Child Support (Registration and Collection) Regulations 2018

I, General the Honourable Sir Peter Cosgrove AK MC (Ret’d), Governor‑General of the Commonwealth of Australia, acting with the advice of the Federal Executive Council, make the following regulations.

Dated 15 March 2018

Peter Cosgrove

Governor‑General

By His Excellency’s Command

Dan Tehan

Minister for Social Services

Contents

Part 1—Preliminary

1 Name

2 Commencement

3 Authority

4 Schedule 1

5 Schedule 2

6 Schedule 3

7 Schedule 4

8 Definitions

9 Protected earnings rate

10 Reciprocating jurisdictions

Part 2—Registration of maintenance liabilities

11 Registrable overseas maintenance liability—penalty under international treaty

12 Transmission of variation claims to overseas authorities

13 Exclusion of liabilities

14 Inclusion of liabilities in Child Support Register—exceptions

15 Conversion of amounts payable under registrable maintenance liabilities

16 Enforcement of Australian liabilities in reciprocating jurisdictions—exceptions

17 Prescribed income test

18 Satisfactory payment record

Part 3—Payment and recovery of child support debts

19 Specified payments

20 Prescribed periodic deduction

21 Prescribed periodic deduction for veterans

Part 4—Departure prohibition orders

22 Departure prohibition orders—prescribed persons

Part 5—Payments to payees

23 Prescribed amount that person not entitled to be paid

24 Prescribed amount—remittances from employers

Part 6—Review by the Administrative Appeals Tribunal

25 Limitation of powers of AAT

Part 7—Miscellaneous

26 Debts due to the Commonwealth

27 Scale of expenses

28 Evidentiary certificates

29 Evidence by affidavit

30 Documents taken to be duly signed

31 Service of notices etc.

32 Service of documents in Australia for overseas authority

33 Giving notices or other communications in reciprocating jurisdictions

34 Address for service

35 Failure to notify change of address

36 Assistance in communicating with overseas authorities

37 Conversion of foreign currency to Australian currency

38 Conversion of Australian currency to New Zealand currency

Schedule 1—Australia–New Zealand Agreement

Schedule 2—Reciprocating jurisdictions

Schedule 3—Powers of Registrar that AAT must not exercise

Part 1—Provisions of the Act

Part 2—Provisions of the Assessment Act

Schedule 4—Repeals

Child Support (Registration and Collection) Regulations 1988

Part 1—Preliminary

1 Name

This instrument is the Child Support (Registration and Collection) Regulations 2018.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | 20 March 2018 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Child Support (Registration and Collection) Act 1988.

4 Schedule 1

Schedule 1 to this instrument sets out the Australia‑New Zealand Agreement.

5 Schedule 2

Schedule 2 to this instrument prescribes each foreign country, or a part of a foreign country, that is a reciprocating jurisdiction for the purposes of the definition of reciprocating jurisdiction in subsection 4(1) of the Act.

6 Schedule 3

Schedule 3 to this instrument prescribes the provisions of the Act that confer powers or discretions on the Registrar that the AAT must not exercise for the purposes of an AAT first review.

7 Schedule 4

Each instrument that is specified in Schedule 4 to this instrument is amended or repealed as set out in the applicable items in that Schedule concerned, and any other item in that Schedule to this instrument has effect according to its terms.

8 Definitions

Note: A number of expressions used in this instrument are defined in the Act, including the following:

(a) Assessment Act;

(b) child support assessment;

(c) Child Support Register;

(d) enforceable maintenance liability;

(e) Human Services Department.

In this instrument:

account means an account, maintained by a person, to which money received on deposit by a bank, or a foreign corporation, from that person is credited.

Act means the Child Support (Registration and Collection) Act 1988.

address for service, in relation to a person, includes both:

(a) the person’s address for the physical delivery of notices; and

(b) the person’s address for the electronic delivery of notices.

Australia‑New Zealand Agreement means the Agreement between the Government of Australia and the Government of New Zealand on Child and Spousal Maintenance done at Canberra on 12 April 2000, a copy of the text of which is set out in Schedule 1.

bank includes a body corporate that is an ADI (authorised deposit‑taking institution) for the purposes of the Banking Act 1959.

consent has the meaning given by section 5 of the Electronic Transactions Act 1999.

electronic communication has the meaning given by section 5 of the Electronic Transactions Act 1999.

Foreign Affairs Department means the Department administered by the Minister responsible for administering the Diplomatic Privileges and Immunities Act 1967.

instalment period means the period for a social security periodic payment determined under paragraph 43(1)(b) of the Social Security (Administration) Act 1999.

minimum annual rate of child support means the amount

set out in subsection 66(5) of the Assessment Act as if

that amount applied to a calendar year in which a periodic deduction is made.

minimum social security rate has the meaning given by subsection 20(3) of this instrument.

minimum veterans rate has the meaning given by subsection 21(3) of this instrument.

ordinary income has the same meaning as in subsection 8(1) of the Social Security Act 1991.

partnered has the same meaning as in paragraph 4(11)(a) of the Social Security Act 1991.

pension period has the same meaning as in section 5Q of the Veterans’ Entitlements Act 1986.

week day means a day other than a Saturday or a Sunday.

9 Protected earnings rate

For the purposes of the definition of protected earnings rate in subsection 4(1) of the Act, the prescribed weekly rate for a year commencing on 1 January is the rate that:

(a) is 75% of the maximum fortnightly basic rate of newstart allowance, as determined under the Social Security Act 1991; and

(b) is payable, on 1 January in that year, to a person who is partnered, has turned 21 years of age and who is without dependent children.

10 Reciprocating jurisdictions

For the purposes of the definition of reciprocating jurisdiction in subsection 4(1) of the Act, each foreign country, or a part of a foreign country, mentioned in Schedule 2 to this instrument is prescribed.

Part 2—Registration of maintenance liabilities

11 Registrable overseas maintenance liability—penalty under international treaty

For the purposes of paragraph 18A(3)(b) of the Act, the following are prescribed:

(a) the Australia‑New Zealand Agreement;

(b) Article 15 of that Agreement.

12 Transmission of variation claims to overseas authorities

(1) If, under a law of a reciprocating jurisdiction, a person claims to be entitled to variation of a registered maintenance liability of a kind mentioned in section 18A of the Act, the person may apply to the Registrar to have a claim for variation transmitted to an overseas authority of the reciprocating jurisdiction.

(2) The Registrar must take, on behalf of the applicant, any action required to be taken, for the purposes of an international maintenance arrangement with the reciprocating jurisdiction, to seek the variation.

(3) The Registrar must not take any action under subsection (2) unless satisfied that the claim is in accordance with the international maintenance arrangement.

13 Exclusion of liabilities

For the purposes of subsection 19(1) of the Act, a liability is not a registrable maintenance liability if:

(a) it is a liability arising under an order made under section 66Q or 77 of the Family Law Act 1975 or under section 139 of the Assessment Act; and

(b) the person who is entitled to receive payments under the liability does not give to the Registrar a duly completed approved form requesting that the liability be enforced under the Act.

14 Inclusion of liabilities in Child Support Register—exceptions

For the purposes of subsection 25A(5) of the Act, New Zealand is prescribed.

15 Conversion of amounts payable under registrable maintenance liabilities

(1) This section is made for the purposes of section 29 of the Act.

(2) For the conversion of amounts payable under a registrable maintenance liability that are quantified by reference to a period, or a multiple of a period, specified in the following table into a rate of payment quantified by reference to another such period, or a multiple of such period, those periods are taken to comprise the number of days respectively specified in the table.

Conversion of amounts payable under registrable maintenance liabilities |

Period | Number of days in the period |

Week | 7 |

Fortnight | 14 |

4 weeks | 28 |

Month | 30.4375 |

Year | 365.25 |

(3) In calculating a conversion, the daily rate is to be rounded to 5 decimal places (rounding up if the sixth decimal place is 5 or more).

16 Enforcement of Australian liabilities in reciprocating jurisdictions—exceptions

For the purposes of the definition of excepted reciprocating jurisdiction in subsection 30A(4) of the Act, each of the following reciprocating jurisdictions is declared to be an excepted reciprocating jurisdiction in respect of a child support assessment:

(a) Brunei Darussalam;

(b) Cook Islands;

(c) Israel;

(d) Niue;

(e) Papua New Guinea;

(f) Samoa;

(g) the Yukon Territory of Canada.

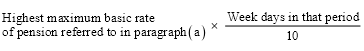

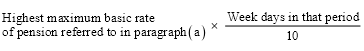

17 Prescribed income test

(1) For the purposes of paragraph 37B(4)(b) of the Act, a payer is taken to satisfy the income test in relation to the first instalment of a social security pension or a social security benefit paid to the payer after the day on which an application is made under subsection 37B(2) of the Act if:

(a) if that instalment was paid in respect of a fortnight—the total of:

(i) the amount of that instalment, less any non‑taxable additional amounts; and

(ii) the amount of the payer’s ordinary income for that fortnight;

is not more than the highest maximum basic rate of pension for a fortnight under Table B of point 1064‑B1 in the Rate Calculator at the end of section 1064 of the Social Security Act 1991; or

(b) if that instalment was paid in respect of a period of less than a fortnight—the total of:

(i) the amount of that instalment, less any non‑taxable additional amounts; and

(ii) the amount of the payer’s ordinary income for that period;

is not more than the amount calculated using the formula:

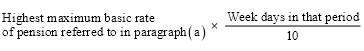

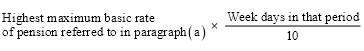

(2) For the purposes of paragraph 37B(5)(b) of the Act, a payer is taken not to satisfy the income test in relation to an instalment of a social security pension or a social security benefit paid to the payer for a particular fortnight if:

(a) if that instalment was paid in respect of a fortnight—the total of:

(i) the amount of that instalment, less any non‑taxable additional amounts; and

(ii) the amount of the payer’s ordinary income for that fortnight;

is more than the highest maximum basic rate of pension for a fortnight under Table B of point 1064‑B1 in the Rate Calculator at the end of section 1064 of the Social Security Act 1991; or

(b) if that instalment was paid in respect of a period of less than a fortnight—the total of:

(i) the amount of that instalment, less any non‑taxable additional amounts; and

(ii) the amount of the payer’s ordinary income for that period;

is more than the amount calculated using the formula:

18 Satisfactory payment record

For the purposes of paragraph 38B(1)(a) of the Act, a payer is taken to have a satisfactory payment record in relation to the previous 6 months period in relation to an enforceable maintenance liability if:

(a) the enforceable maintenance liability has been enforceable for at least 6 months; and

(b) all enforceable maintenance liabilities arising during those 6 months:

(i) were paid when they were due; or

(ii) if they were not paid when they were due, there are circumstances that satisfactorily explain the late payment; and

(c) no arrears are outstanding.

Part 3—Payment and recovery of child support debts

19 Specified payments

For the purposes of paragraph 71C(1)(b) of the Act, payments of the following kinds in relation to an enforceable maintenance liability are specified:

(a) child care costs for the child who is the subject of the enforceable maintenance liability;

(b) fees charged by a school or preschool for that child;

(c) amounts payable for uniforms and books required by a school or preschool for that child;

(d) fees for essential medical and dental services for that child;

(e) the payee’s share of amounts payable for rent or a security bond for the payee’s home;

(f) the payee’s share of amounts payable for utilities, rates or body corporate charges for the payee’s home;

(g) the payee’s share of repayments on a loan that financed the payee’s home;

(h) costs to the payee of obtaining and running a motor vehicle, including repairs and standing costs.

20 Prescribed periodic deduction

(1) If a person:

(a) is a payer of an enforceable maintenance liability covered by subsection 17(2) of the Act; and

(b) is in receipt of a social security pension or social security benefit;

then, for the purposes of paragraph 72AA(1)(b) of the Act, the prescribed periodic deduction from the person’s pension or benefit is the lesser of:

(c) 3 times the minimum social security rate for the instalment period for the pension or benefit; and

(d) the amount of the enforceable maintenance liability payable for the instalment period.

(2) If a person:

(a) has an unpaid child support debt; and

(b) is in receipt of a social security pension or social security benefit;

then, for the purposes of subparagraph 72AA(2)(d)(i) of the Act, the prescribed periodic deduction from the person’s pension or benefit is the lesser of:

(c) 3 times the minimum social security rate for the instalment period, less any amount to be deducted from the person’s pension or benefit under paragraph 72AA(1)(b) of the Act; and

(d) the amount of the unpaid child support debt.

(3) The minimum social security rate, for an instalment period in a calendar year for a person’s social security pension or social security benefit, is worked out as follows:

Method statement

Step 1. Divide the minimum annual rate of child support by 365.25.

Step 2. The amount worked out in step 1 must be rounded to 5 decimal places (rounding up if the sixth decimal place is 5 or more).

Step 3. Multiply the amount worked out in step 2 by the number of days in the instalment period for the person’s social security pension or social security benefit.

Step 4. Round the amount worked out in step 3 to the nearest cent by increasing the second decimal place by 1 if the third decimal place is 5 or more.

21 Prescribed periodic deduction for veterans

(1) If a person:

(a) is a payer of an enforceable maintenance liability under section 17 of the Act; and

(b) is in receipt of a pension or allowance of a kind mentioned in paragraph 72AC(1)(b) of the Act;

then, for the purposes of paragraph 72AC(2)(c) of the Act, the prescribed periodic deduction from the person’s pension or allowance is the lesser of:

(c) 3 times the minimum veterans rate for the pension period for the pension or allowance; and

(d) the amount of the enforceable maintenance liability payable for the pension period.

(2) If a person:

(a) has an unpaid child support debt; and

(b) is in receipt of a pension or allowance of a kind mentioned in paragraph 72AC(1)(b) of the Act;

then, for the purposes of subparagraph 72AC(2)(d)(i) of the Act, the prescribed periodic deduction from the person’s pension or allowance is the lesser of:

(c) 3 times the minimum veterans rate for the pension period, less any amount to be deducted from the person’s pension or allowance under paragraph 72AC(2)(c) of the Act; and

(d) the amount of the unpaid child support debt.

(3) The minimum veterans rate, for a pension period in a calendar year, is worked out as follows:

Method statement

Step 1. Divide the minimum annual rate of child support by 365.25.

Step 2. The amount worked out in step 1 must be rounded to 5 decimal places (rounding up if the sixth decimal place is 5 or more).

Step 3. Multiply the amount worked out in step 2 by the number of days in the pension period.

Step 4. Round the amount worked out in step 3 to the nearest cent by increasing the second decimal place by 1 if the third decimal place is 5 or more.

Part 4—Departure prohibition orders

22 Departure prohibition orders—prescribed persons

For the purposes of subsection 72G(5) of the Act, each of the following persons is prescribed:

(a) the Comptroller‑General of Customs (within the meaning of the Customs Act 1901);

(b) the Commissioner of Police of the Australian Federal Police;

(c) the Secretary of the Foreign Affairs Department.

Part 5—Payments to payees

23 Prescribed amount that person not entitled to be paid

(1) For the purposes of subsection 76(2) of the Act, the following amounts are prescribed:

(a) for a payment to a person that is to be made to an address, or an account, in Australia—$5;

(b) for a payment to a person that is to be made to an account in another country, through an arrangement between Australia and that country under which amounts are transferred to a central authority of that country for payment, in accordance with section 76 of the Act, by electronic transfer—$5;

(c) in any other case—$50.

(2) Subsection (1) does not apply if:

(a) but for that subsubsection, a person would be entitled to be paid an amount under subsection 76(1) of the Act in relation to a registered maintenance liability; and

(b) no further amounts are expected to be payable to the person in relation to that or any other registered maintenance liability.

24 Prescribed amount—remittances from employers

For the purposes of subsection 78(3) of the Act, the amount of $50 is prescribed.

Part 6—Review by the Administrative Appeals Tribunal

25 Limitation of powers of AAT

For the purposes of section 95E of the Act, the following provisions are prescribed:

(a) a provision of the Act specified in Part 1 of Schedule 3 to this instrument;

(b) a provision of the Assessment Act specified in Part 2 of Schedule 3 to this instrument.

Part 7—Miscellaneous

26 Debts due to the Commonwealth

For the purposes of paragraph 113(1)(a) of the Act:

(a) the following places are prescribed as places at which a debt due to the Commonwealth is payable:

(i) the Human Services Department;

(ii) a payment agency that, by arrangement with the Human Services Department, accepts payment of such a debt;

(iii) a financial institution that, by arrangement with the Human Services Department, maintains an account for receipt of payment of such a debt; and

(b) the prescribed manner in which such a debt is payable is:

(i) if the payment of the debt is made to the Human Services Department—by cheque or money order, or by electronic means capable of being processed by the Human Services Department; or

(ii) if the payment of the debt is made to a payment agency or financial institution—by a means capable of being processed by the payment agency or financial institution.

Note: Details of how payments may be made are set out in the Human Services Department website at www.humanservices.gov.au.

27 Scale of expenses

For the purposes of subsection 120(2) of the Act, the prescribed scales of expenses to be allowed to a person (other than a person who is a payer, payee or a personal representative of a payer or payee) required to attend under section 120 of the Act are as follows:

(a) the amount provided for in the High Court Rules (as in force at the commencement of this section) for expenses of witnesses;

(b) if the person is required to be absent overnight from his or her usual place of residence—such amount as is reasonable for meals and accommodation.

28 Evidentiary certificates

In an action for the recovery of a debt payable to the Registrar, a certificate signed by the Registrar certifying that:

(a) the person named in the certificate is liable to pay the debt; and

(b) the debt referred to in the certificate is, at the date of the certificate, a debt payable by the person to the Registrar;

is prima facie evidence of the facts stated in the certificate.

29 Evidence by affidavit

In an action for the recovery of a debt payable to the Registrar:

(a) a person may give evidence by affidavit; and

(b) the court may require the person to attend before it:

(i) to be cross‑examined on the evidence; or

(ii) to give other evidence in relation to the action.

30 Documents taken to be duly signed

(1) A certificate, notice or other document bearing the written, printed or stamped name (including a facsimile of the signature) of a person who is, or was at any time, the Registrar or a delegate of the Registrar in place of that person’s signature must, unless it is proved that the document was issued without authority, be taken to have been duly signed by that person.

(2) Judicial notice must be taken of the names and signatures of the persons who are, or were at any time, the Registrar or a delegate of the Registrar.

31 Service of notices etc.

(1) Any notice or other communication given by or on behalf of the Registrar under the Act may be served on a person:

(a) if the person is a natural person:

(i) by causing it to be personally served on the person; or

(ii) by leaving it at the person’s address for service; or

(iii) if the person has consented to receiving such notices or communications by way of electronic communication—by delivering the notice or other communication by means of electronic communication; or

(iv) by sending it by prepaid post to the person’s address for service; or

(b) if the person is a body corporate:

(i) by leaving it at the person’s address for service; or

(ii) if the person has consented to receiving such notices or communications by way of electronic communication—by delivering the notice or other communication by means of electronic communication; or

(iii) by leaving it at, or sending it by prepaid post to, the head office, a registered office or a principal office of the body corporate.

(2) If service has been attempted by use of prepaid post, then, unless the contrary is proved, service will be taken to have been effected at the time when the notice or other communication would, in the ordinary course of the post, have arrived at the place to which it was addressed.

32 Service of documents in Australia for overseas authority

(1) This section applies if a document is required to be served by an overseas authority of a reciprocating jurisdiction on a person who is in Australia.

(2) The Registrar (or a person authorised to do so on the Registrar’s behalf) may serve the document on behalf of the overseas authority if it is necessary or convenient to do so for the purposes of an international maintenance arrangement with the reciprocating jurisdiction.

33 Giving notices or other communications in reciprocating jurisdictions

For the purposes of section 121C of the Act, a notice or other communication that is required to be given to a payer or payee who is a resident of a reciprocating jurisdiction may be given to an overseas authority of the reciprocating jurisdiction, if the Registrar considers that it is desirable or appropriate to do so.

34 Address for service

(1) The address last notified by a person to the Registrar as the address for service of the person is, for all purposes under the Act and this instrument, that person’s address for service.

(2) If no address for service has been notified to the Registrar but the Registrar’s records contain an address attributed to the person, the last such address in any record held by the Registrar is the person’s address for service under the Act and this instrument.

35 Failure to notify change of address

A person who changes address and fails to give to the Registrar notice of the new address for service cannot plead the change of address as a defence in any proceedings (whether civil or criminal) instituted against that person under the Act or this instrument.

36 Assistance in communicating with overseas authorities

A person in Australia may apply to the Registrar for assistance in communicating with an overseas authority of a reciprocating jurisdiction in relation to a matter if:

(a) a resident of the reciprocating jurisdiction is seeking payment of child support from the person; or

(b) the overseas authority is seeking payment of child support from the person on behalf of a resident of the reciprocating jurisdiction.

37 Conversion of foreign currency to Australian currency

(1) This section applies to the following overseas maintenance liabilities:

(a) a maintenance order made by a judicial authority of a reciprocating jurisdiction (other than New Zealand);

(b) a maintenance agreement registered by an overseas authority of a reciprocating jurisdiction (other than New Zealand);

(c) a maintenance assessment issued by an administrative authority of a reciprocating jurisdiction (other than New Zealand);

(d) an overseas maintenance liability in relation to which an application for entry, in the Child Support Register, of particulars has been made under section 25A of the Act.

(2) If the amount of the overseas maintenance liability is expressed in foreign currency, the liability is taken to refer to the equivalent amount expressed in Australian dollars, converted in accordance with subsection (3), applicable on:

(a) for an order, agreement or assessment of a kind mentioned in paragraph (1)(a), (b) or (c)—the day on which the Registrar receives the application for the liability arising under the order, agreement or assessment to be registered; or

(b) for an overseas maintenance liability of a kind mentioned in paragraph (1) (d)—the day on which the Registrar receives the application for entry in the Child Support Register of the particulars of the overseas maintenance liability.

(3) For the purposes of subsection (2), the foreign currency amount must be converted into the equivalent Australian dollar amount using:

(a) the international money transfer buying rate for the foreign currency, being the rate published by the Commonwealth Bank of Australia that applies to the foreign currency on the day that applies under subsection (2); or

(b) if no such rate is available for the foreign currency on that day—an exchange rate for the foreign currency that the Registrar considers appropriate.

38 Conversion of Australian currency to New Zealand currency

(1) This section applies if:

(a) a decision (within the meaning of Article 1 of the Australia‑New Zealand Agreement) is issued, made or registered by a judicial or administrative authority of Australia; and

(b) the decision refers to an amount of money expressed in Australian currency.

(2) The amount must be converted into the equivalent amount expressed in New Zealand currency using:

(a) the international money transfer buying rates published by the Commonwealth Bank of Australia that applies to New Zealand currency on the day when the decision is transmitted by the Registrar; or

(b) if no such rate is available for New Zealand currency on that day—an exchange rate for the currency that the Registrar considers appropriate.

Schedule 1—Australia–New Zealand Agreement

Note: See the definition of Australia—New Zealand Agreement in section 8.

AGREEMENT BETWEEN THE GOVERNMENT OF AUSTRALIA AND THE GOVERNMENT OF NEW ZEALAND ON CHILD AND SPOUSAL MAINTENANCE

(Canberra, 12 April 2000)

Preamble

THE GOVERNMENT OF AUSTRALIA AND THE GOVERNMENT OF NEW ZEALAND (hereinafter referred to as “the Contracting States”),

CONSIDERING the principle that parents have an obligation, according to their capacity to pay, to provide their children with a proper level of financial support,

CONSIDERING the enforcement abroad of maintenance decisions gives rise to serious practical and legal difficulties,

DESIRING to conclude an Agreement on the jurisdiction of their administrative and judicial authorities, to facilitate recognition and enforcement of decisions, to exchange information and to provide for mutual co‑operation in the collection and payment of monies in relation to child and spousal maintenance,

HAVE AGREED AS FOLLOWS:

PART 1

SCOPE OF THE AGREEMENT

Article 1

Meaning of decision

1 This Agreement applies to a decision made by an administrative or judicial authority of a Contracting State under which money is payable in respect of a maintenance obligation, arising from parentage or marriage, between a payer and payee.

2 For the purposes of this Agreement a decision shall include:

(a) a child support assessment issued by an administrative authority;

(b) an agreement to make payments for the maintenance of a child or spouse which has been registered with an administrative authority;

(c) an assessment, order or agreement suspending, modifying or revoking a decision of the kind referred to in (a) or (b);

(d) an order for child maintenance made by a judicial authority;

(e) an order for spousal maintenance made by a judicial authority;

(f) an agreement to make payments for the maintenance of a child or spouse which has been registered with a judicial authority;

(g) an order or agreement suspending, modifying or revoking a decision of the kind referred to in (d), (e) or (f); and

(h) a liability to pay an amount to an administrative authority for the maintenance of a child or as contribution to the cost of government benefits paid to a payee for the maintenance of a child.

3 For the purposes of this Agreement a decision shall not include:

(a) an agreement to make payments for the maintenance of a child or spouse which has not been registered with an administrative or judicial authority;

(b) a decision requiring the provision of maintenance by way of the transfer or settlement of property; or

(c) a decision under which money is payable in respect of taxes, fines, penalties or other charges of a similar nature.

4 If a decision does not relate solely to the payment of an amount of money for maintenance, the effect of this Agreement is limited to the parts of the decision which concern maintenance obligations.

5 In relation to agreements referred to in Article 1.2(b), (c), (f)

and (g), a reference in this Agreement to the making, suspension, modification or revocation of a decision means a decision by a judicial or administrative authority to register an agreement, to register a variation of an agreement, or to suspend or revoke the registration of an agreement.

Article 2

Limitation to Australia/New Zealand cases

The provisions of this Agreement apply to a judicial or administrative authority of a Contracting State making, suspending, modifying or revoking a decision referred to in Article 1, if:

(a) the payer is habitually resident in a Contracting State; and

(b) the payee is habitually resident in the other Contracting State.

Article 3

Date of decisions

1 This Agreement applies irrespective of the date on which a decision was made.

2 Where a decision has been made prior to the date on which this Agreement enters into force between the Contracting States, this Agreement applies for payments falling due under the decision before and after that date.

PART II

JURISDICTION

Article 4

Jurisdiction of judicial authorities

Subject to Article 11, a judicial authority of a Contracting State has jurisdiction to make a decision if at the date of the decision the payee has his or her habitual residence in that State.

Article 5

Jurisdiction of administrative authorities

1 Subject to Article 5.2 and 5.3, an administrative authority of a Contracting State has jurisdiction to make, suspend, modify or revoke a decision if, according to the national law of that Contracting State, the authority has that jurisdiction.

2 Subject to Article 5.3, where an administrative authority of a Contracting State has made or modified a decision referred to in Article 1.2(a), (b) or (c) in accordance with the law of that Contracting State, and a payer, a payee or a Central Authority gives a notice in writing to that administrative authority indicating that the payee has his or her habitual residence in the other Contracting State:

(a) the jurisdiction of that administrative authority to make or modify a decision referred to in Article 1.2(a), (b) or (c) ceases as from the date of the notice if the payee has his or her habitual residence in the other Contracting State; and

(b) the decision of the administrative authority has force and effect for the period prior to the date of receipt by the administrative authority of the notice.

3 Where a payee has his or her habitual residence in a Contracting State, and there is in force a decision by a judicial or administrative authority of that Contracting State:

(a) an administrative authority of the other Contracting State has no jurisdiction to make or modify a decision referred to in Article 1.2(a), (b) or (c); and

(b) a decision of an administrative authority of the other Contracting State to make or modify a decision referred to in Article 1.2(a), (b) or (c) has no force and effect.

PART III

Applicable law

Article 6

Applicable law

1 Subject to Article 6.2, the administrative and judicial authorities of a Contracting State shall apply the national law of that State in exercising jurisdiction to make a decision.

2 Where a payer has a duty to pay child support to payees in both Contracting States, and administrative assessments may be issued in relation to that payer under the national laws of both Contracting States, the amount payable by the payer under any administrative assessment issued by an authority of a Contracting State shall be calculated according to the proportion which the number of eligible children in the Contracting State bears to the total number of eligible children in both Contracting States.

PART IV

RECOGNITION AND EnforceMENT

Article 7

Recognition and enforcement

1 A decision made by an administrative or judicial authority of a Contracting State (the State of origin) is entitled to recognition and enforcement by operation of law in the territory of the other Contracting State (the State addressed).

2 Recognition or enforcement of a decision may be refused by an administrative or judicial authority of the State addressed:

(a) if the administrative or judicial authority of the State of origin did not have jurisdiction under Article 4, 5 or 11; or

(b) if recognition or enforcement is incompatible with the public policy of the State addressed; or

(c) if the decision was obtained by fraud.

3 Subject to Article 7.2(a), where a decision is incompatible with a previous decision made by an authority in a Contracting State between the same parties and having the same purpose:

(a) the earlier decision shall be recognised and enforced with effect up to but excluding the day on which the later decision was made; and

(b) the later decision shall be recognised and enforced with effect from and including the day on which the later decision was made.

4 If a decision provides for the periodical payment of maintenance, the decision shall be enforceable in respect of unpaid amounts already due and in respect of future payments.

5 There shall be no review by the administrative or judicial authorities of the State addressed of the merits of a decision, unless this Agreement otherwise provides.

Article 8

Procedure for recognition and enforcement

The procedure for recognition and enforcement of a decision shall be governed by the law of the Contracting State in which recognition or enforcement is sought.

Article 9

Partial recognition and enforcement

An application may be made at any time for partial recognition or enforcement.

Article 10

Default decisions

A decision made by default by a judicial authority of a Contracting State shall be entitled to recognition and enforcement only if notice of the institution of the proceedings, including notice of the substance of the claim, has been served on the defaulting party in accordance with the law of the other Contracting State and if, having regard to the circumstances, that party has had sufficient time to enable him or her to defend the proceedings.

Article 11

Provisional orders

1 Where under the law in force in a Contracting State a judicial authority makes, suspends, modifies or revokes a decision which has no effect unless and until confirmed by a judicial authority of the other Contracting State (a provisional order), the following provisions shall apply.

2 A payee or payer under a provisional order who is habitually resident in a Contracting State (hereinafter referred to as the State of origin) may apply to the authorities of that State to have the provisional order transmitted to the authorities of the other Contracting State (hereinafter referred to as the State addressed).

3 The Central Authority of the State of origin shall transmit the provisional order to the authorities of the State addressed.

4 The authorities of the State addressed shall take all appropriate steps to have a judicial authority make a decision whether to confirm, confirm with modification or refuse to confirm the provisional order.

5 The judicial authority of the State addressed may remit the provisional order to the judicial authority in the State of origin to take further evidence or further consider the provisional order.

6 Where a judicial authority in the State addressed confirms a provisional order (with or without modification) the order by operation of law shall be enforceable as a court order in the State addressed and in the State of origin.

PART V

RECOVERY OF MONIES BY GOVERNMENT AUTHORITIES

Article 12

Recovery of monies by government authorities

1 A Central Authority of a Contracting State may, in its discretion, transmit to the Central Authority of the other Contracting State a request for authorities of the State addressed to recover, on behalf of the payee, monies payable under a decision.

2 A Central Authority may only transmit a request under

Article 12.1 in respect of a decision which is entitled to recognition and enforcement in the State addressed under Part IV of this Agreement.

3 The Contracting States agree that, upon receipt of a request under Article 12.1, authorities of the State addressed shall take action to recover the monies payable under the decision.

Article 13

Procedure for recovery of monies

The procedure for the recovery of monies in accordance with Article 12 shall be governed by the laws of the State addressed.

Article 14

Disbursement of monies recovered

1 Monies recovered by the authorities of the State addressed shall be paid to the Central Authority of the State of origin.

2 The Central Authority of the State of origin shall disburse monies paid to it under Article 14.1 in accordance with the laws of the State addressed.

PART VI

PENALTIES

Article 15

Penalties incurred prior to transfer of a decision

1 In this Article “penalty” means a penalty payable to an administrative authority by a payer under the law of a Contracting State:

(a) in respect of an incorrect estimate of income given by the payer for the purpose of the making of a decision; or

(b) in respect of the late payment to the administrative authority by the payer of monies payable under a decision of the kind referred to in Article 1.2(a) to (h).

2 Where a decision by an administrative or judicial authority is transmitted in accordance with Article 12 of this Agreement, any penalty payable under the law of the State of origin in relation to that decision:

(a) shall be recognised and enforced in the State addressed in so far as the penalty relates to a period prior to the date of transmission of the decision;

(b) shall be recovered by authorities of the State addressed if the Central Authority of the State of origin makes a request for its recovery to the Central Authority of the State addressed.

3 Where monies are recovered by the authorities of the State addressed in accordance with a request under Article 15.2(b):

(a) the monies shall be paid to the Central Authority of the State of origin;

(b) the Central Authority of the State of origin shall disburse monies in accordance with the laws of the State of origin.

Article 16

Penalties incurred after transfer of a decision

1 Where a request in relation to a decision by an administrative or judicial authority is transmitted in accordance with Article 12 of this Agreement:

(a) the imposition of a penalty in respect of the late payment to an administrative authority by the payer of monies payable under the decision shall be governed by the law of the State addressed; and

(b) the penalty shall be disbursed in accordance with the laws of the State addressed.

2 Where a request in relation to a decision by an administrative or judicial authority is transmitted in accordance with Article 12 of this Agreement, any penalty payable under the law of the State of origin in respect of an incorrect estimate of income given by the payer for the purpose of the making of the decision:

(a) shall be recognised and enforced in the State addressed;

(b) shall be recovered by authorities of the State addressed if the Central Authority of the State of origin makes a request for its recovery to the Central Authority of the State addressed.

3 Where monies are recovered by the authorities of the State addressed in accordance with a request under Article 16.2(b):

(a) the monies shall be paid to the Central Authority of the State of origin;

(b) the Central Authority of the State of origin shall disburse monies in accordance with the laws of the State of origin.

PART VII

PARENTAGE PRESUMPTIONS

Article 17

Reciprocal recognition of court parentage findings

Where a judicial authority of one Contracting State finds that a person is a parent of a child, and the finding has not been altered, set aside or reversed by the judicial authorities of that State, the person shall be presumed to be a parent of the child by operation of law in the territory of the other Contracting State.

Article 18

Reciprocal recognition of birth registrations

Where a person’s name is registered as a parent of a child in a register of births or parentage information by an administrative authority of a Contracting State, the person shall be presumed to be a parent of the child by operation of law in the territory of the other Contracting State.

Article 19

Reciprocal recognition of instruments of acknowledgment

Where under a law of a Contracting State a person has executed an instrument acknowledging that he is the father of a child, and that instrument has not been annulled or otherwise set aside, the person shall be presumed to be a parent of the child by operation of law in the territory of the other Contracting State.

PART VIII

LEGAL AID

Article 20

No discrimination in provision of legal aid

Nationals of either Contracting State, and persons habitually resident in either Contracting State, shall enjoy legal aid for court proceedings relating to child and spousal maintenance in each Contracting State on the same conditions as if they themselves were nationals or habitually resident in that State.

PART IX

CENTRAL AUTHORITIES

Article 21

Central Authorities

1 The Central Authority for New Zealand shall be the Commissioner of Inland Revenue. The Central Authority for Australia shall be the Child Support Registrar.

2 Each Contracting State shall be free to designate additional Authorities and to determine the extent of their competence. However communications may in all cases be sent directly to the Central Authority.

3 Each Contracting State shall notify the other Contracting State of the Authorities designated from time to time and the extent of their competence.

Article 22

Duties of Central Authorities

The Central Authority of each Contracting State shall:

(a) co‑operate with each other and promote co‑operation amongst administrative and judicial authorities in their States to achieve the purposes of this Agreement;

(b) on request by the Central Authority of the other Contracting State, obtain and provide reports on the progress made by administrative and judicial authorities in recovering monies payable under a decision;

(c) co‑operate in the provision of information to children, payees and payers within its territory on their rights and duties under the law relating to maintenance of the other Contracting State.

Article 23

Exchange of information

1 At the request of the Central Authority of a Contracting State, the Central Authority of the other Contracting State, either directly or through other administrative or judicial authorities, shall take all appropriate steps to obtain and provide to the requesting Central Authority any information necessary or convenient for the operation of this Agreement or for the laws of the Contracting States relating to maintenance, including:

(a) information on the whereabouts of a payer; or

(b) information about the income, earning capacity, property, financial resources or commitments of a child, a payer or payee.

2 Any information about an individual which is transmitted in accordance with this Agreement to an administrative or judicial authority of a Contracting State:

(a) is confidential; and

(b) shall be used only for the purposes of implementing this Agreement and the laws of the Contracting States relating to maintenance; and

(c) shall be disclosed only if disclosure is required or permitted under the laws of the Contracting State.

3 In no case shall the provisions of this Article be construed so as to impose on the administrative or judicial authorities of a Contracting State the obligation to obtain information which is not obtainable under the laws or in the normal course of administration of those authorities.

4 At any time the Contracting Parties may determine that communication between the Contracting States, including exchange of information, may be conducted by electronic data transfer.

PART X

SERVICE ARRANGEMENT

Article 24

Service Arrangement

1 The Child Support Registrar for Australia and the Commissioner of Inland Revenue for New Zealand may enter an arrangement (hereinafter referred to as the Service Arrangement) to facilitate the implementation of this Agreement.

2 The matters which may be dealt with in the Service Arrangement include but are not limited to:

(a) the procedures to be adopted by administrative authorities in the Contracting States in identifying and resolving cases of conflict in jurisdiction between the administrative or judicial authorities of one State and the administrative or judicial authorities of the other State;

(b) the exchange of information between authorities of the Contracting States and the protection of the privacy of the subjects of such information;

(c) the location of payers and the service of documents on payers;

(d) the making of determinations as to the income, earning capacity, property, financial resources or commitments of a child, a payer or payee;

(e) the making of child support assessments and other decisions;

(f) procedures for the recognition and enforcement of decisions to which this Agreement applies;

(g) procedures for the collection and disbursement of monies payable under decisions and penalties to which this Agreement applies;

(h) procedures for determining applications by payers and payees for the suspension, modification or revocation of decisions to which this Agreement applies;

(i) parentage testing;

(j) evaluation of the operation of this Agreement and the Service Arrangement;

(k) the provision of information and advice to payers and payees;

(l) the reimbursement by a Child Support Agency of one Contracting State of the costs incurred by the Child Support Agency of the other Contracting State in the provision of services under this Agreement or the Service Arrangement.

PART XI

TERRITORIAL APPLICATION

Article 25

Australian Territories

This Agreement extends to the following Australian Territories:

Norfolk Island, the Territory of Christmas Island, the Territory of Cocos (Keeling) Islands.

Article 26

Territories associated with New Zealand

This Agreement shall not apply to Tokelau, unless the Contracting States exchange notes agreeing to the terms on which it will so apply.

PART XII

GENERAL PROVISIONS

Article 27

Other treaty obligations

As long as this Agreement is in force, it shall replace, as between the Contracting States, the Convention on the Recovery Abroad of Maintenance signed at New York on 20 June 1956.

Article 28

Resolution of disputes

1 The administrative and judicial authorities of the Contracting States shall resolve, to the extent possible, any difficulties which arise in interpreting or applying this Agreement or the Service Arrangement according to the spirit and fundamental principles of this Agreement.

2 Where the administrative and judicial authorities have not resolved difficulties which arise in interpreting or applying this Agreement or the Service Arrangement, a Contracting State may request consultation. Such consultation shall take place promptly.

Article 29

Review of Agreement

1 The Contracting States may agree at any time to review the whole or any part of this Agreement or the Service Arrangement.

2 At any time a Contracting State may request that the Contracting States meet to review this Agreement or the Service Arrangement. Representatives of the Contracting States shall meet for that purpose no later than six months after the date of that request and, unless the Contracting States otherwise agree, the meeting shall be held in the territory of the Contracting State to which the request was made.

3 The Contracting States shall exchange information as to changes in their laws or administrative practices relating to maintenance which are relevant to the operation of this Agreement or the Service Arrangement.

PART XIII

FINAL PROVISIONS

Article 30

Entry into force

1 The Contracting States shall notify each other through diplomatic channels when their respective requirements for the entry into force of this Agreement have been complied with.

2 This Agreement shall enter into force 30 days after the date on which the Contracting States have notified each other in accordance with Article 30.1.

3 The Contracting States shall notify each other through diplomatic channels when their respective requirements for the entry into force of the Service Arrangement have been complied with.

4 The Service Arrangement shall enter into force 30 days after the date on which the Contracting States have notified each other in accordance with Article 30.3.

Article 31

Termination

1 This Agreement may be terminated by either Contracting State giving notice in writing through the diplomatic channel and the Agreement shall terminate six months after the date of the notice.

2 The Service Arrangement may be terminated by either Contracting State giving notice in writing through the diplomatic channel and the Service Arrangement shall terminate six months after the date of the notice.

IN WITNESS WHEREOF the undersigned, being duly authorised thereto by their respective Governments, have signed this Agreement.

DONE in duplicate at Canberra this twelfth day of April, 2000.

FOR THE GOVERNMENT OF FOR THE GOVERNMENT OF

AUSTRALIA: NEW ZEALAND:

[Signed:] [Signed:]

L ANTHONY SIMON MURDOCH

Schedule 2—Reciprocating jurisdictions

Note: See section 10.

Algeria

Argentina

Austria

Barbados

Belarus

Belgium

Bosnia and Herzegovina

Brazil

Brunei Darussalam

Burkina Faso

Canada, the following Provinces and Territories:

Alberta

British Columbia

Manitoba

New Brunswick

Newfoundland and Labrador

Northwest Territories

Nova Scotia

Nunavut

Ontario

Prince Edward Island

Saskatchewan

Yukon

Cape Verde

Central African Republic

Chile

Colombia

Cook Islands

Croatia

Cyprus

Czech Republic

Denmark

Ecuador

Estonia

Fiji

Finland

Former Yugoslav Republic of Macedonia

France

Germany

Greece

Guatemala

Haiti

Holy See, The

Hong Kong

Hungary

India

Ireland

Israel

Italy

Kazakhstan

Kenya

Kyrgyzstan

Liberia

Lithuania

Luxembourg

Malawi

Malaysia

Malta

Mexico

Moldova

Monaco

Montenegro

Morocco

Nauru

Netherlands

New Zealand

Niger

Niue

Norway

Pakistan

Papua New Guinea

Philippines

Poland

Portugal

Romania

Samoa

Serbia

Seychelles

Sierra Leone

Singapore

Slovakia

Slovenia

South Africa

Spain

Sri Lanka

Suriname

Sweden

Switzerland

Tanzania (excluding Zanzibar)

Trinidad and Tobago

Tunisia

Turkey

Ukraine

United Kingdom (including Alderney, Gibraltar, Guernsey, Isle of Man, Jersey and Sark)

United States of America

Uruguay

Zambia

Zimbabwe

Schedule 3—Powers of Registrar that AAT must not exercise

Note: See section 25.

Part 1—Provisions of the Act

Item | Provision |

1 | subsection 13(2) |

2 | subsections 15(1), (1A) and (2) |

3 | subsections 16A(1), (2), (3), (4) and (5) |

4 | section 16B |

5 | section 16C |

6 | section 21 |

7 | subsection 24(2) |

8 | subsection 30A(2) |

9 | section 37A |

10 | subsections 38B(1) and (2) |

11 | subsection 45(1), paragraph 45(2)(b) and subsection 45(2A) |

12 | subsection 47(4) |

13 | subsection 61(1) |

14 | paragraph 72(1)(c) |

15 | subsection 72A(1) and paragraph 72A(3)(b) |

16 | subsections 72AA(1) and (2) |

17 | subsection 72AB(3) |

18 | subsection 72AC(1) |

19 | subsection 72AD(1) |

20 | subsection 72B(2) |

21 | subsection 72C(1) |

22 | Part VA |

23 | section 111D |

24 | section 111E |

25 | subsection 112(2) |

26 | paragraph 113(1)(b) and subsection 113(2) |

27 | subsections 116(1), (2) and (3) |

28 | subsection 117(1) |

29 | subsection 120(1) |

30 | section 121A |

| | |

Part 2—Provisions of the Assessment Act

Item | Provision |

1 | subsection 145(1) |

2 | subsection 146(2) |

3 | subsections 149(1), (1AA), (1A) and (2) |

4 | subsections 150A(1), (2), (3), (4) and (5) |

5 | section 150D |

6 | section 153 |

7 | subsection 157(1) |

8 | subsection 160(1) |

9 | subsection 161(1) |

10 | section 162A |