Chapter 1—Preliminary

1 Name

This instrument is the Export Control (Tariff Rate Quotas) Order 2019.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | 18 December 2019 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under section 23A of the Export Control Act 1982.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

5 Purpose of this instrument

This instrument provides for, and in relation to, the establishment and administration of a system of tariff rate quotas for the export of goods.

6 Definitions

In this instrument:

additional U.S. note means an additional U.S. note to chapter 4 of the US Harmonized Tariff Schedule.

adjusted individual entitlement: see subsection 32(3).

allocation method means the method set out in Part 3 of Chapter 2.

allocation penalty: see section 33.

allocation trigger: see section 15.

annual access amount, for a quota type and a quota year, means the weight specified under Chapter 3 to be the annual access amount for that quota type in relation to that quota year.

annual application day: see section 27.

Australia‑US Free Trade Agreement means the Australia‑US Free Trade Agreement done at Washington on 18 May 2004, as in force from time to time.

Note: The Agreement is in Australian Treaty Series 2005 No. 1 ([2005] ATS 1) and could in 2019 be viewed in the Australian Treaties Library on the AustLII website (http://www.austlii.edu.au).

certification method means the method set out in Part 4 of Chapter 2.

consignment means a single shipment (by sea or air) of a kind of goods that is exported to a single consignee.

eligible past export, for a quota type and a quota year, means an export of a consignment that is specified under Chapter 3 to be an eligible past export for the quota type in relation to the quota year.

eligible person, for a quota type, means a person that is specified under Chapter 3 to be an eligible person for that quota type.

EU Beef and Buffalo Regulation means Commission Implementing Regulation (EU) No 593/2013, as in force from time to time.

Note: The Regulation could in 2019 be viewed on the EUR‑Lex website (https://eur‑lex.europa.eu).

EU buffalo meat: see section 53.

EU Dairy Regulation means Commission Regulation (EC) No 2535/2001, as in force from time to time.

Note: The Regulation could in 2019 be viewed on the EUR‑Lex website (https://eur‑lex.europa.eu).

EU grain fed beef: see section 57.

EU Grain Fed Beef Regulation means Commission Implementing Regulation (EU) No 481/2012, as in force from time to time.

Note: The Regulation could in 2019 be viewed on the EUR‑Lex website (https://eur‑lex.europa.eu).

EU high quality beef: see section 60.

EU WTO dairy goods: see section 71.

first come, first served method means the method set out in Part 1 of Chapter 2.

first year new entrant: see subsection 28(2).

high‑fill trigger method means the method set out in Part 2 of Chapter 2.

Indonesia‑Australia Comprehensive Economic Partnership Agreement means the Indonesia‑Australia Comprehensive Economic Partnership Agreement done at Jakarta on 4 March 2019, as amended from time to time.

Note: The Agreement could in 2019 be viewed in the Australian Treaties Library on the AustLII website (http://www.austlii.edu.au).

Indonesia quota goods: see subsection 75(1).

initial decision: see section 120.

initial individual entitlement: see subsection 32(1).

Japan‑Australia Economic Partnership Agreement means the Agreement between Australia and Japan for an Economic Partnership, done at Canberra on 8 July 2014, as amended from time to time.

Note: The Agreement is in Australian Treaty Series 2015 No. 2 ([2015] ATS 2) and could in 2019 be viewed in the Australian Treaties Library on the AustLII website (http://www.austlii.edu.au).

Japan quota goods: see subsection 86(1).

maximum transfer percentage: see section 27.

minimum quota allocation, for a quota type and a quota year, means the amount specified under Chapter 3 to be the minimum quota allocation for that quota type in relation to that quota year.

new entrant: see subsection 28(1).

new entrant access amount: see section 27.

new entrant access cap: see section 27.

new entrant available amount: see section 27.

penalty individual threshold: see section 27.

penalty pool threshold: see section 27.

post‑trigger access amount: see section 14.

provisional tariff rate quota entitlement: see subsection 20(1).

quarterly access amount: see subsection 7(1).

quarter of a quota year, for a quota type, means the period specified under Chapter 3 to be a quarter of a quota year for that quota type.

quota type means a kind of goods for export to a particular destination.

quota year, for a quota type, means the period that is specified under Chapter 3 to be a quota year for that quota type.

reclamation day: see section 27.

redistributed individual entitlement: see subsection 32(7).

relevant destination authority, for a kind of goods for export to a particular destination, means the authority or body that is responsible for regulating the importation of that kind of goods into that destination.

relevant liability means:

(a) a fee imposed under the Export Control (Fees) Order 2015 that is due and payable; or

(b) a charge prescribed by the Export Charges (Imposition—Customs) Regulation 2015 that is due and payable; or

(c) a charge prescribed by the Export Charges (Imposition—General) Regulation 2015 that is due and payable.

relevant person, for an initial decision referred to in column 1 of an item in the table in section 120, means the person referred to in column 3 of that item.

required usage percentage: see section 27.

second year new entrant: see subsection 28(3).

standard access amount: see section 27.

tariff rate quota certificate means a tariff rate quota certificate issued under this instrument.

tariff rate quota entitlement: a person’s tariff rate quota entitlement for a quota type and a quota year at a particular time is the weight reserved at that time for the person’s use for the purposes of applications for tariff rate quota certificates in relation to consignments of that quota type for export in that quota year.

third year new entrant: see subsection 28(4).

trigger amount: see section 14.

trigger deadline: see section 14.

uncommitted annual access amount: the uncommitted annual access amount for a quota type and a quota year at a particular time is the annual access amount for that quota type and quota year reduced by the sum of:

(a) the total weight for which tariff rate quota certificates have been issued in relation to consignments of that quota type for export in that quota year; and

(b) if tariff rate quota entitlements have been allocated for that quota type and quota year—the total tariff rate quota entitlements of all persons.

Note: If a tariff rate quota certificate in relation to a consignment is cancelled, the certificate is taken never to have been issued (see subsection 119(5)).

uncommitted new entrant access amount: see section 27.

uncommitted quarterly access amount: see subsection 7(2).

uncommitted standard access amount: see section 27.

uncommitted trigger amount: see section 14.

US beef: see subsection 90(1).

US FTA dairy goods: see subsection 98(1).

US Harmonized Tariff Code means the code used in the US Harmonized Tariff Schedule.

US Harmonized Tariff Schedule means the Harmonized Tariff Schedule of the United States published by the United States International Trade Commission, as in force from time to time.

Note: The Schedule could in 2019 be viewed on the United States International Trade Commission’s website (http://www.usitc.gov).

using new entrant access quota, in relation to issuing a tariff rate quota certificate, has the meaning given by subsection 36(6).

using standard access quota, in relation to issuing a tariff rate quota certificate, has the meaning given by subsection 36(7).

US WTO dairy goods: see section 110.

7 Quarterly access amounts

(1) If a provision of Chapter 3 provides that there is a quarterly access amount for a quota type, then, subject to subsection (4), the quarterly access amount for that quota type and a quarter of a quota year is the annual access amount for that quota type and quota year divided by 4.

(2) The uncommitted quarterly access amount for a quota type and a quarter of a quota year at a particular time is the difference between:

(a) the quarterly access amount for that quota type and quarter; and

(b) the total weight for which tariff rate quota certificates have been issued during that quarter in relation to consignments of that quota type for export in that quota year.

Note: If a tariff rate quota certificate in relation to a consignment is cancelled, the certificate is taken never to have been issued (see subsection 119(5)).

(3) For the purposes of subsection (2), if a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year is issued before the start of the quota year, the certificate is taken to have been issued during the first quarter of the quota year.

(4) If, at the end of the first, second or third quarter of a quota year, the uncommitted quarterly access amount for that quarter is greater than zero, the quarterly access amount for the next quarter of the quota year is increased by that uncommitted quarterly access amount.

Chapter 2—Methods for determining entitlements and issuing certificates

Part 1—First come, first served method

8 Application of this Part

If a provision of Chapter 3 provides that the first come, first served method applies for the purposes of issuing a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year, then this Part applies for the purposes of issuing a tariff rate quota certificate in relation to such a consignment.

9 Applications for tariff rate quota certificates

A person who intends to export a consignment of a quota type in a quota year may apply to the Secretary under this section for a tariff rate quota certificate in relation to the consignment.

Note: See section 114 for requirements and other matters relating to applications.

10 Applications to be dealt with in order of receipt

The Secretary must deal with applications under section 9 in the order in which the applications are received by the Secretary.

Note: Subsection 114(8) deals with when an application is taken to be received by the Secretary.

11 Issuing tariff rate quota certificates—annual access amounts

Application of this section

(1) This section applies in relation to an application under section 9 for a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year (other than an application relating to a quota type for which there is a quarterly access amount).

Note: Section 12 deals with applications relating to a quota type for which there is a quarterly access amount.

When Secretary must issue certificate

(2) Subject to section 115, the Secretary must issue a tariff rate quota certificate to the applicant in relation to the consignment if, at the time the Secretary deals with the application, the uncommitted annual access amount for the quota type and quota year is greater than zero.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

(3) The certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the uncommitted annual access amount at the time the Secretary deals with the application.

12 Issuing tariff rate quota certificates—quarterly access amounts

Application of this section

(1) This section applies in relation to an application under section 9 for a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year if there is a quarterly access amount for that quota type.

Note: There is a quarterly access amount only if a provision of Chapter 3 provides for it (see section 7).

When Secretary must issue certificate

(2) Subject to section 115, the Secretary must issue a tariff rate quota certificate to the applicant in relation to the consignment if, at the time the Secretary issues the certificate, the uncommitted quarterly access amount for the quota type and the current quarter of the quota year is greater than zero.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

(3) For the purposes of subsection (2), if the quota year has not started at the time the Secretary deals with the application, the first quarter of the quota year is taken to be the current quarter.

(4) The certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the uncommitted quarterly access amount at the time the Secretary deals with the application.

Part 2—High‑fill trigger method

Division 1—Preliminary

13 Application of this Part

If a provision of Chapter 3 provides that the high‑fill trigger method applies for the purposes of issuing a tariff rate quota certificate in relation to consignments of a quota type for export in a quota year, then this Part applies for the purposes of:

(a) issuing a tariff rate quota certificate in relation to such a consignment; and

(b) determining tariff rate quota entitlements for that quota type and quota year.

14 Definitions

In this instrument:

post‑trigger access amount, for a quota type and a quota year, means the weight that is the difference between the annual access amount for that quota type and quota year and the trigger amount for that quota type and quota year.

trigger amount, for a quota type and a quota year, means the weight specified under Chapter 3 to be the trigger amount for that quota type in relation to that quota year.

trigger deadline, for a quota type and a quota year, means the day specified under Chapter 3 to be the trigger deadline for that quota type in that quota year.

Note: The trigger deadline is the last day when the allocation trigger for that quota type and quota year can occur (see section 15).

uncommitted trigger amount: the uncommitted trigger amount for a quota type and a quota year at a particular time is the difference between:

(a) the trigger amount for that quota type and quota year; and

(b) the total weight for which tariff rate quota certificates have been issued in relation to consignments of that quota type for export in that quota year.

Note: If a tariff rate quota certificate in relation to a consignment is cancelled, the certificate is taken never to have been issued (see subsection 119(5)).

15 Allocation trigger

(1) The allocation trigger for a quota type and a quota year occurs at the first time that the total weight for which tariff rate quota certificates have been issued in relation to consignments of that quota type in relation to that quota year is equal to the trigger amount for the quota type and quota year.

(2) However, the allocation trigger does not occur if the time mentioned in subsection (1) is after the trigger deadline for the quota type and quota year.

Note: For the allocation of quota after the allocation trigger has occurred, see Division 4.

Division 2—Tariff rate quota certificates if allocation trigger has not occurred

16 Applications for tariff rate quota certificates before allocation trigger

A person who intends to export a consignment of a quota type in a quota year may apply to the Secretary under this section for a tariff rate quota certificate in relation to the consignment if, at the time the application is made, the allocation trigger for the quota type and quota year has not occurred.

Note: See section 114 for requirements and other matters relating to applications.

17 Applications to be dealt with in order of receipt

(1) The Secretary must deal with applications under section 16 in the order in which the applications are received by the Secretary.

Note: Subsection 114(8) deals with when an application is taken to be received by the Secretary.

(2) If the Secretary has not dealt with an application under section 16 and the allocation trigger for the quota type and quota year occurs, the Secretary must treat the application as being made under section 23. The application is taken to be validly made under that section despite being made before the allocation trigger occurred.

18 Issuing tariff rate quota certificates

Application of this section

(1) This section applies in relation to an application under section 16 for a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year.

When Secretary must issue certificate

(2) Subject to section 115, the Secretary must issue a tariff rate quota certificate to the applicant in relation to the consignment if, at the time the Secretary deals with the application:

(a) for the issue of a certificate on or before the trigger deadline for the quota type and quota year—the uncommitted trigger amount for the quota type and quota year is greater than zero; or

(b) for the issue of a certificate after the trigger deadline—the uncommitted annual access amount for the quota type and quota year is greater than zero.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

(3) If the certificate is issued on or before the trigger deadline, the certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the uncommitted trigger amount at the time the Secretary deals with the application.

(4) If the certificate is issued after the trigger deadline, the certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the uncommitted annual access amount at the time the Secretary deals with the application.

Division 3—Provisional tariff rate quota entitlements

19 Notice of provisional tariff rate quota entitlement

(1) If the Secretary believes that the allocation trigger for a quota type and a quota year is likely to occur, the Secretary must give a written notice to each person to whom tariff rate quota certificates have been issued in relation to consignments of that quota type for export in that quota year.

(2) The notice must:

(a) state the amount (if any) of the person’s provisional tariff rate quota entitlement for the quota type and quota year; and

(b) unless the person’s provisional tariff rate quota entitlement is nil—state that the person may request, no later than the day specified in the notice, the amount of that provisional tariff rate quota entitlement that the person wants to have allocated under section 21 as the person’s tariff rate quota entitlement if the allocation trigger occurs;

(c) specify the way in which the person is to make the request.

(3) The day specified for the purposes of paragraph (2)(b) must be at least 10 business days after the date of the notice.

20 Calculation of provisional tariff rate quota entitlement

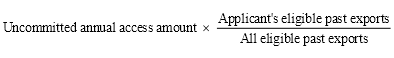

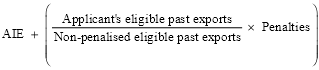

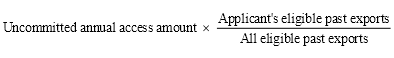

(1) Subject to this section, a person’s provisional tariff rate quota entitlement for a quota type and a quota year is the amount worked out using the following formula:

where:

all eligible past exports is the total weight of all eligible past exports, for the quota type and quota year, by persons to whom tariff rate quota certificates have been issued in relation to consignments of that quota type for export in that quota year.

person’s eligible past exports is the total weight of the person’s eligible past exports for the quota type and quota year.

post‑trigger access amount is the post‑trigger access amount for the quota type and quota year.

(2) If the amount worked out under subsection (1) for a person is less than the minimum quota allocation for the quota type and quota year, the person’s provisional tariff rate quota entitlement for the quota type and quota year is nil.

(3) If subsection (2) applies to the provisional tariff rate quota entitlement of a person (an excluded person), then:

(a) the provisional tariff rate quota entitlement of each person to whom a notice must be issued under subsection 19(1) who is not an excluded person must be recalculated under subsection (1) of this section; and

(b) for the purposes of the recalculation, each excluded person is taken not to be a person to whom tariff rate quota certificates have been issued in relation to consignments of the quota type for export in the quota year.

(4) The amount of each person’s provisional tariff rate quota entitlement, as calculated under subsections (1) to (3), must be rounded to the nearest kilogram, with 0.5 of a kilogram to be rounded up.

(5) However, if the sum of the provisional tariff rate quota entitlements of all persons exceeds the post‑trigger access amount for the quota type and quota year, the amount of each person’s provisional tariff rate quota entitlement must be rounded down to the nearest kilogram instead.

Division 4—Allocation of quota after allocation trigger occurs

21 Allocation of tariff rate quota entitlement

(1) This section applies if the allocation trigger for a quota type and a quota year occurs.

(2) The Secretary must, as soon as practicable after the allocation trigger occurs, allocate the requested amount of tariff rate quota entitlement for the quota type and quota year to each person who has made a request in accordance with paragraph 19(2)(b).

(3) However, the Secretary must not allocate the requested amount to a person if the person is not an eligible person for the quota type.

(4) The Secretary must give each person to whom tariff rate quota certificates have been issued in relation to consignments of the quota type for export in the quota year a written notice stating:

(a) when the allocation trigger occurred; and

(b) if the person has been allocated an amount of tariff rate quota entitlement—the amount of the entitlement.

22 Transfer of tariff rate quota entitlement

(1) A person (the transferor) who has an amount of tariff rate quota entitlement for a quota type and a quota year may, at any time before the end of the quota year, make a written request to the Secretary to transfer all or part of that amount to an eligible person for the quota type (the transferee). The request must include the following:

(a) the name of the transferor;

(b) the name of the transferee;

(c) the amount of the entitlement to be transferred.

(2) If the Secretary receives a request under subsection (1), the amount is transferred in accordance with the request.

Division 5—Tariff rate quota certificates if allocation trigger has occurred

23 Applications for tariff rate quota certificates after allocation trigger occurs

A person who intends to export a consignment of a quota type in a quota year may apply to the Secretary under this section for a tariff rate quota certificate in relation to the consignment if, at the time the application is made, the allocation trigger for that quota type and quota year has occurred.

Note: See section 114 for requirements and other matters relating to applications.

24 Applications to be dealt with in order of receipt

(1) The Secretary must deal with applications under section 23 in the order in which the applications are received by the Secretary.

Note: Subsection 114(8) deals with when an application is taken to be received by the Secretary.

(2) The Secretary must not deal with any applications under section 23 until after the Secretary has allocated amounts of tariff rate quota entitlements for the quota type and quota year in accordance with section 21.

25 Issuing tariff rate quota certificates

Application of this section

(1) This section applies in relation to an application under section 23 for a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year.

When Secretary must issue certificate

(2) Subject to section 115, the Secretary must issue a tariff rate quota certificate to the applicant in relation to the consignment if, at the time the Secretary deals with the application:

(a) the applicant’s tariff rate quota entitlement for the quota type and quota year is greater than zero; or

(b) the uncommitted annual access amount for the quota type and quota year is greater than zero.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

(3) The certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the sum of the applicant’s tariff rate quota entitlement and the uncommitted annual access amount at the time the Secretary deals with the application.

(4) If the applicant’s tariff rate quota entitlement for the quota type and quota year is greater than zero at the time the Secretary deals with the application, the applicant’s tariff rate quota entitlement is reduced (but not below zero) by the weight for which the tariff rate quota certificate is issued.

Part 3—Allocation method

Division 1—Preliminary

26 Application of this Part

If a provision of Chapter 3 provides that the allocation method applies for the purposes of issuing a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year, then this Part applies for the purposes of:

(a) issuing a tariff rate quota certificate in relation to such a consignment; and

(b) determining tariff rate quota entitlements for that quota type and quota year.

27 Definitions

In this instrument:

annual application day, for a quota type and a quota year, means the day specified under Chapter 3 to be the annual application day for that quota type and quota year.

maximum transfer percentage, for a quota type, means the percentage specified under Chapter 3 to be the maximum transfer percentage for that quota type.

new entrant access amount, for a quota type and a quota year, means the weight specified under Chapter 3 to be the new entrant access amount for that quota type in relation to that quota year.

new entrant access cap, for a quota type and a quota year, means the weight specified under Chapter 3 to be the new entrant access cap for that quota type in relation to that quota year.

new entrant available amount: the new entrant available amount, of a person who is a new entrant for a quota type and a quota year, at a particular time is the lesser of:

(a) the uncommitted new entrant access amount at that time for that quota type and quota year; and

(b) the difference between:

(i) the new entrant access cap for that quota type and quota year; and

(ii) the total weight for which tariff rate quota certificates have been issued to the person in relation to consignments of that quota type in relation to that quota year using new entrant access quota.

penalty individual threshold, for a quota type and a quota year, means the amount specified under Chapter 3 to be the penalty individual threshold for that quota type in relation to that quota year.

penalty pool threshold, for a quota type and a quota year, means the amount specified under Chapter 3 to be the penalty pool threshold for that quota type in relation to that quota year.

reclamation day, for a quota type and a quota year, means the day specified under Chapter 3 to be the reclamation day for that quota type and quota year.

required usage percentage, for a quota type, means the percentage specified under Chapter 3 to be the required usage percentage for that quota type.

standard access amount, for a quota type and a quota year, means the weight that is the difference between the annual access amount for that quota type and quota year and the new entrant access amount for that quota type and quota year.

uncommitted new entrant access amount: the uncommitted new entrant access amount for a quota type and a quota year at a particular time is the difference between:

(a) the new entrant access amount for that quota type and quota year; and

(b) the total weight for which tariff rate quota certificates have been issued in relation to consignments of that quota type for export in that quota year using new entrant access quota.

Note: If a tariff rate quota certificate in relation to a consignment is cancelled, the certificate is taken never to have been issued (see subsection 119(5)).

uncommitted standard access amount: the uncommitted standard access amount for a quota type and a quota year at a particular time is the standard access amount for that quota type and quota year reduced by the sum of:

(a) the total weight for which tariff rate quota certificates have been issued in relation to consignments of that quota type for export in that quota year using standard access quota; and

(b) the total tariff rate quota entitlements of all persons for that quota type and quota year.

Note: If a tariff rate quota certificate in relation to a consignment is cancelled, the certificate is taken never to have been issued (see subsection 119(5)).

28 New entrants

(1) A person is a new entrant for a quota type and quota year if the person is:

(a) a first year new entrant for the quota type and quota year; or

(b) a second year new entrant for the quota type and quota year; or

(c) a third year new entrant for the quota type and quota year.

(2) A person is a first year new entrant for a quota type and quota year (the current quota year) if the person:

(a) applied for a tariff rate quota certificate in relation to a consignment of the quota type for export in the current quota year; and

(b) has not been allocated a tariff rate quota entitlement under section 30 or 45 for the quota type and the current quota year or any of the 3 quota years preceding the current quota year; and

(c) has not been issued a tariff rate quota certificate in relation to a consignment of the quota type for export in either of the 2 quota years preceding the current quota year using new entrant access quota; and

(d) is not an associated entity, within the meaning of the Corporations Act 2001, of any person who:

(i) has been allocated a tariff rate quota entitlement under section 30 or 45 for the quota type and the current quota year or any of the 3 quota years preceding the current quota year; or

(ii) has been issued a tariff rate quota certificate in relation to a consignment of the quota type for export in the current quota year, or either of the 2 quota years preceding the current quota year, using new entrant access quota.

(3) A person is a second year new entrant for a quota type and quota year if:

(a) the person was a first year new entrant for the quota type and the previous quota year; and

(b) the person has not been allocated a tariff rate quota entitlement under section 30 for the quota type and quota year.

(4) A person is a third year new entrant for a quota type and quota year if:

(a) the person was a second year new entrant for the quota type and the previous quota year; and

(b) the person has not been allocated a tariff rate quota entitlement under section 30 for the quota type and quota year.

Division 2—Allocation of quota at beginning of quota year

29 Applications for quota

Who may apply

(1) Subject to this section, an eligible person for a quota type may apply to the Secretary for an allocation of an amount of tariff rate quota entitlement for that quota type and a quota year.

Note: A person who is allocated an amount of tariff rate quota entitlement for a quota type and a quota year under section 30 cannot qualify as a new entrant for the quota type for the next 3 quota years—see section 28.

(2) A person is not eligible to apply for an allocation for a quota type and a quota year if, in relation to any of the 3 previous quota years:

(a) the person transferred one or more amounts of tariff rate quota entitlement for the quota type and quota year; and

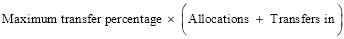

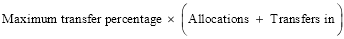

(b) the total of the amounts that the person transferred was more than the amount worked out using the following formula:

where:

allocations is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that the person has been allocated.

maximum transfer percentage is the maximum transfer percentage for the quota type.

transfers in is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that have been transferred to the person.

When to make application

(3) The application must be made on or before the annual application day for the quota type and quota year.

Requirements for applications

(4) The application must:

(a) state the amount of tariff rate quota entitlement being applied for; and

(b) be made in a manner approved, in writing, by the Secretary; and

(c) if the Secretary has approved a form for making the application:

(i) include the information required by the form; and

(ii) be accompanied by any documents required by the form.

Note: A person may commit an offence if the person makes a false or misleading statement in an application or provides false or misleading information or documents (see sections 136.1, 137.1 and 137.2 of the Criminal Code).

(5) The Secretary may accept any information or document previously given to the Secretary in connection with an application made under this instrument as satisfying any requirement to give that information or document under subsection (4).

(6) An application is taken not to have been made if the application does not comply with the requirements referred to in subsection (4) for the application.

30 Allocation of quota

(1) The Secretary must, as soon as practicable after the annual application day for a quota type and a quota year, allocate to applicants under section 29 amounts of tariff rate quota entitlement for that quota type and quota year in accordance with this section.

(2) The amount of tariff rate quota entitlement to be allocated to an applicant is:

(a) if the total amount applied for in all applications is less than or equal to the standard access amount for the quota type and quota year—the amount the person applied for; or

(b) if the total amount applied for in all applications is more than the standard access amount for the quota type and quota year—the amount worked out under section 31.

Note: See also section 32 for calculations required for the purposes of section 31.

31 Calculation of tariff rate quota entitlement allocated from standard access amount

(1) For the purposes of paragraph 30(2)(b), the amount of tariff rate quota entitlement to be allocated to an applicant for a quota type and a quota year is:

(a) if the amount of the applicant’s redistributed individual entitlement for the quota type and quota year is equal to the amount of tariff rate quota entitlement the applicant applied for—that amount;

(b) if the amount of the applicant’s redistributed individual entitlement is less than the minimum quota allocation for the quota type and quota year and paragraph (a) does not apply—nil; and

(c) if neither paragraph (a) nor (b) applies—the amount worked out using the formula in subsection (2), subject to subsections (3) to (6).

Note: For an applicant’s redistributed individual entitlement, see subsections 32(7) to (14). This is worked out from an applicant’s initial individual entitlement (see subsections 32(1) and (2)) and adjusted individual entitlement (see subsections 32(3) to (6)).

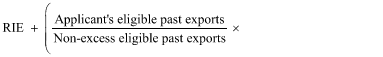

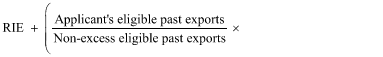

(2) For the purposes of paragraph (1)(c), the formula is:

where:

applicant’s eligible past exports is the total weight of the applicant’s eligible past exports for the quota type and quota year.

non‑excess eligible past exports is the total weight of all eligible past exports, for the quota type and quota year, by all applicants to whose entitlement paragraph (1)(c) applies.

quota for redistribution is the sum of the redistributed individual entitlements of all applicants to whose entitlement paragraph (1)(b) applies.

RIE is the applicant’s redistributed individual entitlement.

Note: For an applicant’s redistributed individual entitlement, see subsections 32(7) to (14). This is worked out from an applicant’s initial individual entitlement (see subsections 32(1) and (2)) and adjusted individual entitlement (see subsections 32(3) to (6)).

(3) If the amount worked out under subsection (2) for any applicant (a quota‑filled applicant) is more than the amount of tariff rate quota entitlement the applicant applied for, then:

(a) the amount of tariff rate quota entitlement to be allocated to each quota‑filled applicant is equal to the amount of tariff rate quota entitlement that applicant applied for; and

(b) the amount of tariff rate quota entitlement to be allocated to each applicant to whom paragraph (1)(c) applies who is not a quota‑filled applicant must be recalculated under subsection (2); and

(c) for the purposes of the recalculation:

(i) each quota‑filled applicant is taken to be an applicant to whose entitlement paragraph (1)(a) applies; and

(ii) the quota available for redistribution is taken to be reduced by the difference, for each quota‑filled applicant, between the amount of tariff rate quota entitlement that applicant applied for and the amount of that applicant’s redistributed individual entitlement.

(4) The recalculation mentioned in subsection (3) must be repeated until subsection (3) no longer applies in relation to any applicant.

(5) The amount of tariff rate quota entitlement to be allocated to each applicant, as calculated under subsections (1) to (4), must be rounded to the nearest kilogram, with 0.5 of a kilogram to be rounded up.

(6) However, if the sum of the tariff rate quota entitlements to be allocated exceeds the standard access amount for the quota type and quota year, the amount of tariff rate quota entitlement to be allocated to each applicant must be rounded down to the nearest kilogram instead.

32 Initial calculations of tariff rate quota entitlement

Initial entitlement calculation using eligible past exports

(1) Subject to subsection (2), an applicant’s initial individual entitlement for a quota type and a quota year is the amount worked out using the following formula:

where:

all eligible past exports is the total weight of all eligible past exports by all applicants for the quota type and quota year.

applicant’s eligible past exports is the total weight of the applicant’s eligible past exports for the quota type and quota year.

standard access amount is the standard access amount for the quota type and quota year.

(2) If the amount worked out under subsection (1) for an applicant is more than the amount of tariff rate quota entitlement the applicant applied for, the amount of the applicant’s initial individual entitlement is the amount of tariff rate quota entitlement the applicant applied for.

Redistribution of excess allocations

(3) The amount of an applicant’s adjusted individual entitlement for a quota type and a quota year is:

(a) if the amount of the applicant’s initial individual entitlement for the quota type and quota year is equal to the amount of tariff rate quota entitlement the applicant applied for—that amount; and

(b) if the amount of the applicant’s initial individual entitlement for the quota type and quota year is less than the amount of tariff rate quota entitlement the applicant applied for—the amount worked out using the formula in subsection (4), subject to subsections (5) and (6).

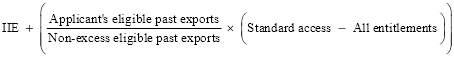

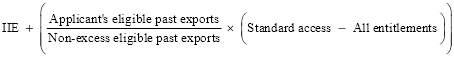

(4) For the purposes of paragraph (3)(b), the formula is:

where:

all entitlements is the total of the initial individual entitlements of all applicants for the quota type and quota year.

applicant’s eligible past exports is the total weight of the applicant’s eligible past exports for the quota type and quota year.

IIE is the applicant’s initial individual entitlement.

non‑excess eligible past exports is the total weight of all eligible past exports, for the quota type and quota year, by all applicants to whose entitlement paragraph (3)(b) applies.

standard access is the standard access amount for the quota type and quota year.

(5) If the amount worked out under subsection (4) for any applicant (a quota‑filled applicant) is more than the amount of tariff rate quota entitlement the applicant applied for, then:

(a) the adjusted individual entitlement of each quota‑filled applicant is equal to the amount of tariff rate quota entitlement that applicant applied for; and

(b) the adjusted individual entitlement of each applicant to whose entitlement paragraph (3)(b) applies who is not a quota‑filled applicant must be recalculated under subsection (4); and

(c) for the purposes of the recalculation, each quota‑filled applicant’s initial individual entitlement is taken to have been equal to the amount of tariff rate quota entitlement that applicant applied for.

(6) The recalculation mentioned in subsection (5) must be repeated until subsection (5) no longer applies in relation to any applicant.

Application and redistribution of penalties

(7) The amount of an applicant’s redistributed individual entitlement for a quota type and a quota year is:

(a) if the applicant has an allocation penalty for the quota type and quota year—the amount of the applicant’s adjusted individual entitlement for the quota type and quota year, less the amount of the allocation penalty, subject to subsections (11) to (14); and

(b) if paragraph (a) does not apply and the applicant’s adjusted individual entitlement for the quota type and quota year is equal to the amount of tariff rate quota entitlement the applicant applied for—that amount; and

(c) if neither paragraph (a) nor (b) applies—the amount worked out using the formula in subsection (8), subject to subsections (9) and (10).

Note: See section 33 for determination of whether a person has an allocation penalty and the amount of the penalty.

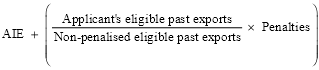

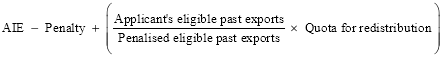

(8) For the purposes of paragraph (7)(c), the formula is:

where:

AIE is the applicant’s adjusted individual entitlement.

applicant’s eligible past exports is the total weight of the applicant’s eligible past exports for the quota type and quota year.

non‑penalised eligible past exports is the total weight of all eligible past exports, for the quota type and quota year, by all applicants to whose entitlement paragraph (7)(c) applies.

penalties is the total of the amount of the allocation penalties of applicants for the quota type and quota year.

(9) If the amount worked out under subsection (8) for any applicant (a quota‑filled applicant) is more than the amount of tariff rate quota entitlement the applicant applied for, then:

(a) the redistributed individual entitlement of each quota‑filled applicant is equal to the amount of tariff rate quota entitlement that applicant applied for; and

(b) the redistributed individual entitlement of each applicant to whose entitlement paragraph (7)(c) applies who is not a quota‑filled applicant must be recalculated under subsection (8); and

(c) for the purposes of the recalculation, each quota‑filled applicant’s adjusted individual entitlement is taken to have been equal to the amount of tariff rate quota entitlement that applicant applied for.

(10) The recalculation mentioned in subsection (9) must be repeated until subsection (9) no longer applies in relation to any applicant.

Partial return of penalties

(11) Subsection (12) applies if, after the recalculation mentioned in subsection (9) has been repeated as many times as required for applicants to whose entitlement paragraph (7)(c) applies, the total of the redistributed individual entitlements of all applicants is less than the standard access amount for the quota type and quota year.

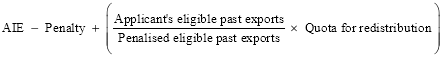

(12) If this subsection applies, the redistributed individual entitlement of an applicant who has an allocation penalty for the quota type and quota year is the amount worked out using the following formula, subject to subsections (13) and (14):

where:

AIE is the applicant’s adjusted individual entitlement.

applicant’s eligible past exports is the total weight of the applicant’s eligible past exports for the quota type and quota year.

penalised eligible past exports is the total weight of all eligible past exports, for the quota type and quota year, by all applicants who have an allocation penalty for the quota type and quota year.

penalty is the amount of the applicant’s allocation penalty for the quota type and quota year.

quota for redistribution is the difference between:

(a) the standard access amount for the quota type and quota year; and

(b) the total of the redistributed individual entitlements of all applicants after the recalculation mentioned in subsection (6) has been repeated as many times as required.

(13) If the amount worked out under subsection (12) for any applicant (a quota‑filled applicant) is more than the amount of tariff rate quota entitlement the applicant applied for, then:

(a) the redistributed individual entitlement of each quota‑filled applicant is equal to the amount of tariff rate quota entitlement that applicant applied for; and

(b) the redistributed individual entitlement of each applicant with an allocation penalty for the quota type and quota year who is not a quota‑filled applicant must be recalculated under subsection (12); and

(c) for the purposes of the recalculation:

(i) each quota‑filled applicant is taken to not have an allocation penalty for the quota type and quota year; and

(ii) the quota available for redistribution is taken to be reduced by the difference, for each quota‑filled applicant, between the amount of tariff rate quota entitlement that applicant applied for and the amount of that applicant’s redistributed individual entitlement as it was worked out under paragraph (7)(a).

(14) The recalculation mentioned in subsection (13) must be repeated until subsection (13) no longer applies in relation to any applicant.

33 Penalty on allocation for unused entitlement in previous quota year

(1) A person has an allocation penalty for a quota type and a quota year if, as at the end of the annual application day for the quota type and quota year, the total weight for which tariff rate quota certificates have been issued to the person in relation to consignments of that quota type in relation to the previous quota year is less than the amount worked out using the following formula: where:

where:

allocations is the sum of all of the amounts of tariff rate quota entitlement for the quota type and the previous quota year that the person has been allocated.

required usage percentage is the required usage percentage for the quota type.

returns is the sum of all of the amounts of tariff rate quota entitlement for the quota type and the previous quota year that the person returned on or before the reclamation day for the previous quota year.

transfers in is the sum of all of the amounts of tariff rate quota entitlement for the quota type and the previous quota year that have been transferred to the person.

transfers out is the sum of all of the amounts of tariff rate quota entitlement for the quota type and the previous quota year that have been transferred from the person to another person.

(2) However, the person does not have an allocation penalty if, as at the end of the annual application day for the quota type and quota year:

(a) the person’s tariff rate quota entitlement for the quota type and the previous quota year is less than the penalty individual threshold for the quota type and the previous quota year; or

(b) the uncommitted annual access amount for the quota type and the previous quota year, less any amounts of tariff rate quota entitlement for the previous quota year that were returned to the Secretary after the reclamation day for the previous quota year, is greater than the penalty pool threshold for the quota type and the previous quota year.

(3) If a person has an allocation penalty for a quota type and a quota year, the amount of the allocation penalty is the amount, as at the end of the annual application day for the quota type and quota year, of the person’s tariff rate quota entitlement for the quota type and the previous quota year.

Division 3—Tariff rate quota certificates before reclamation day

34 Applications for tariff rate quota certificates before reclamation day

A person who intends to export a consignment of a quota type in a quota year may, on or before the reclamation day for the quota type and quota year, apply to the Secretary under this section for a tariff rate quota certificate for the consignment.

Note: See section 114 for requirements and other matters relating to applications.

35 Applications to be dealt with in order of receipt

(1) The Secretary must deal with applications under section 34 in the order in which the applications are received by the Secretary.

Note: Subsection 114(8) deals with when an application is taken to be received by the Secretary.

(2) If the Secretary has not dealt with an application under section 34 before the end of the reclamation day for the quota type and quota year, the Secretary must deal with the application before allocating amounts of tariff rate quota entitlement for the quota type and quota year in accordance with section 42.

36 Issuing tariff rate quota certificates

Application of this section

(1) This section applies in relation to an application under section 34 for a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year.

When Secretary must issue certificate

(2) Subject to section 115, the Secretary must issue a tariff rate quota certificate to the applicant in relation to the consignment if, at the time the Secretary deals with the application:

(a) the applicant’s tariff rate quota entitlement for the quota type and quota year is greater than zero; or

(b) if the applicant is a new entrant for the quota type and quota year—the applicant’s new entrant available amount for the quota type and quota year is greater than zero; or

(c) the uncommitted standard access amount for the quota type and quota year is greater than zero.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

(3) If the applicant is a new entrant, the certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the sum of the applicant’s tariff rate quota entitlement, the applicant’s new entrant available amount and the uncommitted standard access amount at the time the Secretary deals with the application.

Note: A new entrant might have obtained a tariff rate quota entitlement by a transfer of entitlement under section 37.

(4) If the applicant is not a new entrant, the certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the sum of the applicant’s tariff rate quota entitlement and the uncommitted standard access amount at the time the Secretary deals with the application.

(5) If the applicant’s tariff rate quota entitlement for the quota type and quota year is greater than zero at the time the Secretary deals with the application, the applicant’s tariff rate quota entitlement is reduced (but not below zero) by the weight for which the tariff rate quota certificate is issued.

(6) If the applicant is a new entrant for the quota type and quota year, the certificate is taken to be issued using new entrant access quota for the lesser of the following weights:

(a) if the applicant does not have a tariff rate quota entitlement for the quota type and quota year at the time the Secretary deals with the application—the weight for which the tariff rate quota certificate is issued;

(b) if the applicant does have such an entitlement—the difference between the weight for which the tariff rate quota certificate is issued and that entitlement;

(c) the applicant’s new entrant available amount for the quota type and quota year at the time the Secretary deals with the application.

(7) The certificate is taken to be issued using standard access quota for the following weight:

(a) if the applicant is not a new entrant for the quota type and quota year—the weight for which the tariff rate quota certificate is issued;

(b) if the applicant is a new entrant—the difference between the weight for which the tariff rate quota certificate is issued and the weight for which the certificate is taken to be issued using new entrant access quota.

Division 4—Transfer or return of quota

37 Transfer of tariff rate quota entitlement

(1) A person (the transferor) who has an amount of tariff rate quota entitlement for a quota type and a quota year may, at any time on or before the reclamation day for the quota type and quota year, make a written request to the Secretary to transfer all or part of that amount to an eligible person for the quota type (the transferee). The request must include the following:

(a) the name of the transferor;

(b) the name of the transferee;

(c) the amount of the entitlement to be transferred.

Note: Transferring more than a certain amount of entitlement for a quota year will make the person ineligible to apply for an allocation of entitlement for the following 3 quota years: see subsection 29(2).

(2) However, a new entrant for the quota type and quota year is not permitted to be a transferor.

(3) If the Secretary receives a request under subsection (1), the amount is transferred in accordance with the request.

38 Return of tariff rate quota entitlement

(1) A person who has an amount of tariff rate quota entitlement for a quota type and a quota year may, at any time before the end of the quota year, return all or part of that amount by notifying the Secretary in writing of the amount of the entitlement to be returned.

Note 1: If the notice is given after the reclamation day for the quota year, the cancelled quota will be counted in determining a penalty in relation to the following quota year under section 33.

Note 2: A person may also return an amount of tariff rate quota entitlement when giving a notice under section 39.

(2) If the Secretary receives a notice under subsection (1), the amount of the person’s tariff rate quota entitlement stated in the notice is cancelled.

Division 5—Reclamation and reallocation of quota

Subdivision A—Reclamation

39 Notice before reclamation day

(1) A person who has a tariff rate quota entitlement for a quota type and a quota year must give the Secretary a written notice under this section on or before the reclamation day for the quota type and quota year.

(2) The notice must state:

(a) the amount of tariff rate quota entitlement that the person is returning; or

(b) the amount of additional tariff rate quota entitlement that the person is applying for; or

(c) that the person does not intend to either return tariff rate quota entitlement or apply for additional tariff rate quota entitlement.

Note: For applications for tariff rate quota entitlement by persons who do not have an entitlement, see section 44.

(3) The notice must:

(a) be made in a manner approved, in writing, by the Secretary; and

(b) if the Secretary has approved a form for making the notice:

(i) include the information required by the form; and

(ii) be accompanied by any documents required by the form.

Note: A person may commit an offence if the person provides false or misleading information or documents (see sections 137.1 and 137.2 of the Criminal Code).

(4) The Secretary may accept any information or document previously given to the Secretary under this instrument as satisfying any requirement to give that information or document under subsection (3).

(5) A notice is taken not to have been given if the notice does not comply with the requirements referred to in subsection (3) for the notice.

40 Cancellations of tariff rate quota entitlement following notice or reclamation day

Cancellation of notified amount

(1) If the Secretary receives a notice under section 39 from a person that states an amount of tariff rate quota entitlement for a quota type and a quota year that the person is returning, the amount of the person’s tariff rate quota entitlement stated in the notice is cancelled.

Cancellation if no notice given

(2) If a person who has a tariff rate quota entitlement for a quota type and a quota year does not give the Secretary a notice in accordance with section 39:

(a) the person’s tariff rate quota entitlement is forfeited at the start of the day after the reclamation day; and

(b) the whole of that entitlement is cancelled.

Cancellation if less than 25% of entitlement used

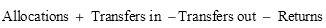

(3) Subsection (4) applies if, at the end of the reclamation day for a quota type and a quota year:

(a) a person has a tariff rate quota entitlement for the quota type and quota year; and

(b) the total weight for which tariff rate quota certificates have been issued to the person in relation to consignments of that quota type in relation to the quota year is less than 25% of:

where:

allocations is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that the person has been allocated.

returns is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that the person has returned.

transfers in is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that have been transferred to the person.

transfers out is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that have been transferred from the person to another person.

(4) If this subsection applies, then:

(a) the person’s tariff rate quota entitlement is forfeited at the start of the day after the reclamation day; and

(b) the whole of that entitlement is cancelled.

Subdivision B—Allocation process for new entrants

41 Application by new entrant for quota allocation after reclamation day

(1) A person may apply to the Secretary under this section for an allocation of an amount of tariff rate quota entitlement for a quota type and a quota year if:

(a) the person is an eligible person for the quota type; and

(b) the person is a new entrant for the quota type and quota year; and

(c) tariff rate quota certificates have been issued to the person in relation to consignments of that quota type in relation to the quota year.

When to make application

(2) The application must be made on or before the reclamation day for the quota type and quota year.

Limit on amount applied for

(3) The maximum amount of tariff rate quota entitlement that the person may apply for is the lesser of:

(a) the total weight of the tariff rate quota certificates that have been issued to the person in relation to consignments of the quota type for export in the quota year using new entrant access quota; and

(b) the difference between the new entrant access cap for the quota type and quota year and the weight mentioned in paragraph (a).

Requirements for applications

(4) The application must:

(a) state the amount of tariff rate quota entitlement being applied for; and

(b) be made in a manner approved, in writing, by the Secretary; and

(c) if the Secretary has approved a form for making the application:

(i) include the information required by the form; and

(ii) be accompanied by any documents required by the form.

Note: A person may commit an offence if the person makes a false or misleading statement in an application or provides false or misleading information or documents (see sections 136.1, 137.1 and 137.2 of the Criminal Code).

(5) The Secretary may accept any information or document previously given to the Secretary in connection with an application made under this instrument as satisfying any requirement to give that information or document under subsection (4).

(6) An application is taken not to have been made if the application does not comply with the requirements referred to in subsection (4) for the application.

42 Allocation of quota after reclamation day—new entrants

(1) The Secretary must, as soon as practicable after the reclamation day for a quota type and a quota year, allocate amounts of tariff rate quota entitlement for the quota type and quota year to applicants under section 41 in accordance with this section.

Note: The Secretary must deal with all applications for tariff rate quota certificates made under section 34 before allocating entitlements in accordance with this section (see subsection 35(2)).

(2) The amount of tariff rate quota entitlement to be allocated to an applicant is:

(a) if the total amount applied for in all applications is less than or equal to the uncommitted new entrant access amount for the quota type and quota year as at the time the Secretary makes the allocation—the amount the person applied for; or

(b) if the total amount applied for in all applications is more than the uncommitted new entrant access amount for the quota type and quota year as at the time the Secretary makes the allocation—the amount worked out under section 43.

43 Calculation of tariff rate quota entitlement for new entrants

(1) For the purposes of paragraph 42(2)(b) and subject to this section, the amount of tariff rate quota entitlement to be allocated to an applicant for a quota type and a quota year is the uncommitted new entrant access amount for the quota type and quota year at the time the Secretary makes the allocation, divided by the number of applicants.

(2) If the amount worked out under subsection (1) for any applicant (a quota‑filled applicant) is more than the amount of tariff rate quota entitlement the applicant applied for:

(a) the amount of tariff rate quota entitlement to be allocated to each quota‑filled applicant is equal to the amount of tariff rate quota entitlement that applicant applied for; and

(b) the amount of tariff rate quota entitlement to be allocated to each applicant who is not a quota‑filled applicant must be recalculated under subsection (1); and

(c) for the purposes of the recalculation:

(i) each quota‑filled applicant is taken not to be an applicant; and

(ii) the uncommitted new entrant access amount is taken to be reduced by the total amount of tariff rate quota entitlement to be allocated to quota‑filled applicants.

(3) The recalculation mentioned in subsection (2) must be repeated until subsection (2) no longer applies in relation to any applicant.

(4) The amount of tariff rate quota entitlement to be allocated to each applicant, as calculated under subsections (1) to (3), must be rounded to the nearest kilogram, with 0.5 of a kilogram to be rounded up.

(5) However, if the sum of the tariff rate quota entitlements to be allocated exceeds the uncommitted new entrant access amount for the quota type and quota year at the time the Secretary makes the allocation, the amount of tariff rate quota entitlement to be allocated to each applicant must be rounded down to the nearest kilogram instead.

Subdivision C—Allocation process for persons other than new entrants

44 Application by person who is not new entrant for quota allocation after reclamation day

(1) Subject to subsection (2), a person may apply to the Secretary under this section for an allocation of an amount of tariff rate quota entitlement for a quota type and a quota year if:

(a) the person is an eligible person for the quota type;

(b) the person is not a new entrant for the quota type and quota year; and

(c) the person does not, at the time of the application, have a tariff rate quota entitlement for the quota type and quota year.

Note 1: A person who has a tariff rate quota entitlement is required to give the Secretary a notice under section 39, and may, as part of that notice, apply for an amount of additional tariff rate quota entitlement.

Note 2: A person who is allocated an amount of tariff rate quota entitlement for a quota type and a quota year under section 45 cannot qualify as a new entrant for the quota type for the next 3 quota years (see section 28).

(2) A person is not eligible to apply for an allocation for a quota type and a quota year if, in relation to any of the 3 previous quota years:

(a) the person transferred one or more amounts of tariff rate quota entitlement for the quota type and quota year; and

(b) the total of the amounts that the person transferred was more than the amount worked out using the following formula:

where:

allocations is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that the person has been allocated.

maximum transfer percentage is the maximum transfer percentage for the quota type.

transfers in is the sum of all of the amounts of tariff rate quota entitlement for the quota type and quota year that have been transferred to the person.

When to make application

(3) The application must be made on or before the reclamation day for the quota type and quota year.

Requirements for applications

(4) The application must:

(a) state the amount of tariff rate quota entitlement being applied for; and

(b) be made in a manner approved, in writing, by the Secretary; and

(c) if the Secretary has approved a form for making the application:

(i) include the information required by the form; and

(ii) be accompanied by any documents required by the form.

Note: A person may commit an offence if the person makes a false or misleading statement in an application or provides false or misleading information or documents (see sections 136.1, 137.1 and 137.2 of the Criminal Code).

(5) The Secretary may accept any information or document previously given to the Secretary in connection with an application made under this instrument as satisfying any requirement to give that information or document under subsection (4).

(6) An application is taken not to have been made if the application does not comply with the requirements referred to in subsection (4) for the application.

45 Allocation of quota after reclamation day—applicants who are not new entrants

(1) The Secretary must allocate amounts of tariff rate quota entitlement for a quota type and a quota year to persons who applied for entitlement in accordance with paragraph 39(2)(b) or under section 44 as soon as practicable after:

(a) all relevant amounts of tariff rate quota entitlement for the quota type and quota year have been cancelled under section 40; and

(b) the Secretary has allocated amounts of tariff rate quota entitlement for the quota type and quota year under section 42.

(2) The amount of tariff rate quota entitlement to be allocated to an applicant is:

(a) if the total amount applied for in all applications is less than or equal to the uncommitted annual access amount for the quota type and quota year as at the time the Secretary makes the allocation—the amount the person applied for; or

(b) if the total amount applied for in all applications is more than the uncommitted annual access amount for the quota type and quota year as at the time the Secretary makes the allocation—the amount worked out under section 46.

Note: The uncommitted annual access amount is not available for the purposes of issuing tariff rate quota certificates until this allocation process is carried out (see subsection 49(5)).

46 Calculation of tariff rate quota entitlement after reclamation day

(1) For the purposes of paragraph 45(2)(b) and subject to this section, the amount of tariff rate quota entitlement to be allocated to an applicant for a quota type and a quota year is the amount worked out using the following formula:

where:

all eligible past exports is the total weight of all eligible past exports by all applicants for the quota type and that quota year.

applicant’s eligible past exports is the total weight of the applicant’s eligible past exports for the quota type and quota year.

uncommitted annual access amount is the uncommitted annual access amount for the quota type and quota year at the time the Secretary makes the allocation.

(2) If the amount worked out under subsection (1) for any applicant (a quota‑filled applicant) is more than the amount of tariff rate quota entitlement the applicant applied for:

(a) the amount of tariff rate quota entitlement to be allocated to each quota‑filled applicant is equal to the amount of tariff rate quota entitlement that applicant applied for; and

(b) the amount of tariff rate quota entitlement to be allocated to each applicant who is not a quota‑filled applicant must be recalculated under subsection (1); and

(c) for the purposes of the recalculation:

(i) each quota‑filled applicant is taken not to be an applicant; and

(ii) the uncommitted annual access amount is taken to be reduced by the total amount of tariff rate quota entitlement to be allocated to quota‑filled applicants.

(3) The recalculation mentioned in subsection (2) must be repeated until subsection (2) no longer applies in relation to any applicant.

(4) The amount of tariff rate quota entitlement to be allocated to each applicant, as calculated under subsections (1) to (3), must be rounded to the nearest kilogram, with 0.5 of a kilogram to be rounded up.

(5) However, if the sum of the tariff rate quota entitlements to be allocated exceeds the uncommitted annual access amount for the quota type and quota year at the time the Secretary makes the allocation, the amount of tariff rate quota entitlement to be allocated to each applicant must be rounded down to the nearest kilogram instead.

Division 6—Tariff rate quota certificates after reclamation day

47 Applications for tariff rate quota certificates after reclamation day

A person who intends to export a consignment of a quota type in a quota year may, after the reclamation day for the quota type and quota year, apply to the Secretary under this section for a tariff rate quota certificate in relation to the consignment.

Note: See section 114 for requirements and other matters relating to applications.

48 Applications to be dealt with in order of receipt

The Secretary must deal with applications under section 47 in the order in which the applications are received by the Secretary.

Note: Subsection 114(8) deals with when an application is taken to be received by the Secretary.

49 Issuing tariff rate quota certificates

Application of this section

(1) This section applies in relation to an application under section 47 for a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year.

When Secretary must issue certificate

(2) Subject to subsection (5) and section 115, the Secretary must issue a tariff rate quota certificate to the applicant in relation to the consignment if, at the time the Secretary deals with the application:

(a) the applicant’s tariff rate quota entitlement for the quota type and quota year is greater than zero; or

(b) the uncommitted annual access amount for the quota type and quota year is greater than zero.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

(3) The certificate must be issued for the lesser of:

(a) the weight of the consignment applied for; and

(b) the sum of the applicant’s tariff rate quota entitlement and the uncommitted annual access amount at the time the Secretary deals with the application.

(4) If the applicant’s tariff rate quota entitlement is greater than zero at the time the Secretary deals with the application, the applicant’s tariff rate quota entitlement is reduced (but not below zero) by the weight for which the tariff rate quota certificate is issued.

No uncommitted annual access amount until after allocation process

(5) For the purposes of this section, the uncommitted annual access amount for a quota type and a quota year is taken to be zero during the period:

(a) beginning at the start of the day after the reclamation day for the quota type and quota year; and

(b) ending when the Secretary has allocated amounts of tariff rate quota entitlement for the quota type and quota year to persons in accordance with section 45.

Part 4—Certification method

50 Application of this Part

If a provision of Chapter 3 provides that the certification method applies for the purposes of issuing a tariff rate quota certificate in relation to a consignment of a quota type for export in a quota year, then this Part applies for the purposes of issuing a tariff rate quota certificate in relation to such a consignment.

51 Applications for tariff rate quota certificates

A person who intends to export a consignment of a quota type in a quota year may apply to the Secretary for a tariff rate quota certificate in relation to the consignment.

Note: See section 114 for requirements and other matters relating to applications.

52 Issuing tariff rate quota certificates

If the Secretary receives an application under section 51, the Secretary must, subject to section 115, issue a tariff rate quota certificate to the applicant in relation to the consignment.

Note: Section 115 deals with when the Secretary may decide not to issue a certificate.

Chapter 3—Exports covered by tariff rate quotas

Part 1—Exports to the European Union

Division 1—EU buffalo meat

53 EU buffalo meat

EU buffalo meat is frozen boneless buffalo meat of the kind referred to in Article 1(1)(b) of the EU Beef and Buffalo Regulation.

54 Quota year

A quota year for EU buffalo meat for export to the European Union is a period of 12 months beginning on 1 July.

55 Method for issuing tariff rate quota certificates

The first come, first served method applies for the purposes of issuing a tariff rate quota certificate in relation to a consignment of EU buffalo meat for export to the European Union in a quota year beginning on or after 1 July 2020.

Note: The first come, first served method is set out in Part 1 of Chapter 2.

56 Annual access amount

The annual access amount for EU buffalo meat for export to the European Union in relation to a quota year is the weight of EU buffalo meat that may, under Article 1(1)(b) of the EU Beef and Buffalo Regulation, be exported from Australia to the European Union in the quota year at the ad valorem customs duty set out in Article 1(3) of that Regulation.

Division 2—EU grain fed beef

57 EU grain fed beef

EU grain fed beef is beef of the kind referred to in Article 1(2) of the EU Grain Fed Beef Regulation.

58 Quota year

A quota year for EU grain fed beef for export to the European Union is a period of 12 months beginning on 1 July.

59 Method for issuing tariff rate quota certificates

The certification method applies for the purposes of issuing a tariff rate quota certificate in relation to a consignment of EU grain fed beef for export to the European Union in a quota year beginning on or after 1 July 2020.

Note: The certification method is set out in Part 4 of Chapter 2.

Division 3—EU high quality beef

60 EU high quality beef

EU high quality beef is beef of the kind referred to in Article 2(b) of the EU Beef and Buffalo Regulation.

61 Quota year

A quota year for EU high quality beef for export to the European Union is a period of 12 months beginning on 1 July.

62 Method for issuing tariff rate quota certificates

The allocation method applies for the purposes of issuing a tariff rate quota certificate in relation to a consignment of EU high quality beef for export to the European Union in a quota year beginning on or after 1 July 2020.

Note: The allocation method is set out in Part 3 of Chapter 2.

63 Annual access amount

The annual access amount for EU high quality beef for export to the European Union in relation to a quota year is the weight of EU high quality beef that may, under Article 2(b) of the EU Beef and Buffalo Regulation, be exported from Australia to the European Union in the quota year at the ad valorem customs duty set out in Article 1(3) of that Regulation.

64 Application and reclamation days