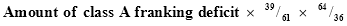

92. After subsection 160AQJ(1A):

Insert:

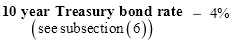

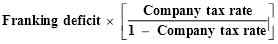

“(1B) If a company has a class C franking deficit at the end of a franking year, the company is liable to pay tax equal to the amount worked out using the formula:

where:

Franking deficit means the amount of the class C franking deficit.

Company tax rate means the applicable general company tax rate.”.

93. Paragraph 160AQJB(1)(a):

Omit “a year of income”, substitute “the 1994-95 year of income”.

94. After section 160AQJB:

Insert in Subdivision BA of Division 5 of Part IIIAA:

Class C deficit deferral tax

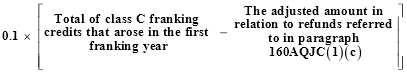

“160AQJC.(1) If:

(a) during a franking year (the first franking year) a company pays one or more instalments under section 221AZK for the 1995-96 year of income or a later year of income; and

(b) at a particular time during the next franking year (the second franking year) the company receives a refund of the whole or a part of the instalment, or one or more of the instalments, under section 221AZL or 221AZQ; and

(c) assuming that the refund, together with any previous refund of one or more instalments for the year of income, had been received by the company on the last day of the first franking year, the company would have had a class C franking deficit, or an increased class C franking deficit, at the end of the first franking year;

a class C deficit deferral amount (defined in subsection (2)) arises in relation to the company and the refund.

“(2) The class C deficit deferral amount is the amount of the class C franking deficit, or the amount of the increase in the class C franking deficit, referred to in paragraph (1)(c).

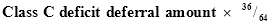

“(3) If a class C deficit deferral amount arises in relation to a company and a refund, the company is liable to pay class C deficit deferral tax in relation to the refund. The amount of the tax is the gross class C deficit

SCHEDULE 2—continued

deferral amount (see subsection (4)) reduced by any class C deficit deferral tax already payable by the company in relation to refunds received in the second franking year.

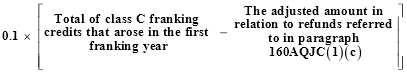

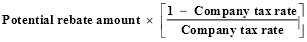

“(4) The gross class C deficit deferral amount is worked out using the formula:

“(5) If an amount is paid under subsection 221AZR(1) in the same year as the instalment mentioned in that subsection, then, for the purposes of this section, the amount is to be treated as being part of the instalment.”.

95. After subparagraph 160AQK(1)(a)(ii):

Insert:

“(iia) class C franking deficit tax for a franking year; or”.

96. After subparagraph 160AQK(1)(a)(iv):

Insert: