AASB 2018-4 |

Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors

[AASB 15 & AASB 16]

AASB 2018-4 |

Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors

[AASB 15 & AASB 16]

This Standard is available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

Website: www.aasb.gov.au

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

COPYRIGHT

© Commonwealth of Australia 2018

This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission. Requests and enquiries concerning reproduction and rights should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

ISSN 1036-4803

Contents

PREFACE

ACCOUNTING STANDARD

AASB 2018-4 AMENDMENTS TO AUSTRALIAN ACCOUNTING STANDARDS – AUSTRALIAN IMPLEMENTATION GUIDANCE FOR NOT-FOR-PROFIT PUBLIC SECTOR LICENSORS

from paragraph

APPLICATION 2

AMENDMENTS TO AASB 15 4

AMENDMENTS TO AASB 16 8

COMMENCEMENT OF THE LEGISLATIVE INSTRUMENT 9

BASIS FOR CONCLUSIONS

Australian Accounting Standard AASB 2018-4 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors is set out in paragraphs 1 – 9. All the paragraphs have equal authority.

Preface

This Standard makes amendments to AASB 15 Revenue from Contracts with Customers (December 2014) and AASB 16 Leases (February 2016).

Main features of this Standard

Main requirements

This Standard primarily amends AASB 15 to add requirements and authoritative implementation guidance for application by not-for-profit public sector licensors to transactions involving the issue of licences.

The amendments to AASB 15 include:

(a) expanding the scope of AASB 15 to include non-contractual licences;

(b) guidance distinguishing a licence from a tax;

(c) guidance clarifying the types of licences issued by not-for-profit public sector licensors;

(d) guidance clarifying the application of the principles in AASB 15 to licences that are not within the scope of other Australian Accounting Standards; and

(e) providing recognition exemptions for short-term licences and licences issued for a low transaction price.

The amendments to AASB 16 clarify that licences that are in substance leases or contain leases, except licences of intellectual property, fall within the scope of AASB 16.

Application date

This Standard applies to annual periods beginning on or after 1 January 2019. Earlier application is permitted.

Accounting Standard AASB 2018-4

The Australian Accounting Standards Board makes Accounting Standard AASB 2018-4 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors under section 334 of the Corporations Act 2001.

Kris Peach

Dated 4 September 2018 Chair – AASB

Accounting Standard AASB 2018-4

Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors

Objective

1 This Standard amends:

(a) AASB 15 Revenue from Contracts with Customers (December 2014); and

(b) AASB 16 Leases (February 2016);

to add requirements and authoritative implementation guidance for application by not-for-profit public sector licensors.

Application

2 The amendments set out in this Standard apply to entities and financial statements in accordance with the application of AASB 15 and AASB 16 as set out in AASB 1057 Application of Australian Accounting Standards (as amended).

3 This Standard applies to annual periods beginning on or after 1 January 2019. This Standard may be applied to annual periods beginning before 1 January 2019, provided that AASB 15 and AASB 16 are also applied to the same period. When an entity applies this Standard to such an annual period, it shall disclose that fact.

Amendments to AASB 15

4 Paragraphs Aus5.2, Aus8.1–Aus8.5, Aus26.1 and a heading before paragraph Aus8.1, are added:

Aus5.2 Notwithstanding paragraph 5, in respect of not-for-profit public sector licensors, this Standard also applies to licences issued, other than licences subject to AASB 16 Leases, or transactions subject to AASB 1059 Service Concession Arrangements: Grantors, irrespective of whether the licences are contracts with customers. Licences include those arising from statutory requirements. Guidance on applying this Standard to licences is set out in Appendix G, including the distinction between a licence and a tax.

Recognition exemptions (paragraphs G22–G27)

Aus8.1 Except as specified in paragraph Aus8.2, a not-for-profit public sector licensor may elect not to apply the requirements in paragraphs 9–90 (and accompanying Application Guidance) to:

(a) short-term licences; and

(b) licences for which the transaction price is of low value.

Aus8.2 The option allowed in paragraph Aus8.1 is not available to licences that have variable consideration in their terms and conditions (see paragraphs 50–59 for identifying and accounting for variable consideration).

Aus8.3 If in accordance with paragraph Aus8.1 a not-for-profit public sector licensor elects not to apply the requirements in paragraphs 9–90 (and accompanying Application Guidance) to either short-term licences or licences for which the transaction price is of low value, the licensor shall recognise the revenue associated with those licences either at the point in time the licence is issued, or on a straight-line basis over the licence term or another systematic basis.

Aus8.4 If in accordance with paragraph Aus8.1 a not-for-profit public sector licensor elects not to apply the requirements in paragraphs 9–90 (and accompanying Application Guidance) to short-term licences, a licence shall be treated as if it is a new licence for the purposes of AASB 15 if there is:

(a) a modification to the scope of, or the consideration for, the licence; or

(b) any change in the term of the licence.

Aus8.5 The election for short-term licences under paragraph Aus8.1 shall be made by class of licence. A class of licences is a grouping of licences of a similar nature and similar rights and obligations attached to the licence. The election for licences for which the transaction price is of low value can be made on a licence-by-licence basis.

Aus26.1 Notwithstanding paragraph 26(i), a not-for-profit public sector licensor shall refer to Appendix G for guidance on accounting for revenue from licences issued.

5 Appendix A.1 Australian Defined Terms is added as set out on page 7 of this Standard.

6 Appendix G Australian implementation guidance for not-for-profit public sector licensors is added as set out on pages 8–12 of this Standard.

7 Australian illustrative examples for not-for-profit public sector licensors is attached to accompany AASB 15 as set out on pages 13–15 of this Standard.

Amendments to AASB 16

8 Paragraph Aus3.1 is added:

Aus3.1 Notwithstanding paragraph 3, in respect of not-for-profit public sector licensors, this Standard also applies to licences that are in substance leases or contain leases, excluding licences of intellectual property. AASB 15 applies to licences of intellectual property. AASB 15 also applies to licences of non-intellectual property that, in substance, are not leases or do not contain leases.

Commencement of the legislative instrument

9 For legal purposes, this legislative instrument commences on 31 December 2018.

Appendix A.1 [FOR AASB 15]

Australian Defined Terms

This appendix is an integral part of AASB 15. The appendix applies only to not-for-profit public sector licensors.

short-term licence A licence that has a term of 12 months or less.

Appendix G [FOR AASB 15]

Australian implementation guidance for not-for-profit public sector licensors

This appendix is an integral part of AASB 15 and has the same authority as other parts of the Standard. The appendix applies only to not-for-profit public sector licensors.

Overview – Accounting framework for licences issued by not-for-profit public sector licensors

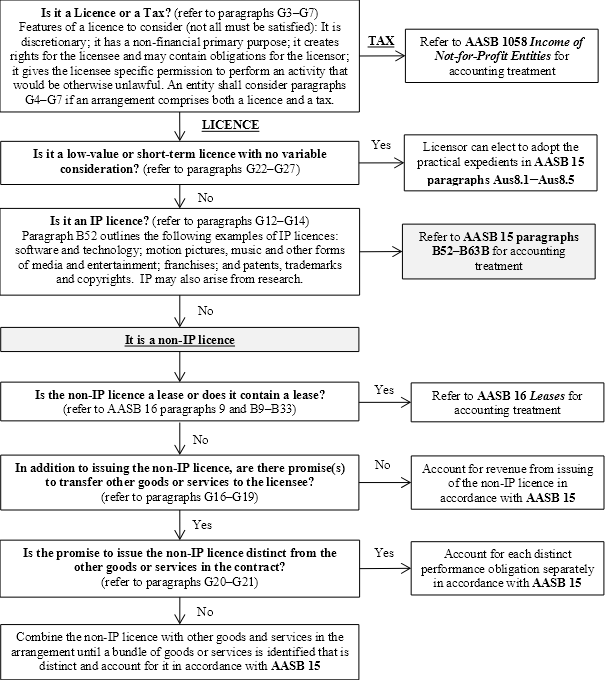

G1 The diagram below summarises the accounting requirements under AASB 15 applicable to not-for-profit public sector licensors when determining how to account for revenue from licences. The diagram should be read in conjunction with the guidance set out in paragraphs G2–G27, and as referenced in the diagram.

G1 The diagram below summarises the accounting requirements under AASB 15 applicable to not-for-profit public sector licensors when determining how to account for revenue from licences. The diagram should be read in conjunction with the guidance set out in paragraphs G2–G27, and as referenced in the diagram.

![]()

![]()

![]()

Introduction

Distinguishing a licence from a tax

G3 In determining whether a transaction is a licence subject to this Standard, as distinct from a tax subject to AASB 1058 Income of Not-for-Profit Entities[1], the following features are pertinent. These features are not an exhaustive list and not all features need to be present for an arrangement to be a licence:

Feature | Licence | Tax |

(a) Is the arrangement discretionary rather than compulsory for the payer? | Discretionary | Compulsory |

(b) What is the primary purpose? | Non-financial purpose (eg equitable allocation of a public resource) | Generating income for the public sector entity (eg very high proceeds in relation to the costs incurred might be indicative of a tax element) |

(c) Does the arrangement create direct rights to use or access an asset for the payer, or perform an activity, and, depending on the type of arrangement, direct obligations of the payee? | Creates direct rights for the payer (licensee), and could create direct obligations for the payee (licensor) | No specific rights for the payer or obligations for the payee |

(d) Does the arrangement give the payer specific permission that must be obtained prior to performing an activity or using or accessing a resource of the payee that would otherwise be unlawful? | Yes | No |

(e) Does the arrangement transfer control of the payee’s underlying asset? | No | Not relevant |

G5 The presumption is rebutted if one of the following criteria are satisfied:

(a) the transaction price is partially refundable in the event the entity does not issue the licence; or

(b) a similar activity effected through a different transaction or organisational structure is subject to a tax, providing evidence of the composite nature of the arrangement or there is other evidence supporting that there is a tax not specific to the licencing arrangement.

Non-contractual licences arising from statutory requirements

G8 The scope of AASB 15 is underpinned by the definition of a contract in Appendix A, which is an agreement between two or more parties that creates enforceable rights and obligations. When determining whether a licence is a contract with a customer a not-for-profit public sector entity shall consider paragraphs F5–F19 of AASB 15, also having regard to paragraphs G9 and G10.

Types of licences issued by not-for-profit public sector licensors

G11 Paragraphs B52–B63B describe the application of AASB 15 to licences of intellectual property (IP). Licences issued by not-for-profit public sector licensors extend beyond IP licences to include licensing arrangements in which the licence does not relate to IP (ie non‑IP licences).

IP licences

(a) software and technology;

(b) motion pictures, music and other forms of media and entertainment;

(c) franchises; and

(d) patents, trademarks and copyrights.

Non-IP licences

G15 Where a not-for-profit public sector licensor determines that a licence is a non-IP licence, the licensor shall consider whether the licence is for:

(a) rights over the licensor’s identified asset(s), in which case the arrangement might be a lease (or contain a lease), and fall within the scope of AASB 16;

(b) rights over the licensor’s non-identified asset(s), in which case the licence might:

(i) not be distinct from other promised goods or services in the arrangement, and shall therefore be combined with the other goods or services and accounted for as a bundle of goods or services (see paragraphs G20 and G21); or

(ii) be distinct from other promised goods or services, and shall therefore be accounted for as a separate performance obligation in accordance with the principles of AASB 15 (see paragraphs G16–G21 for guidance on applying certain aspects of the principles). The Application Guidance for licences of IP in paragraphs B52–B63B shall not be applied to this type of licence; or

(c) the right to perform an activity, which would not involve an asset or assets of the licensor, and if distinct from other goods or services, shall be accounted for as a separate performance obligation in accordance with the principles of AASB 15 (see paragraphs G16–G21 for guidance on applying certain aspects of the principles). The Application Guidance for licences of IP in paragraphs B52–B63B shall not be applied to this type of licence.

Identifying performance obligations

Identifying the customer

Identifying the goods or services

G18 The good or service being transferred in a non-IP licence by a licensor would most commonly be either issuing rights over the licensor’s non-identified assets or issuing rights to the licensee to perform an activity (ie issuing the licence itself is the sole good or service). However, an entity shall also assess the arrangement to identify any other goods or services promised to the licensee.

G19 In accordance with paragraph 25, performance obligations do not include activities that a licensor must undertake to fulfil a contract unless those activities transfer a good or service additional to the licence issued to the licensee. For example:

(b) activities that a licensor is required to undertake in the context of a non-IP licence to benefit the general public or to confirm the terms of the licence are being met (for example ‘policing’ activities to ensure licensee is not carrying out illegal activities or customers of the licensee are of a legally allowable age) are not performance obligations. Such activities do not transfer additional goods or services to the licensee (even though the licensee could benefit from those activities); and

(c) activities that a licensor performs to check that a licensee continues to meet the eligibility requirements of the arrangement are not performance obligations. The licensee controls whether they meet the eligibility requirements of the arrangement. Activities performed by the licensor to uphold the integrity of the licence merely confirm that the arrangement is not breached, and do not transfer goods or services to the licensee.

Licences distinct from other goods and services

(a) the licensor is using the licence as an input to deliver the fish to the licensee, which is the output to the licensee; and

(b) the licence and the promise to deliver the fish are highly interrelated – the licensor would not be able to fulfil its promise of delivering the fish independently of issuing the licence without undermining its policies and customary business practices (ie the fish can only be delivered when a fishing licence has been issued).

In these circumstances, the licence is not separately identifiable from other promises in the arrangement, in accordance with paragraphs 29(a) and (c) of AASB 15.

Recognition exemption: low-value licences (paragraphs Aus8.1–Aus8.3)

G23 Notwithstanding paragraph G22, the option allowed in paragraph Aus8.1 is not available to licences including variable consideration.

G24 Low-value licences qualify for the accounting treatment in paragraph Aus8.3 regardless of whether those licences are material in aggregate to the licensor. The assessment is not affected by the size, nature or circumstances of the licensor. Accordingly, different licensors would be expected to reach the same conclusions about whether a particular licence has a low-value transaction price.

Recognition exemption: short-term licences (Aus8.1–Aus8.5)

Australian illustrative examples for not-for-profit public sector licensors

These illustrative examples accompany, but are not part of, AASB 15. They illustrate aspects of the Australian guidance for not-for-profit public sector licensors in AASB 15, but are not intended to provide interpretative guidance.

These examples illustrating aspects of the Australian guidance for not-for-profit public sector licensors in AASB 15 complement, and have the same status, as the Illustrative Examples accompanying IFRS 15 Revenue from Contracts with Customers, which are available on the AASB website to website users in Australia.

These examples are additional to the illustrative examples accompanying AASB 15 that were added as part of AASB 2016-8 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Entities. Therefore the numbering of these paragraphs starts at IE5 and the numbering of the examples starts at Example 8.

Satisfaction of performance obligations (paragraphs 31–38)

IE6 Example 8 illustrates a not-for-profit public sector licensor recognising revenue when (or as) the licensor satisfies the performance obligation of transferring the promised licence to the licensee. A licence is transferred when (or as) the licensee obtains control of that licence. To determine when a licensee obtains control of the promised rights associated with the licence and the licensor satisfies its performance obligation, the licensor shall consider the requirements for control in AASB 15 paragraphs 31–34 regarding control by the licensee (the customer).

IE7 The licensor shall determine at the inception of each licensing arrangement whether the performance obligation from issuing the licence is recognised over time (in accordance with AASB 15 paragraphs 35–37) or at a point in time (in accordance with AASB 15 paragraph 38).

Example 8—Performance obligations, non-IP licence

Example 8A – Exclusivity rights

Public Sector Authority A (Licensor) issued Casino Operator B (Licensee) a licence to operate a casino in geographical location C for $100 million.

The terms of the arrangement are:

Applying the accounting framework for licences issued by not-for-profit public sector licensors

Is the arrangement a licence or a tax?

Licensor applies paragraph G3 and concludes its arrangement with Licensee is not a tax, on the basis that the majority of the indicators support a licence classification:

Licensor applies paragraphs G4–G6 and concludes there is no tax element that needs to be separated. Although the arrangement has a low cost in relation to the consideration received, which might be indicative of a tax element, the transaction price is not refundable, and there is no other evidence indicating similar activities operating through different structures (such as online gaming) are subject to a tax. Accordingly, the criteria necessary to rebut the presumption for Licensor to allocate the transaction price of $100 million wholly to the licence are not satisfied.

Is it a low-value or short-term licence?

Applying paragraphs Aus8.1 and G22–G27, Licensor concludes that its arrangement with Licensee is not a low-value or short-term licence because the transaction price of the licence is $100 million and the term of the licence is 10 years.

Is it an intellectual property (IP) licence?

Applying paragraph G13, Licensor concludes its arrangement with Licensee is a non-IP licence as the arrangement does not involve rights over IP of Licensor.

Is the non-IP licence a lease or does it contain a lease?

Applying paragraphs Aus5.2 and G14(a), Licensor concludes its arrangement with Licensee gives Licensee a right to perform an activity (ie operate a casino) rather than conveying a right over an identified asset of the Licensor. Therefore the arrangement is not a lease and does not contain a lease.

Identifying the performance obligation

Who is the customer?

Applying paragraph G16, Licensee (Casino Operator B) is identified as the customer. Licensee has entered into an arrangement with Licensor to obtain goods or services that are an output of Licensor’s ordinary activities in exchange for consideration.

What are the goods and services promised in the arrangement?

Applying paragraphs G18–G21, Licensor concludes the only goods and services transferred to Licensee (the customer) is the licence itself, being the ‘right to perform’ gambling activities.

Licensor observes that the following promises/activities are not performance obligations as they do not transfer additional goods or services to Licensee, beyond the licence itself, but instead either confirm the attributes promised at inception of the licence or confirm that the terms of the licence have been met:

Licensor does not identify any remaining promises to transfer a good or service to Licensee in the arrangement that are distinct from the licence.

Licensor concludes there is a single distinct performance obligation to issue the licence.

Example 8B – Distinct goods or services

In this example, the facts of Example 8A apply, except that, in addition to issuing the licence, Licensor will perform maintenance of Licensee’s gaming machines throughout the licence term to ensure that the gaming machines are in working order, have not been tampered with and are not in need of repair. If such services were not provided by Licensor, it is expected that Licensee would engage a third party to carry out the maintenance services to provide assurance to Licensee’s patrons that the machines are functioning as they should be. In addition:

Applying the accounting framework for licences issued by not-for-profit public sector licensors

Licensor concludes on the same basis as Example 8A that its arrangement to issue a non-IP licence to Licensee is not a tax, is not a low-value or short-term licence, is not an IP licence and is not a lease or does not contain a lease.

Identifying the performance obligation

Licensor concludes on the same basis as Example 8A that Licensee is the customer, and identifies the issue of the licence (the right to perform) as a performance obligation.

Applying paragraphs 22 and G15–G20, Licensor concludes there are two distinct performance obligations to:

The promise to perform maintenance services on the gaming machines transfers a series of services that are substantially the same and have the same pattern of transfer to Licensee and in accordance with paragraph 27 this service is distinct from granting the licence to operate a casino, as:

(a) Licensee can benefit from the service either on its own or together with other resources that are readily available to Licensee (paragraph 28) – if Licensor were not providing this service to Licensee, Licensee would be reasonably expected to obtain such services from a third party to ensure machines are operating at capacity to generate maximum revenue; and

(b) Licensor’s promise to transfer the good or service to Licensee is separately identifiable from other promises in the arrangement (paragraph 29) as:

(i) the maintenance services are not integral to the issue of the casino licence;

(ii) the maintenance services do not modify the rights provided by the licence; and

(iii) the nature of Licensor’s promise is to transfer the maintenance services separately to the issue of the casino licence.

Licensor does not identify any remaining promises to transfer a good or service to Licensee in the arrangement that are distinct from the licence and the maintenance services.

Basis for Conclusions

This Basis for Conclusions accompanies, but is not part of, AASB 2018-4 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors.

Introduction

BC1 This Basis for Conclusions summarises the Australian Accounting Standards Board’s considerations in reaching the conclusions in this Standard. It sets out the reasons why the Board developed the Standard, the approach taken to developing the Standard and the key decisions made. In making decisions, individual Board members gave greater weight to some factors than to others.

Reasons for issuing this Standard

BC2 Constituents’ feedback received during the AASB’s Service Concession Arrangements: Grantors project (which addressed some public sector licences) identified there was a risk that revenue from licences issued by not-for-profit (NFP) public sector licensors could be materially understated (revenue is deferred when it should be recognised immediately) or overstated (revenue is recognised immediately when it should be recognised over time) in the absence of guidance on how AASB 15 Revenue from Contracts with Customers applies.

BC3 AASB 15 provides specific guidance on accounting for revenue arising from the issuance of intellectual property (IP) licences. However, as AASB 15 is generally expressed from the perspective of for-profit entities in the private sector, the Board received feedback that it is unclear whether the guidance in AASB 15 could be applied to account for revenue from licences issued by not-for-profit public sector licensors, particularly in the case of non-IP licences and non-contractual licences arising from statutory requirements.

BC5 The Board had previously considered the accounting for revenue from licences issued by not-for-profit public sector licensors as part of its projects relating to:

(a) AASB 1059 Service Concession Arrangements: Grantors (see paragraphs BC38–BC39); and

(b) AASB 1058 Income of Not-for-Profit Entities (see paragraph BC40).

BC6 In both instances, the Board deferred its deliberations pending a specific project to research the extent to which these types of licences exist, as well as the current and potential accounting treatment.

BC7 Consequently, the Board decided to add to its 2017-2019 Work Program a project to clarify the accounting for revenue from licences issued by not-for-profit public sector licensors. The Board decided the project should address:

(a) the nature of the right created by a licence – whether the licence confers the right to use or access a licensor’s asset, or confers a right to perform an activity where there is no licensor asset involved, and whether different accounting treatments for revenue from such licences are appropriate;

(b) whether the scope of AASB 15 should be expanded to encompass non-contractual licences issued under statute and/or non-IP licences; and

(c) whether the guidance in AASB 15 specifically for IP licences is appropriate for all licences issued by not-for-profit public sector entities.

Issue of ED 283 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors

BC8 The Board’s proposals were exposed for public comment in December 2017 as part of ED 283 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors. In developing the proposals, the Board considered past research undertaken as part of its AASB 1058 and AASB 1059 projects, as well as a number of public AASB meeting Agenda Papers that considered the application of existing accounting Standards (see paragraphs BC31–BC52). ED 283 proposed guidance that would clarify the application of AASB 15 to licences that did not fall within the scope of any other Australian Accounting Standard.

BC9 Between issuing ED 283 and finalising the Standard, the Board held targeted outreach with key stakeholders in the NFP public sector, including state and national treasuries, audit offices, accounting firms, the Australian Bureau of Statistics (ABS), credit rating agencies, and representatives of the Australasian Council of Public Accounts Committees (users of NFP public sector financial statements). The ED proposals were also presented at various forums, workshops and discussion groups.

(a) the majority of respondents agreed revenue from non-IP licences should be accounted for in accordance with the general principles of AASB 15 (but not the specific guidance provided for IP licences). However, despite support in principle, numerous respondents raised concern with the outcome of applying the principles in AASB 15, in particular for high-value long-term licences such as casino licences (discussed further in BC84);

(b) some respondents sought clarification of the distinction between licences and taxes, and recommended aligning the distinction between a licence and tax more closely with the definitions of the ABS’s Government Finance Statistics (GFS) Manual to allow for the harmonisation of the two frameworks; and

(c) some respondents raised concerns with the proposal to allocate the transaction wholly to a promise to issue a licence where the arrangement has a dual purpose of issuing a licence and imposing a tax. The respondents were especially concerned with the practical consequences when having to account for any variable consideration, noting that it is possible for an arrangement to demonstrate both elements of licensing and taxation.

BC11 The Board considered these issues as well as a range of other issues identified by constituents in developing this Standard following the ED 283 exposure process.

BC12 In May, June and August 2018, the Board considered issues papers and draft wording for paragraphs of the Standard which were published as Board agenda papers for the public. This gave constituents the opportunity to follow the debate and to provide comments on the issues and drafting contemporaneously.

BC13 In August 2018 the Board decided to finalise its decisions to address issues raised by constituent in the form of a Pre-Ballot Draft of the Standard. The Board felt it unnecessary to issue a fatal-flaw version of the Standard in light of the Board deciding not to make any major changes to the proposals in ED 283. Instead, the Board decided that the final Standard would provide clarification and additional guidance and examples to assist NFP public sector licensors distinguish licences from taxes (and other arrangements within the scope of other Standards), and how the principles of AASB 15 would apply to non-IP licences.

Scope

BC14 The Board decided the scope of the amendments to AASB 15 effected through this Standard should be restricted to NFP public sector licensors. The Board identified a small number of non-IP licences issued by for-profit public sector entities, however consistent with The AASB’s For-Profit Entity Standard-Setting Framework the Board decided not to expand the scope of the guidance as:

(a) the prevalence and magnitude of the transactions in the for-profit public sector are not such that users would be likely to make inappropriate decisions based on the financial statements prepared without regard to the guidance in this Standard; and

(b) in light of the above, the Board preferred to not risk precluding for-profit public sector entities from being able to claim IFRS compliance.

BC15 The Board noted that its decision regarding to apply AASB 1059 to all public sector entities including for-profit entities was the result of a decision made specifically in the context of that project.

Features of licences

BC16 The Board noted that AASB 15 provides some examples of IP licences but none of the Australian Accounting Standards (including AASB 15) describe what a licence is. The Board considered that it would be helpful for licensors in the NFP public sector for the Board to provide guidance in the Standard on identifying the features of a licence. This would help distinguish revenue arising from licences, accounted for in accordance with this Standard, and revenue arising from taxes, accounted for in accordance with AASB 1058.

BC17 In identifying the features of a licence, the Board considered:

(a) the extent to which current Australian Accounting Standards define or infer features of licences, in particular AASB 1058;

(b) the features of a licence considered by the International Public Sector Accounting Standards Board (IPSASB) in its projects; and

(c) other resources, including the ABS GFS Manual, commonly accepted definitions, law and other common features of licences issued by NFP public sector licensors.

AASB 1058 Income of Not-For-Profit Entities: distinguishing a licence from a tax

Economic benefits compulsorily paid or payable to public sector entities in accordance with laws and/or regulations to provide income to the government. Taxes exclude fines.

BC19 The Board noted this definition of ‘taxes’ identifies two points of distinction, being:

(a) the notion of compulsion; and

(b) the purpose of the payment.

BC20 In relation to compulsion, the Board observed that, in contrast to a tax, although a licence fee may be compulsorily payable upon issue, a prospective licensee has discretion over whether to seek a licence. For example, an entity would generally have discretion over whether to perform an activity that requires a licence, whereas a tax would arise generally from activities that are necessary for the entity to operate, for example earning revenue. The Board also observed that the notion of compulsion could be supported by the consequences of evading a licence fee or tax. For example, if an entity were found to have evaded a licence fee, it would not be compulsory for the entity to retrospectively obtain the licence. Any consequence for undertaking unlicensed activities would be in the nature of a fine or other penalty (ie the entity would not be compelled to obtain a licence). In contrast, an entity found to have evaded a tax would be compelled to pay the tax in addition to any fine or other penalty. The Board decided that, in distinguishing a licence from a tax, the notion of compulsion by reference to whether an entity would have discretion over whether to obtain a licence or not would be useful as a primary or singular point of distinction between a licence and tax.

Other Australian Accounting Standards

BC22 The Board considered, but did not identify any features of licences implicit in the following Australian Accounting Standards:

(a) AASB 15;

(b) AASB 16;

(c) AASB 138 Intangible Assets; and

(d) AASB 1059.

The IPSASB

BC23 In identifying other features distinguishing licences from taxes, the Board considered the IPSASB’s project work regarding the accounting for revenue transactions. The Board noted the IPSASB, at the time this Standard was issued, had not specifically considered the accounting for revenue from licences issued by NFP public sector entities, nor defined the term ‘licence’ in any IPSAS.

ABS GFS Manual

BC25 Despite this, some respondents to ED 283 (including the ABS) preferred that the Board align with the ABS’s definition of a licence for distinguishing licences from taxes. However, the Board reaffirmed its decision to not use proportionality of level of work to transaction price as a primary distinguishing feature as:

(a) the Board observed that determining whether the revenue recognised is proportionate to the cost of a licensor’s obligations is a difficult and subjective assessment that, based on feedback from preparers, might not be applied consistently in the preparation of general purpose financial statements;

(b) adopting the ABS GFS Manual approach could result in the majority of the arrangements in question being classified as a tax and accounted for in accordance with AASB 1058. AASB 1058 paragraph B28 specifically precludes taxes from giving rise to a contract liability or revenue recognised in accordance with AASB 15, as they do not promise to provide a good or service in an agreement that creates enforceable obligations. However, the Board noted that a proportion of the arrangements that would be classified as a licence under the guidance in this Standard are different in substance to taxes as:

(i) they do create direct rights for the licensee (most commonly a right to perform) and obligations for the licensor to provide a good or service (also, most commonly, a right to perform); and

(ii) the discretionary nature of licences indicates that the economic purpose of the transaction is to obtain the goods and services (most commonly a right to perform) from the licensor, and therefore it would be counter intuitive to the Board’s policy of transaction neutrality to preclude a NFP public sector licensor from accounting for its revenue when (or as) it transfers control of the good or service, consistent with for-profit entities providing goods or services.

Other resources

BC26 The Board noted, based on common law and other commonly accepted definitions of the term ‘licence’, the following features are also useful in distinguishing licences from taxes:

(a) whether the arrangement creates direct rights of a payer to use (not within the scope of AASB 16) or access the payee’s asset, or perform an activity, and, depending on the type of arrangement, direct obligations of a payee. The Board noted that licences would generally confer direct rights to a licensee, and could, in some instances, create direct obligations for a licensor. The Board considered whether a tax could confer rights (and create obligations), but concluded that the nexus between any right or obligation as a result of a tax and the tax itself would not be sufficiently direct;

(b) based on common law principles, the Board observed that licence arrangements confer a specific permission to perform an activity or to use or access an asset that would otherwise be unlawful; and

(c) also based on common law principles, the Board observed that licences do not transfer control of a payee’s underlying asset. The transfer of control of assets would fall within the scope of other Australian Accounting Standards (eg AASB 116 Property, Plant and Equipment and AASB 138), and therefore would not be within the scope of AASB 15.

(a) the existence of an underlying asset;

(b) refundability;

(c) transferability; and

(d) the term of the arrangement.

Terminology

BC28 In considering the features that would be helpful in distinguishing a licence from a tax, the Board noted the substance of some arrangements might be contradictory to the term used to describe them. For example, an arrangement that is referred to as a ‘tax’ might in fact be a licence in substance, based on the Board’s guidance. Alternatively, an arrangement might not be referred to as either a licence or a tax, but instead, for example, as a ‘permit’. The Board noted that, notwithstanding the term used to describe an arrangement, a licensor should consider its substance in accordance with the guidance provided in this Standard and account for that arrangement accordingly.

Application of Australian Accounting Standards

BC29 The Board considered the applicability of the existing suite of Australian Accounting Standards to licences. The Board also considered the suitability of the scoping principles in AASB 15 in the context of whether its application could be extrapolated to appropriately reflect the economic substance of transactions in accounting for revenue from licences issued under statute. The Board identified the following Australian Accounting Standards as possibly applicable:

(a) AASB 16;

(b) AASB 1058; and

(c) AASB 1059.

BC30 The Board’s views with respect to the application of these Australian Accounting Standards are set out in paragraphs BC31–BC52.

AASB 16 Leases

BC32 In considering whether a licence could satisfy the definition of a lease, and therefore be accounted for in accordance with AASB 16, the Board noted the licence would need to be a contract (see the discussion in paragraphs BC43 for the Board’s deliberations on whether all licences are contracts) conveying a ‘right to use’ an asset for a period of time in exchange for consideration. The asset would also need to be an identified asset with no substantive right of substitution.

BC33 The Board considered the meaning of ‘right to use’ in the context of the Application Guidance in AASB 16, which requires the contract to convey the right to control the use of the identified asset for a period of time. In doing so, an entity is required to assess whether a customer has:

(a) the right to obtain substantially all of the economic benefits from the use of the identified asset, such that the customer has rights to direct how and for what purpose the asset is used; and

(b) the right to direct the use of the identified asset, such that relevant decisions about how and for what purpose the asset is used are predetermined. The customer must also have the right to operate the asset without the supplier having rights to change operating instructions, or the customer designed the asset in a way that predetermines how and for what purpose the asset will be used.

BC34 Accordingly, the Board observed that AASB 16 could only apply to ‘right to use’ identified assets under contractual licences outside the scope of AASB 15, but that the term ‘right to use’ in the context of AASB 16, as outlined in the Application Guidance of that Standard, is used in a different context to the term ‘right to use’ when accounting for revenue from the issue of IP licences addressed in AASB 15.

BC35 In this regard, the Board noted that it would expect most non-IP licences issued by NFP public sector licensors would not constitute ‘right to use’ identified asset type licences, and therefore would not fall within the scope of AASB 16 because:

(a) in most cases there would not be an underlying licensor’s asset involved in the arrangement (for example ‘right to perform’ type licences); or

(b) where a licensor’s asset is involved, it would be in the nature of ‘a capacity portion of an asset that is not physically distinct’ (a phrase used in AASB 16) and not an identified asset.

BC37 The Board decided to amend the scope paragraph of AASB 16 to ensure the interaction of AASB 15 and 16 is clear.

AASB 1059 Service Concession Arrangements: Grantors

AASB 1058 Income of Not-for-Profit Entities

AASB 15 Revenue from Contracts with Customers

BC41 AASB 15 applies to the accounting for revenue from contracts with customers, where the customer is a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. Paragraph 26(i) of AASB 15 explicitly identifies licences as a possible good or service. The Board notes that although paragraph B52 states that a licence establishes a customer’s rights to the IP of an entity, and paragraphs B52 and B62 are written in the context of IP licences, paragraph 26(i)’s reference to ‘licences’ is not limited to IP licences.

BC42 The Board observed that in assessing whether non-IP licences could fall within the scope of AASB 15, non-IP licence arrangements would need to:

(a) constitute a contract with a customer;

(b) constitute goods or services; and

(c) be an output of the licensor’s ordinary activities.

The scope of ‘contract’

BC44 A key legal feature in distinguishing between rights and obligations created by contract versus those created under a statute is the assessment of whether the parties entered into the arrangement voluntarily. Arrangements imposed by statute (for example, taxation) are not contractual given that mutual voluntariness is lacking. However not all relationships prescribed by statute are this conclusive. The Board noted that for significant licences there is likely to be a specific contract put in place between the payer and payee that may operate in parallel with rights and obligations imposed by statute (eg gaming licences), however for other licences it is less clear whether they are contractual or statutory in nature.

BC45 The Board noted that regardless of whether an arrangement or relationship in question arises from a contractual or statutory basis, that arrangement only needs to create enforceable rights and obligations between the relevant parties for it to be appropriately considered within AASB 15. Provided that a NFP public sector licence is sufficiently enforceable, it should be within the scope of AASB 15. This is in line with the Board’s previous decisions in Appendix F to AASB 15, which states in paragraph F13 that the enforceability of agreements does not depend solely on their form.

BC46 The Board also noted that judgement may be needed to determine whether a licence is contractual or statutory in nature and that if the substance is the same, then similar accounting outcomes would be most consistent with the Conceptual Framework. This is also consistent to the approach in Appendix C of AASB 9 Financial Instruments where the scope of AASB 9 is extended to apply to statutory receivables of public sector entities on initial recognition.

The scope of ‘goods and services’

BC48 The Board also considered, in relation to a licence granting a right to perform an activity, whether the absence of a right to an asset of the licensor could preclude the right to perform an activity from constituting goods or services. In its deliberations, the Board noted that the legal meaning of ‘goods and services’, both under statute and general legal definitions, does not exclude the issuing of rights, whether related to an asset or otherwise, from constituting goods or services.

BC49 The Board also acknowledged the Canadian Public Sector Accounting Standards Board’s view that issuing of licences and permits would constitute goods or services, as proposed in Exposure Draft Revenue, Proposed Section 2400 in May 2017, as they could constitute exchange transactions.

The scope of ‘ordinary activities’

BC51 The Board considered whether the issue of a licence would be an output of the public sector entity’s ordinary activities. As AASB 15 does not define the meaning of the term ‘ordinary activities’, the Board noted the term is derived from the definition of revenue in the Conceptual Framework, particularly as distinct from other activities an entity may engage in. The Board regarded the activity of issuing licences as being within the ambit of ordinary activities carried out by a NFP public sector entity that is an issuing authority because issuing licences is a key responsibility of issuing authorities. Accordingly, the Board concluded that the issue of licences would be within the ordinary activities of a NFP public sector entity that issues such licences.

The Board’s conclusion on AASB 15

(a) it is conceivable that some licences are not outputs of ordinary activities; and

(b) future licencing arrangements might be developed that do not have the character of a ‘contract’, ‘goods or services’ or ‘ordinary activities’ in accordance with the Board’s current views.

Allocating a transaction between licences and taxes

BC54 Paragraphs F28–F32 of Appendix F of AASB 15 set out implementation guidance for NFP entities in allocating a transaction price where NFP entities enter into transactions with a dual purpose of:

(a) obtaining goods or services, which, in the context of this Standard, could be a licence element (accounted for under AASB 15); and

(b) to help the NFP entity achieve its objectives, which, again in the context of this Standard, could be a tax element (accounted for under AASB 1058).

BC55 Appendix F of AASB 15 requires the allocation be based on a rebuttable presumption that the transaction price is treated as wholly related to the transfer of promised goods or service (in the context of this Standard, the licence), where the rebuttal is premised on the arrangement being partially refundable in the event the entity does not deliver the promised goods or services (most commonly, a right to perform).

BC56 The Board noted the views that:

(a) if the price of a licence far exceeds the cost of the level of work required to satisfy the performance obligation, consistent with GFS accounting for licences (see paragraph BC24 above), the ‘excess’ over a reasonable price for the performance obligation may be a tax in certain circumstances; and

(b) if an arrangement contains variable consideration (eg a sales-based or usage-based royalty to provide the licensor with additional revenue where the licensee makes a ‘super-profit’), this component of the transaction price may be considered to be a tax in certain circumstances.

BC58 Accordingly, the Board decided that a transaction price should only be allocated between a licence and a tax when the rebuttable presumption in paragraph F29 of Appendix F is met, and the licence fee is partially refundable in the event that the licence conditions are not satisfied, indicative that there is an element that is a tax component as it is not refundable. In that instance the licensor should apply the guidance in paragraphs F28–F32 to disaggregate the transaction price and account for the component that relates to the transfer of a licence in accordance with AASB 15 (and any additional guidance contained in this Standard). The remainder of the transaction price, being the non-refundable component, is accounted for in accordance with AASB 1058.

BC60 Respondents to ED 283 agreed with the Board’s proposal to utilise the rebuttable presumption in Appendix F of AASB 15, however some raised concerns that the proposals did not always allow for the allocation between a licence and a tax where there is variable consideration. The Board was made aware of two scenarios where respondents believed that the variable component was not a sales-based or usage-based royalty, but instead a tax that should be eligible for disaggregation:

BC61 In the scenario noted in paragraph BC60(a), the Board noted that in accordance with the requirements in paragraph 17 of AASB 15, although there may be two agreements entered into by the licensor with the licensee (one for the licence and another labelled as ‘tax’), these agreements should be combined and considered as one ‘contract’ or arrangement (ie licencing arrangement) if they are entered into at or near the same time with the same customer and negotiated as a package with a single commercial (or regulatory) objective.

BC62 However, in the scenario noted in paragraph BC60(b), the Board observed there was an identifiable element that is a tax that can be readily separated. Noting that the rebuttable presumption is intended to make the accounting simpler for preparers (reducing the burden of determining how to split the elements of the transaction), the Board decided that where there is a readily identifiable generic tax element, it would not be onerous for an entity to disaggregate it. To give effect to this decision, the Board added an additional circumstance rebutting the presumption that the transaction price should not be allocated in paragraph G5(b) when there is other evidence supporting similar transactions effected through different structures are taxed.

Accounting for revenue from licences in accordance with AASB 15 – alternatives considered

BC63 The above has outlined the bases for the Board’s decisions about the types of arrangements entered into by NFP public sector entities that could be subject to the principles in AASB 15. The following outlines the bases for the Board’s decisions about how to give effect to those decisions.

What are the types of public sector licences?

(a) IP licences (which would be either a right to use or a right to access intellectual property);

(b) Non-IP licences involving rights over an asset or assets of the licensor; and

(c) Non-IP licences involving the right to perform an activity.

Applying specific guidance for IP licences in AASB 15 to various examples of licences

BC65 In ED 283 the Board considered whether the specific guidance for private sector IP licences in paragraphs B52–B63B of AASB 15 could be easily applied by analogy to examples of non-IP licences (that both involve a licensor’s assets and that involve a right to perform an activity). The Board noted that application of those paragraphs to IP licences appears relatively straight-forward because IP licences issued by NFP public sector licensors appear to align with those IP licences issued by for-profit entities. However, in relation to non-IP licences, the Board observed application of many of the requirements was more challenging. Challenges were particularly notable where the licence did not involve an asset of the licensor. In particular:

(a) many of the requirements (eg AASB 15 paragraphs B58–B59A, which are used to determine whether an IP licence transfers over time) require an assessment of whether the licensor’s activities significantly affect the IP (ie the underlying asset); and

(b) in the case of some NFP public sector non-IP licences, the licensor may conduct a number of actions throughout the licence period, such as monitoring licensees and their activities under their licences. However, the actions are performed more generally in the public interest. It is not clear whether these activities are undertaken to significantly affect the licensee’s rights granted by the licence. The specific guidance in Appendix B of AASB 15 for IP licences does not explicitly address this matter as it is not written from a NFP public sector perspective.

Example: fibre-optic cable

BC68 The Board considered whether the right to utilise a specified capacity within a fibre-optic cable connecting two cities was an example of a licence that provides a licensee a right to access or use a licensor’s asset. The scenario considered was based on Implementation Example 3 – Fibre-optic cable from IFRS 16 Leases (which was determined not to be a lease as it is not an identified asset), where a customer is provided with specified capacity equivalent to them having the use of three fibre strands within a cable. In that example, the supplier makes decisions about the transmission of data (eg lights the fibres, makes decisions about which fibres are used to direct the customer’s traffic and makes decisions about the electronic equipment that it owns and connects to the fibres). The Board concluded that the nature and extent of activities performed by the supplier meant that the supplier is effectively transmitting data for the customer. Therefore, the supplier is providing the customer with a service and the customer can benefit from the licence only in conjunction with that related service. Therefore, in accordance with paragraph 30, the licence is combined with the other goods or services and accounted for as a bundle of goods or services that is a single performance obligation.

Example: abalone/fish

BC71 The Board also observed that despite an arrangement being referred to as a licence, it might be in substance a ‘take or pay’ arrangement, and should be accounted for in accordance with the principles of AASB 15, with consideration of paragraphs B44–B47, which address customers’ unexercised rights. An example of this would be where a NFP public sector licensor issues a ‘licence’ that requires the licensee to pay for a specified quota of a good, regardless of whether or not the licensee subsequently chooses or manages to take the specified quota.

BC72 The Board asked a specific question in ED 283 to understand whether there were any examples of distinct non-IP licences involving an asset of the licensor. Respondents to ED 283 noted a small number, such as mooring licences and road occupancy licences, however the Board noted that the licences identified are not common examples, and would not represent a significant amount of an NFP public sector entity’s overall revenue from licences. The Board therefore decided that Standard-setting activities were not warranted, and that if a NFP public sector entity did happen to have a material amount of revenue from these licences, the guidance for non-IP licences involving a right to perform would be sufficient.

Options for amending AASB 15 to account for revenue from licences

BC73 The Board concluded that most licences issued by NFP public sector licensors are either IP licences or non-IP licences involving the right to perform an activity. Based on this, the Board observed that it would not be appropriate to simply apply the guidance for IP licences by analogy (due to the challenges for non-IP licences involving the right to perform an activity noted in BC65, but instead analysed four possible options for prescribing the accounting for revenue from licences issued by NFP public sector licensors. A summary of the options considered by the Board is detailed below:

| Option 1 | Option 2 | Option 3 | Option 4 |

What is it? | All licences: (i) Apply (unamended) principles from paragraphs B52 to B63B in AASB 15 (ii) Add implementation guidance and examples to help licensors apply (i) to all licences | (i) IP licences: Apply principles from paragraphs B52 to B63B in AASB 15; (ii) Non-IP licences: Develop guidance based on general principles from AASB 15; and (iii) IP and non-IP licences: Add implementation examples to help licensors apply (i) and (ii). | All licences: Practical expedients, being any one, or a combination of the following: (i) Recognise revenue for all licences (IP and non-IP) at a point in time (upfront when licence is issued); (ii) Recognise revenue for all licences (IP and non-IP) over time[2]; (iii) Recognise revenue for all short-term licences (≤1 year) at a point in time (upfront) and all long-term licences (>1 year) over time2; or (iv) Recognise revenue for all low-value licences at a point in time (upfront) and all high-value licences over time.2 | All licences: Split all licence transactions between a licence and a tax (consistent with GFS accounting for licences and taxes), where the reasonable price for the performance obligation is considered a licence and accounted for under AASB 15 (which may need specific guidance) and the ‘excess’ over the reasonable price for the performance obligation is considered a tax and accounted for under AASB 1058. |

Likely revenue recognition outcome |

|

|

|

|

Accounting for revenue from licences under AASB 15 – the chosen option

BC75 The discussion below sets out the Board’s rationale in effecting the chosen option, including the principles of AASB 15 for which the Board decided to develop guidance.

Recognition exemptions for low-value and short-term licences

BC76 As noted in paragraph BC74, the Board proposed practical expedients for low-value or short-term licences in ED 283 consistent with the precedent in AASB 16. This included providing guidance for applying the requirements to low-value licences, but not short-term licences (nor did the Board propose a definition of a ‘short-term licence’). The majority of respondents to ED 283 supported the provision of practical expedients for short-term and low-value licences. However, several respondents requested the Board provide more guidance and examples on:

Short-term licences

BC77 In considering the issue raised in paragraph BC76(a), respondents explained that ‘short-term’ is used in a number of Standards inconsistently. For example, AASB 16 refers to a ‘short-term lease’ as a lease term of 12 months or less at the commencement date, AASB 119 Employee Benefits refers to employee benefits (other than termination benefits) that are expected to be settled wholly before 12 months after the end of the annual reporting period and AASB 107 Statement of Cash Flows refers to a maturity period of three months or less. The Board therefore decided that adding a practical expedient to AASB 15 for NFP public sector licensors without a definition could result in application issues and disparate accounting outcomes. Consequently, consistent with the decision to use the recognition exemptions in AASB 16 as a precedent, the Board decided to define ‘short-term licences’ as a licence that has a term of 12 months or less.

BC78 The Board observed that, in accordance with AASB 16, the term of a lease would take into account a reasonably certain expectation that a lessee would exercise an option to extend or terminate the lease. The Board considered whether this principle should be reflected in this Standard. The Board noted its expectation that an option typically would modify the scope, or the consideration for, the licence, and therefore would be accounted for as a new licence in accordance with paragraph Aus8.4. Nonetheless, for the removal of doubt and to simplify the recognition exemption, the Board decided to specify that an entity need not consider options to renew a licence in determining the lease term.

Low-value licences

BC79 In considering the issue raised in paragraph BC76(a) the Board included examples of low-value licences in ED 283, including driver licences, marriage licences and working with children permits. The Board decided that it would not be appropriate for it to provide a more prescriptive list of examples, nor quantify when a licence would be of low-value, as the Board preferred to utilise a principle rather than a rule.

BC80 Noting the intended consistency with the principle for short-term leases in AASB 16, the Board considered IFRS 16 paragraphs BC98–BC104, which set out the IASB’s considerations in developing this type of recognition exemption. The Board took particular note of IFRS 16 paragraph BC100, which states “…at the time of reaching decisions about the exemption in 2015, the IASB had in mind leases of underlying assets with a value, when new, in the order of magnitude of US$5,000 or less...”. The Board reaffirmed its decision that entities should apply the recognition exemption for low-value licences consistent with the precedent set in AASB 16, with the exception that licences with variable consideration could not be considered low value, given the possible fluctuations in value means it is uncertain that they ultimately will be low value.

Application to arrangements that are both short-term and low-value

BC81 In relation to paragraph BC76(b), the Board noted that, consistent with AASB 16, a licence only has to be one of either short-term or low-value (or both) to be eligible for the practical expedients, however decided not to amend the drafting of the exemption, noting it is presented in a manner consistent with the practical expedients in paragraph 5 of AASB 16. The Board noted that amending the wording of the exemption might cause inconsistency between Standards where the same outcome is intended, and might consequently lead to application issues.

Low-value licences that have a high volume of transactions

BC82 In relation to paragraph BC76(c), respondents raised concern that this might have led to inconsistency as the licensor is provided with a choice of the systematic basis upon which it will recognise revenue. However, the Board observed that because the licences in question would be expected to be issued at a high volume consistently over time, the recognition of revenue would also occur consistently over time, and the Board did not consider that the information provided to users of financial statements would be misleading.

Application to NFP public sector IP licences

(a) it preferred consistent treatment of all licences within the NFP public sector, noting that IFRS compliance is not a primary objective for the NFP public sector; and

(b) this would reduce the need for public sector preparers to apply judgement to determine whether their short-term and low-value licences are related to IP or non-IP (which would usually not be of great materiality, if at all).

Applying the principles of AASB 15 to non-IP licences

(a) serve to maintain confidence in the services, systems and operations of the licensee, upon which the commerciality of the arrangement is underpinned; and

(b) if not performed would substantially detract from the commerciality of the arrangement.

BC85 In considering this feedback, the Board observed its original decision to apply the principles of AASB 15 to non-IP licences, and specifically noted its decision that, when accounting for non-IP licences, the licensor should disregard the guidance for IP licences in paragraphs B52–B63B. Consequently, the Board analysed the requirements of paragraphs 22–30 to the examples of activities provided by the licensor in paragraph BC84 to determine whether those activities would be considered performance obligations to the customer in accordance with AASB 15.

Identifying performance obligations

Identifying the customer

BC86 The Board noted that the customer in the licensing arrangement is the licensee and activities undertaken for the benefit of the general public would not be a transfer of goods or services to the customer (ie not performance obligations to the customer) under the general principles of AASB 15. Accordingly, the Board decided it was not necessary to amend the proposals in ED 283 in respect of this issue.

Identifying what is a good or service

BC87 As noted in paragraphs BC47–BC50, the Board considered that issuing a right to perform would constitute a good or service for the purpose of AASB 15. The Board noted that a right to perform an activity might also have attributes attached, such as exclusivity. The Board noted that upholding the exclusivity of the right to perform that activity over the term of the licence would not be a separate good or service (and thus a performance obligation) as it does not transfer anything extra to the licensee than the original licence they received on day 1. In other words, exclusivity is an attribute and within the boundary of the licence (the good or service) that has been promised to the licensee. Therefore any activities to set up or maintain these exclusivity conditions are not performance obligations.

Satisfaction of performance obligations

BC90 The Board observed that an entity would be required to apply the requirements of paragraphs 31–45 to determine whether the control of the non-IP licence (most commonly a right to perform) is transferred at a point in time or over time. The Board considered that some non-IP licences might be structured such that the licensor has the right to change the rights issued in the licence at any time (ie change the right to perform at any time), which may indicate that the licensee does not control the same licence over the term of the licence, and hence control is transferred over time. The Board considered whether it should provide additional guidance to help licensors make this assessment, but decided it would not be necessary to do so as, in the Board’s view:

(a) the principles and existing guidance in AASB 15 are sufficient for NFP public sector licensors to apply the Standard;

(b) the quantitative magnitude of licences issued by NFP public sector entities do not appear to constitute a significant portion of public sector revenue for the Board to develop public sector specific guidance on this aspect of AASB 15 that, in the context of IFRS compliance and transaction neutrality, might have unintended implications for private sector entities applying AASB 15; and

(c) the facts and circumstances of NFP public sector licences differ significantly, and providing specific guidance on this aspect of AASB 15 might inadvertently encourage licensors to draw conclusions without considering their specific facts and circumstances sufficiently.

BC91 The Board also reaffirmed its view that in majority of instances, a right to perform a licenced activity would not change over the licence term, because as soon as the licensor has issued the licence, the licensee would be able to direct the use of and obtain substantially all of the remaining benefits from the right to perform the licenced activities (ie the licensee controls the same right to perform the licenced activities throughout the term of the licence). Hence, control would be passed on the day the licence is issued for the entire term of the licence, and revenue would generally be recognised at a point in time.

Providing a rule to recognise revenue over time

BC92 In progressing ED 283, the Board also gave consideration as to whether it should provide a specific rule for all licences to be recognised over time (ie revisiting option 3 from paragraph BC73).

BC93 Based on the analysis in paragraphs BC87–BC89, the Board decided that exclusivity and monitoring activities do not represent a performance obligation in accordance with AASB 15. Therefore, the Board observed that if it were to address comments from constituents that such activities should represent a performance obligation (and hence be satisfied over time), the Board would need to create a rule divergent from the principles of AASB 15.

BC94 The Board noted that in AASB 1059, under the ‘grant of a right to the operator’ (GORTO) model, the licensor is effectively licencing the operator to use the service concession asset. The Board noted its consideration of applying the IP licensing guidance in AASB 15 to account for these arrangements in the scope of AASB 1059, but instead decided to require revenue to be recognised over time under the GORTO method. The Board also observed that a licensor is required to perform certain monitoring activities in a service concession arrangement, such as identifying non-paying vehicles and in the collections of non-payment toll fares.

BC95 The Board considered whether this set a precedent to provide a rule for non-IP licences to be recognised over time. However, the Board noted fundamental differences between service concession arrangements and non-IP licences. A service concession arrangement provides an operator with a right to access an asset that is controlled by the public sector. A licence is a right to use IP or non-IP that is not captured by AASB 16, or a right to perform, which provides significantly more control of the asset or the right to perform to the licensee, than is provided in a service concession arrangement. In a service concession arrangement, the public sector grantor capitalises an asset as part of the arrangement as it is considered a financing transaction in substance, and not a licence. The Board considered that recognising revenue immediately (rather than a liability) on the recognition of a service concession asset at fair value being current replacement cost did not reflect the economic substance of the arrangement and would overstate current year financial performance and the financial position when the right to charge users of the asset has been transferred to the operator, as current replacement cost would not reflect that the future cash flows attributable to the asset had been given up by the grantor. This would not be the case for licensing arrangements as the licensor would not, in most cases, be recognising the asset giving rise to the licence in its financial statements. Accordingly, the Board does not consider it appropriate to analogise to service concession arrangements when considering the treatment of licences.

BC96 On balance, the Board decided that AASB 1059 had not set a precedent for a rule for licences, as revenue is recognised over time for reasons specific to service concession arrangements. The Board also noted that the majority of non-IP licences would be addressed by the practical expedients for short-term and low-value licences. Further, the Board noted that the disagreement with the application of AASB 15 (noted in paragraph BC84) related primarily to casino and gaming licences. The Board observed that the prevalence and magnitude of such types of licences did not require specific treatment, in accordance with The AASB’s Not-for-Profit Entity Standard-Setting Framework. The Board made this assessment at the jurisdictional level, observing that casino and gaming licences typically are issued by treasuries or departments of finance, with administering agencies accounting for such licences as administered items. In light of this the Board decided that the underlying principles of AASB 15 are appropriate for the recognition of revenue from non-IP licences, and it did not find a justifiable reason to diverge from its policy on transaction neutrality.

Variable consideration

BC98 Feedback from respondents on this question was mixed. A number of respondents supported the Board taking a transaction neutral approach to accounting for variable consideration (ie applying the general requirements in AASB 15). However many of these respondents also noted they did not issue licences that involved variable consideration. In contrast, some respondents that do issue licences with variable consideration noted the practical difficulties in applying the general requirements in AASB 15 (such as estimating the consideration and the significant adjustments that would be required) and therefore preferred applying the specific requirements in paragraphs B63–B63B for variable consideration of IP licences.

BC99 However, the Board observed that difficulties in estimating variable consideration was only brought to the Board’s attention in the context of long-term licences, such as casino licences. As noted in paragraph BC4, the Board observed that the quantitative magnitude of this type of licence is not of significant materiality. Additionally, outreach with users of NFP public sector financial statements confirmed that the variable component of these types of licences is not material to their decision-making.

BC100 On balance, the Board decided that it was not justifiable (given user needs were addressed), nor sufficiently significant (given the quantitative magnitude) to warrant departure from its policy of transaction neutrality, and reaffirmed its decision to require variable consideration in non-IP licences to be accounted for in accordance with the general principles of AASB 15.

Effective date and transition

BC101 In developing this Standard, the Board was cognisant that the accounting for revenue from licences issued by public sector licensors would preferably be clarified prior to 1 January 2019, which is the mandatory application date of AASB 15 and AASB 1058 for NFP entities. The Board considered whether the issue of this Standard would be too close to its effective date, and not provide preparers enough time to consider its requirements. However, the Board discussed this with various preparers during its outreach on ED 283, who confirmed that it would be more useful to apply AASB 15 and AASB 1058 for the first time with the guidance, rather than applying the Standard by analogy. Accordingly, the Board decided that the effective date of this Standard should be 1 January 2019 (consistent with AASB 15). The Board also decided that additional transitional relief was not required beyond that already provided in AASB 15.

GAAP/GFS convergence

BC102 The Board discussed implications of its decisions on generally accepted accounting principles (GAAP) and GFS harmonisation. As noted in paragraphs BC24 and BC25, the key difference between GAAP and GFS that may arise is where the cost of administrative activities related to the issue of a licence is clearly out of proportion to the revenue, the revenue would be classified as a tax (under GFS) instead of a licence (under GAAP). Therefore, where the cost to issue the licence is proportionate to the expenditure of the licensor, the licence would be classified as a licence, which is ultimately described as sales of goods and services under GFS. The Board noted (based on advice in the ABS’s comments on ED 283) licences that might be subject to different classification would include casino and taxi licences, for which the timing of income recognition under GFS and GAAP would likely be aligned.

BC103 The Board considered its policy on GAAP/GFS harmonisation. Consistent with the rationale provided in paragraph BC25, and consistent with AASB 1058, the Board considered that it was not appropriate to amend its decisions reflected in this Standard in order to achieve full GAAP/GFS harmonisation. The Board also noted that the key difference is caused by a difference in the Board’s view of a tax (and the definition of a tax in AASB 1058), and the underlying principles to distinguish licences from taxes in the GFS Manual. Further, some differences could only be addressed by making changes to the underlying principles in AASB 1058 and AASB 15. The Board noted that AASB 1049 Whole of Government and General Government Sector Financial Reporting requires entities to identify and explain any differences arising from different requirements in GAAP as compared to GFS.

[1] AASB 1058 defines taxes as “Economic benefits compulsorily paid or payable to public sector entities in accordance with laws and/or regulations established to provide income to the government. Taxes exclude fines.”

[2] As a further practical expedient, rather than requiring the licensor to apply paragraphs 39–45 of AASB 15 to select an appropriate method to measure its progress towards complete satisfaction of its performance obligation under the licence, revenue could be recognised using a systematic basis over the licencing period (eg on a straight-line basis).