Families, Housing, Community Services and Indigenous Affairs and Other Legislation Amendment (Further Election Commitments and Other Measures) Act 2011

No. 53, 2011

An Act to amend the law relating to family assistance, child support and social security, and for related purposes

[Assented to 28 June 2011]

The Parliament of Australia enacts:

1 Short title

This Act may be cited as the Families, Housing, Community Services and Indigenous Affairs and Other Legislation Amendment (Further Election Commitments and Other Measures) Act 2011.

2 Commencement

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day this Act receives the Royal Assent. | 28 June 2011 |

2. Schedules 1 to 3 | 1 July 2011. | 1 July 2011 |

4. Schedule 5 | 1 July 2011. | 1 July 2011 |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

3 Schedule(s)

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Family tax benefit advance

Part 1—Amendments

A New Tax System (Family Assistance) Act 1999

1 Subsection 3(1) (definition of FTB advance rate)

Repeal the definition.

2 Subsection 3(1)

Insert:

repayment period, in relation to a family tax benefit advance that is paid to an individual, has the meaning given by subclause 40(3) of Schedule 1.

3 Subsection 3(1) (definition of standard advance period)

Repeal the definition.

4 Subsection 3(1)

Insert:

standard reduction, in relation to a family tax benefit advance, has the meaning given by clause 41 of Schedule 1.

5 Paragraph 21(1)(c)

After “Part 4”, insert “but disregarding reductions (if any) under clause 5 or 25A of Schedule 1”.

6 Clause 5 of Schedule 1

Repeal the clause, substitute:

5 Family tax benefit advance to individual

(1) If:

(a) an individual is entitled to be paid family tax benefit by instalment; and

(b) the individual is paid a family tax benefit advance; and

(c) the individual has not repaid the whole of the advance; and

(d) the amount of unrepaid family tax benefit advance is not an FTB advance debt;

then, subject to clauses 44 and 49, the individual’s Part A rate (as reduced (if at all) under clauses 38J and 38K) is to be reduced in accordance with Division 4 of Part 5 (clauses 40 to 51).

(2) If an individual satisfies paragraphs (1)(a) to (d) for more than one family tax benefit advance, the individual’s Part A rate is to be reduced under subclause (1) for each of those advances.

7 Clause 25A of Schedule 1

Repeal the clause, substitute:

25A Family tax benefit advance to individual

(1) If:

(a) an individual is entitled to be paid family tax benefit by instalment; and

(b) the individual is paid a family tax benefit advance; and

(c) the individual has not repaid the whole of the advance; and

(d) the amount of unrepaid family tax benefit advance is not an FTB advance debt;

then, subject to clauses 44 and 49, the individual’s Part A rate is to be reduced in accordance with Division 4 of Part 5 (clauses 40 to 51).

(2) If an individual satisfies paragraphs (1)(a) to (d) for more than one family tax benefit advance, the individual’s Part A rate is to be reduced under subclause (1) for each of those advances.

8 At the end of Part 5 of Schedule 1

Add:

Division 4—Reduction for family tax benefit advance

40 Reduction for family tax benefit advance

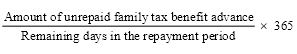

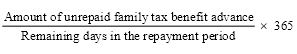

(1) Subject to subclause (2) and clauses 43 and 44, the amount by which an individual’s Part A rate is to be reduced under clause 5 or 25A to repay a family tax benefit advance is worked out using the following formula:

Member of a couple in a blended family

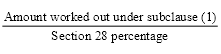

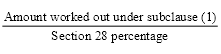

(2) If a determination under section 28 that an individual is eligible for a percentage (the section 28 percentage) of the family tax benefit for FTB children of the individual is in force, the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A to repay the family tax benefit advance is worked out using the following formula:

Meaning of repayment period

(3) The repayment period in relation to a family tax benefit advance that is paid to an individual:

(a) begins on:

(i) the first day of the instalment period after the individual is paid the family tax benefit advance; or

(ii) if it is not practicable for the reduction to start on the day referred to in subparagraph (i)—the first day on which it is practicable to reduce the individual’s Part A rate; or

(iii) if the determination of the individual’s entitlement to the family tax benefit advance is a determination referred to in subsection 35B(3) of the Family Assistance Administration Act (regular family tax benefit advances)—the day the determination is made; or

(iv) such other day determined by the Secretary under this Division; and

(b) is a period of 182 days or such other period determined by the Secretary under this Division.

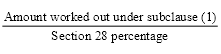

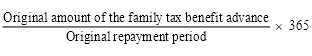

41 Standard reduction

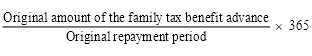

(1) Subject to subclause (2), the standard reduction for a family tax benefit advance is the amount worked out using the following formula:

Member of a couple in a blended family

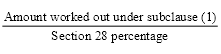

(2) If a determination under section 28 that an individual is eligible for a percentage (the section 28 percentage) of the family tax benefit for FTB children of the individual is in force, the standard reduction for a family tax benefit advance paid to the individual is the amount worked out using the following formula:

Meaning of original repayment period

(3) The original repayment period for a family tax benefit advance is a period of 182 days, unless the Secretary has determined a different period for the advance under clause 42 or 51.

42 Secretary determines shorter repayment period

When determining an individual’s entitlement to a family tax benefit advance under section 35A of the Family Assistance Administration Act, the Secretary may determine that the repayment period for the family tax benefit advance is a period of less than 182 days, if the Secretary is satisfied that it is appropriate to determine the shorter repayment period having regard to:

(a) circumstances affecting the individual’s eligibility for family tax benefit; and

(b) circumstances affecting the rate of family tax benefit that the individual is entitled to be paid.

43 Part A rate insufficient to cover reduction—single family tax benefit advance

(1) This clause applies if:

(a) under clause 5 or 25A, the individual’s Part A rate is to be reduced to repay a family tax benefit advance (the unrepaid advance); and

(b) the individual’s Part A rate is not to be reduced under clause 5 or 25A to repay any other family tax benefit advance; and

(c) the amount by which the individual’s Part A rate would be reduced under clause 5 or 25A to repay the unrepaid advance would exceed the amount of the individual’s Part A rate before reduction (the unreduced Part A rate), if the amount were worked out under clause 40.

(2) Subject to clause 45, the Secretary must determine that the number of days in the repayment period for the unrepaid advance is to be increased so that the individual’s Part A rate is reduced under clause 5 or 25A by an amount that is no more than the individual’s unreduced Part A rate.

(3) If the individual’s unreduced Part A rate later exceeds the amount by which the individual’s Part A rate would be reduced under clause 40, the Secretary may determine that the number of days in the repayment period for the unrepaid advance is to be decreased.

(4) However, the amount by which the individual’s Part A rate is to be reduced as a result of a determination under subclause (3) must be no more than the standard reduction.

Note: The individual may also request that the Secretary determine a shorter or longer repayment period under clause 46 or 47.

44 Part A rate insufficient to cover reduction—multiple family tax benefit advances

(1) This clause applies if:

(a) under clause 5 or 25A, the individual’s Part A rate is to be reduced to repay more than one family tax benefit advance (the unrepaid advances); and

(b) the sum of the amounts by which the individual’s Part A rate would be reduced under clause 5 or 25A to repay the unrepaid advances would exceed the amount of the individual’s Part A rate before reduction (the unreduced Part A rate), if the amounts were worked out under clause 40.

(2) Subject to clause 45, the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A to repay the unrepaid advances is worked out using the following method statement:

Method statement

Step 1. Take each advance, in the order in which the advances were paid.

Step 2. If the unreduced Part A rate, less any amounts by which the individual’s Part A rate has been reduced under a previous application of this step, equals or exceeds the standard reduction for the advance, the individual’s Part A rate is to be reduced by an amount equal to the standard reduction.

Step 3. If the unreduced Part A rate, less any amounts by which the individual’s Part A rate has been reduced under a previous application of step 2, does not equal or exceed the standard reduction for the advance (but is greater than nil), the Secretary must determine that the number of days in the repayment period for the advance is to be increased so that the individual’s Part A rate is reduced by an amount that is no more than the remainder.

Step 4. If the unreduced Part A rate, less any amounts by which the individual’s Part A rate has been reduced under a previous application of step 2 or step 3, is nil, the Secretary must determine that the repayment period for the advance is to be suspended while the determination is in force.

(3) The Secretary may vary a determination made under step 3 of the method statement in subclause (2).

(4) The Secretary may revoke a determination made under step 4 of the method statement in subclause (2).

(5) Subject to clause 45, if the Secretary revokes a determination made under step 4 of the method statement in subclause (2) in relation to a family tax benefit advance, the Secretary must determine the number of days remaining in the repayment period for the advance.

(6) The Secretary must not vary a determination under subclause (3), or make a determination under subclause (5), in relation to a family tax benefit advance so that the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A to repay the advance is more than the standard reduction.

45 Part A rate insufficient to cover reduction—discretion to create FTB advance debt

(1) The Secretary may, instead of making a determination under subclause 43(2), step 3 of the method statement in subclause 44(2) or under subclause 44(5), determine that the amount of unrepaid family tax benefit advance is to be a debt.

Note: See subsection 71A(7) of the Family Assistance Administration Act.

(2) However, the Secretary must not make a determination under subclause (1) unless the individual’s Part A rate before reduction under clause 5 or 25A is less than the amount that would, under clause 26, be the FTB child rate for an FTB child who had not turned 18 if:

(a) the individual’s Part A rate were required to be worked out using Part 3 of this Schedule; and

(b) clause 27 did not apply.

46 Changing the repayment period—individual requests shorter period

Request for shorter repayment period

(1) The Secretary may determine that the number of days in a repayment period for a family tax benefit advance paid to an individual is to be decreased if:

(a) the individual has made a request in accordance with subclause (2) for a shorter repayment period; and

(b) the Secretary is satisfied that the individual would not suffer severe financial hardship if the number of days in the repayment period were decreased as determined.

(2) The request must be made in a form and manner, contain any information, and be accompanied by any documents, required by the Secretary.

Request for variation of the determination

(3) On the request of the individual, the Secretary may, in writing, vary the determination so as to increase the number of days in the repayment period.

(4) However, the Secretary must not vary the determination under subclause (3) if, as a result of the variation, the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A would be less than the standard reduction.

Note: If, after a variation under subclause (3), the reduction in the individual’s Part A rate under clause 5 or 25A would cause the individual to suffer severe financial hardship, the individual may request a longer repayment period under clause 47.

47 Changing the repayment period—individual requests longer period

Request for longer repayment period

(1) The Secretary may determine that the number of days in a repayment period for a family tax benefit advance paid to an individual is to be increased if:

(a) the individual has made a request in accordance with subclause (2) for a longer repayment period; and

(b) the Secretary is satisfied that:

(i) special circumstances relevant to the repayment of the advance exist in relation to the individual that could not reasonably have been foreseen at the time of the individual’s request for a family tax benefit advance; and

(ii) the individual would suffer severe financial hardship if the number of days in the repayment period were not increased as determined.

(2) The request must be made in a form and manner, contain any information, and be accompanied by any documents, required by the Secretary.

Secretary may vary the determination

(3) The Secretary may, in writing, vary the determination so as to reduce the number of days in the repayment period but only if:

(a) the Secretary is satisfied that the individual would not suffer severe financial hardship because of the variation; and

(b) the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A, as a result of the variation, is not greater than the standard reduction.

48 Changing the repayment period—recalculation of amount of unrepaid family tax benefit advance

(1) This clause applies if, during the repayment period for a family tax benefit advance, the amount of the family tax benefit advance that is unrepaid is increased, due to a variation in a determination, or a variation or substitution of a decision on review (other than a variation under subsection 28(2) or (6) of the Family Assistance Administration Act), so that the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A is an amount that is more than the standard reduction.

(2) The Secretary must determine that the number of days in a repayment period is to be increased so that the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A is an amount that is no more than the standard reduction.

Note: The individual may also request that the Secretary determine a shorter or longer repayment period under clause 46 or 47.

49 Suspension of repayment period

Request for suspension of repayment period

(1) The Secretary may determine that the repayment period for a family tax benefit advance paid to an individual is to be suspended while the determination is in force.

(2) However, the Secretary may only make a determination under subclause (1) if:

(a) the individual has made a request in accordance with subclause (3) for the repayment period to be suspended; and

(b) the Secretary is satisfied that:

(i) special circumstances relevant to the repayment of the advance exist in relation to the individual that could not reasonably have been foreseen at the time of the individual’s request for a family tax benefit advance; and

(ii) the individual would suffer severe financial hardship if the individual’s Part A rate were to be reduced for that period.

(3) The request must be made in a form and manner, contain any information, and be accompanied by any documents, required by the Secretary.

Secretary may revoke the suspension

(4) The Secretary may in writing, at any time, revoke the determination, but only if the Secretary is satisfied that the individual would not suffer severe financial hardship from the individual’s Part A rate being reduced under clause 5 or 25A as a result of the revocation.

Determination of repayment period on revocation of suspension

(5) If the Secretary revokes the determination, the Secretary must determine the number of days remaining in the repayment period so that the amount by which the individual’s Part A rate is to be reduced under clause 5 or 25A is an amount that is no more than the standard reduction.

Note: The individual may also request that the Secretary determine a shorter or longer repayment period under clause 46 or 47.

50 Repayment of family tax benefit advance by another method

(1) The Secretary may determine that an individual may repay all or part of an amount of unrepaid family tax benefit advance by a method other than by reduction under clause 5 or 25A if:

(a) the individual has made a request in accordance with subclause (2); and

(b) the method is acceptable to both the individual and the Secretary.

(2) The request must be made in a form and manner, contain any information, and be accompanied by any documents, required by the Secretary.

51 Recalculation of amount of unrepaid family tax benefit advance

(1) This clause applies if:

(a) an individual is paid a family tax benefit advance (the old advance); and

(b) the individual’s Part A rate has been reduced under clause 5 or 25A to repay the old advance; and

(c) the repayment period for the old advance has expired; and

(d) due to a variation in a determination, or a variation or substitution of a decision on review (other than a variation under subsection 28(2) or (6) of the Family Assistance Administration Act), the reduction in the individual’s Part A rate under clause 5 or 25A has not been sufficient to repay the old advance; and

(e) at the time of the variation of the determination, or the variation or substitution of the decision on review:

(i) the individual is entitled to be paid family tax benefit by instalment; and

(ii) the individual’s Part A rate is greater than nil (before reduction under clause 5 or 25A).

Note: If a variation or review occurs during the repayment period for a family tax benefit advance, the Secretary may be required to make a determination under clause 48.

(2) The Secretary must determine that the individual is to be taken to have been paid a family tax benefit advance (the new advance) equal to the amount of the old advance left unrepaid on the day on which the Part A rate is recalculated.

(3) If an individual is taken to have been paid a new advance under subclause (2), the individual is taken to have repaid the old advance.

(4) The Secretary must determine the repayment period for the new advance and the day on which the repayment period is to begin.

(5) The Secretary must not make a determination under subclause (4) that would cause the individual to suffer severe financial hardship.

(6) The Secretary may vary or revoke a determination made under subclause (2) or (4), if a subsequent variation in the determination, or a variation or substitution of the decision on review, occurs.

A New Tax System (Family Assistance) (Administration) Act 1999

9 Subsection 3(1)

Insert:

advance assessment day, in relation to a family tax benefit advance, has the meaning given by subsection 35A(3) and paragraph 35B(3)(b).

10 Subsection 3(1)

Insert:

FTB advance debt has the meaning given by section 71A.

11 Subsection 3(1)

Insert:

maximum amount, in relation to a family tax benefit advance, has the meaning given by section 35D.

12 Subsection 3(1)

Insert:

minimum amount, in relation to a family tax benefit advance that is paid to an individual, means:

(a) 3.75% of the FTB child rate for one FTB child who is under 13 years of age worked out under clause 7 of Schedule 1 to the Family Assistance Act (disregarding clauses 8 to 11 of that Schedule); or

(b) if a determination under section 28 of that Act that the individual is eligible for a percentage (the section 28 percentage) of the family tax benefit for FTB children of the individual is in force—the section 28 percentage of the paragraph (a) amount; or

(c) if the amount that would be the minimum amount under paragraph (a) or (b) is not a number of whole cents—the amount rounded down to the nearest cent.

13 Division 2 of Part 3

Repeal the Division, substitute:

Division 2—Payment of family tax benefit advances

Subdivision A—Request for family tax benefit advance

33 Request

(1) An individual may request a family tax benefit advance.

(2) If an individual makes a request for a family tax benefit advance (the first advance) accompanied by a request under section 35B (regular family tax benefit advances), the individual may also request that entitlement to the first advance be determined on a specified future day.

34 Form of request

(1) To be effective a request:

(a) must be made in a form and manner, contain any information, and be accompanied by any documents required by the Secretary; and

(b) must specify the amount of family tax benefit advance sought; and

(c) the amount of family tax benefit advance sought must be at least the minimum amount.

(2) If an effective request is made, the Secretary must determine the request in accordance with this Division. If a request is not effective, it is taken never to have been made.

35 Request may be withdrawn or varied

(1) An individual may withdraw or vary a request before the request is determined.

(2) The individual may only do so in a manner determined by the Secretary.

(3) If a request is withdrawn, it is taken never to have been made.

Subdivision B—Entitlement to family tax benefit advance

35A Entitlement to family tax benefit advance

(1) The Secretary must determine that an individual is entitled to be paid a family tax benefit advance if:

(a) on the advance assessment day, the individual is entitled to be paid family tax benefit by instalment; and

(b) the individual has made an effective request under section 34 for a family tax benefit advance; and

(c) on the advance assessment day, the individual’s Part A rate (disregarding clauses 5 and 25A of Schedule 1 to the Family Assistance Act) is equal to or exceeds the amount that would, under clause 26 of that Schedule, be the FTB child rate for an FTB child who had not turned 18 if:

(i) the individual’s Part A rate were required to be worked out using Part 3 of that Schedule; and

(ii) clause 27 of that Schedule did not apply; and

(d) on the advance assessment day, the individual has at least one FTB child; and

(e) on the advance assessment day, the amount of advance that the individual would be entitled to is at least the minimum amount; and

(f) the Secretary considers, on the basis of information available to the Secretary on the advance assessment day, that the individual will not suffer financial hardship from the individual’s Part A rate being reduced as a result of being paid the advance; and

(g) on the advance assessment day, the individual is not excluded from being paid a family tax benefit advance under subsection (2).

(2) An individual is excluded from being paid a family tax benefit advance if:

(a) an amount of family tax benefit advance paid to the individual more than 12 months before the advance assessment day has not been fully repaid; or

(b) an amount of family tax benefit advance paid to the individual more than 12 months before the advance assessment day is being repaid as a new advance due to a determination under clause 51 of Schedule 1 to the Family Assistance Act; or

(c) the individual owes a debt to the Commonwealth (whether arising under this Act or not) that is:

(i) recoverable under Part 4 by means of deductions from the individual’s instalments of family tax benefit under section 84 (unless that debt has been written off because of subsection 95(4A) or (4B)); or

(ii) being recovered by deductions from the individual’s instalments of family tax benefit under section 227; or

(d) on the advance assessment day, the Secretary is prohibited from making a payment of family tax benefit to the individual under section 32AA or 32AD (non‑payment for non‑lodgment of tax returns).

(3) An individual’s advance assessment day is the day the Secretary determines the individual’s entitlement to be paid a family tax benefit advance.

(4) If the individual is not entitled to be paid a family tax benefit advance under subsection (1), the Secretary must determine that the individual is not entitled to the family tax benefit advance.

Subdivision C—Regular family tax benefit advances

35B Regular family tax benefit advances

(1) An individual who makes a request in accordance with section 34 for a family tax benefit advance of the minimum amount (the first advance) may, when making the request, also request that a family tax benefit advance of the minimum amount be paid to the individual at regular intervals of 182 days.

(2) For the request for payment of a family tax benefit advance at regular intervals to be effective, the request must be made in a form and manner, contain any information, and be accompanied by any documents, required by the Secretary.

(3) If an individual makes an effective request under this section:

(a) the Secretary must make a determination under section 35A, in relation to the individual’s eligibility for a family tax benefit advance of the minimum amount, at intervals that would best facilitate payment in accordance with the request; and

(b) the advance assessment day for a determination referred to in paragraph (a) is:

(i) if the individual has not previously been paid a family tax benefit advance requested under this section—the day that falls immediately after the end of an interval of 182 days that began on the day the first advance was paid; or

(ii) if the individual has previously been paid a family tax benefit advance requested under this section—the day that falls immediately after the end of the last of the intervals of 182 days, the first of which began on the day the first advance was paid.

(4) The Secretary must, in making a determination referred to in subsection (3), treat paragraph 35A(1)(b) (requirement to make an effective request) as having been satisfied if:

(a) the individual has made an effective request under this section; and

(b) the request has not been withdrawn under subsection (6) before the determination is made; and

(c) the individual has not failed to repay the last family tax benefit advance paid in response to the request under section 34 mentioned in subsection (1), or the request under this section, within 182 days.

(5) A request under subsection (1) ceases to be effective if:

(a) the Secretary, in making a determination referred to in subsection (3), determines that the individual is not entitled to a family tax benefit advance; or

(b) the individual withdraws the request under subsection (6).

(6) An individual may, in a manner determined by the Secretary, withdraw the request at any time.

Subdivision D—Amount of family tax benefit advance

35C Amount of family tax benefit advance

(1) The amount of the family tax benefit advance is the smaller of the following amounts:

(a) the amount of advance sought;

(b) the maximum amount of advance payable to the individual on the advance assessment day worked out under section 35D less the original amount of each family tax benefit advance paid to the individual that is unrepaid on that day.

(2) When working out the original amount of each family tax benefit advance paid to the individual that is unrepaid for the purposes of paragraph (1)(b), disregard clause 51 of Schedule 1 to the Family Assistance Act.

(3) The Secretary may determine that the amount of the family tax benefit advance is a lower amount than the amount that applies under subsection (1) if the Secretary is satisfied that the individual would suffer financial hardship if the individual’s Part A rate were reduced as a result of being paid that amount.

35D Maximum amount of family tax benefit advance payable

(1) Subject to subsection (2), the maximum amount of family tax benefit advance payable to the individual is set out in the following table:

Maximum amount of family tax benefit advance |

Item | If 7.5% of the individual’s adjusted Part A rate is: | The individual’s maximum amount of family tax benefit advance is: |

1 | greater than or equal to 23.3% of the standard rate for a child under 13 | 23.3% of the standard rate for a child under 13 |

2 | less than 23.3% and greater than 7.5% of the standard rate for a child under 13 | 7.5% of the individual’s adjusted Part A rate |

3 | less than or equal to 7.5% of the standard rate for a child under 13 | 7.5% of the standard rate for a child under 13 |

Member of a couple in a blended family

(2) If a determination under section 28 of the Family Assistance Act that the individual is eligible for a percentage (the section 28 percentage) of the family tax benefit for FTB children of the individual is in force, the maximum amount of family tax benefit advance payable to the individual is the section 28 percentage of the amount worked out for the individual under subsection (1).

Rounding

(3) Amounts worked out under this section must be rounded to the nearest cent (rounding 0.5 cents upwards).

Definitions

(4) In this section:

adjusted Part A rate, in relation to an individual, means the individual’s Part A rate disregarding:

(a) clause 38A of Schedule 1 to the Family Assistance Act; and

(b) any reduction under clause 5 or 25A of that Schedule.

standard rate for a child under 13 means the FTB child rate for one FTB child who is under 13 years of age worked out under clause 7 of Schedule 1 to the Family Assistance Act (disregarding clauses 8 to 11 of that Schedule).

Subdivision E—Payment of family tax benefit advance

35E Payment of advance

(1) If an individual is entitled to be paid a family tax benefit advance, the Secretary must, at such time and in such manner as the Secretary considers appropriate, pay the individual the advance.

(2) This section is subject to Part 4, Division 3 of Part 8B and sections 225 and 226.

14 Section 71A

Repeal the section, substitute:

71A Debts arising in respect of family tax benefit advances

No entitlement to advance

(1) If:

(a) a family tax benefit advance has been paid to an individual; and

(b) the individual was not entitled to the advance;

the amount so paid is a debt due to the Commonwealth by the individual.

Overpayment

(2) If:

(a) an amount (the received amount) of family tax benefit advance has been paid to an individual; and

(b) the received amount is greater than the amount (the correct amount) of family tax benefit advance that should have been paid to the individual under the family assistance law;

the difference between the received amount and the correct amount is a debt due to the Commonwealth by the individual.

Debt arising during the repayment period for a family tax benefit advance

(3) If:

(a) an individual is paid a family tax benefit advance; and

(b) the repayment period for the advance has not expired; and

(c) one of the following occurs:

(i) the individual ceases to be entitled to be paid family tax benefit by instalment;

(ii) the individual’s Part A rate becomes nil (before reduction under clause 5 or 25A of Schedule 1 to the Family Assistance Act);

the amount of unrepaid family tax benefit advance becomes a debt due to the Commonwealth by the individual.

Debt arising due to variation or review after the repayment period for a family tax benefit advance has expired

(4) If:

(a) an individual is paid a family tax benefit advance; and

(b) the individual’s Part A rate has been reduced under clause 5 or 25A of Schedule 1 to the Family Assistance Act to repay the advance; and

(c) the repayment period for the advance has expired; and

(d) due to a variation in a determination, or a variation or substitution of a decision on review (other than a variation under subsection 28(2) or (6)), the reduction in the individual’s Part A rate under clause 5 or 25A of Schedule 1 to the Family Assistance Act has not been sufficient to repay the advance; and

(e) at the time of the variation of the determination, or the variation or substitution of the decision on review:

(i) the individual is not entitled to be paid family tax benefit by instalment; or

(ii) the individual’s Part A rate is nil (before reduction under clause 5 or 25A of Schedule 1 to the Family Assistance Act);

the amount of the family tax benefit advance left unrepaid as a result of the variation of the determination, or the variation or substitution of the decision on review, becomes a debt due to the Commonwealth by the individual.

Note: If the individual is entitled to be paid family tax benefit by instalment and has a Part A rate greater than nil, the unrepaid amount of the advance is to be repaid by reductions in the individual’s Part A rate (see clause 51 of Schedule 1 to the Family Assistance Act).

Debt arising due to variation under subsection 28(2) or (6)

(5) If:

(a) an individual is paid a family tax benefit advance; and

(b) the individual’s Part A rate has been reduced under clause 5 or 25A of Schedule 1 to the Family Assistance Act to repay the advance; and

(c) due to a variation in a determination of the individual’s entitlement to family tax benefit made under subsection 28(2) or (6), the reduction in the individual’s Part A rate under clause 5 or 25A of Schedule 1 to the Family Assistance Act has not been sufficient to repay the advance;

the amount of the family tax benefit advance left unrepaid as a result of the variation of the determination becomes a debt due to the Commonwealth by the individual.

(6) If a debt is created under subsection (5) and the Secretary varies the determination of the individual’s entitlement to family tax benefit under subsection 28(3) or (4), the debt is taken never to have been created.

Note: If, after the variation, the individual’s Part A rate was not sufficient to repay the advance, the unrepaid amount of the advance is to be repaid either by reductions in the individual’s Part A rate (see clauses 48 and 51 of Schedule 1 to the Family Assistance Act) or as a debt under subsection (3) or (4).

Debt arising due to determination under clause 45 of Schedule 1 to the Family Assistance Act

(7) If:

(a) an individual is paid a family tax benefit advance; and

(b) the Secretary determines under clause 45 of Schedule 1 to the Family Assistance Act that the amount of the advance that is unrepaid is to be a debt;

the amount of the family tax benefit advance becomes a debt due to the Commonwealth by the individual.

Meaning of FTB advance debt

(8) The debt due to the Commonwealth under subsection (1), (2), (3), (4), (5) or (7) is an FTB advance debt.

15 After subparagraph 111(2)(a)(i)

Insert:

(ia) subsection 34(1);

(ib) subsection 35B(2);

16 At the end of paragraph 111(2)(a)

Add:

(xviii) subclause 46(2), 47(2), 49(3) or 50(2) of Schedule 1 to the Family Assistance Act;

Part 2—Application and transitional

17 Application

The amendments made by Part 1 of this Schedule apply to family tax benefit advances requested on or after the commencement of Part 1.

18 Transitional—percentage of standard rate for a child under 13 for 2011‑12

For the purpose of subsection 35D(1) of the Family Assistance Administration Act as inserted by this Schedule, 23.3% of the standard rate for a child under 13 is taken to be $1000 for the 2011‑12 financial year.

19 Transitional—request for determination on a future day

A request under subsection 33(2) of the Family Assistance Administration Act (as inserted by this Schedule) for a family tax benefit advance to be determined on a specified future day may only be made on or after 1 January 2012.

Part 3—Transitional advance payment

20 Transitional advance payment

(1) This item applies if:

(a) an individual was paid a family tax benefit advance for the individual’s family tax benefit advance period that ended on 30 June 2011; and

(b) under paragraph 33(3)(b) of the Family Assistance Administration Act as in effect immediately before the commencement of this Schedule, the request for the advance operated for a particular standard advance period and all subsequent standard advance periods; and

(c) the individual had not withdrawn the request before 30 June 2011; and

(d) under clause 5 or 25A of Schedule 1 to the Family Assistance Act as in effect immediately before the commencement of this Schedule, the individual’s Part A rate was reduced for the period by the FTB advance rate.

(2) On 1 July 2011, the individual is taken to have made an effective request for a single family tax benefit advance under section 34 of the Family Assistance Administration Act as inserted by this Schedule.

(3) The individual’s advance assessment day is taken to be 1 July 2011.

(4) The amount of the family tax benefit advance is the smallest of the following amounts:

(a) $333.06;

(b) the maximum amount of advance payable to the individual on the advance assessment day worked out under section 35D of the Family Assistance Administration Act as inserted by this Schedule;

(c) the amount determined by the Secretary under subsection 35C(3) of the Family Assistance Administration Act as inserted by this Schedule.

(5) Clauses 47 and 49 of Schedule 1 to the Family Assistance Act as inserted by this Schedule do not apply to the advance.

Schedule 2—Health checks for young FTB children

A New Tax System (Family Assistance) Act 1999

1 Subsection 3(1) (paragraph (b) of the definition of receiving)

After “50T of the Family Assistance Administration Act”, insert “, section 61A of this Act”.

2 Subsection 3(1) (subparagraph (b)(i) of the definition of receiving)

After “those”, insert “sections and”.

3 After section 61

Insert:

61A FTB Part A supplement to be disregarded unless health check requirement satisfied

Parents of FTB children

(1) If:

(a) an individual has an FTB child who turned 4 in an income year; and

(b) the following apply in relation to one or more days (each of which is an applicable day) in that income year:

(i) the child is an FTB child of the individual;

(ii) the individual, or the individual’s partner, is a parent of the child;

(iii) the individual, or the individual’s partner, is receiving a social security pension, a social security benefit, a service pension or income support supplement;

then the Secretary must disregard clause 38A of Schedule 1 in relation to the individual, the FTB child and each applicable day unless:

(c) at any time before the end of the second income year after the income year in which the FTB child turned 4, the Secretary becomes aware of information suggesting that one of the following subparagraphs applies:

(i) the FTB child meets the health check requirement (see subsection (4));

(ii) the FTB child is in a class exempted from the health check requirement by a determination under subsection (6);

(iii) the FTB child is in a class that is taken to meet the health check requirement by a determination under subsection (7);

(iv) special circumstances exist in relation to the individual or the individual’s partner (or both) that make it inappropriate for the individual, and the individual’s partner, to arrange for the FTB child to meet the health check requirement; and

(d) at any time, the Secretary is satisfied that one of those subparagraphs applied before the end of that second income year.

Other FTB recipients

(2) If:

(a) an individual has an FTB child who turned 4 in an income year; and

(b) the following apply in relation to one or more days (each of which is an applicable day) in that income year:

(i) the child is an FTB child of the individual;

(ii) neither the individual, nor the individual’s partner, is a parent of the child;

(iii) the individual, or the individual’s partner, is receiving a social security pension, a social security benefit, a service pension or income support supplement; and

(c) the total number of applicable days in that income year is at least 182 days; and

(d) one of the applicable days is the last day of that income year;

then the Secretary must disregard clause 38A of Schedule 1 in relation to the individual, the FTB child and each applicable day unless:

(e) at any time before the end of the second income year after the income year in which the FTB child turned 4, the Secretary becomes aware of information suggesting that one of the following subparagraphs applies:

(i) the FTB child meets the health check requirement (see subsection (4));

(ii) the FTB child is in a class exempted from the health check requirement by a determination under subsection (6);

(iii) the FTB child is in a class that is taken to meet the health check requirement by a determination under subsection (7);

(iv) special circumstances exist in relation to the individual or the individual’s partner (or both) that make it inappropriate for the individual, and the individual’s partner, to arrange for the FTB child to meet the health check requirement; and

(f) at any time, the Secretary is satisfied that one of those subparagraphs applied before the end of that second income year.

Exception

(3) However, subsection (1) or (2) does not apply if the FTB child dies before the end of the second income year after the income year in which the child turned 4.

Health check requirement

(4) For the purposes of this section, the health check requirement for a child is that the child must meet the requirements specified in an instrument under subsection (5).

(5) The Minister may, by legislative instrument, specify requirements relating to the health of children for the purposes of subsection (4).

Exempt class of children

(6) The Minister may, by legislative instrument, determine that children included in a specified class are exempt from the health check requirement.

Children taken to meet health check requirement

(7) The Minister may, by legislative instrument, determine that children included in a specified class are taken to meet the health check requirement.

Relationship with section 32A of the Family Assistance Administration Act

(8) This section does not limit section 32A of the Family Assistance Administration Act (about disregarding the FTB Part A supplement until the reconciliation conditions are satisfied).

Definition of parent

(9) In this section:

parent includes an adoptive parent and a relationship parent.

4 Application

The amendment made by item 3 applies in relation to the 2011‑12 income year and later income years.

A New Tax System (Family Assistance) (Administration) Act 1999

5 Subsection 107(1)

Omit “subsection (3)”, substitute “subsections (3), (3A) and (3B)”.

6 After subsection 107(3)

Insert:

(3A) Subsection (1) does not limit the date of effect of a review decision, in respect of an original decision that relates to the payment to a person of family tax benefit by instalment, if the following apply:

(a) under section 61A of the Family Assistance Act, the Secretary disregarded clause 38A of Schedule 1 to that Act in relation to the person, an FTB child of the person and a day;

(b) the review is undertaken because:

(i) before the end of the second income year after the income year in which the FTB child turned 4, the Secretary becomes aware of information suggesting that section 61A of that Act does not prevent that clause being taken into account in relation to that person, that FTB child and that day; and

(ii) at any time, the Secretary is satisfied that section 61A of that Act does not prevent that clause being taken into account in relation to that person, that FTB child and that day.

(3B) Subsection (1) does not limit the date of effect of a review decision, in respect of an original decision that relates to the payment to a person of family tax benefit by instalment, if the review is undertaken because of subsection 61A(1) or (2) of the Family Assistance Act not applying in relation to the person because of the operation of subsection 61A(3) of that Act.

7 At the end of subsection 109D(4)

Add:

; or (d) the family assistance is family tax benefit and the following apply:

(i) under section 61A of the Family Assistance Act, the Secretary disregarded clause 38A of Schedule 1 to that Act in relation to the person, an FTB child of the person and a day;

(ii) the Secretary is satisfied the application for review is made because the person considers that section 61A of that Act does not prevent that clause being taken into account in relation to that person, that FTB child and that day;

(iii) the application for review is made before the end of the second income year after the income year in which that FTB child turned 4; or

(e) the family assistance is family tax benefit and the application for review is made because of subsection 61A(1) or (2) of the Family Assistance Act not applying in relation to the person because of the operation of subsection 61A(3) of that Act.

8 At the end of subsection 109E(3)

Add:

; or (d) the following apply:

(i) under section 61A of the Family Assistance Act, the Secretary disregarded clause 38A of Schedule 1 to that Act in relation to the person mentioned in paragraph (1)(a) of this section, an FTB child of the person and a day;

(ii) the Secretary is satisfied the application for review is made because the person considers that section 61A of that Act does not prevent that clause being taken into account in relation to that person, that FTB child and that day;

(iii) the application for review is made before the end of the second income year after the income year in which that FTB child turned 4; or

(e) the application for review is made because of subsection 61A(1) or (2) of the Family Assistance Act not applying in relation to the person mentioned in paragraph (1)(a) of this section because of the operation of subsection 61A(3) of that Act.

Schedule 3—Determinations of adjusted taxable income

Child Support (Assessment) Act 1989

1 Subsection 5(1)

Insert:

ATI indexation factor has the meaning given by subsection 58AA(1).

2 At the end of section 5A

Add:

(5) If:

(a) the Australian Statistician publishes the amount (the later amount) referred to in subsection (1) for a relevant September quarter; and

(b) the later amount is published in substitution for such an amount for that quarter that was previously published by the Australian Statistician;

the publication of the later amount is to be disregarded for the purposes of this Act.

3 Section 55J

Omit:

• The Registrar might make a determination of a parent’s adjusted taxable income if the parent has not lodged a tax return.

substitute:

• The Registrar may determine a parent’s adjusted taxable income in certain circumstances.

4 Subdivision B of Division 7 of Part 5 (heading)

Repeal the heading, substitute:

Subdivision B—Adjusted taxable income determined by reference to taxable income etc.

5 Section 58

Repeal the section, substitute:

58 Determination by the Registrar of a parent’s adjusted taxable income

(1) This section applies if a parent is to be assessed in respect of the costs of a child in relation to a child support period and either of the following apply:

(a) the parent’s taxable income for the last relevant year of income in relation to the period has not been assessed under an Income Tax Assessment Act;

(b) the Registrar is unable to ascertain whether or not the parent’s taxable income for that year has been so assessed.

Information or document in the possession of the Registrar etc.

(2) If:

(a) the Registrar or the Commissioner of Taxation has information (whether oral or written) or a document in his or her possession; and

(b) either:

(i) an amount is specified in that information or document as the parent’s adjusted taxable income for the last relevant year of income; or

(ii) that information or document allows the amount of the parent’s adjusted taxable income for the last relevant year of income to be worked out; and

(c) the Registrar is satisfied that the specified amount, or the amount so worked out, is a reasonable approximation of the parent’s adjusted taxable income for that year;

the Registrar may determine that the specified amount, or the amount so worked out, is the parent’s adjusted taxable income for that year.

Parent’s taxable income assessed for the previous year of income

(3) If:

(a) the parent’s taxable income for a year of income has been assessed under an Income Tax Assessment Act; and

(b) that year (the previous year) is the year of income before the last relevant year of income;

the Registrar may determine that the parent’s adjusted taxable income for the last relevant year of income is the amount worked out by multiplying the parent’s adjusted taxable income for the previous year by the ATI indexation factor.

Parent’s taxable income assessed for an earlier year of income

(4) If:

(a) the parent’s taxable income for the previous year has not been assessed under an Income Tax Assessment Act; but

(b) the parent’s taxable income for an earlier year of income has been so assessed;

the Registrar may determine that the parent’s adjusted taxable income for the last relevant year of income is the greater of the following amounts:

(c) the amount worked out by multiplying the parent’s adjusted taxable income for the earlier year of income (or, if the parent’s taxable income has been so assessed for more than one earlier year of income, the most recent of those years) by the ATI indexation factor;

(d) the amount that is equal to two‑thirds of the annualised MTAWE figure for the relevant September quarter in relation to the child support period.

Other circumstances

(5) If:

(a) subsections (2), (3) and (4) do not apply in relation to the parent; or

(b) the Registrar decides not to make a determination in relation to the parent under one of those subsections;

the Registrar may determine that the parent’s adjusted taxable income for the last relevant year of income is an amount that is at least two‑thirds of the annualised MTAWE figure for the relevant September quarter in relation to the child support period.

58AA ATI indexation factor for determinations under section 58

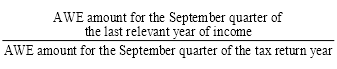

(1) The ATI indexation factor is:

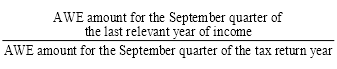

where:

AWE amount for a September quarter of a year of income means the amount published for the reference period in the quarter by the Australian Statistician in a document titled “Average Weekly Earnings, Australia” (or, if that title changes, in a replacement document) under the headings “Average Weekly Earnings—Trend—Persons—All employees total earnings” (or, if any of those headings change, under any replacement headings).

reference period in a September quarter of a year of income means the period described by the Australian Statistician as the last pay period ending on or before the third Friday of the middle month of the quarter.

September quarter of a year of income means the quarter ending on 30 September of that year.

tax return year means:

(a) if subsection 58(3) applies—the year of income before the last relevant year of income in relation to a child support period; or

(b) if subsection 58(4) applies—the earlier year of income that applies under paragraph 58(4)(c).

(2) The ATI indexation factor is to be calculated to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(3) If:

(a) the Australian Statistician publishes an AWE amount (the later amount) for a September quarter of a year of income; and

(b) the later amount is published in substitution for an AWE amount for that quarter that was previously published by the Australian Statistician;

the publication of the later amount is to be disregarded for the purposes of this section.

6 Section 150C

Repeal the section.

7 After subsection 155(2)

Insert:

(2A) Before the end of each calendar year, the Secretary must publish in the Gazette the AWE amount (within the meaning of subsection 58AA(1)) for the quarter ending on 30 September of that year.

8 Subsection 155(3)

Omit “and (2)”, substitute “, (2) and (2A)”.

9 Application—subsection 5A(5) of the Child Support (Assessment) Act 1989

Subsection 5A(5) of the Child Support (Assessment) Act 1989, as inserted by this Schedule, applies in relation to the amount referred to in subsection 5A(1) of that Act that is published before or after the commencement of this item.

10 Application—subsection 58AA(3) of the Child Support (Assessment) Act 1989

Subsection 58AA(3) of the Child Support (Assessment) Act 1989, as inserted by this Schedule, applies in relation to an AWE amount (within the meaning of subsection 58AA(1) of that Act, as inserted by this Schedule) that is published before or after the commencement of this item.

11 Saving provision

If:

(a) a determination was made under section 58 of the Child Support (Assessment) Act 1989 before the commencement of this item; and

(b) the determination was in force immediately before that commencement;

the determination has effect, after that commencement, as if it had been made under section 58 of that Act as inserted by this Schedule.

Schedule 5—Other amendments

A New Tax System (Family Assistance) Act 1999

1 Paragraph 36(2)(ab)

Repeal the paragraph, substitute:

(ab) either:

(i) the individual is the primary carer of the child at any time within the period of 26 weeks starting on the day of the child’s birth; or

(ii) the individual is a member of a couple at any time within the period of 26 weeks starting on the day of the child’s birth and the individual’s partner is the primary carer of the child at that time; and

2 Paragraph 36(2)(d)

Omit “day of the child’s birth”, substitute “first day on which paragraph (ab) applies”.

3 Paragraphs 36(3)(b) and (c)

Repeal the paragraphs, substitute:

(b) either:

(i) the child is entrusted to the care of the individual at any time within the period of 26 weeks starting on the day of the child’s birth; or

(ii) the individual is a member of a couple at any time within the period of 26 weeks starting on the day of the child’s birth and the child is entrusted to the care of the individual’s partner at that time; and

(c) either:

(i) the individual is the primary carer of the child at any time within the period of 26 weeks starting on the day of the child’s birth; or

(ii) the individual is a member of a couple at any time within the period of 26 weeks starting on the day of the child’s birth and the individual’s partner is the primary carer of the child at that time; and

Note: The heading to subsection 36(3) is altered by adding at the end “or individual’s partner”.

4 Paragraph 36(3)(e)

Omit “day the child is entrusted to care as mentioned in paragraph (b)”, substitute “first day on which paragraph (c) applies”.

5 Paragraph 36(5)(bc)

Repeal the paragraph, substitute:

(bc) either:

(i) the individual is the primary carer of the child at any time within the period of 26 weeks starting on the day the child is entrusted to the care of the individual; or

(ii) the individual is a member of a couple at any time within the period of 26 weeks starting on the day the child is entrusted to the care of the individual and the individual’s partner is the primary carer of the child at that time; and

6 Paragraph 36(5)(d)

Omit “day the child is entrusted to the care of the individual”, substitute “first day on which paragraph (bc) applies”.

7 Application—baby bonus

The amendments made by items 1 to 6 apply in relation to claims for payment of baby bonus that are made on or after the commencement of those items.

8 Clause 4 of Schedule 1

Omit “maximum rate”, substitute “Method 2 base rate”.

9 Clause 24N of Schedule 1

Omit “step 3”, substitute “step 4”.

10 Clause 25 of Schedule 1 (method statement, step 1)

Omit “maximum rate”, substitute “Method 2 base rate”.

11 Clause 25 of Schedule 1 (method statement, step 2)

Omit “maximum rate”, substitute “Method 2 base rate”.

12 Clause 25 of Schedule 1 (method statement, step 3)

Repeal the step, substitute:

Step 3. Work out the rate that would be the individual’s income and maintenance tested rate under step 3 of the method statement in clause 3 if the individual’s Part A rate were to be calculated using Part 2 (but disregarding clause 24G): the result is the individual’s Method 2 income and maintenance tested rate.

Step 4. The individual’s Part A rate is:

(a) the individual’s provisional Part A rate if it is equal to or greater than the individual’s Method 2 income and maintenance tested rate; or

(b) the individual’s Method 2 income and maintenance tested rate if it is greater than the individual’s provisional Part A rate.

13 Clause 34 of Schedule 1

Omit “or 25”, substitute “, or an individual’s Method 2 base rate under clause 25,”.

14 Subclause 36(1) of Schedule 1

Omit “or 25”, substitute “, or an individual’s Method 2 base rate under clause 25,”.

15 Subclauses 38A(1) and (4) of Schedule 1

Omit “or 25”, substitute “, or an individual’s Method 2 base rate under clause 25,”.

16 At the end of clause 38C of Schedule 1

Add:

(3) Paragraph (2)(c) does not apply if, at the time the claim for payment of family tax benefit for a past period is made, subsection 32AE(2) of the Family Assistance Administration Act applies in respect of the individual or subsection 32AE(5) of that Act applies in respect of the individual’s partner.

17 Application—rent assistance

The amendment made by item 16 applies in relation to claims for payment of family tax benefit for a past period that are made on or after the commencement of that item.

18 At the end of clause 7 of Schedule 3

Add:

; and (k) if the payment is a payment under the Social Security Act 1991—does not include tax‑exempt pension supplement (within the meaning of subsection 20A(6) of that Act); and

(l) if the payment is a payment under the Veterans’ Entitlements Act 1986—does not include tax‑exempt pension supplement (within the meaning of subsection 5GA(5) of that Act).

A New Tax System (Family Assistance) (Administration) Act 1999

19 Subsection 10(5)

Omit “subsection 32AE(2) or (3) applies in respect of the claimant or the claimant’s partner”, substitute “subsection 32AE(2) applies in respect of the claimant or subsection 32AE(5) applies in respect of the claimant’s partner”.

20 At the end of paragraph 31E(1)(b)

Add:

; (vii) the determination ceases to be in force in the income year and another determination comes into force in that income year under which the claimant is entitled to be paid family tax benefit by instalment or family tax benefit for a past period that falls wholly within that income year.

Note: The heading to section 31E is altered by omitting “payable by instalment”.

21 Subsection 31E(2) (method statement, at the end of step 2)

Add:

; or (g) if subparagraph (1)(b)(vii) applies—the estimate of the claimant’s adjusted taxable income for the income year, and the estimate of the claimant’s maintenance income in that income year, that were used in determining the claimant’s rate of family tax benefit under the other determination referred to in that subparagraph.

22 Subsection 31E(2) (method statement, at the end of step 5)

Add “, and rounding the result of the division to the nearest cent (rounding 0.5 cents upwards)”.

23 Subsection 31E(3)

After “vary the”, insert “applicable”.

24 After subsection 31E(3)

Insert:

(3A) For the purposes of subsection (3), the applicable determination is:

(a) if subparagraph (1)(b)(i), (ii), (iii), (iv), (v) or (vi) applies—the determination referred to in paragraph (1)(a); or

(b) if subparagraph (1)(b)(vii) applies—the other determination referred to in that subparagraph.

25 Subsection 31E(5) (at the end of the definition of applicable day)

Add:

; and (c) if subparagraph (1)(b)(vii) applies—the first day in the income year for which the claimant’s entitlement to be paid family tax benefit arose under the other determination referred to in that subparagraph.

26 Paragraph 39(1A)(a)

After “section 36A”, insert “of the Family Assistance Act”.

27 Paragraph 39(1A)(a)

After “subsection 36A(3)”, insert “of that Act”.

28 Paragraph 66(2)(a)

Omit “23(4),”.

29 Paragraph 66(2)(a)

Omit “a person’s family assistance to someone else on behalf of the person”, substitute “child care benefit in a different way”.

30 After paragraph 66(2)(cc)

Insert:

(cd) Division 3 of Part 8B (about payments to payment nominee); and

31 Section 103

Repeal the section.

Child Support (Assessment) Act 1989

32 Subsection 5(1) (at the end of the definition of tax free pension or benefit)

Add:

; and (j) if the payment is a payment under the Social Security Act 1991—does not include tax‑exempt pension supplement (within the meaning of subsection 20A(6) of that Act); and

(k) if the payment is a payment under the Veterans’ Entitlements Act 1986—does not include tax‑exempt pension supplement (within the meaning of subsection 5GA(5) of that Act).