Part 1—Introduction

1 Name

This instrument is the Higher Education Support (HELP Tuition Protection Levy) (Risk Rated Premium and Special Tuition Protection Components) Determination 2020.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | on the day after this instrument is registered | |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under section 13 of the Higher Education Support (HELP Tuition Protection Levy) Act 2020.

4 Definitions

Note: A number of expressions used in this instrument are defined in section 5 of the Act, including the following:

(a) leviable provider;

(b) risk rated premium component;

(c) special tuition protection component.

(1) In this instrument:

Act means the Higher Education Support (HELP Tuition Protection Levy) Act 2020.

annual financial reporting period has the same meaning given by subsection 19-10(3) in the Higher Education Support Act 2003.

financial statement means the statement provided by a leviable provider to the Minister for the purposes of section 19-10 of the Higher Education Support Act 2003 for the annual financial reporting period ending in 2019.

statement of general information means the information provided by a leviable provider to the Minister in accordance with a notice under section 19-70 of the Higher Education Support Act 2003.

(2) An expression used in this instrument that is also used in the Higher Education Support Act 2003 has the same meaning as in that Act.

Part 2—Risk rated premium component

5 Risk rated premium component

(1) The amount for the purposes of step 1 of the method statement in subsection 11(2) of the Act is $6.00.

(2) The percentage for the purposes of step 2 of the method statement in subsection 11(2) of the Act is 0.06%.

(3) For the purposes of step 4 of the method statement in subsection 11(2) of the Act, the following risk factors are specified:

(a) financial strength risk factor;

(b) completion rate risk factor;

(c) non-compliance history risk factor.

6 Risk factor – financial strength

Risk factor value

(1) For the purposes of step 4 of the method statement in subsection 11(2) of the Act, the risk factor value for the financial strength risk factor for a leviable provider is:

(a) if the provider did not submit financial statements – 2.5;

(b) if the provider submitted financial statements – as set out in the following table:

Financial Strength |

Column 1 | Column 2 | Column 3 |

Item | If the financial strength score of the provider, as determined under subsections (2) and (3) is… | then, the risk factor value is … |

1 | 8 or 9 | 0.0 |

2 | 6 or 7 | 1.0 |

3 | 1 to 5 | 2.0 |

Determining the financial strength score

(2) A leviable provider’s financial strength score is the sum of the following scores:

(a) net profit ratio score;

(b) return on assets score;

(c) debt to equity score.

(3) For the purposes of subsection (2), the scores are worked out in accordance with the table below:

Ratio | Formula | Below Average | Average | Above Average |

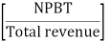

Net profit ratio |

| less than or equal to 0.0 | greater than 0.0 but less than or equal to 0.7 | greater than 0.7 |

Return on assets |

| less than or equal to 0.0 | greater than 0.0 but less than or equal to 0.1 | greater than 0.1 |

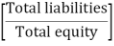

Debt to equity |

| greater than or equal to 2.5; or if the total equity is less than or equal to 0.0 | less than 2.5 but greater than or equal to 1.5 | less than 1.5 but greater than or equal to 0.0 |

Score | | 1 | 2 | 3 |

where:

NPBT means the net profit before tax as stated or derived from the financial statements.

Total assets means the total assets as stated or derived from the financial statements.

Total equity means the total equity as stated or derived from the financial statements.

Total liabilities means the total liabilities as stated or derived from the financial statements.

Total revenue means the total revenue as stated or derived from the financial statements.

7 Risk factor – completion rate

Risk factor value

(1) For the purposes of step 4 of the method statement in subsection 11(2) of the Act, the risk factor value for the completion rate risk factor for a leviable provider is:

(a) if the provider does not report any units of study for the calendar year beginning on 1 January 2019 (previous calendar year) – 0.0;

(b) otherwise, the risk factor value is set out in the following table:

Completion Rate |

Column 1 | Column 2 | Column 3 |

Item | If a leviable provider’s completion rate percentage, as determined under subsection (2) is … | then, the risk factor value is … |

1 | 60% or more | 0.0 |

2 | 35% or more but less than 60% | 3.5 |

3 | 0% or more but less than 35% | 5.5 |

Determining the completion rate percentage

(2) A leviable provider’s completion rate percentage is worked out using the formula:

where:

Data missing EFTSL means the total EFTSL value for units of study with a census day in the previous calendar year for which no unit of study completion status has been reported by the provider in the provider’s statements of general information.

EFTSL has the same meaning as in the Higher Education Support Act 2003.

EFTSL value has the same meaning as in the Higher Education Support Act 2003.

Failed EFTSL means the total EFTSL value for units of study with a census day in the previous calendar year reported by the provider as having a unit of study completion status of ‘failed’ in the provider’s statements of general information.

Ongoing EFTSL means the total EFTSL value for units of study with a census day in the previous calendar year reported by the provider as having a unit of study completion status of ‘unit of study to be commenced later in the year or still in process of completing or completion status not yet determined’ in the provider’s statements of general information.

Passed EFTSL means the total EFTSL value for units of study with a census day in the previous calendar year reported by the provider as having a unit of study completion status of ‘successfully completed all the requirements’ in the provider’s statements of general information.

Withdrawn EFTSL means the total EFTSL value for units of study with a census day in the previous calendar year reported by the provider as having a unit of study completion status of ‘withdrew without penalty’ in the provider’s statements of general information.

8 Risk factor – non-compliance history

Risk factor value

For the purposes of step 4 of the method statement in subsection 11(2) of the Act, the risk factor value for the non-compliance history risk factor for a leviable provider is – 0.0.

Part 3—Special tuition protection component

9 Special tuition protection component

The percentage for the purposes of subsection 12(2) of the Act is 0.15%.