Treasury Laws Amendment (2018 Superannuation Measures No. 1) Act 2019

No. 78, 2019

An Act to amend the law relating to taxation and superannuation, and for related purposes

Treasury Laws Amendment (2018 Superannuation Measures No. 1) Act 2019

No. 78, 2019

An Act to amend the law relating to taxation and superannuation, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedules

Schedule 1—Superannuation: employees with multiple employers

Part 1—Main amendments

Superannuation Guarantee (Administration) Act 1992

Part 2—Consequential amendments

Administrative Decisions (Judicial Review) Act 1977

Schedule 2—Non‑arm’s length income of complying superannuation entities

Income Tax Assessment Act 1997

Schedule 3—Limited recourse borrowing arrangements

Part 1—Amendments

Income Tax Assessment Act 1997

Taxation Administration Act 1953

Part 2—Application provisions

Income Tax (Transitional Provisions) Act 1997

Treasury Laws Amendment (2018 Superannuation Measures No. 1) Act 2019

No. 78, 2019

An Act to amend the law relating to taxation and superannuation, and for related purposes

[Assented to 2 October 2019]

The Parliament of Australia enacts:

This Act is the Treasury Laws Amendment (2018 Superannuation Measures No. 1) Act 2019.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day this Act receives the Royal Assent. | 2 October 2019 |

2. Schedule 1 | The day after this Act receives the Royal Assent. | 3 October 2019 |

3. Schedules 2 and 3 | The first 1 January, 1 April, 1 July or 1 October to occur after the day this Act receives the Royal Assent. | 1 January 2020 |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

Legislation that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Subsection 6(1)

Insert:

employer shortfall exemption certificate means a certificate issued under section 19AB.

2 After section 19

Insert:

(1) This section applies if the Commissioner has issued an employer shortfall exemption certificate to a person in relation to:

(a) an employer of the person; and

(b) a quarter in a financial year.

(2) Treat the maximum contribution base for the quarter as nil for the purposes of working out the employer’s individual superannuation guarantee shortfall under section 19 for the person for the quarter.

Note: An employer shortfall exemption certificate issued to a person in relation to a particular employer does not affect any other employer’s individual superannuation guarantee shortfall for the person.

Application for certificate

(1) A person may apply to the Commissioner for the Commissioner to issue a certificate under this section (an employer shortfall exemption certificate) to the person in relation to:

(a) a specified employer of the person (which must be an employer of the person at the time the application is made); and

(b) a specified quarter in a specified financial year.

(2) The application:

(a) must be in the approved form; and

(b) must specify the employer, the quarter and the financial year; and

(c) must be made on or before the day that is 60 days before the first day of the quarter.

Issuing of certificate

(3) The Commissioner may issue the employer shortfall exemption certificate if the Commissioner is satisfied that:

(a) if the certificate is not issued, the person is likely to have excess concessional contributions (within the meaning of the Income Tax Assessment Act 1997) for the financial year (whether or not issuing the certificate would prevent that result); and

(b) if the certificate is issued, at least one other employer of the person is likely to have an individual superannuation guarantee shortfall for the person for the quarter that:

(i) is greater than nil; or

(ii) would be greater than nil but for a reduction under section 22 or 23; and

(c) it is appropriate in the circumstances to issue the certificate.

(4) For the purposes of paragraph (3)(a), the Commissioner is to have regard to any other employer shortfall exemption certificate that has been issued, or is proposed to be issued, in relation to the person and a quarter in the financial year.

(5) For the purposes of paragraph (3)(b), the Commissioner is to have regard to any other employer shortfall exemption certificate that has been issued, or is proposed to be issued, in relation to the person and the quarter.

(6) For the purposes of paragraph (3)(c), the Commissioner may have regard to:

(a) the effect that issuing the employer shortfall exemption certificate is likely to have on the person’s concessional contributions (within the meaning of the Income Tax Assessment Act 1997) for the financial year; and

(b) any other matter that the Commissioner considers relevant.

(7) A person who is dissatisfied with a decision of the Commissioner under subsection (3) may object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953.

(8) The Commissioner may not vary or revoke an employer shortfall exemption certificate.

(9) An employer shortfall exemption certificate is not a legislative instrument.

(1) If the Commissioner issues an employer shortfall exemption certificate to a person under section 19AB, the Commissioner must give written notice of the decision to:

(a) the person; and

(b) the employer to which the certificate relates.

(2) A notice under subsection (1) must identify the following:

(a) the person;

(b) the employer;

(c) the quarter to which the certificate relates.

(3) If the Commissioner decides not to issue an employer shortfall exemption certificate to a person under section 19AB, the Commissioner must give written notice of the decision to the person.

(4) The Commissioner is taken to have refused to issue an employer shortfall exemption certificate to a person if the Commissioner does not give notice of the Commissioner’s decision before the end of 60 days after the person made the application for the certificate.

3 Application of amendments

The amendments made by this Schedule apply in relation to quarters starting on or after 1 July 2018.

4 Before paragraph (gb) of Schedule 1

Insert:

(gae) decisions of the Commissioner of Taxation under section 19AB of the Superannuation Guarantee (Administration) Act 1992;

1 Subsection 295‑550(1)

Repeal the subsection, substitute:

(1) An amount of *ordinary income or *statutory income is non‑arm’s length income of a *complying superannuation fund, a *complying approved deposit fund or a *pooled superannuation trust if, as a result of a *scheme the parties to which were not dealing with each other at *arm’s length in relation to the scheme, one or more of the following applies:

(a) the amount of the income is more than the amount that the entity might have been expected to derive if those parties had been dealing with each other at arm’s length in relation to the scheme;

(b) in gaining or producing the income, the entity incurs a loss, outgoing or expenditure of an amount that is less than the amount of a loss, outgoing or expenditure that the entity might have been expected to incur if those parties had been dealing with each other at arm’s length in relation to the scheme;

(c) in gaining or producing the income, the entity does not incur a loss, outgoing or expenditure that the entity might have been expected to incur if those parties had been dealing with each other at arm’s length in relation to the scheme.

This subsection does not apply to an amount to which subsection (2) applies or an amount *derived by the entity in the capacity of beneficiary of a trust.

2 Subsection 295‑550(5)

Repeal the subsection, substitute:

(5) Other income *derived by the entity as a beneficiary of a trust through holding a fixed entitlement to the income of the trust is non‑arm’s length income of the entity if, as a result of a *scheme the parties to which were not dealing with each other at *arm’s length in relation to the scheme, one or more of the following applies:

(a) the amount of the income is more than the amount that the entity might have been expected to derive if those parties had been dealing with each other at arm’s length in relation to the scheme;

(b) in acquiring the entitlement or in gaining or producing the income, the entity incurs a loss, outgoing or expenditure of an amount that is less than the amount of a loss, outgoing or expenditure that the entity might have been expected to incur if those parties had been dealing with each other at arm’s length in relation to the scheme;

(c) in acquiring the entitlement or in gaining or producing the income, the entity does not incur a loss, outgoing or expenditure that the entity might have been expected to incur if those parties had been dealing with each other at arm’s length in relation to the scheme.

3 At the end of section 295‑550

Add:

(7) Paragraphs (1)(b) and (c) and (5)(b) and (c) apply to a loss, outgoing or expenditure whether or not it is of capital or of a capital nature.

4 Application of amendments

The amendments made by this Schedule apply in relation to income derived in the 2018‑19 income year and later income years.

1 At the end of subsection 307‑230(1)

Add:

; (d) if you have an LRBA amount under section 307‑231 (about limited recourse borrowing arrangements) in relation to one or more *regulated superannuation funds—the LRBA amounts for each such regulated superannuation fund.

2 At the end of Subdivision 307‑D

Add:

(1) You have an amount under this section (an LRBA amount), in relation to a *regulated superannuation fund in which you have one or more *superannuation interests, if:

(a) the *superannuation provider in relation to the fund has a *borrowing under an *arrangement that is covered by the exception in subsection 67A(1) of the Superannuation Industry (Supervision) Act 1993 (which is about limited recourse borrowing arrangements); and

(b) the borrowing has not been repaid at the time of working out your *total superannuation balance; and

(c) at that time, the asset or assets that secure the borrowing support, to an extent, a superannuation interest of yours; and

(d) the fund is covered by subsection (4) at that time; and

(e) either:

(i) you have satisfied (whether at or before that time) a condition of release specified in paragraph 307‑80(2)(c); or

(ii) the lender is an *associate of the superannuation provider.

Note: Subsection 318(3) of the Income Tax Assessment Act 1936 sets out when an entity is an associate of a trustee.

(2) The amount of your LRBA amount in relation to the *regulated superannuation fund is the sum of the amounts worked out under subsection (3) for:

(a) if subparagraph (1)(e)(i) applies—each *borrowing that satisfies paragraphs (1)(a), (b) and (c); or

(b) if subparagraph (1)(e)(i) does not apply—each borrowing that satisfies paragraphs (1)(a), (b) and (c) and subparagraph (1)(e)(ii).

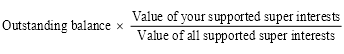

(3) The amount under this subsection, in respect of a *borrowing, is worked out using the following formula:

where:

outstanding balance means the outstanding balance on the *borrowing at the time of working out your *total superannuation balance.

value of all supported super interests means the sum of the *values at that time of all *superannuation interests in the *regulated superannuation fund that are supported by the asset or assets that secure the *borrowing.

value of your supported super interests means the sum of the *values at that time of each *superannuation interest of yours that is supported by the asset or assets that secure the *borrowing.

(4) A *regulated superannuation fund is covered by this subsection at a time if any of the following requirements are satisfied:

(a) the fund is a *self managed superannuation fund at the time;

(b) there are less than 5 *members of the fund at the time.

3 At the end of subsection 390‑5(9) in Schedule 1

Add:

; (e) if the superannuation plan is a *regulated superannuation fund in relation to which the individual has an LRBA amount under section 307‑231 of the Income Tax Assessment Act 1997 (about limited recourse borrowing arrangements)—the amount of the LRBA amount.

4 After section 307‑230

Insert:

(1) Section 307‑231 of the Income Tax Assessment Act 1997 applies in relation to borrowings that arise under contracts entered into on or after 1 July 2018.

(2) For the purposes of subsection (1), a borrowing (the new borrowing) that arises under a contract entered into on or after 1 July 2018 is treated as if it arose under a contract entered into before 1 July 2018 if:

(a) the new borrowing is a refinancing of a borrowing (the old borrowing) that was made under a contract:

(i) entered into before 1 July 2018; and

(ii) covered by the exception in subsection 67A(1) of the Superannuation Industry (Supervision) Act 1993 (which is about limited recourse borrowing arrangements); and

(b) the new borrowing is secured by the same asset or assets as the old borrowing; and

(c) the amount of the new borrowing at the time it is first made equals, or is less than, the outstanding balance on the old borrowing just before the refinancing.

[Minister’s second reading speech made in—

House of Representatives on 24 July 2019

Senate on 12 September 2019]

(131/19)