Family Law (Superannuation) Amendment (ABS) Regulation 2013

Select Legislative Instrument No. 137, 2013

I, Quentin Bryce AC CVO, Governor‑General of the Commonwealth of Australia, acting with the advice of the Federal Executive Council, make the following regulation under the Family Law Act 1975.

Dated 28 June 2013

Quentin Bryce

Governor‑General

By Her Excellency’s Command

Shayne Neumann

Parliamentary Secretary to the Attorney‑General

1 Name of regulation

This regulation is the Family Law (Superannuation) Amendment (ABS) Regulation 2013.

2 Commencement

This regulation commences on 1 July 2013.

3 Authority

This regulation is made under the Family Law Act 1975.

4 Schedule(s)

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Family Law (Superannuation) Regulations 2001

1 Regulation 45D

Omit “February” (wherever occurring), substitute “November”.

2 After Part 7

Insert:

Part 8—Transitional arrangements

73 Purpose of Part 8

This Part makes transitional arrangements in relation to amendments of these Regulations.

74 Amendments made by Family Law (Superannuation) Amendment (ABS) Regulation 2013

(1) This regulation applies to an adjustment period that begins or ends in the financial year beginning on 1 July 2013.

(2) The interest rate for the adjustment period must be:

(a) for subregulation 45D(3)—a rate determined by the Australian Government Actuary that is 2.5 percentage points above the amended percentage change; and

(b) for subregulation 45D(4)—a rate calculated in accordance with a method determined by the Australian Government Actuary that provides for calculation of a rate by reference to a rate that is 2.5 percentage points above the amended percentage change; and

(c) for subregulation 45D(6), when the adjustment period commences before 30 June 2013 and ends during the financial year beginning on 1 July 2013—a rate calculated in accordance with a method determined by the Australian Government Actuary that provides for calculation of a rate by reference to the followings rates:

(i) a rate that is 2.5 percentage points above the percentage change in the original estimate of full‑time adult ordinary time earnings for all persons in Australia, as published by the Australian Bureau of Statistics, during the year ending with the February 2012 quarter;

(ii) a rate that is 2.5 percentage points above the amended percentage change; and

(d) for subregulation 45D(6), when the adjustment period commences before 30 June 2014 and ends during the financial year beginning on 1 July 2014—a rate calculated in accordance with a method determined by the Australian Government Actuary that provides for calculation of a rate by reference to the following rates:

(i) a rate that is 2.5 percentage points above the amended percentage change;

(ii) a rate that is 2.5 percentage points above the percentage change in the original estimate of full‑time adult ordinary time earnings for all persons in Australia, as published by the Australian Bureau of Statistics, during the year ending with the November 2013 quarter.

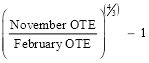

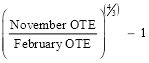

(3) In this regulation, the amended percentage change is worked out using the formula:

where:

February OTE means the original estimate of full‑time adult ordinary time earnings for all persons in Australia published by the Australian Bureau of Statistics for the February 2012 quarter.

November OTE means the original estimate of full‑time adult ordinary time earnings for all persons in Australia published by the Australian Bureau of Statistics for the November 2012 quarter.