Part 1—Preliminary

1 Name

This instrument is the Parliamentary Business Resources Regulations 2017.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | At the same time as the Parliamentary Business Resources Act 2017 commences. | 1 January 2018 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Parliamentary Business Resources Act 2017.

4 Definitions

Note: A number of expressions used in this instrument are defined in the Act, including the following:

(a) member;

(b) parliamentary business;

(c) travel expenses.

In this instrument:

accompanies has a meaning affected by subsection 7(2).

Administrator, in relation to particular public resources, means the resources provider who provides the public resources or arranges for the public resources to be provided.

amount includes a nil amount.

applicant, for the purposes of Division 2 of Part 5 (legal assistance to Ministers), has the meaning given by section 81.

approving Minister, for the purposes of Division 2 of Part 5 (legal assistance to Ministers), has the meaning given by section 83.

Australia has the meaning given by the Acts Interpretation Act 1901.

Note: When used in a geographical sense, Australia includes Norfolk Island, the Territory of Christmas Island and the Territory of Cocos (Keeling) Islands, but does not include any other external Territory: see the definition of Australia in section 2B of the Acts Interpretation Act 1901.

Australian travel allowance has the meaning given by subsection 10(1).

Canberra means any location within a 30km radius of Parliament House.

Canberra daily allowance has the meaning given by subsection 11(1).

chartered transport:

(a) means an unscheduled commercial transport service that includes a driver or pilot; and

(b) to avoid doubt, includes the following:

(i) a taxi;

(ii) a regulated ride sharing service;

(iii) any other commercial car service that includes a driver.

commercial transport means scheduled commercial transport or unscheduled commercial transport.

Commonwealth transport means a transport service operated by the Commonwealth.

Commonwealth transport determination means a determination by the Minister under subsection 33(1) of the Act that determines Commonwealth transport as a public resource to be provided.

Note: Commonwealth transport is prescribed under section 62 and section 63 deals with the use of Commonwealth transport.

compliance information has the meaning given by subsection 98(7).

designated person, in relation to a member, means an individual nominated by the member for the purposes of this definition who:

(a) is a member of the member’s immediate or extended family; or

(b) is substantially dependent on the member; or

(c) has significant caring responsibilities for:

(i) the member’s spouse or nominee, or dependent child; or

(ii) another person who is substantially dependent on the member.

dominant purpose test means the requirements set out in subsections 26(1), (3) and (4) of the Act.

driver means a person who is accredited (however described) to provide the relevant driving services on a commercial basis in the places concerned.

election period has the meaning given by subsection 75(4).

electorate, in relation to a senator, means the State or Territory represented by the senator.

electorate office has the meaning given by section 72.

family member of a member means any of the following:

(a) the member’s spouse or nominee;

(b) a dependent child of the member;

(c) a designated person in relation to the member.

Note 1: For spouse and dependent child, see section 5 of the Act.

Note 2: Nominee and designated person are defined in this section.

family member private vehicle allowance has the meaning given by subsection 27(1).

family reunion purposes, in relation to travel, has the meaning given by section 6.

fare (including an airfare) includes any taxes, booking fees and other costs that are usually associated with travel on the fare.

Finance Minister means the Minister administering the Public Governance, Performance and Accountability Act 2013.

general election means a general election of the members of the House of Representatives.

hired vehicle means a vehicle that is hired without a driver (whether or not a relief driver is engaged separately to drive the vehicle).

home base:

(a) for the Prime Minister—means any of the following:

(i) an official residence of the Prime Minister (or another residence provided by the Commonwealth for the Prime Minister);

(ii) the residence nominated to IPEA by the Prime Minister as the Prime Minister’s principal private place of residence; or

(b) for another member—means the member’s principal place of residence as nominated to IPEA by the member; or

(c) for a family member of a member—means the family member’s principal place of residence as nominated to IPEA by the member.

home base airport, for a person for a journey, means the airport nearest the person’s home base from which the person can use scheduled commercial transport to travel by air for the journey.

international travel:

(a) means:

(i) travel to or from Australia and places outside Australia; or

(ii) travel between places outside Australia; and

(b) includes time spent in places outside Australia.

international travel allowance means:

(a) an international travel equipment allowance; or

(b) an international travel incidentals allowance; or

(c) an international travel meal allowance.

international travel equipment allowance has the meaning given by subsection 60(1).

international travel expenses has the meaning given by section 35.

international travel incidentals allowance has the meaning given by subsection 59(1).

international travel meal allowance has the meaning given by subsection 61(1).

member’s private vehicle allowance has the meaning given by subsection 12(1).

ministerial duties, for the purposes of Division 2 of Part 5 (legal assistance to Ministers), has the meaning given by section 81.

minority party means a party that:

(a) is not part of the Government or the Opposition; and

(b) has at least 5 members in the Parliament.

nominee, in relation to a member, means a person nominated by the member in place of a spouse.

Note: A member can have a nominee for the purposes of some provisions of Division 2 of Part 2 (travel within Australia for family members).

office expenses has the meaning given by subsection 66(1).

pilot means a person who is accredited (however described) to provide the relevant piloting services on a commercial basis in the places concerned.

private plated vehicle means a private plated vehicle provided as part of a member’s remuneration under section 14 of the Act.

private vehicle in relation to a member, or a family member of a member:

(a) includes any vehicle owned by the member or a family member of the member; and

(b) to avoid doubt, does not include a private plated vehicle.

proceedings, for the purposes of Division 2 of Part 5 (legal assistance to Ministers), has the meaning given by section 81.

scheduled commercial transport means transport that is operated:

(a) on a commercial basis; and

(b) over a fixed route; and

(c) on a regular timetable or regularly on demand.

Note: Some vehicular ferry services, for example, operate regularly on demand rather than on a regular timetable.

senior office holder means:

(a) the President of the Senate; or

(b) the Speaker of the House of Representatives; or

(c) a Minister; or

(d) the Leader or Deputy Leader of the Opposition in a House of the Parliament.

senior office holder spouse private vehicle allowance has the meaning given by subsection 28(1).

staff member means a person employed under the Members of Parliament (Staff) Act 1984.

subpoena, for the purposes of Division 2 of Part 5 (legal assistance to Ministers), has the meaning given by section 81.

transport costs has the meaning given by section 5.

transport costs undertaking has the meaning given by subsection 32(2).

travels with has the meaning given by subsection 7(1).

travel within Australia includes travel outside Australia undertaken for the purposes of travelling between places within Australia.

unscheduled commercial transport means transport, other than scheduled commercial transport, that is operated on a commercial basis, and includes the following:

(a) hired vehicles;

(b) chartered transport.

Note: Unscheduled commercial transport does not include Commonwealth transport.

5 Meaning of transport costs

For travel by commercial transport

(1) Transport costs for travel by a particular kind of commercial transport are costs that would normally be required for a person to travel by that kind of transport.

Note 1: For example, transport costs for travel by commercial transport would cover the following:

(a) fares for travel by scheduled commercial transport;

(b) charter or hire costs for travel by unscheduled commercial transport;

(c) car ferry costs for travel by hired vehicle.

Note 2: Fare includes any taxes, booking fees and other costs that are usually associated with travel on the fare: see the definition of fare in section 4.

(2) Transport costs for travel by hired vehicle include any additional costs for parking, fuel, excess reduction insurance or relief drivers.

(3) Transport costs for travel by commercial transport do not include:

(a) fares at higher than business class; or

(b) for travel by hired vehicle:

(i) road tolls; or

(ii) fines or penalties (however described), including for the non‑payment or late payment of road tolls; or

(iii) any administration costs in relation to road tolls, fines or penalties.

For travel by Commonwealth transport

(4) Transport costs for travel by Commonwealth transport do not include costs other than those directly associated with the travel concerned.

6 Meaning of family reunion purposes

A family member of a member travels for family reunion purposes if:

(a) the member is travelling within Australia for the dominant purpose of conducting the member’s parliamentary business; and

(b) the family member travels to accompany or join the member; and

(c) the travel by the family member is for the dominant purpose of facilitating the family life of the member’s family.

7 Meanings of travels with and accompanies

(1) A person who travels with a member travels in the same vehicle, or on the same vessel or aircraft (or other conveyance) as the member.

(2) A person who accompanies a member who is travelling may, but is not required to, travel with the member at all times.

Part 2—Travel expenses and allowances

Division 1—Travel within Australia for members

Subdivision A—Transport costs

8 Travel within Australia

Scheduled or unscheduled commercial transport

(1) For the purposes of section 30 of the Act, transport costs are prescribed for a member to travel by scheduled or unscheduled commercial transport within Australia.

Note: For limits on the use of unscheduled commercial transport, see sections 13 and 14.

Commonwealth transport

(2) For the purposes of section 30 of the Act, transport costs are prescribed for a member to travel by Commonwealth transport within Australia in accordance with a Commonwealth transport determination.

Expenses for travel by private vehicle or private plated vehicle

(3) For the purposes of section 30 of the Act, the following are prescribed for a member to travel by the member’s private vehicle or private plated vehicle, within Australia:

(a) parking fees;

(b) costs for relief drivers;

(c) car ferry costs.

Note: The dominant purpose test applies in relation to claims for travel expenses and allowances prescribed by this Division.

9 Other persons travelling by unscheduled commercial transport for conduct of member’s parliamentary business

For the purposes of section 30 of the Act, any additional transport costs for one or more persons (other than family members) to travel with a member by unscheduled commercial transport within Australia are prescribed if:

(a) transport costs prescribed by this instrument could be claimed for the travel by the member by the kind of unscheduled commercial transport concerned if the member travelled without the other person or persons; and

(b) the travel by the other person or persons is reasonably required for the conduct of the member’s parliamentary business.

Subdivision B—Travel allowances

10 Australian travel allowance

(1) For the purposes of subsection 31(1) of the Act, an allowance (the Australian travel allowance) for accommodation, meals and incidental expenses is prescribed for each night the member stays in accommodation in Australia that is not the member’s home base.

Note: The rate of Australian travel allowance is determined by the Remuneration Tribunal: see subsections 31(2) and 45(1) of the Act.

(2) Australian travel allowance is limited to 10 nights in a financial year for travel for the dominant purpose of one or more of the following:

(a) conducting the member’s party political duties at a location other than Canberra;

(b) conducting the member’s electorate duties at places outside the member’s electorate.

(3) The limit in subsection (2) does not include any night in transit for the purpose of facilitating a journey for a purpose covered by that subsection.

Note: An example of such a night in transit would be a night spent by a member from a rural electorate in a capital city for the purpose of connecting with transport to the member’s destination the following morning.

11 Canberra daily allowance

(1) For the purposes of subsection 31(1) of the Act, an allowance (the Canberra daily allowance) is prescribed for meals and incidental expenses for the following members:

(a) a member whose electorate includes a place in the Australian Capital Territory;

(b) a member of the House of Representatives:

(i) whose electorate borders the Australian Capital Territory; and

(ii) whose home base is in Canberra.

Note: Canberra means any location within a 30km radius of Parliament House: see section 4.

(2) The allowance is payable for each day on which the member travels to a place in Canberra (other than the member’s home base or electorate office) to do one or more of the following:

(a) attend sittings of the House of the Parliament in which the member sits;

(b) attend meetings of the member’s parliamentary political party (including meetings of its executive or committees);

(c) attend meetings of a parliamentary committee of which the member is a member;

(d) conduct official duties, if the member is:

(i) a senior office holder; or

(ii) the Deputy President and Chairman of Committees in the Senate; or

(iii) the Deputy Speaker in the House of Representatives; or

(iv) the leader of a minority party.

Note: The rate of Canberra daily allowance is determined by the Remuneration Tribunal: see subsections 31(2) and 45(1) of the Act.

12 Member’s private vehicle allowance—travel to Canberra

(1) For the purposes of subsection 31(1) of the Act, an allowance (the member’s private vehicle allowance) is prescribed for fuel and running costs for a member for travel between the member’s home base and Canberra in the member’s private vehicle.

Note 1: The private vehicle could be owned by a family member: see the definition of private vehicle in section 4.

Note 2: The rate of member’s private vehicle allowance is determined by the Remuneration Tribunal: see subsections 31(2) and 45(1) of the Act.

(2) The travel by private vehicle may be for the whole or part of the journey.

Subdivision C—Limits on use of unscheduled commercial transport

13 When a private plated vehicle could reasonably be used

Transport costs are not prescribed for travel by unscheduled commercial transport within the member’s electorate if the member could reasonably use the member’s private plated vehicle in the circumstances, assuming the member had a private plated vehicle.

Note: A member’s remuneration under section 14 of the Act may include one or more private plated vehicles or an allowance instead of a private plated vehicle.

A member who chooses an allowance instead of a private plated vehicle could reasonably be expected to use the allowance instead of claiming taxi costs in circumstances where a private plated vehicle could otherwise reasonably be used.

14 Large electorates

(1) Transport costs for unscheduled commercial transport for travel by the following members for the dominant purpose of conducting electorate duties in the members’ electorates during a financial year are limited as follows:

(a) for a senator for New South Wales, Victoria, South Australia or Tasmania—$14,860;

(b) for a senator for Queensland or Western Australia—$26,490;

(c) for a senator for the Northern Territory—$65,760;

(d) for a member of the House of Representatives with an electorate with an area of at least 300,000 km2—$120,000;

(e) for a member of the House of Representatives with an electorate with an area of at least 100,000 km2 but less than 300,000 km2—$38,190;

(f) for a member of the House of Representatives with an electorate with an area of at least 25,000 km2 but less than 100,000 km2—$21,160;

(g) for a member of the House of Representatives with an electorate with an area of at least 10,000 km2 but less than 25,000 km2—$10,420.

Note: Amounts for travel by unscheduled commercial transport within large electorates unused during a financial year may carried over into the following financial year: see section 99.

(2) For the purposes of subsection (1), travel by a member includes travel by persons:

(a) travelling with the member; and

(b) whose transport costs for the travel are prescribed by section 9 (other persons travelling by unscheduled commercial transport for conduct of member’s parliamentary business).

(3) A limit for a member set out in subsection (1) has effect subject to any reduction made:

(a) in accordance with a determination under section 45 of the Act; and

(b) because the member has made a choice available under the determination in relation to one or more private plated vehicles to be provided as part of the member’s remuneration.

Division 2—Travel within Australia for family members

Subdivision A—Transport costs

15 Operation of Subdivision

For the purposes of section 30 of the Act, this Subdivision prescribes travel expenses for family members of a member to travel within Australia.

16 Family reunion travel to Canberra and within local area

(1) This section prescribes transport costs for family members of a member to travel between any of the following for family reunion purposes:

(a) the family member’s home base;

(b) the member’s home base;

(c) Canberra;

(d) places in the State or Territory:

(i) for which the member is a senator; or

(ii) in which the member’s electorate is located.

Note: For family reunion purposes, see section 6.

(2) Transport costs for travel by scheduled commercial transport are prescribed.

(3) Any additional transport costs for a family member to travel with the member by unscheduled commercial transport are prescribed.

Note 1: For annual limits on the use of transport costs prescribed by this section, see section 29.

Note 2: Other provisions of this instrument also prescribe transport costs and fares for family reunion purposes.

Family members for whom costs are not prescribed by this section

(4) This section does not prescribe transport costs for:

(a) a family member of a senator for the Australian Capital Territory; or

(b) a family member of a member whose electorate is in the Australian Capital Territory; or

(c) the spouse of a senior office holder.

Note: For travel by the spouse of a senior office holder, see sections 24 and 28.

17 Australia‑wide family reunion travel

(1) For each financial year, a total of 3 return fares are prescribed for family members of a member to travel for family reunion purposes.

(2) The fares may be used by any family member for travel by scheduled commercial transport at no higher than business class.

(3) If a return fare prescribed by this section is not required for particular travel, a one‑way fare may be used.

(4) For the purposes of this section, a one‑way fare counts as half of a return fare.

Note: A fare prescribed by this section may be exchanged for travel with the member by unscheduled commercial transport: see section 20.

Family members for whom fares are not prescribed by this section

(5) This section does not prescribe fares for the spouse of a senior office holder.

Note: For travel by the spouse of a senior office holder, see sections 24 and 28.

18 Fares for dependent children of certain senior office holders for family reunion purposes

(1) For each financial year, 3 return fares are prescribed for each dependent child of a senior office holder (other than a Parliamentary Secretary) to travel between places in the office holder’s electorate and Canberra for family reunion purposes.

(2) The fares may be used for travel by scheduled commercial transport at no higher than economy class.

(3) If a return fare prescribed by this section is not required for particular travel, a one‑way fare may be used.

(4) For the purposes of this section, a one‑way fare counts as half of a return fare.

Note: A fare prescribed by this section may be exchanged for travel with the senior office holder by unscheduled commercial transport: see section 20.

19 Additional travel for dependent children of certain senior office holders for family reunion purposes

(1) The fares prescribed by this section are prescribed subject to the condition that the Minister approves the travel concerned as reasonably necessary for family reunion purposes.

(2) For each financial year, for each dependent child of a senior office holder (other than a Parliamentary Secretary), fares for travel as follows are prescribed for family reunion purposes:

(a) one visit to any place in Australia;

(b) travel between the child’s home base and Canberra to attend parliamentary functions attended by the senior office holder or the senior office holder’s spouse;

(c) travel between the child’s home base and Canberra when the senior office holder or the senior office holder’s spouse is in Canberra for lengthy periods.

(3) The travel must be by scheduled commercial transport and:

(a) if the child travels with the senior office holder, or the senior office holder’s spouse—at no higher than the same class as the senior office holder or the senior office holder’s spouse; or

(b) otherwise—at no higher than economy class.

Note: A fare prescribed by this section may be exchanged for travel with the senior office holder by unscheduled commercial transport: see section 20.

20 Certain fares may be exchanged for travel with member by unscheduled commercial transport

(1) Additional transport costs are prescribed for a family member of a member to travel with the member by unscheduled commercial transport for family reunion purposes during a financial year if:

(a) transport costs for the member’s travel are prescribed by this instrument; and

(b) there are additional transport costs for the family member to travel with the member; and

(c) a fare is available for the family member under section 17, 18 or 19 for the financial year; and

(d) the fare is exchanged for the additional costs.

(2) The travel may be on a return journey, or a one‑way journey.

(3) For the purposes of sections 17, 18 and 19, a one‑way journey counts as half of a return fare.

Note: More than one fare may be exchanged under this section for travel with the member by unscheduled commercial transport during a financial year.

21 Accompanying infants and carers

(1) This section applies if:

(a) a member is travelling interstate for the dominant purpose of conducting the member’s parliamentary business; and

(b) the member is the mother of a child up to 12 months old; and

(c) there are no further fares available for the member’s family under section 17 (Australia‑wide family reunion travel).

(2) The following transport costs are prescribed:

(a) transport costs (if any) required for the child to accompany or join the member;

(b) transport costs for a family member of the member to accompany the child in order to assist the member in caring for the child.

(3) If the child is travelling with the member:

(a) the child may use the same method of transport and travel at the same class as the member; and

(b) the family member may use the same method of transport as the member but, if there are different fare classes, must travel at economy class.

(4) If the child is travelling to join the member, the travel for the child and the family member must be by:

(a) scheduled commercial transport at no higher than economy class; or

(b) Commonwealth transport in accordance with a Commonwealth transport determination.

22 Travel as member’s representative

(1) Transport costs for travel by a member’s spouse or nominee are prescribed if:

(a) the travel is for the dominant purpose of attending any of the following events as the member’s representative:

(i) a funeral;

(ii) a function at which the member was to receive an award or honour;

(iii) a function in the member’s electorate that the member was invited to attend; and

(b) the member is unable to attend the event because of illness, parliamentary business or family reasons; and

(c) the member’s attendance would have been for the dominant purpose of conducting the member’s parliamentary business.

(2) The travel must be by:

(a) scheduled commercial transport; or

(b) taxi or other chartered transport car service; or

(c) Commonwealth transport in accordance with a Commonwealth transport determination.

Spouses for whom transport costs are not prescribed by this section

(3) This section does not prescribe transport costs for the spouse of a senior office holder.

Note: For travel by the spouse of a senior office holder, see sections 24 and 28.

23 Travel as official invitee

(1) Transport costs are prescribed for the spouse or nominee of a member to attend, by invitation, an official government, parliamentary or vice‑regal function.

(2) If the spouse or nominee travels with the member, the family member may use the same method of transport as the member.

(3) If the spouse or nominee does not travel with the member, the travel must be by:

(a) scheduled commercial transport; or

(b) taxi or other chartered transport car service; or

(c) Commonwealth transport in accordance with a Commonwealth transport determination.

24 Travel as spouse of senior office holder

Travel to attend engagements

(1) Transport costs are prescribed for the spouse of a senior office holder to attend an engagement if the spouse is invited (either with or without the senior office holder) to attend the engagement in the spouse’s capacity as the spouse of a senior office holder.

Travel for family reunion purposes

(2) Transport costs are prescribed for the spouse of a senior office holder to travel for family reunion purposes.

Travel as senior office holder’s representative

(3) Transport costs are prescribed for the spouse of a senior office holder for travel as mentioned in subsection 22(1) (travel as member’s representative).

Type of travel

(4) If the spouse travels with the senior office holder, the spouse may use the same method of transport as the senior office holder.

(5) If the spouse does not travel with the senior office holder, the travel must be by:

(a) scheduled commercial transport; or

(b) taxi or other chartered transport car service; or

(c) Commonwealth transport in accordance with a Commonwealth transport determination.

25 Incidental transport costs

(1) This section applies if transport costs (including fares) are prescribed by this Subdivision for travel (the covered travel) by a family member of a member.

(2) Transport costs are prescribed for travel by the family member that is incidental to covered travel.

(3) The incidental travel must be one or more of the following:

(a) travel for the purposes of commencing or completing a journey that includes the covered travel;

(b) travel by the member’s spouse or nominee between the spouse or nominee’s accommodation in Canberra and Parliament House.

(4) The incidental travel must be by:

(a) scheduled commercial transport; or

(b) hired car, taxi or other chartered transport car service; or

(c) Commonwealth transport in accordance with a Commonwealth transport determination.

26 Parking fees for vehicles used for incidental transport

(1) This section applies if transport costs (including fares) are prescribed by this Subdivision for travel (the covered travel) by a family member of a member.

(2) Parking fees are prescribed for a private vehicle or private plated vehicle used by the family member for travel for the purpose of commencing or completing the journey that includes the covered travel.

Subdivision B—Travel allowances

27 Family member private vehicle allowance—travel to Canberra

(1) For the purposes of subsection 31(1) of the Act, an allowance (the family member private vehicle allowance) is prescribed for fuel and running costs for a family member of a member to travel to or from Canberra in the family member’s private vehicle for family reunion purposes.

Note 1: The private vehicle could be owned by another family member: see the definition of private vehicle in section 4.

Note 2: The rate of family member private vehicle allowance is determined by the Remuneration Tribunal: see subsections 31(2) and 45(1) of the Act.

(2) The travel by private vehicle may be for the whole or part of the journey.

Note: For annual limits on the use of transport costs prescribed by this section, see section 29.

Exchanging fares for allowance

(3) If a fare is available under section 17 or 18 for a family member for a financial year, the fare may be exchanged for family member private vehicle allowance.

(4) For the purposes of sections 17 and 18, a one‑way journey to or from Canberra counts as half of a return fare.

(5) If a fare is exchanged for family member private vehicle allowance, the amount of the allowance is not required to be counted for the purposes of the limit set out in section 29.

Note: More than one fare may be exchanged under subsection (4) during a financial year.

Allowance for some family members is available only if fare is exchanged

(6) Family member private vehicle allowance is available to the following only if a fare is exchanged under subsection (3):

(a) a family member of a senator for the Australian Capital Territory;

(b) a family member of a member whose electorate is in the Australian Capital Territory.

When section does not apply

(7) This section does not prescribe family member private vehicle allowance for the spouse of a senior office holder.

Note: For travel by the spouse of a senior office holder, see sections 24 and 28.

28 Senior office holder spouse private vehicle allowance—travel to Canberra

(1) For the purposes of subsection 31(1) of the Act, an allowance (the senior office holder spouse private vehicle allowance) is prescribed for fuel and running costs for the spouse of a senior office holder to travel to or from Canberra in the spouse’s private vehicle for family reunion purposes.

Note 1: The private vehicle could be owned by another family member: see the definition of private vehicle in section 4.

Note 2: The rate of senior office holder spouse private vehicle allowance is determined by the Remuneration Tribunal: see subsections 31(2) and 45(1) of the Act.

(2) The travel by private vehicle may be for the whole or part of the journey.

Subdivision C—Limit on certain costs

29 Limit on certain costs

(1) The total of the costs that can be claimed by a member for a financial year under the following provisions is limited:

(a) section 16 (family reunion travel to Canberra and within local area);

(b) section 22 (travel as member’s representative);

(c) section 27 (family member private vehicle allowance—travel to Canberra).

Note 1: Family member private vehicle allowance claimed in exchange for a fare under section 17 or 18 is not counted for the purposes of this section: see subsection 27(6).

Note 2: Transport costs for incidental travel prescribed by section 25 (incidental transport costs) are not counted for the purposes of this section.

Working out the limit

(2) The limit is the sum of the following:

(a) the value of 9 business class return airfares for the member’s spouse or nominee to travel from the spouse or nominee’s home base airport to Canberra;

(b) the value of 3 economy class return airfares for each dependent child of the member to travel from the child’s home base airport to Canberra.

Note: The spouse of a senior office holder is included for the purposes of working out this limit.

(3) If the home base for a spouse or nominee, or a dependent child, is within 150 km of Parliament House by road, the limit is to be calculated on the basis of return airfares from Sydney to Canberra.

(4) The value of the airfares for a financial year is to be determined by IPEA based on the reasonable costs of airfares during the latter part of the previous financial year.

When limit is determined

(5) The limit is to be determined by IPEA at the beginning of the financial year based on information provided by the member.

(6) Once determined, the limit is fixed for the financial year, despite changes in the member’s family circumstances during the year.

Note: If a person becomes a member during the year, the limit is pro‑rated under section 53 of the Act.

Division 3—Cost recovered travel by unscheduled commercial transport

30 Members

(1) This section applies if a member travels within Australia, and the member:

(a) would be able to claim transport costs prescribed by this instrument for the travel; but

(b) would not otherwise be able to claim additional transport costs to use unscheduled commercial transport for the travel.

(2) For the purposes of section 30 of the Act, any additional transport costs for the member, and any person travelling with the member, to travel by unscheduled commercial transport are prescribed if the additional costs are covered by a transport costs undertaking.

31 Persons travelling with members

(1) This section applies if:

(a) a member travels by unscheduled commercial transport within Australia; and

(b) transport costs for the member’s travel are prescribed by this instrument.

(2) For the purposes of section 30 of the Act, any additional transport costs for one or more persons to travel with the member are prescribed if the additional costs are covered by a transport costs undertaking.

32 Transport costs undertakings

(1) A person (including a member) may undertake to reimburse the Commonwealth for transport costs for travel by unscheduled commercial transport by one or more of the following:

(a) a member;

(b) one or more persons travelling with a member.

(2) To avoid doubt, the undertaking (the transport costs undertaking):

(a) may be made whether or not there are additional transport costs for a member or one or more other persons for the travel; and

(b) if there are such additional transport costs for the travel—may cover transport costs in excess of the additional costs.

(3) The transport costs undertaking must:

(a) be in writing; and

(b) include the amount of the transport costs to be reimbursed to the Commonwealth; and

(c) be signed, before the transport costs for the travel are claimed, by the person making the undertaking.

Note: Claim includes the incurring of expenses that are payable by the Commonwealth: see the definition of claim in section 5 of the Act.

Transport costs are a debt due to the Commonwealth

(4) The transport costs covered by the transport costs undertaking:

(a) are a debt due to the Commonwealth by the person who made the undertaking; and

(b) may be recovered, on behalf of the Commonwealth, by the resources provider by action in a relevant court.

33 Effect of undertakings on cost limits

(1) This section applies if:

(a) a member claims transport costs prescribed by this instrument for travel by unscheduled commercial transport; and

(b) use by the member of such transport costs is limited; and

(c) transport costs for the travel are covered by a transport costs undertaking.

(2) The costs covered by the transport costs undertaking do not count towards the limit for the member for the financial year concerned.

Note: This section is relevant for the limits set out in section 14 (large electorates) and section 29 (limit on certain costs for travel by family members).

Division 4—International travel

Subdivision A—Preliminary

34 Purpose of Division

For the purposes of sections 30 and 31 of the Act, this Division prescribes travel expenses and travel allowances for the purposes of international travel.

Note: The dominant purpose test applies in relation to claims for expenses and allowances prescribed by this Division for persons other than spouses accompanying members.

35 Meaning of international travel expenses

(1) International travel expenses means the following:

(a) transport costs for travel by scheduled commercial transport;

(b) transport costs for travel by unscheduled commercial transport within and between other countries;

(c) transport costs for travel by Commonwealth transport in accordance with a Commonwealth transport determination;

(d) accommodation costs (but not separate accommodation for a spouse);

(e) meal costs;

(f) pre‑travel medical expenses such as vaccinations;

(g) medical supplies (such as medicine or a first aid kit);

(h) emergency medical, dental or hospital expenses;

(i) for members and staff members, and for medical doctors accompanying the Prime Minister—official or diplomatic passports (including the costs of obtaining visas and photographs);

(j) for members—laundry and dry cleaning;

(k) for staff members, and for medical doctors accompanying the Prime Minister:

(i) premiums for insurance for baggage and personal effects up to an insured value of $5,000; and

(ii) if a claim is made on the insurance—any excess payable in relation to the claim; and

(iii) for travel lasting at least 7 days—laundry and dry cleaning;

(l) taxes, booking fees and other costs normally associated with expenses covered by paragraphs (d) to (k).

Certain vehicles not included

(2) Transport costs covered by paragraph (1)(b) (unscheduled commercial transport within and between other countries) do not include costs for travel in vehicles:

(a) required for the purposes of security; or

(b) available for the use of Australian diplomatic personnel at diplomatic posts.

Note: Such vehicles are provided otherwise than under the Act.

Limits for spouse travel

(3) For a spouse accompanying a member on international travel, transport costs for travel by commercial transport may be used only for the purposes of:

(a) accompanying the member; or

(b) engaging in a spouse program.

36 Transport costs for incidental travel within Australia

(1) This section applies if, in relation to international travel, transport costs for incidental travel within Australia are prescribed for a person other than a member.

(2) The transport costs are prescribed for the purposes of enabling the person to commence or complete the journey that includes the international travel.

(3) The travel must be by:

(a) scheduled commercial transport; or

(b) taxi or other chartered transport car service; or

(c) Commonwealth transport in accordance with a Commonwealth transport determination.

Note: Transport costs for incidental travel by members within Australia are available under Division 1.

37 Valuing first class round‑the‑world airfares

(1) For the purposes of this Division, the value of a first class round‑the‑world airfare for a financial year is to be determined by IPEA.

(2) The determination must be made using reasonable costs of first class airfares during the latter part of the previous financial year.

Subdivision B—Travel and approvals—presiding officers

38 Requirement for approval

(1) An expense (however described) prescribed by this Subdivision for a person (other than a presiding officer) is prescribed subject to the condition:

(a) that the travel by the person has been approved by the presiding officer concerned; or

(b) for an expense in excess of the limit set out in subsection 41(1)—that the expense, or the travel by the person, has been approved by the Prime Minister.

Note: The limit set out in subsection 41(1) does not apply in relation to expenses or travel approved by the Prime Minister: see subsection 41(3).

(2) An expense for a spouse or staff member accompanying a member (including a presiding officer) is also prescribed subject to the condition that if, during the travel, the spouse or staff member undertakes substantial travel (the independent travel) other than by travelling with the member, the independent travel has been expressly approved by:

(a) unless paragraph (b) applies—the presiding officer; or

(b) for travel approved by the Prime Minister as mentioned in subsection 41(3)—the Prime Minister.

Note: A person travels with a member if the person travels in the same vehicle, or on the same vessel or aircraft (or other conveyance) as the member: see section 7.

39 Travel by presiding officers

(1) This section applies in relation to international travel by a presiding officer.

The presiding officer and staff

(2) International travel expenses are prescribed for the following:

(a) the presiding officer;

(b) if the presiding officer’s spouse accompanies the presiding officer—one staff member accompanying the presiding officer;

(c) if the presiding officer’s spouse does not accompany the presiding officer—up to 2 staff members accompanying the presiding officer.

Spouse of the presiding officer

(3) For the spouse of the presiding officer to accompany the presiding officer, the following are prescribed:

(a) international travel expenses;

(b) transport costs for incidental travel within Australia.

40 Member representing presiding officer—approval by presiding officer

(1) This section applies in relation to international travel by a member representing a presiding officer.

Member and staff

(2) International travel expenses are prescribed for the following:

(a) the member;

(b) if the member’s spouse accompanies the member—one staff member accompanying the member;

(c) if the member’s spouse does not accompany the member—up to 2 staff members accompanying the member.

Accompanying spouse

(3) For the spouse of the member to accompany the member, the following are prescribed:

(a) international travel expenses;

(b) transport costs for incidental travel within Australia.

41 Limit on certain expenses

(1) International travel expenses prescribed by this Subdivision are limited to a total of $250,000 for a presiding officer for a financial year.

Note: Costs for incidental travel within Australia prescribed by this Subdivision are not included for the purposes of the limit.

(2) The limit applies to the office of presiding officer, not to the individual holding the office at a particular time.

(3) However, the limit does not apply in relation to an expense prescribed by this Subdivision if the expense or the travel concerned has been approved by the Prime Minister.

Subdivision C—Travel and approvals—Prime Minister

42 Requirements for approval

Travel must be approved by the Prime Minister

(1) An expense (however described) prescribed by this Subdivision for a person (other than the Prime Minister) is prescribed subject to the condition that the travel by the person has been approved by the Prime Minister.

(2) An expense for a spouse or staff member accompanying a member (including the Prime Minister) is also prescribed subject to the condition that if, during the travel, the spouse or staff member undertakes substantial travel (the independent travel) other than by travelling with the member, the independent travel has been expressly approved by the Prime Minister.

Note: A person travels with a member if the person travels in the same vehicle, or on the same vessel or aircraft (or other conveyance) as the member: see section 7.

(3) An expense for a spouse accompanying a member is also prescribed subject to the condition that if, during the travel, the spouse attends a spouse program, the attendance has been expressly approved by the Prime Minister.

When travel by one staff member is taken to have been approved

(4) If the Prime Minister approves international travel under this Subdivision by the Leader or Deputy Leader of the Opposition in the House of Representatives for the purposes of representing Australia, the Prime Minister is taken to have approved travel by one staff member accompanying the Leader or Deputy Leader.

43 Travel by Prime Minister

(1) This section applies in relation to international travel by the Prime Minister.

The Prime Minister, staff and other persons

(2) International travel expenses are prescribed for the following:

(a) the Prime Minister;

(b) staff members:

(i) accompanying the Prime Minister; or

(ii) travelling in advance of the Prime Minister for the purposes of the international travel;

(c) a medical doctor accompanying the Prime Minister;

(d) an interpreter accompanying the Prime Minister.

(3) For a medical doctor accompanying the Prime Minister, the following are prescribed:

(a) transport costs for incidental travel within Australia;

(b) costs of accommodation and meals, and incidental expenses incurred, within Australia to the extent that they are reasonably required for the medical doctor to commence or complete the journey that includes the international travel.

Accompanying spouse

(4) For the spouse of the Prime Minister to accompany the Prime Minister, the following are prescribed:

(a) international travel expenses;

(b) transport costs for incidental travel within Australia.

Additional expenses for the Prime Minister

(5) Expenses for resources reasonably required for the conduct of the Prime Minister’s official duties during international travel, including the following, are prescribed:

(a) hiring office space, office equipment or other premises or facilities;

(b) facilities and services for the use of information and communications technology (other than mobile telecommunications or mobile internet devices or services);

(c) interpreters or other specialist services;

(d) hospitality;

(e) newspapers and other consumables;

(f) booking and cancellation fees;

(g) other associated fees and charges.

44 Other Ministers—approval by Prime Minister

(1) This section applies in relation to international travel by a Minister (including a Parliamentary Secretary).

The Minister and staff

(2) International travel expenses are prescribed for the following:

(a) the Minister;

(b) staff members accompanying the Minister.

Accompanying spouse

(3) For the spouse of the Minister to accompany the Minister, the following are prescribed:

(a) international travel expenses;

(b) transport costs for incidental travel within Australia.

45 Members representing Ministers—approval by Prime Minister

(1) This section applies in relation to international travel by a member (the representative, who may be a Minister) representing the Prime Minister or another Minister.

The representative

(2) International travel expenses are prescribed for the representative.

Accompanying spouse

(3) For the spouse of the representative to accompany the representative, the following are prescribed:

(a) international travel expenses;

(b) transport costs for incidental travel within Australia.

46 Member representing the government or Australia—approval by Prime Minister

(1) This section applies in relation to international travel by a member who is representing the government or Australia.

The member and staff

(2) International travel expenses are prescribed for the following:

(a) the member;

(b) if the member is the Leader or Deputy Leader of the Opposition in the House of Representatives and is representing Australia—the staff member taken to have been approved by the Prime Minister under subsection 42(3).

Accompanying spouse

(3) For the spouse of the member to accompany the member, the following are prescribed:

(a) international travel expenses;

(b) transport costs for incidental travel within Australia.

Subdivision D—Travel and approvals—Leader of the Opposition

47 Requirement for approval

An expense (however described) prescribed by this Subdivision for a person (other than the Leader of the Opposition in the House of Representatives) is prescribed subject to the condition that the travel by the person has been approved by the Leader of the Opposition in the House of Representatives.

48 Travel by Leader of the Opposition

(1) This section applies in relation to international travel by the Leader of the Opposition in the House of Representatives.

The Leader and staff

(2) International travel expenses are prescribed for the following:

(a) the Leader;

(b) up to 2 staff members accompanying the Leader.

49 Member of the Opposition—approval by Leader of the Opposition

(1) This section applies in relation to international travel by a member of the Opposition.

The member and staff

(2) International travel expenses are prescribed for the following:

(a) the member;

(b) up to 2 staff members accompanying the member.

50 Limit on certain expenses

(1) International travel expenses prescribed by this Subdivision for a financial year are limited to a total of the value of 4 first class round‑the‑world airfares.

Note: Section 37 provides for IPEA to determine the value of a first class round‑the‑world airfare.

Adjusting the limit

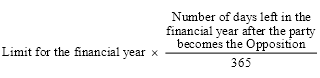

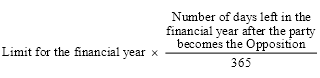

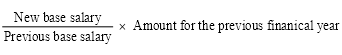

(2) If, during the financial year, a person becomes the Leader of the Opposition in the House of Representatives because the person’s party becomes the Opposition or a part of the Opposition, the limit is to be adjusted in accordance with the following formula:

(3) An adjusted limit must be rounded up to the nearest dollar.

Expenses of one staff member may be disregarded

(4) For the purposes of this section, the international travel expenses of one staff member accompanying a senior office holder may be disregarded.

Subdivision E—Travel and approvals—leader of a minority party

51 Requirement for approval

An expense (however described) prescribed by this Subdivision for a person (other than the leader of a minority party) is prescribed subject to the condition that the travel by the person has been approved by the leader of the minority party concerned.

52 Travel by leader of a minority party

(1) This section applies in relation to international travel by the leader of a minority party.

The leader and staff

(2) International travel expenses are prescribed for the following:

(a) the leader;

(b) up to 2 staff members accompanying the leader.

53 Member of a minority party—approval by leader of the minority party

(1) This section applies in relation to international travel by a member of a minority party.

The member and staff

(2) International travel expenses are prescribed for the following:

(a) the member;

(b) up to 2 staff members accompanying the member.

54 Limit on certain expenses

(1) International travel expenses prescribed by this Subdivision for a financial year are limited to a total of the value of one first class round‑the‑world airfare.

Note: Section 37 provides for IPEA to determine the value of a first class round‑the‑world airfare.

Adjusting the limit

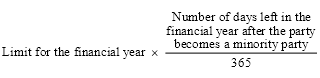

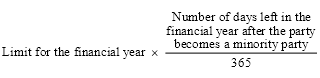

(2) If, during the financial year, a person becomes the leader of a minority party because the person’s party becomes a minority party, the limit is to be adjusted in accordance with the following formula:

(3) An adjusted limit must be rounded up to the nearest dollar.

Expenses of one staff member may be disregarded

(4) For the purposes of this section, the international travel expenses of one staff member accompanying the leader of the minority party may be disregarded.

Subdivision F—Travel and approvals—parliamentary delegations

55 Requirement for approval

(1) An expense (however described) prescribed by this Subdivision for a person is prescribed subject to the condition that the travel by the person has been approved by both presiding officers.

(2) However, subsection (1) does not apply in relation to the following:

(a) international travel expenses prescribed by subsection 56(3) (extended travel);

(b) airfares (or contributions towards airfares) prescribed by subsection 56(4) (spouse travel).

(3) An international travel expense prescribed by subsection 56(3) (extended travel) for a member is prescribed subject to the condition that the additional travel by the member has been approved by the Minister.

56 Member of parliamentary delegation—approval by presiding officers

(1) This section applies in relation to international travel by a member of a parliamentary delegation (other than an Inter‑Parliamentary Union or Commonwealth Parliamentary Association delegation).

Note: Travel expenses for a member of an Inter‑Parliamentary Union or Commonwealth Parliamentary Association delegation may be provided otherwise than under the Act.

The member

(2) International travel expenses are prescribed for the member.

Extended travel for member

(3) International travel expenses are prescribed for the member to include additional travel if the conditions in subsection (5) are met.

Spouse

(4) Airfares (or contributions towards airfares) are prescribed for the spouse of the member to accompany the member if the conditions in subsection (5) are met.

Conditions for additional travel and airfares for spouse

(5) The conditions are:

(a) that the member makes a saving by travelling on airfares that cost less than airfares that may otherwise be claimed for travel by the member as part of the delegation; and

(b) that the combined cost of the following do not exceed the saving made by the member:

(i) any international travel expenses for additional travel by the member;

(ii) any airfares (or contributions towards airfares) for the member’s spouse to accompany the member.

57 Parliamentary delegations—meeting facilities and hospitality

(1) This section applies in relation to international travel by members of a parliamentary delegation (other than an Inter‑Parliamentary Union or Commonwealth Parliamentary Association delegation).

(2) Expenses for the following for the purposes of the travel are prescribed:

(a) facilities and services necessary for meetings of the delegation;

(b) official hospitality, up to a maximum for the delegation of:

(i) if a presiding officer leads the delegation—$5,000; or

(ii) if not—$2,500.

Subdivision G—International travel allowances

58 Operation of Subdivision

(1) This Subdivision prescribes travel allowances for international travel by specified persons.

(2) The travel allowances are not payable unless international travel expenses for the international travel concerned are prescribed:

(a) under this Division; and

(b) for international travel meal allowance—under Subdivision B or F.

59 International travel incidentals allowance

(1) An allowance for incidental expenses (the international travel incidentals allowance) is prescribed for the following for each day (or part day) on which the person is outside Australia:

(a) a member;

(b) a staff member;

(c) a medical doctor accompanying the Prime Minister.

(2) The rate of international travel incidentals allowance is:

(a) for a member—$63 per day; or

(b) for a staff member or medical doctor—$40 per day.

60 International travel equipment allowance

(1) An allowance for equipment and clothing (the international travel equipment allowance) is prescribed for the following:

(a) a member;

(b) a staff member;

(c) a medical doctor accompanying the Prime Minister.

(2) The amount of an international travel equipment allowance is $430, but is not payable to a particular person more than once in any period of 3 consecutive financial years.

61 International travel meal allowance

(1) An allowance for meals (the international travel meal allowance) is prescribed for the following:

(a) a member;

(b) a staff member.

Note: International travel meal allowance is available only if international travel expenses for the international travel concerned are prescribed under Subdivision B or F: see subsection 58(2).

(2) The amount of an international travel meal allowance for a particular person for particular travel is the amount determined by IPEA having regard to the following:

(a) the amount of international travel expenses provided to the person for meals for the travel;

(b) meals provided for the person for the travel otherwise than under this instrument;

(c) any other matters IPEA considers relevant.

Division 5—Travel by Commonwealth transport

62 Provision of Commonwealth transport

For the purposes of subsection 33(1) of the Act, Commonwealth transport is prescribed.

Note: The dominant purpose test applies in relation to public resources prescribed by this section.

63 Use of Commonwealth transport

(1) For the purposes of subsection 33(7) of the Act, a determination providing for Commonwealth transport may provide as mentioned in this section.

When Commonwealth transport may be made available

(2) The determination may set out one or more of the following:

(a) the circumstances in which Commonwealth transport may be available for use by:

(i) a member; or

(ii) a family member of a member; or

(iii) a person travelling with the member;

(b) the circumstances in which costs for travel, by a member or another person, by Commonwealth transport are to be:

(i) deducted from a budget, limit or other amount prescribed by this instrument (including a budget, limit or other amount prescribed for another kind of transport); or

(ii) reimbursed by the member or another person;

(c) if costs are to be deducted or reimbursed—the amount of the costs, or a method for determining the costs.

(3) The circumstances in which Commonwealth transport may be made available under paragraph (2)(a) are not limited by other provisions of this instrument.

Ensuring value for money

(4) If the determination provides for another Minister to approve the use of Commonwealth transport, the determination may specify matters to be considered by the other Minister in deciding whether to approve the use, including the following:

(a) the nature of the related parliamentary business;

(b) the availability and cost of other transport options;

(c) any security concerns around the use of other transport options;

(d) other matters relevant to whether the use would provide value for money.

When Commonwealth transport must be used

(5) The determination may set out circumstances in which Commonwealth transport must be used.

(6) If the Administrator considers it appropriate to do so, the Administrator may refuse to approve a claim in relation to travel by other means in those circumstances.

Effect of this section

(7) This section does not limit the matters that may be dealt with by the determination.

Division 6—Miscellaneous

64 Expenses for travel that spans financial years

For the purposes of this Part:

(a) an expense for a fare (whether one‑way or return) is taken to have been incurred in the financial year in which travel on the fare commenced; and

(b) an expense or allowance for a leg of travel by unscheduled transport is taken to have been incurred in the financial year in which the leg of travel commenced; and

(c) an expense or allowance for an overnight stay is taken to have been incurred in the financial year in which the overnight stay commenced; and

(d) an international travel allowance paid for international travel is taken to have been paid for the financial year in which the travel commenced.

65 Costs relating to cancelled travel

For the purposes of section 30 of the Act and subsection 32(1) of the Act, expenses incurred for cancelling travel arrangements are prescribed if any expenses for the travel could have been claimed under the Act.

Part 3—Work expenses and other public resources

66 Office expenses

(1) For the purposes of subsection 32(1) of the Act, expenses (the office expenses) for the following are prescribed for the conduct of a member’s parliamentary business:

(a) printing on:

(i) paper weighing no more than 700 grams per square metre; or

(ii) flat magnetised material;

(b) producing electronic material;

(c) producing and maintaining audio posters;

(d) creating matter for inclusion in printed or electronic material or an audio poster, including translation, design, artwork, photography and video and sound recordings;

(e) communicating and distributing printed and electronic material and audio posters;

(f) establishing and maintaining websites;

(g) printing and distributing postal vote applications, including reply paid envelopes;

(h) flags and documents related to nationhood, of kinds approved by the Minister, for presentation to constituents or organisations;

(i) office stationery and supplies;

(j) minor office equipment, including accessories, consumables, repairs and maintenance;

(k) accessories for information and communications technology (such as storage devices, portable power banks and camera lenses for mobile devices);

(l) software, including associated servicing, training and backup services;

(m) purchasing publications (whether printed or electronic);

(n) courier or other freight transfer costs for transferring documents and other small items between the member’s offices;

(o) mobile office signage;

(p) conducting virtual town hall meetings by electronic communication;

(q) incidental fees and charges associated with the provision of resources covered by paragraphs (a) to (p), such as transaction, administration and delivery fees or charges.

Note: This subsection does not prevent members entering into cost sharing arrangements with each other, but each member would be required to claim the member’s proportion of the expenses for such purchases.

(2) Office expenses must not be used to pay for production or placement of content for broadcasting on television or radio.

(3) Office expenses must not be used to produce, communicate or distribute material that:

(a) solicits any of the following:

(i) a vote for a person other than the member;

(ii) subscriptions or other financial or non‑financial support (other than volunteering) for a member, political party or candidate;

(iii) applications for or renewals of membership in a political party; or

(b) provides instruction on how to complete a ballot paper.

(4) Office expenses must not be used to produce, communicate or distribute any material that includes an advertisement pursuing a commercial purpose of the member or another person.

(5) Office expenses must not be used to pay for postage stamps or stamped envelopes, other than those provided by a Department of the Parliament established under the Parliamentary Service Act 1999.

Note: The dominant purpose test applies in relation to claims for expenses prescribed by this section.

67 Annual budget for office expenses

Senators

(1) For a senator, the maximum amount payable for office expenses is:

(a) for the 2017‑2018 financial year—$107,331.24; or

(b) for a later financial year—that amount indexed in accordance with section 102.

Members of the House of Representatives

(2) For a member of the House of Representatives, the maximum amount payable for office expenses is:

(a) for the 2017‑2018 financial year—the amount worked out as the office budget for the member for the financial year under regulation 3ED of the Parliamentary Entitlements Regulations 1997 (as in force immediately before the commencement of this subsection); or

(b) for a later financial year—the sum of the following amounts indexed in accordance with section 102 as if the amounts were first paid in the 2017‑2018 financial year:

(i) $134,099.34;

(ii) $1 for each enrolled voter in the member’s electorate.

(3) For the purposes of paragraph (2)(b), the number of enrolled voters in the member’s electorate for the financial year is:

(a) the number of the enrolled voters in the electorate at the end of 31 March in the previous financial year (using the boundaries of the electorate at the last general election); or

(b) if the electorate did not exist at the end of 31 March in the previous financial year—the number of enrolled voters in the electorate as at the next close of the electoral roll for that electorate.

Other members

(4) For a member who is not a senator or a member of the House of Representatives, the amount payable for office expenses is zero.

Calculations for the purposes of this section

(5) For the purposes of this section, an indexed amount must be rounded up to the nearest cent.

68 Postage costs for official duties

For the purposes of subsection 32(1) of the Act, postage expenses for the purposes of conducting official duties are prescribed for the following:

(a) a senior office holder who is a member of the Opposition;

(b) the leader of a minority party.

Note 1: Section 6 of the Act defines official duties for office holders and Ministers.

Note 2: The dominant purpose test applies in relation to claims for expenses prescribed by this section.

69 Photographic services

(1) For the purposes of subsection 32(2) of the Act, 2 sessions of photographic services at Parliament House are prescribed for a member for a financial year.

(2) The photographic services are available:

(a) on request to the Department of Parliamentary Services; and

(b) as arranged between the member and the Department of Parliamentary Services.

(3) For the purposes of subsection 32(2) of the Act, additional sessions of photographic services at Parliament House are prescribed for members:

(a) subject to availability; and

(b) on request to, and at the discretion of, the Department of Parliamentary Services.

(4) The cost of photographic services for all members for a financial year is limited to a combined total of $250,000.

Note: The dominant purpose test applies in relation to claims for public resources prescribed by this section.

70 Chamber flags

(1) For the purposes of subsection 32(2) of the Act, the following are prescribed for members for presentation to constituents or organisations:

(a) flags that were hung, on a sitting day, for or in a chamber of a House of the Parliament;

(b) certificates stating the flags were hung for or in that chamber.

(2) Flags and certificates are provided under this section:

(a) subject to availability; and

(b) on request to, and at the discretion of, the Serjeant‑at‑Arms or Usher of the Black Rod.

Note: The dominant purpose test applies in relation to claims for public resources prescribed by this section.

71 Leasing expenses for additional offices for certain members

(1) This section applies if:

(a) a member of the House of Representatives has an electorate with an area of at least 5,000 km2 but less than 25,000 km2; and

(b) the member leases an office in the electorate for a term of not less than 6 months; and

(c) the office is, or is part of, a permanent building; and

(d) the member leases the office in the member’s personal capacity; and

(e) the office is used for the dominant purpose of conducting the member’s parliamentary business.

(2) For the purposes of subsection 32(2) of the Act, the following maximum amount is prescribed to reimburse the member for costs (including GST) incurred by the member to lease, operate, maintain, establish or vacate the office:

(a) for the 2017‑2018 financial year—$50,000;

(b) for a later financial year—that amount indexed in accordance with section 102.

(3) An indexed amount for a later financial year must be rounded up to the nearest cent.

(4) This section does not apply in relation to any cost to lease, operate or maintain the office that would give rise to any ownership or residual value held by the member in furniture or equipment.

(5) This section does not apply to prescribe an amount to reimburse a member for costs for an office that is used to any extent for commercial purposes.

Note: The dominant purpose test applies in relation to claims for public resources prescribed by this section.

Part 4—Resources determined by the Minister

72 Electorate offices

For the purposes of subsection 33(1) of the Act, one or more offices (the electorate offices) are prescribed for a member in the member’s electorate.

Note 1: A senator’s electorate is the State or Territory represented by the senator: see the definition of electorate in section 4.

Note 2: The dominant purpose test applies in relation to public resources prescribed by this section.

Note 3: Public resources prescribed for the purposes of subsection 33(1) of the Act are provided as determined by the Minister.

73 Offices for Ministers and office holders

(1) For the purposes of subsection 33(1) of the Act, an office or offices are prescribed for a Minister (other than a Parliamentary Secretary).

Note: Offices prescribed by this section are in addition to offices prescribed by section 72.

(2) For the purposes of subsection 33(1) of the Act, an additional office is prescribed for each of the following members:

(a) a presiding officer;

(b) a senior office holder who is a member of the Opposition;

(c) the leader of a minority party.

Note 1: The dominant purpose test applies in relation to public resources prescribed by this section.

Note 2: Public resources prescribed for the purposes of subsection 33(1) of the Act are provided as determined by the Minister.

74 Resources for offices

(1) For the purposes of subsection 33(1) of the Act, the public resources reasonably required for the conduct of a member’s parliamentary business in offices provided by the Commonwealth are prescribed.

(2) The public resources may include the following:

(a) furniture and fittings;

(b) information and communications technology and services;

(c) office equipment;

(d) audio visual equipment;

(e) car parking;

(f) signage;

(g) security;

(h) post office boxes;

(i) flagpoles;

(j) training.

Note: Public resources prescribed for the purposes of subsection 33(1) of the Act are provided as determined by the Minister.

(3) Subsection (2) does not limit subsection (1).

(4) For the purposes of subsection 33(7) of the Act, a determination providing for public resources prescribed by this section may also provide for the use of the resources in other places for the purposes of conducting the member’s parliamentary business.

Note: The dominant purpose test applies in relation to public resources prescribed by this section.

75 Resources during election periods

(1) For the purposes of subsection 33(1) of the Act, facilities and equipment reasonably required for conducting the parliamentary business of the Leader of the Opposition in the House of Representatives during an election period (including for a half‑Senate election) are prescribed.

Note: Public resources prescribed for the purposes of subsection 33(1) of the Act are provided as determined by the Minister.

(2) The facilities and equipment are prescribed for distribution to the following at the discretion of the Leader:

(a) members of the Opposition;

(b) staff members of members of the Opposition.

Determination may specify resources and conditions

(3) For the purposes of subsection 33(7) of the Act, a determination providing for facilities and equipment as mentioned in subsection (1) of this section may provide for:

(a) the kinds of facilities and equipment to be provided; and

(b) conditions on the use of the facilities and equipment.

(4) An election period:

(a) for the House of Representatives:

(i) commences on the day after the House of Representatives is dissolved or expires; and

(ii) ends at the end of the day before the following polling day for the House; and

(b) for the Senate:

(i) commences on the day the first writ for the election is issued; and

(ii) ends at the end of the day before the following polling day for the Senate.

Note: The dominant purpose test applies in relation to public resources prescribed by this section.

76 Mobile phone services for personal staff

(1) For the purposes of subsection 33(1) of the Act, mobile phones and mobile phone services are prescribed for members for use by personal employees who have been allocated under section 12 or 13 of the Members of Parliament (Staff) Act 1984.

(2) The phones and services are prescribed:

(a) for distribution at the discretion of members; and

(b) on the following conditions:

(i) that the Minister is provided with such information as the Minister requires in relation to the use of the phones;

(ii) that a phone is returned when the personal employee to whom it has been distributed ceases to be a personal employee.

Note: Public resources prescribed for the purposes of subsection 33(1) of the Act are provided as determined by the Minister.

Determination may specify administration arrangements

(3) For the purposes of subsection 33(7) of the Act, a determination providing for mobile phones and mobile phone services as mentioned in subsection (1) of this section may provide for administration arrangements for the phones and services.

Note: The dominant purpose test applies in relation to public resources prescribed by this section.

77 Exceptional circumstances determinations

(1) For the purposes of subsection 33(7) of the Act, the Minister must take into account the following matters when deciding whether exceptional circumstances justify a determination under subsection 33(2) of the Act for provision of public resources relating to the conduct of a member’s parliamentary business:

(a) any unexpected event, such as a natural disaster, that has affected the member or the member’s electorate;

(b) any circumstances which mean that the member’s needs cannot otherwise be addressed under the Act;

(c) the member’s family or caring responsibilities;

(d) whether, despite the member being otherwise ineligible for a public resource, providing the member with that resource would represent value for money for the Commonwealth.

(2) The Minister may take into account any other matter the Minister considers relevant.

Part 5—Other resources

Division 1—Insurance

78 Insurance cover for parliamentary business

(1) For the purposes of subsection 42(1) of the Act, the Commonwealth is to provide insurance obtained by the Commonwealth to cover the persons, activities and matters described in this section.

Policies must be approved by the Minister

(2) The insurance must be in the form of a policy or policies of insurance approved by the Minister, and is subject to any terms, conditions, limitations or exclusions specified in the policy or policies concerned.