1 Name

This instrument is the Excise Amendment (Refund Scheme for Alcohol Manufacturers) Regulations 2017.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | 15 July 2017 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Excise Act 1901.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Excise Regulation 2015

1 Section 6

Insert:

alcohol manufacturer means a licensed manufacturer whose manufacturer licence authorises the manufacture of alcoholic beverages.

2 Section 6 (definition of brewery)

Repeal the definition.

3 Section 6 (definition of eligible brewery)

Repeal the definition.

4 Section 11 (table item 6, column headed “Circumstance”)

Omit “item 22”, substitute “item 21 or 22”.

5 Part 7 (heading)

Repeal the heading, substitute:

Part 7—Transitional matters relating to the repeal of the Excise Regulations 1925

6 After Part 7

Insert:

Part 8—Other application and transitional matters

60 Application provision relating to the Excise Amendment (Refund Scheme for Alcohol Manufacturers) Regulations 2017

The amendments made by Schedule 1 to the Excise Amendment (Refund Scheme for Alcohol Manufacturers) Regulations 2017 apply in relation to alcoholic beverages on which excise duty is paid on or after 1 July 2017.

7 Subclause 1(1) of Schedule 1 (table item 21)

Repeal the item, substitute:

21 | Excise duty has been paid during a financial year on an alcoholic beverage that is manufactured by an alcohol manufacturer, and: (a) the duty was paid by the alcohol manufacturer; and (b) in accordance with subclause (6), the alcohol manufacturer is legally and economically independent of any other alcohol manufacturer that has received a refund because of this item in relation to duty paid during the financial year; and (c) the amount of refund paid because of this item to the alcohol manufacturer mentioned in paragraph (a) in relation to duty paid during the financial year does not exceed: (i) if the alcohol manufacturer is an alcohol manufacturer at the start of the financial year—$30,000; or (ii) if the alcohol manufacturer first becomes an alcohol manufacturer after the start of the financial year—an amount worked out under subclause (5); and (d) the alcohol manufacturer fermented or distilled at least 70% by volume of the alcohol content of the alcoholic beverage; and (e) if the alcoholic beverage is obtained from distillation, and the refund is not of duty paid in the first or second financial year in relation to which the alcohol manufacturer could first claim a refund because of this item for any alcoholic beverage: (i) in accordance with subclause (6), the alcohol manufacturer has sole ownership of one or more stills that have a capacity of at least 5 litres; and (ii) at least one of those stills had been installed and was ready to use at the start of the financial year during which the duty mentioned in paragraph (a) was paid; and (iii) at least one of those stills is used by the alcohol manufacturer during the financial year for the purposes of manufacturing any alcoholic beverages. |

8 Subclause 1(5) of Schedule 1

Repeal the subclause, substitute:

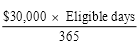

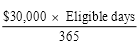

(5) For item 21 of the table in subclause (1), an amount for an alcohol manufacturer is worked out using the formula:

where:

eligible days means the number of days in the period:

(a) starting on the day the alcohol manufacturer first becomes an alcohol manufacturer; and

(b) ending at the end of the relevant financial year.

(6) For item 21 of the table in subclause (1), if the application for the refund of duty is made:

(a) in the financial year after the financial year in which the duty was paid, the circumstance in each of paragraph (b), and subparagraph (e)(i) (if applicable), of that item must exist for the whole financial year in which the duty was paid; or

(b) before the end of the financial year in which the duty was paid:

(i) the circumstance in each of paragraph (b), and subparagraph (e)(i) (if applicable), of that item must exist for the whole period between the day on which the financial year starts and the day on which the application is made; and

(ii) the alcohol manufacturer must have a reasonable expectation that those circumstances will exist for the remainder of the financial year.