Higher Education Legislation Amendment Act 1996

No. 74, 1996

An Act to amend legislation relating to higher education, and for related purposes

Higher Education Legislation Amendment Act 1996

No. 74, 1996

An Act to amend legislation relating to higher education, and for related purposes

Contents |

|

|

1 | Short title............................................. | 2355 |

2 | Commencement........................................ | 2355 |

3 | Schedule(s)........................................... | 2356 |

Schedule 1—Amendments | 2357 | |

Higher Education Funding Act 1988 | 2357 | |

Maritime College Act 1978 | 2366 | |

Higher Education Legislation Amendment Act 1996

An Act to amend legislation relating to higher education, and for related purposes

[Assented to 12 December 1996]

The Parliament of Australia enacts:

This Act may be cited as the Higher Education Legislation Amendment Act 1996.

(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Items 4, 5, 6, 7, 8, 9, 10, 11, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23 and 33 of Schedule 1 commence on 1 January 1997, immediately after the commencement of the items in Schedule 1 to the Higher Education Funding Amendment Act (No. 1) 1996 that also commence on 1 January 1997.

(3) Items 1, 2, 3, 12, 34 and 35 of Schedule 1 commence on 1 January 1998.

3 Schedule(s)

Subject to section 2, each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Higher Education Funding Act 1988

After “institutions of’’, insert “undergraduate or”.

Note: The heading to section 13 is amended by omitting "Post-graduate” and substituting "Undergraduate and post-graduate".

Omit “post-graduate”.

Add:

(3) Guidelines issued under subsection (1) must ensure that, on an equivalent full-time student unit basis, the number of domestic students who may be charged fees for a particular undergraduate course does not exceed 25% of the total number of places available for domestic students in that course.

(4) Guidelines issued under subsection (1) must:

(a) require an institution not to charge a domestic student any fees for any undergraduate course in a year unless the institution meets the undergraduate target that applies for the purpose of calculating grants to the institution under section 15 or 16 for that year; and

(b) specify the amount that is applicable for the purposes of section 108 in respect of a breach of the requirement referred to in paragraph (a) of this subsection.

(5) In this section, domestic student means a student who is not an overseas student.

4 Paragraphs 20(3)(h), (i) and (j)

Repeal the paragraphs, substitute:

(h) in the case of the year 1996—$102,027,000; and

(i) in the case of the year 1997—$102,027,000; and

(j) in the case of the year 1998—$102,027,000.

Repeal the sections, substitute:

20A Grants for special purposes

(1) There is payable to an institution, as financial assistance in respect of a year, in relation to expenditure of the institution for such purposes as the Minister determines, such amount (the special purpose grant) as the Minister determines.

(2) The Minister may grant financial assistance to an institution under subsection (1) on such conditions (if any) as the Minister determines.

(3) The total of the special purpose grants in respect of a year must not exceed the amount set out in section 17 in respect of the following year.

(4) If the Minister determines a special purpose grant for an institution in respect of a year, then the amounts determined to be payable to the institution under section 15 or 16 in respect of:

(a) the year next following that year; or

(b) the 2 years next following that year; or

(c) the 3 years next following that year;

are reduced by amounts that equal in total the amount of the special purpose grant.

(5) Determinations under subsections (1) and (2), and reductions under subsection (4), must be made in accordance with guidelines issued by the Minister.

6 Paragraphs 22A(5)(e) and (f)

Repeal the paragraphs, substitute:

(e) for the year 1997—$215,000; and

(f) for the year 1998—$215,000.

Repeal the paragraph, substitute:

(e) for the year 1998—$467,843,000.

Repeal the paragraphs, substitute:

(i) in the case of the year 1997—$4,819,000; and

(j) in the case of the year 1998—$4,819,000.

9 Paragraphs 27A(6)(d) and (e)

Repeal the paragraphs, substitute:

(d) for the year 1997—$37,556,000; and

(e) for the year 1998—$37,556,000.

Insert:

annual Band amount has the meaning given by section 40A.

Insert:

Band has the meaning given by section 40A.

12 Subsection 34(1) (paragraph (b) of the definition of designated course of study)

Omit “postgraduate”

Insert:

(7) A student is an exempt student in relation to a course of study at an institution in respect of a semester if:

(a) the institution has awarded the student a merit-based equity scholarship for the course; and

(b) the institution awarded the scholarship in accordance with guidelines issued by the Minister for the purposes of this subsection.

Repeal the subsections, substitute:

Amount of contribution for pre-1997 student

(3) The contribution for a pre-1997 student is worked out using the formula:

Annual course contribution × Student load

where:

annual course contribution means the annual course contribution for the year in which the semester occurs.

student load means the student’s student load for the course in the semester, expressed as a proportion of the standard student load for the course in the year in which the semester occurs.

(4) For the purposes of this section, a student is a pre-1997 student in relation to a course of study if:

(a) the student commenced the course before 1997, as a contributing student; or

(b) the institution that provides the course has determined that the student is to be treated as a pre-1997 student in relation to the course, and that determination is made in accordance with guidelines issued by the Minister for the purposes of this subsection.

Amount of contribution for other students

(5) The contribution for a student (other than a pre-1997 student) is the total of the amounts worked out under subsection (6) for each of the Bands.

(6) The amount for a Band is worked out using the formula:

Annual Band amount × Student load for the Band

where:

annual Band amount means the annual Band amount for the Band for the year in which the semester occurs.

student load for the Band means the student’s student load for the course in the semester, for units of study in the Band, expressed as a proportion of the standard student load for the course in the year in which the semester occurs.

Cents to be disregarded

(7) If an amount worked out under subsection (3) or (5) includes any cents, the cents must be disregarded.

Insert:

40A Annual Band amounts that apply from 1997

(1) Each institution must allocate each relevant unit of study to one of the following Bands, in accordance with guidelines issued by the Minister:

(a) Band 3;

(b) Band 2;

(c) Band 1.

For this purpose, relevant unit of study means any unit of study that may be undertaken at the institution as part of a designated course of study in a year to which this Chapter applies.

(2) The annual Band amounts for 1997 are:

(a) $5,500 for Band 3; and

(b) $4,700 for Band 2; and

(c) $3,300 for Band 1.

(3) The annual Band amount for a Band for a later year is worked out by:

(a) multiplying the annual Band amount for that Band for the year before that later year by the factor that applies to the later year under subsection 40(3); and

(b) disregarding any cents.

(4) For each year from 1998 onwards, the Minister must:

(a) work out the annual Band amounts for the year concerned; and

(b) before the start of the year, publish a notice in the Gazette specifying those annual Band amounts and the factor that was used to work them out.

Omit “subsection 39(3)”, substitute “section 39”.

Omit “subsection 39(3)”, substitute “section 39”.

18 Subsection 99(1) (definition of basic charge)

Omit “subsection 104(2)”, substitute “section 104”.

Repeal the subsection.

Omit “the charges that, under the agreement referred to under subsection (1), the Agency may require those clients to pay”, substitute “the basic charges”.

Repeal the section, substitute:

104 Basic charge

(1) The basic charge for a unit of study is the lesser of:

(a) the statutory amount, worked out under this section; and

(b) the amount that the Agency charges for the unit.

(2) The statutory amount is $332 for 1997.

(3) The statutory amount for a later year is worked out by:

(a) multiplying the statutory amount for the year before that later year by the factor that applies to the later year under subsection 40(3); and

(b) disregarding any cents.

(4) For each year from 1998 onwards, the Minister must:

(a) work out the statutory amount for the year concerned; and

(b) before the start of the year, publish a notice in the Gazette specifying the statutory amount and the factor that was used to work it out.

Repeal the section.

Insert:

(1A) A reference in subsection (1) to a unit of study is a reference to a unit of study for which the client is enrolled for the purposes of an approved course of study.

(1B) Subsection (1) does not apply to any unit of study that is in excess of the client’s standard study load for the study period.

Omit “at any time”, substitute “on or before 31 December 1996”.

Insert:

(1A) Subsection (1) does not apply in relation to the 1997-98 year of income or any later year of income.

26 At the beginning of subsection 106Q(1)

Insert “Subject to subsection (7),”.

Repeal the subsection, substitute:

(4) For the purposes of this section:

(a) the minimum prescribed amount or MPA for a year of income is:

(i) for the 1997-98 year of income—$20,700; or

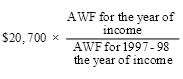

(ii) for a later year of income—the amount worked out using the formula:

(b) the first intermediate prescribed amount for a year of income is:

(i) for the 1997-98 year of income—$21,830; or

(ii) for a later year of income—the amount worked out using the formula:

![]()

(c) the second intermediate prescribed amount for a year of income is:

(i) for the 1997-98 year of income—$23,524; or

(ii) for a later year of income—the amount worked out using the formula:

![]()

C(d) the third intermediate prescribed amount for a year of income is:

(i) for the 1997-98 year of income—$27,288; or

(ii) for a later year of income—the amount worked out using the formula:

![]()

(e) the fourth intermediate prescribed amount for a year of income is:

(i) for the 1997-98 year of income—$32,934; or

(ii) for a later year of income—the amount worked out using the formula:

![]()

(f) the fifth intermediate prescribed amount for a year of income is:

(i) for the 1997-98 year of income—$34,665; or

(ii) for a later year of income—the amount worked out using the formula:

![]()

(g) the maximum prescribed amount for a year of income is:

(i) for the 1997-98 year of income—$37,262; or

(ii) for a later year of income—the amount worked out using the formula:

![]()

(4A) For the purposes of paragraph (4)(a), AWE for a year of income is the number of dollars in the sum of:

(a) the average weekly earnings for all employees for the reference period in the December quarter immediately before the year of income, as published by the Australian Statistician; and

(b) the average weekly earnings for all employees for the reference period in each of the 4 quarters immediately before that December quarter, as published by the Australian Statistician.

(4B) If an amount worked out for the purposes of subsection (4) includes any cents, the cents must be disregarded.

Omit “(4)”, substitute “(4A)”.

29 Application of amendments made by items 27 and 28

The amendments made by items 27 and 28 apply to the 1997-98 year of income and later years of income.

Omit “each following”, substitute “the 1998-99 year of income or a later”.

Add:

(7) Subsection (1) does not require a person to pay an amount for a year of income if, under section 8 of the Medicare Levy Act 1981:

(a) no Medicare levy is payable by the person on the person’s taxable income for the year of income; or

(b) the amount of Medicare levy payable by the person on the person’s taxable income for the year of income is reduced.

32 Application of amendments made by items 26 and 31

The amendments made by items 26 and 31 apply to the 1997-98 year of income and later years of income.

Repeal the paragraph, substitute:

(c) guidelines issued under section 20A, 26 or 27, paragraph 35(7)(b), subsection 36(3) or 39(4) or section 40A.

Omit “post-graduate”, substitute “undergraduate or post-graduate”.

Omit “post-graduate”.

[Minister’s second reading speech made in—

House of Representatives on 9 October 1996

Senate on 4 November 1996]