1 Name of regulation

This regulation is the Environment Protection and Biodiversity Conservation Amendment (Cost Recovery) Regulation 2014.

2 Commencement

This regulation commences on 1 October 2014.

3 Authority

This regulation is made under the Environment Protection and Biodiversity Conservation Act 1999.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Environment Protection and Biodiversity Conservation Regulations 2000

1 Regulation 4.02

Before “A referral”, insert “(1)”.

2 At the end of regulation 4.02

Add:

(2) A referral must be accompanied by a fee of $7 352.00, unless:

(a) it is a referral that is:

(i) made under section 69 or 71 of the Act; or

(ii) made in response to a request under section 70 of the Act; or

(b) it is accompanied by an application for a waiver (see regulation 5.21A) or a notification of qualification for an exemption (see regulation 5.23).

Note: For paragraph (a)—other fees under Division 5.6 may apply in relation to a referral of a kind mentioned in subparagraph (a)(i) or (ii).

(3) If a referral is accompanied by an application for a waiver and the application is unsuccessful, a fee of $7 352.00 is payable.

3 Paragraphs 5.10(d) and (e)

Repeal the paragraphs, substitute:

(d) the name and contact details of the person who originally proposed to take the action (the first person);

(e) a declaration of whether:

(i) the first person was exempt from paying the fee mentioned in subregulation 4.02(2), or a fee that would have otherwise been payable under Division 5.6, in relation to the assessment of the impacts of the action, and if so, which fee or fees; or

(ii) all or part of the fee mentioned in subregulation 4.02(2), or a fee that would have otherwise been payable under Division 5.6 by the first person, in relation to the assessment of the impacts of the action, was waived, and if so, which fee or fees and the amount of each fee that was waived;

(f) the name and contact details of the person now proposing to take the action (the second person);

(g) if the second person has an ABN—the second person’s ABN;

(h) if the second person has an ACN—the second person’s ACN;

(i) a declaration of whether:

(i) the second person would be exempt from paying the fee mentioned in subregulation 4.02(2), or a fee that would otherwise be payable under Division 5.6, in relation to the assessment of the impacts of the action, and if so, which fee or fees; or

(ii) the second person intends to apply for a waiver of all or part of the fee mentioned in subregulation 4.02(2), or a fee that would otherwise be payable under Division 5.6, in relation to the assessment of the impacts of the action, and if so, which fee or fees.

4 At the end of Part 5

Add:

Division 5.6—Fees

Subdivision A—Definitions and key concepts

5.12A Definitions

In this Division:

aggregated turnover has the same meaning as in the Income Tax Assessment Act 1997.

application component: see subregulation 5.12B(2).

base fee means the fee payable for assessing the impacts of an action and set out in the Subdivision that deals with the approach to be used for assessing the impacts of the action.

category, in relation to a listed migratory species, means:

(a) a fish, other than a marine mammal or marine reptile; or

(b) an insect; or

(c) a marine mammal; or

(d) a reptile, including a marine reptile; or

(e) a seabird; or

(f) a shorebird; or

(g) any other kind of bird that is a listed migratory species.

complexity fee means the sum of the following amounts:

(a) if applicable—the fee payable for each application component;

(b) if applicable—the fee payable for each applicable controlling provision component;

(c) if applicable—the fee payable for the exceptional case component;

(d) if applicable—the fee payable for the legislative impact component;

(e) if applicable—the fee payable for the number of project components.

controlling provision component: see subregulation 5.12B(3).

exceptional case component: see subregulation 5.12B(4).

extinct in the wild has the same meaning as in section 528 of the Act.

high complexity:

(a) in relation to an application component: see subregulation 5.12C(1); and

(b) in relation to a controlling provision component: see subregulation 5.12D(2); and

(c) in relation to a legislative impact component: see subregulation 5.12F(4).

income year has the same meaning as in the Income Tax Assessment Act 1997.

legislative impact component: see subregulation 5.12B(5).

low complexity:

(a) in relation to an application component: see subregulation 5.12C(1); and

(b) in relation to a legislative impact component: see subregulation 5.12F(2).

matter protected by a provision of Part 3 has the same meaning as in section 528 of the Act.

moderate complexity:

(a) in relation to an application component: see subregulation 5.12C(1); and

(b) in relation to a controlling provision component: see subregulation 5.12D(2); and

(c) in relation to a legislative impact component: see subregulation 5.12F(3).

point value means:

(a) 2 points for each listed threatened species or listed threatened ecological community included in the critically endangered category; and

(b) 1 point for each listed threatened species included in:

(i) the extinct in the wild category; or

(ii) the endangered category; or

(iii) the vulnerable category; and

(c) 1 point for each listed threatened ecological community included in the endangered category.

project component: see subregulation 5.12B(6).

referral fee means the fee mentioned in subregulation 4.02(2).

seabird means:

(a) a bird that is a listed migratory species; and

(b) a member of the following taxonomic families:

(i) all species in the Family Diomedeidae;

(ii) all species in the Family Fregatidae;

(iii) all species in the Family Hydrobatidae;

(iv) all species in the Family Laridae;

(v) all species in the Family Oceaniidae;

(vi) all species in the Family Phaethontidae;

(vii) all species in the Family Stercorariidae;

(viii) all species in the Family Sulidae.

shorebird means:

(a) a bird that is a listed migratory species; and

(b) a member of the following taxonomic families:

(i) all species in the Family Charadriidae;

(ii) all species in the Family Glareolidae;

(iii) all species in the Family Scolopacidae.

small business entity has the meaning given by section 328‑110 (other than subsection 328‑110(4)) of the Income Tax Assessment Act 1997.

very high complexity:

(a) in relation to a controlling provision component: see subregulation 5.12D(3); and

(b) in relation to a legislative impact component: see subregulation 5.12F(5).

5.12B Components of a complexity fee

(1) The following components may apply in relation to the assessment of the impacts of an action:

(a) an application component;

(b) a controlling provision component;

(c) an exceptional case component;

(d) a legislative impact component;

(e) a project component.

(2) An application component applies in relation to the assessment of the impacts of an action if the assessment involves the consideration of information that is:

(a) required to be included in the referral of the proposal to take the action under section 72 of the Act (see regulation 4.03); and

(b) covered by one of the following subparagraphs:

(i) paragraph 4.01(a) or (j) of Schedule 2;

(ii) item 5.02, 5.04 or 5.05 of Schedule 2;

(iii) item 6 of Schedule 2.

(3) A controlling provision component applies in relation to the assessment of the impacts of an action if a matter protected by a provision of Part 3 prohibits the taking of the action without approval under Part 9 of the Act.

(4) An exceptional case component applies in relation to the assessment of the impacts of an action if the action is of a kind determined by the Minister under subregulation 5.12E(1).

(5) A legislative impact component applies in relation to the assessment of the impacts of an action if the assessment involves one or more legislative processes described in regulation 5.12F.

(6) A project component applies in relation to the assessment of the impacts of an action if the action involves 2 or more activities, as determined by the Minister under subregulation 5.12G(1).

5.12C Determination for each application component

(1) The Minister may determine that an application component is of low complexity, moderate complexity or high complexity.

(2) When making a determination that an application component is of low complexity, moderate complexity or high complexity, the Minister must consider the adequacy of the information provided.

(3) A determination made under this regulation is not a legislative instrument.

5.12D Determination for each controlling provision component

(1) The Minister may determine that a controlling provision component that applies in relation to the assessment of the impacts of an action is of moderate complexity, high complexity or very high complexity.

Determination—moderate complexity or high complexity

(2) When making a determination that a controlling provision component is of moderate complexity or high complexity, the Minister must consider the following:

(a) the matters referred to in paragraphs 87(3)(a) to (e) of the Act;

(b) if section 12 or 15A of the Act is relevant to the action—the characteristics of the relevant declared Word Heritage property;

(c) if section 15B or 15C of the Act is relevant to the action—the characteristics of the relevant National Heritage place;

(d) if section 16, 17B, 23, 24A, 24B, 24C, 26, 27A, 27B, 27C or 28 of the Act is relevant to the action—both:

(i) the scale, scope, duration and severity of the impacts of the action; and

(ii) the timeframe for taking the action;

(e) if section 18 or 18A of the Act is relevant to the action—the point value, which is:

(i) for a case of moderate complexity—5 or less; and

(ii) for a case of high complexity—6 or more but less than 15;

(f) if section 20 or 20A of the Act is relevant to the action—whether the action would affect:

(i) for a case of moderate complexity—one category of listed migratory species; and

(ii) for a case of high complexity—2 categories of listed migratory species;

(g) if section 21 or 22A of the Act is relevant to the action—both:

(i) whether the technology to be used in taking the action is proven; and

(ii) the scale, scope and severity of the impacts of the action;

(h) if section 24D or 24E of the Act is relevant to the action—the scale, scope and severity of the impacts of the action.

Note 1: For paragraphs (b) and (c), see also subregulation (5).

Note 2: For paragraphs (e) and (f), see also subregulation (6).

Determination—very high complexity

(3) When making a determination that a controlling provision component is of very high complexity, the Minister must consider the following:

(a) the matters referred to in paragraphs 87(3)(a) to (e) of the Act;

(b) if section 12 or 15A of the Act is relevant to the action—these factors:

(i) the characteristics of the relevant declared Word Heritage property; and

(ii) the duration of the impacts of the action; and

(iii) the timeframe for taking the action;

(c) if section 15B or 15C of the Act is relevant to the action—these factors:

(i) the characteristics of the relevant National Heritage place; and

(ii) the duration of the impacts of the action; and

(iii) the timeframe for taking the action;

(d) if section 16, 17B, 23, 24A, 24D, 24E, 26, 27A, 27B, 27C or 28 of the Act is relevant to the action—both:

(i) the scale, scope, duration and severity of the impacts of the action; and

(ii) the timeframe for taking the action;

(e) if section 18 or 18A of the Act is relevant to the action—the point value, which is 15 or more;

(f) if section 20 or 20A of the Act is relevant to the action—whether the action would affect 3 or more categories of listed migratory species;

(g) if section 21 or 22A of the Act is relevant to the action—both:

(i) whether the technology to be used in taking the action is proven; and

(ii) the scale, scope and severity of the impacts of the action.

Note 1: For paragraphs (b) and (c), see also subregulation (5).

Note 2: For paragraphs (e) and (f), see also subregulation (6).

(4) Subregulations (2) and (3) do not limit the matters that the Minister may consider.

World Heritage property that is also a National Heritage place

(5) If a declared World Heritage property is also a National Heritage place, the Minister may make a determination under this regulation only in relation to the declared World Heritage property.

Listed threatened species that are also listed migratory species

(6) If a listed threatened species is also a listed migratory species, the Minister may make a determination under this regulation only in relation to the listed threatened species.

(7) A determination made under this regulation is not a legislative instrument.

5.12E Determination of an exceptional case component

(1) The Minister may determine that an exceptional case component applies in relation to the assessment of the impacts of an action if:

(a) both:

(i) the action is of a kind that has not been taken before; and

(ii) the Minister considers that the impacts are uncertain; or

(b) the Minister considers that the impacts of the action on the environment are very high because there are threats of serious or irreversible environmental damage.

(2) A determination made under this regulation is not a legislative instrument.

5.12F Determination for each legislative impact component

(1) The Minister may determine that a legislative impact component is of low complexity, moderate complexity, high complexity or very high complexity.

Determination—low complexity

(2) When making a determination that a legislative impact component is of low complexity, the Minister must be satisfied that the assessment of the impacts of an action involves one of the following legislative processes:

(a) a specified manner of assessment in accordance with a bilateral agreement including a declaration described in section 47 of the Act;

(b) an assessment process that is accredited under subsection 87(4) of the Act;

(c) the implementation of a project mentioned in paragraph 160(2)(a) of the Act;

(d) the adoption or implementation of a plan mentioned in paragraph 160(2)(b) or (c) of the Act;

(e) an action prescribed by the regulations for the purposes of paragraph 160(2)(d) of the Act.

Determination—moderate complexity

(3) When making a determination that a legislative impact component is of moderate complexity, the Minister must be satisfied that:

(a) both:

(i) the assessment of the impacts of an action involves 2 legislative processes; and

(ii) each legislative process is of a kind mentioned in subregulation (2); or

(b) at the time the impacts of an action are being assessed under the Act:

(i) another process relating to the action is being carried out under a law of the Commonwealth or of a State or Territory; and

(ii) the steps to be carried out under the assessment process under the Act and the other legislative process are to be coordinated to the greatest extent possible; and

(iii) the other legislative process is not a legislative process of a kind mentioned in subregulation (2).

Determination—high complexity

(4) When making a determination that a legislative impact component is of high complexity, the Minister must be satisfied that:

(a) the assessment of the impacts of an action involves 2 legislative processes; and

(b) one of those legislative processes is of a kind mentioned in subregulation (2); and

(c) the other of those legislative processes is of a kind mentioned in subparagraph (3)(b)(i) and is one in respect of which paragraph (3)(b) is otherwise satisfied.

Determination—very high complexity

(5) When making a determination that a legislative impact component is of very high complexity, the Minister must be satisfied that:

(a) the assessment of the impacts of an action involves 2 or more legislative processes; and

(b) the legislative processes are any combination of:

(i) a legislative process of a kind mentioned in subregulation (2); and

(ii) a legislative process of a kind mentioned in subparagraph (3)(b)(i) and one in respect of which subparagraph (3)(b)(ii) is otherwise satisfied; and

(c) neither subregulation (3) nor subregulation (4) applies.

(6) When making a determination under this regulation, the Minister must consider the matters referred to in paragraphs 87(3)(a) to (e) of the Act.

(7) A determination made under this regulation is not a legislative instrument.

5.12G Determination of the number of project components

(1) If 2 or more activities are proposed to be carried out in taking an action, the Minister may determine:

(a) the number of activities that would be carried out in taking the action; and

(b) that each activity is a project component in relation to the assessment of the impacts of the action.

Example: Mining Pty Ltd proposes to expand a mine and build a new rail line to a new onshore port facility. The development of the port facility involves offshore dredging for a shipping channel and the building of a jetty. This proposal would require 4 activities to be carried out in taking the action (the expansion of the mine, the building of the port, rail development and offshore dredging).

(2) A determination made under this regulation is not a legislative instrument.

5.12H Making of a determination is a method

For paragraph 520(4C)(c) of the Act, the making of a determination under regulation 5.12C, 5.12D, 5.12E, 5.12F or 5.12G is a method for working out a fee.

Subdivision B—Fees

5.12J Schedule of fees

(1) When the Minister gives written notice to the person proposing to take an action of the approach to be used for assessing the impacts of the action under subsection 91(1) of the Act, the Minister must also give the person a fee schedule that sets out the following:

(a) the base fee;

(b) the complexity fee;

(c) a breakdown of the complexity fee, itemising:

(i) if applicable—the application component; and

(ii) if applicable—the controlling provision component; and

(iii) if applicable—the legislative impact component; and

(iv) if applicable—the project component; and

(v) if applicable—the exceptional case component;

(d) the level of complexity determined for each relevant component;

(e) the fees payable for each stage of the assessment.

(2) The fee schedule may set out the estimated amount payable for the application component of the complexity fee, but for all other fees, the fee schedule must set out the actual amount payable.

(3) Before stage 3 of an approach used for assessing the impacts of an action occurs, the Minister must give the person proposing to take the action another fee schedule that sets out the actual amount payable for the application component of the complexity fee, and this amount must not be more than the estimated amount payable for the component.

5.12K Amount of fees

Base fee

(1) A base fee is payable for the assessment of the impacts of an action. The amount of the fee depends on the approach to be used for assessing the impacts of the action.

Note: The amount of the base fee is set out in the Subdivision of this Division that deals with the assessment approach.

Determination—low complexity

(2) If a determination is made that a legislative impact component is of low complexity, the amount payable for the component is $3 892.00.

Determination—moderate, high or very high complexity

(3) If a determination is made in respect of an application component, controlling provision component or legislative impact component, the amount payable for the component is set out in the following table according to the level of complexity determined for the component:

Fee for each component |

Item | Component | Moderate complexity | High complexity | Very high complexity |

1 | application component—information referred to in subparagraph 5.12B(2)(b)(i) | $14 248.00 | $60 404.00 | |

2 | application component—information referred to in subparagraph 5.12B(2)(b)(ii) | $14 248.00 | $82 316.00 | |

3 | application component—information referred to in subparagraph 5.12B(2)(b)(iii) | $14 248.00 | $93 316.00 | |

4 | controlling provision component (other than section 24B or 24C of the Act) | $5 463.00 | $21 852.00 | $45 711.00 |

5 | controlling provision component—section 24B or 24C of the Act | $2 882.00 | $11 528.00 | |

6 | legislative impact component | $7 783.00 | $15 567.00 | $32 138.00 |

Project component fee

(4) If a project component applies in relation to the assessment of the impacts of an action, the amount payable for the component is set out in the Subdivision of this Division that deals with the approach to be used for assessing the impacts of the action.

Exceptional case component fee

(5) If an exceptional case component applies to the assessment of an action, the amount payable for the component is $577 651.00.

Subdivision C—Bilateral agreement or accredited assessment process

5.13 Application

This Subdivision applies if:

(a) an action is to be assessed in a specified manner for the purposes of a bilateral agreement that includes a declaration described in section 47 of the Act; or

(b) the Minister has decided under section 87 of the Act that the relevant impacts of an action are to be assessed by an accredited assessment process.

5.13A Definitions

(1) In this Subdivision:

assessment report has the same meaning as in the section 528 of the Act.

Environment Minister means the Minister administering Chapter 2 of the Act.

stage 1:

(a) if the accredited assessment process involves a draft report being prepared in accordance with terms of reference (however described)—stage 1 begins when the terms of reference are given to the Environment Minister for review; and

(b) if paragraph (a) does not apply—stage 1 does not occur.

stage 2:

(a) if the accredited assessment process involves a draft report being prepared in accordance with terms of reference (however described)—stage 2 begins when the draft report is given to the Environment Minister for review; and

(b) if paragraph (a) does not apply—stage 2 does not occur.

stage 3:

(a) if the accredited assessment process involves the finalisation of a draft report—stage 3 begins when the finalised report is given to the Environment Minister for review; and

(b) if paragraph (a) does not apply—stage 3 does not occur.

stage 4: stage 4 begins when an assessment report, prepared by relevant Commonwealth, State or Territory officials under the accredited assessment process, is given to the Environment Minister.

(2) To avoid doubt, if:

(a) paragraph (b) of the definition of stage 1 or stage 2 applies, no base fee or Part A complexity fee is payable for that stage; and

(b) paragraph (b) of the definition of stage 3 applies, no base fee, Part A complexity fee or Part B complexity fee is payable for that stage.

Note: For Part A complexity fee and Part B complexity fee, see regulation 5.13C.

5.13B Base fee payable in stages

(1) The base fee for the assessment of the action is payable in 4 stages, before each stage begins.

(2) The amount of the base fee payable for each stage is set out in the following table:

Base fee for assessment by an accredited assessment process |

Item | Stage | Amount payable |

1 | stage 1 | $4 031.00 |

2 | stage 2 | $12 760.00 |

3 | stage 3 | $4 268.00 |

4 | stage 4 | $4 983.00 |

5.13C Complexity fee payable in stages

Complexity fee to be split

(1) The complexity fee is to be split into:

(a) the Part A complexity fee, which is the sum of:

(i) if applicable—the fee for each applicable controlling provision component; and

(ii) if applicable—the fee for the legislative impact component; and

(iii) if applicable—the fee for the relevant number of project components; and

(iv) if applicable—the fee for the exceptional case component; and

(b) the Part B complexity fee, which is the sum of the fee for each application component.

Part A complexity fee

(2) The Part A complexity fee for the assessment of the action is payable in 4 stages, before each stage begins.

(3) The percentage of the Part A complexity fee payable for each stage is set out in the following table:

Part A complexity fee for assessment by an accredited assessment process |

Item | Stage | Percentage payable |

1 | stage 1 | 16% |

2 | stage 2 | 49% |

3 | stage 3 | 16% |

4 | stage 4 | 19% |

Part B complexity fee

(4) The Part B complexity fee for the assessment of the action is payable in 2 stages, before each stage begins.

(5) The percentage of the Part B complexity fee payable for each stage is set out in the following table:

Part B complexity fee for assessment by an accredited assessment process |

Item | Stage | Percentage payable |

1 | stage 1 | nil |

2 | stage 2 | nil |

3 | stage 3 | 81% |

4 | stage 4 | 19% |

5.13D Amount of components of complexity fee

(1) The amount of the fee payable for an application component, controlling provision component or legislative impact component of the complexity fee depends on the level of complexity determined for the component.

Note: See regulation 5.12K.

(2) The amount of the project component of the complexity fee is:

(a) if there is one project component—nil; and

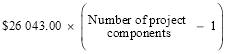

(b) if there are 2 project components—$26 043.00; and

(c) if there are 3 project components—$52 086.00; and

(d) if there are more than 3 project components—the amount worked out using the following formula:

5.13E Method for working out complexity fee

For paragraph 520(4C)(c) of the Act:

(a) the sum of the fees mentioned in paragraph 5.13C(1)(a) is the method for working out the Part A complexity fee; and

(b) the sum of the fee for each application component, as mentioned in paragraph 5.13C(1)(b), is the method for working out the Part B complexity fee.

Subdivision D—Assessment on referral information

5.14 Application

This Subdivision applies if the Minister has decided under section 87 of the Act that the relevant impacts of an action are to be assessed by assessment on referral information under Division 3A of Part 8 of the Act.

5.14A Definitions

In this Subdivision:

stage 1 begins when the Secretary starts to prepare a draft recommendation report, as required by subsection 93(2) of the Act.

stage 2 begins when the Secretary starts to finalise the draft recommendation report, as required by subsection 93(4) of the Act.

stage 3 begins when the Secretary gives the Minister the finalised recommendation report, as required by subsection 93(5) of the Act.

5.14B Base fee payable in stages

(1) The base fee for the assessment of the action is payable in 3 stages, before each stage begins.

(2) The amount of the base fee payable for each stage is set out in the following table:

Base fee for assessment on referral information |

Item | Stage | Amount payable |

1 | stage 1 | $4 784.00 |

2 | stage 2 | $2 878.00 |

3 | stage 3 | $1 755.00 |

5.14C Complexity fee payable in stages

(1) The complexity fee for the assessment of the action is payable in 3 stages, before each stage begins.

(2) The percentage of the complexity fee payable for each stage is set out in the following table:

Complexity fee for assessment on referral information |

Item | Stage | Percentage payable |

1 | stage 1 | 51% |

2 | stage 2 | 31% |

3 | stage 3 | 18% |

5.14D Amount of components of complexity fee

(1) The amount of the fee payable for an application component, controlling provision component or legislative impact component of the complexity fee depends on the level of complexity determined for the component.

Note: See regulation 5.12K.

(2) The amount of the project component of the complexity fee is:

(a) if there is one project component—nil; and

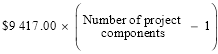

(b) if there are 2 project components—$9 417.00; and

(c) if there are 3 project components—$18 834.00; and

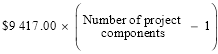

(d) if there are more than 3 project components—the amount worked out using the following formula:

5.14E Method for working out complexity fee

For paragraph 520(4C)(c) of the Act, the sum of the following fees is the method for working out the complexity fee referred to in regulation 5.14C:

(a) if applicable—the fee for each applicable controlling provision component;

(b) if applicable—the fee for the legislative impact component;

(c) if applicable—the fee for the relevant number of project components;

(d) if applicable—the fee for the exceptional case component.

Subdivision E—Assessment on preliminary documentation

5.15 Application

This Subdivision applies if the Minister has decided under section 87 of the Act that the relevant impacts of an action are to be assessed by assessment on preliminary documentation under Division 4 of Part 8 of the Act.

5.15A Definitions

(1) In this Subdivision:

stage 1:

(a) if section 95A of the Act applies—stage 1 begins when the Minister makes a request under subsection 95A(2) of the Act; and

(b) if section 95A of the Act does not apply—stage 1 does not occur.

stage 2: stage 2 begins when a written direction is given under subsection 95(2) or 95A(3) of the Act, as applicable.

stage 3: stage 3 begins when the designated proponent has given the Minister a copy of the document and comments as required by paragraph 95B(1)(b) of the Act or a written statement as required by subsection 95B(3) of the Act, as applicable.

stage 4: stage 4 begins when a recommendation report starts to be prepared under subsection 95C(1) of the Act.

(2) To avoid doubt, if paragraph (b) of the definition of stage 1 applies, no base fee or Part A complexity fee is payable for that stage.

Note: For Part A complexity fee, see regulation 5.15C.

5.15B Base fee payable in stages

(1) The base fee for the assessment of the action is payable in 4 stages, before each stage begins.

(2) The amount of the base fee payable for each stage is set out in the following table:

Base fee for assessment on preliminary documentation |

Item | Stage | Amount payable |

1 | stage 1 | $1 374.00 |

2 | stage 2 | $1 374.00 |

3 | stage 3 | $1 374.00 |

4 | stage 4 | $4 538.00 |

5.15C Complexity fee payable in stages

Complexity fee to be split

(1) The complexity fee is to be split into:

(a) the Part A complexity fee, which is the sum of:

(i) if applicable—the fee for each applicable controlling provision component; and

(ii) if applicable—the fee for the legislative impact component; and

(iii) if applicable—the fee for the relevant number of project components; and

(iv) if applicable—the fee for the exceptional case component; and

(b) the Part B complexity fee, which is the sum of the fees for each application component.

Part A complexity fee

(2) The Part A complexity fee for the assessment of the action is payable in 4 stages, before each stage begins.

(3) The percentage of the Part A complexity fee payable for each stage is set out in the following table:

Part A complexity fee for assessment on preliminary documentation |

Item | Stage | Percentage payable |

1 | stage 1 | 16% |

2 | stage 2 | 16% |

3 | stage 3 | 16% |

4 | stage 4 | 52% |

Part B complexity fee

(4) The Part B complexity fee for the assessment of the action is payable in 2 stages, before each stage begins.

(5) The percentage of the Part B complexity fee payable for each stage is set out in the following table:

Part B complexity fee for assessment on preliminary documentation |

Item | Stage | Percentage payable |

1 | stage 1 | nil |

2 | stage 2 | nil |

3 | stage 3 | 48% |

4 | stage 4 | 52% |

5.15D Amount of components of complexity fee

(1) The amount of the fee payable for an application component, controlling provision component or legislative impact component of the complexity fee depends on the level of complexity determined for the component.

Note: See regulation 5.12K.

(2) The amount of the project component of the complexity fee is:

(a) if there is one project component—nil; and

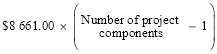

(b) if there are 2 project components—$8 661.00; and

(c) if there are 3 project components—$17 322.00; and

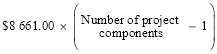

(d) if there are more than 3 project components—the amount worked out using the following formula:

5.15E Method for working out complexity fee

For paragraph 520(4C)(c) of the Act:

(a) the sum of the fees mentioned in paragraph 5.15C(1)(a) is the method for working out the Part A complexity fee; and

(b) the sum of the fee for each application component, as mentioned in paragraph 5.15C(1)(b), is the method for working out the Part B complexity fee.

Subdivision F—Public environment reports

5.16 Application

This Subdivision applies if the Minister has decided under section 87 of the Act that the relevant impacts of an action are to be assessed by a public environment report under Division 5 of Part 8 of the Act.

5.16A Definitions

(1) In this Subdivision:

PER guidelines, in relation to a designated proponent, has the same meaning as in subsection 96A(1) of the Act.

stage 1:

(a) if the PER guidelines given to the designated proponent are standard guidelines made under section 96B of the Act—stage 1 does not occur; and

(b) if the PER guidelines given to the designated proponent are tailored guidelines—stage 1 begins when the tailored guidelines are prepared under section 97 of the Act.

stage 2: stage 2 begins when the draft report is given to the Minister, as required by paragraph 98(1)(ab) of the Act.

stage 3: stage 3 begins when the designated proponent has given the Minister the documents required under subsection 99(3) of the Act.

stage 4: stage 4 begins when a recommendation report starts to be prepared under subsection 100(1) of the Act.

(2) To avoid doubt, if paragraph (a) of the definition of stage 1 applies, no base fee or Part A complexity fee is payable for that stage.

Note: For Part A complexity fee, see regulation 5.16C.

5.16B Base fee payable in stages

(1) The base fee for the assessment of the action is payable in 4 stages, before each stage begins.

(2) The amount of the base fee payable for each stage is set out in the following table:

Base fee for assessment by a public environment report |

Item | Stage | Amount payable |

1 | stage 1 | $4 031.00 |

2 | stage 2 | $12 760.00 |

3 | stage 3 | $4 265.00 |

4 | stage 4 | $9 146.00 |

5.16C Complexity fee payable in stages

Complexity fee to be split

(1) The complexity fee is to be split into:

(a) the Part A complexity fee, which is the sum of:

(i) if applicable—the fee for each applicable controlling provision component; and

(ii) if applicable—the fee for the legislative impact component; and

(iii) if applicable—the fee for the relevant number of project components; and

(iv) if applicable—the fee for the exceptional case component; and

(b) the Part B complexity fee, which is the sum of the fee for each application component.

Part A complexity fee

(2) The Part A complexity fee for the assessment of the action is payable in 4 stages, before each stage begins.

(3) The percentage of the Part A complexity fee payable for each stage is set out in the following table:

Part A complexity fee for assessment by a public environment report |

Item | Stage | Percentage payable |

1 | stage 1 | 14% |

2 | stage 2 | 42% |

3 | stage 3 | 14% |

4 | stage 4 | 30% |

Part B complexity fee

(4) The Part B complexity fee for the assessment of the action is payable in 2 stages, before each stage begins.

(5) The percentage of the Part B complexity fee payable for each stage is set out in the following table:

Part B complexity fee for assessment by a public environment report |

Item | Stage | Percentage payable |

1 | stage 1 | nil |

2 | stage 2 | nil |

3 | stage 3 | 70% |

4 | stage 4 | 30% |

5.16D Amount of components of complexity fee

(1) The amount of the fee payable for an application component, controlling provision component or legislative impact component of the complexity fee depends on the level of complexity determined for the component.

Note: See regulation 5.12K.

(2) The amount of the project component of the complexity fee is:

(a) if there is one project component—nil; and

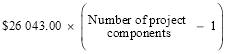

(b) if there are 2 project components—$30 202.00; and

(c) if there are 3 project components—$60 404.00; and

(d) if there are more than 3 project components—the amount worked out using the following formula:

5.16E Method for working out complexity fee

For paragraph 520(4C)(c) of the Act:

(a) the sum of the fees mentioned in paragraph 5.16C(1)(a) is the method for working out the Part A complexity fee; and

(b) the sum of the fee for each application component, as mentioned in paragraph 5.16C(1)(b), is the method for working out the Part B complexity fee.

Subdivision G—Environmental impact statements

5.17 Application

This Subdivision applies if the Minister has decided under section 87 of the Act that the relevant impacts of an action are to be assessed by an environmental impact statement under Division 6 of Part 8 of the Act.

5.17A Definitions

(1) In this Subdivision:

EIS guidelines, in relation to a designated proponent, has the same meaning as in subsection 101A(1) of the Act.

stage 1:

(a) if the EIS guidelines given to the designated proponent are standard guidelines made under section 101B of the Act—stage 1 does not occur; and

(b) if the EIS guidelines given to the designated proponent are tailored guidelines—stage 1 begins when the tailored guidelines are prepared under section 102 of the Act.

stage 2: stage 2 begins when the draft report is given to the Minister, as required by paragraph 103(1)(ab) of the Act.

stage 3: stage 3 begins when the designated proponent has given the Minister the documents required under subsection 104(3) of the Act.

stage 4: stage 4 begins when a recommendation report starts to be prepared under subsection 105(1) of the Act.

(2) To avoid doubt, if paragraph (a) of the definition of stage 1 applies, no base fee or Part A complexity fee is payable for that stage.

Note: For Part A complexity fee, see regulation 5.17C.

5.17B Base fee payable in stages

(1) The base fee for the assessment of the action is payable in 4 stages, before each stage begins.

(2) The amount of the base fee payable for each stage is set out in the following table:

Base fee for assessment by an environmental impact statement |

Item | Stage | Amount payable |

1 | stage 1 | $4 031.00 |

2 | stage 2 | $12 760.00 |

3 | stage 3 | $4 265.00 |

4 | stage 4 | $9 146.00 |

5.17C Complexity fee payable in stages

Complexity fee to be split

(1) The complexity fee is to be split into:

(a) the Part A complexity fee, which is the sum of:

(i) if applicable—the fee for each applicable controlling provision component; and

(ii) if applicable—the fee for the legislative impact component; and

(iii) if applicable—the fee for the relevant number of project components; and

(iv) if applicable—the fee for the exceptional case component; and

(b) the Part B complexity fee, which is the sum of the fee for each application component.

Part A complexity fee

(2) The Part A complexity fee for the assessment of the action is payable in 4 stages, before each stage begins.

(3) The percentage of the Part A complexity fee payable for each stage is set out in the following table:

Part A complexity fee for assessment by an environmental impact statement |

Item | Stage | Percentage payable |

1 | stage 1 | 14% |

2 | stage 2 | 42% |

3 | stage 3 | 14% |

4 | stage 4 | 30% |

Part B complexity fee

(4) The Part B complexity fee for the assessment of the action is payable in 2 stages, before each stage begins.

(5) The percentage of the Part B complexity fee payable for each stage is set out in the following table:

Part B complexity fee for assessment by an environmental impact statement |

Item | Stage | Percentage payable |

1 | stage 1 | nil |

2 | stage 2 | nil |

3 | stage 3 | 70% |

4 | stage 4 | 30% |

5.17D Amount of components of complexity fee

(1) The amount of the fee payable for an application component, controlling provision component or legislative impact component of the complexity fee depends on the level of complexity determined for the component.

Note: See regulation 5.12K.

(2) The amount of the project component of the complexity fee is:

(a) if there is one project component—nil; and

(b) if there are 2 project components—$30 202.00; and

(c) if there are 3 project components—$60 404.00; and

(d) if there are more than 3 project components—the amount worked out using the following formula:

5.17E Method for working out complexity fee

For paragraph 520(4C)(c) of the Act:

(a) the sum of the fees mentioned in paragraph 5.17C(1)(a) is the method for working out the Part A complexity fee; and

(b) the sum of the fee for each application component, as mentioned in paragraph 5.17C(1)(b), is the method for working out the Part B complexity fee.

Subdivision H—Action management plans

5.18 Fee for the approval of an action management plan

(1) This regulation applies if a person proposing to take an action elects, or is taken to have elected, under section 132B of the Act to submit an action management plan for approval.

Note: An election is taken to have been made if an approval is varied to add a condition requiring an action management plan, see subsection 143(1A) of the Act.

(2) For subsection 520(4A) of the Act, the fee for assessing the action management plan is $3 233.00.

(3) For subparagraph 520(4C)(e)(i) of the Act, the fee is payable before the assessment of the action management plan begins.

5.18A Inviting public comment before approving action management plan

For subsection 134A(2) of the Act:

(a) an action management plan and invitation to comment must be published on the internet; and

(b) the invitation to comment must include:

(i) the decision approving the taking of the action to which the plan relates; and

(ii) any conditions that are attached to the approval.

5.18B Variation of action management plan

(1) This regulation applies if, under section 143A of the Act, the holder of an approval applies to the Minister for the variation of an action management plan.

(2) For subparagraph 143A(2)(b)(i) of the Act, the application must:

(a) state the following information:

(i) the holder’s contact details;

(ii) if the holder has an ABN—the holder’s ABN;

(iii) if the holder has an ACN—the holder’s ACN;

(iv) the referral number; and

(b) be accompanied by the following:

(i) a draft of the proposed variation;

(ii) an explanation of the differences between the plan as approved and the plan as proposed to be varied;

(iii) a written statement that sets out the reasons why the holder considers that the proposed variation is required and identifies any impacts on matters protected by a provision of Part 3 that would, or would be likely to, arise if the plan were implemented as varied.

(3) For subparagraph 143A(2)(b)(ii) of the Act, the following application fees are prescribed:

(a) subject to paragraph (5)(b) of this regulation, if the applicant considers that the variation is of an administrative nature—a fee of $943.00;

(b) in any other case—a fee of $3 233.00.

(4) For subparagraph 520(4C)(e)(i) of the Act, the fee is payable before the assessment of the variation begins.

(5) If the Minister considers that a proposed variation of an action management plan by the holder of an approval is not of an administrative nature, then:

(a) the Minister must notify the holder of the approval of that fact; and

(b) the holder of the approval must pay the difference between the fee paid and the fee set out in paragraph (3)(b).

(6) For paragraph 520(4C)(c) of the Act, the Minister’s notification mentioned in paragraph (5)(a) is taken to be a method for working out the application fee for a variation of an action management plan.

Subdivision I—Other fees

5.19 Request to provide specified information

(1) Subject to subregulation (2), if the Minister makes a request for specified information to be provided under:

(a) section 76, 89 or 132 of the Act; or

(b) subsection 134(3D) of the Act;

the information provided in response to the request must be accompanied by a fee of $2 544.00.

(2) If the Minister makes a request for specified information to be provided under section 132 or subsection 134(3D) of the Act in relation to an action that has been, is being, or is to be, assessed by:

(a) a public environment report under Division 5 of Part 8 of the Act; or

(b) an environmental impact statement under Division 6 of Part 8 of the Act;

the information provided in response to the request must be accompanied by a fee of $13 087.00.

(3) For subparagraph 520(4C)(e)(i) of the Act, a fee set out in this regulation is payable before the Minister considers the information provided in response to the request.

5.19A Request for reconsideration of a decision under subsection 75(1) of the Act

If the Minister is requested, under section 78A of the Act, by:

(a) the person proposing to take an action; or

(b) the designated proponent of the action (if the designated proponent is not the person proposing to take the action);

to reconsider a decision made under subsection 75(1) of the Act about the action, the request must be accompanied by a fee of $7 423.00.

5.19B Request to vary a condition attached to an approval

(1) If, under subsection 143(1B) of the Act, the holder of an approval requests the Minister to vary a condition attached to an approval of an action, the request must be accompanied by a fee of $3 320.00.

(2) For subparagraph 520(4C)(e)(i) of the Act, the fee set out in subregulation (1) is payable before the assessment of the variation begins.

Subdivision J—Reconsideration of fees

5.20 Application for reconsideration of fee

Requirements of an application

(1) For paragraph 514Y(3)(a) of the Act, an application must:

(a) be in writing; and

(b) set out the following:

(i) the applicant’s name and contact details;

(ii) if the applicant has an ABN—the applicant’s ABN;

(iii) if the applicant has an ACN—the applicant’s ACN;

(iv) the referral number;

(v) the kind of fee to be reconsidered;

(vi) the amount of the fee;

(vii) the method that was used to work out the fee; and

(c) acknowledge that as a result of the reconsideration:

(i) a new fee may be worked out; and

(ii) the new fee may be higher than the original fee.

Limit on application by a transferee

(2) To avoid doubt, if:

(a) section 145B of the Act applies in relation to an action; and

(b) the transferor mentioned in subsection 145B(1) of the Act applied for a reconsideration of the referral fee or any other fee payable under this Division in relation to the assessment of the impacts of the action;

the transferee mentioned in subsection 145B(1) of the Act may not apply for a reconsideration of a fee in respect of which an application has previously been made.

Limit on application by a second person in case of a change of person taking action

(3) To avoid doubt, if:

(a) section 156F of the Act applies in relation to an action; and

(b) the first person mentioned in subsection 156F(1) of the Act applied for a reconsideration of the referral fee or any other fee payable under this Division in relation to the assessment of the impacts of the action;

the second person mentioned in subsection 156F(1) of the Act may not apply for a reconsideration of a fee in respect of which an application has previously been made.

5.20A Reconsideration results in higher fee

(1) If:

(a) the method used to work out a fee is reconsidered under section 514YA of the Act; and

(b) as a result of the reconsideration, a new fee is worked out by using the method again; and

(c) the new fee is higher than the original fee;

the person must pay the new fee, or if the person had paid the original fee, the amount by which the new fee is higher than the original fee.

(2) The amount of the new fee or by which the new fee is higher than the original fee:

(a) is a debt due by the person to the Commonwealth; and

(b) may be recovered by action in a court of competent jurisdiction.

Subdivision K—Waiver of fees

5.21 Waiver of all or part of a fee

(1) For subparagraph 520(4C)(e)(iv) of the Act, the Minister may, at the Minister’s discretion, waive all or a part of a fee that would otherwise be payable under this Division in the following circumstances:

(a) in respect of an action that has been, is being, or is to be, assessed—the Minister considers that the action’s primary objective is to protect the environment, or protect and conserve heritage, in a way that is consistent with the objects of the Act;

(b) the Minister considers that:

(i) it is in the public interest to do so; or

(ii) there are other exceptional circumstances justifying the waiver.

(2) The Minister’s power under subregulation (1) may be exercised:

(a) on the Minister’s own initiative; or

(b) on the application of a person proposing to take an action.

5.21A Application for waiver of fee

(1) A person proposing to take an action may apply for all or part of a fee to be waived.

(2) The application may be made:

(a) if the Minister has made a determination under subsection 70(3) of the Act in relation to a requested person—within 10 business days of a copy of the determination being given to the requested person; and

(b) if a referral is made and a person is informed of the referral under section 73 of the Act—within 10 business days of the person being so informed; and

(c) if section 145B of the Act applies in relation to the action—at the same time as the Minister’s consent is sought under that section; and

(d) if section 156F of the Act applies in relation to the action—at the same time as notification is given to the Minister under subsection 156F(1); and

(e) in any other case—at any time before, or at the same time as, a referral is made under section 68 of the Act.

(3) The application must:

(a) be in writing; and

(b) set out the following:

(i) the applicant’s name and contact details;

(ii) if the applicant has an ABN—the applicant’s ABN;

(iii) if the applicant has an ACN—the applicant’s ACN;

(iv) having regard to paragraphs 5.21(1)(a) and (b), the grounds on which the applicant considers that a waiver should be made and the reasons why it should be made.

(4) The Minister must consider the application within 20 business days after it is made.

(5) As soon as practicable after considering the application, the Minister must advise the person, by written notice, whether all or part of a fee has been waived and of the reasons for the Minister’s decision.

(6) To avoid doubt, the fact that, after considering the application, the Minister decides not to waive all or part of a fee does not prevent the Minister later waiving all or part of the fee on the Minister’s own initiative.

Subdivision L—Refunds of fees

5.22 Refunds of a fee

(1) For subparagraph 520(4C)(e)(vi) of the Act, this regulation sets out the circumstances in which a fee may be refunded, in whole or in part.

(2) If a person pays a fee that the person is not required to pay, the Department must, on behalf of the Commonwealth, refund the fee.

(3) If a person overpays a fee, the Department must, on behalf of the Commonwealth, refund the amount of the excess.

(4) If a person pays a fee that is reduced after a reconsideration under Part 19A of the Act, the Department must, on behalf of the Commonwealth, refund the amount by which the fee is reduced.

Note: For the appropriation for the refund, see section 77 of the Public Governance, Performance and Accountability Act 2013.

5.22A Refunds of a referral fee

For subparagraph 520(4C)(e)(vi) of the Act, if:

(a) a person refers a proposal to take an action under Division 1 of Part 7 of the Act; and

(b) the person pays the referral fee; and

(c) the Minister decides not to accept the referral under section 74A of the Act;

the Department must, on behalf of the Commonwealth, refund the referral fee.

Note: For the appropriation for the refund, see section 77 of the Public Governance, Performance and Accountability Act 2013.

5.22B Working out the amount of a partial refund

(1) If:

(a) the Department has partially completed a particular stage of assessment of the relevant impacts of an action; and

(b) any of the following are satisfied:

(i) the Minister considers that there are exceptional circumstances justifying a refund of part of a fee that has been paid for that stage of assessment;

(ii) the Minister makes a declaration under section 155 of the Act that Chapter 4 of the Act no longer applies to the action and considers that there should be a refund of part of the fee for the stage of assessment that is being carried out when the declaration takes effect;

(iii) a person withdraws the referral of the proposal to take the action under section 170C of the Act and the Minister considers that there should be a refund of part of the fee for the stage of assessment that is being carried out when written notice of the withdrawal is given to the Minister;

the Minister must work out the amount of the refund using the method set out in subregulation (2).

(2) For the purposes of paragraph 520(4C)(d) of the Act, the following method is prescribed:

(a) first, the Minister must consider:

(i) the steps that the Department has carried out under the relevant assessment approach for the particular stage of assessment; and

(ii) the remaining steps to be carried out under the relevant assessment approach to complete that stage;

(b) second, the Minister must estimate an appropriate portion of the fee payable for the particular stage of assessment that the Minister considers is attributable to the steps mentioned in subparagraphs (a)(i) and (ii).

Subdivision M—Exemptions from fees

5.23 Qualification for an exemption

(1) For subparagraph 520(4C)(e)(v) of the Act, a person proposing to take an action qualifies for an exemption from the referral fee, or one or more fees that would otherwise be payable under this Division, if:

(a) at the time the fee or fees would be payable, the person is:

(i) an individual; or

(ii) a small business entity; and

(b) the person notifies the Secretary of that fact in accordance with this regulation.

(2) The person may notify the Secretary:

(a) in respect of the referral fee—at the same time as the person refers the proposal to take the action; and

(b) in respect of any fee that would otherwise be payable under this Division—at any time, but only in respect of fees that would be payable after the notification is given.

(3) The notification must:

(a) be in writing; and

(b) set out the following:

(i) the person’s name and contact details;

(ii) if the person is not the designated proponent—the designated proponent’s name and contact details;

(iii) if available—the referral number;

(iv) the fee or fees for which the person qualifies for an exemption; and

(c) include a declaration that the person is not taking the action on behalf of, or for the benefit of, any other person or entity; and

(d) if the person is a small business entity—state the day or income year from which the person became a small business entity.

Note: The Secretary may ask a person to provide evidence that the person is a small business entity, see regulation 5.23A.

(4) To avoid doubt:

(a) a person may not give a notification in respect of a fee that has already been paid, even if the person could have given a notification under this regulation in respect of the fee; and

(b) a person is not entitled to a refund of a fee that is paid before a notification is given under this regulation.

5.23A Secretary may request evidence

For the purpose of verifying that a person is a small business entity, the Secretary may request the person to provide evidence to support the person’s notification that the person is a small business entity.

5.23B Person exempt from paying fee to notify Secretary if circumstances change

(1) If the declaration mentioned in paragraph 5.23(3)(c) in a person’s notification ceases to be true, the person must advise the Secretary, in writing, of that fact before the person is required to pay another fee under this Division.

(2) If a person ceases to be a small business entity, the person must advise the Secretary, in writing, of that fact before the person is required to pay another fee under this Division.

(3) A person commits an offence if:

(a) the person is required to advise the Secretary of a fact under this regulation; and

(b) the person fails to advise the Secretary, in writing and within 10 business days, after the person first becomes aware of the fact.

Penalty: 50 penalty units.

(4) An offence against subregulation (3) is an offence of strict liability.

5.23C Effect of ceasing to qualify for an exemption

If regulation 5.23B applies and a person ceases to be qualified for an exemption, the person:

(a) is not, as a result of ceasing to be so qualified, required to pay:

(i) any fee that was not paid because the person qualified for an exemption; or

(ii) a fee for the stage of assessment that is being carried out when the person ceases to be so qualified; but

(b) is required to pay any fee that is payable after the person ceases to be so qualified.

Subdivision N—Miscellaneous rules relating to fees

5.24 Fees and transfer of approvals

(1) This regulation applies if:

(a) section 145B of the Act applies in relation to an action; and

(b) any of the following are satisfied:

(i) the transferor mentioned in subsection 145B(1) of the Act paid the referral fee or any other fee payable under this Division in relation to the assessment of the impacts of the action;

(ii) the transferor mentioned in subsection 145B(1) of the Act was exempt from paying a referral fee or a fee that would have otherwise been payable under this Division in relation to the assessment of the impacts of the action;

(iii) all or part of a fee that would have otherwise been payable under this Division by the transferor mentioned in subsection 145B(1) of the Act in relation to the assessment of the impacts of the action was waived.

(2) For subparagraph 520(4C)(e)(ii) of the Act:

(a) the Secretary must give the transferee mentioned in subsection 145B(1) of the Act a copy of the fee schedule relating to the assessment of the impacts of the action (see regulation 5.12J); and

(b) in a case described in subparagraph (1)(b)(i)—the transferee mentioned in subsection 145B(1) of the Act must pay any fee that is, or will become, payable under this Division in relation to the assessment of the impacts of the action; and

(c) in a case described in subparagraph (1)(b)(ii) or (iii)—the transferee mentioned in subsection 145B(1) of the Act must pay:

(i) if the referral fee was waived or the transferor was exempt from paying the referral fee—the referral fee; and

(ii) any other fee that would have been payable under this Division in relation to the assessment of the impacts of the action.

Note: The transferee may apply for a waiver (see regulation 5.21A) or qualify for an exemption (see regulation 5.23) in relation to some or all fees. However, the transferee’s ability to apply for a reconsideration of some or all fees may be limited (see subregulation 5.20(2)).

5.24A Fees and lapsed proposals

(1) For subparagraph 520(4C)(e)(vi) of the Act, if the Minister makes a declaration under section 155 of the Act that Chapter 4 of the Act no longer applies to a controlled action, the person proposing to take the action:

(a) is not entitled to a refund of:

(i) the referral fee; or

(ii) any fees paid for a completed stage of assessment; but

(b) may be entitled to a partial refund for the stage of assessment that is being carried out when the declaration takes effect.

Note: For paragraph (b), see regulation 5.22B.

(2) To avoid doubt, once the declaration takes effect, fees are no longer payable under this Division in respect of the action.

5.24B Fees and a change of person proposing to take action

(1) This regulation applies if:

(a) section 156F of the Act applies in relation to an action; and

(b) any of the following are satisfied:

(i) the first person mentioned in subsection 156F(1) of the Act paid the referral fee or any other fee payable under this Division in relation to the assessment of the impacts of the action;

(ii) the first person mentioned in subsection 156F(1) of the Act was exempt from paying a referral fee or a fee that would have otherwise been payable under this Division in relation to the assessment of the impacts of the action;

(iii) all or part of a fee that would have otherwise been payable under this Division by the first person mentioned in subsection 156F(1) of the Act in relation to the assessment of the impacts of the action was waived.

(2) For subparagraph 520(4C)(e)(ii) of the Act:

(a) the Secretary must give the second person mentioned in subsection 156F(1) of the Act a copy of the fee schedule relating to the assessment of the impacts of the action (see regulation 5.12J); and

(b) in a case described in subparagraph (1)(b)(i)—the second person mentioned in subsection 156F(1) of the Act must pay any fee that is, or will become, payable under this Division in relation to the assessment of the impacts of the action; and

(c) in a case described in subparagraph (1)(b)(ii) or (iii)—the second person mentioned in subsection 156F(1) of the Act must pay:

(i) if the referral fee was waived or the first person was exempt from paying the referral fee—the referral fee; and

(ii) any other fee that would have been payable under this Division in relation to the assessment of the impacts of the action.

Note: The second person may apply for a waiver (see regulation 5.21A) or qualify for an exemption (see regulation 5.23) in relation to some or all fees. However, the second person’s ability to apply for a reconsideration of some or all fees may be limited (see subregulation 5.20(3)).

5.24C Fees and government agencies

For subparagraph 520(4C)(a)(iii) of the Act and to avoid doubt, regulation 4.02 and the regulations in this Division apply to:

(a) a Commonwealth agency (other than a Minister); and

(b) an agency of a State or self‑governing Territory (other than a Minister of the State or Territory); and

(c) a local government body of a State or self‑governing Territory.

5 Schedule 10 (before item 1 of the table)

Insert:

1A | 5.23B (Person exempt from paying fee to notify Secretary if circumstances change) |

6 Dictionary

Insert:

critically endangered—see Act, section 528.

endangered—see Act, section 528.

listed threatened ecological community—see Act, section 528.

vulnerable—see Act, section 528.