Statute Update (Autumn 2018) Act 2018

No. 41, 2018

An Act to make various technical and minor amendments of the statute law of the Commonwealth, to repeal certain obsolete Acts, and for related purposes

Statute Update (Autumn 2018) Act 2018

No. 41, 2018

An Act to make various technical and minor amendments of the statute law of the Commonwealth, to repeal certain obsolete Acts, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedules

Schedule 1—Amendments of principal Acts

Criminal Code Act 1995

Education Services for Overseas Students Act 2000

Equal Employment Opportunity (Commonwealth Authorities) Act 1987

Renewable Energy (Electricity) Act 2000

Trade Support Loans Act 2014

Schedule 2—Chartered Accountants Australia and New Zealand

Anti‑Money Laundering and Counter‑Terrorism Financing Act 2006

Australian Research Council Act 2001

National Land Transport Act 2014

Natural Resources Management (Financial Assistance) Act 1992

Schedule 3—Amendments consequential on the Acts and Instruments (Framework Reform) Act 2015

Food Standards Australia New Zealand Act 1991

Schedule 4—Norfolk Island

Bankruptcy (Estate Charges) Act 1997

Commonwealth Banks Restructuring Act 1990

Export Inspection Charges Collection Act 1985

Export Inspection (Establishment Registration Charges) Act 1985

Export Inspection (Quantity Charge) Act 1985

Export Inspection (Service Charge) Act 1985

Fringe Benefits Tax Act 1986

Income Tax (Deferred Interest Securities) (Tax File Number Withholding Tax) Act 1991

Marine Navigation Levy Act 1989

Marine Navigation (Regulatory Functions) Levy Act 1991

National Residue Survey (Customs) Levy Act 1998

National Residue Survey (Excise) Levy Act 1998

Primary Industries (Customs) Charges Act 1999

Primary Industries (Excise) Levies Act 1999

Primary Industries Levies and Charges Collection Act 1991

Renewable Energy (Electricity) (Large‑scale Generation Shortfall Charge) Act 2000

Renewable Energy (Electricity) (Small‑scale Technology Shortfall Charge) Act 2010

Telecommunications (Carrier Licence Charges) Act 1997

Telecommunications (Industry Levy) Act 2012

Telecommunications (Numbering Charges) Act 1997

True‑up Shortfall Levy (Excise) (Carbon Tax Repeal) Act 2014

True‑up Shortfall Levy (General) (Carbon Tax Repeal) Act 2014

Schedule 5—Repeals of spent provisions

Social Security Legislation Amendment (One‑off Payments for Carers) Act 2005

Telstra Corporation Act 1991

Schedule 6—Repeals of obsolete amending Acts

ACIS Administration Amendment Act 2000

ACIS Administration Amendment Act 2002

ACIS Administration Amendment Act 2003

ACIS Administration Amendment Act 2009

ACIS Administration Amendment (Application) Act 2009

ACIS Administration Amendment (Unearned Credit Liability) Act 2007

Australian Industry Development Corporation Amendment Act 1980

Australian Industry Development Corporation Amendment Act 1992

Australian Workforce and Productivity Agency Repeal Act 2014

Bounty Acts Amendment Act 1982

Bounty and Subsidy Legislation Amendment Act 1986

Bounty and Subsidy Legislation Amendment Act 1987

Bounty and Subsidy Legislation Amendment Act (No. 2) 1986

Bounty and Subsidy Legislation Amendment Act (No. 2) 1988

Bounty (Commercial Motor Vehicles) Amendment Act 1985

Bounty (Commercial Motor Vehicles) Amendment Act (No. 2) 1985

Bounty (Injection‑moulding Equipment) Amendment Act 1983

Bounty (Injection‑moulding Equipment) Amendment Act 1985

Bounty Legislation Amendment Act 1995

Customs Tariff (Coal Export Duty) Amendment Act 1987

Customs Tariff (Uranium Concentrate Export Duty) Amendment Act 1987

Customs Tariff (Uranium Concentrate Export Duty) Amendment Act 1989

Energy Efficiency Opportunities Amendment Act 2007

Energy Efficiency Opportunities (Repeal) Act 2014

Fertilizers (Subsidy) Amendment Act 1985

Petroleum (Submerged Lands) Amendment Act 1980

Petroleum (Submerged Lands) Amendment Act 1991

Petroleum (Submerged Lands) Amendment Act 2002

Petroleum (Submerged Lands) Amendment Act 2003

Petroleum (Submerged Lands) (Exploration Permit Fees) Amendment Act 1980

Petroleum (Submerged Lands) Legislation Amendment Act 1987

Petroleum (Submerged Lands) Legislation Amendment Act (No. 1) 2000

Petroleum (Submerged Lands) Legislation Amendment Act (No. 2) 2000

Petroleum (Submerged Lands) (Pipeline Licence Fees) Amendment Act 1980

Petroleum (Submerged Lands) (Production Licence Fees) Amendment Act 1980

Petroleum (Submerged Lands) (Registration Fees) Amendment Act 1980

Petroleum (Submerged Lands) (Registration Fees) Amendment Act 2001

Petroleum (Submerged Lands) (Royalty) Amendment Act 1980

States Grants (Petroleum Products) Amendment Act 1978

Textiles, Clothing and Footwear Development Authority Amendment Act 1991

Statute Update (Autumn 2018) Act 2018

No. 41, 2018

An Act to make various technical and minor amendments of the statute law of the Commonwealth, to repeal certain obsolete Acts, and for related purposes

[Assented to 22 May 2018]

The Parliament of Australia enacts:

This Act is the Statute Update (Autumn 2018) Act 2018.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day after this Act receives the Royal Assent. | 23 May 2018 |

2. Schedule 1, items 1 to 6 | The 28th day after this Act receives the Royal Assent. | 19 June 2018 |

3. Schedule 1, items 7 and 8 | 1 July 2017. | 1 July 2017 |

4. Schedules 2 to 6 | The 28th day after this Act receives the Royal Assent. | 19 June 2018 |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

Legislation that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Paragraph 104.29(2)(i) of the Criminal Code

Omit “Crimes Act 1914.”, substitute “Crimes Act 1914;”.

Note: This item fixes a punctuation error.

2 Subsection 149(1)

Omit “authorised employee”, substitute “authorised officer”.

Note: This item fixes a reference to an incorrect concept.

3 Subsection 3(1) (paragraph (a) of the definition of trade union)

Omit “Conciliation and Arbitration Act 1904”, substitute “Fair Work (Registered Organisations) Act 2009”.

Note: This item replaces a reference to a repealed Act with a reference to the correct current Act.

4 Subsection 24(2) (note 1)

Omit “Chapter 3 of the Criminal Code”, substitute “Part IA of the Crimes Act 1914”.

Note: This item fixes an incorrect cross‑reference.

5 Subsection 24(3) (note)

Omit “Chapter 3 of the Criminal Code”, substitute “Part IA of the Crimes Act 1914”.

Note: This item fixes an incorrect cross‑reference.

6 Subsection 154(2) (note 1)

Omit “Chapter 3 of the Criminal Code”, substitute “Part IA of the Crimes Act 1914”.

Note: This item fixes an incorrect cross‑reference.

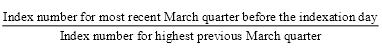

7 Subsection 99(4) (formula)

Repeal the formula, substitute:

8 Paragraph 99(5)(a)

Repeal the paragraph, substitute:

(a) the highest previous March quarter is the March quarter, before the most recent March quarter before the indexation day, with the highest index number (disregarding any March quarter that is earlier than the 2014 March quarter); and

1 Section 5 (paragraph (b) of the definition of qualified accountant)

Omit “the Institute of Chartered Accountants in Australia”, substitute “Chartered Accountants Australia and New Zealand”.

2 Subsection 58(2) (paragraph (c) of the definition of qualified auditor)

Omit “the Institute of Chartered Accountants in Australia”, substitute “Chartered Accountants Australia and New Zealand”.

3 Subsection 4(1) (subparagraph (c)(ii) of the definition of appropriate auditor)

Omit “the Institute of Chartered Accountants in Australia”, substitute “Chartered Accountants Australia and New Zealand”.

4 Subsection 9(5) (paragraph (b) of the definition of qualified accountant)

Omit “the Institute of Chartered Accountants in Australia”, substitute “Chartered Accountants Australia and New Zealand”.

1 At the end of subsection 6(1)

Add:

Note 1: Section 42 (disallowance) of the Legislation Act 2003 does not apply to the declaration: see subsection 44(1) of that Act.

Note 2: Part 4 of Chapter 3 (sunsetting) of the Legislation Act 2003 does not apply to the declaration: see subsection 54(1) of that Act.

2 Subsection 6(4)

Repeal the subsection.

3 At the end of subsection 23(1)

Add:

Note 1: Section 42 (disallowance) of the Legislation Act 2003 does not apply to the guidelines: see subsection 44(1) of that Act.

Note 2: Part 4 of Chapter 3 (sunsetting) of the Legislation Act 2003 does not apply to the guidelines: see subsection 54(1) of that Act.

4 Subsection 23(4)

Repeal the subsection.

5 Subsection 82(2)

Omit “, but neither section 42 (disallowance) nor Part 6 (sunsetting) of the Legislative Instruments Act 2003 applies to the variation”.

6 At the end of subsection 82(2)

Add:

Note 1: Section 42 (disallowance) of the Legislation Act 2003 does not apply to the variation: see subsection 44(1) of that Act.

Note 2: Part 4 of Chapter 3 (sunsetting) of the Legislation Act 2003 does not apply to the variation: see subsection 54(1) of that Act.

7 Subsection 82(7)

Omit “Legislative Instruments Act 2003”, substitute “Legislation Act 2003”.

8 Subsection 82(8)

Repeal the subsection, substitute:

When variation commences

(8) Despite subsection 12(1) of the Legislation Act 2003, a variation made under subsection (1) of this section commences on the day a copy of the variation is published as mentioned in subsection (7) of this section.

9 Section 94

Repeal the section, substitute:

A standard, or a variation of a standard, in relation to which a notice is published under section 92 is a legislative instrument.

Note 1: Section 42 (disallowance) of the Legislation Act 2003 does not apply to the standard or variation: see subsection 44(1) of that Act.

Note 2: Part 4 of Chapter 3 (sunsetting) of the Legislation Act 2003 does not apply to the standard or variation: see subsection 54(1) of that Act.

10 Subsection 97(6)

Repeal the subsection, substitute:

Standards and variations are legislative instruments

(6) The standard, or the variation of the standard, in relation to which notice is published under subsection (4), is a legislative instrument.

Note 1: Section 42 (disallowance) of the Legislation Act 2003 does not apply to the standard or variation: see subsection 44(1) of that Act.

Note 2: Part 4 of Chapter 3 (sunsetting) of the Legislation Act 2003 does not apply to the standard or variation: see subsection 54(1) of that Act.

11 At the end of subsection 106(1)

Add:

Note 1: Section 42 (disallowance) of the Legislation Act 2003 does not apply to the instrument of revocation or amendment: see subsection 44(1) of that Act.

Note 2: Part 4 of Chapter 3 (sunsetting) of the Legislation Act 2003 does not apply to the instrument of revocation or amendment: see subsection 54(1) of that Act.

12 Subsection 106(6)

Repeal the subsection.

1 Section 3

Omit “, of the Northern Territory or of Norfolk Island”, substitute “or of the Northern Territory”.

2 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

3 Section 3B

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

4 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

5 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

6 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

7 Section 4

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

8 Section 3

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

9 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

10 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

11 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

12 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

13 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

14 Section 5

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

15 Subsection 5(1)

Omit “and of Norfolk Island”.

16 Section 4

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

17 Section 4

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

18 Section 3

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

19 Section 4

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

20 Section 3

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

21 Section 4

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

22 Section 4

Omit “, of the Northern Territory and of Norfolk Island”, substitute “and of the Northern Territory”.

1 Schedule 1

Repeal the Schedule.

2 Subsections 36(2), (2A) and (6)

Repeal the subsections.

1 Repeals of Acts

Repeal the following Acts:

2 Saving provision

If, under an Act repealed by this Schedule, a decision, act or thing was taken to be, or to continue to be, valid to any extent immediately before the commencement of this item, then the decision, act or thing continues to be taken to be valid to the same extent after the commencement of this item.

[Minister’s second reading speech made in—

House of Representatives on 28 March 2018

Senate on 9 May 2018]

(75/18)