1 Name

This is the Customs Amendment (Fees and Charges) Regulation 2015.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 4 and anything in this instrument not elsewhere covered by this table | The day after this instrument is registered. | 15 December 2015 |

2. Schedule 1 | At the same time as Schedule 1 to the Customs Amendment (Fees and Charges) Act 2015 commences. | 1 January 2016 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Customs Act 1901.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Customs Regulation 2015

1 Section 4 (definition of instalment period)

Omit “subsection 38(4)”, substitute “subsection 37(3)”.

2 Section 4 (definition of relevant instalment period)

Omit “subsection 38(4)”, substitute “subsection 37(3)”.

3 Division 1 of Part 6

Repeal the Division, substitute:

Division 1—Warehouse licences

35 Payment of warehouse licence charge in respect of the grant of a warehouse licence

(1) For section 85A of the Act, this section sets out when a warehouse licence charge in respect of the grant of a warehouse licence must be paid.

Warehouse licence comes into force on 1 July

(2) For a warehouse licence that comes into force on 1 July in a financial year and for which the amount of the warehouse licence charge is worked out under section 6D of the Customs Licensing Charges Act 1997, the charge must be paid:

(a) in full before the end of that 1 July; or

(b) in 4 equal instalments, before the end of that 1 July and the end of 1 October, 1 January and 1 April in that financial year.

Warehouse licence comes into force on another day

(3) For a warehouse licence that comes into force on a day in a financial year other than 1 July and for which the amount of the warehouse licence charge is worked out under section 6D of the Customs Licensing Charges Act 1997, the charge must be paid in accordance with the following table:

Payment of warehouse licence charge |

Item | If the warehouse licence comes into force … | the warehouse licence charge must be paid … |

1 | after 1 July and before 2 October | either in full before the end of the day the licence comes into force, or in the following instalments: (a) 1/2 of the amount of the charge before the end of the day the licence comes into force; (b) 1/4 of the amount of the charge before the end of the next 1 January; (c) 1/4 of the amount of the charge before the end of the next 1 April. |

2 | on or after 2 October and before 2 January | either in full before the end of the day the licence comes into force, or in the following instalments: (a) 3/4 of the amount of the charge before the end of the day the licence comes into force; (b) 1/4 of the amount of the charge before the end of the next 1 April. |

3 | on or after 2 January and on or before 30 June | in full before the end of the day the licence comes into force. |

Dual‑licensed place

(4) For a warehouse licence for which the amount of the warehouse licence charge is worked out under section 6E of the Customs Licensing Charges Act 1997, the charge must be paid in full before the end of the day the licence comes into force.

Election to pay in full or by instalments

(5) If, under this section, a warehouse licence charge may be paid in full or in instalments, the person or partnership liable to pay the charge must, by notice given to the Comptroller‑General of Customs, elect to pay the charge in full or in instalments.

36 Payment of warehouse licence charge in respect of the renewal of a warehouse licence

(1) For section 85A of the Act, this section sets out when a warehouse licence charge in respect of the renewal of a warehouse licence must be paid.

(2) For the renewal of a warehouse licence for a financial year, the amount of the warehouse licence charge must be paid:

(a) in full before the end of 1 July in that financial year; or

(b) in 4 equal instalments, before the end of 1 July, 1 October, 1 January and 1 April in that financial year.

Election to pay in full or by instalments

(3) The holder of the warehouse licence must, by notice given to the Comptroller‑General of Customs, elect to pay the charge in full or in instalments.

37 Refund of warehouse licence charge

Warehouse licence charge paid in full

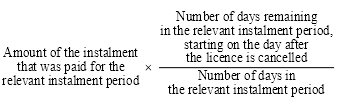

(1) For section 87A of the Act, if the warehouse licence charge for the licence was paid in full, the amount of the refund is worked out using the formula:

Warehouse licence charge paid in instalments

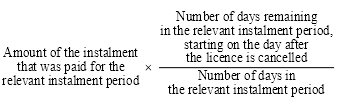

(2) For section 87A of the Act, if the warehouse licence charge for the licence was paid in instalments, the amount of the refund is worked out using the formula:

Definitions

(3) In this instrument:

instalment period means a period, in a financial year, that:

(a) starts on the day on which an instalment is due to be paid; and

(b) ends on the day immediately before:

(i) the day on which the next instalment for the financial year is due to be paid; or

(ii) if no more instalments are due to be paid for the financial year—the start of the next financial year.

relevant instalment period means the instalment period during which the licence is cancelled.

4 Sections 115 and 116

Repeal the sections.

5 Schedule 1 (note to Schedule heading)

Omit “, 36”.

6 Clause 3 of Schedule 1

Repeal the clause.