Commercial Broadcasting (Tax) (Individual Transmitter Amounts) Determination 2017

I, Mitch Fifield, Minister for Communications, make the following determination.

Dated 17 October 2017

Mitch Fifield

Minister for Communications

Commercial Broadcasting (Tax) (Individual Transmitter Amounts) Determination 2017

I, Mitch Fifield, Minister for Communications, make the following determination.

Dated 17 October 2017

Mitch Fifield

Minister for Communications

Contents

Part 1—Preliminary

1 Name

2 Commencement

3 Authority

4 Definitions

5 Population densities

Part 2—Individual transmitter amounts

6 Individual transmitter amounts

7 Adjustment for variations during year before anniversary

This instrument is the Commercial Broadcasting (Tax) (Individual Transmitter Amounts) Determination 2017.

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | 1 July 2017. | 1 July 2017 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

This instrument is made under subsection 8(2) of the Commercial Broadcasting (Tax) Act 2017.

Note: A number of expressions used in this instrument are defined in the Act, including the following:

(a) indexation factor;

(b) individual transmitter amount cap;

(c) tax;

(d) transmitter;

(e) transmitter licence.

In this instrument:

Act means the Commercial Broadcasting (Tax) Act 2017.

alternative transmitter means a transmitter that:

(a) is covered by a transmitter licence; and

(b) under the licence, is authorised to operate only when another transmitter that is authorised under the licence to operate in a specified location is not in operation.

band has the meaning given by subsection 9(3) of the Act.

daily amount has the meaning given by subsection 7(2).

dollars per kHz of spectrum bandwidth has the meaning given by subsections 6(5) and (6).

maximum power has the meaning given by subsection 9(4) of the Act.

maximum power factor has the meaning given by subsection 6(8).

minimum uncapped individual transmitter amount has the meaning given by subsections 6(3) and (4).

population density has the meaning given by section 5.

remote has the meaning given by subsection 5(2).

spectrum bandwidth has the meaning given by subsection 6(7).

uncapped individual transmitter amount has the meaning given by subsection 6(2) and section 7.

(1) The following table defines the population density of a location:

Population densities | ||

Item | Column 1 The population density of the location is … | Column 2 if … |

1 | high | the location is in the Sydney area, the Melbourne area or the Brisbane area |

2 | medium | (a) the location is not in the Sydney area, the Melbourne area or the Brisbane area; and (b) the location is in the Perth area, the Adelaide area or the Newcastle area. |

3 | low | (a) the location is not in the Sydney area, the Melbourne area, the Brisbane area, the Perth area, the Adelaide area or the Newcastle area; and (b) the location is in the East Australia low density area, the Western Australia low density area, the Tasmania low density area or the Darwin low density area. |

(2) A location is remote if no item of the table in subsection (1) applies to the location.

(3) In this section, Sydney area, Melbourne area, Brisbane area, Perth area, Adelaide area, Newcastle area, East Australia low density area, Western Australia low density area, Tasmania low density area and Darwin low density area have the meanings given by Part 1 of Schedule 1 to the Radiocommunications (Transmitter Licence Tax) Determination 2015, as in force on 1 July 2017.

(1) For the purposes of paragraph 8(1)(a) of the Act, the individual transmitter amount for a transmitter covered by a transmitter licence at a particular time in a financial year is the lesser of:

(a) the individual transmitter amount cap for the transmitter for the financial year; and

(b) the uncapped individual transmitter amount for the transmitter at that particular time.

Uncapped individual transmitter amount

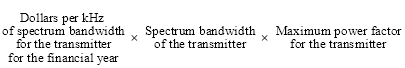

(2) The uncapped individual transmitter amount for a transmitter at a particular time in a financial year is, subject to section 7 of this instrument, the following amount, rounded to the nearest dollar (with 50 cents rounded up):

(a) if:

(i) under the transmitter licence, the transmitter is authorised to operate at a remote location; or

(ii) the transmitter is an alternative transmitter;

the minimum uncapped individual transmitter amount for the financial year;

(b) otherwise—the greater of:

(i) the minimum uncapped individual transmitter amount for the financial year; and

(ii) the amount worked out using the following formula:

Minimum uncapped individual transmitter amount

(3) The minimum uncapped individual transmitter amount for the financial year beginning on 1 July 2017 is $39.57.

(4) The minimum uncapped individual transmitter amount for:

(a) the financial year beginning on 1 July 2018; or

(b) a later financial year;

is the amount worked out using the following formula:

![]()

where:

indexation factor means the indexation factor for the financial year.

previous minimum uncapped individual transmitter amount means the minimum uncapped individual transmitter amount for the previous financial year.

Dollars per kHz of spectrum bandwidth

(5) The dollars per kHz of spectrum bandwidth for a transmitter for the financial year beginning on 1 July 2017 is the amount per kHz worked out using the following table:

Dollars per kHz of spectrum bandwidth—financial year beginning on 1 July 2017 | |||||

Item | Column 1 Population density of the location at which, under the transmitter licence, the transmitter is authorised to operate | Column 2 Amount per kHz if transmitter operates in the AM band | Column 3 Amount per kHz if transmitter operates in the FM band | Column 4 Amount per kHz if transmitter operates in the VHF band | Column 5 Amount per kHz if transmitter operates in the UHF band |

1 | Low | $0.2079 | $0.2079 | $0.2417 | $0.2417 |

2 | Medium | $9.2741 | $9.2741 | $13.1579 | $13.1579 |

3 | High | $20.2667 | $20.2667 | $26.6588 | $26.6588 |

(6) The dollars per kHz of spectrum bandwidth for a transmitter for:

(a) the financial year beginning on 1 July 2018; or

(b) a later financial year;

is the amount per kHz worked out using the following formula:

![]()

where:

indexation factor means the indexation factor for the financial year.

previous dollars per kHz of spectrum bandwidth means the dollars per kHz of spectrum bandwidth for the transmitter for the previous financial year.

Spectrum bandwidth

(7) The following table defines the spectrum bandwidth of a transmitter:

Spectrum bandwidth | ||

Item | Column 1 The spectrum bandwidth of a transmitter is … | Column 2 if the transmitter operates in the … |

1 | 18 kHz | AM band. |

2 | 200 kHz | FM band. |

3 | 7,000 kHz | VHF band. |

4 | 7,000 kHz | UHF band. |

Maximum power factor

(8) The following table defines the maximum power factor for a transmitter:

Maximum power factor | ||

Item | Column 1 The maximum power factor for a transmitter is … | Column 2 if the maximum power of the transmitter is … |

1 | 0.1 | low. |

2 | 1.0 | medium. |

3 | 10.0 | high. |

(1) This section applies to the uncapped individual transmitter amount for a transmitter covered by a transmitter licence at a particular time if:

(a) the time occurs:

(i) on an anniversary (the current anniversary) of the day the licence came into force; and

(ii) after 1 July 2017; and

(b) the licence was varied on one or more occasions during the period (the previous tax period) beginning at the latest of:

(i) the end of the day the licence came into force; and

(ii) the end of the last anniversary (if any) of the day the licence came into force that occurred before the current anniversary; and

(iii) the end of 1 July 2017;

and ending at the end of the day before the current anniversary.

(2) The uncapped individual transmitter amount for the transmitter on the current anniversary must be increased or decreased in accordance with the following method statement:

Adjustment Calculator

This is how to increase or decrease the uncapped individual transmitter amount.

Method statement

Step 1. Work out the daily amount for each day in the previous tax period by:

(a) working out the uncapped individual transmitter amount for the transmitter at the start of that day (disregarding this section); and

(b) dividing it by the number of days in the financial year in which the current anniversary occurs.

Note: Under subsection (3), any indexation of the minimum uncapped individual transmitter amount and the dollars per kHz of spectrum bandwidth that occurs after the start of the previous tax period is disregarded for the purposes of this step.

Step 2. Work out the uncapped individual transmitter amount for the transmitter at the start of the previous tax period (disregarding this section).

Step 3. If the total of the daily amounts worked out under step 1 is greater than the amount worked out under step 2, increase the uncapped individual transmitter amount for the transmitter at the current anniversary by the difference.

Step 4. Otherwise, decrease the uncapped individual transmitter amount for the transmitter at the current anniversary by the difference.

Example: On 1 January 2018, tax of $921,053.00 is imposed on a transmitter licence which authorises the operation of a high power UHF transmitter at a location with a medium population density. On 1 December 2018, the licence is amended to authorise medium power. On 1 January 2019, tax is payable on the licence again.

The uncapped individual transmitter amount for the transmitter on 1 January 2019 worked out under section 6 of this instrument ($92,105.30, assuming there was no indexation on 1 July 2018) is decreased using the method statement in this subsection as follows:

(a) step 1 produces 334 daily amounts of $2523.43 (for each day between 1 January and 30 November 2018), and 31 daily amounts of $252.34 (for each day between 1 December and 31 December 2018);

(b) for step 2, the uncapped individual transmitter amount on 1 January 2018 was $921,053.00;

(c) the total of the step 1 daily amounts ($850,648.16) is less than the step 2 uncapped individual transmitter amount on 1 January 2018 ($921,053.00) and so the uncapped individual transmitter amount on 1 January 2019 is decreased under step 4 by the difference ($70,404.84) to $21,700.46.

Indexation

(3) In applying subsections 6(3) to (6) for the purposes of step 1 of the method statement in subsection (2) of this section, each day in the previous tax period is taken to have occurred in the financial year in which the previous tax period started.

Transmitters added to licence during previous tax period

(4) For the purposes of subsection (1), the uncapped individual transmitter amount for the transmitter on a day, in the previous tax period, before the transmitter licence began to cover the transmitter is taken to be nil.