Telecommunications (Collection of Numbering Charges) Determination 2014

Telecommunications Act 1997

The AUSTRALIAN COMMUNICATIONS AND MEDIA AUTHORITY makes this Determination under subsections 468(3) and (4) of the Telecommunications Act 1997.

Dated 15 December 2014

Chris Chapman

[signed]

Member

Richard Bean

[signed]

Member/General Manager

Australian Communications and Media Authority

Part 1 Introduction

1 Name of Determination

This Determination is the Telecommunications (Collection of Numbering Charges) Determination 2014.

2 Commencement

This Determination commences on 1 April 2015.

Note 1 All legislative instruments and compilations must be registered on the Federal Register of Legislative Instruments required to be maintained under the Legislative Instruments Act 2003.

Note 2 On the commencement day, this Determination will replace, and continue the arrangements provided for in, the Telecommunications (Due Date for Annual Charge) Determination 1999 and the Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000. On that day, unless repealed or revoked earlier, the first-mentioned Determination of 1999 will be repealed by section 50 of the Legislative Instruments Act 2003 and the second-mentioned Determination of 2000 will be revoked by section 3 of this Determination. This Determination is substantively in the same terms as those other Determinations.

3 Revocation of determination specifying late payment penalty for unpaid annual charge

The Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000 (FRLI No. F2005B00369) is revoked.

4 Definitions

In this Determination:

ACMA means the Australian Communications and Media Authority.

Act means the Telecommunications Act 1997.

annual charge has the meaning given by subsection 468 of the Act.

commencement day means 1 April 2015.

late payment penalty has the meaning given by section 468 of the Act.

previous financial year average GIC rate means the rate worked out in accordance with Schedule 1.

Part 2 Due date for annual charge

5 When annual charge is due and payable

For the purposes of subsection 468(3) of the Act, an annual charge is due and payable by a person on the later of:

(a) 15 June of the year in which the charge is imposed; or

(b) 30 calendar days from the date of the invoice issued to the person by the ACMA in relation to the annual charge.

Part 3 Late payment penalty for unpaid annual charge

6 Late payment penalty payable

(1) If any annual charge payable by a person remains unpaid after the time when it becomes due for payment, the person is liable to pay to the Commonwealth, by way of penalty, an amount calculated in accordance with this Part.

(2) The amount is calculated, for each day the charge remains unpaid from that time, by multiplying the daily rate worked out by reference to the rate of late payment penalty mentioned in section 7 for the day by the sum of so much of the following amounts as remain unpaid:

(a) annual charge;

(b) late payment penalty in respect of previous days.

7 Rate of late payment penalty

In order to work out the daily rate referred to in subsection 6(2), the rate of late payment penalty is:

(a) 20% per annum; or

(b) if, for any day, the previous financial year average GIC rate is less than 20% per annum – the previous financial year average GIC rate.

8 Attribution of payments made to the ACMA

(1) This section applies if a person:

(a) is liable to pay an annual charge; and

(b) is liable to pay a late payment penalty on the annual charge; and

(c) pays an amount of money to the ACMA without any attribution by the person or the ACMA as to how the money is to be credited to the annual charge and the late payment penalty.

(2) The person’s payment is to be credited to the amount of annual charge first, and is to be credited to the amount of the late payment penalty only if all of the amount of annual charge is paid.

Part 4 Decisions about remission of late payment penalty

9 Remission of late payment penalty: general

(1) For the purposes of subsection 468(6) of the Act, the ACMA may decide:

(a) to remit all, or a part, of an amount of late payment penalty payable by a person; or

(b) not to remit any part of an amount of late payment penalty payable by a person.

(2) The person may apply to the ACMA, in writing, to remit all or part of the amount.

(3) An application for remission must be:

(a) made within 120 days after the time when the annual charge became due for payment; and

(b) in a form approved in writing by the ACMA.

(4) However, the ACMA may:

(a) make a decision under subsection (1) irrespective of whether or not it has received an application for remission; and

(b) remit all or part of the amount only for a reason set out in section 10.

10 Remission of late payment penalty: reasons

(1) A reason for remission is that the ACMA is satisfied that:

(a) the circumstances that contributed to the delay in payment of the annual charge were not due to an act or omission of the person, and were not caused, directly or indirectly, by an act or omission of the person; and

(b) the person has taken reasonable action to mitigate the circumstances or their effects.

(2) A reason for remission is that the ACMA is satisfied that:

(a) the circumstances that contributed to the delay in payment of the annual charge were due to an act or omission of the person, or were caused, directly or indirectly, by an act or omission of the person;

(b) the person has taken reasonable action to mitigate the circumstances or their effects; and

(c) having regard to the nature of the circumstances, it would be fair and reasonable to remit all or part of the amount.

(3) A reason for remission is that the ACMA is satisfied that it is not reasonably practicable to attempt to recover a late payment penalty.

(4) A reason for remission is that the ACMA is satisfied that payment of all or part of the amount would cause, or has caused, financial hardship to the person.

(5) A reason for remission is that the ACMA is satisfied that there are other circumstances by reason of which it would be fair and reasonable to remit all or part of the amount.

11 Notification of decision

If the ACMA makes a decision on an application for remission, it must:

(a) tell the applicant, in writing, of its decision; and

(b) give the applicant a written statement of:

(i) the reasons for the decision; and

(ii) if the application is refused, the arrangements under the Act for reviewing the decision.

Note An application may be made to the ACMA for reconsideration of a decision about the remission of the whole or a part of an amount of late payment penalty (see section 555 of the Act and paragraph 1(w) of Schedule 4 to the Act). If the ACMA affirms or varies the original decision under section 559 of the Act, an application may be made to the Administrative Appeals Tribunal for review of the decision (see section 562 of the Act).

Part 5 Miscellaneous

12 Judgment for payment of annual charge and interest only

(1) This section applies if:

(a) judgment is given by, or entered in, a court for the payment of an annual charge; and

(b) the judgment carries interest.

(2) This section does not apply if section 13 applies.

(3) A late payment penalty is not taken to have ceased to be payable only because of the giving or entering of the judgment.

(4) The late payment penalty that would, but for this subsection, be payable is reduced by the amount of the judgment interest.

13 Judgment for payment of annual charge, interest and other amounts

(1) This section applies if:

(a) judgment is given by, or entered in, a court for the payment of an amount that includes an annual charge; and

(b) the judgment carries interest.

(2) A late payment penalty is not taken to have ceased to be payable only because of the giving or entering of the judgment.

(3) The late payment penalty that would, but for this subsection, be payable is reduced by:

(a) the amount of the judgment interest; or

(b) an amount that is the same proportion to the amount of the judgment interest as the amount of the annual charge is to the amount of the judgment debt.

14 Rounding of amount of late payment penalty

If an amount of a late payment penalty ends in a part of a whole cent, the part of the cent is to be dealt with as follows:

(a) if the part of the cent is at least 0.5 of a cent, it is taken to be rounded up to 1 cent;

(b) in any other case, the part of the cent is to be disregarded.

Part 6 Transitional arrangements

15 Annual charge unpaid as at the commencement day

If an annual charge:

(a) became due for payment before the commencement day; and

(b) remains wholly or partly unpaid on the commencement day;

then:

(c) the late payment penalty payable in relation to the unpaid charge is to be calculated in accordance with the Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000 as if that Determination had not been revoked; and

(d) any application for remission of late payment penalty is to be made and dealt with in accordance with the Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000 as if that Determination had not been revoked.

16 Application for remission under the Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000

If:

(a) an application for a remission of a late payment penalty was made in accordance with the Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000; and

(b) a decision about the application was not made before the commencement day;

then the application is to be dealt with in accordance with the Telecommunications (Annual Numbering Charge — Late Payment Penalty) Determination 2000 as if that Determination had not been revoked.

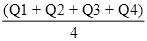

Schedule 1 Calculation of previous financial year average GIC rate

(section 4)

Previous financial year average GIC rate is the rate worked out as follows:

1. Use the formula:

where:

Q1 means the average of the general interest charge rates, determined under section 8AAD of the Taxation Administration Act 1953, that applied during the first quarter of the financial year that ended most recently before the day for which the rate is being worked out;

Q2 means the average of the general interest charge rates, determined under section 8AAD of the Taxation Administration Act 1953, that applied during the second quarter of the financial year that ended most recently before the day for which the rate is being worked out;

Q3 means the average of the general interest charge rates, determined under section 8AAD of the Taxation Administration Act 1953, that applied during the third quarter of the financial year that ended most recently before the day for which the rate is being worked out; and

Q4 means the average of the general interest charge rates, determined under section 8AAD of the Taxation Administration Act 1953, that applied during the fourth quarter of the financial year that ended most recently before the day for which the rate is being worked out; and

2. round the amount obtained using the formula in paragraph 1 to the second decimal place (for example 0.005 should be rounded upwards)

Note The average of the general interest charge rates determined for each quarter is published by the Australian Taxation Office on the website www.ato.gov.au, where it is referred to as ‘GIC annual rate’. That reference may be found by searching on that website for ‘GIC rates’.