Chapter 3—Specialist liability rules

Part 3‑32—Co‑operatives and mutual entities

Division 315—Demutualisation of private health insurers

Table of Subdivisions

Guide to Division 315

315‑A Capital gains and losses connected with a demutualisation of a private health insurer to be disregarded

315‑B Cost base of certain shares and rights in private health insurers

315‑C Lost policy holders trust

315‑D Special cost base rules for certain shares and rights in holding companies

315‑E Special CGT rule for legal personal representatives and beneficiaries

315‑F Non‑CGT consequences of demutualisation

Guide to Division 315

315‑1 What this Division is about

This Division sets out the taxation consequences of the demutualisation of private health insurers.

Policy holders, demutualising health insurers and certain other entities can disregard capital gains and losses arising under a demutualisation (see Subdivision 315‑A).

Shares and rights issued under the demutualisation are given a cost base based on the market value of the demutualising health insurer at the time of issue (see Subdivisions 315‑B and 315‑D).

Assets held by a lost policy holders trust are given roll‑over relief if transferred to the lost policy holder, or if the lost policy holder becomes absolutely entitled to them. Otherwise the trustee of the lost policy holders trust is taxed on any capital gains (see Subdivision 315‑C).

A legal personal representative can disregard capital gains and losses made when passing an asset to a beneficiary of a policy holder’s estate (see Subdivision 315‑E).

Shares, rights or cash received under a demutualisation are not assessable income and not exempt income (see Subdivision 315‑F).

Subdivision 315‑A—Capital gains and losses connected with a demutualisation of a private health insurer to be disregarded

Table of sections

Rules for policy holders

315‑5 Policy holders to disregard capital gains and losses related to demutualisation of private health insurer

315‑10 Effect on the legal personal representative or beneficiary

315‑15 Demutualisations to which this Division applies

315‑20 What assets are covered

Rules for demutualising health insurer

315‑25 Demutualising health insurers to disregard capital gains and losses related to demutualisation

Rules for other entities

315‑30 Other entities to disregard capital gains and losses related to demutualisation

Rules for policy holders

315‑5 Policy holders to disregard capital gains and losses related to demutualisation of private health insurer

Disregard a *capital gain or *capital loss of an individual from a *CGT event that happens in relation to a *CGT asset if:

(a) the CGT event happens under a demutualisation to which this Division applies; and

(b) the individual is, or has been, a policy holder (within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015) of, or another person insured through, the demutualising entity (the demutualising health insurer); and

(c) the CGT asset is covered by section 315‑20.

315‑10 Effect on the legal personal representative or beneficiary

Disregard a *capital gain or *capital loss of an entity from a *CGT event that happens in relation to a *CGT asset if:

(a) the CGT asset forms part of the estate of a deceased individual who is mentioned in paragraph 315‑5(b); and

(b) the entity is the deceased individual’s *legal personal representative or a beneficiary in the deceased individual’s estate; and

(c) the CGT asset devolves to the entity or *passes to the entity; and

(d) the CGT event happens under a demutualisation to which this Division applies; and

(e) the CGT asset is covered by section 315‑20.

315‑15 Demutualisations to which this Division applies

This Division applies to a demutualisation of an entity if:

(a) the entity:

(i) is an entity to which item 6.3 of the table in section 50‑30 applies; and

(ii) is not registered under Part 3 of the Life Insurance Act 1995; and

(iia) is not an entity to whose demutualisation Division 316 applies; and

(iii) does not have capital divided into shares; and

Note: Item 6.3 of the table in section 50‑30 applies to a private health insurer within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015 that is not carried on for the profit or gain of its individual members.

(b) an application by the entity to convert to being registered as a for profit insurer (within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015) is approved under subsection 20(5) of that Act; and

(c) consistently with the conversion scheme mentioned in paragraph 20(2)(a) of that Act, the entity becomes registered as a for profit insurer (within the meaning of that Act).

315‑20 What assets are covered

These *CGT assets are covered:

(a) an interest in the demutualising health insurer as a policy holder;

(b) a membership interest in the demutualising health insurer;

(c) a right or interest of another kind in the demutualising health insurer;

(d) a right or interest of another kind that arises under the demutualisation.

Rules for demutualising health insurer

315‑25 Demutualising health insurers to disregard capital gains and losses related to demutualisation

Disregard a *capital gain or *capital loss of an entity from a *CGT event if:

(a) the CGT event happened under a demutualisation to which this Division applies; and

(b) the entity is the demutualising health insurer.

Rules for other entities

315‑30 Other entities to disregard capital gains and losses related to demutualisation

Disregard a *capital gain or *capital loss of an entity from a *CGT event if:

(a) the entity is established solely for the purpose of participating in a demutualisation to which this Division applies; and

(b) the entity is not a trust covered by Subdivision 315‑C (about lost policy holders); and

(c) the CGT event:

(i) happened under a demutualisation to which this Division applies; and

(ii) happened before or at the same time as the allocation or distribution (in the form of shares or cash) of the accumulated surplus of the demutualising health insurer; and

(iii) was connected to that allocation or distribution.

Note: The allocation or distribution of the accumulated surplus could happen through an arrangement involving more than one transaction.

Subdivision 315‑B—Cost base of certain shares and rights in private health insurers

Table of sections

315‑80 Cost base and acquisition time of demutualisation assets

315‑85 Demutualisation asset

315‑90 Participating policy holders

315‑80 Cost base and acquisition time of demutualisation assets

Cost base adjustment

(1) The first element of the *cost base and *reduced cost base of a *CGT asset is its *market value on the day it is issued if:

(a) the asset is covered by section 315‑85 (a demutualisation asset); and

(b) the asset is issued to an entity (a participating policy holder) covered by section 315‑90.

Note: There is an exception to this rule in Subdivision 315‑D where the asset is a share or right in a holding company with other assets.

Acquisition rule

(2) The participating policy holder is taken to have *acquired the demutualisation asset at the time it is issued.

315‑85 Demutualisation asset

(1) This section covers an asset if:

(a) the asset is:

(i) a share in the demutualising health insurer; or

(ii) a right to *acquire a share in the demutualising health insurer; or

(iii) a share in an entity that owns all of the shares in the demutualising health insurer; or

(iv) a right to acquire a share in an entity mentioned in subparagraph (iii); and

(b) the share or right is issued under a demutualisation to which this Division applies; and

(c) the share or right is issued in connection with:

(i) the variation or abrogation of rights attaching to or consisting of a *CGT asset covered by section 315‑20; or

(ii) the conversion, cancellation, extinguishment or redemption of such a CGT asset.

Exclusion for rights with an exercise price

(2) Despite subsection (1), this section does not cover a right to *acquire a share in an entity if the holder of the right must pay an amount to exercise the right.

Exclusion where assets not issued simultaneously

(3) Despite subsection (1), an asset is not covered by this section unless all of the assets covered by subsection (1) for the demutualisation in question are issued:

(a) at the same time; and

(b) to an entity that is either:

(i) a participating policy holder (see section 315‑90); or

(ii) the trustee of a trust covered by Subdivision 315‑C (about the lost policy holders trust).

315‑90 Participating policy holders

(1) This section covers an individual who:

(a) is, or has been, a policy holder (within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015) of, or another person insured through, the demutualising health insurer; and

(b) is entitled, under the demutualisation, to an allocation of demutualisation assets.

(2) This section also covers an entity who became entitled to an allocation of demutualisation assets because of the death of an individual mentioned in subsection (1).

Subdivision 315‑C—Lost policy holders trust

Table of sections

315‑140 Lost policy holders trust

315‑145 CGT treatment of demutualisation assets in lost policy holders trust

315‑150 Roll‑over where assets transferred to lost policy holder

315‑155 Trustee assessed if assets dealt with not for benefit of lost policy holder

315‑160 Subdivision 126‑E does not apply to lost policy holders trust

315‑140 Lost policy holders trust

This Subdivision covers a trust (a lost policy holders trust) in relation to a demutualisation to which this Division applies if:

(a) the conversion scheme mentioned in paragraph 20(2)(a) of the Private Health Insurance (Prudential Supervision) Act 2015 for the demutualisation provides for the trust; and

(b) under the demutualisation, demutualisation assets (see section 315‑85) are issued to the trustee of the trust; and

(c) the trust exists solely for the purpose of holding shares or rights to *acquire shares on behalf of:

(i) individuals (lost policy holders) who are, or have been, policy holders (within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015) of, or other persons insured through, the demutualising health insurer; or

(ii) if the lost policy holder has died—the *legal personal representative of the lost policy holder or a beneficiary in the estate of the lost policy holder.

Example: An example of an individual on whose behalf the trust might hold assets would be an individual who has not completed a formal step required for them to be issued with demutualisation assets directly. Another example might be an individual living overseas.

315‑145 CGT treatment of demutualisation assets in lost policy holders trust

Cost base adjustment

(1) The first element of the *cost base and *reduced cost base of a demutualisation asset issued to the trustee of a lost policy holders trust is its *market value on the day it is issued.

Note: There is an exception to this rule in Subdivision 315‑D where the asset is a share or right in a holding company with other assets.

Acquisition rule

(2) The trustee is taken to have *acquired the demutualisation asset at the time it is issued.

315‑150 Roll‑over where assets transferred to lost policy holder

(1) This section applies in relation to a *CGT event if:

(a) the CGT event happens in relation to an asset held by the trustee of a lost policy holders trust on behalf of a lost policy holder; and

(b) the CGT event happens because the lost policy holder (or, if the lost policy holder has died, the *legal personal representative of the lost policy holder or a beneficiary in the estate of the lost policy holder) either:

(i) is transferred the asset by the trustee; or

(ii) becomes absolutely entitled to the asset.

Note: The asset may be a demutualisation asset, or some other asset.

Consequence for trustee

(2) Disregard a *capital gain or *capital loss the trustee makes from the *CGT event.

Consequence for lost policy holder

(3) The *cost base of the asset in the hands of the trustee of the lost policy holders trust just before the *CGT event becomes the first element of the cost base and *reduced cost base of the asset in the hands of the lost policy holder, *legal personal representative or beneficiary.

(4) The lost policy holder, *legal personal representative or beneficiary is taken to have *acquired the asset when the trustee of the lost policy holders trust acquired it.

315‑155 Trustee assessed if assets dealt with not for benefit of lost policy holder

(1) This section applies in relation to a *capital gain from a *CGT event if:

(a) the CGT event happens in relation to an asset held by the trustee of a lost policy holders trust; and

(b) section 315‑150 does not apply to the CGT event.

(2) If this section applies:

(a) sections 115‑215 and 115‑220 do not apply in relation to the *capital gain; and

(b) for the purposes of this Act, the trustee is taken to be *specifically entitled to all of the capital gain.

315‑160 Subdivision 126‑E does not apply to lost policy holders trust

Subdivision 126‑E does not apply in relation to a demutualisation to which this Division applies.

Subdivision 315‑D—Special cost base rules for certain shares and rights in holding companies

Table of sections

315‑210 Cost base for shares and rights in certain holding companies

315‑210 Cost base for shares and rights in certain holding companies

(1) This section applies in relation to a *CGT asset that is a demutualisation asset if:

(a) the demutualisation asset is:

(i) a share in an entity mentioned in subparagraph 315‑85(1)(a)(iii); or

(ii) a right to *acquire a share in an entity mentioned in that subparagraph; and

(b) the entity owns other assets in addition to the shares in the demutualising health insurer; and

(c) the share or right is issued to a participating policy holder or the trustee of a lost policy holders trust.

This section applies despite sections 315‑80 and 315‑145.

Cost base adjustment

(2) The first element of the *cost base and *reduced cost base of the *CGT asset is worked out under the method statement.

Method statement

Step 1. Start with the *market value of the demutualising health insurer on the day the asset is issued.

Step 2. Divide the result of step 1 by the sum of:

(a) the number of shares in the entity that are issued under the demutualisation; and

(b) the number of shares in the entity that can be *acquired under rights that are demutualisation assets issued under the demutualisation.

Step 3. The result of step 2 is the first element of the *cost base and *reduced cost base of the asset, unless the asset is a right.

Step 4. If the asset is a right, multiply the result of step 2 by the number of shares that can be *acquired under the right. The result is the first element of the *cost base and *reduced cost base of the asset.

Example: Wellbeing Health demutualises on 1 April 2008 and has a market value of $400 million on that day. It distributes its accumulated mutual surplus in the form of rights to acquire shares in its holding company Healthiness Insurance Ltd (Healthiness). The rights do not have an exercise price.

A total of 800 million shares can be acquired in Healthiness under rights issued under the demutualisation. Each right allows the holder to acquire 50 shares. No shares in Healthiness are issued.

Under the method statement, the first element of the cost base and reduced cost base of each right is worked out by dividing the market value of Wellbeing Health (step 1) by the number of shares in Healthiness that can be acquired under the demutualisation (step 2) and multiplying the result by the number of shares that can be acquired under the right (step 4):

Acquisition rule

(3) The participating policy holder or trustee is taken to have *acquired the *CGT asset at the time it is issued.

Subdivision 315‑E—Special CGT rule for legal personal representatives and beneficiaries

Table of sections

315‑260 Special CGT rule for legal personal representatives and beneficiaries

315‑260 Special CGT rule for legal personal representatives and beneficiaries

(1) This section sets out what happens if a *CGT asset:

(a) is a demutualisation asset; and

(b) forms part of the estate of a participating policy holder mentioned in subsection 315‑90(1) who has died, but was not owned by the policy holder just before dying; and

(c) *passes to a beneficiary in the policy holder’s estate because the asset is transferred to the beneficiary by the policy holder’s *legal personal representative.

Note: Division 128 deals with the effect of death in relation to CGT assets a person owns just before dying.

(2) Disregard a *capital gain or *capital loss the *legal personal representative makes if the asset *passes to a beneficiary in the policy holder’s estate.

Consequence for beneficiary

(3) The *cost base and *reduced cost base of the asset in the hands of the *legal personal representative just before the asset *passes to the beneficiary becomes the first element of the cost base and reduced cost base of the asset in the hands of the beneficiary.

(4) The beneficiary is taken to have *acquired the asset when the *legal personal representative acquired it.

Subdivision 315‑F—Non‑CGT consequences of demutualisation

Table of sections

315‑310 General taxation consequences of issue of demutualisation assets etc.

315‑310 General taxation consequences of issue of demutualisation assets etc.

(1) An amount of *ordinary income or *statutory income of an entity to which subsection (2) applies is not assessable and not *exempt income if:

(a) the amount would otherwise be included in the ordinary income or statutory income of the entity only because a demutualisation asset was issued to the entity; or

(b) the amount is a payment made to the entity, under a demutualisation to which this Division applies, in connection with:

(i) the variation or abrogation of rights attaching to or consisting of a *CGT asset covered by section 315‑20; or

(ii) the conversion, cancellation, extinguishment or redemption of such a CGT asset.

(2) This subsection applies to an entity that:

(a) is, or has been, a policy holder (within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015) of, or another person insured through, the demutualising health insurer; or

(b) is issued with the demutualisation asset, or receives the payment, because of the death of a policy holder mentioned in paragraph (a).

Division 316—Demutualisation of friendly society health or life insurers

Table of Subdivisions

Guide to Division 316

316‑A Application

316‑B Capital gains and losses connected with the demutualisation

316‑C Cost base of shares and rights issued under the demutualisation

316‑D Lost policy holders trust

316‑E Special CGT rules for legal personal representatives and beneficiaries

316‑F Non‑CGT consequences of the demutualisation

Guide to Division 316

316‑1 What this Division is about

Special tax consequences follow the demutualisation of a friendly society that provides health insurance or life insurance, or has a wholly‑owned subsidiary that does.

Subdivision 316‑A—Application

Table of sections

316‑5 Application of this Division

316‑5 Application of this Division

This Division applies in relation to a demutualisation of a *friendly society if:

(a) the society is, or has a *wholly‑owned subsidiary (a health/life insurance subsidiary) that is:

(i) a private health insurer as defined in the Private Health Insurance (Prudential Supervision) Act 2015; or

(ii) a company registered under section 21 of the Life Insurance Act 1995; and

(b) the society does not have capital divided into *shares held by its *members; and

(c) after the demutualisation the society is to be carried on for the object of securing a profit or pecuniary gain for its *members.

Subdivision 316‑B—Capital gains and losses connected with the demutualisation

Guide to Subdivision 316‑B

316‑50 What this Subdivision is about

Disregard capital gains and losses made by any entity from a CGT event happening under the demutualisation, unless the entity:

(a) is or has been a member of the friendly society or insured through the society or any of its wholly‑owned subsidiaries; and

(b) receives money for the event.

Table of sections

Gains and losses of members, insured entities and successors

316‑55 Disregarding capital gains and losses, except some involving receipt of money

316‑60 Taking account of some capital gains and losses involving receipt of money

316‑65 Valuation factor for sections 316‑60, 316‑105 and 316‑165

316‑70 Value of the friendly society

Friendly society’s gains and losses

316‑75 Disregarding friendly society’s capital gains and losses

Other entities’ gains and losses

316‑80 Disregarding other entities’ capital gains and losses

Gains and losses of members, insured entities and successors

316‑55 Disregarding capital gains and losses, except some involving receipt of money

(1) Disregard an entity’s *capital gain or *capital loss from a *CGT event that happens under the demutualisation to a *CGT asset if:

(a) the entity:

(i) is or has been a *member of the *friendly society; or

(ii) is or has been insured through the friendly society or a health/life insurance subsidiary of the friendly society; and

(b) the CGT asset is one of these (an interest affected by demutualisation):

(i) an interest in the friendly society as the owner or holder of a policy of insurance with the friendly society or health/life insurance subsidiary;

(ii) a *membership interest in the friendly society;

(iii) a right or interest of another kind in the friendly society;

(iv) a right or interest of another kind that arises under the demutualisation, except an interest in a lost policy holders trust (see section 316‑155).

Note: Subdivision 316‑D deals with the effects of CGT events happening to interests in lost policy holders trusts.

(2) Disregard a *capital gain or *capital loss of an entity (the successor) from a *CGT event that happens under the demutualisation to a *CGT asset if:

(a) the successor is the *legal personal representative, or beneficiary in the estate, of a deceased individual who was:

(i) a *member of the *friendly society; or

(ii) insured through the friendly society or a health/life insurance subsidiary of the friendly society; and

(b) the CGT asset:

(i) forms part of the deceased individual’s estate; and

(ii) devolves or *passes to the successor; and

(iii) is an interest affected by demutualisation (see paragraph (1)(b)).

316‑60 Taking account of some capital gains and losses involving receipt of money

(1) This section applies if:

(a) a *CGT event happens under the demutualisation to an entity’s interest affected by demutualisation (see section 316‑55); and

(b) the event involves:

(i) the variation or abrogation of rights attaching to or consisting of the interest; or

(ii) the conversion, cancellation, extinguishment or redemption of the interest; and

(c) either:

(i) the entity is one described in paragraph 316‑55(1)(a); or

(ii) the entity is one described in paragraph 316‑55(2)(a) and the interest is a *CGT asset described in paragraph 316‑55(2)(b); and

(d) the *capital proceeds from the event include or consist of money received by the entity.

(2) Work out whether the entity makes a *capital gain or *capital loss from the *CGT event, and the amount of the gain or loss, assuming that:

(a) the *capital proceeds from the CGT event were the amount they would be if they did not include any *market value of property other than money; and

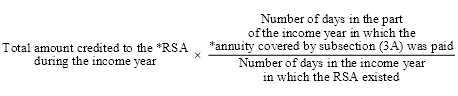

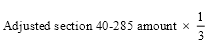

(b) the *cost base and *reduced cost base for the interest were the amount worked out using the formula:

Example: Assume the entity receives $50 in money and 10 shares with a market value of $4 each in respect of CGT event C2 happening, and that the valuation factor worked out under section 316‑65 is 0.9. The entity makes a capital gain from the event of $5, worked out as follows:

This ignores the market value of the shares because they are property other than money.

Note: Division 114 (Indexation of cost base) is not relevant, because this section provides exhaustively for working out the amount of the cost base.

(3) The *capital gain or *capital loss is not to be disregarded, despite:

(a) section 316‑55; and

(b) any provision of this Act for disregarding the *capital gain or *capital loss because the interest affected by demutualisation was *acquired before 20 September 1985.

Note: The capital gain is not a discount capital gain: see section 115‑55.

316‑65 Valuation factor for sections 316‑60, 316‑105 and 316‑165

(1) For the purposes of sections 316‑60, 316‑105 and 316‑165, the valuation factor is the amount worked out using the formula:

where:

embedded value of the friendly society’s other business (if any) means the amount that would be the value of the *friendly society worked out under section 316‑70 assuming that neither the friendly society, nor any health/life insurance subsidiary of it, carried on any health insurance business within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015.

market value of the friendly society’s health insurance business (if any) means the total *market value of every health insurance business, within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015, carried on by either or both of the *friendly society and its health/life insurance subsidiaries (if any), taking account of any consideration paid to the society or subsidiary for disposal or control of that business.

(2) Disregard paragraph 316‑60(2)(a) for the purposes of the formula in subsection (1) of this section.

316‑70 Value of the friendly society

(1) The value of the *friendly society is the sum, worked out in accordance with this section, of the friendly society’s existing business value and its adjusted net worth on the day (the applicable accounting day) identified under subsection (3).

Eligible actuary and Australian actuarial practice

(2) The sum is to be worked out, according to Australian actuarial practice, by an *actuary who is not an employee of:

(a) the *friendly society; or

(b) a health/life insurance subsidiary of the friendly society; or

(c) an entity of which the friendly society is to become a *wholly‑owned subsidiary under the demutualisation.

Applicable accounting day

(3) The applicable accounting day is:

(a) if an accounting period of the *friendly society ends on the day (the demutualisation resolution day) identified under subsection (4)—that day; or

(b) in any other case—the last day of the most recent accounting period of the friendly society ending before the demutualisation resolution day.

Demutualisation resolution day

(4) The demutualisation resolution day is:

(a) the day on which the resolution to proceed with the demutualisation is passed; or

(b) if, under the demutualisation, the whole of the *life insurance business of the *friendly society or of a health/life insurance subsidiary of the friendly society is transferred to another company under a scheme confirmed by the Federal Court of Australia—the day (or the last day) on which the transfer takes place.

Adjustment for changes after applicable accounting day

(5) In a case covered by paragraph (3)(b), if any significant change in the amount of the existing business value or adjusted net worth occurs between the applicable accounting day and the demutualisation resolution day, the amount is to be adjusted to take account of the change.

Continued business assumption

(6) In working out the existing business value or the adjusted net worth, assume:

(a) that after the applicable accounting day the *friendly society, and any health/life insurance subsidiary of the friendly society, will continue to conduct *business and any other activity in the same way as before that day, and will not conduct any different business or other activity; and

(b) that the demutualisation will not occur; and

(c) that any health/life insurance subsidiary of the friendly society will continue to be a *wholly‑owned subsidiary of the friendly society.

Expenditure assumption

(7) In working out the existing business value, assume that expenditure that the *friendly society and any of its health/life insurance subsidiaries will incur, in conducting *business, on recurring items after the demutualisation resolution day will be of the same kinds and amounts (increased to take account of any inflation) as it incurred in the accounting period, or part of an accounting period, ending on the demutualisation resolution day.

Friendly society’s gains and losses

316‑75 Disregarding friendly society’s capital gains and losses

Disregard the *friendly society’s *capital gain or *capital loss from a *CGT event that happens under the demutualisation.

Other entities’ gains and losses

316‑80 Disregarding other entities’ capital gains and losses

Disregard an entity’s *capital gain or *capital loss from a *CGT event that happens under the demutualisation if:

(a) the entity is established solely for the purpose of participating in the demutualisation and is not a lost policy holders trust (see section 316‑155); and

(b) the CGT event:

(i) happens before or at the same time as the allocation or distribution of the accumulated surplus of the *friendly society; and

(ii) is connected to that allocation or distribution.

Note: The allocation or distribution of the accumulated surplus could happen through an arrangement involving more than one transaction.

Subdivision 316‑C—Cost base of shares and rights issued under the demutualisation

Guide to Subdivision 316‑C

316‑100 What this Subdivision is about

The value of the friendly society and its business affects cost bases of shares and certain rights issued under the demutualisation to:

(a) entities that are or were members of the friendly society; or

(b) entities insured through the society or its subsidiaries; or

(c) successors of such entities; or

(d) the trustee of the lost policy holders trust.

Table of sections

316‑105 Cost base and time of acquisition of shares and certain rights issued under demutualisation

316‑110 Demutualisation assets

316‑115 Entities to which section 316‑105 applies

316‑105 Cost base and time of acquisition of shares and certain rights issued under demutualisation

First element of cost base

(1) The first element of the *cost base and *reduced cost base of a *CGT asset is the amount worked out using the formula in subsection (2) if:

(a) the asset is a CGT asset (a demutualisation asset) covered by section 316‑110; and

(b) the asset is issued to an entity covered by section 316‑115.

(2) The formula is:

Time of acquisition

(3) The entity is taken to have *acquired the *CGT asset at the time it is issued.

316‑110 Demutualisation assets

(1) This section covers a *CGT asset that:

(a) is:

(i) a *share in the *friendly society; or

(ii) a right to *acquire a share in the friendly society; or

(iii) a share in an entity that owns all of the shares in the friendly society; or

(iv) a right to acquire a share in an entity mentioned in subparagraph (iii); and

(b) is issued under the demutualisation; and

(c) is issued in connection with:

(i) the variation or abrogation of rights attaching to or consisting of an interest affected by demutualisation (see paragraph 316‑55(1)(b)); or

(ii) the conversion, cancellation, extinguishment or redemption of an interest affected by demutualisation.

Exclusion for rights with an exercise price

(2) Despite subsection (1), this section does not cover a right to *acquire a *share in an entity if the holder of the right must pay an amount to exercise the right.

Exclusion where assets not issued simultaneously

(3) Despite subsection (1), a *CGT asset is not covered by this section unless all of the CGT assets covered by subsection (1) for the demutualisation are issued:

(a) at the same time; and

(b) to entities that are covered by section 316‑115.

316‑115 Entities to which section 316‑105 applies

(1) This section covers an entity that:

(a) either:

(i) is or has been a *member of the *friendly society; or

(ii) is or has been insured through the friendly society or a health/life insurance subsidiary of the friendly society; and

(b) is entitled under the demutualisation to an allocation of demutualisation assets.

(2) This section also covers an entity that has become entitled to an allocation of demutualisation assets because of the death of an individual who was an entity described in subsection (1).

(3) This section also covers the trustee of a lost policy holders trust (see section 316‑155).

Subdivision 316‑D—Lost policy holders trust

Guide to Subdivision 316‑D

316‑150 What this Subdivision is about

If the demutualisation creates a trust just to hold shares, rights to acquire shares or money for entities that were members of the friendly society or insured through the society or its subsidiary, or are successors of such entities, then:

(a) capital gains or losses from CGT events happening to beneficiaries’ interests in the trust are disregarded, except where the capital proceeds include money; and

(b) when a CGT event happens involving the transfer of the shares or rights to a beneficiary, or a beneficiary’s absolute entitlement to them, the trustee’s capital gain or loss is disregarded and the beneficiary has the same cost base and time of acquisition as the trustee; and

(c) the trustee is assessed on any capital gains from other CGT events happening to the shares or rights.

Table of sections

Application

316‑155 Lost policy holders trust

Effects of CGT events happening to interests and assets in trust

316‑160 Disregarding beneficiaries’ capital gains and losses, except some involving receipt of money

316‑165 Taking account of some capital gains and losses involving receipt of money by beneficiaries

316‑170 Roll‑over where shares or rights to acquire shares transferred to beneficiary of lost policy holders trust

316‑175 Trustee assessed if shares or rights dealt with not for benefit of beneficiary of lost policy holders trust

316‑180 Subdivision 126‑E does not apply

Application

316‑155 Lost policy holders trust

(1) This Subdivision applies if the conditions in subsections (2) and (5) are met.

First condition

(2) The first condition is that, under the demutualisation, a trust (the lost policy holders trust) exists solely for one or both of the purposes that are described in subsection (3) in relation to persons (beneficiaries of the lost policy holders trust) covered by subsection (4).

(3) The purposes are as follows:

(a) holding demutualisation assets (see section 316‑110) that are *shares or rights to *acquire shares, or proceeds from disposal of those assets, on behalf of one or more beneficiaries of the lost policy holders trust and transferring those assets or proceeds to those beneficiaries;

(b) holding on behalf of one or more beneficiaries of the lost policy holders trust, and paying to them, money payable to them for:

(i) the variation or abrogation of rights attaching to or consisting of the beneficiaries’ interests affected by demutualisation (see paragraph 316‑55(1)(b)); or

(ii) the conversion, cancellation, extinguishment or redemption of those interests.

(4) This subsection covers:

(a) a person who is or has been a *member of the friendly society or is or has been insured through the *friendly society or a health/life insurance subsidiary of the friendly society; and

(b) a *legal personal representative, or beneficiary in the estate, of such a person who has died.

Second condition

(5) The second condition is that, under the demutualisation, the trustee of the lost policy holders trust is:

(a) issued with demutualisation assets that are *shares, or rights to *acquire shares; or

(b) paid money described in paragraph (3)(b) to hold and pay to beneficiaries of the lost policy holders trust.

Effects of CGT events happening to interests and assets in trust

316‑160 Disregarding beneficiaries’ capital gains and losses, except some involving receipt of money

Disregard a *capital gain or *capital loss of a beneficiary of the lost policy holders trust from a *CGT event that happens to the beneficiary’s interest in the trust.

316‑165 Taking account of some capital gains and losses involving receipt of money by beneficiaries

(1) This section applies if:

(a) a *CGT event happens to an interest of a beneficiary of the lost policy holders trust in that trust; and

(b) the *capital proceeds from the event include or consist of money received by the beneficiary.

(2) Work out whether the beneficiary makes a *capital gain or *capital loss from the *CGT event, and the amount of the gain or loss, assuming that:

(a) the *capital proceeds from the CGT event were the amount they would be if they did not include any *market value of property other than money; and

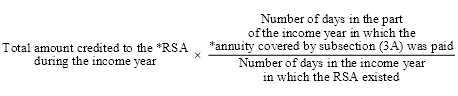

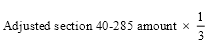

(b) the *cost base and *reduced cost base for the interest were the amount worked out using the formula:

Example: Assume that the beneficiary of the lost policy holders trust is paid $50 in money by the trustee to satisfy the beneficiary’s interest in the trust so that a CGT event happens, and that the valuation factor worked out under section 316‑65 is 0.9. The beneficiary makes a capital gain from the event of $5, worked out as follows:

Note: Division 114 (Indexation of cost base) is not relevant, because this section provides exhaustively for working out the amount of the cost base.

(3) The *capital gain or *capital loss is not to be disregarded, despite sections 316‑55 and 316‑160.

Note: The capital gain is not a discount capital gain: see section 115‑55.

316‑170 Roll‑over where shares or rights to acquire shares transferred to beneficiary of lost policy holders trust

(1) This section applies in relation to a *CGT event if:

(a) the CGT event happens in relation to an asset that:

(i) is a *share or a right to *acquire one or more shares; and

(ii) is held by the trustee of the lost policy holders trust on behalf of a beneficiary of the lost policy holders trust; and

(b) the CGT event happens because the beneficiary of the lost policy holders trust either:

(i) is transferred the asset by the trustee; or

(ii) becomes absolutely entitled to the asset.

Consequence for trustee

(2) Disregard a *capital gain or *capital loss the trustee makes from the *CGT event.

Consequences for beneficiary

(3) The *cost base and *reduced cost base of the asset in the hands of the trustee of the lost policy holders trust just before the *CGT event becomes the first element of the cost base and reduced cost base of the asset in the hands of the beneficiary of the lost policy holders trust.

Note: Section 316‑105 affects the cost base of the asset in the hands of the trustee of the lost policy holders trust if the asset is covered by section 316‑110.

(4) The beneficiary of the lost policy holders trust is taken to have *acquired the asset when the trustee acquired it.

316‑175 Trustee assessed if shares or rights dealt with not for benefit of beneficiary of lost policy holders trust

(1) This section applies in relation to a *capital gain from a *CGT event if:

(a) the CGT event happens in relation to a demutualisation asset that:

(i) is a *share or a right to *acquire a share; and

(ii) is held by the trustee of a lost policy holders trust; and

(b) section 316‑170 does not apply to the CGT event.

(2) If this section applies:

(a) sections 115‑215 and 115‑220 do not apply in relation to the *capital gain; and

(b) for the purposes of this Act, the trustee is taken to be *specifically entitled to all of the capital gain.

316‑180 Subdivision 126‑E does not apply

Subdivision 126‑E does not apply in relation to the demutualisation.

Note: Subdivision 126‑E is about an entitlement to shares after demutualisation and scrip for scrip roll‑over.

Subdivision 316‑E—Special CGT rules for legal personal representatives and beneficiaries

Table of sections

316‑200 Demutualisation assets not owned by deceased but passing to beneficiary in deceased estate

316‑205 Interest in lost policy holders trust not owned by deceased but passing to beneficiary in deceased estate

316‑200 Demutualisation assets not owned by deceased but passing to beneficiary in deceased estate

(1) This section sets out what happens if a *CGT asset:

(a) is a demutualisation asset (see section 316‑110); and

(b) forms part of the estate of an individual who is an entity described in subsection 316‑115(1) and has died; and

(c) was not owned by the individual just before dying; and

(d) *passes to a beneficiary in the individual’s estate because the asset is transferred to the beneficiary by the individual’s *legal personal representative.

Note: Division 128 deals with the effect of death in relation to CGT assets a person owns just before dying.

Consequence for legal personal representative

(2) Disregard a *capital gain or *capital loss the *legal personal representative makes because the asset *passes to the beneficiary.

Consequence for beneficiary

(3) The *cost base and *reduced cost base of the asset in the hands of the *legal personal representative just before the asset *passes to the beneficiary becomes the first element of the cost base and reduced cost base of the asset in the hands of the beneficiary.

(4) The beneficiary is taken to have *acquired the asset when the *legal personal representative acquired it.

316‑205 Interest in lost policy holders trust not owned by deceased but passing to beneficiary in deceased estate

(1) This section sets out what happens if a *CGT asset:

(a) is an interest in a lost policy holders trust (see section 316‑155); and

(b) forms part of the estate of an individual who is an entity described in subsection 316‑115(1) and has died; and

(c) was not owned by the individual just before dying; and

(d) *passes to a beneficiary in the individual’s estate because the asset is transferred to the beneficiary by the individual’s *legal personal representative.

Note: Division 128 deals with the effect of death in relation to CGT assets a person owns just before dying.

Consequence for legal personal representative

(2) Disregard a *capital gain or *capital loss the *legal personal representative makes because the asset *passes to the beneficiary.

Subdivision 316‑F—Non‑CGT consequences of the demutualisation

Guide to Subdivision 316‑F

316‑250 What this Subdivision is about

In many cases, income from demutualisation is assessed through the CGT provisions rather than as ordinary income or other statutory income.

Franking debits arise for the friendly society and its subsidiaries to ensure they do not enjoy a franking surplus. Franking debits and credits arise to negate credits and debits from things attributable to the time before demutualisation.

Table of sections

316‑255 General taxation consequences of issue of demutualisation assets etc.

316‑260 Franking debits to stop the friendly society and its subsidiaries having franking surpluses

316‑265 Franking debits to negate franking credits from some distributions to friendly society and subsidiaries

316‑270 Franking debits to negate franking credits from post‑demutualisation payments of pre‑demutualisation tax

316‑275 Franking credits to negate franking debits from refunds of tax paid before demutualisation

316‑255 General taxation consequences of issue of demutualisation assets etc.

(1) An amount of *ordinary income or *statutory income (other than a *net capital gain) of an entity covered by subsection (2) is not assessable income and is not *exempt income if:

(a) the amount would otherwise be included in the ordinary income or statutory income of the entity only because a demutualisation asset (see section 316‑110) was issued to the entity; or

(b) the amount is a payment made to the entity, under the demutualisation, in connection with:

(i) the variation or abrogation of rights attaching to or consisting of an interest affected by demutualisation (see paragraph 316‑55(1)(b)); or

(ii) the conversion, cancellation, extinguishment or redemption of an interest affected by demutualisation; or

(c) the amount would otherwise be included in the ordinary income or statutory income of the entity only because a *share or a right to *acquire one or more shares was transferred to the entity by the trustee of a lost policy holders trust (see section 316‑155); or

(d) the amount is a payment made to the entity from a lost policy holders trust in connection with:

(i) the variation or abrogation of rights attaching to or consisting of an interest affected by demutualisation; or

(ii) the conversion, cancellation, extinguishment or redemption of an interest affected by demutualisation.

(2) This subsection covers an entity that:

(a) is or has been a *member of the *friendly society; or

(b) is or has been insured through the friendly society or a health/life insurance subsidiary of the friendly society; or

(c) is issued with the demutualisation asset, or receives the payment, because of the death of a person covered by paragraph (a) or (b); or

(d) is a beneficiary of a lost policy holders trust (see section 316‑155).

316‑260 Franking debits to stop the friendly society and its subsidiaries having franking surpluses

(1) A *franking debit arises in the *franking account of the *friendly society or a *wholly‑owned subsidiary of the society if the account is in *surplus immediately before the demutualisation resolution day identified under subsection 316‑70(4).

(2) The amount of the *franking debit equals the *surplus.

(3) The *franking debit arises at the start of that day.

316‑265 Franking debits to negate franking credits from some distributions to friendly society and subsidiaries

(1) This section applies if a *franking credit arises in the *franking account of the *friendly society or a *wholly‑owned subsidiary of the society because a *distribution declared before the demutualisation resolution day identified under subsection 316‑70(4) is made to the society or subsidiary on or after that day.

(2) A *franking debit arises in that account.

(3) The amount of the *franking debit equals the amount of the *franking credit.

(4) The *franking debit arises at the same time as the *franking credit arises.

316‑270 Franking debits to negate franking credits from post‑demutualisation payments of pre‑demutualisation tax

(1) This section applies if a *franking credit arises in the *franking account of the *friendly society or a *wholly‑owned subsidiary of the society because, on or after the demutualisation resolution day identified under subsection 316‑70(4), the society or subsidiary *pays a PAYG instalment, or *pays income tax, that is wholly or partly attributable to a period before that day.

(2) A *franking debit arises in that account.

(3) The amount of the *franking debit is so much of the *franking credit as is attributable to the period before that day.

(4) The *franking debit arises at the same time as the *franking credit arises.

316‑275 Franking credits to negate franking debits from refunds of tax paid before demutualisation

(1) This section applies if a *franking debit arises in the *franking account of the *friendly society or a *wholly‑owned subsidiary of the society because, on or after the demutualisation resolution day identified under subsection 316‑70(4), the society or subsidiary *receives a refund of income tax that is wholly or partly attributable to a period before that day.

(2) A *franking credit arises in that account.

(3) The amount of the *franking credit is so much of the *franking debit as is attributable to the period before that day.

(4) The *franking credit arises at the same time as the *franking debit arises.

Part 3‑35—Insurance business

Division 320—Life insurance companies

Table of Subdivisions

Guide to Division 320

320‑A Preliminary

320‑B What is included in a life insurance company’s assessable income

320‑C Deductions and capital losses

320‑D Income tax, taxable income and tax loss of life insurance companies

320‑E No‑TFN contributions of life insurance companies that are RSA providers

320‑F Complying superannuation asset pool

320‑H Segregation of assets to discharge exempt life insurance policy liabilities

320‑I Transfers of business

Guide to Division 320

320‑1 What this Division is about

This Division provides for the taxation of life insurance companies in a broadly comparable way to other entities that derive similar kinds of income.

Because of the nature of the business of life insurance companies, the Division contains special rules for working out their taxable income.

Those rules:

• include certain amounts in assessable income;

• identify certain amounts of exempt income and non‑assessable non‑exempt income;

• identify specific deductions.

Life insurance companies can have one or both of these taxable incomes for any income year for the purposes of working out their income tax for that year:

• a taxable income of the complying superannuation class, which consists of taxable income that relates to complying superannuation business, and is taxed at the rate of tax that applies to complying superannuation funds;

• a taxable income of the ordinary class, which consists of taxable income that relates to other businesses and is taxed at the corporate tax rate.

Life insurance companies can also have tax losses that correspond to those 2 classes. The Division provides that tax losses of a particular class can be deducted only from incomes in respect of that class.

The Division ensures that the income tax worked out on the basis of these taxable incomes and tax losses is a single amount of income tax on one taxable income.

The Division also contains rules for segregating the assets of life insurance companies into:

• assets that relate to complying superannuation business;

• assets that relate to immediate annuity and other exempt business.

This Division also ensures that life insurance companies that are RSA providers are liable to pay tax on no‑TFN contributions income.

Operative provisions

Subdivision 320‑A—Preliminary

320‑5 Object of Division

(1) The object of this Division is to provide for the taxation of *life insurance companies in a broadly comparable way to other entities that *derive similar kinds of income.

(2) To achieve this object, the Division:

(a) identifies certain amounts that are included in the assessable income, or are *exempt income or *non‑assessable non‑exempt income, of a *life insurance company; and

(b) identifies certain amounts that a life insurance company can deduct; and

(c) enables a life insurance company to have taxable incomes and *tax losses of the following classes for the purposes of working out its income tax for an income year:

(i) the *complying superannuation class;

(ii) the *ordinary class; and

(d) contains other provisions necessary to enable the income tax on the taxable income of a life insurance company to be worked out.

Note: Section 320‑5 of the Income Tax (Transitional Provisions) Act 1997 provides that the tax consequences of certain transfers of assets of a life insurance company that is a friendly society to a complying superannuation fund are to be disregarded.

Subdivision 320‑B—What is included in a life insurance company’s assessable income

Guide to Subdivision 320‑B

320‑10 What this Subdivision is about

This Subdivision provides for certain amounts to be included in a life insurance company’s assessable income and for certain other amounts to be exempt income or non‑assessable non‑exempt income.

Table of sections

Operative provisions

320‑15 Assessable income—various amounts

320‑30 Assessable income—special provision for certain income years

320‑35 Exempt income

320‑37 Non‑assessable non‑exempt income

320‑45 Tax treatment of gains or losses from CGT events in relation to complying superannuation assets

Operative provisions

320‑15 Assessable income—various amounts

(1) A *life insurance company’s assessable income includes:

(a) the total amount of the *life insurance premiums paid to the company in the income year; and

(b) amounts received or recovered under *contracts of reinsurance (except amounts that relate to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies) to the extent to which they relate to the *risk components of claims paid under *life insurance policies; and

(c) any amount received or recovered that is a refund, or in the nature of a refund, of the life insurance premium paid under a contract of reinsurance (except any amount that relates to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies); and

(ca) any reinsurance commission received or recovered by the company in respect of a contract of reinsurance (except any commission that relates to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies); and

(d) any amount received under a profit‑sharing arrangement contained in, or entered into in relation to, a contract of reinsurance; and

(da) the *transfer values of assets transferred by the company from a *complying superannuation asset pool under subsection 320‑180(1) or 320‑195(3); and

(db) the transfer values of assets transferred by the company to a complying superannuation asset pool under subsection 320‑180(3) or 320‑185(1); and

(e) if an asset (other than money) is transferred from or to a complying superannuation asset pool under subsection 320‑180(1) or (3), to a complying superannuation asset pool under section 320‑185 or from a complying superannuation asset pool under subsection 320‑195(2) or (3)—the amount (if any) that is included in the company’s assessable income of the income year in which the asset was transferred because of section 320‑200; and

(f) the transfer values of assets transferred by the company from the company’s *segregated exempt assets under subsection 320‑235(1) or 320‑250(2); and

(g) if an asset (other than money) is transferred to the company’s segregated exempt assets under subsection 320‑235(3) or section 320‑240—the amount (if any) that is included in the company’s assessable income because of section 320‑255; and

(h) subject to subsection (2), if the *value, at the end of the income year, of the company’s liabilities under the *net risk components of life insurance policies is less than the value, at the end of the previous income year, of those liabilities—an amount equal to the difference; and

Note: Where the value at the end of the income year exceeds the value at the end of the previous income year, the excess can be deducted: see section 320‑85.

(i) amounts specified in agreements under section 295‑260; and

(j) *specified roll‑over amounts paid to the company; and

(ja) amounts imposed by the company in respect of risk riders for *ordinary investment policies in an income year in which the company did not receive any life insurance premiums for those policies; and

(k) fees and charges (not otherwise included in, or taken into account in working out, the company’s assessable income) imposed by the company in respect of life insurance policies; and

(l) if the company is an *RSA provider—contributions made to *RSAs provided by the company that would be included in the company’s assessable income under Subdivision 295‑C if that Subdivision applied to the company.

(2) Paragraph (1)(h) does not cover any liabilities under:

(a) a *life insurance policy that provides for *participating benefits or *discretionary benefits; or

(b) an *exempt life insurance policy; or

(c) a *funeral policy.

(3) An amount included in assessable income under paragraph (1)(i) is included for the income year of the *life insurance company that includes the last day of the transferor’s income year to which the agreement referred to in section 295‑260 relates.

320‑30 Assessable income—special provision for certain income years

(1) This section applies to a *life insurance company for each of the following income years (each a relevant income year):

(a) the income year in which 1 July 2000 occurs;

(b) the 4 following income years.

Note: The effect of this section is modified when the life insurance business of a life insurance company is transferred to another life insurance company: see section 320‑340.

(2) If:

(a) the *value of the company’s liabilities at the end of 30 June 2000 under its *continuous disability policies (being the value used by the company for the purposes of its *income tax return);

exceeds

(b) the value of the company’s liabilities at the end of 30 June 2000 under the *net risk components of its continuous disability policies as calculated under subsection 320‑85(4);

the company’s assessable income for each relevant income year includes an amount equal to one‑fifth of the excess.

(3) However, if a *life insurance company ceases in a relevant income year to carry on *life insurance business or to have any liabilities under the *net risk components of *continuous disability policies, subsection (2) does not apply for that income year or any future income years but the company’s assessable income for that income year includes so much of the excess referred to in subsection (2) as has not been included in the company’s assessable income for any previous relevant income years.

320‑35 Exempt income

These amounts *derived by a *life insurance company are exempt from income tax:

(a) amounts of *ordinary income and *statutory income accrued before 1 July 1988 that were derived from assets that have become *complying superannuation assets;

(b) if the company is an *RSA provider—any amounts that are disregarded because of paragraph 320‑137(3)(d) or (e) in working out the company’s taxable income of the *complying superannuation class.

320‑37 Non‑assessable non‑exempt income

(1) These amounts *derived by a *life insurance company are not assessable income and are not *exempt income:

(a) amounts of ordinary income and statutory income derived from *segregated exempt assets, being income that relates to the period during which the assets were segregated exempt assets;

(b) amounts of ordinary income and statutory income derived from the *disposal of units in a *pooled superannuation trust;

(c) if an *Australian/overseas fund or an *overseas fund established by the company derived foreign establishment amounts—the foreign resident proportion of the foreign establishment amounts;

(d) if the company is a *friendly society:

(i) amounts derived before 1 July 2001 that are exempt from income tax under section 50‑1; and

(ii) amounts derived on or after 1 July 2001 but before 1 January 2003, that are attributable to *income bonds, *funeral policies or *sickness policies; and

(iii) amounts derived on or after 1 July 2001 but before 1 January 2003, that are attributable to *scholarship plans and would have been exempt from income tax under section 50‑1 if they had been received before 1 July 2001; and

(iv) amounts derived on or after 1 January 2003 that are attributable to income bonds, funeral policies or *sickness policies, that were issued before 1 January 2003; and

(v) amounts derived on or after 1 January 2003 that are attributable to scholarship plans issued before 1 January 2003 and that would have been exempt from income tax if they had been received before 1 July 2001.

Note: The effect of this section is modified when the life insurance business of a life insurance company is transferred to another life insurance company: see section 320‑325.

(1A) For the purposes of paragraph (1)(c), foreign establishment amounts for the *life insurance company means the total amount of assessable income that was *derived in the income year:

(a) in the course of the carrying on by the company of a business in a foreign country at or through a *permanent establishment of the company in that country; and

(b) from sources in that or any other foreign country; and

(c) from assets that:

(i) are attributable to the permanent establishment; and

(ii) are held to meet the liabilities under the *life insurance policies issued by the company at or through the permanent establishment.

(2) For the purposes of paragraph (1)(c), the foreign resident proportion of the *foreign establishment amounts is the amount worked out using the formula:

where:

all foreign establishment policy liabilities means the average value for the income year (as calculated by an *actuary) of the policy liabilities (as defined in the *Valuation Standard) for all *life insurance policies that:

(a) were included in the class of *life insurance business to which the company’s *Australian/overseas fund or *overseas fund relates; and

(b) were issued by the company at or through the *permanent establishment to which the foreign establishment amounts relate.

foreign resident foreign establishment policy liabilities means the average value for the income year (as calculated by an *actuary) of the policy liabilities (as defined in the *Valuation Standard) for all *life insurance policies that:

(a) are *foreign resident life insurance policies; and

(b) were issued by the company at or through the *permanent establishment to which the foreign establishment amounts relate.

320‑45 Tax treatment of gains or losses from CGT events in relation to complying superannuation assets

(1) If a *CGT event happens in respect of a *CGT asset that is a *complying superannuation asset of a *life insurance company, section 295‑85 and 295‑90 applies for the purpose of working out the amount of any *capital gain or *capital loss that arises from the event.

Note: See Subdivision 295‑B of the Income Tax (Transitional Provisions) Act 1997 for rules about cost base for assets owned by superannuation entities at the end of 30 June 1988.

(2) Subsection (1) has effect despite anything in Division 230.

Subdivision 320‑C—Deductions and capital losses

Guide to Subdivision 320‑C

320‑50 What this Subdivision is about

This Subdivision specifies particular deductions that are available to a life insurance company, specifies particular amounts that a life insurance company cannot deduct and contains provisions relating to a life insurance company’s capital losses.

Table of sections

Operative provisions

320‑55 Deduction for life insurance premiums where liabilities under life insurance policies are to be discharged from complying superannuation assets

320‑60 Deduction for life insurance premiums where liabilities under life insurance policies are to be discharged from segregated exempt assets

320‑65 Deduction for life insurance premiums in respect of life insurance policies that provide for participating or discretionary benefits

320‑70 No deduction for life insurance premiums in respect of certain life insurance policies payable only on death or disability

320‑75 Deduction for ordinary investment policies

320‑80 Deduction for certain claims paid under life insurance policies

320‑85 Deduction for increase in value of liabilities under net risk components of life insurance policies

320‑87 Deduction for assets transferred from or to complying superannuation asset pool

320‑100 Deduction for life insurance premiums paid under certain contracts of reinsurance

320‑105 Deduction for assets transferred to segregated exempt assets

320‑110 Deduction for interest credited to income bonds

320‑111 Deduction for funeral policy payout

320‑112 Deduction for scholarship plan payout

320‑115 No deduction for amounts credited to RSAs

320‑120 Capital losses from assets other than complying superannuation assets or segregated exempt assets

320‑125 Capital losses from complying superannuation assets

Operative provisions

320‑55 Deduction for life insurance premiums where liabilities under life insurance policies are to be discharged from complying superannuation assets

(1) This section applies to a *life insurance company in respect of *life insurance policies where the company’s liabilities under the policies are to be discharged out of *complying superannuation assets.

(2) The company can deduct:

(a) the amounts of the *life insurance premiums received in respect of the policies that are transferred to its *complying superannuation assets in the income year;

less:

(b) so much of those amounts as relate to the company’s liability to pay amounts on the death or disability of a person.

(3) For the purposes of subsection (2) only, the amount of a *life insurance premium that relates to the company’s liability to pay amounts on the death or disability of a person is:

(a) if the policy provides for *participating benefits or *discretionary benefits—nil; or

(b) if paragraph (a) does not apply and the policy states that the whole or a specified part of the premium is payable in respect of such a liability—the whole or that part of the premium, as appropriate; or

(c) if neither paragraph (a) nor (b) applies:

(i) if the policy is an *endowment policy—10% of the premium; or

(ii) if the policy is a *whole of life policy—30% of the premium; or

(iii) otherwise—so much of the premium as an *actuary determines to be attributable to such a liability.

320‑60 Deduction for life insurance premiums where liabilities under life insurance policies are to be discharged from segregated exempt assets

A *life insurance company can deduct the amounts of *life insurance premiums transferred in the income year to its *segregated exempt assets under subsection 320‑240(3).

320‑65 Deduction for life insurance premiums in respect of life insurance policies that provide for participating or discretionary benefits

A *life insurance company can deduct the amounts of *net premiums received in respect of *life insurance policies (other than *complying superannuation life insurance policies or *exempt life insurance policies) that provide for *participating benefits or *discretionary benefits.

320‑70 No deduction for life insurance premiums in respect of certain life insurance policies payable only on death or disability

(1) A *life insurance company cannot deduct any part of the amounts of *life insurance premiums received in respect of *life insurance policies under which amounts are to be paid only on the death or disability of a person.

(2) This section does not apply to:

(a) *life insurance policies that provide for *participating benefits or *discretionary benefits; or

(b) funeral policies.

320‑75 Deduction for ordinary investment policies

(1) This section applies to a *life insurance company in respect of *ordinary investment policies issued by the company.

(2) The company can deduct, in respect of *life insurance premiums received in the income year for those policies:

(a) the sum of the *net premiums;

less:

(b) so much of the net premiums as an *actuary determines to be attributable to fees and charges charged in that income year.

(3) In making a determination under subsection (2), an *actuary is to have regard to:

(a) the changes over the income year in the sum of the *net current termination values of the policies; and

(b) the movements in those values during the income year.

(4) In addition, if an *actuary determines that:

(a) there has been a reduction in the income year (the current year) of exit fees that were imposed in respect of those policies in a previous income year; and

(b) the reduction (or a part of it) has not been taken into account in a determination under subsection (2) for the current year;

the company can deduct so much of that reduction as has not been so taken into account.

320‑80 Deduction for certain claims paid under life insurance policies

(1) A *life insurance company can deduct the amounts paid in respect of the *risk components of claims paid under *life insurance policies during the income year.

(2) The risk component of a claim paid under a *life insurance policy is:

(a) if:

(i) the policy does not provide for *participating benefits or *discretionary benefits; and

(ii) the policy is neither an *exempt life insurance policy nor a *funeral policy; and

(iii) an amount is payable under the policy only on the death or disability of the insured person;

the amount paid under the policy as a result of the occurrence of that event; or

(b) if the policy provides for participating benefits or discretionary benefits or is an exempt life insurance policy or a funeral policy—nil; or

(c) otherwise—the amount paid under the policy as a result of the death or disability of the insured person less the *current termination value of the policy (calculated by an *actuary) immediately before the death, or the occurrence of the disability, of the person.

(3) Except as provided by subsection (1), a *life insurance company cannot deduct amounts paid in respect of claims under *life insurance policies.

320‑85 Deduction for increase in value of liabilities under net risk components of life insurance policies

(1) A *life insurance company can deduct the amount (if any) by which the *value, at the end of the income year, of its liabilities under the *net risk components of *life insurance policies exceeds the value, at the end of the previous income year, of those liabilities.

Note 1: Where the value at the end of the income year is less than the value at the end of the previous income year, the difference is included in assessable income: see paragraph 320‑15(1)(h).

Note 2: Section 320‑85 of the Income Tax (Transitional Provisions) Act 1997 makes special provision in respect of the calculation of the value of a life insurance company’s liabilities under the net risk components of life insurance policies at the end of the income year immediately preceding the income year in which 1 July 2000 occurs.

(2) Subsection (1) does not cover any liabilities under:

(a) a *life insurance policy that provides for *participating benefits or *discretionary benefits; or

(b) an *exempt life insurance policy; or

(c) a *funeral policy.

(3) If a *life insurance policy is a *disability policy (other than a *continuous disability policy), the value at a particular time of the liabilities of the *life insurance company under the *net risk component of the policy is the *current termination value of the component at that time (calculated by an *actuary).

(4) In the case of *life insurance policies other than policies to which subsection (3) applies, the value at a particular time of the liabilities of the *life insurance company under the *net risk components of the policies is the amount calculated by an *actuary to be:

(a) the sum of the policy liabilities (as defined in the *Valuation Standard) in respect of the net risk components of the policies at that time;

less

(b) the sum of any cumulative losses (as defined in the Valuation Standard) for the net risk components of the policies at that time.

320‑87 Deduction for assets transferred from or to complying superannuation asset pool

(1) A *life insurance company can deduct the *transfer values of assets that are transferred by the company in the income year from a *complying superannuation asset pool under subsection 320‑180(1) or 320‑195(3).

(2) A *life insurance company can deduct the *transfer values of assets that are transferred by the company in the income year to a *complying superannuation asset pool under subsection 320‑180(3) or 320‑185(1).

(3) If an asset (other than money) is transferred by a *life insurance company:

(a) from a *complying superannuation asset pool under subsection 320‑180(1) or 320‑195(2) or (3); or

(b) to a complying superannuation asset pool under subsection 320‑180(3) or section 320‑185;

the company can deduct the amount (if any) that it can deduct because of section 320‑200.

320‑100 Deduction for life insurance premiums paid under certain contracts of reinsurance

A *life insurance company can deduct amounts that:

(a) were paid by the company in the income year as *life insurance premiums under *contracts of reinsurance; and

(b) do not relate to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies.

320‑105 Deduction for assets transferred to segregated exempt assets

(1) A *life insurance company can deduct the *transfer values of assets transferred in the income year to the company’s *segregated exempt assets under subsection 320‑235(3) or 320‑240(1).

(2) If an asset (other than money) is transferred to a *life insurance company’s *segregated exempt assets under subsection 320‑235(3) or section 320‑240, the company can deduct the amount (if any) that it can deduct because of section 320‑255.

320‑110 Deduction for interest credited to income bonds

(1) A *life insurance company that is a *friendly society can deduct interest credited in the income year to the holders of *income bonds issued after 31 December 2002 where the interest accrued on or after 1 January 2003.

(2) This section has effect despite subsection 320‑80(3).

320‑111 Deduction for funeral policy payout

(1) A *life insurance company that is a *friendly society can deduct the amount of a benefit provided in the income year by the company under a *funeral policy issued after 31 December 2002, reduced by so much of the sum of the amounts deducted or deductible by the company under section 320‑75 for any income year as is reasonably related to the benefit.

(2) This section has effect despite subsection 320‑80(3).

320‑112 Deduction for scholarship plan payout

(1) A *life insurance company that is a *friendly society can deduct the amount of a benefit it provides in the income year and on or after 1 January 2003:

(a) under a *scholarship plan covered by subsection (2) or (3); and

(b) to, or on behalf of, a person nominated in the plan as a beneficiary whose education is to be helped by the benefit;

reduced by so much of the sum of the amounts deducted or deductible by the company under section 320‑75 for any income year as is reasonably related to the benefit.

(2) This subsection covers a *scholarship plan issued by the *life insurance company after 31 December 2002.

(3) This subsection covers a *scholarship plan if:

(a) the plan was issued by the *life insurance company before 1 January 2003; and

(b) no amount received by the company on or after 1 January 2003 and attributable to the plan is *non‑assessable non‑exempt income of the company under paragraph 320‑37(1)(d).

(4) This section has effect despite subsection 320‑80(3).

320‑115 No deduction for amounts credited to RSAs

A *life insurance company that is an *RSA provider cannot deduct amounts credited to *RSAs.

320‑120 Capital losses from assets other than complying superannuation assets or segregated exempt assets

(1) This section applies to assets (ordinary assets) of a *life insurance company other than:

(a) *complying superannuation assets; or

(b) *segregated exempt assets.

(2) In working out a *life insurance company’s *net capital gain or *net capital loss for the income year, *capital losses from ordinary assets can be used only to reduce *capital gains from ordinary assets.

(3) If some or all of a *capital loss from an ordinary asset cannot be applied in an income year, the unapplied amount can be applied in the next income year in which the company’s *capital gains from ordinary assets exceed the company’s capital losses (if any) from ordinary assets.

(4) If the company has 2 or more unapplied *net capital losses from ordinary assets, the company must apply them in the order in which they were made.

Note: This section affects the amount of assessable income that is to be taken into account in working out a taxable income or tax loss of the ordinary class: see sections 320‑139 and 320‑143.