Tax Laws Amendment (Long‑term Non‑reviewable Contracts) Act 2005

No. 10, 2005

An Act to amend the law relating to taxation, and for related purposes

Tax Laws Amendment (Long‑term Non‑reviewable Contracts) Act 2005

No. 10, 2005

An Act to amend the law relating to taxation, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedule(s)

Schedule 1—Long‑term non‑reviewable contracts

A New Tax System (Commonwealth‑State Financial Arrangements) Act 1999

A New Tax System (Goods and Services Tax) Act 1999

A New Tax System (Goods and Services Tax Imposition—Customs) Act 1999

A New Tax System (Goods and Services Tax Imposition—Excise) Act 1999

A New Tax System (Goods and Services Tax Imposition—General) Act 1999

A New Tax System (Goods and Services Tax Transition) Act 1999

A New Tax System (Luxury Car Tax) Act 1999

A New Tax System (Wine Equalisation Tax) Act 1999

Taxation Administration Act 1953

Tax Laws Amendment (Long-term Non-reviewable Contracts) Act 2005

No. 10, 2005

An Act to amend the law relating to taxation, and for related purposes

[Assented to 22 February 2005]

The Parliament of Australia enacts:

This Act may be cited as the Tax Laws Amendment (Long‑term Non‑reviewable Contracts) Act 2005.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent. | 22 February 2005 |

2. Schedule 1, items 1 to 11 | 1 July 2005. | 1 July 2005 |

3. Schedule 1, items 12 to 14 | The day on which this Act receives the Royal Assent. | 22 February 2005 |

4. Schedule 1, item 15 | Immediately after the start of the day on which this Act receives the Royal Assent. | 22 February 2005 |

5. Schedule 1, items 16 to 18 | 1 July 2005. | 1 July 2005 |

6. Schedule 1, item 19 | The day on which this Act receives the Royal Assent. | 22 February 2005 |

Note: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

(2) Column 3 of the table contains additional information that is not part of this Act. Information in this column may be added to or edited in any published version of this Act.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Subparagraph 2(1)(b)(ii)

Repeal the subparagraph.

2 Section 4 (at the end of the definition of GST Imposition Acts)

Add:

; (d) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005;

(e) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Excise) Act 2005;

(f) the A New Tax System (Goods and Services Tax Imposition (Recipients)—General) Act 2005.

3 Section 2‑1 (note)

Omit “3 Acts”, substitute “6 Acts, the most important of which are”.

4 Section 195‑1 (after paragraph (a) of the definition of customs duty)

Insert:

(aa) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005; or

5 Section 195‑1 (at the end of the definition of GST)

Add:

; or (d) the A New Tax System (Goods and Services Tax Imposition (Recipients)—General) Act 2005; or

(e) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005; or

(f) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Excise) Act 2005.

6 At the end of the title

Add “and is not imposed on recipients of supplies”.

7 Subsection 3(2)

Repeal the subsection, substitute:

(2) This section imposes GST only so far as that tax:

(a) is a duty of customs within the meaning of section 55 of the Constitution; and

(b) is not imposed by the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005.

8 At the end of the title

Add “and is not imposed on recipients of supplies”.

9 Subsection 3(2)

Repeal the subsection, substitute:

(2) This section imposes GST only so far as that tax:

(a) is a duty of excise within the meaning of section 55 of the Constitution; and

(b) is not imposed by the A New Tax System (Goods and Services Tax Imposition (Recipients)—Excise) Act 2005.

10 At the end of the title

Add “and is not imposed on recipients of supplies”.

11 Subsection 3(2)

Repeal the subsection, substitute:

(2) This section imposes GST only so far as that tax:

(a) is neither a duty of customs nor a duty of excise within the meaning of section 55 of the Constitution; and

(b) is not imposed by the A New Tax System (Goods and Services Tax Imposition (Recipients)—General) Act 2005.

12 After the heading to Part 3

Insert:

13 After subsection 13(4A)

Insert:

(4B) If:

(a) a change is made to the consideration for supplies that are specifically identified by an agreement of the kind referred to in subsection (1); and

(b) the change is made after the commencement of this subsection; and

(c) the change applies to supplies made before 1 July 2005;

supplies that are specifically identified by the agreement are not GST‑free under this section to the extent that the supplies are made on or after the day on which the change takes effect.

(4C) Whether a supply made before 1 July 2005 is GST‑free under this section is not affected by:

(a) a change (made after the commencement of this subsection), whether agreed to before, on or after 1 July 2005, to the consideration for supplies made on or after 1 July 2005 that are specifically identified by an agreement; or

(b) the carrying out, whether before, on or after 1 July 2005, of any of the processes referred to in Subdivision C of Division 2 in relation to supplies made on or after 1 July 2005 that are specifically identified by an agreement.

(4D) In subsections (4B) and (4C):

change, to the consideration for a supply, means a change to that consideration (including a change to the method by which the consideration is worked out) not provided for in an agreement of the kind referred to in subsection (1).

14 At the end of Part 3

Add:

(1) This Division provides for the payment of GST on taxable supplies made on or after 1 July 2005 that would have been GST‑free under section 13 if they had been made immediately before 1 July 2005.

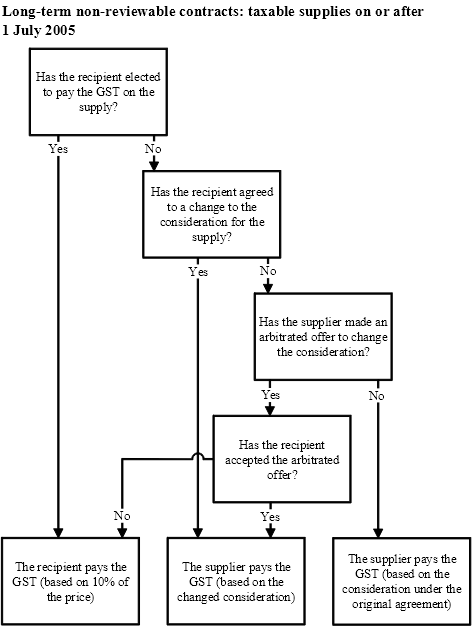

(2) The following diagram shows how, as a result of this Division and the GST law in general, each of the 3 possible ways to treat the GST on such a taxable supply will apply in particular cases.

In this Division:

applicable day, for a supply, has the meaning given by subsection 15C(2).

arbitrated offer has the meaning given by section 15J.

arbitrator means a person or body specified in, or included in a class of persons or bodies specified in, the regulations.

change, to the consideration for a supply, includes a change to the method by which the consideration is worked out.

(1) To the extent that a taxable supply is made on or after the applicable day for the supply under subsection (2), the GST on the supply is payable by the recipient of the supply, and is not payable by the supplier, if:

(a) the supply is specifically identified by an agreement:

(i) that is of the kind referred to in subsection 13(1); and

(ii) that does not provide that the consideration for the supply is not to be changed to take account of GST or similar value added tax imposed on the supply; and

(b) had the supply been made immediately before 1 July 2005, it would have been GST‑free under section 13; and

(c) either:

(i) the recipient notifies the supplier in writing that the recipient elects to pay the GST on the supply; or

(ii) the recipient has failed to accept an arbitrated offer by the supplier to change the consideration for supplies that are made on or after 1 July 2005 and that are specifically identified by the agreement.

(2) The applicable day for the supply is:

(a) if subparagraph (1)(c)(i) applies:

(i) the day on which the recipient notifies the supplier as mentioned in that subparagraph; or

(ii) 1 July 2005;

whichever is later; or

(b) if subparagraph (1)(c)(ii) applies:

(i) the day on which the recipient fails to accept an arbitrated offer as mentioned in that subparagraph; or

(ii) 1 July 2005;

whichever is later.

(3) Subsection (1) does not apply if:

(a) before either of the events referred to in paragraph (1)(c) happens, the supplier and the recipient agree (whether or not an arbitrated offer is made) to change the consideration for supplies that are made on or after 1 July 2005 and that are specifically identified by the agreement; or

(b) subsection 13(3) applies to the supply.

(4) For the purposes of subparagraph (1)(c)(ii), the recipient is taken to have failed to accept the offer referred to in that subparagraph if:

(a) the recipient gives to the supplier a written rejection of the offer; or

(b) the final offer period referred to in section 15M expires without the recipient having notified the supplier that the recipient accepts the offer.

Note: If an offer is accepted, any GST on the supply will be payable by the supplier, on the basis of the consideration as changed, in accordance with the GST Act: see in particular Division 19 of that Act.

(5) For the purposes of subparagraph (2)(b)(i), the day on which the recipient fails to accept an arbitrated offer is:

(a) the day applicable under paragraph (4)(a) or (b); or

(b) if a day is applicable under both of those paragraphs—the earlier of those days.

(6) To avoid doubt, the fact that the GST on the supply is payable by the recipient does not affect any entitlement of the recipient to an input tax credit for the acquisition to which the supply relates.

(7) An election referred to in subparagraph (1)(c)(i) cannot be revoked.

(8) This section has effect despite section 9‑40 of the GST Act (which is about liability for the GST on taxable supplies).

(1) If GST is payable by the recipient of the taxable supply because of this Division, the amount of GST on the supply is 10% of the price of the supply to the extent that it is made on or after the applicable day for the supply.

(2) If the supplier and the recipient are associates and:

(a) the supply is without consideration; or

(b) the consideration for the supply is less than the GST exclusive market value of the supply;

the reference in subsection (1) to the price of the supply is taken to be a reference to the GST exclusive market value of the supply.

(3) Subsection (2) does not apply if:

(a) the recipient acquires the thing supplied solely for a creditable purpose; and

(b) the recipient is registered or required to be registered.

(4) This section has effect despite section 9‑70 of the GST Act (which is about the amount of GST on taxable supplies).

(1) This section has effect if:

(a) you are the recipient of any taxable supplies for which the GST is payable by you because of this Division; and

(b) you are not registered or required to be registered.

Tax periods

(2) Despite section 7‑10 of the GST Act, you have tax periods applying to you.

(3) Subsection 27‑40(1A) of the GST Act (which is about an entity ceasing to carry on any enterprise) does not apply to you.

GST returns

(4) Division 31 of the GST Act applies to you as if you were registered or required to be registered.

(1) This section has effect if:

(a) you are the recipient of any taxable supplies for which the GST is payable by you because of this Division; and

(b) your registration is cancelled.

(2) Subsection 27‑40(2) of the GST Act (which is about the effect of an entity’s registration being cancelled) has effect but only in relation to your liabilities and entitlements to input tax credits that arise otherwise than because of this Division.

(1) This section has effect if:

(a) you are the recipient of a taxable supply for which the GST is payable by you because of this Division; and

(b) the whole or part of the consideration for the supply has not been received by the supplier; and

(c) the supplier writes off as bad the whole or a part of the debt, or the whole or a part of the debt has been overdue for 12 months or more.

(2) Section 21‑5 of the GST Act does not apply to the taxable supply.

(3) Instead, you have a decreasing adjustment equal to 10% of the amount written off, or 10% of the amount that has been overdue for 12 months or more, as the case requires. However, you cannot have an adjustment under this section if you account on a cash basis.

(4) You have an increasing adjustment if:

(a) you were the recipient of a taxable supply in relation to which you had a decreasing adjustment under subsection (3); and

(b) you subsequently pay to the supplier the whole or a part of the amount written off, or the whole or a part of the amount that has been overdue for 12 months or more, as the case requires.

The amount of the increasing adjustment is 10% of the amount paid.

(1) If the GST on a taxable supply is payable by the recipient of the supply because of this Division:

(a) the supplier is not required to issue a tax invoice for the supply; and

(b) the supplier is not required to issue an adjustment note for an adjustment that arises from an adjustment event relating to the taxable supply.

(2) Subsection (1) has effect despite sections 29‑70 and 29‑75 of the GST Act (which are about the requirement to issue tax invoices and adjustment notes).

(3) If the GST on a taxable supply is payable by the recipient of the supply because of this Division, subsection 29‑10(3) of the GST Act (which is about attributing input tax credits) does not apply to the creditable acquisition constituted by that taxable supply.

(4) If the GST on a taxable supply is payable by the recipient of the supply because of this Division, subsection 29‑20(3) of the GST Act (which is about attributing adjustments) does not apply to an adjustment that arises from an adjustment event relating to the taxable supply.

(1) To the extent that the recipient of a taxable supply who is liable for the GST on the supply because of this Division would, apart from this section, attribute that GST to a tax period ending before the applicable day for the supply, the recipient must instead attribute that GST to the first tax period starting on or after the applicable day for the supply.

(2) Subsection (1) has effect subject to Division 156 of the GST Act (which is about supplies and acquisitions made on a progressive or periodic basis).

(3) This section has effect despite section 29‑5 of the GST Act (which is about attributing the GST).

An offer (the final offer) to change the consideration for supplies, that are made on or after 1 July 2005 and that are specifically identified by an agreement of a kind referred to in subsection 13(1), is an arbitrated offer if:

(a) the supplier has, in accordance with section 15K, made an offer (the initial offer) to the recipient of the supplies to change the consideration; and

(b) change to the consideration has been arbitrated in accordance with section 15L; and

(c) the supplier makes the final offer in accordance with section 15M.

(1) The initial offer:

(a) must be in writing; and

(b) must set out a change to the consideration for the supplies; and

(c) must state the period (the initial offer period) for which the offer remains open.

(2) The initial offer period must be a period of at least 28 days after the supplier gives the initial offer to the recipient.

(1) Change to the consideration must be arbitrated as follows:

(a) the supplier must apply to an arbitrator for the appointment of an assessor to determine an appropriate change to the consideration;

(b) the arbitrator must appoint as an assessor a person whom the arbitrator is satisfied:

(i) is suitably qualified to determine an appropriate change to the consideration; and

(ii) is independent of both the supplier and the recipient;

(c) in determining an appropriate change, the assessor must only take into account the impact of the New Tax System changes on the supplier’s costs and expenses;

(d) the assessor’s determination of an appropriate change must be made within 28 days of the end of the offer period and:

(i) be in writing, signed and dated by the assessor; or

(ii) be in the form specified in the regulations.

(2) The supplier must not apply under paragraph (1)(a) until after:

(a) the end of the initial offer period; or

(b) the recipient gives to the supplier a written rejection of the initial offer;

whichever happens earlier.

(3) In this section:

New Tax System changes has the same meaning as in Part VB of the Trade Practices Act 1974.

(1) The final offer:

(a) must be in writing; and

(b) must set out as a change to the consideration the assessor’s determination of an appropriate change; and

(c) must state the period (the final offer period) for which the offer remains open.

(2) The final offer period must be a period of at least 21 days after the supplier gives the final offer to the recipient.

15 After section 15I

Insert:

Subsection 36(1) of the Taxation Administration Act 1953 does not apply to a refund under section 35‑5 of the GST Act in respect of a tax period to the extent that the refund arises because:

(a) the GST on a taxable supply was attributable to that tax period and was payable by the supplier; and

(b) the recipient of the supply becomes liable for the GST on the supply because of section 15C of this Act.

16 Section 27‑1 (after paragraph (a) of the definition of customs duty)

Insert:

(aa) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005; or

17 Section 33‑1 (after paragraph (a) of the definition of customs duty)

Insert:

(aa) the A New Tax System (Goods and Services Tax Imposition (Recipients)—Customs) Act 2005; or

18 After paragraph 70(1)(ca)

Insert:

or (cb) are liable, as a recipient of a taxable supply, to pay the GST on a taxable supply because of section 15C of the A New Tax System (Goods and Services Tax Transition) Act 1999;

19 Application

The amendment made by item 15 of this Schedule applies to tax periods starting on or after 1 July 2000.

[Minister’s second reading speech made in—

House of Representatives on 8 December 2004

Senate on 9 December 2004]

(254/04)