Private Health Insurance Amendment (Income Thresholds) Act 2021

No. 52, 2021

An Act to amend the Private Health Insurance Act 2007, and for related purposes

Private Health Insurance Amendment (Income Thresholds) Act 2021

No. 52, 2021

An Act to amend the Private Health Insurance Act 2007, and for related purposes

Contents

1 Short title

2 Commencement

3 Schedules

Schedule 1—Amendments

Private Health Insurance Act 2007

Private Health Insurance Amendment (Income Thresholds) Act 2021

No. 52, 2021

An Act to amend the Private Health Insurance Act 2007, and for related purposes

[Assented to 24 June 2021]

The Parliament of Australia enacts:

This Act is the Private Health Insurance Amendment (Income Thresholds) Act 2021.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this Act | 1 July 2021. | 1 July 2021 |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

Legislation that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Private Health Insurance Act 2007

1 Section 22‑35

Repeal the section, substitute:

22‑35 Private health insurance singles thresholds

(1) A person’s singles tier 1 threshold for the 2021‑22 and 2022‑23 financial year is $90,000. This amount is indexed for later financial years under section 22‑45.

(2) A person’s singles tier 2 threshold for the 2021‑22 and 2022‑23 financial year is $105,000. This amount is indexed for later financial years under section 22‑45.

(3) A person’s singles tier 3 threshold for the 2021‑22 and 2022‑23 financial year is $140,000. This amount is indexed for later financial years under section 22‑45.

Note: A person may be a tier 1 earner, tier 2 earner or tier 3 earner if the person’s income for surcharge purposes exceeds the applicable threshold for that tier: see section 22‑30.

2 Subsection 22‑40(4) (example)

Repeal the example, substitute:

Example: If the person has 3 such dependants who are children, the person’s family tier 2 threshold for the 2021‑22 and 2022‑23 financial year is:

![]()

3 Subsection 22‑45(1)

Repeal the subsection, substitute:

(1) An amount mentioned in section 22‑35 is indexed for the 2023‑24 financial year, and later financial years, in accordance with this section.

4 Paragraph 22‑45(2)(a)

Repeal the paragraph, substitute:

(a) firstly, multiplying the amount by the *indexation factor for the financial year under subsection (4); and

5 Subsection 22‑45(2) (examples 1 and 2)

Repeal the examples, substitute:

Example 1: If the amount to be indexed is $105,000 and the indexation factor increases this to an indexed amount of $107,500, the indexed amount is rounded back down to $107,000.

Example 2: If the amount to be indexed is $140,000 and the indexation factor increases this to an indexed amount of $142,500, the indexed amount is rounded down to $142,000.

6 Subsections 22‑45(3) to (3B)

Repeal the subsections, substitute:

(3) However, do not index the amount for a financial year if the amount worked out under subsection (2) for the financial year is less than the amount applicable under section 22‑35 or this section for the previous financial year.

(3A) If the amount is not indexed for a financial year because of subsection (3), the amount for the financial year is the same as the amount for the previous financial year.

Repeal the subsection, substitute:

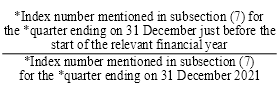

(4) For the purposes of this section, the indexation factor for a financial year is:

8 Subsection 22‑45(5)

Repeal the subsection.

9 Subsection 22‑45(6)

Omit “mentioned in subsection (4) or (5)”.

10 Application

The amendments of the Private Health Insurance Act 2007 made by this Schedule apply in relation to the 2021‑22 financial year and later financial years.

[Minister’s second reading speech made in—

House of Representatives on 12 May 2021

Senate on 15 June 2021]

(48/21)