Part 1—Preliminary

1 Name

This instrument is the Taxation Administration Regulations 2017.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | 1 October 2017. | 1 October 2017 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Taxation Administration Act 1953.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable item in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

5 Definitions

In this instrument:

Act means the Taxation Administration Act 1953.

double tax agreement means an agreement within the meaning of the International Tax Agreements Act 1953.

double tax country has the meaning given by section 43.

effective, in relation to an address, has the meaning given by subsection 15(3).

electronic communication has the same meaning as in the Electronic Transactions Act 1999.

foreign resident has the meaning given by subsection 995‑1(1) of the Income Tax Assessment Act 1997.

indirect tax zone has the same meaning as in the A New Tax System (Goods and Services Tax) Act 1999.

international agreement has the meaning given by subsection 58(3).

other party, to a double tax agreement or international tax sharing treaty, has the meaning given by section 45.

preferred address for service has the meaning given by subsection 15(1).

tax‑related liability has the meaning given by section 255‑1 in Schedule 1 to the Act.

tax sharing country has the meaning given by section 44.

top rate means the sum of:

(a) the highest rate specified in the table in Part I of Schedule 7 to the Income Tax Rates Act 1986; and

(b) the rate of levy specified in subsection 6(1) of the Medicare Levy Act 1986.

Part 2—General administration (not relating to Schedule 1 to the Act)

Division 1—Preliminary

6 Interpretation

To avoid doubt, paragraph 13(1)(b) of the Legislation Act 2003 has effect in relation to this Part.

Note: The effect of paragraph 13(1)(b) of the Legislation Act 2003 is that expressions have the same meaning in this Part as in the Act (except Schedule 1) as in force from time to time.

Division 2—Prosecutions and offences

7 Certificates—failure to comply with requirements of taxation laws

(1) In a prosecution of a person for an offence against subsection 8C(1), 8D(1) or 8D(2) of the Act in relation to the refusal or failure of the person to comply with a requirement made under or pursuant to a taxation law, a certificate in writing signed by the Commissioner, a Second Commissioner or a Deputy Commissioner certifying that the person, in the circumstances stated in the certificate, refused or failed, as the case may be, to do a matter or thing mentioned in subsection 8C(1), 8D(1) or 8D(2) is prima facie evidence of the facts stated in the certificate.

(2) In any proceedings, a document purporting to be a certificate given in accordance with this section and signed by a person authorised to sign the certificate is, unless the contrary is proved, taken to be such a certificate and to have been duly given.

8 Compliance with taxation law requirements—manner of serving orders

For the purposes of subsection 8G(2) of the Act, a copy of an order under subsection 8G(1) of the Act is served in the prescribed manner on the person to whom the order is addressed if the copy:

(a) where the person is a natural person:

(i) is delivered to the person personally; or

(ii) is left at, or sent by pre‑paid post to, the address of the place of residence or business of the person last known to the person causing the copy to be served; or

(b) where the person is a body corporate—is left at, or sent by pre‑paid post to, the head office, a registered office or a principal office of the body corporate.

9 Enforcement of orders for payment of amounts to Commissioner

(1) A certificate issued under subsection 8ZG(2) of the Act in relation to an order of a court for the payment of an amount to the Commissioner must be in accordance with Form 1 in Schedule 1, and must contain the following particulars:

(a) the name and location of the court;

(b) the date on which the order was made;

(c) the provision of the taxation law under which the order was made;

(d) the amount to be paid to the Commissioner;

(e) the name and address of the person ordered to pay the amount.

(2) For the purposes of subsection 8ZG(3) of the Act:

(a) a certificate issued under subsection 8ZG(2) of the Act is to be registered in a court by the proper officer of the court entering the particulars of the certificate in a book kept by the court for that purpose; and

(b) if the order to which a certificate referred to in paragraph (a) relates was made more than 12 months before the day on which the registration of the certificate is sought, the registration of the certificate in a court is subject to the condition that leave to register the certificate has first been obtained from the court.

10 Prosecution of prescribed taxation offences—election to have cases tried in Supreme Court

For the purpose of subsection 8ZJ(5) of the Act, a person prosecuted for a prescribed taxation offence may elect to have the case tried in the Supreme Court of the State or Territory in which the prosecution was instituted by serving on the person who instituted the prosecution, and filing in the court in which the prosecution was instituted, a notice in accordance with Form 2 in Schedule 1.

Division 3—Departure from Australia

11 Departure prohibition orders

(1) For the purposes of subsection 14S(1) of the Act, Form 3 in Schedule 1 is prescribed.

(2) For the purposes of paragraph 14S(4)(a) of the Act, a person is informed, as prescribed, of the making of a departure prohibition order if a copy of the order is served in accordance with section 14.

(3) For the purposes of subparagraph 14S(4)(b)(ii) of the Act, each of the following persons is prescribed:

(a) the Comptroller‑General of Customs (within the meaning of the Customs Act 1901);

(b) the Commissioner of Police referred to in section 6 of the Australian Federal Police Act 1979;

(c) the Secretary of the Department administered by the Minister administering the Diplomatic Privileges and Immunities Act 1967.

12 Revocation and variation of departure prohibition orders

(1) For the purposes of paragraph 14T(4)(a) of the Act, notification of the revocation or variation of a departure prohibition order is served, as prescribed, on a person if a document containing the particulars of the revocation or variation is served in accordance with section 14.

(2) For the purposes of subsection 14T(5) of the Act, notification of a decision referred to in that subsection is served, as prescribed, on a person if a document containing the particulars of the decision is served in accordance with section 14.

13 Departure authorisation certificates

(1) For the purposes of subsection 14U(3) of the Act, a copy of a departure authorisation certificate is served, as prescribed, on a person if the copy is served in accordance with section 14.

(2) For the purposes of subsection 14U(4) of the Act, notification of a decision referred to in that subsection is served, as prescribed, on a person if a document containing particulars of the decision is served in accordance with section 14.

Division 4—Service of documents

14 Service of documents

(1) The Commissioner may serve a document on a person for the purposes of the taxation laws by:

(a) if the person has given a preferred address for service that is a physical address—leaving a copy of the document at that address; or

(b) if the person has given a preferred address for service that is a postal address—posting a copy of the document to that address; or

(c) if the person has given a preferred address for service that is an electronic address:

(i) sending an electronic copy of the document to that address; or

(ii) sending an electronic communication to that address that notifies the person that a copy of the document is available to be retrieved by electronic means.

(2) This section does not affect the operation of any other law of the Commonwealth, or any law of a State or Territory, that deals with the service of documents.

Note: For an example of another law that deals with the service of documents, see sections 28A and 29 of the Acts Interpretation Act 1901.

15 Preferred address for service

(1) An address in Australia used by or associated with a person is a preferred address for service of the person if:

(a) it is of one of the following kinds of address:

(i) a physical address;

(ii) a postal address;

(iii) an electronic address; and

Note 1: An address may be both a physical address and a postal address (for example a street address).

Note 2: The following are examples of an electronic address:

(a) an email address;

(b) a secure website that the person can access to obtain a document.

(b) the person has given it to the Commissioner as an address for the service of documents by the Commissioner under a taxation law; and

(c) the designation of the address or other circumstances indicate that the person wishes the address to be used by the Commissioner in preference to other addresses of the person, whether generally or in specific circumstances.

(2) The designation of an address in a form or correspondence as an ‘address for service’, a ‘preferred address’, an ‘address for correspondence’ or similar term satisfies paragraph (1)(c).

(3) An address is effective if the person to whom the address relates:

(a) will receive documents delivered to the address; or

(b) will receive electronic communications sent to the address.

16 Requirement to maintain a preferred address for service

If a person is required to give the Commissioner a preferred address for service for a purpose (for example, by the approved form for a return), the person must subsequently maintain a preferred address for service for the purpose.

17 Change or withdrawal of preferred address for service

(1) A person may change or withdraw a preferred address for service only by giving the Commissioner notice in the approved form.

(2) If the person is required to maintain a preferred address for service under a taxation law, the person may withdraw a preferred address for service only if another effective preferred address for service that is a postal address remains.

(3) If the person is required to maintain a preferred address for service under a taxation law, and a preferred address for service becomes ineffective, the person must change or withdraw the ineffective address within 28 days.

18 Substitute preferred address for service

(1) This section applies if:

(a) a person has not given the Commissioner a preferred address for service; or

(b) the Commissioner is satisfied that none of a person’s preferred addresses for service is effective.

(2) If the Commissioner has a record of another address relating to the person (whether or not a physical address), and it appears to the Commissioner that it is likely that the address is effective, the Commissioner may treat that address as the person’s preferred address for service for all purposes under the taxation laws.

19 Failure to notify change of address

A person whose preferred address for service is no longer effective, and who has not changed or withdrawn the address under section 17, may not plead the fact that the address was not effective as a defence in any proceedings (whether civil or criminal) instituted against the person under a taxation law.

Division 5—Miscellaneous

20 Payments out of Consolidated Revenue Fund—prescribed provisions

For the purposes of sub‑subparagraph 16(2)(a)(i)(B) of the Act, subsection 353‑10(3) in Schedule 1 to the Act is prescribed.

21 Payment of tax‑related liabilities

(1) A person who pays a tax‑related liability must pay the liability in Australian currency.

(2) The person must pay the tax‑related liability using a method approved by the Commissioner and in accordance with any instructions provided by the Commissioner.

(3) The person must pay the amount of the tax‑related liability in a single payment unless the Commissioner agrees that the person may make more than one payment.

22 When receipts are to be given

The Commissioner is not required to give a receipt to a person who pays a tax‑related liability unless the person asks for the receipt.

23 Payment of postage on mail to Commissioner

(1) The full amount of postage on an item addressed to the Commissioner in relation to a matter must be paid by the sender before the letter is sent.

(2) If:

(a) the Commissioner contributes to the cost of postage of an unstamped, or insufficiently stamped, item; and

(b) the Commissioner receives a payment in relation to a tax‑related liability;

the Commissioner may deduct the amount of the contribution from the payment.

(3) The amount of the payment remaining after deduction of the Commissioner’s contribution is to be credited towards payment of the tax‑related liability.

24 Presumption as to signatures

(1) A document bearing the name (however produced) of a person who is, or was at any time, the Commissioner, a Second Commissioner, a Deputy Commissioner or a delegate of the Commissioner in the place of the person’s signature is taken to have been duly signed by the person, unless it is proved that the document was issued without authority.

(2) A document given under a taxation law that purports to be signed by the authority of the Commissioner is as effective for all purposes under the taxation laws as if it had been signed personally by the Commissioner.

(3) Any notice that, under a taxation law, is to be given to an entity by the Commissioner may be given to the entity by an officer who is authorised by the Commissioner to do so.

Part 3—Income tax (Chapter 2 in Schedule 1 to the Act)

Division 1—Preliminary

25 Interpretation

Paragraph 13(1)(b) of the Legislation Act 2003 has effect in relation to this Part as if the reference in that paragraph to the enabling legislation was a reference to Schedule 1 to the Act.

Note 1: The effect of modifying paragraph 13(1)(b) of the Legislation Act 2003 is that expressions have the same meaning in this Part as in Schedule 1 to the Act as in force from time to time.

Note 2: Under section 3AA of the Act, an expression has the same meaning in Schedule 1 as in the Income Tax Assessment Act 1997.

26 Rounding amounts for PAYG withholding

(1) This section applies to:

(a) the amount of a payment that is to be dealt with under a provision of Division 2 or 3 of this Part; and

(b) an amount that has been worked out under a provision of Division 2 or 3 of this Part.

(2) If the amount is less than $1, disregard the amount.

(3) If the amount is more than $1 and includes a number of cents that is less than a whole dollar, disregard the number of cents by which the amount exceeds the whole dollar.

Division 2—Pay as you go (PAYG) withholding—Payments from which amounts must be withheld

Subdivision A—Payments for work or services

27 Payment under labour hire arrangement, or specified by regulations

For the purposes of subsection 12‑60(2) in Schedule 1 to the Act, payments of the following kinds are prescribed:

(a) payments for tutorial services that are provided to improve the education of Indigenous people and are financially supported (directly or indirectly) by the Commonwealth;

(b) payments for translation and interpretation services provided for the Translating and Interpreting Service (also known as TIS) conducted by the Department administered by the Minister administering the Migration Act 1958;

(c) payments under a contract to an individual engaged as a performing artist to perform in an activity in which the individual:

(i) endorses or promotes goods or services; or

(ii) appears or participates in an advertisement;

unless the individual is engaged primarily because he or she is a sportsperson;

(d) payments of green army allowance (within the meaning of the Social Security Act 1991).

Subdivision B—Payments where TFN not quoted

28 Thresholds for withholding on investment payments

(1) This section is made for the purposes of section 12‑170 in Schedule 1 to the Act.

Investments other than public company shares, investors aged under 16

(2) An amount is not required to be withheld from a payment under section 12‑140 or 12‑145 in Schedule 1 to the Act if:

(a) the payment is not a payment in relation to an investment mentioned in item 6 (shares in a public company) of the table in subsection 202D(1) of the Income Tax Assessment Act 1936; and

(b) the payment is to be made to an investor:

(i) who had not turned 16 on the 1 January before the date on which the payment was made; and

(ii) about whose age the investment body is aware; and

(c) the amount of the payment is less than:

(i) in the case of a payment in respect of the whole of a financial year—$420; and

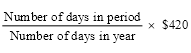

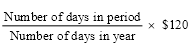

(ii) in any other case—an amount worked out using the formula:

where:

number of days in period is the number of days in the period in the financial year in respect of which the amount is payable.

number of days in year is the number of days in the financial year.

Interest‑bearing investments

(3) An amount is not required to be withheld from a payment under section 12‑140 or 12‑145 in Schedule 1 to the Act if:

(a) the payment is not a payment to which subsection (2) applies; and

(b) the payment is in respect of an investment of a kind mentioned in item 1 or 2 of the table in subsection 202D(1) of the Income Tax Assessment Act 1936; and

(c) the amount of the payment is less than:

(i) in the case of a payment in respect of the whole of a financial year—$120; and

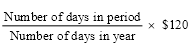

(ii) in any other case—the amount worked out using the formula:

where:

number of days in period is the number of days in the period in the financial year in respect of which the amount is payable.

number of days in year is the number of days in the financial year.

29 Distributions of income of closely held trusts—prescribed trusts

(1) For the purposes of subparagraph 12‑175(1)(c)(iii) in Schedule 1 to the Act, the following trusts are prescribed:

(a) a discretionary mutual fund (within the meaning of subsections 5(5) and (6) of the Financial Sector (Collection of Data) Act 2001);

(b) a trust that is a fund that provides professional indemnity insurance or insurance‑like cover to a legal practitioner, including a fund established under legislation or by a State or Territory law society to provide professional indemnity cover to its members;

(c) an employee share trust for an employee share scheme;

(d) a trust covered by subsection (2).

Law practice trusts

(2) This subsection covers a trust that is:

(a) created and maintained for the purposes of, or in connection with:

(i) the provision of legal services by a duly qualified legal practitioner; or

(ii) the deposit of money of a kind described in column 1 of item 4 of the table in subsection 202D(1) of the Income Tax Assessment Act 1936; and

(b) regulated by a State or Territory law for the regulation of legal practices or legal services.

30 Threshold for withholding on net income of closely held trusts

(1) This section is made for the purposes of section 12‑185 in Schedule 1 to the Act.

(2) An amount is not required to be withheld under section 12‑175 or 12‑180 in Schedule 1 to the Act from a payment (including a payment mentioned in subsection 12‑180(3)) if the payment is less than:

(a) if the payment is for the whole of a financial year—$120; or

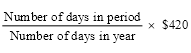

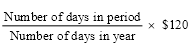

(b) if the payment is for part of a financial year—the amount worked out using the formula:

where:

number of days in period is the number of days in the period in the financial year in respect of which the amount is payable.

number of days in year is the number of days in the financial year.

Subdivision C—Payments to foreign residents

31 Kinds of payments—gaming junkets

(1) For the purposes of paragraph 12‑315(1)(b) in Schedule 1 to the Act, a payment for operating or promoting an arrangement covered by subsection (2) is prescribed.

Note: For the amount to be withheld from the payment, see section 49.

Gaming junkets

(2) This subsection covers an arrangement for the promotion or organising of gaming in one or more casinos, whether or not any of the casinos is required by an agreement to make a payment, by which:

(a) an individual or a group of people comes to Australia for the purpose of gaming at particular casinos; and

(b) the entity receives payment, from one or more of the casinos, that is:

(i) a reward made in relation to arranging for the individual or the people to go to a casino for gaming; or

(ii) a commission based on the gaming or losses of the individual or group of people.

(3) For the purposes of subsection (2), gaming means playing a game of chance or a game that is partly a game of chance and partly a game of skill.

32 Kinds of payments—entertainment or sports activities

(1) For the purposes of paragraph 12‑315(1)(b) in Schedule 1 to the Act, a payment to an entity for entertainment or sports activities is prescribed.

Examples: Appearance fees, award for player of the series, bonuses, endorsement fees, expense reimbursements, match payments, non‑cash prizes, performance fees, preparation fees, prize money, promotional fees, sponsorship.

Note: For the amount to be withheld from the payment, see section 50.

(2) For the purposes of subsection (1), the activities may include giving a speech or a sports commentary.

Entertainment or sports activities

(3) For the purposes of subsection (1), entertainment or sports activities means the activities of:

(a) a performing artist or a sportsperson; or

(b) support staff relating to the activity.

33 Kinds of payments—construction and related activities

(1) For the purposes of paragraph 12‑315(1)(b) in Schedule 1 to the Act, a payment made under a contract entered into after 30 June 2004 (including payments to subcontractors) for works or related activities is prescribed.

Note: For the amount to be withheld from the payment, see section 51.

Works

(2) For the purposes of subsection (1), works includes the construction, installation and upgrade of buildings, plant and fixtures.

Examples: Dam, electricity links, mine site development, natural gas field development, natural resource infrastructure, oilfield development, pipeline, power generation infrastructure, railway or road, residential building, resort development, retail or commercial development, upgrading airport, upgrading telecommunications equipment, water treatment plant.

Related activities

(3) For the purposes of subsection (1), related activities includes activities associated with the construction, installation and upgrading of buildings, plant and fixtures.

Examples: Administration, assembly, de‑commissioning plant, design, commissioning and operation of facilities, costing, engineering, erection, fabrication, hook‑up, installation, project management, site management, supervision and provision of personnel, supply of plant and equipment, warranty repairs.

Subdivision D—Distributions of withholding MIT income

34 Information exchange countries

(1) For the purposes of subsection 12‑385(4) in Schedule 1 to the Act, a country mentioned in an item of the table in subsection (2) is specified as an information exchange country with effect from the date specified in the item.

(2) A reference to a country in the table is a reference to the country to the extent to which it is described in an agreement mentioned in:

(a) the definition of agreement in subsection 3(1) of the International Tax Agreements Act 1953; or

(b) the definition of international agreement in subsection 23(4) of the International Tax Agreements Act 1953.

Information exchange countries |

Item | Country | Date of effect |

1 | Argentina | 1 July 2008 |

2 | Bermuda | 1 July 2008 |

3 | Canada | 1 July 2008 |

4 | China | 1 July 2008 |

5 | Czech Republic | 1 July 2008 |

6 | Denmark | 1 July 2008 |

7 | Fiji | 1 July 2008 |

8 | Finland | 1 July 2008 |

9 | France | 1 July 2008 |

10 | Germany | 1 July 2008 |

11 | Hungary | 1 July 2008 |

12 | India | 1 July 2008 |

13 | Indonesia | 1 July 2008 |

14 | Ireland | 1 July 2008 |

15 | Italy | 1 July 2008 |

16 | Japan | 1 July 2008 |

17 | Kiribati | 1 July 2008 |

18 | Malta | 1 July 2008 |

19 | Mexico | 1 July 2008 |

20 | Netherlands | 1 July 2008 |

21 | Netherlands Antilles | 1 July 2008 |

22 | New Zealand | 1 July 2008 |

23 | Norway | 1 July 2008 |

24 | Papua New Guinea | 1 July 2008 |

25 | Poland | 1 July 2008 |

26 | Romania | 1 July 2008 |

27 | Russia | 1 July 2008 |

28 | Slovakia | 1 July 2008 |

29 | South Africa | 1 July 2008 |

30 | Spain | 1 July 2008 |

31 | Sri Lanka | 1 July 2008 |

32 | Sweden | 1 July 2008 |

33 | Taipei | 1 July 2008 |

34 | Thailand | 1 July 2008 |

35 | United Kingdom | 1 July 2008 |

36 | United States of America | 1 July 2008 |

37 | Vietnam | 1 July 2008 |

| | |

38 | Antigua and Barbuda | 1 July 2010 |

39 | British Virgin Islands | 1 July 2010 |

40 | Isle of Man | 1 July 2010 |

41 | Jersey | 1 July 2010 |

| | |

42 | Gibraltar | 1 January 2011 |

43 | Guernsey | 1 January 2011 |

| | |

44 | Belize | 1 July 2011 |

45 | Cayman Islands | 1 July 2011 |

46 | The Commonwealth of the Bahamas | 1 July 2011 |

47 | Principality of Monaco | 1 July 2011 |

48 | The Republic of San Marino | 1 July 2011 |

49 | The Republic of Singapore | 1 July 2011 |

50 | Saint Kitts and Nevis | 1 July 2011 |

51 | Saint Vincent and the Grenadines | 1 July 2011 |

| | |

52 | Anguilla | 1 January 2012 |

53 | Aruba | 1 January 2012 |

54 | Belgium | 1 January 2012 |

55 | Malaysia | 1 January 2012 |

56 | Turks and Caicos Islands | 1 January 2012 |

| | |

57 | Cook Islands | 1 July 2012 |

58 | Macau | 1 July 2012 |

59 | Mauritius | 1 July 2012 |

60 | Republic of Korea | 1 July 2012 |

Division 3—Pay as you go (PAYG) withholding—Working out the amount to withhold

Subdivision A—Withholding amounts for Subdivision 12‑E

35 Part VA investment payments

(1) The amount to be withheld under section 12‑140 or 12‑145 in Schedule 1 to the Act from a payment made in respect of a Part VA investment is an amount equal to the product of the top rate and the amount of the payment.

Note: For the thresholds for withholding, see section 28.

(2) However, subsection (3) applies if:

(a) the payment from which that amount is to be withheld is a franked distribution; and

(b) the franking percentage is less than 100%.

(3) The amount to be withheld from the payment is the product of the unfranked part of the distribution and the top rate.

36 Closely held trust—distribution of income of closely held trust

The amount to be withheld by a trustee of a closely held trust from a distribution to a beneficiary of the trust under subsection 12‑175(2) in Schedule 1 to the Act is the product of the amount of the distribution to be made to the beneficiary and the top rate.

Note 1: The amount of a distribution in a financial year is affected by the operation of subsection 12‑175(4) in Schedule 1 to the Act.

Note 2: For the threshold for withholding, see section 30.

37 Closely held trust—beneficiary is presently entitled to income

The amount to be withheld by a trustee of a closely held trust from a beneficiary’s share of the net income of the trust under subsection 12‑180(2) in Schedule 1 to the Act, is the product of the amount of the beneficiary’s share of the net income of the trust and the top rate.

Note 1: The amount of an entitlement in a financial year is affected by the operation of subsection 12‑180(4) in Schedule 1 to the Act.

Note 2: For the threshold for withholding, see section 30.

38 Payment for supply where ABNs not quoted

(1) This section applies to a payment to which subsection 12‑190(1) in Schedule 1 to the Act applies.

(2) The amount to be withheld from the payment is an amount equal to the product of the top rate and the amount of the payment.

Subdivision B—Withholding amounts for Subdivision 12‑F

39 Application to a part of a dividend

This Subdivision applies to a part of a dividend in the same way as to a dividend.

40 Dividend payments

(1) The amount to be withheld from a dividend to which section 12‑210 in Schedule 1 to the Act applies is:

(a) if an address mentioned in paragraph 12‑210(a), or a place mentioned in paragraph 12‑210(b), in Schedule 1 to the Act is in a tax sharing country and the relevant international tax sharing treaty applies to the dividend—an amount calculated at the rate provided for in the treaty; and

(b) if paragraph (a) does not apply, but that address or place is in a double tax country—an amount calculated at the rate provided for in the relevant double tax agreement; and

(c) if paragraphs (a) and (b) do not apply—an amount equal to 30% of the amount of the dividend.

(2) The amount to be withheld from a dividend to which section 12‑215 in Schedule 1 to the Act applies is:

(a) if a foreign resident mentioned in paragraph 12‑215(1)(b) in Schedule 1 to the Act is a resident of a tax sharing country and the relevant international tax sharing treaty applies to the dividend—an amount calculated at the rate provided for in the treaty; and

(b) if paragraph (a) does not apply, but that foreign resident is a resident of a double tax country—an amount calculated at the rate provided for in the relevant double tax agreement; and

(c) if paragraphs (a) and (b) do not apply—an amount equal to 30% of the amount of the dividend.

(3) However, paragraphs (1)(b) and (2)(b) do not apply in relation to a dividend that is:

(a) paid to a resident of the United States of America; and

(b) included in a class of dividends that is exempt from tax under the law of that country.

41 Interest payments

The amount to be withheld under section 12‑245, 12‑250 or 12‑255 in Schedule 1 to the Act from interest (within the meaning of Division 11A of Part III of the Income Tax Assessment Act 1936) is an amount equal to 10% of the amount of the interest.

42 Royalty payments

The amount to be withheld under section 12‑280 or 12‑285 in Schedule 1 to the Act from a royalty is:

(a) if the person to whom the royalty is paid, or a foreign resident mentioned in paragraph 12‑285(1)(b) in that Schedule, is a resident of the other party to an international tax sharing treaty that applies to the royalty—the amount calculated at the rate provided for in the treaty; and

(b) if paragraph (a) does not apply, but the person to whom the royalty is paid, or a foreign resident mentioned in paragraph 12‑285(1)(b) in Schedule 1 to the Act, is a resident of the other party to a double tax agreement—the amount calculated at the rate provided for in the agreement; and

(c) if paragraphs (a) and (b) do not apply, but the person to whom the royalty is paid, or a foreign resident mentioned in paragraph 12‑285(1)(b) in that Schedule, is a resident of a country other than Australia—30% of the amount of the royalty; and

(d) if the person to whom the royalty is paid is a resident of Australia—30% of the amount of the royalty.

43 Meaning of double tax country

(1) If a double tax agreement includes provisions that have the force of law because of the International Tax Agreements Act 1953, and relate to a withholding payment:

(a) on income derived by a non‑resident on or after a particular day; or

(b) in respect of dividends derived on or after a particular day;

the other party to the agreement is a double tax country on and after that day.

(2) If a double tax agreement, not being an agreement to which subsection (1) applies, includes a provision that has the force of law because of the International Tax Agreements Act 1953, and limits the amount of Australian tax payable in respect of a dividend, the other party to the agreement is a double tax country.

(3) The Netherlands, as defined in Article 3 of the Netherlands agreement referred to in the International Tax Agreements Act 1953, is a double tax country for this Division.

44 Meaning of tax sharing country

(1) If an international tax sharing treaty includes provisions that have the force of law because of an Act, and relate to withholding payment:

(a) on income derived by a non‑resident on or after a particular day; or

(b) in respect of dividends derived on or after a particular day;

the other party to the treaty is a tax sharing country on and after that day.

(2) If an international tax sharing treaty, not being a treaty to which subsection (1) applies, includes a provision that has the force of law because of an Act, and limits the amount of Australian tax payable in respect of a dividend, the other party to the treaty is a tax sharing country.

45 Meaning of other party

The other party to a double tax agreement or international tax sharing treaty is:

(a) if the agreement or treaty was made between Australia and another country—the other country; or

(b) if the agreement or treaty was made between the government of Australia and the government of another country—the other country.

Subdivision C—Withholding amounts for Subdivisions 12‑FA and 12‑FAA

46 Departing Australia superannuation payments

The amount to be withheld under section 12‑305 in Schedule 1 to the Act from a departing Australia superannuation payment is the amount of tax payable on the payment, worked out under section 5 of the Superannuation (Departing Australia Superannuation Payments Tax) Act 2007.

47 Excess untaxed roll‑over amounts

The amount to be withheld from an excess untaxed roll‑over amount under section 12‑312 in Schedule 1 to the Act is the amount of tax payable on the excess untaxed roll‑over amount, worked out under section 5 of the Superannuation (Excess Untaxed Roll‑over Amounts Tax) Act 2007.

Subdivision D—Withholding amounts for Subdivision 12‑FB

48 Limits on amounts withheld under this Subdivision

(1) This section applies to an amount that is required by Subdivision 12‑FB in Schedule 1 to the Act (including regulations made for the purposes of that Subdivision) to be withheld from a payment if any amounts are already withheld under that Subdivision from the payment.

(2) The amount to be withheld is reduced by the amounts already withheld from the payment.

Example: A payer is required to withhold an amount under section 12‑315 in Schedule 1 to the Act from a payment made to a foreign resident. However, if the foreign resident has an agent who is an intermediary, the intermediary is required to withhold an amount under section 12‑317 in that Schedule from that payment. The amount to be withheld under section 12‑317 in that Schedule is reduced by the amount already withheld under section 12‑315 in that Schedule.

49 Gaming junkets

(1) This section applies to an amount that is required by section 12‑315 in Schedule 1 to the Act to be withheld from a payment prescribed by section 31.

(2) The amount to be withheld from the payment is an amount equal to 3% of the total payment.

50 Entertainment or sports activities

(1) This section applies to an amount that is required by section 12‑315 in Schedule 1 to the Act to be withheld from a payment prescribed by section 32.

(2) The amount to be withheld from the payment is:

(a) if the payment is made to a company—the amount worked out by applying to the payment, as if the amount of the payment was the taxable income of the company, the rates mentioned in section 23 of the Income Tax Rates Act 1986; or

(b) if the payment is made to an individual—the amount worked out by applying to the payment, as if the amount of the payment was the taxable income of the individual, the rates mentioned in Part II of Schedule 7 of the Income Tax Rates Act 1986.

51 Construction and related activities

(1) This section applies to an amount that is required by section 12‑315 in Schedule 1 to the Act to be withheld from a payment prescribed by section 33.

(2) The amount to be withheld from the payment is an amount equal to 5% of each payment made under the contract mentioned in subsection 33(1).

Subdivision E—Withholding amounts for Subdivisions 12‑FC and 12‑G

52 Seasonal Labour Mobility Program

The amount to be withheld from a payment of salary, wages, commission, bonuses or allowances under section 12‑319A in Schedule 1 to the Act is an amount equal to 15% of the amount of the payment.

Note: Section 12‑319A relates to payments made to a holder of a Subclass 416 (Special Program) visa as an employee of an Approved Employer under the Seasonal Labour Mobility Program.

53 Mining payments

The amount to be withheld under subsection 12‑320(1) in Schedule 1 to the Act from a mining payment is an amount equal to 4% of the amount of the payment.

Subdivision F—Declarations

54 When declarations cease to have effect

(1) If an individual who has given a declaration to an entity under subsection 15‑50(1) in Schedule 1 to the Act directs the entity in writing to disregard the declaration, the declaration ceases to be in effect.

(2) If an individual who has given a declaration (the earlier declaration) to an entity under subsection 15‑50(1) in Schedule 1 to the Act about a matter, later gives another declaration about the matter to the entity, the earlier declaration ceases to be in effect.

(3) If an individual who has given a declaration to an entity under subsection 15‑50(1) in Schedule 1 to the Act permanently ceases to receive withholding payments covered by Subdivision 12‑B, 12‑C or 12‑D in that Schedule from the entity, the declaration ceases to be in effect.

(4) If an individual has given a declaration to an entity under subsection 15‑50(1) or (3) in Schedule 1 to the Act, the declaration ceases to be in effect if a TFN declaration made by the individual in relation to the entity ceases to have effect because of subsection 202CA(1B) or (1C) of the Income Tax Assessment Act 1936.

55 Certain Defence Force members taken to have given Medicare levy variation declaration

(1) This section applies to an individual:

(a) who, on a particular day, is entitled (because of being a member of the Defence Force) to free medical treatment for any incapacity, disease or disabling condition; and

(b) who:

(i) has not given, as a member of the Defence Force, a declaration under subsection 15‑50(1) in Schedule 1 to the Act to the effect that the individual is entitled to full relief from the Medicare levy; and

(ii) has not previously been taken to have given a declaration under subsection (2).

(2) On that day, the individual is taken to have given, as a member of the Defence Force, a declaration under subsection 15‑50(1) in Schedule 1 to the Act to the effect that the individual is entitled to relief from 50% of the Medicare levy.

56 When new declaration to be given

(1) An individual to whom subsection (2) or (3) applies must give a new declaration in the approved form to the entity mentioned in that subsection.

(2) This subsection applies to an individual if:

(a) the individual gives to an entity a declaration under subsection 15‑50(1) or (3) in Schedule 1 to the Act about a matter; and

(b) the individual’s circumstances change in relation to the matter.

(3) This subsection applies to an individual who:

(a) gives a TFN declaration to an entity expressing a wish to reduce the amount withheld to correspond with the tax‑free threshold (within the meaning of the Income Tax Rates Act 1986); and

(b) becomes a foreign resident.

Part 4—Other taxes (Chapter 3 in Schedule 1 to the Act)

Division 1—Preliminary

57 Interpretation

Paragraph 13(1)(b) of the Legislation Act 2003 has effect in relation to this Part as if the reference in that paragraph to the enabling legislation was a reference to Schedule 1 to the Act.

Note 1: The effect of modifying paragraph 13(1)(b) of the Legislation Act 2003 is that expressions have the same meaning in this Part as in Schedule 1 to the Act as in force from time to time.

Note 2: Under section 3AA of the Act, an expression has the same meaning in Schedule 1 as in the Income Tax Assessment Act 1997.

Division 2—Indirect taxes

58 Refund scheme—specified kinds of entity

(1) For the purposes of paragraph 105‑125(1)(a) in Schedule 1 to the Act, an entity of the kind mentioned in subsection (2) is specified.

(2) For the purposes of subsection (1), an entity must be an entity that is the subject of an international agreement that provides that the Commonwealth is under an obligation to grant indirect tax concessions in relation to the entity.

Example: The Australian‑American Educational Foundation, which was established under the Agreement between the Government of the Commonwealth of Australia and the Government of the United States of America for the Financing of Certain Educational and Cultural Exchange Programmes.

The text of the agreement is set out in Australian Treaty Series [1964] ATS 15. In 2017, the text of the agreement in the Australian Treaty Series was accessible through the Australian Treaties Library on the AustLII website (www.austlii.edu.au).

(3) International agreement means:

(a) a convention or treaty to which Australia is a party; or

(b) an agreement between Australia and a foreign country;

and includes, for example, an agreement, arrangement or undertaking between a Minister and an official or authority of a foreign country.

59 Refund scheme—specified kinds of acquisition

(1) For the purposes of paragraph 105‑125(1)(b) in Schedule 1 to the Act, an acquisition, by an entity mentioned in section 58, of the kind mentioned in subsection (2) is specified.

(2) The acquisition must be:

(a) an acquisition that is permitted by the international agreement relevant to the entity; and

(b) an acquisition of:

(i) a thing the supply of which is a taxable supply; or

(ii) wine on which the entity has borne wine tax (within the meaning of the A New Tax System (Wine Equalisation Tax) Act 1999).

60 Refund scheme—conditions and limitations

(1) This section is made for the purposes of subsection 105‑125(2) in Schedule 1 to the Act.

(2) An entity of the kind specified in section 58 is entitled to a refund of an amount of indirect tax paid on an acquisition of a kind specified in section 59 if the entity has agreed, in writing, to repay the amount worked out under subsection (3) to the Commissioner in any of the following circumstances:

(a) if the entity purchased a car, and agreed to retain the car for 3 years after purchasing the car—the entity disposes of the car to an entity (other than an entity of a kind specified by section 58) before the end of 3 years after the first entity purchased the car;

(b) if the entity purchased goods (within the meaning of the A New Tax System (Goods and Services Tax) Act 1999) other than a car—the entity disposes of the goods (other than to an entity of a kind specified by section 58) in the indirect tax zone or an External Territory before the end of 2 years after the entity purchased the goods;

(c) if the entity acquired a service—the entity assigns the entity’s entitlement to the service to another entity (other than an entity of a kind specified by section 58) in the indirect tax zone or an External Territory.

(3) The amount to be repaid is:

(a) for an acquisition to which paragraph (2)(a) or (b) applies—the proportion of the amount of indirect tax paid for the acquisition that is equal to the proportion of the period mentioned in the paragraph remaining after the entity disposes of the acquisition; and

(b) for an acquisition to which paragraph (2)(c) applies—the amount of indirect tax paid for the acquisition.

(4) The amount of indirect tax to be refunded to an applicant is limited by the terms of the international agreement to which the entity is subject.

(5) The entity must use the taxable supply acquired by the entity in accordance with the terms of the international agreement to which the entity is subject.

61 Refund scheme—period and manner

(1) This section is made for the purposes of subsection 105‑125(2) in Schedule 1 to the Act.

(2) An application for a refund:

(a) must be signed by the applicant; and

(b) must be sent:

(i) to the Australian Taxation Office; and

(ii) with the tax invoice for the acquisition; and

(c) in the case of an acquisition of a car—may be sent any time after the acquisition; and

(d) in the case of an acquisition that is not a car—may be:

(i) sent with another claim; or

(ii) sent at least 3 months after another claim made by the entity.

(3) The amount to be refunded is to be paid to a single recipient or account nominated by the entity.

Part 5—Generic rules (Chapter 4 in Schedule 1 to the Act)

Division 1—Preliminary

62 Interpretation

Paragraph 13(1)(b) of the Legislation Act 2003 has effect in relation to this Part as if the reference in that paragraph to the enabling legislation was a reference to Schedule 1 to the Act.

Note 1: The effect of modifying paragraph 13(1)(b) of the Legislation Act 2003 is that expressions have the same meaning in this Part as in Schedule 1 to the Act as in force from time to time.

Note 2: Under section 3AA of the Act, an expression has the same meaning in Schedule 1 as in the Income Tax Assessment Act 1997.

Division 2—Estimates of liability

63 Requirements for statutory declaration or affidavit—prescribed individual for body corporate (Australian government agency)

(1) For the purposes of paragraph (b) of item 2 of the table in subsection 268‑90(3) in Schedule 1 to the Act, the individual mentioned in subsection (2) is prescribed.

(2) The prescribed individual is the public official of an Australian government agency who is responsible for the financial affairs of the agency:

(a) under an Australian law; or

(b) because the public official holds a particular office in the agency.

64 Requirements for statutory declaration or affidavit—prescribed individual for body politic

(1) For the purposes of item 3 of the table in subsection 268‑90(3) in Schedule 1 to the Act, the individual mentioned in subsection (2) is prescribed.

(2) The prescribed individual is the public official of an Australian government agency who is responsible for the financial affairs of the agency:

(a) under an Australian law; or

(b) because the public official holds a particular office in the agency.

Part 6—Administration (Chapter 5 in Schedule 1 to the Act)

Division 1—Preliminary

65 Interpretation

Paragraph 13(1)(b) of the Legislation Act 2003 has effect in relation to this Part as if the reference in that paragraph to the enabling legislation was a reference to Schedule 1 to the Act.

Note 1: The effect of modifying paragraph 13(1)(b) of the Legislation Act 2003 is that expressions have the same meaning in this Part as in Schedule 1 to the Act as in force from time to time.

Note 2: Under section 3AA of the Act, an expression has the same meaning in Schedule 1 as in the Income Tax Assessment Act 1997.

Division 2—The Australian Taxation Office

Subdivision A—Powers to obtain information and evidence

66 Expenses for certain attendances

(1) This section applies to an entity (a witness) that is required to attend before the Commissioner, or an individual authorised by the Commissioner, under paragraph 353‑10(1)(b) in Schedule 1 to the Act.

(2) The scale of expenses set out in Schedule 2 is prescribed to be allowed to the witness in relation to an attendance before the Commissioner, or an individual authorised by the Commissioner, on or after 1 October 2017.

(3) However subsection (2) does not apply if the witness is required to attend before the Commissioner, or an individual authorised by the Commissioner, in relation to any of the following:

(a) the witness’s own obligations under a taxation law;

(b) the obligations of another entity under a taxation law if the witness is an agent or representative of the other entity;

(c) the obligations of another entity under a taxation law if the witness’s financial affairs are interrelated with the financial affairs of the other entity.

Subdivision B—Confidentiality of taxpayer information

67 Disclosure for law enforcement and related purposes—prescribed taskforce

For the purposes of subsection 355‑70(12) in Schedule 1 to the Act, the taskforces in the table are prescribed.

Prescribed taskforce |

Item | Taskforce |

1 | Criminal Assets Confiscation Taskforce |

2 | National Criminal Intelligence Fusion Centre |

3 | National Anti‑Gang Taskforce |

4 | Trusts Taskforce |

5 | Phoenix Taskforce |

6 | Fraud and Anti‑Corruption Centre |

7 | Taskforce Cadena |

Division 3—Rulings

68 Private rulings—amount of charge for valuations and reviews of valuations

For the purposes of subsection 359‑40(4) in Schedule 1 to the Act:

(a) the charge for the valuer making a valuation is the amount that the Commissioner is required to pay the valuer for making the valuation; and

(b) the charge for the valuer reviewing a valuation is the amount that the Commissioner is required to pay the valuer for reviewing the valuation.

Note: The charge for the service may be taxable under the A New Tax System (Goods and Services Tax) Act 1999. As a result, while the amount the Commissioner can charge for making or reviewing a valuation must be equal to the amount the Commissioner was required to pay for making or reviewing the valuation, the Commissioner can also charge the applicant GST for the service.

Division 4—Record‑keeping etc.

69 Reporting to Agriculture Department about Farm Management Deposits

(1) For the purposes of paragraph 398‑5(3)(d) in Schedule 1 to the Act, an FMD provider must give the following information to the Agriculture Secretary:

(a) the month to which the information relates;

(b) in relation to each farm management deposit held by the provider at any time in that month, the information set out in subsection (2).

(2) For the purposes of subsection (1), the information that is required is:

(a) the industry code for the depositor, by reference to the Australian and New Zealand Standard Industrial Classification (ANZSIC) 2006 published by the Australian Bureau of Statistics, as in force or existing at the time when this instrument commences; and

(b) an account number that is modified by the FMD provider to prevent the disclosure of the identity of the depositor and the identity of the owner (if the owner is not the depositor), and that remains the same while the owner holds the farm management deposit; and

(c) a personal identification number that is modified by the FMD provider to prevent the disclosure of the identity of the depositor and the identity of the owner (if the owner is not the depositor), and that remains the same while the owner holds any farm management deposits with the FMD provider; and

(d) the closing balance of the farm management deposit at the end of the month to which the report relates; and

(e) the State or Territory of the residence of the owner; and

(f) the year of birth of the owner; and

(g) the year and month of the deposit.

Division 5—Verification system

70 Transaction reporting by purchasers

(1) For the purposes of section 405‑5 in Schedule 1 to the Act, a supply by a supplier to a purchaser is specified if all of the following circumstances apply:

(a) the purchaser is carrying on a business that is primarily in the building and construction industry;

(b) the purchaser has an ABN;

(c) the supplier supplies to the purchaser:

(i) building and construction services; or

(ii) a combination of goods and building and construction services, unless the supply of services is incidental to the supply of the goods.

(2) Subsection (1) does not apply if both the supplier and the purchaser are members of:

(a) the same consolidated group; or

(b) the same MEC group.

(3) Subsection (1) does not apply if the payment made for the supply is a payment of the kind mentioned in paragraph (a) of the definition of withholding payment in subsection 995‑1(1) of the Income Tax Assessment Act 1997.

(4) A purchaser is taken to be carrying on a business that is primarily in the building and construction industry only if:

(a) in the current financial year, 50% or more of the purchaser’s business activity relates to building and construction services; or

(b) in the current financial year, 50% or more of the purchaser’s business income is derived from providing building and construction services; or

(c) in the financial year immediately preceding the current financial year, 50% or more of the purchaser’s business income was derived from providing building and construction services.

(5) For the purposes of this section, building and construction services include any of the following activities, if the activities are performed on, or in relation to, any part of a building, structure, works, surface or sub‑surface:

(a) alteration;

(b) assembly;

(c) construction;

(d) demolition;

(e) design;

(f) destruction;

(g) dismantling;

(h) erection;

(i) excavation;

(j) finishing;

(k) improvement;

(l) installation;

(m) maintenance;

(n) management of building and construction services;

(o) modification;

(p) organisation of building and construction services;

(q) removal;

(r) repair;

(s) site preparation.

Part 7—Transitional matters

71 Things done under old regulations

(1) If:

(a) a thing was done for a particular purpose under the Taxation Administration Regulations 1976 as in force immediately before those regulations were repealed; and

(b) the thing could be done for that purpose under this instrument;

the thing has effect for the purposes of this instrument as if it had been done under this instrument.

(2) Without limiting subsection (1), a reference in that subsection to a thing being done includes a reference to an election, a declaration, a certificate, a notice, an application, an order or a document being given, made or served.

Example 1: A certificate given in accordance with regulation 5 of the Taxation Administration Regulations 1976 has effect for the purposes of this instrument as if it had been made under section 7 of this instrument.

Example 2: If the Commissioner served a document on a person under regulation 12F of the Taxation Administration Regulations 1976, the service of the document has effect for the purposes of this instrument as if it had been done under section 14 of this instrument.

72 Approved forms

If:

(a) a form was approved under section 388‑50 in Schedule 1 to the Act for the purposes of a provision of the Taxation Administration Regulations 1976 as in force immediately before those regulations were repealed; and

(b) the form could be approved for that purpose under this instrument;

the form has effect for the purposes of this instrument as if it had been approved for the purposes of the corresponding provision of this instrument.