1 Name

This instrument is the Parliamentary Business Resources Amendment (2018 Measures No. 1) Regulations 2018.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | 15 May 2018 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Parliamentary Business Resources Act 2017.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Parliamentary Business Resources Regulations 2017

1 At the end of paragraph 66(1)(o)

Add “, and mobile office facilities and equipment”.

2 Paragraph 71(1)(a)

Omit “but less than 25,000 km2”.

3 Paragraphs 71(2)(a) and (b)

Repeal the paragraphs, substitute:

(a) if the member’s electorate has an area of less than 25,000 km2:

(i) for the 2017‑2018 financial year—$50,000; or

(ii) for a later financial year—that amount indexed in accordance with section 102;

(b) if the member’s electorate has an area of 25,000 km2 or more:

(i) for the 2017‑2018 financial year—$20,000; or

(ii) for a later financial year—that amount indexed in accordance with section 102.

4 Section 72 (heading)

Repeal the heading, substitute:

72 Offices for members

5 Section 72

Before “For the”, insert “(1)”.

6 Section 72 (note 1)

Omit “1”.

7 Section 72 (notes 2 and 3)

Repeal the notes.

8 At the end of section 72

Add:

(2) For the purposes of subsection 33(1) of the Act, temporary office accommodation and facilities in capital cities are prescribed for members.

Note 1: The dominant purpose test applies in relation to public resources prescribed by this section.

Note 2: Public resources prescribed for the purposes of subsection 33(1) of the Act are provided as determined by the Minister.

9 Section 76

Repeal the section.

10 After section 96

Insert:

96A Annual amounts reduced if a person begins to be a member during a year

(1) This section applies if:

(a) an annual amount, other than a dollar amount, of either of the following is to be provided to a person (whether relating to a calendar or financial year):

(i) public resources under this instrument;

(ii) resources prescribed under section 42 of the Act; and

(b) the person becomes a member during the year.

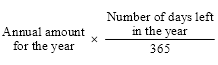

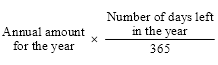

(2) The annual amount is worked out using the following formula:

(3) The amount must be rounded to the nearest whole number that is more than zero.

(4) This section applies only in relation to a person who becomes a member after the commencement of this section.