Part 1 Preliminary

1 Name of regulation

This regulation is the High Court of Australia (Fees) Regulation 2012.

2 Commencement

This regulation commences on 1 January 2013.

3 Definitions

(1) In this regulation:

Act means the Judiciary Act 1903.

corporation: see section 4.

filing fee means a fee mentioned in any of items 101 to 107 of Schedule 1.

half day means a period of up to 3 hours in a scheduled hearing day.

hearing fee means a fee mentioned in any of items 108 to 111 of Schedule 1.

liable person, in relation to a fee, means the person who is required to pay the fee under Division 2.2.

proceeding includes an application to commence a proceeding.

publicly listed company means a company that is listed on a stock exchange or financial market in any country.

Registrar means the following:

(a) the Chief Executive and Principal Registrar of the Court appointed under section 18 of the High Court of Australia Act 1979;

(b) the Senior Registrar of the Court, or the Deputy Registrar of the Court, appointed under subsection 26 (1) of that Act;

(c) a person appointed to act in a position mentioned in paragraph (a) or (b).

Rules means the Rules of Court made under section 86 of the Act.

(2) A term or expression used in this regulation and in the Rules has the same meaning in this regulation as it has in the Rules.

4 Meaning of corporation

(1) In this regulation, corporation includes the following:

(a) a company;

(b) a body corporate;

(c) an unincorporated body that, under the law of the place where the body is formed, may:

(i) sue or be sued; or

(ii) hold property in the name of the secretary of the body or an office holder of the body appointed for that purpose;

(d) a public authority;

(e) a corporation registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006;

(f) a trade union.

(2) However, corporation does not include the following:

(a) a corporation sole that is not a public authority;

(b) a small business;

(c) an unincorporated not-for-profit association.

(3) A corporation is not required to be subject to the Corporations Act 2001 to be a corporation for this regulation.

(4) In this section:

not-for-profit association means a society, club, institution or body that is not formed for the purpose of trading or securing pecuniary profit from its transactions for its members.

public authority means the following:

(a) a body or authority of the Commonwealth or of a State or Territory, including the following:

(i) a Department of the Commonwealth or of a State or Territory;

(ii) a Department of the Parliament established under the Parliamentary Service Act 1999, a Department of the Parliament of a State or a Department of the legislature of a Territory;

(iii) a prescribed Agency under the Financial Management and Accountability Act 1997;

(b) a person representing a body or authority of the Commonwealth or of a State or Territory;

(c) a Minister for the Commonwealth or for a State or Territory;

(d) a statutory office holder.

small business means a business with:

(a) no more than 19 employees; and

(b) a total turnover of less than $2 million each year.

5 Application

This regulation applies to fees for:

(a) the filing of a document lodged on or after 1 January 2013; and

(b) the following if it is requested on or after 1 January 2013:

(i) the obtaining of a document;

(ii) a hearing in relation to a proceeding;

(iii) the provision of a service.

Part 2 Fees

Division 2.1 Fees—general

6 Purpose of Part

For section 88 of the Act, this Part sets out matters relating to fees.

7 Fees

(1) Schedule 1 sets out the fees payable for the following:

(a) the filing of a document;

(b) a hearing before the Full Court or a single Justice;

(c) obtaining a document;

(d) the provision of a service.

Note 1 Fees are subject to increase under section 16.

Note 2 Fees are not payable in some circumstances: see section 10.

(2) If the person liable to pay a fee mentioned in an item in Schedule 1 (or, if more than one person is liable, any of those persons) is a corporation, the fee payable is:

(a) if the corporation is a publicly listed company—the fee mentioned in the item for a publicly listed company; or

(b) if the corporation is not a publicly listed company—the fee mentioned in the item for a corporation; or

(c) if no fee is mentioned in the item specifically for a corporation or a publicly listed company—the fee mentioned in the item.

(3) However, if:

(a) under Division 2.2, a particular fee mentioned in an item in Schedule 1 is payable by more than one person; and

(b) the item mentions different fees for a publicly listed company, another corporation and another person (the different persons); and

(c) at least 2 of the persons mentioned in paragraph (a) are different persons;

the only fee that is payable in relation to that particular fee is the highest fee that applies to any of those persons.

Division 2.2 Liability to pay fee

8 Fees other than hearing fees

(1) A fee is payable as set out in this section, unless the Court, a Justice of the Court or a Registrar directs otherwise.

(2) A filing fee is payable:

(a) by the person for whom the document is filed; and

(b) before the document is filed.

(3) A fee mentioned in Part 2 of Schedule 1 is payable:

(a) for a fee for obtaining a document:

(i) by the person for whom the document is obtained; and

(ii) before the document is obtained; and

(b) in any other case:

(i) by the person for whom the service is provided; and

(ii) before the service is provided.

9 Hearing fees

(1) A hearing fee in relation to a proceeding is payable by the person who commences the proceeding.

(2) However, the Court, a Justice of the Court or a Registrar may order that another party to the proceeding is liable to pay the hearing fee or part of the hearing fee instead of the person mentioned in subsection (1).

When fee must be paid

(3) The hearing fee mentioned in item 108 or 109 of Schedule 1 must be paid when the document to which the hearing relates is filed.

(4) The hearing fee mentioned in item 110 of Schedule 1 for a hearing in relation to a proceeding must be paid as follows:

(a) if the hearing day is the 2nd or a subsequent business day after the day when the document to which the hearing relates is filed—no later than 2 business days before the hearing day;

(b) if the hearing day (the later hearing day) is the first business day after an earlier scheduled hearing day for the proceeding—no later than 9.30 am on the later hearing day.

(5) The hearing fee mentioned in item 111 of Schedule 1 for a hearing in relation to a proceeding must be paid as follows:

(a) if the hearing day is the day, or the first business day after the day, when the document to which the hearing relates is filed—at the time the document is filed;

(b) if the hearing day is the 2nd or a subsequent business day after the day when the document to which the hearing relates is filed—no later than 2 business days before the hearing day;

(c) if the hearing day (the later hearing day) is the first business day after an earlier scheduled hearing day for the proceeding—no later than 9.30 am on the later hearing day.

Division 2.3 When fee is not payable

10 When fee is not payable

(1) A fee mentioned in Schedule 1 is not payable by the liable person if another person has paid the fee.

(2) A fee mentioned in Schedule 1 is not payable in a proceeding for which an international convention to which Australia is party provides that no fee is to be payable.

(3) The fee mentioned in any of items 108 to 110 of Schedule 1 is not payable in relation to an interlocutory proceeding.

(4) A hearing fee is not payable in relation to a hearing if the sole purpose of the hearing is the delivery of a reserved judgement.

Division 2.4 Exemptions from liability to pay fee

11 Persons exempt from paying fees

(1) A person is exempt from paying a filing fee or a hearing fee if, at the time the fee is payable, one or more of the following apply:

(a) the person has been granted legal aid under a legal aid scheme or service:

(i) established under a law of the Commonwealth or of a State or Territory; or

(ii) approved by the Attorney-General;

for the proceeding for which the fee would otherwise be payable;

(b) the person is the holder of any of the following cards issued by the Commonwealth:

(i) a health care card;

(ii) a pensioner concession card;

(iii) a Commonwealth seniors health card;

(iv) any other card that certifies the holder’s entitlement to Commonwealth health concessions;

(c) the person is serving a sentence of imprisonment or is otherwise detained in a public institution;

(d) the person is younger than 18;

(e) the person is receiving youth allowance or Austudy payments under the Social Security Act 1991 or benefits under the ABSTUDY Scheme;

(f) the person has been granted assistance under Part 11 of the Native Title Act 1993 by:

(i) a representative body within the meaning given by section 253 of that Act; or

(ii) a person or body to whom funding has been granted under section 203FE of that Act;

for the proceeding for which the fee would otherwise be payable.

(2) For paragraph (1) (b), the holder of a card does not include a dependant of the person who is issued the card.

12 Financial hardship fee

(1) If:

(a) a fee mentioned in an item in Schedule 1 is payable by an individual; and

(b) the item mentions a financial hardship fee; and

(c) in the opinion of a Registrar at the time the fee is payable, the payment of the fee would cause financial hardship to the individual;

the Registrar may determine that the person may pay the financial hardship fee mentioned in the item instead of the fee that would otherwise be payable.

(2) In considering whether payment of a fee would cause financial hardship to an individual, the Registrar must consider the individual’s income, day-to-day living expenses, liabilities and assets.

Note A decision of the Registrar under this section is reviewable by the AAT: see section 17.

Division 2.5 Payment of fees

13 Deferral of payment of fee

(1) Paragraph 8 (2) (b) and subsections 9 (3) to (5) do not apply to a fee if a Registrar defers the payment of the fee.

(2) The Registrar may defer the payment of a fee under subsection (1) if:

(a) the fee is a filing fee or a hearing fee; and

(b) in the Registrar’s opinion, the need to file the document or hear the proceeding is so urgent that it overrides the requirement to pay the fee when the fee would otherwise be payable.

(3) If the payment of a fee is deferred, the fee must be paid:

(a) within 28 days after the day the payment is deferred; or

(b) within another period approved, in writing, by the Registrar for the payment of that fee.

(4) A fee can be deferred under this section only once.

14 What happens if fee is not paid

(1) This section applies if the payment of a fee is not deferred under section 13.

(2) If a person is required to pay a filing fee or a fee mentioned in Part 2 of Schedule 1 in relation to a proceeding before the filing or obtaining of a document or the provision of a service, the document must not be filed, and the document or service must not be provided, until the whole fee is paid.

(3) If a hearing fee for a hearing day is not paid in relation to a proceeding:

(a) the Court or a Justice of the Court may, on application by a party to the proceeding, order that no proceeding, or no proceeding other than a specified proceeding, is to take place except by leave; and

(b) a person other than the person liable to pay the fee may pay the fee without affecting any power of the Court or a Justice of the Court to make an order for costs for the fee; and

(c) the Court or a Justice of the Court may vacate the hearing day.

Division 2.6 Miscellaneous

15 Refund of fees

General

(1) A person is entitled to a refund of an amount in relation to the payment of a fee if the person pays more than the person is required to pay for the fee under this regulation.

(2) The amount to be refunded is the difference between the amount paid by the person and the amount that the person is required to pay for the fee.

Hearing fees

(3) A person is entitled to the refund of the amount paid by the person as a hearing fee if:

(a) the person notifies a Registrar, in accordance with subsection (4), that the hearing will not occur and:

(i) the hearing does not occur; or

(ii) a hearing is conducted only for the purpose of making formal orders; or

(b) a hearing day has not been fixed and the proceeding to which the hearing relates is discontinued or otherwise determined.

(4) The person must notify the Registrar in writing:

(a) if the hearing day was fixed less than 10 business days before the hearing day—at least 2 business days before the hearing day; and

(b) in any other case—at least 10 business days before the hearing day.

16 Biennial increase in fees

(1) The amount of each fee mentioned in Schedule 1 is increased on 1 July 2014, and on each second 1 July following that day.

Fees other than financial hardship fees

(2) Subsections (3) and (4) apply to a fee mentioned in Schedule 1 other than a fee described as a financial hardship fee.

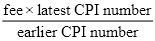

(3) If, in a relevant period, the latest CPI number is greater than the earlier CPI number, the fee is increased, on 1 July immediately following the end of the period, in accordance with the formula:

where:

earlier CPI number is the CPI number for the last March quarter before the start of the relevant period.

fee is the fee in force at the end of the relevant period.

latest CPI number is the CPI number for the last March quarter before the end of the relevant period.

(4) The amount of the fee worked out under subsection (3) is to be rounded to an amount of dollars and cents and then further rounded as follows:

(a) if the amount is $50 or more—the amount is to be rounded to the nearest amount that is a multiple of $5;

(b) if the amount is less than $50—the amount is to be rounded to the nearest whole dollar;

(c) if the amount to be rounded is 50 cents, the amount is to be rounded down.

Financial hardship fee

(5) If:

(a) a fee (the first fee) is increased and rounded under subsections (3) and (4); and

(b) the item in Schedule 1 that mentions the fee also mentions a financial hardship fee;

the financial hardship fee is increased, at the same time as the first fee, in accordance with subsection (6).

(6) The increased financial hardship fee is one-third of the amount of the first fee (as increased and rounded under subsections (3) and (4)), rounded down to the nearest multiple of $5.

Other rules

(7) If the Australian Statistician publishes for a particular March quarter a CPI number in substitution for a CPI number previously published by the Australian Statistician for that quarter, the publication of the later CPI number is disregarded for this section.

(8) However, if the Australian Statistician changes the reference base for the Consumer Price Index, then for the application of this section after the change is made, regard must be had only to CPI numbers published in terms of the new reference base.

(9) In this section:

CPI number means the All Groups Consumer Price Index number (being the weighted average of the 8 Australian capital cities) published by the Australian Statistician.

March quarter means a period of 3 months ending at the end of March.

relevant period means a 2 year period beginning on 1 July 2012 or each second 1 July following that day.

17 Notice of decision and AAT review

(1) A Registrar must give a person liable to pay a fee a notice in accordance with this section if the Registrar makes a decision about the fee under section 12.

(2) The Registrar must give the notice to the liable person within 28 days after making the decision.

(3) The notice must set out:

(a) the decision; and

(b) if the decision is to not determine that a person may pay a financial hardship fee:

(i) a statement that the liable person may apply to the Administrative Appeals Tribunal for review of the decision; and

(ii) reasons for the decision.

(4) The liable person may apply to the Administrative Appeals Tribunal for review of the decision.

(5) Failure to comply with paragraph (3) (b) does not affect the validity of the decision.

18 Debt due to Commonwealth

Any fee that is not paid in accordance with this regulation is recoverable by the Commonwealth as a debt due to the Commonwealth.

Part 3 Repeal and transitional

19 Repeal

(1) The following regulations are repealed:

(a) the High Court of Australia (Fees) Regulations 2004 (Statutory Rules 2004 No. 372);

(b) the High Court of Australia (Fees) Amendment Regulations 2005 (No. 1) (Select Legislative Instrument (SLI) 2005 No. 110);

(c) the High Court of Australia (Fees) Amendment Regulations 2010 (No. 1) (SLI 2010 No. 168);

(d) the High Court of Australia (Fees) Amendment Regulations 2010 (No. 2) (SLI 2010 No. 245).

(2) Despite the repeal of the High Court of Australia (Fees) Regulations 2004 by subsection (1), those Regulations, as in force immediately before 1 January 2013, continue to apply to a fee for a service, a hearing, or the obtaining of a document, requested under those Regulations before 1 January 2013.