An Act to regulate private health insurance, and for related purposes

Chapter 1—Introduction

Part 1‑1—Introduction

Division 1—Preliminary

1‑1 Short title

This Act may be cited as the Private Health Insurance Act 2007.

1‑5 Commencement

This Act commences on 1 April 2007.

1‑10 Identifying defined terms

(1) Many of the terms in this Act are defined in the Dictionary in Schedule 1.

(2) Most of the terms that are defined in the Dictionary are identified by an asterisk appearing at the start of the term: as in “*health benefits fund”. The footnote with the asterisk contains a signpost to the Dictionary.

(3) An asterisk usually identifies the first occurrence of a term in a section (if not divided into subsections), subsection, definition, table item or diagram. Later occurrences of the term in the same provision are not usually asterisked.

(4) Terms are not asterisked in headings, notes, examples or guides.

(5) If a term is not identified by an asterisk, disregard that fact in deciding whether or not to apply to that term a definition or other interpretation provision.

(6) The following basic terms used throughout the Act are not identified with an asterisk:

Terms that are not identified with an asterisk |

Item | This term ... | is defined in ... |

2 | Federal Court | the Dictionary in Schedule 1 |

3 | insurance | section 5‑1 |

4 | Chief Executive Medicare | the Dictionary in Schedule 1 |

5 | Private Health Insurance Ombudsman | the Dictionary in Schedule 1 |

6 | private health insurer | the Dictionary in Schedule 1 |

1‑15 Extension to Norfolk Island

This Act extends to Norfolk Island.

Division 3—Overview of this Act

3‑1 What this Act is about

This Act is about private health insurance. It:

(a) provides incentives to encourage people to have private health insurance; and

(b) sets out rules governing private health insurance *products.

Note: The Private Health Insurance (Prudential Supervision) Act 2015 sets out the registration process for private health insurers, imposes requirements about how private health insurers conduct health insurance business and deals with other matters in relation to the prudential supervision of private health insurers.

3‑5 Incentives (Chapter 2)

Chapter 2 provides the following incentives:

(a) reductions in premiums for *complying health insurance policies;

(c) a lifetime health cover scheme, under which premiums may rise for people who do not maintain private health insurance from an early age.

3‑10 Complying health insurance products (Chapter 3)

Chapter 3 requires insurers who make private health insurance available to people to do so in a non‑discriminatory way, to offer *products that comply with this Act, and to meet certain other obligations imposed by this Act in relation to those products.

3‑15 Health insurance business, health benefits funds and miscellaneous obligations of private health insurers (Chapter 4)

Chapter 4 defines the key concepts of *health insurance business and *health benefits funds. It also deals with some related matters and imposes miscellaneous obligations on private health insurers.

3‑20 Enforcement (Chapter 5)

Chapter 5 provides for a range of enforcement mechanisms aimed at monitoring and ensuring compliance with this Act and protecting the interests of *policy holders.

3‑25 Administration (Chapter 6)

Chapter 6 contains administrative and machinery provisions relating to the operation of this Act.

3‑30 Dictionary (Schedule 1)

The Dictionary in Schedule 1 contains definitions of terms used throughout this Act.

Division 5—Constitutional matters

5‑1 Meaning of insurance

In this Act:

insurance means insurance to which paragraph 51(xiv) of the Constitution applies.

5‑5 Act not to apply to State insurance within that State

This Act does not apply with respect to State insurance that does not extend beyond the limits of the State concerned.

5‑10 Compensation for acquisition of property

(1) If the operation of this Act would result in an acquisition of property from a person otherwise than on just terms, the Commonwealth is liable to pay a reasonable amount of compensation to the person.

(2) If the Commonwealth and the person do not agree on the amount of the compensation, the person may institute proceedings in the Federal Court for the recovery from the Commonwealth of such reasonable amount of compensation as the court determines.

(3) In this section:

acquisition of property has the same meaning as in paragraph 51(xxxi) of the Constitution.

just terms has the same meaning as in paragraph 51(xxxi) of the Constitution.

Chapter 2—Incentives

Part 2‑1—Introduction

Division 15—Introduction

15‑1 What this Chapter is about

This Chapter contains the following incentives to encourage people to have private health insurance:

(a) reductions in premiums (see Division 23);

(c) lifetime health cover (see Part 2‑3).

Part 2‑2—Premiums reduction scheme

Division 20—Introduction

20‑1 What this Part is about

To encourage people to take out, and continue to hold, private health insurance, this Part provides that people may reduce the premiums payable for their complying health insurance policies by participating in the premiums reduction scheme in Division 23.

Note: The premiums reduction scheme is complemented by the private health insurance offset provided for by Subdivision 61‑G of the Income Tax Assessment Act 1997.

20‑5 Private Health Insurance (Incentives) Rules

Matters relating to the *premiums reduction scheme are also dealt with in the Private Health Insurance (Incentives) Rules. The provisions of this Part indicate when a particular matter is or might be dealt with in these Rules.

Note: The Private Health Insurance (Incentives) Rules are made by the Minister under section 333‑20.

Division 22—PHIIB, PHII benefit and related concepts

Subdivision 22‑A—PHIIB, PHII benefit and related concepts

22‑1 Application of Subdivision

This Subdivision applies if a premium, or an amount in respect of a premium, was paid, or is payable, during a financial year under a *complying health insurance policy in respect of a period (the premium period).

22‑5 Meaning of PHIIB

Adults insured under policy

(1) Each *adult insured under the *complying health insurance policy throughout the premium period is a PHIIB, in respect of the premium or amount.

Note: PHIIB is short for private health insurance incentive beneficiary.

Dependent child‑only policies

(2) Subsections (3) and (4) apply if the only persons insured under the *complying health insurance policy throughout the premium period are one or more *dependent children.

(3) Each person who is a parent (within the meaning of Part 2.11 of the Social Security Act 1991) in relation to one or more of those *dependent children on the last day of the financial year mentioned in section 22‑1 is a PHIIB, in respect of the premium or amount.

(4) However, the person who pays the premium or amount is the only PHIIB, in respect of the premium or amount, if:

(a) disregarding this subsection, more than one person would be a *PHIIB in respect of the premium or amount because of subsection (3); and

(b) those persons are not married to each other (within the meaning of the A New Tax System (Medicare Levy Surcharge—Fringe Benefits) Act 1999) at the end of the financial year; and

(c) the person who pays the premium or amount is not a *dependent child.

22‑10 Meaning of PHII benefit

The amount of the PHII benefit, in respect of the premium or amount, is:

(a) if there is only one *PHIIB in respect of the premium or amount—the PHIIB’s *share of the PHII benefit in respect of the premium or amount; or

(b) if there is more than one PHIIB in respect of the premium or amount—the sum of each of those PHIIB’s share of the PHII benefit in respect of the premium or amount.

Note: PHII benefit is short for private health insurance incentive benefit.

22‑15 Meaning of share of the PHII benefit—single PHIIB

(1) If there is only one *PHIIB in respect of the premium or amount, the amount of the *PHIIB’s share of the PHII benefit, in respect of the premium or amount, is the sum of:

(a) 30% of the amount of the premium, or of the amount in respect of a premium, paid or payable in respect of days in the premium period on which no person insured under the policy was aged 65 years or over; and

(b) 35% of the amount of the premium, or of the amount in respect of a premium, paid or payable in respect of days in the premium period on which:

(i) at least one person insured under the policy was aged 65 years or over; and

(ii) no person insured under the policy was aged 70 years or over; and

(c) 40% of the amount of the premium, or of the amount in respect of a premium, paid or payable in respect of days in the premium period on which at least one person insured under the policy was aged 70 years or over.

Private health insurance tiers

(2) Reduce the amount of each percentage specified in subsection (1) (as affected by subsection (5A)) by 10 percentage points if the *PHIIB is a *tier 1 earner for the financial year mentioned in section 22‑1.

(3) Reduce the amount of each percentage specified in subsection (1) (as affected by subsection (5A)) by 20 percentage points if the *PHIIB is a *tier 2 earner for the financial year mentioned in section 22‑1.

(4) Reduce the amount of each percentage specified in subsection (1) (as affected by subsection (5A)) to nil if the *PHIIB is a *tier 3 earner for the financial year mentioned in section 22‑1.

(5) For the purposes of applying subsections (2), (3) and (4) in relation to the premium or amount, treat the table in subsection 22‑30(1) as applying to the *PHIIB for the financial year if he or she is a PHIIB in respect of the premium or amount because of subsection 22‑5(3) or (4).

Note 1: The table in subsection 22‑30(1) sets out the private health insurance tiers for families.

Note 2: Subsections 22‑5(3) and (4) apply if the only persons insured under the policy are dependent children.

Annual adjustment of percentages

(5A) For each adjustment year, each percentage specified in subsection (1), (2) or (3) is replaced by the percentage worked out as follows:

(a) for the adjustment year starting on 1 April 2014—multiply the specified percentage by the adjustment factor for the adjustment year;

(b) for a later adjustment year—multiply the specified percentage, as worked out under this subsection for the preceding adjustment year, by the adjustment factor for the later adjustment year.

(5B) Percentages are to be worked out under subsection (5A) to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(5C) The percentages worked out under subsection (5A) for an adjustment year apply in relation to premiums, or amounts in respect of premiums, that were paid, or that are payable, at any time in the adjustment year.

(5D) Each of the following is an adjustment year:

(a) the period of 12 months starting on 1 April 2014;

(b) the period of 12 months starting on each later 1 April.

(5E) The adjustment factor for an adjustment year is to be determined in accordance with the Private Health Insurance (Incentives) Rules. However, if the factor so determined for an adjustment year is more than 1, the adjustment factor for that year is instead taken to be 1.

Lifetime health cover loading

(6) For the purposes of applying paragraphs (1)(a), (b) and (c), reduce the amount of the premium, or the amount in respect of a premium, by any part of that amount that is attributable to an increase in the premium in accordance with Division 34.

22‑20 Meaning of share of the PHII benefit—multiple PHIIBs

If there is more than one *PHIIB in respect of the premium or amount, work out in accordance with section 22‑15 the amount of each of those PHIIB’s share of the PHII benefit, in respect of the premium or amount, on the following assumptions:

(a) assume that the PHIIB is the only person who is a PHIIB in respect of the premium or amount;

(b) assume that the premium or amount is the amount of the premium (or the amount in respect of the premium) divided by the number of persons who are PHIIBs in respect of the premium or amount.

22‑25 Application of subsection 22‑15(1) after a person 65 years or over ceases to be covered by policy

(1) If:

(a) the *PHIIB mentioned in subsection 22‑15(1) was insured under a *complying health insurance policy (the original policy) (whether or not the policy mentioned in section 22‑1) at a time before the start of the premium period mentioned in that section; and

(b) the PHIIB was not a *dependent child at that time; and

(c) at that time, another person (the entitling person) was:

(i) insured under the original policy; and

(ii) aged 65 years or over; and

(d) the entitling person subsequently ceased to be insured under the original policy;

subsection 22‑15(1) applies in relation to the complying health insurance policy mentioned in section 22‑1 as if:

(e) the entitling person were also insured under that policy; and

(f) the entitling person were the same age as the age at which he or she ceased to be insured under the original policy.

(2) Subsection (1) ceases to apply if a person (other than a *dependent child) who was not insured under the original policy at the time the entitling person ceased to be insured under it becomes insured under the *complying health insurance policy mentioned in section 22‑1.

(3) Subsection (1) does not apply if its application would result in the *PHIIB’s *share of the PHII benefit being less than it would otherwise have been.

Subdivision 22‑B—Private health insurance tiers

22‑30 Private health insurance tiers

Families

(1) The following table applies to a person (the first person) for a financial year if:

(a) on the last day of the financial year, the person is married (within the meaning of the A New Tax System (Medicare Levy Surcharge—Fringe Benefits) Act 1999); or

(b) on any day in the financial year, the person contributes in a substantial way to the maintenance of a *dependent child who is:

(i) the person’s child (within the meaning of the Income Tax Assessment Act 1997); or

(ii) the person’s sibling (including the person’s half‑brother, half‑sister, adoptive brother, adoptive sister, step‑brother, step‑sister, foster‑brother or foster‑sister) who is dependent on the person for economic support:

Private health insurance tiers—families |

Item | Column 1 For the financial year, the person is a ... | Column 2 if his or her income for surcharge purposes for the financial year exceeds the following for the financial year … | Column 3 but does not exceed the following (if applicable) for the financial year … |

1 | tier 1 earner | his or her *family tier 1 threshold | his or her *family tier 2 threshold. |

2 | tier 2 earner | his or her *family tier 2 threshold | his or her *family tier 3 threshold. |

3 | tier 3 earner | his or her *family tier 3 threshold | not applicable. |

(2) For the purposes of subsection (1), if paragraph (1)(a) applies, treat the *income for surcharge purposes for the financial year of the person to whom the first person is married (as mentioned in that paragraph) as included in the first person’s income for surcharge purposes for the financial year.

(3) Subdivision 960‑J of the Income Tax Assessment Act 1997 (Family relationships) applies to subparagraphs (1)(b)(i) and (ii) of this section in the same way as it applies to that Act.

Singles

(4) The following table applies to a person for a financial year if the table in subsection (1) does not apply to the person for the financial year:

Private health insurance tiers—singles |

Item | Column 1 For the financial year, the person is a ... | Column 2 if his or her income for surcharge purposes for the financial year exceeds the following for the financial year … | Column 3 but does not exceed the following (if applicable) for the financial year … |

1 | tier 1 earner | his or her *singles tier 1 threshold | his or her *singles tier 2 threshold. |

2 | tier 2 earner | his or her *singles tier 2 threshold | his or her *singles tier 3 threshold. |

3 | tier 3 earner | his or her *singles tier 3 threshold | not applicable. |

22‑35 Private health insurance singles thresholds

(1) A person’s singles tier 1 threshold for the 2008‑09 financial year is $70,000. This amount is indexed annually.

(2) A person’s singles tier 2 threshold for the 2010‑11 financial year is $90,000. This amount is indexed annually.

(3) A person’s singles tier 3 threshold for the 2010‑11 financial year is $120,000. This amount is indexed annually.

Note 1: A person may be a tier 1 earner, tier 2 earner or tier 3 earner if his or her income for surcharge purposes exceeds the applicable threshold for that tier: see section 22‑30.

Note 2: Section 22‑45 shows how to index amounts.

22‑40 Private health insurance family thresholds

(1) A person’s family tier 1 threshold for a financial year is an amount equal to double his or her *singles tier 1 threshold for the financial year.

(2) A person’s family tier 2 threshold for a financial year is an amount equal to double his or her *singles tier 2 threshold for the financial year.

(3) A person’s family tier 3 threshold for a financial year is an amount equal to double his or her *singles tier 3 threshold for the financial year.

(4) However, if the person has 2 or more dependants (within the meaning of the A New Tax System (Medicare Levy Surcharge—Fringe Benefits) Act 1999) who are children, increase his or her family tier 1 threshold, family tier 2 threshold and family tier 3 threshold for the financial year by the result of the following formula:

Example: If the person has 3 such dependants who are children, his or her family tier 2 threshold for the 2010‑11 financial year is:

Note: A person may be a tier 1 earner, tier 2 earner or tier 3 earner if his or her income for surcharge purposes exceeds the applicable threshold for that tier: see section 22‑30.

22‑45 Indexation

(1) This section applies in relation to an amount mentioned in section 22‑35 (Private health insurance singles thresholds).

Indexing amounts

(2) Index the amount by:

(a) firstly:

(i) if the amount is mentioned in subsection 22‑35(1) (singles tier 1 threshold)—multiplying the amount for the 2008‑2009 financial year by its *indexation factor mentioned in subsection (4); or

(ii) if the amount is mentioned in subsection 22‑35(2) or (3) (singles tier 2 threshold or singles tier 3 threshold)—multiplying the amount for the 2010‑2011 financial year by its indexation factor mentioned in subsection (5); and

(b) next, rounding the result in paragraph (a) down to the nearest multiple of $1,000.

Example 1:If the amount to be indexed is $90,000 and the indexation factor increases this to an indexed amount of $90,500, the indexed amount is rounded back down to $90,000.

Example 2:If the amount to be indexed is $120,000 and the indexation factor increases this to an indexed amount of $121,500, the indexed amount is rounded down to $121,000.

(3) Do not index the amount if its indexation factor mentioned in subsection (4) or (5) is 1 or less.

(3A) Do not index the amount for the 2015‑16, 2016‑17, 2017‑18, 2018‑19, 2019‑20 or 2020‑21 financial year.

(3B) If the amount is not indexed for a financial year because of the operation of subsection (3A), the amount for the financial year is the amount for the most recent financial year for which the amount was indexed.

Indexation factor

(4) For indexation of the amount on an annual basis in accordance with subparagraph (2)(a)(i), the indexation factor is:

(5) For indexation of the amount on an annual basis in accordance with subparagraph (2)(a)(ii), the indexation factor is:

(6) Work out the *indexation factor mentioned in subsection (4) or (5) to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

Index number

(7) For calculating the amounts, the index number for a *quarter is the estimate of full‑time adult average weekly ordinary time earnings for the middle month of the quarter first published by the Australian Statistician in respect of that month.

Division 23—Premiums reduction scheme

Subdivision 23‑A—Amount of reduction

23‑1 Reduction in premiums

(1) The amount of premiums payable under a *complying health insurance policy in respect of a period is reduced in accordance with this section if a person is a *participant in the *premiums reduction scheme in respect of the policy.

(2) The amount of the reduction for each premium is the *PHII benefit in respect of the premium.

Subdivision 23‑B—Participation in the premiums reduction scheme

23‑15 Registration as a participant in the premiums reduction scheme

(1) A person may apply to a private health insurer, in the *approved form, to become a *participant in the *premiums reduction scheme in respect of a *complying health insurance policy issued by the insurer if:

(a) the insurer is a *participating insurer; and

(b) the person is a *PHIIB in respect of a premium paid or payable under the policy; and

(c) the person meets any requirements specified in the Private Health Insurance (Incentives) Rules for the purposes of this paragraph.

(2) A private health insurer that receives an application under subsection (1) must notify the Chief Executive Medicare of the application, in the *approved form, no more than 14 days (or any other period determined by the Chief Executive Medicare) after receiving the application.

(3) If notified of an application and satisfied that paragraphs (1)(a), (b) and (c) apply, the Chief Executive Medicare must register the applicant as a *participant in respect of the policy.

(4) The Chief Executive Medicare must notify the private health insurer that issued the policy if the Chief Executive Medicare registers a person as a *participant in the *premiums reduction scheme in respect of the policy.

23‑20 Refusal to register

(1) If the Chief Executive Medicare refuses to register the applicant in respect of a policy, the Chief Executive Medicare must give the applicant, and the private health insurer that issued the policy, notice of the refusal together with reasons for the refusal.

Note: Refusals to register are reviewable under Part 6‑9.

(2) The applicant is taken to be registered as a *participant in respect of the policy if the Chief Executive Medicare does not give notice of refusal within 14 days after receiving the notice under subsection 23‑15(2) from the private health insurer to which the applicant applied for registration.

23‑30 Participants who want to withdraw from scheme

(1) A *participant must notify the private health insurer that issued the policy in respect of which a person is a participant if the person no longer wishes to be registered in respect of the policy.

(2) A private health insurer must notify the Chief Executive Medicare of each notice the insurer receives under subsection (1), in the *approved form and no more than 14 days (or any other period determined by the Chief Executive Medicare) after receiving the notice.

(3) If notified under subsection (2), the Chief Executive Medicare must revoke the person’s registration in respect of the policy.

23‑35 Revocation of registration

(1) The Chief Executive Medicare must revoke a person’s registration in respect of a *complying health insurance policy if the Chief Executive Medicare is satisfied that the person is not eligible to participate in the *premiums reduction scheme in respect of the policy.

Note: Revocations of registration are reviewable under section Part 6‑9.

(2) Revocation of registration under subsection (1) does not affect a person’s right to make another application for registration under section 23‑15.

(3) The Chief Executive Medicare must give notice of the revocation of a person’s registration in respect of a *complying health insurance policy to the person, and to the private health insurer that issued the policy, within 28 days after the day on which the revocation occurs.

23‑40 Variation of registration

(1) A private health insurer must notify the Chief Executive Medicare if the treatments *covered by a *complying health insurance policy, issued by the private health insurer and in respect of which a person is a *participant, are varied.

(2) On receiving such a notice, the Chief Executive Medicare must vary the details of the registration accordingly and give notice of the variation to the private health insurer.

23‑45 Retention of applications by private health insurers

(1) A private health insurer must retain an application made to it under subsection 23‑15(1) for the period of 5 years beginning on the day on which the application was made.

(2) The private health insurer may retain the application in any form approved in writing by the Chief Executive Medicare.

(3) An application retained in such a form must be received in all courts or tribunals as evidence as if it were the original.

Part 2‑3—Lifetime health cover

Division 31—Introduction

31‑1 What this Part is about

People are encouraged to take out hospital cover by the time they turn 30. A person who is older than 30 when he or she takes out hospital cover for the first time, or who drops hospital cover for a period after having turned 30, may have to pay higher premiums for hospital cover. This scheme is known as lifetime health cover.

31‑5 Private Health Insurance (Lifetime Health Cover) Rules

Matters relating to lifetime health cover are also dealt with in the Private Health Insurance (Lifetime Health Cover) Rules. The provisions of this Part indicate when a particular matter is or might be dealt with in these Rules.

Note: The Private Health Insurance (Lifetime Health Cover) Rules are made by the Minister under section 333‑20.

Division 34—General rules about lifetime health cover

34‑1 Increased premiums for person who is late in taking out hospital cover

(1) A private health insurer must increase the amount of premiums payable for *hospital cover in respect of an *adult if the adult did not have hospital cover on his or her *lifetime health cover base day.

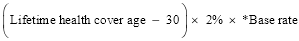

(2) The amount of the increase is worked out as follows:

where:

base rate, for *hospital cover, is the amount of premiums that would be payable for the cover if:

(a) the premiums were not increased under this Part; and

(b) there was no discount of the kind allowed under subsection 66‑5(2).

lifetime health cover age, in relation to an *adult who takes out *hospital cover after his or her *lifetime health cover base day, means the adult’s age on the 1 July before the day on which the adult took out the hospital cover.

34‑5 Increased premiums for person who ceases to have hospital cover after his or her lifetime health cover base day

(1) A private health insurer must increase the amount of premiums payable for *hospital cover in respect of an *adult if, after the adult’s *lifetime health cover base day, the adult ceases to have hospital cover.

(2) The amount of the increase is worked out as follows:

where:

base rate is the *base rate for the *hospital cover.

years without hospital cover is the number obtained by:

(a) dividing by 365 the number of days (other than *permitted days without hospital cover), after the first day on which subsection (1) applied to the *adult, on which he or she did not have *hospital cover; and

(b) rounding up the result to the nearest whole number.

(3) Any increase under this section in the amount of premiums payable for *hospital cover is in addition to any increase under section 34‑1 in the amount of premiums payable for that hospital cover.

34‑10 Increased premiums stop after 10 years’ continuous cover

(1) A private health insurer must stop increasing the amount of premiums payable for *hospital cover in respect of an *adult under this Part if the adult has had hospital cover (including under an *applicable benefits arrangement), the premiums for which have been increased under this Part or *old Schedule 2:

(a) for a continuous period of 10 years; or

(b) for a period of 10 years that has been interrupted only by *permitted days without hospital cover or periods during which the adult was taken to have had hospital cover otherwise than because of paragraph 34‑15(2)(a) (none of which count towards the 10 years).

(2) The amount must stop being increased on the day after the last day of the 10 year period.

(3) The amount of premiums payable for *hospital cover in respect of the *adult must start to be increased under this Part again if:

(a) after the end of the 10 year period, the adult ceases to have hospital cover; and

(b) the adult later takes out hospital cover again; and

(c) the days in the period between ceasing to have the cover and taking it out again are not all *permitted days without hospital cover in respect of the adult.

(4) Subsection (3) does not prevent this section applying again in respect of any later 10 year period.

(5) In subsection (1):

old Schedule 2 means Schedule 2 to the National Health Act 1953 as in force before 1 April 2007.

34‑15 Meaning of hospital cover

(1) Hospital cover is so much of a *complying health insurance policy as *covers *hospital treatment. An *adult has hospital cover if he or she is insured under a complying health insurance policy that covers hospital treatment.

(2) An *adult is taken to have *hospital cover:

(a) at any time during which the adult was covered by an *applicable benefits arrangement; or

(b) at any time during which the adult holds a *gold card; or

(c) at any time during which the adult is in a class of adults specified in the Private Health Insurance (Lifetime Health Cover) Rules for the purposes of this paragraph.

(3) In this section:

gold card means a card that evidences a person’s entitlement to be provided with treatment:

(a) in accordance with the Treatment Principles prepared under section 90 of the Veterans’ Entitlements Act 1986; or

(b) in accordance with a determination made under section 286 of the Military Rehabilitation and Compensation Act 2004 in respect of the provision of treatment.

34‑20 Meaning of permitted days without hospital cover

(1) Any of the following days that occur after an *adult ceases, for the first time after his or her *lifetime health cover base day, to have *hospital cover are permitted days without hospital cover in respect of that adult:

(a) days on which the cover was suspended by the private health insurer in accordance with the rules for suspensions set out in the Private Health Insurance (Lifetime Health Cover) Rules;

(b) days (not counting days covered by paragraph (a)) on which the adult is *overseas that form part of a continuous period overseas of more than one year;

(c) the first 1,094 days (not counting days covered by paragraph (a) or (b)) on which the adult did not have hospital cover.

(2) The Private Health Insurance (Lifetime Health Cover) Rules may specify days that, despite subsection (1), are taken not to be *permitted days without hospital cover.

34‑25 Meaning of lifetime health cover base day

General rule: 1 July after person turns 31

(1) Subject to subsections (2), (3), (4) and (4A), a person’s lifetime health cover base day is the 1 July after the person turns 31.

Note: See also section 37‑5.

Person who had lifetime health cover base day on or before 30 June 2010

(2) If a person had a lifetime health cover base day on or before 30 June 2010, that lifetime health cover base day remains the person’s lifetime health cover base day.

Person who is not an Australian citizen and is not covered by subsection (2)

(3) Subject to subsection (4), the lifetime health cover base day of a person who is not an Australian citizen on the person’s *medicare eligibility day and is not covered by subsection (2) is the later of:

(a) the 1 July after the person turns 31; and

(b) the first anniversary of the person’s medicare eligibility day.

Note: See also section 37‑5.

Person overseas on day worked out under subsection (1) or (3)

(4) However, if the person is *overseas on the day worked out under subsection (1) or (3), the person’s lifetime health cover base day is the first anniversary of:

(a) the person’s first return to Australia from overseas; or

(b) the person’s first entry to Australia;

after the day worked out under subsection (1) or (3), whichever is applicable.

Person living on Norfolk Island at the final transition time

(4A) If:

(a) a person was living on Norfolk Island at the final transition time (within the meaning of the Norfolk Island Act 1979); and

(b) the person had turned 31 before that time;

the person’s lifetime health cover base day is the first day after the end of the 12‑month period that began at that time.

(4B) If:

(a) a person is living on Norfolk Island at the final transition time (within the meaning of the Norfolk Island Act 1979); and

(b) the person turns 31 at or after that time;

the person’s lifetime health cover base day is whichever is the later of the following:

(c) the 1 July after the person turns 31;

(d) the first day after the 12‑month period that began at that time.

Medicare eligibility day

(5) A person’s medicare eligibility day is the day on which the person is registered by the Chief Executive Medicare as an eligible person within the meaning of section 3 of the Health Insurance Act 1973.

34‑30 When a person is overseas or enters Australia

(1) Without limiting when a person is taken to be *overseas for the purposes of this Part:

(a) a person who lived on Norfolk Island before the final transition time (within the meaning of the Norfolk Island Act 1979) is taken, while the person was living on Norfolk Island before that time, to have been overseas; and

(b) any period in which a person returns to Australia for less than 90 days counts as part of a continuous period overseas.

(2) For the purposes of this Part, a person is taken not to have returned to Australia from *overseas, or entered Australia, if the person returns to Australia, or enters Australia, but remains in Australia for a period of less than 90 days.

Division 37—Exceptions to the general rules about lifetime health cover

37‑1 People born on or before 1 July 1934

(1) The amount of premiums payable for *hospital cover in respect of an *adult does not increase under this Part if the adult was born on or before 1 July 1934.

(2) However, this section does not prevent section 37‑20 applying to the *hospital cover in respect of any *adults who were born after 1 July 1934.

37‑5 People over 31 and overseas on 1 July 2000

A person:

(a) who turned 31 on or before 1 July 2000; and

(aa) who:

(i) was an Australian citizen on 1 July 2000; or

(ii) was an Australian resident (within the meaning of section 3 of the Health Insurance Act 1973) on 1 July 2000; or

(iii) had a lifetime health cover base day on or before 30 June 2010; and

(b) who was *overseas on 1 July 2000;

is taken, for the purposes of section 34‑1, to have had *hospital cover on the person’s *lifetime health cover base day.

37‑7 Person yet to turn 31

If the 1 July after a person turns 31 has not arrived, lifetime health cover does not yet apply to the person.

37‑10 Hardship cases

A person is treated for the purposes of this Part as if he or she had *hospital cover on 1 July 2000 if a determination under clause 10 of Schedule 2 to the National Health Act 1953 (as in force immediately before 1 April 2007) had effect in relation to the person immediately before 1 April 2007.

37‑15 Increases cannot exceed 70% of base rates

The maximum amount of any increase under this Part in the amount of premiums payable for *hospital cover in respect of an *adult is an amount equal to 70% of the *base rate for the hospital cover.

37‑20 Joint hospital cover

(1) If:

(a) more than one *adult is covered under the same *hospital cover; and

(b) the amount of premiums payable for the cover in respect of at least one of those adults is increased under this Part;

the amount of the premiums payable for the cover in respect of all of the adults is increased.

(2) The amount of the increase in the premiums payable for the cover is worked out by:

(a) dividing the *base rate for the cover by the number of *adults it covers; and

(b) using that rate to work out for each adult what the amount of the increase for that adult (if any) would be; and

(c) adding together the results of paragraph (b).

Division 40—Administrative matters relating to lifetime health cover

40‑1 Notification to insured people etc.

(1) A private health insurer must comply with any requirements specified in the Private Health Insurance (Lifetime Health Cover) Rules relating to providing information to:

(a) *adults in respect of *hospital cover with the private health insurer; and

(b) other adults who apply for, or inquire about, that hospital cover;

about increases under this Part in the amounts of premiums payable for hospital cover in respect of those adults.

(2) A private health insurer must comply with any requirements specified in the Private Health Insurance (Lifetime Health Cover) Rules relating to providing information to other private health insurers about increases under this Part in the amounts of premiums payable for *hospital cover with the private health insurer.

(3) The Private Health Insurance (Lifetime Health Cover) Rules may require or permit a private health insurer to provide information of a kind referred to in this section in the form of an age notionally attributed, to an *adult or other person, as the age from which the adult or other person will be treated as having had continuous *hospital cover.

(4) A private health insurer must keep separate records in relation to each *adult who has *hospital cover.

(5) When an *adult ceases to be *covered by *hospital cover under which more than one adult was covered, the private health insurer must notify each other adult that the adult has ceased to be covered by the cover.

40‑5 Evidence of having had hospital cover, or of a person’s age

A private health insurer must comply with any requirements specified in the Private Health Insurance (Lifetime Health Cover) Rules relating to whether, and in what circumstances, particular kinds of evidence are to be accepted, for the purposes of this Part, as conclusive evidence of:

(a) whether a person had *hospital cover at a particular time, or during a particular period; or

(b) a person’s age.

Chapter 3—Complying health insurance products

Part 3‑1—Introduction

Division 50—Introduction

50‑1 What this Chapter is about

Broadly, health insurance that is made available to the public must meet the requirements in this Chapter. This means that:

(a) the insurance must be community‑rated (that is, made available in a way that does not discriminate between people) (see Part 3‑2); and

(b) the insurance must be in the form of a complying health insurance product (see Part 3‑3); and

(c) the private health insurers who make the products available must meet certain obligations to people insured or seeking to be insured under the products (see Part 3‑4).

50‑5 Private Health Insurance Rules relevant to this Chapter

Matters relating to *complying health insurance products are also dealt with in the Private Health Insurance (Complying Product) Rules, the Private Health Insurance (Benefit Requirements) Rules, the Private Health Insurance (Prostheses) Rules and the Private Health Insurance (Accreditation) Rules. The provisions of this Chapter indicate when a particular matter is or may be dealt with in these Rules.

Note: These Rules are all made by the Minister under section 333‑20.

Part 3‑2—Community rating

Division 55—Principle of community rating

55‑1 What this Part is about

To ensure that everybody who chooses has access to health insurance, the principle of community rating prevents private health insurers from discriminating between people on the basis of their health or for any other reason described in this Part.

55‑5 Principle of community rating

(1) A private health insurer must not:

(a) take or fail to take any action; or

(b) in making a decision, have regard or fail to have regard to any matter;

that would result in the insurer *improperly discriminating between people who are or wish to be insured under a *complying health insurance policy of the insurer.

(2) Improper discrimination is discrimination that relates to:

(a) the suffering by a person from a chronic disease, illness or other medical condition or from a disease, illness or medical condition of a particular kind; or

(b) the gender, race, sexual orientation or religious belief of a person; or

(c) the age of a person, except to the extent allowed under Part 2‑3 (lifetime health cover) or subsection 63‑5(4); or

(d) where a person lives, except to the extent allowed under subsection 66‑10(2) or section 66‑20; or

(e) any other characteristic of a person (including but not just matters such as occupation or leisure pursuits) that is likely to result in an increased need for *hospital treatment or *general treatment; or

(f) the frequency with which a person needs hospital treatment or general treatment; or

(g) the amount or extent of the benefits to which a person becomes entitled during a period under a *complying health insurance policy, except to the extent allowed under section 66‑15; or

(h) any matter set out in the Private Health Insurance (Complying Product) Rules for the purposes of this paragraph.

(3) Despite subsection (2), discrimination by a *restricted access insurer is not improper discrimination to the extent to which the insurer:

(a) takes or fails to take an action; or

(b) in making a decision, has regard or fails to have regard to a matter;

only to ensure that its *complying health insurance products are not made available to persons to whom its constitution or *rules prohibits it from making the products available.

(4) Despite subsection (2), discrimination by a private health insurer is not improper discrimination to the extent to which:

(a) the insurer:

(i) takes or fails to take an action; or

(ii) in making a decision, has regard or fails to have regard to a matter; and

(b) taking or failing to take the action, or having regard or failing to have regard to that matter, has the effect of the premiums payable under an insurance policy that covers a person who is:

(i) employed by a particular person or body; or

(ii) under contract to provide services to a particular person or body;

being the subject of a discount or discounts (whether or not the policy also covers one or more persons who are not so employed and are not under such a contract); and

(c) the premiums meet the premium requirement in section 66‑5.

(5) To avoid doubt, subsection (4) does not apply if taking or failing to take the action, or having regard or failing to have regard to that matter, has the effect of an insurance policy being cancelled because a person ceases to be an employee of, or ceases to be under contract to provide services to, a particular employer.

55‑10 Closed products, and terminated products and product subgroups

The principle of community rating in section 55‑5 does not:

(a) prevent a private health insurer from closing a *complying health insurance product, such that the *product will not be available to anyone except those persons, who at the time of closing, are insured under a policy forming part of the product; or

(b) prevent a private health insurer from terminating a complying health insurance product or a *product subgroup of a complying health insurance product, such that:

(i) in the case of a product—the product will not be available to any person insured under a policy forming part of the product; and

(ii) in the case of a product subgroup—the product subgroup will not be available to any person insured under a policy that belongs to the product subgroup.

55‑15 Pilot projects

(1) The principle of community rating in section 55‑5 does not prevent a private health insurer from:

(a) taking or failing to take any action; or

(b) in making a decision, having regard or failing to have regard to any matter;

for the purposes of conducting a pilot project in accordance with the Private Health Insurance (Complying Product) Rules.

(2) The Private Health Insurance (Complying Product) Rules may permit pilot projects of a kind specified in the Rules to be conducted by private health insurers in accordance with requirements specified in the Rules.

Part 3‑3—Requirements for complying health insurance products

Division 60—Introduction

60‑1 What this Part is about

Complying health insurance products (which are made up of complying health insurance policies) are the only kind of insurance that private health insurers are allowed to make available as part of their health insurance business (see section 63‑1 and Division 84). This Part sets out the requirements that an insurance policy must meet in order to be a complying health insurance policy.

Division 63—Basic rules about complying health insurance products

63‑1 Obligation to ensure products are complying products

(1) A private health insurer must ensure that the only kind of insurance that it makes available as part of its *health insurance business is insurance in the form of *complying health insurance products.

(2) However, subsection (1) does not apply in relation to *health insurance business of a kind that the Private Health Insurance (Complying Product) Rules specify is excluded from subsection (1).

63‑5 Meaning of complying health insurance product

(1) A complying health insurance product is a *product made up of *complying health insurance policies.

(2) A product is all the insurance policies issued by a private health insurer:

(a) that *cover the same treatments; and

(b) that provide benefits that are worked out in the same way; and

(c) whose other terms and conditions are the same as each other.

(2A) A product subgroup, of a *product, is all the insurance policies in the product:

(a) under which the addresses of the people insured, as known to the private health insurer, are located in the same *risk equalisation jurisdiction; and

(b) under which the same kind of insured group (within the meaning of the Private Health Insurance (Complying Product) Rules) is insured.

(2B) The Private Health Insurance (Complying Product) Rules may specify insured groups for the purposes of paragraph (2A)(b). An insured group may be specified by reference to any or all of the number of people in the group, the kind of people in the group, or any other matter. A group may consist of only one person.

(3) Different premiums may be payable under policies in the same *product.

(4) A premium payable for a policy that covers an insured group of 2 or more people that includes a *dependent child non‑student may be higher than a premium payable for a policy in the same *product that covers an insured group of 2 or more people that includes one or more *dependent children but no dependent child non‑student.

(5) A dependent child non‑student is a *dependent child who:

(a) is aged between 18 and 24 (inclusive); and

(b) is not receiving full‑time education at a school, college or university.

63‑10 Meaning of complying health insurance policy

A complying health insurance policy is an insurance policy that meets:

(a) the community rating requirements in Division 66; and

(b) the coverage requirements in Division 69; and

(c) if the policy *covers *hospital treatment—the benefit requirements in Division 72; and

(d) the waiting period requirements in Division 75; and

(e) the portability requirements in Division 78; and

(f) the quality assurance requirements in Division 81; and

(g) any requirements set out in the Private Health Insurance (Complying Product) Rules for the purposes of this paragraph.

Division 66—Community rating requirements

66‑1 Community rating requirements

(1) An insurance policy meets the community rating requirements in this Division if:

(a) the policy prohibits the private health insurer that issued the policy from breaching the principle of community rating in section 55‑5 in relation to a person insured under the policy; and

(b) the policy has no terms or conditions that would allow the insurer to *improperly discriminate against a person insured under the policy; and

(c) the only discounts (if any) available under the policy are discounts allowed under subsection 66‑5(2); and

(d) unless the policy is issued under a new *product (see subsection (2))—the premiums payable under the policy meet the premium requirement in section 66‑5.

(2) For the purposes of paragraph (1)(d), an insurance policy is issued under a new *product if the amount of premiums charged under policies in the product has not changed since the first policy in the product was issued.

66‑5 Premium requirement

(1) For the purposes of paragraph 66‑1(1)(d), the premiums payable under an insurance policy for a period meet the premium requirement in this section if the amount of premiums payable under the policy for the period:

(a) is the amount specified for the *product subgroup to which the policy belongs in the most recent approval under section 66‑10; or

(b) is the proportion, for the period, of that amount; or

(c) would be the amount mentioned in paragraph (a) or (b) except that a different amount is payable:

(i) because of the application of Part 2‑3 (lifetime health cover); or

(ii) because of a discount or discounts allowed under subsection (2), if the total percentage discount (not counting discounts available for the reason in paragraph (3)(f)) does not exceed the percentage specified in the Private Health Insurance (Complying Product) Rules as the maximum percentage discount allowed; or

(iii) because of a combination of subparagraphs (i) and (ii).

(2) A discount is allowed if:

(a) it is for a reason in subsection (3); and

(b) the discount is also available for that reason under every policy in the *product; and

(c) if there are different percentage discounts available for that reason—the same percentage discount is available on the same basis under every policy in the product; and

(d) any other conditions set out in the Private Health Insurance (Complying Product) Rules are met.

(3) A discount may be for any of these reasons:

(a) because premiums are paid at least 3 months in advance;

(b) because premiums are paid by payroll deduction;

(c) because premiums are paid by pre‑arranged automatic transfer from an account at a bank or other financial institution;

(d) because the persons insured under the policy have agreed to communicate with the private health insurer, and make claims under the policy, by electronic means;

(e) because a person insured under the policy is, under the *rules of the private health insurer, treated as belonging to a contribution group;

(f) because the insurer is not required to pay a levy in relation to the policy under a law of a State or Territory;

(g) for a reason set out in the Private Health Insurance (Complying Product) Rules.

66‑10 Minister’s approval of premiums

(1) A private health insurer that proposes to change the premiums charged under a *complying health insurance product must apply to the Minister for approval of the change:

(a) in the *approved form; and

(b) at least 60 days before the day on which the insurer proposes the change to take effect.

(2) The application may propose different changes for policies in the *product, but the proposed changed amount must be the same for each policy in the product that belongs to the same *product subgroup.

(3) The Minister must, by written instrument, approve the proposed changed amount or amounts, unless the Minister is satisfied that a change that would increase the amount or amounts would be contrary to the public interest.

(4) If the Minister approves the proposed changed amount or amounts, the approval has effect:

(a) from the day specified in the approval as the day the change takes effect; and

(b) until replaced by another approval for the *product under this section.

(6) If the Minister refuses to approve the proposed changed amount or amounts, the Minister must table the Minister’s reasons for refusal in each House of the Parliament no later than 15 sitting days of that House after the refusal.

(7) An instrument made under subsection (3) is not a legislative instrument.

66‑15 Entitlement to benefits for general treatment

Neither:

(a) the community rating principle in section 55‑5; nor

(b) the community rating requirement in paragraph 66‑1(1)(b);

prevents a private health insurer from determining a person’s entitlement under a *complying health insurance policy to a benefit for *general treatment (other than *hospital‑substitute treatment) in respect of a period by having regard to the amount of benefits for that kind of treatment already claimed for the person in respect of the period.

66‑20 Different amount of benefits depending on where people live

Neither:

(a) the community rating principle in section 55‑5; nor

(b) the community rating requirements in section 66‑1;

prevents the amount of a benefit for a treatment under a *complying health insurance policy from being different from the amount of a benefit for the same treatment under another policy that is in the same *product, if the difference is only because the persons insured under the policies live in different *risk equalisation jurisdictions.

Division 69—Coverage requirements

69‑1 Coverage requirements

(1) An insurance policy meets the coverage requirements in this Division if:

(a) the only treatments the policy *covers are:

(i) specified treatments that are *hospital treatment; or

(ii) specified treatments that are hospital treatment and specified treatments that are *general treatment; or

(iii) specified treatments that are general treatment but none that are hospital‑substitute treatment; and

(b) if the policy provides a benefit for anything else—the provision of the benefit is authorised by the Private Health Insurance (Complying Product) Rules.

(2) Despite paragraph (1)(a), the policy must also *cover any treatment that a policy of its kind is required by the Private Health Insurance (Complying Product) Rules to cover.

(3) Despite paragraph (1)(a), the policy must not *cover any treatment that a policy of its kind is not allowed under the Private Health Insurance (Complying Product) Rules to cover.

69‑5 Meaning of cover

(1) An insurance policy covers a treatment if, under the policy, the insurer undertakes liability in respect of some or all loss arising out of a liability to pay fees or charges relating to the provision of goods or a service that is or includes that treatment.

(2) An insurance policy also covers a treatment if the insurer provides an insured person, or arranges for an insured person to be provided with, goods or a service that is or includes that treatment.

(3) If an insurance policy *covers a treatment in the way described in subsection (2), this Part applies as if the provision of the goods or service were a benefit provided under the policy.

69‑10 Meaning of hospital‑substitute treatment

Hospital‑substitute treatment means *general treatment that:

(a) substitutes for an episode of *hospital treatment; and

(b) is any of, or any combination of, nursing, medical, surgical, podiatric surgical, diagnostic, therapeutic, prosthetic, pharmacological, pathology or other services or goods intended to manage a disease, injury or condition; and

(c) is not specified in the Private Health Insurance (Complying Product) Rules as a treatment that is excluded from this definition.

Division 72—Benefit requirements for policies that cover hospital treatment

72‑1 Benefit requirements

(1) An insurance policy that *covers *hospital treatment meets the benefit requirements in this Division if:

(a) the policy meets the requirements in the table in subsection (2); and

(b) the policy meets any requirements specified in the Private Health Insurance (Complying Product) Rules to be benefit requirements; and

(c) the policy does not provide benefits for:

(i) the cost of care and accommodation in an aged care service (within the meaning of the Aged Care Act 1997); or

(ii) a charge for a pharmaceutical benefit supplied under Part VII of the National Health Act 1953, unless the circumstances of the charge are covered by section 92B of that Act; or

(iii) any other treatment specified in the Private Health Insurance (Complying Product) Rules as a treatment for which benefits must not be provided; and

(d) the *rules of the private health insurer that issues the policy meet the rules requirement in section 72‑5.

(2) These are the requirements that a policy must meet for the purposes of paragraph (1)(a):

Requirements that a policy that *covers *hospital treatment must meet |

Item | There must be a benefit for ... | The amount of the benefit must be ... |

1 | any part of *hospital treatment that is one or more of the following: (a) psychiatric care; (b) rehabilitation; (c) palliative care; if the treatment is provided in a *hospital and no *medicare benefit is payable for that part of the treatment. | at least the amount set out, or worked out using the method set out, in the Private Health Insurance (Benefit Requirements) Rules as the minimum benefit, or method for working out the minimum benefit, for that treatment. |

2 | *hospital treatment *covered under the policy for which a *medicare benefit is payable. | (a) if the charge for the treatment is less than the *schedule fee for the treatment—so much of the charge (if any) as exceeds 75% of the schedule fee; and (b) otherwise—at least 25% of the schedule fee for the treatment. |

3 | if the policy *covers *hospital‑substitute treatment—hospital‑substitute treatment covered under the policy for which a *medicare benefit is payable. | (a) if the charge for the treatment is less than the *schedule fee for the treatment—so much of the charge (if any) as exceeds 75% of the schedule fee; and (b) otherwise—at least 25% of the schedule fee for the treatment; but the benefit must not be provided if a medicare benefit of an amount that is at least 85% of the schedule fee is claimed for the treatment. |

4 | (a) *hospital treatment *covered under the policy; and (b) if the policy covers *hospital‑substitute treatment—hospital‑substitute treatment covered under the policy; that is the provision of a prosthesis, of a kind listed in the Private Health Insurance (Prostheses) Rules, as described in either of the following paragraphs: (c) the prosthesis is provided in circumstances in which a *medicare benefit is payable, and, if those Rules set out conditions that must be satisfied in relation to the provision of the prosthesis in those circumstances, those conditions are satisfied; (d) the prosthesis is provided in other circumstances set out in those Rules, and, if those Rules set out conditions that must be satisfied in relation to the provision of the prosthesis in those circumstances, those conditions are satisfied. | (a) at least the amount set out, or worked out using the method set out, in the Private Health Insurance (Prostheses) Rules as the minimum benefit, or method for working out the minimum benefit, for the prosthesis; and (b) if the Private Health Insurance (Prostheses) Rules set out an amount, or a method for working out an amount, as the maximum benefit, or method for working out the maximum benefit, for the prosthesis—no more than that amount or the amount worked out using that method. |

5 | any treatment for which the Private Health Insurance (Benefit Requirements) Rules specify there must be a benefit. | at least the amount set out, or worked out using the method set out, in the Private Health Insurance (Benefit Requirements) Rules as the minimum benefit, or method for working out the minimum benefit, for that treatment. |

Note: If a private health insurer provides an insured person with, or arranges for an insured person to be provided with, treatment, it is treated as a benefit for the purposes of this Division (see subsection 69‑5(3)).

72‑5 Rules requirement in relation to provision of benefits

(1) For the purposes of paragraph 72‑1(1)(d), the *rules of the private health insurer that issues the policy meet the rules requirement in this section if the rules have the effect required by subsection (2).

(2) The effect required is that if, under an agreement or arrangement with a private health insurer, a particular *health care provider (other than a *medical practitioner) provides particular *hospital treatment or *hospital‑substitute treatment to people insured under the same *complying health insurance product of the insurer, any charge for the treatment:

(a) that is payable by an insured person; and

(b) which is not recoverable by a benefit under the product;

must be the same for all of the people insured under the product, irrespective of:

(c) the frequency with which that provider provides that particular treatment to people insured under that product; or

(d) any other matter.

(3) The Private Health Insurance (Complying Product) Rules may modify the effect required by subsection (2) in relation to all or particular kinds of *complying health insurance products, benefits, treatments or *health care providers. To the extent the Rules do so, the rules requirement is taken to be met if the conditions in the Rules are met.

72‑10 Minimum benefits for prostheses

(1) Private Health Insurance (Prostheses) Rules made for the purposes of item 4 of the table in subsection 72‑1(2) must only list a kind of prosthesis if:

(a) an application has been made under subsection (2) in relation to that kind of prosthesis; and

(b) the Minister has granted the application.

(2) A person may apply to the Minister to have the Private Health Insurance (Prostheses) Rules list a prosthesis of the kind to which the application relates.

(3) The application must be:

(a) in the *approved form; and

(b) accompanied by any application fee imposed under the Private Health Insurance (Prostheses Application and Listing Fees) Act 2007.

(4) The Minister must inform the applicant in writing of the Minister’s decision whether or not to grant the application. If the Minister decides not to grant the application, the Minister must also inform the applicant of the reason for that decision.

(5) If:

(a) the Minister grants the application; and

(b) the applicant pays to the Commonwealth any initial listing fee imposed under the Private Health Insurance (Prostheses Application and Listing Fees) Act 2007 within 14 days of being informed of the Minister’s decision to grant the application;

the Minister must, on the next occasion when the Minister makes or varies the Private Health Insurance (Prostheses) Rules:

(c) list the kind of prosthesis to which the application relates in those Rules; and

(d) set out in those Rules a minimum benefit for the prosthesis; and

(e) if the Minister considers it appropriate—set out in those Rules a maximum benefit for the prosthesis.

(6) The Private Health Insurance (Prostheses) Rules may set out criteria (listing criteria) to be satisfied in order for an application (a listing application) made under subsection (2) to be granted. The Rules may provide for different listing criteria to apply in different circumstances.

(7) The Minister must not grant a listing application if any applicable listing criteria are not satisfied in relation to the application.

Note: The Minister may refuse to grant a listing application even if the applicable listing criteria are satisfied.

72‑15 Ongoing listing fee for prostheses

(1) This section applies if the Minister lists a kind of prosthesis in the Private Health Insurance (Prostheses) Rules as a result of an application under subsection 72‑10(2).

(2) The applicant must pay to the Commonwealth the ongoing listing fee for which the applicant is liable under the Private Health Insurance (Prostheses Application and Listing Fees) Act 2007, within 28 days of each day specified under that Act as an ongoing listing fee imposition day.

(3) If the applicant fails to pay an ongoing listing fee in accordance with subsection (2), the Minister may remove the kind of prosthesis from the list in the Private Health Insurance (Prostheses) Rules.

72‑20 Other matters

The Private Health Insurance (Prostheses) Rules may, in relation to application fees, initial listing fees or ongoing listing fees imposed under the Private Health Insurance (Prostheses Application and Listing Fees) Act 2007, provide for, or for matters relating to, any or all of the following:

(a) methods for payment;

(b) extending the time for payment;

(c) refunding or otherwise applying overpayments.

Division 75—Waiting period requirements

75‑1 Waiting period requirements

(1) An insurance policy meets the waiting period requirements in this Division if the *waiting period that applies to a person who did not *transfer to the policy is no longer than:

(a) for a benefit for *hospital treatment or *hospital‑substitute treatment that is obstetric treatment or treatment for a *pre‑existing condition (other than treatment covered by paragraph (b))—12 months; and

(b) for a benefit for hospital treatment or hospital‑substitute treatment that is psychiatric care, rehabilitation or palliative care (whether or not for a pre‑existing condition)—2 months; and

(c) for any other benefit for hospital treatment or hospital‑substitute treatment—2 months.

(2) The Private Health Insurance (Complying Product) Rules may modify the requirements in subsection (1) in relation to all or particular kinds of private health insurers, benefits or insured persons. To the extent the Rules do so, the waiting period requirements in this Division are taken to be met if the conditions in the Rules are met.

Note: If a private health insurer provides an insured person with, or arranges for an insured person to be provided with, treatment, it is treated as a benefit for the purposes of this Division (see subsection 69‑5(3)).

75‑5 Meaning of waiting period

The waiting period that applies to a person for a benefit under an insurance policy is the period:

(a) starting at the time the person becomes insured under the policy; and

(b) ending at the time specified in the policy;

during which the person is not entitled to the benefit.

75‑10 Meaning of transfers

A person transfers to a policy (the new policy) from another policy (the old policy) if:

(a) either:

(i) the person is insured under the old policy at the time the person becomes insured under the new policy; or

(ii) the person ceased to be insured under the old policy no more than 7 days, or a longer number of days allowed by the new policy’s insurer for this purpose, before becoming insured under the new policy; and

(b) the old policy is a *complying health insurance policy; and

(c) the person’s premium payments under the old policy were up to date at the time the person became insured under the new policy.

Note: See section 99‑1 about transfer certificates.

75‑15 Meaning of pre‑existing condition

(1) A person insured under an insurance policy has a pre‑existing condition if:

(a) the person has an ailment, illness or condition; and

(b) in the opinion of a *medical practitioner appointed by the insurer that issued the policy, the signs or symptoms of that ailment, illness or condition existed at any time in the period of 6 months ending on the day on which the person became insured under the policy.

(2) In forming an opinion for the purposes of paragraph (1)(b), the *medical practitioner must have regard to any information in relation to the ailment, illness or condition that the medical practitioner who treated the ailment, illness or condition gives him or her.

(3) If:

(a) a private health insurer replaces a *complying health insurance product with another complying health insurance product; and

(b) a person who was insured under a policy that was in the replaced *product is *transferred by the insurer to a policy that is in the replacement product;

the reference in paragraph (1)(b) to the day on which the person became insured under the policy is taken to be a reference to the day on which the person became insured under the replaced policy.

Division 78—Portability requirements

78‑1 Portability requirements

(1) An insurance policy meets the portability requirements in this Division if the policy meets the requirements in subsections (2), (3), (4) and (5A).

(2) An insurance policy meets the requirement in this subsection if the *waiting period that applies to a person who *transferred to the policy (the new policy) from another policy (the old policy) is no longer than:

(a) for a benefit for *hospital treatment or *hospital‑substitute treatment that was not *covered under the old policy—the period allowed under section 75‑1; and

(b) for a benefit for hospital treatment or hospital‑substitute treatment that was covered under the old policy—the balance of any unexpired waiting period for that benefit that applied to the person under the old policy.

(3) An insurance policy meets the requirement in this subsection if the policy does not impose on a person who *transferred to the policy any period (other than a *waiting period allowed under subsection (2)) during which the amount of a benefit in relation to any particular *hospital treatment or *hospital‑substitute treatment is less than the amount the person would be eligible for during any other period.

(4) An insurance policy meets the requirement in this subsection if, in relation to a benefit for *hospital treatment or *hospital‑substitute treatment:

(a) that was *covered under the old policy; and

(b) in respect of which a higher excess or higher co‑payment applied under the old policy than is the case under the new policy;

any period during which the higher excess or higher co‑payment continues to apply under the new policy to a person who *transferred to the policy is no longer than the *waiting period allowed under section 75‑1 for a benefit for that treatment.

(5) In working out:

(a) for the purposes of subsection (2) or (4), whether a treatment was *covered under an old policy; or

(b) for the purposes of subsection (3), whether the amount of a benefit under a new policy during a period is less than the amount it would be during another period;

disregard the existence or otherwise of contracts between the insurer in relation to either of the policies and particular *health care providers or groups of health care providers.

(5A) An insurance policy meets the requirement in this subsection if:

(a) the policy forms part of a *complying health insurance product or belongs to a *product subgroup of a complying health insurance product; and

(b) the *product or product subgroup is being terminated by the private health insurer, and as a consequence, an *adult insured under the policy is to be transferred to a new policy; and

(c) the insurer informs the adult insured under the policy, in writing, of the matters set out in the Private Health Insurance (Complying Product) Rules; and

(d) the adult insured under the policy is informed of those matters a reasonable time before the transfer to the new policy is to take effect.

Note: See also section 55‑10.

(6) The Private Health Insurance (Complying Product) Rules may modify the requirements in this section in relation to all or particular kinds of private health insurers, benefits or insured persons. To the extent the Rules do so, the portability requirements in this Division are taken to be met if the conditions in the Rules are met.

Note: If a private health insurer provides an insured person with, or arranges for an insured person to be provided with, treatment, it is treated as a benefit for the purposes of this Division (see subsection 69‑5(3)).

Division 81—Quality assurance requirements

81‑1 Quality assurance requirements

An insurance policy meets the quality assurance requirements in this Division if the policy prohibits the payment of benefits for a treatment that does not meet the standards in the Private Health Insurance (Accreditation) Rules.

Note: The Private Health Insurance (Accreditation) Rules are made by the Minister under section 333‑20.

Division 84—Enforcement of this Part

84‑1 Offence: advertising, offering or insuring under non‑complying policies

(1) A person commits an offence if:

(a) the person:

(i) advertises a *product; or

(ii) offers a person insurance under a policy; or

(iii) insures a person under a policy; or

(iv) arranges for another person to do a thing mentioned in subparagraph (i), (ii) or (iii); and

(b) the insurance under the policy, or under a policy in the product, is *health insurance business; and

(c) the policy is not a *complying health insurance policy; and

(d) the *health insurance business is not business of a kind specified in the Private Health Insurance (Complying Product) Rules as excluded from subsection 63‑1(1).

Penalty: 1,000 penalty units or imprisonment for 5 years, or both.

(2) In imposing a penalty on a private health insurer for an offence under subsection (1), the court:

(a) must have regard to the possible impact of a penalty on the insurer’s capital adequacy, solvency and the level of premiums for its *complying health insurance products; and

(b) must not impose a penalty if satisfied that doing so would adversely affect the insurer’s capital adequacy or solvency, or be likely to lead to an increase in premiums for its products.

84‑5 Offence: directors and chief executive officers liable if systems not in place to prevent breaches

A person commits an offence if:

(a) the person is a *director or *chief executive officer of a private health insurer; and

(b) the insurer commits an offence under section 84‑1; and

(c) the person failed to exercise due diligence to ensure that adequate systems were in place to prevent the insurer from committing the offence.

Penalty: 1,000 penalty units or imprisonment for 5 years, or both.

84‑10 Injunction in relation to non‑complying policies

(1) If a private health insurer has engaged, is engaging, or is proposing to engage, in conduct:

(a) that contravenes or would contravene section 63‑1; or

(b) that is or that would be an offence against section 84‑1;

the Federal Court may, on application by a person mentioned in subsection (3), grant an injunction restraining the insurer from engaging in the conduct.

(2) If:

(a) a private health insurer has refused or failed, is refusing or failing, or is proposing to refuse or fail, to do a thing; and

(b) the refusal or failure:

(i) contravenes or would contravene section 63‑1; or

(ii) is or would be an offence against section 84‑1;

the Federal Court may, on application by a person mentioned in subsection (3), grant an injunction requiring the insurer to do the thing.

(3) For the purposes of subsections (1) and (2), an application may be made by:

(a) the Minister; or

(c) any other person.

(4) The court may grant an interim injunction pending the determination of an application under subsection (1) or (2).

(5) The court must not require an applicant for an injunction to give an undertaking as to damages as a condition of granting an interim injunction.

(6) The court may discharge or vary an injunction granted under this section.

(7) The power of the court to grant an injunction restraining a private health insurer from engaging in conduct may be exercised:

(a) whether or not it appears to the court that the insurer intends to engage again, or to continue to engage, in conduct of that kind; and

(b) whether or not the insurer has previously engaged in conduct of that kind.

(8) The power of the court to grant an injunction requiring a private health insurer to do a thing may be exercised:

(a) whether or not it appears to the court that the insurer intends to refuse or fail again, or to continue to refuse or fail, to do that thing; and

(b) whether or not the insurer has previously refused or failed to do that thing.

84‑15 Remedies for people affected by non‑complying policies

On application by the Minister, if the Federal Court is satisfied that:

(a) a private health insurer has engaged in conduct that contravenes section 63‑1 or is an offence against section 84‑1; or

(b) both:

(i) a private health insurer has refused or failed to do a thing; and