1 Name

This instrument is the Ozone Protection and Synthetic Greenhouse Gas Management Legislation Amendment (2017 Measures No. 1) Regulations 2017.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 4 and anything in this instrument not elsewhere covered by this table | The day after this instrument is registered. | 29 July 2017 |

2. Schedule 1 | 1 August 2017. | 1 August 2017 |

3. Schedule 2 | 1 January 2018. | 1 January 2018 |

4. Schedule 3 | 1 January 2020. | 1 January 2020 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under:

(a) the Ozone Protection and Synthetic Greenhouse Gas (Import Levy) Act 1995; and

(b) the Ozone Protection and Synthetic Greenhouse Gas Management Act 1989; and

(c) the Ozone Protection and Synthetic Greenhouse Gas (Manufacture Levy) Act 1995.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments commencing 1 August 2017

Part 1—HFCs

Ozone Protection and Synthetic Greenhouse Gas (Import Levy) Regulations 2004

1 Regulations 3 and 5

Repeal the regulations.

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

2 Regulation 2

Insert:

base period for an HFC quota allocation period has the meaning given by regulation 46.

covers: an SGG licence covers a period if the licence is in force for the whole of the period.

Note: For when a licence is in force, see section 19 of the Act.

first HFC quota allocation period means the HFC quota allocation period mentioned in subregulation 41(2).

Note: The first HFC quota allocation period starts on 1 January 2018.

grandfathered percentage for an HFC quota allocation period has the meaning given by regulation 46.

grandfathered quota means an amount to which a person is entitled under regulation 48, 49 or 50 (as affected by Subdivision 4A.3.5).

HFC quota allocation period has the meaning given by regulation 41.

licensed regulated HCFC activity means a regulated HCFC activity engaged in under a controlled substances licence.

licensed regulated HFC activity means a regulated HFC activity engaged in under an SGG licence.

maximum grandfathered quota has the meaning given by subregulation 58(4).

non‑grandfathered percentage for an HFC quota allocation period has the meaning given by regulation 46.

non‑grandfathered quota means an amount to which a person is entitled under regulation 51.

second HFC quota allocation period means the HFC quota allocation period starting on 1 January 2020.

3 Subregulation 3(1)

Omit “subsection 13(1A)”, substitute “the purposes of subsection 13(3)”.

4 Subregulation 3(2)

Omit “subparagraph 13(6A)(b)(ii)”, substitute “the purposes of paragraph 13(5)(b)”.

5 Subregulation 3(3)

Omit “subparagraph 13(6A)(b)(iii)”, substitute “the purposes of paragraph 13(5)(c)”.

6 Subregulations 3(5) and (6)

Repeal the subregulations, substitute:

Low‑volume thresholds

(5) For the purposes of paragraph 13(6)(a) of the Act, 10 kilograms is prescribed.

(6) For the purposes of paragraph 13(6)(b) of the Act, 25 kilograms is prescribed in relation to each of the following SGGs:

(a) HFC;

(b) PFC;

(c) sulfur hexafluoride.

(7) For the purposes of paragraph 13(6)(c) of the Act, it is a condition, in relation to an importation of SGG equipment by a person at a time in a calendar year, that the total amount of SGG contained in:

(a) SGG equipment in the importation; and

(b) any other SGG equipment the person imported during the calendar year at or before that time;

is not greater than 25 kg.

(8) For the purposes of paragraph 13(6)(c) of the Act, the following conditions are prescribed in relation to an importation of ODS equipment by a person:

(a) there are no more than 5 units of ODS equipment in the importation;

(b) the importation is the first importation of ODS equipment by the person in the 2 years ending on the day the importation occurs.

7 Subparagraph 5(1)(b)(vii)

Omit “schedule”, substitute “scheduled”.

Note: This item fixes a spelling error.

8 After Part 3

Insert:

Part 4A—HFC quotas

Division 4A.1—Preliminary

40 Simplified outline of this Part

HFC quotas are allocated for each of 2 consecutive years at a time. A person is eligible for HFC quotas for the years if the person:

(a) applies for quotas; and

(b) holds an SGG licence for the years.

The quotas allocated for the 2 years are identical.

An HFC quota consists of grandfathered and non‑grandfathered quota. Grandfathered quota is allocated:

(a) for 2018 and 2019—to applicants who engaged in licensed regulated HCFC or HFC activities during 2009 to 2014; and

(b) for 2020 and 2021—to applicants who were allocated HFC quotas for 2018 and 2019; and

(c) for later years—to applicants who were allocated grandfathered quota for earlier years.

The sizes of grandfathered quotas are worked out on the basis of the applicants’ past regulated HCFC and HFC activities and quotas.

Non‑grandfathered quota is allocated in accordance with a legislative instrument made by the Minister.

A holder of grandfathered quota may apply to retire some of the holder’s future entitlement to grandfathered quota. Retirement does not affect the amount of quota to which other licensees are entitled.

41 HFC quota allocation periods

(1) An HFC quota allocation period is 2 years.

(2) The first HFC quota allocation period starts on 1 January 2018.

(3) Each HFC quota allocation period, except the first, starts at the end of the last preceding one.

Division 4A.2—HFC industry limit

42 HFC industry limit

For the purposes of subsection 36A(1) of the Act, the HFC industry limit for a calendar year in an HFC quota allocation period mentioned in an item of the following table is the quantity of HFCs, expressed in CO2e megatonnes, specified in that item.

Base HFC industry limits |

Item | Column 1 HFC quota allocation period starting on 1 January … | Column 2 Quantity of HFCs, expressed in CO2e megatonnes |

1 | 2018 | 8.000 |

2 | 2020 | 7.250 |

3 | 2022 | 6.250 |

4 | 2024 | 5.250 |

5 | 2026 | 4.250 |

6 | 2028 | 3.200 |

7 | 2030 | 2.900 |

8 | 2032 | 2.650 |

9 | 2034 | 2.100 |

10 | in 2036 or a later year | 1.607 |

Division 4A.3—Applications, allocation and size of HFC quotas

Subdivision 4A.3.1—Purpose of this Division

43 Purpose of this Division

For the purposes of subsection 36C(1) of the Act, this Division provides in relation to:

(a) a process for applying for HFC quotas, including who may apply; and

(b) a process for the Minister to allocate HFC quotas for calendar years to SGG licensees; and

(c) a process for the Minister to:

(i) vary the size of HFC quotas; or

(ii) cancel HFC quotas; and

(d) the method for working out the size of HFC quotas.

Subdivision 4A.3.2—Applications and allocation

44 Applying for HFC quotas

(1) A person may apply for HFC quotas for both of the calendar years in an HFC quota allocation period if:

(a) the person holds an SGG licence that covers the period; or

(b) both:

(i) the person has applied for such a licence; and

(ii) the application has not been refused.

Note: The Minister must consider the applications mentioned in paragraph (b) before allocating HFC quotas: see subregulation (4). A person who does not hold an SGG licence that covers an HFC quota allocation period is not entitled to an amount of HFC quota for a year in that period: see Subdivision 4A.3.3.

(2) The application must:

(a) be in the approved form; and

(b) be given to the Minister on or before:

(i) if the HFC quota allocation period is the first HFC quota allocation period—the day determined under subregulation (3); or

(ii) otherwise—31 August in the last year before the start of the HFC quota allocation period; and

(c) specify the calendar years to which the application relates; and

(d) state whether the applicant wishes to be allocated non‑grandfathered quota for the years.

(3) The Minister must, by legislative instrument, determine the day on or before which applications for HFC quotas for the calendar years in the first HFC quota allocation period must be given.

Minister must determine licence applications before allocating quotas

(4) If paragraph (1)(b) applies to any of the applicants for HFC quotas for the years in an HFC quota allocation period because the applicants have applied for SGG licences, the Minister must determine each of those applications under Part III of the Act by:

(a) issuing an SGG licence; or

(b) refusing the application;

before the Minister allocates any HFC quotas for the years.

(5) Subregulation (4) has effect as if a reference in section 17 of the Act to section 66 included a reference to that subregulation.

45 Allocating HFC quotas for HFC quota periods

(1) The Minister must, subject to subregulation 44(4), allocate an HFC quota for each of the calendar years in an HFC quota allocation period to a person if the person is entitled to amounts of grandfathered quota or non‑grandfathered quota for the years.

Note: For when a person is entitled to amounts of grandfathered quota or non‑grandfathered quota, see Subdivision 4A.3.3.

(2) The Minister must determine the size of each HFC quota in accordance with regulation 47.

(3) An HFC quota is allocated by written notice given to the person.

(4) The notice must:

(a) specify the size of the HFC quota; and

(b) specify:

(i) how much of the quota is an amount of grandfathered quota; and

(ii) how much of the quota is an amount of non‑grandfathered quota; and

(c) specify the calendar year for which the quota is allocated.

Subdivision 4A.3.3—Entitlement to, and size of, HFC quotas

46 Definitions

The following table defines the base period, grandfathered percentage and non‑grandfathered percentage for an HFC quota allocation period.

Definitions relating to HFC quota allocation periods |

Item | Column 1 HFC quota allocation period | Column 2 Base period | Column 3 Grandfathered percentage | Column 4 Non‑grandfathered percentage |

1 | the first HFC quota allocation period | the 6 years starting on 1 January 2009 | 90% | 10% |

2 | the second HFC quota allocation period | the 12 months starting on 1 January 2018 | 95% | 5% |

3 | any other HFC quota allocation period | the 2 years starting 3 years before the start of the HFC quota allocation period | 95% | 5% |

47 Size of HFC quotas

The size of an HFC quota allocated to an SGG licensee for a calendar year is the total of any amounts of grandfathered quota and non‑grandfathered quota to which the person is entitled for the year.

48 Grandfathered quota—first HFC quota allocation period

Entitlement

(1) A person is entitled to an amount of grandfathered quota for each of 2018 and 2019 if:

(a) the person applies in accordance with regulation 44 for HFC quotas for the years; and

(b) the person holds an SGG licence that covers the whole of the first HFC quota allocation period; and

(c) the person engaged in a licensed regulated HCFC activity or licensed regulated HFC activity at any time during 2009 to 2014.

Amount

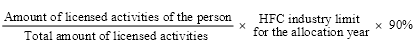

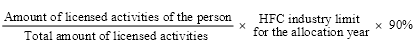

(2) The amount of grandfathered quota to which a person is entitled for 2018 or 2019 (the allocation year) is the amount worked out using the following formula:

where:

amount of licensed activities of a person means the sum of:

(a) 75% of the total quantity (including nil) of HCFCs, expressed in CO2e megatonnes, involved in licensed regulated HCFC activities engaged in by the person during 2009 to 2014; and

(b) the total quantity (including nil) of HFCs, expressed in CO2e megatonnes, involved in licensed regulated HFC activities engaged in by the person during 2009 to 2014.

total amount of licensed activities means the sum of the amounts of licensed activities of each person who is entitled to grandfathered quota for the allocation year.

Importations of HCFCs in excess of HCFC quota disregarded

(3) Subsection (4) applies if:

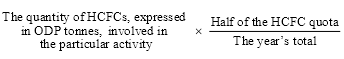

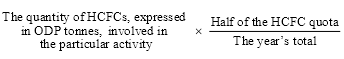

(a) the total quantity (the year’s total) of HCFCs, expressed in ODP tonnes, involved in licenced regulated HCFC activities engaged in by a person during a calendar year in a quota period (within the meaning of section 23A of the Act); exceeds

(b) half of the HCFC quota allocated to the person for the quota period.

(4) For the purposes of paragraph (a) of the definition of amount of licensed activities in subregulation (2), the quantity of HCFCs, expressed in ODP tonnes, involved in a particular licensed regulated HCFC activity engaged in by the person during the year is taken to be the amount worked out using the following formula:

Exports of HFCs disregarded

(5) For the purposes of paragraph (b) of the definition of amount of licensed activities in subregulation (2), any quantities of HFCs exported by a person during 2009 to 2014 are disregarded.

Note: Subsection 36B(2) of the Act reduces the quantity of HFCs that is taken to be involved in regulated HFC activities engaged in by an SGG licensee in a period by the quantity of HFCs exported by the licensee in the period.

49 Grandfathered quota—second HFC quota allocation period

Entitlement

(1) A person is entitled to an amount of grandfathered quota for each of 2020 and 2021 if:

(a) the person applies in accordance with regulation 44 for HFC quotas for the years; and

(b) the person holds an SGG licence that covers the whole of the second HFC quota allocation period; and

(c) HFC quotas were allocated to the person for the calendar years in the first HFC quota allocation period.

Amount

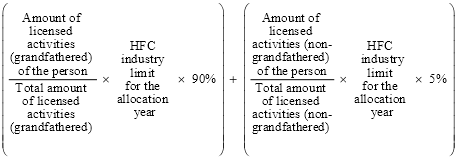

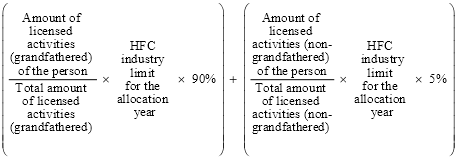

(2) The amount of grandfathered quota to which a person is entitled for 2020 or 2021 (the allocation year) is the amount worked out using the following formula:

where:

amount of licensed activities (grandfathered) of a person means the lesser of:

(a) the total quantity (including nil) of HFCs, expressed in CO2e megatonnes, involved in licensed regulated HFC activities engaged in by the person during 2018; and

(b) the amount (including nil) of grandfathered quota included in the HFC quota allocated to the person for 2018.

amount of licensed activities (non‑grandfathered) of a person means the lesser of:

(a) the total quantity (including nil) of HFCs, expressed in CO2e megatonnes, involved in licensed regulated HFC activities engaged in by the person during 2018, reduced (but not below nil) by the amount of licensed activities (grandfathered) of the person; and

(b) the amount (including nil) of non‑grandfathered quota included in the HFC quota allocated to the person for 2018.

total amount of licensed activities (grandfathered) means the sum of the amounts of licensed activities (grandfathered) of each person who is entitled to grandfathered quota for the allocation year.

total amount of licensed activities (non‑grandfathered) means the sum of the amounts of licensed activities (non‑grandfathered) of each person who is entitled to grandfathered quota for the allocation year.

50 Grandfathered quota—later HFC quota allocation periods

Entitlement

(1) A person is entitled to an amount of grandfathered quota for each of the calendar years in an HFC quota allocation period, other than the first or second HFC quota allocation period, if:

(a) the person applies in accordance with regulation 44 for HFC quotas for the years; and

(b) the person holds an SGG licence that covers the whole of the period; and

(c) HFC quotas were allocated to the person for the calendar years in the previous HFC quota allocation period; and

(d) those quotas included amounts of grandfathered quota.

Amount

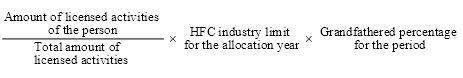

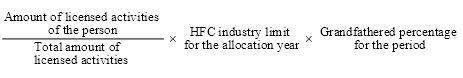

(2) The amount of grandfathered quota to which a person is entitled for a year (the allocation year) in an HFC quota allocation period, other than the first or second HFC quota allocation period, is the amount worked out using the following formula:

where:

amount of licensed activities of a person means the sum of the annual amounts of licenced activities of the person for the calendar years in the base period for the HFC quota allocation period.

annual amount of licenced activities of a person for a calendar year means the lesser of:

(a) the total quantity (including nil) of HFCs, expressed in CO2e megatonnes, involved in licensed regulated HFC activities engaged in by the person during the year; and

(b) the amount of grandfathered quota included in the HFC quota allocated to the person for the year.

total amount of licensed activities means the sum of the amounts of licensed activities of each person who is entitled to grandfathered quota for the allocation year.

51 Non‑grandfathered quota

Entitlement

(1) A person is entitled to an amount of non‑grandfathered quota for each of the calendar years in an HFC quota allocation period if:

(a) the person applies in accordance with regulation 44 for HFC quotas for the years; and

(b) the application states, under paragraph 44(2)(d), that the person wishes to be allocated non‑grandfathered quota for the years; and

(c) the person holds an SGG licence that covers the whole of the period; and

(d) a determination under subregulation (4) of this regulation is in force in relation to the period; and

(e) the person meets the requirements prescribed by the determination in relation to the year.

Amount

(2) The amount of non‑grandfathered quota to which a person is entitled for a calendar year in an HFC quota allocation period is the amount worked out under the determination made under subregulation (4).

(3) The sum of all the amounts of non‑grandfathered quota to which persons are entitled for a calendar year in an HFC quota allocation period must not exceed the amount worked out using the following formula:

Determination

(4) The Minister may, by legislative instrument, determine the following in relation to an HFC quota allocation period:

(a) requirements for a person to be entitled to an amount of non‑grandfathered quota for each of the calendar years in the period;

(b) the amount, or the method for working out the amount, of non‑grandfathered quota to which a person is entitled for each of the years.

(5) In making a determination under subregulation (4), the Minister:

(a) must have regard to Australia’s international obligations, and the policies of the Commonwealth Government, in relation to the manufacture, importation or consumption of scheduled substances; and

(b) may have regard to any other matters he or she thinks relevant.

(6) A determination made under subregulation (4) may provide in relation to review of decisions made under the determination.

52 Business succession

Requests

(1) A person who engaged in a licensed regulated HCFC activity in the base period for the first HFC quota allocation period may request that:

(a) the activity be taken to have been engaged in by another specified person; and

(b) all or part of an HCFC quota allocated to the first person for the quota period (within the meaning of section 23A of the Act) in which the licensed regulated HCFC activity was engaged in be taken to have been:

(i) allocated to the other person; and

(ii) not allocated to the first person.

(2) A person who engaged in a licensed regulated HFC activity in the base period for an HFC quota allocation period may request that:

(a) the activity be taken to have been engaged in by another specified person; and

(b) all or part of an HFC quota allocated to the first person for the calendar year in which the licensed regulated HFC activity was engaged in be taken to have been:

(i) allocated to the other person; and

(ii) not allocated to the first person.

(3) A request under subregulation (1) or (2) must be:

(a) in the approved form; and

(b) given to the Minister before the day on or before which, under paragraph 44(2)(b), applications for HFC quotas for the calendar years in the HFC quota allocation period must be made.

(4) If the Minister receives a request under subregulation (1) or (2) in accordance with subregulation (3), then, for the purposes of applying this Subdivision in allocating HFC quotas for the HFC quota allocation period mentioned in subregulation (1) or (2) (whichever is applicable) and later HFC quota allocation periods:

(a) the activity specified in the request is taken to have been engaged in by the person specified in the request, rather than by the person who makes the request; and

(b) all or part of the HCFC quota or HFC quota specified in the request is taken to have been allocated to the person specified in the request, rather than to the person who makes the request.

Variations and withdrawals

(5) A person who makes a request under subregulation (1) or (2) may vary or withdraw it.

(6) The variation or withdrawal must be:

(a) in the approved form; and

(b) given to the Minister no later than 30 days after the day mentioned in paragraph (3)(b).

Licence requirements

(7) To avoid doubt, for the purposes of this Subdivision, an activity that a person is taken under subregulation (4) to have engaged in at a time is a licensed regulated HCFC activity or licensed regulated HFC activity even if the person did not actually hold at that time a controlled substances licence or SGG licence that allowed the activity.

53 Transfer of HFC quotas

A transfer of an HFC quota under section 36F of the Act does not affect the relative proportions of any amounts of grandfathered quota and non‑grandfathered quota included in the HFC quota.

Subdivision 4A.3.4—Correcting HFC quotas

54 Correcting HFC quotas

Varying size of HFC quotas

(1) If, after an HFC quota is allocated to a person for a calendar year, the Minister becomes satisfied that the size of the quota is incorrect, the Minister must, by written notice given to the person, amend the size of the HFC quota to be the correct amount.

Note: For the correct size of an HFC quota, see regulation 47.

Example: The size of an HFC quota allocated to an SGG licensee for a year could be incorrect because another SGG licensee was incorrectly taken to be, or not to be, entitled to an amount of grandfathered quota or non‑grandfathered quota for the year.

(2) An amendment of an HFC quota under subregulation (1) has effect from the start of the calendar year for which the quota was allocated.

Cancelling HFC quotas

(3) If, after an HFC quota is allocated to a person for a calendar year, the Minister becomes satisfied that the person was not entitled to such a quota, the Minister must, by written notice given to the person, cancel the quota.

Note: For when a person is entitled to an HFC quota, see subregulation 45(1).

(4) An HFC quota cancelled under subregulation (3) is taken never to have been in force and never to have been allocated.

Subdivision 4A.3.5—Retiring HFC quota entitlements

55 Applying to retire quota entitlements

(1) An SGG licensee may apply for the retirement of a specified percentage of the licensee’s entitlement to HFC quotas for calendar years occurring in or after a specified HFC quota allocation period (the retirement period) (other than the first HFC quota allocation period) if:

(a) the licensee has been allocated HFC quotas for the calendar years in the HFC quota allocation period occurring immediately before the retirement period; and

(b) if the retirement period occurs after the second HFC quota allocation period—the quotas mentioned in paragraph (a) include amounts of grandfathered quota.

(2) The application must:

(a) be in writing; and

(b) be given to the Minister no later than 30 June before the start of the retirement period.

56 Consultation before retiring quota entitlements

(1) Before the Minister makes a decision on an application under regulation 55 to retire a percentage of an SGG licensee’s entitlement to HFC quotas for calendar years occurring in or after a specified HFC quota allocation period (the retirement period), the Minister must consult industry and the public about the application.

(2) Without limiting the ways in which the Minister may comply with the obligation in subregulation (1), the Minister is taken to comply with that obligation if the Minister:

(a) on the Department’s website:

(i) makes available the application for the retirement, or a description of the proposed retirement; and

(ii) invites the public to comment on the proposed retirement; and

(b) notifies each SGG licensee (other than the applicant) to whom HFC quotas have been allocated for the calendar years in the HFC quota allocation occurring immediately before the retirement period:

(i) that the application or description is available on the Department’s website; and

(ii) that the SGG licensee is invited to comment on the proposed retirement; and

(c) does not make a decision on the application before the end of the 20 days starting on the day the Minister makes the application or description available under paragraph (a).

(3) A failure to consult as required by subregulation (1) does not invalidate a decision under this Division.

57 Retiring quota entitlements

(1) If an SGG licensee applies under regulation 55 to retire a percentage of the licensee’s entitlement to HFC quotas for calendar years occurring in or after a specified HFC quota allocation period, the Minister must:

(a) by notifiable instrument, retire a specified percentage of the licensee’s entitlement to HFC quotas for those years; or

(b) refuse the application by written notice given to the applicant.

(2) The percentage specified under paragraph (1)(a) must be:

(a) the percentage specified in the application; or

(b) a lesser percentage.

(3) In deciding the application, the Minister:

(a) must have regard to the likely demand for HFC in Australia in those years; and

(b) must have regard to Australia’s international obligations, and the policies of the Commonwealth Government, in relation to the manufacture, importation or consumption of scheduled substances; and

(c) may have regard to any other matters he or she thinks relevant.

58 Retiring quota entitlements—effects

(1) This section applies if, under regulation 57, the Minister retires a percentage (the retirement percentage) of the entitlement of an SGG licensee (the applicant) to HFC quotas for calendar years occurring in or after a particular HFC quota allocation period (the retirement period).

Reduction in applicant’s HFC quotas

(2) The amount of grandfathered quota (if any) to which the applicant is entitled for each of those years is:

(a) if the year occurs in the retirement period—reduced by the retirement percentage; or

(b) if the year occurs after the retirement period—reduced to equal the amount (the reduced maximum) worked out by reducing the maximum grandfathered quota for the year by the retirement percentage (if the amount of grandfathered quota would otherwise exceed the reduced maximum).

Note 1: For the maximum grandfathered quota, see subregulation (4).

Note 2: An amount of grandfathered quota that is reduced under this subregulation is not reallocated to another SGG licensee.

Retirement does not affect entitlements of other SGG licensees

(3) In applying:

(a) the definitions of total amount of licensed activities (grandfathered) and total amount of licensed activities (non‑grandfathered) in subregulation 49(2); and

(b) the definition of total amount of licensed activities in subregulation 50(2);

for the purposes of allocating HFC quotas for calendar years in an HFC quota allocation period (the current period) occurring after the retirement period:

(c) the applicant is taken to have been allocated an HFC quota for each calendar year occurring in or after the retirement period (if the applicant was not actually allocated a quota for the year); and

(d) the applicant is taken to have been entitled to grandfathered quota for each calendar year occurring in or after the retirement period (if the applicant was not actually so entitled); and

(e) for each calendar year (the earlier year) occurring in or after the retirement period and in or before the base period for the current period, both:

(i) the amount of grandfathered quota to which the applicant was entitled for the earlier year; and

(ii) the total quantity of HFCs, expressed in CO2e megatonnes, involved in licensed regulated HFC activities engaged in by the applicant during the earlier year;

are taken to equal the maximum grandfathered quota for the earlier year.

(4) The maximum grandfathered quota for a calendar year (the current year) is the amount of grandfathered quota to which the applicant would be entitled for the current year if:

(a) the applicant were allocated an HFC quota each calendar year occurring in or after the retirement period; and

(b) the applicant were entitled to grandfathered quota for each calendar year occurring in or after the retirement period; and

(c) the amount of the grandfathered quota to which the applicant was entitled for each calendar year occurring in the retirement period were equal to the grandfathered quota to which the applicant would have been entitled for that year apart from paragraph (2)(a); and

(d) for each calendar year (the earlier year) occurring in or after the retirement period and in or before the base period for the current period, both:

(i) the amount of grandfathered quota to which the applicant was entitled for the earlier year (unless the year occurs in the retirement period); and

(ii) the total quantity of HFCs, expressed in CO2e megatonnes, involved in licensed regulated HFC activities engaged in by the applicant during the earlier year;

were equal to the maximum grandfathered quota for the earlier year.

9 Part 5 (notes 1 and 2 to the heading)

Repeal the notes.

10 Paragraphs 73(1)(aa) and (ab)

Omit “paragraph 13(6A)(c)”, substitute “subsection 13(6)”.

11 Paragraph 121(1)(b)

Repeal the paragraph, substitute:

(b) be in the approved form; and

12 Section 200 (definition of approved form)

Repeal the definition.

13 Paragraph 222(1A)(a)

Omit “form approved by the Minister”, substitute “approved form”.

14 Paragraph 313(1)(a)

Omit “a form approved by the Minister”, substitute “an approved form”.

Ozone Protection and Synthetic Greenhouse Gas (Manufacture Levy) Regulations 2004

15 Regulations 3 and 5

Repeal the regulations.

Part 2—References to equipment and products

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

16 Paragraphs 2A(a) and (b)

Omit “or products”.

17 Paragraph 2A(b)

Omit “products or”.

18 At the end of Part 2

Add:

2B Bulk scheduled substances and equipment

For the purposes of subsection 9(6) of the Act, an HCFC or HFC that is in a polyol blend:

(a) is taken to be a bulk scheduled substance; and

(b) is taken not to be contained in equipment; and

(c) is taken not to be used in the operation of equipment.

19 At the end of subregulation 3(1)

Add:

Note 1: Subsection 13(3) of the Act applies to bulk SGGs: see subsection 9(1) of the Act.

Note 2: Medical devices, medicine, veterinary devices and veterinary medicines are not SGG equipment (see regulation 2A) and so are not covered by the Act’s restrictions on importing SGG equipment.

20 Paragraph 3(2)(f)

Omit “products”, substitute “equipment”.

21 Paragraph 3AA(1)(a)

Omit “a product”, substitute “equipment”.

22 Before subparagraph 3AA(2)(a)(i)

Insert:

(ia) the Montreal Protocol; and

23 Paragraphs 3AA(3)(a) and (b)

Repeal the paragraphs, substitute:

(a) states the person intends to use the SGG in the manufacture of equipment; and

(b) explains the process to be used to manufacture the equipment; and

24 Paragraph 3AA(4)(b)

Omit “a product”, substitute “equipment”.

25 Paragraph 3AA(4)(c)

Omit “product”, substitute “equipment”.

26 Part 5 (heading)

Repeal the heading, substitute:

Part 5—Manufacture of equipment using scheduled substances

27 Subregulation 80(2)

Omit “a product”, substitute “equipment”.

Part 3—References to the Navigation Act 1912

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

28 Regulation 110 (definition of AMSA certificate)

Omit “the Marine Orders, Part 3: Seagoing Qualifications, Issue 6, Order No. 8 of 2004 (made by the Australian Maritime Safety Authority under subsection 425(1AA) of the Navigation Act 1912)”, substitute “section 31 of the Navigation Act 2012”.

29 Regulation 110 (definition of AMSA vessel)

Repeal the definition, substitute:

AMSA vessel means a vessel:

(a) to which the Navigation Act 2012 applies; or

(b) that is taken to be a facility under clause 4 of Schedule 3 to the Offshore Petroleum and Greenhouse Gas Storage Act 2006.

Part 4—Delegations

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

30 Subregulations 73(2) and (3) and 123(3) and (4)

Repeal the subregulations.

31 Regulation 246

Repeal the regulation (including the note).

32 Subregulations 315(3) and (4)

Repeal the subregulations.

33 Regulation 913

Repeal the regulation.

34 Before regulation 920

Insert:

916 Delegation by Secretary

(1) The Secretary may, in writing, delegate all or any of his or her functions or powers under these Regulations to:

(a) an SES employee or acting SES employee in the Department; or

(b) an APS employee who holds, or is acting in, an Executive Level 2, or equivalent, position in the Department.

Note: Sections 34AA to 34A of the Acts Interpretation Act 1901 contain provisions relating to delegations.

(2) In performing a delegated function or exercising a delegated power, the delegate must comply with any written directions of the Secretary.

Part 5—Other amendments

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

35 Regulation 110 (definition of temporary licence)

Repeal the definition.

36 Subregulation 130(3)

Omit “, other than a temporary licence,”.

37 Subdivision 6A.2.3 (note to Subdivision heading)

Repeal the note.

38 Subparagraph 326(1)(c)(ii)

Repeal the subparagraph.

39 Subparagraph 326(1)(c)(iii)

Omit “otherwise”.

40 Subparagraph 343(a)(iii)

Repeal the subparagraph.

Part 6—Transitional provisions

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

41 In the appropriate position in Part 10

Insert:

Division 2—Amendments made by the Ozone Protection and Synthetic Greenhouse Gas Management Legislation Amendment (2017 Measures No. 1) Regulations 2017

956 Application of amendments made by item 6 of Schedule 1

The amendments made by item 6 of Schedule 1 to the Ozone Protection and Synthetic Greenhouse Gas Management Legislation Amendment (2017 Measures No. 1) Regulations 2017 apply in relation to importing ODS equipment or SGG equipment on or after the commencement of this regulation.

957 Transitional provision—approved forms

For the purposes of these Regulations, if:

(a) the Minister approved a form under a provision of these Regulations; and

(b) the approval was in force immediately before the commencement of this regulation;

the approval has effect from that commencement as if it had been made under section 66A of the Act, as amended by Schedule 1 to the Ozone Protection and Synthetic Greenhouse Gas Management Legislation Amendment Act 2017, for the purposes of the provision mentioned in paragraph (a) of this regulation.

958 Transitional provision—delegations

(1) A delegation:

(a) made under subregulation 913(1); and

(b) in force immediately before the commencement of this regulation;

has effect, from that commencement, as if it had been made under subregulation 916(1) as inserted by Schedule 1 to the Ozone Protection and Synthetic Greenhouse Gas Management Legislation Amendment (2017 Measures No. 1) Regulations 2017.

(2) A direction:

(a) given under subregulation 913(2); and

(b) in force immediately before the commencement of this regulation;

has effect, from that commencement, as if it had been made under subregulation 916(2) as inserted by Schedule 1 to the Ozone Protection and Synthetic Greenhouse Gas Management Legislation Amendment (2017 Measures No. 1) Regulations 2017.

Schedule 2—Amendments commencing 1 January 2018

Part 1—Licences

Division 1—Renewing licences

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

1 After regulation 3C

Insert:

3D Application fee for renewing licence

For the purposes of paragraph 19AA(3)(b) of the Act:

(a) the application fee for a renewal of a licence of a particular type is the same as the application fee for a licence of that type under subregulation 3C(1); and

(b) the Minister may waive the application fee for a renewal of a licence of a particular type in the circumstances in which the Minister could waive the application fee for a licence of that type under subregulation 3C(2), (3) or (4).

2 At the end of regulation 6A

Add:

; (d) a decision under paragraph 3D(b) to refuse to waive the fee for a renewal of a licence.

3 After paragraph 44(1)(b)

Insert:

; or (c) all of the following subparagraphs apply:

(i) the person has applied for the renewal of an SGG licence;

(ii) the application has not been refused;

(iii) if the licence is renewed, the licence will cover the whole of the period.

4 Subregulation 44(1) (note)

Omit “paragraph (b)”, substitute “paragraphs (b) and (c)”.

5 Subregulation 44(4)

After “paragraph (1)(b)”, insert “or (c)”.

6 Subregulation 44(4)

After “for SGG licences”, insert “or for the renewal of SGG licences”.

7 Paragraph 44(4)(a)

After “issuing”, insert “or renewing”.

8 Subregulation 44(5)

After “section 17”, insert “or 19AD”.

Division 2—Equipment licences

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

9 Paragraph 3C(1)(d)

Omit “ODS/SGG”.

10 Before regulation 4

Insert:

3E Circumstances in which Minister may grant equipment licences that allow Schedule 4 activities or section 69G activities

For the purposes of paragraph 16(6A)(a)(ii) of the Act, the following Schedule 4 activities are prescribed:

(a) importing HCFC pre‑charged air conditioning equipment, if the importation of the equipment satisfies the conditions mentioned in subsection 13(6) of the Act;

(b) importing HCFC pre‑charged refrigeration equipment, if the importation of the equipment satisfies the conditions mentioned in subsection 13(6) of the Act.

11 Paragraphs 73(1)(aa) and (ab)

Repeal the paragraphs.

12 Division 5.2

Repeal the Division.

Division 3—Unlicensed manufacture or import of HFCs

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

13 Subparagraph 3(1)(a)(ii)

After “veterinary medicine”, insert “, and the SGG is not an HFC”.

Part 2—Levy periods, thresholds and penalty interest

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

14 Regulation 2

Insert:

quarter means a period of 3 months commencing on 1 January, 1 April, 1 July or 1 October.

scheduled kind of a scheduled substance has the meaning given by subregulation 900(4).

15 Regulation 900 (heading)

Repeal the heading, substitute:

900 Periodic reports by manufacturers, importers, exporters and destroyers of scheduled substances and equipment

16 Subregulation 900(3)

Repeal the subregulation, substitute:

(3) The report must state the following:

(a) the name and address of the person;

(b) the combination of numbers, letters or symbols used to provide a unique identifier for the licence (if any) granted to the person under section 16 of the Act;

(c) the reporting period to which the report relates;

(d) the information required by the following table.

Information to be included in report |

Item | Column 1 If the following provision of the Act applies to the report (taking into account the exceptions in that provision) … | Column 2 the report must include the following information … |

1 | item 1 or 2 of the table in subsection 46(1) of the Act (manufacturing, importing, exporting or destroying a scheduled substance, including an SGG) | (a) each scheduled kind of scheduled substance that the person manufactured, imported, exported or destroyed during the reporting period; (b) for each of those scheduled kinds of scheduled substances—the total amount, in metric tonnes, of scheduled substance that the person manufactured, imported, exported or destroyed during the reporting period. |

2 | item 3 of the table in subsection 46(1) of the Act (importing ODS equipment or SGG equipment) | (a) the categories of ODS equipment or SGG equipment mentioned in subregulation (5) that the person imported during the reporting period; (b) for each of those categories of equipment—the total number of units of the equipment that the person imported during the reporting period; (c) for each of those categories of equipment—the total amount, in metric tonnes, of each scheduled kind of the following scheduled substances contained in the equipment in that category that the person imported during the reporting period: (i) HCFC; (ii) HFC; (iii) nitrogen trifluoride; (iv) PFC; (v) sulfur hexafluoride. |

3 | item 4 of the table in subsection 46(1) of the Act (a Schedule 4 activity or a section 69G activity) | (a) the categories of equipment mentioned in subregulation (5) or (6) manufactured or imported as part of the Schedule 4 activities and section 69G activities that the person engaged in during the reporting period; (b) the scheduled kinds of scheduled substances contained in that equipment; (c) for each of those scheduled kinds of scheduled substances—the total amount, in metric tonnes, of scheduled substance contained in that equipment. |

(4) A scheduled kind of a scheduled substance is a kind of the scheduled substance specified by an item of the relevant table in Schedule 1 to the Act.

(5) For the purposes of column 2 of items 2 and 3 of the table in subregulation (3), the categories of ODS equipment or SGG equipment are as follows:

(a) commercial use air‑conditioning excluding heat pumps;

(b) domestic use air‑conditioning excluding heat pumps;

(c) motor vehicle, watercraft or aircraft air‑conditioning;

(d) commercial or domestic use heat pumps;

(e) commercial use refrigeration;

(f) domestic use refrigeration;

(g) motor vehicle, watercraft or aircraft refrigeration;

(h) expanding polyurethane foam aerosols;

(i) food, household and personal use aerosols;

(j) industrial, safety or technical use aerosols excluding fire protection equipment mentioned in paragraph (q) or (r);

(k) metered dose inhalers;

(l) novelty use aerosols or any other aerosol not mentioned in paragraphs (h) to (k);

(m) consumer goods not mentioned in paragraphs (h) to (l);

(n) electrical switchgear;

(o) components and parts that contain ODS equipment or SGG equipment;

(p) medical, scientific, or electrical equipment not mentioned in any other paragraph;

(q) fixed systems and components for fire protection not mentioned in any other paragraph;

(r) portable extinguishers for fire protection not mentioned in any other paragraph.

(6) For the purposes of column 2 of item 3 of the table in subregulation (3), the categories of equipment are as follows:

(a) dry cleaning machinery;

(b) automotive air‑conditioning maintenance kits;

(c) extruded polystyrene packaging and insulation;

(d) aerosol equipment;

(e) equipment containing halon;

(f) rigid polyurethane foam equipment;

(g) moulded flexible polyurethane foam;

(h) disposable containers of CFCs;

(i) refrigeration and air‑conditioning equipment containing CFCs;

(j) refrigeration and air‑conditioning equipment containing HCFCs.

(7) The report may also include the following information:

(a) both:

(i) the kinds of SGGs that the person manufactured or imported during the reporting period under a permit granted to the person under regulation 3A; and

(ii) for each of those kinds of SGGs—the total amount, in metric tonnes, of SGGs of that kind that the person manufactured or imported during the reporting period under the permit;

(b) both:

(i) the kinds of SGGs that the person manufactured or imported during the reporting period in accordance with regulation 3AA; and

(ii) for each of those kinds of SGGs—the total amount, in metric tonnes, of SGGs of that kind that the person manufactured or imported during the reporting period in accordance with that regulation.

17 Regulations 900A to 902

Repeal the regulations.

18 After regulation 916

Insert:

918 Licence levy threshold

For the purposes of subsection 69(3) of the Act, $330 is prescribed.

Part 3—Synthetic greenhouse gases

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

19 After paragraph 3(6)(a)

Insert:

(aa) nitrogen trifluoride;

Schedule 3—Amendments commencing 1 January 2020

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

1 Regulation 2

Insert:

replacement part does not include a complete, or substantially complete, indoor or outdoor unit of a split system air conditioning unit.

2 Subregulations 3(5) and (8)

Repeal the subregulations.

3 At the end of regulation 3E

Add:

; (c) importing replacement parts for existing HCFC refrigeration or air conditioning equipment;

(d) importing equipment insulated with foam manufactured with HCFC;

(e) importing equipment for which the Minister considers it would be impracticable:

(i) for the importer or licence holder to comply with the ban in paragraph 13(1)(c) of the Act; and

(ii) to remove or retrofit the equipment because it is incidental to the main import.

Example: For subparagraph (e)(ii), air conditioning equipment incorporated into a large boat or drilling rig.

4 Part 5

Repeal the Part.

5 Subregulation 900(3) (table item 2, columns 1 and 2)

Omit “ODS equipment or”.

6 Subregulation 900(3) (table item 2, subparagraph (c)(i) of column 2)

Repeal the subparagraph.

7 Subregulation 900(5)

Omit “ODS equipment or” (wherever occurring).