Tax Laws Amendment (Personal Tax Reduction and Improved Depreciation Arrangements) Act 2006

No. 55, 2006

An Act to amend the law relating to taxation, and for related purposes

Tax Laws Amendment (Personal Tax Reduction and Improved Depreciation Arrangements) Act 2006

No. 55, 2006

An Act to amend the law relating to taxation, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedule(s)

Schedule 1—Reduced personal income tax rates

Part 1—Main amendments

Income Tax Rates Act 1986

Part 2—Related amendments

A New Tax System (Ultimate Beneficiary Non‑disclosure Tax) Act (No. 1) 1999

A New Tax System (Ultimate Beneficiary Non‑disclosure Tax) Act (No. 2) 1999

Family Trust Distribution Tax (Primary Liability) Act 1998

Income Tax (Bearer Debentures) Act 1971

Income Tax Rates Act 1986

Trust Recoupment Tax Act 1985

Trust Recoupment Tax Assessment Act 1985

Part 3—Application

Schedule 2—Reduced fringe benefits tax rate

Fringe Benefits Tax Act 1986

Schedule 3—Increased low income tax offset

Income Tax Assessment Act 1936

Schedule 4—Increased threshold for Medicare levy

Medicare Levy Act 1986

Schedule 5—Improved depreciation arrangements

Part 1—Main amendments

Income Tax Assessment Act 1997

Income Tax (Transitional Provisions) Act 1997

Part 2—Consequential amendments

Income Tax Assessment Act 1997

Tax Laws Amendment (Personal Tax Reduction and Improved Depreciation Arrangements) Act 2006

No. 55, 2006

An Act to amend the law relating to taxation, and for related purposes

[Assented to 19 June 2006]

The Parliament of Australia enacts:

This Act may be cited as the Tax Laws Amendment (Personal Tax Reduction and Improved Depreciation Arrangements) Act 2006.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent. | 19 June 2006 |

2. Schedule 1 | 1 July 2006. | 1 July 2006 |

3. Schedule 2 | The day on which this Act receives the Royal Assent. | 19 June 2006 |

4. Schedules 3 and 4 | 1 July 2006. | 1 July 2006 |

5. Schedule 5 | The day on which this Act receives the Royal Assent. | 19 June 2006 |

Note: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

(2) Column 3 of the table contains additional information that is not part of this Act. Information in this column may be added to or edited in any published version of this Act.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Clause 1 of Part I of Schedule 7 (table)

Repeal the table, substitute:

Tax rates for resident taxpayers | ||

Item | For the part of the ordinary taxable income of the taxpayer that: | The rate is: |

1 | exceeds $6,000 but does not exceed $25,000 | 15% |

2 | exceeds $25,000 but does not exceed $75,000 | 30% |

3 | exceeds $75,000 but does not exceed $150,000 | 40% |

4 | exceeds $150,000 | 45% |

2 Clause 1 of Part II of Schedule 7 (table)

Repeal the table, substitute:

Tax rates for non‑resident taxpayers | ||

Item | For the part of the ordinary taxable income of the taxpayer that: | The rate is: |

1 | does not exceed $25,000 | 29% |

2 | exceeds $25,000 but does not exceed $75,000 | 30% |

3 | exceeds $75,000 but does not exceed $150,000 | 40% |

4 | exceeds $150,000 | 45% |

3 Section 4

Omit “48.5%”, substitute “46.5%”.

4 Section 4

Omit “48.5%”, substitute “46.5%”.

5 Section 4

Omit “48.5%”, substitute “46.5%”.

6 Section 6

Omit “47%”, substitute “45%”.

7 Paragraph 12(7)(a) (definition of A)

Omit “47%”, substitute “45%”.

8 Paragraph 12(7)(b) (definition of A)

Omit “47%”, substitute “45%”.

9 Paragraph 12(8)(a) (definition of A)

Omit “47%”, substitute “45%”.

10 Paragraph 12(8)(b) (definition of A)

Omit “47%”, substitute “45%”.

11 Subsection 12(9)

Omit “47%”, substitute “45%”.

12 Subsection 13(2)

Omit “$1,445”, substitute “$1,307”.

13 Paragraphs 13(5)(b), (6)(c) and (8)(b)

Omit “$1,445”, substitute “$1,307”.

14 Paragraphs 15(2)(b), (4)(d) and (6)(b)

Omit “$810”, substitute “$732”.

15 Paragraphs 23(4)(c) and (4A)(d) and 26(1)(b)

Omit “47%”, substitute “45%”.

16 Subsection 26(2)

Omit “47%”, substitute “45%”.

17 Paragraph 27(1)(b)

Omit “47%”, substitute “45%”.

18 Subsection 27(2)

Omit “47%”, substitute “45%”.

19 Paragraph 27A(b)

Omit “47%”, substitute “45%”.

20 Paragraph 1(aa) of Part I of Schedule 7

Omit “47%”, substitute “45%”.

21 Paragraph 1(aa) of Part II of Schedule 7

Omit “47%”, substitute “45%”.

22 Subparagraph 2(b)(ii) of Division 2 of Part I of Schedule 8

Omit “$21,600” (wherever occurring), substitute “$25,000”.

23 Paragraph 2(b) of Part I of Schedule 10

Omit “$21,600” (wherever occurring), substitute “$25,000”.

24 Clause 2 of Part I of Schedule 11

Omit “47%”, substitute “45%”.

25 Clause 3 of Part I of Schedule 11 (definition of C)

Omit “47%”, substitute “45%”.

26 Clause 2 of Part II of Schedule 11

Omit “47%”, substitute “45%”.

27 Clause 3 of Part II of Schedule 11 (definition of C)

Omit “47%”, substitute “45%”.

28 Clause 2 of Part I of Schedule 12

Omit “47%”, substitute “45%”.

29 Clause 2 of Part II of Schedule 12

Omit “47%”, substitute “45%”.

30 Paragraph 5(a)

Omit “47%”, substitute “45%”.

31 Subsection 6(3)

Omit “2.12”, substitute “2.22”.

32 Application

(1) The amendments made by this Schedule, except the amendment of the Income Tax (Bearer Debentures) Act 1971, apply to assessments for the 2006‑2007 year of income and later years of income.

(2) The amendment of the Income Tax (Bearer Debentures) Act 1971 made by this Schedule applies to interest paid or credited after 30 June 2006.

1 Section 6

Omit “48.5%”, substitute “46.5%”.

2 Application

The amendment made by this Schedule applies in relation to the year of tax starting on 1 April 2006 and later years of tax.

1 Subsection 159N(1)

Omit “$27,475”, substitute “$40,000”.

2 Subsection 159N(2)

Omit “$235”, substitute “$600”.

3 Subsection 159N(2)

Omit “$21,600”, substitute “$25,000”.

4 Application

The amendments made by this Schedule apply in relation to assessments for the 2006‑07 year of income and later years of income.

1 Subsection 3(1) (paragraph (a) of the definition of phase‑in limit)

Omit “$23,749”, substitute “$29,255”.

2 Subsection 3(1) (paragraph (a) of the definition of threshold amount)

Omit “$21,968”, substitute “$24,867”.

3 Subsection 7(2)

Omit “20%”, substitute “10%”.

4 Subsection 7(4)

Omit “$450”, substitute “$490”.

5 Subsection 7(4)

Omit “20%”, substitute “10%”.

6 Subsection 8(2) (formula)

Repeal the formula, substitute:

![]()

7 Subsection 8(7)

Omit “$31,729”, substitute “$33,500”.

8 Application

The amendments made by this Schedule apply to assessments for the 2006‑07 year of income and later years of income.

1 After section 40‑70

Insert:

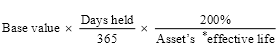

(1) You work out the decline in value of a *depreciating asset for an income year using the diminishing value method in this way if you started to *hold the asset on or after 10 May 2006:

where:

base value has the same meaning as in subsection 40‑70(1).

days held has the same meaning as in subsection 40‑70(1).

Note: If you recalculate the effective life of a depreciating asset, you use that recalculated life in working out your deduction.

You can choose to recalculate effective life because of changed circumstances: see section 40‑110. That section also requires you to recalculate effective life in some cases.

Exception: intangibles

(2) You cannot use the *diminishing value method to work out the decline in value of:

(a) *in‑house software; or

(b) an item of *intellectual property (except copyright in a *film); or

(c) a *spectrum licence; or

(d) a *datacasting transmitter licence; or

(e) a *telecommunications site access right.

Limit on decline

(3) The decline in value of a *depreciating asset under this section for an income year cannot be more than the amount that is the asset’s base value in the formula in subsection (1) for that income year.

2 After section 40‑830

Insert:

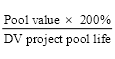

(1) You calculate your deduction for an income year for a project pool in this way if the project pool contains only *project amounts incurred on or after 10 May 2006 for projects that start to operate on or after that day:

where:

DV project pool life has the same meaning as in subsection 40‑830(3).

pool value has the same meaning as in subsection 40‑830(3).

(2) If, in an income year, you abandon, sell or otherwise dispose of a project for which you have a project pool, you can deduct for that year the sum of the pool’s *closing pool value for the previous income year and any *project amounts allocated to the pool for the income year.

(3) Your assessable income for that income year includes any amount you receive for the abandonment, sale or other disposal.

(4) Your assessable income for an income year includes other capital amounts that you *derive in that year in relation to a *project amount allocated to your project pool or in relation to something on which the project amount is expended.

(5) Your deduction for an income year cannot be more than the amount of the component “pool value” in the formula in subsection (1) for that year.

3 After section 40‑70

Insert:

(1) If:

(a) you are taken to start holding a depreciating asset on or after 10 May 2006 because of section 40‑115 (about splitting a depreciating asset) or 40‑125 (about merging depreciating assets) of the Income Tax Assessment Act 1997; and

(b) it is reasonable to conclude that you split the asset or merged the assets for the main purpose of ensuring that the decline in value of the asset or assets (after the splitting or merging) would be worked out under section 40‑72 of that Act;

that Act applies to you as if you had started to hold the split or merged asset or assets before 10 May 2006.

(2) The Income Tax Assessment Act 1997 applies to you as if you had started to hold a depreciating asset before 10 May 2006 if:

(a) you had actually started to hold it before that day; and

(b) on or after 10 May 2006, you stop holding the depreciating asset; and

(c) it is reasonable to conclude that you did this for the main purpose of ensuring that the decline in value of the asset would be worked out under section 40‑72 of that Act.

(3) The Income Tax Assessment Act 1997 applies to you as if you had started to hold a depreciating asset (the substituted asset) before 10 May 2006 if:

(a) you started to hold the substituted asset on or after that day under an arrangement; and

(b) the substituted asset is identical to or has a purpose similar to another depreciating asset that another entity acquired from you on or after that day under that arrangement; and

(c) you did not deal with the other entity at arm’s length; and

(d) it is reasonable to conclude that you entered into the arrangement for the main purpose of ensuring that the decline in value of the substituted asset would be worked out under section 40‑72 of that Act.

4 After section 40‑825

Insert:

If:

(a) on or after 10 May 2006 you abandon, sell or otherwise dispose of a project; and

(b) you have deducted or can deduct amounts for project amounts in relation to that project; and

(c) on or after that day, you start to operate that project again; and

(d) it is reasonable to conclude that you did this for the main purpose of ensuring that deductions for project amounts in relation to that project would be worked out under section 40‑832 of that Act;

the Income Tax Assessment Act 1997 applies to you as if the project had started to operate before 10 May 2006.

5 Section 10‑5 (table item headed “Project pools”)

After “40‑830”, insert “, 40‑832”.

6 Section 12‑5 (table item headed “capital allowances”)

Omit:

project pools ............................. | 40‑830 |

substitute:

project pools ............................. | 40‑830, 40‑832 |

7 Subsection 40‑25(1) (note 1)

Repeal the note, substitute:

Note 1: Sections 40‑70, 40‑72 and 40‑75 show you how to work out the decline for most depreciating assets. There is a limit on the decline: see subsections 40‑70(3), 40‑72(3) and 40‑75(7).

8 Subsection 40‑65(1) (note 2)

Omit “section 40‑70”, substitute “sections 40‑70 and 40‑72”.

9 At the end of subsection 40‑830(3)

Add:

Note: The calculation is made under subsection 40‑832(3) for project amounts incurred on or after 10 May 2006 for projects that start to operate on or after that day.

10 Section 40‑835

After “section 40‑830”, insert “or 40‑832”.

11 Subsection 995‑1(1) (definition of diminishing value method)

Omit “section 40‑70”, substitute “sections 40‑70 and 40‑72”.

[Minister’s second reading speech made in—

House of Representatives on 11 May 2006

Senate on 13 June 2006]

(59/06)