Financial Sector (Collection of Data) (reporting standard) determination No. 26 of 2018

Reporting Standard ARS 330.1 Interest Income and Interest Expense

Financial Sector (Collection of Data) Act 2001

I, Alison Bliss, delegate of APRA, under paragraph 13(1)(a) of the Financial Sector (Collection of Data) Act 2001 (the Act) and subsection 33(3) of the Acts Interpretation Act 1901:

(a) REVOKE Financial Sector (Collection of Data) (reporting standard) determination No. 44 of 2008, including Reporting Standard ARS 330.1 Interest Income and Interest Expense made under that Determination; and

(b) DETERMINE Reporting Standard ARS 330.1 Interest Income and Interest Expense, in the form set out in the Schedule, which applies to the financial sector entities to the extent provided in paragraph 3 of the reporting standard.

Under section 15 of the Act, I DECLARE that the reporting standard shall begin to apply to those financial sector entities, and the revoked reporting standard shall cease to apply, on 1 April 2018.

This instrument commences on 1 April 2018.

Dated: 21 March 2018

[Signed]

Alison Bliss

General Manager

Data Analytics Division

Interpretation

In this Determination:

APRA means the Australian Prudential Regulation Authority.

financial sector entity has the meaning given by section 5 of the Act.

Schedule

Reporting Standard ARS 330.1

Interest Income and Interest Expense

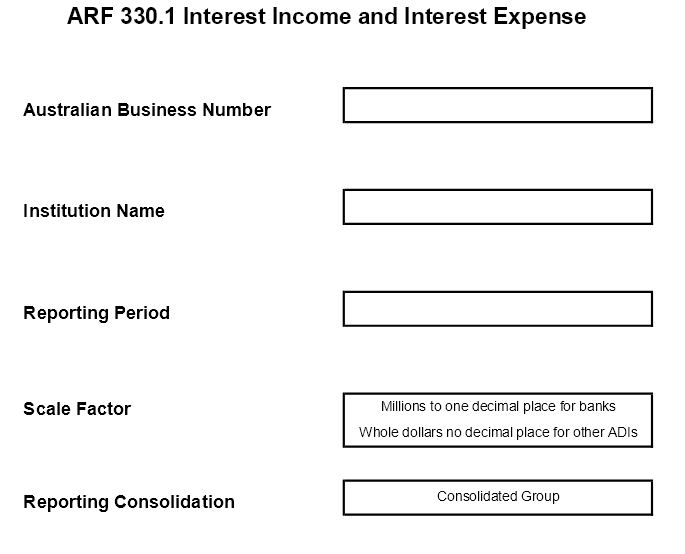

This Reporting Standard is made under section 13 of the Financial Sector (Collection of Data) Act 2001 and outlines the overall requirements for the provision of information to APRA relating to an authorised deposit-taking institution’s interest income and expense. It should be read in conjunction with the versions of Reporting Form ARF 330.1 Interest Income and Interest Expense designated for a ‘Licensed ADI’ and ‘Consolidated Group’ and the associated instructions (all of which are attached and form part of this Reporting Standard).

- This Reporting Standard is made under section 13 of the Financial Sector (Collection of Data) Act 2001.

Purpose

2. Data collected in Reporting Form ARF 330.1 Interest Income and Interest Expense (ARF 330.1) is used by APRA for the purpose of prudential supervision. It may also be used by the Reserve Bank of Australia (RBA) and the Australian Bureau of Statistics (ABS).

Application and commencement

3. This Reporting Standard applies to all authorised deposit-taking institutions (ADIs).

4. This Reporting Standard commences on 1 April 2018.

Information required

5. An ADI to which this Reporting Standard applies must provide APRA with the information required by the version of ARF 330.1 designated for a ‘Licensed ADI’ for each reporting period.

6. An ADI to which this Reporting Standard applies that is a highest parent entity in relation to a consolidated ADI group must also provide APRA the information required by the version of ARF 330.1 designated for a ‘Consolidated Group’ for each reporting period.

Form and method of submission

7. The information required by this Reporting Standard must be given to APRA in electronic format, using the ‘Direct to APRA’ application or by a method notified by APRA, in writing, prior to submission.

Note: the Direct to APRA application software (also known as D2A) may be obtained from APRA.

Reporting periods and due dates

8. Subject to paragraph 9, an ADI to which this Reporting Standard applies must provide the information required by this Reporting Standard for each quarter based on the financial year (within the meaning of the Corporations Act 2001) of the ADI.

9. APRA may, by notice in writing, change the reporting periods, or specified reporting periods, for a particular ADI, to require it to provide the information required by this Reporting Standard more frequently, or less frequently, having regard to:

(a) the particular circumstances of the ADI;

(b) the extent to which the information is required for the purposes of the prudential supervision of the ADI; and

(c) the requirements of the RBA or the ABS.

10. The information required by this Reporting Standard must be provided to APRA in accordance with the table below. The right hand column of the table sets out the number of business days after the end of the reporting period to which the information relates within which information must be submitted to APRA by an ADI in the classes set out in the left hand column.

Class of ADI | Number of business days |

Australian-owned Bank | 25 |

Foreign Subsidiary Bank | 25 |

Branch of a Foreign Bank | 25 |

Building Society | 15 |

Credit Union | 15 |

Other ADI | 25 |

11. APRA may grant an ADI an extension of a due date in writing, in which case the new due date for the provision of the information will be the date on the notice of extension.

Quality control

12. All information provided by an ADI under this Reporting Standard (except for the information required under paragraph 6) must be the product of systems, processes and controls that have been reviewed and tested by the external auditor of the ADI as set out in Prudential Standard APS 310 Audit and Related Matters. Relevant standards and guidance statements issued by the Auditing and Assurance Standards Board provide information on the scope and nature of the review and testing required from external auditors. This review and testing must be done on an annual basis or more frequently if required by the external auditor to enable the external auditor to form an opinion on the accuracy and reliability of the information provided by an ADI under this Reporting Standard.

13. All information provided by an ADI under this Reporting Standard must be subject to processes and controls developed by the ADI for the internal review and authorisation of that information. These systems, processes and controls are to assure the completeness and reliability of the information provided.

Authorisation

14. If an ADI submits information under this Reporting Standard using the D2A application, or other method notified by APRA, it will be necessary for the officer to digitally sign the relevant information using a digital certificate acceptable to APRA.

Minor alterations to forms and instructions

15. APRA may make minor variations to:

(a) a form that is part of this Reporting Standard, and the instructions to such a form, to correct technical, programming or logical errors, inconsistencies or anomalies; or

(b) the instructions to a form, to clarify their application to the form

without changing any substantive requirement in the form or instructions.

16. If APRA makes such a variation it must notify in writing each ADI that is required to report under this Reporting Standard.

Interpretation

17. In this Reporting Standard:

AASB has the meaning in section 9 of the Corporations Act 2001.

ADI means an authorised deposit-taking institution within the meaning of the Banking Act 1959.

APRA means the Australian Prudential Regulation Authority established under the Australian Prudential Regulation Authority Act 1998.

Australian-owned bank means a locally incorporated ADI that assumes or uses the word ‘bank’ in relation to its banking business and is not a foreign subsidiary bank.

branch of a foreign bank means a ‘foreign ADI’ as defined in section 5 of the Banking Act 1959.

building society means a locally incorporated ADI that assumes or uses the expression ‘building society’ in relation to its banking business.

business days means ordinary business days, exclusive of Saturdays, Sundays and public holidays.

class of ADI means each of the following:

(i) Australian-owned bank;

(ii) foreign subsidiary bank;

(iii) branch of a foreign bank;

(iv) building society;

(v) credit union; and

(vi) other ADI.

consolidated ADI group means a group comprising:

(a) an ADI that is a highest parent entity; and

(b) each subsidiary (within the meaning of Accounting Standard AASB 127) of that ADI, whether the subsidiary is locally-incorporated or not, other than a subsidiary that is excluded by the instructions attached to this standard.

credit union means a locally incorporated ADI that assumes or uses the expression ‘credit union’ in relation to its banking business and includes Cairns Penny Savings & Loans Limited.

due date means the relevant due date under paragraph 10 or, if applicable, paragraph 11.

foreign ADI has the meaning in section 5 of the Banking Act 1959.

foreign subsidiary bank means a locally incorporated ADI in which a bank that is not locally incorporated has a stake of more than 15 per cent.

highest parent entity means an ADI that satisfies all of the following conditions:

(a) it is locally-incorporated;

(b) it has at least one subsidiary (within the meaning of Accounting Standard AASB 127); and

(c) it is not itself a subsidiary (within the meaning of Accounting Standard AASB 127) of an ADI that is locally-incorporated.

locally incorporated means incorporated in Australia or in a State or Territory of Australia, by or under a Commonwealth, State or territory law.

other ADI means an ADI that is not an Australian-owned bank, a branch of a foreign bank, a building society, a credit union or a foreign subsidiary bank but does not include Cairns Penny Savings & Loans Limited.

reporting period means a period mentioned in paragraph 8 or, if applicable, paragraph 9.

stake means a stake determined under the Financial Sector (Shareholdings) Act 1998, as if the only associates that were taken into account under paragraph (b) of subclause 10(1) of the Schedule to that Act were those set out in paragraphs (h), (j) and (l) of subclause 4(1).

18. Unless the contrary intention appears, a reference to an Act, Prudential Standard, Reporting Standard, Australian Accounting or Auditing Standard is a reference to the instrument as in force from time to time.

Reporting Form ARF 330.1

Interest Income and Interest Expense

Instruction Guide

Reporting entity

This form is to be completed by all authorised deposit-taking institutions (ADIs) on both a licensed ADI and consolidated ADI group basis (where applicable).

Branches of foreign banks are required to complete this form for the Australian branch only.

Licensed ADI

This refers to the operations of the reporting ADI on a stand-alone basis.

Securitisation deconsolidation principle

Except as otherwise specified in these instructions, the following applies:

- Where an ADI (or a member of its Level 2 consolidated group) participates in a securitisation that meets APRA’s operational requirements for regulatory capital relief under Prudential Standard APS 120 Securitisation (APS 120):

(a) special purpose vehicles (SPVs) holding securitised assets may be treated as non-consolidated independent third parties for regulatory reporting purposes, irrespective of whether the SPVs (or their assets) are consolidated for accounting purposes;

(b) the assets, liabilities, revenues and expenses of the relevant SPVs may be excluded from the ADI’s reported amounts in APRA’s regulatory reporting returns; and

(c) the underlying exposures (i.e. the pool) under such a securitisation may be excluded from the calculation of the ADI’s regulatory capital (refer to APS 120). However, the ADI must still hold regulatory capital for the securitisation exposures that it retains or acquires and such exposures are to be reported in Reporting Form ARF 120.1 Securitisation – Regulatory Capital. The risk-weighted assets (RWA) relating to such securitisation exposures must also be reported in Reporting Form ARF 110.0.1 Capital Adequacy (Level 1) and Reporting Form ARF 110.0.2 Capital Adequacy (Level 2).

2. Where an ADI (or a member of its Level 2 consolidated group) participates in a securitisation that does not meet APRA’s operational requirements for regulatory capital relief under APS 120, or the ADI undertakes a funding-only securitisation or synthetic securitisation, such exposures are to be reported as on-balance sheet assets in APRA’s regulatory reporting returns. In addition, these exposures must also be reported as a part of the ADI’s total securitised assets within Reporting Form ARF 120.2 Securitisation – Supplementary Items.

Consolidated ADI group

The basis of consolidation required in this form is in accordance with the accounting consolidated group. The accounting consolidated group is to be determined in accordance with the requirements of the Australian accounting standards, notably AASB 127 and AASB 3.

Exclude from the accounting consolidated group SPVs whose assets have satisfied the clean sale requirements set down in APS 120 (refer Securitisation deconsolidation principle).

Reporting period

Amounts denominated in foreign currency are to be converted to AUD in accordance with AASB 121 The Effects of Changes in Foreign Exchange Rates (AASB 121).

The general requirements of AASB 121 for translation are:

- foreign currency monetary items outstanding at the reporting date must be translated at the spot rate at the reporting date;

- foreign currency non-monetary items that are measured at historical cost in a foreign currency must be translated using the exchange rate at the date of the transaction;

- foreign currency non-monetary items that are measured at fair value will be translated at the exchange rate at the date when fair value was determined.

Transactions arising under foreign currency derivative contracts at the reporting date must be prepared in accordance with AASB 139 Financial Instruments: Recognition and Measurement (AASB 139). However, those foreign currency derivatives that are not within the scope of AASB 139 (e.g. some foreign currency derivatives that are embedded in other contracts) remain within the scope of AASB 121.

For APRA purposes equity items must be translated using the foreign currency exchange rate at the date of investment or acquisition. Post-acquisition changes in equity are required to be translated on the date of the movement.

As foreign currency derivatives are measured at fair value, the currency derivative contracts are translated at the spot rate at the reporting date.

Exchange differences should be recognised in profit and loss in the period which they arise. For foreign currency derivatives, the exchange differences would be recognised immediately in profit and loss if the hedging instrument is a fair value hedge. For derivatives used in a cash flow hedge, the exchange differences should be recognised directly in equity.

The ineffective portion of the exchange differences in all hedges would be recognised in profit and loss; and

Basis of preparation