Financial Sector (Collection of Data) (reporting standard) determination No. 5 of 2020

Reporting Standard RRS 331.0 Selected Revenues and Expenses

Financial Sector (Collection of Data) Act 2001

I, Sean Carmody, a delegate of APRA, under paragraph 13(1)(a) of the Financial Sector (Collection of Data) Act 2001 (the Act) DETERMINE Reporting Standard RRS 331.0 Selected Revenues and Expenses, in the form set out in the Schedule, which applies to financial sector entities to the extent provided in paragraph 3 of the reporting standard.

Under section 15 of the Act, I DECLARE that the reporting standard shall begin to apply to those financial sector entities on 6 May 2020.

This instrument commences on 6 May 2020.

Dated: 6 May 2020

[Signed]

Sean Carmody

Executive Director

Cross-industry Insights and Data Division

Interpretation

In this Determination:

APRA means the Australian Prudential Regulation Authority.

financial sector entity has the meaning given by section 5 of the Act.

Schedule

Reporting Standard RRS 331.0 Selected Revenues and Expenses comprises the document commencing on the following page.

Reporting Standard RRS 331.0

Selected Revenues and Expenses

Objective of this reporting standard

This reporting standard is made under section 13 of the Financial Sector (Collection of Data) Act 2001.

Subject to what follows, it requires a registered entity that had total assets of $500 million or more at the end of the most recent complete financial year at the time of reporting, to give the APRA quarterly statements of selected revenues and expenses.

It also provides that if there are two or more registered entities of the same category[1] in a group of related bodies corporate (e.g. two or more money market corporations in the group), and the combined value of their total assets was $500 million or more at the end of the most recent complete financial year, one of them must give APRA quarterly statements of selected revenues and expenses.

If there is more than one registered entity of the same category in a group of related bodies corporate, only one of them will have to report to APRA under this reporting standard.[2] That report must cover all registered entities of the same category in the group.

This reporting standard outlines the overall requirements for the provision of the required information to APRA. It should be read in conjunction with Reporting Form RRF 331.0 Selected Revenues and Expenses and the associated instructions (all of which are attached and form part of this reporting standard).

Authority

- This Reporting Standard is made under section 13 of the Financial Sector (Collection of Data) Act 2001.

Purpose

2. Data collected in Form RRF 331.0 Selected Revenues and Expenses (RRF 331.0) is used for the purposes of the Australian Bureau of Statistics (ABS) for the purposes of economic statistics. It may also be used by the Reserve Bank of Australia and APRA.

Application

3. This reporting standard applies to those registered entities outlined in paragraph 4.

Information required

4. Subject to paragraph 5, a registered entity must provide APRA with the information required by RRF 331.0 in respect of a reporting period if, at the end of the most recent complete financial year for the registered entity, it:

(a) had total assets of $500 million or more; or

(b) was one of a number of registered entities that, during the reporting period, were:

(i) of the same category as the first-mentioned registered entity; and

(ii) related bodies corporate of each other

and, at the end of the most recent complete financial year for the first-mentioned registered entity, had combined total assets of $500 million or more.

5. However, a registered entity is not required to report in respect of a particular reporting period if another registered entity has reported under this reporting standard in respect of that reporting period, and that other entity is both:

(a) a related body corporate of the first-mentioned registered entity; and

(b) of the same category as the first-mentioned registered entity.

Example of the application of paragraphs 4 and 5: RE1 Ltd is a registered entity. Under section 11 of the Collection of Data Act it has been allocated to the category of ‘money market corporation’. At the end of the most recent complete financial year it had assets of $40 million. RE2 Pty Ltd is a subsidiary, and therefore a related body corporate, of RE1. It is also a money market corporation. At the end of the most recent complete financial year it had assets of $20 million. For the purposes of the test in paragraph 4(b) their respective total assets are added together, producing a total of $60 million. This exceeds the $50 million test in paragraph 4(b). Having regard to paragraph 5, one of the two companies is required to report to APRA under this reporting standard in respect of the reporting period (assuming there are no other money market corporations in the group that have reported to APRA in respect of that reporting period).

Reporting periods and due dates

6. Subject to paragraph 7, a registered entity must provide the information required by this reporting standard for each quarter ending 31 March 2020 and 30 June 2020.

7. APRA may, by notice in writing to a particular registered entity, vary the timing of a reporting period for the registered entity (to align it with the registered entity's own financial year, within the meaning of the Corporations Act 2001) or vary the duration of a reporting period for the registered entity.

8. The information required by this reporting standard must be provided to APRA within 40 calendar days after the end of the reporting period to which it relates.

9. APRA may grant a registered entity an extension of a due date in writing, in which case the new due date for the provision of the information will be the date on the notice of extension.

Forms and method of submission

10. The information required by this Reporting Standard must be given to APRA in electronic format, using the ‘Direct to APRA’ application or by a method notified by APRA, in writing, prior to submission.

Note: the Direct to APRA application software (also known as D2A) may be obtained from APRA.

Authorisation

11. All information provided by a registered entity under this Reporting Standard must be subject to processes and controls developed by the registered entity for the internal review and authorisation of that information. It is the responsibility of the board and senior management of the registered entity to ensure that an appropriate set of policies and procedures for the authorisation of data submitted to APRA is in place.

12. When an officer of a registered entity submits information under this Reporting Standard using the D2A application, it will be necessary for an officer of the registered entity to digitally sign the relevant information using a digital certificate acceptable to APRA.

Minor alterations to forms and instructions

13. APRA may make minor variations to:

(a) a form that is part of this reporting standard, and the instructions to such a form, to correct technical, programming or logical errors, inconsistencies or anomalies; or

(b) the instructions, to clarify their application to the form

without changing any substantive requirement in the form or instructions.

14. If APRA makes such a variation it must notify in writing each registered entity that is required to report under this reporting standard.

Interpretation

16. In this reporting standard:

category means a category to which a registered entity has been allocated under section 11 of the Financial Sector (Collection of Data) Act 2001.

Principal Executive Officer means the principal executive officer of the registered entity for the time being, by whatever name called, and whether or not he or she is a member of the governing board of the entity.

registered entity has the meaning given in the Financial Sector (Collection of Data) Act 2001 (that is, a corporation whose name is entered in the Register of Entities kept by APRA under section 8 of that Act).

Note: references to registered financial corporations in the forms and instructions that form part of this reporting standard are taken to have the same meaning as registered entity.

related body corporate has the meaning given in section 50 of the Corporations Act 2001.

reporting period means a period defined in paragraph 6 or, if applicable, paragraph 7.

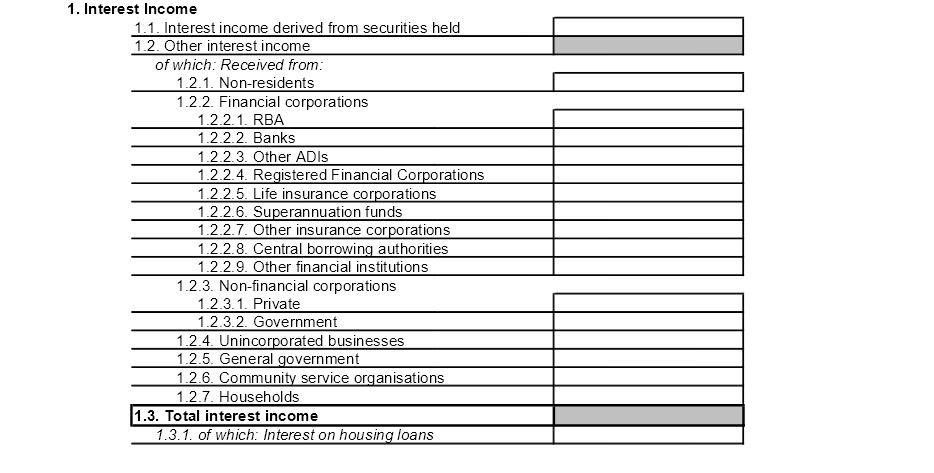

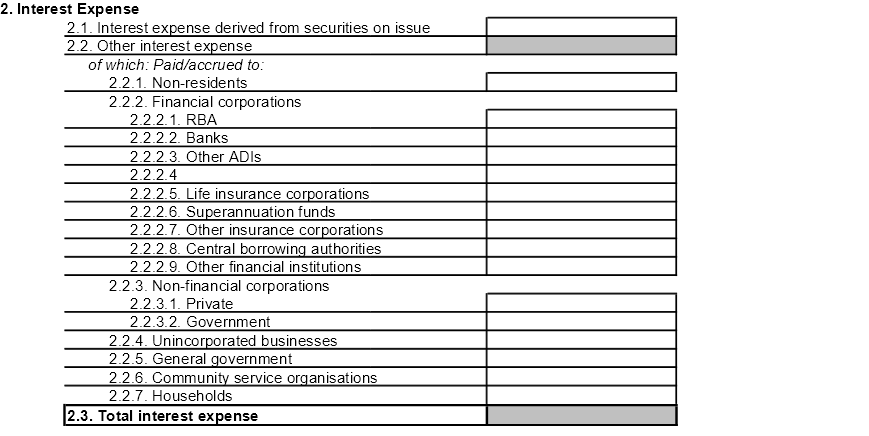

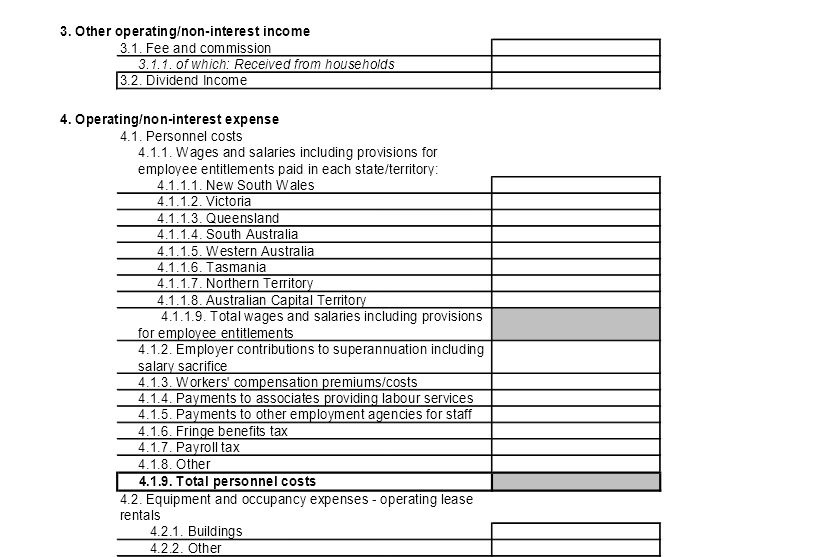

Reporting Form RRF 331.0

Selected Revenue and Expenses Instruction Guide

General directions and notes

Reporting entity

This form is to be completed by all Registered Financial Corporations (RFCs) that have total assets equal to or greater than $500 million, after consolidating all RFCs of the same category in a group of related bodies corporate (e.g. two or more money market corporations in the same group) on a Domestic books basis.

The Domestic books of the registered entity relates to the Australian books of the Australian entity and has the following scope:

• this form should be completed on a consolidated basis for all legal entities in your Australian enterprise group that are required to file this return;

• do not consolidate Australian and offshore controlled entities or associated entities that are not required to complete this form;

• exclude offshore branches of the Australian registered entity from this reporting unit;

• report your Australian consolidated entity’s operations/transactions that are booked inside Australia; and

• include transactions with non-residents recorded on Australian books.

Reporting period

The form is to be completed as at the last business day of the stated quarter (i.e. 31 March 2020 and 30 June 2020). Closing stock data items are to be reported as at the last business day of the stated quarter. All RFCs that have total assets equal to or greater than $500 million should submit the completed form to APRA within 40 calendar days of the end of the quarter.

Unit of measurement

All RFCs that have total assets equal to or greater than $500 million are asked to complete the form in thousands of Australian dollars rounded to the nearest whole number (no decimal place).

Where denominated in foreign currency stock market values in foreign currency should be converted to AUD at the spot rate effective as at the reference date.

Specific instructions

Wages and salaries including provisions for employee entitlements

Refers to gross earnings before taxation and other deductions.

Report wages and salaries as recorded in this business’ financial or management accounts, including provisions for employee entitlements (i.e. on an accruals basis).

Report wages and salaries paid in each state/territory in which this business operates.

Include:

• severances, terminations and redundancies;

• salaries and fees of directors and executives;

• retainers and commissions of persons who received a retainer;

• bonuses; and

• recreation and other types of leave.

Exclude:

• salary sacrificed superannuation contributions (i.e. sacrifice of salary for extra superannuation). This is to be reported as Employer contributions to superannuation including salary sacrifice; and

• payments to self-employed persons such as consultants, contractors and persons paid solely by commission without a retainer.

Employer contributions to superannuation including salary sacrifice Include:

• all contributions paid or payable (gross of contributions tax) to any

superannuation fund during the quarter;

• contributions made in respect of award, superannuation guarantee and enterprise bargaining agreements; and

• contributions arising from salary sacrifice agreements.