Social Services and Other Legislation Amendment (Seniors Health Card and Other Measures) Act 2014

No. 98, 2014

An Act to amend the law relating to social security, student assistance, aged care, health, data‑matching and veterans’ entitlements, and for related purposes

[Assented to 11 September 2014]

The Parliament of Australia enacts:

1 Short title

This Act may be cited as the Social Services and Other Legislation Amendment (Seniors Health Card and Other Measures) Act 2014.

2 Commencement

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day this Act receives the Royal Assent. | 11 September 2014 |

2. Schedules 1, 2 and 3 | The day after this Act receives the Royal Assent. | 12 September 2014 |

3. Schedule 4, items 1 to 14 | As follows: (a) if this Act receives the Royal Assent before 1 July 2014—immediately after the commencement of Part 2 of Schedule 5 to the Aged Care (Living Longer Living Better) Act 2013; (b) if this Act receives the Royal Assent on or after 1 July 2014—the 28th day after this Act receives the Royal Assent. | 9 October 2014 (paragraph (b) applies) |

4. Schedule 4, item 15 | The later of: (a) the start of the day this Act receives the Royal Assent; and (b) immediately after the commencement of Part 2 of Schedule 5 to the Aged Care (Living Longer Living Better) Act 2013. | 11 September 2014 (paragraph (a) applies) |

5. Schedule 4, items 16 and 17 | Immediately after the commencement of the provision(s) covered by table item 3. However, the provision(s) do not commence at all if item 106 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014 commences before the time the provision(s) covered by table item 3 commence. | Never commenced |

6. Schedule 4, item 18 | The later of: (a) immediately after the commencement of the provision(s) covered by table item 3; and (b) immediately after the commencement of item 106 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014. However, the provision(s) do not commence at all if the event mentioned in paragraph (b) does not occur. | 9 October 2014 (paragraph (a) applies) |

7. Schedule 4, items 19 and 20 | Immediately after the commencement of the provision(s) covered by table item 3. However, the provision(s) do not commence at all if item 109 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014 commences before the time the provision(s) covered by table item 3 commence. | Never commenced |

8. Schedule 4, items 21 and 22 | The later of: (a) immediately after the commencement of the provision(s) covered by table item 3; and (b) immediately after the commencement of item 109 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014. However, the provision(s) do not commence at all if the event mentioned in paragraph (b) does not occur. | 9 October 2014 (paragraph (a) applies) |

9. Schedule 4, item 23 | The later of: (a) immediately after the commencement of the provision(s) covered by table item 3; and (b) immediately after the commencement of item 112 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014. However, the provision(s) do not commence at all if the event mentioned in paragraph (b) does not occur. | 9 October 2014 (paragraph (a) applies) |

10. Schedule 4, item 24 | Immediately after the commencement of the provision(s) covered by table item 3. However, the provision(s) do not commence at all if item 112 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014 commences before the time the provision(s) covered by table item 3 commence. | Never commenced |

11. Schedule 4, item 25 | As follows: (a) if this Act receives the Royal Assent before 1 July 2014—immediately after the commencement of Part 2 of Schedule 5 to the Aged Care (Living Longer Living Better) Act 2013; (b) if this Act receives the Royal Assent on or after 1 July 2014—the 28th day after this Act receives the Royal Assent. | 9 October 2014 (paragraph (b) applies) |

12. Schedule 4, item 26 | Immediately after the commencement of the provision(s) covered by table item 3. However, the provision(s) do not commence at all if item 117 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014 commences before the time the provision(s) covered by table item 3 commence. | Never commenced |

13. Schedule 4, item 27 | The later of: (a) immediately after the commencement of the provision(s) covered by table item 3; and (b) immediately after the commencement of item 117 of Schedule 2 to the Farm Household Support (Consequential and Transitional Provisions) Act 2014. However, the provision(s) do not commence at all if the event mentioned in paragraph (b) does not occur. | 9 October 2014 (paragraph (a) applies) |

14. Schedule 4, item 28 | As follows: (a) if this Act receives the Royal Assent before 1 July 2014—immediately after the commencement of Part 2 of Schedule 5 to the Aged Care (Living Longer Living Better) Act 2013; (b) if this Act receives the Royal Assent on or after 1 July 2014—the 28th day after this Act receives the Royal Assent. | 9 October 2014 (paragraph (b) applies) |

15. Schedule 5 | The later of: (a) the start of the day this Act receives the Royal Assent; and (b) immediately after the commencement of Part 2 of Schedule 5 to the Aged Care (Living Longer Living Better) Act 2013. | 11 September 2014 (paragraph (a) applies) |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

3 Schedule(s)

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Indexation of seniors health card income limit

Social Security Act 1991

1 At the end of point 1071‑12

Add:

Note: The amounts in column 3 are to be indexed on 20 September 2014 and each later 20 September in line with CPI increases (see sections 1190 to 1194).

2 Section 1190 (after table item 36)

Insert:

| Income limits | | |

36A. | seniors health card income limit | seniors health card income limit | [Point 1071‑12—table—column 3—all amounts] |

3 Subsection 1191(1) (after table item 26)

Insert:

| Income limits | | | | |

26A. | seniors health card income limit | 20 September | June | highest June quarter before reference quarter (but not earlier than June quarter 2013) | $1.00 |

| | | | | | | |

4 After subsection 1192(5A)

Insert:

(5B) The first indexation of amounts under item 26A of the CPI Indexation Table in subsection 1191(1) is to take place on 20 September 2014.

Veterans’ Entitlements Act 1986

5 At the end of point 118ZZA‑11

Add:

Note 4: The amounts in column 3 are to be indexed on 20 September 2014 and each later 20 September in line with CPI increases (see section 198FAA).

6 After section 198FA

Insert:

198FAA Indexation of seniors health card income limit

(1) This section applies to the dollar amount mentioned in column 3 of item 1, 2, 3 or 4 of the table in point 118ZZA‑11.

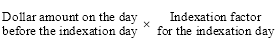

(2) That dollar amount, for an indexation day on which the indexation factor is greater than 1, is replaced by the amount that is worked out using the following formula:

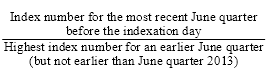

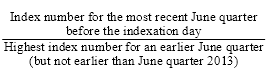

(3) The indexation factor for an indexation day is the number worked out using the following formula:

(4) The indexation factor is to be calculated to 3 decimal places, but increased by 0.001 if the fourth decimal place is more than 4.

(5) If an amount worked out under subsection (2) is not a multiple of a dollar, the amount is to be rounded to the nearest multiple of a dollar (rounding up in the case of 50 cents).

(6) In this section:

indexation day means 20 September 2014 and each later 20 September.

Schedule 2—Review of decisions

A New Tax System (Family Assistance) (Administration) Act 1999

1 Subsection 149(2)

Omit “the prescribed number of copies of the statement prepared by the SSAT under paragraph 141(1)(a) of this Act”, substitute “2 copies of the statement prepared by the SSAT under subparagraph 141(1A)(c)(ii) or paragraph 141(1)(a) of this Act”.

Social Security (Administration) Act 1999

2 Subsection 186(2)

Omit “the prescribed number of copies of the statement prepared by the SSAT under paragraph 177(1)(a)”, substitute “2 copies of the statement prepared by the SSAT under subparagraph 177(1A)(c)(ii) or paragraph 177(1)(a) of this Act”.

Student Assistance Act 1973

3 Subsection 3(1)

Insert:

Principal Member means the Principal Member of the Social Security Appeals Tribunal.

4 Subsection 3(1) (definition of Social Security or Veterans’ legislation overpayment)

Repeal the definition.

5 Subsection 303(5) (heading)

Repeal the heading, substitute:

Notice to Principal Member

6 Subsection 303(5)

Omit “National Convener”, substitute “Principal Member”.

7 Section 310 (note)

Repeal the note.

8 Subsection 316(1)

Omit “(other than a decision referred to in subsection (7))”.

9 Subsection 316(1) (note)

Repeal the note.

10 Subsection 321(3)

Omit “either”.

11 Paragraph 321(3)(d)

Repeal the paragraph, substitute:

(d) request the Principal Member to dismiss the application under section 322A; or

(e) notify, under section 322B, the Social Security Appeals Tribunal that the application is discontinued or withdrawn.

12 Subsection 322(3)

Omit “National Convener”, substitute “Principal Member”.

13 Subsection 322(5) (heading)

Repeal the heading, substitute:

Principal Member may make order

14 Subsection 322(5)

Omit “National Convener”, substitute “Principal Member”.

15 Subsection 322(5) (note)

Repeal the note.

16 At the end of Division 2 of Part 9

Add:

322A Dismissal of application for review by SSAT

(1) The Principal Member may, on the request of a party or on his or her own initiative, dismiss an application for review of a decision if:

(a) the decision is not reviewable under this Division; or

(b) the application is frivolous or vexatious; or

(c) all of the parties consent; or

(d) the Principal Member is satisfied:

(i) after having communicated with each party; or

(ii) after having made reasonable attempts to communicate with each party and having failed to do so;

or a combination of both, that none of the parties intends to proceed with the application; or

(e) all of the parties fail to attend the hearing.

(2) The Principal Member may dismiss an application under paragraph (1)(b) only if:

(a) one of the following applies:

(i) the Principal Member has received and considered submissions from the applicant for review;

(ii) the Principal Member has otherwise communicated with the applicant in relation to the grounds of the application;

(iii) the Principal Member has made reasonable attempts to communicate with the applicant in relation to the grounds of the application and has failed to do so; and

(b) all of the parties (other than the applicant) consent to the dismissal.

(3) If the Principal Member dismisses an application under subsection (1) (other than under paragraph (1)(b)), a party to the review may:

(a) within 28 days after receiving notification that the application has been dismissed; or

(b) within such longer period as the Principal Member, in special circumstances, allows;

request that the Principal Member reinstate the application.

(4) If the Principal Member considers it appropriate to do so, he or she may reinstate the application and give such directions as he or she considers appropriate in the circumstances.

(5) If it appears to the Principal Member that an application has been dismissed under subsection (1) in error, he or she may, on the request of a party to the review or on his or her own initiative, reinstate the application and give such directions as he or she considers appropriate in the circumstances.

322B Applicant for review may discontinue or withdraw application

(1) An applicant for review may notify the Social Security Appeals Tribunal at any time that the application for review is discontinued or withdrawn.

(2) If the applicant orally notifies the Social Security Appeals Tribunal, the person who receives the notification must make a written record of the day on which the notification was given.

(3) If notification is given under subsection (1), the Principal Member is taken to have dismissed the application.

(4) If the Principal Member dismisses an application under subsection (3), the applicant may:

(a) within 28 days after receiving notification that the application has been dismissed; or

(b) within such longer period as the Principal Member, in special circumstances, allows;

request that the Principal Member reinstate the application.

(5) If the Principal Member considers it appropriate to do so, he or she may reinstate the application and give such directions as he or she considers appropriate in the circumstances.

322C Notification of decisions

Social Security Appeals Tribunal affirms decisions

(1) If the Social Security Appeals Tribunal makes a decision on a review and the decision is of a kind mentioned in paragraph 316(1)(a), the Tribunal must:

(a) prepare a written statement (the initial statement) that sets out the decision of the Tribunal on the review; and

(b) give each party to the review a copy of the initial statement within 14 days after making the decision; and

(c) within 14 days after making the decision, either:

(i) give reasons for the decision orally to each party to the review and explain that the party may make a written request for a statement under subparagraph (ii) within 14 days after the copy of the initial statement is given to the party; or

(ii) give each party to the review a written statement (whether or not as part of the initial statement) that sets out the reasons for the decision, sets out the findings on any material questions of fact and refers to evidence or other material on which the findings of fact are based; and

(d) return to the Secretary any document that the Secretary has provided to the Tribunal in connection with the review; and

(e) give the Secretary a copy of any other document that contains evidence or material on which the findings of fact are based.

(2) If the Social Security Appeals Tribunal does not give a written statement to a party under subparagraph (1)(c)(ii), the party may, within 14 days after the copy of the initial statement is given to the party, make a written request of the Tribunal for such a statement.

(3) The Social Security Appeals Tribunal must comply with a request under subsection (2) within 14 days after the day on which it receives the request.

Social Security Appeals Tribunal varies decisions or sets decisions aside

(4) If the Social Security Appeals Tribunal makes a decision on a review and the decision is of a kind mentioned in paragraph 316(1)(b) or (c), the Tribunal must:

(a) prepare a written statement that:

(i) sets out the decision of the Tribunal on the review; and

(ii) sets out the reasons for the decision; and

(iii) sets out the findings on any material questions of fact; and

(iv) refers to evidence or other material on which the findings of fact are based; and

(b) give each party to the review a copy of the statement referred to in paragraph (a) within 14 days after the making of the decision in relation to the review; and

(c) return to the Secretary any document that the Secretary has provided to the Tribunal in connection with the review; and

(d) give the Secretary a copy of any other document that contains evidence or material on which the findings of fact are based.

Notice of further review right

(5) After the Social Security Appeals Tribunal determines a review, the Principal Member must give each party to the review (except the Secretary) a written notice stating that, if the party is dissatisfied with the Tribunal’s decision, application may, subject to the Administrative Appeals Tribunal Act 1975, be made to the Administrative Appeals Tribunal for review of the decision.

(6) A failure to comply with subsection (5) in relation to a decision of the Social Security Appeals Tribunal does not affect the validity of the decision.

17 Section 328

Repeal the section.

18 Subsection 331(2)

Omit “the prescribed number of copies of the statement prepared by the Social Security Appeals Tribunal under paragraph 1281(1)(a) of the Social Security Act”, substitute “2 copies of the statement prepared by the Social Security Appeals Tribunal under subparagraph 322C(1)(c)(ii) or paragraph 322C(4)(a) of this Act”.

19 Subsection 331(3) (notes 1 and 2)

Repeal the notes.

20 Section 332

Omit “section 333”, substitute “section 324”.

21 Section 332

Omit “National Convener”, substitute “Principal Member”.

22 Section 332 (note)

Repeal the note, substitute:

Note: The effect of this section is that if the Administrative Appeals Tribunal considers that the statement referred to in paragraph 37(1)(a) of the Administrative Appeals Tribunal Act 1975 is not adequate, it may order the Principal Member to lodge an additional statement containing further and better particulars.

23 Paragraph 335(1)(c)

Omit “National Convener of the Social Security Appeals Tribunal”, substitute “Principal Member”.

24 Subsection 335(4) (heading)

Repeal the heading, substitute:

Principal Member and Tribunal to have regard to statement

25 Subsection 335(4)

Omit “National Convener” (wherever occurring), substitute “Principal Member”.

26 Section 336 (heading)

Repeal the heading, substitute:

336 The Secretary and Principal Member may agree on administrative arrangements

27 Section 336

Omit “National Convener of the Social Security Appeals Tribunal”, substitute “Principal Member”.

28 Application provisions

(1) The amendments made by items 11 and 16 (to the extent that item 16 inserts sections 322A and 322B of the Student Assistance Act 1973) apply in relation to an application to the Social Security Appeals Tribunal for a review of a decision, where the application is made on or after the commencement of those items.

(2) The amendments made by items 16 (to the extent that item 16 inserts section 322C of the Student Assistance Act 1973), 17 and 18 apply in relation to a decision of the Social Security Appeals Tribunal made on or after the commencement of those items.

Schedule 3—Machinery of government changes

Data‑matching Program (Assistance and Tax) Act 1990

1 Subsection 3(1) (paragraph (a) of the definition of assistance agency)

Repeal the paragraph.

2 Subsection 3(1) (paragraph (b) of the definition of assistance agency)

Omit “Department of Employment, Education and Training”, substitute “Education Department”.

3 Subsection 3(1) (paragraph (c) of the definition of assistance agency)

Omit “Department of Social Security”, substitute “Social Services Department”.

4 Subsection 3(1) (paragraph (d) of the definition of assistance agency)

Omit “Department of Veterans’ Affairs”, substitute “Veterans’ Affairs Department”.

5 Subsection 3(1)

Insert:

Education Department means the Department that is responsible for administering the payments known as child care benefit and child care rebate.

6 Subsection 3(1) (paragraph (a) of the definition of matching agency)

Omit “Department of Social Security”, substitute “Social Services Department”.

7 Subsection 3(1) (paragraph (b) of the definition of personal assistance)

Omit “any assistance dealt with by the Department of Employment, Education and Training or by the Human Services Department and”, substitute “assistance”.

8 Subsection 3(1) (paragraphs (ca), (da), (db), (dc), (de) and (df) of the definition of personal assistance)

Repeal the paragraphs.

9 Subsection 3(1)

Insert:

Social Services Department means the Department administered by the Minister administering this Act.

10 Subsection 3(1)

Insert:

Veterans’ Affairs Department means the Department administered by the Minister administering the Veterans’ Entitlements Act 1986.

11 Section 3A (heading)

Repeal the heading, substitute:

3A Directions by Secretary of the Social Services Department

12 Paragraph 3A(1)(a)

Omit “Secretary of the Department of Social Security”, substitute “Secretary of the Social Services Department”.

13 Paragraph 3A(1)(a)

Omit “the Secretary’s”, substitute “that Secretary’s”.

14 Paragraph 3A(1)(b)

Omit “the Department”, substitute “that Department”.

15 Subsection 3A(1)

Omit “the Secretary may”, substitute “that Secretary may”.

16 Subsection 3A(1)

Omit “the Department is not”, substitute “that Department is not”.

17 Subsection 4(1)

Omit “Secretary to the Department of Social Security”, substitute “Secretary of the Social Services Department”.

Social Security Act 1991

18 Subsection 23(1) (definition of approved program of work for income support payment)

Omit “Employment Secretary”, substitute “Secretary”.

19 Subsection 23(1) (definition of Employment Department)

Omit “Department of Employment, Education and Training”, substitute “Department administered by the Minister administering the Fair Entitlements Guarantee Act 2012”.

20 Subsection 23(1) (definition of Employment Secretary)

Omit “Secretary to”, substitute “Secretary of”.

21 Subsection 23(1) (definition of Health Department)

Repeal the definition.

22 Subsection 23(1) (definition of Health Secretary)

Repeal the definition.

23 Subsection 23(1) (subparagraph (b)(ii) of the definition of Secretary)

Repeal the subparagraph.

24 Subsections 28(1) and (2)

Omit “Employment Secretary”, substitute “Secretary”.

25 Section 28A

Omit “Secretary of the Department of Employment, Education and Training”, substitute “Secretary”.

26 Transitional provision—sections 28 and 28A of the Social Security Act 1991

(1) A declaration in force under subsection 28(1) of the Social Security Act 1991 immediately before the commencement of this item has effect, on and after that commencement, as if it had been made under that subsection as amended by this Schedule.

(2) An approval in force under section 28A of the Social Security Act 1991 immediately before the commencement of this item has effect, on and after that commencement, as if it had been made under that section as amended by this Schedule.

27 Subparagraph 94(1)(c)(ii)

Repeal the subparagraph, substitute:

(ii) the Secretary is satisfied that the person is participating in the program administered by the Commonwealth known as the supported wage system; and

28 Sub‑subparagraph 1035(1)(d)(ii)(C)

Omit “of the Employment Department”.

29 Subparagraph 1046(2B)(b)(iii)

Omit “of the Employment Department”.

30 Transitional provision—sections 1035 and 1046 of the Social Security Act 1991

(1) A nomination in force under sub‑subparagraph 1035(1)(d)(ii)(C) of the Social Security Act 1991 immediately before the commencement of this item has effect, on and after that commencement, as if it had been made under that sub‑subparagraph as amended by this Schedule.

(2) A nomination in force under subparagraph 1046(2B)(b)(iii) of the Social Security Act 1991 immediately before the commencement of this item has effect, on and after that commencement, as if it had been made under that subparagraph as amended by this Schedule.

31 Paragraph 1061ZZGE(1)(b)

Repeal the paragraph, substitute:

(b) the Minister administering the Migration Act 1958.

32 Subsection 1061ZZGH(3)

Omit “Minister administering section 65 of the Migration Act 1958”, substitute “Minister administering the Migration Act 1958”.

33 Subsection 1228(2) (note)

Repeal the note.

Social Security (Administration) Act 1999

34 Paragraph 129(4)(e)

Repeal the paragraph.

35 Paragraph 144(e)

Omit “Employment Secretary”, substitute “Secretary”.

36 Paragraph 144(e)

Omit “unemployment payment”, substitute “income support payment”.

37 Subsections 234(5) and (6)

Repeal the subsections.

Schedule 4—Aged care amendments

Part 1—Main amendments

Aged Care Act 1997

1 Subsection 44‑24(12) (note)

Repeal the note.

2 Subsection 85‑4(2)

Repeal the subsection.

3 Subsection 85‑5(2)

Repeal the subsection.

4 Sections 85‑6 and 85‑7

Repeal the sections.

5 Section 86‑4

Omit “powers under Part 2.3 have been delegated under subsection 96‑2(5), or a person making assessments under section 22‑4, may make a record of, disclose or otherwise use *protected information, relating to a person and acquired in the course of exercising those powers”, substitute “powers or functions under Part 2.3 have been delegated under subsection 96‑2(14), or a person making assessments under section 22‑4, may make a record of, disclose or otherwise use *protected information, relating to a person and acquired in the course of exercising those powers or performing those functions”.

6 Section 86‑7

Omit “or a Departmental employee (within the meaning of the Human Services (Centrelink) Act 1997)”, substitute “, a Departmental employee (within the meaning of the Human Services (Centrelink) Act 1997), the *Chief Executive Medicare or a Departmental employee (within the meaning of the Human Services (Medicare) Act 1973)”.

7 Section 96‑2

Repeal the section, substitute:

96‑2 Delegation of Secretary’s powers and functions

Officer of the Department

(1) The Secretary may, in writing, delegate to an officer of the Department all or any of the powers and functions of the Secretary under this Act, the regulations or any Principles made under section 96‑1.

Aged Care Commissioner

(2) The Secretary may, in writing, delegate to the *Aged Care Commissioner all or any of the powers and functions of the Secretary under this Act, the regulations or any Principles made under section 96‑1.

Aged Care Pricing Commissioner

(3) The Secretary may, in writing, delegate to the *Aged Care Pricing Commissioner the powers and functions of the Secretary that the Secretary considers necessary for the Aged Care Pricing Commissioner to perform the Aged Care Pricing Commissioner’s functions under this Act.

Chief Executive Centrelink

(4) The Secretary may, in writing, delegate to the *Chief Executive Centrelink:

(a) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(b) the Secretary’s powers and functions under section 44‑26C; or

(c) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering the following decisions:

(i) a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income;

(ii) a decision under section 44‑26C.

(5) If, under subsection (4), the Secretary delegates a power or function to the *Chief Executive Centrelink, the Chief Executive Centrelink may, in writing, sub‑delegate the power or function to a Departmental employee (within the meaning of the Human Services (Centrelink) Act 1997).

Chief Executive Medicare

(6) The Secretary may, in writing, delegate to the *Chief Executive Medicare:

(a) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(b) the Secretary’s powers and functions under section 44‑26C; or

(c) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering the following decisions:

(i) a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income;

(ii) a decision under section 44‑26C.

(7) If, under subsection (6), the Secretary delegates a power or function to the *Chief Executive Medicare, the Chief Executive Medicare may, in writing, sub‑delegate the power or function to a Departmental employee (within the meaning of the Human Services (Medicare) Act 1973).

Veterans’ Affairs Secretary

(8) The Secretary may, in writing, delegate to the Secretary of the Department administered by the Minister who administers the Veterans’ Entitlements Act 1986:

(a) the Secretary’s powers and functions under section 44‑26C; or

(b) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering a decision under section 44‑26C.

(9) If, under subsection (8), the Secretary delegates a power or function to the Secretary of the Department administered by the Minister who administers the Veterans’ Entitlements Act 1986, the Secretary of that Department may, in writing, sub‑delegate the power or function to an APS employee in that Department.

Repatriation Commission

(10) The Secretary may, in writing, delegate to the *Repatriation Commission:

(a) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(b) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income.

(11) If, under subsection (10), the Secretary delegates a power or function to the *Repatriation Commission, the Repatriation Commission may, in writing, sub‑delegate the power or function to any person to whom it may delegate powers under the Veterans’ Entitlements Act 1986 under section 213 of that Act.

Social Services Secretary

(12) The Secretary may, in writing, delegate to the Secretary of the Department administered by the Minister who administers the Data‑matching Program (Assistance and Tax) Act 1990:

(a) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(b) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income.

(13) If, under subsection (12), the Secretary delegates a power or function to the Secretary of the Department administered by the Minister who administers the Data‑matching Program (Assistance and Tax) Act 1990, the Secretary of that Department may, in writing, sub‑delegate the power or function to an APS employee in that Department.

Person making an assessment for the purposes of section 22‑4

(14) The Secretary may, in writing, delegate to a person making an assessment for the purposes of section 22‑4:

(a) all or any of the Secretary’s powers and functions under Part 2.3; and

(b) all or any of the Secretary’s powers and functions under the Subsidy Principles that relate to respite supplement.

CEO of the Quality Agency

(15) The Secretary may, in writing, delegate to the *CEO of the Quality Agency the powers and functions of the Secretary that the Secretary considers necessary for the CEO to perform the CEO’s functions under the Australian Aged Care Quality Agency Act 2013.

Sub‑delegation

(16) Sections 34AA, 34AB and 34A of the Acts Interpretation Act 1901 apply in relation to a sub‑delegation in a corresponding way to the way in which they apply to a delegation.

8 Application provisions

(1) The amendments made by items 2, 3 and 4 apply in relation to determinations made under section 44‑24 of the Aged Care Act 1997 on or after the commencement of those items.

(2) The amendment made by item 6 applies in relation to protected information acquired on or after the commencement of that item.

Aged Care (Transitional Provisions) Act 1997

9 Subsection 44‑24(12) (note)

Repeal the note.

10 Subsection 85‑4(2)

Repeal the subsection.

11 Subsection 85‑5(2)

Repeal the subsection.

12 Sections 85‑6 and 85‑7

Repeal the sections.

13 Section 96‑2

Repeal the section, substitute:

96‑2 Delegation of Secretary’s powers and functions

Officer of the Department

(1) The Secretary may, in writing, delegate to an officer of the Department all or any of the powers and functions of the Secretary under this Act, the regulations or any Principles made under section 96‑1.

Chief Executive Centrelink

(2) The Secretary may, in writing, delegate to the *Chief Executive Centrelink:

(a) the Secretary’s powers and functions under section 44‑8AA or 44‑8AB; or

(b) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(c) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering the following decisions:

(i) a decision under section 44‑8AA or 44‑8AB;

(ii) a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income.

(3) If, under subsection (2), the Secretary delegates a power or function to the *Chief Executive Centrelink, the Chief Executive Centrelink may, in writing, sub‑delegate the power or function to a Departmental employee (within the meaning of the Human Services (Centrelink) Act 1997).

Chief Executive Medicare

(4) The Secretary may, in writing, delegate to the *Chief Executive Medicare:

(a) the Secretary’s powers and functions under section 44‑8AA or 44‑8AB; or

(b) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(c) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering the following decisions:

(i) a decision under section 44‑8AA or 44‑8AB;

(ii) a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income.

(5) If, under subsection (4), the Secretary delegates a power or function to the *Chief Executive Medicare, the Chief Executive Medicare may, in writing, sub‑delegate the power or function to a Departmental employee (within the meaning of the Human Services (Medicare) Act 1973).

Veterans’ Affairs Secretary

(6) The Secretary may, in writing, delegate to the Secretary of the Department administered by the Minister who administers the Veterans’ Entitlements Act 1986:

(a) the Secretary’s powers and functions under section 44‑8AA or 44‑8AB; or

(b) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering a decision under section 44‑8AA or 44‑8AB.

(7) If, under subsection (6), the Secretary delegates a power or function to the Secretary of the Department administered by the Minister who administers the Veterans’ Entitlements Act 1986, the Secretary of that Department may, in writing, sub‑delegate the power or function to an APS employee in that Department.

Repatriation Commission

(8) The Secretary may, in writing, delegate to the *Repatriation Commission:

(a) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(b) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income.

(9) If, under subsection (8), the Secretary delegates a power or function to the *Repatriation Commission, the Repatriation Commission may, in writing, sub‑delegate the power or function to any person to whom it may delegate powers under the Veterans’ Entitlements Act 1986 under section 213 of that Act.

Social Services Secretary

(10) The Secretary may, in writing, delegate to the Secretary of the Department administered by the Minister who administers the Data‑matching Program (Assistance and Tax) Act 1990:

(a) the Secretary’s powers and functions under section 44‑24 relating to making a determination for the purposes of working out a care recipient’s *total assessable income; or

(b) the Secretary’s powers and functions under section 85‑4 or 85‑5 relating to reconsidering a determination under section 44‑24 for the purposes of working out a care recipient’s total assessable income.

(11) If, under subsection (10), the Secretary delegates a power or function to the Secretary of the Department administered by the Minister who administers the Data‑matching Program (Assistance and Tax) Act 1990, the Secretary of that Department may, in writing, sub‑delegate the power or function to an APS employee in that Department.

Sub‑delegation

(12) Sections 34AA, 34AB and 34A of the Acts Interpretation Act 1901 apply in relation to a sub‑delegation in a corresponding way to the way in which they apply to a delegation.

14 Application provision

The amendments made by items 10, 11 and 12 apply in relation to determinations made under section 44‑24 of the Aged Care (Transitional Provisions) Act 1997 on or after the commencement of those items.

Health and Other Services (Compensation) Act 1995

15 Paragraph 42(1)(f)

After “Secretary”, insert “of the Department administered by the Minister administering the Aged Care Act 1997”.

Part 2—Contingent amendments

Social Security (Administration) Act 1999

16 Paragraph 126(1)(c)

Omit “or”.

17 Paragraphs 126(1)(e) and (f)

Repeal the paragraphs.

18 Subsection 126(1)

Repeal the subsection, substitute:

(1) The Secretary may review, subject to subsection (2), a decision of an officer under the social security law if the Secretary is satisfied that there is sufficient reason to review the decision.

19 Paragraph 129(1)(c)

Omit “or”.

20 Paragraphs 129(1)(e) and (f)

Repeal the paragraphs.

21 Subsection 129(1)

Repeal the subsection, substitute:

(1) Subject to subsections (3) and (4), a person affected by a decision of an officer under the social security law may apply to the Secretary for review of the decision.

22 Saving—validity of applications

The amendment made by item 21 does not affect the validity of an application that was made under subsection 129(1) of the Social Security (Administration) Act 1999 before the commencement of that item.

23 Paragraph 140(1)(b)

Omit “force; and”, substitute “force.”.

24 Paragraph 140(1)(d)

Omit “1992; and”, substitute “1992.”.

25 Paragraphs 140(1)(f) and (g)

Repeal the paragraphs.

26 Paragraphs 178(1)(b) and (c)

Repeal the paragraphs.

27 Subsection 178(1)

Repeal the subsection, substitute:

(1) Unless a contrary intention appears, the provisions of this Division apply to all decisions of an officer under the social security law.

28 Saving provision—general

Despite the amendments made by this Part, paragraphs 126(1)(e) and (f), 129(1)(e) and (f), 140(1)(f) and (g) and 178(1)(b) and (c) of the Social Security (Administration) Act 1999, as in force immediately before the commencement of this item, continue to apply on and after that commencement in relation to a decision under section 44‑24 of the Aged Care Act 1997 or the Aged Care (Transitional Provisions) Act 1997 that was made before that commencement.

Schedule 5—Definitions and technical corrections

Part 1—Signposting definitions

Social Security Act 1991

1 After section 3A

Insert:

3B Definitions—simplified outline

Sections 4 to 23 contain definitions of terms that are used in the social security law.

Subsection 23(1) contains an entry for each expression that is defined for the purposes of this Act. That subsection is like a Dictionary.

The entry is either an actual definition of the expression or a signpost definition that identifies the provision that defines the expression.

Many other sections in this Part contain the actual definitions relating to a particular topic. For example, sections 4 and 5 contain family relationship definitions and section 8 contains income test definitions.

2 Section 23 (heading)

Repeal the heading, substitute:

23 Dictionary

3 Subsection 23(1)

Insert:

AAT: see section 22.

AAT Act: see section 22.

accommodation bond: see subsection 11(1).

accommodation bond balance: see subsection 11(1).

accommodation charge: see subsection 11(1).

adopted child: see subsection 5(1).

Adult Disability Assessment Tool: see subsection 38C(3).

aged care resident: see subsections 13(8A), (8B) and (8C).

amount of rent paid or payable: see subsections 13(6) and (7).

approved care organisation: see section 6.

approved deposit fund: see subsection 9(1).

approved respite care: see subsection 4(9).

approved scholarship: see subsection 8(1).

armed services widow: see subsection 4(1).

armed services widower: see subsection 4(1).

asset: see subsections 11(1), (3AA), (3B), (3C) and (3D).

asset‑tested income stream (long term): see subsection 9(1).

asset‑tested income stream (short term): see subsection 9(1).

asset‑test exempt income stream: see sections 9A, 9B and 9BA.

ATO small superannuation account: see subsection 9(1).

Australian resident: see subsection 7(2).

automatic issue card: see subsection 6A(1).

automatic issue health care card: see subsection 6A(1).

available money: see subsection 8(1).

benefit PP (partnered): see section 18.

bereavement lump sum period: see paragraph 21(2)(e).

bereavement notification day: see paragraph 21(2)(b).

bereavement period: see paragraph 21(2)(a).

bereavement rate continuation period: see paragraph 21(2)(d).

board when used in the expression board and lodging: see subsection 13(1).

charge exempt resident: see subsection 11(1).

child: see subsection 5(1).

commencement day in relation to an income stream: see subsection 9(1).

compensation: see section 17.

compensation affected payment: see subsection 17(1).

compensation part in relation to a lump sum compensation payment: see subsection 17(1).

compensation payer: see subsection 17(1).

concession card: see subsection 6A(1).

current figure: see subsection 20(1).

dad and partner pay: see subsection 8(1).

daily accommodation contribution: see subsection 11(1).

daily accommodation payment: see subsection 11(1).

deductible amount in relation to a defined benefit income stream for a year: see subsection 9(1).

deferred annuity: see subsection 9(1).

deferred payment amount in relation to a sale leaseback agreement: see subsections 12B(6), (7) and (8).

defined benefit income stream: see subsection 9(1F).

dependant:

(a) in relation to a person who is the holder of a pensioner concession card or an automatic issue health care card (other than a health care card for which the person is qualified under subsection 1061ZK(4))—see section 6A; or

(b) in relation to a person who is the holder of a health care card for which the person is qualified under subsection 1061ZK(4) or Subdivision B of Division 3 of Part 2A.1—see section 6A; or

(c) in relation to a person, other than a child in foster care, who has made a claim for a health care card—see section 6A.

dependent child: see subsections 5(2) to (8A).

deposit money: see subsection 8(1).

deprived asset: see subsection 9(4).

designated NDIS amount: see subsection 9(1).

designated temporary entry permit: see subsection 7(1).

disability expenses maintenance: see section 10.

disability support wife pension: see subsection 17(1).

disposes of assets: see section 1123.

disposes of ordinary income: see sections 1106 to 1111.

domestic payment: see subsection 8(3).

double orphan: see sections 993 and 994.

earned, derived or received: see subsection 8(2).

eligible descendant: see subsection 17A(1).

eligible former partner of a qualifying farmer: see subsection 17A(2).

eligible former partner of a qualifying sugarcane farmer: see subsection 17B(2).

eligible interest:

(a) in a sugarcane farm—see subsection 17B(5); or

(b) in a relevant sugarcane farm asset—see subsection 17B(6).

employment income: see subsections 8(1), (1A) and (1B).

event that gives rise to a person’s entitlement to compensation: see subsection 17(5A).

exempt assets: see subsection 11(1).

exempt lump sum: see subsection 8(11).

family law affected income stream: see section 9C.

farm: see subsection 17A(1).

farm enterprise: see subsection 17A(1).

financial asset: see subsection 9(1).

financial investment: see subsections 9(1) and (1D).

first available bereavement adjustment payday: see paragraph 21(2)(c).

fishing operations: see subsection 11(1).

forest operations: see subsection 11(1).

former payment type: see subsection 17(1).

former refugee: see subsection 7(1).

friendly society: see subsection 9(1).

full‑time student load for a course of study: see subsection (20).

funeral investment: see subsection 19E(3).

gainful employment: see section 19.

governing rules in relation to an income stream: see subsection 9(1).

Government rent: see subsections 13(1), (3AC) and (5).

granny flat interest: see subsection 12A(2).

granny flat resident: see subsection 12A(3).

handicapped person: see section 19.

health care card means a card under Division 3 of Part 2A.1.

holder in relation to a visa: see subsection 7(1).

home equity conversion agreement: see subsections 8(1) and (7).

homeowner: see subsection 11(4).

illness separated couple: see subsection 4(7).

in a care situation: see subsection 13(9).

income: see subsection 8(1).

income amount: see subsection 8(1).

income cut‑out amount in relation to a person who has received a compensation payment: see subsections 17(1) and (8).

income from personal exertion: see subsection 8(1).

income stream: see subsections 9(1) and (1E).

income year: see subsection 11(1).

independent:

(a) in Parts 2.11, 2.11B, 3.4A, 3.4B, 3.5 and 3.7—see section 1067A; and

(b) in Part 2.24A—see section 1061PL.

independently of a program of support: see subsection 16B(2).

index number: see subsections 20(1), (4) and (5).

in disability accommodation: see subsection (4C).

industrial action: see subsections 16(1) and (2).

ineligible homeowner: see subsection 13(1).

in gaol: see subsection (5).

initial payment amount in relation to a sale leaseback agreement: see subsection 12B(4).

in residential care: see subsection (4CA).

in severe financial hardship: see subsections 19C(2) and (3) and section 19D.

instalment of parental leave pay: see subsection 8(1).

invalid wife pension: see subsection 17(1).

investment:

(a) in relation to a superannuation fund, approved deposit fund or deferred annuity—see subsection 9(9); or

(b) in relation to an ATO small superannuation account—see subsection 9(9A); or

(c) in relation to an FHSA (within the meaning of the First Home Saver Accounts Act 2008)—see subsection 9(9B).

investor in relation to an ATO small superannuation account: see subsection 9(1).

life expectancy: see subsection 9(1).

liquid assets test waiting period: see sections 549A to 549C, 575A to 575C, 598 and 676.

listed security: see subsection 9(1).

living away from the person’s parental home: see subsection (4D).

main supporter of a secondary pupil child: see section 5G.

maintenance: see section 10.

maintenance income: see section 10.

managed investment: see subsections 9(1A), (1B) and (1C).

member of a couple: see subsections 4(2), (3), (3A), (6) and (6A).

member of an ordinary couple with different principal homes: see subsection 12(2).

members of a trade union: see subsection 16(3).

new PRC (temporary) entry permit: see subsection 7(1).

non‑benefit PP (partnered): see section 18.

not payable in relation to a social security payment: see subsection (16).

November earnings average: see subsections 20(1) and (6).

old PRC (temporary) entry permit: see subsection 7(1).

ordinary income: see subsection 8(1) and section 1072.

original family law affected income stream: see section 9C.

parent: see subsection 5(1).

parenting payment: see section 18.

participating in the pension loans scheme: see subsection (11).

partner: see subsection 4(1).

partner bereavement payment: see subsection 21(1).

partnered: see paragraph 4(11)(a).

partnered (partner getting benefit): see paragraph 4(11)(e).

partnered (partner getting neither pension nor benefit): see paragraph 4(11)(b).

partnered (partner getting pension): see paragraph 4(11)(d).

partnered (partner getting pension or benefit): see paragraph 4(11)(c).

partnered (partner in gaol): see paragraph 4(11)(f).

pensioner concession card means a card under Division 1 of Part 2A.1.

pensioner couple: see subsection 9(1).

pension PP (single): see section 18.

pension year: see subsections 11(10) and (10AAA).

periodic payments period: see subsection 17(1).

permanent visa: see subsection 7(1).

physically present in a remote area: see subsection 14(2).

potential compensation payer: see subsection 17(1).

prescribed educational scheme: see subsection 5(1).

prescribed student child: see subsection 5(11).

primary FLA income stream: see section 9C.

primary producer: see subsection 11(1).

primary production: see subsection 11(1).

principal carer of a child: see subsections 5(15) to (24).

principal home: see section 11A.

proprietary company: see subsection 17A(1).

protected SCV holder: see subsections 7(2A), (2B), (2C) and (2D).

psychiatric confinement: see subsections (8) and (9).

public unit trust: see subsection 9(1).

purchase price in relation to an income stream: see subsection 9(1).

qualifying Australian residence: see subsection 7(5).

qualifying farmer: see subsections 17A(3) and (4).

qualifying interest:

(a) in a farm—see subsection 17A(5); or

(b) in a relevant farm asset—see subsection 17A(6).

qualifying residence exemption: see subsections 7(6) and (6AA).

qualifying sugarcane farmer: see subsections 17B(3) and (4).

RASF closing day: see section 1185N.

RASF commencement day: see section 1185N.

reasonable security of tenure: see subsection 11A(10).

receives compensation: see subsection 17(5).

refundable deposit: see subsection 11(1).

refundable deposit balance: see subsection 11(1).

relative (other than a parent): see section 5E.

relevant AWOTE: see subsection 16A(1).

relevant farm asset in relation to a farm: see subsection 17A(1).

relevant number in relation to an income stream: see subsection 9(1).

relevant State land law: see subsection 17A(1).

relevant sugarcane farm asset: see subsection 17B(1).

remote area: see subsection 14(1).

rent: see section 13.

residing in a nursing home: see subsection 13(8).

residual capital value in relation to an income stream: see subsections 9(1) and (10).

respite care couple: see subsection 4(8).

retirement savings account: see subsection 9(1).

retirement village: see subsections 12(3) and (4).

retirement village resident: see subsection 12(5).

return:

(a) in relation to an ATO small superannuation account—see subsection 9(1); or

(b) in relation to any other investment in the nature of superannuation—see subsection 9(1); or

(c) in relation to an investment in an FHSA (within the meaning of the First Home Saver Accounts Act 2008)—see subsection 9(1).

sale leaseback agreement: see subsections 12B(2) and (3).

sale leaseback home: see subsection 12B(9).

sale leaseback resident: see subsections 12B(10) and (11).

seasonal work: see subsections 16A(1), (1A) and (2).

seasonal work income: see subsection 16A(1).

seasonal work preclusion period: see subsections 16A(3) and (4).

secondary FLA income stream: see sections 9C and 9D.

secondary pupil child: see section 5F.

seniors health card means a card under Division 2 of Part 2A.1.

served the waiting period: see subsections (10) and (10A).

severely disabled: see subsection (4B).

sheltered employment: see section 19.

single person sharing accommodation: see section 5A.

social security law: see subsections (17) and (18).

special category visa: see subsection 7(1).

special needs disability support wife pension: see subsection 17(1).

special needs invalid wife pension: see subsection 17(1).

special residence: see subsection 12C(2).

special resident: see subsection 12C(3).

SSAT: see section 22.

step‑child: see subsection 5(1).

step‑parent: see subsection 5(1).

student child: see subsection 5(1A).

student income bank: see subsection 8(1).

subject to a seasonal work preclusion period: see subsection 16A(11).

sugarcane farm: see subsection 17B(1).

sugarcane farm enterprise: see subsection 17B(1).

superannuation benefit: see subsection 9(1).

superannuation contributions surcharge: see subsection 9(1).

superannuation fund: see subsection 9(1).

temporarily separated couple: see subsection 4(9A).

temporary visa: see subsection 7(1).

total net value: see section 1185S.

trade union: see subsection 16(1).

transfer:

(a) in relation to an eligible interest in a sugarcane farm—see subsections 17B(7), (8), (10), (11) and (12); or

(b) in relation to an eligible interest in a relevant sugarcane farm asset—see subsections 17B(9), (11) and (12); or

(c) in relation to a qualifying interest in a farm—see subsections 17A(7), (8), (10) and (11); or

(d) in relation to a qualifying interest in a relevant farm asset—see subsections 17A(9) and (11).

transfer day, in relation to a transferee to a social security pension or benefit, has the same meaning as in the Administration Act.

transferee, in relation to a social security pension or benefit, has the same meaning as in the Administration Act.

treating health professional: see section 38F.

unavoidable or reasonable expenditure: see subsection 19C(4).

unemployment: see subsection 16(1).

unlisted public security: see subsection 9(1).

unrealisable asset: see subsections 11(12) and (13).

value of a charge or encumbrance on an asset: see subsection 11(3).

value of a liability: see subsection 11(3A).

value of a particular asset: see subsection 11(2).

visa: see subsection 7(1).

vocational training: see section 19.

working credit participant: see subsection 8(1).

young person: see subsection 5(1B).

4 Subsection 23(19)

Repeal the subsection.

5 Part 2.26 (after the heading)

Insert:

Note: Section 19A contains many of the definitions that are relevant to the provisions of this Part.

6 Chapter 2B (after the heading)

Insert:

Note: Section 19AB contains many of the definitions that are relevant to the provisions of this Chapter.

7 Section 1067G (after the heading to Module G of the Youth Allowance Rate Calculator)

Insert:

Note: Section 10B contains many of the definitions that are relevant to the provisions of this Module.

8 Part 3.9 (after the heading)

Insert:

Note: Section 10A contains many of the definitions that are relevant to the provisions of this Part.

Part 2—Technical corrections

Social Security Act 1991

9 Subsection 4(6) (note)

Omit “section”, substitute “Section”.

10 Subsection 4(9A) (note)

Omit “for”, substitute “For”.

11 Subsection 5(1) (note to paragraph (ca) of the definition of prescribed educational scheme)

Repeal the note.

12 Subsection 5(1) (at the end of the definition of prescribed educational scheme)

Add:

Note: For paragraph (ca), an application under the Student Financial Supplement Scheme cannot be made in respect of a year, or a part of a year, that begins on or after the day on which the Student Assistance Legislation Amendment Act 2006 receives the Royal Assent (see subsection 1061ZY(2)).

13 Subsection 5(1A)

Omit “student child”, substitute “student child”.

14 Subsection 5(1B)

Omit “young person”, substitute “young person”.

15 Subsection 5(3)

Omit “dependent child”, substitute “dependent child”.

16 Subsection 5(3) (note)

Omit “the”, substitute “The”.

17 Subsection 5(4)

Omit “dependent child”, substitute “dependent child”.

18 Subsection 5(7) (note)

Omit “for”, substitute “For”.

19 Subsection 5A(1)

Omit “single person sharing accommodation”, substitute “single person sharing accommodation”.

20 Subsection 7(6AA)

Omit “qualifying residence exemption”, substitute “qualifying residence exemption”.

21 Subsection 8(1)

Insert:

approved exchange trading system has the meaning given by subsection (10).

22 Subsection 8(1) (definition of dispose of income)

Repeal the definition.

23 Subsection 8(1)

Insert:

disposes of ordinary income has the meaning given by sections 1106 to 1111.

24 Subsection 8(1)

Insert:

exchange trading system has the meaning given by subsection (9).

25 Subsection 8(1) (note at the end of the definition of home equity conversion agreement)

Omit “see”, substitute “See”.

26 Subsection 8(1) (note 2 at the end of the definition of income)

Omit “where”, substitute “Where”.

27 Subsection 8(1) (note 3 at the end of the definition of income)

Omit “income is”, substitute “Income is”.

28 Subsection 8(1) (note 1 at the end of the definition of ordinary income)

Omit “for”, substitute “For”.

29 Subsection 8(1) (note 2 at the end of the definition of ordinary income)

Omit “amounts received”, substitute “Amounts received”.

30 Paragraph 8(8)(ma) (note)

Omit “for”, substitute “For”.

31 Paragraph 8(8)(z) (note)

Omit “the rule”, substitute “The rule”.

32 Paragraph 8(8)(zj) (note)

Omit “for”, substitute “For”.

33 Subsection 9(1) (definition of asset‑test exempt income stream)

Relocate the definition to its appropriate alphabetical position, determined on a letter‑by‑letter basis.

34 Subsection 9(1) (note at the end of the definition of financial asset)

Omit “subsection 9(4)”, substitute “subsection (4)”.

35 Paragraphs 9(1B)(d), (e), (f) and (g) (note)

Repeal the note.

36 At the end of subsection 9(1B)

Add:

Note 1: For paragraph (d), see paragraph (1C)(a) for superannuation investments held before pension age is reached.

Note 2: For paragraph (e), see paragraph (1C)(b) for investments in approved deposit funds held before pension age is reached.

Note 3: For paragraph (f), see paragraph (1C)(c) for deferred annuities held before pension age is reached.

Note 4: For paragraph (g), see paragraph (1C)(ca) for investments in ATO small superannuation accounts held before pension age is reached.

37 Subsection 9(1C) (note 2)

Omit “for”, substitute “For”.

38 Subsection 9A(7) (paragraph (a) of the definition of liquid assets)

Omit “Corporations Law”, substitute “Corporations Act 2001”.

39 Subsection 11(1) (definition of pension year)

Omit “subsection (10)”, substitute “subsections (10) and (10AAA)”.

40 Subsection 11(1) (definition of unrealisable asset)

Omit “subsections (12), (13) and (14)”, substitute “subsections (12) and (13)”.

41 Subsection 11(1) (definition of value)

Repeal the definition.

42 Subsection 11(1)

Insert:

value of a charge or encumbrance on an asset has the meaning given by subsection (3).

value of a liability has the meaning given by subsection (3A).

value of a particular asset has the meaning given by subsection (2).

43 Subsection 11(3A)

Omit “value of a liability”, substitute “value of a liability”.

44 Subsection 11(4) (note)

Omit “see”, substitute “See”.

45 Subparagraph 11A(9)(e)(ii)

After “while”, insert “not”.

46 Subsection 12(1) (definition of actual value)

Repeal the definition.

47 Subsection 12(1)

Insert:

member of an ordinary couple with different principal homes has the meaning given by subsection (2).

48 Subsection 12(5)

Omit “retirement village resident”, substitute “retirement village resident”.

49 Subsection 12A(2)

Omit “granny flat interest”, substitute “granny flat interest”.

50 Subsection 12A(3)

Omit “granny flat resident”, substitute “granny flat resident”.

51 Subsection 12B(1) (definition of deferred payment amount)

Omit “subsections (6) and (7)”, substitute “subsections (6), (7) and (8)”.

52 Subsections 12B(2) and (3)

Omit “sale leaseback agreement”, substitute “sale leaseback agreement”.

53 Subsection 12B(4)

Omit “initial payment amount”, substitute “initial payment amount”.

54 Subsection 12B(6)

Omit “deferred payment amount”, substitute “deferred payment amount”.

55 Subsection 12B(7)

Omit “deferred payment amount” (last occurring), substitute “deferred payment amount”.

56 Subsection 12B(7) (note)

Omit “sections”, substitute “Sections”.

57 Subsection 12B(9)

Omit “sale leaseback home”, substitute “sale leaseback home”.

58 Subsection 12B(10)

Omit “sale leaseback resident”, substitute “sale leaseback resident”.

59 Subsection 12B(11)

Omit “sale leaseback resident” (first occurring), substitute “sale leaseback resident”.

60 Subsection 12B(11) (note)

Omit “subsection (11)”, substitute “Subsection (11)”.

61 Subsection 12C(2)

Omit “special residence”, substitute “special residence”.

62 Subsection 12C(3)

Omit “special resident”, substitute “special resident”.

63 Subsection 13(1) (note at the end of the definition of ineligible homeowner)

Omit “for approved”, substitute “For approved”.

64 Subsection 13(1) (definition of rent)

Omit “subsection (2)”, substitute “this section”.

65 Subsection 13(2) (note)

Omit “for retirement”, substitute “For retirement”.

66 Subsection 13(3AC)

Omit “taken to be Government rent”, substitute “taken to be Government rent”.

67 Subsection 14A(2)

Omit “person’s liquid assets”, substitute “person’s liquid assets”.

68 Subsection 16(1) (note at the end of the definition of industrial action)

Omit “see”, substitute “See”.

69 Subsection 16(1) (note at the end of the definition of trade union)

Omit “see”, substitute “See”.

70 Subsection 17(1) (definition of event that gives rise to an entitlement to compensation)

Repeal the definition.

71 Subsection 17(1)

Insert:

event that gives rise to a person’s entitlement to compensation has the meaning given by subsection (5A).

72 Subsection 17(5A)

Omit “event that gives rise to a person’s entitlement to compensation”, substitute “event that gives rise to a person’s entitlement to compensation”.

73 Section 19 (definition of sheltered employment)

Omit “direction”, substitute “determination”.

74 Subsections 19D(2) and (3)

Omit “in severe financial hardship”, substitute “in severe financial hardship”.

75 Subsection 23(1) (definition of additional child amounts)

Repeal the definition.

76 Subsection 23(1) (note at the end of the definition of Australia)

Omit “see also subsection”, substitute “See also subsections”.

77 Subsection 23(1) (note at the end of the definition of decision)

Omit “subsection”, substitute “Subsection”.

78 Subsection 23(1) (note at the end of the definition of long‑term social security recipient)

Repeal the note, substitute:

Note: See also the definition of social security recipient status in this subsection.

79 Subsection 23(1) (definition of RAS authority)

Repeal the definition.

80 Subsection 23(1) (definition of Rural Adjustment Scheme)

Repeal the definition.

81 Subsection 23(1) (definition of subsection 11(14) asset)

Repeal the definition.

82 Subsection 23(1) (note at the end of the definition of tax year)

Omit “section 6”, substitute “Section 6”.

83 Subsection 23(4)

Omit “receiving”, substitute “receiving”.

84 Subsection 23(4A)

Omit “person is taken to be receiving”, substitute “person is taken to be receiving”.

85 Paragraph 23(11)(b) (note)

Repeal the note.

86 At the end of subsection 23(11)

Add:

Note: For paragraph (b), for maximum payment rate see step 4 of the method statement in Module A of the relevant Pension Rate Calculator.

87 Subsection 39(5) (example)

Omit “Example”, substitute “Example”.

88 Subsection 39(5) (example)

Omit “point 1068‑E8”, substitute “Point 1068‑E8”.

89 Subsection 39(5) (note)

Omit “paragraph”, substitute “Paragraph”.

90 Subsection 47(2) (note 1)

Omit “another”, substitute “Another”.

91 Subsection 82(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

92 Subsection 91(2) (note 1)

Omit “for”, substitute “For”.

93 Subsection 91(2) (note 2)

Omit “for” (first occurring), substitute “For”.

94 Subsection 95(1) (note)

Omit “for”, substitute “For”.

95 Subsection 103(2) (note 1)

Omit “another”, substitute “Another”.

96 Subsection 103(2) (note 2)

Omit “social”, substitute “Social”.

97 Subsection 146F(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

98 Subsection 146F(2) (note)

Omit “if a”, substitute “If a”.

99 Subsection 146Q(2) (note 2)

Repeal the note, substitute:

Note: For the death of a person qualified for bereavement payments under Subdivision A, see section 146K.

100 Section 147 (note)

Omit “for”, substitute “For”.

101 Subsection 151(2) (note 1)

Omit “another”, substitute “Another”.

102 Section 186 (note)

Omit “a woman”, substitute “A woman”.

103 Subsection 188(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

104 Subsection 202(2) (note 1)

Omit “another”, substitute “Another”.

105 Subsection 237(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

106 Subsection 237(1) (note 3)

Omit “a person”, substitute “A person”.

107 Subsection 246(2) (note)

Omit “for” (first occurring), substitute “For”.

108 Subsection 321(2) (note 1)

Omit “another”, substitute “Another”.

109 Subsections 321(3) and (4) (note)

Omit “for”, substitute “For”.

110 Subsection 368(2) (note 1)

Omit “another”, substitute “Another”.

111 Subsection 368(3) (note)

Omit “for”, substitute “For”.

112 Subsection 407(2) (note)

Omit “for”, substitute “For”.

113 Subsections 408CF(2) and (4) (note 1)

Omit “Note 1”, substitute “Note”.

114 Subsection 500C(3) (note)

Omit “and for PP (partnered) payday see section 18”.

115 Subsection 500Z(2) (note 1)

Omit “Note 1”, substitute “Note”.

116 Subsection 502(9)

Repeal the subsection.

117 Subsection 513(2) (note 2)

Omit “Note 2”, substitute “Note”.

118 Subsection 541D(4)

Repeal the subsection.

119 Subsection 549A(1) (note 1)

Omit “Note 1”, substitute “Note”.

120 Subsection 549A(1) (note 2)

Repeal the note.

121 Subsection 549A(3) (note 2)

Omit “unavoidable or reasonable expenditure”, substitute “unavoidable or reasonable expenditure”.

122 Subsection 552A(1) (note 1)

Omit “Note 1”, substitute “Note”.

123 Subsection 575A(1) (note 1)

Omit “Note 1”, substitute “Note”.

124 Subsection 578A(1) (note 1)

Omit “Note 1”, substitute “Note”.

125 Subsection 593(1) (note 1)

Omit “a person”, substitute “A person”.

126 Subsection 593(1) (note 2)

Omit “the”, substitute “The”.

127 Subsection 593(1) (notes 3, 5 and 6)

Omit “for”, substitute “For”.

128 Subsection 593(1) (notes 8 and 9)

Omit “a person”, substitute “A person”.

129 Subsection 593(1) (note 13)

Omit “a newstart”, substitute “A newstart”.

130 Subsection 593(4) (note)

Omit “subsection (4)”, substitute “Subsection (4)”.

131 Subsection 596(3) (note)

Omit “for”, substitute “For”.

132 Section 596A (note)

Omit “for”, substitute “For”.

133 Subsection 598(1) (notes 1 and 2)

Omit “for”, substitute “For”.

134 Subsection 598(1) (notes 3 and 4)

Repeal the notes, substitute:

Note 3: For served the waiting period in relation to a liquid assets test waiting period, see subsection 23(10A).

135 Subsection 601(2D)

Repeal the subsection.

136 Subsection 603(2) (notes 1 and 2)

Omit “for”, substitute “For”.

137 Subsection 611(2) (notes 1 and 2)

Omit “for”, substitute “For”.

138 Subsection 611(2) (note 3)

Omit “if item 2”, substitute “If item 2”.

139 Subsection 611(2) (note 4)

Omit “if a”, substitute “If a”.

140 Subsection 611(2) (notes 5 and 6)

Omit “the”, substitute “The”.

141 Subsection 611(2) (note 7)

Omit “the” (first occurring), substitute “The”.

142 Subsection 614(2) (note 1)

Omit “another”, substitute “Another”.

143 Subsection 614(2) (note 3)

Omit “for”, substitute “For”.

144 Subsection 614(3) (note 1)

Omit “for”, substitute “For”.

145 Subsection 614(3) (note 2)

Omit “widow”, substitute “A widow”.

146 Subsection 614(3A) (note)

Omit “for”, substitute “For”.

147 Subsection 614(4) (note 1)

Repeal the note, substitute:

Note: For prescribed educational scheme see section 5.

148 Subsection 660LA(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

149 Subsection 660LA(1) (note 3)

Omit “for”, substitute “For”.

150 Subsection 660XCF(2) (note 1)

Omit “Note 1”, substitute “Note”.

151 Subsection 660XKG(2) (note 2)

Omit “Note 2”, substitute “Note”.

152 Subsection 660YCF(2) (note 1)

Omit “Note 1”, substitute “Note”.

153 Subsection 660YCG(1) (note 1)

Omit “Note 1”, substitute “Note”.

154 Subsection 666(1) (note 1)

Omit “see”, substitute “See”.

155 Subsection 666(1) (note 3)

Omit “for”, substitute “For”.

156 Subsection 667(4) (note)

Omit “for”, substitute “For”.

157 Subsection 669(4) (note)

Omit “for”, substitute “For”.

158 Subsection 669(7) (note)

Omit “if the”, substitute “If the”.

159 Subsection 676(1) (notes 1 and 2)

Omit “for”, substitute “For”.

160 Subsection 676(1) (note 4)

Repeal the note, substitute:

Note 3: For served the waiting period in relation to a liquid assets test waiting period, see subsection 23(10A).

161 Subsection 680(3) (notes 1 and 2)

Omit “for”, substitute “For”.

162 Subsection 680(3) (note 3)

Omit “if item 2”, substitute “If item 2”.

163 Subsection 680(3) (note 4)

Omit “if a”, substitute “If a”.

164 Subsection 680(3) (notes 5 and 6)

Omit “the”, substitute “The”.

165 Subsection 680(3) (note 7)

Omit “the” (first occurring), substitute “The”.

166 Subsection 686(2) (note 1)

Omit “another”, substitute “Another”.

167 Subsections 686(3) and (5) (note)

Omit “for”, substitute “For”.

168 Subsection 694(1) (note 3)

Omit “Note 3”, substitute “Note”.

169 Subsection 728PA(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

170 Subsection 728PA(1) (note 3)

Omit “for”, substitute “For”.

171 Subsection 729(1) (note)

Omit “special”, substitute “Special”.

172 Subsection 729(2) (note 1)

Repeal the note, substitute:

Note: For Australian resident see subsection 7(2).

173 Subsection 729(6) (note)

Omit “subsection (6)”, substitute “Subsection (6)”.

174 Subsection 731B(7)

Repeal the subsection.

175 Subsection 733(3) (notes 1 and 2)

Omit “for”, substitute “For”.

176 Subsection 733(3) (note 3)

Omit “if item 2”, substitute “If item 2”.

177 Subsection 733(3) (note 4)

Omit “if a”, substitute “If a”.

178 Subsection 733(3) (notes 5 and 6)

Omit “the”, substitute “The”.

179 Subsection 733(3) (note 7)

Omit “the” (first occurring), substitute “The”.

180 Subsection 735(2) (note 1)

Omit “another”, substitute “Another”.

181 Subsections 735(3) and (4) (note)

Omit “for”, substitute “For”.

182 Subsection 737(1) (note)

Omit “for”, substitute “For”.

183 Subsection 738(1) (notes 1 and 2)

Omit “for”, substitute “For”.

184 Subsection 768A(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

185 Subsection 768A(1) (note 3)

Omit “for”, substitute “For”.

186 Subsection 771HI(2) (note 1)

Omit “Note 1”, substitute “Note”.

187 Subsection 771PA(1)

Omit “(1)”.

188 Section 773

Omit “Inability to work”.

189 Section 773 (note)

Omit “a person”, substitute “A person”.

190 Section 774 (note 1)

Omit “for”, substitute “For”.

191 Section 774 (note 2)

Omit “a person”, substitute “A person”.

192 Section 778 (note 1)

Omit “for”, substitute “For”.

193 Section 778 (note 2)

Omit “a person”, substitute “A person”.

194 Subsection 787(2) (note 1)

Omit “another”, substitute “Another”.

195 Subsections 787(3) and (4) (note)

Omit “for”, substitute “For”.

196 Point 796‑C1 (note)

Omit “if a”, substitute “If a”.

197 Subsection 822(1) (notes 1 and 2)

Omit “section”, substitute “Section”.

198 Subsection 830(2) (note 2)

Repeal the note, substitute:

Note: For the death of a person qualified for bereavement payments under Subdivision A, see section 826.

199 Subsection 993(1) (notes 1 and 2)

Omit “for”, substitute “For”.

200 Subsection 993(1) (note 3)

Omit “if the”, substitute “If the”.

201 Subsection 993(2) (notes 1, 2, 3 and 5)

Omit “for”, substitute “For”.

202 Subsection 994(1) (notes 1, 2, 3 and 4)

Omit “for”, substitute “For”.

203 Subsection 997(1) (note)

Omit “for”, substitute “For”.

204 Subsection 999(2) (notes 1 and 2)

Omit “for”, substitute “For”.

205 Section 1037 (note)

Omit “for”, substitute “For”.

206 Subsection 1044(2) (note 2)

Repeal the note, substitute:

Note: The rate of mobility allowance is indexed annually in line with CPI increases (see sections 1191 to 1194).

207 Section 1061JD (note)

Omit “for”, substitute “For”.

208 Subsection 1061Q(1) (note 1)

Repeal the note, substitute:

Note: For telephone subscriber see subsection (5).

209 Paragraph 1061Q(3)(a)

Omit “widow allowance newstart allowance”, substitute “widow allowance, newstart allowance”.

210 Paragraph 1061Q(3)(b) (notes 1 and 2)

Repeal the notes.

211 Subsection 1061Q(3) (note)

Repeal the note, substitute:

Note 1: For income support payment see subsection 23(1).

Note 2: For the determination of the continuous period in respect of which a person received income support payments see section 38B.

Note 3: For telephone subscriber see subsection (5).

212 Paragraph 1061Q(3A)(e) (notes 1 and 2)

Repeal the notes.

213 Subsection 1061Q(3A) (notes 1 and 2)

Repeal the notes, substitute:

Note 1: For telephone subscriber see subsection (5).

Note 2: For income support payment see subsection 23(1).

Note 3: For the determination of the continuous period in respect of which a person received income support payments see section 38B.

214 Subsection 1061Q(5) (note at the end of the definition of telephone subscriber)

Omit “for”, substitute “For”.

215 Subsection 1061S(1) (note)

Omit “the” (first occurring), substitute “The”.

216 Subsection 1061S(3) (note)

Omit “because”, substitute “Because”.

217 Subsection 1061S(4) (note at the end of the definition of person not getting pension or benefit before 12 March 1992)

Omit “clause”, substitute “Clause”.

218 Subsection 1063(1) (note)

Omit “see”, substitute “See”.

219 Subsection 1064(1) (note 2)

Omit “the rate”, substitute “The rate”.

220 Subsection 1064(2) (note)