Tax Laws Amendment (Loss Recoupment Rules and Other Measures) Act 2005

No. 147, 2005

An Act to amend the law relating to taxation, and for related purposes

Tax Laws Amendment (Loss Recoupment Rules and Other Measures) Act 2005

No. 147, 2005

An Act to amend the law relating to taxation, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedule(s)

Schedule 1—Loss recoupment rules for companies etc.

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Schedule 2—Foreign residents’ income with an underlying foreign source

Part 1—Main amendment

Income Tax Assessment Act 1997

Part 2—Other amendments

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Taxation Administration Act 1953

Part 3—Application and transitional

Schedule 3—Denying deductions for illegal activity

Income Tax Assessment Act 1997

Schedule 4—Film copyright

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Schedule 5—Employee share schemes

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Income Tax (Transitional Provisions) Act 1997

Taxation Laws Amendment Act (No. 3) 2003

Schedule 6—Superannuation guarantee charge

Income Tax Assessment Act 1997

Superannuation Guarantee (Administration) Act 1992

Schedule 7—Superannuation on back payments

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Superannuation Guarantee (Administration) Act 1992

Tax Laws Amendment (Loss Recoupment Rules and Other Measures) Act 2005

No. 147, 2005

An Act to amend the law relating to taxation, and for related purposes

[Assented to 14 December 2005]

The Parliament of Australia enacts:

This Act may be cited as the Tax Laws Amendment (Loss Recoupment Rules and Other Measures) Act 2005.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent. | 14 December 2005 |

2. Schedules 1 to 4 | The day on which this Act receives the Royal Assent. | 14 December 2005 |

3. Schedule 5, items 1 to 15 | The day on which this Act receives the Royal Assent. | 14 December 2005 |

4. Schedule 5, item 16 | Immediately after the commencement of the provision(s) covered by table item 3. | 14 December 2005 |

5. Schedule 5, items 17 to 20 | The day on which this Act receives the Royal Assent. | 14 December 2005 |

6. Schedules 6 and 7 | The day on which this Act receives the Royal Assent. | 14 December 2005 |

Note: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

(2) Column 3 of the table contains additional information that is not part of this Act. Information in this column may be added to or edited in any published version of this Act.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Loss recoupment rules for companies etc.

Income Tax Assessment Act 1936

1 After subsection 80B(8)

Insert:

(8A) A person is not prevented from:

(a) beneficially owning shares in a company; or

(b) having the right to exercise voting power in a company; or

(c) having the right to receive any dividends that may be paid by a company; or

(d) having the right to receive any distribution of capital of a company;

merely because:

(e) the company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) a body with a similar status, under the Companies Code of the relevant State or a foreign law, to an externally‑administered body corporate; or

(f) either:

(i) a provisional liquidator is appointed to the company under section 472 of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) a person with a similar status, under the Companies Code of the relevant State or a foreign law, to a provisional liquidator is appointed to the company.

(8B) A company (the stakeholding company) is not prevented from:

(a) beneficially owning shares, or any other interests in shares, in another company; or

(b) having the right to exercise voting power in another company either directly or indirectly; or

(c) having the right to receive, either directly or indirectly, any dividends that may be paid by another company; or

(d) having the right to receive, either directly or indirectly, any distribution of capital of another company;

merely because:

(e) the stakeholding company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) a body with a similar status, under the Companies Code of the relevant State or a foreign law, to an externally‑administered body corporate; or

(f) either:

(i) a provisional liquidator is appointed to the stakeholding company under section 472 of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) a person with a similar status, under the Companies Code of the relevant State or a foreign law, to a provisional liquidator is appointed to the stakeholding company.

2 After section 160ZNR

Insert:

160ZNRA Companies in liquidation

(1) For the purposes of a test, an entity is not prevented from:

(a) beneficially owning shares in a company; or

(b) having the right to exercise, controlling, or being able to control, voting power in a company; or

(c) having the right to receive any dividends that a company may pay; or

(d) having the right to receive any distribution of capital of a company;

merely because:

(e) the company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) an entity with a similar status, under the Companies Code of the relevant State or a foreign law, to an externally‑administered body corporate; or

(f) either:

(i) a provisional liquidator is appointed to the company under section 472 of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) a person with a similar status, under the Companies Code of the relevant State or a foreign law, to a provisional liquidator is appointed to the company.

(2) For the purposes of a test, a company (the stakeholding company) is not prevented from:

(a) beneficially owning shares in another company, or any other interest in another entity; or

(b) having the right to exercise, controlling, or being able to control, voting power in another company or any other entity; or

(c) having the right to receive any dividends that another company or any other entity may pay; or

(d) having the right to receive any distribution of capital of another company or any other entity;

merely because:

(e) the stakeholding company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) an entity with a similar status, under the Companies Code of the relevant State or a foreign law, to an externally‑administered body corporate; or

(f) either:

(i) a provisional liquidator is appointed to the stakeholding company under section 472 of the Corporations Law (as set out in section 82 of the Corporations Act 1989); or

(ii) a person with a similar status, under the Companies Code of the relevant State or a foreign law, to a provisional liquidator is appointed to the stakeholding company.

3 At the end of subsection 160ZNSK(1)

Add:

; (g) 160ZNRA (which deals with companies in liquidation).

Income Tax Assessment Act 1997

4 Subsection 4‑15(2) (table item 1)

Omit “continue to carry on the same business”, substitute “satisfy the same business test”.

5 Subsection 25‑35(5) (table item 1)

Omit “carried on the same business”, substitute “satisfied the same business test”.

6 Section 36‑25 (table item 1 in the table headed “Tax losses of companies”)

Omit “carried on the same business”, substitute “satisfied the same business test”.

7 Section 36‑25 (table item 2 in the table headed “Tax losses of companies”)

Repeal the table item, substitute:

2. | A company wants to deduct a tax loss. It cannot do so unless: • the same people owned the company during the loss year, the income year and any intervening year; and • no person controlled the company’s voting power at any time during the income year who did not also control it during the whole of the loss year and any intervening year; or the company has satisfied the same business test. | Subdivision 165‑A |

8 Section 102‑30 (table item 4)

Omit “carried on the same business”, substitute “satisfied the same business test”.

9 Section 102‑30 (table item 5)

Repeal the table item, substitute:

5 | A company | It cannot apply a net capital loss unless: • the same people owned the company during the loss year, the income year and any intervening year; and • no person controlled the company’s voting power at any time during the income year who did not also control it during the whole of the loss year and any intervening year; or the company has satisfied the same business test. | Subdivision 165‑CA |

10 Subsection 125‑60(2)

After “in a company”, insert “that is the *head entity of a *demerger group”.

11 Subparagraph 125‑60(3)(a)(i)

Repeal the subparagraph.

12 Section 165‑5

Repeal the section, substitute:

165‑5 What this Subdivision is about

A company cannot deduct a tax loss unless:

(a) it has the same owners and the same control throughout the period from the start of the loss year to the end of the income year; or

(b) it satisfies the same business test by carrying on the same business, entering into no new kinds of transactions and conducting no new kinds of business.

(Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for that year.)

13 Paragraph 165‑10(b)

Omit “carrying on the same business”, substitute “satisfying the same business test”.

14 Section 165‑10 (note)

Repeal the note, substitute:

Note 1: In the case of a widely held or eligible Division 166 company, Subdivision 166‑A modifies how this Subdivision applies, unless the company chooses otherwise.

Note 2: Companies whose total income for an income year is more than $100 million cannot meet the condition in section 165‑13 for that year: see section 165‑212A.

15 At the end of subsection 165‑12(1)

Add:

Note: See section 165‑255 for the rule about incomplete test periods.

16 Subsection 165‑12(6)

Omit “at the beginning of”, substitute “at any time during”.

17 After subsection 165‑12(7)

Insert:

(7A) If the company is:

(a) a *non‑profit company; or

(b) a *mutual affiliate company; or

(c) a *mutual insurance company;

during the whole of the *ownership test period, the conditions in subsections (3) and (4) are taken to have been satisfied by the company.

18 Section 165‑13 (heading)

Repeal the heading, substitute:

165‑13 Alternatively, the company must satisfy the same business test

19 Subsection 165‑13(1)

Omit “the company” (first occurring), substitute “a company (other than a company covered by section 165‑212A)”.

20 Subsection 165‑13(1) (note)

Omit “Note”, substitute “Note 1”.

21 At the end of subsection 165‑13(1)

Add:

Note 2: Companies whose total income for the income year is more than $100 million cannot meet the condition in this section for that year: see section 165‑212A.

22 Section 165‑15 (heading)

Repeal the heading, substitute:

23 At the end of subsection 165‑15(1)

Add:

Note: A person can still control the voting power in a company that is in liquidation etc.: see section 165‑250.

24 At the end of subsection 165‑15(2)

Add:

Note: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for that year: see section 165‑212A.

25 At the end of section 165‑23

Add:

(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for that year.)

26 Section 165‑30

Repeal the section, substitute:

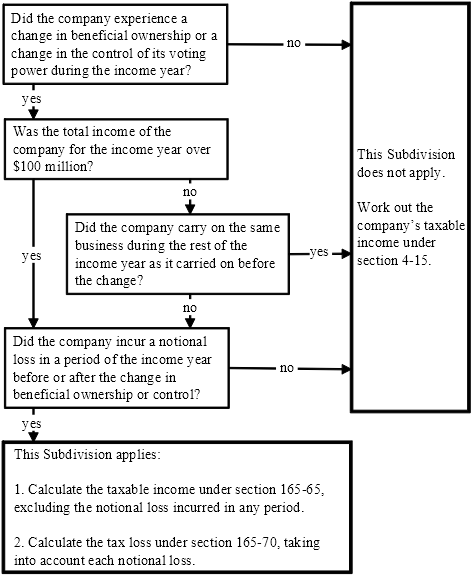

165‑30 Flow chart showing the application of this Subdivision

Note: If the company was a partner during the income year, special rules apply to calculating a notional loss or notional taxable income.

27 Section 165‑35 (heading)

Repeal the heading, substitute:

165‑35 On a change of ownership, unless the company satisfies the same business test

28 Section 165‑35 (notes)

Repeal the notes, substitute:

Note 1: For the same business test, see Subdivision 165‑E.

Note 2: In the case of a widely held or eligible Division 166 company, Subdivision 166‑B modifies how this Subdivision applies, unless the company chooses otherwise.

Note 3: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the rest of the year: see section 165‑212A.

29 Subsection 165‑37(3)

Omit “at the beginning of”, substitute “at any time during”.

30 After subsection 165‑37(4)

Insert:

(4A) If the company is:

(a) a *non‑profit company; or

(b) a *mutual affiliate company; or

(c) a *mutual insurance company;

during the whole of the *ownership test period, the conditions in paragraphs (1)(b) and (c) are taken to have been satisfied by the company.

31 Section 165‑40 (heading)

Repeal the heading, substitute:

32 At the end of subsection 165‑40(1)

Add:

Note: A person can still control the voting power in a company that is in liquidation etc.: see section 165‑250.

33 At the end of subsection 165‑40(2)

Add:

Note: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the rest of the year: see section 165‑212A.

34 At the end of subsection 165‑45(3)

Add:

Note: See section 165‑255 for the rule about incomplete periods.

35 Subsection 165‑45(4) (notes)

Repeal the notes, substitute:

Note 1: For the same business test, see Subdivision 165‑E.

Note 2: See section 165‑225 for a special alternative to this section.

Note 3: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the same business test period: see section 165‑212A.

36 Section 165‑93

Repeal the section, substitute:

165‑93 What this Subdivision is about

In working out its net capital gain for an income year, a company cannot apply a net capital loss for an earlier income year unless:

(a) it has the same owners and the same control from the start of the loss year to the end of the income year; or

(b) it satisfies the same business test by carrying on the same business, entering into no new kinds of transactions and conducting no new kinds of business.

(Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for that year.)

37 Subsection 165‑96(1)

Omit “or *net capital loss”.

38 Subsection 165‑96(1) (note 1)

Omit “or net capital loss”.

39 Subsection 165‑96(1) (note 2)

Omit “in the loss year or the income year”, substitute “in the period from the start of the loss year to the end of the income year”.

40 At the end of section 165‑99

Add:

(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for that year.)

41 Section 165‑102 (heading)

Repeal the heading, substitute:

42 Section 165‑102 (note)

Repeal the note, substitute:

Note: In the case of a widely held or eligible Division 166 company, Subdivision 166‑B modifies how this Subdivision applies, unless the company chooses otherwise.

43 At the end of section 165‑115

Add:

(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for that year.)

44 At the end of subsection 165‑115B(4)

Add:

Note: Companies whose total income for an income year is more than $100 million cannot meet the condition in section 165‑13 for that year: see section 165‑212A.

45 At the end of subsection 165‑115BA(4)

Add:

Note: Companies whose total income for an income year is more than $100 million cannot meet the condition in section 165‑13 for that year: see section 165‑212A.

46 Subsection 165‑115C(3)

Omit “at the reference time”, substitute “at any time during the period from the reference time to the *test time”.

47 After subsection 165‑115C(4)

Insert:

(4A) If the company is:

(a) a *non‑profit company; or

(b) a *mutual affiliate company; or

(c) a *mutual insurance company;

during the whole of the period from the reference time to the *test time, the test time is taken not to be a *changeover time in respect of the company because of the application of paragraphs (1)(b) and (c).

48 At the end of subsection 165‑115D(1)

Add:

Note: A person can still control the voting power in a company that is in liquidation etc.: see section 165‑250.

49 Subsection 165‑115L(4)

Omit “at the reference time”, substitute “at any time during the period from the reference time to the *test time”.

50 At the end of section 165‑115L

Add:

(5) If the company is:

(a) a *non‑profit company; or

(b) a *mutual affiliate company; or

(c) a *mutual insurance company;

during the whole of the period from the reference time to the *test time, the test time is taken not to be an *alteration time in respect of the company because of the application of paragraphs (1)(b) and (c).

51 At the end of subsection 165‑115M(1)

Add:

Note: A person can still control the voting power in a company that is in liquidation etc.: see section 165‑250.

52 Section 165‑117

Repeal the section, substitute:

165‑117 What this Subdivision is about

A company cannot deduct a bad debt unless:

(a) if the debt was incurred in an earlier income year—the company had the same owners and the same control throughout the period from the day on which the debt was incurred to the end of the income year in which it writes off the debt as bad; or

(b) if the debt was incurred in the current year—the company had the same owners and the same control during the income year both before and after the debt was incurred;

or, if there has been a change of ownership or control, the company satisfies the same business test by carrying on the same business, entering into no new kinds of transactions and conducting no new kinds of business.

(Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the second continuity period.)

53 Paragraph 165‑120(1)(c)

Omit “carrying on the same business”, substitute “satisfying the same business test”.

54 Subsection 165‑120(1) (note 1)

Repeal the note, substitute:

Note 1: In the case of a widely held or eligible Division 166 company, Subdivision 166‑C modifies how this Subdivision applies, unless the company chooses otherwise.

55 At the end of subsection 165‑120(1)

Add:

Note 4: Companies whose total income for the current year is more than $100 million cannot meet the condition in section 165‑126 for the second continuity period: see section 165‑212A.

56 At the end of subsection 165‑123(1)

Add:

Note: See section 165‑255 for the rule about incomplete test periods.

57 Subsection 165‑123(6)

Omit “at the beginning of”, substitute “at any time during”.

58 After subsection 165‑123(7)

Insert:

(7A) If the company is:

(a) a *non‑profit company; or

(b) a *mutual affiliate company; or

(c) a *mutual insurance company;

during the whole of the *ownership test period, the conditions in subsections (3) and (4) are taken to have been satisfied by the company.

59 Section 165‑126 (heading)

Repeal the heading, substitute:

165‑126 Alternatively, the company must satisfy the same business test

60 Subsection 165‑126(1)

Omit “the company” (first occurring), substitute “a company (other than a company covered by section 165‑212A)”.

61 Subsection 165‑126(1) (note)

Omit “Note”, substitute “Note 1”.

62 At the end of subsection 165‑126(1)

Add:

Note 2: Companies whose total income for the current year is more than $100 million cannot meet the condition in this section for the second continuity period: see section 165‑212A.

63 Section 165‑129 (heading)

Repeal the heading, substitute:

64 At the end of subsection 165‑129(1)

Add:

Note: A person can still control the voting power in a company that is in liquidation etc.: see section 165‑250.

65 At the end of subsection 165‑129(2)

Add:

Note: Companies whose total income for the current year is more than $100 million cannot satisfy the same business test for the second continuity period: see section 165‑212A.

66 Paragraph 165‑132(1)(b)

Omit “carrying on the same business”, substitute “satisfying the same business test”.

67 At the end of subsection 165‑132(1)

Add:

Note: Companies whose total income for the later income year is more than $100 million cannot satisfy the same business test for that year: see section 165‑212A.

68 At the end of subsection 165‑180(1)

Add:

Example: The Commissioner may treat a person as not having beneficially owned redeemable shares at a particular time if the conditions in subsections (2) and (3) are met in respect of those shares.

69 Section 165‑195

Repeal the section.

70 Subsection 165‑200(1)

Omit “, 165‑190 and 165‑195”, substitute “and 165‑190”.

71 After section 165‑200

Insert:

165‑202 Shares held by government entities and charities etc.

(1) For the purposes of a test, *shares that are beneficially owned by each of the following entities are taken to be beneficially owned instead by a person (who is not a company):

(a) the Commonwealth, a State or a Territory;

(b) a municipal corporation;

(c) a local governing body;

(d) the government of a foreign country, or of part of a foreign country;

(e) a company, established under a law, in which no person has a *membership interest;

(f) a *non‑profit company;

(g) a charitable institution, a charitable fund or any other kind of charitable body (other than such an institution, fund or body that is a trust).

(2) For the purposes of a test, *shares that are beneficially owned through a charitable institution, a charitable fund, or any other kind of charitable body, that is a trust are taken to be beneficially owned instead by a person (who is neither a company nor a trustee).

165‑203 Companies where no shares have been issued

For the purposes of a test, if no *shares have been issued in a company, each *membership interest in the company is taken to be a share in the company.

72 Section 165‑207

Repeal the section, substitute:

165‑207 Trustees of family trusts

(1) This section applies if one or more trustees of a *family trust:

(a) owns *shares in a company; or

(b) controls, or is able to control, (whether directly, or indirectly through one or more interposed entities) voting power in a company; or

(c) has a right to receive (whether directly, or *indirectly through one or more interposed entities) a percentage of a *dividend or a distribution of capital of a company.

(2) For the purposes of a primary test, a single notional entity that is a person (but is neither a company nor a trustee) is taken to own the *shares beneficially.

Note: For a primary test, see subsections 165‑150(1), 165‑155(1) and 165‑160(1).

(3) For the purposes of an alternative test, a single notional entity that is a person (but is neither a company nor a trustee) is taken:

(a) to control, or have the ability to control, the voting power in the company; or

(b) to have the right to receive (whether directly or *indirectly) the percentage of the *dividend or distribution for the entity’s own benefit.

Note: For an alternative test, see subsections 165‑150(2), 165‑155(2) and 165‑160(2).

(4) If a trustee of the trust is subsequently replaced by another trustee of the trust, the same single notional entity is taken:

(a) to own the *shares beneficially; or

(b) to control, or have the ability to control, the voting power in the company; or

(c) to have the right to receive (whether directly or *indirectly) the percentage of the *dividend or distribution for the entity’s own benefit.

73 At the end of Subdivision 165‑D

Add:

165‑208 Companies in liquidation etc.

(1) For the purposes of a primary test or an alternative test, an entity is not prevented from:

(a) beneficially owning *shares in a company; or

(b) having the right to exercise, controlling, or being able to control, voting power in a company; or

(c) having the right to receive any *dividends that a company may pay; or

(d) having the right to receive any distribution of capital of a company;

merely because:

(e) the company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Act 2001; or

(ii) an entity with a similar status under a *foreign law to an externally‑administered body corporate; or

(f) either:

(i) a provisional liquidator is appointed to the company under section 472 of the Corporations Act 2001; or

(ii) a person with a similar status under a foreign law to a provisional liquidator is appointed to the company.

Note 1: For a primary test, see subsections 165‑150(1), 165‑155(1) and 165‑160(1).

Note 2: For an alternative test, see subsections 165‑150(2), 165‑155(2) and 165‑160(2).

(2) For the purposes of a primary test or an alternative test, a company (the stakeholding company) is not prevented from:

(a) beneficially owning *shares in another company, or any other interest in another entity; or

(b) having the right to exercise, controlling, or being able to control, voting power in another company or any other entity; or

(c) having the right to receive any *dividends that another company or any other entity may pay; or

(d) having the right to receive any distribution of capital of another company or of any other entity;

merely because:

(e) the stakeholding company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Act 2001; or

(ii) an entity with a similar status under a *foreign law to an externally‑administered body corporate; or

(f) either:

(i) a provisional liquidator is appointed to the stakeholding company under section 472 of the Corporations Act 2001; or

(ii) a person with a similar status under a foreign law to a provisional liquidator is appointed to the stakeholding company.

Section 165‑150 does not apply to *shares that are *dual listed company voting shares.

74 Subsection 165‑210(1)

Omit “The company”, substitute “A company (other than a company covered by section 165‑212A)”.

75 At the end of subsection 165‑210(1)

Add:

Note: Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for the same business test period: see section 165‑212A.

76 At the end of Subdivision 165‑E

Add:

165‑212A Some companies cannot satisfy the same business test

For the purposes of this Division and Division 166, a company does not satisfy the *same business test for the whole or a part of the income year if the *total income of the company for the income year is more than $100 million.

Note: Section 165‑212C sets out how to work out the total income of a company that is not able to work out its total income for a 12 month period.

165‑212B Definition of total income

(1) The total income of a company for an income year is the total of the following:

(a) any *assessable income (other than any *net capital gains) *derived during the year by the company;

(b) any *exempt income derived during the year by the company;

(c) any *non‑assessable non‑exempt income derived during the year by the company.

(2) In working out the amount of a company’s *non‑assessable non‑exempt income under paragraph (1)(c), do not include:

(a) any amount covered by section 17‑5 (which is about GST); or

(b) any amount of non‑assessable non‑exempt income that is not included in the company’s *assessable income because an equivalent amount has already been included in the company’s assessable income (whether in that year or an earlier income year).

Note: For example, under section 70‑90, the actual amount received for trading stock disposed of outside the ordinary course of business is not included in a company’s assessable income because the market value of that stock has already been included in the company’s assessable income.

165‑212C Total income of companies who cannot work out their total income for a 12 month period

(1) This section sets out how to apply sections 165‑212A and 716‑805 if:

(a) the company does not exist for the whole income year; or

(b) the company is a *subsidiary member of a *consolidated group or a *MEC group for a part of the income year.

(2) The *total income of the company for the income year is the amount that the company reasonably estimates would be the total income if:

(a) the company were in existence for the whole of the income year; and

(b) the company were not a *subsidiary member of a *consolidated group or a *MEC group at any time during the year.

(3) This section applies instead of section 716‑850 (which is about grossing up threshold amounts).

165‑212D Restructure of MDOs etc.

(1) An *MDO does not fail to satisfy the *same business test merely because, before 1 July 2003:

(a) the MDO restructured the way it *provides medical indemnity cover; or

(b) the MDO ceased to provide medical indemnity cover;

in order to comply with the Medical Indemnity (Prudential Supervision and Product Standards) Act 2003.

(2) A *general insurance company which is an *associate of an *MDO does not fail to satisfy the *same business test merely because, before 1 July 2003:

(a) the MDO restructured the way it *provides medical indemnity cover; or

(b) the MDO ceased to provide medical indemnity cover;

in order to comply with the Medical Indemnity (Prudential Supervision and Product Standards) Act 2003.

165‑212E Entry history rule does not apply for the purposes of the same business test

For the purposes of the *same business test, if an entity (the joining entity) becomes a *subsidiary member of a *consolidated group or a *MEC group, section 701‑5 (the entry history rule) does not operate to take the *business of the *head company of the group to include the business of the joining entity before it became a *member of the group.

77 Paragraph 165‑235(2)(c)

Omit “or net capital loss”.

78 At the end of Division 165

Add:

Subdivision 165‑G—Other special provisions

Table of sections

165‑250 Control of companies in liquidation etc.

165‑255 Incomplete periods

165‑250 Control of companies in liquidation etc.

(1) For the purposes of sections 165‑15, 165‑40, 165‑115D, 165‑115M and 165‑129, a person is not prevented from controlling, or being or becoming able to control, voting power in a company merely because:

(a) the company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Act 2001; or

(ii) an entity with a similar status under a *foreign law to an externally‑administered body corporate; or

(b) either:

(i) a provisional liquidator is appointed to the company under section 472 of the Corporations Act 2001; or

(ii) a person with a similar status under a foreign law to a provisional liquidator is appointed to the company.

(2) For the purposes of sections 165‑15, 165‑40, 165‑115D, 165‑115M and 165‑129, a company (the stakeholding company) is not prevented from controlling, or being or becoming able to control, voting power in another company merely because:

(a) the stakeholding company is or becomes:

(i) an externally‑administered body corporate within the meaning of the Corporations Act 2001; or

(ii) an entity with a similar status under a *foreign law to an externally‑administered body corporate; or

(b) either:

(i) a provisional liquidator is appointed to the stakeholding company under section 472 of the Corporations Act 2001; or

(ii) a person with a similar status under a foreign law to a provisional liquidator is appointed to the stakeholding company.

(1) If:

(a) this Division or Division 166 requires a company to meet or satisfy a condition or test, or work out an amount, for a period; and

(b) the company is only in existence after the beginning of the period;

then the period is taken to start on the first day that the company is in existence.

(2) If:

(a) this Division or Division 166 requires a company to meet or satisfy a condition or test, or work out an amount, for a period; and

(b) the company ceases to be in existence before the end of the period;

then the period is taken to end on the day the company ceases to be in existence.

79 Division 166

Repeal the Division, substitute:

Table of Subdivisions

Guide to Division 166

166‑AA The object of this Division

166‑A Deducting tax losses of earlier income years

166‑B Working out the taxable income, tax loss, net capital gain and net capital loss for the income year of the change

166‑C Deducting bad debts

166‑CA Changeover times and alteration times

166‑D Tests for finding out whether the widely held or eligible Division 166 company has maintained the same owners

166‑E Concessional tracing rules

166‑1 What this Division is about

This Division modifies the way the rules in Division 165 apply to a widely held or eligible Division 166 company by making it easier for the company to apply the rules.

If the company has maintained the same owners as between certain points of time, it does not need to prove it has maintained the same owners throughout the periods in between.

In certain cases, special concessional tracing rules deem entities to hold voting, dividend or capital stakes in the company so that the company does not have to trace through to the ultimate beneficial owners of the stakes.

Subdivision 166‑AA—The object of this Division

166‑3 The object of this Division

(1) The object of this Division is to make it easier for a *widely held company, or an *eligible Division 166 company, to apply the rules in Division 165 (because of the difficulty the company might have under that Division in actually tracing through to the ultimate beneficial owners of *voting stakes, *dividend stakes and *capital stakes in the company).

(2) This Division makes it easier to apply the rules in Division 165 by:

(a) making it unnecessary for the company to prove that it has maintained the same owners throughout a period, if the company had the same owners at certain test times; and

(b) making it unnecessary for the company to trace through to the ultimate beneficial owners of:

(i) *voting stakes, *dividend stakes and *capital stakes in the company held by certain entities (whether directly, or *indirectly through one or more interposed entities); and

(ii) small *voting stakes, *dividend stakes and *capital stakes in the company.

Subdivision 166‑A—Deducting tax losses of earlier income years

Table of sections

166‑5 How Subdivision 165‑A applies to a widely held or eligible Division 166 company

166‑15 Companies can choose that this Subdivision is not to apply to them

166‑5 How Subdivision 165‑A applies to a widely held or eligible Division 166 company

(1) This Subdivision modifies the way Subdivision 165‑A applies to a company that is:

(a) a *widely held company at all times during the income year; or

(b) an *eligible Division 166 company at all times during the income year; or

(c) a widely held company for a part of the income year and an eligible Division 166 company for the rest of the income year.

Note 1: Subdivision 165‑A is about the conditions a company must meet before it can deduct a tax loss for an earlier income year.

Note 2: A company can choose that this Subdivision is not to apply to it: see section 166‑15.

Note 3: See section 165‑255 for the rule about incomplete income years.

Meaning of test period

(2) The company’s test period is the period consisting of the *loss year, the income year and any intervening period.

Note: See section 165‑255 for the rule about incomplete test periods.

Substantial continuity of ownership

(3) The company is taken to have met the conditions in section 165‑12 (which is about the company maintaining the same owners) if there is *substantial continuity of ownership of the company as between the start of the *test period and:

(a) the end of each income year in that period; and

(b) the *end of each *corporate change in that period.

Note: See sections 166‑145 and 166‑175 to work out whether there is substantial continuity of ownership and a corporate change.

No substantial continuity of ownership

(4) The company is taken to have failed to meet the conditions in section 165‑12 if there is no *substantial continuity of ownership of the company as between the start of the *test period and:

(a) the end of an income year in that period; or

(b) the *end of a *corporate change in that period.

Satisfies the same business test

(5) However, if the company satisfies the *same business test for the income year (the same business test period), it is taken to have satisfied the condition in section 165‑13.

Note 1: For the same business test, see Subdivision 165‑E.

Note 2: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for that year: see section 165‑212A.

Note 3: See section 165‑255 for the rule about incomplete test periods.

(6) Apply the *same business test to the *business that the company carried on immediately before the earlier of the following times (the test time):

(a) the end of the first income year;

(b) the first time in the test period that a *corporate change in the company *ends;

for which there is no *substantial continuity of ownership of the company as between the start of the *test period and that time.

166‑15 Companies can choose that this Subdivision is not to apply to them

(1) The company can choose that Subdivision 165‑A is to apply to it for the income year without the modifications made by this Subdivision.

(2) The company must choose on or before the day it lodges its *income tax return for the income year, or before a later day if the Commissioner allows.

Table of sections

166‑20 How Subdivisions 165‑B and 165‑CB apply to a widely held or eligible Division 166 company

166‑25 How to work out the taxable income, tax loss, net capital gain and net capital loss

166‑35 Companies can choose that this Subdivision is not to apply to them

166‑20 How Subdivisions 165‑B and 165‑CB apply to a widely held or eligible Division 166 company

(1) This Subdivision modifies how Subdivisions 165‑B and 165‑CB apply to a company that is:

(a) a *widely held company at all times during the income year (the test period); or

(b) an *eligible Division 166 company at all times during the income year (the test period); or

(c) a widely held company for a part of the income year and an eligible Division 166 company for the rest of the income year (the whole year being the test period).

Note 1: Subdivision 165‑B is about when a company must calculate its taxable income and tax loss for the income year in a special way. Subdivision 165‑CB is about when a company must calculate its net capital gain and net capital loss for the income year in a special way.

Note 2: A company can choose that this Subdivision is not to apply to it: see section 166‑35.

Note 3: See section 165‑255 for the rule about incomplete test periods.

No corporate change etc.

(2) If:

(a) no *corporate change in the company *ends at any time in the *test period; or

(b) a corporate change in the company *ends during the test period, but there is *substantial continuity of ownership as between the start of the test period and immediately after the corporate change ends;

the company is taken to have met the condition in paragraph 165‑35(a) (which is about there being persons having *more than a 50% stake in it during the whole of the income year).

Note: See sections 166‑145 and 166‑175 to work out whether there is substantial continuity of ownership and a corporate change.

Corporate change

(3) If:

(a) a *corporate change in the company *ends at any time in the *test period; and

(b) there is no *substantial continuity of ownership as between the start of the test period and immediately after the corporate change ends;

then the company is taken to have failed to meet the condition in paragraph 165‑35(a).

Satisfies the same business test

(4) However, if the company satisfies the *same business test for the rest of the income year (the same business test period) after the first time (the test time) in the *test period that a *corporate change in the company *ended, the company is taken to have satisfied the condition in paragraph 165‑35(b).

Note 1: For the same business test, see Subdivision 165‑E.

Note 2: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the rest of the year: see section 165‑212A.

Note 3: See section 165‑255 for the rule about incomplete test periods.

(5) Apply the *same business test to the *business that the company carried on immediately before the *test time.

166‑25 How to work out the taxable income, tax loss, net capital gain and net capital loss

(1) If the company must calculate its taxable income and *tax loss for the income year under Subdivision 165‑B, and its *net capital gain and *net capital loss under Subdivision 165‑CB, then, in dividing the income year into periods, apply subsection (2) of this section instead of subsection 165‑45(3).

(2) The last period ends at the end of the income year. Each period (except the last) ends at the earlier of:

(a) the earliest time when:

(i) a *corporate change in the company *ends; and

(ii) there is no *substantial continuity of ownership of the company as between the start of the *test period and that time; or

(b) the earliest time when a person begins to control, or becomes able to control, the voting power in the company (whether directly, or indirectly through one or more interposed entities) for the purpose, or for purposes including the purpose, of:

(i) getting some benefit or advantage to do with how this Act applies; or

(ii) getting such a benefit or advantage for someone else.

Note: See sections 166‑145 and 166‑175 to work out whether there is substantial continuity of ownership and a corporate change.

166‑35 Companies can choose that this Subdivision is not to apply to them

(1) The company can choose that Subdivisions 165‑B and 165‑CB are to apply to it for the income year without the modifications made by this Subdivision.

(2) The company must choose on or before the day it lodges its *income tax return for the income year, or before a later day if the Commissioner allows.

Subdivision 166‑C—Deducting bad debts

Table of sections

166‑40 How Subdivision 165‑C applies to a widely held or eligible Division 166 company

166‑50 Companies can choose that this Subdivision is not to apply to them

166‑40 How Subdivision 165‑C applies to a widely held or eligible Division 166 company

(1) This Subdivision modifies the way Subdivision 165‑C applies to a company that is:

(a) a *widely held company at all times during the *current year; or

(b) an *eligible Division 166 company at all times during the current year; or

(c) a widely held company for a part of the current year and an eligible Division 166 company for the rest of the current year.

Note 1: Subdivision 165‑C is about the conditions a company must meet before it can deduct a bad debt.

Note 2: A company can choose that this Subdivision is not to apply to it: see section 166‑50.

Note 3: See section 165‑255 for the rule about incomplete current years.

Meaning of test period

(2) The company’s test period is the period:

(a) that begins at whichever of the following times the company chooses:

(i) the start of the income year in which the debt was incurred;

(ii) the start of the *first continuity period; and

(b) that ends at the end of the *second continuity period;

and includes any intervening period.

Note: See section 165‑255 for the rule about incomplete test periods.

Substantial continuity of ownership

(3) The company is taken to have met the conditions in section 165‑123 (about the company maintaining the same owners) if there is *substantial continuity of ownership of the company as between the start of the *test period and:

(a) the end of each income year in that period; and

(b) the *end of each *corporate change in that period.

Note: See sections 166‑145 and 166‑175 to work out whether there is substantial continuity of ownership and a corporate change.

No substantial continuity of ownership

(4) The company is taken to have failed to meet the conditions in section 165‑123 if there is no *substantial continuity of ownership of the company as between the start of the *test period and:

(a) the end of an income year in that period; or

(b) the *end of a *corporate change in that period.

Satisfies the same business test

(5) However, if the company satisfies the *same business test for the *second continuity period (the same business test period), it is taken to have satisfied the condition in section 165‑126.

Note 1: For the same business test, see Subdivision 165‑E.

Note 2: Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the second continuity period: see section 165‑212A.

Note 3: See section 165‑255 for the rule about incomplete test periods.

(6) Apply the *same business test to the *business that the company carried on immediately before the earlier of the following times (the test time):

(a) the end of the first income year;

(b) the first time in the test period that a *corporate change in the company *ends;

for which there is no *substantial continuity of ownership of the company as between the start of the *test period and that time.

166‑50 Companies can choose that this Subdivision is not to apply to them

(1) The company can choose that Subdivision 165‑C is to apply to it for the income year without the modifications made by this Subdivision.

(2) The company must choose on or before the day it lodges its *income tax return for the income year, or before a later day if the Commissioner allows.

Subdivision 166‑CA—Changeover times and alteration times

Table of sections

166‑80 How Subdivision 165‑CC or 165‑CD applies to a widely held or eligible Division 166 company

166‑90 Companies can choose that this Subdivision is not to apply to them

166‑80 How Subdivision 165‑CC or 165‑CD applies to a widely held or eligible Division 166 company

(1) This Subdivision modifies the way in which:

(a) Subdivision 165‑CC applies in determining whether a changeover time (within the meaning of section 165‑115C) has occurred; or

(b) Subdivision 165‑CD applies in determining whether an alteration time (within the meaning of section 165‑115L) has occurred;

in relation to a company that is:

(c) a *widely held company at all times during the income year; or

(d) an *eligible Division 166 company at all times during the income year; or

(e) a widely held company for a part of the income year and an eligible Division 166 company for the rest of the income year.

Note 1: Subdivision 165‑CC is about the conditions a company that has an unrealised net loss must satisfy before it can have capital losses taken into account or deduct revenue losses. Subdivision 165‑CD provides for reductions in cost bases and certain other reductions after alterations have occurred in the ownership or control of a loss company.

Note 2: A company can choose that this Subdivision is not to apply to it: see section 166‑90.

Note 3: See section 165‑255 for the rule about incomplete income years.

Meaning of test period and test time

(2) The company’s test period is the period starting at the time that is the reference time for the purposes of Subdivision 165‑CC or section 165‑115L, as the case may be, and ending at each of the following times (the test time):

(a) the end of the income year in which the reference time occurred;

(b) the end of a later income year;

(c) the *end of a *corporate change in the company.

Note 1: See section 165‑255 for the rule about incomplete test periods.

Note 2: See section 166‑175 to work out whether there is a corporate change.

Substantial continuity of ownership

(3) A changeover time or an alteration time is taken not to have occurred in respect of the company during the test period if there is *substantial continuity of ownership of the company as between the start of the *test period and the *test time.

Note: See section 166‑145 to work out whether there is substantial continuity of ownership.

No substantial continuity of ownership

(4) Subsections (5) and (6) have effect if there is no *substantial continuity of ownership of the company as between the start of the *test period and the *test time.

(5) The *test time is taken to have been a changeover time or an alteration time, as the case may be, in respect of the company.

(6) No other time during the *test period is a changeover time or an alteration time in respect of the company.

166‑90 Companies can choose that this Subdivision is not to apply to them

(1) The company can choose that Subdivision 165‑CC or 165‑CD is to apply to it in respect of a *test period for the purposes of section 166‑80 without the modifications made by this Subdivision.

(2) The company must choose on or before the day it lodges its *income tax return for the income year in which the *test period begins, or before a later day if the Commissioner allows.

166‑135 What this Subdivision is about

This Subdivision has the tests to work out whether a widely held or eligible Division 166 company has maintained the same owners as between different times. (Subdivision 166‑E has rules which make it easier for the company to satisfy these tests.)

This Subdivision also defines when there has been a corporate change in the company.

Table of sections

The ownership tests: substantial continuity of ownership

166‑145 The ownership tests: substantial continuity of ownership

166‑165 Relationship with rules in Division 165

Corporate change in a company

166‑175 Corporate change in a company

The ownership tests: substantial continuity of ownership

166‑145 The ownership tests: substantial continuity of ownership

(1) There is substantial continuity of ownership of the company as between the start of the *test period and another time in the test period if (and only if) the conditions in this section are met.

Note: Section 166‑165, and Subdivision 166‑E, affect how this section is applied.

Voting power

(2) There must be persons (none of them companies or trustees) who had *more than 50% of the voting power in the company at the start of the *test period. Also, those persons must have had *more than 50% of the voting power in the company immediately after the other time in the test period.

Note: To work out who had more than 50% of the voting power, see section 165‑150.

Rights to dividends

(3) There must be persons (none of them companies) who had rights to *more than 50% of the company’s dividends at the start of the *test period. Also, those persons must have had rights to *more than 50% of the company’s dividends immediately after the other time in the test period.

Note: To work out who had rights to more than 50% of the company’s dividends, see section 165‑155.

Rights to capital distributions

(4) There must be persons (none of them companies) who had rights to *more than 50% of the company’s capital distributions at the start of the *test period. Also, those persons must have had rights to *more than 50% of the company’s capital distributions immediately after the other time in the test period.

Note: To work out who had rights to more than 50% of the company’s capital distributions, see section 165‑160.

When to apply the test

(5) To work out whether a condition in this section was satisfied at a time (the ownership test time), apply the alterative test for that condition.

Note: For the alternative test, see subsections 165‑150(2), 165‑155(2) and 165‑160(2).

Conditions in subsections (3) and (4) satisfied by non‑profit and mutual companies

(6) If the company is:

(a) a *non‑profit company; or

(b) a *mutual affiliate company; or

(c) a *mutual insurance company;

during the whole of the *test period, the conditions in subsections (3) and (4) are taken to have been satisfied by the company.

166‑165 Relationship with rules in Division 165

(1) The provisions of Subdivision 165‑D (other than section 165‑165) apply for the purposes of the tests in section 166‑145.

(2) The following provisions apply for the purposes of the tests in section 166‑145 as if the reference to a particular time were a reference to the *ownership test time:

(a) section 165‑180 (which is about arrangements affecting beneficial ownership of shares);

(b) subsection 165‑185(2) (which treats some shares as never having carried rights);

(c) subsection 165‑190(2) (which treats some shares as always having carried rights).

166‑175 Corporate change in a company

Meaning of corporate change

(1) There is a corporate change in a company if:

(a) there is a *takeover bid for *shares in the company; or

(b) there is a scheme of arrangement, involving more than 50% of the company’s shares, that has been approved by a court; or

(c) there is any other arrangement, involving the acquisition of more than 50% of the company’s shares, that is regulated under the Corporations Act 2001 or a *foreign law; or

(d) there is an issue of *shares in the company that results in an increase of 20% or more in:

(i) the issued share capital of the company; or

(ii) the number of the company’s shares on issue; or

(e) there is a corporate change in another company which beneficially owns one or more of the following stakes in the first company:

(i) a *voting stake that carries rights to more than 50% of the voting power of the first company;

(ii) a *dividend stake that carries rights to receive more than 50% of any dividends the first company may pay;

(iii) a *capital stake that carries rights to receive more than 50% of any distribution of capital of the first company;

(whether the other company owns those stakes directly, or *indirectly through one or more interposed entities).

When a corporate change ends

(2) A *corporate change ends:

(a) if paragraph (1)(a) applies (or paragraph (1)(e) applies because of paragraph (1)(a))—at the latest time when a *bid period of the *takeover bid ends; and

(b) if paragraph (1)(b) or (c) applies (or paragraph (1)(e) applies because of paragraph (1)(b) or (c))—when the scheme of arrangement or other arrangement ends; and

(c) if paragraph (1)(d) applies (or paragraph (1)(e) applies because of paragraph (1)(d))—when the offer period for the issue of *shares ends.

Subdivision 166‑E—Concessional tracing rules

166‑215 What this Subdivision is about

This Subdivision has rules which make it easier for a widely held or eligible Division 166 company to satisfy the ownership tests in Subdivision 166‑D.

Special concessional tracing rules deem entities to hold the following stakes in the company so that the company does not have to trace through to the beneficial owners of the stakes:

(a) stakes of less than 10% in the company;

(b) stakes of between 10% and 50% that are held by widely held companies;

(c) stakes that are held by complying superannuation funds, complying approved deposit funds, special companies and managed investment schemes;

(d) stakes in interposed foreign listed companies that are held as bearer shares;

(e) stakes in interposed foreign listed companies that are held by depository entities.

Table of sections

Application of this Subdivision

166‑220 Application of this Subdivision

Stakes of less than 10% in the tested company

166‑225 Direct stakes of less than 10% in the tested company

166‑230 Indirect stakes of less than 10% in the tested company

166‑235 Voting, dividend and capital stakes

Stakes held directly and/or indirectly by widely held companies

166‑240 Stakes held directly and/or indirectly by widely held companies

166‑245 Stakes held by other entities

When identity of foreign stakeholders is not known

166‑255 Bearer shares in foreign listed companies

166‑260 Depository entities holding stakes in foreign listed companies

Other rules relating to voting power and rights

166‑265 Persons who actually control voting power or have rights are taken not to control power or have rights

166‑270 Single notional entity stakeholders taken to have minimum voting control, dividend rights and capital rights

166‑272 Same shares or interests to be held

When the rules in this Subdivision do not apply

166‑275 Rules in this Subdivision intended to be concessional

166‑280 Controlled test companies

Application of this Subdivision

166‑220 Application of this Subdivision

This Subdivision applies to a company (the tested company) that is:

(a) a *widely held company at all times during the income year; or

(b) an *eligible Division 166 company at all times during the income year; or

(c) a widely held company for a part of the income year and an eligible Division 166 company for the rest of the income year.

Note: See section 165‑255 for the rule about incomplete income years.

Stakes of less than 10% in the tested company

166‑225 Direct stakes of less than 10% in the tested company

(1) This section modifies how the ownership tests in section 166‑145 are applied to the tested company if:

(a) a *voting stake that carries rights to less than 10% of the voting power in the company is held directly in the company; or

(b) a *dividend stake that carries the right to receive less than 10% of any dividends that the company may pay is held directly in the company; or

(c) a *capital stake that carries the right to receive less than 10% of any distribution of capital of the company is held directly in the company.

Note: Other rules might affect this provision: see sections 166‑270, 166‑275 and 166‑280.

Notional shareholder

(2) The tests are applied to the tested company as if, at the *ownership test time, a single notional entity:

(a) directly controlled the voting power that is carried by each such *voting stake; and

(b) had the right to receive, for its own benefit and directly:

(i) any *dividends the tested company may pay in respect of each such *dividend stake; and

(ii) any distributions of capital of the tested company in respect of each such *capital stake; and

(c) were a person (other than a company).

Note: The persons who actually control the voting power and have rights to dividends and capital are taken not to control that power or have those rights: see section 166‑265.

(3) To avoid doubt, the single notional entity mentioned in subsection (2) is a different single notional entity from the one mentioned in section 165‑207 and the one mentioned in section 166‑255.

166‑230 Indirect stakes of less than 10% in the tested company

(1) This section modifies how the ownership tests in section 166‑145 are applied to the tested company if it is the case, or it is reasonable to assume that:

(a) an entity (the stakeholder) indirectly holds any of these stakes in the tested company:

(i) a *voting stake that carries rights to less than 10% of the voting power in the company; or

(ii) a *dividend stake that carries the right to receive less than 10% of any dividends that the company may pay; or

(iii) a *capital stake that carries the right to receive less than 10% of any distribution of capital of the company; and

(b) either:

(i) the stakeholder indirectly holds the stake in the tested company by holding *shares directly in a company (the top interposed entity) that is interposed between the stakeholder and the tested company; or

(ii) the stakeholder indirectly holds the stake in the tested company by holding another interest directly in an entity (the top interposed entity) that is not a company and that is interposed between the stakeholder and the tested company.

Note 1: There might also be other entities interposed between the top interposed entity and the tested company.

Note 2: Other rules might affect this provision: see subsection (3) and sections 166‑272, 166‑275 and 166‑280.

Top interposed entity deemed to hold stakes directly in the tested company

(2) The tests are applied to the tested company as if, at the *ownership test time:

(a) if the stake is a *voting stake—the top interposed entity controls, or is able to control, the voting power in the tested company that is carried by that stake at that time; and

(b) if the stake is a *dividend stake—the top interposed entity *indirectly had the right to receive, for its own benefit, any *dividends the tested company may pay in respect of that stake at that time; and

(c) if the stake is a *capital stake—the top interposed entity indirectly had the right to receive, for its own benefit, any distributions of capital of the tested company in respect of that stake at that time; and

(d) in any case—the top interposed entity were a person (other than a company).

Note: The persons who actually control the voting power and have rights to dividends and capital are taken not to control that power or have those rights: see section 166‑265.

Acquisition of top interposed entity by another entity

(3) If:

(a) a new entity (the new interposed entity) acquires all the *shares or other interests in the top interposed entity (the old interposed entity); and

(b) the new interposed entity has the same classes of shares or other interests as the old interposed entity; and

(c) if the new interposed entity is a company—the shares are not *redeemable shares; and

(d) in any case—each stakeholder holds the same proportion of the total *voting stakes, *dividend stakes or *capital stakes in the new interposed entity immediately after the acquisition as the stakeholder held in the old interposed entity immediately before the acquisition;

then, at all times that the old interposed entity held or is taken to have held a stake in the tested company, the new interposed entity is taken to have held that stake.

(4) Except for the purposes of determining whether a time is an alteration time (within the meaning of section 165‑115L), section 166‑272 (which is about the same shares or interests) is to be disregarded when applying subsection (3).

166‑235 Voting, dividend and capital stakes

Meaning of voting stake

(1) An entity holds a voting stake in a company if:

(a) the entity is the registered holder of *shares in the company; and

(b) the shares carry rights to exercise voting power in the company.

(2) An entity (the stakeholder) also holds a voting stake in a company if:

(a) one or more other entities are interposed between the company and the stakeholder; and

(b) the stakeholder controls, or is able to control, voting power in the company indirectly through the interposed entity or entities.

Meaning of dividend stake

(3) An entity holds a dividend stake in a company if:

(a) the entity is the registered holder of *shares in the company; and

(b) the shares carry rights to all or any *dividends that the company may pay.

(4) An entity (the stakeholder) also holds a dividend stake in a company if:

(a) one or more other entities are interposed between the company and the stakeholder; and

(b) the stakeholder has the right to receive, for its own benefit and *indirectly through the interposed entity or entities, all or any *dividends that the company may pay.

Meaning of capital stake

(5) An entity holds a capital stake in a company if:

(a) the entity is the registered holder of *shares in the company; and

(b) the shares carry rights to all or any of a distribution of capital of the company.

(6) An entity (the stakeholder) also holds a capital stake in a company if:

(a) one or more other entities are interposed between the company and the stakeholder; and

(b) the stakeholder has the right to receive, for its own benefit and *indirectly through the interposed entity or entities, all or any of a distribution of capital of the company.

Stakes held by nominees

(7) For the purposes of sections 166‑225 and 166‑230, if:

(a) an entity (the nominee entity) holds a *voting stake, a *dividend stake, or a *capital stake, in a company; and

(b) the nominee entity is itself a company; and

(c) the nominee entity holds the stake as a nominee for more than one other entity;

then, for each entity for whom a part of the stake is held by the nominee entity, that entity’s part of the stake may be treated instead as a separate stake.

Stakes held directly and/or indirectly by widely held companies

166‑240 Stakes held directly and/or indirectly by widely held companies

(1) This section modifies how the ownership tests in section 166‑145 are applied to the tested company if a *widely held company directly or indirectly (through one or more interposed entities), or both directly and indirectly, holds any of the following:

(a) a *voting stake that carries rights to between 10% and 50% (inclusive) of the voting power in the company;

(b) a *dividend stake that carries the right to receive between 10% and 50% (inclusive) of any dividends that the company may pay;

(c) a *capital stake that carries the right to receive between 10% and 50% (inclusive) of any distribution of capital of the company.

Note: Other rules might affect this provision: see subsections (3) and (4) and sections 166‑272, 166‑275 and 166‑280.

(2) The tests are applied to the tested company as if, at the *ownership test time:

(a) if the stake is a *voting stake—the *widely held company controls, or is able to control, the voting power in the tested company that is carried by that stake at that time; and

(b) if the stake is a *dividend stake—the widely held company had the right to receive (whether directly or *indirectly), for its own benefit, any *dividends the tested company may pay in respect of that stake at that time; and

(c) if the stake is a *capital stake—the widely held company had the right to receive (whether directly or indirectly), for its own benefit, any distributions of capital of the tested company in respect of that stake at that time; and

(d) in any case—the widely held company were a person (other than a company).

Note: The persons who actually control the voting power and have rights to dividends and capital are taken not to control that power or have those rights: see section 166‑265.

Exception

(3) This section does not apply in respect of a *widely held company if the company is not a widely held company for the whole income year in which the *ownership test time occurs.

Note: See section 165‑255 for the rule about incomplete periods.

Acquisition of widely held company by another entity

(4) If:

(a) a new company acquires all the *shares in the *widely held company; and

(b) immediately before the acquisition, the shares in the widely held company were listed for quotation in the official list of an *approved stock exchange; and

(c) immediately after the acquisition, the shares in the new company are listed for quotation in the official list of an approved stock exchange; and

(d) the new company has the same classes of shares (not being *redeemable shares) as the widely held company; and

(e) each entity that held stakes in the widely held company immediately before the acquisition holds the same proportion of the total *voting stakes, *dividend stakes or *capital stakes in the new company immediately after the acquisition as the entity held in the widely held company immediately before the acquisition;

then, at all times that the widely held company held or is taken to have held a stake in the tested company, the new company is taken to have held that stake.

(5) Except for the purposes of determining whether a time is an alteration time (within the meaning of section 165‑115L), section 166‑272 (which is about same shares or interests) is to be disregarded when applying subsection (4).

166‑245 Stakes held by other entities

(1) This section modifies how the ownership tests in section 166‑145 are applied to the tested company if:

(a) an entity mentioned in subsection (2) directly or indirectly (through one or more interposed entities) holds a *voting stake, a *dividend stake or a *capital stake in the company; and

(b) neither the entity nor another entity has, under section 166‑225, 166‑230 or 166‑240, been taken to control voting power or have rights in respect of the stake; and

(c) the entity mentioned in subsection (2) satisfies the condition in subsection (3).

Note: Other rules might affect this provision: see sections 166‑272, 166‑275 and 166‑280.

(2) For the purposes of subsection (1), these are the entities:

(a) a *superannuation fund; and

(b) an *approved deposit fund; and

(c) a *special company; and

(d) a *managed investment scheme; and

(e) any other entity, or entity of a kind, prescribed by the regulations.

(3) For the purposes of paragraph (1)(c), an entity satisfies the condition in this subsection if at all times during the income year of the tested company in which the *ownership test time occurs:

(a) if the entity is a *superannuation fund:

(i) the fund is a *complying superannuation fund; or

(ii) the fund is a superannuation fund that is established in a foreign country and is regulated under a *foreign law; or

(b) if the entity is an *approved deposit fund—the fund is a *complying approved deposit fund; or

(c) if the entity is a *special company—the company is a special company; or

(d) if the entity is a *managed investment scheme:

(i) the scheme is registered under the Corporations Act 2001; or

(ii) the entity is recognised, under a *foreign law relating to corporate regulation, as an entity with a similar status to a managed investment scheme; or

(e) if the entity is an entity, or an entity of a kind, prescribed by the regulations—the entity meets any conditions prescribed by the regulations.

Note: See section 165‑255 for the rule about incomplete periods.

If the entity has 10 members or fewer

(4) If the entity has 10 *members or fewer, the tests are applied to the tested company as if, at the *ownership test time:

(a) if the stake is a *voting stake—each member controls, or is able to control, an equal proportion of the voting power in the tested company that is carried by that stake at that time; and

(b) if the stake is a *dividend stake—each member had the right to receive (whether directly or *indirectly), for its own benefit, an equal proportion of any *dividends the tested company may pay in respect of that stake at that time; and

(c) if the stake is a *capital stake—each member had the right to receive (whether directly or indirectly), for its own benefit, an equal proportion of any distributions of capital of the tested company in respect of that stake at that time; and

(d) in any case—each member were a person (other than a company or a trustee).

Note 1: If each member’s proportion of the voting power, the dividends or the distributions is less than 10%, then subsections (5) and (6) apply instead.

Note 2: The persons who actually control the voting power and have rights to dividends and capital are taken not to control that power or have those rights: see section 166‑265.

If the entity has more than 10 members etc.

(5) The ownership tests are applied as set out in subsection (6) if:

(a) the entity has more than 10 *members; or

(b) under subsection (4):

(i) the proportion of the voting power in the company that each member controls, or is able to control, is less than 10% of the total voting power; or

(ii) the proportion of the *dividends that the tested company may pay for the benefit of each member is less than 10% of the total dividends; or

(iii) the proportion of the distributions of capital that the tested company may pay for the benefit of each member is less than 10% of the total distributions.

(6) The ownership tests are applied to the tested company as if, at the *ownership test time:

(a) if the stake is a *voting stake—the entity controls, or is able to control, the voting power in the tested company that is carried by that stake at that time; and

(b) if the stake is a *dividend stake—the entity had the right to receive (whether directly or *indirectly), for its own benefit, any *dividends the tested company may pay in respect of that stake at that time; and

(c) if the stake is a *capital stake—the entity had the right to receive (whether directly or indirectly), for its own benefit, any distributions of capital of the tested company in respect of that stake at that time; and

(d) in any case—the entity were a person (other than a company or a trustee).

Note: The persons who actually control the voting power and have rights to dividends and capital are taken not to control that power or have those rights: see section 166‑265.

When identity of foreign stakeholders is not known

166‑255 Bearer shares in foreign listed companies

(1) This section modifies how the ownership tests in section 166‑145 are applied to the tested company if:

(a) at the *ownership test time, it is the case, or it is reasonable to assume, that persons (none of them companies or trustees) hold a *voting stake, a *dividend stake or a *capital stake in the tested company; and

(b) an entity has not, under section 166‑225, 166‑230, 166‑240 or 166‑245, been taken to control voting power or have rights in respect of the stake; and

(c) another company (the foreign listed company) is interposed, at that time, between those persons and the tested company; and

(d) at all times during the income year of the tested company in which the ownership test time occurs, the *principal class of shares in the foreign listed company is listed for quotation in the official list of an *approved stock exchange; and

(e) at the ownership test time:

(i) voting stakes that carry rights to 50% or more of the voting power in the foreign listed company; or

(ii) dividend stakes that carry rights to receive 50% or more of any dividends that the foreign listed company may pay; or

(iii) capital stakes that carry rights to receive 50% or more of any distribution of capital of the foreign listed company;

as the case requires, are directly held by way of bearer shares; and

(f) the beneficial owners of some or all of those bearer shares have not been disclosed to the foreign listed company.

Note 1: See section 165‑255 for the rule about incomplete test periods.

Note 2: Other rules might affect this provision: see sections 166‑270, 166‑275 and 166‑280.

(2) The tests are applied to the tested company as if, at the *ownership test time, for each of those bearer shares whose owners have not been disclosed: