Part 1—Preliminary

1 Name

This is the Banking Regulation 2016.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | 13 December 2016 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Banking Act 1959.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

5 Definitions

Note: A number of expressions used in this instrument are defined in the Act, including the following:

(a) account‑holder;

(b) ADI (authorised deposit‑taking institution);

(c) APRA (Australian Prudential Regulation Authority);

(d) protected account.

In this instrument:

Act means the Banking Act 1959.

farm management deposit has the meaning given by section 393‑20 of the Income Tax Assessment Act 1997.

retirement savings account means an account:

(a) within the meaning of subsection 8(1) of the Retirement Savings Accounts Act 1997; and

(b) that is provided by an ADI.

6 Banking business—purchased payment facilities

For the purposes of subparagraph (b)(ii) of the definition of banking business in subsection 5(1) of the Act, the provision of a purchased payment facility (within the meaning of the Payment Systems (Regulation) Act 1998) is banking business if APRA determines that the facility:

(a) is of a type for which the purchaser of the facility is able to demand payment, in Australian currency, of all, or any part, of the balance of the amount held in the facility that is held by the holder of the stored value (within the meaning of the Payment Systems (Regulation) Act 1998); and

(b) is available, on a wide basis, as a means of payment, having regard to:

(i) any restrictions that limit the number or types of people who may purchase the facility; and

(ii) any restrictions that limit the number or types of people to whom payments may be made using the facility.

Part 2—Financial claims scheme

7 Protected accounts

For the purposes of paragraph 5(4)(a) of the Act, the following kinds of accounts are prescribed:

(a) call accounts;

(b) cash management accounts;

(c) cheque accounts;

(d) current accounts;

(e) debit card accounts;

(f) farm management deposit accounts;

(g) mortgage offset accounts (whether a full or partial offset) that are separate deposit accounts;

(h) pensioner deeming accounts;

(i) personal basic accounts;

(j) retirement savings accounts;

(k) savings accounts;

(l) term deposit accounts;

(m) transactions accounts;

(n) trustee accounts.

8 Accounts that are not protected accounts

For the purposes of subsection 5(7) of the Act, the following accounts are prescribed:

(a) accounts kept at a foreign branch of an ADI;

(b) credit balances on credit card facilities or other loans;

(c) purchased payment facilities (within the meaning of the Payment Systems (Regulation) Act 1998);

(d) pre‑paid card facilities or similar products;

(e) nostro accounts and vostro accounts of foreign corporations that carry on banking business or otherwise provide financial services in a foreign country.

9 Support that is not external support

(1) For the purposes of subsection 11CA(1C) of the Act, a form of support that is entered into in the normal course of business is not to be considered external support for the purposes of subsection 11CA(1B) of the Act.

(2) For the purposes of subsection 13A(1A) of the Act, a form of support that is entered into in the normal course of business is not to be considered external support for the purposes of paragraph 13A(1)(b) of the Act.

(3) For the purposes of subsection 13E(3) of the Act, a form of support that is entered into in the normal course of business is not to be considered external support for the purposes of paragraph 13E(1)(b) of the Act.

10 Clearance period

For the purposes of subsection 16AF(1) of the Act, 5 business days is the prescribed period of clearance.

11 Financial claims scheme—limit on payments

For the purposes of subsection 16AG(1) of the Act, the prescribed limit in relation to a protected account, or protected accounts, that an account‑holder has with a particular declared ADI at a particular time is $250,000.

12 Payment of entitlements to certain kinds of accounts by APRA

For the purposes of subsection 16AH(5) of the Act, the following kinds of protected account are prescribed:

(a) retirement savings accounts;

(b) farm management deposit accounts.

13 Recovery of overpayments

(1) This regulation is made for the purposes of section 16AM of the Act.

(2) If an amount is paid to, or applied for the benefit of, an account‑holder purportedly to meet an entitlement of the account‑holder under Subdivision C of Division 2AA of Part II of the Act and the amount is in excess of the account‑holder’s entitlement (if any) under that Subdivision, the excess amount is a debt due to APRA.

(3) APRA may recover the amount of the debt:

(a) by bringing proceedings for recovery of the debt in a court of competent jurisdiction; or

(b) by withholding the amount of the debt from another payment that would otherwise be paid to the account‑holder under Subdivision C of Division 2AA of Part II of the Act; or

(c) from any distribution payable to the account‑holder under Subdivision E of Division 2AA of Part II of the Act.

(4) Nothing in this regulation is intended to limit the way in which APRA may recover the debt.

(5) APRA may, if it considers it appropriate to do so in the particular circumstances of the case, waive the whole or a part of the debt.

14 Liquidator must admit debt or claim over the limit

For the purposes of subsection 16AQ(2) of the Act, the liquidator must admit as a debt or claim the amount of the debt or claim, in relation to one or more protected accounts held by an account‑holder with a declared ADI, that is in excess of the limit on payments prescribed by section 11 for the purposes of subsection 16AG(1) of the Act.

15 Payment of distributions to certain kinds of accounts by liquidator

For the purposes of subsection 16AR(1) of the Act, the following kinds of protected account are prescribed:

(a) retirement savings accounts;

(b) farm management deposit accounts.

16 Disclosure of information by APRA or liquidator to ADI regarding establishment of account

The following information is prescribed for the purposes of paragraph 16AT(2)(b) of the Act in the circumstances where APRA or a liquidator establishes an account with an ADI under section 16AH or 16AR of the Act:

(a) the name, address and, if the account‑holder is an individual, date of birth of the account‑holder;

(b) the tax file number of the account‑holder;

(c) any information available to APRA or the liquidator that would assist the ADI, as a reporting entity under the Anti‑Money Laundering and Counter‑Terrorism Financing Act 2006, to carry out its obligations under that Act in relation to the new account;

(d) if the account is a retirement savings account—information required in relation to a retirement savings account by or under section 390‑10 in Schedule 1 to the Taxation Administration Act 1953;

(e) if the account is a farm management deposit account—information required by or under Schedule 1 to the Income Tax (Farm Management Deposits) Regulations 1998;

(f) information relating to the status of the account:

(i) obtained by APRA under subsection 16AK(1) of the Act for the purpose of establishing an account under section 16AH of the Act on behalf of the account‑holder; or

(ii) used by the liquidator for the purpose of paying distributions to an account of the same kind held by an account‑holder, or established by the liquidator on behalf of an account‑holder, under section 16AR of the Act.

Part 3—Unclaimed moneys

Division 1—Specified accounts and conditions

17 Scope of Division

For the purposes of subsection 69(1B) of the Act, this Division specifies accounts and conditions relating to those accounts.

Note: Under subsection 69(1B) of the Act, moneys to the credit of an account specified in the regulations are unclaimed moneys if, and only if, the conditions specified in the regulations are satisfied.

However:

(a) section 23 (made for the purposes of subsection 69(1D) of the Act) specifies accounts to which subsection 69(1) of the Act does not apply; and

(b) section 24 (made for the purposes of subsection 69(1E) of the Act) specifies deposits to which subsections 69(1) and (1A) of the Act do not apply.

18 Linked accounts

(1) This subsection specifies an account to which the following apply:

(a) the account is opened or maintained as a condition of holding another account in the same ADI;

(b) the account and the other account are linked in accordance with the terms and conditions of either or both of the accounts.

(2) This subsection specifies the account described in subsection (1) as the other account.

(3) The conditions relating to an account specified by subsection (1) or (2) are that, for at least 7 years:

(a) no deposits have been made into the account and any of the accounts to which it is linked; and

(b) no withdrawals have been made from the account and any of the accounts to which it is linked.

19 Sub accounts

(1) This section specifies an account (a sub account) to which the following apply:

(a) the account is operated or maintained as part of another account (a parent account);

(b) the account is part of the parent account.

(2) The conditions relating to a sub account are that:

(a) no deposits have been made into the sub account for at least 7 years; and

(b) no withdrawals have been made from the sub account for at least 7 years; and

(c) no deposits have been made into the parent account for at least 7 years; and

(d) no withdrawals have been made from the parent account for at least 7 years; and

(e) for each other sub account of the parent account:

(i) no deposits have been made into that sub account for at least 7 years; and

(ii) no withdrawals have been made from that sub account for at least 7 years.

20 Frozen accounts

Accounts frozen by court order

(1) This subsection specifies an account to which the following apply:

(a) deposits into the account and withdrawals from the account have not been allowed by order of a court;

(b) the order no longer prohibits deposits into the account and withdrawals from the account.

(2) The conditions relating to an account specified by subsection (1) are that:

(a) no deposits have been made into the account for at least 7 years after the day the order mentioned in paragraph (1)(a) ceased to prohibit deposits into the account and withdrawals from the account; and

(b) no withdrawals have been made from the account for at least 7 years after the day that order ceased to prohibit deposits into the account and withdrawals from the account.

Accounts frozen by operation of law

(3) This subsection specifies an account to which the following apply:

(a) deposits into the account and withdrawals from the account have not been allowed by the operation of a law;

(b) the law no longer prohibits deposits into the account and withdrawals from the account.

(4) The conditions relating to an account specified by subsection (3) are that:

(a) no deposits have been made into the account for at least 7 years after the day the law mentioned in paragraph (3)(a) ceased to prohibit deposits into the account and withdrawals from the account; and

(b) no withdrawals have been made from the account for at least 7 years after the day that law ceased to prohibit deposits into the account and withdrawals from the account.

21 Security, set‑off or escrow accounts

(1) This section specifies an account to which the following apply:

(a) the account is held:

(i) as security for a loan or another financial obligation; or

(ii) for set‑off or account combination purposes for a loan or another financial obligation; or

(iii) in escrow for a contract;

(b) on that basis, the ability of the holder or holders of the account to make deposits and withdrawals is restricted by:

(i) the ADI; or

(ii) the terms and conditions of the establishment of the account;

(c) the account‑holder has notified the ADI of:

(i) the purpose of the account, as mentioned in subparagraph (a)(i), (ii) or (iii), and the period of the loan, financial obligation or contract covered by the applicable subparagraph; or

(ii) only the purpose of the account, as mentioned in subparagraph (a)(i), (ii) or (iii).

(2) The conditions relating to an account to which subparagraph (1)(c)(i) relates are that:

(a) no deposits have been made into the account for at least 7 years after the loan, financial obligation or contract covered by subparagraph (1)(a)(i), (ii) or (iii) has been discharged; and

(b) no withdrawals have been made from the account for at least 7 years after the loan, financial obligation or contract covered by subparagraph (1)(a)(i), (ii) or (iii) has been discharged.

(3) The conditions relating to an account to which subparagraph (1)(c)(ii) relates are that:

(a) no deposits have been made into the account for at least 7 years; and

(b) no withdrawals have been made from the account for at least 7 years.

22 Controlled accounts

(1) This section specifies an account to which the following apply:

(a) the account is opened and held as a requirement of a law of the Commonwealth, a State or a Territory or a contract;

(b) the ability of a holder of the account to make deposits into the account or withdrawals from the account is restricted by the law of the Commonwealth, a State or a Territory or the contract;

(c) the account‑holder has notified the ADI of:

(i) for an account opened and held as a requirement of a contract—the purpose of the account and the period of the requirement; or

(ii) for an account opened and held as a requirement of a contract—only the purpose of the account; or

(iii) for an account opened and held as a requirement of a law of the Commonwealth, a State or a Territory—the purpose of the account and the period (if any) of the requirement; or

(iv) for an account opened and held as a requirement of a law of the Commonwealth, a State or a Territory—only the purpose of the account.

(2) The conditions relating to a controlled account to which subparagraph (1)(c)(i) or (iii) relates are that:

(a) no withdrawals have been made from the account for at least 7 years after the requirement mentioned in paragraph (1)(a) ceases; and

(b) no deposits have been made into the account for at least 7 years after the requirement mentioned in paragraph (1)(a) ceases.

(3) The conditions relating to a controlled account to which subparagraph (1)(c)(ii) or (iv) relates are that:

(a) no deposits have been made into the account for at least 7 years; and

(b) no withdrawals have been made from the account for at least 7 years.

Division 2—Unclaimed moneys: other matters

23 Accounts to which subsection 69(1) of the Act does not apply

For the purposes of subsection 69(1D) of the Act, if the holder of an account, or an agent of the holder, has notified the ADI, within the previous 7 years, that the holder wishes to treat the account as active, the account is specified.

24 Deposits to which subsection 69(1) of the Act do not apply

For the purposes of subsection 69(1E) of the Act, a term deposit is specified.

25 Annual statement of unclaimed moneys

For the purposes of subsection 69(3) of the Act, the amount prescribed is $500.

26 Interest payable

(1) This section sets out how to work out the interest for the purposes of paragraph 69(7AA)(a) of the Act.

(2) If the unclaimed money is paid to the Commonwealth in more than one payment, the interest is to be worked out separately for each payment.

(3) The interest is to be worked out for the period (the interest period) that:

(a) starts on the day when the unclaimed money was paid to the Commonwealth; and

(b) ends on the 14th day after the Commonwealth last authorised the unclaimed money to be paid under subsection 69(7) of the Act.

(4) The interest is to be worked out by adding together the interest for each financial year during the interest period.

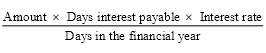

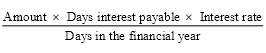

(5) The interest for each financial year is worked out using the following formula, and rounding the result to the nearest cent:

where:

amount means the amount of unclaimed money plus the interest (if any) worked out for each earlier financial year for which interest is payable.

days interest payable means the number of days in the financial year for which interest is payable.

days in the financial year means the number of days in the financial year.

interest rate, for a financial year, means:

(a) the percentage change in the All Groups Consumer Price Index number (the weighted average of the 8 capital cities), published by the Australian Bureau of Statistics, between the 2 March quarters most recently published before the first day of the financial year (rounded up to 4 decimal places); or

(b) if that percentage change is less than 0%—0%.